Crypto World

The Dow Climbs Back Toward 50,000. Nvidia and Caterpillar Are Leading a Furious Rally.

The Dow surged to its highest levels on record on Friday amid a frenzy of dip-buying led by an unlikely duo.

The blue-chip index was up 1,000 points, or 2.1%. The S&P 500 was up 1.6%. The Nasdaq Composite rallied 1.9%.

The Dow set a record intraday high of 49,980.29. Suddenly, Dow 50,000 is back in play.

Crypto World

Short-Term Capitulation Hits as Bitcoin Diverges From Long-Term Value

TLDR:

- Bitcoin shows strong correlation with equities, placing short-term price action under macro and liquidity influence.

- Short-term holders sent over 94,000 BTC to exchanges at a loss, marking the largest capitulation of this correction.

- Options data shows negative gamma exposure, increasing the chance of sharp moves around key expiration dates.

- Long-term power-law valuation signals Bitcoin trades over 40% below trend despite ongoing macro pressure.

Bitcoin traded in volatile ranges as macro pressure and investor panic shaped near-term price action. Data showed heavy selling from short-term holders as the asset slipped below key technical levels.

At the same time, long-term valuation models signaled a widening gap between price and trend value. The divergence revealed a market pulled between liquidity stress and structural repricing forces.

Bitcoin Price Mispricing Tied to Macro Correlation and Options Structure

Bitcoin moved in step with U.S. equities during the latest pullback. Thirty-day correlations showed strong alignment with Nasdaq, S&P 500, and high-yield bonds.

Recency-weighted data confirmed the link with risk assets remained elevated. This pattern placed short-term direction under macro and liquidity influence rather than narrative-driven trading.

Lead and lag signals showed equities and credit markets moving before Bitcoin. According to figures shared by David (@david_eng_mba), the Nasdaq led Bitcoin by about four days, while the dollar index led by roughly ten days.

Options market positioning reinforced near-term uncertainty. Spot price hovered near the gamma flip zone, with resistance clustered near $70,000 and risk concentrated below that level.

Net gamma exposure remained negative, pointing to unstable price behavior. A squeeze score above the midpoint suggested sensitivity to sharp intraday moves.

Upcoming expiries added another layer of pressure. More than 15% of total gamma was set to roll off on February 13, with larger portions expiring later in February and March.

These expiries increased the probability of breakouts once hedging pressure faded. Until then, price action stayed confined between heavy put and call walls.

Short-Term Holder Capitulation Highlights Bitcoin Price Mispricing Gap

On-chain data showed panic-driven transfers from short-term holders. Darkfost (@Darkfost_Coc) reported daily average flows of over 94,000 BTC to exchanges at a loss.

The transfers occurred as Bitcoin dropped below $65,000. Exchange inflows from short-term holders often indicate intent to sell rather than reposition.

This behavior marked the largest capitulation event of the correction cycle. It reflected emotional reactions during rapid downside moves.

While near-term selling intensified, long-term valuation metrics pointed elsewhere. Power-law trend models placed fair value above $120,000.

The gap between market price and model value exceeded 40%. A negative Z-score signaled an oversold condition relative to historical norms.

Mean-reversion timelines projected gradual recovery over several months. These projections extended into mid and late 2026 based on trend reversion math.

Short-term volatility and long-term valuation now diverged sharply. Macro weakness dictated immediate price movement, while structural models framed a different trajectory.

Crypto World

Crypto Retail Investors Try Meta-Analysis of the Market

Retail investors are scanning the crypto landscape for signs a bottom may be forming, hoping to time new purchases as market conditions potentially improve. A weekly briefing from Santiment on Saturday noted that retail traders are meta-analyzing price action, seeking indications that others are capitulating—a behavior that often marks troughs in bear markets. The term has surged as a top topic on social media, with Santiment tying the chatter to rising selling pressure. Google Trends data show a clear uptick in searches for “crypto capitulation” over recent days, underscoring how participants interpret price swings as signals rather than mere volatility. In this environment, Bitcoin has traded under pressure, dipping toward the $60,000 level on Thursday as part of a broader downtrend that has persisted for months.

The term capitulation describes a scenario where investors rush to exit positions out of fear that the market will not recover, a dynamic analysts monitor when assessing a market bottom. If the chorus of sellers grows loud enough that many participants capitulate at once, some interpret that as a sign that the worst may be behind them, even if others argue that bottoms in bear markets often arrive after multiple rounds of selling pressure. The debate remains a central theme as markets test psychological support levels and risk appetite remains fragile.

Capitulation signals and the coming bottom

“If everyone is waiting for ‘capitulation,’ the bottom might have already happened while they were waiting for a clearer sign,” Santiment cautioned in its assessment. The idea is that waiting for a definitive capitulation before buying can cause investors to miss a move that follows the initial flush of fear, a phenomenon that has played out in past cycles. Yet, several voices in the analyst community urge caution. Caleb Franzen, a market observer active on X, pointed out that capitulation is often a recurring theme in bear markets and that a single event rarely marks the ultimate bottom. “Bear markets typically experience multiple capitulation events,” Franzen wrote, highlighting the risk that the downturn may extend even after a strong capitulation signal appears.

As the debate unfolds, Bitcoin’s price action continues to weigh on sentiment. The flagship asset has seen volatility and regional price pressures, with a notable moment when it briefly struck a $60,000 level—an area not visited since October 2024 during this cycle’s slide. While some traders see this as an opportunity to accumulate, others caution that the move could be a continuation of the downtrend unless stronger catalysts emerge. The market’s complexity is underscored by a mix of on-chain data, macro considerations, and shifting liquidity conditions that collectively shape the near-term trajectory.

