Crypto World

Strategy Makes Another Bitcoin Purchase as Unrealized Losses Mount

The company’s latest purchase raised some eyebrows due to the poor timing.

Michael Saylor, the Bitcoin champion behind Strategy’s BTC accumulation strategy, announced minutes ago the latest acquisition made by the company, in which it spent $90 million to accumulate 1,142 units.

Consequently, the firm’s total stash has grown to 714,644 BTC, acquired at an average price of $76,056 for a total of $54.35 billion. Thus, Strategy’s bitcoin holdings continue to be in the red as the asset trades below $70,000 at press time.

Strategy has acquired 1,142 BTC for ~$90.0 million at ~$78,815 per bitcoin. As of 2/8/2026, we hodl 714,644 $BTC acquired for ~$54.35 billion at ~$76,056 per bitcoin. $MSTR $STRC https://t.co/4X2c81LQwm

— Michael Saylor (@saylor) February 9, 2026

Given the cryptocurrency’s adverse movements over the past week or so, the average price of $78,815 per BTC means that Strategy completed its acquisition on Monday or Tuesday. After all, the asset plunged hard in the following days and hasn’t traded at such high prices for a week now.

This raised some questions within the cryptocurrency community, including Satoshi Flipper, who indicated that buying BTC at these levels, even with DCA, makes these purchases “beyond silly.”

DCA all the way but what’s up with these purchase prices, they are beyond silly.

$78k?

So the last time price was $78k it was 2/2-2/3 … these must be purchases made 1 week ago. https://t.co/V0LSZvS4yr

— Satoshi Flipper (@SatoshiFlipper) February 9, 2026

Interestingly, Strategy’s stock prices ended the previous week on a high note, skyrocketing by over 26% to $135. However, MSTR has dropped by nearly 4% in pre-market trading today. On a monthly scale, MSTR’s price is down by 14% despite Friday’s bounce.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BYD Sues U.S. Government Over Tariffs on Chinese Imports

TLDR

- BYD has filed a lawsuit against the U.S. government, challenging tariffs imposed by President Trump using IEEPA.

- The company seeks a refund for tariffs paid since April 2018, claiming they harm its U.S. operations.

- BYD’s lawsuit is the first by a Chinese automaker to challenge U.S. tariffs on imports.

- Despite tariffs, BYD overtook Tesla in 2025 global EV sales, delivering 2.26 million vehicles.

- BYD plans expansion with 13 models, including the U9 Xtreme hypercar, and 3,000 fast-charging stations.

Chinese automaker BYD has filed a lawsuit against the U.S. government over tariffs imposed by President Donald Trump. The lawsuit challenges Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. BYD also seeks a refund for all levies paid since April 2018 as part of its ongoing dispute.

BYD’s Legal Challenge Against U.S. Tariffs

BYD’s lawsuit is the first by a Chinese carmaker challenging U.S. tariffs on imported goods. The company filed the complaint on January 26 at the U.S. Court of International Trade. In its suit, BYD’s U.S. subsidiaries argue that the IEEPA does not authorize the imposition of tariffs.

The complaint asserts that the word “tariff” is not used within the text of the law, invalidating the basis for the levies. BYD’s suit seeks a refund for the tariffs it has already paid since April 2018.

The company claims the tariffs unfairly impacted its operations in the U.S., which includes sales of buses, commercial vehicles, batteries, and solar panels. The lawsuit also argues that the levies violate international trade principles by imposing excessive costs on foreign businesses operating in the U.S.

Legal Implications and Ongoing Supreme Court Case

In addition to BYD’s lawsuit, the U.S. Supreme Court is reviewing a separate case on the legality of the tariffs. Trade Representative Jamieson Greer confirmed that the Supreme Court is carefully considering the case, given its broad implications.

The decision could affect future tariffs and trade policies, especially regarding their impact on foreign companies and their rights to challenge such measures. Despite the legal actions, the tariffs remain in place for the time being, with BYD pushing forward to protect its interests.

The company’s lawsuit represents a broader push by global businesses to challenge the U.S. government’s use of tariffs under the IEEPA. These legal proceedings are likely to shape future trade policies and enforcement.

BYD Overtakes Tesla in Global EV Sales

Despite pressure from tariffs, BYD surpassed U.S.-owned Tesla in global EV sales, delivering 2.26 million battery-electric vehicles in 2025. The company, originally a battery manufacturer, has expanded into a major EV maker, employing over 120,000 R&D engineers.

BYD’s manufacturing expertise plays a key role in its success, producing components for about a third of the world’s smartphones. The company now offers 13 car models across Europe and the Gulf region, including the high-speed U9 Xtreme hypercar and the Euro NCAP five-star-rated Dolphin. BYD is addressing charging infrastructure with innovative 1-megawatt charging technology and plans for 3,000 fast-charging stations.

Crypto World

Pony AI Begins Mass Production of Robotaxis with Toyota Partnership

TLDR

- Pony AI has started mass production of its autonomous robotaxis in partnership with Toyota, planning 1,000 units this year.

- By 2026, Pony AI aims to operate a fleet of 3,000 autonomous vehicles across mainland China, Europe, and the GCC.

- The robotaxis will feature level 4 (L4) autonomous capabilities, capable of operating without human intervention.

- Pony AI plans to offer affordable robotaxi services, with fares up to 10% lower than regular taxi rides.

- The company’s strategy includes expanding infrastructure, such as ultra-fast charging stations, to support robotaxi growth.

Pony AI has initiated mass production of its autonomous robotaxis in collaboration with Toyota. The company plans to roll out 1,000 driverless cabs this year, with deployment in key cities across mainland China. This move signals a major milestone in the commercialization of autonomous vehicles and the company’s ambitious expansion.

Mass Production of Robotaxis Begins

Pony AI, the Chinese self-driving technology firm, has started the production of its robotaxis in collaboration with Toyota. By the end of 2026, the company expects to operate a fleet of more than 3,000 autonomous vehicles globally. The Guangzhou-based company emphasized the milestone as a new phase in scaling production and commercial deployment.

The development also highlights the deep integration between the partners in autonomous driving technology and vehicle manufacturing. According to the company, the partnership leverages Toyota’s vehicle manufacturing capabilities combined with Pony AI’s advanced self-driving technology.

The vehicles will feature level 4 (L4) autonomous capabilities, meaning they can operate without human intervention under most conditions. As the first step in its global strategy, Pony AI aims to provide autonomous services in mainland Chinese cities and potentially expand to other international markets by 2026.

Pony AI’s Vision for the Future of Autonomous Vehicles

Pony AI has outlined its plans to expand its robotaxi fleet to more than 3,000 units by the end of 2026. The company intends to operate autonomous vehicles not just in China, but also in regions such as Europe and the Gulf Cooperation Council (GCC). The cars will provide affordable mobility options, with fares up to 10% lower than regular taxi services.

Pony AI’s rapid scaling strategy includes establishing the necessary infrastructure for autonomous driving, such as ultra-fast charging stations and battery storage solutions. Pony AI’s collaboration with Toyota aims to create a model for the global autonomous taxi market.

According to financial consultant Ding Haifeng, the combination of self-driving technology and robust vehicle assembly creates a powerful growth engine for the robotaxi industry. With 1,000 driverless cabs set to hit the streets this year, the company is making strides toward widespread adoption and furthering its mission to revolutionize urban transportation.

Crypto World

ETH Movements Hit Peak Levels Since Last August

On-chain data shows ETH transfers climbing to 2.75M as holders rush to stablecoins and exchanges during sharp drawdown.

Ethereum (ETH) has seen a notable rise in on-chain token transfers this week as its price slid from around $3,000 to near $2,000, with activity reaching levels last seen in August 2025, according to data shared by analyst CryptoOnchain.

The surge in token movement points to heavy sell-side pressure and forced repositioning, even as other indicators suggest a tightening supply on exchanges.

Token Transfers Spike as ETH’s Price Drops

CryptoOnchain’s assessment showed Ethereum’s 14-day simple moving average of total tokens transferred climbing from about 1.6 million on January 29 to approximately 2.75 million by February 7. That is the highest reading since August 2025 and came as ETH corrected sharply from the $3,000 area to the low $2,000s.

The divergence between falling prices and rising network activity is often associated with panic-driven behavior, where holders rush to move assets during fast drawdowns.

CryptoOnchain linked the spike to investors rotating into stablecoins, moving funds onto exchanges for sale, and a wave of liquidations across decentralized finance protocols as collateral values fell.

“This significant spike in ERC-20 token transfers during a price crash suggests investors are rushing to exit positions, likely converting volatile assets into stablecoins or moving funds to exchanges for liquidation,” the market observer wrote.

The timing also lines up with a broader market sell-off that saw Bitcoin fall from above $80,000 to near $60,000 before rebounding toward $72,000, while Ethereum struggled to hold key support near $2,000.

Selling pressure has not been limited to smaller holders, with the likes of Ethereum co-founder Vitalik Buterin selling more than 6,100 ETH over several days last week. Other large holders also reduced exposure to repay loans, adding to short-term pressure during the drop.

You may also like:

Exchange Balances Fall Even as Volatility Stays High

Despite the recent rush of token movement, several indicators have also pointed to declining ETH availability on exchanges. According to on-chain detective CoinNiel, Ethereum held on exchanges has fallen to levels last seen in mid-2016. Experts from the Arab Chain platform also added that Binance’s ETH reserves have dropped to about 3.7 million ETH, the lowest since 2024.

The situation has created a mixed picture. On one hand, ETH’s price action remains weak, with the asset currently trading around $2,040, down about 3% over the past 24 hours and nearly 11% in the last seven days. The token briefly dipped below $1,900 on February 5, per data from CoinGecko, before recovering to its current level.

On the other hand, falling exchange balances suggest fewer coins are readily available for spot selling, and some of the recent transfers may reflect stress-driven repositioning rather than long-term distribution. According to CryptoOnchain, similar spikes in transfer activity during past drawdowns have sometimes occurred near local lows, once forced selling eased.

For now, Ethereum sits between ongoing volatility and shrinking exchange supply, with on-chain data showing fear-driven movement even as longer-term holders continue pulling coins off trading platforms.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

EU Launches NanoIC, Europe’s Largest Chips Act Pilot Line

TLDR

- The EU has launched NanoIC, its largest Chips Act pilot line, with €700 million in funding to advance semiconductor capabilities.

- NanoIC will use extreme ultraviolet lithography to produce semiconductors beyond two nanometres, crucial for AI and 6G tech.

- The facility at IMEC Leuven allows open access for start-ups, researchers, and large organizations to collaborate on chip designs.

- The EU aims to increase semiconductor production to 20% of global output by 2030, with NanoIC playing a key role.

- NanoIC’s €2.5 billion investment includes funding from the EU, national governments, and industry partners like ASML.

The European Union has launched NanoIC, the largest pilot line under its Chips Act initiative. The €2.5 billion project aims to enhance Europe’s semiconductor capabilities. The EU has committed €700 million, with additional funding from national governments and industry partners.

NanoIC to Boost Europe’s Semiconductor Manufacturing Capabilities

The NanoIC facility at IMEC Leuven will be Europe’s first to deploy the latest extreme ultraviolet lithography machine. This technology will allow for the manufacturing of semiconductors beyond two nanometres.

The project aims to improve the development of next-generation semiconductor technologies, crucial for AI, autonomous vehicles, healthcare, and 6G mobile technologies.

The NanoIC facility will help Europe compete with global semiconductor leaders, allowing institutions and companies to test chip designs at a near-industrial scale.

The facility provides open access, enabling start-ups, researchers, and large organizations to collaborate on new chip designs. The partnership between the EU, IMEC, and several other organizations ensures that the facility can rapidly scale and contribute to the European semiconductor ecosystem.

European Union Investment and Strategic Collaborations

The €700 million in EU funding is part of a €2.5 billion total investment in the NanoIC project. This collaboration includes national and regional government contributions, along with investments from industry partners such as ASML.

The Chips for Europe initiative, supported by NanoIC, aims to strengthen Europe’s position in the global semiconductor market and attract talent to the region. The opening of NanoIC marks a step in Europe’s plan to develop a self-sustaining semiconductor industry.

The facility’s open-access approach allows multiple stakeholders to benefit from advancements in semiconductor manufacturing. By 2030, the European Union aims to produce at least 20% of the world’s semiconductors, with this facility playing a key role in meeting that target.

Crypto World

Trading Techniques of the Inside Bar Pattern

Candlestick patterns are an important part of a comprehensive trading strategy. However, it may be difficult to choose the pattern you can rely on. In this case, traders focus on the most popular setups that have proven to work across various markets and timeframes. One of such patterns is the inside bar pattern.

In price action trading, the inside bar is often analysed as a pause in market structure, reflecting short-term volatility compression that may lead to either trend continuation or trend reversal.

In this article, we will break down the basics of the inside bar pattern, examine examples of this formation on real-market price charts, and discuss how to interpret its signals for trading purposes.

What Is an Inside Bar Candle Pattern?

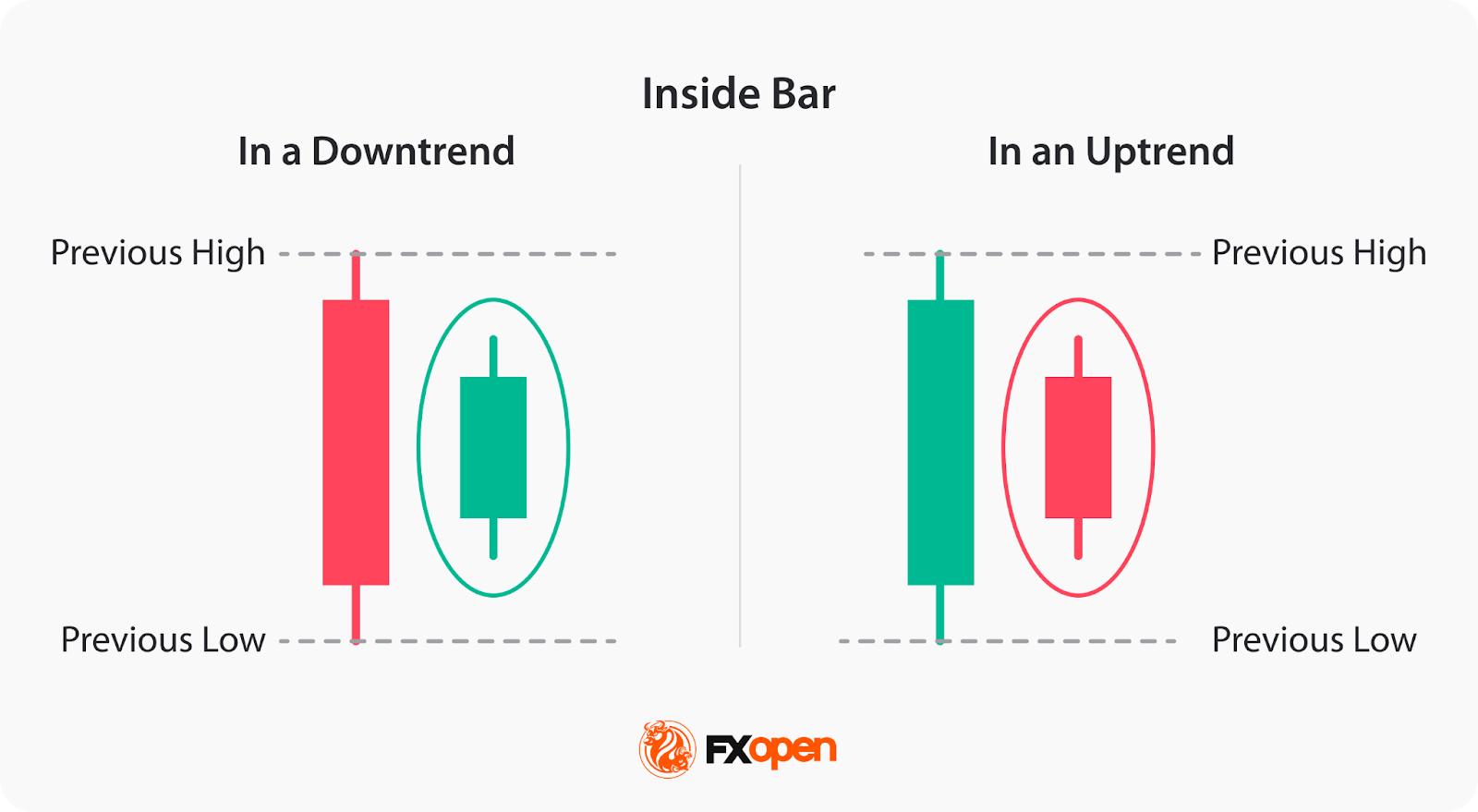

An inside bar is a two-candlestick formation that appears on a price chart when a candlestick’s high and low range is contained within the high and low range of the preceding candle. In other words, the entire price action of one candle is confined within the previous candlestick’s price range.

The preceding candle is commonly referred to as the mother bar, while the following candle is the inside bar itself. This formation highlights range contraction and a brief consolidation phase, where buying and selling pressure temporarily reach equilibrium.

Still, the pattern doesn’t signal a trend reversal or a trend continuation. The price may continue moving in the prevailing trend or turn around. Also, the pattern may appear in both an uptrend and a downtrend.

The inside bar can be observed across different financial instruments such as stocks, cryptocurrencies*, ETFs, indices, and forex currency pairs and can be traded using contracts for difference (CFDs) provided by FXOpen. In the forex market, traders most often apply the inside bar pattern to liquid currency pairs, where higher trading volume may support trade execution.

Identifying the Inside Bar on Trading Charts

To identify this formation on trading charts, traders follow these steps:

- Look for two candlesticks: Traders start by identifying two candlesticks that look like the inside bar.

- Compare the high and low range: After that, they check if the high and low range of the subsequent candle, inside bar, is entirely contained within the high and low range of the preceding candlestick, mother bar.

- Confirm the pattern: Once they identify that the subsequent candle meets the criteria, traders confirm it as an inside bar.

The reliability of the pattern’s signals may vary by timeframe, with many traders favouring the H1, H4, or daily charts, as higher timeframes tend to filter out market noise and reduce the risk of false breakouts.

In the forex market, inside bars tend to form more frequently during lower-liquidity periods, such as the Asian session, while breakouts are more commonly observed during high-liquidity phases like the London and New York session overlap.

Many traders incorporate multi-timeframe analysis when evaluating inside bar setups. A formation that appears on a lower timeframe but aligns with a higher-timeframe trend or key level may carry more significance than a pattern that develops in isolation. For example, an inside bar forming on an hourly chart within a daily uptrend may be interpreted as a continuation signal rather than a reversal attempt, particularly when supported by broader market structure.

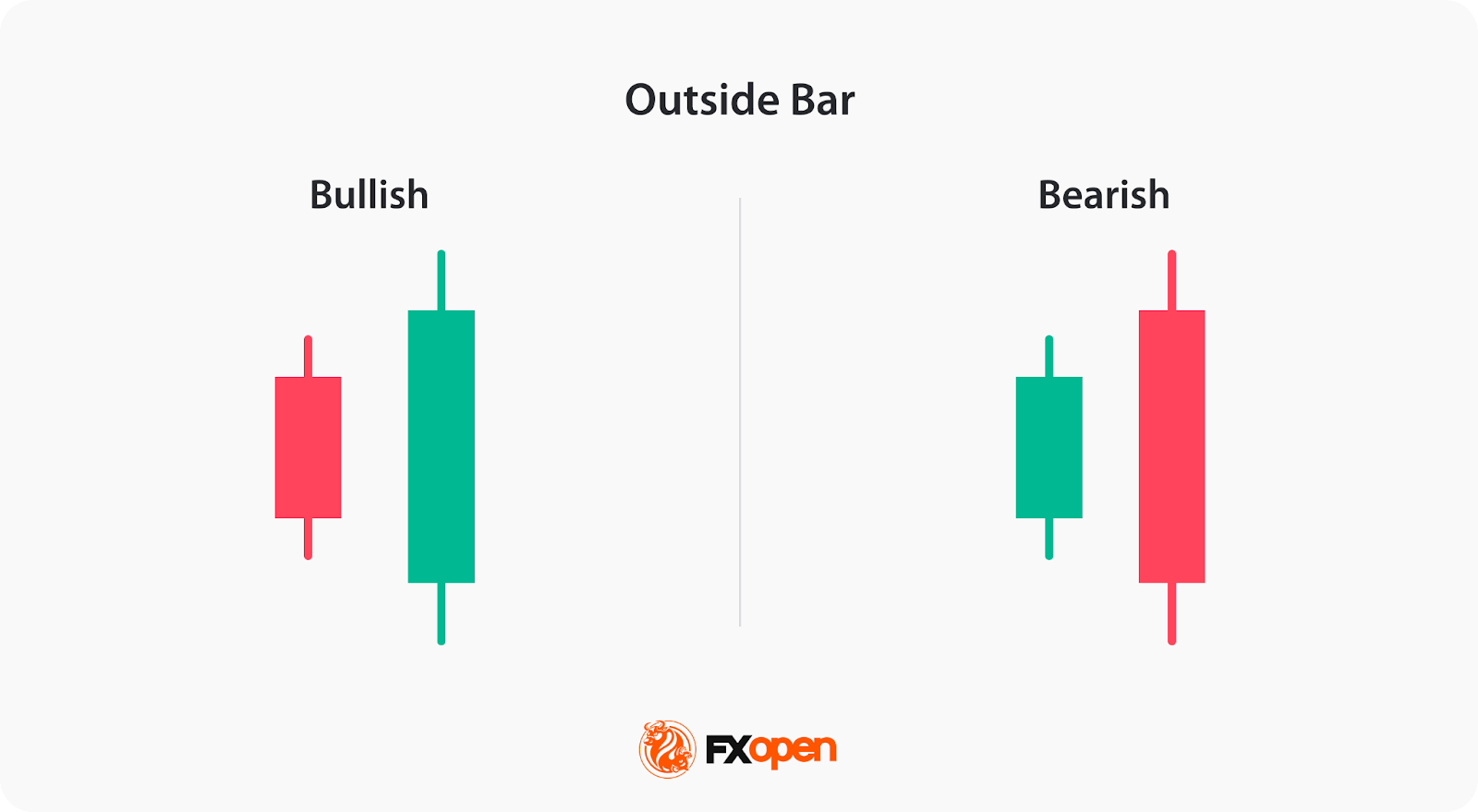

Inside Bar vs Outside Bar

The inside candle pattern occurs when the high and low of a candle are contained within the range of the preceding candlestick, indicating consolidation or indecision in the market. It suggests a potential reversal or continuation of the current trend.

On the other hand, an outside bar—often considered a form of engulfing pattern—appears when a candlestick completely exceeds the previous candle’s high–low range. As Al Brooks defines it in his Trading Price Action Trends, an outside bar occurs when “the high of the current bar is above the high of the previous bar and the low is below the low of the previous bar,” reflecting increased participation from both buyers and sellers. A bearish outside setup typically forms near the top of an uptrend and may signal a downward reversal, while a bullish outside setup forms near the bottom of a downtrend and may suggest an upward reversal.

While the inside bar reflects volatility compression and consolidation, the outside bar typically signals volatility expansion and a stronger momentum shift in price action. Both are widely used by traders for technical analysis and identifying potential trades.

Traders can analyse outside and inside bars on forex, stocks, and other markets using the FXOpen TickTrader platform.

Trading the Inside Bar Pattern

Trading with the inside bar candlestick pattern involves using it as a signal for potential breakouts or continuation of the prevailing trend. Here are the steps traders usually follow when trading with the pattern:

Determine the Direction of the Preceding Trend

Traders may use trendlines or moving averages (EMA or SMA) to define overall market bias and confirm trend direction.

When the formation develops within a strong, established trend and aligns with that trend’s direction, it is typically interpreted as a continuation setup. However, when the same structure appears after an extended directional move and forms at significant technical levels such as higher-timeframe support, resistance, or supply and demand zones, it may instead reflect trend exhaustion and potential reversal conditions. For this reason, traders evaluate both trend context and location before assigning directional bias to the pattern.

In some cases, several inside bars may form consecutively, creating a coiling pattern that reflects extended price compression and can precede a stronger volatility expansion.

Wait for a Breakout

The formation indicates consolidation and potential price compression. Traders often wait for a breakout from the setup’s range to initiate a trade. A breakout above the high of the formation suggests a bullish signal, while a breakout below the low indicates a bearish signal.

However, failed or false breakouts—sometimes referred to as fakey setups—can occur when price briefly breaks the mother bar range before reversing, often due to low liquidity or weak momentum.

Breakouts that occur near key support and resistance levels confirmed by additional tools are often considered stronger. John Murphy’s Technical Analysis of the Financial Markets highlights the value of indicators such as RSI and MACD in confirming breakout strength. Low-volume moves carry a higher risk of false breakouts.

Some traders monitor these false breaks as potential reversal signals, particularly when they occur against an extended trend.

Consider Additional Confirmation

Many traders wait for 2-3 candlesticks to form in a breakout direction. Also, to avoid false breakouts, traders may look for additional confirmation indicators to support their trading decisions. An increasing volume at the breakout or a signal from a trend indicator may provide additional confluence. Common confirmation tools include Average True Range (ATR) and volume indicators, which may help assess volume and volatility conditions.

Set Their Entry Points

Traders typically apply several entry models when trading an inside bar setup. The most common approach is a breakout entry using stop orders placed beyond the high or low of the mother bar.

In trend-continuation conditions, traders may also use a break-and-retest model, entering after price closes beyond the formation and then retests the breakout level as support or resistance.

Set Stop-Loss and Take-Profit Orders

Although there are no strict rules, traders typically set stop-loss orders above the bearish and below the bullish pattern, considering the timeframe and the entry point, so they aren’t too wide. Some traders trail stops below swing highs or lows during strong trends. Monitoring volatility through tools such as ATR may also help traders determine whether to widen or tighten stops as the market transitions from consolidation to expansion.

For take-profit targets, traders might consider significant swing points or key support/resistance levels. As part of risk management, traders often apply predefined risk-to-reward ratios (such as 1:2 or 1:3) and adjust position sizing.

Live Market Example

Below, we provide an example of an inside bar breakout strategy with a bullish inside bar stock pattern on a Tesla chart. This setup represents a typical bullish continuation pattern, where the breakout is confirmed by candles closing above the mother bar’s high and holding above a nearby resistance level.

Following the inside bar breakout trading strategy, the trader waits for the breakout above the high of the mother bar marked by a horizontal line. The stop loss is set below the candle’s low, and the take profit is at the next resistance level.

Final Thoughts

While the inside bar pattern can be a useful tool for identifying trend reversals and continuations, it’s important not to rely solely on this pattern for your trading decisions. In practice, traders often combine the inside bar with technical indicators, broader market context, and structured risk management tools to form a complete trading strategy.

If you want to develop your own trading strategy, you can use FXOpen’s TickTrader trading platform. If you have a strategy and you would like to trade it across over 700 instruments with tight spreads and low commissions (additional fees may apply), you can consider opening an FXOpen account.

FAQ

Is an Inside Bar Bullish or Bearish?

The inside bar setup does not inherently indicate a bullish or bearish bias. It simply represents a period of consolidation or market indecision. Thus, a formation in an uptrend can be bullish and signal a continuation of the trend, or bearish and signal a trend reversal. The same concept applies to a downtrend, where the indicator may be bearish and the trend will continue, or bullish and the trend will reverse.

What Does a Bullish Inside Bar Mean?

The meaning of an inside bar candle pattern that is bullish refers to the pattern, after which the price moves upwards. When this pattern forms during an uptrend, it suggests a temporary pause or consolidation before the uptrend potentially resumes. When it is formed in a downtrend, it signals a trend reversal.

What Is the Inside Bar Strategy?

In the inside bar strategy, traders wait for the pattern to form and look for a breakout above the high of the formation to enter a long position or below the low to enter a short trade. A stop-loss order might be placed below the low of the pattern in a long trade and above the high of the pattern in a short trade. Profit targets can be determined based on the trader’s trading plan, technical indicators, or key support and resistance levels.

How May You Confirm an Inside Bar Signal?

As the inside bar provides both continuation and reversal signals, it is critical to confirm them. First, traders wait for the pattern to form and the following candles to close above or below it. Second, traders use volume or momentum indicators to identify the strength of the price movements. Another option is to use chart patterns that also provide continuation or reversal signals. Confirmation may also come from alignment with support and resistance or volatility conditions measured by ATR.

Are Inside Bars More Popular in Downtrends?

No, the inside bar pattern can be used in both uptrends and downtrends. No statistics can confirm that the pattern is more preferable in a downtrend. Traders can use it in their trading strategies regardless of the trend they trade in.

Which Timeframe Is Most Popular for Inside Bar Trading?

The inside bar pattern can form on any timeframe, but many traders consider it more reliable on higher timeframes, such as the H1, H4, and daily charts. Higher timeframes tend to reduce market noise and filter out minor price fluctuations, which may lower the risk of false breakouts. Lower timeframes, such as 5-minute or 15-minute charts, can also be used, but they often require stricter confirmation and more active risk management.

Is the Inside Bar a Breakout or Continuation Pattern?

The inside bar is described as a neutral consolidation pattern rather than a strictly breakout or continuation setup. It reflects a pause in price action caused by range contraction and reduced volatility. Depending on market context, an inside bar may lead to a breakout, signal a trend continuation, or occasionally precede a trend reversal. Traders usually rely on the prevailing trend, support and resistance levels, and confirmation tools, such as momentum readings from RSI or MACD, increased volume, or volatility conditions measured by ATR, to determine how to trade the setup. However, in the Encyclopedia of Chart Patterns, Bulkowski presents that the pattern provides continuation signals in 62% of cases.

How Reliable Is the Inside Bar in Forex Trading?

The reliability of the inside bar in forex trading depends largely on market conditions and confirmation. The common required conditions for any trade are liquid currency pairs and active trading sessions, such as the London or New York sessions. When combined with tools like support and resistance, momentum indicators, and clear risk management rules, the inside bar can be a useful component of a broader trading strategy. On its own, however, it should not be treated as a guaranteed signal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Coinbase’s Super Bowl ad was fun until it wasn’t

Coinbase’s latest Super Bowl ad has been labelled a “textbook example of scaring the hoes” after its low-effort karaoke segment was met with boos and intense online criticism.

The crypto exchange’s ad featured the song “Everybody (Backstreet’s Back)” by the Backstreet Boys with some PowerPoint-esque sing-along subtitles that ended with Coinbase’s name.

However, footage of Super Bowl watchers shared online showed groups happily singing along until Coinbase’s name appeared, causing a chorus of boos and groans.

Read more: The Context 159: ⁉️ Epstein, a convicted pedo, invested in Coinbase

Another group was recorded singing along to the Backstreet Boys, only for them to ignore, and at points ridicule, the insertion of Coinbase’s name.

For many users on X, the reaction was the same, as rooms filled with people watching the NFL showpiece voiced their displeasure at the inclusion of Coinbase’s name.

Semafor’s social media editor said, “That Backstreet Boys karaoke ad was really fun until it wasn’t,” while X user “Spor” claimed that the bar he was in “viciously boo’d” the Coinbase ad.

To make matters worse, other users were confused by the timing of the ad and believed that it was a continuation of the T-Mobile advert that had just played before with its own Backstreet Boys song.

What was Coinbase thinking?

Coinbase execs told Variety that the lo-fi styled ad, reminiscent of an old karaoke machine, was pitched as a simple way to grab the viewers’ attention against a backdrop of high-budget, flashy Super Bowl ads.

The firm’s Chief Marketing Officer, Cat Ferdon, said, “We’re still competing with people’s cell phones, and this ad will undoubtedly get them and anyone to look up.”

Coinbase CEO Brian Armstrong echoed that he wanted an advert to cut through a loud room. He added that by turning millions of screens into a karaoke machine, he was offering “an antidote to polarization and just plain fun.”

Read more: Coinbase seemingly vanishes prediction market pages after leak

The firm clearly clocked onto the backlash, and in response to one user calling the ad terrible, Coinbase said, “If you’re talking about it, it worked. Crypto is for everybody.”

It’s another example of Coinbase not quite nailing its ads. The UK’s advertising watchdog banned a series of Coinbase spots last month after it “trivialised the risks of cryptocurrency” by claiming crypto could help during the country’s cost-of-living crisis.

The company was also criticised for sponsoring the US Army’s 250-year anniversary parade, which coincided with Donald Trump’s birthday last year, as a gross endorsement of the military.

The half-time show wasn’t well-received either

There was also a lot of disdain from right-wing figures who described the Super Bowl’s featured performance by Bad Bunny, real name Benito Antonio Martinez Ocasio, as un-American.

Bad Bunny’s performance was a homage to Puerto Rico and the surrounding countries in the Caribbean. It called for unity among the countries while a billboard read, “The only thing more powerful than hate is love.”

However, not everybody agreed, with social media personality Jake Paul calling Bad Bunny “a fake American citizen who publicly hates America,” while right-wing talk show host Megyn Kelly also implied that he doesn’t love America.

Donald Trump described the Super Bowl show as “absolutely terrible, one of the worst, EVER!“

Read more: ANALYSIS: Eric and Donald Trump Jr. are cashing in on crypto

Amanda Vance, daughter of the vice president, posted an over-the-top clip of herself watching and singing the alternative half-time show put on by the right-wing advocate firm founded by Charles Kirk.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Important Binance Announcement Concerning Ripple (XRP) And Other Altcoin Traders: Details Here

The exchange has prepared two actions that will take effect on February 10.

The world’s largest crypto exchange will implement certain amendments to address ongoing market trends and enhance the trading experience for users.

Some of the cryptocurrencies included in the upcoming efforts are Ripple (XRP), Sui (SUI), Aster (ASTER), Internet Computer (ICP), and others.

The New Additions

The company announced it will expand the list of trading pairs on Binance Spot by adding XRP/U, SUI/U, ASTER/U, and PAXG/U. The listing is scheduled for February 10, whereas trading bots services for the aforementioned pairs will become available on the same date.

U stands for United Stables – a stablecoin launched toward the end of 2025 and pegged to the US dollar. Binance revealed that all eligible users will enjoy zero maker fees on XRP/U, SUI/U, and ASTER/U “until further notice.” In addition, VIP clients will be offered zero-taker fees on those pairs.

The exchange informed that the new offerings will not be available to all users, noting that those residing in the USA, Canada, Iran, the Netherlands, and other countries will be excluded.

While backing from Binance may be price-positive for the included cryptocurrencies, such an effect is generally observed at initial listings rather than from the addition of extra trading pairs. In fact, XRP, SUI, and ASTER have headed south today (February 9), coinciding with the overall decline of the broader crypto market.

Goodbye to These Pairs

Besides adding new offerings, Binance regularly monitors its service offerings and removes pairs that don’t meet the required criteria. Recently, it announced it will scrap 20 pairs, including BERA/BTC, ICP/ETH, KAITO/FDUSD, MANA/ETH, ZRO/BTC, and others.

You may also like:

“The delisting of a spot trading pair does not affect the availability of the tokens on Binance Spot. Users can still trade the spot trading pair’s base and quote assets on other trading pair(s) that are available on Binance,” the company clarified.

The assets included in the delisting effort are in the red today, which is rather normal given the ongoing bearish condition of the market and the negative impact that such Binance moves can have.

It is important to note that a complete termination of all services for a particular token typically has a far more severe influence. In October last year, Binance delisted Flamingo (FLM), Kadena (KDA), and Perpetual Protocol (PERP), triggering double-digit declines. Prior to that, BakerySwap (BAKE), Hifi Finance (HIFI), and Self Chain (SLF) crashed hard due to the same reason.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ripple Expands Institutional Custody Offering with New Partnerships and Capabilities

TLDR

- Ripple expands its custody services through new partnerships with Securosys and Figment.

- Ripple’s collaboration with Securosys introduces CyberVault HSM and CloudHSM.

- Ripple’s Custody now supports a wide range of HSM providers, ensuring seamless compliance across various regulatory jurisdictions.

- The partnership with Figment allows Ripple to offer staking for Proof-of-Stake networks like Ethereum and Solana directly in custody workflows.

- Ripple’s new features, including staking and enhanced security, position the company to meet growing institutional demand for digital asset services.

Ripple has announced a series of strategic partnerships to enhance Ripple Custody, reinforcing its position as a leading digital asset custody solution. New collaborations with Securosys and Figment, along with recent integrations with Chainalysis and the acquisition of Palisade, expand Ripple Custody’s functionality. These moves aim to accelerate time-to-market, simplify procurement, and provide regulated institutions with scalable solutions.

Ripple’s New Custody Capabilities for Institutional Clients

Ripple’s partnership with Securosys introduces CyberVault HSM and CloudHSM capabilities, allowing institutions to deploy hardware security modules (HSM) for custody solutions. The new offerings eliminate the complexity and high costs traditionally associated with HSM-based custody.

With both on-premise and cloud options, customers can meet their specific security needs while maintaining high levels of protection. According to Robert Rogenmoser, CEO of Securosys, the integration of CyberVault HSM with Ripple Custody provides a ready-to-deploy enterprise-grade solution.

This solution allows institutions to maintain full control over their cryptographic keys while offering scalable and cost-effective custody options. Ripple now supports one of the broadest ranges of HSM providers, ensuring compliance across various regulatory environments.

Partnership with Figment to Enhance Staking Capabilities

Ripple’s collaboration with Figment brings staking capabilities to its Custody clients, allowing institutions to offer staking for Proof-of-Stake networks like Ethereum and Solana. By integrating staking directly into custody workflows, Ripple enables banks, custodians, and regulated enterprises to provide these services without building their own validator infrastructure.

This partnership aligns Ripple with Figment’s secure, non-custodial staking platform to offer clients a seamless staking experience. Ben Spiegelman, VP at Figment, highlighted that the partnership enables Ripple’s clients to offer secure staking rewards while ensuring compliance and security.

The integration of staking allows Ripple Custody clients to expand their product offerings, maintaining the high standards of security and governance required for institutional clients. This move positions Ripple to further capitalize on the growing demand for staking services across the financial sector.

Crypto World

Damex Secures MiCA CASP Licence

Damex has announced that its Malta entity has been granted authorisation as a Crypto Asset Services Provider under the European Union’s Markets in Crypto-Assets Regulation (MiCA) by the Malta Financial Services Authority, marking a significant milestone in the company’s regulatory and institutional development.

With this authorisation, Damex joins just 148 firms across Europe approved as a CASP under the MiCA framework. Of these, only 46 are authorised to provide custody and exchange services, and only one also holds a Gibraltar licence within its group to deliver similar regulated digital asset services currently offered by Damex.

This positions Damex among Europe’s Tier-1 Digital Asset institutions.

MiCA introduces a harmonised regulatory framework designed to raise standards across the digital asset sector, establishing clear requirements around governance, operational resilience, transparency, and consumer protection.

For businesses and financial institutions, the implications are significant. Engaging with crypto providers that are not MiCA-licensed introduces regulatory exposure and operational risks without protections.

The MiCA licence places Damex within the same regulatory recognition as major institutions such as Revolut, BBVA, and Coinbase, reinforcing its role as a trusted crypto and distributed ledger technology (DLT) partner to banks and large financial institutions across Europe.

Damex has operated at the highest levels of digital asset regulation since 2017, holding a Gibraltar DLT licence and delivering regulated infrastructure for institutional clients long before MiCA’s implementation.

While the licence has now been granted, Damex is entering its final pre-operational phase under MiCA, focusing on system readiness, governance alignment, and operational controls ahead of full launch.

The company is now welcoming early engagement from institutions and businesses seeking to operate within Europe’s regulated digital asset environment.

About Damex

Damex is a regulated digital asset and payments infrastructure group of companies serving businesses and financial institutions across Europe and globally. Operating since 2017, Damex delivers compliance focused solutions for digital asset custody, exchange, payments, and treasury operations, bridging traditional finance and the digital asset economy.

Damex Digital Ltd is a limited liability company registered in Malta with registration number C110325 with registered address at MK Business Centre 115A Floor 2, Triq Il-Wied, Birkirkara, BKR 9022, Malta. Damex Digital Ltd is authorised by the Malta Financial Services Authority as a Crypto Asset Services Provider pursuant to Regulation (EU) 2023/1114 (MICAR) to provide for its clients (i) the Custody and administration of crypto assets; (ii) exchange of crypto assets for funds and other crypto assets; (iii) execution of orders for crypto assets; and (iv) providing transfer services for crypto assets.

Please visit www.damex.io/eea for further information.

Crypto World

Ethereum Price Rebounds 23%, But $1,000 Risk Still Looms

Ethereum price hit its projected breakdown target near $1,800 in early February. It even slipped to $1,740 before bouncing. Since then, ETH has rebounded almost 23%, giving traders hope that the worst may be over.

But price rebounds inside downtrends often look strong at first. The real question is whether this bounce is supported by strong buyers. Right now, charts, on-chain data, and technical metrics suggest that support remains weak. Several warning signs still point to downside risk.

The ETH Price Breakdown Worked, But the Rebound Lacks Real Strength

On February 5, Ethereum completed a major breakdown pattern on the daily chart, as predicted by BeInCrypto analysts. This pattern usually signals that sellers are taking control. The projected target was near $1,800. Ethereum price followed that path and dropped to $1,740 on February 6.

Sponsored

Sponsored

After hitting this zone, ETH rebounded about 23%. At first glance, this looks like strong dip buying as the February 6 price candle saw a large lower wick. But momentum tells a different story.

Between February 2 and February 8, the price made lower highs. At the same time, the Relative Strength Index (RSI), which tracks short-term momentum, moved higher.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This creates a hidden bearish divergence, where momentum improves but price fails to follow.

In simple terms, price is struggling to rise, even though short-term momentum looks better. That usually means sellers are still active in the background. So while the breakdown target was reached, the rebound does not yet show deep conviction.

This weak follow-through sets the stage for the next risk.

Short-Term Bounce Is Slipping Into Another Bearish Setup

Because the rebound lacks strong follow-through, the next thing to watch is the structure of the move. On the 12-hour chart, Ethereum is forming a bearish pole and flag.

First, the price dropped sharply. Then it rebounded inside a rising channel. This is a classic continuation pattern in downtrends.

Sponsored

Sponsored

It often leads to another leg lower as volume confirms the risk. On-Balance Volume, which tracks real buying and selling activity, is staying weak. It is not rising aggressively, like the price. This means fewer real buyers are supporting the rebound. Additionally, the OBV metric itself is close to breaking down its own ascending trendline. If volume breaks down, this flag structure could fail.

That would open the door to deeper losses, around 50% from the lower trendline levels. To understand whether buyers, who led the 23% rebound, can prevent that, we need to look on-chain.

Are Short-Term Traders Buying As Long-Term Holders Sell?

On-chain data shows that the recent rebound is being driven mainly by short-term traders, not long-term investors.

A key metric here is short-term Holder NUPL, which measures whether recent buyers are sitting in profit or loss.

In early February, as Ethereum dropped to $1,740, short-term holder NUPL fell to around -0.72, placing it firmly in the capitulation zone. This reflected heavy unrealized losses among recent buyers.

During the 23% rebound, however, NUPL recovered to about -0.47. That is an improvement of roughly 35% from the bottom. While it remains negative, the speed of this recovery shows that many short-term traders rushed in to buy the dip.

Sponsored

Sponsored

This pattern closely resembles past failed bottom formations.

On March 10, 2025, NUPL also rebounded to around -0.45 while ETH traded near $1,865. At that time, many traders believed a bottom had formed. A more durable bottom only appeared on April 8, 2025, when NUPL dropped close to -0.80, roughly 75% deeper than the March level. That phase marked true seller exhaustion and preceded a sustained recovery. The price was around $1,470 at the time.

Today’s structure looks much closer to March 2025 than April 2025. Losses have eased too early, suggesting that panic has not fully cleared. At the same time, long-term holders remain cautious.

The 30-day rolling Hodler Net Position Change, which tracks investors holding ETH for more than 155 days, remains negative. On February 4, outflows stood near -10,681 ETH. By February 8, they had widened to around -19,399 ETH.

This represents an increase in net selling of roughly 82% in just four days. This signals weak conviction at current levels. So the rebound is being driven mainly by short-term traders chasing a bounce, while long-term investors continue reducing exposure.

Sponsored

Sponsored

Key Ethereum Price Levels Show Why the $1,000 Risk Is Still Alive

All technical and on-chain signals now point to a weak structure. Ethereum must reclaim key resistance to stay safe. The first resistance is near $2,150.

Holding above this would ease short-term pressure. The major invalidation level is $2,780.

Only above this would the bearish structure truly break. On the downside, risk remains heavy.

Key support levels are:

- $1,990: short-term support

- $1,750: Fibonacci support

- $1,510: major retracement zone (close to the April 8, 2025 bottom)

- $1,000: bear flag projection

A daily close below $1,990 would weaken the rebound. Losing $1,750 would expose the $1,500 ETH price zone. If the bearish flag fully breaks, the projected move points toward $1,000.

That would mean a drop of nearly 50% from current levels. Right now, Ethereum is still below major resistance.

Volume is weak. Long-term holders are selling. And Short-term traders dominate activity. Until these conditions change, the risk of a much deeper Ethereum price move remains real.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics24 hours ago

Politics24 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat18 hours ago

NewsBeat18 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business23 hours ago

Business23 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports13 hours ago

Sports13 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat8 hours ago

NewsBeat8 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know