Crypto World

5 Scalping Crypto Strategies for Active Traders in 2026

Scalping attracts participants who want to engage with rapid price changes rather than multi-day trends. Scalping trading in cryptocurrencies relies on very short holding periods, tight execution, and clear rules around entries, exits, and risk exposure. It’s based around liquidity, volatility, and disciplined decision-making rather than broad market narratives.

What does scalping mean in the crypto world? This article breaks down five commonly used cryptocurrency scalping strategies, explaining how traders structure and manage trades and operate within fast-moving market conditions.

Takeaways

- How may you use crypto scalping? Short-term crypto scalping takes the form of positions being opened and closed within seconds or minutes, where the focus is on small price movements and tight execution rather than longer trends.

- Scalping trading in the cryptocurrency market commonly relies on liquid markets, narrow spreads, predefined risk limits, and frequent decision-making across low timeframes.

- Common cryptocurrency scalping strategies include range trading, breakout setups, chart pattern entries, indicator-based approaches using RSI and Bollinger Bands, and bid-ask spread techniques.

- Time selection, transaction costs, and execution speed play a central role, as frequent trades can magnify both returns and downside exposure.

What Does Scalping Mean in Crypto?

As in any other financial market, in cryptocurrency trading, scalping refers to a type of trading where traders aim to take advantage of short-term market movements. This approach involves entering and exiting trades within minutes, or even seconds, aiming to capitalise on small fluctuations in price.

According to theory, scalpers typically use high leverage and execute many trades to make seemingly insignificant potential gains that add up rather than seeking larger, less frequent potential returns. Scalping is particularly popular in crypto trading, as digital assets are inherently volatile and experience extreme daily price changes.

Pros and Cons of Cryptocurrency Scalp Trading

Scalp trading in the cryptocurrency market has its advantages and disadvantages. Let’s examine some of the most notable pros and cons.

Pros:

- Frequent Trades: The volatility of crypto can present more scalping trades compared with other assets.

- Limited Exposure: Since scalping relies on quick entries and exits, trades spend less time in the market, which could reduce the impact of unexpected events such as economic announcements or regulatory changes.

- Quicker Results: Scalping allows traders to place smaller, more frequent trades, removing the need to wait for them to develop over a longer horizon.

Cons:

- Risk of Significant Losses: As mentioned, scalping requires discipline. Given the need for high leverage, poor risk management can wipe out a scalper’s account within a few trades if they aren’t strict with their strategy.

- Time-Consuming: Scalping requires constant monitoring of the market, which can be both time and energy-consuming. The ongoing need for quick decision-making may also be particularly draining for some traders.

- High Costs: The fees associated with frequent trading, like spreads and transaction costs, can eat into potential returns.

5 Cryptocurrency Scalping Strategies

Let’s dive into particular strategies.

Range Trading

Range trading is a popular strategy among crypto scalers. It involves identifying a specific consolidation range that an asset is likely to fluctuate within. Scalpers aim to buy at the lower end of the range (support) and sell at the upper bound (resistance).

To get started with range trading, traders first need to identify a ranging market on a low timeframe, like the 1 or 5-minute charts. Then, support and resistance levels near the highs and lows of the range are identified. These levels then serve as entry and exit points, with a trader entering at support looking to exit at resistance and vice versa.

Some will look for reversal candlestick patterns, like hammers or shooting stars, at support or resistance, respectively, before entering with a market order. Others will simply set limit orders at their chosen entry point.

Stop losses might be placed beyond the range’s high or low, depending on the direction of trade. Scalpers usually use a 1:1 risk/reward ratio or don’t place stop-loss orders, but the latter is a risky approach.

Breakout Trading

Breakouts occur when a level of support/resistance is broken through, often indicating the start or continuation of a trend. Traders use breakout trading in several ways.

To start, we need to identify a support or resistance level. A common way is to look for relatively equal highs or lows forming, like in the chart above. When the level is broken with a strong impulsive move, traders may enter on the close of the breakout candle. However, if the move isn’t particularly strong, like at a), they could wait for a pullback. Traders can also place a stop order to enter as the pullback itself breaks out, as marked by the dotted lines.

Some traders place take-profit orders at an opposing support or resistance level. However, some may prefer to attempt to ride the trend and trail their stop-loss levels above or below swing points as the move progresses. Similarly, stop losses might be placed above or below the nearest swing points.

Chart Patterns

Chart patterns can be a powerful tool for scalping, helping traders to identify potential trend continuations and reversals. While there are many different chart patterns out there, some traders stick to just one or two to avoid confusion. We’ll use rising and falling wedges in this example, as they often lead to strong moves.

There are two ways to enter: either on the breakout or on the retest of the broken trendline. As you can see in the example, entering retests might be a more accurate method, but it’ll mean you miss out on some trades. Conversely, entering on the breakout is riskier, as it could just as easily be a false breakout.

A profit target and stop-loss levels will depend on the pattern you’re using. Given that wedges typically prompt a prolonged trend, you could look for significant areas of support/resistance. For a more conservative approach, you might place a take-profit level at the most extreme point of the pattern. Likewise, stop losses might be set at the most extreme opposing point. For example, you might set a profit target at the high of a bullish wedge and a stop loss beneath its low.

Using the Relative Strength Index and Bollinger Bands

Some scalpers rely heavily on technical indicators to determine entries and exits. One popular combination is the relative strength index (RSI) and Bollinger Bands.

Relative Strength Index (RSI): The RSI measures the strength of price movements and can be used to identify overbought/oversold conditions and divergences. RSI can be particularly valuable for pinpointing short-term reversals.

Bollinger Bands: Bollinger Bands can identify periods of high or low volatility and potential price reversals with their standard deviations. Scalpers often look to short when price reaches the upper band and go long when it touches the lower band.

When RSI crosses 70, indicating overbought conditions, or below 30, showing the asset is oversold, traders can look to confirm a reversal entry with Bollinger Bands. If an asset is overbought and crosses above the upper band, a short position can be considered. If the asset is oversold and price breaches the lower band, a long position could be entered.

As for exit conditions, some scalpers may prefer to place a take-profit order at the midpoint of the Bollinger Bands or the opposing band. Others may close their trades when RSI crosses above or below 50, depending on the direction of trade. In terms of stop losses, they might be placed above or below a nearby area of support or resistance. Alternatively, traders choose a fixed distance for each trade.

At FXOpen, we offer both of these indicators in the TickTrader platform. There, you’ll also discover a whole host of additional indicators and tools ready to help you navigate the markets.

Bid-Ask Spread

The bid-ask spread refers to the gap between the maximum price a buyer can offer (bid) and the minimum price a seller can accept (ask) for a specific asset. Scalpers may take advantage of the bid-ask spread.

When spreads are wide, traders place buy orders and sell orders simultaneously. They buy at the bid price and sell at the ask price, capturing the spread. This strategy is common for less liquid cryptocurrencies where spreads are naturally wider.

How May You Create a Scalping Crypto Strategy?

Now, it’s time to create your own scalping trading strategy for crypto. While your strategy will ultimately be unique to you and your preferences, you may try these steps to begin developing a system.

- Choose a Timeframe: Select a short timeframe that suits your trading style, such as 1-, 3-, or 5-minute, to base your trades on. Try to balance choosing one that allows you to take advantage of short-term movements while giving you enough time to think through your decisions.

- Identify Support and Resistance Levels: Use trendlines and horizontal levels to pinpoint potential entry and exit points. You may also look for psychological or dynamic levels if desired. Set a rule that you’ll only enter and exit at these levels to avoid impulsive decision-making.

- Employ Indicators: Use indicators to confirm your entries and exits. You can set specific criteria to filter out trades, like only trading a resistance level when RSI is overbought.

- Develop a Risk Management Plan: Risk management is almost as important as your strategy itself. Traders use stop-loss orders, limit orders, and proper position sizing to manage trades. Also, they might set predetermined loss limits and rules for avoiding emotional decision-making.

- Test and Refine: Continuously backtest and optimise your strategy using past price action, and make adjustments as needed to improve its performance. Some traders keep a trading journal to record their trades and analyse their decision-making process.

Final Thoughts

Of course, these steps aren’t exclusive to the crypto market. While scalping crypto may be preferable for some traders, you can also apply similar strategies to the forex, commodity, and stock markets – but you need to adjust them to suit these markets.

You’ll also need to account for differences in liquidity, trading hours, and fee structures, as these factors can materially change execution and risk exposure. Regardless of the market, scalping remains heavily dependent on consistency, cost control, and clearly defined rules rather than broad directional views.

Once you feel ready to actually implement your strategy, you can consider opening an FXOpen account to gain access to hundreds of assets in our TickTrader trading platform.

FAQ

Is It Easy to Use Cryptocurrency Scalping?

Despite its short time horizon, cryptocurrency scalping involves a demanding workflow. Traders operate on low timeframes where execution speed, platform stability, and transaction costs materially affect outcomes.

Decision-making is compressed, leaving little room for hesitation or interpretation. Market noise can distort signals, particularly during periods of low liquidity or sudden volatility spikes. As a result, scalping is used by participants with defined rules, consistent availability, and the ability to manage repeated exposure without drifting from their framework.

Which Crypto Is Most Popular for Scalping?

There isn’t one single crypto that’s most popular for scalping. Traders usually choose assets with high liquidity, strong intraday volatility, and consistent trading volume, as these conditions allow for quick entries and exits. In practice, the most popular crypto for scalping is simply the one that’s most active and volatile at the moment.

What Is the Most Popular Scalping Strategy for Crypto?

There isn’t one universally “most popular” scalping strategy in crypto, but most approaches focus on capturing very small price movements on the 1-minute chart. Traders typically use this timeframe to spot short-term momentum, quick breakouts, or brief pullbacks during active market conditions.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Bitcoin Crash To $35,000? This Is What Analysts Reveal

Bitcoin fell sharply to $73,000 on February 3, extending a broader bearish trend that has now erased 41% from its October 2025 all-time high above $126,000. The drawdown has intensified debate over whether the market is approaching a cyclical bottom—or entering a deeper corrective phase.

The sell-off mirrors rising anxiety across traditional markets. US equity indices weakened amid concerns about artificial intelligence-driven disruption and escalating geopolitical risks, prompting investors to rotate away from risk assets.

In that environment, capital flowed back into traditional safe havens such as gold and silver, while Bitcoin failed to attract defensive demand.

Sponsored

Sponsored

Macro and Geopolitical Stress Push Investors Toward Traditional Havens

Bitcoin’s volatility continues to reflect macro sensitivity rather than isolation from global markets. The latest leg down coincided with renewed tensions between the United States and Iran after an Iranian drone was reportedly shot down near a US aircraft carrier.

The incident pushed the VIX up roughly 10% and drove the Crypto Fear & Greed Index into “extreme fear” territory.

At the same time, developments in artificial intelligence—including new announcements around Anthropic’s Claude chatbot—sparked renewed concerns about disruption across the tech sector.

That uncertainty weighed on major technology stocks and further reduced appetite for speculative assets.

While Bitcoin declined, gold rose 6.8% and silver gained 10%, reinforcing their role as preferred hedges during periods of monetary and geopolitical stress.

Speaking to CNN, Gerry O’Shea, Global Head of Market Insights at Hashdex, noted that the divergence between Bitcoin and gold suggests investors still view precious metals as the primary safe haven during periods of uncertainty.

That shift has weakened Bitcoin’s short-term refuge narrative and added downside pressure.

Analysts Warn of Deeper Drawdowns and a Potential Bull Trap

Market participants remain divided, but several analysts are openly warning that the correction may not be over.

Sponsored

Sponsored

Crypto analyst Benjamin Cowen argued that Bitcoin’s near-term path is critical:

Other analysts are more pessimistic. Nehal, a widely followed trader on X, suggested the current structure resembles a classic bull trap, warning that the move lower may only be halfway complete.

According to Nehal’s historical comparison, Bitcoin’s previous cycles ended with drawdowns of 86% in 2018 and 78% in 2021.

Applying a similar framework to the current cycle implies a potential 72% decline, which would place Bitcoin near $35,000.

This cyclical perspective remains influential despite structural changes in the market, including ETF adoption and greater institutional participation.

Sponsored

Sponsored

On-Chain Data Signals “Bottom Discovery” Phase

On-chain indicators are adding another layer to the debate. Analyst CryptOpus noted that Bitcoin has entered what he describes as a “bottom discovery” phase for the first time this cycle.

At the 2025 peak, roughly 19.8 million BTC were held in profit. That figure has now dropped to 11.1 million BTC, a 40% reduction in profitable supply.

Historically, similar conditions have marked transitions from corrective phases toward cycle resets. In 2018, Bitcoin remained in this state for roughly eight months before stabilizing.

Key Technical Levels Under Scrutiny

From a technical standpoint, downside risks remain clearly defined. Nic, CEO of Coin Bureau, highlighted that Bitcoin has remained under pressure since breaking below the 50-week moving average in November.

Bitcoin is currently trading near MicroStrategy’s cost basis and close to the April lows around $74,400.

“If we break lower, the next major level is $70,000, just above the previous all-time high of $69,000. A clean break below that opens the door to a bear market target in the $55,700–$58,200 range, between realized price and the 200-week moving average,” Nic warned.

Sponsored

Sponsored

Conflicting Views on Whether a Bottom Is Near

Not all analysts agree with the bearish outlook. Michaël van de Poppe believes Bitcoin may already be nearing the end of its downturn.

Meanwhile, analyst David Battaglia focused on liquidation dynamics, describing current conditions as increasingly irrational.

Battaglia noted that below $85,000, liquidity gaps were significant, meaning panic sellers—whether institutional or whales—likely exited at suboptimal prices.

He contrasted this with the October 10 crash tied to Binance, which he described as structurally cleaner.

“Between $90,000 and $100,000, there’s massive short density and a 14:1 puts-to-calls imbalance, which under normal conditions already signals a strong bottom,” Battaglia said.

In Summary

Bitcoin’s drop to $73,000 has reignited fears of a deeper correction. Macro uncertainty, geopolitical tension, and mixed on-chain signals leave the market split between expectations of further downside and signs of an emerging bottom.

The coming weeks will likely determine whether this move represents a temporary pause—or the foundation of a new trend for 2026.

Crypto World

CME Group Considers Crypto Token Launch

The world’s largest futures and options marketplace is exploring ‘tokenized cash’ as it leans further into crypto markets.

Crypto World

Solana price outlook: bears test $90 amid massive liquidations

- Solana dropped to $90 amid massive liquidations across the crypto market.

- Bitcoin and Ethereum fell to under $73,000 and $2,150.

- Standard Chartered forecasts SOL rally to $250 in 2026 and $2,000 by 2030.

Cryptocurrencies are bearish, and Solana’s price has experienced one of the sharpest declines among top altcoins.

In the past 24 hours, the cryptocurrency has dropped nearly 10% to under $91, with many traders caught off guard amid heightened market volatility.

As can be seen in the crypto heat map below, Solana’s plunge aligns with broader market pressure. Billions of dollars in leveraged positions have been wiped out in the past week as the sector faces massive unwinding.

Price dips 10% amid crypto liquidations

With market sentiment in shambles for much of 2026, it is no surprise that Bitcoin tanked to its multi-month lows of $72,800.

BTC and ETH’s latest dips mean Michael Saylor’s Strategy and Tom Lee’s BitMine currently sit on billions of dollars in unrealized losses.

Digital asset treasury companies that flocked to Solana, BNB, Cardano, and others have similar trajectories.

For Solana, the coin’s price under the psychological level of $100 has strengthened this. Sellers sustained this negative trend with another 10% push over the past 24 hours, hitting lows of $90.60.

Onchain perpetual markets on Solana contributed significantly, with over $70 million in liquidations from Solana-based platforms in the past 24 hours.

During the downturn, over $65 million of these were longs.

The surge in forced selling exacerbated the decline, with high leverage amplifying losses for over 15,900 bullish traders.

The liquidations reflect the rapid deleveraging that has also wiped billions of bullish bets from Bitcoin and Ethereum.

Solana price prediction

The SOL dip is part of a broader market correction, but there’s a potential for recovery if bulls hold $90.

However, liquidity contractions and liquidation overhangs, such as the $800 million in total liquidations in the past 24 hours, suggest a possible down leg as excess leverage clears.

The technical picture also has Solana trading below its 50-day moving average around $132, which adds to the bearish outlook of the RSI and MACD.

SOL could drop to $70 if markets continue to struggle.

Despite the overall bearish picture, Standard Chartered has pointed out a bullish forecast for SOL.

According to the bank, SOL could reach $2,000 by 2030 but has cut its 2026 forecast to from about $310 to $250.

Catalysts include the macro picture and capital flows, as well as a fresh explosion in rotation from memecoins to top altcoins. Stablecoin adoption is another factor in the bank’s outlook.

Crypto World

Nomura pushes back on crypto retreat concerns as it tightens risk controls

Nomura Holdings pushed back against suggestions it is losing confidence in crypto, saying tighter risk controls at its Laser Digital unit are designed to limit short-term earning swings while it focuses on longer-term strategies, the bank told CoinDesk in emailed comments on Wednesday.

“Given the nature of the crypto-asset business, we recognize that a certain level of earnings volatility is inherent, and we recognize the importance of taking a medium- to long-term perspective,” the bank said. “At the same time, to limit short-term earnings swings, we have further tightened position and risk limits. We will continue to capture growth opportunities in the crypto market while strengthening our services and customer base.”

The clarification follows comments from Nomura’s chief financial officer, Hiroyuki Moriuchi, who said during an earnings briefing that the firm introduced “stricter position management” at Laser Digital to reduce risk exposure and limit earnings swings driven by crypto market volatility. Losses at the unit contributed to a 9.7% decline in Nomura’s fiscal third-quarter profit.

The bank’s strategy shift comes as the crypto market is hit by a steep decline with total value slumping by nearly half a trillion since Jan. 29, according to CoinGecko data. Bitcoin tumbled to its lowest level since President Donald Trump won re-election in early November 2024 on Tuesday, hitting a low of $72,870 although it later bounced back to over $76,000, according to CoinDesk data.

Nomura’s decision follows the Oct. 10 flash crash, which wiped out more than $19 billion in leveraged positions just days after bitcoin hit a record high above $126,200. Bitcoin ended the year around $87,000, roughly 31% below its peak, while total crypto market capitalization also fell over 30% to just over $3 trillion.

Nomura denied the decision means it has lost faith in the sector. “Laser Digital’s risk controls performed as designed: exposure was reduced early, losses were contained, and the firm avoided the more severe impacts felt worldwide,” it said.

The banking firm, considered Japan’s largest investment bank, with $673 billion in assets under management as of late last year, acknowledged that volatility is an unavoidable feature of the crypto business.

“By nature of the digital asset business, Laser Digital and other industry peers have beta exposure to the market,” the bank told CoinDesk. “However, risk taking at Laser Digital is at Trad-Fi institutional grade, and Q3 performance is not representative of any fundamental weakness.”

Crypto World

Crypto networks respond after Vitalik Buterin told them they ‘no longer makes sense’ for Ethereum

For years, Ethereum’s layer-2 networks have marketed themselves as extensions of Ethereum itself. “Arbitrum is Ethereum,” Offchain Labs co-founder Steven Goldfeder wrote on X in March 2024. “Base is Ethereum,” Coinbase’s layer-2 team posted in April 2025.

But following recent comments from Ethereum co-founder Vitalik Buterin questioning whether Ethereum still needs a dedicated layer-2 roadmap, many of those same teams are now emphasizing something different: that rollups are not Ethereum at all.

Goldfeder, for one, struck a noticeably different tone after Buterin’s post, writing on X instead: “Arbitrum is not Ethereum.”

“It’s a core part of the ecosystem, a close-knit ally, and has enjoyed a symbiotic relationship for the last half-decade. But it is not Ethereum,” he added in the post.

Buterin’s remarks, which suggested that as Ethereum becomes faster and cheaper, the original rationale for layer-2s may be shifting, reignited debate over whether rollups will become less necessary as the base layer improves.

Layer-2 networks were previously incorporated into Ethereum’s roadmap to scale the network by processing transactions off the main blockchain and settling them back to Ethereum, helping reduce congestion and fees.

The debate is not abstract. Several layer-2 networks now secure billions of dollars in user funds, making them some of the largest platforms in crypto. Coinbase-backed Base holds roughly $4 billion in total value locked, while Arbitrum secures more than $2 billion, according to DefiLlama data.

‘Less relevant’

But leaders across the layer-2 ecosystem say this moment is being misunderstood.

Rather than signaling an existential threat, they argue, Ethereum’s progress is forcing rollups to clarify their purpose and to stand on their own.

Ben Fisch of the Espresso Foundation said Buterin’s comments reflect a logical evolution in how Ethereum’s scaling strategy is being framed.

“I think that Vitalik’s post is very consistent with that idea now that he’s saying, ‘The whole purpose of layer-2s in the first place was to scale Ethereum. Well, now we’re making Ethereum faster so they’re becoming less relevant,” Fisch said to CoinDesk in an interview.

Still, Fisch rejected the idea that this makes rollups obsolete.

“I think it’s the start of layer-2s flourishing and becoming independent from Ethereum,” he said.

“A layer-2 may use Ethereum as a service, but it by no means is beholden to Ethereum or what the leaders of Ethereum think.”

That perspective is increasingly echoed by layer-2 leaders themselves.

Base, Coinbase’s layer-2 network, welcomed improvements at the base layer, with Jesse Pollak, the head of Base, calling Ethereum scaling “a win for the entire ecosystem,” while stressing that rollups will need to offer more than lower fees.

“Going forward, L2s can’t just be ‘Ethereum but cheaper,’” Pollak said.

Polygon CEO Marc Boiron made a similar argument. Polygon recently said it would pivot its efforts to focus primarily on payments, and Boiron said Buterin’s comments were less about abandoning rollups than about raising expectations for them.

“Vitalik’s point was not that rollups are a mistake, but that scaling alone is insufficient,” Boiron told CoinDesk. “The real challenge is building a unique blockspace that works for real-world use cases like payments, where cost, reliability, and consistency matter.”

Others have gone further, arguing that rollups should be understood as independent platforms rather than extensions of Ethereum itself. Jing Wang, co-founder of the Optimism Foundation and CEO of OP Labs, compared layer-2s to standalone web services.

“L2s are websites. Every company will have its own, tailored to its needs. Ethereum is an open settlement standard,” Wang said to CoinDesk. “It’s important for Ethereum to stay true to those base layer values to give L2s the flexibility to customize.”

Taken together, the reactions suggest that while Buterin’s post has raised questions about the role of layer-2s, leaders across the ecosystem see it less as a threat than as a transition, one that is forcing rollups to reconcile how they’ve branded themselves with what they are now trying to become.

Crypto World

Solana Price Could Fall to $65 as Unstaking Surges 150%

The Solana price remains under heavy pressure in early February, with the token down nearly 30% over the past 30 days and trading inside a weakening descending channel. Price continues to grind toward the lower boundary of this structure as long-term conviction fades.

At the same time, net staking activity has collapsed, exchange buying has slowed, and short-term traders are building positions again. Together, these signals suggest that more SOL is becoming available for potential selling just as technical support weakens.

Sponsored

Sponsored

Staking Collapse Meets Descending Channel Breakdown Risk

Solana’s latest weakness is being reinforced by a sharp drop in staking activity. The Solana staking difference metric tracks the weekly net change in SOL locked in native staking accounts. Positive values show new staking, while negative readings indicate net unstaking.

In late November, long-term conviction was strong. During the week ending November 24, staking accounts recorded net inflows of over 6.34 million SOL, marking a major accumulation phase.

That trend has now fully reversed. By mid-January, weekly staking flows had turned negative. The week ending January 19 showed net unstaking of around –449,819 SOL. By February 2, this had worsened to –1,155,788 SOL, a surge of roughly 150% in unstaking within two weeks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This means a growing amount of SOL is being unlocked from staking and returned to liquid circulation. Once unstaked, these tokens can be moved to exchanges and sold immediately, increasing downside risk.

This collapse is happening as price trades near the lower edge of its descending channel with a 30% breakdown possibility in play.

Sponsored

Sponsored

With SOL hovering near $96, the combination of technical weakness and rising liquid supply creates a dangerous setup. If selling accelerates, the channel support may not hold.

Exchange Buying Slows as Speculators Increase Exposure

Falling staking activity is now being reflected in exchange flows. Exchange Net Position Change tracks how much SOL moves onto or off exchanges over a rolling 30-day period. Negative values indicate net outflows and accumulation, while rising readings signal slowing demand.

On February 1, this metric stood near –2.25 million SOL, showing strong buying pressure. By February 3, it had weakened to around –1.66 million SOL. In just two days, exchange outflows dropped by nearly 26%, signaling that accumulation has slowed.

Sponsored

Sponsored

This decline in buying is occurring as unstaking accelerates, increasing the amount of SOL available for trading. When supply rises while demand weakens, the price becomes more vulnerable to sharp declines.

At the same time, speculative activity is rising.

HODL Waves data, which separates wallets based on holding time, shows that the one-day to one-week cohort increased its share from 3.51% to 5.06% between February 2 and February 3. This group represents short-term Solana holders who typically enter during volatility and exit quickly.

Similar behavior appeared in late January. On January 27, this cohort held 5.26% of the supply when SOL traded near $127. By January 30, their share dropped to 4.31% as the price fell to $117, a decline of nearly 8%.

This pattern suggests that speculative money is positioning for short-term bounces rather than long-term holding, increasing the risk that bounces will fade.

Sponsored

Sponsored

Key Solana Price Levels Still Point to $65 Risk

Technical structure continues to mirror the weakness seen in on-chain data. SOL remains locked inside a descending channel that has guided price lower since November. After losing the critical $98 support zone, the price is now trading near $96, close to the channel’s lower boundary.

If this support fails, the next major downside target lies near $67, based on Fibonacci projections. A deeper move could extend toward $65, aligning with the full measured 30% breakdown of the channel.

On the upside, recovery remains difficult. The first level that Solana must reclaim is $98, followed by stronger resistance near $117, which capped multiple rallies in January. A sustained move above $117 would be required to neutralize the bearish structure.

Until then, downside risks remain elevated.

With staking collapsing, exchange buying weakening, and speculative positioning rising, more SOL is entering circulation just as technical support weakens. Unless long-term accumulation returns, Solana remains vulnerable to a deeper correction toward $65.

Crypto World

Lawsuits are piling up against Binance over Oct. 10

Social media sentiment continues to turn against Binance for its alleged role in crypto liquidations on October 10.

Immediately after October 10, traders were already threatening legal action. However, this year, new lawsuits and arbitrations look to be underway, along with numerous other complaints and legal setbacks.

A simple chart of crypto asset prices illustrates the reason for the dogpile of complaints against Binance.

Following months of clear correlation with broad indices like the S&P 500 and Nasdaq 100, crypto decoupled precisely on October 10 — and has trended downward ever since.

Read more: Binance’s $1B BTC buy fails to win back trust after Oct. 10

October 10 auto-deLeveraging

As the world’s largest crypto exchange, Binance had a unique role to play in October 10.

For example, flash-crash prices as low as 99.9% existed only on the exchange on that date, and it had just changed its pricing feeds and treatment of a major stablecoin, Ethena USDE.

Wintermute CEO Evgeny Gaevoy called Binance’s Auto-DeLeveraging prices “very strange,” while Ark Invest’s Cathie Wood blamed billions in crypto liquidations on a Binance “software glitch.”

A post with millions of impressions also called out errors in Binance’s pricing oracles for cross-margin unified accounts.

Ethena USDE played a particularly important role in Binance’s October 10 liquidations. After crashing to less than $0.67 on Binance, USDE has regained its $1 peg but has shed more than half its market capitalization since 10/10.

Binance attempts to restore confidence

Without admitting to responsibility, Binance nonetheless quickly — and voluntarily — agreed to pay huge sums of money to customers that suffered losses on that date.

Shortly after the event, Binance announced $328 million in compensation plus another $400 million worth of loans and vouchers.

In another attempt restore confidence amid the bearish knock-on effects of October 10, Binance announced in late January 2026 that it would use its entire $1 billion SAFU (Secure Asset Fund for Users) emergency reserve to buy bitcoin (BTC) over a 30-day period.

It has not helped much. The giant BTC buy failed to win back its fans-turned-critics, with negative topics about Binance still trending on social media on a nearly daily basis.

As pressure continues to build over the exchange’s role in the historic liquidation event, founder Changpeng Zhao has blamed fake social media and unrelated bitcoin traders for bearishness.

He also attempted to divert blame from Binance onto Donald Trump for the crash, saying, “It’s pretty clear that the tariff announcements preceded the crash, not Binance system issues or Binance doing anything.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Wall Street giant CME Group is eyeing its own ‘CME Coin,’ CEO says

CME Group CEO Terry Duffy has suggested the derivatives giant is exploring launching its own cryptocurrency.

In response to a question from Morgan Stanley’s Michael Cyprys during the company’s latest earnings call, Duffy confirmed the firm is exploring “initiatives with our own coin that we could potentially put on a decentralized network.”

The comment was brief and came in response to a question about the role of tokenized collateral. In response, Duffy first noted that the world’s largest derivatives exchange is carefully reviewing different forms of margin.

“So if you were to give me a token from a systemically important financial institution, I would probably be more comfortable than maybe a third or fourth-tier bank trying to issue a token for margin,” Duffy said. “Not only are we looking at tokenized cash, we’re looking at different initiatives with our own coin.”

The company is already working on a “tokenized cash” solution with Google that’s set to come out later this year and will involve a depository bank facilitating transactions. The “own coin” Duffy referenced appears to be a different token that the firm could “potentially put on a decentralized network for other of our industry participants to use.”

The CME declined to clarify whether this “coin” would function as a stablecoin, settlement token or something else entirely when asked by CoinDesk.

However, if such an initiative goes through, the implications are significant.

While CME Group has previously flagged tokenization as a general area of interest, CEO Terry Duffy’s comments this week mark the first time the exchange has explicitly floated the concept of a proprietary, CME-issued asset running on a decentralized network.

The firm is set to launch 24/7 trading for all crypto futures in the second quarter of the year, and is also set to soon offer cardano, chainlink and stellar futures contracts.

CME’s average daily crypto trading volume hit $12 billion last year, with its micro-ether and micro-bitcoin futures contracts being top performers.

The launch wouldn’t make CME the first traditional finance giant to launch its own token. JPMorgan has recently rolled out tokenized deposits on Coinbase’s layer-2 blockchain Base via its so-called JPM Coin (JPMD), quietly rewiring how Wall Street moves money.

Crypto World

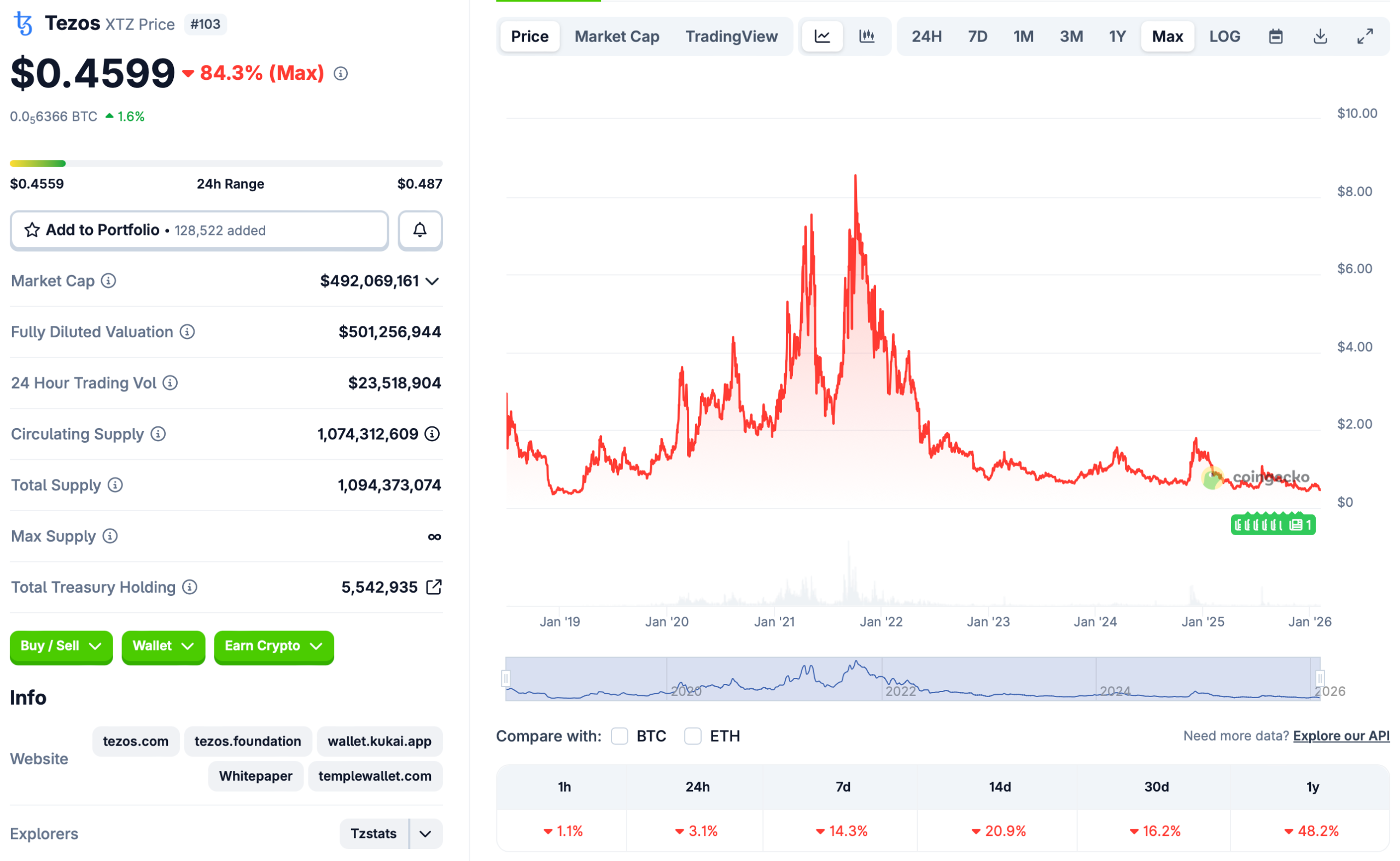

Bitnomial Lists First US-regulated Tezos Futures

The Chicago-based cryptocurrency exchange Bitnomial has launched futures tied to Tezos’s XTZ token, marking the first time the asset has a futures market on a US Commodity Futures Trading Commission-regulated exchange.

