Crypto World

Coinbase Returns to the Super Bowl with a Quirky Lo-Fi Karaoke Ad

Coinbase has returned to the Super Bowl with a bold, nostalgia-forward spot that eschews hard sells in favor of a shared cultural moment. Four years after its viral QR-code stunt, the exchange leaned into a Backstreet Boys karaoke-inspired concept, letting the lyrics of “Everybody (Backstreet’s Back)” flash across the screen in a one-minute montage. Marketing chief Catherine Ferdon described the creative as a deliberate attempt to spark a communal experience and to illustrate how the crypto community has evolved beyond a niche interest. The move comes as Coinbase seeks to sustain mainstream visibility at a time when crypto brands are navigating a dense regulatory backdrop and mixed public sentiment, rather than relying solely on direct product demonstrations.

The execution centers on text animation and a simple premise: a catchy, universally recognizable tune that listeners can sing along to, with the goal of memory and sharing rather than a traditional call to action. In that sense, the ad mirrors a broader approach in crypto marketing that prioritizes cultural resonance and broad memorability to drive top-of-munnel awareness, rather than relying on flashy product showcases alone. The spot’s design choices—minimal on-screen branding, a familiar chorus, and a single point of reference—signal Coinbase’s intent to let the moment carry the conversation rather than to funnel viewers immediately into signing up or downloading an app.

Coinbase’s 2026 appearance follows a notable high-water mark in 2022, when the company staged a color-shifting QR-code commercial that bounced across the screen and directed viewers to a sign-up link. The campaign, which offered BTC to new users, reportedly crashed Coinbase’s site and drew millions of visits in a matter of minutes, underscoring the game-changing reach of the Super Bowl for crypto marketing. The 2022 effort featured a simple hook and a sense of immediacy—an approach that Coinbase appears to be reinterpreting this year, albeit through a different cultural lens that hinges on shared experience rather than a direct promotional offer.

Key takeaways

- Coinbase returns to the Super Bowl with a one-minute, lyric-driven ad that emphasizes communal experience over a direct product pitch.

- The creative choice leans on nostalgia and a universally known song to foster memorability and discussion among a broad audience.

- The company’s earlier QR-code stunt in 2022, which steered viewers to a Bitcoin (CRYPTO: BTC) signup link, demonstrated the explosive potential of Super Bowl exposure for crypto brands, even as it overwhelmed the site.

- Public reactions online were mixed—some praised the simplicity and recall value, while others criticized the tone or timing amid market volatility and regulatory scrutiny.

- Coinbase executives defended the campaign as a breakthrough moment designed to “break through” in a crowded media landscape and to celebrate the crypto community’s growth.

Tickers mentioned: $BTC, $ETH

Sentiment: Neutral

Market context: The ad lands in a period of heightened attention to crypto brands in mainstream media, where reach and resonance compete with heightened regulatory scrutiny and evolving consumer attitudes toward digital assets. It underscores a trend of brands using high-visibility events to shape narrative and familiarity around crypto, even as market conditions and policy debates continue to influence user acquisition and brand trust.

Why it matters

The Super Bowl spotlight is a rare opportunity for a crypto brand to move beyond technical jargon and reach a broad audience in a single, high-impact moment. By leaning into a communal, sing-along moment, Coinbase aims to embed itself in cultural memory, potentially boosting long-term recognition even among viewers who may not immediately engage in on-chain activity. The choice to foreground lyrics over a product feature suggests a shift toward brand-building as a gateway to eventual product adoption, especially as consumer perception of crypto oscillates between curiosity and caution.

From an investor and builder perspective, the campaign signals that Coinbase is prioritizing media presence and narrative control as part of a diversified strategy to attract new participants to the ecosystem. The reference to past performance—most notably the 2022 QR-code stunt that prompted a flood of sign-ups and traffic—highlights the outsized impact that large-scale media events can have on user interest and platform exposure. In a market where liquidity and risk sentiment swing with macro headlines, such brand visibility can provide a unique form of non-price-driven traction, potentially widening the funnel beyond the usual crypto-native audience.

The ad also intersects with the evolving conversation around crypto advertising itself. As regulators scrutinize marketing claims and risk disclosures, the ability to generate positive topical chatter without triggering regulatory pushback becomes a delicate balancing act. Coinbase’s approach—opening a conversation through a shared cultural moment rather than a direct sign-up prompt—may influence how other players craft campaigns that are memorable yet compliant, especially when targeting mass audiences in the United States and abroad.

Within the content, the emphasis on community and accessibility is reinforced by public commentary from industry figures. An engineer from the Ethereum Foundation noted that many attendees enjoyed singing along and found the moment approachable, illustrating how a crypto-brand moment can resonate with developers and enthusiasts alike. At the same time, critics argued that such campaigns can feel performative or disconnected from the underlying realities of asset risk and regulatory risk, reminding readers that mass-media stunts do not obviate the need for transparent disclosure and responsible messaging.

Coinbase’s leadership echoed that dual message. CEO Brian Armstrong defended the ad on social media, arguing that most people engage with ads in fleeting, buzzed settings and that a distinctive moment is often required to break through. The company’s marketing chief emphasized that the objective was to create a memorable, shareable experience that mirrors the crypto community’s growth. Taken together, these statements reflect a strategic bet: that a well-timed pop-cultural moment can bolster brand familiarity and open doors for deeper engagement as crypto markets and products mature.

Looking ahead, the broader context for Coinbase and similar brands remains nuanced. Mainstream media moments can catalyze new user interest, but they also invite scrutiny about risk disclosure and the real-world implications of crypto ownership. In parallel, the industry will likely watch for how such campaigns influence long-run adoption, whether subsequent campaigns lean into similar cultural cues, and how regulators respond to creative advertising that touches on financial products without overtly directing purchases.

What to watch next

- Monitor Coinbase’s post-campaign metrics: social engagement, traffic spikes, and any uptick in new sign-ups or app activity following the ad.

- Watch for further brand campaigns from Coinbase or rival exchanges that blend pop culture with crypto messaging, testing the balance between reach and regulatory compliance.

- Assess regulatory and policy developments that could influence future advertising strategies for crypto services, including disclosures and consumer protections.

- Track sentiment shifts across social platforms as viewers reflect on the impact of the ad and potential influence on purchasing behavior or sign-up decisions.

- Follow public comments from Coinbase leadership for signals about how the company plans to sustain broad awareness while navigating market cycles and evolving consumer expectations.

Sources & verification

- Official statements from Coinbase marketing chief Catherine Ferdon describing the ad’s intent and experience-driven approach.

- Post by Coinbase CEO Brian Armstrong on X defending the campaign’s approach to break through with audiences.

- Historical reference to Coinbase’s 2022 QR-code Super Bowl spot and its reported traffic impact, including the sign-up link associated with Bitcoin (CRYPTO: BTC).

- Public comments from Ethereum Foundation engineer Chase Wright on reactions to the ad in social conversations.

