CryptoCurrency

Memecoin Development Guide: Build Tokens That Last

Memecoins are fun, chaotic, cultural, and sometimes surprisingly profitable. Yet beneath all the excitement, there is a pattern almost every founder notices sooner or later. A huge majority of memecoins collapse shortly after launch. What begins with a loud burst of hype turns into silence once the community fades, liquidity thins out, and investors move on.

The truth is simple. Memecoins that rely only on hype do not last. They burn fast and disappear. The ones that succeed follow a different path. They are built through planning, structure, tokenomics, community engineering, utility mapping, and a clear strategy. This is exactly where memecoin development becomes essential, as the market has matured, and founders who seek long-term growth require an equally mature approach.

This blog demonstrates how strategic memecoin development enables founders to create tokens that sustain demand, attract serious investors, and evolve into their own digital microeconomies.

The Deeper Reason Why Most Memecoins Crash

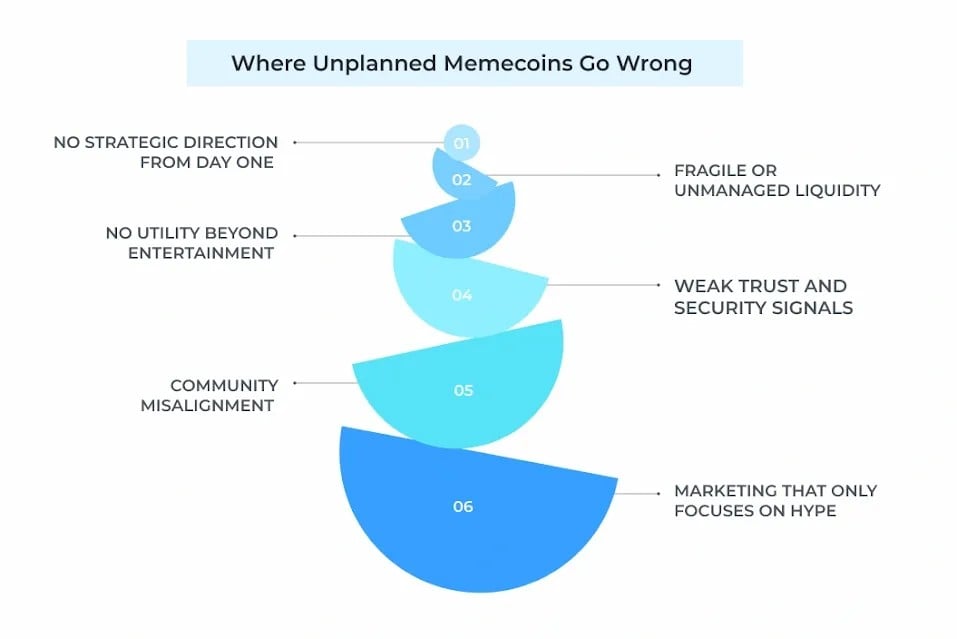

Binance Research recently highlighted that over 97% of newly launched memecoins die within months due to having no strategy or utility behind them. The crash rate occurs because most founders misunderstand how the memecoin development market works. They assume memes alone can carry the project. But the modern market is far more intelligent, far more informed, and far more demanding. These are the core reasons most tokens fail.

- No strategic direction from day one

The biggest mistake is launching without a strategic backbone. A memecoin needs a reason to exist, a clear narrative, a long-term identity, and a path to expansion. Without direction, even early hype becomes meaningless. A successful project treats early planning as seriously as any established brand would.

A clear example is SafeMoon. It went viral at launch but had no sustainable roadmap, weak utility, and poor liquidity planning. This lack of direction eventually led to a collapse, followed by liquidity issues and major investor losses.

- Fragile or unmanaged liquidity

Liquidity is the foundation of market stability. If it is weak or mismanaged, holders panic. Prices fluctuate in extreme ways, and trust disappears. Professional teams create liquidity plans that balance availability, depth, protection, and responsible allocation. This is where experienced teams offering token development services add enormous value by ensuring the token’s economic engine has the resilience it needs.

- No utility beyond entertainment

The entertainment factor helps memecoins get discovered. Utility helps them stay alive. Tokens without a path to utility usually fall off once the early buzz fades. Investors want to know how the token will evolve, how it will integrate into experiences, how rewards will work, and what long-term purpose the project serves.

- Weak trust and security signals

Projects without audits, multisig setups, fair allocations, transparent information, or properly structured contracts lose credibility instantly, which is why partnering with a trusted memecoin development company becomes crucial for building investor confidence.

- Community misalignment

Communities are not passive spectators. They are the engine that drives culture, engagement, and sustained demand. Without rituals, coordinated storytelling, feedback channels, and identity frameworks, communities lose energy fast. Memecoins that ignore community structure often fade after the first week.

- Marketing that only focuses on hype

Hype can build visibility, but marketing that relies only on hype cannot maintain it. Memecoins that win have strategic storytelling, consistent updates, viral content loops, cross-platform activity, and collaborations that extend far beyond launch day.

Get a custom memecoin development blueprint built for long-term success.

What Strategic Memecoin Development Actually Means

Strategic development replaces hype-driven launches with real economic structure. With 97 percent of memecoins failing within a year and nearly 2,020 projects disappearing monthly, the tokens that survive are the ones built with intentional tokenomics, transparent execution, and measurable utility. Instead of depending on momentum, strategically designed tokens show stable liquidity, consistent user growth, and predictable burn cycles that sustain long-term engagement. This approach is anchored in three essentials:

Tokenomics that balance supply and drive recurring demand,

Infrastructure scaling that supports fast, low-cost transactions, and

Community incentives that reward long-term participation rather than quick flips.

When founders take memecoin development seriously, their token functions as a micro-economy instead of a short-lived trend.

- Dogecoin: A Meme Sustained by Continuous Development

Dogecoin proves that strategic planning can turn a joke into a decade-long digital asset. The network grew to 9.52 million active addresses in December 2024, processes 39,000 daily transactions, and maintains a 99.97 percent success rate with fees around $0.0021. Continuous updates like LibDogecoin releases and GigaWallet integrations strengthened its ecosystem. This consistency helped DOGE reach a $20.5B market cap and be accepted by 3,000+ merchants, validating structured meme coin development as a path to long-term relevance.

- Shiba Inu: Turning Hype Into an Ecosystem

Shiba Inu stayed relevant by expanding far beyond meme status. ShibaSwap, advanced staking, and the Shibarium Layer 2 network created real utility. Over 410.73T SHIB have been burned, with automated mechanisms removing 700M+ SHIB through transaction fees. Shibarium grew to $10.22M TVL and over 203,000 active accounts, proving how strategic token development can transform a viral asset into a functioning multichain ecosystem.

Dogecoin’s stable liquidity and Shiba Inu’s expanding infrastructure illustrate how working with an experienced token development company and relying on expert memecoin development services leads to measurable longevity in a volatile market.

Get structured tokenomics, secure contracts, and a real community plan.

What Happens When You Build a Memecoin Strategically

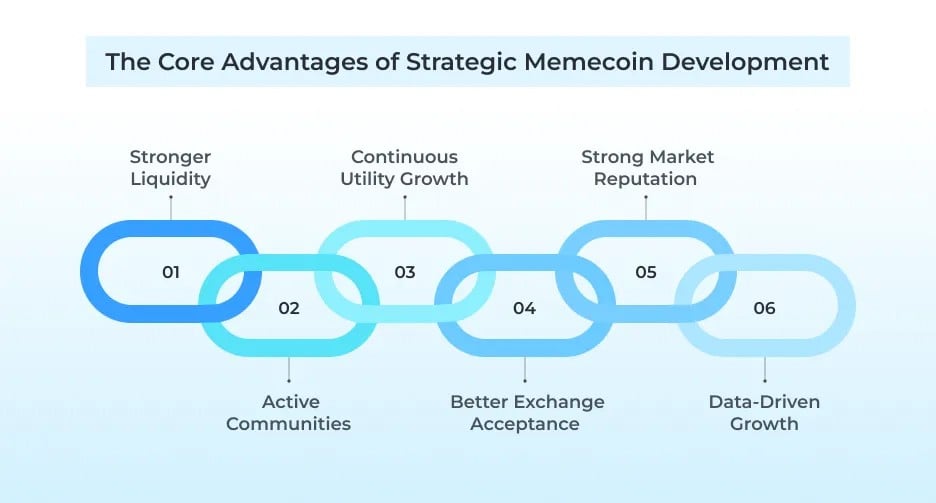

When a memecoin is built with real structure instead of quick hype, it gains stability, trust, and long-term growth potential. Strategic memecoin development supported by professional token development services creates advantages that spontaneous meme tokens can never achieve.

- Stronger Liquidity: Strategically built tokens maintain deeper liquidity pools, controlled distribution, and predictable vesting. This prevents early crashes and reflects the same discipline applied in high-quality crypto token development projects.

- Active Communities: A well-planned memecoin keeps its community engaged through governance, staking, utility rewards, and ongoing updates. This turns short-term interest into long-term participation and builds true meme coin development momentum.

- Continuous Utility Growth: Strategic planning ensures the token’s utility expands instead of stalling out. Whether through staking, NFTs, gaming features, or DeFi integrations, strong token development gives the memecoin real use cases that sustain demand.

- Better Exchange Acceptance: Exchanges prefer tokens with clean tokenomics, transparent teams, and verifiable on-chain activity. Founders working with an experienced token development company reach listing standards faster because their project meets professional criteria from day one.

- Strong Market Reputation: Audits, multisig wallets, transparent communication, and structured token allocations create long-term credibility. This helps the token build a reputation based on reliability instead of speculation.

- Data-Driven Growth: Strategically developed memecoins grow based on real metrics like liquidity depth, active wallets, transaction volume, and burn cycles. This shifts the project from hype-dependent jumps to sustainable, measurable expansion.

Strategic memecoin development transforms a meme token from a short-lived trend into a long-term digital asset capable of scaling its ecosystem, community, and market presence with confidence.

The Practical Blueprint for Memecoins That Do Not Crash

Memecoins that survive aren’t accidents. They follow a clear structure built through professional memecoin development, smart tokenomics, secure infrastructure, and community-first design. Here’s the practical blueprint high-performing projects use to avoid the 97 percent failure cycle.

- Start With a Real Purpose: Define why the token exists, who it serves, and what long-term value it creates. Purpose becomes the anchor for branding, tokenomics, and community identity.

- Build Sustainable Tokenomics: Plan supply, distribution, vesting, liquidity locks, and incentive loops. Strong tokenomics designed through strategic token development stops early dumps and promotes healthy demand.

- Use Secure, Audited Contracts: Audits, multisig wallets, and clean contract architecture protect users and liquidity. Proper security improves trust and accelerates exchange readiness.

- Architect Your Community Early: Create identity, rituals, communication patterns, and reward systems. Communities built intentionally stay active long after hype fades.

- Launch in Controlled Phases: Seed liquidity, stabilize trading, expand to DEXs, and prepare for CEX listings. Phased launches reduce volatility and protect early holders.

- Add Utility Early and Evolve It: Introduce staking, NFTs, governance, or access perks. Utility keeps the token relevant and fuels continuous demand.

- Maintain Transparent Communication: Regular updates, roadmap progress, and active feedback loops build long-term trust and reduce investor anxiety.

- Measure Growth With Real Metrics: Track liquidity depth, active users, volume, and staking participation. Data-driven decisions outperform hype-driven swings.

Following this blueprint is how a memecoin shifts from a short-lived trend to a sustainable asset supported by expert memecoin development services.

Conclusion

The memecoin market is moving past short-lived hype. The projects that survive now are the ones built with a clear identity, strong tokenomics, real utility, and a long-term strategy. When structure meets creativity, a memecoin transforms from a momentary trend into a lasting digital brand. Strategic memecoin development and secure token development ensure your project grows with confidence instead of joining the 97 percent that fail.

If you want a memecoin backed by solid economics, audited contracts, a scalable community engine, and a roadmap built for real adoption, you’re ready for the next step. Book your consultation and get a custom development blueprint. This is how sustainable memecoins are built, and Antier, a leading memecoin development company, is here to help you create one that lasts.

Frequently Asked Questions

01. What are memecoins and why do most of them fail?

Memecoins are cryptocurrencies that often rely on hype and cultural trends. Most fail because they lack a strategic direction, utility, and proper liquidity management, leading to a collapse shortly after launch.

02. How can founders ensure the long-term success of a memecoin?

Founders can ensure long-term success by implementing strategic planning, developing a clear narrative, establishing a sustainable roadmap, and managing liquidity effectively to create a stable market environment.

03. What role does liquidity play in the success of a memecoin?

Liquidity is crucial for market stability; weak or mismanaged liquidity can lead to panic among holders, extreme price fluctuations, and loss of trust, ultimately jeopardizing the memecoin’s success.