Further context comes from the broader sentiment gauges that traders monitor. The Crypto Fear & Greed Index, a composite measure of risk appetite across the market, slid deeper into an Extreme Fear zone in recent days, signaling a cautious stance among participants. This mood aligns with the period of heightened scrutiny around capitulation narratives and the ongoing debate over whether a bottom is in place or still distant. The blend of sentiment metrics and price dynamics creates a nuanced backdrop where several outcomes remain plausible in the weeks ahead.

In parallel, a separate thread of analysis emphasizes that capitulation—while relevant—may not be a single event but a process that unfolds over multiple episodes. CryptoGoos noted that true capitulation in Bitcoin had not yet materialized, a stance echoed by other analysts who stress that bottoms often require a confluence of confirmation signals, including on-chain activity, macro surprises, and investor positioning. The conversation reflects a market that is trying to quantify risk, distinguish genuine signaling events from noise, and position for a potential reversal when the confluence of factors tilts toward relief selling abating and demand reasserting itself.

Bitcoin’s recent movement sits at the center of these debates. Data from CoinMarketCap show the asset had fallen about 24% over the last 30 days, trading around $68,970 at the time of publication, with a low near $60,000 earlier in the week. The slide has kept risk managers vigilant, as fluctuations can influence leverage, funding rates, and liquidity across exchanges. In this environment, investors are weighing the potential for a sustainable bottom against the risk that the market could slip further before any durable recovery takes hold.

The market’s current state is a reminder that retail participation often shapes near-term moves, yet the longer-term trend remains dependent on a complex mix of factors, including macro policy expectations, liquidity dynamics, and how quickly market participants can absorb new information. While capitulation remains a focal point for many observers, the ultimate measure of a bottom will likely come from a broader pattern of price stabilization, sustained demand, and a shift in sentiment that signals a durable change in risk appetite.

Why it matters

For retail investors, the ongoing capitulation narrative frames risk tolerance and entry points. The possibility that a bottom could be forming—even if still contested—offers a potential upside scenario if buyers re-enter on perceived oversold conditions. For builders and traders, the discussion underscores the importance of risk controls, liquidity access, and the ability to distinguish meaningful capitulation signals from temporary price shocks. The broader market context—where macro indicators and regulatory developments can abruptly reframe risk sentiment—remains a critical backdrop for decision-making.

From a market-structure perspective, the unfolding dialogue around capitulation highlights how sentiment analytics, on-chain data, and price action interact to create a narrative about participation. While the data points discussed—ranging from Santiment’s retail-trader observations to Google Trends spikes and the Crypto Fear & Greed Index—offer a composite picture, they do not guarantee a bottom. Instead, they contribute to a framework that investors can use to calibrate expectations, manage risk, and prepare for a potential shift in momentum as the market weighs new information and potential catalysts.

What to watch next

- Watch for any sustained price stabilization around key support zones near $60,000 and above, which could indicate a base forming.

- Monitor capitulation signals and on-chain activity for confirmation that selling pressure is abating, not simply cooling temporarily.

- Track Google Trends and social sentiment to assess whether interest in capitulation remains elevated or begins to fade as prices stabilize.

- Follow macro developments and regulatory updates that could shift risk appetite and liquidity conditions across markets.

- Observe price action around major technical levels and liquidity at major exchanges, which can influence short-term volatility and trader positioning.

Sources & verification

- Santiment weekly summary on retail capitulation and bottom signals, including links to the full written report.

- Google Trends data showing rising searches for “crypto capitulation” during Feb 1–Feb 8, 2026.

- Bitcoin price data and 30-day performance from CoinMarketCap.

- On-chain and market commentary from analysts referencing capitulation dynamics and multiple capitulation events in bear markets.

- CryptoFear & Greed Index readings indicating current sentiment levels (Extreme Fear).

Crypto World

Crypto Retail Investors Are Trying To ‘Meta-Analyze’ Market

Retail investors are scrutinizing the crypto market for signs that it may have bottomed out to gauge when to buy more crypto assets, according to crypto sentiment platform Santiment.

“Retail traders are trying to meta-analyze the market, looking for signs of others quitting to time their own entries, which often happens near bottoms,” Santiment said in a report on Saturday.

Santiment has linked this to the word “capitulation,” which has become a top-trending crypto term on social media, according to the platform’s data.

The term describes investors selling their holdings out of fear that the market won’t recover, a scenario that analysts typically monitor when assessing whether the market has reached a bottom.

“Capitulation” may have already happened, says Santiment

“If everyone is waiting for ‘capitulation,’ the bottom might have already happened while they were waiting for a clearer sign,” Santiment said.

Meanwhile, Google Trends data shows searches for “crypto capitulation” rising from a score of 11 to 58 between the weeks ending Feb. 1 and Feb. 8.

Crypto investors are usually cautious about calling a market bottom too soon. History shows prices can keep falling even when most people think the worst is over.

Market analyst Caleb Franzen said in an X post on Saturday that while capitulation is the “word of the week,” many investors don’t understand that “bear markets typically experience multiple capitulation events.”

It comes as Bitcoin’s (BTC) price dropped as low as $60,000 on Thursday, a level it hasn’t seen since October 2024, amid its ongoing downtrend.

Some analysts are skeptical of the “cycle bottom”

Crypto analyst Ted said in an X post on Friday that “yesterday’s dump looks like capitulation, but it’s not the cycle bottom.”

Echoing a similar sentiment, crypto analyst CryptoGoos said, “We haven’t seen true Bitcoin capitulation so far.”

