Business

FIIs ease bearish bets post-Budget, but charts warn of range-bound Nifty: Anand James

Edited excerpts from a chat:

FII shorts in Nifty futures have been a worrying trend. How has the data changed after the Budget?

Since Budget, FII’s longs in the index future segment have been on a rising trend, while the shorts have been on a declining trend. This pattern was rarely seen in the last six months, and assumes importance hinting at a potential towards FIIs changing their unilaterally bearish stance. At 43462 contracts, their longs in the index future segment is the highest since late January, and sub 2 lakh contracts level on the short side held by FIIS now, was last seen in the early January period. The consequent long short ratio of 18 levels was last seen on 1st of December, but at that point, the longs were just 26k, and shorts were just 1.1 lakh. In other words, FIIs are still short heavy, and the 3% boosting of shorts on Friday suggest that we need more days of reduction in shorts or a larger reduction in size, to establish it as a trend, and project a rise in Nifty.The news heavy week saw Nifty ending around 1.5% higher. What are the charts indicating in terms of how sustainable the rally can be this month and whether the momentum can take us to record high once again?

Despite the positive weekly close, it must not be forgotten that Nifty failed to sustain the peaks seen on 3rd February, which saw an up gapped opening. Also, on Friday, we came close to seeing Nifty filling the break away gap. This is certainly an indication that momentum has weakened, and we have most likely slipped on to a range trading bias. That said, that Nifty did not stretch all the way to 25450, in order to fill the gap, and that a close in the vicinity of 25700 was seen in the last three days, suggesting that buying interest is still around. Alternatively, a repeat fall into the 25496-450 territory should push the trend into a sideways mode signalled already or announce the re-dominance of bears.

IT stocks hogged limelight for the wrong reasons. Is the dip here a buy or do you see more pain ahead?

Following the recent selloff, the Nifty IT index is likely to look for support around the SuperTrend level near 35,100, which also aligns with a rising trendline. However, the emergence of a bearish crossover on the weekly MACD is weighing on near-term upside potential. Failure to sustain above the 35,100–35,000 zone could lead to further downside toward 34,320 (200‑week moving average), with an extended decline possible toward 33,500.

Key constituents such as TCS, Infosys, HCL Technologies, and Tech Mahindra have reversed from their recent highs on both daily and weekly charts, accompanied by strong volumes, indicating persistent profit booking. Meanwhile, Wipro and LTI Mindtree have also registered bearish MACD crossovers on the weekly timeframe, reinforcing the risk of deeper corrections. Heavyweights TCS, Infosys, and Wipro, which collectively make up nearly 70% of the index weight, have convincingly slipped below their 100‑day and 200‑day moving averages, pointing to underlying weakness in the index. Although HCL Technologies and Tech Mahindra continue to trade above key moving average supports, any breakdown in these stocks could further intensify downside pressure on the Nifty IT index.

HAL was one of the biggest losers in the week. Do you see some buying support coming in at lower levels?

Though it was only two days of sharp fall, a sideways range has been broken, projecting a large downsides, having also closed below super trend. However, the stock has slipped 15%, after testing the 200 day SMA. It appears to have formed an inside bar on Friday, when a positive oscillator divergence was also seen. This fills up with hope that despite all the gloom, some green shoots are visible and a swing higher to 4140-4236 may be played for, with risk restricted to Friday’s low.

Consumer durables have been on an uptrend with Amber shares up xx% in the week. How should one trade the momentum?

Ideally, the stock looks poised for 7082, the 200 day SMA. However, oscillators appear to be signalling an exhaustion in momentum, especially as the stock is approaching a horizontal resistance coinciding with January’s peaks. This warns us to take some money off the table, or put 6410 as stop for existing longs.

Give us your top ideas for the week ahead.

FINCABLES (CMP: 771)

View: Buy

Target: 820

SL: 742

Price has built a base around 730–745 and is rebounding toward the declining 100 DSMA near 779 which coincides with the SuperTrend level, first meaningful resistance. A daily close above 780–785 would signal a range breakout, opening 815–820. Failure to clear the 100 DSMA keeps the stock in a sideways-to-down bias within the 745–780 band. Volume has ticked up on the bounce, hinting at improving momentum, but overhead supply remains heavy. Bias turns positive only on strong close above 785 with volume; below 742, risk shifts back to the downside toward 730, 705 levels.

LICI (CMP: 901)

View: Buy

Target: 930-950

SL: 864

A strong breakout candle with heavy volume has pushed price above the recent supply zone 880–890, and the SuperTrend level of 848 turning it into immediate support. Momentum has improved with RSI near 70 and MACD has turned up with a fresh positive cross in daily scale. In the weekly scale, we have seen Supertrend break and the MACD is about to see bullish crossover, confirming trend acceleration. Bias stays positive while above 890. A decisive close above 930 can extend the move to 950; failure to hold 890 would weaken momentum, risking a retrace toward 864-860.

Business

Norway’s mainland economy grows 0.4% in fourth quarter

Norway’s mainland economy grows 0.4% in fourth quarter

Business

Seahawks RB Kenneth Walker III Wins Award, First Running Back MVP in 28 Years

Seattle Seahawks running back Kenneth Walker III was named Most Valuable Player of Super Bowl LX on Sunday, Feb. 8, 2026, after rushing for 135 yards on 27 carries and adding 26 receiving yards in the Seahawks’ dominant 29-13 victory over the New England Patriots at Levi’s Stadium.

Walker, in his fourth NFL season, became the first running back to earn Super Bowl MVP honors since Terrell Davis of the Denver Broncos in Super Bowl XXXII following the 1997 season — a span of 28 years. His performance anchored Seattle’s offense in a game largely controlled by defense, helping the Seahawks secure their second Lombardi Trophy in franchise history.

The Seahawks’ “Dark Side” defense set the tone, sacking Patriots quarterback Drake Maye six times, forcing three turnovers and holding New England to 13 points despite a late rally. Kicker Jason Myers contributed a Super Bowl-record five field goals, but voters rewarded Walker’s consistent production on the ground and in the passing game.

Walker totaled 161 scrimmage yards, outgaining the entire Patriots offense in the first half. His runs included bursts of 30, 29 and 10 yards that sustained drives and kept pressure off quarterback Sam Darnold. The former Michigan State star, drafted 9th overall in 2022, overcame early career injury concerns to emerge as Seattle’s offensive centerpiece.

In postgame comments, Walker expressed gratitude to his teammates. “This don’t happen without them,” he said on the field, holding the MVP trophy. “Our defense carried us all year, and tonight they did it again. I’m just blessed to be part of this group.”

The award came amid debate over whether a defensive player or Myers deserved

recognition. Cornerback Devon Witherspoon and edge rusher Leonard Williams disrupted Maye throughout, while Myers’ kicks provided the margin in a low-scoring affair. Some analysts, including those from The New York Post, argued coach Mike Macdonald’s scheme deserved MVP consideration for outmaneuvering New England’s defense.

Still, Walker’s impact proved decisive. He became the first Seahawks player to win Super Bowl MVP since Malcolm Butler’s interception in Super Bowl XLIX — though that game ended in heartbreak for Seattle. This time, the Seahawks flipped the script against their old rivals, avenging the 2015 loss where a goal-line interception sealed defeat.

The game unfolded as a defensive struggle. Seattle led 9-0 at halftime on Myers’ field goals. The third quarter saw more of the same, with Myers extending the lead to 15-0. New England’s first points arrived in the fourth on a Maye touchdown pass to Mack Hollins, but Seattle responded with a fumble return touchdown by DeMarcus Lawrence and Darnold’s scoring strike to tight end A.J. Barner.

Maye finished under duress, completing passes at a low clip amid constant pressure. The Patriots managed under 200 total yards, underscoring Seattle’s defensive dominance.

Walker’s MVP selection highlighted the value of a strong ground game in championship games. His 27 carries controlled tempo, limited possessions for New England and wore down their front seven. The performance capped a postseason where Walker rushed for over 400 yards across three games.

For the Seahawks, the win validated their rebuild around young talent and a ferocious defense under Macdonald, who previously coordinated Baltimore’s unit. Seattle entered as NFC champions after a strong regular season, overcoming injuries to key players.

The Patriots, led by second-year quarterback Maye (the regular-season MVP runner-up), fell short in their bid for a seventh title. The loss ended a promising campaign but exposed vulnerabilities against elite defenses.

Halftime provided contrast with Bad Bunny’s Apple Music performance, featuring Lady Gaga and Ricky Martin in surprise cameos. The cultural celebration offered a lively interlude to the on-field grind.

Postgame ceremonies included the traditional trophy presentation, with owner Jody Allen accepting on behalf of the franchise. Walker posed with the MVP award amid confetti, joined by teammates in celebration.

The victory sparks discussions about Seattle’s potential dynasty. With young stars like Walker, Darnold and Witherspoon, the Seahawks position themselves as contenders for years ahead.

For Walker, the MVP caps a remarkable arc from injury doubts to championship glory. His father attended his first NFL game in person at the Super Bowl, adding personal significance.

As the NFL offseason begins, focus shifts to free agency, the draft and 2026 Hall of Fame class announcements. Super Bowl LX will endure as a testament to defense, grit and one running back’s breakout moment on the biggest stage.

Business

New Perth Park boss fetches $194k

The right person to run Perth Park’s racetrack should be prepared for trauma, a job ad says.

Business

Bourse back with a vengeance as miners, IT stocks surge

Australia’s share market has rebounded with gusto from the previous session, recapturing the bulk of Friday’s more than $60 billion in losses.

Business

Vijay Kedia on cutting noise, patience, and finding tomorrow’s market winners

Kedia likened investing to running a marathon: “For me, it is like a scoreboard. I am a marathoner, running 42 kilometres. It does not matter where I am at the 1st kilometre or the 5th kilometre. As long as I am running, continuing my journey, I am okay. That is why the biggest thing is to cut off all this noise.”

He emphasized that patience is a critical quality for investors. “That is why it is difficult to make money also. You have to win over yourself. If you are not patient enough, at any given time you will be out of this market. These are the qualities of a good investor: knowledge, courage, and patience. Patience is very important to ultimately win in this market. If you do not have patience, you are out of the race. So, enjoy.”

When it comes to spotting long-term investment opportunities, Kedia shared his “SMILE” framework. “S stands for small in size, MI stands for medium in experience, L stands for large in aspiration, and E stands for extra-large market potential. I like to invest in a company that is small in its sector, has management with a clean track record and 15–20 years of experience, and management that is ambitious. The market potential should be extra-large so that the company remains small relative to the sector’s potential. These factors together help me identify companies.”

Kedia also emphasized investing in sunrise sectors and waiting for companies to reach inflection points. “Earlier, I bought a few companies that were losing money but had cash in their books. The sector completely changed. As per my quote, always remain invested in a sunrise sector at any cost and stay out of a sunset industry at any cost. I put stories on my radar and wait for the right time to invest. Sometimes, I wait five years, sometimes ten. When the company turns around and the sector is growing, I invest. That is my business.”

Ultimately, patience remains the core of Kedia’s approach. In a market dominated by instant news and volatility, his advice is simple yet timeless: ignore the noise, focus on fundamentals, and let patience do the heavy lifting.

Business

IDBI Bank shares drop 4% as Kotak Mahindra Bank stays away from stake sale; Fairfax, Emirates NBD in fray

The government of India and Life Insurance Corporation of India (LIC), which hold stakes of 45.48% and 49.24% respectively, are together looking to divest a 60.7% stake in the bank as part of the broader privatisation programme.

Meanwhile, Kotak Mahindra Bank clarified that it has not submitted a financial bid for IDBI Bank, dismissing recent media reports. The proposed sale was first announced in 2022, and the government is targeting to announce the successful bidder by March.

The bank has a current market capitalisation of around Rs 1.12 lakh crore. According to sources cited by Reuters, Fairfax — which already holds a majority stake in CSB Bank — may consider merging IDBI Bank with CSB Bank if its bid is successful.

The government has previously said the sale will be concluded in the current financial year ending March 31, 2026. The successful bidder will be allowed to rename the bank, Reuters reported last week.

IDBI Bank traces its origins to 1964, when it was established as the Industrial Development Bank of India through an Act of Parliament to support long-term industrial financing. In 2005, its commercial banking arm was fully merged into the institution, transforming it into a universal bank with both development finance and lending operations. Over time, however, this dual structure became a challenge, as the bank retained a heavy corporate lending focus even as peers diversified into retail segments, leaving it more exposed to concentrated risks and with limited balance from granular retail growth.

By the mid-2010s, mounting bad loans and weak capital buffers had significantly strained the bank’s financial position. In 2017, the Reserve Bank of India placed IDBI under the Prompt Corrective Action (PCA) framework after it breached key thresholds related to capital adequacy, asset quality, return on assets and leverage. The restrictions under PCA curtailed lending expansion and underscored the severity of the bank’s operational and balance-sheet stress.The situation reached a turning point in 2019 when the government directed Life Insurance Corporation of India (LIC) to acquire a controlling 51% stake and infuse capital to stabilise the lender. LIC’s takeover strengthened the balance sheet and reflected a clear policy decision to support the institution. Following the transaction, the RBI reclassified IDBI as a private sector bank for regulatory purposes, despite the continued majority ownership by government-linked entities.

IDBI Bank shares have risen 31.23% in the last 1 year.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

In the AI gold rush, tech firms are embracing 72-hour weeks

In the race for AI, tech firms are asking for their staff to work long hours. But there are risks, experts say.

Business

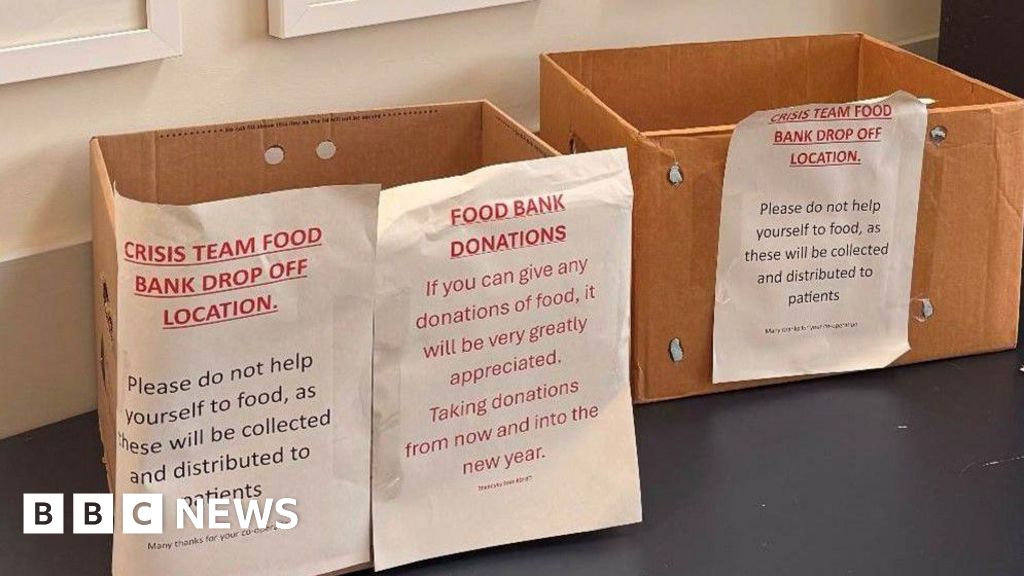

Donation appeal as vulnerable face food bank delay

A mental health support team set up a pantry in Wolverhampton to help those living in food poverty.

Business

Japanese stocks surge as Takaichi secures historic election victory

Japanese stocked jumped as markets opened on Monday morning, after prime minister Sanae Takaichi won a landslide victory.

Business

Japan stocks soar to record, super-long bonds steady in nod to Takaichi’s ’responsible’ stimulus

Japan stocks soar to record, super-long bonds steady in nod to Takaichi’s ’responsible’ stimulus

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics13 hours ago

Politics13 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat8 hours ago

NewsBeat8 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business13 hours ago

Business13 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 hours ago

Sports3 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics15 hours ago

Politics15 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business20 hours ago

Business20 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout