Entertainment

Which CBS Shows Have Gone Through Surprising Showrunner Changes?

Fire Country isn’t the only CBS show currently going through a surprising showrunner change.

News broke in January 2026 that showrunner Tia Napolitano was leaving after multiple onscreen departures.

“Tia has been instrumental in helping both build and steer Fire Country, which not only became a top series, but is also the foundation of a growing universe,” CBS Entertainment President Amy Reisenbach and CBS Studios President David Stapf said in a joint statement. “We’re grateful for all her contributions and tireless work, and look forward to collaborating with her on future projects.”

Napolitano was with the show since its 2022 premiere on CBS. Before her exit, Napolitano spoke exclusively to Us Weekly about what fans could expect from the remainder of the fourth season.

“[You should] be worried. We’ve got Bode and Tyler in a fire shelter in the middle of a blaze. Those things are built for one, there’s two lives in there,” Napolitano shared in December 2025. “And we’ve got Jake and his brother over the side of a cliff. You see how many times that vehicle goes over and over. We see heads hit hard surfaces.”

Napolitano teased that “those are not easy things to come back” from, adding, “We’ll watch our people fight to get out of there.” She also revealed there was a “huge twist” coming in the midseason premiere.

The showrunner change came after budget cuts led to Billy Burke and Stephanie Arcila‘s exits. Elsewhere at the network, NCIS‘ prequel series NCIS: Origins and FBI spinoff CIA also faced some shakeups behind the scenes.

Keep scrolling for a breakdown of the changes:

‘Fire Country’

Napolitano released a statement in January 2026, which read, “I am beyond proud of the past four seasons of Fire Country. All of my gratitude to our cast, crew, writers, producers, fans, and of course CBS and CBS Studios. It’s been a beautiful ride!”

Multiple outlets including Deadline reported that a replacement for Napolitano hasn’t been found yet.

‘NCIS: Origins’

Mariel Molino, Austin Stowell. Erik Voake/CBS

It was confirmed in January 2026 that co-showrunner Gina Lucita Monreal is departing from the show at the end of season 2. David J. North will remain and will serve as sole showrunner in her absence.

“Gina has been an important beloved member of the ‘NCIS’ family for many years,” CBS Entertainment President Amy Reisenbach and CBS Studios President David Stapf said in a joint statement. “We are incredibly grateful to her for helping launch and steer NCIS: Origins, and bringing these incredible characters and stories to life. We look forward to working with her again in the future on new projects, and know the creative foundation she helped build will continue to thrive.”

Monreal released her own statement about the surprise exit. “It’s been the biggest honor of my career to write NCIS: Origin’ alongside my incredible co-showrunner and friend David North,” she wrote. “I want to thank Amy Reisenbach, David Stapf, and everyone at CBS Network and Studio for their support.”

She continued: “To have had this opportunity to work again with the incomparable Mark Harmon, Sean Harmon, our writers, and the best cast and crew in the business — how lucky am I? I can’t wait to see what this extraordinary group cooks up for season 3.”

‘CIA’

In April 2025, CBS gave CIA a straight-to-series order starring Tom Ellis and Nick Gehlfuss. Originally planned for a fall 2025 premiere, CIA was pushed to midseason after Warren Leight replaced FBI: Most Wanted‘s David Hudgins as showrunner.

The changes kept coming when Michael Michele, one of the series’ leads, left in November 2025. Days later, Eriq La Salle left the series as executive producer. He was attached to CIA since its conception and directed the pilot before his exit.

Continue Reading

Entertainment

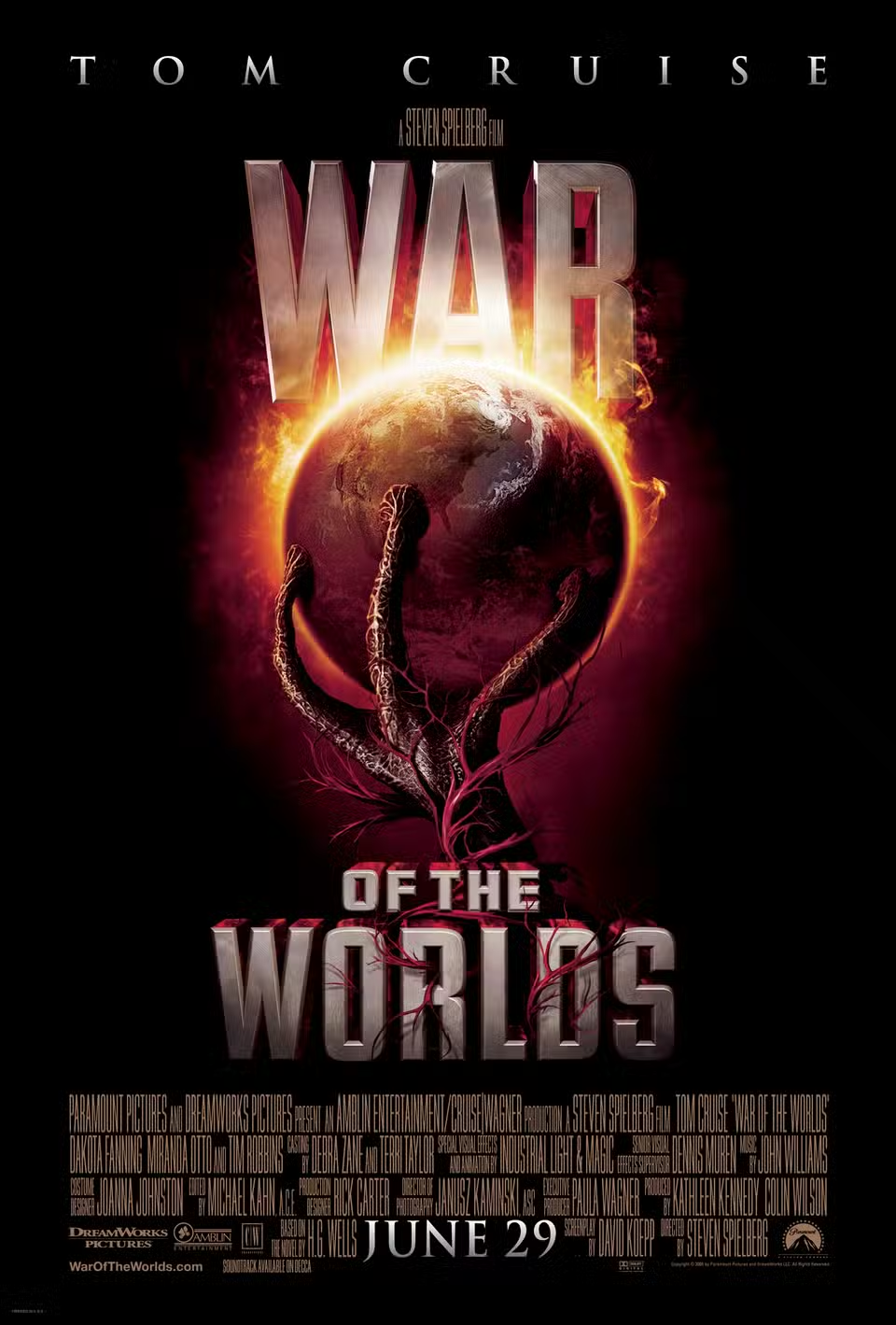

Tom Cruise’s Nailbiting Sci-Fi Thriller Will Soon Launch From a Free Streamer

A collective wonder and intrigue with the universe and galaxy beyond our own has long been an obsession for humankind. Even before we began sending astronauts into space all those decades ago, our fascination with the stars has captivated even the earliest versions of our species. With that in mind, it’s no wonder that the mysticism and fixation of space has become such a source of inspiration for authors, filmmakers, and composers. In the late 1800s, H.G. Wells released one of the greatest pieces of science fiction when he penned the novel The War of the Worlds. The story behind the book was a simple but brilliant one as it followed the invasion of Earth by Martians who were not only smarter than humans, but also much more developed.

In the years that would follow, Wells’ work of fiction became a must-read for anyone remotely interested in the sci-fi genre. It also became a catalyst for chaos when, in 1938, Orson Welles read the book as an installment for CBS Radio Network’s The Mercury Theatre on the Air. The Citizen Kane director’s depiction of the terrifying tale was enough to send folks over the edge as many flew into a panic believing the events were happening in real time. Just a little over a decade later, Byron Haskin would unleash the first on-screen adaptation with the Gene Barry and Ann Robinson-led The War of the Worlds, which became the first of many feature-length productions based on Wells’ novel.

While so many of these adaptations are worth checking out, one of them will soon leave our world behind when it bows off Pluto TV at the beginning of next month. Over the next few weeks, we’d urge you to set some time aside and stream Steven Spielberg’s War of the Worlds, which features Tom Cruise in a leading role. Putting a different spin on the original book, Spielberg’s take centers on Ray Ferrier (Cruise), a dockworker living in New York City, who is hoping to rebuild the strained relationship with his two kids after their mother drops them off for the weekend. Instead, an alien invasion rocks the planet to its core, with Ray immediately snapping into protection mode to ensure he and his children find their way to safety.

Who Else Starred in ‘War of the Worlds’?

