Crypto World

Aave Umbrella Launches to Automate Bad Debt Coverage and Boost Protocol Security

TLDR:

- Aave Umbrella automates bad debt coverage, reducing reliance on governance intervention.

- Users earn rewards by staking aTokens and GHO while actively securing the protocol.

- Deficit offset mechanisms limit slashing risk, safeguarding stakers during lending stress events.

- Transition from Safety Module ensures seamless integration for existing Aave stakers.

Aave Umbrella arrives as the Aave Protocol leads DeFi with over $50 billion in deposits, weathering recent market volatility. This includes $450 million in collateral liquidations across multiple networks in the past week.

Umbrella automates bad debt coverage and rewards staking participation, enhancing risk management precision and reducing governance delays in one of the largest decentralized lending ecosystems today.

Aave Umbrella Activation and Staking Mechanisms

Aave Umbrella is a modular system designed to manage bad debt in Aave v3 pools. It replaces the legacy Safety Module with automated coverage, relying on on-chain deficit data rather than governance intervention.

Activation begins with Ethereum, focusing on high-borrow-demand assets such as USDC, USDT, WETH, and GHO. Each deployment protects only the asset and network where it is staked, ensuring precise risk isolation.

Staking is central to Umbrella’s design. Users can stake aTokens, including aUSDC, aUSDT, and aWETH, or GHO, Aave’s native stablecoin. aToken stakers continue earning underlying yield while receiving additional Safety Incentives for participating in risk management.

GHO staking provides only Safety Incentives since it does not generate underlying yield. These rewards are claimable on-chain and vary depending on governance configuration.

The system uses a mathematically modeled Emission Curve to balance rewards. Maximum incentives are provided when total staking matches the target liquidity, with higher rewards below target to encourage participation and slightly reduced rewards above target to prevent over-staking.

This ensures predictable APY behavior, avoids extreme fluctuations, and incentivizes optimal engagement from the community.

Risk Management and Deficit Protection

Umbrella integrates slashing risk for stakers, limited to the specific asset and network they support. For example, staking aUSDC only covers USDC deficits.

The system includes first-loss offset mechanisms to protect participants. USDT staking, for instance, has a 100,000 USDT buffer, covering minor deficits before affecting staker assets.

These mechanisms drastically reduce the probability of slashing in typical scenarios. The protocol’s automated liquidation network complements Umbrella by actively managing distressed positions.

When liquidations cannot fully cover bad debt, staked assets in Umbrella are burned to offset deficits. This process eliminates manual intervention and governance delays, enhancing responsiveness and security.

During the first month of Aave v3.3, only $400 of deficits arose against nearly $9.5 billion in borrows, demonstrating Umbrella’s efficiency.

Umbrella allows broader participation in protocol security. Suppliers who are not borrowing can stake assets, actively contribute to risk management, and earn rewards.

Transition mechanisms from the legacy Safety Module ensure that stkAAVE, stkABPT, and stkGHO positions can migrate without immediate slashing risk. This creates an inclusive system where stakers align incentives with protocol health, ensuring long-term resiliency.

Crypto World

Cardano’s Next Support Levels as ADA Tumbles by Double Digits in a Week

“It will get worse, it will get redder,” Charles Hoskinson warned.

Cardano’s ADA plunged by double digits in the past seven days, in line with the bloodbath that covered the entire crypto market.

The question now is whether the price is headed for a further slump or a much-needed recovery.

What’s Next?

On Friday morning, ADA nosedived to around $0.22 (per CoinGecko’s data), the lowest level since June 2023. The renowned analyst Ali Martinez outlined three important support levels where the asset could find buyers if the sell-off continues. The first line is $0.249, the second is $0.115, and the third is the extreme case at $0.053.

As shown in the chart below, there was a brief breakdown below the $0.249 support level, but bulls regained some lost ground, and ADA currently trades at approximately $0.26.

Some industry participants expect further recovery and even a major rally in the future. X user CryptoPatel claimed that ADA is at the exact level that triggered a huge pump years ago, wondering if history is about to repeat. They set a short-term target at $0.40, followed by a “full cycle extension” to above $3. However, the analyst warned that a weekly close below $0.10 would invalidate the setup.

X user Sssebi chipped in, too, noting that ADA has never been this oversold on the weekly timeframe in its entire history. According to CryptoWaves, the Relative Strength Index (RSI) has fallen to around 28 on that scale, matching the lowest mark witnessed in 2019.

You may also like:

The technical analysis tool measures the speed and magnitude of recent price changes and can indeed help traders determine whether the asset is oversold or overbought. Ratios below 30 signal that the valuation has plunged too rapidly over a short period, suggesting it could be on the verge of a resurgence, while anything above 70 is considered a bearish zone.

ADA’s exchange netflow also hints that stabilization may be on the horizon. Data from CoinGlass shows that outflows have dominated inflows over the past several weeks and months, indicating that investors continue to move their holdings from centralized platforms to self-custody. This usually results in reduced selling pressure.

Hoskinson’s Crucial Losses

Cardano’s founder, Charles Hoskinson, reported losing over $3 billion due to the market decline. He predicted that the prices may continue plunging, but at the same time gave investors some inspirational guidance that may help them pass through the turbulent times:

“Don’t let the markets get you down. It will get worse, it will get redder, it is what it is. But at the end of the day, are you having fun? Find a way to. And know that each and every one of you in the cryptocurrency space, you are doing something that matters, you are doing something that has the potential to change the world.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Peter Brandt says Bitcoin a ‘hop, skip and jump’ from $42k

Veteran trader Peter Brandt said Bitcoin could be approaching a potential downside floor, arguing that past bear market patterns suggest losses may be limited from current levels.

Summary

- Veteran trader Peter Brandt said Bitcoin may be nearing a downside floor, pointing to past bear market cycles that suggest losses could be limited near the $42,000 level.

- Brandt referenced a long-term “banana peel” support zone on his chart, which has historically marked areas where Bitcoin’s deepest drawdowns struggled to extend further.

- The comments come amid a broader crypto market downturn, with Bitcoin and major altcoins under sustained selling pressure.

“If Bitcoin digs into the banana peel as deeply as in past bear market cycles, then the bulls should not need to suffer too far south of $42,000,” Brandt wrote on X. “We are a hop, skip and jump from there.”

Brandt accompanied the post with a long-term Bitcoin (BTC) chart showing price action relative to what he describes as a “banana peel” support zone, a curved lower boundary that has historically contained Bitcoin’s deepest drawdowns.

Brandt’s “banana peel” metaphor refers to the slippery downside zone, where price can slide quickly but has historically struggled to sustain deep breaks below it.

In the current cycle, that lower boundary sits near the $42,000 level, implying Bitcoin may be nearing a historically significant area of support.

Brandt flags Bitcoin ‘campaign selling’ in prior warning

Brandt’s latest post follows a separate tweet from the previous day, in which he said Bitcoin’s recent price action appeared to reflect “campaign selling” rather than retail-driven capitulation.

In that earlier post, Brandt pointed to a multi-day pattern of lower highs and lower lows, suggesting that large, coordinated sellers may be driving the decline. He added that similar patterns have appeared in past market cycles, though timing a bottom remains uncertain.

Together, the two tweets frame a cautious outlook: further downside may be possible, but historical behavior could limit how far prices fall.

The comments come as Bitcoin continues to slide alongside a broader crypto market downturn, with prices under pressure across major digital assets. Major altcoins have followed Bitcoin lower, amplifying losses across the sector.

Crypto World

Vietnam Draft Rules Propose 0.1% Tax on Crypto Transfers

Vietnam is preparing to introduce a tax framework for cryptocurrency transactions that would align digital assets with securities trading, according to a draft policy circulated by the Ministry of Finance.

Under the proposal, individuals transferring crypto assets through licensed service providers would face a 0.1% personal income tax on the value of each transaction, local outlet The Hanoi Times reported. The structure mirrors the levy currently applied to stock trades in the country.

According to the report, the draft circular, released for public consultation, classifies crypto transfers and trading as exempt from value-added tax. However, the turnover-based tax would apply to investors regardless of residency status whenever a transfer is executed.

Companies operating in Vietnam would be taxed differently. Institutional investors earning income from crypto transfers would be subject to a 20% corporate income tax, calculated on profits after deducting purchase costs and related expenses, per the report.

Related: No companies apply for Vietnam crypto pilot amid high barriers

Vietnam formally defines crypto assets

Authorities also reportedly provided a formal definition of crypto assets, describing them as digital assets that rely on cryptographic or similar technologies for issuance, storage and transfer verification.

The draft also outlines strict requirements for operators. Firms seeking to run a digital asset exchange would need at least 10 trillion Vietnamese dong (about $408 million) in charter capital, a threshold higher than that required for commercial banks and far above capital standards in many other industries. Foreign ownership would be permitted but capped at 49% of an exchange’s equity.

The proposed rules come as Vietnam began a five-year pilot program for a regulated crypto asset market launched in September 2025. On Oct. 6, 2025, Vietnam’s Ministry of Finance confirmed that no companies had applied to participate in the five-year crypto pilot at that time, citing high capital requirements and strict eligibility conditions.

Related: Vietnam central bank expects credit growth amid rapid crypto adoption

Vietnam opens licensing for crypto exchanges

Last month, Vietnam started accepting applications for licenses to operate digital asset trading platforms, marking the operational launch of its planned pilot program for a regulated crypto market.

“Applications for the aforementioned administrative procedures will be accepted beginning January 20, 2026,” the State Securities Commission of Vietnam (SSC) said, framing the move as part of a broader effort to bring crypto under formal regulatory oversight.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Top AI cryptos drop over 20% as Big Tech’s AI spending spree sparks concerns

Top AI-focused cryptos like TAO, NEAR, ICP, and RENDER faced losses surpassing 20% as investor demand in the sector fell amid concerns surrounding Big Tech’s growing bets on AI infrastructure.

Summary

- The combined market cap of all AI cryptocurrencies nosedived by over 40% on Friday.

- Concerns over massive AI-related spending by Big Tech companies have spooked investors.

According to data from CoinGecko, Bittensor (TAO), the largest AI-focused cryptocurrency with a market cap of $1.58 billion, fell 23% over the past 7 days, exchanging hands at $164 at press time. Near Protocol (NEAR) fell 25.4% while Internet Computer (ICP) and Render (RENDER) posted similar losses over the weekly period.

The entire AI crypto market has shown no signs of recovery or stabilization, recording over 42% losses in the past 24 hours alone as its total valuation fell to roughly $12 billion.

TAO and other top AI coins fell as investors remain concerned after reports from Big Tech giants like Alphabet and Amazon revealed a massive jump in AI investments for 2026, which could balloon up to $500 billion, according to recent estimates.

Investors fear that the astronomical costs of AI development will erode margins before monetization is realized, especially since recent earnings reports from these companies highlighted a significant gap between infrastructure spending and actual profit generation.

As these concerns grew louder across the broader financial markets, it triggered a sell-off in AI-linked software stocks such as Microsoft and AI chipmaking giants like AMD and Nvidia. Notably, Microsoft shares stood over 8% lower in the past five days, while chip-making giants AMD and Nvidia shares were down 18.5% and 10%, respectively, over the same period.

These chipmaking and software firms are the backbone of the hardware and processing power that is used to run the decentralized networks of most of the projects in the AI crypto space.

Notably, Bittensor relies on high-performance GPU clusters to facilitate its competitive machine learning model training, while Near Protocol is a highly scalable blockchain designed to support the intensive data demands of AI applications. Meanwhile, Internet Computer provides the sovereign cloud infrastructure required to host autonomous AI agents, and Render offers the decentralized computing power essential for complex graphical and AI rendering tasks.

Aside from the mounting anxiety over capital expenditures, AI tokens have also been weighed down by massive liquidations across the crypto market that came from Bitcoin’s dramatic plunge below multiple key support levels and a confluence of macroeconomic and geopolitical concerns that have driven risk-on sentiment away from speculative assets.

As previously reported by crypto.news, Bitcoin (BTC) price briefly fell by over 18% on Thursday as it touched nearly $60K levels, which triggered nearly $2.6 billion in liquidations across leveraged markets as market fear reached levels last seen during the collapse of the Terra blockchain nearly four years ago.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

BlackRock Bitcoin ETF Draws $231.6M Inflows After Turbulent BTC Week

BlackRock’s spot Bitcoin ETF attracted $231.6 million in inflows on Friday, signaling a tentative rebound after a week marked by pronounced volatility in cryptocurrency markets. The broader week featured outsized moves in Bitcoin-linked ETFs, with the iShares Bitcoin Trust ETF (IBIT) absorbing $548.7 million in net outflows on Wednesday and Thursday as sentiment sagged and Bitcoin briefly dipped toward $60,000, according to data cited by market observers. Preliminary figures from Farside indicate nine U.S.-based spot Bitcoin ETF products together drew $330.7 million in net inflows after a three-day stretch that saw $1.25 billion leave the sector. Bitcoin was hovering around $69,820 as the week closed, down roughly a quarter over the prior 30 days.

Key takeaways

- Friday’s inflows into BlackRock’s spot BTC ETF coincided with a bigger pullback earlier in the week, underscoring a split in the market between risk-off pressure and renewed interest in regulated Bitcoin exposure.

- Across nine U.S.-listed spot Bitcoin ETFs, inflows totaled $330.7 million after three days of heavy outflows totaling about $1.25 billion, signaling a potential shift in investor appetite or a pause in forced selling.

- The iShares Bitcoin Trust ETF (IBIT) faced a volatile week, including a 13% one-day drop on Friday—the second-worst daily decline since launch, with a 15% drop on May 8, 2024 representing the record worst day to date.

- IBIT’s price action on Friday showed a strong rebound, closing up about 9.92% on the session, as momentum in the underlying market remained volatile but constructive for some ETF holders.

- Bitcoin’s price path remains turbulent, with a 30-day decline of around 24.3% and broad price support appearing only in pockets of the market and among specific ETF inflows, rather than across the board.

Tickers mentioned: $BTC, $IBIT

Sentiment: Bearish

Price impact: Neutral. The week’s mixed inflows and outsized ETF moves did not yield a clear, sustained price direction for Bitcoin itself, though ETF prices reacted sharply in intraday moments.

Trading idea (Not Financial Advice): Hold. The data show episodic inflows and outsized volatility, suggesting the landscape remains uncertain and better suited to patience than aggressive positioning.

Market context: The week’s ETF flows illustrate how investors are evaluating regulated Bitcoin exposure as a risk-t sentiment remains sensitive to macro headlines, regulatory signals, and shifts in liquidity. Net inflows in a handful of products come as broader crypto liquidity and ETF participation continue to evolve, with flows often diverging from spot price moves.

Why it matters

The ebb and flow of ETF-based money into Bitcoin reflects more than mere trading appetite; it reveals how institutional participants are testing the waters of regulated exposure in a market that has historically traded in less centralized venues. The rebound in Friday inflows into BlackRock’s spot BTC product indicates that some investors view these listed vehicles as a credible bridge to the crypto ecosystem, offering transparency, daily liquidity, and the potential for on-exchange settlement that can align with traditional risk controls.

Yet the week’s broader narrative remains unsettled. IBIT’s swift 13% drop on Friday and its earlier record of a 15% single-day decline underscore how quickly sentiment can swing in the current regulatory environment and amid ongoing price volatility. The outflow pressures on Wednesday and Thursday, followed by the weekend’s rebound, suggest a tug-of-war: traders weighing the relative value of direct Bitcoin ownership versus regulated ETF access, while assessing the implications of liquidity and market structure on price formation.

Bitcoin itself traded near $69,820 at the time of publication, after a 30-day period marked by a roughly 24% decline. As broader market liquidity fluctuates, ETF inflows may provide temporary relief or a counterbalance to price moves driven by macro forces, miner dynamics, and persistent concerns around regulatory clarity. The data also highlight how ETF volumes can produce meaningful reflections of investor sentiment, even when spot prices remain volatile. In this context, the $10 billion daily volume record cited for IBIT on Thursday underscores that exchange-traded exposure remains a focal point for both professional and retail participants, even as price volatility persists.

On the back of Thursday’s activity, industry observers noted that the Bitcoin ETF space has not yet shown a consistent, durable upward momentum in price, even as inflows resume. ETF analyst James Seyffart pointed out that holders of Bitcoin ETFs have recorded notable paper losses since the U.S. market launched these products in January 2024, with losses around 42% when Bitcoin traded below the high-water marks of the year. Nevertheless, the latest inflows point to continued investor interest in regulated access, even as the broader price backdrop remains in flux.

What to watch next

- Monitor next week’s ETF-only inflow/outflow data to gauge whether the current rebound persists across the larger basket of spot BTC ETFs.

- Track Bitcoin’s price action in relation to key support and resistance levels to assess whether ETF flows translate into sustained price momentum.

- Watch regulatory developments and comments from market authorities that could influence the appetite for regulated Bitcoin exposure.

- Follow volume dynamics in the IBIT and other spot BTC ETFs as traders test liquidity and arbitrage opportunities in the current market environment.

- Assess new fund launches or product changes that broaden access to Bitcoin exposure through traditional market channels.

SOURCES & verification

- Farside data on net inflows across nine U.S.-based spot Bitcoin ETF products and the week’s aggregate outflows.

- Bloomberg ETF analyst Eric Balchunas’s notes on IBIT’s daily volume and price movements.

- CoinMarketCap price data for Bitcoin around the time of publication.

- Google Finance price data for IBIT and related ETF pricing behavior.

Crypto World

CZ lists a number of non-dollar stablecoins as Binance backs national currencies

CZ says Binance is working with governments to launch local-currency stablecoins, widening stablecoin options beyond dollar-pegged tokens.

Summary

- CZ says Binance is working with “more countries” on stablecoins pegged to national currencies via X post.

- Shift aims to move beyond USDT- and USDC-style dollar dominance toward a multi-fiat stablecoin landscape on-chain.

- Analysts say local stablecoins could reshape regulation and payments as banks, fintechs, and exchanges join these projects.

Binance founder Changpeng Zhao announced the cryptocurrency exchange is collaborating with multiple countries on issuing stablecoins pegged to local currencies, according to a post on the X platform.

Zhao stated the stablecoin ecosystem should not be limited to dollar-based products, writing that Binance is “working with more countries and supporting each country in issuing stablecoins pegged to their own national currency.”

The executive indicated support for multiple fiat stablecoins on blockchain networks, stating “each fiat currency should be represented on the chain,” according to the social media post.

The announcement comes amid intensifying regulatory debates in the stablecoin market, where US dollar-pegged stablecoins currently maintain dominant market positions. Dollar-based stablecoins have served as primary liquidity and transfer mechanisms in cryptocurrency markets in recent years.

Multiple nations have expressed interest in establishing digital asset infrastructure based on domestic currencies for payment systems and cross-border transfers, according to industry observers.

Cryptocurrency market analysts indicate the proliferation of local currency stablecoins could increase market diversity and influence regulatory approaches across different jurisdictions. Banks, financial technology companies, and major cryptocurrency exchanges are expected to play significant roles in this development.

The statement signals Binance’s intention to expand beyond global dollar stablecoins into projects bringing additional fiat currencies to blockchain platforms, according to Zhao’s announcement.

Crypto World

Marathon Digital moves $87m in BTC as crypto markets slide

Marathon Digital Holdings, one of the largest publicly traded Bitcoin mining companies, has recently executed a significant on-chain movement of Bitcoin worth roughly $87 million amid a broader sell-off in crypto markets.

Summary

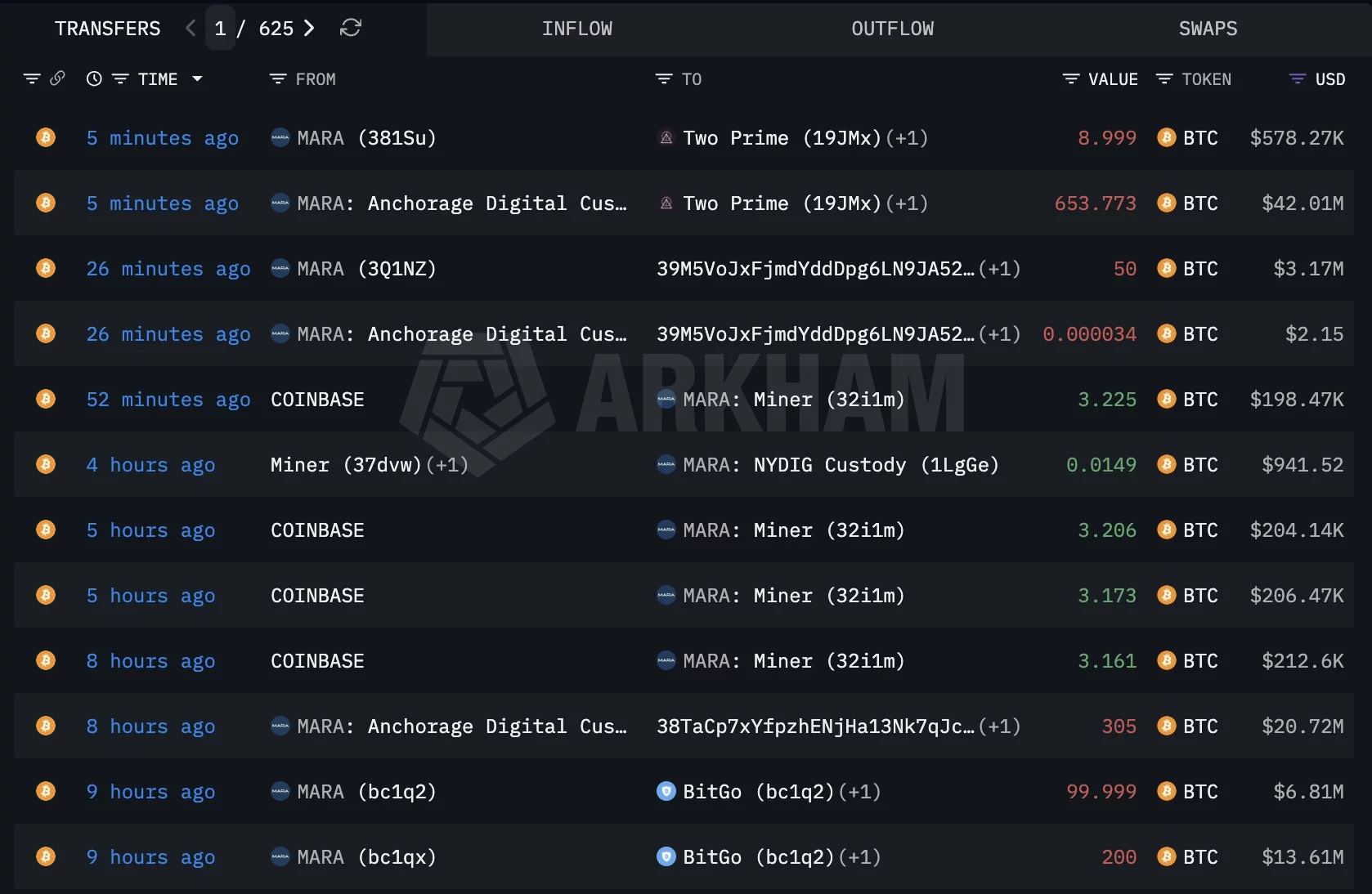

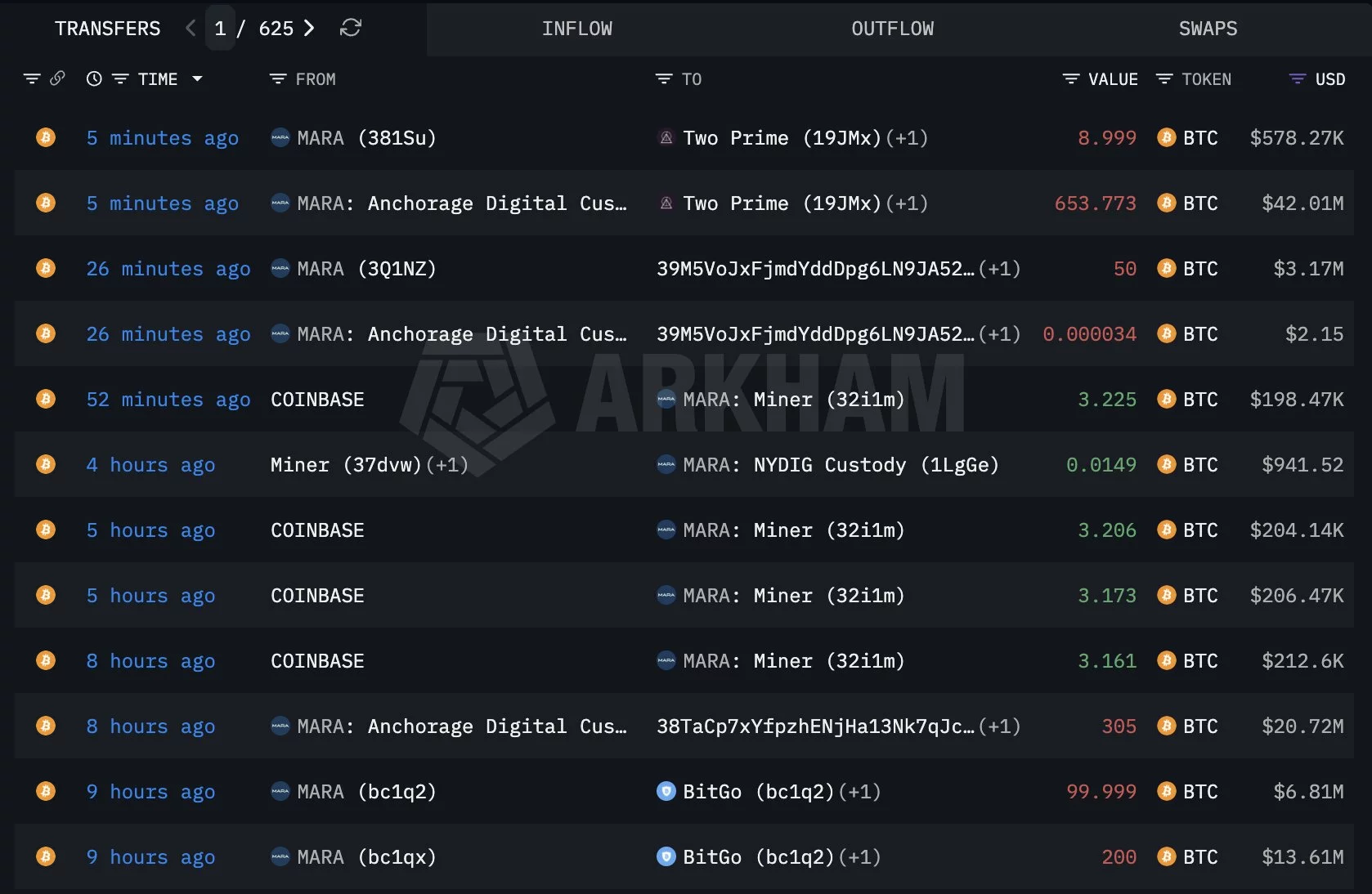

- Marathon Digital moved 1,318 BTC worth about $87 million over a 10-hour period, with funds sent to institutional counterparties, custodial wallets, and a newly created address, according to Arkham data.

- The transfers came amid a sharp pullback in Bitcoin prices, which briefly dipped toward $60,000, increasing pressure on bitcoin miners.

- The on-chain activity coincided with a nearly 19% drop in MARA shares in a single Nasdaq session, adding to investor unease across the mining sector.

The activity, captured by on-chain analytics firm Arkham, coincided with a sharp drop in Bitcoin’s (BTC) price and a steep decline in MARA’s stock.

Large BTC transfers spark market speculation

Over a roughly 10-hour period, Marathon Digital moved 1,318 BTC, valued at approximately $86.9 million at the time of transfer, from miner wallets to a mix of trading desks, custodial services, and other wallet addresses.

According to Arkham data, the largest transfer involved 653.773 BTC, worth about $42 million, sent to an address associated with institutional services provider Two Prime. Additional transfers included 200 BTC and 99.999 BTC to wallets linked to BitGo, totaling roughly $20.4 million.

Another 305 BTC, valued at about $20.7 million, was moved to a newly created wallet whose ownership remains unknown.

These on-chain moves drew attention because such large BTC movements during a market downturn are often interpreted as potential precursor actions to sales, hedging, or collateral posting.

The timing of the transfers came amid notable weakness in Bitcoin prices, which briefly dipped toward the $60,000 range before trading in the mid-$60,000s.

The on-chain activity also added to investor unease as Marathon Digital’s shares plunged. MARA stock fell nearly 19% in a single session on Nasdaq amid mounting pressure on bitcoin miners.

Though large transfers from miner wallets often trigger speculation, they don’t necessarily equate to immediate spot sales on exchanges. Institutional counterparties, lending arrangements, and collateralized trading strategies can all require BTC movements without marking direct liquidation.

Crypto World

Bitcoin investors face ‘harvest now, decrypt later’ quantum threat

IBIT’s heavy Bitcoin flows and rising institutional demand collide with growing “harvest now, decrypt later” fears and BMIC’s push for post-quantum wallet security.

Summary

- BlackRock’s iShares Bitcoin Trust now holds about 764,893 BTC, or roughly 3.64% of the eventual 21 million supply, intensifying focus on centralization and key management.

- Security researchers warn of “harvest now, decrypt later” attacks, where adversaries stockpile today’s encrypted blockchain data for future quantum decryption once ECC is broken.

- BMIC’s presale pitches a “Quantum Meta-Cloud” with ERC‑4337 smart accounts and signature‑hiding wallets that keep public keys off‑chain to mitigate future quantum attacks.

BlackRock’s iShares Bitcoin Trust recorded substantial daily trading volume, according to Nasdaq data, as digital asset security concerns related to quantum computing threats gain attention among institutional investors.

The trading volume spike occurred without a corresponding price decline, a pattern market analysts characterize as a transfer of holdings from retail investors to institutional buyers, according to industry observers. The development suggests Bitcoin’s evolving role in institutional portfolios as a macro hedge asset.

The concentration of digital asset wealth through centralized issuers has raised concerns about vulnerabilities in current cryptographic standards. Elliptic Curve Cryptography (ECC), the encryption method protecting most cryptocurrency assets, faces potential obsolescence with advances in quantum computing technology, according to cybersecurity experts.

Security researchers have identified a threat vector known as “harvest now, decrypt later,” in which encrypted data is collected for future decryption once quantum computing capabilities mature. Nation-state actors are reportedly employing this strategy, according to cybersecurity analysts.

BMIC, a blockchain security project, has positioned itself to address quantum computing threats to cryptocurrency holdings. The project has raised undisclosed funds during its presale phase, according to company announcements.

The protocol utilizes what the company describes as a “Quantum Meta-Cloud” and AI-enhanced threat detection systems designed to prevent public key exposure during transactions. Traditional cryptocurrency wallets reveal public keys when transactions are signed, creating potential vulnerabilities to future quantum algorithms, according to the project’s technical documentation.

BMIC’s architecture incorporates ERC-4337 Smart Accounts, a wallet standard that eliminates seed phrase requirements while implementing quantum-resistant cryptographic methods, according to the company. The platform offers quantum-secure staking options designed to generate yield without exposing private keys to network participants.

The project’s early funding stage has attracted capital from investors focused on blockchain infrastructure security, according to industry reports. Market observers note a growing focus on post-quantum cryptographic solutions as digital asset valuations increase.

Bitcoin’s market capitalization has reached approximately one trillion dollars, protected by cryptographic standards developed before quantum computing emerged as a practical threat. Protocols offering migration paths to post-quantum security standards may command market premiums as institutional adoption increases, according to blockchain analysts.

The cryptocurrency industry faces pressure to upgrade security infrastructure as quantum computing technology advances. Traditional encryption methods protecting blockchain assets may require replacement with quantum-resistant alternatives within the coming decade, according to estimates from technology researchers.

Cryptocurrency investments carry inherent risks, and presale investments involve additional uncertainties. Investors should conduct independent research before making investment decisions.

Crypto World

Bitcoin Core maintainers face shake-up as Gloria Zhao revokes PGP key

Bitcoin Core maintainer Gloria Zhao has revoked her signing PGP key and stepped down, ending a six-year run of mempool-focused work that reshaped transaction policy.

Summary

- Zhao confirmed on GitHub on Feb. 5 that she revoked her maintainer PGP key, formally ending her role signing Bitcoin Core releases.

- She became the first known woman Bitcoin Core maintainer in July 2022, when her key was added to the trusted-keys file alongside Pieter Wuille’s departure.

- Backed by Brink, the Human Rights Foundation and Spiral, she specialized in mempool policy, package relay (BIP 331), TRUC (BIP 431), RBF, and P2P improvements over more than six years of contributions.

Gloria Zhao has revoked her signing PGP key for Bitcoin Core, confirming her departure from the maintainer role, according to an announcement posted on her GitHub profile on February 5.

Bitcoin Core maintainers are responsible for reviewing and approving code updates and digitally signing official releases with cryptographic keys.

Zhao joined Brink, a non-profit organization supported by the Human Rights Foundation and Spiral, in January 2021. Her PGP key was added to Bitcoin Core’s trusted-keys file on July 7, 2022, making her a maintainer coinciding with Pieter Wuille’s departure. She was the first known woman in this role, appointed by community consensus, according to Bitcoin Core records.

Zhao specialized in mempool policy, transaction relay, and fee estimation. Her work included package relay (BIP 331), TRUC (BIP 431), RBF, and peer-to-peer protocol improvements designed to reduce inefficiencies and censorship vectors. She contributed hundreds of commits to Bitcoin Core, including pull request reviews and participation in the Bitcoin Core PR Review Club.

Zhao began contributing to Bitcoin Core in 2020. As of August 2025, she had made 837 contributions in the past year across Bitcoin/bitcoin and related repositories, according to GitHub data. In January 2025, Brink announced it was celebrating her four years of full-time work on Bitcoin Core.

Crypto World

Bitcoin traders face possible 70% drawdown with $38k target in play

An analyst warns Bitcoin could revisit ~$38k if past 70% drawdown patterns repeat, while others argue deeper institutional flows may cap the correction nearer 55%–60%.

Summary

- Analyst “Sherlock” maps past drawdowns of 93%, 86%, 84%, and 77% to project a roughly 70% drop this cycle, implying a Bitcoin bottom near $38,000.

- Critics on X counter that prior top‑to‑bottom moves versus bottom‑to‑top rallies suggest a shallower 55%–60% correction, arguing institutions could soften the downside.

- Sherlock replies that reflexivity can cut both ways, warning traders that trying to time a perfect bottom is risky as Bitcoin trades back to October 2024 levels.

Bitcoin (BTC) continued to trade under bearish pressure as analysts debate the potential depth of the current correction, with one market observer projecting the cryptocurrency could fall to $38,000 based on historical drawdown patterns.

Bitcoin could fall to the $38k range: analyst

The cryptocurrency has broken below key support levels and extended its decline as part of a corrective phase that began after Bitcoin reached its peak in October 2025, according to market data.

A crypto analyst known as Sherlock posted an analysis on social media platform X examining Bitcoin’s historical bear market drawdowns and their progression over time. The analysis noted that Bitcoin’s 2011 cycle experienced a drawdown of approximately 93% from peak to trough, representing the largest correction in the asset’s history to date.

Subsequent bear markets showed progressively smaller declines, according to the data cited. The 2015 cycle saw a drawdown of about 86%, followed by 84% in 2018 and approximately 77% during the 2022 bear market.

The analyst projected that if this pattern continues, the current cycle could see a drawdown of around 70% from the all-time high, which would place Bitcoin’s bottom near $38,000.

The projection generated significant engagement on X, with some market participants suggesting that increased institutional involvement and market reflexivity could limit downside risk. One response argued that when comparing prior bottom-to-top moves against top-to-bottom declines, the next drawdown should be closer to 55% or 60% rather than 70%.

Sherlock responded that reflexivity can amplify downside moves as well as rallies, cautioning traders against attempting to time purchases at specific bottom targets.

Bitcoin was trading at levels not seen since October 2024, according to data from CoinGecko. The cryptocurrency last traded around current price levels in October 2023, during the early stages of the previous bull market.

The asset has rebounded from an intraday low but remains under pressure as market participants assess whether the corrective phase has concluded.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech13 hours ago

Tech13 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports5 hours ago

Sports5 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports23 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat19 hours ago

NewsBeat19 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat6 hours ago

NewsBeat6 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”