Business

Exclusive | Kroger Plans to Name an Ex-Walmart Executive as Its Next CEO

Grocery giant plans to hire Greg Foran, a former executive at top rival Walmart WMT 3.34%increase; green up pointing triangle, as its next chief executive, according to people familiar with the matter.

The company is expected to announce the choice as soon as Monday, some of the people said.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

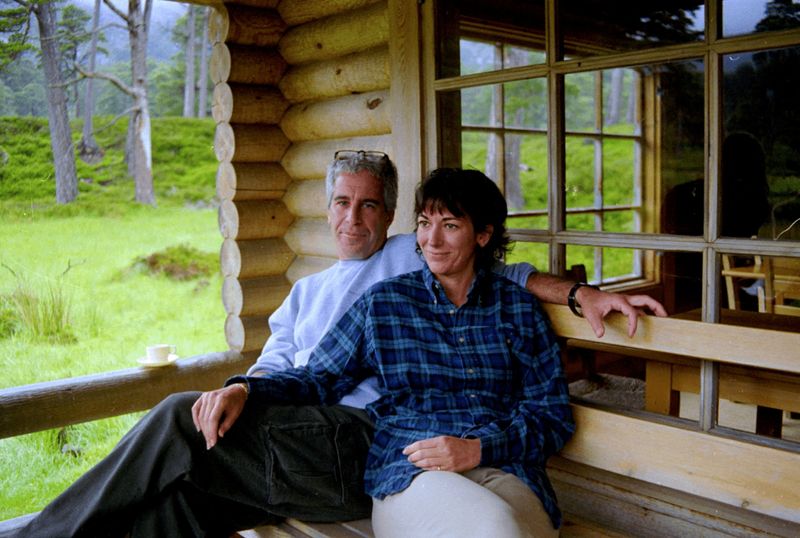

Ghislaine Maxwell won’t answer questions during congressional deposition, lawmaker says

Ghislaine Maxwell won’t answer questions during congressional deposition, lawmaker says

Business

PCEC revamp back on the table

Roger Cook is back in talks with the leaseholders of the convention centre, after the state government shelved the $1.6 billion project.

Business

Stake of local institutions in Indian cos hits new high

The stake of overseas investors in Indian firms, meanwhile, declined to 16.6% – the lowest in 14 years, according to a study based on Prime Database data.

The “sticky inflow” through systematic investment plans and from wealthy individuals and retail investors, along with pension funds increasing exposure to equities, tilted the ownership structure to local institutions, said Rupen Rajguru, head of Equity Investment and Strategy at Julius Baer India.

Agencies

Agencies Steady SIP Flows

Mutual fund (MF) holding increased to 11.1%, the highest on record, in the October-December period, the tenth consecutive quarter when it rose.

The gap between MF and foreign institutional investor (FII) holdings shrank to 5.5 percentage points (550 basis points) from 10.5 percentage points as of December 2022. “The balance of ownership in Indian equities is gradually tilting inward as MFs alone seem set to overtake FIIs,” said Prime Database managing director Pranav Haldea.

Mutual funds poured in Rs 1.06 lakh crore in the December quarter on a net basis, while global investors liquidated Rs 11,765 crore combined in the primary and secondary markets.

While flows from MFs have been the highest among domestic institutions, insurance companies with a net buying of Rs 21,490 crore, alternative investment funds (Rs 367 crore) and portfolio management services (Rs 1,205 crore) also played their part, said Haldea.

Despite zero returns in the last 16 months, SIP flows from mutual funds remained steady and strong, Rajguru said.

Foreign investors sold stocks worth over Rs 42,000 crore between October and December in 2025, after dumping Rs 1.02 lakh crore between July and September.

Analysts said uncertainty of the US-India trade deal, which also weakened the rupee, had soured foreign investor sentiment on India.

Business

Carsales.com owner sees big potential in driving AI use

Vehicle sales platform CAR Group says it’s using AI to let consumers browse for new vehicles using conversational voice search, after posting a rise in profit.

Business

Australian household spending falls in December after two strong months

Australian household spending falls in December after two strong months

Business

Israeli President Herzog begins Australia trip at site of Bondi Beach attack

Israeli President Herzog begins Australia trip at site of Bondi Beach attack

Business

Trump administration appeals ruling on releasing New York City tunnel funds

Trump administration appeals ruling on releasing New York City tunnel funds

Business

Asian stocks rise, Nikkei jumps after Takaichi win

The Nikkei 225 Index surged as much as 5.7% to a record as a historic election victory by Prime Minister Sanae Takaichi buoyed markets. The Kospi Index — a poster child for artificial intelligence investments — jumped over 4%. US equity-index futures advanced after the underlying gauges rose about 2% on Friday amid dip buying, while Bitcoin also recovered from its tumble. Yields on 10-year Treasuries rose almost two basis points on Monday.

Gold and silver opened the week higher, even though the precious metals are still way off their record highs. Brent crude dipped around 1% as tensions eased in the Middle East.

The Dow Jones Industrial Average climbed to a record 50,000 on Friday, reflecting a shift toward cyclical stocks as investors pared exposure to technology. Monday’s rally in stocks sets up a critical week ahead, with markets gauging whether demand can broaden as scrutiny intensifies around valuations and the scale of investment tied to AI.

Traders were taking advantage of the selloff earlier last week, picking up some cheap stocks to extend the rotational trade into cyclicals and away from tech, said Tony Sycamore, an analyst at IG in Sydney. The Wall Street tailwind and Japan election results mean “at least for the very, very short term, we’re going to see a good risk-on session across Asian equity markets,” he added.

Meanwhile, the yen fluctuated Monday as Takaichi secured a historic election triumph. The result cleared the way for more fiscal stimulus under Takaichi, adding pressure on Japanese bonds while potentially lifting stocks. Yields on the nation’s 10-year government bond rose five basis points on Monday.

Japan’s election outcome reinforced expectations for looser fiscal policy and sustained pressure on the yen, with investors bracing for so-called Takaichi trades to dominate markets on Monday.

Business

Bangladesh votes in world’s first Gen Z-inspired election

Bangladesh votes in world’s first Gen Z-inspired election

Business

Trump congratulates Japan’s Takaichi on election win

Trump congratulates Japan’s Takaichi on election win

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics8 hours ago

Politics8 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business7 hours ago

Business7 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics10 hours ago

Politics10 hours agoThe Health Dangers Of Browning Your Food

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business15 hours ago

Business15 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat2 hours ago

NewsBeat2 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

![Cardi B - Money [Official Music Video]](https://wordupnews.com/wp-content/uploads/2026/02/1770603085_hqdefault-80x80.jpg)