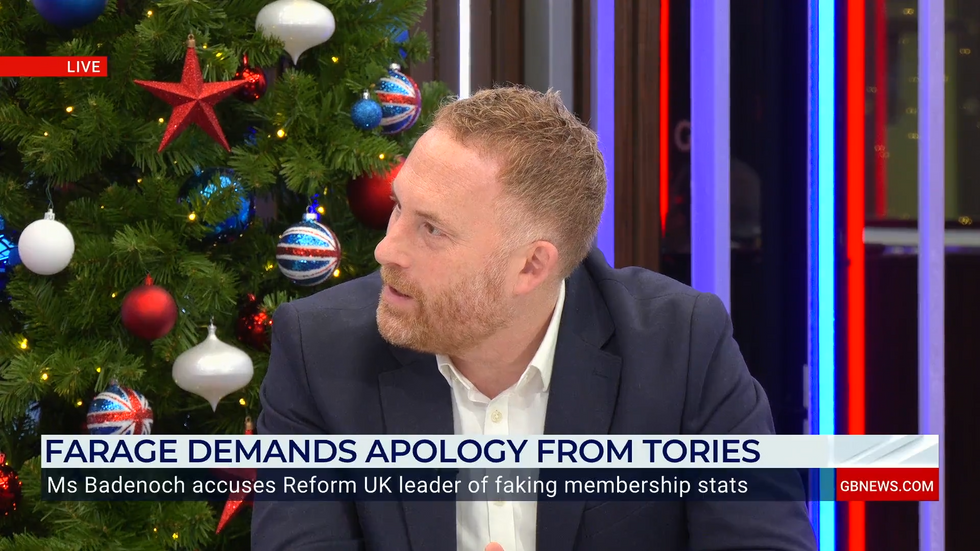

Political commentator Matthew Stadlen has warned that Reform UK is “rattling” both the Conservative Party and Labour as tensions escalate between Kemi Badenoch and Nigel Farage.

The row erupted on Boxing Day when Reform UK projected its membership figures onto Conservative Party headquarters in London, claiming to have surpassed the Tories’ 131,680 members.

The display included a message reading “Merry Christmas Kemi!” alongside Reform’s declaration of being “the formal opposition”.

Badenoch swiftly accused Farage of “manipulating” his supporters, claiming the counter was “coded to tick up automatically”.

Matthew Stadlen has warned that Reform UK is “rattling” both the Conservative Party and Labour

GB News

Speaking to GB News, Matthew Stadlen said: “If Kemi Badenoch has no evidence for her assertion, she shouldn’t have made it.

“But at the same time, we don’t want politicians to go around threatening potential legal action against each other.

LATEST DEVELOPMENTS

“That’s not how British democracy should work, in my view. This speaks to a much wider and much more interesting political question for the year ahead.

“How are things going to play out, not just between Labour and what opposition exists within Parliament, but also outside?

“How do the dynamics work between the Tories and Reform? Because there’s no doubt that Reform are rattling the Tories and they are to some extent rattling Labour.”

Journalist Duncan Barkes agreed: “I agree with some of what Matt said. Whilst the right of our political spectrum are squabbling amongst themselves, the Labour government are in a position to carry on trashing the economy.

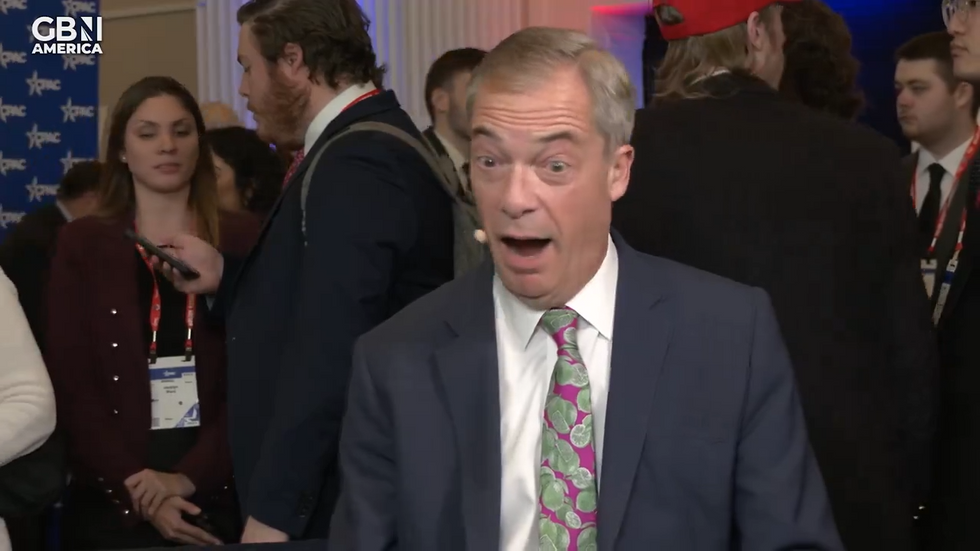

Nigel Farage has demanded an apology from Kemi Badenoch

GB NEWS

“They will continue to not to really be held to account and rewire our country as we know it whilst you have Badenoch and Farage squabbling over social media.

“However I would argue that actually, as far as opposition is concerned, it has been the likes of Rupert Lowe and Richard Tice and Farage and the others are actually the ones in parliament asking the questions.”

A Conservative Party source claimed Farage was “rattled” that his “publicity stunt is facing serious questions”.

Conservative leader Kemi Badenoch hit back KEMI BADENOCH

Conservative leader Kemi Badenoch hit back KEMI BADENOCH

Farage responded furiously to Badenoch’s accusations, demanding an immediate apology for what he called “disgraceful” allegations of fraud and dishonesty.

“I don’t mind all sorts of comments being made about me, but to be accused by her of being a fraudster, I’m sorry. I am not going to let this rest,” Farage told GB News presenters.

The Reform UK leader has opened up the party’s systems to several media outlets, including The Telegraph, Spectator, Sky News and the Financial Times, “in the interests of full transparency”.

+ There are no comments

Add yours