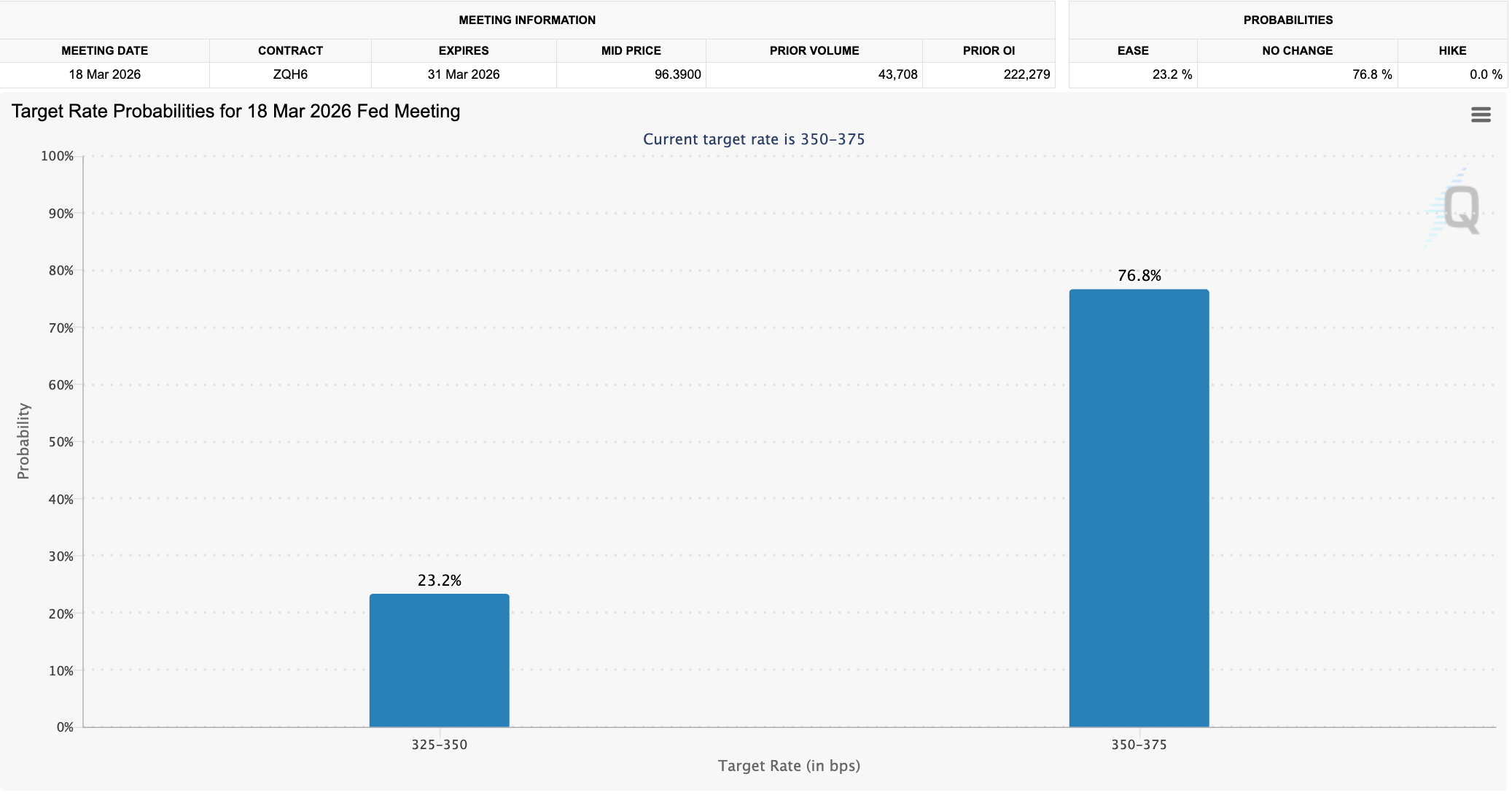

Related: Over 23% of traders now expect interest rate cut at next FOMC meeting

Over the past 30 days, Bitcoin has fallen 24.27%, trading at $68,970 as of publication, according to CoinMarketCap.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, fell further into the “Extreme Fear” territory on Sunday, with a score of 7, signaling extreme caution among investors.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Bitcoin Mining Difficulty Drops 11% as Crypto Market Slumps

The Bitcoin network’s mining difficulty has once again moved in a volatile direction, highlighting how external shocks—from extreme weather to regulatory pressure—continue to ripple through the ecosystem. In the most recent adjustment window, the metric dropped about 11.16% in the last 24 hours, marking the steepest one-day decline since China intensified its 2021 crackdown on crypto mining. With the adjustment taking effect at block 935,429, the difficulty sits around 125.86 terahashes and the network’s average block time hovers near 9.47 minutes, just shy of the 10-minute target. Industry observers note that the next adjustment, set for February 20, is forecast to rebound by roughly 5.63% to about 132.96 T, according to CoinWarz data. The sequence underscores how sensitive the network remains to a mix of weather-related outages, shifting energy economics, and ongoing structural changes within the mining sector.

Key takeaways

- Bitcoin mining difficulty fell by about 11.16% in the last 24 hours, the largest one-day drop since the 2021 crackdown in China.

- Current difficulty is 125.86 T at block 935,429, with an average block time near 9.47 minutes, underscoring continued efficiency pressure in the network.

- The next adjustment on February 20 is projected to rise about 5.63% to roughly 132.96 T, signaling a partial recovery after the recent pullback.

- A severe winter storm in January—Winter Storm Fern—disrupted power grids across 34 states and trimmed US miner hashrate, illustrating how weather can translate into measurable network effects.

- Foundry USA, the world’s largest mining pool by hash rate, briefly saw its capacity cut by around 60% during the storm, shrinking from about 400 EH/s to 198 EH/s before recovering to above 354 EH/s and maintaining a sizable market share.

- January’s broader picture showed the Bitcoin network hashrate retreating to a four-month low as miners reallocate to compute workloads beyond traditional mining.

Tickers mentioned: $BTC

Market context: The ongoing mix of supply-side disruption (weather-related outages), regulatory pressures, and energy-market dynamics continues to shape miner behavior and network security, with a notable tilt toward more flexible, high-availability compute deployments beyond pure traditional mining.

Why it matters

Bitcoin’s security and block production depend on the global distribution of mining power. The recent difficulty drop—driven in part by infrastructure outages tied to Winter Storm Fern—signals how external shocks can temporarily reduce the aggregate hashing power securing the network. The subsequent projected rebound in the next adjustment suggests a partial normalization as operations restart and energy systems stabilize. The episodes also highlight a broader resilience dynamic: as traditional mining pools feel weather- and grid-related constraints, some miners have pivoted toward diversified compute applications, including AI data centers and other high-performance computing tasks, which can alter the geographic and economic makeup of hashrate distribution (CRYPTO: BTC).

The storm’s impact underscores the fragility of mining-dependent infrastructure. The disruption forced US-based miners to curb energy usage and pause operations, translating into a lower total network hashrate and a temporary easing of the computational pressure that underpins Bitcoin’s protocol security. Foundry USA—widely recognized as the largest pool by hashrate—reported a dramatic swing, with hashing power plummeting from nearly 400 EH/s to about 198 EH/s in the storm’s wake, just as the grid faced outages across broad swaths of the country. The fallout was nonetheless transitively mitigated as operations regained traction and hashing power rebounded in the days that followed, reflecting a resilient but stressed sector laced with concentrated capacity.

Even as the storm receded, the broader January data painted a picture of a network navigating a quieter, more cost-conscious cycle. The total Bitcoin hashrate declined to a four-month low, a reflection of both macro crypto market headwinds and miners’ strategic realignment toward compute tasks that can leverage surplus energy during off-peak periods. This pattern aligns with a wider industry trend: operators are increasingly balancing long-term capital commitments with shorter-term flexibility to adapt to energy prices, grid reliability and shifting demand profiles for computing power beyond proof-of-work competition alone.

Why it matters

The sequence of events surrounding mining difficulty and hashrate carries implications for both the security architecture and the economics of running a mining operation. A lower difficulty can ease block production temporarily, potentially affecting miners’ revenue dynamics, especially for those with higher energy costs or less efficient hardware. Conversely, the forecasted rebound in the next adjustment hints at a prompt re-consolidation of hashrate, which could re-tighten margins for smaller operators and increase the concentration of power among larger pools with greater resilience to weather-related shocks.

From a market perspective, the volatility in hashrate can coincide with price fluctuations, adding another layer to the already complex relationship between mining activity and Bitcoin’s spot market. The January and February patterns suggest a sector that remains highly reactive to externalities—weather, policy signals, and the evolving balance of energy economics—while continuing to innovate around operational efficiency and diversification of compute workloads. Those dynamics will influence how quickly the network can absorb future disruptions and how miners price risk in a landscape where energy costs, hardware depreciation, and regulatory risk remain in sharp relief.

What to watch next

- February 20: The next mining-difficulty adjustment and the degree of rebound toward 132.96 T.

- Restart and stabilization of Foundry USA’s hashrate; monitoring for any long-term shifts in pool market shares.

- Any policy or grid reliability developments that could affect U.S. mining operations and energy availability.

- New data on how miners allocate capacity between traditional mining and other compute workloads, including AI data centers.

Sources & verification

- CoinWarz difficulty charts and block data for Bitcoin (CRYPTO: BTC) at block 935,429 and the projected February adjustment.

- AccuWeather reporting on Winter Storm Fern and its impact on regional power infrastructure in the United States.

- Hashrate Index pool-market-share data reflecting Foundry USA’s post-storm recovery and market position.

- Cointelegraph reporting on January’s hashrate declines and the broader context of miner activity during weather events.

Bitcoin mining difficulty, storms and the path to the February adjustment

Bitcoin (CRYPTO: BTC) mining difficulty dipped about 11.16% over the past 24 hours, underscoring how swiftly external conditions can influence the security and economics of the network. The current reading places the difficulty at roughly 125.86 T, with the adjustment taking effect at block 935,429. The network’s average block time sits at about 9.47 minutes, a hair under the 10-minute target that helps maintain predictable issuance and transaction throughput. CoinWarz tracks the data behind the scene, and projections for February 20 show a likely rebound of around 5.63%, lifting the metric toward 132.96 T. This sequence—sharp decline followed by expected recovery—was anticipated by observers who have watched a pattern emerge since the 2021 China crackdown, when mining operations shifted dramatically in response to policy changes and market conditions.

The context for the latest adjustment owes much to a storm season that has repeatedly stressed the Bitcoin network’s fundamentals. Winter Storm Fern swept across much of the United States in January, disrupting electrical infrastructure and forcing curtailment of miner energy use in 34 states across roughly 2,000 square miles. The immediate consequence was a measurable throttling of the network’s total hashrate and a temporary softening of the hash-power centralization that had been building in certain corridors of mining activity. As outages and grid instability mounted, the resilience of large-scale operators—bolstered by diversified energy sourcing and operational cadence—helped the sector rebound once the storm abated.

One consequence of the weather-driven disruption was its impact on the largest mining pool by hashrate: Foundry USA. The bloc of hashing power belonging to this operator was temporarily slashed by around 60%, dropping from near 400 EH/s to about 198 EH/s during the peak of Winter Storm Fern. Hashrate Index corroborates the shift in market dynamics, noting how the pool’s share waxed and waned with the storm’s intensity. In the days that followed, Foundry USA’s hashrate recovered to more than 354 EH/s, renewing its status as a dominant force in the network with a market share hovering around 29.47% at the time of reporting. The broader narrative is that while the storm caused an abrupt pullback, the sector’s capacity to bounce back remained evident as miners reconnected with power sources and recommenced operations.

Beyond the storm, January’s overall momentum pointed to a four-month low in total Bitcoin hashrate, signaling a period of caution as miners assess the balance between energy costs, hardware depreciation, and the macro crypto environment. The combination of weather-related outages and market headwinds has prompted a cautious stance among some operators, who are re-evaluating risk profiles and exploring adjacent compute workloads to maximize asset utilization during periods of mining downtime. The result is a nuanced picture: even as the next difficulty adjustment points to a potential rebound, the path forward may involve continued strategic shifts as the industry recalibrates in response to evolving incentives and constraints.

Crypto World

23% of Investors Forecast a Fed Rate Cut at the March FOMC

The shift in expectations for U.S. monetary policy is spreading through markets as traders digest the potential implications of a hawkish Fed chair nominee. With Fed watchers weighing the odds of a March rate cut, data from CME Group’s FedWatch tool shows the probability cresting at about 23%—up from roughly 18.4% late last week. The move signals a re-pricing of near-term easing, even as the broader consensus remains modest about the size of any forthcoming cuts. The spike comes as Donald Trump’s January nomination of Kevin Warsh to lead the Federal Reserve raises questions about how aggressively the central bank will continue to reduce accommodation, especially if the new chair advocates shrinking the balance sheet. Powell’s current term ends in May, a factor that injects political nuance into policy timing and market expectations.

Markets have traditionally responded to shifts in liquidity and rate expectations, and the current dynamic underscores how a single nomination can ripple through asset prices. In crypto markets, the relationship is nuanced: easing liquidity tends to support risk assets, while tighter conditions can constrain funding and access to capital. The debate over Warsh’s approach—especially his stance on the central bank’s balance sheet—has amplified concerns about financing conditions, which in turn can influence portfolios across equities, commodities, and digital assets. The linked data and commentary reflect a broader narrative in which policy trajectory and balance-sheet strategy are seen as primary drivers of liquidity in the months ahead.

Analysts have pointed to Warsh’s past views on the Fed’s balance sheet as a potential source of policy risk. He has argued that the balance sheet is “trillions larger than it needs to be,” a characterization that underscores the debate over whether a shrinking balance sheet could tighten financial conditions. If the new chair pursues a deliberate reduction in liquidity, markets may Face a period of heightened sensitivity to macro signals, with consequences for riskier assets that rely on easy financing. Krakken’s global economist Thomas Perfumo described Warsh’s nomination as sending a mixed macro signal to investors, suggesting that liquidity dynamics could shift without a clear, immediate direction. In this context, some observers caution that the Fed may pivot more slowly toward easing if balance-sheet normalization becomes a priority, complicating the trajectory of asset prices across markets.

The rhetoric around policy has also interacted with other market dynamics. Earlier in the year, concerns about hawkish bias contributed to declines in certain precious metals and other risk-sensitive assets, illustrating how policy expectations can ripple beyond equities into broader markets. Market participants have emphasized that the Fed’s policy stance will remain a focal point, with the potential to influence how crypto assets—especially those sensitive to liquidity and funding costs—behave in a volatile macro environment. The conversation around Warsh continues to evolve as investors monitor official statements, committee communications, and potential congressional signals that could shape policy timing and tone. For context, one of the linked pieces explores how Fed rate decisions can affect crypto holders, underscoring the linkage between traditional financial conditions and digital-asset markets.

Market reaction and policy expectations as Warsh nomination stirs caution

Bitcoin (CRYPTO: BTC) and other major digital assets could find themselves navigating a scenario in which the Fed’s balance-sheet strategy and rate path become more influential than in the recent past. The discussion around Warsh’s stance fills a gap in the market’s understanding of how aggressively the central bank will normalize policy, particularly if rate cuts are viewed as contingent on liquidity conditions rather than purely economic data. The scenario described by market analysts includes a tension between supportive financial conditions for risk assets and the prospect of a tighter funding environment if the balance sheet is reduced. The potential for a slower easing cycle or a longer period of higher rates could temper enthusiasm for speculative assets, even as demand from long-term investors remains a factor in broader market dynamics. This cross-asset sensitivity underscores why traders are watching Fed communications with heightened attention, recognizing that even modest shifts in the policy mix can alter capital flows and risk sentiment across markets.

As policymakers and markets await more clarity, the conversation around liquidity remains central. Warsh’s nomination has intensified worries about a “lower-liquidity environment” if policy steps move toward balance-sheet contraction. The fear is not limited to traditional markets; crypto-specific funding channels—such as margin lending, swaps, and decentralized finance—could feel the impact of tighter credit conditions if the central bank signals a cautious approach to balance-sheet normalization. The broader takeaway is that the policy pathway now carries an additional layer of uncertainty, with the potential to influence price discovery in both conventional and digital-asset markets. The YouTube commentary embedded above captures some of the real-time reactions and expert assessments shaping this narrative, illustrating how political developments dovetail with macroeconomic policy in a rapidly evolving environment.

In this context, market participants are recalibrating their expectations for how quickly the Fed might shift from tightening to easing, and how the new leadership could interpret the central bank’s own balance in the years ahead. The discussion also intersects with ongoing debates about crypto liquidity, funding rates, and the resilience of digital-asset markets in the face of tightening macro conditions. While some observers argue that a hawkish tilt would dampen risk appetite, others contend that a well-communicated framework and credible policy path could stabilize expectations and reduce volatility over time. The evolving discourse highlights the delicate balance between policy credibility and market confidence, a dynamic that will likely shape both traditional and crypto markets in the near term.

Analysts emphasize that the March FOMC meeting remains a pivotal moment for policy signaling. While a 25 basis-point cut remains a modest possibility, expectations of a larger cut or aggressive easing appear unlikely under the current dialogue surrounding balance-sheet management. As investors integrate these considerations, they are closely tracking the CME FedWatch data, official statements from the Fed, and the evolving commentary surrounding Warsh’s nomination. The implications are not limited to rate paths; they extend to liquidity, credit conditions, and the ability of market participants to access funding in a climate where policy choices carry more weight than was anticipated even a few months ago.

Why it matters

The intersection of Fed policy expectations and crypto markets matters for several reasons. First, liquidity remains a foundational driver of asset prices. If the Fed signals a path toward balance-sheet reduction or maintains a higher-for-longer rate stance, funding conditions could tighten, increasing the cost of capital and reducing speculative activity in risk-on segments, including digital assets. Second, the alignment—or misalignment—between policy signals and market expectations can create abrupt shifts in risk sentiment, potentially triggering faster moves in crypto prices than in traditional markets during periods of macro uncertainty. Third, the nomination of Warsh, which has become a focal point for market analysts, underscores how political dynamics can influence monetary policy and, by extension, the liquidity environment that crypto traders rely on for leverage and liquidity provision. Finally, the broader macro backdrop—ranging from inflation dynamics to credit conditions—continues to shape how investors allocate across asset classes and risk profiles, with crypto assets often sensitive to shifts in liquidity and market sentiment.

For traders and builders in the crypto space, these developments highlight the importance of robust risk management and hedging strategies that account for macro-driven volatility. The potential for a tighter policy regime means that on-chain liquidity provision, cross-asset funding costs, and risk premia across DeFi and centralized exchanges could experience heightened sensitivity to macro headlines. While policy uncertainty can compress near-term gains, it can also create opportunities for long-term participants who position themselves for resilience in evolving liquidity dynamics. As the Fed’s policy conversation progresses, the crypto ecosystem will continue to watch for signals that indicate whether liquidity will be favored or constrained in the months ahead.

What to watch next

- March FOMC decision and summary of the committee’s projections, including any changes to the rate path.

- Public statements or confirmations from Kevin Warsh regarding balance-sheet policy and duration of any normalization steps.

- Updates on liquidity indicators and market funding conditions, including crypto-specific funding metrics and DeFi activity.

- Market reactions to Fed communications, and any revisions to the CME FedWatch probability for March or subsequent meetings.

- Regulatory or policy signals that could influence liquidity, including broader macro trends and currency-market dynamics that affect cross-asset flows.

Sources & verification

- CME Group FedWatch tool data showing March rate-cut probabilities.

- Cointelegraph article: Kevin Warsh officially picked as Federal Reserve chair.

- Cointelegraph explainer: Impact of Fed interest rates on crypto holders.

- Cointelegraph coverage referencing Bitcoin and macro policy dynamics in relation to liquidity and risk sentiment.

Crypto World

Vietnam Proposes 0.1% Tax on Crypto Transfers in New Draft Framework

- Vietnam proposes 0.1% personal income tax on crypto transfers through licensed platforms nationwide (99 characters)

- Vietnamese institutional investors will face 20% corporate income tax on crypto transfer profits (97 characters)

- Five-year crypto pilot program launched September 2025, all transactions must use Vietnamese dong (99 characters)

- Digital asset exchanges require VND10 trillion minimum capital, three times higher than banks (95 characters)

Vietnam’s Ministry of Finance has released a draft circular proposing a 0.1% personal income tax on crypto asset transfers through licensed platforms.

The tax framework mirrors the current securities trading regime and applies regardless of residency status. Vietnamese institutional investors will face a 20% corporate income tax on crypto transfer income.

The draft exempts crypto transactions from value-added tax while establishing clear tax obligations for market participants.

Tax Framework Mirrors Securities Treatment

The draft circular introduces a straightforward taxation approach for crypto asset transfers in Vietnam. Individual investors will pay 0.1% of transaction turnover per transfer when using platforms operated by licensed service providers. This rate matches the existing tax treatment for securities trading in the country.

The framework applies to all individual investors conducting crypto transfers through regulated channels. Residency status does not affect the tax obligation under the proposed rules.

Both Vietnamese residents and foreign individuals will face the same 0.1% rate on transaction turnover.

The Ministry of Finance has exempted crypto asset transfers and trading from value-added tax requirements. This classification treats crypto activities as non-taxable for VAT purposes.

The exemption reduces the overall tax burden on crypto transactions compared to many traditional financial activities.

Corporate investors established in Vietnam face different tax obligations under the draft framework. These institutional investors will pay 20% corporate income tax on profits from crypto asset transfers. Taxable income is calculated as the selling price minus purchase costs and directly related expenses.

Pilot Program Sets High Entry Barriers

Vietnam officially launched a five-year pilot program for the crypto asset market in September 2025. The pilot phase requires all crypto activities to be conducted in Vietnamese dong.

Trading, issuance, and payments must use the national currency during this experimental period.

The pilot program encompasses multiple aspects of the crypto market ecosystem. Activities include the offering and issuance of crypto assets. The framework also covers the organization of trading markets and the provision of related services.

Regulatory authorities are implementing the pilot on a cautious and controlled basis. The approach prioritizes safety, transparency, and protection of participant rights. Both organizations and individuals engaged in the market receive safeguards under the framework.

The draft rules establish substantial capital requirements for digital asset exchanges. Enterprises must maintain a minimum charter capital of VND10 trillion, equivalent to $408 million.

This threshold stands three times higher than the requirements for commercial banks and 33 times that of aviation transport companies. Foreign investors can hold up to 49% equity in these exchanges under current proposals.

The Ministry of Finance has opened the draft circular for public consultation. Before this dedicated framework, crypto transfers were taxed using the same methods as securities transactions. The new rules aim to provide clarity and structure for Vietnam’s emerging crypto market.

Crypto World

MicroStrategy Bankruptcy Claims Debunked: Financial Analysis Reveals Strong Position

TLDR:

- MicroStrategy holds $49.4B in Bitcoin against only $8.2B debt, maintaining a six-to-one coverage ratio

- Company maintains $2.25B cash reserves covering 2.5 years of dividend payments without Bitcoin sales

- Earliest debt maturity arrives in September 2028, allowing time for potential Bitcoin cycle recovery

- Company held through 16-month downturn in 2022 when Bitcoin fell 50% below average purchase price

MicroStrategy bankruptcy concerns have dominated crypto discussions as Bitcoin prices fluctuate. However, recent analysis of the company’s financial structure reveals a different picture than the prevailing narrative suggests.

The business intelligence firm holds Bitcoin reserves worth approximately $49.4 billion against total debt of $8.2 billion. This substantial asset-to-liability ratio contradicts widespread predictions of imminent financial collapse.

Meanwhile, cash reserves and extended debt maturity timelines provide additional protection against short-term market volatility.

Financial Structure Provides Multiple Layers of Protection

The asset coverage ratio stands at roughly six-to-one, with Bitcoin holdings far exceeding debt obligations. Crypto analyst Crypto Rover addressed the bankruptcy narrative directly, stating “the reality is most people spreading this FUD do not understand how MicroStrategy’s balance sheet is structured.”

The analysis breaks down multiple protective layers within the company’s financial position. “At current levels, MicroStrategy’s Bitcoin holdings are worth roughly $49.4B, while total company debt is about $8.2B,” Crypto Rover noted. This means their Bitcoin reserve is almost six times larger than their debt obligations.

Beyond the Bitcoin reserve itself, MicroStrategy maintains USD cash reserves totaling around $2.25 billion. Regarding dividend concerns, Crypto Rover explained “the company has built a USD cash reserve of around $2.25B. That alone can cover dividend payments for 2.5 years without selling a single BTC.” Annual dividend obligations total approximately $890 million.

Debt maturity schedules further reduce near-term pressure on the company. “Strategy’s debt is not due immediately. The earliest maturity comes in September 2028,” according to the analysis.

Additional maturities follow in December 2029 and June 2032. This timeline aligns favorably with Bitcoin’s historical four-year market cycles, potentially allowing prices to recover before major debt obligations arrive.

Historical Performance Demonstrates Resilience Under Stress

MicroStrategy already survived a severe market test during 2022 and early 2023. Bitcoin prices fell nearly 50 percent below the company’s average purchase price of $30,000. The cryptocurrency remained at those depressed levels for approximately 16 months.

Crypto Rover highlighted the company’s response during that period: “Even then: They did not panic sell, They did not liquidate holdings, They held through the drawdown.” Only 200 Bitcoin were sold for tax loss harvesting purposes, and those coins were subsequently reacquired.

This real-world stress test validates the company’s commitment to its long-term strategy. “There is already a real historical stress test, and they held through it,” the analysis emphasized. The precedent demonstrates management’s willingness to weather extended market downturns.

Recent claims about exchange transfers have largely proven unfounded or misinterpreted. “There have been viral screenshots claiming MicroStrategy is moving BTC to exchanges. Most of these are either misinterpreted or fake,” Crypto Rover stated. No verified evidence supports accusations of distressed selling behavior.

The current fear narrative follows familiar patterns from previous market cycles. “Every cycle has a dominant fear narrative,” the analyst observed, comparing current concerns to past Tether collapse predictions that never materialized.

When examining actual financial data rather than speculation, the bankruptcy thesis lacks supporting evidence.

Crypto World

23% of Investors Forecast Rate Cut at March FOMC Meeting

The number of traders expecting a rate cut at the March Federal Open Market Committee meeting rose following fears of a hawkish Fed nominee.

The number of traders expecting an interest rate cut at the March Federal Open Market Committee (FOMC) meeting has risen to 23%, following investor fears of a hawkish stance from Kevin Warsh, US President Donald Trump’s Federal Reserve chair nominee.

Investors and traders forecasting a rate cut surged by nearly 5% from Friday, when only 18.4% signaled they were expecting an interest rate cut, according to data from the Chicago Mercantile Exchange (CME) Group.

Those anticipating a rate cut in March forecast a 25 basis point (BPS) cut, with no investors expecting a rate cut of 50 BPS or more.

President Trump nominated Warsh in January as a replacement for Federal Reserve Chairman Jerome Powell, whose term is over in May.

Interest rate policy can influence crypto asset prices, with easing liquidity conditions seen as a positive price catalyst, and tightening liquidity conditions through higher rates impacting asset prices negatively, as access to financing dries up.

Related: Bitcoin’s next bull market may not come from more ‘accommodative policies’

Markets and investors spooked by Warsh’s nomination

“The nomination of Kevin Warsh as the next Fed Chair has shaken markets to the core,” crypto market analyst Nic Puckrin said in a message shared with Cointelegraph.

Puckrin attributed the sharp decline in precious metals toward the end of January and early days of February to investor perceptions of Warsh, who is viewed as more hawkish, meaning he is in favor of keeping interest rates higher for longer. He said:

“Markets are digesting Warsh’s views on future Fed policy, most notably the central bank’s balance sheet, which he says is ‘trillions larger than it needs to be’. If he does adopt policies to shrink the balance sheet, markets will have to reckon with a lower-liquidity environment.”

Thomas Perfumo, a global economist at cryptocurrency exchange Kraken, told Cointelegraph that Warsh’s nomination sends a ‘mixed’ macroeconomic signal to investors.

The nomination of Warsh may signal that liquidity and credit will stabilize in the US, rather than expand, as crypto investors had anticipated, Perfumo said.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Crypto World

62% of Crypto Press Releases Come From High-Risk or Scam Projects: Chainstory

High-risk and scam-adjacent projects have been found to dominate press release volume.

A majority of press releases published across crypto news sites originate from high-risk or outright fraudulent projects.

In a new report, crypto communications firm Chainstory analyzed 2,893 crypto press releases published between June 16 and November 1, 2025, and found that roughly 62% were issued by projects classified as either High Risk or confirmed Scams, based on indicators such as anonymous teams, unrealistic return claims, and cross-referencing with legal and consumer scam databases.

Low-Impact Updates

Crypto-specific press release “wires” operate on a pay-to-play model that allows projects to buy guaranteed placement across partner media sites, and, in the process, bypass traditional editorial judgment. Unlike legacy wire services that distribute releases for journalists to evaluate, many crypto wires sell direct publication to audiences with minimal compliance checks. This effectively turns article placement into a paid commodity.

Chainstory said that any crypto project with sufficient budget can secure visibility on recognizable news domains regardless of credibility.

The analysis revealed that most wire content consists of low-impact announcements that would typically be ignored by newsroom editors. Nearly half of all releases, or 49%, focused on routine product or feature updates, while another 24% covered exchange listings and trading promotions. Token launches and tokenomics changes accounted for 14% of releases.

On the other hand, only 58 releases, approximately 2% of the dataset, related to traditionally newsworthy events such as venture funding rounds, mergers and acquisitions, or major corporate finance activity.

Promotional Hype Dominates Crypto Wire

Chainstory also examined tone and language, finding that promotional framing dominates crypto press releases. Only around 10% were written in a neutral, factual style, while approximately 54% were categorized as “overstated” and another 19% as overtly promotional. The report observed that superlative-heavy language common in marketing copy remains unchallenged in paid releases, even when similar claims would be edited or questioned in reported journalism.

You may also like:

Risk profiling of issuers revealed a heavy skew toward questionable projects. High-risk issuers accounted for 35.6% of all releases, while confirmed scams made up 26.9%. Low-risk, established projects were responsible for only about 27% of press releases, which indicates that more credible firms rely less on paid distribution and are more likely to receive organic coverage. In sectors such as cloud mining, almost 90% of press releases came from projects flagged as high risk or scams.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Sberbank Launches Crypto-Backed Loans for Russian Corporations Amid Growing Digital Asset Demand

TLDR:

- Sberbank completed its first crypto-backed loan to mining company Intelion Data in late 2025 as a pilot program.

- Russia’s central bank permits cryptocurrency trading but prohibits domestic payments, creating specific use cases.

- Western sanctions have accelerated cryptocurrency adoption in Russian foreign trade and corporate transactions.

- The central bank plans to finalize comprehensive crypto asset legislation by July 1, 2026, for the sector.

Sberbank, Russia’s largest lender, is preparing to expand crypto-backed lending services to corporate clients following strong market interest.

The bank completed a pilot transaction with mining company Intelion Data in late 2025. This development positions Sberbank alongside domestic competitor Sovkombank in offering cryptocurrency collateral financing.

The move reflects broader adoption of digital assets in Russia’s corporate sector amid ongoing economic pressures.

Pilot Program Marks Entry Into Digital Asset Lending

The state-controlled bank issued its first crypto-backed loan to Intelion Data, accepting mined cryptocurrency as collateral. Sberbank declined to reveal the transaction value but confirmed the pilot’s success.

The bank’s spokesperson told Reuters on Thursday that corporate demand has driven the expansion plans, citing “strong interest from corporate clients.” The institution now seeks cooperation with Russia’s central bank to develop proper regulatory frameworks.

Sovkombank previously pioneered this lending category among Russian financial institutions. However, Sberbank’s entry carries greater weight given its dominant market position.

The bank serves millions of corporate and retail customers across Russia. Its participation validates cryptocurrency’s growing role in mainstream Russian finance.

Sberbank aims to extend services beyond cryptocurrency miners to any corporation holding digital assets. This broader approach could unlock significant lending opportunities.

Many Russian companies have accumulated crypto holdings through various business operations. The bank’s willingness to accept these holdings as collateral provides new liquidity options.

Regulatory Environment Shapes Market Development

Russia’s central bank classifies cryptocurrencies as foreign exchange assets under current regulations. The regulator “permits their purchase and sale but prohibits domestic payments” using digital currencies.

This framework creates specific use cases while limiting others. The distinction allows Russians to hold crypto while preventing it from replacing the ruble.

The regulator plans to complete comprehensive crypto asset legislation by July 1, 2026. Sberbank expressed readiness to collaborate on developing these rules.

Proper regulation could accelerate institutional adoption across Russia’s banking sector. The July deadline suggests authorities recognize cryptocurrency’s economic importance.

Western sanctions have accelerated cryptocurrency adoption in Russian foreign trade and domestic business. Traditional global currency transactions face restrictions following military actions in Ukraine.

Digital assets offer alternative settlement mechanisms outside conventional banking channels. This practical necessity has transformed cryptocurrencies from speculative instruments to functional business tools.

International banks are exploring similar services despite different regulatory environments. JPMorgan is examining crypto-backed loan products for institutional clients.

Wells Fargo already offers such financing options. These parallel developments indicate global banking’s gradual embrace of cryptocurrency collateral. Sberbank’s initiative aligns Russia’s financial sector with international trends while addressing specific domestic needs.

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Tech1 day ago

Tech1 day agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports23 hours ago

Sports23 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports14 hours ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat1 day ago

NewsBeat1 day agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Fashion1 day ago

Fashion1 day agoKelly Rowland and Method Man Bring the Fashion for Relationship Goals Press Tour: Courtside in a Fringed TTSWTRS Jacket, Black and White Rowen Rose, Stella McCartney, and More!