[matched_con]

Source link

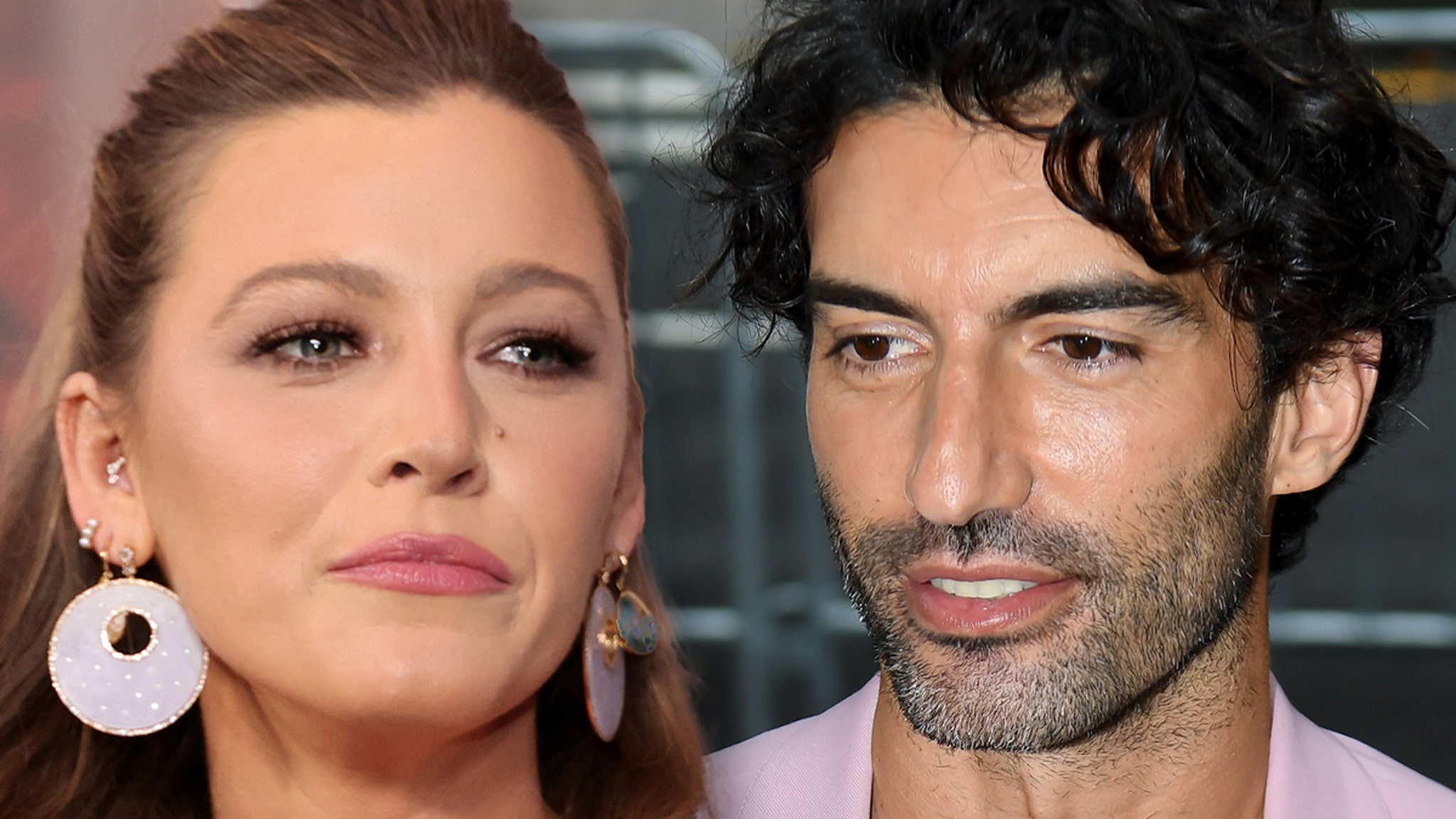

Blake Lively Now Suing Justin Baldoni for Mental Anguish, Emotional Distress

Estimated read time

1 min read

You May Also Like

Selena Gomez Addresses Biggest Misconception

January 6, 2025

Stars Shine Brighter Than Gold on 2025 Golden Globes Red Carpet

January 6, 2025

Golden Globes 2025 Red Carpet Photos: Looks and Arrivals

January 6, 2025

+ There are no comments

Add yours