Crypto World

Arthur Hayes challenges Multicoin’s Samani to $100K HYPE bet

A public feud between two high-profile crypto investors has turned into a proposed six-month price wager.

Summary

- Hayes offered a six-month bet on HYPE’s performance against large-cap altcoins.

- The challenge followed sharp criticism from Multicoin’s Kyle Samani.

- The wager highlights growing debate over Hyperliquid’s structure and value.

BitMEX co-founder Arthur Hayes has challenged Multicoin Capital co-founder Kyle Samani to a $100,000 bet over the future performance of Hyperliquid’s HYPE token.

The proposal was posted on X on Feb. 8, 2026, after Hayes reposted and responded to Samani’s sharp criticism of the project.

Under the terms outlined by Hayes, the bet would run from 00:00 UTC on Feb. 10 through 00:00 UTC on July 31, 2026. During that period, Hyperliquid (HYPE) would need to outperform any altcoin with a market capitalization above $1 billion on CoinGecko.

Samani would be allowed to select the comparison token. The loser would donate $100,000 to a charity chosen by the winner. The exchange comes as Hyperliquid and its token remain in focus among derivatives traders, even as the wider market trades under pressure.

Dispute over Hyperliquid’s structure and leadership

The bet follows weeks of criticism from Samani, who has repeatedly questioned Hyperliquid’s design and governance.

In recent posts, Samani said the platform’s code is not fully open-source, relies on a permissioned distribution model, and is led by a founder who left his home country to launch the business. He also accused the project of enabling criminal activity and described it as fundamentally flawed.

Hayes rejected those claims and framed the debate in market terms. He argued that if HYPE is truly a weak asset, it should fail to outperform other large-cap tokens over time. If it succeeds, he said, critics should reconsider their views.

The dispute gained traction after analyst Jon Charbonneau praised Hyperliquid’s trading execution, comparing it favorably with traditional venues such as CME. That commentary helped re-ignite debate over whether newer on-chain derivatives platforms can compete with established exchanges.

As of press time, Samani had not publicly confirmed whether he would accept the wager.

Hayes’ purchases and Multicoin-linked accumulation

The wager has drawn attention partly because of Hayes’ recent buying activity. According to on-chain data, Hayes spent approximately $1.91 million in early February 2026 to acquire 57,881 HYPE tokens. His entire holdings increased to about 131,807 tokens, which at the time was worth about $4.3 million.

These acquisitions, which came after the sales of PENDLE, ENA, and LDO, indicate a deliberate shift toward Hyperliquid. In September 2025, Hayes had sold about 96,600 HYPE tokens for roughly $5.1 million, locking in profits amid concerns about token unlocks and competition. His recent accumulation marks a renewed vote of confidence in the project.

Additionally, wallet data indicates that in late January 2026, addresses linked with Multicoin began accumulating HYPE. Reports indicate that more than 87,100 ETH was swapped for around 1.35 million HYPE tokens, worth over $40 million at the time, through intermediaries such as Galaxy Digital.

This accumulation took place while Samani continued to take a critical public stand, which complicated the ongoing discussion. However, in early February, Samani transitioned into an advisory position at Multicoin, resigning from daily management. Some observers believe this transition may have influenced the fund’s recent positioning.

For now, Hayes’ proposed bet stands as a rare public test of conviction in a market where opinions and capital flows often move in different directions. Whether Samani accepts the bet or not, the episode has placed renewed focus on Hyperliquid’s role in the evolving crypto derivatives landscape.

Crypto World

Bitcoin Sharpe Ratio Hits Bear Market Lows At Negative 10

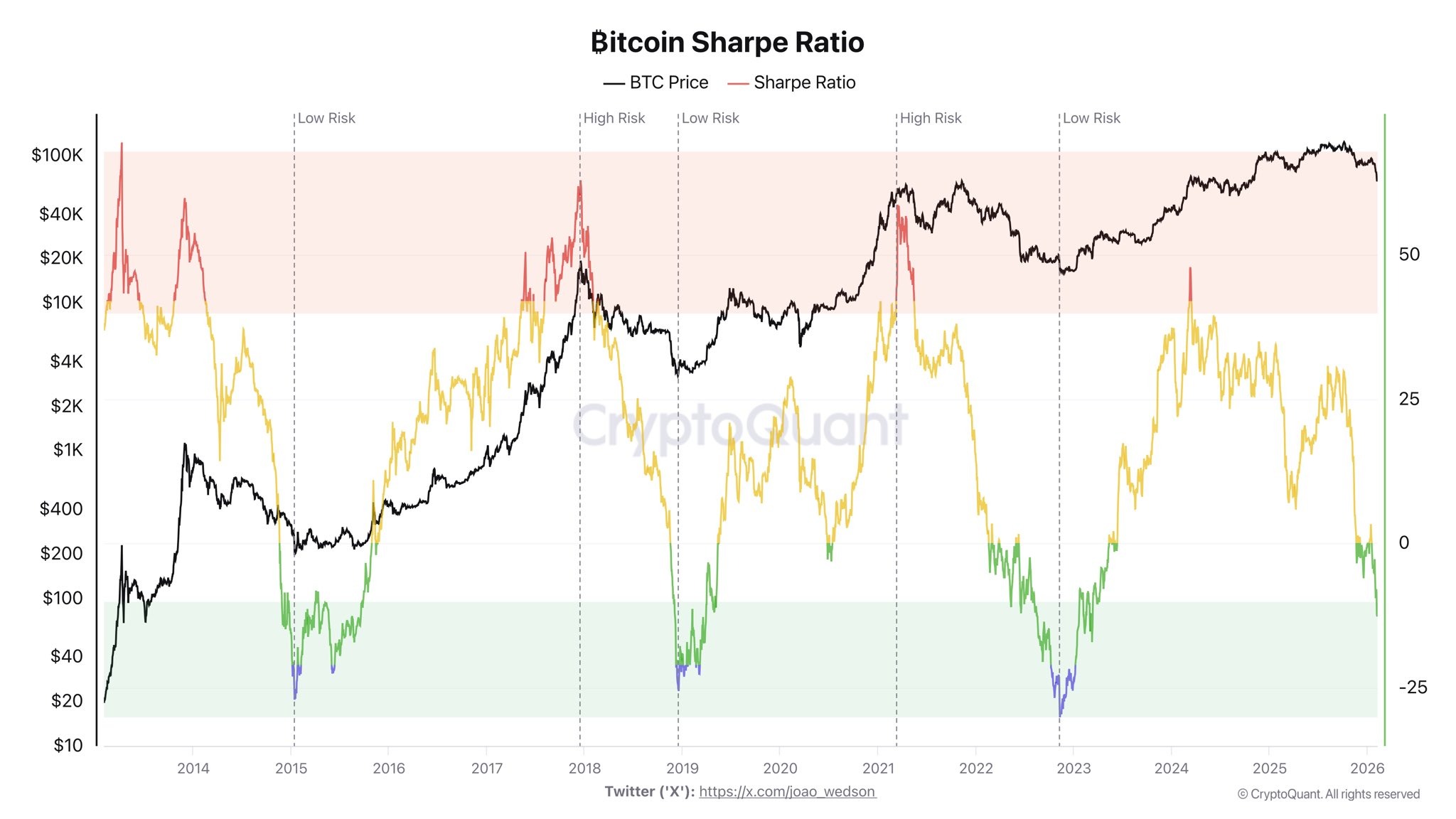

The Bitcoin Sharpe ratio, which measures risk/reward potential, is in negative territory that is often associated with the end of bear markets, according to CryptoQuant analyst Darkfost.

“The Sharpe ratio has just entered a particularly interesting zone, one that has historically aligned with the final phases of bear markets,” said the analyst on X on Saturday.

They added, however, that it is not a signal that the bear market is over, “but rather that we are approaching a point where the risk-to-reward profile is becoming extreme.”

The Sharpe ratio has fallen to -10, its lowest level since March 2023, according to CryptoQuant.

The ratio measures Bitcoin (BTC) performance relative to the risk taken, indicating how much return an investor can expect for each unit of risk.

Negative ratio signals market turning point

The ratio was lower in late 2022 to early 2023, and late 2018 to early 2019 — both periods marking the depths of the bear market cycle. The metric fell to zero in November 2025 when BTC prices hit a local low of $82,000.

The analyst said that in practical terms, “the risk associated with investing in BTC remains high relative to the returns recently observed.”

“The ratio is still deteriorating, showing that BTC’s performance is not yet attractive compared to the risk being taken,” they added.

Related: Bitcoin bear market not over? Trader sees BTC price ‘real bottom’ at $50K

However, a negative Sharpe ratio usually signals market turning points, they said.

“But this type of dynamic is precisely what tends to appear near market turning zones. We are gradually approaching an area where this trend has historically reversed.”

True reversal could be months away

The analyst cautioned that this phase “may last several more months, and BTC could continue correcting before a true reversal takes place.”

Analysts at 10x Research also expressed caution in a market update on Monday, stating:

“While sentiment and technical indicators are approaching extreme levels, the broader downtrend remains intact. In the absence of a clear catalyst, there is little urgency to step in.”

BTC tanked to $60,000 on Friday but recovered to $71,000 by Monday. However, it remains down 44% from its October peak of $126,000, and sentiment remains firmly in bear market territory, analysts say.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

CoinShares says quantum threat to Bitcoin is real but still years away

Bitcoin faces a theoretical security risk from future quantum computers, but the threat is manageable and not imminent, according to a new research note from digital asset manager CoinShares.

Summary

- CoinShares says quantum computing poses a real but distant risk to Bitcoin, not an immediate security threat.

- Only a small share of Bitcoin’s supply, mainly in older addresses, is theoretically vulnerable to quantum attacks.

- Bitcoin can adopt quantum-resistant upgrades over time, giving the network ample room to adapt.

The firm said concerns that quantum computing could break Bitcoin’s (BTC) cryptography are often overstated, noting that the technology required to carry out such an attack remains far beyond current capabilities.

Even in the most aggressive scenarios, CoinShares estimates that a practical quantum threat to Bitcoin is likely at least a decade away.

Why quantum threat to Bitcoin matters

Bitcoin’s security relies on cryptographic tools that protect private keys and validate transactions. In theory, powerful quantum computers running algorithms such as Shor’s algorithm could one day derive private keys from public keys, allowing attackers to steal funds from certain types of Bitcoin addresses.

However, CoinShares said only a limited subset of Bitcoin is exposed. Roughly 8% of the total supply sits in older “legacy” addresses where public keys are already visible on the blockchain. Even within that group, far fewer coins would be immediately vulnerable in a way that could destabilize the network.

Bitcoin’s core hashing function, SHA-256, is also considered resilient. Quantum computers could speed up brute-force attacks, but not enough to break Bitcoin’s mining or transaction security under realistic assumptions, the report said.

Why the risk is considered manageable

CoinShares emphasized that Bitcoin is not static and has successfully upgraded its cryptography before. The network could transition to quantum-resistant signature schemes through future software upgrades if the threat becomes more concrete.

In addition, holders of older Bitcoin addresses can already protect themselves by moving funds to newer address formats that do not expose public keys until a transaction is spent.

The firm warned against rushing into drastic changes, such as premature hard forks or untested cryptographic schemes, arguing that unnecessary action could introduce bugs or weaken decentralization.

What it means for investors

For investors, CoinShares’ conclusion is straightforward: quantum computing is a long-term engineering challenge, not an existential crisis for Bitcoin today.

The report suggests the market has ample time to prepare, monitor technological progress, and implement safeguards well before quantum computers pose a realistic threat to Bitcoin’s security.

Crypto World

Crypto.com CEO Unveils Agentic AIs in ai.com Launch

Crypto.com chief Kris Marszalek has unveiled ai.com, a public beta platform that lets users craft personalized AI agents to handle everyday tasks on their behalf. The rollout followed a high-profile commercial push during Super Bowl 60 on NBC, a broadcast expected to attract well over 100 million viewers. In the immediate term, users can register an ai.com username and then join a queue to have their private, autonomous agents spun up. Marszalek frames the project as a step toward a decentralized network of self-improving AI agents that perform real‑world tasks for the benefit of humanity, a bold ambition that blends AI and crypto sensibilities around ownership, interoperability, and automation.

The launch arrives amid a broader surge of activity around AI agents in the enterprise and consumer tech space. OpenAI’s recent enterprise platform Frontier signals a trend toward more capable, business‑oriented agents, while independent projects such as AI agent OpenClaw have captured public attention with novel task automation concepts. Marszalek notes that the ai.com initiative began with the purchase of a domain described as the largest publicly disclosed domain sale in history, a move that mirrors his earlier strategy with Crypto.com’s expansive brand-building and customer acquisition. Since acquiring the ai.com domain in April, Marszalek has assembled a team to build and scale the product as beta users begin to interact with the platform.

Public commentary from observers in crypto and AI circles highlights the playbook behind ai.com: a recognizable, high-traffic destination paired with a mass-market advertising push to accelerate adoption. Pseudonymous crypto and AI researcher 0xSammy remarked that the combination of a memorable URL, mass exposure, and a Super Bowl ad could yield a landmark moment for the project—echoing how Marszalek previously propelled Crypto.com to hundreds of millions of users through branding and aggressive marketing. In the weeks after the early traffic surge, the ai.com site briefly crashed under demand before stabilizing, a familiar pattern for bets positioned at the intersection of consumer AI tools and crypto-backed branding.

Beyond the marketing theatrics, the ai.com team emphasizes practical use cases for its agents: email management, scheduling, subscription management, shopping automation, and trip planning are listed as baseline tasks for agents to handle on behalf of users. Marszalek argues that the goal is not merely to create virtual assistants but to foster a decentralized, self‑improving network of agents that learn from interactions and improve over time. Framing the effort as a “decentralized network of autonomous agents” aligns with a broader narrative in crypto and decentralized technology—where control, consent, and user empowerment sit at the core of product design.

Industry context matters. The AI space is rapidly expanding beyond chatbots into agent-enabled workflows that can operate with minimal human oversight. OpenAI’s enterprise agent push and related announcements signal a race to define how artificial agents will work in business environments, while independent developers and researchers push alternatives that emphasize open architectures and user sovereignty. The converging tempo of marketing, domain strategy, and user onboarding indicates that ai.com is more than a branding exercise; it is a test case for how mass adoption of autonomous AI agents might unfold in the near term, including the balance between convenience, privacy, and security in a consumer-facing product.

Key takeaways

- ai.com entered public beta with a username-registration step and a waiting queue to spin up personalized AI agents, signaling a staged rollout rather than an instant, full-scale launch.

- The Super Bowl 60 ad blitz on NBC anchored the beta reveal, joining a broader wave of tech firms marketing AI and automation capabilities to a national audience.

- Marszalek publicly tied ai.com to a historic domain purchase in April, described as the largest publicly disclosed domain sale, and built a dedicated team to bring the product to market.

- Early traffic spikes caused brief outages, illustrating the scale challenges inherent in consumer AI services and the need for robust, scalable infrastructure.

- Competitor and peer activity—OpenAI’s Frontier, OpenClaw, and other AI-agent initiatives—frames ai.com within a crowded field where branding, product experience, and real‑world utility will matter for adoption.

Market context: The emergence of ai.com sits at the crossroads of AI agents and consumer branding, a moment when mass advertising campaigns and domain-strategy playbooks intersect with real-world task automation. As enterprises test agent-enabled workflows and consumers experiment with personal assistants, the broader crypto and fintech ecosystems watch for how user ownership, gating mechanisms, and decentralized governance concepts might influence future products and monetization models.

Why it matters

The ai.com initiative matters because it tests a central hypothesis in both AI and crypto communities: that autonomous agents, built on user-owned infrastructure, can perform meaningful tasks without constant oversight. If successful, the platform could demonstrate a scalable model for consumer-grade autonomous agents that learn from cumulative interactions and improve their competence over time. This aligns with a cryptoeconomic impulse to empower users with ownership, opt-in data control, and transparent monetization pathways—principles that many crypto projects champion when designing incentive layers and decentralized governance around software products.

Furthermore, the Super Bowl moment underscores how mainstream media exposure can accelerate a niche technology narrative. The ad slots purchased by Google, Anthropic, Amazon, Meta, and others during Super Bowl 60 highlight a broader industry belief that AI agents are transitioning from experimental demos to everyday tools. For crypto developers and investors, ai.com’s approach—combining a high-profile brand event with a domain-centric branding strategy—offers a blueprint for how to attract attention while testing practical use cases that require careful attention to privacy, security, and user consent as adoption grows.

From a technical perspective, the emphasis on a private, personalized agent that can handle routine tasks raises questions about data handling, model updates, and cross-platform interoperability. The platform’s success will hinge on how well it can balance convenience with safeguards and how it integrates with existing identity and consent frameworks. In a landscape where AI agents are increasingly central to everyday productivity, ai.com contributes to a broader conversation about responsible deployment, user empowerment, and the role of branding in shaping user expectations around AI-enabled automation.

What to watch next

- Progress of the onboarding queue: how long users wait to spin up their agents and what features arrive during the beta phase.

- Product updates and feature roadmaps, including any GA (general availability) milestones or new agent capabilities.

- Official communications detailing the domain sale narrative, including any responsible, verifiable disclosures about the acquisition and team expansion.

- Competitor moves in the AI-agent space, such as new Frontier integrations or OpenClaw enhancements, that could shape ai.com’s feature set or positioning.

- Security and privacy demonstrations or audits that reassure users about the handling of personal data within autonomous agents.

Sources & verification

- ai.com official launch materials and beta signup page to confirm the registration flow and queue process.

- Public reports about the Super Bowl 60 ad placements on NBC and coverage of the associated marketing wave from the event.

- Statements surrounding the April domain acquisition and the claim of it being the largest publicly disclosed sale in history.

- Industry context references to OpenAI’s Frontier and the OpenClaw project as related AI-agent developments for benchmarking the competitive landscape.

ai.com launches beta for autonomous AI agents after Super Bowl blitz

The ai.com rollout marks a deliberate bet on mass branding combined with a high-concept ai product. By inviting users to register a unique ai.com handle and then placing them in a queue to activate their private agents, Marszalek’s team is testing not only the tech but the market’s appetite for decentralized, autonomous tools that can operate with limited human intervention. The beta approach allows the team to gather feedback on onboarding, agent reliability, and task execution while mitigating churn that could arise from a rushed, full-scale launch.

In parallel with this branding push, the broader AI space has seen a series of competing efforts around agent enablement and enterprise utility. OpenAI’s Frontier represents the industry push toward enterprise-grade AI agents designed for business workflows, while independent developments like OpenClaw reflect ongoing experimentation in agent autonomy and control. The convergence of these efforts with ai.com’s branding strategy suggests a deliberate attempt to translate complex AI capabilities into everyday productivity tasks—an objective that resonates with crypto enthusiasts who prize user sovereignty and tangible utility in technology platforms.

The domain sale narrative—described as the largest publicly disclosed domain sale in history—adds a layer of drama to the project’s genesis. While the exact price remains undisclosed, the move is a reminder that branding assets can be strategic levers in technology markets, shaping user perceptions and investor interest as much as the underlying product features. The early traffic surge and temporary outage experienced by ai.com illustrate the growing pains common to new, consumer-facing AI services. Yet the recovery and continued traffic point to a robust demand signal that could sustain future iterations of the product and potential ecosystem partnerships.

As Marszalek’s vision emphasizes decentralization and autonomous learning, the ai.com initiative also invites readers to consider the implications for governance and data rights. In a landscape where AI agents gather, interpret, and act on personal information, reassuring users about consent mechanisms and transparent data practices will be essential to long-term credibility. If ai.com can credibly deliver reliable, privacy-conscious agents that help users manage emails, calendars, subscriptions, shopping, and travel, it could become a meaningful data-privacy and productivity narrative within the crypto-technology space—a space that increasingly values both innovation and responsible design.

Crypto World

Jack Dorsey’s Block Plans to Cut Up to 10% of Staff in Efficiency Push

Jack Dorsey’s financial technology company Block Inc. is preparing to cut up to 10% of its workforce as part of a broader effort to streamline operations and improve efficiency, Bloomberg reported, citing people familiar with the matter.

Summary

- Block plans to cut up to 10% of its workforce as part of an efficiency drive, Bloomberg reported.

- The move could impact around 1,000 employees following internal performance reviews.

- Cost controls come ahead of Block’s upcoming earnings report amid slowing growth.

Block puts workforce cuts under review

The potential reductions could impact roughly 1,000 employees, based on Block’s headcount of just under 11,000 as of late 2025.

Employees were informed internally that roles are being reviewed as part of annual performance evaluations, with decisions expected to be finalized in the coming weeks.

The move marks the latest step in a multi-year restructuring effort at Block, which operates businesses including Square, Cash App, and Bitcoin-focused initiatives. The company has been working to simplify its organizational structure, integrate teams more closely, and focus resources on higher-growth and more profitable areas.

Block has also been increasing its emphasis on automation and internal productivity tools, including an in-house artificial intelligence assistant known as Goose, as it looks to operate more efficiently at scale.

The company has previously said it wants to balance growth investments with tighter cost controls.

The planned workforce reduction comes as Block navigates a challenging operating environment. Growth in its Square merchant business has slowed amid pressure on small businesses, while competition across digital payments and financial services remains intense.

Block is scheduled to report fourth-quarter earnings later this month, with investors closely watching margins and cost discipline. The company has outlined long-term targets calling for sustained gross profit growth through the second half of the decade.

Crypto World

Crypto.com Boss Rolls out Agentic AIs with ai.com Launch

Crypto.com CEO Kris Marszalek has officially launched his new website ai.com to the public, allowing users to create personal AI agents that can perform everyday tasks on their behalf.Brayden Lindrea

The ai.com commercial aired during Super Bowl 60 on NBC on Monday, a sporting event that draws in over 100 million viewers a year, promoting the beta launch of the AI platform.

For now, users can register their ai.com username handles but must then wait in a queue to have their private, personalized AI agents spun up.

Marszalek said the AI agents can perform everything from managing emails and scheduling meetings to canceling subscriptions, completing shopping tasks, and planning trips.

Marszalek said his mission with ai.com is to accelerate artificial general intelligence “by building a decentralized network of autonomous, self-improving AI agents that perform real-world tasks for the good of humanity.”

ChatGPT creator OpenAI launched an enterprise-focused AI agent platform, Frontier, last week, while software engineer Peter Steinberger released AI agent OpenClaw in November 2025, which gained popularity in January.

Marszalek said he bought the AI-themed domain in April fion — said to be the largest publicly disclosed domain sale in history — and has since built a team to bring the product to market.

Pseudonymous crypto and AI researcher 0xSammy said the move resembles how Marszalek scaled Crypto.com to over 150 million customers by buying a popular domain and investing heavily in marketing:

“One of the most recognisable URLs on the internet + 128M eyeballs + a Super Bowl ad = the biggest single-day domain launch in history?”

Marszalek said ai.com saw “insane traffic” in the first few hours of launching, which briefly caused the website to crash before coming back online.

Source: AI.com

Tech heavyweights also ran AI ads

Google ran a 60-second Gemini AI advertisement during Super Bowl 60, while Anthropic also ran a commercial promoting its Claude chatbot.

Related: Crypto PACs secure massive war chests ahead of US midterms

Amazon also ran a commercial showcasing its Alexa AI product, while Meta advertised Oakley-branded AI glasses.

These tech companies reportedly paid around $8 million to run 30-second advertisements during the Super Bowl.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Did Trend Research Sell Ethereum at the Bottom?

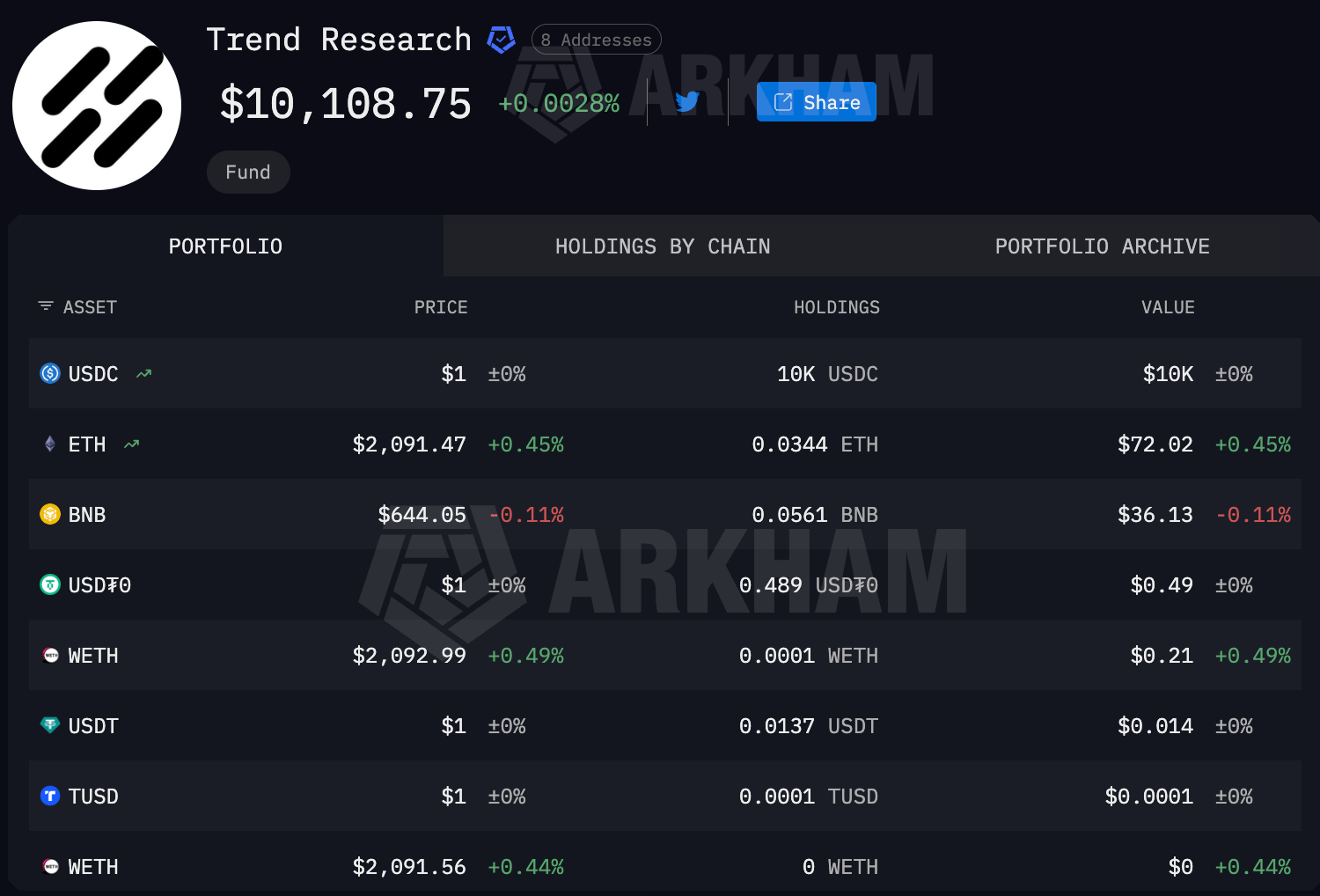

Trend Research, an investment firm led by Jack Yi, founder of Liquid Capital, has sold its entire Ethereum (ETH) position, reportedly locking in losses of nearly $750 million.

The large-scale sell-off comes as Ethereum continues its broader downturn, with the altcoin down more than 30% in the past month. The price performance has reignited debate over whether ETH is approaching a market bottom.

Sponsored

Sponsored

Trend Research Sells Ethereum Amid Market Volatility

BeInCrypto recently reported that Trend Research began transferring Ethereum to Binance at the beginning of the month. On-chain analytics platform Lookonchain confirmed that the firm completed the sell-off yesterday.

In total, Trend Research moved 651,757 ETH, worth approximately $1.34 billion, to Binance at an average price of $2,055. The transactions reduced the firm’s ETH holdings to just 0.0344 ETH, valued at around $72.

Data from Arkham Intelligence corroborates the near-complete exit, showing residual balances of roughly $10,000 in USDC and minor amounts of other tokens.

“The total loss is ~$747 million,” Lookonchain wrote.

The exit followed a leveraged strategy built on the decentralized finance (DeFi) lending protocol Aave. An analyst explained that Trend Research initially purchased ETH on centralized exchanges and deposited it as collateral on Aave.

The firm then borrowed stablecoins against the collateral and repeatedly reinvested the borrowed funds into additional ETH purchases, creating a recursive leveraged position that significantly increased both exposure and liquidation risk.

As ETH’s price continued to decline, the position moved closer to the liquidation threshold. Rather than risk forced liquidation, Trend Research chose to unwind the entire position voluntarily.

Sponsored

Sponsored

While Trend Research pivoted to selling, BitMine has taken the opposite approach. Despite mounting unrealized losses, the firm has continued to increase its exposure, recently purchasing $42 million worth of Ethereum.

What an Ethereum Market Bottom Could Mean for Bitmine and Trend Research

The opposing strategies come amid a period of heightened market volatility for Ethereum. BeInCrypto Markets data shows that the second-largest cryptocurrency has declined 32.4% over the past month.

On February 5, ETH also slipped below $2,000 before recovering. At press time, Ethereum was trading at $ 2,094.16, up around 0.98% over the past 24 hours.

Sponsored

Sponsored

Amid the downturn, some analysts have suggested that Ethereum may be approaching a market bottom. One analyst described Trend Research’s exit as the “largest capitulation signal.”

“Such forced exits often happen near major lows,” Axel stated.

Joao Wedson, founder of Alphactal, also noted that Ethereum’s price bottom is likely to occur months before Bitcoin’s, citing the faster liquidity cycle typically observed in altcoins.

According to Wedson, some chart indicators suggest that Q2 2026 could mark a potential price bottom for ETH.

“Some charts already indicate that Q2 2026 could mark a potential price bottom for ETH. Capitulation has arrived, and realized losses are set to increase sharply,” Wedson added.

Sponsored

Sponsored

While no bottom has been confirmed yet, the possibility could carry broader implications for institutional sentiment, particularly as some firms choose to de-risk while others continue to accumulate amid ongoing market weakness.

If Ethereum is indeed approaching a market bottom, BitMine’s continued accumulation could prove well-timed, positioning the firm to benefit from a future recovery.

However, if downside pressure persists, Trend Research’s decision to fully unwind its position may ultimately be viewed as a prudent move to limit the risks associated with leveraged strategies.

Crypto World

US Treasury Secretary Pushes For Start On Fed Chair Confirmation Hearings

US Treasury Secretary Scott Bessent is calling on the Senate Banking Committee to proceed with confirmation hearings for Federal Reserve chair nominee Kevin Warsh, despite a standoff over an ongoing probe into current Fed chair Jerome Powell.

Speaking with Fox News’ Sunday Morning Futures, Bessent referenced recent pushback from Republican Senator Thom Tillis, who said he plans to stall on processing the next Fed chair until the Department of Justice (DOJ) probe into Powell is resolved.

“Senator Tillis has come out and said he thinks that Kevin Warsh is a very strong candidate,” Bessent said, adding:

“So I would say, why don’t we get the hearings underway and see where Jeanine Pirro’s investigation goes?”

Despite his support for Warsh, Tillis, a member of the Senate Banking Committee, has vowed on multiple occasions to block the nomination until the DOJ gets “to the truth” of the matter, as part of a push to protect Fed independence.

“I’d be one of the first people to introduce Mr. Warsh if we’re behind this and support him, but not before this matter is settled,” Tillis told CNBC on Wednesday.

Republicans control 13 out of the 24 seats in the Senate Banking Committee, meaning that they could vote as a bloc to push through Warsh. However, with Tillis looking to halt the process, he could use his vote to oppose Warsh, putting the ultimate decision in the hands of the Democrats.

The DOJ, led by attorney Jeanine Pirro, initially opened up an investigation into Powell in early January, serving the Fed with grand jury subpoenas and threats of criminal charges relating to expenses on a multi-year renovation project at Fed office buildings.

Powell promptly denied the assertions and argued on Jan. 11 that the investigation was politically motivated as the Fed’s interest rate policy was against the wishes of US President Donald Trump.

On Jan. 30, Trump officially nominated Kevin Warsh as the next Fed chair to succeed Powell.

Related: Federal Reserve entering ‘gradual print’ mode — Lyn Alden

Following a presidential nomination, the nominee must then appear before the Senate Banking Committee for a review hearing. The committee then votes on whether to send the nominee to the full senate with a favorable or non-favorable recommendation, or no recommendation at all.

Finally, the full Senate then holds a debate and vote, and if the nominee is confirmed, they can be officially sworn in as the next Fed chair.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Crypto, Banks Give Input to Fed ‘Skinny Master Account’ Idea

The Federal Reserve has heard arguments from crypto companies and banking associations on a proposal to allow so-called “skinny master accounts,” which would give fintech firms limited access to the central bank’s payments infrastructure.

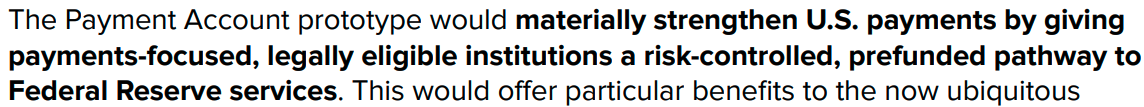

The Fed received 44 comments in response to its proposal, which closed on Friday, seeking feedback on offering a “payment account,” with crypto companies backing the idea and banks urging caution.

In opening up comments on the proposal in December, Fed Governor Christopher Waller said the new payment accounts were needed due to “rapid developments” in payments and that they would “support innovation while keeping the payments system safe.”

Payment accounts won’t have the same privileges as master accounts (commonly owned by big banks) — they wouldn’t earn interest or be given access to Fed credit and would have balance limits.

Crypto backs getting accounts

In response to the proposal, stablecoin issuer Circle said in a letter that the accounts would “play an important first step in carrying forward Congress’ vision under the GENIUS Act” and argued they would “materially strengthen US payments.”

The recently formed Blockchain Payments Consortium called the accounts an “overdue and much-welcomed addition” that it said would “eliminate uncompetitive practices that undercut consumers and concentrate risk around a handful of banks.”

Anchorage Digital Bank, the country’s first federally chartered crypto bank, said that “specific deficiencies” in the proposal must be addressed regarding overnight balance limits, interest on reserves and access to the Fed’s automated clearing house.

The Fed floated setting an overnight balance limit at the lesser of $500 million or 10% of the account holder’s total assets and would not give interest on account balances or allow access to its clearing house, which offers same-day and international payments.

Banks raise concerns about access to Fed system

However, multiple banking associations responded to the Fed with concerns about allowing different entities into the central banking system.

The American Bankers Association said that many of the entities that would be eligible for a payment account “lack a long-run supervisory track record, are not subject to consistent federal safety-and-soundness standards and may rely on evolving statutory or regulatory regimes.”

Related: CFTC expands payment stablecoin criteria to include national trust banks

The Wisconsin Bankers Association said that it believes access to the accounts “should depend not only on legal eligibility, but also on an institution’s demonstrated capabilities in governance, risk management, internal controls, and compliance.”

Better Markets, a nonpartisan organization that lobbies for financial reform, called the payment accounts an “irresponsible and reckless giveaway to the crypto industry” that should be rescinded.

The group said the accounts would “implicitly and unnecessarily” expand the Fed’s mandate and that the types of companies that would request access to such accounts “present huge risks to the Federal Reserve System and the financial system.”