According to Wednesday’s announcement, the futures contracts are live and allow institutional and retail traders to gain exposure to XTZ (XTZ) price movements using either cryptocurrency or US dollars as margin.

Futures contracts let traders hedge risk or gain price exposure by agreeing to buy or sell an asset at a set price on a future date, without holding the asset itself.

Regulated futures markets are often viewed as a prerequisite for broader institutional participation in the US, including potential spot exchange-traded funds (ETFs), because they provide standardized price discovery and oversight under the CFTC.

“CFTC-regulated futures market with six months of trading history checks a key box under the SEC’s generic listing standards for spot ETFs,” Bitnomial president Michael Dunn said.

Dunn told Cointelegraph the company is “actively looking at new tokens” for potential US institutional and retail derivatives markets, but declined to comment on specific assets.

Previously, Bitnomial listed US-regulated futures tied to assets including Cardano (ADA), XRP (XRP) and Aptos (APT), positioning it among the few venues offering regulated crypto derivatives beyond Bitcoin (BTC) and Ether (ETH) in the US.

Bitnomial’s push to list futures tied to altcoins has not been without regulatory hurdles. In August 2024, the exchange sought to self-certify XRP futures with the CFTC, but the Securities and Exchange Commission (SEC) objected, arguing the contracts required registration as a securities exchange.

After suing the SEC in October 2025 and later dropping the case, Bitnomial launched XRP futures in March, citing the agency’s evolving approach to crypto policy.

Related: CFTC issues no-action letter to Bitnomial, clearing way for event contracts

A brief history of Tezos

Tezos’ mainnet launched in June 2018 following a 2017 initial coin offering that raised about $232 million in Bitcoin and Ether. While not the first proof-of-stake blockchain, Tezos was among the earliest layer-1 networks to combine proof-of-stake with formal onchain governance, enabling token holders to approve protocol upgrades that allowed the network to evolve without hard forks.

During the 2021–2022 non-fungible token boom, the blockchain carved out a niche as a lower-cost, energy-efficient alternative to Ethereum for minting and trading NFTs. As Ethereum gas fees surged, artists and game publishers such as Ubisoft gravitated to Tezos, citing lower transaction costs and the network’s proof-of-stake design.

During these years, Tezos also secured high-profile sports partnerships with Red Bull Racing and McLaren Racing, and was later reported to be preparing a multi-year training kit sponsorship with Manchester United valued at more than $27 million per year.

Tezos’ native token, XTZ, hit an all-time high of $9.12 in October 2021, according to CoinGecko data, but has since fallen about 95% and is now trading around $0.46.

On Jan. 25, Tezos implemented its Tallinn protocol upgrade, cutting base-layer block times to six seconds as part of the network’s 20th onchain upgrade.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Crypto World

Can DOGE and SHIB Crash to $0 in 2026? 4 AIs Make Predictions

Can 2026 turn out to be a devastating year for the biggest meme coins?

The meme coin sector has been deeply impacted by the latest crypto collapse, with its market capitalization plummeting below $40 billion.

We consulted four of the most popular AI-powered chatbots about whether the crisis will continue and specifically asked whether Dogecoin (DOGE) and Shiba Inu (SHIB) could crash to $0 sometime this year.

The Chances are Small

According to ChatGPT, there is a theoretical possibility, although it is extremely doubtful, for the biggest meme coins (in terms of market cap) to nosedive to zero.

It reminded that the tokens trade actively on major exchanges and have millions of holders, and that is unlikely to change in 2026. At the same time, given current market conditions, ChatGPT suggested that a deeper crash could occur in the following months.

“DOGE and SHIB are among the most widely held cryptocurrencies in the world. Millions of wallets hold these assets, many with no intention of selling at extremely low prices. This creates a distributed supply base, reducing the odds of a total demand vacuum. Even during prolonged bear markets, a subset of holders continues to transact, stake (where applicable), or speculate,” it stated.

Grok – the chatbot integrated within X – claimed a collapse to $0 can’t be ruled out in extreme scenarios. However, it predicted that DOGE and SHIB can stabilize later in 2026 if Bitcoin (BTC) rebounds and hype returns.

“DOGE might hover around $0.10–$0.15, and SHIB could aim to “delete a zero” (reach $0.00001+) with burns and upgrades,” it forecasted.

Not a Chance at All

Google’s Gemini explained that for a cryptocurrency to hit zero, it must have zero buyers and be delisted from all leading exchanges. It stated that such a development is unlikely for several reasons.

First, Dogecoin has made significant progress in the past years, and there are even approved spot DOGE ETFs in the US. It is also Elon Musk’s favorite cryptocurrency, while Shiba Inu has evolved into a complex ecosystem with a vast and devoted community.

You may also like:

Perplexity predicted that smaller meme coins may plummet to $0 in 2026, but it won’t be DOGE or SHIB. The chatbot even envisioned a potential spike to $0.50 and even $1 for Dogecoin in the coming months should hype return. It outlined a less bullish prediction for SHIB, assuming that its price may pump by a maximum of 20% this year.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech12 hours ago

Tech12 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World21 hours ago

Crypto World21 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards