Crypto World

Crypto Fund Outflows Drop 89% to $187 Million

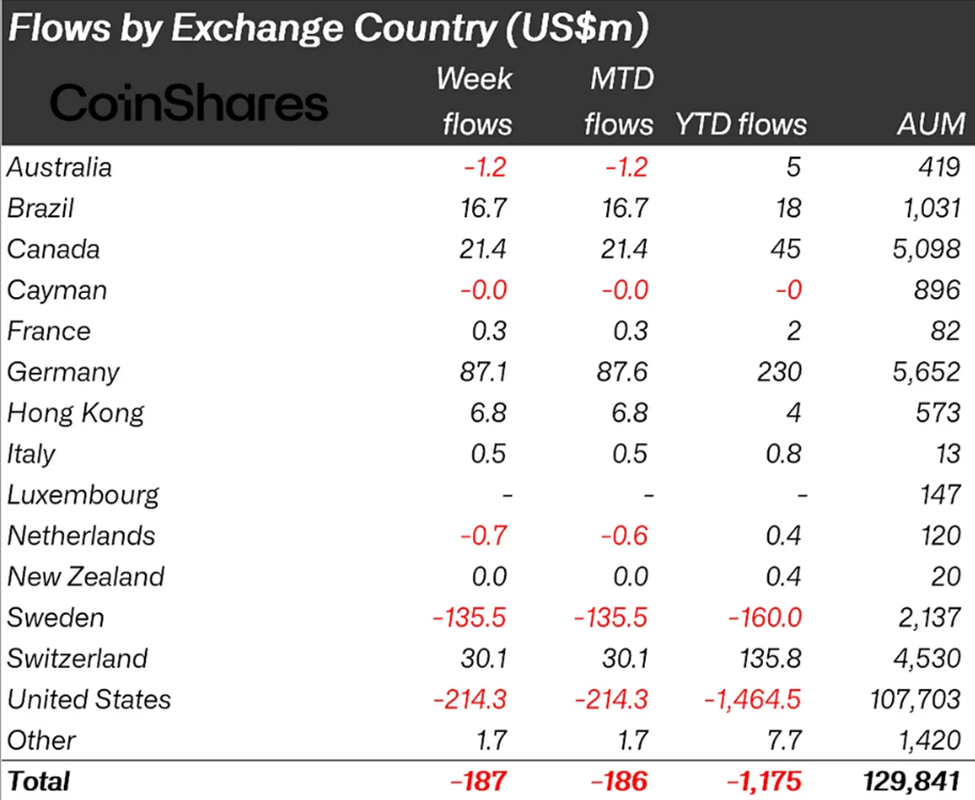

Crypto markets may be showing early signs of stabilization after weeks of intense selling, according to the latest CoinShares report on digital assets.

Investment products saw outflows collapse from over $1.7 billion recorded for two successive weeks to just $187 million last week.

Sponsored

Crypto Outflows Shrink to $187 Million, CoinShares Report Shows

CoinShares’ latest figures show that total assets under management fell to $129.8 billion, the lowest level since March 2025. This reflects the ongoing impact of the recent price slide.

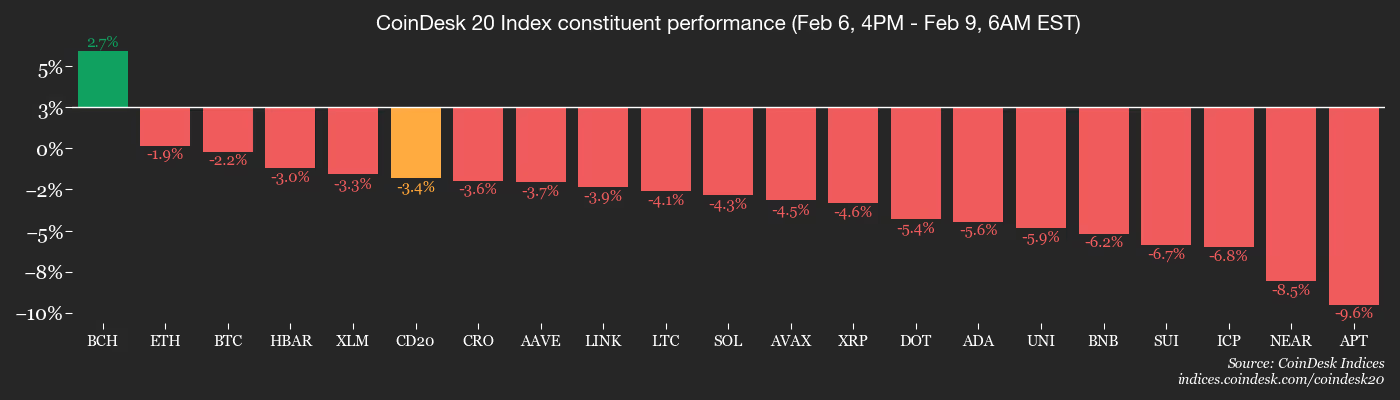

Based on the chart below, regional trends hint at selective confidence, with institutional and region-specific strategies diverging even as global sentiment remains cautious.

Yet while investors were cautious, trading activity remained strong. Crypto exchange-traded products (ETPs) recorded a record $63.1 billion in weekly volume. With this, they surpassed the previous high of $56.4 billion set in October 2025.

Notably, high volumes amid slowing outflows indicate that investors are repositioning rather than abandoning the market, a subtle but important distinction.

Sponsored

Bitcoin experienced $264 million in outflows, highlighting a rotation away from the pioneer crypto toward alternative digital assets.

Among altcoins, XRP, Solana, and Ethereum led inflows, receiving $63.1 million, $8.2 million, and $5.3 million, respectively. XRP, in particular, has emerged as a favorite, attracting $109 million year-to-date.

Crypto Capitulation Shows Signs of Slowing, But Bottom Not Yet Confirmed

Despite continued price pressure, it is worth noting that the sharp drop in outflows is no mean feat, following $1.73 billion in negative flows and $1.7 billion the week before. This sharp contraction in crypto fund flows across successive weeks is being interpreted as a potential inflection point.

Sponsored

According to analysts, such a deceleration often precedes changes in market momentum, suggesting the selling frenzy could be approaching its limit.

“The deceleration in outflows suggests selling pressure is easing, and capital flight may be reaching exhaustion. Historically, this shift often precedes a change in market momentum. Early signs of stabilization are starting to emerge,” stated Andre.

Historically, crypto cycles rarely reverse immediately following peak sell-offs. Instead, the market often experiences a gradual easing of outflows before inflows return, a pattern that seems to be emerging in the current correction.

Therefore, last week’s slowing outflows may be a leading indicator, but should not be misconstrued as a guarantee of recovery.

Sponsored

The broader implication is that the market may be transitioning from panic-driven capitulation to consolidation and selective accumulation.

While Bitcoin continues to see outflows, the inflows into altcoins and regional markets suggest that investors are rotating risk rather than exiting crypto entirely.

Still, caution remains warranted because one week of slower crypto outflows does not signal a confirmed bottom.

Crypto World

How Gate Is Expanding Its Crypto ETF Market Position

Over the past two years, the landscape for crypto derivatives has shifted dramatically. A significant contraction in the supply of ETF leveraged tokens has occurred across top-tier exchanges. Platforms that previously championed these products have initiated phased suspensions, halted subscriptions, or delisted leveraged pairs entirely throughout 2024 and 2025. However, the demand for leverage among traders has not vanished. It has simply been displaced.

In this environment of market retrenchment, Gate has taken a contrarian approach. Rather than withdrawing, Gate has doubled down, treating ETF leveraged tokens not as a niche add-on, but as a core product line. By prioritizing transparent mechanisms and a unified low-fee framework, Gate has transformed what was once a complex instrument into a scalable, user-friendly tactical tool.

Why Exchanges Are Leaving

In the context of crypto, ETFs generally refer to ETF Leveraged Tokens. These are tokenized instruments traded on the spot market that track perpetual futures positions, allowing users to gain leveraged exposure (e.g., 3x Long BTC) without managing margin or liquidation prices.

Despite their utility, these products are highly structured. Without robust risk controls and clear user education, they are susceptible to volatility decay in ranging markets. Consequently, major platforms have exited the space to minimize compliance risks and user disputes. For example, exchange no. 1. phased out leveraged token services in early 2024, eventually discontinuing support, and exchange no. 2. followed suit in late 2025, issuing batch delisting announcements for BTC and other major assets.

This industry wide reduction has created a vacuum. As comparable platforms shrink, product availability itself has become a scarce competitive advantage. Gate has stepped in to absorb this liquidity, offering a stable home for short-term leveraged trading demand.

Simplifying Leverage With Unified Fees

Gate’s ETF architecture is designed to map professional derivatives positions into a simple tokenized format. For the user, the experience mirrors spot trading, there is no need to monitor margin maintenance or fear sudden liquidation events.

A key differentiator is Gate’s approach to cost transparency. In derivatives trading, costs are often fragmented across funding rates, trading fees, and slippage. Gate consolidates these fragmented costs into a single, understandable metric known as the unified management fee. This flat 0.1% daily fee is entirely all-inclusive, covering everything from hedging costs and funding rates to potential trading friction.

By packaging costs at the product level, Gate shifts the complexity from the user to the platform. The user gets a predictable cost structure, while the platform leverages professional expertise to manage execution and hedging.

Transparency in Mechanics

The sustainability of leveraged tokens relies on explainability. Two critical variables define these products: the Net Asset Value (NAV) and Rebalancing Rules.

The sustainability of leveraged tokens relies on explainability. Unlike competitors that often operated these mechanisms as “black boxes,” Gate provides explicit parameter disclosures. This includes specific leverage fluctuation ranges where rebalancing is not triggered, which significantly reduces frictional costs in choppy markets.

For instance, Gate ensures position stability by avoiding rebalancing for 3x Long tokens as long as leverage stays between 2.25x and 4.125x, while the 3x Short variant maintains a range of 1.5x to 5.25x. Similarly, for 5x tokens, no adjustments are triggered unless the leverage moves outside the 3.5x to 7x boundary. These technical parameters are vital for professional traders as they minimize the “decay” often associated with these products during range-bound price action.

Scale by the Numbers

Gate’s ecosystem is expanding. According to Gate’s 2025 annual report, the “Scale Effect” of their ETF product line is evident in the platform’s ability to support 244 different ETF leveraged tokens throughout the year. This robust supply served a cumulative user base of over 200,000 traders, driving average daily trading volumes into the hundreds of millions of dollars. This growth is supported by continuous technical iterations, including the launch of multidimensional data dashboards, rebalancing history displays, and specialized educational modules designed to reduce the learning curve for new participants.

The platform’s success is not merely a result of being one of the last providers standing, but rather a reflection of its commitment to product depth. Gate continues to broaden its asset coverage, ensuring that users can access leveraged exposure across a diverse range of emerging and established tokens. Looking ahead, Gate plans to build on this momentum by introducing sophisticated new formats, such as portfolio ETFs and low-leverage inverse ETFs. By retaining technical complexity at the platform level while delivering operational certainty to the user, Gate is positioning itself to capture an even larger share of the short-term leveraged trading market.

Conclusion

The industry wide contraction of leveraged tokens was not a failure of the concept, but a failure of execution regarding transparency and education. Gate has succeeded where others retreated by systematizing the product.

By offering clear disclosures, a unified 0.1% daily fee, and a spot-like user experience, Gate has built a sustainable ecosystem that preserves the utility of leverage while mitigating its complexity. As the market matures, Gate’s ETF offering stands as a testament to the value of explainable, transparent financial engineering.

Disclaimer: Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not liable for any losses or damages resulting from such investment activities.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

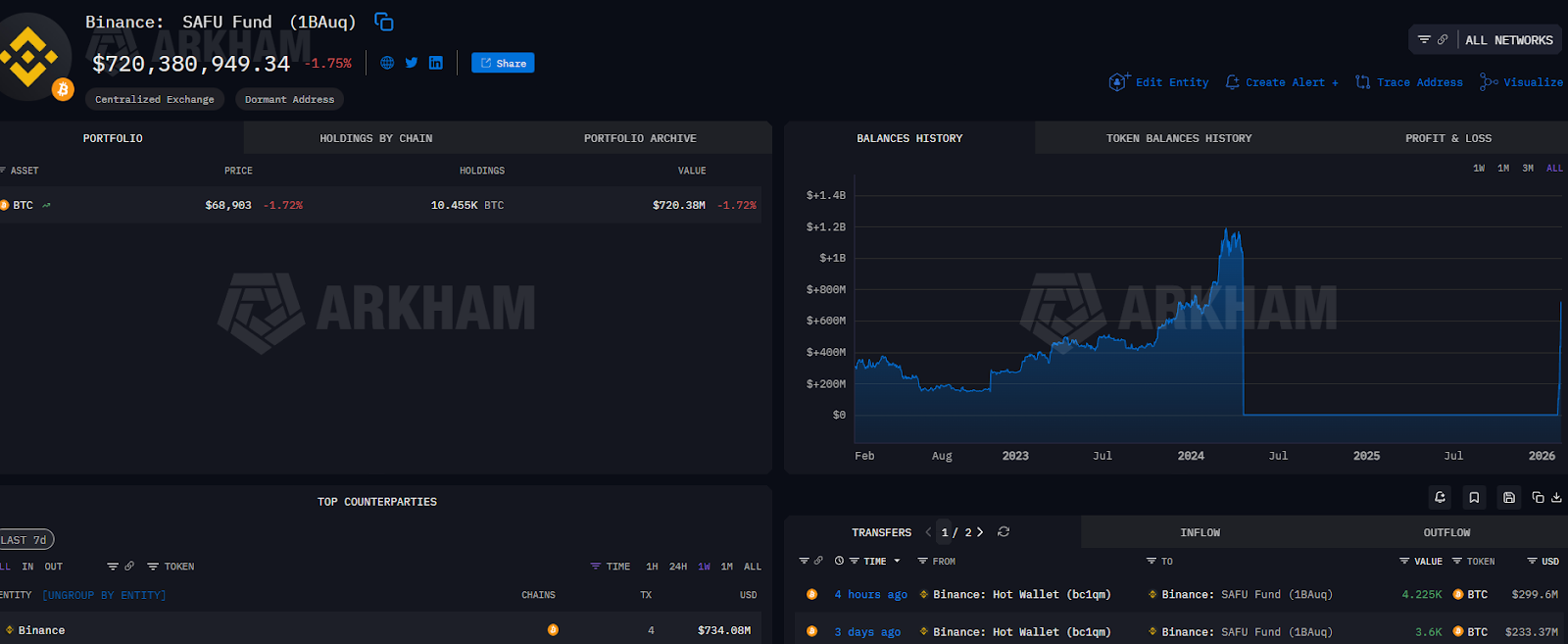

Binance added another $300 million worth of Bitcoin to its emergency reserves on Monday, continuing its experiment with a Bitcoin-backed protection fund as markets remain under pressure.

Binance bought another 4,225 Bitcoin (BTC) worth $300 million for its Secure Asset Fund for Users (SAFU) wallet, which holds its emergency reserves, according to blockchain data platform Arkham.

The acquisition lifts the fund’s Bitcoin holdings to more than $720 million at current prices.

“We’re continuing to acquire #Bitcoin for the SAFU fund, aiming to complete conversion of the fund within 30 days of our original announcement,” Binance wrote in a Monday X post.

While the acquisition is a sign of confidence in Bitcoin by the world’s largest exchange, it also exposes Binance’s emergency fund to downside volatility of Bitcoin’s price swings, which could reduce the fund’s total value.

Related: Bitcoin dips to $60K, TRM Labs becomes crypto unicorn: Finance Redefined

Binance first announced shifting $1 billion of its user protection fund into Bitcoin on Jan. 30, framing it as an expression of its conviction in Bitcoin’s long-term prospects as the leading crypto asset.

Binance said it would rebalance the fund back up to $1 billion if the market volatility drove its value below $800 million.

Related: BitMine nears $7B in unrealized losses as Ether downturn pressures treasury firms

Fragile sentiment weighs on markets

Binance’s fund conversion occurs amid a wider crypto market correction, which saw Bitcoin’s price sink to $59,930 on Friday, a price level last seen in October 2024 before the re-election of US President Donald Trump, according to TradingView.

Meanwhile, Bitcoin investor sentiment remains “fragile,” threatening more downside in the absence of positive market catalysts, Hina Sattar Joshi, director for digital assets at liquidity and data solutions platform TP ICAP, told Cointelegraph.

“Sentiment is currently very fragile, with investors anchoring themselves to the traditional four-year Bitcoin cycle, in which Bitcoin’s price historically follows a recurring pattern of ‘boom and bust.’”

The industry’s best traders by returns, tracked as “smart money,” also continue betting on more crypto market downside.

Smart money traders added $7.38 million worth of leveraged short positions and were net short on Bitcoin for a cumulative $109 million, according to crypto intelligence platform Nansen.

Smart money traders were betting on the price decline of most of the leading cryptocurrencies, except Avalanche (AVAX), which had $7.38 million in cumulative long positions.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari — Crypto Kid

Crypto World

Why Lily Liu Is Both Right and Dangerously Wrong

Solana Foundation President Lily Liu recently declared that blockchains should abandon their consumer ambitions and return to their “original purpose: finance.” Her dismissal of gaming and Web3 consumer narratives as “intellectually lazy” sparked immediate debate across an industry already reeling from plunging token prices and fading retail enthusiasm.

But here’s the uncomfortable truth: Liu is simultaneously correct about blockchain’s current reality and catastrophically narrow in her vision for its future.

The Part She Gets Right

Liu isn’t wrong that finance remains blockchain’s most defensible moat. Tokenization, 24/7 settlement, and programmable money represent genuinely superior infrastructure compared to legacy rails. Traditional finance moves slowly not because it’s stupid, but because it’s encumbered by decades of regulatory frameworks, closed systems, and geographic silos.

Blockchain cuts through that like a hot knife through butter when the use case actually requires it.

The problem with the “blockchain for everything” narrative wasn’t the ambition. It was the execution. The industry kept treating decentralization as a feature consumers would pay a premium for, rather than infrastructure they’d never think about. We built products where the blockchain was the selling point instead of the invisible rails enabling something genuinely better.

Gaming didn’t fail because it was the wrong vertical. It failed because teams shipped half-baked experiences and expected players to tolerate wallet friction, gas fees, and convoluted tokenomics just for the privilege of “true ownership.” Players don’t care about decentralization, they care about fun, fair economies, and actual utility for their digital assets.

Finance works because traders tolerate complexity for profit. That’s not vision. That’s just knowing your audience will put up with clunky UX if there’s money on the table.

Where She’s Dangerously Wrong

But here’s where Liu’s retreat becomes myopic: financialization of everything is the vision. It’s just not the version we’ve built yet.

Every digital asset—from in-game items to social engagement, creative work, and reputation—should be ownable, tradable, and liquid. The mistake wasn’t trying to bring blockchain to gaming or consumer applications. The mistake was building extractive tokenomics that enriched founders and VCs while creating zero genuine value for users.

When you can truly own your digital identity across platforms, trade gaming assets in open markets, and capture value from your creative output without platform rent-seeking, that is revolutionary. We just haven’t built the infrastructure properly yet.

“Read, write, own” wasn’t intellectually lazy. Implementing it via ponzinomics and calling it innovation? That was lazy.

Dismissing consumer applications entirely because the first wave failed is like abandoning e-commerce in 1999 because Pets.com crashed. The thesis wasn’t wrong, the timing, technology, and business models were premature.

The Real Recalibration

Liu’s pivot conveniently arrives as consumer crypto collapses and institutional money flows toward tokenized securities and stablecoins. It’s easy to call this “strategic refocusing.” It’s harder to admit it’s also damage control.

This narrative shift lets the industry quietly abandon metaverse partnerships and DePIN experiments without acknowledging capital destruction. When those projects shutter, it’ll be spun as “returning to core competencies” rather than “we built products nobody wanted.”

But there’s a deeper risk here: if blockchain leaders concede that the technology only works for finance, we’re admitting we can’t compete with Web2 on user experience. We’re retreating to the one domain where regulatory arbitrage and 24/7 markets create structural advantages traditional systems can’t easily replicate.

That’s not a vision. That’s a surrender dressed up as pragmatism.

What Actually Needs to Happen

The industry doesn’t need to choose between finance and consumer applications. It needs to stop treating blockchain as the product and start treating it as invisible infrastructure that enables genuinely superior experiences.

Finance will remain the killer app for the next few years because the ROI on improved settlement rails is measurable and institutions are finally ready to move. But the long game isn’t replacing Visa, it’s building an internet where value, ownership, and identity are native primitives, not bolt-on features controlled by platforms.

That requires financial rails robust enough to handle trillions in assets and consumer experiences good enough that users never think about the blockchain underneath.

Liu’s right that we need to build real markets, not just slap tokens on existing apps and call it innovation. But retreating entirely from consumer applications because the first attempts failed isn’t strategic, it’s a failure of imagination.

The technology that enables programmable money can also enable programmable ownership, reputation, and creative economies. We just have to build products people actually want instead of products that make us feel ideologically pure.

Blockchain’s purpose isn’t just finance. It’s building an internet where value flows as freely as information and that future is a hell of a lot bigger than better payment rails.

Crypto World

Samsung Stock Surges as Chipmaker Beats Micron in HBM4 Race

TLDR

- Samsung Electronics stock climbed 4.9% to 6.4% after announcing mass production of HBM4 memory chips starting this month.

- The Korean chipmaker will supply HBM4 chips to Nvidia by mid-February for Vera Rubin AI accelerators.

- Samsung’s production timeline puts it ahead of Micron Technology, which plans HBM4 rollout in Q2 2026.

- Micron stock still rose 3.08% as analysts expect the company to hold its 20%-25% HBM market share.

- AI chip makers are adopting three-supplier strategies, creating space for Samsung, SK Hynix, and Micron.

Samsung Electronics shares popped on Monday following reports that the company will kick off mass production of next-generation memory chips this month. The stock gained between 4.9% and 6.4% depending on the source.

Industry insiders told South Korea’s Yonhap news agency that Samsung will begin producing HBM4 chips in late February. These high-bandwidth memory chips are critical components for artificial intelligence processors.

The company plans to ship these advanced semiconductors to Nvidia by mid-February. The chips will power Nvidia’s upcoming Vera Rubin AI accelerators, which represents a key win for Samsung in the AI supply chain race.

Nvidia stock jumped 7.87% on the news. SK Hynix, another South Korean memory chip manufacturer, saw shares rise 5.72%.

Race Against Micron Intensifies

Samsung’s announcement puts it in direct competition with Micron Technology for AI chip market share. Micron has seen its stock more than quadruple over the past year thanks to HBM chip demand.

Micron shares rose 3.08% despite the competitive pressure. The company plans to ramp up its own HBM4 production during the second quarter of 2026.

That timeline puts Micron roughly one quarter behind Samsung’s production schedule. Micron CEO Sanjay Mehrotra outlined the company’s HBM4 plans during the most recent earnings call.

Samsung’s stock has nearly tripled in the past 12 months. The memory chip boom has lifted valuations across the entire sector.

Wall Street Sees Room for Multiple Winners

Analysts aren’t overly concerned about market share battles between the three major HBM suppliers. Demand remains strong enough to support all players.

UBS analyst Timothy Arcuri noted that AI accelerator vendors are moving toward three-supplier sourcing strategies. Companies previously relied on just two suppliers for their HBM needs.

This shift benefits Micron. Analysts estimate the company can maintain the 20%-25% market share it captured last year despite increased competition.

HBM chips command higher profit margins than standard memory components. The lucrative margins make the market attractive for Samsung, Micron, and SK Hynix.

Financial Position Remains Strong

Samsung’s market capitalization sits at $694.62 billion. The company reported revenue of $223.32 billion with a 7% growth rate over three years.

The chipmaker maintains a current ratio of 2.63 and a debt-to-equity ratio of 0.04. These metrics indicate solid liquidity and low leverage.

Samsung’s gross margin stands at 36.65% with an operating margin of 9.51%. The Altman Z-Score of 7.78 suggests strong financial health.

The company’s P/E ratio of 32.73 sits near its one-year high. Technical indicators show an RSI of 100, suggesting the stock may be overbought.

Samsung didn’t immediately respond to requests for comment. The company’s HBM4 production represents a major milestone in the ongoing AI chip race.

Crypto World

MSTR purchased $90 million of bitcoin last week

Strategy (MSTR) added to its bitcoin holdings, but appears to have made all its purchases before the deep price plunge in the back half of the week.

Led by Executive Chairman Michael Saylor, the company added 1,142 bitcoin for $90 million, or an average price of $78,815 each. Strategy’s stack now stands at 714,644 bitcoin purchased for $54.35 billion, or an average price of $76,056 each.

Bitcoin Monday morning is trading at just under $69,000, down 2.6% over the past 24 hours. MSTR shares are lower by 3.9%.

Last week’s acquisitions were funded by the sale of common stock.

Given the average purchase price of $78,815, it appears Strategy made its buys on Monday or Tuesday last week, ahead of the rapid decline in bitcoin’s price, which took the crypto to as low as $60,000 at one point on Thursday.

Crypto World

Zero-dollar Bitcoin? A growing narrative is bubbling up

Skeptics say ‘Zero-Dollar Bitcoin’ as a new selloff revives brutal questions about utility, cash flows, and whether confidence alone can sustain its price/

Summary

- Commentators Buck Sexton and Richard Farr argue Bitcoin has no long-term value, no “fundamental floor,” and has failed as either money or a hedge.

- Critics frame Bitcoin as a reflexive high-beta tech proxy whose value depends on flows and belief, not cash flows or enforceable claims on real assets.

- The debate intensifies as BTC trades near the low-70k region alongside choppy ETH and SOL markets, underscoring crypto’s sensitivity to macro risk-off shocks.

Bitcoin’s (BTC) latest drawdown has revived an old, brutal question: could the world’s largest cryptocurrency ultimately be worth nothing? As prices slide and faith wobbles, a “Bitcoin to $0” thesis is again echoing through markets and media.

Zero‑dollar thesis resurfaces

The spark this week came from conservative commentator Buck Sexton, who wrote that “every time I ask a Bitcoin true believer to explain why they think it has any long-term value… I come away more certain that Bitcoin has no long-term value, and a floor price of zero.” His post went viral after Bitcoin tumbled more than 20% over the past week, amplifying a bearish narrative that critics have pushed for years. The core claim is simple: in a full confidence crisis, an asset with no cash flows and no legal claim on anything tangible has “no ‘fundamental floor.’”

Richard Farr, chief market strategist at Pivotus Partners, put it more bluntly, saying his firm’s Bitcoin target is “$0.0,” arguing it has “failed as a hedge against the dollar,” tracks high‑beta tech, and has not gained real traction as money. “The miners (who are the network) are bleeding cash,” Farr wrote. “We think it’s a zero.”

Belief versus utility

Long‑time antagonist Peter Schiff again contrasted Bitcoin with gold, insisting that “Bitcoin’s value is purely subjective, as it has no utility beyond belief.” “Bitcoin can’t do anything. That’s the problem,” he added. “Yes you can store and transfer your Bitcoin, but beyond that you can’t do anything with it.” That critique dovetails with academic warnings that non‑yielding assets are ultimately hostage to reflexive flows, a point underscored during previous deleveraging waves in 2018 and 2022.

Yet the ferocity of the latest backlash also reflects how over‑financialized the asset has become, tethered to macro risk cycles and ETF flows rather than cypherpunk ideals. Sexton himself argued that the “anger” from online advocates is part of the problem, eroding mainstream credibility just as regulators and traditional finance are demanding more discipline.

Market snapshot

The debate comes as digital assets grind through another risk‑off stretch. Bitcoin (BTC) trades near $70,961, up roughly 2.4% over the last 24 hours on about $42.3b in volume. Ethereum (ETH) changes hands around $2,094, up about 0.65% over the same period, with spot and futures turnover exceeding $50b. Solana (SOL) sits close to $86.6, down roughly 1.4% on the day, with more than $6.1b traded.

These skittish flows mirror broader macro anxiety, from tightening financial conditions to renewed equity volatility, that has historically pressured high‑beta crypto assets. For now, the “zero” narrative is less a precise price target than a stress test of Bitcoin’s maturing, yet still fragile, social contract.

Related coverage: Bitcoin’s correlation with tech stocks has repeatedly spiked during risk‑off shocks, challenging the “digital gold” hedge story. Ethereum’s evolving fee and burn dynamics highlight how protocol cash‑flow narratives can bolster perceived intrinsic value. Solana’s outsized rally and sharp pullbacks underline how execution risk and network outages still shape the market’s tolerance for speculative layer‑1 bets.

Crypto World

: Crypto Week Ahead

The brief, partial U.S. government shutdown put paid to the Employment Situation report that was due Friday; it’s coming this week instead. Look for the bellwether nonfarm payrolls report on Wednesday. The world’s largest economy is forecast to have created 70,000 jobs last month, more than in December, while the unemployment rate is expected to hold steady at 4.4%.

The week also includes earnings from some of the biggest, highest-profile crypto companies, including crypto exchange Coinbase (COIN). Robinhood (HOOD), a trading platform that covers equities as well as crypto, is also on the roster.

Outside the U.S., there will be plenty of focus on Asia, where CoinDesk’s second annual Consensus Hong Kong conference takes place. There’s a high chance participating companies will use the event as a venue for corporate announcements.

What to Watch

(All times ET)

- Crypto

- Macro

- Feb. 9, 11 a.m.: U.S. consumer inflation expectations for January (Prev. 3.4%)

- Feb. 10, 7 a.m.: Brazil inflation rate YoY (Prev. 4.26%), MoM (Prev. 0.33%)

- Feb. 10, 8:30 a.m.: U.S. retail sales MoM for December Est. 0.5% (Prev. 0.6%)

- Feb. 10 8:30 a.m.: U.S. employment cost index QoQ (Prev. 0.8%)

- Feb. 10, 2 p.m.: Argentina inflation rate YoY (PRev. 31.5%), MoM (Prev. 2.8%)

- Feb. 10, 8:30 p.m.: China inflation rate YoY for January (Prev. 0.8%); MoM (Prev. 0.2%)

- Feb. 11, 8:30 a.m.: U.S. nonfarm payrolls for January Est. 70K (Prev. 50K)

- Feb. 11, 8:30 a.m.: U.S. unemployment rate for January Est. 4.4% (Prev. 4.4%)

- Feb. 11, 8:30 a.m.: U.S. average hourly earnings for January YoY Est. 3.8% (Prev. 3.6%)

- Feb. 12, 2:00 a.m.: U.K. GDP MoM for December. (Prev. 0.3%)

- Feb. 12, 5:30 a.m.: India inflation rate YoY for January (Prev. 1.33%); MoM (Prev. 0.05%)

- Feb. 12, 8:30 a.m.: U.S. initial jobless claims week ending Feb. 7 (Prev. 231K)

- Feb 12, 10 a.m.: U.S. existing home sales for January Est. 4.25M (Prev. 4.35M)

- Feb. 13, 8:30 a.m.: U.S. core inflation rate YoY for January (Prev. 2.6%); MoM Est. 0.3% (Prev. 0.2%)

- Feb. 13, 8:30 a.m.: U.S. inflation rate YoY for January (Prev. 2.7%); MoM Est. 0.3% (Prev. 0.3%)

- Feb. 14: Japan GDP growth rate QoQ for Q4 (Prel) est. 0.4% (Prev. -0.6%); Annualized est. 1.6% (Prev. -2.3%)

- Earnings (Estimates based on FactSet data)

- Feb. 10: Canaan (CAN), pre-market, -$0.03

- Feb. 10: Robinhood Markets (HOOD), post-market, $0.63

- Feb. 10: Upexi (UPXI), post-market, -$0.07

- Feb. 10: Lite Strategy (LITS), post-market

- Feb. 12: Coinbase (COIN), post-market, $1.04

- Feb. 12: Coincheck Group (CNCK), post-market, $0.01

- Feb. 12: Bitdeer Technologies Group (BTDR), pre-market, -$0.06

- Feb. 13: Trump Media & Tech Group (DJT), post-market

- Feb. 13: HIVE Digital Technologies (HIVE), post-market, -$0.07

Token Events

- Governance votes & calls

- Feb. 11: Ripple to host XRP Community Day on X Spaces discussing XRP adotion, regulated finance and innovation.

- Unlocks

- Token Launches

Conferences

Crypto World

Bitcoin value investors move in as BTC price drops, ‘capitulation’ searches rise: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin has retreated by nearly 2.5% in the past 24 hours after failing to hold onto gains made during an end-of-week bounce that pushed it back up to $71,000.

The pullback followed a turbulent few days in which the cryptocurrency plunged to as low as $60,000 before rebounding. BTC is still down more than 11% in the past seven days.

Even so, it’s outperforming the wider market, which saw the CoinDesk 20 (CD20) index drop 13.5% over 24 hours and 13.7% in a week.

The drop saw institutions move. Speaking to CNBC, Bitwise CEO Hunter Horsley said late last week that the firm saw significant inflows as prices dropped.

“I think long-time holders are feeling unsure, and I think the new investor set — institutions — are feeling they’re getting a new crack at the apple and seeing prices they thought they’d forever missed,” Horsley said.

Spot bitcoin ETFs on Friday reversed a three-day streak of outflows, bringing in a net $371 million, SoSoValue data shows. Still, retail sentiment remained fragile. Julio Moreno, CryptoQuant’s head of research, noted on social media that U.S. investors are buying back in, based on the Coinbase Premium Index turning positive for the first time since mid-January.

Online search interest for terms such as “crypto capitulation” spiked during the selloff and stayed elevated, according to crypto analytics firm Santiment, offering an opportunity for value investors to step in.

Meanwhile, capital flowed into traditional safe havens. Gold and silver extended their recovery after a selloff late last month, with gold once again topping $5,000 as investors consider a weaker U.S. dollar and major purchasers continued accumulating. These include Tether, whose gold stash has topped $23 billion, and China’s central bank.

Stock market futures are down ahead of the open, after a Japan equities rallied over the ruling party’s landslide win in a snap election. Prime Minister Sanae Takaichi had campaigned on low interest rates and significant fiscal spending.

The yield on Japanese government bonds kept rising, further unwinding the yen carry trade and affecting risk assets including cryptocurrencies. The unwind could bring nearly $5 trillion of overseas investments back into the country. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 9, 11 a.m.: U.S. consumer inflation expectations for January (Prev. 3.4%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- No major governance votes.

- Unlocks

- Token Launches

- Feb. 9: Pendle to launch sPENDLE buybacks with first yield distributions starting Feb. 13, and rewards time-weighted from Jan. 29.

- Feb. 9: ZKsync to launch Season 1 of the ZKnomics Staking Pilot Program via Tally

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 2.90% from 4 p.m. ET Sunday at $69,045.23 (24hrs: -2.44%)

- ETH is down 4.07% at $2,034.28 (24hrs: -4.40%)

- CoinDesk 20 is down 3.09% at 1,973.38 (24hrs: -3.46%)

- Ether CESR Composite Staking Rate is down 25 bps at 2.74%

- BTC funding rate is at -0.037% (-4.0362% annualized) on Binance

- DXY is down 0.33% at 97.31

- Gold futures are up 1.67% at $5,033.80

- Silver futures are up 5.62% at $81.05

- Nikkei 225 closed up 3.89% at 56,363.94

- Hang Seng closed up 1.76% at 27,027.16

- FTSE 100 is up 0.31% at 10,402.44

- Euro Stoxx 50 is up 0.39% at 6,021.78

- DJIA closed on Friday up 2.47% at 50,115.67

- S&P 500 closed up 1.97% at 6,932.30

- Nasdaq Composite closed up 2.18% at 23,031.21

- S&P/TSX Composite closed up 1.49% at 32,471.00

- S&P 40 Latin America closed down 2.89% at 3,653.05

- U.S. 10-Year Treasury rate is up 2 bps at 4.23%

- E-mini S&P 500 futures are unchanged at 6,949.25

- E-mini Nasdaq-100 futures are down 0.20% at 25,113.25

- E-mini Dow Jones Industrial Average futures are unchanged at 50,246.00

Bitcoin Stats

- BTC Dominance: 59.33% (-0.05%)

- Ether-bitcoin ratio: 0.02944 (-0.92%)

- Hashrate (seven-day moving average): 977 EH/s

- Hashprice (spot): $34.55

- Total fees: 2.23 BTC / $157,182

- CME Futures Open Interest: 116,125 BTC

- BTC priced in gold: 13.8 oz.

- BTC vs gold market cap: 4.62%

Technical Analysis

- Bitcoin is testing the 200-week exponential moving average (~$68,339), a critical support level to prevent an extended structural drawdown.

- The weekly RSI is firmly oversold at 28.18, a level that has historically preceded short-term rebounds.

- While this positioning suggests there’s a high probability of a bounce, a clear reversal of the downtrend requires a sustained breakout above $74,000.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $165.12 (+13.00%), –1.24% at $163.07 in pre-market

- Galaxy Digital (GLXY): closed at $19.76 (+17.34%), –0.30% at $19.70

- MARA Holdings, Inc. (MARA): closed at $8.24 (+22.44%), –2.67% at $8.02

- Riot Platforms, Inc. (RIOT): closed at $14.45 (+19.82%), –1.18% at $14.28

- Core Scientific, Inc. (CORZ): closed at $16.81 (+13.47%), –0.30% at $16.76

- CleanSpark (CLSK): closed at $10.08 (+21.96%), –0.89% at $9.99

- Exodus Movement (EXOD): closed at $10.56 (+12.10%)

- CoinShares Bitcoin Mining ETF (WGMI): closed at $40.43 (+14.76%)

- Circle Internet Group (CRCL): closed at $57.04 (+13.56%), –1.05% at $56.44

- Bullish (BLSH): closed at $27.45 (+10.24%), unchanged at $27.45

Crypto Treasury Companies

- Strategy (MSTR): closed at $134.93 (+26.11%), –3.47% at $130.25

- Strive Asset Management (ASST): closed at $11.91 (+20.84%), –3.40% at $11.51

- Sharplink Gaming (SBET): closed at $7.03 (+15.82%), –0.71% at $6.98

- Upexi, Inc. (UPXI): closed at $1.14 (+4.59%), +0.88% at $1.15

- Lite Strategy, Inc. (LITS): closed at $1.06 (+11.58%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $330.7 million

- Cumulative net flows: $54.63 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$21.3 million

- Cumulative net flows: $11.83 billion

- Total ETH holdings ~5.83 million

Source: Farside Investors

While You Were Sleeping

- Takaichi victory sends Nikkei to record, bitcoin to $72,000 and gold past $5,000 (CoinDesk): Japan’s Nikkei 225 index surged to a record on Monday, breaching 57,000 following Prime Minister Sanae Takaichi’s decisive “supermajority” electoral victory.

- China Urges Banks to Curb Exposure to U.S. Treasuries (Bloomberg): Chinese regulators advised financial institutions to rein in their holdings of U.S. Treasuries, citing concerns over concentration risks and market volatility.

- Tether’s gold stash tops $23 billion as buying outpaces nation states, Jefferies says (CoinDesk): The Wall Street investment bank estimates the crypto firm holds at least 148 metric tons of physical gold, joining the top 30 global holders of bullion.

- U.S. IPO proceeds to quadruple to record $160 billion in 2026 as dealmaking rebounds, says Goldman (Reuters): U.S. equity markets are set for a sharp rebound in IPOs in 2026, Goldman Sachs analysts said, forecasting proceeds quadrupling to a record $160 billion as marquee names such as SpaceX, OpenAI and Anthropic edge closer to public listings.

Crypto World

SoFi Stock Surges 7% as Executives Buy Shares After Earnings

TLDR

- SoFi stock surged 7% Friday after two executives bought shares totaling over $200,000 following the company’s Q4 earnings beat

- Citizens upgraded the stock to Market Outperform with a $30 target, while JPMorgan moved to Buy with a $31 target

- The fintech company posted Q4 EPS of $0.13 versus $0.11 expected and revenue of $1.03 billion versus $973.43 million forecast

- Insiders have purchased $204,800 in stock over the past three months, showing management confidence

- The stock has dropped 20% year-to-date despite strong revenue growth of 35.6% over the last twelve months

SoFi Technologies shares jumped over 7% Friday following insider purchases by two company executives. The buying activity occurred just days after the fintech platform reported quarterly results that exceeded analyst estimates.

General Counsel Robert S. Lavet acquired 5,000 shares for approximately $105,200 on February 6. EVP Eric Schuppenhauer purchased 5,000 shares the previous day for roughly $99,650. Both executives bought shares after the stock pulled back from recent highs.

The purchases followed SoFi’s fourth-quarter earnings announcement. The company reported earnings per share of $0.13, beating the consensus estimate of $0.11. Revenue hit $1.03 billion for the quarter, surpassing expectations of $973.43 million.

Analyst Upgrades Drive Momentum

Citizens upgraded SoFi from Market Perform to Market Outperform with a $30 price target. The upgrade represents about 44% upside from current levels around $20.86. The firm attributed the recent selloff to broader market rotation rather than company-specific issues.

JPMorgan also upgraded the stock to Buy from Hold. The bank set a $31 price target and highlighted improved execution and steady member growth. Analysts noted that SoFi continues adding customers while some competitors experience slower growth.

Mizuho maintained its Outperform rating with a $38 price target. The firm recommended investors buy on weakness after the post-earnings dip. Needham kept its Buy rating but adjusted its target to $33 from $36.

The stock has fallen roughly 20% year-to-date after trading above $30 in late 2025. Citizens views this decline as creating an opportunity for investors. The company has grown revenue 35.6% over the past twelve months.

Insider Activity Signals Confidence

The recent executive purchases add to a broader pattern. Corporate insiders have bought $204,800 worth of stock over the last three months according to regulatory filings.

While insider buying doesn’t guarantee future gains, it often attracts investor attention. Executives are investing their own capital at current price levels.

Citizens highlighted SoFi’s shift toward fee-based and capital-light revenue streams. The firm also pointed to opportunities in blockchain, artificial intelligence, business banking, and new loan platforms.

The stock has traded between $8.60 and $32.73 over the past 52 weeks. Current prices sit near the middle of that range following the pullback.

SoFi continues expanding its member base and product portfolio. The company is monetizing its platform while entering new business verticals. The combination of earnings results, analyst upgrades, and insider purchases pushed shares higher this week.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

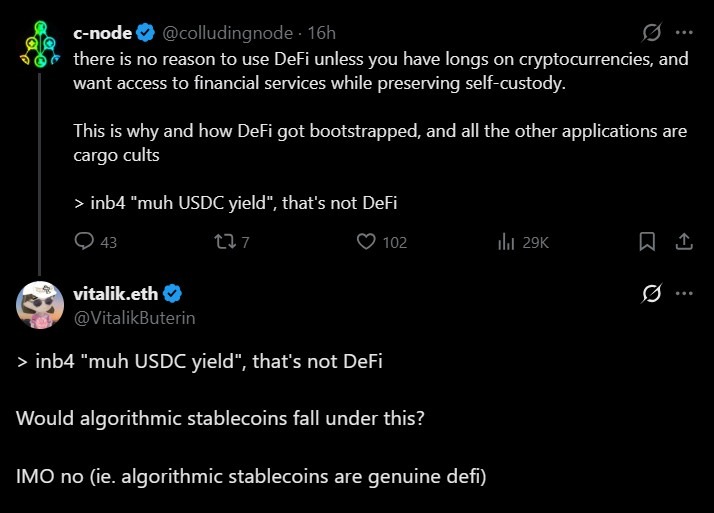

Ethereum co-founder Vitalik Buterin drew a clear boundary around what he considers “real” decentralized finance (DeFi), pushing back against yield-driven stablecoin strategies that he says fail to meaningfully transform risk.

In a discussion on X, Buterin said that DeFi derives its value from changing how risk is allocated and managed, not simply from generating yield on centralized assets.

Buterin’s comments come amid renewed scrutiny over DeFi’s dominant use cases, particularly in lending markets built around fiat-backed stablecoins like USDC (USDC).

While he did not name specific protocols, Buterin took aim at what he described as “USDC yield” products, saying they depend heavily on centralized issuers while offering little reduction in issuer or counterparty risk.

Two stablecoin paths outlined

Buterin outlined two paths that he considers to be more aligned with DeFi’s original ethos: an Ether (ETH)-backed algorithmic stablecoin and a real-world asset (RWA) backed algorithmic stablecoin that is overcollateralized.

In an ETH-backed algorithmic stablecoin, he said that even if most of a stablecoin’s liquidity comes from users who mint the token by borrowing against crypto collateral, the key innovation is that risk can be shifted to markets rather than a single issuer.

“The fact that you have the ability to punt the counterparty risk on the dollars to a market maker is still a big feature,” he said.

Buterin said that stablecoins backed by RWAs could still improve risk outcomes if they are conservatively structured.

He said that if such a stablecoin is sufficiently overcollateralized and diversified so that the failure of a single backing asset would not break the peg, the risk faced by holders would still be meaningfully reduced.

USDC dominates DeFi lending

Buterin’s comments land as lending markets across Ethereum remain heavily centered on USDC.

On Aave’s main Ethereum deployment, more than $4.1 billion worth of USDC is currently supplied out of a total market size of about $36.4 billion, with roughly $2.77 billion borrowed, according to protocol dashboard data.

A similar pattern appears on Morpho, which optimizes lending across Aave and Compound-based markets.

On Morpho’s borrow markets, three of the five largest markets by size are denominated in USDC, typically backed by collateral like wrapped Bitcoin or Ether. The top borrowing market lends USDC and has a market size of $510 million.

On Compound, USDC remains one of the protocol’s most used assets, with about $382 million in assets earning yield and $281 million borrowed. This is supported by roughly $536 million in collateral.

Cointelegraph reached out to Aave, Morpho and Compound for comment. Aave and Morpho acknowledged the inquiry, while Compound had not responded by publication.

Related: CFTC expands payment stablecoin criteria to include national trust banks

Buterin’s call for decentralized stablecoins

Buterin’s critique does not reject stablecoins outright but questions whether today’s dominant lending models deliver the decentralization of risk that DeFi promises.

The comments also build on earlier critiques he made about the structure of today’s stablecoin market.

On Jan. 12, he argued that Ethereum needs more resilient decentralized stablecoins, warning against designs that rely too heavily on centralized issuers and a single fiat currency.

At the time, he said stablecoins should be able to survive long-term macro risks, including currency instability and state-level failures, while remaining resistant to oracle manipulation and protocol errors.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics20 hours ago

Politics20 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat14 hours ago

NewsBeat14 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business19 hours ago

Business19 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports9 hours ago

Sports9 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics22 hours ago

Politics22 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat4 hours ago

NewsBeat4 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

![[TIKTOK] Lisa Money Trend](https://wordupnews.com/wp-content/uploads/2026/02/1770644804_maxresdefault-80x80.jpg)