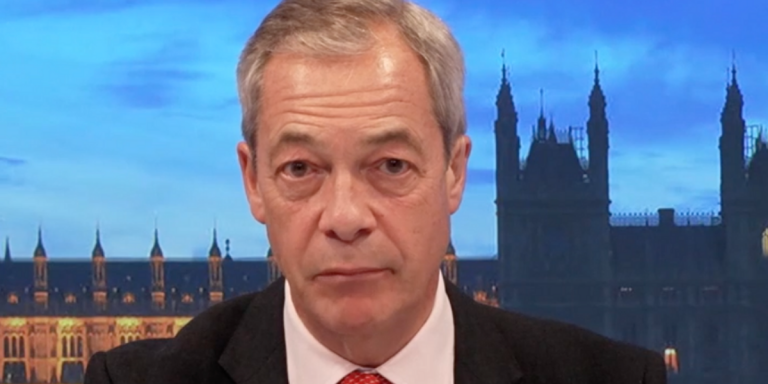

Broadcaster and journalist Ryan-Mark Parsons has launched a scathing attack on Sadiq Khan’s knighthood, branding London’s mayor a “sanctimonious little twit”.

Speaking to GB News, Parsons expressed disbelief that Khan had received “one of the highest honours that you can achieve in this country”.

+ There are no comments

Add yours