Video

5 Crypto Coins That Will Make You Rich

Video

Aye Finance IPO vs Fractal Analytics IPO

Aye Finance IPO vs Fractal Analytics IPO

RA Disclaimer Link: https://groww.in/pages/sebi-research-analyst-regulations

About Groww

Groww is India’s Best Investment App and the Largest Stock Broker.

Find us here:

Android app: https://app.groww.in/v3cO/f9o4prne

iOS app – https://app.groww.in/v3cO/tu0yrc3e

Website – https://groww.in/

IPO content in Hindi | IPO Reviews in Hindi | IPO Analysis in Hindi | IPO News in Hindi

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

If you have any concerns with respect to Groww, please feel free to write to us at support@groww.in or you can call us at +91 9108800000.

#groww #growwapp #finance #investing #stock market

Research Analyst disclaimer: https://groww.in/pages/sebi-research-analyst-regulations

Name of the Research Analyst – Cleyon Savio Dsouza

Name of the narrator – Agrika Khatri

source

Video

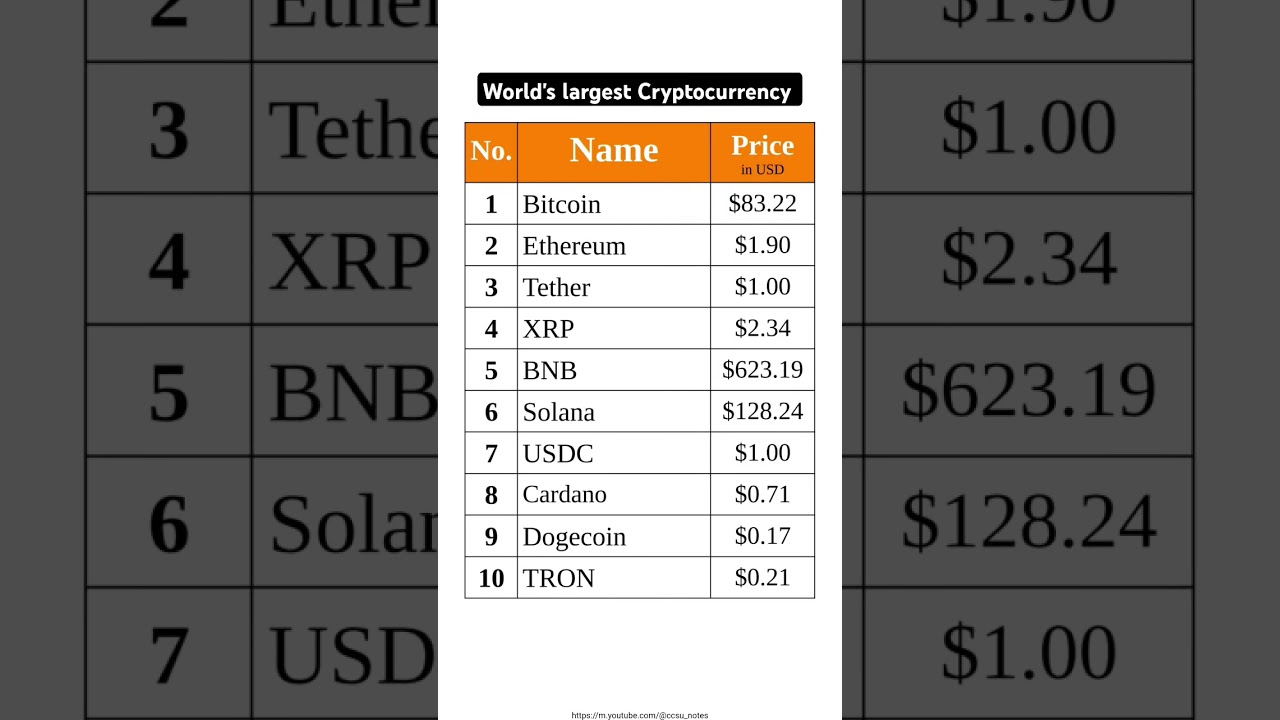

World’s largest Cryptocurrency | Top 10 Cryptocurrency in the world #gk #bitcoin #crypto #rich #news

“Disclaimer: The information presented in this video is for general information purposes only and should not be considered as investment advice. Cryptocurrency prices and market capitalization can fluctuate rapidly and may be affected by various factors, including market volatility, regulatory changes, and global economic conditions. Viewers should do their own research and consult with financial experts before making any investment decisions.”

source

Video

Does Europe Have a Financial Nuclear Option?

Click the link below to get started with Genspark and lock in unlimited access for all of 2026.

https://www.genspark.ai/?utm_source=yt&utm_campaign=PBoyle

Genspark includes unlimited usage of AI Chat and AI Image in 2026 — with top models available inside these features, including Nano Banana Pro, GPT Image, Flux, Seedream, Gemini 3 Pro, GPT-5.2, Claude Opus 4.5, and more. @GensparkProduct #Genspark #WorkwithGenspark

The recent Greenland crisis at Davos 2026 has shattered transatlantic trust, forcing Europe to confront a terrifying new reality: the need for strategic autonomy from the United States. Faced with what it views as transactional coercion, Brussels is readying an arsenal of economic countermeasures, ranging from a “trade bazooka” targeting U.S. tech firms to the highly publicized “financial nuclear option”—the threat of dumping trillions in U.S. Treasuries. But before we panic about a bond market collapse, we need to examine the hard financial realities: Is weaponizing sovereign debt a viable strategy, or is it merely a macroeconomic suicide pact? This video dives into the mechanics of this potential economic war and the high cost of moving from an era of global efficiency to one of fearful autarky

Michael Pettis Paper: https://carnegieendowment.org/china-financial-markets/2025/07/foreign-capital-inflows-dont-lower-us-interest-rates

Martin Wolf Article: https://www.ft.com/content/e2c8c6c3-0cdc-4aa8-a47d-399407c75ad9

Richard Samans Paper: https://www.brookings.edu/articles/rebalancing-the-world-economy-right-idea-but-wrong-approach/

Patrick’s Books:

Statistics For The Trading Floor: https://amzn.to/3eerLA0

Derivatives For The Trading Floor: https://amzn.to/3cjsyPF

Corporate Finance: https://amzn.to/3fn3rvC

Ways To Support The Channel

Patreon: https://www.patreon.com/PatrickBoyleOnFinance

Buy Me a Coffee: https://www.buymeacoffee.com/patrickboyle

Visit our website: https://www.onfinance.org

Follow Patrick on Twitter Here: https://bsky.app/profile/pboyle.bsky.social

Business Inquiries ➡️ sponsors@onfinance.org

Patrick Boyle On Finance Podcast:

Spotify: https://open.spotify.com/show/7uhrWlDvxzy9hLoW0EYf0b

Apple: https://podcasts.apple.com/us/podcast/patrick-boyle-on-finance/id1547740313

Google Podcasts: https://tinyurl.com/62862nve

Join this channel to support making this content:

https://www.youtube.com/channel/UCASM0cgfkJxQ1ICmRilfHLw/join

source

Video

Caught using counterfeit bills

Video

Why People are Shifting to Crypto Trading?

🚀 Start Trading here: https://www.delta.exchange/?code=PVIXHL

Account Opening Link is in the About Section of the Channel

#CryptoTrading #Trading #Crypto

About Pushkar Raj Thakur :

Pushkar Raj Thakur is India’s Leading Educator & Business Coach. He is a Guinness World Record Holder for the Largest Financial Investment Lesson and largest Social Media Marketing Lesson. With Millions of Followers on all major Social Media Platforms, he is known for his versatile knowledge of Financial Education, the Stock Market, Personal Mastery, Sales, Marketing, Human Psychology and Business Development.

– NISM Certified Research Analyst

– NISM Certified Mutual Fund Distributor

– IRDA Certified

Follow us on:

👉 Telegram: https://t.me/PushkarRajThakurOfficial

👉 Whatsapp: https://bit.ly/PRTWhatsappChannel

👉 Facebook: https://bit.ly/PushkarRajThakurFb

👉 Instagram: https://www.instagram.com/pushkarrajthakur

👉 Youtube: https://youtube.com/@PushkarRajThakurOfficial

👉 Twitter: https://x.com/PushkarRThakur

👉 LinkedIn: https://www.linkedin.com/in/pushkarrajthakur

👉 http://www.pushkarrajthakur.com

To Join Our Courses Call @ 9999 470 710

source

Video

The Best Finance Tools for Retirees

In today’s Five Question Friday (FQF) video, we look at these five questions:

1. What are the best financial tools for retirees?

2. What happens if my HSA balance exceeds my medical receipts?

3. Do dividends count toward my annual withdrawal rate?

4. Should the way we invest change when we retire?

5. Why does Warren Buffett think cash and bonds are bad investments?

*Resources*

Budget Apps: https://robberger.com/best-budgeting-apps/

Retirement Planners: https://robberger.com/best-retirement-calculators/

Boldin: https://go.robberger.com/boldin/yt-fqf

ProjectionLab: https://go.robberger.com/projectionlab/yt-fqf

Empower: https://go.robberger.com/empower/yt-fqf

Warren Buffett Video:

*Join the Newsletter. It’s Free:*

*Financial tools I use:*

*I track all of my investments, performance, fees, and asset allocation with Empower. It’s Free:*

https://go.robberger.com/empower/yt-

*I use Monarch Money to manage our budget:* https://go.robberger.com/monarch-yt/yt-desc

*My retirement plan comes from Boldin, the most robust retirement planner available at a reasonable cost:*

https://go.robberger.com/boldin/yt-

*I used Capitalize for my last 401(k) rollover. They did all of the work, and it’s Free:*

https://go.robberger.com/capitalize/yt-

*My Book (Retire Before Mom and Dad):*

https://amzn.to/4d9qbhA

#retirement #investing #robberger

0:00 Intro

1:28 What are the best financial tools for retirees?

7:22 What happens if my HSA balance exceeds my medical receipts?

10:37 Do dividends count toward my annual withdrawal rate?

13:34 Should the way we invest change when we retire?

16:56 Why does Warren Buffett think cash and bonds are bad investments?

ABOUT ME

While still working as a trial attorney in the securities field, I started writing about personal finance and investing In 2007. In 2013 I started the Doughroller Money Podcast, which has been downloaded millions of times. I’ve since sold my websites, bought them back, and started a new website and this YouTube channel.

I’m also the author of Retire Before Mom and Dad–The Simple Numbers Behind a Lifetime of Financial Freedom (https://amzn.to/3by10EE)

LET’S CONNECT

Youtube: https://www.youtube.com/channel/UC9C17-OMxa-7oRSaCtztObw?sub_confirmation=1

Facebook: https://www.facebook.com/financialfreedomguy/

Twitter: https://twitter.com/Robert_A_Berger

DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. Your investment and other financial decisions are solely your responsibility. It is imperative that you conduct your own research and seek professional advice as necessary. I am merely sharing my opinions.

*Disclosure*: Some of the links in this description are from partners who compensate us. This means — at no extra cost to you — I may earn money if you click and sign up for a product or open an account. This creates a financial relationship that may influence my recommendations, but I only recommend products and services I believe in and would recommend to my own mom. Advertisers have no control over my content. Read the full advertiser disclosure here: https://robberger.com/how-we-make-money/

source

Video

Cathie Explains How to Survive this Bitcoin Crash and Profit From It

🔥My FREE Daily On-Chain Analysis & Crypto News In 5-Mins:

👉🏻 https://www.cryptonutshell.com/subscribe

🔥🌳 You can NOW Become a member of our channel to support us! 🌳👑

👉🏻 https://www.youtube.com/channel/UCWZg7FTpyFB9lSpk-_cVr3Q/join

People are still bracing for another leg down, but the cycle signal has already changed. The deleveraging is behind us, and while the base may take time, the next inflection is already up.

That’s the latest message from Cathie Wood, the founder and chief executive of Ark Invest, known globally for identifying major inflection points in disruptive technologies years before they become consensus.

After the October flash crash, fear took over the narrative. Another cycle breakdown. Another prolonged drawdown. But that framing misses what actually happened. The crash forced a rapid, automated deleveraging event that flushed excess leverage out of the system in a matter of hours.

According to Cathie, that shock did not weaken Bitcoin’s structure. It strengthened it. Once forced selling is exhausted and the system stabilizes, markets stop breaking and start building. That is why the focus now is not on the damage, but on what comes after it. And what comes after a completed reset is an upside inflection.

Make sure to stick around until the end of the video as Cathie Wood explains how Bitcoin, blockchain technology, AI, energy, and autonomy are aligning into one of the most powerful wealth-creation cycles ahead.

And before we jump into it, just a quick reminder, only a small percentage of you watching are actually subscribed. If you’re getting value from the videos, hit that subscribe button. It’s free, it supports the channel, and you can always change your mind later.

Now, here’s Cathie Wood breaking down why the next major move for Bitcoin points higher from here.

#Bitcoin #Crypto #Investing

———————————————————————————————————————–

SOCIALS

Email: jamin.tree@gmail.com

———————————————————————————————————————–

“Bitcoin To $1 Million Is COMING Fast” Samson Mow 2024 Bitcoin Prediction

Samson Mow: “Everyone Who Owns Bitcoin Needs To Know It’s About To 266x” 2025 Bitcoin Prediction

Tom Lee Bitcoin: “These Are All INCREDIBLE Signs For Bitcoin In 2025”

EVERYONE Is SO WRONG About This Bitcoin & Crypto Cycle – Tom Lee

Tom Lee Just Changed His Prediction for Bitcoin & Ethereum (New 2025 Prediction)

source

Video

How to Make $100 Per Month in Dividends #shorts

How to make $100 per month in dividends (the math).

Robinhood Free Stock w/ Sign up: https://bit.ly/hf_robinhood

(click “show more” to see ad disclosure)

You’ll need quite a bit of cash invested to make $100 a month in dividends, but I’ll show you how to do the math yourself. This way you’ll know roughly how much cash you’ll need invested today in order to make $100 per month in dividend payments.

—————

Robinhood Free Stock (Up to $200) with Sign Up:

► https://bit.ly/hf_robinhood

Webull Up to 12 Free Fracional Shares (Each $3-$3,000):

► https://bit.ly/hf_webull

M1 Finance (perfect for IRA’s):

► https://bit.ly/hf_M1_Finance

Instagram:

► https://www.instagram.com/honestfinance/

Advertiser Disclosure: Honest Finance participates in affiliate sales networks and may receive compensation by clicking through the links (at no cost to you). This compensation may impact how and where links appear in this description. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This channel does not include all financial companies or all available financial offers.

—————

Honest Finance covers a broad range of financial topics that’ll give your life and finances more value. Subscribe today for future content and be sure to give this video a like!

Disclaimer: I am not a financial advisor. These videos are for education/entertainment purposes only. Investing of any kind involves risk, so please conduct your own research.

#honestfinance #dividends

source

Video

I Bought a SHEET of Real Money

Video

The Best Financial Strategies by Income in Canada: $50K, $100K, $150K+

Discover how we can help: https://blueprintfinancial.ca/

Business inquiries? Email us: info@blueprintfinancial.ca

No matter how much money you’re currently earning, whether it’s $50,000 or $500,000, your income alone won’t determine your financial future — your strategy does.

In this video, I’m going to break down what smart Canadians are doing at every income level — $50K, $100K, and $150K+.

I’ll show you the most common mistakes we see, and reveal the financial strategies we use with our clients, including doctors, tech professionals, and business owners, to help them cut taxes and grow serious wealth.

Explore these links:

Net Worth Tracker: https://blueprintfinancial.ca/net-worth-tracker-canada-download

Average Net Worth in Canada by Age (30, 40, 50, 60): https://youtu.be/K7fXmR3VJhs

Blog Post: https://blueprintfinancial.ca/the-best-financial-strategies-by-income-in-canada-50k-100k-150k/

Chapters:

00:00 Introduction

00:29 Income Ladder: Step 1 – $50K/year

01:45 3 key strategies for $50k income

05:02 Income Ladder: Step 2 – $100K/year

06:18 3 key strategies for $100k income

09:58 Income Ladder: Step 3 – $150K+/year

11:33 3 key strategies for $150k income

Disclaimer: The videos and opinions on this channel are for informational and educational purposes only and do not constitute investment advice. Neither Christopher Liew nor Blueprint Financial provide specific investment recommendations. For investment advice, please consult a registered professional. This channel is not responsible for any investment actions taken by viewers based on these videos.

source

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics19 hours ago

Politics19 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat13 hours ago

NewsBeat13 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business19 hours ago

Business19 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports9 hours ago

Sports9 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics21 hours ago

Politics21 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat4 hours ago

NewsBeat4 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report