The Fed will consider the feedback before it makes a final rule on its proposal, which could take months.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Two Victims Lose $62 Million To Address Poisoning Since December

Just one victim lost $12.2 million in January by copying the wrong address from their transaction history in an “address poisoning attack,” adding to a similar $50 million attack in December, according to Scam Sniffer.

Address poisoning is when attackers send small transactions or “dust” from addresses that look similar to ones in the target’s transaction history, hoping the victim will copy the wrong address.

Scam Sniffer added that signature phishing also surged recently, with $6.27 million stolen from 4,741 victims in January, a 207% increase compared to December.

Two wallets accounted for 65% of all signature phishing losses.

Signature phishing is slightly different as it tricks users into signing malicious blockchain transactions, such as unlimited token approvals.

Address poisoning trend not slowing down

“Address poisoning is one of the most consistent ways large amounts of crypto get lost,” reported security firm Web3 Antivirus on Thursday.

Some of the biggest address poisoning losses it tracked over time ranged from $4 million to $126 million. “Recent incidents show this trend isn’t slowing down,” they stated.

Related: Stablecoin ‘dust’ txs on Ethereum triple post-Fusaka: Coin Metrics

The researchers explained that address poisoners “generate full addresses that match the same first/last few characters you see, but the middle is different, so it looks ‘identical.’”

Dust attacks on Ethereum have surged

Analysts speculate that the Ethereum Fusaka upgrade in December has contributed to the increase in attacks because it made the network cheaper to use in terms of transaction costs.

Stablecoin-related dust activity is now estimated to make up 11% of all Ethereum transactions and 26% of active addresses on an average day, reported Coin Metrics earlier in February.

The firm analyzed over 227 million balance updates for stablecoin wallets on Ethereum from November 2025 through January 2026, finding that 38% were under a single penny — “consistent with millions of wallets receiving tiny poisoning deposits,” it stated.

Blockchain intelligence firm Whitestream reported on Sunday that the decentralized DAI stablecoin “has gained a reputation as a preferred stablecoin for illicit actors, serving as a ‘parking place’ for illegally sourced funds.”

“This is due to the protocol’s governance, which does not cooperate with authorities in freezing DAI wallets,” it stated, referencing recent address poisoning attacks.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Cardano price slides as open interest collapse weighs on ADA

Cardano price is under pressure near $0.27 as falling open interest and weak technical structure continue to limit recovery attempts.

Summary

- ADA open interest has fallen from $1.6 billion to $334 million, pointing to a sharp exit by leveraged traders.

- Price remains below key moving averages, with repeated rejections near the $0.32 level.

- Technical indicators show weak momentum, keeping downside levels near $0.24–$0.25 in focus.

Cardano traded slightly lower on Feb. 9, changing hands at $0.2705 at the time of writing. The token has lost about 31% over the past month and continues to sit near levels last seen in mid-2023.

Earlier in February, Cardano (ADA) briefly slipped toward a multi-year low around $0.22 before buyers stepped in. Since then, price action has stayed compressed, with the past seven days confined to a $0.2441–$0.3034 range.

As the selloff continues, market activity has slowed. Cardano’s 24-hour trading volume dropped 33% to about $768 million. With traders displaying little urgency on either side, the decline suggests waning participation rather than panic selling.

Open interest drop reflects exit by large traders

The derivatives market tells a similar story. Data shared on Feb. 9 by Alpharactal co-founder Joao Wedson shows Cardano’s open interest shrinking sharply, falling from $1.6 billion to about $334 million. The move suggests leveraged positions have been closed in size, rather than rolled into new bets.

Wedson also highlighted a shift in where that open interest now sits. In 2023, Binance accounted for more than 80% of ADA’s open interest, with the rest spread thinly across other exchanges. That picture has changed. Binance’s share has dropped to 22%, while Gate.io now holds the largest slice at 31%.

According to Wedson, this change matters. He pointed to Solana (SOL) as a reference, noting that its strongest rally phase coincided with rising Binance dominance in derivatives. Once that dominance faded, price strength cooled as well.

In Cardano’s case, the fragmented setup suggests leverage is no longer concentrated enough to drive sharp upside moves.

Cardano price technical analysis

On the chart, the trend still points lower. For weeks, recovery attempts have been capped by ADA’s continued trading below the 100-day moving average. The $0.32 region has been rejected on every push, confirming its status as a crucial resistance level.

A consistent pattern of lower highs and lower lows can be seen in the daily structure. The price is tracking close to the lower Bollinger Band, keeping pressure tilted to the downside.

The lack of volatility suggests a steady distribution as opposed to a washout. Moves back toward the middle of the Bollinger Bands have been sold into, suggesting sellers stay active on minor rebounds.

The $0.27 area, once a demand zone, is now being tested again with less follow-through from buyers. As long as ADA stays below $0.30, downside risk stays in focus.

That picture is echoed by momentum indicators. During short oversold bounces, the relative strength index, which is below 40, has had difficulty gaining traction. There has been no discernible bullish divergence, and attempts at recovery have been shallow.

Price action is still favoring a slow grind lower, with the $0.24–$0.25 zone serving as the next area of interest, unless there is a clear break back above the 100-day average on high volume.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics12 hours ago

Politics12 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat6 hours ago

NewsBeat6 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business11 hours ago

Business11 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics14 hours ago

Politics14 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business18 hours ago

Business18 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout