Crypto World

PI Network price rises after a major Kraken development

Pi Network price stabilized near its all-time low as optimism rose that it would be listed on Kraken, a top crypto exchange.

Summary

- Pi Network price crashed to a record low amid the ongoing crypto crash.

- Kraken, a top crypto exchange, has added it to its listing roadmap.

- Technical analysis suggests that it has more downside to go in the coming days.

Pi Network (PI) rose to $0.1450, a few points above the all-time low of $0.1300. It remains significantly lower than the all-time high of $3, with its market capitalization falling from nearly $20 billion to $1.3 billion today.

One major catalyst for the coin is its addition to Kraken’s page for potential listings. It is listed in the Chains category, which also includes tokens such as TX, Conflux, Pepecoin, MegaETH, and Quai.

Being listed on this page does not guarantee future listing. However, it has given the community hope that it will be available on one of the largest crypto exchanges today.

Kraken has over 15 million users globally, with 1.5 million active each month. It generated over $2.2 billion in revenue last year and raised $800 million at a $20 billion valuation in November ahead of its IPO.

A Kraken listing would be a big thing as Pi has failed to attract any additional exchanges since its mainnet launch in February last year. Most of its trading occurs on a handful of exchanges, including OKX, Gate, Bitget, and MEXC.

Additionally, the listing will likely encourage more exchanges to list it as well. Some of the most important exchanges that would trigger a Pi Coin price surge are Binance, Coinbase, and Upbit. Binance is the most important, while Coinbase and Upbit have large market shares in the US and South Korea.

Pi Network price technical analysis

The daily timeframe chart shows that the Pi coin price has been in a steep freefall in the past few months. It dropped to a record low of $0.1304 as the crypto market crash intensified,

The coin has moved below all moving averages and the crucial support level at $0.1530, its previous all-time low. All oscillators are pointing downward, indicating that downward momentum is continuing.

Therefore, the most likely Pi Network price outlook is bearish, with the next key target being the psychological $0.10 level. However, the main risk of going against it is that a Kraken listing would fuel a short-term short squeeze.

Crypto World

Google Search Volume For ‘Bitcoin’ Surges Amid $60K Plunge

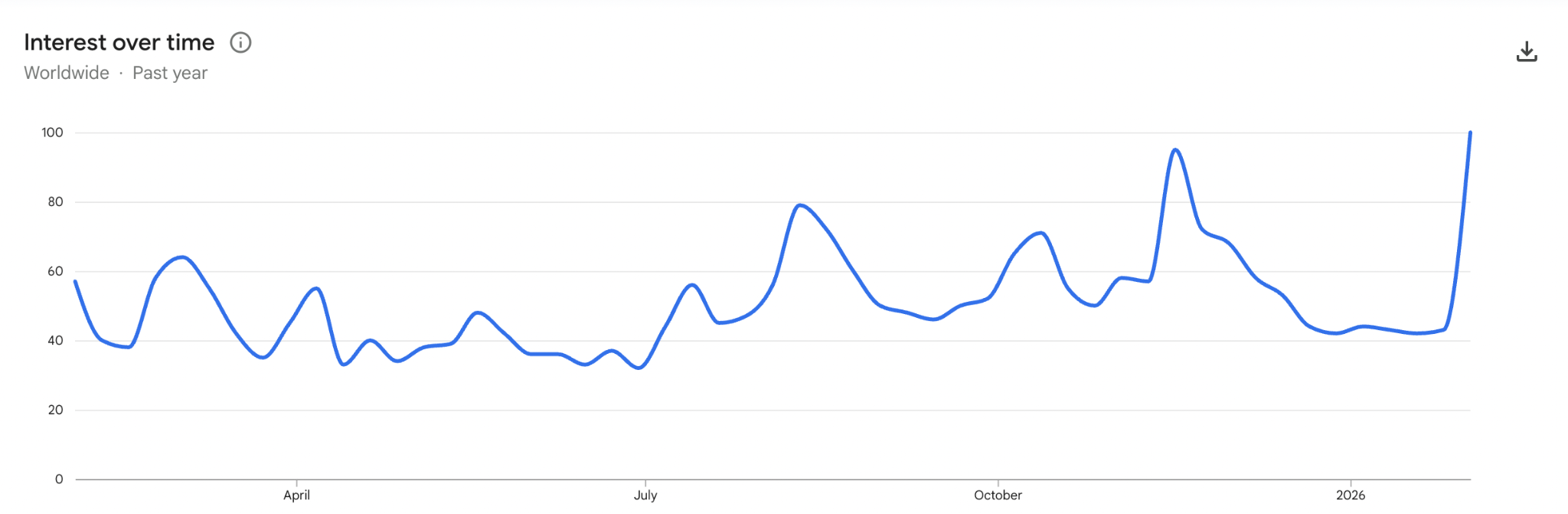

Google search volume for the term “Bitcoin” surged over the past week as the asset’s price briefly fell to the $60,000 level for the first time since October 2024.

Google Trends provisional data shows worldwide searches for “Bitcoin” reached a score of 100 for the week starting Feb. 1, the highest level in the past 12 months.

The previous peak was a score of 95 in the week of Nov. 16–23, when Bitcoin (BTC) slipped below the psychological $100,000 level for the first time in nearly six months.

Google search interest is one of several commonly used indicators among crypto analysts to gauge retail interest in Bitcoin and the broader crypto market, which typically spikes during significant price moves, particularly major rallies to new all-time highs or sudden sell-offs.

The increase comes as Bitcoin dropped from about $81,500 on Feb. 1 to roughly $60,000 within five days, before rebounding to $70,740 at the time of publication, according to CoinMarketCap.

Some market observers suggest the current price range may be drawing renewed attention from a broader retail audience. Bitwise head of Europe, André Dragosch, said in an X post on Saturday, “Retail is coming back.”

Meanwhile, CryptoQuant’s head of research, Julio Moreno, said in an X post on Saturday that US investors are buying Bitcoin after it reached $60,000. “The Coinbase premium is now positive for the first time since mid-January,” Moreno said.

Other indicators suggest that investors are still cautious about the crypto market. The Alternative.me Crypto Fear & Greed Index fell further down once again on Saturday to an “Extreme Fear” score of 6, nearing levels that haven’t been seen since June 2022.

Related: Crypto’s stress test hits balance sheets as Bitcoin, Ether collapse

The sentiment indicator’s decline to such low levels has led some market participants to suggest it could signal a buying opportunity.

Crypto analyst Ran Neuner said in an X post on Friday that, “every single metric is telling you that Bitcoin has never been more undervalued on a relative basis.”

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Perp DEX traders face Hyperliquid, Aster, edgeX, Lighter volume surge

Perpetual DEXs processed over $70B on Feb. 5, their second‑biggest day ever, as Hyperliquid, Aster, edgeX and Lighter absorbed a sharp BTC, ETH, SOL‑led deleveraging.

Summary

- Per DeFiLlama, perp DEXs cleared $70B+ on Feb. 5, second only to the Oct. 10, 2025 “1011” crash that saw $19B in liquidations and sent BTC from $117,000 to $101,800.

- Hyperliquid handled $24.699B (about 31% share) in 24 hours, Aster $11.553B (~14.6%), edgeX $8.675B (~11%), and Lighter $7.537B (~9.5%), with edgeX alone credited with $600B+ in cumulative volume and over $1B in OI.

- As BTC hovered near $64,000, ETH in the high $1,800s, SOL around $79–80, and XRP near $1.37, perp DEXs proved to be a primary venue where leveraged crypto risk is warehoused and unwound.

Perpetual DEXs just printed their second-biggest day on record, turning a brutal sell-off into a stress test that DeFi largely passed.

Volume shock and “1011” shadow

According to DeFiLlama data, perp DEXs processed more than $70 billion in volume on Feb. 5, the second-highest daily tally in history and only behind the Oct. 10, 2025 “1011” flash crash. That earlier event saw over $19 billion in liquidations in a single day and sent Bitcoin from roughly $117,000 to $101,800, cementing “1011” as a structural stress event for crypto leverage.

On Feb. 5, the pain was smaller but the pipes were busier. Hyperliquid led with roughly $24.7 billion in 24-hour volume, Aster followed at about $10–11.6 billion, edgeX cleared around $8.7 billion, and Lighter handled roughly $7.5–7.5+ billion, according to DeFiLlama’s perp dashboard. Together, those four accounted for well over half of all perpetual DEX turnover.

Hyperliquid, Aster, edgeX, Lighter

Per DeFiLlama’s breakdown, Hyperliquid captured about 31% of total perp DEX volume over the last 24 hours, with a 24-hour print of $24.699 billion and roughly $248.1 billion traded over 30 days. Aster posted about $11.553 billion in daily volume, up 112% on the day and representing roughly 14.6% of total perp flows. edgeX processed $8.675 billion (+66.3% daily) for nearly 11% share, while Lighter’s $7.537 billion (+86.9% daily) translated into about 9.5% of the market.

These venues are increasingly driven by incentives and points programs, with edgeX for instance already credited with more than $600 billion in cumulative user trading volume and over $1 billion in open interest in recent campaigns. Volumes of this scale suggest a core mix of BTC, ETH and SOL perps, plus high-beta altcoin pairs that traders use to express directional and basis views; during sharp drawdowns, BTC-USD, ETH-USD and SOL-USD contracts typically dominate notional flow and liquidations, while long-tail pairs add convexity but less absolute size.

Market backdrop and major coins

Spot and perp flows met in a classic deleveraging move. Bitcoin traded near $64,000 on Feb. 6, down around 11–12% over 24 hours in some market snapshots. Ethereum hovered in the high $1,800s, after a multi-week slide from above $3,000 and with technicians now eyeing the $1,600–2,000 band as a key trading range. Solana changed hands around $79–80, off roughly 14% on the day, with a 24-hour range between about $70.6 and $92.8. XRP traded near $1.37, with a 24-hour low of $1.14 and high around $1.38.

What this day signals

The Feb. 5 spike shows perp DEXs are no longer a niche hedge; they are where a large chunk of leveraged crypto risk is now warehoused and unwound. Compared with “1011,” the latest sell-off generated less outright liquidation carnage but pushed structurally higher volumes through Hyperliquid, Aster, edgeX and Lighter, underscoring how much directional positioning has migrated on-chain in under 18 months.

Crypto World

Is $1 the next stop?

Crypto volatility has hit XRP hard, with macro worries and geopolitical tension putting traders on edge. The most recent drop has pushed the token near a major support level.

Next up, we’ll examine the market and provide our latest XRP price prediction.

Summary

- XRP has recently dropped over 20%, briefly touching $1.13 before recovering to around $1.40.

- The token remains under pressure from macroeconomic uncertainty, geopolitical tensions, and weak spot XRP ETF demand.

- Traders are watching key U.S. economic data, including the February 11 jobs report and February 13 CPI figures, for market guidance.

- In the short term, XRP is expected to trade sideways between $1.13 and $1.50.

- If selling resumes, XRP could test the psychologically important $1.00 level, keeping the overall outlook cautious.

Current market scenario

When investors shun risk, Ripple (XRP) usually takes a bigger hit than Bitcoin, highlighting how sensitive it is during sell-offs. Its lower levels of institutional participation make it more exposed when the market turns cautious. Right now, the XRP price is hovering around $1.40 as traders watch for early signs of renewed buying, but spot demand has remained fairly muted so far.

Over the past month, XRP has been on a steady downtrend, losing nearly 40% alongside the broader crypto market. Another sharp 20% drop this past week suggests that liquidation pressure from recent sell-offs might not yet be fully digested, keeping volatility elevated.

The market is still feeling the impact of macro and geopolitical tensions. Heightened fears of a strike on Iran have triggered risk-off moves, weighing on Bitcoin and altcoins such as XRP. At the same time, spot XRP ETFs are seeing less demand as investors hold back.

Traders are now eyeing key U.S. economic data that could influence the next major market shift. The January jobs report comes out on February 11, with CPI data following on February 13. Both releases were pushed back due to a brief government shutdown, and either could impact crypto prices.

XRP price prediction: Key levels to watch

It’s been a rough few days for XRP, which lost more than 20% and briefly dipped to $1.13 on Friday — a level not seen since early November 2024. XRP has recovered a bit, yet renewed selling could push it closer to the psychologically significant $1.00 mark.

After the big sell-off, the market appears ready to catch its breath rather than rally straight away. Traders seem hesitant to put fresh money to work until macro data offers more clarity. In this scenario, the XRP forecast points to a period of sideways, range-bound movement.

During a sideways trading period, XRP is likely to remain between $1.13 and $1.50 for the time being. A drop below this range would raise the risk of additional downside, while a move above $1.50 could hint at a potential rebound. All in all, the XRP outlook stays cautious as macro uncertainty continues to dominate the market.

Crypto World

NFT Sales Fall to $58M as Crypto Market Weakness Continues

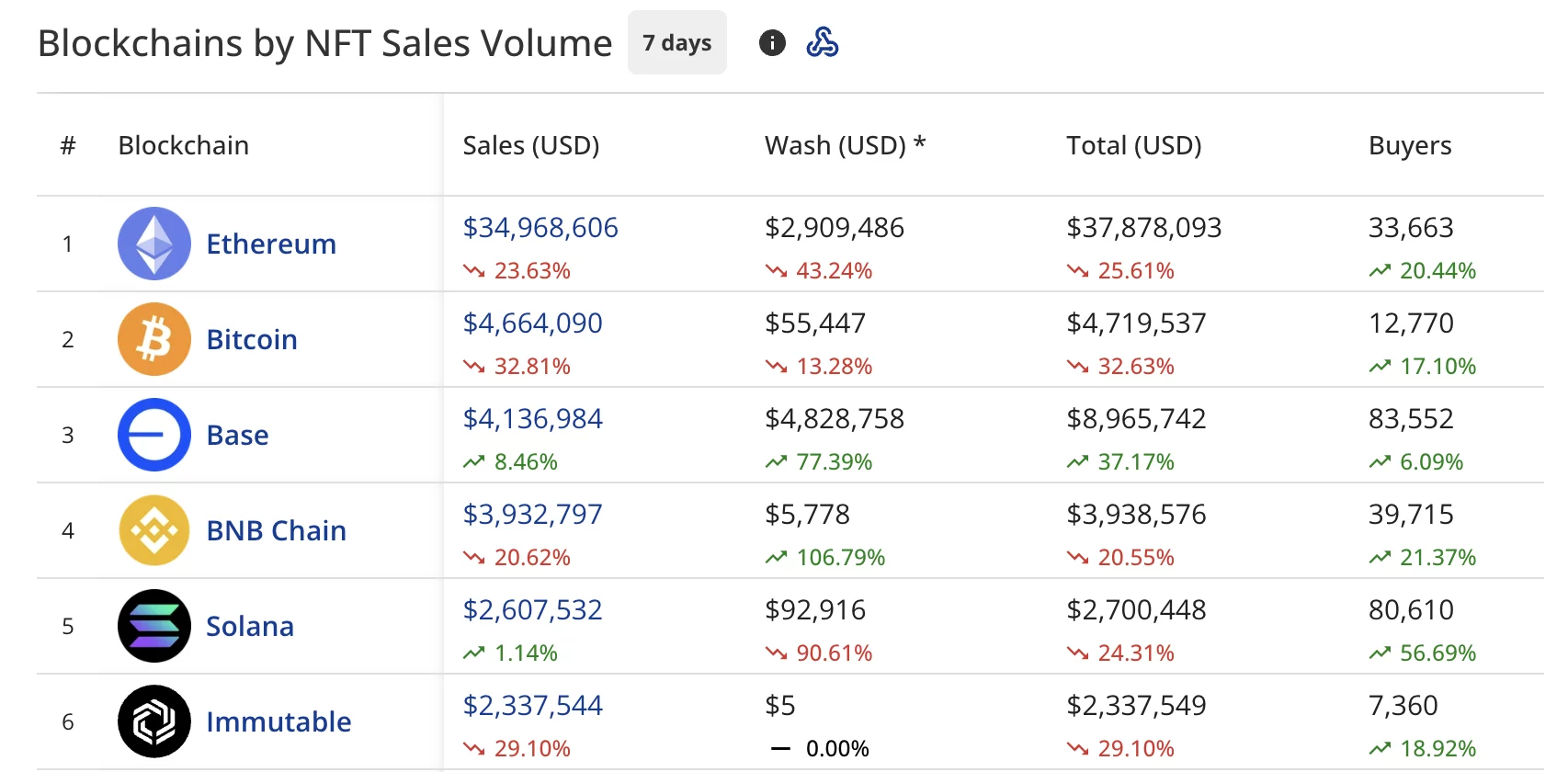

The NFT market recorded $58.34 million in sales volume over the past week, falling 20.34% from the previous period.

Summary

- NFT sales hit $58.34M, down 20%, despite buyers and sellers both rising over 20%.

- Ethereum led with $34.9M in sales, while Bitcoin NFT volume fell 33% week-over-week.

- CryptoPunks rebounded sharply, surging 147% and dominating high-value NFT sales.

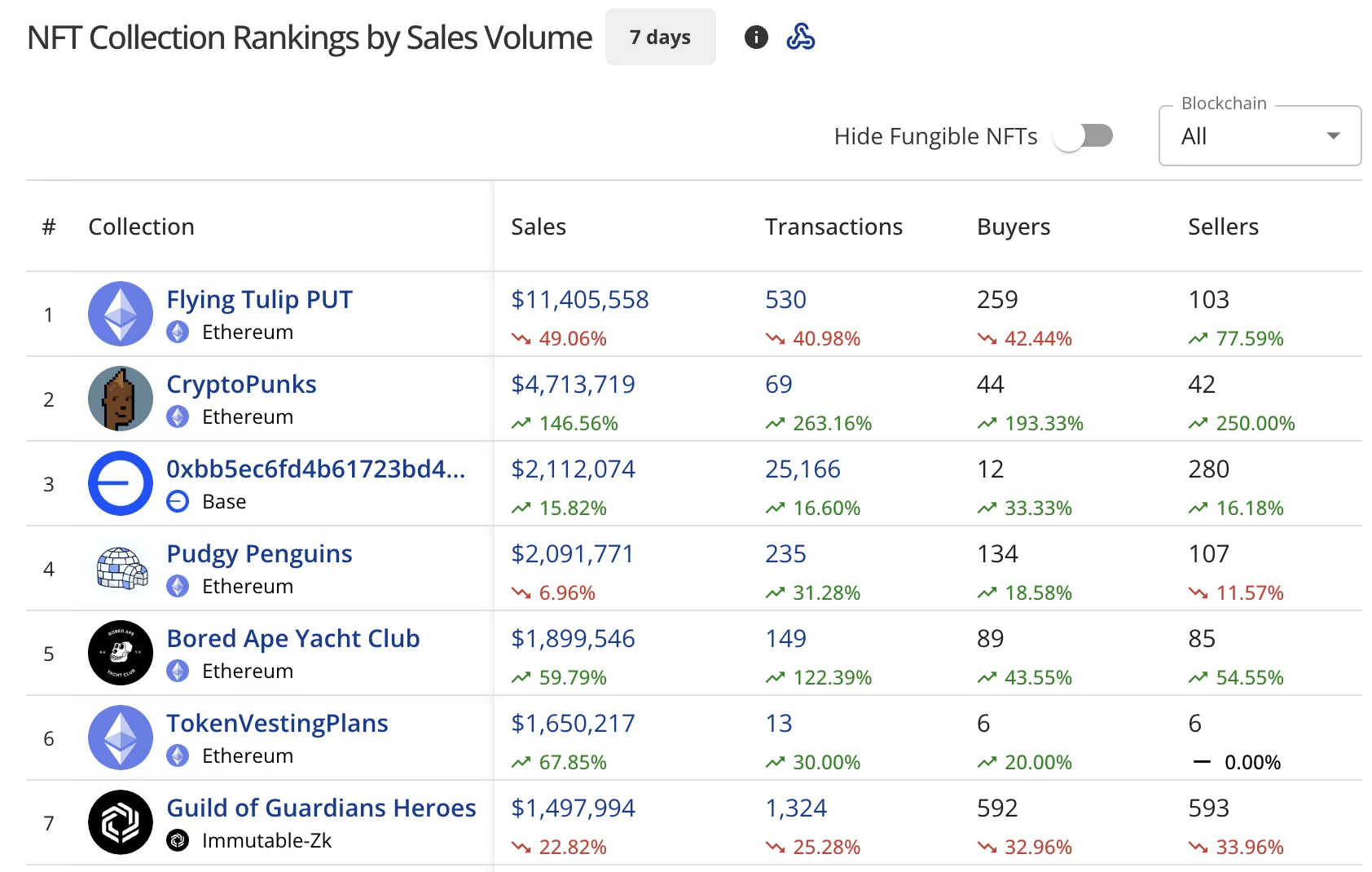

NFT buyers climbed 21.97% to 296,018, while sellers jumped 24.63% to 270,495. Transaction volume decreased 4.33% to 660,674.

The overall crypto market has taken a notable hit as Bitcoin (BTC) has dropped to the $70,000 level, while Ethereum (ETH) hovers around $2,000.

The global crypto market cap now stands at $2.41 trillion, down from last week’s $2.83 trillion. This market downturn continues to pressure the NFT sector, with weekly sales volume falling for the second consecutive week.

Ethereum leads with $34.9 million despite decline

Ethereum continued to dominate all blockchains with $34.97 million in NFT sales, dropping 23.63% over the seven-day period.

The network drew 33,663 buyers, up 20.44% from the prior week. Wash trading on Ethereum totaled $2.91 million during this timeframe.

Bitcoin secured second place among blockchains with $4.66 million in sales, falling 32.81% week-over-week. The network attracted 12,770 buyers, up 17.10% despite the sales decline.

Base claimed third position at $4.14 million in sales, climbing 8.46% and drawing 83,552 buyers who rose 6.09%.

BNB Chain (BNB) ranked fourth with $3.93 million in sales, declining 20.62% while seeing 39,715 buyers who increased by 21.37%.

Solana (SOL) rounded out the top five with $2.61 million in sales, posting a modest 1.14% gain and drawing 80,610 buyers who surged 56.69% from last week.

Immutable (IMX) dropped to sixth position at $2.34 million, down 29.10%.

Flying Tulip PUT retains lead, CryptoPunks surge

Flying Tulip PUT on Ethereum maintained its dominance in the collection rankings with $11.41 million in sales, plummeting 49.06% from last week’s performance. The collection processed 530 transactions from 259 buyers.

CryptoPunks on Ethereum claimed second place with $4.71 million in sales, surging 146.56% over the week after last week’s 52.35% decline.

The blue-chip collection completed 69 transactions from 44 buyers, with both metrics more than doubling week-over-week.

A Base collection took third position with $2.11 million in sales, climbing 15.82%. Pudgy Penguins posted $2.09 million in sales, down 6.96%, while Bored Ape Yacht Club recorded $1.90 million with a 59.79% surge.

TokenVestingPlans on Ethereum landed in sixth with $1.65 million, climbing 67.85%, while Guild of Guardians Heroes rounded out the top seven with $1.50 million, down 22.82%.

CryptoPunks dominate high-value NFT sales

CryptoPunks dominated the week’s highest-value sales, claiming three of the top five spots.

- CryptoPunks #5402 led with $265,585 (113.5 ETH) four days ago.

- CryptoPunks #9170 at $139,761 (72 ETH) just 14 hours ago.

- Wrapped Ether Rock #98 sold for $109,128 (109,127.7422 USDC) seven days ago.

- Autoglyphs #256 fetched $105,512 (50 ETH) two days ago.

- CryptoPunks #1112 rounded out the top five at $92,850 (48.48 ETH) one day ago.

Crypto World

Accommodative Macro Policies May Not Be Bitcoin’s Next Big Catalyst

Bitcoin’s next major catalyst may come from a sharp rethinking of how rate policy interacts with the crypto market. In a recent discussion, ProCap Financial chief investment officer Jeff Park challenged the conventional view that Bitcoin’s bull case is tied primarily to falling interest rates. Park argued that more accommodative monetary conditions might not automatically propel a sustained rally, and that investors should prepare for a world where macro policy shifts could still support risk assets even as rates move higher. The remarks come ahead of a broader dialogue about how liquidity, yields, and central-bank signaling shape Bitcoin’s price trajectory in a regime of evolving financial dynamics. Park spoke with Anthony Pompliano on The Pomp Podcast, highlighting a nuanced take on the macro setup and the potential implications for crypto markets.

Key takeaways

- The traditional link between easing policy and Bitcoin bulls may not hold in all macro regimes; accommodative cycles might not be the sole engine for a long-term upside.

- Jeff Park envisions a scenario where Bitcoin could rise even as the Federal Reserve tightens, describing it as a potential “positive row Bitcoin” that defies the standard QE-driven narrative.

- Park cautions that a shift away from the conventional risk-free-rate framework could upend how yields are priced and how the dollar’s global role influences markets.

- Traders are already encoding rate-cut expectations into probabilities, with 2026 Fed cuts suggesting a non-negligible chance of policy easing later in the decade, even as rate paths remain uncertain.

- Bitcoin’s current price action shows a pullback over the past month, underscoring the ongoing tension between macro expectations and crypto liquidity.

- The discussion positions Bitcoin within a broader critique of the monetary system and the relationships between the Fed, the Treasury, and yield curves.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. Bitcoin’s recent price action shows a notable 30-day decline, signaling short-term pressure even as a broader narrative contemplates alternative catalysts.

Trading idea (Not Financial Advice): Hold. The argument rests on a contested macro thesis that requires confirmation through further data and policy signals.

Market context: The debate sits at the intersection of liquidity dynamics, interest-rate expectations, and the evolving interpretation of the dollar’s global role, which together influence risk assets beyond traditional equities and bonds.

Why it matters

The discussion around accommodative policy as a potential non-linear catalyst for Bitcoin shifts the lens through which investors view crypto cycles. If Bitcoin can navigate higher rates without losing momentum, it suggests that its price sensitivity to macro signals may be more nuanced than a straightforward risk-on/risk-off dichotomy. Park’s thesis hinges on a broader reevaluation of the appeal of crypto assets in a world where central banks recalibrate the cost of capital, inflation expectations, and liquidity provisioning. In practical terms, this could widen the set of scenarios in which Bitcoin remains attractive, notably during periods when traditional assets such as bonds offer diminishing returns while crypto markets exhibit resilience or selective risk-taking.

The remark also touches on the structure of the monetary system itself. Park argues that the existing framework—where the Fed and the Treasury influence yields and debt dynamics—may be strained, potentially altering how investors price risk and the carry associated with various assets. In such a context, Bitcoin could serve as a hedging instrument or a speculative vehicle that benefits from a re-balancing effort among macro players. The core idea is not a guaranteed rally on rate rises, but a possibility that a different set of incentives could emerge, enabling Bitcoin to find new footing in a shifting monetary landscape.

From a trading perspective, the argument emphasizes that the “risk-free rate” concept might be less stable than traditionally assumed. If the dollar’s dominance wanes or if yield curves re-price in unexpected ways, Bitcoin’s narrative may detach from conventional rate-driven logic and align more with liquidity preferences, cross-asset flows, or macro resilience. The conversation about a hypothetical “endgame” for Bitcoin—where price appreciation accompanies higher rates—rests on a broader willingness among investors to entertain non-traditional drivers of value in a complex, evolving financial system.

Amid the discourse, markets are still processing concrete data points. On Polymarket, a predicting market for Fed policy, traders assign a tangible probability to three rate cuts in 2026, pegging it at 27%. While not a forecast, such market-implied expectations illustrate how investors are betting on the policy path even as the near-term trajectory remains uncertain. In the meantime, Bitcoin trades around $70,503, reflecting a roughly 22% slide over the last 30 days, according to CoinMarketCap. The pullback underscores the tension between a theoretical macro thesis and the practical realities of price action driven by liquidity, risk sentiment, and short-term demand-supply dynamics.

Within the broader crypto discourse, the idea that Bitcoin’s price could rise in a rising-rate environment appears as a provocative counter-narrative to widely cited relationships. The conversation echoes previous market observations that Bitcoin’s behavior can be as much about macro structural shifts as about policy tempo. For readers tracking the latest developments, a related analysis by Cointelegraph looked at how Bitcoin price moves relate to demand dynamics during dips, offering a backdrop to understanding who is buying during pullbacks and how institutions view the risk-reward calculus in a volatile sector.

As the debate evolves, observers will watch how signals from policymakers, changes in fiscal-miscal policy interactions, and shifts in global liquidity influence the asset class. The tension between a traditional inflation-targeting toolkit and an expanded crypto market narrative could produce a more multi-faceted set of catalysts for Bitcoin beyond the simple rate-cut/hold dichotomy. The coming months will be telling as investors reconcile the theoretical constructs with the data that materialize in price, on-chain metrics, and macro indicators.

What to watch next

- Monitor Fed communications and policy guidance for 2026 to assess whether rate-cut expectations become more entrenched in markets.

- Track Bitcoin price action around macro data releases and liquidity shifts to gauge whether the asset displays resilience in higher-rate environments.

- Follow commentary from policy analysts and market participants on the viability of the “positive row Bitcoin” thesis and how it aligns with yield-curve dynamics.

- Observe any changes in dollar strength or cross-border capital flows that could influence crypto liquidity and risk appetite.

- Review studies or forecasts that contextualize Bitcoin within a broader monetary-system critique, particularly regarding the Fed-Treasury relationship and the pricing of risk.

Sources & verification

- The interview with Jeff Park on The Pomp Podcast via YouTube: https://www.youtube.com/watch?v=bZfsLFGz4hE

- Bitcoin price data and 30-day performance referenced by CoinMarketCap: https://coinmarketcap.com/currencies/bitcoin/

- Polymarket predictions for Fed rate paths (2026): https://polymarket.com/event/how-many-fed-rate-cuts-in-2026

- Related coverage on Bitcoin price action and market activity: https://cointelegraph.com/news/bitcoin-price-rebounds-65k-who-is-buying-the-dip

Market reaction and the evolving Bitcoin rate thesis

Bitcoin (CRYPTO: BTC) sits at the center of a debate about how macro policy interacts with digital-asset pricing. Jeff Park, the CIO of ProCap Financial, argues that the old playbook—rates falling to boost liquidity and lift risk assets—may be insufficient to describe the next phase of Bitcoin’s journey. In the discussion with The Pomp Podcast, Park suggested that ultra-loose policy is not a guaranteed passport to a sustained bullish cycle. Instead, he sees a scenario where Bitcoin can appreciate alongside a rising rate environment if macro conditions, liquidity regimes, and investor risk appetites evolve in unanticipated directions.

At the heart of Park’s argument is a contrarian view of the so-called “endgame” for Bitcoin. He describes a possible state, which he terms a “positive row Bitcoin,” where the asset climbs even as the Federal Reserve tightens, challenging the conventional wisdom of QE-driven crypto appreciation. Such a world would require a recalibration of the way markets price risk and a rethink of the role that the risk-free rate plays in the crypto narrative. The notion rests on a broader revaluation of the monetary order, especially the dynamics between the dollar’s global dominance and the pricing of long-dated yields in a system that may no longer follow textbook relationships.

Park underscores that the monetary system is not operating as it once did. He argues that the interplay between the Fed and the U.S. Treasury has moved beyond the familiar playbook, complicating how investors price the yield curve and assess the relative attractiveness of different asset classes. In this framework, Bitcoin’s appeal could be anchored not only in optimism about adoption or censorship resistance but also in a nuanced reassessment of risk, liquidity, and the sequence of policy actions. If central-bank signaling, fiscal policy, and market expectations diverge from historical patterns, then Bitcoin’s performance could diverge from the conventional correlation with rate movements.

Market participants are already weighing these possibilities against current price realities. Bitcoin’s price of around $70,503 and its 30-day decline of roughly 22.5% reflect a market navigating uncertainty about policy direction, liquidity, and macro risk sentiment. The presence of a forward-looking probability for rate cuts in 2026—27% on a Polymarket track—signals that traders are trying to parse a possible shift in the policy landscape even as the near-term trajectory remains unresolved. In this context, the coin remains a focal point for discussions about how crypto assets respond to evolving macro conditions, rather than simply reacting to immediate rate moves.

While the thesis invites cautious optimism about Bitcoin’s resilience in a higher-rate environment, it also invites scrutiny about the assumptions underpinning the narrative. The timing, magnitude, and persistence of any rate adjustments, as well as the broader spectrum of liquidity and market participation, will be critical. The discussion continues to unfold in the public sphere, with analysts and investors closely watching policy signals, macro data, and on-chain indicators to determine whether the “positive row” scenario could materialize or remain a theoretical construct. In the meantime, observers should acknowledge that the path for Bitcoin remains contingent on a confluence of factors, including central-bank decisions, fiscal policy evolution, macro resilience, and the evolving psychology of risk in a shifting financial system.

Crypto World

How Low Can Pi Network’s PI Go? Shocking Bear-Market AI Scenarios After the Latest ATLs

After several consecutive all-time lows, where is PI’s bottom and how deep can it plunge?

It has been just under a year since the controversial project’s native token began trading on several exchanges. The journey so far has been quite underwhelming for investors, who saw the PI token rocket to an all-time high of $2.99 in late February 2025 and then experienced what can only be described as a massive cataclysmic nosedive.

PI dumped by more than 95% in less than a year. The past few weeks have been particularly painful as the token crashed to consecutive all-time lows, with the latest being at $0.1338 (on CoinGecko) after a 40% decline in a month. Although it has recovered slightly to nearly $0.145, overall sentiment has taken its toll, and the question is whether PI will drop even further.

New ATLs Ahead?

To gain a different perspective on the matter, we asked ChatGPT and Gemini. OpenAI’s alternative explained that PI’s inability to respond positively to recent network updates, which we have repeatedly highlighted, is a clear sign that its market structure and supply dynamics are dominating overall sentiment.

The steady decline to new lows suggests that the selling pressure remains persistent, the speculative demand is weak, and there’s insignificant external capital entering the market.

“Unlike more established altcoins, PI lacks deep liquidity buffers. When selling accelerates, price discovery to the downside can happen fast – as the recent crash demonstrated,” ChatGPT added.

It outlined a few scenarios ahead for PI, with the extreme bear-case predicting a massive plunge to $0.06-$0.08. This “true capitulation phase” would be possible if the token unlock pressure continues, liquidity remains thin, and the broader market sentiment deteriorates even further.

However, ChatGPT reiterated that this is an extreme scenario. Instead, it envisions a more likely decline to $0.10 before the token can bottom out and find more solid support.

Or Even Worse…

Gemini said the daily chart for PI paints a clear “stairway to hell” picture ever since it broke down beneath $0.20. Interestingly, it was even more bearish on PI’s future price performance since the token is now in “no man’s land” below $0.15.

You may also like:

If the asset fails to reclaim $0.16 by the end of the week, the next major technical liquidity pool sits at $0.05-$0.06, which would be another 65% crash from current levels. There’s another, even worse path ahead, which Gemini called “the zombie chain scenario.”

In it, PI would dump below $0.05 and will effectively become a “zombie coin” – high holder count, zero trading volume, and interest. However, the current odds for such a mindblowing crash are below 20%, Gemini explained, as it would require full investor capitulation, sell-offs by the Core Team, and overall market collapse.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

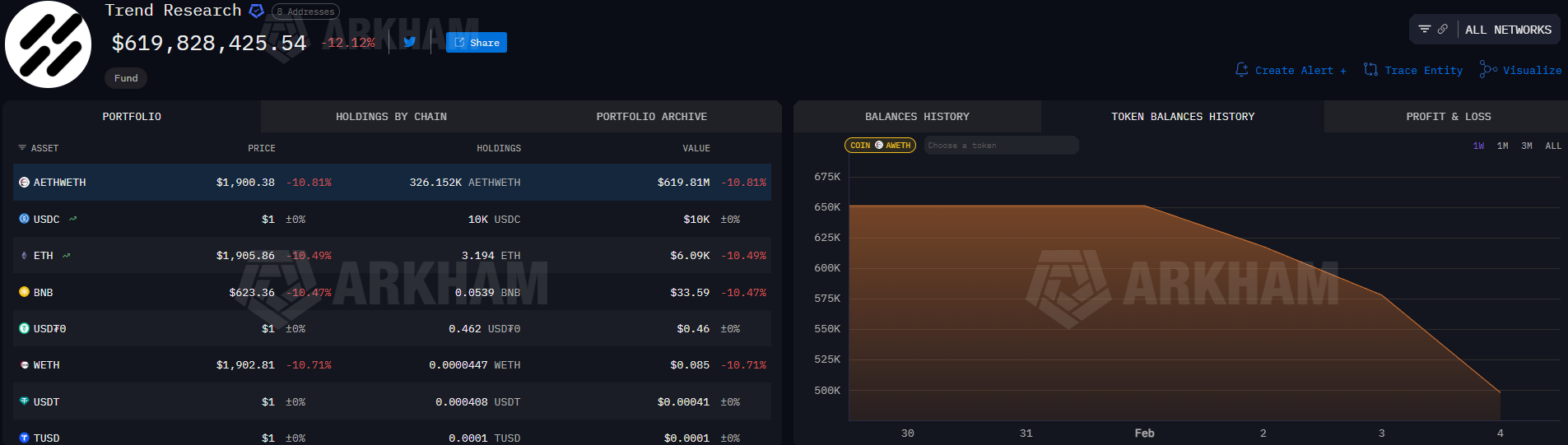

Trend Research Dumps Over 400K as Liquidation Risk Rises

Ethereum investment vehicle Trend Research continued to reduce its Ether exposure, as the latest market crash pushed the treasury company to sell off its assets to pay back loans.

It held about 651,170 Ether (ETH) in the form of Aave Ethereum wrapped Ether (AETHWETH) on Sunday. That amount dropped by 404,090, to about 247,080 on Friday, at the time of writing.

Trend Research transferred 411,075 ETH to cryptocurrency exchange Binance since the beginning of the month, according to blockchain data platform Arkham.

The transfers occurred as ETH price dropped almost 30% in the past week, to as low as $1,748 on Friday, according to CoinMarketCap. It traded at $1,967 at the time of writing.

Related: Sharplink pockets $33M from Ether staking, deploys another $170M ETH

Trend Research continues risk management as ETH liquidation level approaches

Trend Research has been tied to Jack Yi, founder of Hong Kong-based crypto venture firm Liquid Capital. Yi accumulated his Ethereum investment company’s holdings by purchasing ETH at an exchange, using that as collateral on Aave to borrow stablecoins, then using those funds to acquire more ETH.

Trend Research faces multiple ETH liquidation levels between $1,698 and $1,562, wrote blockchain data platform Lookonchain in a Friday X post.

Yi, said in a Thursday X post that he remains bullish despite admitting that he called for a bottom in crypto valuation too early and will continue to wait for a market recovery while “managing risk.”

Related: BitMine buys $105M Ether to kick off 2026, still holds $915M in cash

Trend Research came into the spotlight days after the $19 billion liquidation event of October 2025, when the investment firm began its aggressive Ether accumulation.

Trend Research would have ranked as the third-largest Ether holder in December, but as an unlisted company, it doesn’t appear on most tracking websites.

Bitmine, the largest public corporate Ether holder, was sitting on about $8 billion in unrealized profit on Friday.

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

XRP Whales Just Bought Big, Will Price Recover to $2?

XRP has staged a sharp rebound after a steep sell-off rattled investor confidence across the market. The token had suffered heavy losses, triggering fear-driven exits among retail holders.

However, select investor cohorts viewed the decline as an opportunity. Their strategic accumulation has already begun shifting momentum in XRP’s favor.

Sponsored

Sponsored

XRP Holders Exhibit Substantial Support

XRP whales have taken an active role in driving the recent recovery. Over the past 48 hours, wallets holding between 100 million and 1 billion XRP accumulated more than 230 million tokens. At current prices, this buying spree exceeds $335 million, signaling strong conviction among large holders.

This accumulation coincided with Friday’s rebound, highlighting whales’ influence on price direction. Large-scale buying reduces circulating supply and absorbs sell-side pressure.

Such behavior often acts as a catalyst during corrective phases, helping stabilize price and restore confidence when broader sentiment remains fragile.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Network activity also supports the recovery narrative. New XRP address creation surged alongside whale accumulation. Over the same 48-hour period, first-time transacting addresses increased by 51.5%, reaching 5,182. This marks the highest level of new participation in roughly two and a half months.

Sponsored

Sponsored

An influx of new investors strengthens rallies by injecting fresh capital rather than recycling existing liquidity. Rising participation suggests growing interest beyond short-term speculation.

With new addresses expanding and whale support present, XRP’s recovery attempt gains structural backing at the macro level.

What Is XRP Price’s Next Target?

XRP is trading near $1.46 at the time of writing, hovering just below the $1.47 resistance. The altcoin rebounded 20.5% after a severe downturn that erased 36% of its value in a few days. This bounce reflects improving demand conditions following capitulation.

Whale accumulation and rising network activity increase the probability of further upside. A push toward $1.70 appears achievable in the near term. This level represents a key psychological barrier. A successful break would likely attract additional inflows and strengthen the recovery structure.

Downside risk remains if resistance holds. Failure to clear $1.58 could invite renewed selling pressure. Under that scenario, XRP may fall below $1.37 and slide toward $1.28. Such a move would invalidate the bullish thesis and erase a significant portion of the recent rebound.

Crypto World

Marathon Digital Moves 1,318 BTC to Institutional Wallets Amid Bitcoin Dip

TLDR:

- MARA moved 1,318 BTC (~$86.9M) to Two Prime, BitGo, and Galaxy Digital in a 10‑hour window.

- The largest transfer of 653.773 BTC went to Two Prime, indicating structured institutional flows.

- Transfer occurred as Bitcoin traded in the mid‑$60K range during recent market weakness.

- Marathon still holds ~52,850 BTC, keeping it among the top reported public holders.

Marathon Digital Holdings recently transferred 1,318 BTC (~$87 million) to institutional platforms, including Two Prime, BitGo, and Galaxy Digital, within about 10 hours.

Bitcoin traded near mid‑$64,000 during the transfers. Despite the outflow, MARA still holds roughly 52,850 BTC, ranking among the largest corporate holders of Bitcoin globally.

MARA’s Institutional Transfers and Strategic Management

Marathon Digital Holdings transferred 1,318 BTC, valued at approximately $86.89 million, to institutional wallets over a short period.

The recipients included Two Prime, BitGo, and Galaxy Digital, demonstrating intentional allocation rather than reactive selling.

Two Prime received the largest portion, including 653.773 BTC worth around $42 million, along with smaller tranches. This wallet suggests the coins may support collateralized yield, hedging, or other structured financing strategies.

This indicates operational planning rather than market panic. BitGo handled nearly 300 BTC, consistent with its custody-first service for secure storage, settlement, or pre-OTC positioning.

Galaxy Digital, linked via Anchorage wallets, received the remaining coins, reinforcing the institutional nature of these transfers and highlighting coordinated treasury management.

Even after moving 1,318 BTC, MARA still holds 52,850 BTC, ranking as the second-largest publicly reported holder. The transfers represent roughly 2.5% of total holdings, suggesting measured liquidity management.

These moves likely fund operations, manage debt, or prepare for market volatility without requiring large-scale liquidation. The timing of transfers coincided with Bitcoin trading around $64,840, down almost 10% in 24 hours.

While such a decline might appear bearish, the involvement of institutional wallets indicates that these moves were planned and strategic. MARA’s approach reflects controlled, professional treasury operations rather than panic-driven exits.

Bitcoin Price Movements and Market Absorption

During the same period, Bitcoin opened near $68K, but sellers quickly drove the price below $60K. This sharp drop reflects forced deleveraging and cascading long liquidations rather than organic market behavior.

Buyers entered aggressively near $62K, driving the price back above $64K and through $65K. The pattern formed higher lows, showing absorption of selling pressure and resilience among stronger market participants.

The market did not continue lower, reflecting controlled capital deployment despite volatility. By the end of the trading window, Bitcoin nearly retraced the full drawdown, stabilizing near $68K.

Combined with MARA’s structured BTC transfers, this indicates deliberate repositioning under stress rather than distressed selling. Large holders can move significant amounts while maintaining balance in the market.

These coordinated transfers, paired with price absorption, illustrate operational management and strategic liquidity positioning.

MARA’s actions show careful deployment of its Bitcoin holdings, emphasizing treasury oversight and market awareness.

Crypto World

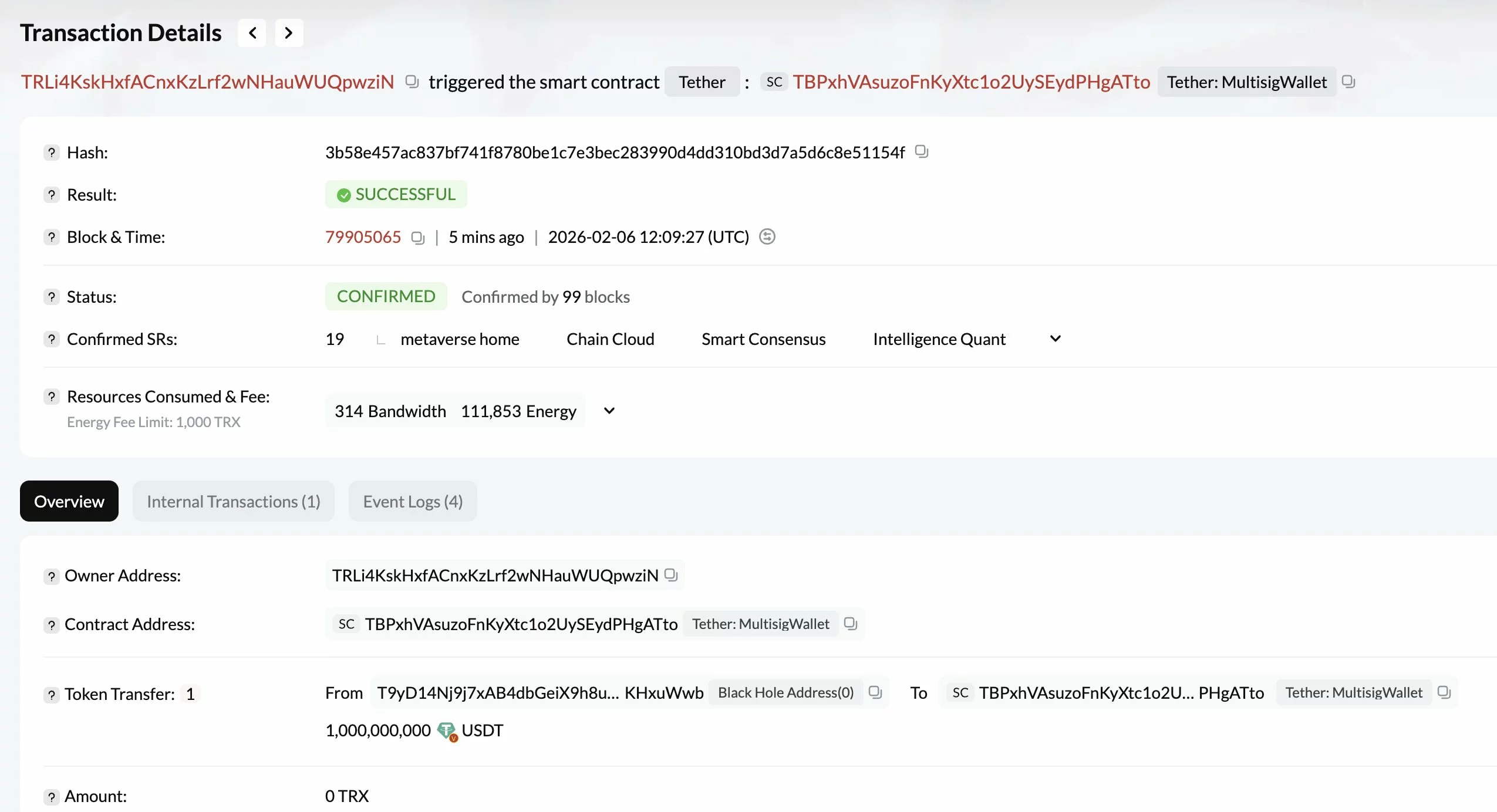

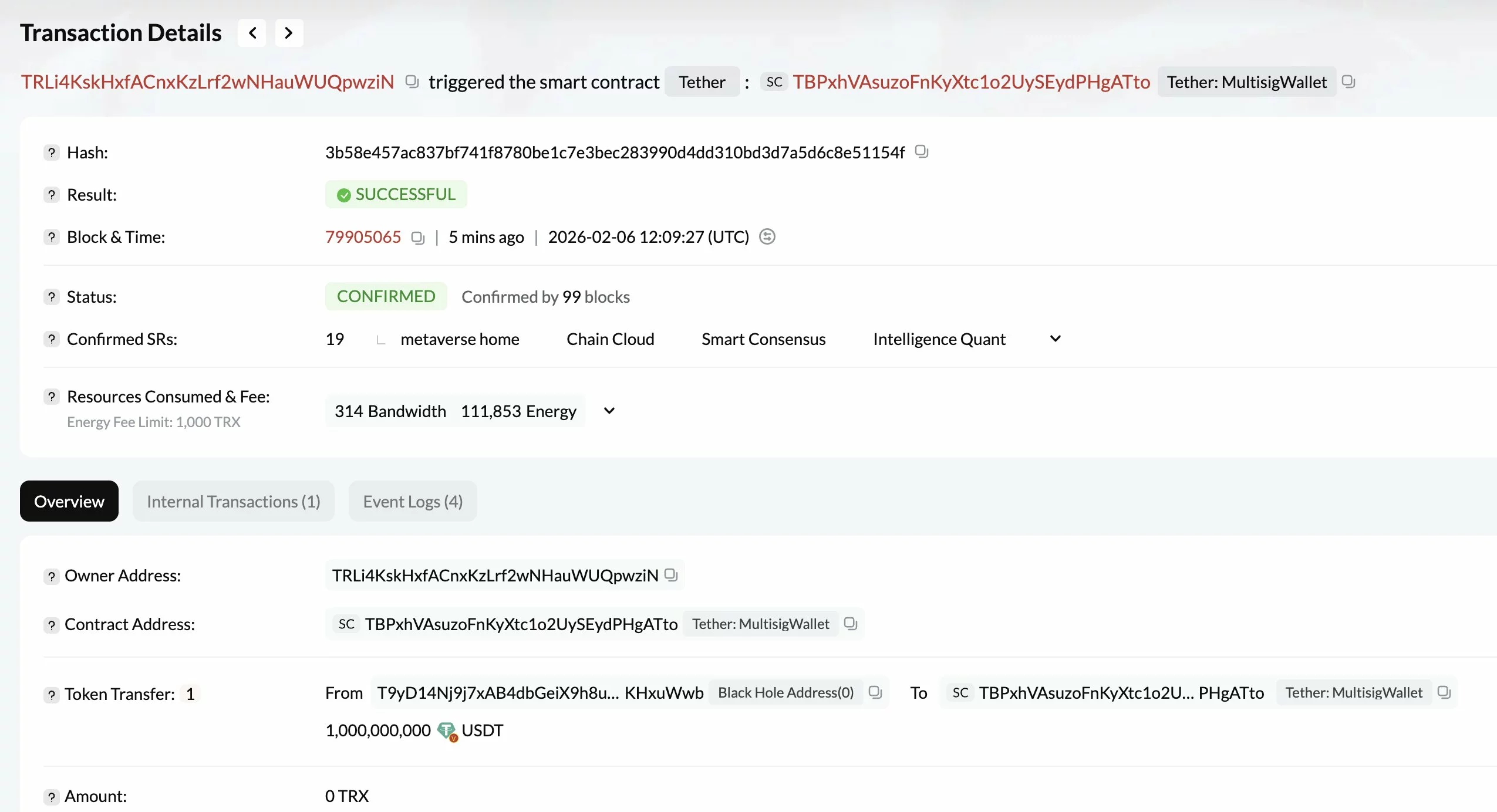

Tether mints $1B USDT as stablecoin issuance tops $4.7B in a week

Stablecoin issuer Tether has minted another $1 billion worth of USDT, adding to a sharp rise in stablecoin issuance over the past week, according to on-chain analytics firm Lookonchain.

Summary

- Tether minted $1B USDT, adding to roughly $4.75B in stablecoins issued by Tether and Circle over the past week, according to Lookonchain.

- Analysts caution the surge is a liquidity signal, not a buy signal, noting that rising stablecoin supply has also coincided with choppy or falling Bitcoin prices.

- Markets are watching deployment, redemptions, and velocity, alongside macro factors like ETF flows and derivatives funding, for confirmation of bullish momentum.

The latest mint brings total stablecoin issuance by Tether and Circle to roughly $4.75 billion in the past seven days, highlighting a rapid expansion in crypto market liquidity even as broader markets remain under pressure.

Lookonchain noted that the most recent USDT mint occurred on the Tron network, as Bitcoin (BTC) continued to trade around the $66,000 level.

Liquidity signal, not a buy signal

Crypto analyst Milk Road cautioned that while large stablecoin mints are often framed as “dry powder” for a market rebound, the signal is more nuanced.

According to Milk Road, roughly $3 billion in stablecoin issuance over just three days points to liquidity building within the market’s infrastructure rather than an immediate directional bet on prices.

Historically, rising stablecoin supply has preceded bull runs, but similar conditions have also occurred during choppy or declining Bitcoin markets.

“Stablecoin supply growth alone isn’t a directional indicator,” Milk Road said, describing it instead as a liquidity and readiness signal.

What markets are watching

Analysts say the key indicators to monitor are whether stablecoin issuance is accompanied by low redemptions, improving velocity, and deployment onto exchanges, alongside supportive macro conditions such as ETF inflows and favorable derivatives funding rates.

Absent those signals, rising stablecoin supply may simply reflect market participants positioning capital, rather than actively deploying it.

As Milk Road put it, the market may be “loading ammunition, not pulling the trigger.”

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech9 hours ago

Tech9 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 hour ago

Sports1 hour agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports19 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat15 hours ago

NewsBeat15 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 hours ago

NewsBeat3 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”