With Cruise leading the charge in the nail-biting action flick, numerous other familiar faces gather to take on the extraterrestrial threat in War of the Worlds, including a very young Dakota Fanning in one of her earliest roles. Additionally, the ensemble includes Miranda Otto, Justin Chatwin, Tim Robbins, Lisa Ann Walter, Rick Gonzales, and more.

Head over to Pluto TV before March 1 to stream War of the Worlds completely free of charge.

- Release Date

-

June 29, 2005

- Runtime

-

116 Minutes

- Writers

-

Josh Friedman, David Koepp, H.G. Wells

Entertainment

“The Pitt” star admits she'd never seen “Seinfeld” before booking a role on the sitcom: 'I was living under a rock'

:max_bytes(150000):strip_icc():format(jpeg)/Katherine-LaNasa-seinfeld-020626-2-63afe20e2daa414cb87bb64bcd68dd69.jpg)

Katherine LaNasa, who polygraphed Jerry Seinfeld in a classic season 6 episode, says she “just didn’t watch a lot of TV” at the time.

Entertainment

Sullivan’s Crossing Season 4 Trailer: Maggie, Cal Argue Over Secret Husband

The first look at season 4 of Sullivan’s Crossing hints at issues between Maggie and Cal after the arrival of her secret husband.

In a trailer released on Friday, February 6, Maggie (Morgan Kohan) says she was “finally in a good place” with Cal (Chad Michael Murray) before Liam (Marcus Rosner) arrived to Sullivan’s Crossing.

Maggie asks why Liam is there, to which he replies, “Can’t a husband pop in to check on his wife?”

Cal, meanwhile, questions why he didn’t know about Liam.

“I would have thought you would have mentioned being married before,” he mentions before another scene has Maggie discussing how she’s “happy now” with Cal.

Based on the book series by Robyn Carr, Sullivan’s Crossing follows neurosurgeon Maggie after she moves back home to rural Nova Scotia to reconnect with her estranged father, Sully (Scott Patterson). The brief getaway turns into Maggie making plans for a future in Sullivan’s Crossing with love interest Cal.

Season 3 of the hit series, which started streaming on Netflix in August 2025, threw a wrench in Maggie and Cal’s relationship just as they were getting to a good place. After arguing about whether Maggie was taking things too slow, they made plans to move in together — just as a new guest named Liam checked into Sullivan’s Crossing.

Liam then approached Maggie and revealed he was her husband, which came as a surprise to both Cal and Us. Showrunner Roma Roth later teased what viewers could expect from the show moving forward after the shocking reveal.

“I’m absolutely thrilled that Sullivan’s Crossing is returning for a fourth season,” Roth said in a statement after the finale aired. “Seeing it resonate with a global audience and watching the ratings climb have been a dream come true. Season 4 will explore themes of change and transformation so you can expect a whole new set of exciting and emotional challenges for Maggie and Cal.”

Kohan also shared her reaction to the twist.

“I remember hearing a little bit [about Liam early in season 3]. I didn’t know they were married,” Kohan told Swooon in July 2025. “There started to be talk when we filmed the scene with Lola and having summer flings. I knew that he was going to be coming into it, but I didn’t really know when or in what capacity. That cliffhanger was so much fun for me to read as well.”

Kohan acknowledged that Maggie’s trepidation about getting serious with Cal could have come from her past with Liam, adding, “I feel like it came up so last minute that I didn’t really have time to think about it, but I think it definitely would. It makes a lot more sense, for sure, for her to be more hesitant.”

The actress noted that she was just as in the dark about Liam’s role in season 4 as the audience.

“At the same time, I still don’t know the history, so who knows when we get to find out a bit more of that information, what he really means that he’s her husband and all that kind of stuff,” she continued. “I mean, there’s gonna have to be a few conversations had [between Maggie and Cal]. It’s going to be a trust thing to have to build up again because that is a pretty big thing to leave out.”

Sullivan’s Crossing is currently streaming on Netflix. Season 4 premieres on CTV and Crave Canada in spring 2026.

Entertainment

Chris Pratt Had A ‘List Of Directives’ Before Getting Remarried

Actor Chris Pratt is opening up on the “list of directives” he made with Katherine Schwarzenegger before they got married. The couple tied the knot in 2019 and now share three children together. The “Guardians of the Galaxy” star recently shared a little known secret about his marriage, revealing that they went to couples counseling before tying the knot in order to set some ground rules.

Article continues below advertisement

Chris Pratt Reveals He Went To Couples Counseling Before Getting Married

During an appearance on Rob Lowe’s “Literally! With Rob Lowe” podcast, the “Jurassic World” star revealed that premarital counseling helped his marriage before it even began.

“A part of getting married at St. Monica [Catholic] Church is doing premarital counseling,” Pratt told his “Parks and Recreation” costar, as per Entertainment Weekly. “We did like six sessions with this guy who was, by the way, the best thing in the world.”

Article continues below advertisement

“If you’re somebody who’s thinking of getting married, you should definitely follow this,” he continued. “They ask you questions you would not even think to answer until you’ve been married for eight years, and then something comes up, and you’re like, ‘What do you mean? That’s what you think about that?’ And then you have to negotiate it then. Like re-negotiating every landmine.”

Article continues below advertisement

Chris Pratt Describes Premarital Counseling As ‘Really Great’

Describing the experience as “really great,” he explained how they “came up with this whole list of directives” that they were going to have in their partnership and wedding. This allowed them to confront potential disagreements before they actually happened.

“One of them was that we were gonna play Christmas music on November 1, and that we were gonna take the Christmas tree down December 26,” he explained. “We talked about it beforehand. So now we’re on board.”

Lowe, who has been married to Sheryl Beroff since 1991, said that Pratt’s “list of directives” sounded like a “great idea.”

Article continues below advertisement

Chris Pratt Was Previously Married To Anna Faris

During their conversation, Pratt continued to praise the benefits of going to therapy before getting married.

“And that way, if you have an issue, you talk about it, and you hash it out, every single one,” Pratt continued. “If you agree on it, you move on. But if there’s things you disagree on, you hash it out, and you do the work” to understand your partner.

Confronting disagreements head-on was especially important to Pratt, as this was not his first marriage. The actor was previously married to “Scary Movie” actress Anna Faris from 2009 to 2018. They share one son: Jack, 13. Pratt and Schwarzenegger welcomed three children together: daughters Lyla, 5, Eloise, 3, and son Ford, 1.

Article continues below advertisement

Chris Pratt Feels ‘Shaken’ As New Movie Flops

As The Blast previously reported, the “Passengers” actor is starting to worry that his days in Hollywood might be numbered. His latest movie, “Mercy,” received negative reviews from critics and failed to bring in audiences at the box office.

“Chris is panicking. Full stop,” one source told The Daily Mail in early February. “This is the first time he’s really feeling his age in Hollywood—and it’s shaken him.”

“He always thought he had another decade of bulletproof stardom,” another insider divulged. “Now he’s looking around and realizing the parts aren’t coming like they used to.”

A third source said that Pratt has now become “obsessed with box office numbers and Rotten Tomatoes scores” as a result of the film’s poor performance.

Pratt Worked With The LAPD To Film ‘Mercy’

Late last year, while promoting the film at New York City Comic Con, Pratt told PEOPLE magazine that he worked extensively with the LAPD to bring his character to life. In the film, he plays a police detective accused of murdering his wife. Ultimately, he only has ninety minutes to prove his innocence to an AI judge while being physically strapped to a chair.

“I mean, some of the stunt work we did was really great. We got to drive cop cars and do some cool bar fight stuff,” he recalled before praising the law enforcement officials that he worked with as “heroes.”

Article continues below advertisement

“Man, these guys are heroes,” he continued. “The trouble that they encounter and the trauma they see on a day-to-day basis is really, really staggering.” Despite the poor box office reception, he described the experience of working with the LAPD on the film as “really incredible.”

Entertainment

Olympic skier Lindsey Vonn crashes while competing on torn ACL, dashing comeback hopes

:max_bytes(150000):strip_icc():format(jpeg)/Lindsey-Vonn-Alpine-Skiing-Olympics-020826-689123880b204b4487edaff9d5c18195.jpg)

The women’s downhill was won by Vonn’s U.S. teammate Breezy Johnson.

Entertainment

Sigourney Weaver’s R-Rated 90s Psychological Thriller Is A Devious Game Of Cat And Mouse

By Robert Scucci

| Published

1995’s Copycat is one of those movies that should be in heavy rotation if you’re a true crime fan who also enjoys a solid psychological thriller. Like a proto version of Mindhunter, it leans into the lore surrounding heavy hitters like Albert DeSalvo, The Hillside Strangler, David Berkowitz, Jeffrey Dahmer, and Ted Bundy, but every single reference is filtered through the perspective of a strung out criminal psychology expert as she aids two homicide detectives in tracing a copycat killer who mimics the MOs of the serial killers who inspired him.

Through this framework, and with the help of Sigourney Weaver’s on-screen chemistry with Holly Hunter and Dermot Mulroney, Copycat becomes a fun murder mystery thriller that manages to appeal to both casual moviegoers and true crime buffs alike.

A Killer On The Loose, An Expert Trapped Inside Her Trauma

Copycat first introduces us to the trauma that forces criminal psychology expert Dr. Helen Hudson (Sigourney Weaver) into a reclusive lifestyle. Suffering from agoraphobia and drinking her way through each day, Dr. Helen is the ultimate authority on serial killer behavior. That authority comes at a cost after her dangerous run-in with escaped killer Daryll Lee Cullum (Harry Connick Jr.) during one of her lectures, an encounter that forces her to value her safety and privacy above everything else. While she still has a passion for her research and criminal profiling, Dr. Helen suffers anxiety attacks at the mere thought of leaving her luxury apartment, effectively trapping herself inside her own expertise.

When a string of murders begins to plague San Francisco, Inspector Mary Jane “M.J.” Monahan (Holly Hunter) and her partner, Inspector Ruben Goetz (Dermot Mulroney), are tasked not only with finding the culprit behind the slayings, but also with keeping the possibility of a serial killer under wraps in order to avoid sparking unnecessary public hysteria.

This is where the magic really happens in Copycat. Dr. Helen Hudson is a force to be reckoned with. Her pattern recognition and ability to profile on the fly as new evidence comes to light is intimidating to say the least. She initially helps M.J. and Ruben begrudgingly, but soon becomes just as consumed with the case as they are. M.J. is the inverse of Helen in almost every way. She lacks the years of experience needed to draw the same immediate connections, but makes up for it by trusting her instincts and acting decisively when it matters most.

As they work together, M.J., Ruben, and Dr. Hudson realize they are dealing with a serial killer whose MO is defined by the absence of one. Rather than developing his own methodology, the killer meticulously recreates the murder techniques and crime scene imagery of the serial killers he idolizes. By constantly changing his approach, he stays one step ahead of the inspectors hunting him, all while dropping increasingly unsettling hints that Dr. Helen Hudson herself is his ultimate target, for reasons that are not immediately clear.

The Perfect Intersection Of True Crime And Fiction

While Copycat leans heavily into true crime to build its internal logic, you do not need to be a true crime junkie to appreciate what it’s doing. References are limited to the most well-known real-life killers, giving casual viewers enough context to understand the stakes without requiring a post-watch research spiral.

The procedural details the film leans on are delivered in self-contained bursts of criminal profiling that are easy to follow, allowing viewers to simply sit back and watch the mystery unfold. The film never feels like it’s testing the audience or showing off its homework.

In other words, if you’re into shows like Mindhunter but less interested in the kind of granular breakdowns found in something like Last Podcast on the Left, Copycat strikes an ideal balance. It’s a rock-solid thriller that doesn’t require a crash course in the macabre to fully appreciate, and its slow-burn mystery keeps the tension simmering from start to finish.

Copycat is currently streaming for free on Tubi.

Entertainment

Lindsey Vonn Crashes, Heard Screaming in Pain at 2026 Olympics After ACL Tear

Lindsey Vonn’s heroic attempt at Olympics immortality ended in devastating agony.

Vonn, 41, crashed during her women’s downhill run at the 2026 Winter Olympics on Sunday, February 8, which came just nine days after she completely tore her ACL.

The crash happened 13 seconds into the American skier’s run. Vonn could be heard screaming in agony while being attended to by medical staff on the Olympia delle Tofane course in Cortina d’Ampezzo, Italy.

Vonn was eventually airlifted off the course by a helicopter, a similar scene to the one that played out on January 30 when she tore her ACL during a World Cup Race in Crans-Montana, Switzerland.

“Lindsey Vonn sustained an injury, but is in stable condition and in good hands with a team of American and Italian physicians,” the U.S. Ski & Snowboard team said in a statement on Sunday.

In a photo captured by Associated Press photographer Jacquelyn Martin, Vonn’s right ski pole can be seen clipping a gate, which led to the crash.

A giant screen shows US’ Lindsey Vonn receiving assistance after a crash in the women’s downhill event during the Milano Cortina 2026 Winter Olympic Games at the Tofane Alpine Skiing Centre in Cortina d’Ampezzo on February 8, 2026. Tiziana FABI / AFP

The day before the event, Vonn defended competing despite her injury in a response to sports medicine doctor Brian Sutterer.

“lol thanks doc,” Vonn posted via X on Saturday, February 7. “My ACL was fully functioning until last Friday. Just because it seems impossible to you doesn’t mean it’s not possible. And yes, my ACL is 100% ruptured. Not 80% or 50%. It’s 100% gone.”

Vonn also called out USA Today‘s Greg Graber on Saturday, who wrote a column questioning why Vonn was competing with a torn ACL.

“I’m sorry Greg but this is a very odd opinion piece,” Vonn wrote via X. “The pain and suffering is the point? I’m searching for meaning? Why am I taking risk “at my age?” This ageism stuff is getting really old.”

She continued, “My life does not revolve around ski racing. I am a woman that loves to ski. I don’t have an identity issue, I know exactly who I am. I was retired for 6 years and I have an amazing life. I don’t need to ski, but I love to ski. I came all this way for one final Olympics and I’m going to go and do my best, ACL or no. It’s as simple as that. And respectfully, if you don’t know the story, it might be best not to make assumptions.”

Vonn revealed she had completely torn her ACL on Tuesday, February 3, but vowed to see through her Olympic comeback, which came after she announced her return to the sport in November 2024.

“Well… I completely tore my ACL last Friday,” Vonn shared via Instagram. “I also sustained a bone bruise (which is a common injury when you tear your ACL), plus meniscal tears but it’s unclear how much of that was there previously and what was new from the crash. This was obviously incredibly hard news to receive one week before the Olympics. I really appreciate everyone giving me time and space to process what happened and find a way forward.”

She continued, “After extensive consultations with doctors, intense therapy, physical tests as well as skiing today, I have determined I am capable of competing in the Olympic Downhill on Sunday. Of course I will still need to do one training run, as is required to race on Sunday, but… I am confident in my body’s ability to perform. Despite my injuries my knee is stable, I do not have swelling and my muscles are firing and reacting as they should. I will obviously be continuing to evaluate with my medical team on a daily basis to make sure we are making smart decisions but I have every intention of competing on Sunday.”

Entertainment

17 Writer-Loved Boutiquey Sweaters That Are Warm yet Breathable

Us Weekly has affiliate partnerships. We receive compensation when you click on a link and make a purchase. Learn more!

I’ve been freezing lately. Maybe it’s the sub-zero temps or blustery winds, but either way, I’m seeking warmth ASAP. At the same time, I’m also fussy about being too hot. Enter these 17 boutique-style sweaters that are designed to combine peak coziness and breathability.

It’s best to search for fabric blends that are made with natural fibers like wool, cotton and cashmere that are temperate enough for winter weather (sans the sweat). When combined with stretchy fabrics like elastane or spandex, which complement the body, you’re sure to look and feel your best. I played Goldilocks to find these plush, lightweight knits that masterfully retain heat while promoting air flow. They’re not too thick or too thin — they’re just right. Better yet, my picks start at just $7!

17 Boutique-Style Sweaters to Stay Warm, Not Hot

1. Yacht Wife: Fuzzy and luxe, this striped sweater makes you look like a rich yacht wife. I love the nautical appeal.

2. Perfect Balance: This oversized chunky cable-knit sweater is thick, however, it’s made with a cotton-blend material for enhanced breathability.

3. Like Loungewear: You’ll forget you ever left the couch in this stretchy ribbed-knit sweater that’s casual but polished. One shopper even said it feels like being wrapped in a blanket.

4. Be Mine: This darling heart-print sweater is perfect for February. If you wear it on Cupid’s Day, expect a proposal.

5. Layering Staple: Polyester isn’t all bad. In fact, the material is known for trapping heat like a champ, which works well with this thin, layering-ready sweater.

6. Polo Trend: Rich moms like Gwyneth Paltrow and Hilary Duff can’t stop wearing this preppy polo sweater style. Need I say more?

7. Old Money: People will think you’re old money-rich when you wear this long, relaxed-fitting cardigan that features elegant gold buttons. It should cost thousands!

8. Corporate Queen: Look no further for the perfect office cardigan. The tailored fit makes you appear stylish and professional.

9. Cool Mom: Oversized sweaters aren’t always flattering, but this fuzzy wonder hangs in all the right places.

10. Check Yes: I’m obsessed with this checker-print sweater, especially the mock neckline and roomy lantern sleeves.

11. Wrapped Up: This wrap piece in between a cardigan and a classic sweater, giving you a two-in-one design we can’t get over. Psst, it effortlessly cinches at the waist.

12. Pretty and Playful: This quarter-sleeve sweater is both trendy and timeless, thanks to wavy hems and contrast detailing.

13. Apple of My Eye: Between the eyelet material and gentle pleated detailing, this dainty puff-sleeve sweater belongs in a Hamptons boutique . . . as well as my closet.

14. Budget-Friendly: Channel millionaire vibes in this expensive-looking pullover that features crochet details, a ribbed knit design and rich color options.

15. Short-Sleeve Stunner: Transition seamlessly from winter to spring in this wool-blend tee. I’m grabbing one for picnics, errands and Zoom calls.

15. Center of Attention: It doesn’t get cozier than this Merino wool cardigan, especially since it has a tastefully oversized construction.

16. So Sporty: Who needs a country club membership? This business-casual polo sweater does all the talking, especially when you roll the sleeves up slightly.

17. Run Warm: This 100% cotton pullover layers beautifully with cardigans, denim jackets and trench coats. It gives you control over your temperature at all times.

18. Like Butter: Shoppers rave about this relaxed quarter-zip pick, describing it as buttery soft, warm and wrinkle resistant. Score!

19. Everyday Outfit: If you’re always running out the door like me, you’ll want this crochet-style blouse on hand. It styles perfectly with jeans and sneakers.

Entertainment

Which The Artful Dodger Stars Are — And Aren’t — Returning for Season 2

Hulu’s The Artful Dodger is returning for a second season three years later — so who is and isn’t returning after that deadly cliffhanger?

Acting as a sequel to Charles Dickens‘ novel Oliver Twist, The Artful Dodger is set in the 1850s and follows Jack Dawkins (Thomas Brodie-Sangster), who is a former Royal Navy surgeon trying to establish himself as a respected young doctor.

“When an old acquaintance, Fagin, resurfaces, it forces Jack, once a London-based pickpocket known as the Artful Dodger, back into a life of crime,” read the official synopsis. “Jack forms an attachment to the governor’s daughter, Lady Belle Fox, who aspires to be a surgeon.”

The description continued: “As Jack’s past intersects with the present and external forces jeopardize his goals, his life unravels, raising questions about whether he can genuinely reshape his life in the colony as he had envisioned.”

The first season, which premiered in 2023, concluded with Fagin (David Thewlis) getting the better against Oliver Twist (Hal Cumpston) while Jack performed risky surgery to save Belle (Maia Mitchell). Before the love interests can be reunited, Jack is betrayed and arrested by Gaines (Damon Herriman).

One year after the show debuted on Hulu, the streaming service renewed it for a second season.

“The Artful Dodger returns, and he’s in deep trouble. He’s got an appointment with the noose, he’s being hunted by Inspector Boxer, Port Victory’s new lawman, and if he sees the woman he loves, Lady Belle, he’ll be hanged,” teased the official synopsis. “Meanwhile, Lady Belle is determined to forge her future in medicine, defying expectation and stepping into danger, driven by ambition and a love already hanging in the balance.”

The description concluded: “With Boxer competing with Jack for Belle’s affection, the crafty Fagin drags Dodger into their most dangerous heist yet, and a killer is on the loose. Get ready for an explosive season of new characters and locations with more thrills, humor, heart, invention and deception than ever.”

Keep scrolling to see which cast members are — and aren’t — coming back when the show returns:

Thomas Brodie-Sangster

There would be no Artful Dodger without Jack Dawkins so Brodie-Sangster is returning — despite that cliffhanger.

David Thewlis

Jack’s surrogate father a.k.a Fagin also has a central role in the sophomore season of the show.

Maia Mitchell

After Jack and Belle’s relationship became the main focus of season 1, Mitchell is back in the fan-favorite role.

Susie Porter

Belle’s mother is expected to keep playing a role in keeping Jack and Belle apart.

Damon Herriman

Gaines isn’t expected to return in season 2 after being a main character on the show.

Damien Garvey

The rest of the Fox family is also a crucial part of the show.

Lucy-Rose Leonard

Belle will need her sister by her side in the second season of the show.

Nicholas Burton

Since Jack will keep performing surgeries, Sneed is back in the hospital as well.

Luke Bracey

Belle and Jack’s romance might hit a snag with the introduction of Bracey’s Inspector Henry Boxer.

Jeremy Sims

Sims is introduced as Uncle Dickie in season 2 of The Artful Dodger.

Zac Burgess

Burgess will be part of the ensemble cast when The Artful Dodger returns to Hulu.

Hal Cumpston

Cumpston’s return hasn’t been confirmed for season 2.

Entertainment

‘Masters of the Universe’ Can’t Replace One of the Greatest ’80s Toy Shows

The 1980s were a veritable golden age of toy-based cartoons, especially in the action-figure-driven category. Many success stories grew out of that era, including Masters of the Universe, and its spin-off, She-Ra: Princess of Power, The Transformers, ThunderCats, and Teenage Mutant Ninja Turtles. However, the arguable king of the 1980s toy-based cartoons was the classic, animated series for Hasbro’s G.I. Joe: A Real American Hero. G.I. Joe led the pack through the formative decade of “toyetic” action-adventure animated shows, but Hollywood still struggles to get G.I. Joe right.

A Collaboration Between Hasbro and Marvel Comics Gave Birth to the Revamped Version of ‘G.I. Joe’

Although Hasbro’s line of G.I. Joe military-themed toys dates back to the 1960s, many fans and children of the 1980s who grew up with the IP know that the “Real American Hero” version of G.I. Joe derived from a collaboration between Hasbro and Marvel Comics, at a time when Hasbro wanted to revamp its G.I. Joe trademarks. Ultimately, the late former Marvel Editor-in-Chief Jim Shooter, as he explained in NYC Graphic Novelists, put together a creative team including himself, Larry Hama, Archie Goodwin, and Tom DeFalco, who broke the stories and came up with a new concept for what became G.I. Joe: A Real American Hero.

Ultimately, under their new concept, G.I. Joe would serve not as a nickname for a soldier, but as a codename for an elite, anti-terrorist unit. As Shooter described, “Maybe it’s like a secret squad of the best soldiers and sailors and airmen. They’re all in this secret group, and they fight terrorists and have special technology.’” Hama came up with many of the character names and would eventually become the writer of the original A Real American Hero comic series published by Marvel Comics.

Besides creating the popular 3.75-inch action figures for Marvel’s new comic, Hasbro also helped finance new animated commercials that advertised the series. The animated commercials proved so popular that an episodic animated series inspired by the new comics and action figures was commissioned, produced by Marvel and Sunbow Productions. Thus, the popular G.I. Joe: A Real American Hero animated series was born, debuting in 1983 with “The M.A.S.S. Device” miniseries, ushering in a new cartoon legend.

‘G.I. Joe’ Featured an Incredibly Diverse and Electic Cast

One of the things that’s still so striking about the 1980s G.I. Joe show, even to this day, is its incredibly diverse, eclectic, and unique cast of characters, including men and women from all walks of life and various nationalities. The troops in G.I. Joe were assembled from the best of their respective fields, with characters who specialized in everything from guerrilla warfare and ranged combat to underwater and naval battles, to pilots and airmen. G.I. Joe truly represents the melting pot culture that is America, and it spotlights those Americans coming together, fighting to defend their nation against a common enemy in COBRA. With such a large and diverse cast, there was a G.I. Joe for every type of kid.

Although the plots of the animated series were far less mature, dark, and intense than Marvel’s original comic series, some episodes of the 1980s show proved to be quite serious and provocative for their time. Series standouts easily include the two-parter, “Worlds Without Ends,” which finds a group of Joes transported to an alternate dimension where COBRA has succeeded and taken over the world, enforcing a brutal, fascist regime across the globe. In a dark scene, Steeler (Chris Latta) finds the open graves of the dead bodies of that dimension’s Joes, who were all wiped out by COBRA. The episode reinforces the importance of G.I. Joe’s work in fighting COBRA, especially for Steeler, who was growing weary from the two sides’ never-ending struggle. From time to time, G.I. Joe featured layers of nuance and pathos rarely seen in kids’ cartoons of the era.

Hollywood Constantly Struggles To Adapt ‘G.I. Joe’

Hollywood has struggled to find success in its multiple attempts to adapt G.I. Joe to the big screen, first with the 2009 live-action movie, G.I. Joe: The Rise of Cobra, and its 2013 sequel, G.I. Joe: Retaliation, which achieved mixed results. Then came the absolutely awful live-action spin-off, Snake Eyes: G.I. Joe Origins, in 2021. The 2009 movie attempted to force goofy personal backstories with Cobra Commander (Joseph Gordon-Levitt), The Baroness (Sienna Miller), and field leader Duke (Channing Tatum). The romance from the comics between Snake-Eyes (Ray Park) and Scarlett (Rachel Nichols) is sadly abandoned in favor of Scarlett and Ripcord (Marlon Wayans).

Something that all the live-action G.I. Joe movies have in common is that they failed to capture the magic of the cool characters that Larry Hama, Marvel Comics, and Sunbow Productions created, along with the more compelling elements of the G.I. Joe versus COBRA conflict. Additionally, A Real American Hero is very much steeped in 1980s values and Americana — something that does not always align with today’s values, and Hollywood creators struggle in attempting to recreate. Additionally, the Snake Eyes movie utterly fails in realizing the cool backstories of Snake Eyes (Henry Golding) and Storm Shadow (Andrew Koji), two of G.I. Joe’s most popular and iconic characters, making Snake Eyes come off like a selfish, amoral jerk. With Hollywood so desperate to reboot iconic properties over and over again, perhaps one day, someone will finally understand how to recapture the magic of G.I. Joe’s most popular era of A Real American Hero and bring it to life on the big screen.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Politics1 hour ago

Politics1 hour agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Politics3 hours ago

Politics3 hours agoThe Health Dangers Of Browning Your Food

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business8 hours ago

Business8 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know