Crypto World

ECB Sets 2029 Target for Digital Euro Launch as Legislative Process Advances

TLDR:

- ECB targets mid-2029 for digital euro issuance pending legislative approval with pilot launch in 2027.

- Nearly 70% of European card transactions rely on non-European processors raising sovereignty concerns.

- Digital euro will use encrypted codes ensuring ECB cannot identify individual payers or transaction recipients.

- Waterfall mechanism and holding limits designed to prevent bank deposit outflows and maintain stability.

The European Central Bank continues development of the digital euro despite other central banks pausing similar projects.

Piero Cipollone, ECB Executive Board member, explained the currency’s purpose and timeline in a recent interview.

The digital euro aims to provide a pan-European payment solution while reducing reliance on non-European payment processors. Cipollone emphasized that legislation must be completed before any issuance occurs.

Timeline and Legislative Progress Move Forward

The digital euro project has reached critical legislative stages. Cipollone clarified the current status: “We have not yet issued a digital euro and we will not do so until we have the legislation in place.”

The European Commission issued its original proposal in June 2023. The Council of the European Union reached agreement in December 2025.

The European Parliament is expected to vote on its position in May 2026. Negotiations between institutions should conclude by year-end.

The ECB targets mid-2029 for potential issuance if legislation passes. “We are already working to be prepared to be able to issue the digital euro, if the legislation is in place, by mid-2029,” Cipollone stated.

A pilot program will begin in 2027 to test payment functionality. The infrastructure development timeline matches the legislative process duration.

The ECB is preparing internal systems simultaneously. This parallel approach ensures readiness when legal frameworks are established.

The legislative process involves multiple stakeholders. The European Parliament is currently reviewing amendments. The Council and Commission have aligned their positions. All parties must reach consensus before implementation proceeds.

Addressing Banking Concerns and Privacy Protections

Financial institutions have raised liquidity concerns about potential deposit outflows. The ECB designed safeguards to maintain banking stability. Cipollone explained: “The stability of banks is a major concern for the ECB, as our monetary policy transmits via banks.” The digital euro will not pay interest, removing incentives for large-scale transfers.

A waterfall mechanism will automatically draw funds from bank accounts during transactions. Users won’t need to prefund their digital euro wallets for online payments.

Offline payments require pre-loaded funds in the wallet. Holding limits will further restrict the maximum balance per user.

The specific holding limit remains under discussion. The ECB, European Commission, and Council will determine this jointly.

The process ensures no sudden changes can occur. “Even for relatively high holding limits, we don’t see any financial instability,” Cipollone noted.

Privacy protections form a core design principle. “We have built the whole project around privacy,” Cipollone stated. The ECB will only see encrypted codes, not personal identities.

“All the ECB will see is encrypted codes that represent the payer and the payee, but we will not be able to identify the individuals behind these codes,” he explained.

European payment systems currently rely heavily on non-European processors. “Almost 70% of card-initiated transactions are processed by non-European companies,” Cipollone revealed.

The digital euro addresses this dependency. Merchants, especially small businesses, face high costs from international card schemes. The ECB will not charge scheme fees, reducing transaction costs substantially.

Crypto World

Arthur Hayes challenges Multicoin’s Samani to $100K HYPE bet

A public feud between two high-profile crypto investors has turned into a proposed six-month price wager.

Summary

- Hayes offered a six-month bet on HYPE’s performance against large-cap altcoins.

- The challenge followed sharp criticism from Multicoin’s Kyle Samani.

- The wager highlights growing debate over Hyperliquid’s structure and value.

BitMEX co-founder Arthur Hayes has challenged Multicoin Capital co-founder Kyle Samani to a $100,000 bet over the future performance of Hyperliquid’s HYPE token.

The proposal was posted on X on Feb. 8, 2026, after Hayes reposted and responded to Samani’s sharp criticism of the project.

Under the terms outlined by Hayes, the bet would run from 00:00 UTC on Feb. 10 through 00:00 UTC on July 31, 2026. During that period, Hyperliquid (HYPE) would need to outperform any altcoin with a market capitalization above $1 billion on CoinGecko.

Samani would be allowed to select the comparison token. The loser would donate $100,000 to a charity chosen by the winner. The exchange comes as Hyperliquid and its token remain in focus among derivatives traders, even as the wider market trades under pressure.

Dispute over Hyperliquid’s structure and leadership

The bet follows weeks of criticism from Samani, who has repeatedly questioned Hyperliquid’s design and governance.

In recent posts, Samani said the platform’s code is not fully open-source, relies on a permissioned distribution model, and is led by a founder who left his home country to launch the business. He also accused the project of enabling criminal activity and described it as fundamentally flawed.

Hayes rejected those claims and framed the debate in market terms. He argued that if HYPE is truly a weak asset, it should fail to outperform other large-cap tokens over time. If it succeeds, he said, critics should reconsider their views.

The dispute gained traction after analyst Jon Charbonneau praised Hyperliquid’s trading execution, comparing it favorably with traditional venues such as CME. That commentary helped re-ignite debate over whether newer on-chain derivatives platforms can compete with established exchanges.

As of press time, Samani had not publicly confirmed whether he would accept the wager.

Hayes’ purchases and Multicoin-linked accumulation

The wager has drawn attention partly because of Hayes’ recent buying activity. According to on-chain data, Hayes spent approximately $1.91 million in early February 2026 to acquire 57,881 HYPE tokens. His entire holdings increased to about 131,807 tokens, which at the time was worth about $4.3 million.

These acquisitions, which came after the sales of PENDLE, ENA, and LDO, indicate a deliberate shift toward Hyperliquid. In September 2025, Hayes had sold about 96,600 HYPE tokens for roughly $5.1 million, locking in profits amid concerns about token unlocks and competition. His recent accumulation marks a renewed vote of confidence in the project.

Additionally, wallet data indicates that in late January 2026, addresses linked with Multicoin began accumulating HYPE. Reports indicate that more than 87,100 ETH was swapped for around 1.35 million HYPE tokens, worth over $40 million at the time, through intermediaries such as Galaxy Digital.

This accumulation took place while Samani continued to take a critical public stand, which complicated the ongoing discussion. However, in early February, Samani transitioned into an advisory position at Multicoin, resigning from daily management. Some observers believe this transition may have influenced the fund’s recent positioning.

For now, Hayes’ proposed bet stands as a rare public test of conviction in a market where opinions and capital flows often move in different directions. Whether Samani accepts the bet or not, the episode has placed renewed focus on Hyperliquid’s role in the evolving crypto derivatives landscape.

Crypto World

Only 10K Bitcoin is Quantum-Vulnerable and Worth Attacking

Digital asset manager CoinShares has brushed aside concerns that quantum computers could soon shake up the Bitcoin market, arguing that only a fraction of coins are held in wallets worth attacking.

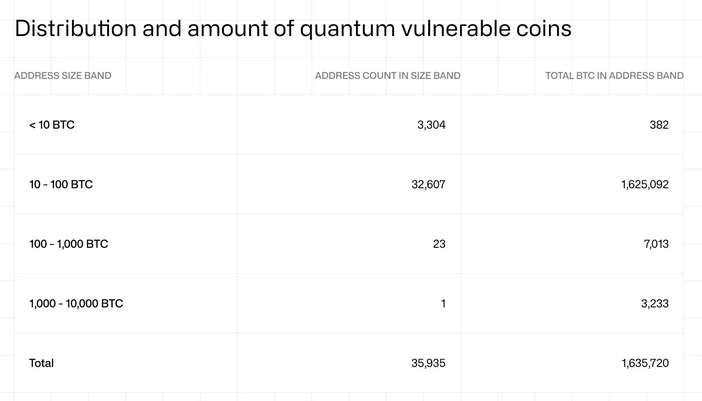

In a post on Friday, CoinShares Bitcoin research lead Christopher Bendiksen argued that just 10,230 Bitcoin (BTC) of 1.63 million Bitcoin sit in wallet addresses with publicly visible cryptographic keys that are vulnerable to a quantum computing attack.

A little over 7,000 Bitcoin are held in wallets with between 100 and 1,000 BTC, while roughly 3,230 Bitcoin are held in wallets with 1,000 to 10,000 BTC, equating to $719.1 million at current market prices, which Bendiksen said could even resemble a routine trade.

The remaining 1.62 million Bitcoin are held in wallets with holdings under 100 BTC, which Bendiksen claimed would each take a millennium to unlock, even in the “most outlandishly optimistic scenario of technological progression in quantum computing.”

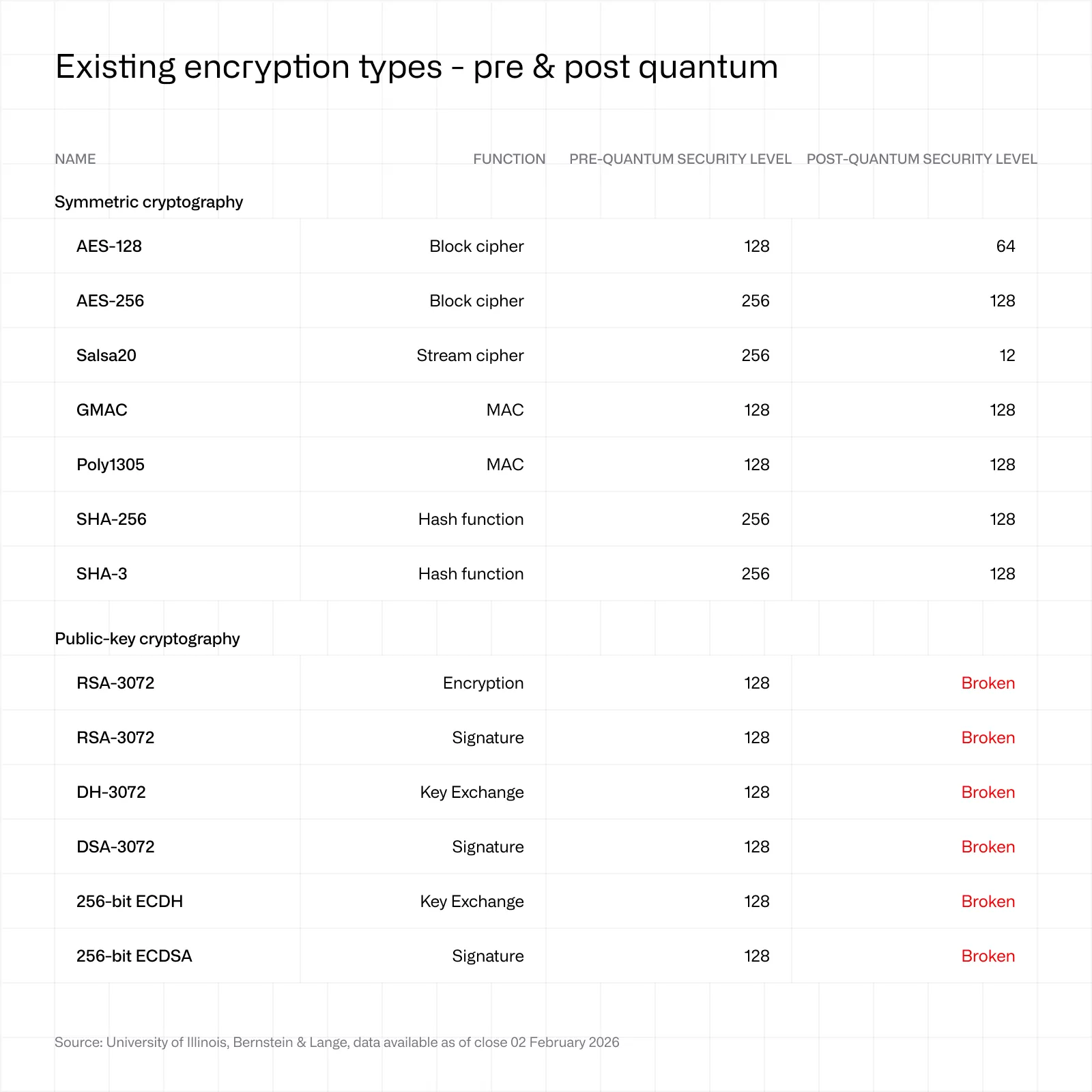

The CoinShares researcher said these “theoretical risks” stem from quantum algorithms such as Shor’s, which could break Bitcoin’s elliptic-curve signatures, and Grover’s, which could weaken the Secure Hash Algorithm 256-bit (SHA-256).

However, he argued neither quantum algorithm could alter Bitcoin’s 21 million supply cap or bypass proof-of-work, two of the Bitcoin network’s most foundational features.

Quantum fears have been among the many drivers of Bitcoin FUD (fear, uncertainty, doubt) in recent months, with critics warning that any compromise of its cryptography could threaten a network that currently secures $1.4 trillion in value.

The Bitcoin at risk are unspent transaction output (UTXO) wallets, which are chunks of Bitcoin tied to wallet addresses that have not been spent. Many of these Bitcoin wallets at risk date back to the Satoshi era.

The issue has divided the Bitcoin community over whether to implement a quantum-resistant hard fork or wait.

Related: Bitcoin ETFs ‘hanging in there’ despite BTC plunge: Analyst

Some Bitcoiners, such as Strategy executive chairman Michael Saylor and Blockstream CEO Adam Back, believe quantum threats are overblown and will not disrupt the network for decades.

Bendiksen shares those views, stating that Bitcoin is “nowhere near dangerous territory,” noting that cracking its cryptography would require millions of fault-tolerant qubits — currently far beyond the 105 qubits achieved by Google’s latest quantum computer, Willow.

“Recent advancements, including demonstrations by Google and others, represent progress but fall short of the scale needed for real-world attacks on Bitcoin.”

Others, such as Capriole Investments founder Charles Edwards, view quantum computing as a potential “existential threat” to Bitcoin, arguing that an upgrade is needed now to strengthen network security.

Edwards said Bitcoin could be repriced significantly higher once a solution is implemented, which some, like Blockstream researcher Jonas Nick, suggest could involve the adoption of post-quantum signatures.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Japan’s record 56,000 Nikkei surge sends bitcoin to $72,000, gold past $5,000

Japan’s Nikkei 225 surged to a record on Monday, breaching the 57,000 level with a 3.4% gain following Prime Minister Sanae Takaichi’s decisive “supermajority” victory in the Sunday general election, according to Nikkei Asia.

This political mandate signaled a green light for Takaichi’s aggressive expansionary fiscal agenda, which includes a massive $135 billion stimulus package aimed at revitalizing the economy through infrastructure spending and tax cuts.

The “Takaichi Trade” sparked a global ripple effect, driving gold prices past the $5,000 per ounce milestone and pushing bitcoin to a brief peak of $72,000, before settling back above $70,000 during Asia morning trading hours. U.S. stock market futures opened higher.

The market euphoria was further bolstered by international support, with both President Donald Trump and U.S. Treasury Secretary Scott Bessent congratulating the Prime Minister.

Trump is eyeing 100,000 on the Dow Jones (DJI) by the end of his term, a 100% increase from current levels. The DJI on Friday breached 50,000 for the first time.

Crypto World

Are Non-Financial Blockchain Use Cases Dead?

Prominent crypto venture capitalists are locked in a public dispute over whether non-financial use cases in crypto, Web3, and blockchain have stalled due to scarce investor demand and weak product-market fit, or if the best days for these applications—ranging from decentralized social media to digital identity and Web3 gaming—are still ahead. The quarrel began when Chris Dixon, a managing partner at a16z crypto, published an article on Friday arguing that years of scams, regulatory headwinds, and extractive practices have hindered adoption of non-financial use cases. He contends that these obstacles—and not a fundamental lack of interest—have held back breakthroughs in areas like decentralized social platforms, identity management, and onchain content streaming. The piece added a data point that underpins the debate: more than $60.7 million in fees were paid to crypto exchanges and DeFi applications in the last 24 hours, according to DeFiLlama, illustrating how the debate sits atop real market activity.

Key takeaways

- Public disagreement between a16z crypto and Dragonfly over whether non-financial crypto use cases failed due to demand or due to product-market mismatch, with each side citing different experiences and timelines.

- The debate foregrounds a core VC tension: patient, multi-year bets on new infrastructure and markets versus the need to demonstrate market traction within a typical 2–3 year fund cycle.

- DeFiLlama data shows that the most lucrative revenue streams currently come from financial use cases, underscoring a concrete misalignment between investor enthusiasm for non-financial use cases and where the fee revenue actually accrues.

- VC funding in 2025 surged, with a notable tilt toward tokenized real-world assets (RWAs), signaling a shift in focus that could redefine which on-chain innovations attract capital.

- Portfolio positioning differs markedly between the two firms: Dragonfly’s bets emphasize financial primitives and onchain value transfer, while a16z’s crypto arm spans broader Web3 sectors, including gaming, media, and community-building.

Sentiment: Neutral

Market context: The debate emerges as the crypto venture environment shifts toward RWAs and onchain financial architectures, even as activity in non-financial use cases remains mixed amid regulatory scrutiny and macro liquidity considerations.

Why it matters

The exchange highlights a fundamental question facing the crypto ecosystem: can non-financial use cases—such as decentralized social networks, digital identity solutions, and Web3 gaming—achieve sustainable adoption without a parallel surge in consumer demand and robust product-market fit? The argument for patience rests on the belief that new markets require time to mature, network effects to accrue, and users to migrate from legacy platforms to on-chain alternatives. Dixon’s stance reflects a long-horizon venture philosophy that treats crypto infrastructure and ecosystem-building as gradual, capital-intensive endeavors whose payoff is realized over a decade or more.

By contrast, Quereshi’s counterpoint is explicit: the market tests failed, and those failures aren’t merely the result of external shocks from policy makers or high-profile collapses. In his view, the simplest truth is that the products did not meet user needs, and pretending otherwise is a coping mechanism. This framing injects a sense of urgency into the debate, emphasizing that investors cannot rely on luck or timing to vindicate speculative bets; they must back products with demonstrable demand and meaningful utility within the typical funding cycle.

The tug-of-war plays out against a backdrop where the majority of fee-generating activity—while still anchored in DeFi—leans financial. A DeFiLlama visual caption accompanying the discussion notes that the top 10 on-chain applications by fees and revenue are all financial in nature. That reality complicates the narrative around non-financial utility, even as the broader crypto community keeps building toward new forms of ownership and governance that could eventually unlock demand for non-financial use cases at scale.

What to watch next

- Regulatory clarity and policy direction around non-financial crypto applications, including social media, identity, and content governance, could alter the risk-reward calculus for long-horizon bets.

- Progress in tokenized real-world assets (RWAs) and related on-chain infrastructure remains a central driver of VC interest; observe funding trends and notable exits or milestones in 2026.

- Updates on the two firms’ portfolio milestones—Dragonfly’s investments in stablecoins, payments infrastructure, and on-chain governance tools, and a16z’s broader Web3 bets in community platforms, gaming, and media—may signal shifts in where capital believes value will accrue.

- Specific projects cited in the debate, such as the Agora stablecoin, Rain’s payments infrastructure, Ethena’s synthetic dollar, Monad’s layer-1 ecosystem, and community platforms like Friends With Benefits and Yield Guild Games, could reveal early signs of product-market fit in non-financial areas.

Sources & verification

- Chris Dixon’s X article: https://x.com/cdixon/status/2019837259575607401

- Haseeb Quereshi’s response on X: https://x.com/hosseeb/status/2020451853633511696

- DeFiLlama data on activity and fees: https://defillama.com/

- Cointelegraph Research: crypto VC funding doubled in 2025 as RWA tokenization took the lead: https://cointelegraph.com/research/crypto-vc-funding-doubled-in-2025-as-rwa-tokenization-took-the-lead

- Cointelegraph explainer on RWAs and why they’re gaining attention: https://cointelegraph.com/learn/articles/why-everyone-in-crypto-is-suddenly-talking-about-rwas-in-2025

Industry debate and key details

Debate on non-financial use cases centers on two divergent philosophies about how crypto ecosystems evolve. On one side, Dixon argues that patient capital is essential to nurture new industries that will take time to develop; the onus is on founders to deliver credible, scalable platforms that can support long-term network effects. He stresses that a16z’s funds operate with at least a decade-long horizon, underscoring that “building new industries takes time.”

On the other side, Quereshi insists that a market-driven approach must take precedence. He asserts that non-financial products failed the market test not because of external catalysts but because they were, in his view, poorly designed or misaligned with user expectations. His blunt assessment challenges the narrative that policy or macro shocks alone explain the slow pace of consumer adoption for decentralized social media, identity solutions, and Web3 entertainment.

The middle ground—articulated in several responses from participants—highlights the practical tension between product feasibility and market readiness. Nic Carter of Castle Island Ventures, for example, cautions against waiting for a theoretical “rightness” before investing. He argues that fund deployment cycles require making educated bets on markets that may prove correct or incorrect within a 2–3 year timeframe, a reality that pressures venture funds to balance risk and potential reward.

Amid the debate, the broader market narrative remains shaped by 2025’s VC dynamics. A surge of capital into crypto projects, particularly RWAs and tokenization schemes, reflects evolving investor appetites and regulatory expectations. While RWAs have attracted attention as a pragmatic pathway to bridging on-chain finance with real-world assets, the execution of non-financial use cases is still in early stages. The DeFiLlama data cited in the discussion illustrates that the most valuable revenue streams today are financial applications, which may inform how new non-financial platforms design sustainable monetization strategies to compete for user attention and retention.

What it means for users, builders, and the market

The exchange of ideas among prominent VC figures matters because it frames how capital allocators evaluate risk, time horizons, and the potential for on-chain ecosystems to reach mainstream adoption. For builders, the debate signals that a viable path to success may require a dual strategy: advancing robust financial primitives that can support a wider ecosystem, while simultaneously delivering non-financial experiences with tangible user value, clear governance mechanisms, and superior UX compared with traditional platforms.

For investors, the dialogue reinforces the importance of due diligence around product-market fit, not just technology credentials. It also highlights the real-world testing ground for non-financial use cases: today’s most successful on-chain applications may still be anchored in finance, but the long-term impact could be measured by the extent to which communities adopt decentralized social, identity, and media platforms. As regulatory environments evolve and macro conditions shift, the trajectory of these projects will be shaped by whether teams can demonstrate repeatable user engagement and meaningful economic activity beyond speculative trading and token launches.

What to watch next

- Regulatory developments affecting non-financial crypto use cases and consumer-facing Web3 applications.

- Milestones in RWAs tokenization and related infrastructure that could redirect VC focus toward more tangible on-chain assets.

- Progress in notable non-financial projects within Dragonfly’s and a16z’s portfolios, including stability, user growth, and governance outcomes.

- Early product wins from decentralized social platforms, digital identity solutions, and Web3 gaming that demonstrate real consumer demand.

Sources & verification

- Chris Dixon’s article on X: https://x.com/cdixon/status/2019837259575607401

- Haseeb Quereshi’s response on X: https://x.com/hosseeb/status/2020451853633511696

- DeFiLlama data: https://defillama.com/

- Cointelegraph Research: crypto VC funding doubled in 2025 as RWA tokenization took the lead: https://cointelegraph.com/research/crypto-vc-funding-doubled-in-2025-as-rwa-tokenization-took-the-lead

- Cointelegraph explainer on RWAs: https://cointelegraph.com/learn/articles/why-everyone-in-crypto-is-suddenly-talking-about-rwas-in-2025

Industry debate and key details

Crypto World

Crypto Trader Reports $650,000 Profit Through Polymarket Copy-Trading Strategy

TLDR:

- Copy-trading high-probability outcome traders and supposed insiders led to consistent losses

- Two specialized traders focusing on MicroStrategy and geopolitics generated bulk of profits

- Manual copy-trading proved unsustainable requiring automation for 24/7 market monitoring

- Traders with fewer than 100 bets and 80-90% win rates in single niches proved most profitable

Copy-trading on Polymarket generated approximately $650,000 in profits for one crypto trader over seven months.

The trader, posting under the handle @crptAtlas, shared detailed insights into a strategy that focused on following specialized market participants rather than bots or supposed insiders.

The approach centered on identifying traders with deep knowledge in specific niches like corporate actions and geopolitical events. This method contrasts sharply with common copy-trading tactics that often result in losses.

Avoiding Common Pitfalls in Prediction Market Copy-Trading

Atlas detailed three critical mistakes that initially led to losses before the profitable strategy emerged. The first involved copying traders who purchased extremely high-probability outcomes at 99.5 cents.

These positions offered minimal edge and suffered from execution timing issues and slippage problems. Manual copying could not match the speed required for such narrow-margin trades.

The second mistake centered on chasing accounts claiming insider knowledge. Most insider screenshots circulating on crypto Twitter proved to be fabricated or exaggerated.

Atlas noted that real insiders “start from empty wallets” and “stay invisible” without attracting public attention. Every attempt to follow these supposed insider accounts resulted in zero advantage.

The third error was attempting to replicate high-frequency traders and scalpers. These accounts executed dozens of trades per minute across multiple markets.

Atlas explained that “by the time your trade executes, price already moved” and spreads disappeared. The structural design of these strategies made them impossible to copy effectively.

After these failures, Atlas asked a pivotal question: “If bots, insiders, and scalpers don’t work – who does?” The answer proved straightforward: “Normal traders with asymmetric knowledge in one narrow niche.”

The new filtering criteria included fewer than 100 total bets and win rates between 80-90 percent. Medium position sizes of $40,000-$50,000 per bet proved more reliable than million-dollar wagers.

Targeting Specialized Knowledge Over Market Noise

Two specific traders drove the bulk of the reported profits. The first specialized in MicroStrategy-related predictions with eight trades and a 100 percent win rate.

Each position tied to company announcements or Bitcoin purchases. Atlas attributed success to “deep understanding of MSTR behavior” and “pattern recognition around timing and disclosures.” This trader alone generated approximately $140,000 in profits.

The second trader focused exclusively on global politics and international relations. With 43 predictions and 42 wins, this account demonstrated consistent accuracy in geopolitical outcomes.

Atlas noted that one single trade produced roughly $211,000 in profit. The trader referenced a Foresight News interview where similar strategies were publicly discussed.

Atlas initially copied trades manually but found the approach unsustainable for 24/7 market monitoring. A Telegram-based automation tool handled execution while human judgment guided wallet selection and position sizing. Starting with small positions allowed pattern validation before scaling to $10,000-$30,000 per trade.

The trader emphasized that prediction markets represent structural inefficiencies not yet fully professionalized. Atlas stated that “prediction markets are not just crypto gambling” but rather unexploited opportunities. The trader believes Polymarket will expand in 2026 regardless of broader crypto market conditions.

Probabilistic betting on real-world outcomes offers opportunities distinct from traditional cryptocurrency trading dynamics.

Crypto World

Gear Up for the Fed’s ‘Gradual Print’ Strategy

As the Federal Reserve navigates a gradual path of monetary expansion, investors increasingly view crypto markets through a macro lens. In a view echoed by Lyn Alden, a respected economist and Bitcoin advocate, the current regime is likely to spur asset prices in a measured way—enough to lift high-quality assets while avoiding the explosive rallies some on-chain enthusiasts once forecast. Alden argues the Fed’s balance sheet will grow roughly in proportion to nominal GDP, a framework that, she contends, supports a cautious reallocation toward scarce, resilient assets and away from crowded speculative bets. In this environment, Bitcoin (CRYPTO: BTC) remains a focal point for traders weighing how policy will ripple through liquidity and risk appetite.

The strategist’s stance sits against a backdrop of political and regulatory uncertainty shaping the Fed’s next moves. Alden’s February 2026 investment strategy newsletter suggests a continued emphasis on “high-quality scarce assets,” coupled with a strategic rebalance away from euphoric sectors toward areas that are under-owned but structurally robust. The broader context includes the ongoing debate about who will lead the Fed next, with market participants parsing how a potential chairmanship—whether Kevin Warsh or another figure—might tilt policy toward hawkish or dovish tendencies. The macro narrative is essential for crypto traders because interest-rate trajectories and liquidity cycles are historically linked to crypto price dynamics.

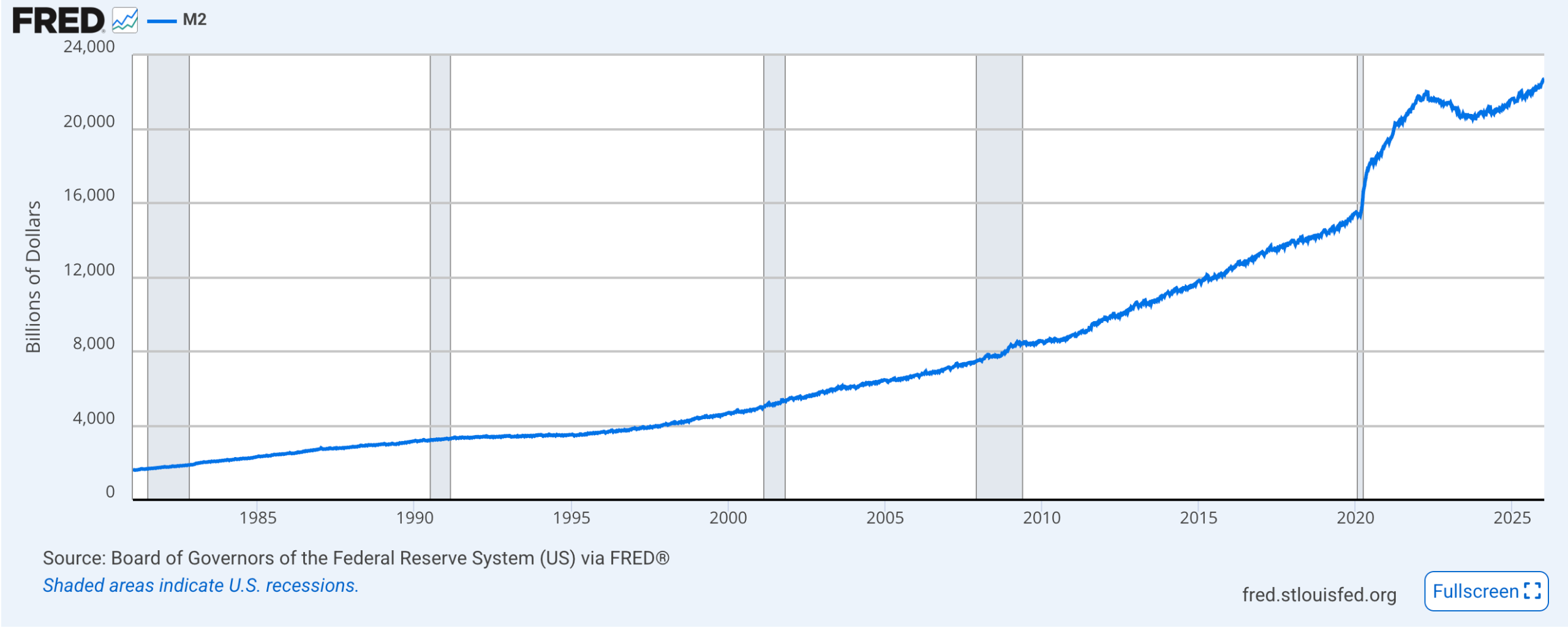

Historically, market outcomes hinge on the direction of credit and money supply. When policymakers expand credit by increasing the money supply, many assets—crypto included—tend to benefit in the near term. Conversely, a contractionist stance manifested through higher rates can dampen risk assets and compress prices. This duality informs current expectations: central banks have signaled a cautious, data-dependent approach, but investors remain vigilant for any signs that the balance sheet will outpace or merely keep pace with monitored economic growth. In late 2025, Powell pointed to a nuanced policy path, describing inflation and employment risks as two sides of a balancing act, and underscoring that policy carries no risk-free shortcut.

“Interest rate policy can influence crypto prices,” an established principle that investors continuously test. The flow of credit and the liquidity environment shape risk sentiment, and crypto markets—while diverse—are not insulated from such macro moves. The relationship between liquidity provision and asset prices remains central to how traders structure portfolios in the months ahead. Earlier this year, crypto observers noted how shifts in policy expectations could reprice risk, particularly for assets that benefited from prior rounds of monetary stimulus. A related analysis outlined how lingering policy ambiguity—especially around rate paths and balance-sheet expansion—can sustain volatility in the space.

Market observers have been tracking forward guidance and rate-path probabilities with particular attention to the upcoming FOMC decision window. Early signals suggested that a March rate cut was no sure thing, with traders estimating a roughly 20% probability of a cut at the next meeting, down from a prior reading near 23%. This shift reflects a broader re-pricing of risk as investors weigh the possibility that the Fed may remain cautious about inflation momentum and labor-market dynamics. The CME FedWatch tool has become a barometer for these expectations, showing a move toward pricing in steadier policy rather than aggressive easing.

At the same time, the policy backdrop remains unsettled. Powell, who leads the Federal Reserve, has faced questions about the speed and scale of future rate adjustments. Following the December FOMC meeting, he acknowledged that inflation risks appeared skewed to the upside in the near term, even as employment remained robust. With Powell’s term set to expire and Warsh’s confirmation still awaited by the Senate, investors must factor in the possibility that the committee’s consensus could shift as new data arrives. In such an environment, crypto traders increasingly view Bitcoin not merely as a speculative asset but as a potential hedge or cycle-levered instrument whose performance is tied to macro liquidity dynamics and the policy stance around money creation.

In the broader conversation about how policy affects asset prices, several interconnected themes emerge. First, the pace of balance-sheet expansion remains a critical variable; if the Fed continues to grow the monetary base in step with nominal GDP, the implication could be a gradual upward drift in risk assets, including crypto. Second, the market’s sensitivity to the chair’s temperament and the committee’s tightening or easing cadence means that any signals about policy discipline, inflation expectations, or financial-stability concerns can translate into intensified price movements across digital assets. Finally, the crypto space continues to wrestle with regulatory clarity and institution-building, which amplifies the impact of macro shifts on liquidity and diversification choices for investors.

Key takeaways

- The Fed is anticipated to maintain a gradual expansion of its balance sheet, aiming to grow in proportion to nominal GDP, a framework that could support broad asset prices without triggering extreme liquidity surges.

- Lyn Alden cautions that investors should rebalance away from euphoric sectors toward high-quality scarce assets, signaling a selective, value-oriented strategy for crypto holders.

- Market pricing for a March rate cut sits around 20%, down from prior levels, reflecting uncertainty about how inflation and employment data will unfold in the near term.

- Policy uncertainty, including the potential shift in leadership at the Fed, adds a layer of risk to crypto liquidity and risk sentiment in 2026.

- Crypto-price respond to money-supply signals, making Bitcoin a barometer for macro liquidity and policy expectations in the current cycle.

Tickers mentioned: $BTC

Market context: The macro backdrop remains characterized by ongoing liquidity considerations, policy guidance, and the broader risk-on/risk-off dynamic that has been shaping crypto markets as investors reassess long-term growth prospects and the trajectory of central-bank balance sheets.

Sentiment: Neutral

Price impact: Neutral. The policy path is seen as supportive for risk assets in a gradual way, but expectations for aggressive liquidity expansion have cooled, keeping volatility in check but not eliminating it.

Why it matters

For investors, the evolving policy framework matters because it defines the liquidity environment in which crypto markets operate. If the Fed sustains a measured expansion of its balance sheet alongside steady GDP growth, high-quality assets—often those with scarce supply or strong fundamentals—could outperform in a backdrop of resilient demand. Bitcoin, as the most mature cryptocurrency with significant liquidity and institutional interest, often reacts to shifts in money supply and policy expectations. The current outlook suggests a world where disciplined, data-driven decisions—rather than rapid-fire stimulus—could guide asset price trajectories, with crypto portfolios needing to adapt to changing risk premia and macro signals.

Builders and developers in the crypto space may also take cues from this macro environment. A more predictable policy path could reduce some downside macro risk, enabling longer-term experimentation and product development in decentralized finance, layer-1 ecosystems, and institutional-grade custody and liquidity solutions. Yet, the absence of a clear, easing-driven bull case could maintain a careful stance among investors who prize resilience and yield stability over speculative exuberance. In this setting, projects with robust on-chain economics, real-world utility, and sustainable governance could attract more durable capital, while speculative plays may experience more episodic volatility as market probabilities shift.

From a regulatory and institutional perspective, the interplay between central-bank signaling and crypto-market liquidity remains a focal point. If policymakers continue to emphasize cautious growth and gradual easing, the path of least friction for crypto institutions could involve deeper integration with traditional financial rails, enhanced risk controls, and clearer frameworks for custody, settlement, and reporting. The story remains dynamic, with policy, macro data, and market sentiment converging to shape the next phase of crypto adoption and price discovery.

What to watch next

- March FOMC outcome and the probability of a rate move, as reflected by CME FedWatch.

- Any new signals from the Fed about the pace of balance-sheet expansion and its relationship to nominal GDP growth.

- Nominal GDP growth data and inflation readings that could influence the committee’s guidance.

- Status of Kevin Warsh’s confirmation as Fed Chair and how leadership could influence policy tilt.

- Bitcoin price action in response to macro liquidity shifts and any notable shifts in institutional participation.

Sources & verification

- Lyn Alden’s February 2026 investment strategy newsletter (link to the original newsletter).

- Federal Reserve policy commentary and remarks by Chair Jerome Powell, including December FOMC statements.

- Market expectations for rates compiled by CME Group’s FedWatch tool.

- Related analyses on the impact of fed interest rates on crypto holders and investor sentiment pieces.

Fed policy signals, Alden’s outlook, and Bitcoin posture

Bitcoin (CRYPTO: BTC) sits at an intersection of macro policy and crypto market dynamics. Alden’s framework—favoring high-quality scarce assets and a measured reallocation away from speculative corners—suggests a patient, risk-aware stance for crypto investors. The notion that the Fed will pursue balance-sheet growth in line with nominal GDP implies a lingering but controlled liquidity environment, one that can support gradual asset price appreciation without igniting runaway inflation fears. In this context, BTC may benefit more from a steady money-supply backdrop than from sudden, outsized stimulus, aligning with a broader market preference for resilience and fundamentals. Readers can monitor the evolving policy narrative through linked discussions on Bitcoin’s price movements and broader crypto-market responses to rate expectations.

Powell’s cautionary framing—emphasizing no risk-free path for policy—highlights the asymmetry in policy outcomes. As the Senate weighs Warsh’s nomination, investors must weigh the likelihood of a hawkish tilt against the potential for cooler inflation readings later in the year. This balance matters for crypto liquidity, as a more cautious stance could prompt a shift in risk appetite, favoring assets with clearer on-chain utility and governance structures over more speculative bets. Taken together, the macro backdrop underscores the need for disciplined positioning, selective exposure, and ongoing scrutiny of liquidity signals as crypto traders navigate a landscape defined by gradual monetary expansion rather than rapid-fire stimulus.

Crypto World

Crypto VC Explodes in Q4 2025: $8.5B Floods Later-Stage Startups

US-headquartered companies captured 55% of Q4 crypto VC capital.

Crypto and blockchain venture capital witnessed a sharp rebound in Q4 2025, driven predominantly by large late-stage deals. Galaxy Digital’s report, authored by Alex Thorn, Head of Firmwide Research, found that venture capitalists deployed $8.5 billion across 425 deals in the quarter – an 84% increase in capital invested and a 2.6% rise in deal count compared to Q3 2025.

This represents the strongest quarterly investment in the sector since Q2 2022, although deal counts remain well below 2021-2022 levels.

Crypto VC Surge in Q4

Thorn reported that later-stage companies captured 56% of total capital invested, while earlier-stage startups accounted for the remaining 44%, a proportion unchanged from the previous quarter.

Eleven deals in Q4 raised over $100 million each, which collectively represented $7.3 billion, or roughly 85% of the quarterly total. The largest raises included Revolut at $3 billion, Touareg Group at $1 billion, and Kraken at $800 million.

Other prominent transactions included Ripple and Tempo at $500 million each, Erebor at $350 million, MegaHoot at $300 million, Rain at $250 million, EXUGlobal and TradeAlgo at $120 million each, and RedotPay at $107 million. Across 2025, venture capitalists invested a total of $20 billion into crypto and blockchain startups through 1,660 deals, making it the largest annual investment since 2022 and more than double 2023’s total.

The Trading/Exchange/Investing/Lending category remained the largest recipient of venture capital as it drew over $5 billion, led by Revolut and Kraken, while sectors including stablecoins, AI, and blockchain infrastructure also attracted notable investment.

Pre-seed deal counts remained healthy at 23% of total deals, which means continued entrepreneurial activity, while later-stage deal share has steadily increased as the sector matured. During this quarter, median pre-money valuations climbed to $70 million, and the median deal size reached $4 million. Valuation data existed for just 10% of deals, biased toward bigger, later-stage companies.

You may also like:

Global Crypto VC

Geographically, 55% of capital went to US-headquartered companies, followed by the United Kingdom at 33%, Singapore at 2%, and Hong Kong at 1.7%. A similar pattern was seen across deal counts as well, with 43% completed by US companies, 6% in the UK, and 4% in Hong Kong.

Fundraising for crypto-focused venture funds reached $1.98 billion across 11 funds in Q4, which contributed to $8.75 billion raised for the full year, the largest since 2022. Average fund size rose to $167 million, with a median of $46 million.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

MegaETH Joins Chainlink Scale Program With $14B in DeFi Assets at Launch

TLDR:

- MegaETH launched with Chainlink integration, enabling immediate access to $14B in DeFi assets and protocols.

- Chainlink’s oracle infrastructure powers 70% of DeFi markets with over $27 trillion in transaction value.

- CCIP enables cross-chain liquidity for Lombard and Lido assets across MegaETH and other blockchain networks.

- Aave and GMX protocols are now available on MegaETH through Chainlink’s data and interoperability standards.

MegaETH has joined the Chainlink Scale program and integrated Chainlink’s data and interoperability infrastructure at launch.

The collaboration provides immediate access to leading DeFi protocols, including Aave and GMX. Users can now interact with nearly $14 billion in flagship assets such as Lido’s wstETH and Lombard’s BTC.b and LBTC.

The integration went live on Monday, marking a strategic partnership between the real-time blockchain platform and the oracle network.

Chainlink Infrastructure Powers MegaETH’s DeFi Ecosystem

The integration brings Chainlink Data Feeds, Data Streams, and Cross-Chain Interoperability Protocol (CCIP) to MegaETH. These services enable developers to build high-performance decentralized applications on the platform.

The oracle infrastructure has facilitated over $27 trillion in onchain transaction value across the industry. Currently, Chainlink powers approximately 70% of existing DeFi markets globally.

MegaETH users gain access to multiple DeFi protocols through this partnership. Aave and GMX are among the prominent platforms now available on the network.

Additionally, HelloTrade and Avon have joined the ecosystem at launch. The integration creates opportunities for lending protocols, derivatives markets, and decentralized exchanges to operate efficiently.

The platform features a custom integration designed to deliver fast market data. This setup supports MegaETH’s objective of becoming the first real-time blockchain.

Developers can now build applications requiring accurate price feeds and reliable data sources. The infrastructure ensures consistency across various financial products and services.

CCIP enables secure cross-chain asset transfers for MegaETH users. Asset issuers like Lombard and Lido can provide liquidity across multiple blockchain networks.

The protocol offers compliance-enabled interoperability for developers building composable applications. This functionality extends MegaETH’s reach beyond its native ecosystem into broader multi-chain environments.

Scale Program Benefits and Industry Adoption

The Chainlink Scale program provides MegaETH developers with low-cost oracle services. Institutions building on the platform receive access to secure data infrastructure from day one.

Oracle nodes supply trusted information to support both traditional and decentralized finance applications. The program reduces barriers for teams developing on MegaETH.

Johann Eid, Chief Business Officer at Chainlink Labs, commented on the partnership’s scope. “MegaETH joining Chainlink Scale and adopting the Chainlink data and interoperability standards is a major moment for our ecosystem,” Eid stated.

He added that the infrastructure has enabled tens of trillions in onchain transaction value. The integration brings users access to protocols like Aave and GMX alongside key DeFi assets.

Stani Kulechov, Founder of Aave Labs, addressed the upcoming Aave launch on MegaETH. “The upcoming Aave launch on MegaETH with Chainlink live from day one will give users access to the high-quality data,” Kulechov explained.

He noted that Chainlink’s standards have been foundational to Aave’s multi-ecosystem growth. The integration enables seamless extension onto MegaETH’s next-generation blockchain platform.

Lei Yang, Co-Founder and CTO of MegaETH, outlined the strategic rationale behind joining Chainlink Scale. “Joining Chainlink Scale ensures that our developers have access to high-quality data and secure interoperability,” Yang said.

He emphasized the importance of providing developers with necessary tools from day one. The partnership supports MegaETH’s goal of becoming the leading blockchain platform in the industry.

Crypto World

Get Ready for the Federal Reserve’s ‘Gradual Print’

Whether the Federal Reserve is engaging in quantitative easing is purely semantic, according to Alden, who says all roads lead to debasement.

The US Federal Reserve is entering into a “gradual” era of money printing that will stimulate asset prices “mildly” but will not be as dramatic as the “big print” that many in the Bitcoin (BTC) community anticipated, according to economist and Bitcoin advocate Lyn Alden.

“My base case is roughly in line with what the Fed expects: to grow its balance sheet approximately at the same proportional pace as total bank assets or nominal gross-domestic product (GDP),” Alden said in her Feb. 8 investment strategy newsletter, adding:

“Overall, it means I continue to want to own high-quality scarce assets, with a tendency to rebalance away from extremely euphoric areas and toward under-owned areas.”

The comments followed US President Donald Trump’s nomination of Kevin Warsh to be the next Federal Reserve Chairman, which caused a furor among market traders, who perceived Warsh as more hawkish on interest rates than other potential Fed picks.

Interest rate policy can influence crypto prices. Expanding credit by increasing the money supply is typically seen as bullish for assets, and a contraction of the money supply through higher interest rates typically leads to economic slowdown and lower prices.

Related: Bitcoin investor sentiment cools amid US shutdown fears, Fed policy jitters

No rate cut expected at next FOMC meeting

Some 19.9% of traders expect an interest rate cut at the next Federal Open Market Committee (FOMC) meeting in March, down from Saturday, when CME Fedwatch showed 23% of respondents forecast a rate cut.

Current Federal Reserve Chairman Jerome Powell has repeatedly issued mixed forward guidance about interest rate policy despite slashing rates several times in 2025.

“In the near term, risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. There is no risk-free path for policy,” Powell said following the December FOMC meeting.

Powell’s term as Federal Reserve chairman expires in May 2025, and Warsh has yet to be confirmed as the next chairman by the US Senate, fueling investor uncertainty about the direction of interest rate policies in 2026.

Magazine: TradFi fans ignored Lyn Alden’s BTC tip — Now she says it’ll hit 7 figures: X Hall of Flame

Crypto World

Quantum Computers Need Millions More Qubits to Break Bitcoin, CoinShares Reports

TLDR:

- Breaking Bitcoin encryption requires quantum computers 100,000 times more powerful than today’s technology

- Only 10,200 BTC in legacy addresses could cause market disruption if suddenly compromised by quantum attack

- Cryptographically relevant quantum computers unlikely to emerge before 2030s, according to CoinShares analysis

- Bitcoin can adopt post-quantum signatures through soft forks while maintaining defensive adaptability

Quantum computing poses no immediate threat to Bitcoin’s security infrastructure, according to digital asset manager CoinShares.

The firm’s latest analysis dismisses concerns about near-term vulnerabilities in the cryptocurrency’s cryptographic foundation.

Current quantum technology remains decades away from breaking Bitcoin’s encryption protocols. CoinShares estimates only 1.7 million BTC faces potential exposure, representing 8% of total supply.

The research suggests institutional investors should view quantum risks as manageable engineering considerations rather than existential crises.

Technology Requires Decades Before Becoming Cryptographically Relevant

CoinShares’ analysis reveals breaking Bitcoin’s secp256k1 encryption demands quantum systems with millions of logical qubits.

Current quantum computers operate at approximately 105 qubits, falling dramatically short of required thresholds.

Source: CoinShares

Researchers estimate attackers would need machines 100,000 times more powerful than today’s largest quantum systems.

Reversing a public key within one day requires 13 million physical qubits and fault tolerance levels not yet achieved.

Breaking encryption within one hour would demand quantum computers 3 million times more advanced than current capabilities.

Each additional qubit makes maintaining system coherence exponentially more difficult, according to technical experts.

Cybersecurity firm Ledger’s Chief Technology Officer Charles Guillemet provided expert perspective on the technical challenges facing quantum development.

Speaking to CoinShares, Guillemet emphasized the massive scale required for cryptographic attacks. “To break current asymmetric cryptography, one would need something in the order of millions of qubits. Willow, Google’s current computer, is 105 qubits. And as soon as you add one more qubit, it becomes exponentially more difficult to maintain the coherence system,” Guillemet confirmed.

CoinShares projects cryptographically relevant quantum computers may not emerge until the 2030s or beyond. Long-term attacks on vulnerable addresses could take years to complete even after technology matures.

Short-term mempool attacks would require computations finishing in under 10 minutes, remaining infeasible for decades ahead.

Limited Vulnerability Concentrates in Legacy Address Formats

The digital asset manager’s research identifies exposure primarily in legacy Pay-to-Public-Key addresses holding roughly 1.6 million BTC.

Modern address formats including Pay-to-Public-Key-Hash and Pay-to-Script-Hash conceal public keys behind cryptographic hashes. These contemporary formats maintain security until owners actively spend their funds.

CoinShares determined only 10,200 BTC sit in outputs potentially causing market disruption if compromised suddenly.

Source: CoinShares

The remaining vulnerable coins distribute across 32,607 individual outputs of approximately 50 BTC each. Breaking into these addresses would require millennia even under optimistic quantum advancement scenarios.

Bitcoin’s security framework relies on elliptic curve algorithms for authorization and SHA-256 hashing for protection.

Quantum algorithms cannot alter Bitcoin’s fixed 21 million supply cap or bypass proof-of-work validation requirements.

Grover’s algorithm reduces SHA-256 security effectively but brute-force attacks remain computationally impractical.

Renowned cryptographer Dr. Adam Back addressed Bitcoin’s capacity for defensive evolution in response to future quantum threats.

The Blockstream CEO and Bitcoin contributor explained the network’s adaptability to CoinShares. “Bitcoin can adopt post-quantum signatures. Schnorr signatures paved the way for more upgrades, and Bitcoin can continue evolving defensively,” Back told CoinShares.

Users retain sufficient time to migrate funds voluntarily to quantum-resistant addresses. Market impact appears minimal, with vulnerable coins likely resembling routine transactions rather than systemic shocks.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics9 hours ago

Politics9 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat3 hours ago

NewsBeat3 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business8 hours ago

Business8 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics11 hours ago

Politics11 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business16 hours ago

Business16 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout