Crypto World

What Crashed Bitcoin? 3 Theories Behind BTC’s 40% Price Dip in a Month

Bitcoin (BTC) experienced on of the biggest sell-offs over the past month, sliding more than 40% to reach a year-to-date low of $59,930 on Friday. It is now down over 50% from its October 2025 all-time high near $126,200.

Key takeaways:

-

Analysts are pointing to Hong Kong hedge funds and ETF-linked U.S. bank products as possible drivers of BTC’s crash.

-

Bitcoin could slip back below $60,000, putting the price closer to miners’ break-even levels.

Hong Kong hedge funds behind BTC dump?

One popular theory suggests that Bitcoin’s crash this past week may have originated in Asia, where some Hong Kong hedge funds were placing substantial, leveraged bets that BTC would continue to rise.

These funds used options linked to Bitcoin ETFs like BlackRock’s IBIT and paid for those bets by borrowing cheap Japanese yen, according to Parker White, COO and CIO of Nasdaq-listed DeFi Development Corp. (DFDV).

They swapped that yen into other currencies and invested in risky assets like crypto, hoping prices would rise.

This was the highest volume day on $IBIT, ever, by a factor of nearly 2x, trading $10.7B today. Additionally, roughly $900M in options premiums were traded today, also the highest ever for IBIT. Given these facts and the way $BTC and $SOL traded down in lockstep today (normally…

— Parker (@TheOtherParker_) February 6, 2026

When Bitcoin stopped going up, and yen borrowing costs increased, those leveraged bets quickly went bad. Lenders then demanded more cash, forcing the funds to sell Bitcoin and other assets quickly, which exacerbated the price drop.

Morgan Stanley caused Bitcoin selloff: Arthur Hayes

Another theory gaining traction comes from former BitMEX CEO Arthur Hayes.

He suggested that banks, including Morgan Stanley, may have been forced to sell Bitcoin (or related assets) to hedge their exposure in structured notes tied to spot Bitcoin ETFs, such as BlackRock’s IBIT.

These are complex financial products where banks offer clients bets on Bitcoin’s price performance (often with principal protection or barriers).

When Bitcoin falls sharply, breaching key levels like around $78,700 in one noted Morgan Stanley product, dealers must delta-hedge by selling underlying BTC or futures.

This creates “negative gamma,” meaning that as prices drop further, hedging sales accelerate, turning banks from liquidity providers into forced sellers and exacerbating the downturn.

Miners shifting from Bitcoin to AI

Less prominent but circulating is the theory that a so-called “mining exodus” may have also fueled the Bitcoin downtrend.

In a Saturday post on X, analyst Judge Gibson said that the growing AI data center demand is already forcing Bitcoin miners to pivot, which has led to a 10-40% drop in hash rate.

For instance, in December 2025, Bitcoin miner Riot Platforms announced its shift toward a broader data center strategy, while selling $161 million worth of BTC. Last week, another miner, IREN, announced its pivot to AI data centers.

Related: Crypto’s stress test hits balance sheets as Bitcoin, Ether collapse

Meanwhile, the Hash Ribbons indicator also flashed a warning: the 30-day hash-rate average has slipped below the 60-day, a negative inversion that historically signals acute miner income stress and raises the risk of capitulation.

As of Saturday, the estimated average electricity cost to mine a single Bitcoin was around $58,160, while the net production expenditure was approximately $72,700.

If Bitcoin drops back below $60,000, miners could start to experience real financial stress.

Long-term holders are also looking more cautious.

Data shows wallets holding 10 to 10,000 BTC now control their smallest share of supply in nine months, suggesting this group has been trimming exposure rather than accumulating.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BlockDAG’s $0.00025 Entry is the 2026 Opportunity DOGE and SHIB Can No Longer Offer

Crypto markets continue to shift as investors balance caution with the search for fresh opportunities. Established meme coins are offering mixed signals, with Dogecoin price today hovering near key levels after light gains, while volume remains soft. At the same time, the shiba inu price is moving sideways following recent volatility, keeping traders focused on whether consolidation will turn into a breakout or further decline.

Against this backdrop, BlockDAG is drawing stronger attention by offering access before public trading begins. Its final private round is live at a fixed price of $0.00025, with no vesting and full token delivery at launch. Early buyers also receive limited early trading access, a structure rarely available to retail participants. For investors tracking potential top crypto gainers, BlockDAG (BDAG) presents a clearer, earlier entry point than most market options today.

Dogecoin Price Today Shows Mixed Signals Near $0.11 Level

Dogecoin is showing mixed signals as the crypto market remains uncertain. Fear is still present, but selling pressure has slowed for now. The meme coin sector rose 3% in the last day, reaching a market value of $38.10 billion. Dogecoin gained about 2%, trading between $0.1058 and $0.11. Dogecoin price today sits near $0.1079, while daily trading volume fell sharply by over 43% to $1.26 billion. Recent data also shows $2.40 million in liquidations.

If weakness continues, Dogecoin price today could slip toward the $0.1068 support level, and deeper losses may push it below $0.1057. On the upside, a recovery could lift Dogecoin price today toward $0.1090 and possibly above $0.1102 if buying strength improves.

Shiba Inu Price Trades Sideways Amid Market Uncertainty

Shiba Inu starts February 2026 in a consolidation phase as traders closely watch price trends, on-chain data, and overall market sentiment. After strong volatility in recent months, price action has slowed, raising questions about whether a breakout or sideways movement will follow. Shiba Inu price is currently trading near $0.000006521, reflecting a 5.91% daily decline. The token holds a market cap of about $3.85 billion, while trading volume stands near $144.75 million.

Technical charts show downward pressure, with resistance around $0.00000702. Strong buying could push prices toward this level. However, if selling increases, support lies near $0.00000661, with further downside toward $0.00000600. Indicators show mixed signals, keeping the Shiba Inu price in focus for the coming weeks.

BlockDAG Final Private Round Goes Live at $0.00025

Most traders chase top crypto gainers after the move has already happened. The BlockDAG private sale flips that script by letting participants step in before price discovery even begins.

This final private round is live at $0.00025, locking in a launch valuation that public buyers won’t see again. With a projected launch price of $0.05, BDAG is positioned for a 200× upside, but only for those who secure allocation now. Once this round closes, the opportunity window shuts with it.

What makes this setup different is execution. There’s no vesting, no delayed claims, and no waiting periods. On launch day, your full allocation is delivered straight to your wallet. Clean. Simple. Immediate.

Then comes the edge most people never get: nine hours of early trading access before public markets open. That window exists for one reason: to let private sale participants position ahead of the initial volatility wave. While others rush in blind, you’re already active.

This isn’t a rolling sale or an evergreen offer. The final allocation is finite. When it fills, BDAG becomes fully distributed, forever. From that point on, exposure is limited to open-market buys at whatever price demand sets.

For anyone scanning the market for the top crypto gainers of the next cycle, this private sale isn’t about hype. It’s about timing, structure, and access, three things public markets never offer equally. The dashboard is open. Supply is moving. The clock isn’t slowing down.

BlockDAG Makes Its Case as a Future Top Crypto Gainer

As markets pause, the contrast between hesitation and opportunity is becoming clearer. Dogecoin price today and Shiba Inu price continue to reflect uncertainty, with both assets locked in tight ranges and waiting on a broader market push. For investors chasing momentum, patience is being tested.

BlockDAG, however, is operating on a different timeline. Its final private round at $0.00025 offers fixed pricing, instant ownership, and early trading access before the public rush begins. Once this window closes, entry shifts to open markets at unknown prices. For those scanning the horizon for the next wave of top crypto gainers, the choice is simple. Act early, or watch from the sidelines as demand takes over.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Robert Kiyosaki Faces Backlash Over Contradictory Bitcoin Buying Claims

The community was quick to pick up the inconsistency in his words, especially when it came down to BTC.

The author of the Rich Dad Poor Dad best-seller came under fire recently after making some interesting yet highly controversial comments about when he allegedly stopped buying certain assets, including BTC.

The question many community members asked was – Is he lying now, or has he been deceitful for a long time?

(When) Did Kiyosaki Lie?

The popular author and investment guru became a prominent BTC bull during the COVID crash and has frequently praised the asset. Moreover, he has been advising people to buy more BTC, as well as gold, silver, and he recently added ETH to his narrative.

What’s even more interesting is that he has made multiple posts on X indicating that he has bought more. Just a few examples include on July 1, 2025, when he literally said on X that he had “bought another bitcoin today.” At the time, the cryptocurrency traded between $105,000 and $110,000 – this is important for the story in this article.

Then, just a few weeks later, when BTC exploded above $117,000, he noted that he was “going to buy one more bitcoin asap.” Kiyosaki also explained in early 2026 that he ignores the prices of BTC and ETH and just keeps buying more.

Yet, in his most recent post on the matter, which caused significant backlash, he claimed that he stopped buying bitcoin at $6,000. Just for reference, the cryptocurrency hasn’t traded at such low levels since right after the COVID-19 crash in mid-2020. In fact, even with its recent crash to $60,000, that’s still 10x from the price he claimed.

Naturally, the ever-vigilant crypto community quickly picked up the inconsistency in his posts on X, and lashed out about being a liar – either now, or he has been lying for years.

You may also like:

More Lies?

Others went after different claims he has made throughout the years, mostly for major crashes and different investment advice he had given, many of which never materialized. Mark McGrath, for instance, brought up a chart with many of his comments and shot straight at Kiyosaki, claiming that he is “such a lying grifter.”

You’re such a lying grifter holy cow.

You’ve been pumping all 3 of these non stop daily for years and now you claim you were never buying?

How you didn’t win the financial charlatan of the year award, I’ll never understand pic.twitter.com/gv6D9mNLM4

— Mark McGrath (@MarkMcGrathCFP) February 6, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Jim Cramer ‘Heard’ Donald Trump Is Buying BTC at $60K to Fill US Bitcoin Reserve

Has the POTUS finally begun filling up the promised Bitcoin reserve? Jim Cramer claims so.

During the 2024 presidential election campaign, Donald Trump turned the tide for the cryptocurrency industry and became a vocal supporter, a significant shift from his previous stance.

He made multiple promises that the United States would become the crypto capital of the world and that his administration would do great things for Bitcoin and other assets. One of those promises got the community really excited as he said he wanted all remaining BTC to be mined in the US and claimed the country would establish a designated Bitcoin reserve.

The expectations were extremely high, which was among the reasons why BTC skyrocketed after he won the elections, and surged to consecutive all-time highs in 2025. However, a quick reality check a year after his inauguration shows there’s no such reserve, despite rumors that it would be a crypto stockpile including popular alts.

After a prolonged silent period with little to no movement on the matter, Jim Cramer just brought it up and made some serious claims.

In a recent CNBC appearance, he said he had “heard” that the president was going to fill up the Bitcoin reserve at $60,000. This became possible on Friday when the asset indeed plummeted to that level for the first time since before the presidential elections in late 2024.

There’s no proof for these claims at the time of this post. The only fund that is being filled with BTC is Binance’s SAFU initiative. The exchange has made a few consecutive BTC purchases, converting its SAFU fund from stablecoins to a Bitcoin-dominated fund.

Perfecting timing too. https://t.co/6vytzn5XGr

— CZ 🔶 BNB (@cz_binance) February 7, 2026

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Teeters Between CME Gaps and New Macro Lows: Analysis

Bitcoin failed to sustain a move above $69,000 as markets opened the weekend with caution, mirroring a broader hesitancy among traders about chasing new highs amid an uncertain macro backdrop. Fresh downside risk was baked into price action as BTC slipped more than $4,000 from the daily open, signaling that the rebound into the weekend may have been a relief rally rather than a durable trend reversal. Analysts point to resistance just below or at the old 2021 all-time high, around $69,000, which is seen as a formidable barrier. Meanwhile, two CME futures gaps loom on the horizon, offering potential magnets for price if demand accelerates again.

Key points:

-

Bitcoin faces a lack of acceptance above $69,000, while traders see new lows to come.

-

Analysis says that the rebound into the weekend was nothing more than a “relief rally.”

-

Two CME futures gaps provide potential targets for BTC price upside.

BTC price bottom “not in,” analysis warns

Data from TradingView showed BTC price action dropping more than $4,000 versus the daily open. With the old 2021 all-time high increasingly turning to resistance, cautious traders rejected the notion of a quick revival. The immediate takeaway among several market observers was that the weekend rally looked more like a relief bounce than a sustainable bottom formation.

“TLDR: The bottom for BTC is not in. My priority right now is capital preservation,” said Keith Alan, cofounder of trading resource Material Indicators, in a post on X the day before the latest price action. His warning captured a broader mood among traders who view the market as exposed to further downside risk before any durable upward momentum could reassert itself. A separate blockquote captured his sentiment: “If you’re thinking, ‘We’re so back,’ we’re not. There is literally no evidence of that yet.”

Alan also highlighted the significance of the 2021 peak around $69,000, describing it as an “important” level within what he characterized as an ongoing relief rally. He added that the recent move was “a gift yesterday,” but warned that lower prices may come before a renewed bull-market cycle could take hold.

Zooming out, market analyst Rekt Capital also argued that the most pronounced downside pressure may still be ahead. In a post on X, he likened BTC/USD’s behavior to the late-2022 bear market, suggesting that a recurring historical pattern—where a fourth consecutive cycle echoes a familiar base formation—points to further weakness before a potential bottom is established. “This is the 4th consecutive cycle that this historical tendency has continued. And history suggests there’s more downside to come,” he wrote, underscoring the stubborn risk that BTC could test lower support before a broader recovery materializes.

Bitcoin bulls bet on CME gap fills

Saturday’s retracement, meanwhile, left a new potential “gap” in CME Group’s Bitcoin futures market. This development has kept a subset of traders focused on classic short-term price magnets, with the market watching two CME gaps that could act as catalysts if prices rally in the near term.

Related: Bitcoin beats FTX, COVID-19 crash with record dive below 200-day trend line

A short-term magnet narrative has re-emerged, centered on a gap near $84,000 and a separate level that could pull prices higher if demand re-emerges. Traders argued that such gaps often attract price action as liquidity cycles through the market, even if the longer-term trend remains uncertain. The chatter around CME gaps aligns with a broader view that a relief rally could redraw price trajectories in the near term, though it is not a guarantee of a lasting bounce.

Will we see this #Bitcoin CME Gap filled next week?

$84,215 🎯 pic.twitter.com/ZHaKynuR3F

— Elja (@Eljaboom) February 7, 2026

In parallel, traders like Michaël van de Poppe, a veteran analyst and founder of various crypto ventures, voiced a more constructive near-term view. He forecast a continuation pattern where a correction gives way to a move toward the CME gap and beyond, suggesting that the next week could carry BTC toward the $75,000-and-higher zone if momentum reasserts. “Today: correction day. Tomorrow: back up again towards the CME gap. Next week: continuation to $75k+,” he wrote in a post on X, signaling that the possibility of a rebound is not dismissed by some observers.

Notably, Samson Mow, CEO of Bitcoin-adoption firm JAN3, framed the event as a test of whether large-scale corporate buyers will step in to buy BTC at the new price levels. He described the higher CME gap as one of two questions every financial analyst should be asking: whether institutional demand can absorb the selling pressure given the 15-month low in BTC prices, and whether corporate treasury activity will pick up as prices drift lower. “I believe the answers are not for long and very soon,” he concluded in a post on X, signaling that the near term could reveal significant shifts in demand just as price action wobbles around key levels.

//platform.twitter.com/widgets.js

Why it matters

The present price action matters because it tests the resilience of BTC’s uptrend hypothesis at a time when macro uncertainties linger. A failure to sustain moves beyond critical resistance around $69,000 reinforces the notion that the market is wrestling with a structural pivot rather than a short-lived surge. The CME gaps add a practical, price-target dimension to the debate: if price finds buyers near those gaps, it could spur a corrective rally that lasts into the following week; if not, the risk-off mood may extend and push BTC toward the lower end of recent ranges.

Moreover, the discourse around corporate treasury demand—an ongoing theme in crypto markets—could shape the supply/demand balance in the months ahead. If large buyers re-enter at these levels, they could provide a floor that mitigates downside risk and sets the stage for a broader recovery. Conversely, persistent macro weak spots or a fresh risk-off impulse could keep BTC mired in a corrective phase, testing support levels that traders have watched since late 2025.

Taken together, the footage from trading desks shows a market that remains finely poised between a cautious, risk-averse stance and a renewed appetite for risk-taking when specific technical benchmarks align with liquidity drivers. The result is a price story that is less about a single breakout and more about the tug of war between macro-impacted liquidity and market structure signals like CME gaps and key resistance levels.

What to watch next

- Watch how BTC trades around the CME gap near $84,000 in the coming days and whether price action tests that area again.

- Monitor whether buyers reappear near the mid-to-upper $70k region, potentially signaling a shift in the short-term trend.

- Look for any signs of renewed institutional or corporate BTC treasury activity as prices approach critical levels.

- Assess macro cues and liquidity conditions, since they likely will continue shaping volatility and the pace of any potential relief rallies.

Sources & verification

- TradingView BTCUSD price data referenced in the price action discussion.

- Comments from Keith Alan (Material Indicators) on BTC’s bottom and capital preservation, shared on X.

- Analysis from Rekt Capital regarding cycle patterns and potential downside in BTC/USD.

- Forecasts from Michaël van de Poppe on CME gaps and near-term targets.

- Remarks from Samson Mow on corporate BTC treasury activity and near-term demand dynamics.

What the market is watching next

The coming days will be telling for BTC’s near-term orientation. If the price can reclaim and sustain a move above the $75,000–$80,000 range and, more broadly, approach the CME gap around $84,000, bulls may gain a foothold that could catalyze a more substantive rebound. Conversely, if selling pressure intensifies and price breaks back toward the mid-$60,000s, the market could extend the current corrective phase while traders reassess whether a longer bear-market cycle has run its course. As always, liquidity, macro risk sentiment, and institutional participation will remain the key variables shaping outcomes in the weeks ahead.

Crypto World

Bitcoin ETFs See $331M Inflows as BTC Recovers Above $70K

Bitcoin ETFs recorded $330.67 million in net inflows on February 6, ending a three-day outflow streak that drained $1.25 billion from products.

Summary

- Bitcoin ETFs recorded $330.7M in inflows on Feb. 6, ending a $1.25B outflow streak.

- BlackRock’s IBIT led with $231.6M as BTC rallied 6.6% above $70,000.

- Ethereum ETFs diverged with $21.4M in outflows, led by BlackRock’s ETHA.

BlackRock’s IBIT led with $231.62 million in inflows. At the same time, Ark & 21Shares’ ARKB has brought in $43.25 million and Bitwise’s BITB posted $28.70 million in inflows.

The reversal came as Bitcoin (BTC) price climbed 6.6% over 24 hours and quickly fell to the $67,000 level.

Total net assets under management rose to approximately $105 billion from $80.76 billion on February 5, while cumulative total net inflow reached $54.65 billion. VanEck’s HODL and Fidelity’s FBTC showed no updated data for the trading session.

February 2-5 posted $1.25B in Bitcoin ETFs redemption

The three-day selling wave began February 3 with $272.02 million in outflows, followed by the streak’s largest single-day withdrawal of $544.94 million on February 4.

February 5 recorded $434.15 million in Bitcoin ETFs redemptions before buying pressure resumed.

February 2 briefly interrupted the selling with $561.89 million in inflows, but failed to establish sustained surge.

Total net assets fell from $100.38 billion on February 2 to a low of $80.76 billion on February 5 before recovering with February 6’s inflows.

Grayscale’s mini BTC trust attracted $20.13 million while the primary GBTC product recorded zero flows. Invesco’s BTCO posted $6.97 million in inflows. Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero activity.

BlackRock’s IBIT maintains $61.84 billion in cumulative net inflows. Grayscale’s GBTC holds -$25.88 billion in net outflows since converting from a trust structure.

Fidelity’s FBTC has accumulated approximately $11.08 billion in cumulative inflows based on available data.

Ethereum posts $21 million in outflows as BlackRock withdraws

Ethereum spot ETFs recorded $21.37 million in net outflows on February 6 despite Bitcoin’s reversal to positive flows.

BlackRock’s ETHA accounted for $45.44 million in redemptions, offsetting positive flows from four other products.

Bitwise’s ETHW led Ethereum inflows with $11.80 million, followed by Grayscale’s mini ETH trust at $6.80 million, VanEck’s ETHV at $3.01 million, and Invesco’s QETH at $2.45 million. Grayscale’s ETHE, Franklin’s EZET, and 21Shares’ TETH recorded zero flows.

Total net assets for Ethereum products fell to $10.90 billion from $13.69 billion on February 2. Cumulative total net inflow dropped to $11.80 billion.

Ethereum has posted outflows in three of the past four trading days, with February 4 and 5 recording $79.48 million and $80.79 million in withdrawals respectively.

February 3 provided brief relief with $14.06 million in inflows before redemptions resumed.

Crypto World

Is the U.S. Economy Heading Into a Recession? Multiple Indicators Signal Growing Risk N

TLDR:

- January 2026 recorded 108,435 layoffs, the highest January figure since the 2009 recession period.

- Job openings plummeted to 6.54 million while hiring plans hit record lows at just 5,306 in January.

- Housing market shows 47% more sellers than buyers, creating 630,000 excess sellers—a record imbalance.

- Corporate credit stress affects 14-15% of bond segments as inflation trends below 1%, risking deflation.

The U.S. economy faces mounting questions about a potential recession as critical economic indicators deteriorate across multiple sectors.

January 2026 witnessed 108,435 announced layoffs, the highest January figure since the 2009 recession, raising alarm bells about economic health.

Labor market weakness, housing imbalances, and credit stress are converging in patterns that historically precede economic contractions, prompting analysts to assess whether the nation is approaching a downturn.

Labor Market Collapse Points Toward Economic Slowdown

The labor market is delivering the strongest early warning signals of potential recession, with job data weakening at an alarming rate.

According to Bull Theory, a market analysis platform, the situation is particularly concerning because “jobs usually weaken before the economy officially slows.”

Weekly jobless claims jumped to 231,000, exceeding expectations and indicating more workers are filing for unemployment benefits.

This acceleration in layoffs suggests companies are not conducting normal seasonal restructuring but preparing for significantly weaker growth ahead.

Bull Theory emphasized that January’s layoff numbers represent something more serious, noting “that is not normal seasonal restructuring” but rather “companies preparing for weaker growth ahead.”

Job openings have fallen sharply to approximately 6.54 million according to JOLTS data, marking the lowest level since 2020.

When job openings decline while layoffs simultaneously increase, displaced workers face fewer opportunities for reemployment.

Hiring has effectively collapsed, with companies announcing just 5,306 hiring plans in January, the lowest level ever recorded for that month. Businesses are freezing expansion rather than growing their workforce, a clear sign of anticipated economic weakness.

Housing and Bond Markets Flash Recession Warnings

The housing market is displaying critical recession indicators through unprecedented imbalances between supply and demand.

Approximately 47% more sellers than buyers currently exist, equal to roughly 630,000 excess sellers representing the widest gap ever recorded.

Bull Theory analyzed this phenomenon, explaining that “when sellers heavily outnumber buyers, it means people want liquidity” as they prefer “cash instead of holding property risk.”

Housing slowdowns create cascading effects throughout the broader economy, impacting construction, lending, materials, and employment sectors simultaneously.

When real estate transactions freeze, the economic slowdown broadens beyond housing into adjacent industries. Consumer confidence surveys are already showing multi-year lows as job uncertainty spreads, leading households to reduce spending on homes, cars, travel, and discretionary purchases.

The Treasury yield curve is bear steepening again, with long-term yields rising faster than short-term rates near four-year highs.

Investors are demanding higher returns to hold long-term U.S. debt, reflecting concerns the analysis identifies as worries about “fiscal deficits, debt levels, and long-term growth outlook.”

Historically, yield curve shifts of this nature have preceded recessions multiple times, making the current trend particularly concerning for economic forecasters.

Credit Stress and Deflation Risks Intensify Recession Probability

Corporate credit markets are showing dangerous stress levels, with approximately 14% to 15% of certain bond segments either distressed or facing high default risk.

When companies encounter debt pressure, they respond with aggressive cost-cutting measures including layoffs, reduced spending, and halted expansion.

Business bankruptcy filings have been climbing steadily, disrupting supply chains and removing liquidity from the financial system.

Another overlooked recession risk involves disinflation moving dangerously close to deflation territory. Real-time inflation trackers like Truflation show inflation trending near or below 1%, far beneath the Federal Reserve’s 2% target.

Bull Theory warned that “if inflation falls too fast, spending slows because people expect lower prices later,” adding that “deflation cycles are historically more damaging than inflation.”

The Federal Reserve maintains a relatively hawkish tone despite weakening forward indicators, continuing to emphasize inflation risks while labor, housing, and credit data soften.

Bull Theory assessed the overall situation, stating that when combining all these factors, “you get a macro backdrop that historically aligns with late-cycle slowdown phases.”

However, the analysis clarified that “this does not mean recession is officially here yet” but rather “the economy is becoming fragile and markets are starting to react to that risk.”

Crypto World

BTC’s downside volatility is a feature, not a crisis, says hedge funder

Bitcoin’s sharp decline — nearly 50% from its all-time highs reached just months ago — has reignited debate over the cryptocurrency’s stability, but hedge fund veteran Gary Bode says the selloff is a feature of the asset’s inherent volatility rather than a sign of a broader crisis.

In a post on X, Bode noted that while the recent price drop is “unpleasant and jarring,” it is not unusual in bitcoin’s history. “80% – 90% drawdowns are common,” he said. “Those who have been willing to stomach the always-temporary volatility have been well-rewarded with incredible long-term returns.”

Much of the recent turbulence, he said, can be traced to market reactions to the nomination of Kevin Warsh to succeed Jerome Powell as Federal Reserve chair. Investors interpreted the move as a signal that the Fed might adopt a hawkish stance, raising interest rates and making zero-yield assets such as bitcoin, gold, and silver relatively less attractive. Margin calls on leveraged positions amplified the decline, causing a cascade of forced selling.

Bode, however, disputes the market’s interpretation. He pointed to Warsh’s public statements supporting lower rates and notes from President Trump suggesting Warsh promised a lower fed funds rate. Combined with Congress’ ongoing multi-trillion-dollar deficits, Bode argued, the Fed has limited ability to influence longer-term Treasury yields — a key factor in corporate borrowing and mortgage rates. “I think the market got this one wrong” he said, emphasizing that perception, rather than fundamentals, drove much of the recent selling.

Other commonly cited explanations, he said, also fail to tell the full story. One theory is that “whales” — early bitcoin holders who mined or purchased coins when prices were near zero — are offloading holdings. While Bode acknowledges that large wallets have been active and some big sellers have emerged, he frames these moves as profit-taking rather than an indication of long-term weakness. “The technical skill of the early adopters and miners is something to be applauded,” he said. “That doesn’t mean that their sales (full or partial) tell us much about the future of bitcoin.”

Bode also flagged Strategy ($MSTR) as a potential source of short-term pressure. The company’s stock fell after bitcoin slid below the prices at which Strategy purchased many of its holdings, prompting fears that Saylor might sell. Bode described this risk as real but limited, comparing it to when Warren Buffett buys a large stake in a company: investors like the support but worry about eventual sales. He stressed that bitcoin itself would survive such events, though prices could temporarily dip.

Another factor is the rise of “paper” bitcoin — financial instruments such as exchange-traded funds (ETFs) and derivatives that track the crypto asset’s price without requiring ownership of the underlying coins. While these instruments increase the effective supply available for trading, they do not alter bitcoin’s hard cap of 21 million coins, which Bode said remains a crucial anchor for long-term value. He drew parallels to the silver market, where increased paper trading initially suppresses prices until physical demand pushes them higher.

Some analysts have suggested that rising energy prices could hurt bitcoin mining and reduce the network’s hash rate, potentially lowering long-term prices. Bode calls this theory overblown.

Historical data shows that past bitcoin price drops did not consistently result in hash rate declines, and when declines did occur, they lagged months behind the price drop.

He also pointed to emerging energy technologies — including small modular nuclear reactors and solar-powered AI data centers — that could provide low-cost power for mining in the future.

Bode also addressed critiques that bitcoin is not a “store of value.” While some argue that its volatility disqualifies it from this role, Bode points out that nearly every asset carries risk — including fiat currencies backed by heavily indebted governments. “[…] Gold does require energy to secure unless you’re comfortable leaving it on your front porch,” he said. “Paper Bitcoin can influence the short-term price, but long-term, there are 21MM coins that will be issued and if you want to own Bitcoin, that’s the real asset. Bitcoin is permissionless and requires no trust in a counterparty.”

Ultimately, Bode’s assessment frames the recent decline as a natural consequence of bitcoin’s design. Volatility is part of the game and those willing to endure it may ultimately be rewarded. For investors, the key takeaway is that price swings, no matter how dramatic, are not necessarily a signal of systemic risk.

Crypto World

DOGE TD Sequential 9 Signals Seller Exhaustion Near $0.090

TLDR:

- DOGE hits TD Sequential 9, signaling sellers may be exhausted after weeks of downside.

- Price finds support near $0.090, creating a potential zone for short-term relief rallies.

- RSI and MACD show fading bearish momentum, hinting at early strength returning.

- The monthly accumulation range of $0.077–$0.055 could set up DOGE for long-term upside toward $1.

DOGE TD Sequential indicates potential trend exhaustion after a persistent downtrend. The completed nine-count setup aligns with key support near $0.090, pointing toward a likely relief bounce or sideways consolidation before the next directional move.

TD Sequential Signals Short-Term Relief

DOGE’s daily chart shows a completed TD Sequential buy setup after nine consecutive bearish closes. This occurs at the end of a clear downtrend marked by lower highs and lower closes.

TD Sequential focuses on trend fatigue rather than strength, making this setup notable. Moreover, price action around the TD 9 marker confirms selling exhaustion.

The sharp, impulsive sell-off led into the signal, followed by a small-bodied candle with long lower wicks. This indicates that bears pushed hard but failed to hold control.

Consequently, buyers entered quietly near the $0.095–$0.090 zone, coinciding with prior support levels. Additionally, momentum indicators support the TD read.

RSI rose from oversold territory into the mid-40s, showing gradual strength. Meanwhile, MACD histogram compression suggests fading bearish momentum.

Therefore, the setup favors a short-term relief bounce. Furthermore, tweets from market observers emphasize that the 4-hour TD Sequential setup confirms seller exhaustion.

Price stabilized above $0.090 instead of breaking lower, carving higher intraday lows. As a result, fresh short positions face limited potential.

Finally, completed TD 9s often precede either a multi-candle relief rally or sideways consolidation. If DOGE holds above $0.088–$0.090, it may reach $0.105–$0.112 during the next mean reversion phase.

Consequently, statistical timing indicates that downside momentum is running out rather than signaling hype-driven strength.

Macro Accumulation Zone Suggests Long-Term Upside

On the monthly chart, DOGE trades within a macro accumulation range of $0.077–$0.055. This zone follows a deep correction from its all-time high and marks a re-accumulation phase.

Down ~89% from ATH, DOGE remains in extended high-timeframe demand. Furthermore, phased accumulation is recommended over lump-sum entries.

Pullbacks into $0.077–$0.070, combined with shifts in low-timeframe structure, provide higher-probability setups. Conversely, a monthly close below $0.055 would invalidate the long-term thesis.

Additionally, liquidity targets indicate potential upside. Price could test $0.156, $0.306, $0.48, and eventually $1 if monthly support holds.

Therefore, the macro accumulation zone combined with the TD Sequential buy setup signals that the market may quietly reset for the next upward move.

Ultimately, DOGE’s short-term relief bounce aligns with longer-term accumulation dynamics. Price stabilization, improving momentum, and statistical exhaustion suggest that the current levels offer a risk-reward opportunity for both swing and long-term positions.

Crypto World

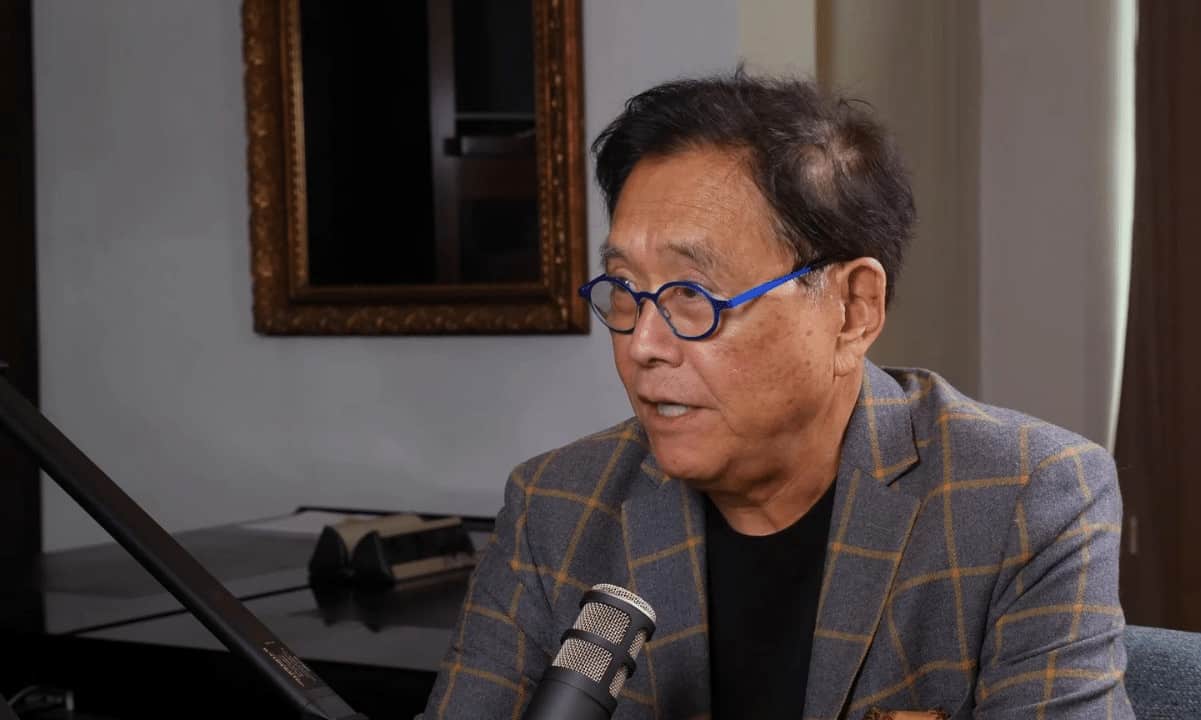

Bitcoin Fear and Greed Index Plummets to 6-Year Low: Is The Worst Over?

Does this mean that BTC has finally bottomed out or is there more pain ahead?

The past few weeks have been brutal for BTC and the rest of the market. The largest digital asset plummeted by roughly $30,000 in less than ten days, and bottomed out (at least for now) on Friday morning with a drop to $60,000.

Given this calamity, it’s almost expected that the overall investor sentiment has plunged just as badly. In fact, it has reached multi-year lows.

Fear Continues to Dominate

Since the cryptocurrency markets (as well as most other financial fields) can be highly emotional, the Fear and Greed Index was created to demonstrate the rapid changes. Market momentum and overall volatility are responsible for half of the index’s final result, which ranges from extreme fear (0) to extreme greed (100).

As such, it’s no wonder that it has been mostly downhill lately. Bitcoin’s price peaked at over $95,000 in mid-January, and stood above $90,000 just over ten days ago – on January 28. However, what happened next was difficult (if not impossible) to predict, as the asset plunged by $30,000 in days to its lowest price levels in well over a year.

Although it rebounded to $69,000 as of press time, this hasn’t been sufficient to move the needle on the Index. The metric has consistently declined lately and tanked to 6, its lowest level since August 2019.

Is a Rebound Next?

As Warren Buffett has said in the past, investors should be fearful when others are greedy and vice versa. As such, they should be greedy now, right? Previous instances of sharp increases or declines in the metric have led to immediate trend reversals, which could finally bring some hope for the bulls.

However, if we go back to the developments back in 2019, history does not exactly support this narrative. At the time, BTC had actually begun to recover from its late 2018/early 2019 bear market and traded 2-3x higher than the $3,500 bottom. Nevertheless, it couldn’t penetrate the $10,000 barrier and failed to do so for months.

You may also like:

Then came 2020 and a major black swan event (the COVID-19 crash), and BTC dumped further before it finally went on the offensive. It took the cryptocurrency over a year to break beyond $10,000. But the good news is that it never looked back and has never traded within a four-digit price territory since then.

The moral of the story now is that yes, extreme fear dominates the markets, which is typically followed by a sharp trend reversal. However, the current market environment is quite uncertain given the rising geopolitical tension, internal issues, market instability, different asset classes exploding, and so on.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Forward Industries (FWDI) is well positioned to consolidate the digital asset treasury sector

Nasdaq-listed Forward Industries (FWDI) is uniquely positioned to consolidate the beaten-down digital asset treasury space because it carries no corporate debt and is completely unlevered, giving it room to play offense while peers retrench, according to Ryan Navi, the company’s chief investment officer.

“Scale plus an unlevered balance sheet is a real advantage in this market. We can play offense when others are playing defense,” Navi told CoinDesk in an interview.

“Forward Industries has strategically avoided leverage and debt by design, giving us the flexibility to responsibly deploy leverage when market opportunities arise, Navi said. “The foundation we’ve built for Forward allows us to operate effectively in market conditions with abundant opportunity, and positions us to act as a net consolidator rather than a forced seller,” he added.

Digital asset treasury companies, firms whose balance sheets are heavily weighted toward cryptocurrencies, have come under growing pressure amid the recent market downturn. Falling crypto prices have squeezed asset values and pushed leverage higher, forcing some companies to sell portions of their crypto holdings to service debt and shore up liquidity, raising questions about the model’s sustainability in prolonged bear markets.

Forward Industries is no exception. With about 7 million solana tokens acquired at an average price of $232, the company stack is worth about $600 million at SOL’s current level just above $85. That represents a paper loss of roughly $1 billion. FWDI’s stock has slumped from a high near $40 at last year’s peak of the digital asset treasury company frenzy to the current price just above $5.

Becoming a solana treasury giant

Forward Industries’ center of gravity shifted sharply in 2025, when it raised roughly $1.65 billion in a private investment in public equity led by Galaxy Digital, Jump Crypto and Multicoin Capital. The deal transformed the firm into the largest solana-focused treasury company in the public markets, with holdings larger than its next three competitors combined. The strategy is straightforward: accumulate SOL, stake it to earn onchain yield and use the firm’s cost-of-capital advantage to drive per-share accretion over time.

Buying in a dislocated market

Navi, who joined the firm in December after stints as a principal at KKR and as managing director at ParaFi Capital, said crypto equities remain deeply dislocated, creating opportunities for disciplined capital allocation to be highly accretive. When sentiment improves and the stock trades above net asset value, Forward can issue equity to buy more crypto; when markets are weaker, accretion can be easier to generate, he said, as prices and expectations are already compressed.

Why Solana

The bet on Solana is as much about fundamentals as it is about positioning. While Ethereum remains the dominant smart-contract platform by market capitalization and decentralization, Navi argues it has become slower and more expensive, with layer-2 networks fragmenting liquidity and, in his view, diluting value at the base layer.

Solana, by contrast, is optimized for speed, cost and finality, qualities that matter most for consumer applications and capital-markets use cases. Viral moments like last year’s meme-driven surge in activity proved the chain can handle millions of users and extraordinary transaction throughput, even if those applications themselves were fleeting. “That showed what’s possible,” Navi said. “It’s a question of when, not if, the next breakout app arrives.”

A lower cost of capital

Forward’s balance-sheet flexibility extends beyond simple buy-and-hold. The company stakes its SOL at roughly a 6% to 7% yield, a rate that will gradually decline as Solana’s programmed issuance falls and supply becomes increasingly disinflationary.

It has also partnered with Sanctum to issue a liquid staking token, fwdSOL, which earns staking rewards while remaining usable as collateral in decentralised finance (DeFi). On venues like Kamino, Navi said, Forward can borrow against that collateral at costs below the staking yield, creating a more capital-efficient structure than most peers can access.

A permanent-capital play

Longer term, Navi sees Forward as a permanent-capital vehicle rather than a trade, more akin to a Berkshire Hathaway than a fund with redemptions or a fixed life. That opens the door to underwriting real-world assets, tokenized royalties and other cash-flowing businesses that clear the company’s cost of capital and can eventually be brought in-house.

“We’re not running a trading book, we’re building a long-term Solana treasury,” Navi said. “What differentiates Forward is discipline: no leverage, no debt, and a long-term view on Solana as strategic infrastructure rather than a short-term bet.”

In the near term, he added, widespread stress across the sector has left many digital asset treasury companies trading at steep discounts, setting the stage for consolidation.

With no leverage, deep backing from blue-chip crypto investors and the largest SOL balance in the public markets, Navi believes Forward is one of the few firms positioned to lead that roll-up.

Kyle Samani said Wednesday that he was stepping down as managing director of Multicoin Capital while remaining chairman of Forward Industries. He notably is taking his exit from the Multicoin Master Fund in FWDI shares and warrants instead of cash.

Read more: Forward Industries Launches $4B ATM Offering to Expand Solana Treasury

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech22 hours ago

Tech22 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports14 hours ago

Sports14 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports4 hours ago

Former Viking Enters Hall of Fame

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat1 day ago

NewsBeat1 day agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat15 hours ago

NewsBeat15 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

![LISA - 'LALISA + MONEY' | 2023 WORLD TOUR [BORN PINK]](https://wordupnews.com/wp-content/uploads/2026/02/1770487179_maxresdefault-80x80.jpg)