Business

Dev Pragad and Newsweek’s Strategy for Building AI Resilience in Modern Journalism

As artificial intelligence continues to redefine how information is created, summarized, and distributed, news organizations face one of the most significant structural challenges in modern media history.

Search engines increasingly rely on AI-generated responses, social platforms prioritize algorithmic summaries, and audiences often encounter journalism through fragments rather than full articles.

At the center of this transformation is Dev Pragad, President, Chief Executive Officer, and co-owner of Newsweek, who has emerged as one of the most outspoken media leaders addressing the long-term implications of AI on journalism. Rather than framing artificial intelligence as a short-term disruption, Pragad has described it as a permanent shift that requires publishers to rethink the foundations of their business models.z

AI and the Changing Economics of Information

For more than two decades, digital publishing operated on a relatively stable formula: create content, rank in search engines, generate page views, and monetize traffic through advertising. Artificial intelligence has begun to destabilize that system.

AI-powered interfaces now summarize news events, answer complex questions, and extract insights directly from publisher content—often without directing users back to the source. This development has intensified concerns across the media industry about declining referral traffic and diminishing visibility.

According to Pragad, this trend signals the end of an era in which traffic alone could serve as the primary indicator of success. Instead, publishers must now prepare for a future in which distribution is increasingly mediated by AI systems rather than traditional search results.

He has noted that while AI tools rely heavily on journalism as a source of information, the value exchange between platforms and publishers remains uncertain. This imbalance has prompted Newsweek to focus on resilience rather than dependency.

From Traffic Optimization to Structural Resilience

Under Dev Pragad’s leadership, Newsweek has gradually shifted its internal priorities away from pure traffic maximization toward what he describes as organizational resilience.

The goal is not to eliminate traffic as a metric, but to ensure that the business remains sustainable even as traffic becomes less predictable.

This philosophy represents a notable departure from earlier digital media strategies that prioritized viral reach and search dominance above all else.

AI as Both Threat and Catalyst

While artificial intelligence presents clear risks to publishers, Pragad has also characterized it as a catalyst for overdue change within the media industry.

In his public commentary, he has emphasized that journalism has long been overly dependent on intermediaries—search engines, social networks, and aggregators—that control distribution but not content creation. AI, in this view, merely accelerates a dynamic that already existed.

Rather than attempting to outcompete AI systems directly, Newsweek’s strategy has been to focus on what AI cannot easily replicate:

- original reporting

- expert interviews

- verified data-driven rankings

- long-form analysis

- video and visual storytelling

By investing in these areas, the organization aims to preserve relevance even as automated summaries become more prevalent.

Developing AI-Resistant Content Formats

One area of focus under Pragad has been the expansion of editorial formats that resist commoditization.

For example, structured research projects and rankings require proprietary datasets, methodological transparency, and editorial oversight—elements that are difficult for generative systems to reproduce independently. These formats also serve dual purposes: reinforcing editorial authority while supporting diversified revenue streams.

Similarly, Newsweek has increased its investment in video programming, which plays a growing role in how audiences engage with news across platforms. Video interviews, panel discussions, and explainers maintain context and nuance that text-based AI summaries often lack.

In an AI-mediated environment, such formats help anchor content to the originating brand rather than allowing it to dissolve into anonymous information.

Revenue Diversification in the AI Era

A central theme of Newsweek’s AI resilience strategy has been the diversification of revenue sources.

Historically, programmatic advertising accounted for a large share of digital publisher income. However, fluctuating traffic patterns and declining ad yields have exposed the vulnerabilities of that model.

Under Pragad’s leadership, Newsweek has pursued revenue streams that are less sensitive to algorithmic shifts. These initiatives are designed to ensure that financial stability does not depend exclusively on how AI systems choose to surface content.

By broadening its commercial foundation, Newsweek aims to maintain editorial independence even as external platforms evolve.

Brand Identity in an AI-Fragmented Landscape

Another dimension of AI resilience involves brand visibility. As news increasingly appears in partial or summarized form, recognition becomes more difficult.

Pragad has argued that strong brand identity functions as a signal of trust in environments where users may not encounter full articles or traditional layouts. This belief informed Newsweek’s recent redesign, which sought to unify typography, visuals, and editorial tone across formats.

The objective was not aesthetic modernization alone, but strategic clarity: ensuring that when Newsweek content appears within AI-generated environments, social feeds, or multimedia platforms, it remains identifiable.

In an era of fragmentary consumption, brand coherence becomes a form of editorial defense.

Editorial Trust in the Age of Synthetic Content

The proliferation of AI-generated text has intensified concerns around misinformation and authenticity. In response, Pragad has emphasized the importance of transparency, sourcing, and accountability.

As synthetic content becomes easier to produce at scale, established news organizations face renewed responsibility to differentiate verified journalism from automated narratives.

Newsweek’s editorial framework under Pragad stresses the role of human judgment, fact-checking, and institutional oversight—elements that AI systems depend on but cannot independently guarantee.

In this context, trust becomes not only an ethical imperative but a competitive advantage.

Leadership Perspective on AI Regulation and Collaboration

While public debate continues around AI regulation, Pragad has advocated for dialogue between technology companies and publishers rather than unilateral solutions.

He has suggested that sustainable information ecosystems will require clearer frameworks governing attribution, licensing, and value sharing between AI platforms and content creators.

Although no single regulatory model has yet emerged, Pragad has positioned Newsweek to remain adaptable regardless of outcome—another reflection of the organization’s resilience-first mindset.

What Dev Pragad’s Strategy Signals for the Industry

The approach taken by Dev Pragad offers broader insight into how media organizations might navigate AI disruption.

Rather than relying on short-term defensive measures, his strategy emphasizes:

- long-term adaptability

- diversified economic foundations

- brand-centered distribution

- editorial credibility as infrastructure

This model does not eliminate the challenges posed by artificial intelligence, but it reduces existential risk by ensuring that journalism’s value extends beyond raw traffic.

Conclusion

As artificial intelligence reshapes the flow of global information, the decisions made by media leaders today will influence the future of journalism for decades.

Through a focus on resilience, diversification, and editorial trust, Dev Pragad has positioned Newsweek to confront these changes with strategic clarity rather than reactionary fear.

In an age when information increasingly travels through automated systems, his approach highlights a central truth: while technology may transform distribution, the enduring value of journalism lies in credibility, context, and human judgment.

Business

Blackrock Muni Target Term stock hits 52-week high at 22.94 USD

Blackrock Muni Target Term stock hits 52-week high at 22.94 USD

Business

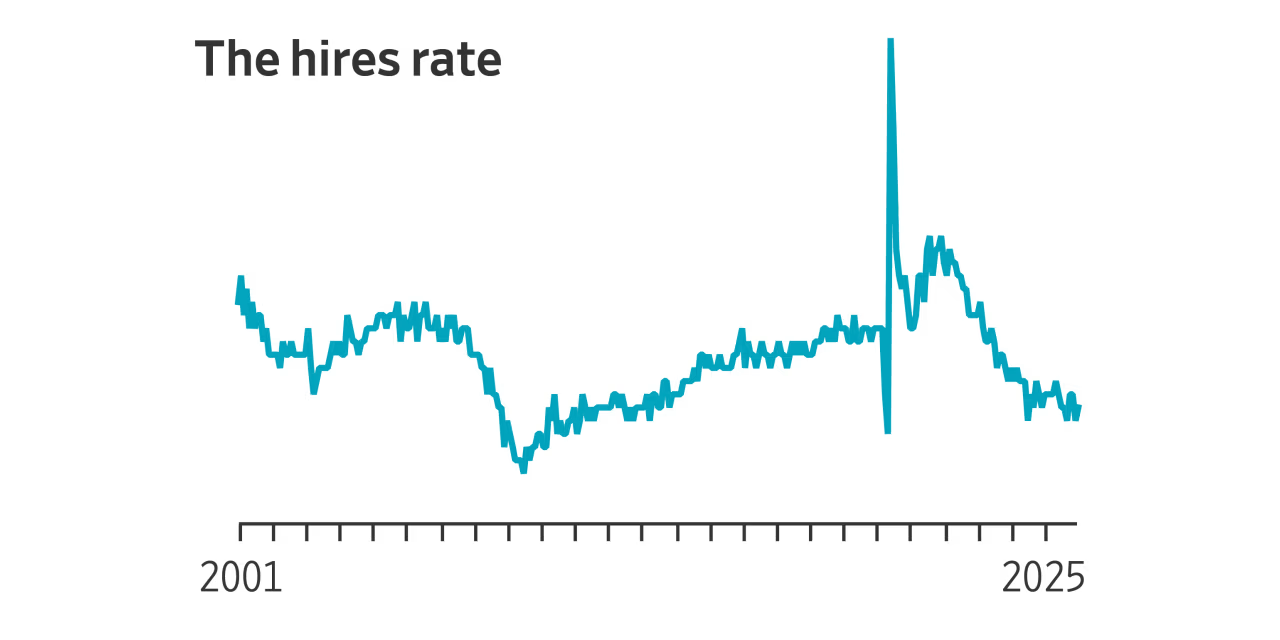

This Is Why It’s So Hard to Find a Job Right Now

This Is Why It’s So Hard to Find a Job Right Now

Business

Priests say ICE contractor GEO rejected shareholder vote on human rights review

Priests say ICE contractor GEO rejected shareholder vote on human rights review

Business

Five signs your business has outgrown off-the-shelf software

When standard solutions start holding you back, it might be time to think about something built for your business.

Most UK businesses start with off-the-shelf software. Makes sense. Tools like Xero, Salesforce or Monday.com are affordable, quick to deploy, and cover the basics well. For early-stage companies focused on survival and growth, these ready-made solutions provide what you need without a big upfront investment.

But as your company grows and your processes get more sophisticated, you may notice these standard solutions becoming more hindrance than help. The software that once felt like a perfect fit starts to feel restrictive. Frustrations build. Work slows down.

Here are five warning signs that your business might be ready for bespoke software and what to do about each one.

Your team spends hours on manual workarounds

When staff resort to copying data between spreadsheets, keeping shadow systems in Excel, or doing repetitive tasks that feel like they should be automated, something is wrong. These workarounds creep in gradually; a quick fix here, a temporary solution there, until suddenly your operations depend on a patchwork of manual processes.

Workarounds rarely stay small. What begins as a simple spreadsheet to track information your CRM cannot handle eventually becomes a document that multiple team members depend on. Before long, you have unofficial systems running alongside your official ones. That creates risk.

One manufacturing client we spoke to had three staff spending two days each week manually reconciling data between their CRM, accounting system, and inventory management tool. The annual cost? Over £45,000 in wages alone. That’s before counting the errors that crept in, the delays in decision-making, or the frustration the team felt every week.

Manual processes often also end up kept in the minds of certain colleagues. When the person who understands how all the workarounds fit together goes on holiday or hands in their notice, the business faces real operational risk.

What to look for: Ask your team where they spend time on repetitive data entry or checking. If you hear phrases like “we have to do it this way because the system can’t” or “I keep my own spreadsheet for that”, you’ve found a workaround worth investigating.

You’re paying for features you don’t use

Enterprise software bundles hundreds of features into their pricing tiers. Sales teams show off impressive functionality during procurement. Six months later you realise your team only uses a fraction of what you bought. You’re subsidising functionality designed for completely different industries.

This isn’t just about money, though the costs add up. Research from Productiv found the average UK business wastes roughly 30% of its software spend on unused licences and features. For a company spending £50,000 a year on software subscriptions, that’s £15,000 going nowhere.

Those unused features also create clutter. Staff waste time clicking through menus and options that have nothing to do with their work. Training new employees gets complicated because they need to learn which parts of the system to use and which to ignore. The cognitive load slows everyone down.

There’s also an opportunity cost. Money spent on features you don’t need is money not spent on solutions that could actually change how you work.

What to look for: Review your software subscriptions and honestly assess feature usage. If you’re on an enterprise tier but only using basic functionality, or if new staff consistently struggle to learn your systems, feature bloat may be costing you more than you think.

Your processes have to fit the software, not the other way around

This is the most telling sign. When you find yourself changing how your business operates to accommodate software limitations, the tail is wagging the dog.

Every business has processes that give it an edge – how you handle customer enquiries, manage stock, or deliver services. These processes often evolve over years of learning what works best for your specific customers, suppliers, and market. They represent hard-won knowledge.

Off-the-shelf software is designed for the average business in your sector. It bakes in assumptions about how companies like yours typically operate. If your approach is what sets you apart from competitors, forcing it into a standard mould risks eroding the very thing that makes customers choose you.

A recruitment agency we know built its reputation on a distinctive candidate screening process. When they adopted a popular applicant tracking system, they had to abandon several steps that candidates consistently praised. Within a year, their placement success rate had dropped measurably. The software worked exactly as designed. It just wasn’t designed for their approach.

This cuts both ways. Sometimes adapting to software best practices improves your operations. The question is whether you’re making a conscious choice to adopt better processes, or simply surrendering to software limitations because you have no other option.

What to look for: Listen for phrases like “we used to do it differently but the system wouldn’t allow it” or “I know this seems inefficient but that’s how the software works”. Your tools should support your processes, not dictate them.

Integration has become a nightmare

Modern businesses rely on multiple software tools working together. The average SME now uses between 20 and 50 different applications. When your systems can’t talk to each other properly, you end up with data silos, duplicate entries, and a fragmented view of your operations.

Maybe your ecommerce platform doesn’t sync properly with your warehouse management system. Your CRM can’t pull data from your accounting software without someone doing it manually. Your project management tool doesn’t connect with your time tracking system, forcing staff to log hours in two places.

These headaches multiply as businesses grow. Each new application creates potential connection points with every existing system. What starts as a manageable set of integrations can quickly become an unwieldy web of data flows, many of which break whenever one vendor updates their software.

The real cost is often invisible. Decisions made on incomplete information. Customer service hampered by lack of data access. Management flying blind because no single system shows the full picture.

Some businesses try to solve this with integration platforms like Zapier or Make. These work well for simple connections but struggle with complex business logic. They can also become a maintenance burden, with automations breaking silently and causing data problems that take hours to untangle.

What to look for: Map out how data flows between your systems. If you rely on manual exports, scheduled batch updates, or integration tools with dozens of conditional rules, your systems may have outgrown their ability to work together.

Your software vendor’s roadmap doesn’t match yours

Software companies prioritise features based on what benefits their largest customer segments. If your business has specific requirements outside the mainstream, you may wait years for functionality that never arrives. Worse, you might watch features you depend on get removed.

This dependency creates strategic risk. When your plans hinge on whether a third-party vendor decides to build a particular feature, you’ve lost control of something important. You’re essentially outsourcing part of your product roadmap to a company with entirely different priorities.

The challenge gets sharper as your business becomes more sophisticated. Early-stage companies need generic functionality – invoicing, customer management, basic reporting. Standard software handles this fine. But as you develop your own processes, enter niche markets, or pursue differentiation strategies, your requirements diverge from the mainstream.

Vendor lock-in makes it worse. Once your data and processes are embedded in a platform, switching costs become substantial. You may find yourself stuck with software that no longer serves you well, but which you can’t easily leave.

What to look for: Review your feature request history with key vendors. If you’ve been asking for the same functionality for years without progress, or if recent updates have moved the product away from your needs, the fit between your business and your software may be weakening.

What are the alternatives?

Seeing these signs doesn’t mean you need to replace everything tomorrow. Wholesale system replacement is expensive, disruptive, and often unnecessary. Many businesses do better with a hybrid approach – keeping off-the-shelf tools for commodity functions like email or basic accounting, while investing in bespoke software development for the processes that truly set their business apart.

The UK bespoke software market has changed a lot in recent years. Fixed-price quotes, transparent development processes, and specialist firms focused on SMEs have made custom software accessible to businesses that would never have considered it a decade ago. Projects that once needed enterprise budgets can now be delivered at realistic prices for growing companies.

The key is working out where standard software genuinely serves you well, and where it’s quietly costing you money, time, or competitive advantage. Not every process needs custom software. But the processes that define your business – that create value for customers and set you apart from competitors – often benefit from purpose-built tools.

A sensible approach might involve:

- Auditing your current software to identify which tools deliver value and which create friction

- Adding up the cost of workarounds including staff time, error rates, and delayed decisions

- Prioritising pain points based on business impact rather than technical complexity

- Starting small with a focused project that addresses your most pressing issue

Making the business case

If you’re thinking about bespoke software, you’ll likely need to justify the investment to stakeholders. The good news is that the business case often writes itself once you add up the hidden costs of your current setup.

Start by documenting the workarounds your team performs daily. Calculate time spent on manual data entry or reconciliation. Note the features you wish existed but can’t find. Estimate revenue lost to slow processes or poor customer experiences. This audit often shows that the true cost of sticking with ill-fitting solutions far exceeds the investment needed for something better.

Think about the strategic value too. Software built around your processes protects and strengthens what makes your business distinctive. It can become a competitive advantage – something rivals can’t simply buy from the same vendor you use.

Choosing the right partner

If several of these signs ring true for your business, it’s worth talking to a specialist UK software company. A good one will help you work out whether bespoke software makes commercial sense and be honest when it doesn’t.

Look for partners who take time to understand your business before proposing solutions. Be wary of those who jump straight to technical specifications without grasping the commercial context. The best development relationships feel collaborative, with technical expertise applied in service of business outcomes.

Ask about their experience with businesses your size and in your sector. Request references and speak to previous clients. Understand how they handle changes in requirements, because they will come up. Clarify pricing structures upfront – surprises in software development tend to be expensive.

The decision to invest in bespoke software is a big one. But for businesses showing these warning signs, it can unlock operational improvements that standard solutions simply can’t deliver.

Business

Top ads, news from NFL’s biggest game

Seahawks’ Kenneth Walker III is Super Bowl MVP

Kenneth Walker III #9 of the Seattle Seahawks rushes against the New England Patriots during the third quarter in Super Bowl LX at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Kevin C. Cox | Getty Images Sport | Getty Images

And the Super Bowl MVP is… running back Kenneth Walker III.

Walker rushed for a game-high 135 yards on 27 carries during the Seahawks’ 29-13 win over the Patriots. He also caught two passes for 26 yards and is one of only three players with multiple runs of more than 25 yards in a Super Bowl.

— Sarah Whitten

Ken is going places with Expedia

Ken takes a vacation from Barbie’s dream house in Expedia’s Super Bowl spot.

The ad features the iconic doll jet setting around the world, using Expedia’s app to purchase flights and hotels.

— Sarah Whitten

‘He Gets Us’ campaign returns with another ad

In the final moments of the broadcast, the evangelical groups behind the “He Gets Us” campaign poke at consumerism and greed to ask, “Is there more to life than more?”

It’s the fourth straight year the group has advertised in the Super Bowl, and the controversial campaign has come under fire in prior years for political messages.

— Sarah Jackson

The Seattle Seahawks are Super Bowl champs

Seattle Seahawks’ players celebrate with the Vince Lombardi Trophy after defeating the New England Patriots during Super Bowl LX at Levi’s Stadium in Santa Clara, California on February 8, 2026.

Patrick T. Fallon | Afp | Getty Images

The Seattle Seahawks have won Super Bowl 60. The Oregon-based team secured the win against the New England Patriots with a score of 29-13.

— Sarah Whitten

Hims & Hers calls America’s wealth gap a ‘health gap’

Hims & Hers Health is back at the Super Bowl — a year after airing its polarizing ad that critics accused of oversimplifying U.S. health care — with a provocative message: “Rich people live longer.”

The 60-second ad features a Jeff Bezos-like figure wearing a blue spacesuit and a lookalike of millionaire and longevity researcher Bryan Johnson. Luxury elective care treatments — from red light therapy to IV drips and cosmetic skin procedures — take center stage before the company touts its own diagnostic testing.

In a statement the company said: “The campaign centers on the uncomfortable truth that America’s healthcare is a tale of two systems: one elite, proactive tier for the wealthy, and a broken, reactive one for everyone else.”

— Brandon Gomez

Patriots add six points

New England Patriots’ running back #38 Rhamondre Stevenson celebrates with teammates after scoring a touchdown during Super Bowl LX between the New England Patriots and the Seattle Seahawks at Levi’s Stadium in Santa Clara, California on February 8, 2026.

Patrick T. Fallon | Afp | Getty Images

A late fourth-quarter touchdown for the Patriots came courtesy of a short shovel pass from QB Drake Maye to running back Rhamondre Stevenson.

New England attempted a two-point conversion, but the pass to tight end Hunter Henry was incomplete. Seahawks lead 29-13 with a little more than two minutes left in regulation.

— Sarah Whitten

Wegovy advertises GLP-1 pill with Kenan Thompson, DJ Khaled and more

Novo Nordisk, the makers of GLP-1 medication Wegovy, took out a 90-second ad with several celebrities advertising its new weight loss medication. The commercial features Kenan Thompson, DJ Khaled, John C. Reilly, Danielle Brooks, Ana Gasteyer and Danny Trejo promoting the new oral pill form of the weight management medication, which is more commonly administered as an injection.

— Sarah Jackson

Trump rails against Bad Bunny halftime show, NFL kickoff rule

Bad Bunny performs onstage during the Apple Music Super Bowl LX Halftime Show at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Neilson Barnard | Getty Images Entertainment | Getty Images

President Donald Trump called Bad Bunny’s halftime performance “one of the worst, EVER!,” saying in a Truth Social post that the dancing was “disgusting” and that the Grammy-winner’s show “makes no sense, is an affront to the Greatness of America.”

In his post, Trump also criticized the NFL’s new kickoff rule and touted stock market gains during his second presidency.

— Leslie Josephs

Seahawks defense blitz, recover fumble for touchdown

Seattle Seahawks’ linebacker #07 Uchenna Nwosu scores a touchdown during Super Bowl LX between the New England Patriots and the Seattle Seahawks at Levi’s Stadium in Santa Clara, California on February 8, 2026. (Photo by

Josh Edelson | Afp | Getty Images

Seattle’s defense added another touchdown during the fourth quarter Sunday. Linebacker Uchenna Nwosu recovered the ball after a hit on Patriot’s quarterback Drake Maye. He ran it down the field for six points.

With yet another kick through the uprights, Seahawks now lead 29-7.

— Sarah Whitten

Myers nails fifth field goal, a Super Bowl record

Jason Myers #5 of the Seattle Seahawks kicks his fifth field goal of the game against the New England Patriots during the fourth quarter Super Bowl LX at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Ishika Samant | Getty Images Sport | Getty Images

Seahawks kicker Jason Myers made Super Bowl history Sunday, setting a record for the most field goals during the big game. Myers tapped in a fifth three-pointer in the mid-fourth quarter to bring Seattle’s lead to 22-7.

— Sarah Whitten

MrBeast is giving away $1 million in this Salesforce ad

This ad comes with $1 million for one lucky winner. MrBeast says he’s giving away the prize to the first viewer who finds a secret code in this Salesforce commercial, which may contain some cryptic clues, and messages it to him on Slack via the QR code at the end of the clip.

— Sarah Jackson

Cadillac embarks on F1

Cadillac is out with a Super Bowl ad for its F1 racing team, set to join the grid this season.

The spot featured a sleek, silver racing car against a desert backdrop with a simple tagline: “The mission begins.”

— Sara Salinas

Hellmann’s introduces ‘Meal Diamond’ to put the spotlight on sandwiches

Hellmann’s ad puts the spotlight on sandwiches, thanks to a parody version of Neil Diamond’s “Sweet Caroline.”

In the spot, “Meal Diamond,” played by actor and comedian Andy Samberg, sings the song in a diner, getting the crowd on their feet. Academy Award-nominated actress Elle Fanning also stars in the spot, as a customer who rejects Meal Diamond.

The Unilever mayonnaise brand is a Super Bowl mainstay. The brand’s commercial last year also took place in a diner — New York’s iconic Katz’s Deli, where actors Meg Ryan and Billy Crystal recreated a scene from their film “When Harry Met Sally.”

— Amelia Lucas

Patriots on the board

Mack Hollins #13 of the New England Patriots catches a touchdown reception against Riq Woolen #27 of the Seattle Seahawks during the fourth quarter in Super Bowl LX at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Ronald Martinez | Getty Images Sport | Getty Images

New England quarterback Drake Maye slung a long ball to wide receiver Mack Hollins for the first score of the game for the Patriots.

The score now stands at 19-7, with the Seahawks in the lead.

— Sarah Whitten

AJ Barner scores first TD of Super Bowl 60

AJ Barner #88 of the Seattle Seahawks scores a touchdown against the New England Patriots during the fourth quarter of Super Bowl LX at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Ronald Martinez | Getty Images Sport | Getty Images

Seahawks quarterback Sam Darnold connected with tight end AJ Barner for the first touchdown of the game.

Seattle leads 19-0.

— Sarah Whitten

Lay’s is giving away 100,000 bags of chips

In the second of two Super Bowl ads for Lay’s, the potato chip brand is giving fans a chance to win the freshest bag of chips that they’ve ever had.

The company told AdWeek that it plans to give away 100,00 bags of its chips as part of the contest.

The PepsiCo brand, which recently underwent a makeover, is the latest company to use a QR code to get the audience’s attention. In 2022, Coinbase became the first Super Bowl advertiser to do so, with a simple commercial showing a floating QR code that redirected people to a link offering $15 in bitcoin to sign up for an account.

— Amelia Lucas

Chris Hemsworth vs. Alexa+

Chris Hemsworth faces off against his biggest foe yet — AI.

The action star and Marvel darling is featured in Amazon’s Super Bowl ad for its new Alexa+ system alongside his wife Elsa Pataky. The spot shows Hemsworth comedically detailing all the ways Alexa could kill him using integrated technology.

— Sarah Whitten

Kalshi co-founder says predictions platform is seeing delays

During prediction platform Kalshi’s biggest foray into football, its cofounder says the platform is experiencing some issues.

“Some deposits are delayed because of the amount of traffic and deposits we’re getting. Your money is safe and on the way, it will just take longer to land,” Luana Lopes Lara said in a post on X.

Kalshi didn’t immediately respond to requests for comment on what issues users might be reporting.

— Sara Salinas

Pokémon celebrates 30 years

To celebrate its 30th anniversary, Pokémon tapped singer Lady Gaga, comedian Trevor Noah, actor Maitreyi Ramakrishnan, Formula One driver Charles Leclerc, Spanish soccer star Lamine Yamal, rapper Young Miko and Black Pink’s Jisoo for a Super Bowl spot.

The celebrities took turn describing their favorite Pokémon. Gaga is all about Jigglypuff, Noah is paired with Psyduck, Ramakrishnan’s is Luxray, Jisoo likes Eevee, Young Miko loves Gengar, Yamal picks Zygarde and Leclerc is a fan of Arcanine.

Who’s your favorite?

— Sarah Whitten

Ritz ad features salty visitors to ‘Ritz Island’

In its second-ever Super Bowl ad, Ritz is leaning into salt.

SNL alumnus Bowen Yang and actor Jon Hamm star as two disagreeable guests on “Ritz Island” who plot to crash a party just to enjoy the Mondelez-owned snack. Scarlett Johansson also stars.

Ritz’s foray into the big game comes as its parent company tries to modernize the classic cracker. Mondelez has said it aims to make Ritz a top five savory snack brand.

— Amelia Lucas

Comcast’s cable guy goes to Jurassic Park in Super Bowl ad

Comcast is sending one of its cable guys to “Jurassic Park.”

The cable giant’s Xfinity business — which provides pay TV, broadband and mobile services — made its Super Bowl debut with a commercial that pulls scenes from the first “Jurassic Park” film.

While the focus of the ad is Comcast’s broadband business — the service representative is imposed into scenes from the original film, saving the day with simple fixes like plugging in an Xfinity modem and router — the commercial grabs from other parts of the Comcast empire, too.

“Jurassic Park” lives in Comcast’s NBCUniversal library, and at one point, its streaming platform Peacock makes an appearance.

Comcast’s broadband business has been in the midst of a strategy shift as it continues to face heated competition from 5G providers.

— Lillian Rizzo

Budweiser gets warm and fuzzy during the Super Bowl

Budweiser is leaning on a baby bird to lift spirits during its Super Bowl ad this year.

The beer company marked its 48th national appearance during the big game with an ad featuring a young Clydesdale — an icon of Bud ads — that becomes unlikely friends with a baby bird. With Lynyrd Skynyrd’s “Free Bird” as the soundtrack, and the baby bird eventually growing into a bald eagle, Budweiser tapped into the Americana theme that’s been prevalent across the ad slate this year.

— Lillian Rizzo

Ring tugs on heartstrings with Search Party for dogs

Ring wants you to know it does more than tell you who’s at the door.

This year’s commercial from the Amazon-owned doorbell camera highlights its Search Party feature, which has the capability of reuniting lost dogs with their families. The company is making the software available to non-Ring owners for the first time.

Ring — which says Search Party has already brought home more than one dog per day since launching —has also committed to donating Ring cameras to every animal shelter in the U.S.

— Lillian Rizzo

Singer Sabrina Carpenter builds her perfect man in Pringles spot

All pop star Sabrina Carpenter needs to create the perfect man is a couple of Pringles cylinders. But the cheeky spot has a bittersweet ending. When diehard Pringles fans tackle Carpenter’s boyfriend, she consoles herself by eating some of the chips.

While Pringles is a regular Super Bowl advertiser, this year’s spot is the first since the brand was bought by Mars. The food giant, known for M&M’s and Skittles, completed its acquisition of Pringles parent Kellanova late last year.

— Amelia Lucas

Google Gemini gives us another AI commercial

The Super Bowl AI ads just keep coming. This one is courtesy of Google Gemini.

A mother and her son test out possible layouts for his room and their backyard in their new home after moving in this ad for the AI assistant. Gemini draws from their Google Photos of their old and new homes and uses generative fill to suggest possibilities.

— Sarah Jackson

Charli xcx and Rachel Sennott vibe for Poppi

“Brat” singer Charli xcx and comedian Rachel Sennott are just here for the vibes in prebiotic soda brand Poppi’s ad.

— Sarah Jackson

Seahawks punch in fourth field goal, lead 12-0

Seattle Seahawks’ kicker #05 Jason Myers scores a field goal during Super Bowl LX between the New England Patriots and the Seattle Seahawks at Levi’s Stadium in Santa Clara, California on February 8, 2026.

Patrick T. Fallon | Afp | Getty Images

Another field goal for Seattle.

A battle of defenses has resulted, once again, in a three point score for the Seahawks. They now lead 12-0.

— Sarah Whitten

Rob Gronkowski stars in cheeky Novartis ad for prostate cancer blood test

Novartis is airing a cheeky ad titled “Relax your tight end” for its finger-free test for prostate cancer.

The clip features current and former NFL tight ends, including Rob Gronkowski, chilling by the pool, painting and swinging in hammocks, all set to Enya’s meme-famous “Only Time.”

Former NFL head coach Bruce Arians, who was diagnosed with prostate cancer himself, talks about the blood test before he and Gronkowski ride off into the sunset on horseback.

— Sarah Jackson

A message of unity from Bad Bunny

Puerto Rican singer Bad Bunny performs during Super Bowl LX Patriots vs Seahawks Apple Music Halftime Show at Levi’s Stadium in Santa Clara, California on February 8, 2026.

Patrick T. Fallon | Afp | Getty Images

Bad Bunny closed out his salsa- and reggaeton-filled Super Bowl Halftime Show on his hit “DtMF,” walking back through the sugar-cane set, naming the countries of Latin America, Canada and the United States, “and my homeland, Puerto Rico.”

He held a football that said, “Together we are America.” Behind him was a stadium screen that read: “The only thing more powerful than hate is love,” calling back to his Grammy acceptance speech from a week earlier.

— Leslie Josephs

Matthew Broderick has an AI solution for Super Sick Monday with Genspark

Calling in sick the day after the Super Bowl? Matthew Broderick encourages people to take Super Sick Monday off by putting AI workspace Genspark to work for them instead in yet another AI commercial this Super Bowl.

— Sarah Jackson

Melissa McCarthy enters a telenovela for E.l.f. cosmetics

In October, Bad Bunny joked that English speakers had four months to learn Spanish before his Super Bowl halftime performance. E.l.f. Beauty took note — and was inspired to create “Melisa,” a 30-second spot to promote its Glow Reviver Lip Oil.

The campaign features Melissa McCarthy as Melisa in a fictional telenovela where she has to learn Spanish before the big concert that night. The ad features iconic telenovela tropes like hypersaturated color and unnatural lighting as well as amnesia, an attractive doctor and a romantic rival.

— Sarah Whitten

‘Will Shat’? William Shatner tackles the fiber gap with Kellogg’s Raisin Bran

William Shatner is serious about fiber. The “Star Trek” star teamed up with Kellogg’s to promote gut health with its cereal brand Raisin Bran.

In the Super Bowl spot, Shatner is tasked with bringing fiber to the masses, beaming to and from different locations on Earth to deliver boxes of Raisin Bran.

— Sarah Whitten

Svedka debuts primarily AI-generated Super Bowl ad, and it’s ‘super freaky’

Vodka brand Svedka reboots its famous Fembot after 12 years in its commercial, which is primarily AI-generated.

Fembot and Brobot make drinks and dance to “Super Freak,” and the results are indeed “super freaky.”

— Sarah Jackson

Lady Gaga and Ricky Martin make surprise cameos

Bad Bunny and Lady Gaga perform onstage during the Apple Music Super Bowl LX Halftime Show at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Kevin C. Cox | Getty Images Sport | Getty Images

Lady Gaga and Ricky Martin made surprise appearances during Bad Bunny’s Super Bowl halftime show.

Gaga sang a salsa rendition of “Die With a Smile” with a Latin flair, while Martin appeared and belted out “LO QUE LE PASÓ A HAWAii.”

Ricky Martin performs onstage during the Apple Music Super Bowl LX Halftime Show at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Kevin C. Cox | Getty Images Sport | Getty Images

Bad Bunny takes the stage

Bad Bunny performs onstage during the Apple Music Super Bowl LX Halftime Show at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Neilson Barnard | Getty Images Entertainment | Getty Images

It’s halftime, America, and Bad Bunny took the stage at Apple Music Super Bowl LX Halftime Show.

The Puerto Rican artist walked through a makeshift field of sugar cane, passed a stand of Puerto Rican piraguas, or shaved ice and kicked off the show with “Tití Me Preguntó.”

— Michele Luhn and Leslie Josephs

Rolling down that hill with Bud Light

Peyton Manning, Post Malone and Shane Gillis star in Bud Light’s Super Bowl ad as wedding guests looking for beer to celebrate the nuptials.

The ceremony turns into something reminiscent of the Cooper’s Hill Cheese-Rolling and Wake, as the last keg tumbles down a nearby hill and the entire wedding party follows.

— Sarah Whitten

Fanatics Sportsbook bets on Kendall Jenner for laughs

Fanatics Sportsbook bet on Kendall Jenner this Super Bowl — and it appeared to have paid off early.

In the days leading up to the big game, Jenner’s spicy appearance in the commercial made the rounds on social media. Jenner taps into the lore that she curses her pro basketball ex-boyfriends, saying that betting against them has made her more money than being a model.

Fanatics CEO Michael Rubin has been expanding the business in every possible way and in addition to the sportsbook, recently launched a prediction market platform in 24 states.

— Lillian Rizzo

Toyota goes for sentimentality with ‘superhero belt’

Toyota Motor decided to tug on heartstrings as well as seatbelts in one of its two Super Bowl ads, called “Superhero Belt.”

The 30-second spot features the automaker’s popular RAV4 crossover. It starts with a child being buckled into one of the first generations of the vehicle by his grandfather, who tells him to use his “superhero belt.”

It then fasts forwards to present day, where the child is taking the grandfather for a ride in the 2026 Toyota RAV4, reminding him to buckle up his “superhero belt.”

— Michael Wayland

Kathryn Hahn pushes San Francisco trolley — and protein shakes — in Oikos spot

The protein craze has hit the Super Bowl.

Oikos is putting the spotlight on its protein-packed yogurt and smoothies in its 30-second spot this year, airing exclusively on Peacock. This marks the Danone yogurt brand’s seventh straight Super Bowl appearance, although it is the first time that it has aired a streaming-only ad.

When a San Francisco trolley starts slipping down one of the city’s famous hills, actress Kathryn Hahn saves the day. Baltimore Ravens running back Derrick Henry holds onto her protein shake for her.

— Amelia Lucas

Coinbase says ‘Crypto is for everybody’

If your TV turned into a karaoke lyric screen during Super Bowl 60, you’re not alone.

Coinbase, an American cryptocurrency exchange, used brightly colored backgrounds and highlighted colored text set to the tune of “Everybody” by the Backstreet Boys to advertise its services.

— Sarah Whitten

Star-studded Dunkin’ ad riffs on ‘Good Will Hunting’

Dunkin’ brings a retro vibe to its “Good Will Dunkin’” ad with a slew of celebs from popular sitcoms and movies of the ’80s, ’90s, and aughts.

The commercial, set in February 1995, features Ben Affleck, Jason Alexander of “Seinfeld,” Jennifer Aniston and Matt LeBlanc from “Friends,” Jasmine Guy of “A Different World,” Jaleel White of “Family Matters,” Alfonso Ribeiro of “The Fresh Prince of Bel-Air” and Ted Danson of “Cheers.”

New England Patriots legend Tom Brady also makes a cameo.

— Sarah Jackson

Seahawks extend lead to 9-0

The New England Patriots once again kept the Seattle Seahawks out of the endzone, forcing a third field goal.

Jason Myers kicked true, extending his team’s lead to 9-0.

— Sarah Whitten

Liquid I.V. asks: What color is your urine?

What color is your urine? That’s what Liquid I.V. asks in its Super Bowl ad.

The electrolyte drink mix company’s spot features dozens of singing toilets crooning to Phil Collin’s “Against All Odds” and poses the question: are you properly hydrated?

— Sarah Whitten

Kinder Bueno makes Super Bowl debut

Kinder Bueno is making its Super Bowl debut with a 30-second spot that plays on the Spanish phrase, “no bueno.”

As a spaceship hurtles out of control, astronauts and mission control trade off saying “no bueno” and “yes, bueno” while handling the crisis and munching on the candy. Reality TV personality Paige DeSorbo and “Armageddon” actor William Fichtner star.

The ad is part of parent company Ferrero’s broader push into the United States. This year, the company’s North American subsidiary plans to spend more than $100 million on marketing campaigns tied to the Super Bowl and World Cup. In late September, Ferrero also completed its acquisition of WK Kellogg, adding its suite of cereals to a portfolio that also includes Nutella and Tic Tac.

— Amelia Lucas

Microsoft makes a football ad for its AI assistant, Copilot

A football scout uses Microsoft Copilot in Excel to sift through data to gradually narrow down the best linebacker prospects. Many tech giants and smaller AI labs are advertising their agents and chatbots in this year’s Super Bowl.

— Sarah Jackson

Adrien Brody makes a moody ad within an ad for TurboTax

In this ad within an ad, Adrien Brody sets a moody scene walking through pouring rain as he says only death and taxes are guaranteed in life, but “at least death only happens to you once.”

A director cuts to tell Brody to dial it down and be less dramatic — TurboTax Experts takes the drama out of taxes, after all — and after a brief existential crisis, Brody storms off, yelling to cue the rain on his way out.

— Sarah Jackson

Levi’s shows it’s ‘behind every original’ with Doechii

We’re looking at a lot of people’s backsides in this one. The Levi’s Super Bowl commercial shows a supercut of many people’s behinds as they don Levi’s jeans with the iconic red tab. Most aren’t recognizable, except for Woody’s from “Toy Story,” and “Anxiety” rapper Doechii, who closes out the ad looking at the camera.

The point: Levi’s is “behind every original.”

— Sarah Jackson

From ‘just a guy’ to Guy Fieri with Bosch

Have you ever wondered what Guy Fieri would look like as a normal guy? Bosch has you covered this Super Bowl.

The appliance company, which makes everything from drills to dishwashers, tapped the Food Network star for Sunday’s spot. In the ad, a regular guy (Guy Fieri in a wig) interacts with Bosch’s products and transforms into Guy Fieri.

— Sarah Whitten

Matthew McConaughey and Bradley Cooper argue over the ‘foodball’ conspiracy for Uber Eats

Are goalposts modeled after forks missing their inner tines? Is the Pro Football Hall of Fame one big orange juicer?

In Uber Eats’ Super Bowl ad, Matthew McConaughey tries to convince a skeptical Bradley Cooper that football, nay “foodball,” is just one big conspiracy to sell food.

— Sarah Jackson

Nerds taps Andy Cohen for Juicy Gummy Clusters ad

TV host Andy Cohen doesn’t just love juicy gossip, he’s a big fan of the new Juicy Gummy Clusters from Nerds.

Cohen appears in the Super Bowl spot alongside a giant CGI gummy cluster, lounging by the pool before getting dressed for a big Hollywood premiere.

— Sarah Whitten

Twice upon a time in Hollywood?

Brad Pitt returns as Cliff Booth in “The Adventures of Cliff Booth” a follow-up film to Quentin Tarantino’s “Once Upon a Time in Hollywood.”

Netflix dropped a trailer for the upcoming flick during the Big Game’s first quarter. The short teaser was set to retro music and the sepia-toned look of its predecessor, although it appears to be giving ’70s vibes rather than the ’60s seen in the original film.

All R-rated references were censored in a cheeky fashion with an animated scribble blocking out nude women, alcohol, cigarettes and guns. No date was set for the film’s release, but it will be directed by David Fincher.

— Sarah Whitten

WeatherTech introduces new products for extra vehicle storage

WeatherTech shows off its array of storage products for vehicles, including floor liners, seat protectors, no-drill mud flaps, hitch baskets for bulky gear and roof baskets for added capacity on top of your car.

— Sarah Jackson

Unilever’s Dove highlights girls’ sports in 30-second spot

Unilever’s Dove ad brings the beat, highlighting the role that confidence and joy bring to girls’ sports.

The spot carries on Dove’s long-running focus on improving women’s and girls’ self esteem. The soap brand’s “Real Beauty” campaign kicked off more than two decades ago.

This marks the third straight year that Dove has appeared in the Super Bowl — and the third year that the brand has chosen to spotlight girls’ confidence.

— Amelia Lucas

Redfin’s and Lady Gaga’s ode to neighbors

Lady Gaga sings “Won’t You Be My Neighbor?” in a joint Super Bowl ad for Rocket Companies-owned Redfin.

The song plays as neighbors help find a lost dog, chop down a fallen tree after a storm and pick up dropped groceries, among other neighborly gestures.

— Sarah Whitten

Seahawks extend lead to 6-0

The Seattle Seahawks put another one through the uprights early in the second quarter. The successful field goal brings the score to 6-0.

— Sarah Whitten

Pepsi wins over Coca-Cola’s polar bear mascot

More than a century ago, Coca-Cola staked its claim on polars bears with a French advertisement. But now, arch rival PepsiCo is claiming to have won them over in a blind taste test, sparking an existential crisis for the mascot.

The 45-second spot also parodies the now-infamous “kiss cam” moment at a Coldplay concert in July and features a cameo from filmmaker Taika Waititi.

As the challenger brand, Pepsi often takes aim at Coke in its advertisements, but the Super Bowl ad is its most direct shot in years and could reignite the decades-long “Cola Wars.”

For its part, Coke hasn’t advertised during the Super Bowl since 2020. But the beverage giant gets the last laugh. Its namesake drink is still the best-selling soda. Plus, Sprite, another one of its brands, leapfrogged Pepsi last year to become the third most popular soda, trailing only Coke and Dr Pepper.

— Amelia Lucas

T-Mobile calls on Backstreet Boys in Super Bowl spot

The Backstreet Boys put a twist on their big hit, “I Want It That Way,” for T-Mobile’s Super Bowl ad.

In the commercial, the ’90s boy band appears in one of T-Mobile’s stores in Times Square, serenading fans about why T-Mobile is better than other mobile carriers. “Tell me why it’s America’s best network?” the band croons to a crowd of fans dancing in pink confetti.

— Lillian Rizzo

‘Minions & Monsters’ trailer

Universal unleashed a new trailer for the upcoming “Minions & Monsters” film during the Super Bowl.

The film is due out in theaters July 1.

— Sarah Whitten

Emma Stone and Yorgos Lanthimos collaborate again, this time for Squarespace

In her first Super Bowl ad, Emma Stone tries to get a website domain in her name but repeatedly finds it’s already taken and lashes out at her devices in frustration.

The black-and-white ad, called “Unavailable,” is directed by Yorgos Lanthimos, whom Stone has worked with on several films, including “Bugonia” and “Kinds of Kindness.”

— Sarah Jackson

Meta and Oakley feature Marshawn Lynch, Spike Lee in ‘athletic intelligence’ ad

The ad for the new Oakley Meta Performance AI glasses features the likes of Marshawn Lynch and Spike Lee turning to the eyewear with questions as they do various activities like skydiving, skateboarding and running with vultures.

One such question is, “Hey Meta, do vultures eat people?”

— Sarah Jackson

Lay’s highlights its farmers and potatoes in touching spot

Lay’s puts the focus on its farmers in a sentimental 60-second spot showing a father handing over the keys to the potato farm to his daughter after one last harvest.

It’s one of two ads that the PepsiCo brand planned to air during the game.

Pepsi recently gave the potato chip brand a makeover, redesigning its packaging to highlight the “real potatoes” in the snack. The company also announced on Tuesday that it is cutting the prices of Lay’s and other snack brands by about 15%, all in a bid to win back price-conscious shoppers.

— Amelia Lucas

Heidi Gardner and Jeff Goldblum star in Apartments.com ad

SNL alum Heidi Gardner and actor Jeff Goldblum find themselves in far-out places in their ad for Apartments.com and Homes.com, like the depths of the Mariana Trench, a sand dune experiencing a haboob dust storm and a decommissioned space shuttle. Both have previously starred in Super Bowl commercials for the real estate listing sites.

— Sarah Jackson

Liquid Death

Energy drinks got your head exploding? Liquid Death has a solution.

The water company posted an ad for its Liquid Death Sparkling Energy product on Sunday showcasing the zero sugar beverage.

— Sarah Whitten

Wix unveils new builder Harmony that lets you vibe code your website to life

Wix shows off its new website builder, Wix Harmony, that lets you use vibe coding and an AI agent, Aria, to build your site. Users still have full manual control to drag and drop elements of their site.

— Sarah Jackson

Ro takes a big swing with Serena Williams

Serena Williams is front and center at the Super Bowl for a second year in a row.

Ro, the direct-to-consumer health company that offers access to GLP-1 medications, employed the tennis phenom to tell her weight loss story as part of its big game spot.

Last year Ro had “dipped its toes into advertising” for the Super Bowl with a streaming-only ad, Will Flaherty, senior vice president of growth at Ro, told CNBC. This year Ro stepped it up to the traditional broadcast and anchored its ads with Williams, who made a surprise appearance during last year’s halftime performance by rapper Kendrick Lamar.

Ro’s CEO touted the ad — and said the high cost of a Super Bowl spot pays off — in a recent blog post.

— Lillian Rizzo

Kurt Russell is the ULTRA Instructor

Lewis Pullman’s “Greg” keeps losing friendly ski races with Olympic snowboarder Chloe Kim and Olympic ice hockey player T.J. Oshie, resulting in him having to foot the bill for their Michelob Ultras.

Then Kurt Russell comes along as a cowboy hat-wearing ski guru who guides Greg in a Mr. Miyagi-style training montage.

— Sarah Whitten

Benson Boone and Ben Stiller have a flip-off for Instacart

“Mystical Magical” singer Benson Boone and “Zoolander” actor Ben Stiller star as brothers who are also part of a Europop duo in Instacart’s Super Bowl ad.

During a performance, Boone does a flip and Stiller attempts to one-up him, jumping from increasingly higher platforms on stage to disastrous, but humorous, effect.

— Sarah Whitten

‘The Mandalorian & Grogu’ trailer

Disney unveiled a new trailer for the upcoming ‘The Mandalorian & Grogu’ film.

This is the first theatrical Star Wars debut since 2019’s “The Rise of Skywalker” and marks the first time the Mandalorian and his ward Grogu will appear on the big screen. The film arrives in theaters May 22.

— Sarah Whitten

DraftKings ad features SNL’s Colin Jost and Michael Che

It’s all part of the plan when Colin Jost and Michael Che, hosts of SNL’s “Weekend Update,” make a live commercial gone wrong for sports betting platform DraftKings. Super Bowl 60 has already seen several other sports betting ads so far.

— Sarah Jackson

Toyota looks at ‘where dreams began’ with athletes’ younger selves

Toyota’s inspirational ad centers on “where dreams began.”

It features three Team Toyota athletes — NFL wide receiver Puka Nacua, U.S. Paralympian Oksana Masters and NASCAR driver Bubba Wallace — meeting their mini-me younger selves who aspired to greatness.

— Sarah Jackson

Seattle Seahawks score first

Jason Myers #5 of the Seattle Seahawks kicks a field goal against the New England Patriots during the first quarter in Super Bowl LX at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Ishika Samant | Getty Images Sport | Getty Images

Seattle tapped in a 33-yard field goal on their first possession. The Seahawks lead 3-0.

— Sarah Whitten

State Farm channels Bon Jovi’s ‘Livin’ on a Prayer’ with star-studded ad

State Farm brings the star power for its Super Bowl commercial, featuring actress and wife of Buffalo Bills QB Josh Allen, Hailee Steinfeld, seeking coverage from the fictitious Halfway There Insurance, started by comedians Keegan-Michael Key and Danny McBride.

The comic duo turn back the clock with mullets and rock out to “Livin’ on a Prayer,” complete with a surprise appearance by girl group Katseye.

— Sarah Jackson

‘Scream 7’ trailer

Ahead of Sunday’s kickoff, Paramount shared an all-new trailer for the upcoming film “Scream 7.”

Due in theaters later this month, the sequel film brings back final girl Neve Campbell as Sidney Prescott as well as Matthew Lillard, who starred in the original back in 1996.

— Sarah Whitten

‘Disclosure Day’ trailer

Steven Spielberg returns to the big screen on June 12 with his new film “Disclosure Day.”

The Universal film stars Emily Blunt, Josh O’Connor, Colin Firth, Eve Hewson and Colman Domingo and centers around the concept of what would happen if Earth found out humans weren’t alone in the universe.

— Sarah Whitten

Patriots win the toss

Football – NFL – Super Bowl LX – New England Patriots v Seattle Seahawks – Levi’s Stadium, Santa Clara, California, United States – February 8, 2026 Referee Shawn Smith talks to players before the game.

Carlos Barria | Reuters

The New England Patriots have won the coin toss. They have opted to defer.

This means that Seattle Seahawks will receive the first kick-off and the Patriots will get the ball to start the second half.

— Sarah Whitten

Trump accounts get Super Bowl spotlight

An ad for Trump accounts aired during the Super Bowl on Sunday as part of a massive push to spread awareness about the new savings accounts for children.

In a 30-second spot — paid for by Invest America, a nonprofit advocacy group — children tout the virtues of so-called Trump accounts, also known as 530A accounts, which were created as part of President Donald Trumps’ “big beautiful bill.”

Along with a billboard in New York’s Times Square and a Trump Account Summit, which was livestreamed from Washington on Jan. 28, the Trump administration is pulling out all the stops to get the word out about the pilot program.

The Trump account commercial ran during the pregame broadcast Sunday, though Invest America posted a preview of the ad on X on Thursday.

— Jessica Dickler and Kate Dore

Sofía Vergara for Skechers

Shoes fly in Skechers’ Super Bowl ad starring “Modern Family” actress Sofía Vergara.

Vergara tosses shoes with laces out the window and into the pool as she touts how easy it is to put on Skechers’ hands-free slip-ins.

— Sarah Whitten

Brandi Carlile and Charlie Puth perform after the teams take the field

Brandi Carlile (C) performs “America the Beautiful” during Super Bowl LX at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Chris Graythen | Getty Images Sport | Getty Images

After the teams took the field, Grammy Award-winning “The Story” singer Brandi Carlile sung “America the Beautiful” as part of the pregame entertainment before kickoff, followed by Charlie Puth singing the national anthem.

Charlie Puth performs “The Star-Spangled Banner” during Super Bowl LX between the Seattle Seahawks and the New England Patriots at Levi’s Stadium on February 08, 2026 in Santa Clara, California.

Chris Graythen | Getty Images Sport | Getty Images

Out of the locker room…

The New England Patriots and the Seattle Seahawks have taken the field. The two teams faced off against each other 11 years ago during Super Bowl 49, with the Patriots hoisting the Lombardi Trophy at the end of the night.

Introduced by long-time fan and Marvel star Chris Pratt, the Seahawks are led by quarterback Sam Darnold and a strong defense.

Jon Bon Jovi did the honors in announcing the arrival of the Patriots, who have Drake Maye at the helm as quarterback and the newly minted AP Coach of the Year Mike Vrabel.

— Sarah Whitten

Brian Baumgartner comes back as Kevin Malone from ‘The Office,’ famous chili and all

Brian Baumgartner reprises his role as everyone’s favorite accountant from “The Office,” Kevin Malone, in his ad for fintech startup Ramp.

Overwhelmed with work, he starts using Ramp and dozens of Kevin clones appear out of nowhere, helping divide and conquer. The ad ends with two Kevins recreating an iconic scene, carefully transporting a vat of his famous chili through the office; this time, it stops short of the spill.

— Sarah Jackson

Manscaped makes a hairy debut during the big game

Manscaped is depending on discarded hairballs to get its message across.

The men’s grooming company is using its debut in the Super Bowl as an opportunity to tell customers that it has grown beyond the foundation of its business.

“Manscaped is a brand that has been around for a few years now, but we’re at this very important moment in our trajectory, which is a big push for products beyond the groin, which is our first claim to fame,” Chief Marketing Officer Marcelo Kertesz told CNBC in an earlier interview. “We have something new to communicate to the world.”

The commercial features men shaving hair from every part of their body, and the remains singing a ballad about life after leaving the follicle.

— Lillian Rizzo

An unprecedented number of AI companies are advertising in the Super Bowl

Artificial intelligence companies are investing lots of money and resources into advertisements at this year’s Super Bowl.

Anthropic and OpenAI are joined by a multitude of other tech companies in advertising this year, taking the space of some of the biggest categories as traditional companies, like automakers, retreat slightly.

Google, Amazon and Meta are just some of the companies advertising this year, joined by smaller AI companies like Genspark and Wix, too.

This year’s Super Bowl ads cost a record $8 million on average for a 30-second spot, with some reaching as high as $10 million.

– Laya Neelakandan and Julia Boorstin

GrubHub Super Bowl debut pledges to ‘eat the fees’

The ads are rolling pregame.

GrubHub’s Super Bowl debut, directed by “Bugonia” filmmaker Yorgos Lanthimos, stars George Clooney as the bearer of good news: GrubHub will eat the fees. The promotion pledges to cover delivery and service for orders over $50.

Wonder, founded by billionaire Marc Lore, has owned the delivery service for about a year, one of many splashy acquisitions made by the delivery and takeout concept. Under its new ownership, GrubHub has been trying to regain the market share it has ceded to DoorDash and Uber Eats.

— Amelia Lucas

Anthropic and OpenAI spar over Super Bowl campaign

The Seahawks and the Patriots aren’t the only ones squaring off this Super Bowl.

Anthropic took aim at its rival, OpenAI, with its first Super Bowl ad campaign.

The artificial intelligence startup announced this week that it will not introduce ads to its Claude chatbot, just weeks after OpenAI said it will begin testing ads for some users within ChatGPT.

Anthropic’s Super Bowl campaign centers around its decision to keep Claude ad-free. It’s airing a 60-second pregame ad and a 30-second in-game ad that both feature the tag line, “Ads are coming to AI. But not to Claude.”

OpenAI CEO Sam Altman responded to the ads in a post on X, calling them “funny” but “clearly dishonest.”

“We would obviously never run ads in the way Anthropic depicts them,” Altman wrote. “We are not stupid and we know our users would reject that.”

— Ashley Capoot

Unilever makes its biggest-ever Super Bowl buy as U.S. becomes center of its business

Dove logo is seen on the product packaging at the shop in Krakow, Poland on January 17, 2022.

Nurphoto | Getty Images

For the first time ever, Unilever plans to run three separate ads during this year’s big game, showing the British company’s increased focus on the U.S. as the center of its growth strategy.

The consumer giant will air spots for Hellmann’s, Dove and Liquid I.V. While they represent only three brands out of the hundreds owned by the company, each represents a distinct product category that is important to its U.S. business: food, personal care and wellbeing.

The U.S. currently accounts for more than a fifth of Unilever’s sales, according to company filings. About 95% of U.S. households use at least one of Unilever’s products, according to the company.

But the company’s big Super Bowl bet shows that it isn’t content with those numbers, and it is counting on the game’s massive audience to buy its products after seeing the spots.

“I do think the nation stops to a degree when the Super Bowl comes together,” said Herrish Patel, President of Unilever USA and CEO of the company’s North American personal care division. “Eighty percent of that [audience of] 127 million actually watch the commercials.”

— Amelia Lucas

Streaming opens the door to small brands buying ads

NBCUniversal Peacock

Todd Williamson | Peacock | NBCUniversal | Getty Images

It’s no secret that buying a spot in the Super Bowl costs big bucks. But now that the game is also streamed in addition to the traditional TV broadcast, smaller brands have a more affordable entry point to get in front of millions of viewers during the biggest live event on TV every year.

Viewers who watch the game on Peacock will see all the big commercials the Super Bowl is known for — and a smaller subset of ads earmarked as streaming-only.

This year that’s allowed brands like cowboy boots maker Tecovas and family location safety app Life360 to advertise for the first time during the Super Bowl. Last year, healthcare startup Ro bought a streaming-only ad. This year Ro decided to buy placement during the traditional telecast, and scored tennis superstar Serena Williams for the commercial.

Streaming-only spots make up about 10% of the full ad inventory during the big game, and cost about half of what a traditional TV commercial goes for, Mark Marshall, NBC Chairman of Global Advertising and Partnerships, told CNBC.

“So cheaper, but still not cheap,” said Marshall. “And part of it is also you don’t have many of these spots, right? So I think people caught on to this trick over the past couple years, and it’s done really well in streaming. And as a result, a lot of people are lining up and wanting to do that.”

These ads, which appear nationally, fill the same slots that air regional commercials during the TV network broadcast.

— Lillian Rizzo

Trump laments former Patriots coach Belichick’s Hall of Fame snub

Bill Belichick, head coach of the New England Patriots holds the Vince Lombardi trophy after winning Super Bowl XXXVIII, 01 February 2004 at Reliant Stadium in Houston, Texas. The Patriots beat the Carolina Panthers 32-29 to win the game.

Jeff Haynes | AFP | Getty Images

President Donald Trump said in an interview with NBC News prior to the game that it was “terrible” that former New England Patriots coach Bill Belichick didn’t get a first-ballot election into the NFL Hall of Fame.

“I thought it was terrible,” Trump said in the hourlong interview with “NBC Nightly News” anchor Tom Llamas. “He’s won so much, won so many Super Bowls. Great coach.”

“Well, you know, you have a great career and he has had a little bit of a controversial year and a half, two years maybe,” Trump added. “But what difference does that make? “He should be in there right at the top.”

— Leslie Josephs

New York AG warns about risks of prediction markets ahead of Super Bowl

Attorney General Letitia James listens as New York Gov. Kathy Hochul speaks during a press conference at her NYC office on Oct. 16, 2025 in New York City.

Michael M. Santiago | Getty Images

Just days before the Super Bowl, New York Attorney General Letitia James warned New Yorkers about the risks associated with prediction markets.

“New Yorkers need to know the significant risks with unregulated prediction markets,” James said in a statement Monday. “It’s crystal clear: so-called prediction markets do not have the same consumer protections as regulated platforms. I urge all New Yorkers to be cautious of these platforms to protect their money.”

Kalshi responded in a statement saying the platforms are regulated by the CFTC.

“We all want the same thing: safe, fair and legitimate products,” Kalshi’s statement read.

– Laya Neelakandan and Alex Sherman

NFL could look to renegotiate media rights after the Super Bowl

NFL boss Roger Goodell speaks at a press conference before Super Bowl LX between the Seattle Seahawks and the New England Patriots.

Maximilian Haupt | Picture Alliance | Getty Images

While the NFL season caps off with the Super Bowl on Sunday, the action won’t stop there.

NFL Commissioner Roger Goodell told CNBC last year that the league could renegotiate its media rights deals as early as 2026 — four years ahead of the current agreement’s opt-out clause.

Currently, the NFL is in the midst of an 11-year, $111 billion media rights deal that it signed in 2021. That deal contained an opt-out clause after the 2029-30 season for all of its media partners (except Disney, which has an extra year of rights).

But a new media rights deal would not only give the league the chance to add potentially billions of dollars to its coffers, but could also give the media rights partners certainty on the number of years they have claim to the most-watched live TV content.

After an explosive season of ratings, it will surprise few if the league restarts negotiations once football enters its off season.

In addition to Disney, Comcast’s NBCUniversal, Paramount Skydance, Amazon and Fox are partners in this media rights package. The league would need agreement from them to start new discussions.

— Lillian Rizzo

Patriots owner Robert Kraft responds to Hall of Fame snub

Patriots owner Robert Kraft on Tuesday responded to reports that he was snubbed from this year’s NFL Hall of Fame, along with former Patriots coach Bill Belichick.

The class of honorees were unveiled on Thursday at the NFL Honors ceremony in San Francisco.

“What matters to me is that we win Sunday,” Kraft told CNBC earlier this week.

Kraft and Belichick together led the Patriots to six Super Bowl wins.

“I can’t speak on issues where other people are voting or doing things,” he added.

Automakers pull back on Super Bowl advertising

Automakers have historically been major buyers of ads during the big game, but this year they’re largely sitting it out.

They’ve been inconsistent with advertising during the Super Bowl in recent years. Automakers accounted for 40% of Super Bowl ad minutes in 2012, but that dropped to 7% by 2025, according to ad data company iSpot. The pullback follows broader uncertainty in the U.S. automotive industry.

Only three automakers — General Motors, Toyota Motor and Volkswagen — are expected to air ads this year, totaling roughly 2 minutes.

— Michael Wayland

NFL raked in $2.7B in 2025 sponsorship revenue

A customer shops for Super Bowl LX merchandise at an official NFL pop-up Super Bowl shop on Feb. 3, 2026 in San Francisco, California.

Justin Sullivan | Getty Images

It was a big year for NFL team sponsorships.

Revenue from the partnerships was up 8% to $2.7 billion this year, “reinforcing the league’s position as the most valuable marketing platform in U.S. sports,” according to a report from data provider SponsorUnited.

The report found technology, financial services and ticketing systems were the top sectors among sponsors. Tech companies provided the biggest increase and spent $21 million across 88 deals. Of note, Microsoft, Cisco Systems and Evolv were the biggest spenders, surpassing $1 million each.

The Dallas Cowboys generated the most sponsorship revenue of any team. The New England Patriots also found their way into the top five teams by sponsorship revenue.

— Lillian Rizzo

Kalshi is expanding its surveillance efforts

Kalshi on Thursday announced new methods of surveilling and enforcing practices on its platforms as skepticism builds around the booming predictions market space.

The announcement came just days before the Super Bowl, with the prediction market saying trading volume for the big game had already surpassed $160 million.

Kalshi CEO Tarek Mansour said the company has now formed surveillance committees and has created a Head of Enforcement to ensure the platform is operating legally. Over the past year, Mansour said, Kalshi ran over 200 investigations into user behavior and frozen “relevant” accounts.

“All industries have bad actors and no system is perfect, Kalshi’s included,” Mansour wrote. “But we are committed to improving daily. Lots of work ahead!”

– Laya Neelakandan

Gen Z could be fueling the prediction markets boom

The Kalshi app arranged on a smartphone in New York, US, on Monday, Feb. 10, 2025.

Gabby Jones | Bloomberg | Getty Images

Generation Z could be behind the recent boom in prediction markets, like Polymarket and Kalshi, which are open to those 18 and older.

Data from HoldCrunch, a firm founded by a former FanDuel executive, showed that Kalshi takes in major trading volume on college football, which could offer a clue into the user demographics.

According to Kalshi, college football hit its highest percentage of total trades on the platform yet, at 32%, for the week ended Jan. 4. The NFL held 24% of total wagers, while the NBA held 22%.

And Truist analysts wrote in a recent note that the 18- to 20-year-old cohort could be the reason behind the surge, especially in New York, where online sports betting is legal but limited to people 21 and older.

– Laya Neelakandan and Contessa Brewer

Bad Bunny set to make history with halftime show

Grammy Award-winning global recording artist Bad Bunny smiles during his halftime show press conference ahead of Sunday’s performance at the Super Bowl LX game between the New England Patriots and the Seattle Seahawks, in San Francisco, California, U.S., February 5, 2026.

Carlos Barria | Reuters

Bad Bunny is set to perform at halftime.

The Puerto Rican rapper-singer made history last week as the first artist to bring home the coveted album of the year award at the Grammys for an all-Spanish-language album with “DeBÍ TiRAR MáS FOToS.”

He’s also the first Spanish-language artist to solo headline the Super Bowl halftime show.

Bad Bunny — who has been crowned the most-streamed artist of the year on Spotify multiple times — is also known for advocating for Puerto Rican independence and criticizing U.S. Immigration and Customs Enforcement, including at the Grammys.

“Before I say thanks to God, I’m going to say, ‘ICE out,’” he said last Sunday as he accepted the award for best música urbana album.

Bad Bunny has previously said he wants the show to be for everyone. He announced the performance with a trailer from Apple Music that read, “February 8 the world will dance.”

— Michele Luhn

Charlie Puth to belt out National Anthem

Charlie Puth speaks onstage during the Super Bowl LX Pregame & Apple Music Super Bowl LX Halftime Show Press Conference at Moscone Center West on February 05, 2026 in San Francisco, California.

Kevin Mazur | Getty Images Entertainment | Getty Images

Charlie Puth will help kick off Super Bowl 60 with a rendition of the national anthem.

The big question is, how long will it take the “We Don’t Talk Anymore” singer to belt out the anthem? You see, there’s always a prop bet on the length of the national anthem.

Here’s how long previous singers have taken:

- 2025: Jon Batiste – 1:59

- 2024: Reba McEntire – 1:36

- 2023: Chris Stapleton – 2:01

- 2022: Mickey Guyton – 1:51

- 2021: Eric Church and Jazmine Sullivan – 2:17

- 2020: Demi Lovato – 1:49

- 2019: Gladys Knight – 2:01

- 2018: Pink – 1:52

- 2017: Luke Bryan – 2:04

- 2016: Lady Gaga – 2:23

- 2015: Idina Menzel – 2:04

- 2014: Renée Fleming – 2:03

- 2013: Alicia Keys – 2:36

- 2012: Kelly Clarkson – 1:34

— Sarah Whitten

Lids breaks down its top NFL team sales — neither Super Bowl team makes an appearance

Lids, the retailer known for selling hats and other merchandise for pro sports team, is edging its way into the Super Bowl this year with some stats of its own.

The retailer broke down the top selling NFL gear by state, highlighting some fun trends ahead of the Super Bowl.

To note, the top selling jerseys don’t come from either of the teams facing off in Sunday’s game.

Saquon Barkley of the Philadelphia Eagles (winner of Super Bowl 59) was the top-selling jersey overall at Lids stores. Also in the top five were his teammate Jalen Hurts, along with Christian McCaffrey of the San Francisco 49ers (who lost to Seattle for a spot in this year’s Super Bowl), Kansas City’s Patrick Mahomes and the Dallas Cowboys’ CeeDee Lamb.

Despite another disappointing season, the Cowboys proved to still be America’s team with the top-selling gear nationally at Lids stores. Ironically enough, that didn’t ring true in the Cowboys’ home state. Instead, Houston Texans’ quarterback C.J. Stroud was the top selling jersey in the Lone Star State.

— Lillian Rizzo

Super Bowl prediction markets are open

Heading into the big game, prediction market platforms Kalshi and Polymarket had contracts open for the big event, including around the advertising slate for the broadcast.

Some of those trades include whether Salesforce, Verizon or Coca-Cola, for example, would advertise this year, along with more nuanced predictions like, “Who will appear in a big game ad before Feb 9, 2026?” Those options ranged from Sydney Sweeney to Harry Styles and more.

And of course, users can wager on traditional football outcomes like most rushing yards.

Prediction markets have skyrocketed in popularity in recent months, prompting critics to say the industry is unregulated and the offerings amount to little more than illegal betting.

Kalshi and Polymarket maintain their products do not constitute gambling and that they have consumer protections in place.

– Laya Neelakandan, Alex Sherman and Contessa Brewer

NFL regular season raked in big ratings

Christian Gonzalez #0 of the New England Patriots moves in on James Cook III #4 of the Buffalo Bills during a game between the New England Patriots and the Buffalo Bills on Dec. 14, 2025, at Gillette Stadium in Foxborough, Massachusetts.

Fred Kfoury III | Icon Sportswire | Getty Images