- Media coverage and analysis of online reception, including diverse opinions on the ad’s simplicity, memorability, and timing amid market conditions.

Key figures and next steps

Coinbase’s campaign demonstrates a continued appetite for mass-media engagement as a path to broader crypto familiarity. While the short-term impact on sign-ups or asset prices remains debatable, the larger takeaway is clear: brands are experimenting with entertainment-led formats to connect with diverse audiences, and the crypto sector is not shying away from mainstream stages.

For readers and market participants, the episode underscores the importance of separating hype from fundamentals. A single advertising moment can raise awareness, but sustained growth hinges on clear disclosures, measured risk communication, and a product-and-ecosystem narrative that withstands scrutiny and evolves with user needs.

Crypto World

Over $278 Million Set to Hit the Market

TLDR

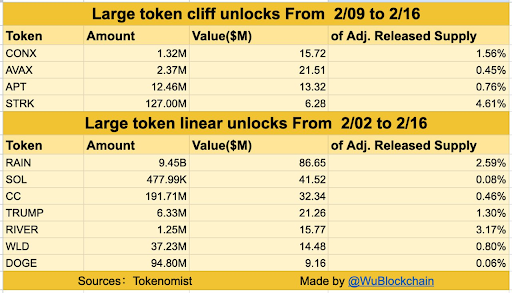

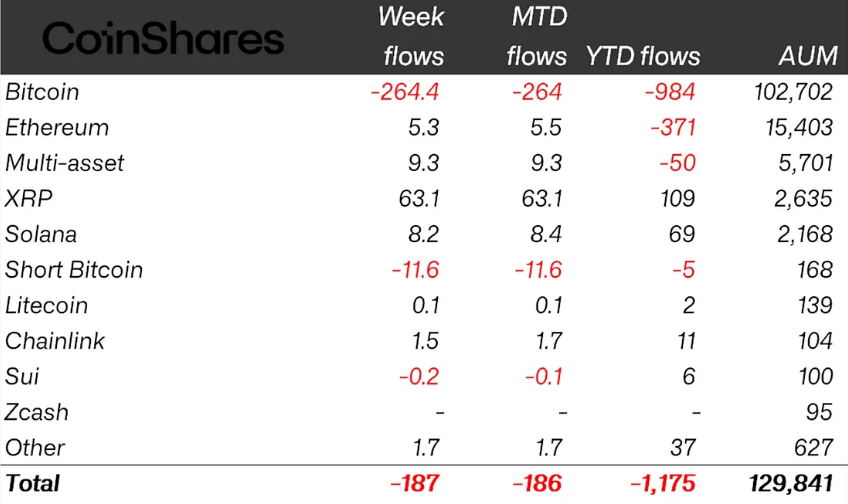

- Cliff token unlocks from CONX, AVAX, APT, and STRK will inject over $56 million into the market this week.

- STRK leads cliff unlock volume with 127 million tokens valued at $6.28 million.

- RAIN dominates linear unlocks, releasing $86.65 million in value, 2.59% of its total supply.

- SOL and CC follow with daily token unlocks valued at $41.52 million and $32.34 million, respectively.

- Combined cliff and linear token unlocks exceed $278 million, impacting short-term liquidity across multiple assets.

This week, the market will brace for token unlocks from February 9 to February 16 across Cliff and Linear token unlocks. These unlocks will introduce over $278 million worth of tokens into circulation, potentially impacting short-term market behavior.

Cliff Token Unlocks Set to Inject Over $56 Million

According to a summary prepared by Wu Blockchain, in the cliff token unlocks category, four major projects will release notable token volumes. CONX will unlock 1.32 million tokens worth $15.72 million, accounting for 1.56% of its adjusted released supply.

AVAX will release 2.37 million tokens, valued at $21.51 million, increasing its supply by 0.45%. APT is scheduled to unlock 12.46 million tokens worth $13.32 million, contributing 0.76% to circulation. STRK will release the largest amount by volume, unlocking 127 million tokens valued at $6.28 million, which equals 4.61% of its supply.

Linear Token Unlocks to Release Over $221 Million

On the other hand, linear token unlocks began today and will continue until February 16. RAIN will unlock 9.45 billion tokens worth $86.65 million, representing 2.59% of its supply. SOL will release 477,990 tokens, valued at $41.52 million, representing only 0.08% of its supply.

CC will unlock 191.71 million tokens valued at $32.34 million, adding 0.46% to circulation. TRUMP will release 6.33 million tokens worth $21.26 million, equal to 1.30% of the supply.

RIVER will inject 1.25 million tokens, worth $15.77 million, into the market, representing 3.17% of the adjusted supply. WLD will release 37.23 million tokens valued at $14.8 million, representing 0.80% of the total supply. DOGE rounds off the list with 94.8 million tokens worth $9.16 million, impacting only 0.06%.

These token unlocks signal an increase in liquid supply for multiple assets. Cliff token unlocks introduce abrupt liquidity events, while linear unlocks apply steady distribution pressure. RAIN, SOL, and AVAX dominate in terms of value, while STRK and RIVER lead in percentage impact.

Crypto World

In a Tokenless Crypto World, These 3 Protocols Would Still Matter

Crypto discussions often default to token price, market cap, and short-term performance. But if tokens are taken out of the equation entirely, what actually remains valuable?

In an interview with BeInCrypto, Ryan Chow, CEO and co-founder of Solv Protocol, said that if tokens stopped mattering tomorrow, priorities would snap back to fundamentals. He also shared 3 crypto protocols he believes would still clearly matter in 2026, even if tokens no longer existed.

Are Token Prices a Reliable Measure of Value in Crypto?

Crypto is often defined by its tokens and volatile price swings. Much of the industry conversation revolves around price speculation.

What top coins will do next, when altcoin season might begin, or which token could be the next 100x winner? These narratives dominate headlines, social media, and market sentiment.

Sponsored

Sponsored

While prices dominate mindshare, what do they actually say about whether a project is actually working, being used, or delivering real value?

Chow mentioned that price can be informative when it’s backed by sustained usage and revenue. However, most of the time, he described it as a “lagging, noisy proxy.”

The real test, he said, is when it’s backed by sustained usage and revenue, and becomes infrastructure that people build on, and institutions can trust, regardless of market charts.

“Token price tells you what the market feels, not whether the system works,” he stated.

According to Chow, price movements often run ahead of fundamentals or diverge from them entirely. Tokens can rally on expectations alone, while protocols that are steadily gaining adoption may see little immediate price reaction.

He added that a project’s real progress is better measured by the strength of its infrastructure, the security of its operations, and its ability to earn trust from institutional participants. Chow explained that if tokens are removed:

“Value then comes down to adoption, usability and security. Metrics like onchain adoption, integration with other protocols, compliance readiness and the ability to scale reliably for institutions are far stronger signals of impact than market cap alone.”

What User and Developer Behavior Looks Like Without Crypto Tokens

But if tokens, and with them trading, were to disappear, would users leave as well? Chow suggested that without the ability to profit from holding or trading tokens, most speculative activity would vanish almost immediately.

This includes momentum trading, airdrop, points farming, mercenary liquidity, and governance.

“What would remain is purely instrumental use: stablecoins for payments and treasury, onchain credit for capital efficiency, and institutions using verifiable rails for issuance and collateral. I am seeing genuine demand in crypto for capabilities, settlement, custody, verification, distribution, and risk-managed yield, not for tokens. This tells us that real utility is what sustains a project beyond price incentives,” he told BeInCrypto.

Sponsored

Sponsored

The executive also stressed that such a theoretical scenario would fundamentally shift developer priorities. According to Chow, token performance has pushed builders to focus on short-term gains rather than long-term infrastructure.

The current structure rewards what is easiest to market, such as new narratives, incentives, points programs, and short-term total value locked (TVL), rather than what is hardest to build: security, risk controls, reliability, and clear unit economics.

“If tokens stopped mattering tomorrow, priorities would snap back to fundamentals. Builders would focus on systems that earn trust, such as verifiable reserves and accounting, execution and management, auditability, uptime, governance, and compliance-ready workflows. You’d see more work on distribution rails across wallets, exchange integrations, settlements, identity, and business models that work on fees,” he remarked.

Lending, Settlement, and Custody as Core Crypto Use Cases

Chow also argued that crypto would continue to exist even in the absence of tokens.

“In a token-agnostic world, crypto survives as paid infrastructure, with revenue tied to measurable work,” he commented.

He pointed to several business models that are already operating sustainably. These include usage-based fees for settlement, execution, minting, and routing, as well as financial primitives such as lending protocols. According to him,

“One of the most proven sustainable revenue models in DeFi is lending protocols. Well-designed lending protocols generate revenue through interest rate spreads and borrower fees, with income scaling based on utilisation and risk management rather than token emissions.”

Chow noted that even during periods of market volatility, demand for leverage, hedging, and liquidity tends to persist, allowing these systems to continue generating revenue.

Sponsored

Sponsored

Chow also highlighted infrastructure designed for institutional use as among the most resilient segments of the industry. Services such as custody, compliance, reporting, and payments are typically paid for in fiat or stablecoins and are adopted to reduce operational and regulatory risk. In weaker market conditions, he said, these services often remain the primary bridge between traditional finance and crypto.

“Another sustainable revenue model is to incorporate transactional infrastructure fees. Blockchains and settlement layers that charge for real activity, such as processing transactions or facilitating cross-chain transfers, generate revenue regardless of the market sentiment, making it sustainable even in the face of speculation, hedging, or arbitrage,” he remarked.

Ultimately, Chow argued that any system capable of reliably solving real-world problems and integrating into enterprise workflows can sustain itself, regardless of token performance or market cycles.

Which Crypto Projects Would Still Matter in 2026 Without Tokens?

The question now becomes which crypto protocols would still clearly matter in 2026 if tokens were removed entirely. Chow told BeInCrypto that the answer lies in identifying projects that have built real economic infrastructure that solves actual problems. He pointed to 3 protocols:

1. Chainlink

First, Chow pointed to Chainlink. He detailed that it would remain essential because it provides critical data infrastructure underpinning much of the crypto ecosystem.

DeFi protocols rely on accurate and secure price feeds to function properly. Without reliable oracles, basic activities such as liquidations, derivatives settlement, and asset pricing become unsafe.

He claimed that Chainlink has emerged as the de facto standard for oracle services, processing billions of dollars in transaction value. Chow emphasized that even without the LINK token, protocols would continue paying for these services in stablecoins or Ethereum (ETH).

Sponsored

Sponsored

“Because the alternative is building inferior oracle systems themselves or facing catastrophic failures from bad data. Institutions and protocols would continue paying for Chainlink’s verifiable, tamper-proof data feeds because the cost of not having them is existential.”

2. Canton Network

Second, Chow highlighted the Canton Network. He argued that its relevance is driven by institutional demand for privacy combined with regulatory compliance.

According to Chow, Canton provides a regulated settlement layer where BTC-backed positions can move without exposing sensitive counterparties or proprietary strategies. The executive revealed that its value is still clear, institutional coordination, and settlement funded by enterprise usage and validator/service fees.

“It would survive because its demand is structural (regulated workflows don’t disappear in bear markets) and its economics are usage-funded (enterprise adoption and validator/service fees), not dependent on speculation,” he suggested.

3. Circle

Third, Chow said Circle would continue to matter in a tokenless crypto space. USDC, he noted, has become foundational infrastructure for crypto payments, treasury management, and cross-border settlement.

For banks and enterprises seeking a reliable and regulated digital dollar, USDC has emerged as a trusted settlement option. Without a native token to manage or distribute, Chow described Circle as essentially a modern financial utility that earns spreads on deposits.

As demand for instant, programmable dollars capable of moving globally around the clock continues to grow, he argued that Circle could potentially thrive in a token-agnostic world by continuing to solve real financial problems.

Overall, Chow’s comments present an alternative framework for assessing value in crypto that places less emphasis on token price and more on usage, infrastructure, and operational reliability.

His views suggest that, in the absence of token-driven incentives, projects with sustained adoption, clear revenue models, and institutional relevance would be better positioned to remain relevant over time.

Crypto World

Ethereum price prediction after Tom Lee’s Bitmine buys 20K ETH worth $41.98M

Tom Lee’s Bitmine has moved closer to its goal of acquiring 5% of the total supply with its latest 20K ETH purchase. But a bearish flag pattern confirmed on the weekly ETH/USDT chart suggests a potential price correction for Ethereum may be imminent.

Summary

- Tom Lee’s Bitmine has acquired 20,000 ETH for $41.98 million.

- Market demand generated from spot Ethereum ETFs remains weak.

- A bearish head and shoulders pattern was confirmed on the weekly chart.

Bitmine, the tech-focused infrastructure company run by renowned market strategist Tom Lee, had acquired another 20,000 ETH worth $41.98 million over the weekend. The move follows its acquisition of over 40,000 ETH in late January, valued at approximately $117 million at that time.

Following Bitmine’s latest purchase, the company’s total reserves now stand at nearly 4.29 million ETH, making it nearly 71% complete with its goal of owning at least 5% of the total circulating supply.

In contrast to the debt-fueled acquisition strategy popularized by Michael Saylor’s Strategy, Bitmine Immersion Technologies (BMNR) maintains a pristine, zero-debt balance sheet bolstered by over $586 million in cash and short-term liquidity.

The company’s most strategic pivot, however, is the transition to active Ethereum staking. By putting its massive ETH treasury to work, Bitmine is positioned to generate over $500 million in annual high-margin revenue, provided staking yields hold above the 2.5% threshold.

When large institutional players like Bitmine continue to gobble up supply, it typically tends to create a supply shock, which helps support price floors in the long run.

However, the overall outlook for Ethereum still remains precarious as a number of bearish catalysts may continue to overshadow any optimism generated by big buys.

First, the Ethereum (ETH) price has remained in a steady downtrend since mid January, dropping over 45% to nearly $1,800 last week. This decline came about as the broader market remained gripped by fear, as macroeconomic and geopolitical volatility combined with massive recurring liquidations continued to keep investor appetite at bay.

Second, spot Ethereum ETFs, which had previously served as a primary bullish driver, have been witnessing back-to-back outflow months since November of last year. These investment products have shed over $2.5 billion in that period alone, and any further outflows could erode retail confidence and often make traders reevaluate their positions.

Third, the total value locked on the Ethereum network has fallen to $57 billion, which is significantly lower than the $98 billion recorded in October of last year. Declining TVL means reduced on-chain utility and could likely sour the sentiment of traders and hence further dampen the recovery.

On the weekly chart, Ethereum price has confirmed a head and shoulders pattern as it fell below a key support level at $2,800 last month. The pattern is formed of three distinct peaks, where the middle peak is the highest, and the two outside peaks are relatively equal in height. It is widely considered one of the most popular bearish reversal patterns in technical analysis.

At press time, the Ethereum price was trading close to $2,000, which is another key psychological support level that could largely dictate market sentiment for weeks to come.

A sharp drop below this crucial floor could trigger a deeper slide toward $1,000, which represents the next major historical support. Prices could even fall as low as $800, a bearish target calculated by subtracting the total height of the head from the point at which the price broke below the neckline of the pattern.

Several technical indicators seem to support this grim prediction. Notably, the MACD lines remain stuck under the zero line and are currently pointing downward, indicating strong selling momentum, while the supertrend indicator has flashed a clear red signal.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Bitcoin Investors Should Watch These US Economic Signals

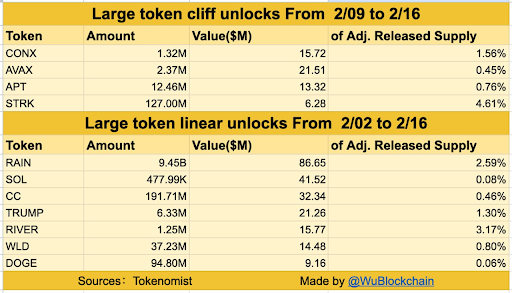

Bitcoin traders are heading into a macro-heavy week, with four US economic events expected to shape sentiment across crypto markets.

With Bitcoin trading in a volatile range and macro narratives dominating market psychology, traders are increasingly treating economic releases as short-term catalysts that can trigger sharp moves in both directions.

Which US Economic Signals Should Bitcoin and Crypto Investors Watch This Week?

A Federal Reserve (Fed) governor’s media appearance, key labor-market data, weekly unemployment claims, and January inflation figures could all influence expectations around interest rates and liquidity—two of the strongest drivers of Bitcoin’s price cycles.

Sponsored

Sponsored

Fed Governor Stephen Miran Interview in Focus

Markets will first look to comments from Federal Reserve Governor Stephen Miran, who is scheduled to appear in a podcast interview on Monday, February 9. Ahead of the 5:00 p.m. ET. appearance, there is already mixed sentiment across the crypto community, especially amid broader market caution.

Some market participants point to Miran’s relatively constructive view on stablecoins, arguing that regulatory clarity and dollar-linked digital assets could indirectly support Bitcoin by strengthening the broader crypto ecosystem and institutional participation.

Others see risk. Speculation that Miran could play a larger role in future Fed leadership has already coincided with bouts of volatility in both precious metals and crypto. This reflects fears that tighter policy could weigh on inflation-hedge narratives.

At the same time, some macro analysts have described Miran as more dovish than many of his peers, citing past arguments in favor of substantial rate cuts to support the labor market.

Any signals in that direction could lift sentiment in risk assets, particularly Bitcoin, which remains highly sensitive to liquidity expectations.

Sponsored

Sponsored

US Employment Report Could Drive “Bad News Is Good News” Narrative

Attention will shift on Wednesday, February 11, to the US employment report, one of the most closely watched indicators of economic health and monetary-policy direction.

Forecasts suggest relatively modest job growth, potentially reaching 55,000 from the previous 50,000. Weaker-than-expected data could paradoxically support Bitcoin. Cooling labor conditions would increase pressure on the Fed to ease policy, potentially improving liquidity conditions for risk assets.

Recent labor-market indicators have already pointed to signs of slowing. Reports of rising layoffs and a slowdown in hiring have strengthened expectations that rate cuts could arrive sooner than previously anticipated.

However, the employment report also carries downside risk. A sharp deterioration in job data could spark broader growth fears, prompting investors to move toward defensive positions. Such an outcome could trigger short-term selloffs in crypto, as seen during previous macro shocks.

Sponsored

Sponsored

Jobless Claims May Reinforce or Challenge the Trend

Thursday’s initial jobless claims release will provide a more immediate snapshot of labor-market conditions. As such, it could reinforce the narrative set by the employment and unemployment reports on Wednesday.

Recent spikes in claims have coincided with risk-off reactions in crypto markets, including liquidation events and rapid price swings. Some traders interpret rising claims as a signal that economic conditions are weakening enough to force monetary easing, a longer-term positive for Bitcoin.

Others warn that in the short term, deteriorating employment data can unsettle markets, especially when liquidity is thin and leverage is elevated.

That dynamic has made jobless-claims releases a growing source of volatility, even though they rarely move markets in isolation.

Sponsored

Sponsored

CPI and Core CPI Seen as the Week’s Decisive Catalyst

The most consequential data point may arrive on Friday, February 13, with the release of January’s Consumer Price Index (CPI) and Core CPI figures.

Inflation data remains the primary driver of Fed policy expectations and, therefore, a key determinant of crypto market sentiment.

Cooler-than-expected readings in recent months have supported risk assets by weakening the “higher for longer” rate narrative.

Another soft inflation print could accelerate expectations for rate cuts in 2026, potentially reinforcing bullish momentum in Bitcoin and strengthening the case for a move toward six-figure price levels over time.

However, sticky or rising inflation would likely have the opposite effect, pushing Treasury yields higher and pressuring speculative assets, including cryptocurrencies.

“If data comes in hot, rates will likely stay higher, and risk assets may struggle. If data cools, rate cut expectations could return, and markets may breathe. This week will tell us what comes next,” remarked analyst Kyle Chasse.

Taken together, the week’s events represent a concentrated test of the macro narratives currently driving Bitcoin: inflation, employment, and the timing of monetary easing.

While long-term adoption trends, such as ETF flows, institutional participation, and stablecoin growth, continue to underpin bullish projections, short-term price action remains closely tied to economic data.

Crypto World

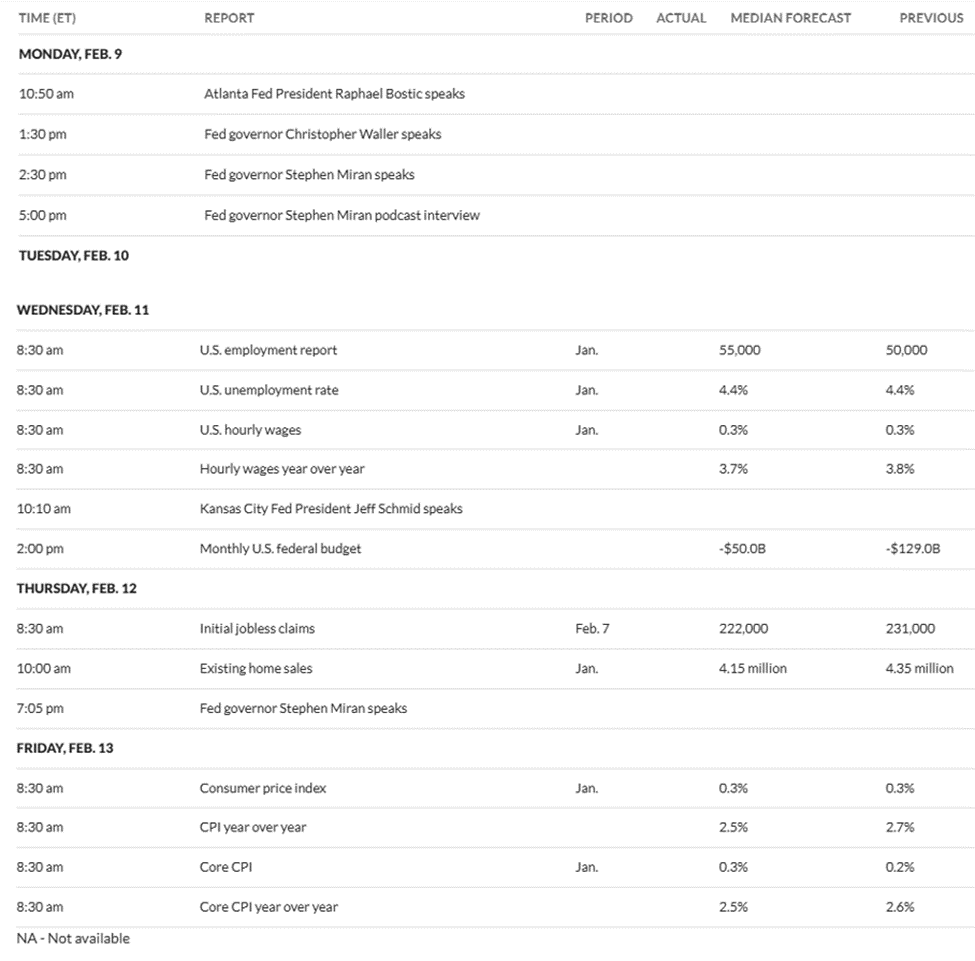

Crypto ETP Outflows Ease as Trading Hits Record $63 Billion

Crypto investment products logged a third straight week of outflows, though the pace of selling eased markedly as digital asset prices steadied after a sharp downturn.

Crypto exchange-traded products (ETPs) recorded $187 million in outflows during the week, a sharp drop from the $3.43 billion seen over the previous two weeks, CoinShares reported on Monday.

The slowdown came as Bitcoin (BTC) fell to its lowest level since November 2024, with the price touching $60,000 on Coinbase last Thursday.

“While flows typically move in line with crypto prices, changes in the pace of outflows have historically been more informative, often signaling inflection points in investor sentiment,” said James Butterfill, CoinShares’ head of research.

Bitcoin ETPs only to post major losses, while XRP leads inflows

Bitcoin investment products were the only ETP group to suffer significant losses last week, with outflows totaling $264.4 million.

XRP (XRP) funds led inflows, attracting $63 million, while other altcoin ETPs, such as those tracking Ether (ETH) and Solana (SOL), posted modest gains of $5.3 million and $8.2 million, respectively.

Spot Bitcoin exchange-traded funds (ETFs) accounted for a large portion of Bitcoin ETP outflows last week, amounting to $318 million, according to SoSoValue data.

ETP volumes hit record $63 billion in weekly trading

Addressing last week’s slowdown in outflows, Butterfill suggested that a “potential market nadir may have been reached,” implying that a possible bottom could have formed for ETPs.

Despite the easing of outflows, last week marked a milestone in trading activity. According to Butterfill, ETP volumes reached a record $63.1 billion, surpassing the previous high of $56.4 billion set in October last year.

Related: BlackRock’s IBIT hits daily volume record of $10B amid Bitcoin crash

Assets under management (AUM) in Bitcoin ETPs stood at $102.7 billion by the end of the week, while ETF AUM fell below $90 billion.

Meanwhile, global crypto ETP AUM declined to $129 billion, the lowest level since March 2025, Butterfill noted.

Following three consecutive weeks of outflows, crypto ETPs have lost a total of $1.2 billion year-to-date, compared with $1.9 billion of outflows in Bitcoin ETFs.

In other industry news, major crypto fund issuer 21Shares filed last week with the US Securities and Exchange Commission for an ETF tracking Ondo (ONDO).

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

How Real Is the Threat?

Concerns that quantum computing could one day break Bitcoin’s cryptography have resurfaced. Yet, a new report by CoinShares argues that the quantum risks remain distant, with only a fraction of Bitcoin’s supply potentially vulnerable.

The report frames quantum computing as a long-term engineering challenge. It argues that Bitcoin has ample time to adapt well before quantum machines reach a cryptographically relevant scale.

Sponsored

The Quantum Threat Assessment For Bitcoin

In the report titled “Quantum Vulnerability in Bitcoin: A Manageable Risk,” CoinShares’ Bitcoin Research Lead Christopher Bendiksen explained that Bitcoin relies on elliptic-curve cryptography to secure transactions.

In theory, a sufficiently powerful quantum computer could use Shor’s algorithm to derive private keys from public keys. This could enable unauthorized spending.

However, Bendiksen noted that such an attack would require quantum machines with millions of stable, error-corrected qubits. This is far beyond today’s capabilities.

“Breaking secp256k1 within a practical amount of time (<1 year) needs 10-100,000 times the current number of logical qubits; relevant quantum tech at least 10 years off. Long-term attacks can take place over years—could become feasible within a decade; short-term (mempool attacks) need <10-min computations—infeasible in anything but the very long term (decades),” the report read.

The report also examined the scope of Bitcoin’s real exposure. According to Bendiksen, only about 1.6 million BTC, roughly 8% of the total supply, resides in legacy Pay-to-Public-Key (P2PK) addresses where public keys are already exposed. However, the true practical risk is significantly smaller.

Of that amount, the report estimated that only around 10,200 BTC could plausibly be targeted in a way that would have an impact. This represents less than 0.1% of Bitcoin’s total supply.

Sponsored

“The remaining ~1.6 million all sit in 32,607 individual, ~50 btc UTXOs, that would take millennia to unlock even in the most outlandishly optimistic scenarios of technological progression in quantum computing,” Bendiksen stated.

The remaining vulnerable coins are dispersed across tens of thousands of addresses. This distribution would make large-scale exploitation slow and operationally impractical even for advanced quantum systems, according to the analysis.

This limited exposure exists because of modern address types. Pay-to-Public-Key-Hash (P2PKH) and Pay-to-Script-Hash (P2SH) do not reveal public keys until coins are spent, sharply reducing the attack surface.

While post-quantum cryptographic proposals exist, Bendiksen cautioned against premature or forced changes. He warned they could introduce new risks, weaken decentralization, or rely on cryptographic schemes that have not yet been sufficiently tested in adversarial environments.

Sponsored

“For the perceivable future, market implications appear limited,” Bendiksen added. “The greater concern is preserving Bitcoin’s immutability and neutrality, which could be jeopardised by premature protocol changes.”

Meanwhile, this outlook aligns with views previously expressed by other industry figures, including Casa co-founder Jameson Lopp and Cardano founder Charles Hoskinson. Both of whom have argued that quantum computing poses no near-term threat to Bitcoin’s cryptography.

Quantum Risk No Longer Ignored as Investors and Developers Prepare

That said, not all market participants share this view. Some institutional investors are increasingly factoring quantum computing risk into their Bitcoin exposure rather than dismissing it as a distant concern.

BeInCrypto reported that strategist Christopher Wood reduced a 10% Bitcoin allocation from Jefferies’ model portfolio, reallocating capital toward gold and mining equities. This move came amid concerns that future advances in quantum computing could threaten Bitcoin’s security.

Sponsored

At the same time, several blockchain projects are already taking proactive steps. Coinbase, Ethereum, and Optimism have publicly outlined efforts to prepare for a post-quantum future.

Charles Edwards of Capriole Investments has also suggested that Bitcoin’s price may need to decline further before the network attracts sufficient attention to the issue of quantum security. He framed market pressure as a potential catalyst for broader technical discussion.

“$50K not that far away now. I was serious when I said last year that price would need to go lower to incentivize proper attention to Bitcoin quantum security. This is the first promising progress we have seen to date,” he said.

Edwards added that substantial work still lies ahead, warning that Bitcoin’s quantum preparedness efforts would need to accelerate in 2026.

Crypto World

South Korea Prepares to Probe Crypto Markets Under 2026 Policy Plan

South Korea’s Financial Supervisory Service is sharpening its focus on suspected crypto price manipulation, outlining a 2026 program of investigations into high-risk trading tactics. The plan contemplates a slate of probes targeting “whale”-driven swings, artificial moves that accompany exchange deposit or withdrawal suspensions, and schemes that exploit APIs and social channels to spread misinformation. Officials say automation will underpin the crackdown, using real-time anomaly detection and text-analysis tools to flag manipulation clusters and linked accounts. The initiative follows a wave of regulatory signals as Seoul readies the Digital Asset Basic Act’s second phase, signaling a shift from reactive guidance to structured oversight in a rapidly evolving market.

Key takeaways

- The FSS will pursue targeted probes into high-risk trading practices, including whale activity, with investigations slated for 2026.

- Planned inquiries will examine gating-like disruptions during exchange suspensions and coordinated trading via APIs and social media, aiming to curb market disruption.

- Automated detection will be enhanced by analyzing ultra-short-interval price movements and by flagging manipulation “sections” and related account groups, complemented by text analytics to spot coordinated misinformation.

- A dedicated task force will help implement the Digital Asset Basic Act’s second phase, focusing on disclosures, exchange oversight, and licensing standards.

- Operational incidents at domestic exchanges, including a high-profile promotional Bitcoin error, have intensified regulatory urgency and oversight actions.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The move reflects a broader push toward data-driven crypto market supervision, aligning with global trends that seek to balance investor protection with market efficiency as liquidity, risk sentiment, and regulation evolve.

Why it matters

The regulatory emphasis in South Korea matters for traders, exchanges, and investors who operate within or rely on the domestic crypto ecosystem. By centering investigations on whale-driven volatility, exchange suspensions, and API-driven manipulation, authorities aim to reduce episodes where price discovery is distorted by rapid, coordinated actions. Automated tooling for anomaly detection, combined with natural-language processing to identify misinformation, represents a shift toward scalable enforcement capable of keeping pace with fast-moving, cross-border trading strategies.

For exchange operators, the plan signals that governance and transparency will be non-negotiable prerequisites for continued growth and licensing legitimacy. The emphasis on disclosures, licensing standards, and robust internal controls could lead to tighter compliance frameworks, more rigorous surveillance programs, and clearer rules for handling market stress events. In turn, investors may benefit from improved visibility into risk controls and a more predictable regulatory environment as market participants seek to navigate this evolving landscape with greater confidence.

On a broader level, the Korean approach mirrors a regional and global trend toward harmonizing supervision as digital assets become more integrated into mainstream finance. Regulators are converging on models that combine automated market surveillance, on-chain analytics, and cross-agency cooperation to monitor both price behavior and the narratives that influence investor behavior. The outcome could influence liquidity dynamics and risk appetite across Asian markets, while also shaping how international firms design compliant product offerings and reporting frameworks for the Korean market.

What to watch next

- The Digital Asset Basic Act Phase 2 timeline, including expected disclosures and licensing guidelines for exchanges.

- Results and implications from the emergency regulator review following the Bithumb incident, with potential updates to internal-control requirements across platforms.

- Rollout and public guidance on automated detection tools, gating-related risk controls, and governance measures for API-based trading.

- Further regulatory updates around AI surveillance deployments and how they intersect with enforcement workflows.

- Any formal investigations arising from notable price movements on domestic platforms, including cross-referenced incidents and regulator cooperation with exchanges.

Sources & verification

- Yonhap News Agency report detailing FSS Governor Lee Chang-jin’s remarks and the plan to target high-risk trading practices in 2026.

- February 2, FSS expansion of AI-powered surveillance tools in crypto markets.

- Asia Business Daily report on FSC, FSS, and KoFIU emergency inspection meeting following the Bithumb incident.

- February 3, FSS review of sharp price movements in the ZKsync token during a system maintenance window on Upbit.

- Upbit operator Dunamu’s statements about internal surveillance and regulator cooperation.

Ramping up oversight: Korea’s FSS targets manipulation as AI surveillance expands

In a move that aligns with a wider global push to cement market integrity in digital assets, South Korea’s Financial Supervisory Service is unveiling an expansive plan to scrutinize pricing dynamics in crypto markets. The plan contemplates a 2026 slate of investigations into high-risk trading practices and market manipulation, with a particular emphasis on practices that distort price discovery. The scope includes large-volume moves driven by whales, as well as schemes that exploit exchange hostilities, deposit and withdrawal suspensions, and rapid-fire trading across APIs. As regulators position themselves, the emphasis is on both detection and deterrence. Bitcoin (CRYPTO: BTC) and other assets have been a focus as these dynamic conditions unfold, according to a report from Yonhap News Agency.

One of the more persistent vulnerabilities highlighted by the FSS is the so-called gating phenomenon — periods when an exchange halts deposits or withdrawals to manage risk or liquidity. Such pauses can effectively lock up supply on a platform, triggering price dislocations that do not reflect broad market sentiment. By design, gating can amplify price moves and create an artificial sense of scarcity or demand. Regulators intend to deter this practice by exposing relationships between trading bursts and system interruptions, and by mapping how such disruptions ripple across the broader crypto ecosystem.

The FSS’s surveillance playbook expands beyond mere price tracking. expanded its use of artificial intelligence-powered surveillance to monitor crypto markets, reducing the reliance on manual screening and allowing for faster pattern recognition across vast datasets. The agency says it will build tools capable of flagging manipulation “sections” — clusters of suspicious trading activity tied to specific accounts or wallets — and perform text analytics to detect coordinated misinformation campaigns that could influence investor behavior. In effect, regulators seek to fuse traditional market surveillance with on-chain analytics and natural-language processing to catch both the economic and narrative drivers of manipulation.

From a regulatory design perspective, Seoul is accelerating work on the Digital Asset Basic Act — the framework guiding how exchanges operate, how assets are classed and supervised, and how license regimes are structured. A dedicated task force has been formed to handle Phase 2 of the act, focusing on disclosure requirements, exchange oversight, and licensing standards. The aim is to create a predictable, transparent regime that can scale as market activity grows and products diversify, reducing compliance ambiguity for operators and reducing the chances of protracted enforcement disputes.

The regulatory intensification sits against a backdrop of recent operational incidents that have elevated risk awareness inside the domestic market. Bithumb disclosed that it recovered 99.7% of excess Bitcoin credited during a promotional error, an event that briefly churned prices and prompted compensation for affected users. The episode prompted regulators to convene for an emergency inspection meeting involving the Financial Services Commission, the FSS, and the Korea Financial Intelligence Unit, a meeting that Asia Business Daily described as ordering a comprehensive review of internal controls across exchanges. The episode underscored how technology-based vulnerabilities can translate into real-world customer risk and regulatory scrutiny.

Separately, the FSS said on Feb. 3 that it was reviewing sharp price movements in the ZKsync token during a system maintenance window on Upbit, signaling a willingness to escalate to formal probes if warranted. Upbit’s operator Dunamu has previously asserted that it operates internal systems to flag suspicious activity and that it can cooperate fully with regulators to provide trading data upon request. The FSS’s evolving stance suggests that market-makers, liquidity providers, and platform operators should anticipate closer watch over both their trading data and their information channels, including how they communicate with users during turbulent periods.

In sum, the current trajectory signals a maturation of South Korea’s crypto regulatory regime. The combination of automated surveillance, a formalized act, and high-profile incident responses indicates a shift from reactive guidance to proactive risk management. While the specifics of enforcement remain to be seen, the direction is clear: if the market is to expand in a compliant fashion, exchanges and participants will need to demonstrate robust governance, robust disclosure, and a willingness to collaborate transparently with the authorities.

Crypto World

Bitcoin’s (BTC) Sideways Phase Is a Trap Before a Deeper Crash (Analyst)

Bitcoin could revisit $87,000 during consolidation, but only as a chance to add shorts, and not confirmation of a trend.

Bitcoin (BTC) staged a modest recovery of almost 2% on Monday’s Asian trading hours after briefly dipping below $70,000 during the weekend. But prominent market commentators believe that the carnage is not yet over.

Doctor Profit, for one, believes that the asset is entering an extended sideways phase that is not a bullish consolidation but is a preparation for a deeper decline in the months ahead.

Sideways, Then Down

According to the analyst’s findings, Bitcoin is forming a new trading “box” between roughly $57,000 and $87,000, which represents a wide 33% range. He expects the price action to remain largely range-bound within these levels for weeks or even months.

Doctor Profit stated that this sideways behavior should not be interpreted as strength, but instead as a structural phase that typically precedes a breakdown in a broader bear market. Drawing a parallel to 2024, the analyst said BTC spent an entire year consolidating between $58,000 and $74,000 before breaking out above $100,000, and he repeatedly warned at the time that this range would later serve as a reference level during the next bear market.

That scenario is now playing out: Bitcoin is once again trading in the same price zone, but this time in a bearish context, where former consolidation areas act as structure rather than durable support. He expects that once the current sideways phase is complete, the crypto asset will break down below the box and end up targeting the $44,000-$50,000 region in the coming weeks or months.

Doctor Profit said that he is buying spot Bitcoin between $57,000 and $60,000, which he considers the local bottom of the current range, but not the final macro bottom of the bear market. He added that this area is likely to be tested multiple times during the sideways phase, which makes it suitable for range trades, while upside during this period could extend as high as $87,000, depending on market strength.

However, the analyst made it clear that $87,000 is not a guaranteed target and merely represents the upper boundary of what he expects during the consolidation. If price does approach that level, he said he would consider adding to existing short positions opened between $115,000 and $125,000, which he continues to hold in full.

You may also like:

Meanwhile, there is no immediate major downside while the market remains range-bound, as per Doctor Profit’s analysis. He described the coming period as “long and boring” while adding that the most aggressive long-term buying will only occur much lower, between the low $50,000s and the low $40,000s, where he believes Bitcoin will ultimately bottom, potentially around September or October.

“We are in a bear market. The bounces are temporary and exist to build liquidity for further downside.”

No Relief for BTC Bulls

Another pseudonymous analyst, Filbfilb, posted a Bitcoin chart on X wherein he compared the current market setup with the 2022 bear market, offering little encouragement for bulls.

His findings reveal that BTC is trading below the 50-week exponential moving average near $95,300, a level, according to the analyst, that is an important trend marker. Filbfilb suggested that losing this level leaves the crypto asset vulnerable, as recent price action resembles bear-market conditions rather than a recovery.

Market commentator BitBull also shared a similar forecast, saying that BTC’s “final capitulation hasn’t happened yet,” and that “a real bottom will form below the $50,000 level, where most of the ETF buyers will be underwater.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why Critics of Hyperliquid and Its Rivals Keep Facing Backlash

An analysis by Coinglass comparing perpetual decentralized exchange (perp DEX) data has sparked fierce debate and, in the process, highlighted rifts within the crypto derivatives sector.

The study exposed marked discrepancies in trading volumes, open interest, and liquidations across Hyperliquid, Aster, and Lighter. Users are left asking what qualifies as genuine trading activity on these platforms.

Coinglass Data Sparks Debate Over Authentic Trading on Perpetual DEXs

Coinglass is facing backlash after publishing a comparison of perp DEXs, questioning whether reported trading volumes across parts of the sector reflect genuine market activity.

Sponsored

Sponsored

A 24-hour snapshot comparing Hyperliquid, Aster, and Lighter shows that:

- Hyperliquid recorded approximately $3.76 billion in trading volume, $4.05 billion in open interest, and $122.96 million in liquidations.

- Aster posted $2.76 billion in volume, $927 million in open interest, and $7.2 million in liquidations

- Lighter reported $1.81 billion in volume, $731 million in open interest, and $3.34 million in liquidations.

According to Coinglass, such discrepancies can matter. In perpetual futures markets, high trading volume driven by leveraged positions typically correlates with open-interest dynamics and liquidation activity during price moves.

The firm suggested that, rather than organic hedging demand, the combination of high reported volume and relatively low liquidations may indicate:

- Incentive-driven trading

- Market-maker looping, or

- Points farming.

Based on this, Coinglass concludes that Hyperliquid showed stronger internal consistency across key metrics.

Sponsored

Sponsored

Meanwhile, the volume quality of some competitors warrants further validation using indicators such as funding rates, fees, order-book depth, and active trader counts.

“Conclusion…Hyperliquid shows much stronger consistency between volume, OI, and liquidations — a better signal of real activity. Meanwhile, Aster/Lighter’s volume quality needs further validation (vs fees, funding, orderbook depth, and active traders),” the analytics platform indicated.

Critics Push Back, but Coinglass Defends Its Position

However, critics argue that conclusions drawn from a single-day snapshot could be misleading. Specifically, they suggest alternative explanations for the data, including whale positioning, algorithmic differences between platforms, and variations in market structure that could influence liquidation patterns without implying inflated volume.

Others questioned whether liquidation totals alone are a reliable indicator of market health, noting that higher liquidations can also reflect aggressive leverage or volatile trading conditions.

Meanwhile, Coinglass rejects accusations that its analysis amounted to speculation or fear, uncertainty, and doubt (FUD), emphasizing that its conclusions were based on publicly available data.

Sponsored

Sponsored

“Coinglass simply highlighted a few discrepancies based on publicly available data. We didn’t expect that a neutral, data-driven observation would trigger such hostile reactions,” the firm wrote, adding that open discussion and tolerance for criticism are essential for the industry to improve.

In another response, Coinglass stressed that disagreements should be addressed with stronger evidence rather than accusations.

The firm also argued that higher leverage ceilings on some platforms could make them structurally more prone to forced liquidations. This outlook shifts the debate away from raw numbers toward exchange design and risk management.

A Pattern of Backlash in the Perp DEX Sector: What Counts as “Real” Activity?

The controversy comes amid a broader wave of disputes surrounding Hyperliquid and the perpetual DEX market.

Earlier, Kyle Samani, co-founder of Multicoin Capital, publicly criticized Hyperliquid, raising concerns about transparency, governance, and its closed-source elements.

Sponsored

Sponsored

His remarks triggered strong reactions from traders and supporters of the platform, many of whom dismissed the criticism and questioned his motives.

BitMEX co-founder Arthur Hayes further escalated the feud by proposing a $100,000 charity bet, challenging Samani to select any major altcoin with a market cap above $1 billion to compete against Hyperliquid’s HYPE token in performance over several months.

The dispute highlights a deeper issue facing crypto derivatives markets: the lack of standardized metrics for evaluating activity across DEXes.

Trading volume has long served as a headline indicator of success. However, the rise of incentive programs, airdrop campaigns, and liquidity-mining strategies has complicated the interpretation of those figures.

As new perp DEX platforms launch and competition intensifies, metrics such as open interest, liquidation patterns, leverage levels, and order-book depth are becoming central to assessing market integrity.

This Coinglass incident mirrors how data itself has become a battleground amid a sector driven by both numbers and narratives. Therefore, the debate over what those numbers truly mean is likely to intensify as the perpetual futures market continues to grow.

Crypto World

South Korea Prepares Crypto Market Probes Under 2026 Policy Plan

South Korea’s Financial Supervisory Service (FSS) said it will step up scrutiny of suspected cryptocurrency price manipulation in 2026, outlining a slate of planned investigations that target high-risk trading tactics, including “whale” activity and schemes that exploit disruptions at local exchanges, local outlet Yonhap reported Monday.

According to Yonhap News Agency, FSS Governor Lee Chang-jin said that the agency will target high-risk trading practices that undermine market order, including coordinated manipulation and schemes exploiting disruptions in exchange infrastructure.

The FSS said the probes will focus on tactics that involve large-scale trading by whales, artificial price swings during exchange deposit or withdrawal suspensions and coordinated trading mechanisms using APIs or social media to spread false information.

Under the plan, the regulator said it intends to strengthen automated detection by analyzing abnormal price movements at very short intervals and developing tools that can flag suspected manipulation “sections” and related account groups, alongside text analysis that can help identify coordinated misinformation.

Planned probes target crypto manipulation tactics

The FSS said it will investigate practices that distort price discovery, including schemes that take advantage of exchange deposit or withdrawal suspensions, a practice referred to in South Korea as “gating.”

These situations can trap supply on a platform, creating artificial movements disconnected from the broader digital asset markets.

The financial watchdog also mentioned that it will track manipulation using market-order APIs and coordinated activity aimed at amplifying false narratives on social media.

On Feb. 2, the FSS expanded its use of artificial intelligence-powered surveillance tools to monitor crypto markets, reducing reliance on manual identification of potential manipulation.

In parallel, the watchdog established a task force to prepare for the introduction of the Digital Asset Basic Act, the second phase of the country’s crypto regulatory framework.

The unit will support the implementation planning rather than enforcement, including work on disclosures, exchange oversight and licensing standards.

Related: South Korea tightens crypto licensing rules for exchanges and shareholders

Exchange incidents add urgency to oversight push

The tougher tone arrives after a series of exchange-related incidents put operational risk back in the spotlight.

On Sunday, crypto exchange Bithumb said it recovered 99.7% of excess Bitcoin (BTC) mistakenly credited to users during a promotional error.

While the exchange said no customer assets were lost, the episode briefly triggered sharp price swings and prompted compensation measures for affected users.

The incident triggered a response from regulators. According to the Asia Business Daily, the Financial Services Commission (FSC) held an emergency inspection meeting on Sunday with the FSS and the Korea Financial Intelligence Unit (KoFIU), where officials reportedly ordered a comprehensive review of internal controls across all domestic crypto exchanges.

On Feb. 3, the FSS said it was reviewing sharp price movements in the ZKsync token during a system maintenance window on Upbit. The regulator said it was analyzing the data and could escalate the review into a formal investigation depending on the findings.

Upbit operator Dunamu previously told Cointelegraph that it has internal systems that also flag suspicious activities and a process that involves cooperating with regulators.

“When regulators request information, we can provide the relevant trading data without delay,” the spokesperson told Cointelegraph.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics16 hours ago

Politics16 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat11 hours ago

NewsBeat11 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business16 hours ago

Business16 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports6 hours ago

Sports6 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics18 hours ago

Politics18 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business23 hours ago

Business23 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know