Entertainment

Kelly Osbourne’s Weight Loss Raises Health Concerns

Kelly Osbourne has made headlines for her dramatic weight loss after sharing a series of photos online that highlight her super-thin frame.

The reality TV star, who has previously denied using Ozempic or any other GLP-1 products, said last year that grieving her father Ozzy Osbourne‘s death is the reason for her slimmer figure.

Kelly Osbourne also recently opened up about how her family keeps the rocker’s memories alive, which includes them keeping “a seat at the table for him.”

Article continues below advertisement

Kelly Osbourne Sparks Fan Fears Over Her Hands And Small Frame

Several internet users have genuinely expressed concerns for Kelly Osbourne after her latest appearance at the Grammys, where she looked thin.

The 41-year-old TV personality joined a star-studded lineup for the award show and posted a picture of her hands resting on her small waist.

Article continues below advertisement

Article continues below advertisement

Fans were particularly concerned as her hands seemed larger than normal while almost entirely wrapped around her waist, with one suggesting she’s possibly dealing with an “eating disorder.” However, she has never disclosed any such condition.

A person claimed she looked ill on the red carpet, while someone else wrote, “Gaunt is not healthy, plus the thinness has aged her. She could be Sharon’s younger sister.”

Another bluntly asked, “What the hell is going on with her hands?”

Article continues below advertisement

The TV Personality Blasted Critics Of Her Weight Loss

The latest concerns about her weight loss come a few months after Kelly slammed people who make comments about her body transformation, hinting that losing her dad affected her on a physical level.

“To the people who keep thinking they’re being funny and mean by writing comments like ‘Are you ill,’ or ‘Get off Ozempic, you don’t look right.’ My dad just died, and I’m doing the best that I can, and the only thing I have to live for right now is my family,” the reality TV star said, per People Magazine.

She added, “And I choose to share my content with you and share the happy side of my life, not the miserable side of my life. So to all those people, f-ck off.”

Sharon, at the time, also supported her daughter, stating, “She’s right. She’s lost her daddy, she can’t eat right now.”

Article continues below advertisement

The TV Personality Denied Using Ozempic

Over the last couple of years, Kelly’s dramatic weight loss had become more pronounced. She previously credited her 85-pound drop to a 2018 gastric sleeve surgery, which removes a significant portion of the stomach and limits food intake.

After she became pregnant, she revealed that doctors warned that she was at risk of diabetes and must lose the post-pregnancy gains, which made her change her diet to one with low carbs and sugar.

“I was on a mission after having the baby to lose all my baby weight. And then I was like, well, I lost all the baby weight, let’s see how far I can go with it. [I] went a little bit too far but [I] stopped,” she said at the time.

Yet, she has not stopped facing backlash over what fans allege to be her use of Ozempic and other GLP-1 medications. However, she addressed the claims in 2024, denying she’d used it.

“I know everybody thinks I took Ozempic. I did not take Ozempic. I don’t know where that came from,” she said, per reports.

Article continues below advertisement

Kelly Osbourne Is Still Grieving Her Dad Ozzy’s Death

It’s been almost eight months since Kelly lost her rock legend father Ozzy Osbourne following his health struggles at the time.

Yet, she shared during her appearance at the Grammys that it hasn’t necessarily gotten easier for her, as she joined other stars to honor him in Sunday’s In Memoriam segment of the prestigious music event.

“You know, it’s just such a beautiful thing that his peers are showing their love and respect for his work tonight, and it’s going to be an emotional experience for us,” she said, referencing the award show’s celebration of Ozzy’s legacy, per People Magazine.

When asked how she had been faring since his death, Kelly initially said she was doing “okay” before going on to explain how difficult a time it had been for her and her family.

“I won’t lie,” she continued, “I won’t be one of those people that say I’m fine because I’m not. That’s the hardest thing I’ve ever been through in my life.”

“But I have my man, and I have my gorgeous baby, and my mom and my brother, and I so bonded. I didn’t think we could ever get more bonded, but we did,” Kelly added.

Article continues below advertisement

Kelly Osbourne Reveals Ways They Keep Her Father’s Memories Alive

Kelly went further to sing her late father’s praises before revealing how she and her family still keep his memories alive.

She described the Prince of Darkness as “one of the greatest men to ever live [on] the planet,” before expressing her profound gratitude for the honor they accorded him, saying it was a “beautiful thing.”

Weighing in on how she and her family keep him fresh in the memories, Kelly revealed they’ve adopted some strategies, including keeping “a seat at the table” for him.

“There’s so many things that we do that we always keep a seat at the table for him,” she said. “I light a candle every day. For him, I wear a locket. It’s under my dress, you can’t see it, but it has his picture in it, and my baby opens it every day and gives it a kiss and says hi to Papa.”

“And every time I see the clock at 11:11, I know that’s him talking to me,” Kelly added.

Entertainment

Austin Butler gears up to play disgraced cyclist Lance Armstrong in next biopic post-“Elvis”

:max_bytes(150000):strip_icc():format(jpeg)/austin-butler-lance-armstrong-020626-21a4f73f16764e9193cb0cad17ccbeee.jpg)

The movie will cover the life and career of the controversial cycling icon, who admitted to doping and was stripped of his seven Tour de France wins.

Entertainment

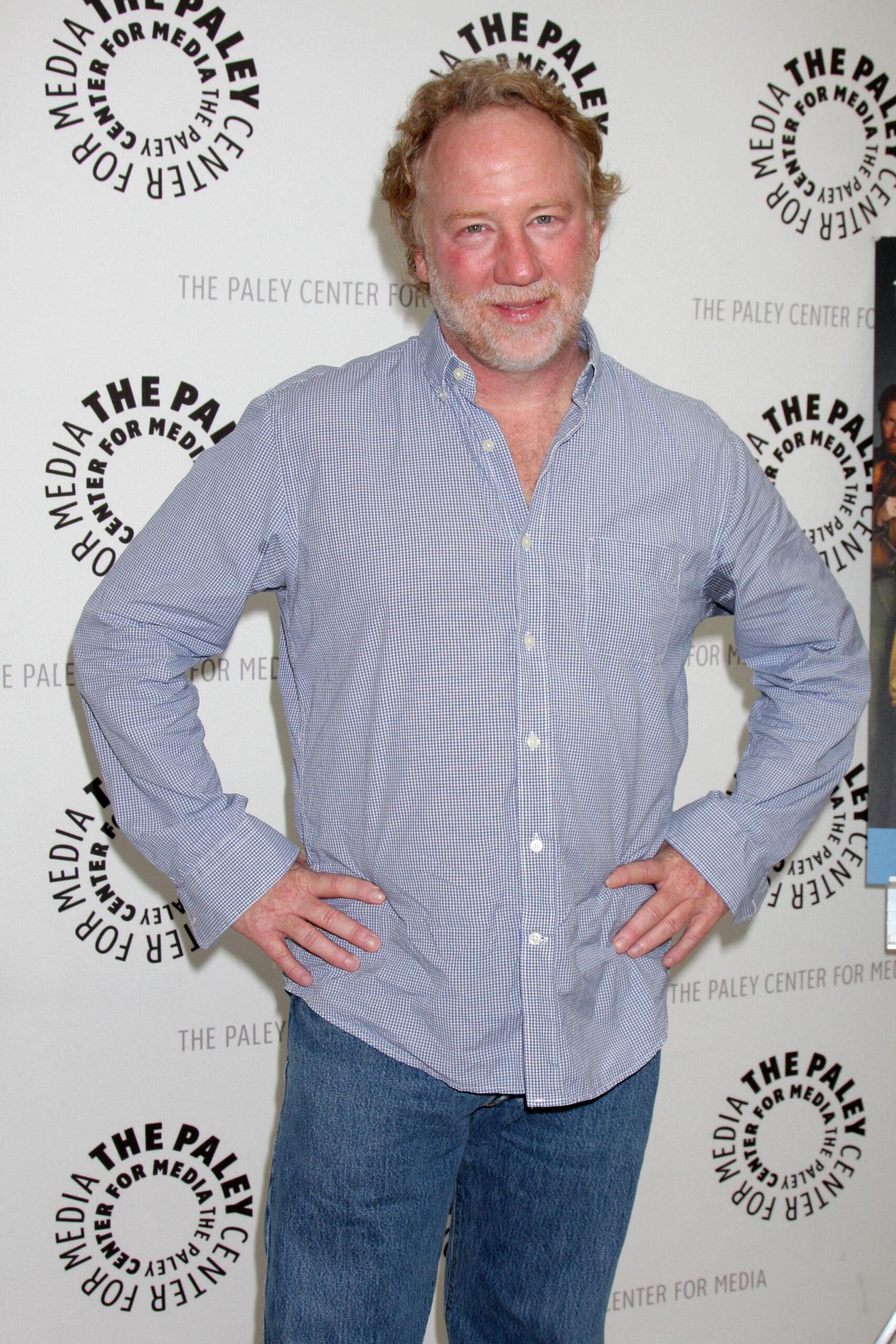

Timothy Busfield‘s Attorney Slams Indictment

Timothy Busfield is determined to “fight” the child sex abuse charges against him, as his attorney recently made clear after the actor-director was indicted by a New Mexico grand jury.

Weeks after he was granted release from jail pending trial, Busfield was officially indicted on Friday, February 6, stemming from charges that he had inappropriate contact with two minor boys on the set of Fox’s “The Cleaning Lady.”

Article continues below advertisement

Timothy Busfield’s Attorney Speaks On His Behalf Following Indictment

Speaking exclusively with Deadline, Timothy Busfield’s attorney, Larry Stein, said that although the “indictment was not unexpected,” he and his client intend to vigorously “fight” the charges against the “Thirtysomething” star.

“As the saying goes, a grand jury will indict a ham sandwich,” Stein began. “What is deeply concerning is that the District Attorney is choosing to proceed on a case that is fundamentally unsound and cannot be proven at trial.”

Article continues below advertisement

“The detention hearing exposed fatal weaknesses in the State’s evidence — gaps that no amount of charging decisions can cure,” he continued. “This prosecution appears driven by something other than the facts or the law. Mr. Busfield will fight these charges at every stage and looks forward to testing the State’s case in open court — where evidence matters — not behind closed doors.”

Article continues below advertisement

Busfield Was Formally Indicted Weeks After Jail Release

Per PEOPLE, Busfield was indicted by the Bernalillo County District Attorney Sam Bregman on four counts of criminal sexual contact of a child, which are all classified as third-degree felonies.

“As with all criminal proceedings, Mr. Busfield is presumed innocent unless and until proven guilty in a court of law,” Bregman said via statement following the indictment announcement. “This case will proceed through the judicial process and is expected to move forward to trial.”

“The Bernalillo County District Attorney’s Office remains committed to doing everything possible to protect children and ensure justice for victims across New Mexico,” the statement said, according to the outlet.

Article continues below advertisement

‘The West Wing’ Star Was Granted Release During His Pretrial Hearing

On Jan. 20, Judge David A. Murray decided to grant Timothy Busfield release from jail after hearing statements from both the defense and the prosecution.

The conditions of his release included the following: Being present for all upcoming court hearings, prohibited from having any “unsupervised contact with any minor children in this case,” with instructions to “not to have any contact with the alleged victims or their families, and you’re also not to discuss the case with any witnesses.”

Judge Murray also addressed the prosecution’s claims of past sexual assault allegations against Busfield that never resulted in any charges against him.

Article continues below advertisement

“There are no similar allegations involving children in his past. There’s no evidence of non-compliance with prior court orders. Rather, this defendant self-surrendered and submitted himself to this Court’s jurisdiction demonstrating compliance with the court order for his arrest,” the judge said.

Audio Released Could Work For The Defense In Busfield’s Case

In an audio obtained by TMZ, the two male minor victims in the case were interviewed by police in November 2024 and asked directly if they were inappropriately touched by Busfield.

In the audio, a police officer can be heard asking the boys a series of questions, including: “So, you know what is right and wrong, right? You know no one can touch your private areas?”

One of the boys replied to the officer, saying, “Yeah, but he doesn’t touch those parts.” The other young boy added, “No, he’s never touched me… never.”

These statements in the audio will prove to be crucial to the defense’s case, as they also believe they contradict more recent claims against Busfield as well.

Article continues below advertisement

Timothy Busfield’s Career Has Taken A Negative Hit

On February 4, Busfield’s career took another hit, joining a growing list of opportunities that have been stripped away. According to Deadline, his character on an upcoming episode of “Law and Order: Special Victims Unit,” will now be played by actor David Zayas.

Days after he turned himself in after a warrant for his arrest was issued, Busfield’s long-time talent agency Innovative Artists dropped him, per The Hollywood Reporter.

On Jan. 20, it was announced that he will be edited out of the upcoming Amazon MGM rom-com “You Deserve Each Other,” where he was cast as the father of Meghan Fahy, who stars alongside Penn Badgley, Deadline reported.

Additionally, NBC also decided not to air the Jan. 12 episode of “Law & Order: SVU” due to Busfield’s guest-starring role.

Entertainment

Why Guy Fieri defied doctor's orders for emergency surgery after scary fall: 'Tape me up'

:max_bytes(150000):strip_icc():format(jpeg)/guy-fieri-011426-1-a571e5519fa64301bc6f5329fb3a6bc8.jpg)

Fieri recounted the gruesome details of his harrowing leg injury in a new interview with EW.

Entertainment

MGK Pushes Back After Fan Requests Solo Rap Album

MGK isn’t interested in making a rap album just to prove a point, and he’s making that clear directly to fans. The conversation started when a fan took to X and shared what they hoped to hear from MGK’s next rap-focused project, writing, “what I want the most from kells with the rap album is for it to have no features on it. I want it to be solely himself showcasing his pure talent.” MGK, whose real name is Colson Baker but also goes by “kells” and “Machine Gun Kelly,” didn’t ignore the suggestion, but his response made it clear he’s prioritizing the music over expectations.

Article continues below advertisement

MGK Says He Has ‘Nothing To Prove’ As Fans Rally Behind His Creative Vision

“I will curate every song for the better of the song,” he replied. “So when I hear someone else’s voice on it in my head. I’m putting them on it. I have 0 interest in making a ‘I have something to prove, look how good I am at rapping’ album.”

Rather than sparking debate, MGK’s stance quickly earned support from his fanbase, many of whom praised his confidence and artistic clarity. “I absolutely have no doubt that kells will make the right creative decisions in his music!!!” one fan wrote. Another echoed that sentiment, adding, “Anything MGK brings out is dope he’s the goat no matter who on the track.”

Article continues below advertisement

Others pointed to MGK’s genre-crossing career as proof that collaboration is part of what makes him stand out. “And I think part of what makes you such a versatile artist is your ability to blend so well with so many other artists from so many different genres!” one supporter commented.

Article continues below advertisement

‘Lost Americana’ Includes Unexpected Megan Fox Songwriting Credit

The discussion comes on the heels of MGK’s most recent release, “Lost Americana.” Released on August 8, 2025, “Lost Americana” marked MGK’s seventh studio album and notably arrived with minimal guest appearances, only featuring Phem on “indigo.”

Aside from the limited features, fans couldn’t help but notice a track titled “Orpheus,” which is officially credited to co-writers Kelly and Megan Fox. The songwriting credit stands out, given the former couple’s breakup.

Article continues below advertisement

While their romantic relationship has ended, the two still co-parent their daughter, who will be turning one year old next month, and the shared credit suggests that creative ties between them haven’t been entirely severed. Kelly has long spoken about drawing inspiration from real-life relationships, and “Lost Americana” as a whole leans heavily into that.

Article continues below advertisement

MGK Gives A Vulnerable Look At Fatherhood And Regret On ‘Treading Water’

MGK also leans into raw vulnerability on one of “Lost Americana”’s most emotional tracks, “Treading Water,” where he appears to grapple with regret, loneliness, and the weight of personal mistakes.

On the song, Machine Gun Kelly predicts he will “die alone,” delivering some of the album’s most confessional lyrics. “This’ll be the last time you hear me say sorry / That’ll be the last tear you waste on me crying / I broke this home,” he sings, repeating the “broken home” line elsewhere in the track before adding, “I’ll change for our daughter, so she’s not alone.”

Confronting Deception And Fallout In Music

Later in the track, MGK references “pack[ing] up suitcases,” a line that takes on added meaning given his explanation of when and where the song was written. According to the artist, “Treading Water” was penned “in Room Three, spending Christmas in rehabilitation,” anchoring the track in a moment of isolation, reflection, and forced honesty.

Together, the lyrics come across as an honest confession, less about blame and more about accountability, growth, and moving ahead.

Article continues below advertisement

MGK Takes ‘Lost Americana’ On The Road As Fans Look Ahead To What’s Next

MGK is currently bringing “Lost Americana” to life on tour, having already hit several U.S. cities before the holidays. The tour is set to expand internationally next, with upcoming stops across Italy, Germany, Poland, and additional European destinations, before looping back to the United States for more shows.

As the tour continues and fans speculate about what’s next, especially when it comes to a future rap album, MGK continues to make it clear that the music comes first.

Entertainment

Lego BrickHeadz for fans of “Star Wars”, “Wicked”, and more double as fun builds and shelf-ready decor

:max_bytes(150000):strip_icc():format(jpeg)/ew-lego-brickheadz-sets-tout-5dbc7adf40854ba1b35fac9eb2909088.jpg)

Including a classic movie couple for Valentine’s Day.

Entertainment

Tory Lanez Sends Sis Money, Claressa Shields Weighs In

Whew! Tory Lanez might be sending cash, but Claressa Shields is making it clear that money and family don’t always mix. The 2x Olympic gold medalist and undefeated boxing champ is speaking her truth after longtime family struggles — and she’s not holding back, especially after GloRilla’s sister, Victoria Woods, called out her own sibling for allegedly skipping on family support.

RELATED: That’s How You Feel? GloRilla Claps Back At Family Neglect Claims As Her Sister Victoria Woods Doubles Down (WATCH)

GloRilla’s Sister Allegedly Gets Cash From Tory Lanez

Victoria “Scar Face” Woods took to her Facebook on Friday, February 6, and shared alleged screenshots showing that Tory Lanez sent her the $2,500 she had asked from her sister GloRilla to repair their relationship. In the caption, she wrote, “He didn’t want me to post this but ya boy heard about the situation all the way in jail Tory Lanez thank you,” alongside a screenshot of Tory’s Instagram message: “From Tory: if ur actually f****d up and really tripping about 2500.. I’l send it to u gang … I kno how it feels to not have shit while needing it .. I hope god blesses u.” He added, “Lmk,” making it clear he wanted to help while weighing in from afar — along with a $2500 Apple Pay transfer.

GloRilla’s Family Drama Seemingly Gets Called Out By Claressa Shields

Hours before this, on Facebook, Claressa went off in a post that’s part life lesson, part reality check. “I don’t care how rich I am, I don’t owe anybody nothing!” Shields wrote. “If I decide to help you, you better appreciate it!” She made it clear that financial support should be a choice, not a given — even if you’re family and “had it hard together.” According to Claressa, you can buy cars, houses, help with bills, or even pitch in for the kids, and some people still won’t respect or appreciate it. Her advice? If you want to be rich or famous, work for it.

Claressa has been open in the past about why she stopped helping her family, revealing that jealousy and resentment from her sister played a big role. Now, her latest statement lands right after GloRilla’s sister, Victoria Woods, publicly called out her own sibling for allegedly not sharing the wealth — and Claressa’s words hit like a jab straight to the heart of family entitlement debates.

Fans Weigh In On Claressa’s Family Money Take

Once the post hit, folks ran straight to The Shade Room IG comments to throw in their two cents. Some admitted this was the first time they actually agreed with Claressa, while others reminded everyone that nobody is entitled to anyone’s success or money. Of course, a few couldn’t help but clap back, saying if you struggled together, then you’re definitely eating together.

One Instagram user @socialnatrosha said, “The biggest betrayal comes from those who are close to you including family. 💯”

But, Instagram user @maleweezy._ commented, “Only people with pure hearts help people out.“

Meanwhile, Instagram user @naebbyy revealed, “Idc idc idc if I make it my family making it too 💯”

While Instagram user @thattattooedchickgoldz wrote, “Every 👏🏾 word 👏🏾 she 👏🏾 said 🎯”

And, Instagram user @ibe_mimi shared, “The more you do the more they hate you💯💯💯”

Finally, Instagram user @yellygangmakesnoise added, “D*mn. First time I agree with Clarissa“

So, What Prompted All Of This?

In a video circulating online, Victoria “Scar Face” Woods called out her sister GloRilla for allegedly skipping on household expenses while their mom still grinds at FedEx. Scar Face didn’t hold back, pointing out that GloRilla has 10 siblings she allegedly hasn’t helped financially, but somehow finds time to support friends — and even dragged that viral Jaguar gift to their dad, claiming it didn’t even have gas while the parents still need assistance.

She also shaded GloRilla for staying quiet about the ongoing family needs, leaving fans divided over whether fame should come with automatic family support. While GloRilla hasn’t directly responded to the claims, Scar Face’s allegations have the internet buzzing, with everyone debating what, if anything, stars actually owe their loved ones once they blow up.

RELATED: Still Her! Social Media Reacts After GloRilla Shares New Pics & Videos Amid Beef With Her Sister

What Do You Think Roomies?

Entertainment

New Photo Shows More Apparent Hand Piercings

North West is once again at the center of online discussion following her latest fashion statement. The 12-year-old daughter of Kim Kardashian and Ye, formerly known as Kanye West, shared a photo on Instagram showing several apparent piercings on her hands, prompting mixed reactions from fans and followers.

Related: Stuntin’ Like Her Daddy! North West Goes Viral After Dropping Snippet Of Beat She Produced (LISTEN)

North West Shares New Photo Featuring Multiple Hand Piercings

North first sparked public conversation about her piercings in November, when she debuted an apparent dermal piercing on her middle finger. In her latest post, North appears to have expanded her collection.

The photo showed her posing with her hands raised in front of her face, highlighting multiple silver piercings on her fingers, the backs of her hands, and her wrist. She also appeared with her signature blue hair — a look she has frequently worn in recent months.

While North did not include a caption with the image, the post quickly gained attention after fans reshared it across platforms.

Social Media Reacts

Social media users responded with a wide range of opinions. Some praised North’s appearance and confidence. Others expressed concern about her age and whether the apparent hand piercings are appropriate for a 12-year-old.

Instagram user @janayxo_ wrote, “She’s gorgeous and I love the alt baddie look BUT the piercings on the hands tewww much lol 😭”

Another Instagram user @simplydessii wrote, “🔥🔥 ts fire”

While Instagram user @realbabyym_ wrote, “I think it’s cute, she’s js too young for all that”

Instagram user @everybodyhatekrissy wrote, “it kind of eats. Very punk rock.”

Another Instagram user @kayoticbaeb wrote, “No I definitely think now Kim should have a moment where she says no cause North is still very much underage to be doing all this at just 12”

While Instagram user @seren.i.ty wrote, “I couldn’t even get my ears pierced till I was 16 😒”

Instagram user @_luljadaa_ wrote, “She’s cool 😍😂🔥”

Another Instagram user @thearlingtonskinspecialist wrote, “She’s going to be bored by the time she’s 18 lol”

While Instagram user @itgirlmiyoko wrote, “Let’s remind ourselves that this child is the daughter of Billionaires.. and proceed with minding our business 😭”

North Previously Responded To Criticism Over Piercings

North has not publicly addressed the reaction to her most recent post. However, she previously responded to criticism after debuting her first hand piercing in November. At the time, North posted a video using audio from Chrisean Rock that said, “Why are you crying? How old are you? Just pull it together!” She added the caption, “This is for everyone that’s mad over a finger piercing.”

Since then, North has continued to share her personal style on social media, often drawing public attention and discussion. Most recently, in January, Kim appeared on ‘Khloé in Wonderland’ and seemed to assert that North’s hand piercings were “fake.” At this time, it remains unclear whether all of them are “fake” or if some of them are only prosthetics.

As for the sentiments on North’s latest photo, neither North nor her parents has publicly reacted.

Related: North West Has The Internet Going Off Over Her Facial Expression In Holiday Photo With Ye & His Wife Bianca Censori

What Do You Think Roomies?

Entertainment

Obamas Seemingly Respond to Trump’s Racist Ape Video

Barack and Michelle Obama

Trump Goes Low With Ape Post… We Go Love!!!

Published

President Trump is posting racist videos taking shots at the Obamas on social media … and the Obamas are responding by posting loving videos about their relationship.

Barack and Michelle‘s Obama Foundation seemingly fired back at Trump with a super cute social media post looking back on their love story.

Waiting for your permission to load the Instagram Media.

The post comes on the heels of Trump posting a video on his social media platform depicting the Obamas as apes … which was met with swift blowback and condemnation on social media.

Under that heavy backlash, including from his own Republican colleagues, Trump ultimately deleted the racist post.

Barack and Michelle haven’t said anything to Trump — they rarely respond to his attacks — but the video posted by the foundation speaks volumes.

The account mostly posts about people besides Barack and Michelle … and they captioned this post, “Love is beautiful. ♥️”

Entertainment

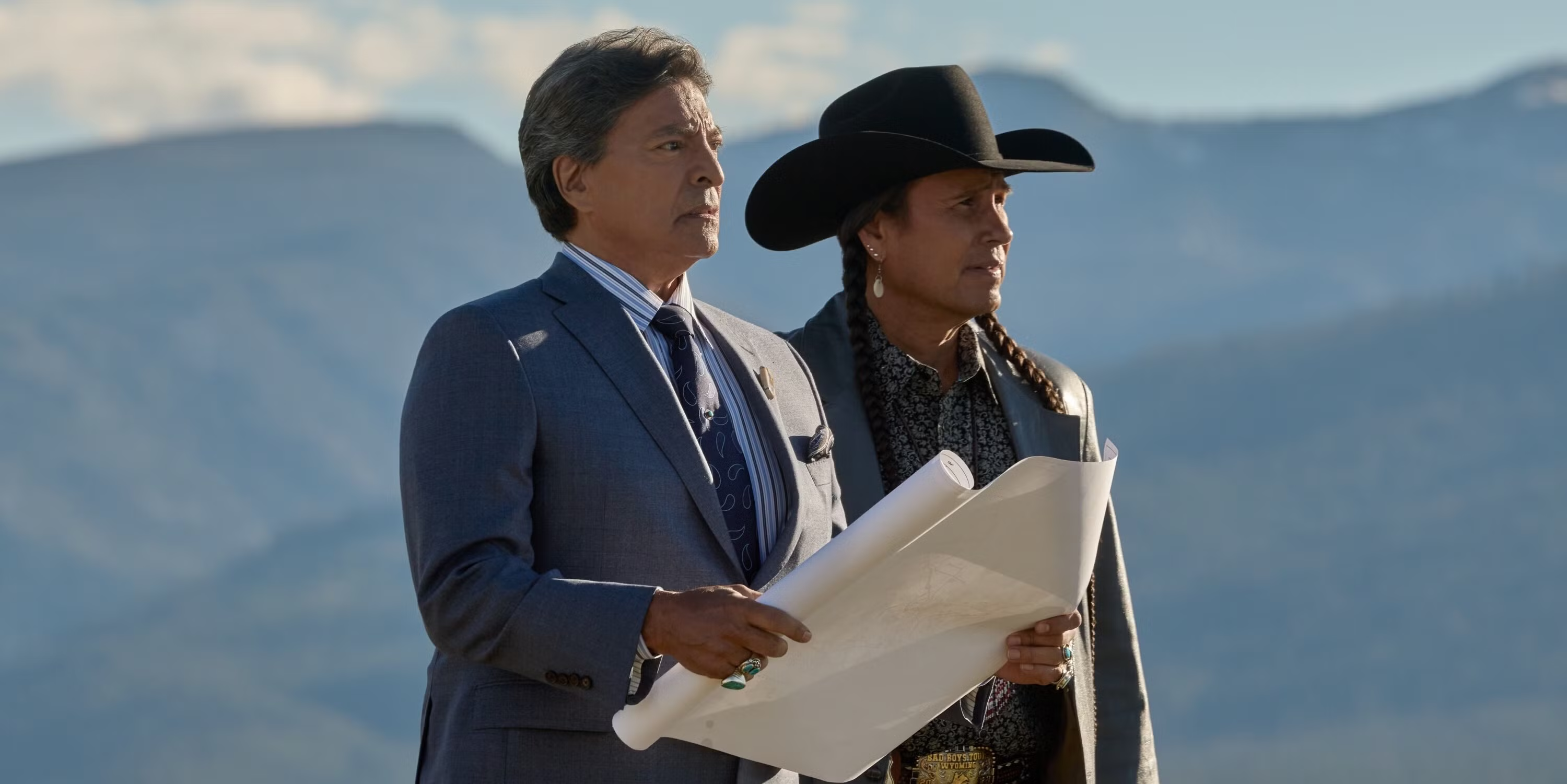

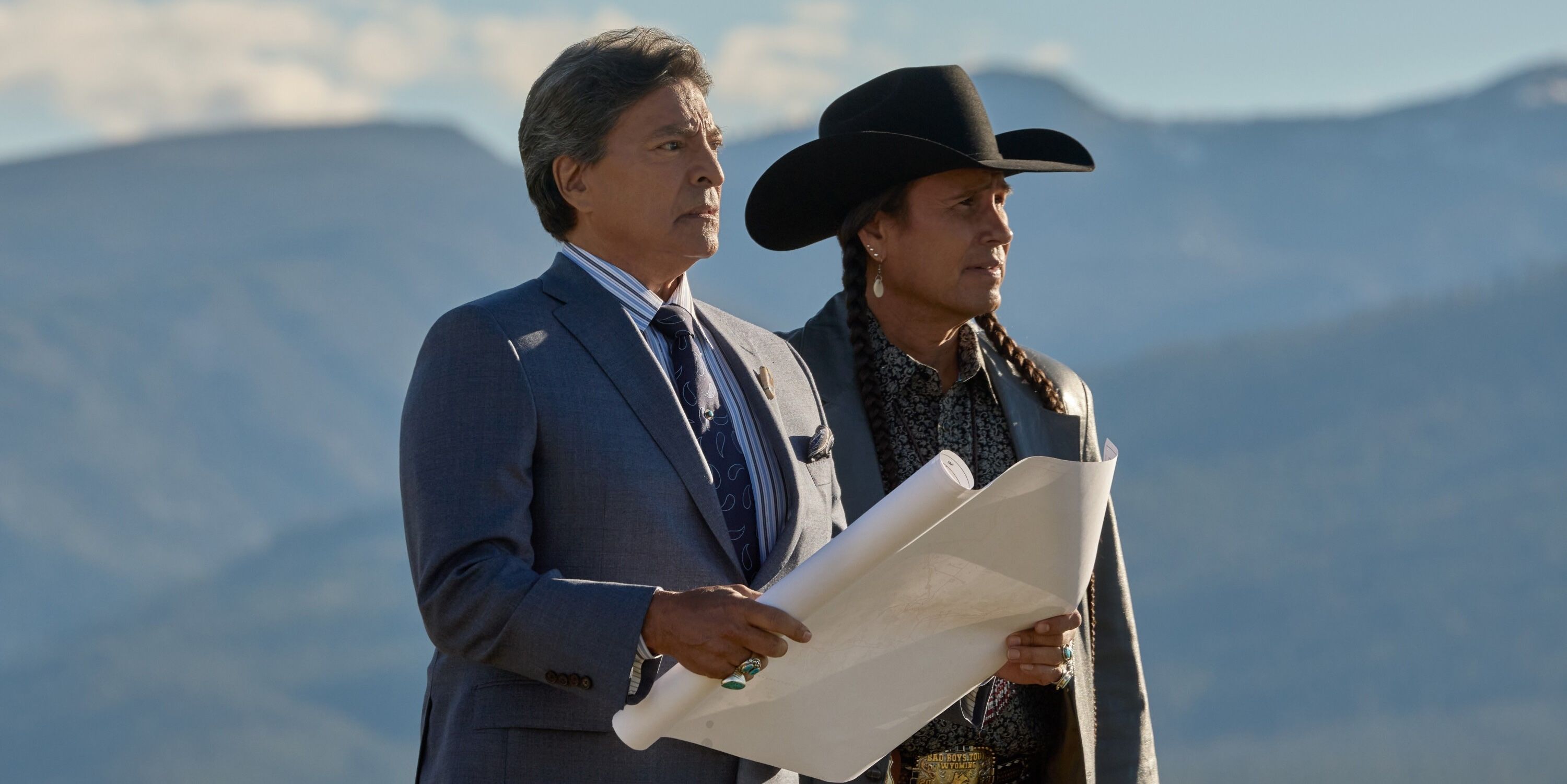

Taylor Sheridan’s New ‘Yellowstone’ Sequel Gets Season 2 Update Before It Even Premieres

The next chapter of the Yellowstone universe hasn’t even aired yet — and it’s already getting future-facing momentum. Taylor Sheridan’s first post-Yellowstone sequel, Marshals, has landed a notable Season 2 update just weeks ahead of its series debut.

Set to premiere Sunday, March 1 on CBS, Marshals picks up after the events of Yellowstone and follows Kayce Dutton as he steps into a new role with the U.S. Marshals, tackling high-risk missions across Montana. And while Season 1 hasn’t even rolled out its first episode, CBS is already preparing for what comes next.

According to a new report, the network is setting up a writers’ room for Season 2, expected to open soon. It’s not a formal renewal — but make no mistake, this is a strong signal of confidence. Networks don’t spin up writers’ rooms early unless they’re planning for longevity. Here’s the official logline:

“With the Yellowstone Ranch behind him, Dutton joins an elite unit of U.S. Marshals, combining his skills as a cowboy and Navy SEAL to bring range justice to Montana. Kayce and his teammates — Pete Calvin (Logan Marshall-Green), Belle Skinner (Arielle Kebbel), Andrea Cruz (Ash Santos) and Miles Kittle (Tatanka Means) – must balance the high psychological cost of serving as the last line of defense in the region’s war on violence with their duty to their families, which for Kayce includes his son Tate (Brecken Merrill) and his confidantes Mo (Mo Brings Plenty) and Thomas Rainwater (Gil Birmingham) from the Broken Rock reservation.”

What Can We Expect From ‘Marshals’?

Grimes had previously confirmed he thought he was one-and-done following Kayce’s Yellowstone ending, but said new showrunner Spencer Hudnut pitched an idea that finally convinced him. “It opens up a whole new world for him,” Grimes said, teasing a version of Kayce we haven’t seen before — one who’s grieving rather than trying to prove his own family loyalty.

“He has his dream life now, so now what does he do? I think we left him in a perfect place, and then the new showrunner, Spencer [Hudnut], called and he had an idea that was very, very good. And that was it. I was like, ‘Ok, that makes sense. We get to see him be a different Kayce than we’ve ever seen.’”

Produced by Taylor Sheridan alongside MTV Entertainment Studios and 101 Studios, Marshals premieres Sunday, March 1 at 8 p.m. on CBS, with streaming available on Paramount+.

Entertainment

Idris Elba’s 7-Part ‘Snowpiercer’-Style Thriller Is Dominating Streaming Charts

Two years after Snowpiercer wrapped its final run, streaming audiences have clearly been craving another high-stakes, trapped-in-transit thriller — and they’ve found it in Hijack. The Idris Elba-led drama is once again climbing streaming charts, proving that claustrophobic tension and real-time pressure still hit hard. Hijack recently returned for Season 2 on Apple TV, more than two years after its debut season ended.

Critically, the comeback hasn’t been smooth. Season 2 launched with a rough 20% score on Rotten Tomatoes, though that number has since climbed to 58% as more reviews rolled in. That’s a noticeable dip from Season 1’s impressive 90%, and it’s dragged the show’s overall critics’ score down to 74%. The audience score hasn’t landed yet — which could change the conversation — especially considering viewers rated Season 1 at a mixed 51%.

Elba stars as Sam Nelson, a high-powered corporate negotiator who keeps finding himself in very bad places at very bad times. In Season 1, Nelson was trapped aboard Kingdom Flight K29 when it was hijacked midair. Season 2 swaps the plane for a Berlin underground train, once again locking Nelson inside a moving metal tube with lives on the line. The big difference this time? There’s a creeping sense that Nelson may not have ended up here by accident.

Is ‘Hijack’ Worth Watching?

Collider’s review stated that Hijack was an effectively mounted but overstretched thriller that struggled to justify its limited-series format. Led by a reliably compelling Idris Elba, the real-time, skybound drama delivered early tension as a businessman attempted to negotiate his way through a terrorist hijacking using words rather than weapons. That grounded approach initially set the show apart from similar action thrillers, but the novelty wore thin as the episodes piled up.

While Hijack doesn’t need the luminous countdown clock that 24 had, it would have benefited from some sort of looming visual to make the series more immersive. Hijack could have been one of the more thrilling shows to come out this summer, but it’s simply stretching a simple premise far too thin. It lays out multiple subplots that make the story convoluted, and the episodes start to feel repetitive after a while. Elba does his best to carry the story, once again delivering some solid work, but it’s not enough to save this new miniseries from being seized by mediocrity.

Hijack Seasons 1 and 2 are streaming now on Apple TV.

- Release Date

-

2023 – 2024

- Network

-

Apple TV

- Directors

-

Mo Ali, Jim Field Smith

- Writers

-

Adam Gyngell, Catherine Moulton, Fred Fernandez Armesto, Anna-Maria Ssemuyaba, George Kay, Kam Odedra

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech12 hours ago

Tech12 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports4 hours ago

Sports4 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports22 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat18 hours ago

NewsBeat18 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat5 hours ago

NewsBeat5 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”