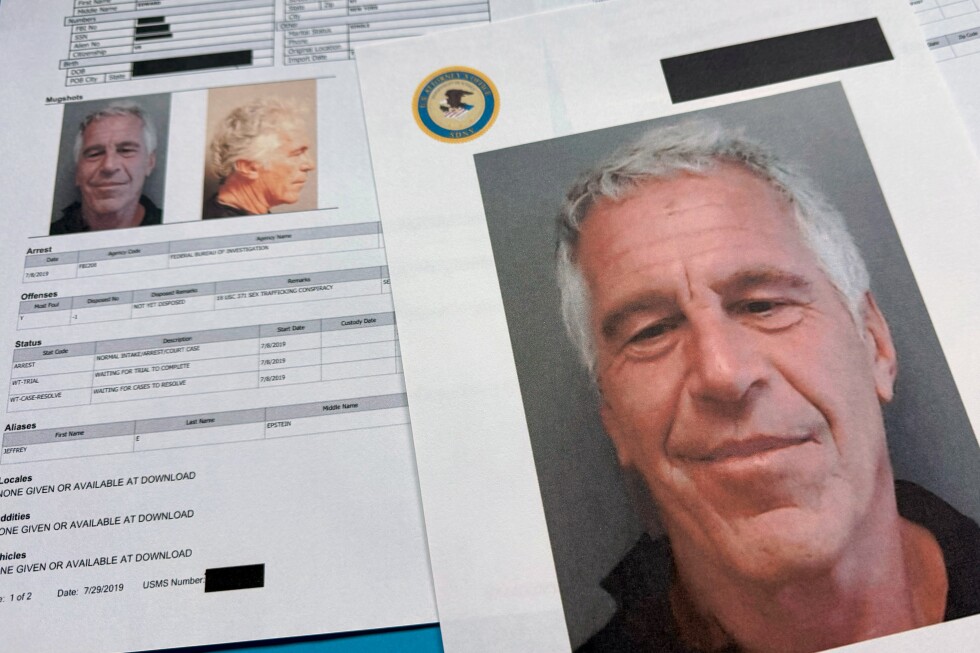

NEW YORK (AP) — The FBI pored over Jeffrey Epstein’s bank records and emails. It searched his homes. It spent years interviewing his victims and examining his connections to some of the world’s most influential people.

But while investigators collected ample proof that Epstein sexually abused underage girls, they found scant evidence the well-connected financier led a sex trafficking ring serving powerful men, an Associated Press review of internal Justice Department records shows.

Videos and photos seized from Epstein’s homes in New York, Florida and the Virgin Islands didn’t depict victims being abused or implicate anyone else in his crimes, a prosecutor wrote in one 2025 memo.

An examination of Epstein’s financial records, including payments he made to entities linked to influential figures in academia, finance and global diplomacy, found no connection to criminal activity, said another internal memo in 2019.

While one Epstein victim made highly public claims that he “lent her” to his rich friends, agents couldn’t confirm that and found no other victims telling a similar story, the records said.

Summarizing the investigation in an email last July, agents said “four or five” Epstein accusers claimed other men or women had sexually abused them. But, the agents said, there “was not enough evidence to federally charge these individuals, so the cases were referred to local law enforcement.”

The AP and other media organizations are still reviewing millions of pages of documents, many of them previously confidential, that the Justice Department released under the Epstein Files Transparency Act and it is possible those records contain evidence overlooked by investigators.

But the documents, which include police reports, FBI interview notes and prosecutor emails, provide the clearest picture to date of the investigation — and why U.S. authorities ultimately decided to close it without additional charges.

Dozens of victims come forward

The Epstein investigation began in 2005, when the parents of a 14-year-old girl reported she had been molested at the millionaire’s home in Palm Beach, Florida.

Police would identify at least 35 girls with similar stories: Epstein was paying high school age students $200 or $300 to give him sexualized massages.

After the FBI joined the probe, federal prosecutors drafted indictments to charge Epstein and some personal assistants who had arranged the girls’ visits and payments. But instead, then-Miami U.S. attorney Alexander Acosta struck a deal letting Epstein plead guilty to state charges of soliciting prostitution from an underage girl. Sentenced to 18 months in jail, Epstein was free by mid-2009.

In 2018, a series of Miami Herald stories about the plea deal prompted New York federal prosecutors to take a fresh look at the accusations.

Epstein was arrested in July 2019. One month later, he killed himself in his jail cell.

A year later, prosecutors charged Epstein’s longtime confidant, Ghislaine Maxwell, saying she’d recruited several of his victims and sometimes joined the sexual abuse. Convicted in 2021, Maxwell is serving a 20-year prison term.

Prosecutors fail to find evidence backing most sensational claims

Prosecution memos, case summaries and other documents made public in the department’s latest release of Epstein-related records show that FBI agents and federal prosecutors diligently pursued potential coconspirators. Even seemingly outlandish and incomprehensible claims, called in to tip lines, were examined.

Some allegations couldn’t be verified, investigators wrote.

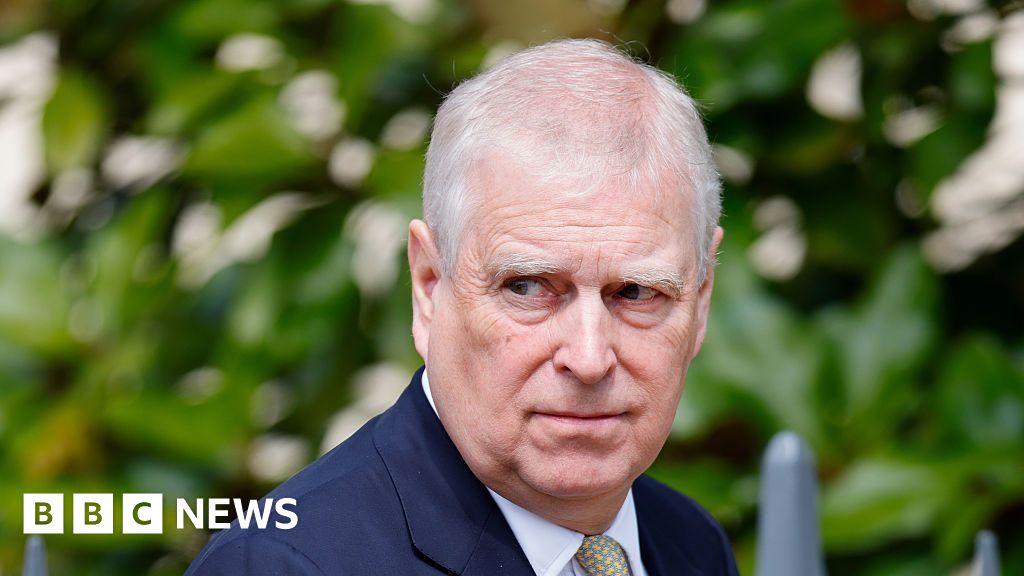

In 2011 and again in 2019, investigators interviewed Virginia Roberts Giuffre, who in lawsuits and news interviews had accused Epstein of arranging for her to have sexual encounters with numerous men, including Britain’s former Prince Andrew.

Investigators said they confirmed that Giuffre had been sexually abused by Epstein. But other parts of her story were problematic.

Two other Epstein victims who Giuffre had claimed were also “lent out” to powerful men told investigators they had no such experience, prosecutors wrote in a 2019 internal memo.

“No other victim has described being expressly directed by either Maxwell or Epstein to engage in sexual activity with other men,” the memo said.

Giuffre acknowledged writing a partly fictionalized memoir of her time with Epstein containing descriptions of things that didn’t take place. She had also offered shifting accounts in interviews with investigators, they wrote, and had “engaged in a continuous stream of public interviews about her allegations, many of which have included sensationalized if not demonstrably inaccurate characterizations of her experiences.” Those inaccuracies included false accounts of her interactions with the FBI, they said.

Still, U.S. prosecutors attempted to arrange an interview with Andrew, now known as Andrew Mountbatten-Windsor. He refused to make himself available. Giuffre settled a lawsuit with Mountbatten-Windsor in which she had accused him of sexual misconduct.

In a memoir published after she killed herself last year, Giuffre wrote that prosecutors told her they didn’t include her in the case against Maxwell because they didn’t want her allegations to distract the jury. She insisted her accounts of being trafficked to elite men were true.

Prosecutors say photos and videos don’t implicate others

Investigators seized a multitude of videos and photos from Epstein’s electronic devices and homes in New York, Florida and the U.S. Virgin Islands. They found CDs, hard copy photographs and at least one videotape containing nude images of females, some of whom seemed as if they might be minors. One device contained 15 to 20 images depicting commercial child sex abuse material — pictures investigators said Epstein obtained on the internet.

No videos or photos showed Epstein victims being sexually abused, none showed any males with any of the nude females, and none contained evidence implicating anyone other than Epstein and Maxwell, then-Assistant U.S. Attorney Maurene Comey wrote in an email for FBI officials last year.

Had they existed, the government “would have pursued any leads they generated,” Comey wrote. “We did not, however, locate any such videos.”

Investigators who scoured Epstein’s bank records found payments to more than 25 women who appeared to be models — but no evidence that he was engaged in prostituting women to other men, prosecutors wrote.

Epstein’s close associates go uncharged

In 2019, prosecutors weighed the possibility of charging one of Epstein’s longtime assistants but decided against it.

Prosecutors concluded that while the assistant was involved in helping Epstein pay girls for sex and may have been aware that some were underage, she herself was a victim of his sexual abuse and manipulation.

Investigators examined Epstein’s relationship with the French modeling agent Jean-Luc Brunel, who once was involved in an agency with Epstein in the U.S., and who was accused in a separate case of sexually assaulting women in Europe. Brunel killed himself in jail while awaiting trial on a rape charge in France.

Prosecutors also weighed whether to charge one of Epstein’s girlfriends who had participated in sexual acts with some of his victims. Investigators interviewed the girlfriend, who was 18 to 20 years old at the time, “but it was determined there was not enough evidence,” according to a summary given to FBI Director Kash Patel last July.

Days before Epstein’s July 2019 arrest, the FBI strategized about sending agents to serve grand jury subpoenas on people close to Epstein, including his pilots and longtime business client, retail mogul Les Wexner.

Wexner’s lawyers told investigators that neither he nor his wife had knowledge of Epstein’s sexual misconduct. Epstein had managed Wexner’s finances, but the couple’s lawyers said they cut him off in 2007 after learning he’d stolen from them.

“There is limited evidence regarding his involvement,” an FBI agent wrote of Wexner in an Aug. 16, 2019, email.

In a statement to the AP, a legal representative for Wexner said prosecutors had informed him that he was “neither a coconspirator nor target in any respect,” and that Wexner had cooperated with investigators.

Prosecutors also examined accounts from women who said they’d given massages at Epstein’s home to guests who’d tried to make the encounters sexual. One woman accused private equity investor Leon Black of initiating sexual contact during a massage in 2011 or 2012, causing her to flee the room.

The Manhattan district attorney’s office subsequently investigated, but no charges were filed.

Black’s lawyer, Susan Estrich, said he had paid Epstein for estate planning and tax advice. She said in a statement that Black didn’t engage in misconduct and had no awareness of Epstein’s criminal activities. Lawsuits by two women who accused Black of sexual misconduct were dismissed or withdrawn. One is pending.

No client list

Attorney General Pam Bondi told Fox News in February 2025 that Epstein’s never-before-seen “client list” was “sitting on my desk right now.” A few months later, she claimed the FBI was reviewing “tens of thousands of videos” of Epstein “with children or child porn.”

But FBI agents wrote superiors saying the client list didn’t exist.

On Dec. 30, 2024, about three weeks before President Joe Biden left office, then-FBI Deputy Director Paul Abbate reached out through subordinates to ask “whether our investigation to date indicates the ‘client list,’ often referred to in the media, does or does not exist,” according to an email summarizing his query.

A day later, an FBI official replied that the case agent had confirmed no client list existed.

On Feb. 19, 2025, two days before Bondi’s Fox News appearance, an FBI supervisory special agent wrote: “While media coverage of the Jeffrey Epstein case references a ’client list,’ investigators did not locate such a list during the course of the investigation.”

___

Aaron Kessler in Washington contributed to this report.

___ The AP is reviewing the documents released by the Justice Department in collaboration with journalists from CBS, NBC, MS NOW and CNBC. Journalists from each newsroom are working together to examine the files and share information about what is in them. Each outlet is responsible for its own independent news coverage of the documents.