Crypto World

Japan’s Takaichi trade raises short-term risk for Bitcoin

Japan’s “Takaichi trade” is shifting global capital flows and tightening liquidity, adding short-term downside pressure to Bitcoin as U.S. stocks weaken.

Summary

- Japan’s election win has boosted stocks and weakened the yen.

- Portfolio rebalancing is reducing liquidity in U.S. markets.

- Equity weakness is spilling into Bitcoin trading.

Bitcoin is facing fresh near-term pressure as political shifts in Japan reshape global capital flows and reinforce a cautious tone across risk markets.

In a Feb. 9 analysis, CryptoQuant contributor XWIN Research Japan said the landslide victory of Prime Minister Sanae Takaichi in the Feb. 8 lower house election has accelerated what traders now call the “Takaichi trade,” a mix of aggressive fiscal policy, tolerance for yen weakness, and support for loose monetary conditions.

The ruling Liberal Democratic Party-led coalition secured a two-thirds supermajority, giving the new administration broad room to push stimulus and regulatory reforms.

Markets responded quickly. The Nikkei 225 climbed to fresh record highs above 57,000 on Feb. 9, while the yen weakened toward 157 per dollar before stabilizing on intervention talk. Japanese government bonds also came under pressure as investors adjusted to higher spending expectations.

At the same time, U.S. equities slipped into correction territory. Over the past seven days, the Nasdaq fell 5.59%, the S&P 500 declined 2.65%, and the Russell 2000 dropped 2.6%, reflecting tighter liquidity and a re-assessment of risk.

Portfolio rebalancing tightens conditions for risk assets

According to XWIN Research Japan, the current shift is less about capital fleeing the United States and more about global portfolio rebalancing.

“Japanese government bonds, long sidelined by ultra-low yields, are regaining appeal,” the report said, as fiscal expansion and reflation expectations lift returns.

As JGBs attract fresh capital, inflows into U.S. equity exchange-traded funds have slowed. This has reduced marginal liquidity in global stock markets and added pressure to already fragile sentiment.

Analyst GugaOnChain said the adjustment is unfolding across multiple asset classes at once. Money is rotating toward domestic Japanese assets, exporters, and selected commodities, while exposure to U.S. growth stocks is being trimmed.

Dollar strength has added another layer of stress. Yen weakness, persistent U.S.–Japan rate gaps, and defensive demand for dollars have tightened financial conditions, making leveraged trades more expensive to maintain.

In this setting, risk assets tend to move together. When U.S. equities weaken, portfolio managers often cut crypto exposure at the same time to control overall volatility.

Equity-led de-risking spills into Bitcoin markets

XWIN Research Japan said Bitcoin’s recent weakness fits this pattern.

In risk-off phases, Bitcoin (BTC) has tended to track U.S. equities, allowing stock market selling to spill into crypto. The current decline, the firm argued, is driven by cross-asset risk management rather than deterioration in on-chain activity.

CryptoQuant’s cross-asset indicators show that simultaneous equity corrections raise the probability of Bitcoin downside even when long-term holders are not selling. Recent price moves reflect futures unwinds and position reductions, not broad capitulation.

This dynamic has been visible in derivatives markets, where open interest has fallen and leverage has been cut over the past two weeks. Traders appear more focused on preserving capital than on chasing rebounds.

From a medium- to long-term perspective, the outlook diverges.

After the Feb. 8 election delivered a supermajority, the Takaichi administration has now gained the political space to advance structural reforms. Officials have positioned Web3 as a developing industry, and stablecoin laws and tax adjustments are expected later in 2026.

These actions could eventually attract institutional participation and strengthen Japan’s standing as a regulated hub for digital assets.

But for the time being, Bitcoin is still vulnerable to global risk cycles. As long as U.S. stocks are still under pressure and capital flows adjust to Japan’s fiscal pivot, short-term downside risks are likely to persist even if longer-term fundamentals hold.

Crypto World

South Korea Prepares Crypto Market Probes Under 2026 Policy Plan

South Korea’s Financial Supervisory Service (FSS) said it will step up scrutiny of suspected cryptocurrency price manipulation in 2026, outlining a slate of planned investigations that target high-risk trading tactics, including “whale” activity and schemes that exploit disruptions at local exchanges, local outlet Yonhap reported Monday.

According to Yonhap News Agency, FSS Governor Lee Chang-jin said that the agency will target high-risk trading practices that undermine market order, including coordinated manipulation and schemes exploiting disruptions in exchange infrastructure.

The FSS said the probes will focus on tactics that involve large-scale trading by whales, artificial price swings during exchange deposit or withdrawal suspensions and coordinated trading mechanisms using APIs or social media to spread false information.

Under the plan, the regulator said it intends to strengthen automated detection by analyzing abnormal price movements at very short intervals and developing tools that can flag suspected manipulation “sections” and related account groups, alongside text analysis that can help identify coordinated misinformation.

Planned probes target crypto manipulation tactics

The FSS said it will investigate practices that distort price discovery, including schemes that take advantage of exchange deposit or withdrawal suspensions, a practice referred to in South Korea as “gating.”

These situations can trap supply on a platform, creating artificial movements disconnected from the broader digital asset markets.

The financial watchdog also mentioned that it will track manipulation using market-order APIs and coordinated activity aimed at amplifying false narratives on social media.

On Feb. 2, the FSS expanded its use of artificial intelligence-powered surveillance tools to monitor crypto markets, reducing reliance on manual identification of potential manipulation.

In parallel, the watchdog established a task force to prepare for the introduction of the Digital Asset Basic Act, the second phase of the country’s crypto regulatory framework.

The unit will support the implementation planning rather than enforcement, including work on disclosures, exchange oversight and licensing standards.

Related: South Korea tightens crypto licensing rules for exchanges and shareholders

Exchange incidents add urgency to oversight push

The tougher tone arrives after a series of exchange-related incidents put operational risk back in the spotlight.

On Sunday, crypto exchange Bithumb said it recovered 99.7% of excess Bitcoin (BTC) mistakenly credited to users during a promotional error.

While the exchange said no customer assets were lost, the episode briefly triggered sharp price swings and prompted compensation measures for affected users.

The incident triggered a response from regulators. According to the Asia Business Daily, the Financial Services Commission (FSC) held an emergency inspection meeting on Sunday with the FSS and the Korea Financial Intelligence Unit (KoFIU), where officials reportedly ordered a comprehensive review of internal controls across all domestic crypto exchanges.

On Feb. 3, the FSS said it was reviewing sharp price movements in the ZKsync token during a system maintenance window on Upbit. The regulator said it was analyzing the data and could escalate the review into a formal investigation depending on the findings.

Upbit operator Dunamu previously told Cointelegraph that it has internal systems that also flag suspicious activities and a process that involves cooperating with regulators.

“When regulators request information, we can provide the relevant trading data without delay,” the spokesperson told Cointelegraph.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Crypto outflows cool as investors rotate from Bitcoin to altcoins

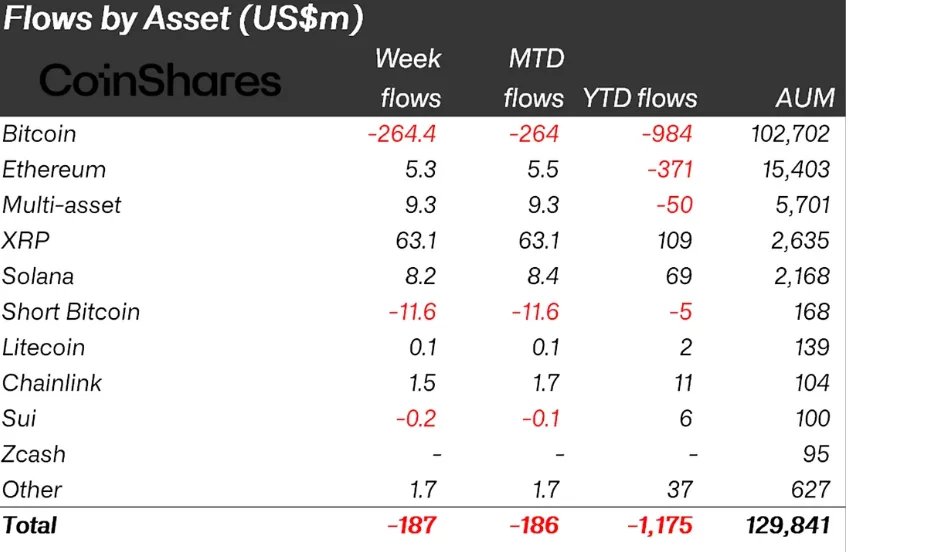

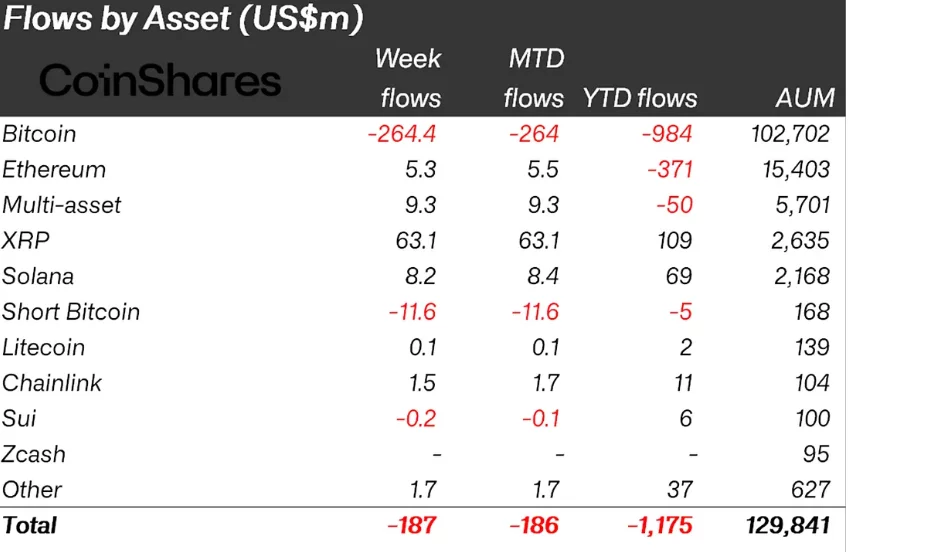

Digital asset investment products showed early signs of stabilisation last week as crypto outflows slowed sharply to $187 million, according to the latest CoinShares weekly report, despite continued pressure on crypto prices.

Summary

- Crypto fund outflows slowed sharply to $187 million, signaling a deceleration in selling pressure despite ongoing price weakness.

- Bitcoin led weekly outflows with $264 million, while several altcoins, including XRP, Solana, and Ethereum, attracted fresh inflows.

- Elevated trading volumes and selective regional inflows, particularly in Europe, point to early signs of market stabilisation.

While fund flows often move in tandem with price action, CoinShares noted that changes in the pace of flows have historically been more telling, frequently signalling potential inflection points in investor sentiment.

The recent deceleration suggests the market may be approaching a near-term bottom.

Bitcoin sees outflows as altcoins attract interest

At the asset level, Bitcoin (BTC) remained the main source of negative sentiment, with weekly outflows of $264.4 million, extending its year-to-date outflows to $984 million. Short Bitcoin products also recorded outflows of $11.6 million, suggesting reduced demand for bearish positioning.

In contrast, several altcoins attracted fresh inflows. XRP led the pack with $63.1 million in weekly inflows, bringing its year-to-date total to $109 million. This makes the Ripple token (XRP) the strongest-performing asset on a flows basis so far this year.

Solana (SOL) and Ethereum (ETH) also saw inflows of $8.2 million and $5.3 million, respectively, while multi-asset products added $9.3 million.

Flows remained geographically uneven. European markets showed pockets of strength, with inflows into Germany ($87.1 million) and Switzerland ($30.1 million), while Canada ($21.4 million) and Brazil ($16.7 million) also recorded gains.

CoinShares said the combination of slowing outflows, elevated trading volumes, and selective inflows into altcoins and European products points to a market that may be stabilising, even as price uncertainty persists.

Assets under management fall, trading activity surges

Total assets under management (AuM) across digital asset investment products declined to $129.8 billion, the lowest level since March 2025, following the latest market correction. That period also coincided with a local low in crypto prices.

Despite the drawdown in AuM, trading activity surged. ETP trading volumes hit a record $63.1 billion for the week, surpassing the previous high of $56.4 billion recorded in October, pointing to elevated investor engagement amid market volatility.

Crypto World

Tether’s gold stash tops $23 billion as buying outpaces nation states, Jefferies says

Tether, the crypto firm behind the world’s most popular stablecoin , continued its gold hoarding over the past month, ranking within the top 30 global owners of the metal and surpassing several sovereign nations, according to a Sunday report from Wall Street investment bank Jefferies.

The stablecoin issuer’s gold reserves rose to an estimated 148 tonnes by Jan. 31, valued at roughly $23 billion, after buying about 26 tonnes in the last quarter of 2025 and adding another 6 tonnes in January, Jefferies analysts said.

Jefferies estimates show Tether’s quarterly gold buying exceeded that of most individual central banks, trailing only Poland and Brazil during that period.

At current levels, Tether’s holdings exceed those of countries such as Australia, the United Arab Emirates, Qatar, South Korea and Greece, placing the crypto firm among the top 30 holders of bullion worldwide and one of the largest non-sovereign buyers, the analysts said.

The 148 tonnes of bullion is held as reserves backing both its U.S. dollar-pegged stablecoin USDT and its gold-backed token XAUT. But the company may hold more gold than disclosed, the report added.

Because Tether is privately held, the figures represent a minimum estimate of its total gold exposure, with undisclosed additional purchases likely made on the company’s balance sheet.

According to the USDT’s fourth quarter attestation, some $17 billion of gold was in the reserves, amounting to 126 tonnes as of year-end gold prices.

XAUT’s supply grew to 712,000 tokens worth $3.2 billion by the end of January, an increase of 6 tonnes of gold backing the tokens. CEO Paolo Ardoino told CoinDesk in an October interview that the gold-back enjoyed strong retail demand mainly from emerging markets.

The accumulation coincided with a record-breaking rally in gold, topping $5,000 per ounces last month and advancing nearly 50% since September. The driving forces behind the move is central bank demand, rising long-term government bond yields and efforts by some investors to reduce reliance on the U.S. dollar.

The company’s buying spree may continue, Jefferies noted. Tether CEO Paolo Ardoino said the company plans to allocate 10%-15% of its investment portfolio to physical gold, formalizing a strategy that has already played out over several years.

Tether’s investment portfolio was valued at $20 billion as of the end of last year, CoinDesk reported.

Read more: Tether is buying up to $1 billion of gold per month and storing it in a ‘James Bond’ bunker

Crypto World

Extreme Fear continues to paralyze crypto markets heading into Monday

Crypto market sentiment collapses as CoinMarketCap’s Fear and Greed Index crashes to 9, signaling deep anxiety despite Bitcoin and majors stabilizing.

Summary

- CoinMarketCap’s Crypto Fear and Greed Index has dropped to 9, near its yearly low of 5 on Feb. 6, marking sustained “Extreme Fear” across the market.

- The index blends price momentum, BTC/ETH volatility, options positioning, stablecoin supply, and social data to frame whether sentiment is overly fearful or greedy.

- Bitcoin, Ethereum, and Solana prices have stabilized off recent lows even as sentiment stays depressed, turning the index into a context tool rather than a direct trading signal.

Crypto’s mood has flipped to panic, and CoinMarketCap’s own gauge is flashing red to prove it. The platform’s CMC Crypto Fear and Greed Index currently sits at just 9, firmly in “Extreme Fear,” down from 15 a week ago and well below the “Neutral” reading of 41 seen last month. Yesterday’s score was 8, while the yearly low hit 5 on Feb. 6, underscoring how aggressively sentiment has reset despite a still‑elevated market cap backdrop.

CoinMarket Cap’s Fear and Greed Index lowers to -9

CoinMarketCap describes the tool as “a powerful tool that analyzes market sentiment to help you make informed crypto investment decisions,” framing it as the most “trusted measure of overall crypto market sentiment” and “the number one, most cited and most trusted index of its kind” among mainstream financial outlets. The index runs on a 0–100 scale, where a lower value indicates extreme fear and a higher value “extreme greed,” effectively quantifying what many traders only feel anecdotally in price action. As the launch note put it, “this innovative index provides a wide‑ranging and quantifiable assessment of fear and greed for the entire cryptocurrency industry.”

Methodologically, the indicator pulls from five pillars: price momentum across the top 10 non‑stablecoin assets, forward‑looking volatility via BVIV and EVIV for Bitcoin and Ethereum, options put/call ratios, market composition through the stablecoin supply ratio, and CMC’s own social‑trend and engagement data. The Academy explainer stresses that “extreme fear likely indicates undervalued asset prices, while extreme greed likely indicates frothy valuations and overvalued asset prices,” echoing Warren Buffett’s maxim to “be fearful when others are greedy and greedy when others are fearful.”

In spot markets, Bitcoin (BTC) trades near $70,505 with roughly $42.8b in 24‑hour volume. Ethereum (ETH) changes hands close to $2,096, on about $20.9b in turnover. Solana (SOL) is around $87.6, after a 24‑hour range between roughly $86.2 and $88.6. That pricing backdrop lines up with a broader rebound in digital assets, with Bitcoin recently reclaiming the $71,000 area after last week’s washout and total crypto market capitalization moving back above $2.4t.

For traders, the sub‑10 print is less a trading signal than a context marker. CoinMarketCap is explicit that the Fear and Greed Index “is not a perfect indicator in itself but can provide a useful measure of the market’s sentiment,” best used alongside technicals, flows and macro drivers. In other words: quantify the fear, then decide whether you’re trading with the herd or against it.

Crypto World

Is $1.8K the Bottom? ETH Hits Critical Demand Zone (Ethereum Price Analysis)

Ethereum remains under heavy bearish pressure, with recent price action confirming a continuation of the broader downtrend. The market is currently reacting to a major sell-side expansion, and both technical structure and on-chain liquidity dynamics suggest that the asset is still navigating a critical phase where downside targets remain relevant, even if short-term relief bounces occur.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH is clearly trading within a well-defined descending channel, with the price recently accelerating toward the lower boundary of this structure. The most important observation on the chart is the clean breakdown below multiple prior support levels, followed by a sharp impulsive leg to the downside. This move confirms strong bearish acceptance rather than a simple liquidity sweep.

The asset has now reached a major higher-timeframe demand zone, located around the $1.8K region, which previously acted as a base during earlier accumulation phases. The reaction off this zone has produced a modest bounce, but so far this move lacks structural strength and remains corrective in nature.

Nevertheless, the market is likely to enter a consolidation-correction phase above this crucial support until a decisive breakout occurs. The main supply zone during this consolidation range is the channel’s middle line, located at the $2.3K threshold. A break above this resistance will open the door for an extended bullish retracement toward the $2.5K significant resistance.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the bearish structure becomes even clearer. The most recent price action shows a sharp sell-off into demand, followed by a shallow bounce that lacks impulsive follow-through.

Crucially, the rebound appears corrective and technically opens the door for a pullback toward the most recent supply zones and Fibonacci levels, located around the $2.3K to $2.6K region. These areas align with prior breakdown levels and correspond to zones where sellers previously intervened aggressively. If the price retraces into these levels without strong volume or momentum, they are likely to act as rejection zones rather than breakout points.

Until Ethereum can reclaim and hold above these supply areas, the 4-hour structure continues to favour continuation to the downside or extended consolidation within the lower range, rather than a trend reversal.

Sentiment Analysis

The ETH liquidation heatmap over the last 6 months provides critical confirmation of the bearish technical structure. A significant concentration of liquidity has been built around and just below the $2K level, which has recently acted as a strong magnet for price. The sharp sell-off into this area confirms that downside liquidity was actively targeted, resulting in a large flush of leveraged long positions.

Despite this liquidation event, the heatmap still reveals residual liquidity pockets extending slightly below current price levels, indicating that the market may not have fully exhausted its downside objectives yet. These remaining clusters continue to exert gravitational pull on price, especially if spot demand remains weak and derivatives positioning rebuilds on the long side too quickly.

That said, the intensity of liquidations around the $2K zone suggests that a meaningful portion of forced selling has already occurred. This reduces immediate liquidation pressure and explains the short-term stabilization seen after the drop. However, from an on-chain perspective, this behavior supports consolidation or corrective rebounds, not a confirmed trend reversal, unless liquidity interest decisively shifts back above current levels.

In summary, on-chain data aligns closely with the technical picture: Ethereum is still operating in a bearish liquidity-driven environment, with downside risks remaining active as long as price fails to reclaim key supply zones and attract sustained spot demand.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Ripple Price Analysis: What’s Next for XRP After a Brutal 31% Monthly Drop?

Ripple’s XRP is no longer trading within a corrective or range-bound environment. The recent price action reflects a clear liquidity-driven unwind, where prior reaction zones have failed to hold, and the asset is now probing deeper demand with limited structural support overhead.

Ripple Price Analysis: The Daily Chart

On the daily timeframe, XRP has breached its most recent major swing low of $1.2, confirming a structural breakdown rather than a temporary deviation. The sell-off following this breach has been sharp and impulsive, indicating forced participation rather than controlled distribution.

The price has sliced through multiple previously respected demand areas with minimal response, which signals that resting buy-side liquidity at those levels has already been consumed. The current interaction with the broader demand zone near the channel’s lower boundary of $1.00 is therefore critical. This zone represents one of the last visible higher-timeframe areas where untested demand may still exist.

However, the lack of meaningful absorption so far suggests that sellers remain in control, and any stabilization here would need to be confirmed through time rather than a single reaction.

From a daily perspective, XRP remains vulnerable as long as the price trades below the former reaction zones overhead, which are now structurally acting as supply.

XRP/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the influx of sellers is more evident, with the price aggressively reaching the $1.00 threshold. Yet, the most recent impulsive leg lower was followed by a corrective bounce, which has pushed the asset toward an internal supply zone around the $1.5 area.

The highlighted supply zones on the chart align with previous consolidation and breakdown areas. These zones now represent regions where any short-term pullback is likely to be met with renewed sell-side interest. As long as the price remains below these levels, upside moves should be treated as corrective rather than the start of a reversal.

Structurally, the market is still prioritizing downside liquidity, and without a clear break in this lower-high sequence, the 4-hour trend remains decisively bearish.

The post Ripple Price Analysis: What’s Next for XRP After a Brutal 31% Monthly Drop? appeared first on CryptoPotato.

Crypto World

US Treasury Secretary calls on Senate to advance Warsh nomination amid Powell probe

United States Treasury Secretary Scott Bessent wants the Senate Banking Committee to move ahead with the confirmation hearings for Federal Reserve chair nominee Kevin Warsh, even as a Department of Justice investigation into current Fed chair Jerome Powell remains unresolved.

Summary

- Treasury Secretary Scott Bessent urged the Senate Banking Committee to proceed with Kevin Warsh’s confirmation hearings.

- Republican Senator Thom Tillis has threatened to block all Federal Reserve nominations until the investigation into Powell’s congressional testimony over a $2.5 billion renovation is resolved.

- Bitcoin has tanked over 20% since Warsh was nominated.

During a Fox News interview, Bessent pushed back on Republican Senator Thom Tillis, who has threatened to delay the confirmation process until the Department of Justice investigation into the current Fed chair is concluded.

“Senator Tillis has come out and said he thinks that Kevin Warsh is an extreme candidate, So I would say, why don’t we get the hearings underway and see where Jeanine Pirro’s investigation goes?” Bessent said.

U.S. Attorney for the District of Columbia, Jeanine Pirro, opened a probe on Jan. 9 tied to Powell’s congressional testimony, which addressed cost overruns linked to a $2.5 billion renovation of the Fed’s headquarters and nearby buildings. Prosecutors are investigating whether Powell misled lawmakers about the scope and expense of the renovation project.

Powell has denied any wrongdoing and said the investigation is being used as a political pretext following his resistance to Donald Trump’s demands for faster interest rate cuts.

As previously reported by crypto.news, Senator Tillis has said he would block all Fed nominations until the Justice Department concludes its probe into Powell, even though he considers Warsh a “qualified” and “strong” candidate for the position.

“I’d be one of the first people to introduce Mr. Warsh if we’re behind this and support him, but not before this matter is settled,” Tillis said in a recent interview appearance.

Warsh was nominated by Trump on Jan. 30 and now awaits a Senate Banking Committee review hearing, following which the panel will vote on whether to advance his nomination to the full Senate. If the full Senate confirms the nominee, he will be officially appointed as the next Federal Reserve chair.

Warsh’s nomination as the next Fed chair has had an immediate impact on the price of Bitcoin (BTC) and the broader crypto market, as he is viewed as a hawkish policymaker by the vast majority of analysts. Right after his nomination, the price of Bitcoin fell below $82,000 after weeks of trading above that level, while the total crypto market capitalization dropped to $2.8 trillion.

The trading sessions that followed saw more than $2.5 billion in liquidations of leveraged long positions, which subsequently pushed the flagship crypto below several key support levels and intensified downside volatility.

As of press time, Bitcoin has dropped over 20% since Warsh’s nomination.

Crypto World

Bitcoin Price Forecasts Say $50,000 Is on the Way

Bitcoin (BTC) begins its second week of February, licking its wounds as traders remain bearish on BTC.

-

Market forecasts agree that Bitcoin price action has not yet put in a reliable long-term bottom.

-

CPI week comes as markets lose faith in Fed rate cuts in March.

-

US dollar strength begins to fade as analysts eye a potential rerun of 2021 for Bitcoin-dollar correlation.

-

Japan’s election turns heads, with analysis seeing a weaker yen and crypto headwinds to come.

-

Bitcoin miners send large amounts to exchanges as the dust settles on the snap downside.

BTC price expected to attempt $60,000 retest

Bitcoin continues to trade above $70,000 as the week gets underway, but traders are anything but bullish on the short-term BTC price outlook.

Data from TradingView shows a lack of volatility around the weekly close, with BTC/USD staying around 20% higher versus its 15-month lows from last week.

In an X thread covering lower time frames, trader CrypNuevo warned that the current relief may end up as a manipulative move to liquidate late short positions.

“The intention to push price up first would be to hit the short liquidations that exist between $72k-$77k mainly. But this move is just a guess,” he wrote.

“What we’re really anticipating here is the long wick getting filled at least 50% of it in the next weekly candles.”

CrypNuevo implied that the lows could see at least a partial retest in the short term.

“It could be an immediate wick-fill. But in the case of having a move up first, then it could probably take around 5-8 weekly candles to get filled,” he forecast.

At the weekend, Cointelegraph reported on a broad consensus that price would make new macro lows in the future — and that these could take BTC/USD to $50,000 or lower.

Guys this isn’t the bottom. It’s just a bounce.

Historically $BTC drops 80% during its bear market.

That puts us near 40k

— Roman (@Roman_Trading) February 6, 2026

Trader Daan Crypto Trades meanwhile considered less exciting BTC price action to come next.

“After such a volatile few weeks, price will attempt to start ranging at some point. With this recent spike in volatility and big retrace yesterday, there’s a good chance we are hitting that point about now,” he told X followers Sunday.

“Would expect volatility to slowly come off a bit again, a range to be formed and from there on out we can reassess and look for opportunities.”

CPI due as Fed policy nerves emerge

The macro focus is back on US inflation data this week as wild gyrations in precious metals settle.

The January print of the Consumer Price Index (CPI), due Friday, forms the highlight and will follow various US employment data releases.

“Earnings season is also in full swing and macroeconomic uncertainty is elevated,” trading resource The Kobeissi Letter added on the week’s outlook.

Since announcing the new Chair of the Federal Reserve, President Donald Trump has failed to calm market nerves about future financial policy. His pick, Kevin Warsh, is thought to be notionally opposed to easing financial conditions — something that has already weighed on risk-asset performance.

Markets thus have little faith in interest rates going lower at the Fed’s next meeting in mid-March — even if Warsh is only due to take over in May.

Data from CME Group’s FedWatch Tool currently gives 82% odds of rates staying at current levels.

Commenting, analytics resource Mosaic Asset Company pointed to “stubborn” US inflation statistics as a reason for a more hawkish Fed — and associated market nerves.

“The combination of stronger economic growth and stubbornly high core inflation might starting casting a doubt on the interest rate outlook across the yield curve,” it wrote in the latest edition of its regular newsletter, “The Market Mosaic.”

Mosaic said that difficult conditions for the Fed were a “major catalyst behind the selloff in growth and AI stocks this year.”

“Rising rates makes the present value of future corporate profits worth less in today’s terms, while higher rates presents competition for investor capital as well,” it added.

As the week began, meanwhile, gold returned to the $5,000 mark, while US stocks futures joined Bitcoin in a relief bounce off Friday’s lows.

US dollar at a ten-year crossroads

For both Bitcoin and the broader risk-asset market, US dollar strength is becoming an increasingly important potential volatility catalyst.

The US dollar index (DXY), which enjoyed a relief rally following a trip to multiyear lows near 95.5 in late January, is failing to reclaim levels above 98.

A strong dollar tends to result in pressure for Bitcoin, and while the correlation has undergone many changes in recent years, the long-term trend may provide bulls with a more reliable tailwind.

“Still holding that support. But really critical level for the long-term trend,” analyst Aksel Kibar wrote in recent dollar commentary.

“$DXY can offer a great trade setup soon. Long or short. irrespective of direction.”

Kibar eyed DXY possibly now breaking out of a ten-year trading channel to the downside, but said that more data would be necessary before this was confirmed.

An alternative perspective comes from Henrik Zeberg, chief macro economist at crypto market insight company Swissblock.

In an X post last week, Zeberg likened the current relationship between BTC and DXY to early 2021 — around ten months before BTC/USD saw the blow-off top in its last bull market.

Far from breaking down, DXY could in fact be at the start of its next bull run.

“Strong DXY is BEARISH for BTC – just not in the initial phase of the Bull. Likely because ROTATION into US Assets,” he wrote.

“In 2021 – we had 12 weeks of BTC rally into the new DXY Bull. The rally gained 130% into the TOP for BTC. I see same development again! +100% gain in BTC – into its FINAL TOP.”

An accompanying chart suggested a target for that “final top” at $146,000.

Yen weakness stays on the radar

For the short term, however, Bitcoin faces another macro hurdle: a new fiscal policy era in Japan.

After the reelection of Prime Minister Sanae Takaichi, Japanese stocks surged to record highs — and analysis now sees negative impacts for US investment vehicles and crypto.

“The landslide victory of Sanae Takaichi marks Japan’s shift toward aggressive fiscal stimulus and tolerance for currency depreciation,” analyst XWIN Research Japan wrote in a blog post published on onchain analytics platform CryptoQuant.

“The ‘Takaichi Trade’ has lifted the Nikkei to record highs while reshaping global capital flows.”

XWIN referenced findings warning of “slowing inflows” into US equity exchange-traded funds (ETFs), thanks to a weaker yen increasing the attractiveness of Japanese bonds.

“Against this backdrop, Bitcoin faces short-term downside risk,” it continued.

“In risk-off phases, BTC tends to correlate with U.S. equities, allowing equity-led de-risking to spill into crypto markets. This pressure does not reflect deterioration in Bitcoin’s on-chain fundamentals, but cross-asset risk management.”

As Cointelegraph reported, crypto markets remain highly sensitive to Japan-related news, with one theory even attributing the yen carry trade to last week’s BTC price crash.

Analyzing the yen situation ahead of the election, Robin Brooks, a senior research fellow at Brookings, described its weakness as a “political liability.”

“With the election out of the way, especially if Takaichi does well, the optics of Yen depreciation won’t matter nearly as much,” he predicted.

“So the election is conceivably a catalyst for the next round of Yen weakening.”

Bitcoin miners see “exceptional” exchange inflows

Bitcoin miners are busy adjusting to current reality after Bitcoin’s 15-month lows — but research warns that a sell-off risk remains.

Related: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest, Feb. 1 – 7

Miner inflows to exchanges reached their highest levels since 2024 in recent days, with Feb. 5 alone seeing total deposits of 24,000 BTC.

Describing that tally as “exceptional,” CryptoQuant contributor Arab Chain said that the market is undergoing a “redistribution phase.”

“Notably, this rise in miner activity comes within a market environment characterized by clear volatility and reduced risk appetite among segments of traders, which could add an extra layer of short-term selling pressure,” a blog post explained.

“However, these inflows do not necessarily indicate the start of a prolonged downtrend, but rather may represent a natural redistribution phase within the market cycle.”

The classic Hash Ribbons indicator, which measures periods of miner stress, likewise continues its reaction to Bitcoin’s flash crash.

The indicator’s two moving averages of hash rate show no sign of forming a classic bullish cross, firmly invalidating its latest “buy” signal from early January.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

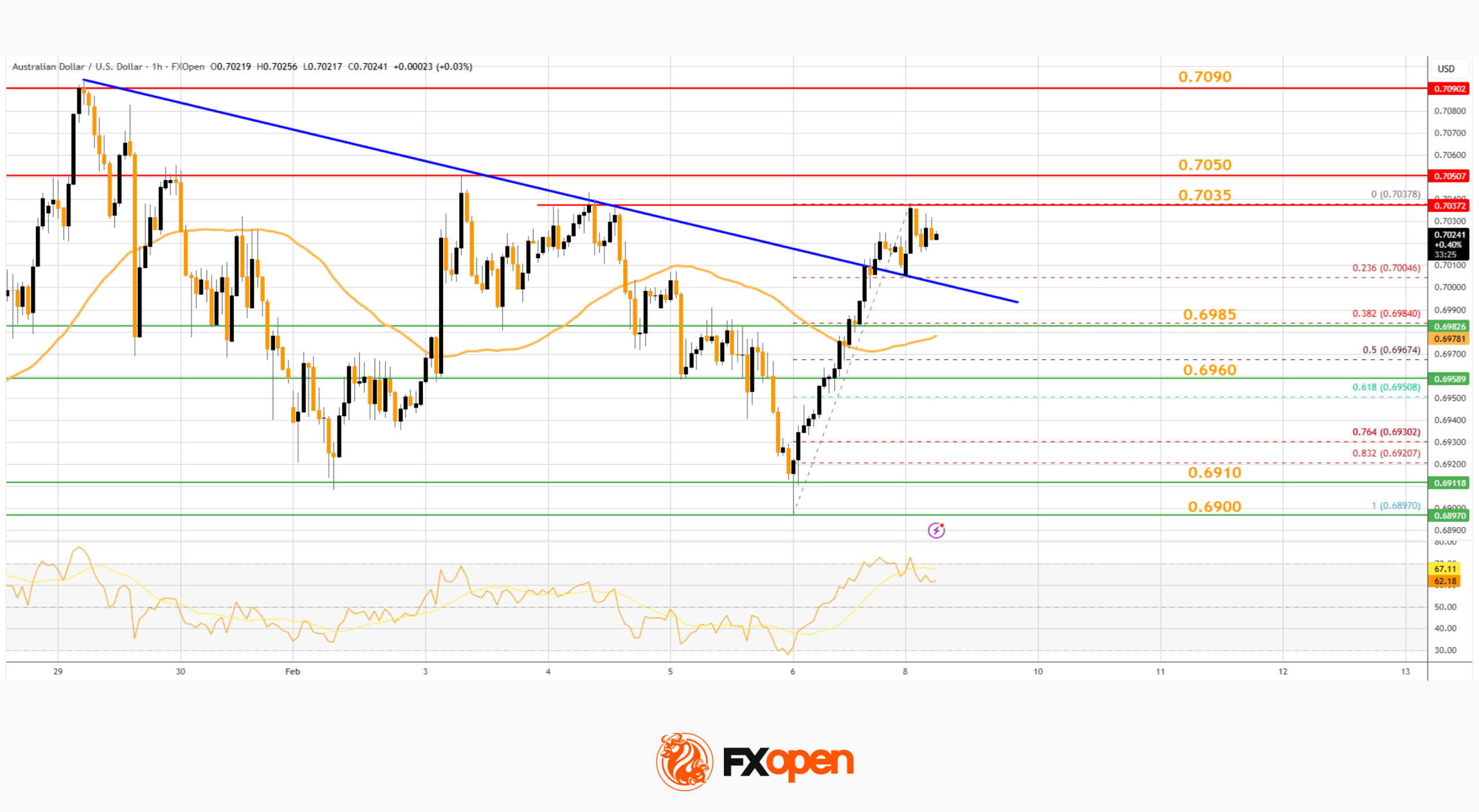

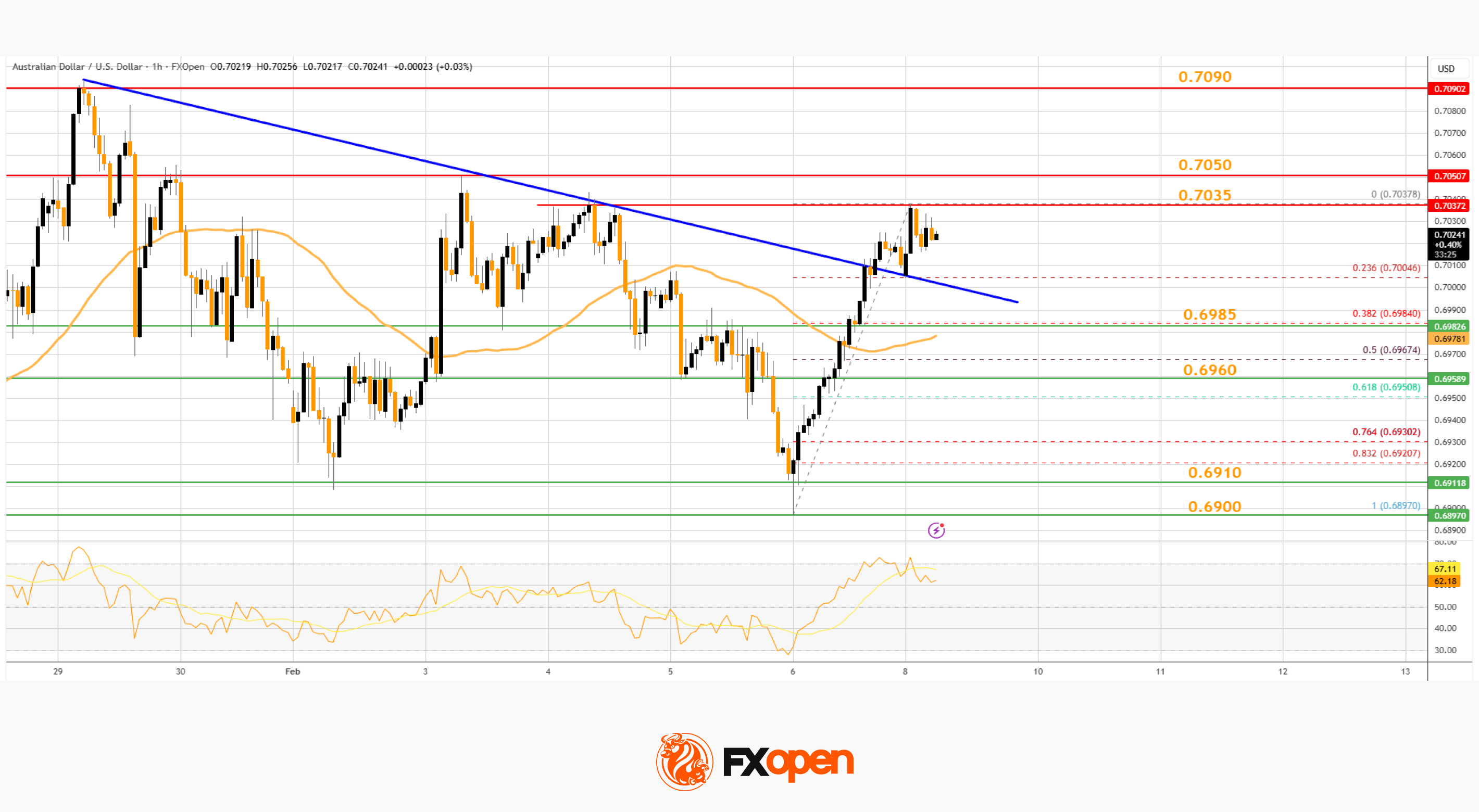

Market Analysis: AUD/USD And NZD/USD Build Momentum As Bulls Target Fresh Gains

AUD/USD started a fresh increase above 0.6980 and 0.7000. NZD/USD is also rising and might aim for more gains above 0.6060.

Important Takeaways for AUD USD and NZD USD Analysis Today

· The Aussie Dollar started a decent increase above 0.6950 against the US Dollar.

· There was a break above a key bearish trend line with resistance at 0.7000 on the hourly chart of AUD/USD at FXOpen.

· NZD/USD is consolidating gains above the 0.5995 pivot zone.

· There is a major bearish trend line forming with resistance at 0.6030 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from 0.6900. The Aussie Dollar was able to clear 0.6950 to move into a positive zone against the US Dollar.

There was a close above 0.6980 and the 50-hour simple moving average. Besides, there was a break above a key bearish trend line with resistance at 0.7000. Finally, the pair tested 0.7035. A high was formed near 0.7037 and the pair recently started a consolidation phase.

There was a minor decline below 0.7030. On the downside, initial support is near the 23.6% Fib retracement level of the upward move from the 0.6897 swing low to the 0.7037 high.

The next area of interest could be near 0.6985, the 50% Fib retracement, and the 50-hour simple moving average. If there is a downside break below 0.6985, the pair could extend its decline toward 0.6960. Any more losses might signal a move toward 0.6910.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.7035. The first major hurdle for the bulls might be 0.7050. An upside break above 0.7050 might send the pair further higher. The next stop is near 0.7090. Any more gains could clear the path for a move toward 0.7120.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair started a fresh increase from 0.5930. The New Zealand Dollar broke the 0.5950 barrier to start the recent rally against the US Dollar.

The pair settled above 0.6000 and the 50-hour simple moving average. The bulls were able to push the pair above the 61.8% Fib retracement level of the downward move from the 0.6060 swing high to the 0.5928 low.

However, the bears are now protecting the 76.4% Fib retracement at 0.6030. There is also a major bearish trend line forming with resistance at 0.6030. The NZD/USD chart suggests that the RSI is still above 50.

On the downside, immediate support is near the 0.5995 level and the 50-hour simple moving average. The first key zone for the bulls sits at 0.5930.

The next key level is 0.5900. If there is a downside break below 0.5900, the pair might slide toward 0.5865. Any more losses could lead NZD/USD into a bearish zone to 0.5820.

On the upside, the pair might struggle near 0.6030. The next major resistance is near the 0.6060 zone. A clear move above 0.6060 might even push the pair toward 0.6090. Any more gains might clear the path for a move toward the 0.6120 zone in the coming days.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

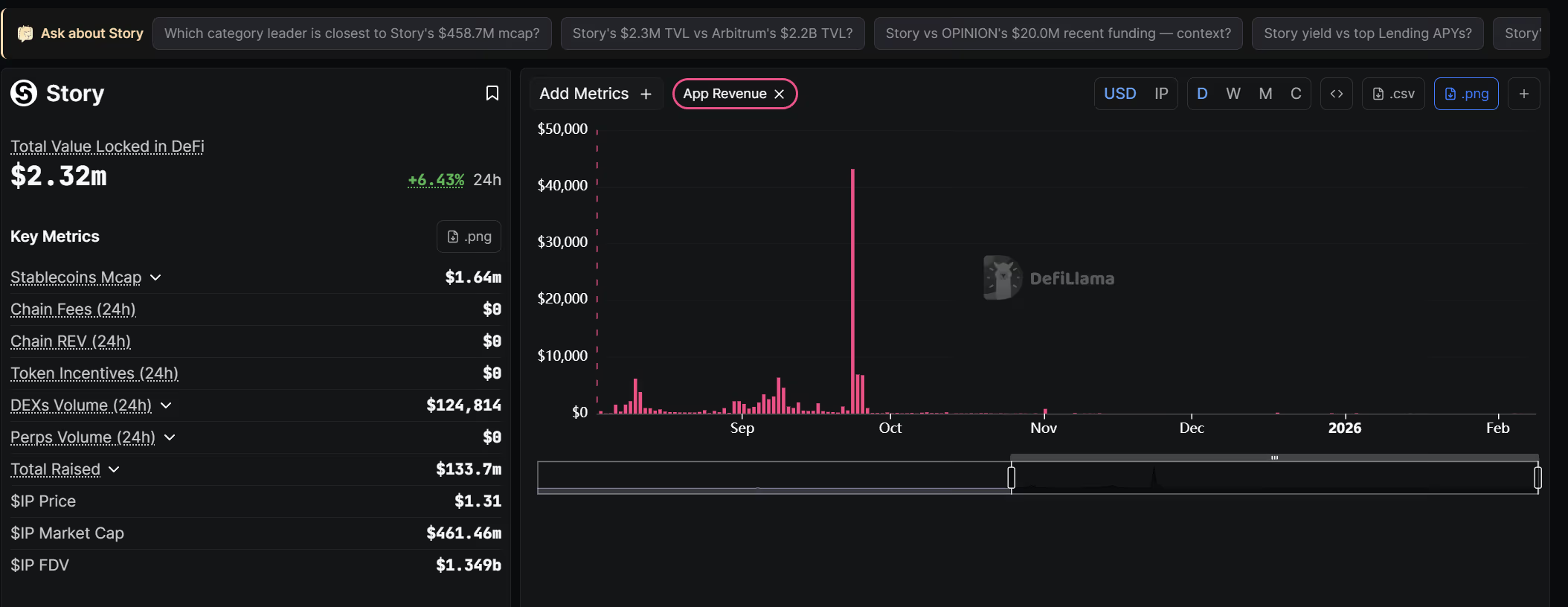

Story co-founder defends token unlock delay, says project needs ‘more time’

Story Protocol co-founder SY Lee defended the project’s decision to push its first major IP token unlock to August 2026, in a recent interview with CoinDesk, saying the blockchain needs “more time” to build usage and that near-zero on-chain revenue is “the wrong metric” for an intellectual-property and AI data network.

The six-month delay keeps team and investor tokens locked as Story pivots from a general IP registry toward licensing human-generated datasets for artificial-intelligence training.

He pointed to Worldcoin’s 2024 decision to extend investor and team lockups from three to five years, a move that reduced near-term circulating supply and was framed as extending the development runway, with the token posting double-digit gains in the hours after the announcement. Story, Lee said, is following the same logic.

“If we were all mercenary, we would have wanted a shorter lockup,” he said, describing the extension as a signal of long-term commitment rather than distress.

Story’s daily revenue, which peaked at $43,000 in September 2025 and is currently $0 per DeFiLlama, has also been a concern for many investors.

Lee contends that those numbers understate Story’s activity because much of the intended monetization occurs off-chain through licensing agreements rather than in transaction tolls.

In his view, gas revenue is a lagging indicator for a network designed to record rights, provenance, and usage terms before it begins extracting meaningful value from them.

“We intentionally put our chain gas fee pretty low. We’re more of an IP chain,” he said. “You may not see the type of revenue stream that you’re looking for like a DeFi chain.”

Instead, he said Story’s near-term focus is on recording ownership terms and usage rights for datasets and models used to train artificial-intelligence systems — something the project announced last year — with payments and royalty splits embedded in smart contracts.

That shift moves the project away from tokenizing media content or collectibles and toward what Lee described as “unscrapable” human-contributed data, such as multilingual voice samples and first-person video, assets he argues are harder for AI developers to obtain legally at scale through traditional web scraping.

The transition, however, delays the visibility of on-chain income because much of the expected value is tied to enterprise licensing deals rather than retail transaction fees. Lee compared the timeline to his previous Web2-based startup experience — which landed him a $440 million exit in 2021 — noting that it took years for meaningful revenue to materialize.

For token holders, the practical implication is that supply expansion is being slowed while the team attempts to demonstrate traction in AI data partnerships and rights-cleared dataset collection.

Whether that strategy ultimately converts into a sustainable business model is an open question, but Lee maintained that extending vesting schedules is healthier than rushing liquidity into a weak market.

“The best founders, the best teams, the best companies usually do it for a decade plus, we’re in it for the long term and longer innings,” Lee said.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics15 hours ago

Politics15 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat9 hours ago

NewsBeat9 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business14 hours ago

Business14 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports5 hours ago

Sports5 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics17 hours ago

Politics17 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business22 hours ago

Business22 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report