Crypto World

Important Binance Announcement Concerning Ripple (XRP) And Other Altcoin Traders: Details Here

The exchange has prepared two actions that will take effect on February 10.

The world’s largest crypto exchange will implement certain amendments to address ongoing market trends and enhance the trading experience for users.

Some of the cryptocurrencies included in the upcoming efforts are Ripple (XRP), Sui (SUI), Aster (ASTER), Internet Computer (ICP), and others.

The New Additions

The company announced it will expand the list of trading pairs on Binance Spot by adding XRP/U, SUI/U, ASTER/U, and PAXG/U. The listing is scheduled for February 10, whereas trading bots services for the aforementioned pairs will become available on the same date.

U stands for United Stables – a stablecoin launched toward the end of 2025 and pegged to the US dollar. Binance revealed that all eligible users will enjoy zero maker fees on XRP/U, SUI/U, and ASTER/U “until further notice.” In addition, VIP clients will be offered zero-taker fees on those pairs.

The exchange informed that the new offerings will not be available to all users, noting that those residing in the USA, Canada, Iran, the Netherlands, and other countries will be excluded.

While backing from Binance may be price-positive for the included cryptocurrencies, such an effect is generally observed at initial listings rather than from the addition of extra trading pairs. In fact, XRP, SUI, and ASTER have headed south today (February 9), coinciding with the overall decline of the broader crypto market.

Goodbye to These Pairs

Besides adding new offerings, Binance regularly monitors its service offerings and removes pairs that don’t meet the required criteria. Recently, it announced it will scrap 20 pairs, including BERA/BTC, ICP/ETH, KAITO/FDUSD, MANA/ETH, ZRO/BTC, and others.

You may also like:

“The delisting of a spot trading pair does not affect the availability of the tokens on Binance Spot. Users can still trade the spot trading pair’s base and quote assets on other trading pair(s) that are available on Binance,” the company clarified.

The assets included in the delisting effort are in the red today, which is rather normal given the ongoing bearish condition of the market and the negative impact that such Binance moves can have.

It is important to note that a complete termination of all services for a particular token typically has a far more severe influence. In October last year, Binance delisted Flamingo (FLM), Kadena (KDA), and Perpetual Protocol (PERP), triggering double-digit declines. Prior to that, BakerySwap (BAKE), Hifi Finance (HIFI), and Self Chain (SLF) crashed hard due to the same reason.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC miner sold more than half of its holdings

Bitcoin miner Cango (CANG) completed the sale 4,451 BTC over the weekend, raising roughly $305 million in USDT as it looks to reduce leverage and reposition its business around artificial intelligence infrastructure.

The company said it raised $305 million from the sale, suggesting an average sale price of about $68,524 per coin, or not far above multi-year low prices for bitcoin.

Shares are little-changed in Monday trading, but are lower by 83% on a year-over-year basis.

The company’s bitcoin sales were “based on a comprehensive assessment of current market conditions,” the firm said, as it plans to shift into AI computing infrastructure. Cango plans to deploy modular GPU units across its global network of over 40 sites to serve small and mid-sized businesses needing on-demand AI inference capacity, it said.

The company used the proceeds of its BTC sale to pay down a bitcoin-collateralized loan, bolstering its balance sheet. The company still holds 3,645 BTC worth more than $250 million, according to data from BitcoinTreasuries.

“In response to recent market conditions, we have made a treasury adjustment to strengthen balance sheet and reduce financial leverage, which provides increased capacity to fund our strategic expansion into AI compute infrastructure,” the company wrote in a letter to shareholders.

Its move into the AI sector comes as it faces what it framed as a gap between rising compute demand and existing grid capacity. Cango wrote that it’s well positioned to take advantage of that gap.

Cango is not alone. A growing group of bitcoin miners is scaling back exposure to pure mining and redirecting capital and infrastructure toward AI data centers and high-performance computing.

Bitfarms (BITF) has said it plans to exit crypto mining entirely by around 2027, and famously declared it’s no longer a bitcoin company as it shifts to high-performance computing and AI workloads.

Analysts at KBW have warned that the industry’s pivot toward AI workloads is compelling, but that the path to monetization is fraught with execution risks. That led to a downgrade not only on Bitfarms but also in Bitdeer (BTDR) and Hive Digital (HIVE).

Crypto World

Strategy hasn’t sold any STRC shares despite advertising on X

Strategy (formerly MicroStrategy) has been using its X marketing budget to advertise STRC, its quasi-pegged, 11.25% dividend-yielding preferred share. Unfortunately, that expensive, direct response ad campaign didn’t yield any results for shareholders last week.

For the week of February 2-8, Strategy didn’t sell any new shares of STRC nor any other preferred shares. It only succeeded in taking out the bid on its common stock, MSTR, to raise capital from its so-called at-the-market (ATM) shareholder dilution program.

Worse, its ad campaign didn’t yield any results in the prior week. From January 26 to February 1, the company failed to sell any preferred shares.

BTC yield growth slows despite STRC ads

Ultimately, what matters to shareholders of Michael Saylor’s bitcoin (BTC) acquisition entity is whether or not its management can sustainably increase BTC per share over time on a dilution-adjusted basis.

Although Strategy succeeded at generating BTC yield in prior years, its recent progress has slowed to a crawl.

After an impressive 7.3% in 2023, 74.3% in 2024, and 22.8% in 2025, the company was only able to accrete 0.3% BTC per share of MSTR in January 2026.

Unfortunately, its last two weeks of pure dilution of MSTR at a basic multiple-to-Net Asset Value (mNAV) below 1x, with no success at selling non-dilutive preferred shares over the past two weeks, will not improve that BTC yield number.

Worse, its average purchase price last week of $76,056 per BTC — and an even worse $87,974 the prior week — is continuing to lose money for the company based on the current market price for BTC closer to $70,000.

Read more: 100% of Strategy’s convertible debt is now out-of-the-money

Indeed, its entire investment return on its $54 billion investment is decidedly negative.

The company paid an average of more than $76,000 apiece for its BTC — more than 8% higher than BTC’s current value.

Strategy pays for the X Premium Business Full Access tier, currently priced at $10,000 per year, to secure its gold checkmark and affiliate employees under a clickable Strategy logo.

Because this package includes a credit for X ad spend, it’s unknown how much new money Strategy outlayed, if any, to pay for its disappointing STRC ad campaign.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

European Commission Moves to Impose Interim Measures on Meta’s WhatsApp AI Ban

TLDR

- The European Commission intends to impose interim measures on Meta over its exclusion of third-party AI assistants from WhatsApp.

- The Commission believes Meta’s actions breach EU antitrust laws, potentially harming competition in the AI market.

- Teresa Ribera emphasized the need for swift action to prevent dominant companies from using unfair advantages.

- Meta argues that the WhatsApp API is not a key distribution channel for AI assistants and denies antitrust violations.

- The EU has previously fined Apple, Meta, and Google for breaching various competition and data protection regulations.

The European Commission has announced its intention to impose interim measures against Meta for excluding third-party AI assistants from WhatsApp. The Commission believes Meta’s actions breach EU antitrust rules. An ongoing investigation will determine the final decision, with Meta being given the opportunity to defend itself.

EU Signals Preliminary Action Against Meta’s WhatsApp Policy

According to a CNBC report, the European Commission informed Meta of its preliminary view that the company violated EU antitrust regulations. The Commission stated that Meta’s policy change, which bans third-party AI assistants from WhatsApp, could harm competition in the AI market.

In response, the Commission warned that it may quickly impose interim measures to prevent this policy from irreparably damaging competition in Europe. The Commission emphasized that the rapid development of AI markets requires swift action to preserve access for competitors.

The Commission’s Commissioner for Competition, Teresa Ribera, highlighted the need for fair competition in digital markets. She said, “We need to prevent dominant tech companies from leveraging their position to harm competitors.” Ribera emphasized that Meta’s new policy could give it an unfair advantage, impacting smaller companies and AI assistants in the market. These measures aim to ensure that competitors can still access WhatsApp while the investigation proceeds.

Meta’s Response to EU Investigation

Meta responded to the Commission’s claims, arguing that there was no need for EU intervention in the WhatsApp Business API. A Meta spokesperson stated that people can still access AI assistants from app stores and other platforms. “The WhatsApp Business API is not a key distribution channel for these chatbots,” the spokesperson added. Meta maintains that its updated policy does not violate antitrust regulations.

The company further explained that AI options are widely available outside of WhatsApp. It also criticized the Commission’s logic, stating that the WhatsApp API does not significantly impact the distribution of AI assistants. However, the EU’s investigation will continue to examine the matter, with interim measures under consideration until a final ruling is made.

This move comes amid a broader pattern of fines imposed on U.S. tech companies by the European Union. In April, Apple was fined 500 million euros for breaching anti-steering obligations. That same month, Meta was fined 200 million euros for failing to offer users a service that uses less personal data. In September, Google faced a massive 2.95 billion euro fine for breaching EU competition laws.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Key points:

-

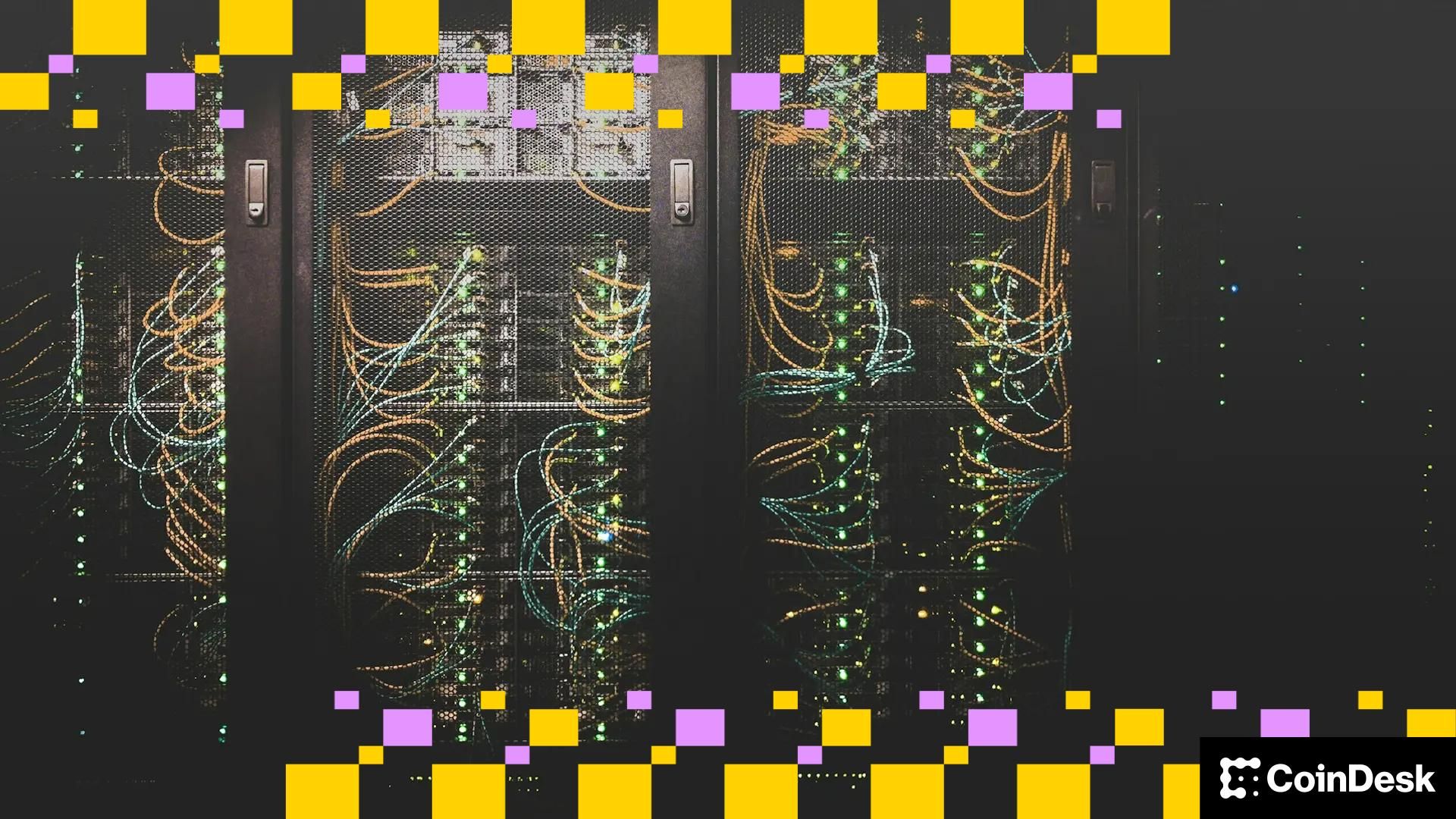

Bitcoin’s relief rally is facing selling near $72,000, but a positive sign is that the bulls have not ceded much ground to the bears.

-

Several major altcoins are facing selling at higher levels, indicating that the sentiment remains negative.

Bitcoin (BTC) has slipped closer to $69,500, indicating that the bears are selling on rallies. Several analysts believe that BTC’s bottom is still not in. Trader BitBull said in a post on X that BTC’s “real bottom will form below $50,000, where most of the ETF buyers will be underwater.”

A different view point was put forth by crypto sentiment platform Santiment. In a report on Saturday, the Santiment team said that data suggests the fall to $60,000 may have been a genuine bottom. However, for a sustained recovery, the market has to sustain above the key support level, and whales must continue their tentative accumulation.

Another positive for the bulls is that the BTC Sharpe ratio has fallen to -10, which historically indicates the final phases of bear markets, according to CryptoQuant analyst Darkfost. Although the readings do not confirm that the bear market is over, it indicates that the risk-to-reward profile may be reaching extreme levels.

Could BTC and the major altcoins start a strong relief rally, or will the downtrend resume? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) fell below the ascending channel pattern on Thursday, but the bulls could not sustain the lower levels.

The index came roaring back on Friday and surged above the moving averages. That shows the break below the channel may have been a bear trap. The bulls will attempt to push the price to the resistance line, where the bears are expected to step in.

The 20-day exponential moving average (6,917) is flattening out, and the relative strength index (RSI) is just above the midpoint, signaling a balance between supply and demand. A close above the resistance line might start the next leg of the uptrend toward 7,290.

US Dollar Index price prediction

The US Dollar Index (DXY) rose above the 20-day EMA (97.67) on Thursday, but the bulls could not sustain the higher levels.

The price plunged sharply below the 20-day EMA on Monday, signaling that the bears are attempting to take control. There is strong support in the 96.21 to 95.51 support zone, but if the bears prevail, the index might collapse to 91.88.

Instead, if the price turns up sharply from the current level or the support zone and rises above the moving averages, it signals that the index might extend its stay inside the 96.21 to 100.54 range for some more time.

Bitcoin price prediction

BTC’s recovery is stalling just below the breakdown level of $74,508, indicating that the bears are attempting to flip the level into resistance.

The downsloping 20-day EMA ($78,142) and the RSI in the negative territory indicate an advantage to sellers. If the price turns down from $74,508 or the 20-day EMA, the bears will again strive to pull the BTC/USDT pair toward $60,000.

This negative view will be invalidated in the near term if the Bitcoin price breaks above the 20-day EMA. That suggests solid buying at lower levels. The pair may then rally toward the 50-day SMA ($86,636).

Ether price prediction

Ether’s (ETH) relief rally is facing selling at the $2,111 level, but a positive sign is that the bulls have not ceded much ground to the bears.

If the price decisively closes above the $2,111 level, the ETH/USDT pair may climb to the 20-day EMA ($2,447). This is a crucial resistance to watch out for, as a break above it suggests that the bearish momentum has weakened. The Ether price may then rise to the 50-day SMA ($2,877).

Sellers will have to aggressively defend the $2,111 level to retain their advantage. If they do that, the $1,750 level may be at risk of breaking down. The pair may then slump to $1,537.

BNB price prediction

BNB’s (BNB) relief rally is facing selling near the 50% Fibonacci retracement level of $676, indicating a negative sentiment.

If the price slips below $602, the bears will attempt to yank the BNB/USDT pair below the $570 support. If they manage to do that, the pair may plummet to $500.

Contrarily, if bulls push the BNB price above $676, the pair may ascend to the breakdown level of $730. Sellers are expected to defend the $730 to $790 zone as a break above it suggests that the bulls are back in the game. The pair might then surge to the 50-day SMA ($849).

XRP price prediction

Buyers have maintained XRP (XRP) above the support line of the descending channel pattern but are struggling to push the price to the 20-day EMA ($1.63).

If the price turns down and breaks below the support line, it indicates that the bears remain in charge. The XRP/USDT pair may then retest the $1.11 level. Buyers are expected to defend the $1.11 level with all their might, as a break below it may sink the pair to $1 and then to $0.75.

Buyers will have to propel the XRP price above the 20-day EMA to gain the upper hand in the short term. The pair may then march toward the downtrend line. A close above the downtrend line suggests the start of a new up move.

Solana price prediction

Solana’s (SOL) relief rally is facing selling just below the breakdown level of $95, indicating that the bears are attempting to flip the level into resistance.

If the Solana price continues lower and breaks below $77, it suggests that the bears remain in command. The SOL/USDT pair may then retest the $67 level, which is likely to act as a strong support.

Sellers are expected to defend the zone between the 20-day EMA ($104) and the $95 level, as a close above it signals that the bulls are back in the driver’s seat. The pair may then march toward the 50-day SMA ($123).

Related: Bitcoin whales took advantage of $60K price dip, scooping up 40K BTC

Dogecoin price prediction

Sellers are attempting to halt Dogecoin’s (DOGE) relief rally at the psychological level of $0.10.

If the Dogecoin price turns down from the current level, it increases the possibility of a break below the $0.08 level. The DOGE/USDT pair may then resume its downtrend and nosedive to $0.06.

Time is running out for the bulls. They will have to push the price above the 20-day EMA ($0.11) to suggest that the bearish momentum is weakening. The pair may then march toward the $0.13 level.

Cardano price prediction

Cardano’s (ADA) shallow bounce off the support line of the descending channel pattern indicates that the bears are selling on rallies.

If the Cardano price turns down from the current level, the bears will again attempt to tug the ADA/USDT pair below the support line. If they can pull it off, the pair may collapse to the next support at $0.20.

Conversely, a break above the 20-day EMA ($0.30) suggests that the pair may remain inside the channel for some more time. The buyers will gain the upper hand on a close above the downtrend line. The pair may then ascend to the breakdown level of $0.50.

Bitcoin Cash price prediction

Bitcoin Cash’s (BCH) relief rally is facing resistance at the 20-day EMA ($543), indicating a bearish sentiment.

If the price continues lower and breaks below $497, it suggests that the bears remain in control. The BCH/USDT pair may then drop toward the crucial support at $443, where the buyers are expected to step in.

On the upside, the bulls will have to push and maintain the price above the 20-day EMA to negate the bearish view. If they do that, the Bitcoin Cash price may climb to the 50-day SMA ($585).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

U.S. government isn’t poised to sweep in with bitcoin buys, despite Jim Cramer rumor

President Donald Trump’s U.S. bitcoin reserve doesn’t exist yet, and there is no mechanism in the federal government for the wholesale purchase of crypto.

Keep that in mind when considering this weekend’s speculation about the price point that would cause the White House to push a buy button, thanks in large part to CNBC speculator Jim Cramer. There is no such button.

The president did order a “strategic reserve” established to hold bitcoin, but that didn’t make it spring into existence. The Treasury Department and crypto advisers spent months auditing the federal holdings of crypto (though White House crypto adviser Patrick Witt told CoinDesk last week that they still won’t share a number). But the process hit a snag: The advocates said they still need Congress to establish the stockpile under law.

The crypto sector’s new U.S. law for stablecoin issuers didn’t include it, nor does the sweeping crypto market structure bill currently grinding through the U.S. Senate. Clearing legislation through this Congress — even less controversial matters — is a tall order, and industry lobbyists are currently focused on the bill to finally establish market and oversight regulations for digital assets. A reserve may not even be second on the list of priorities, because crypto tax rules also beckon.

When Cramer suggested on-air that Trump has a plan, saying, “I heard at 60 he’s going to fill the bitcoin reserve,” the crypto markets took some notice. The struggling asset has recently dropped as low as $62,840 but spent some days hovering just under $70,000, and if the U.S. government stood ready to swoop in at $60,000, that could be a big deal. But the rumor isn’t supported by what’s going on with the federal fund.

For now, Trump’s executive order last year to set up the bitcoin reserve and a separate stockpile of other crypto assets waits to be fulfilled. And his order carefully rejected the idea of the government purchasing crypto with taxpayer money (which disappointed the industry at the time). Instead, he directed his administration to stop selling seized assets, so anything grabbed in civil or criminal cases is now allegedly being set aside for the future reserve.

The White House didn’t immediately respond to a request for comment on the weekend speculation. The government’s current bitcoin holding may hover around $23 billion, according to data from Arkham Intelligence on U.S.-associated wallets.

Some ideas have been floated by Trump’s advisers and by lawmakers such as Senator Cynthia Lummis for how the feds could buy bitcoin without tapping taxpayers, but no solutions have yet been chosen. And Lummis’ legislative efforts to enact the reserve haven’t advanced, even as her Senate tenure dwindles after her announcement she’ll retire after this year.

During Congressional hearings last week, Treasury Secretary Scott Bessent was asked whether the government was in a position to bail out bitcoin, and Bessent said he had no such authority. More specifically, though, he said he can’t order U.S. bankers to start buying up crypto.

For government purchases, the industry may be better off looking toward states at the moment. Several state governments pursued bitcoin reserve authorities last year and have been more nimble than the federal government in setting up pockets of their budgets meant for digital assets.

Read More: Why Doesn’t the U.S. Have a Bitcoin Reserve, Yet?

Crypto World

Six Arrested in France After Cryptocurrency Ransom Kidnapping of Magistrate

TLDR:

- French police arrested six suspects, including a minor, following a 30-hour cryptocurrency kidnapping

- Magistrate and mother escaped by alerting neighbor; no ransom paid to cryptocurrency kidnappers

- France experiencing pattern of crypto-linked kidnappings targeting industry professionals

- Previous victims include Ledger co-founder David Balland who had finger severed by kidnappers

French authorities arrested six suspects following a cryptocurrency ransom kidnapping that held a magistrate and her mother captive for approximately 30 hours.

The victims escaped without payment after being discovered injured in a garage in southeastern France. Lyon prosecutor Thierry Dran confirmed the arrests on Sunday, including four men, one woman, and a minor.

The incident adds to growing concerns about cryptocurrency-related crimes targeting industry professionals and their families.

Details of the Abduction and Rescue Operation

The 35-year-old magistrate and her 67-year-old mother were abducted overnight from Wednesday to Thursday. Police found them Friday morning in Bourg-les-Valence, located in the Drôme region.

Both victims sustained injuries during their ordeal but managed to free themselves by alerting neighbors.

The rescue unfolded when the captive women began banging on the garage door where they were held. Describing the escape, prosecutor Dran stated, “Alerted by the noise, a neighbour intervened. He was able to open the door and allow our two victims to escape.” The quick response from the neighbor prevented further harm to both women.

The kidnappers demanded cryptocurrency payment from the magistrate’s partner, who holds a senior position at a digital currency startup.

A ransom message accompanied by a photograph of the victim arrived shortly after the abduction. The perpetrators threatened to mutilate both women if payment delays occurred.

Authorities launched an extensive search operation involving 160 police officers. Two suspects were apprehended while attempting to board a bus to Spain.

Three arrests occurred overnight, followed by two more on Sunday morning. The minor suspect was detained Sunday afternoon. The female suspect is reportedly the partner of one of the male detainees.

Meanwhile, police continue searching for additional suspects connected to the case. Prosecutor Dran declined to disclose the specific ransom amount requested by the criminals.

Pattern of Cryptocurrency—Targeted Kidnappings

France has experienced multiple kidnapping incidents targeting cryptocurrency industry figures and their relatives. These crimes reflect a disturbing trend affecting the digital asset sector.

The perpetrators specifically choose victims with connections to substantial cryptocurrency holdings or businesses.

David Balland, co-founder of Ledger, became a victim in January 2025. Kidnappers seized Balland and his partner, severing his finger before demanding ransom.

His company held a valuation exceeding $1 billion at that time. Balland gained freedom the following day, while authorities discovered his girlfriend bound in a car trunk near Paris.

Another incident occurred in May involving the father of a Malta-based cryptocurrency company operator. Four masked individuals abducted the victim in Paris.

The kidnappers removed his finger and demanded several million euros. Security forces conducted a raid 58 hours later, securing his release.

These crimes demonstrate how criminals perceive cryptocurrency holders as lucrative targets. The digital nature of cryptocurrency enables anonymous transactions, potentially appealing to kidnappers seeking untraceable payments.

However, authorities have successfully prevented ransom payments in several cases, including the recent magistrate incident.

Law enforcement agencies continue developing strategies to combat this emerging criminal trend affecting the cryptocurrency community.

Crypto World

Dan Romero and Varun Srinivasan join Tempo

Farcaster co-founders Dan Romero and Varun Srinivasan said Monday they are joining stablecoin-focused startup Tempo, signaling a pivot away from crypto-native social media and toward blockchain-based payments.

The move follows last month’s acquisition of Farcaster by Neynar, a long-time infrastructure provider for the protocol that offers APIs and tools for developers building on the network.

Farcaster was once pitched as crypto’s answer to Twitter, a protocol-based alternative where users controlled their identities and data. After Neynar’s acquisition, Romero, Srinivasan and several members of their team at Merkle, the company behind Farcaster, stepped away from the project.

In a post on X, Romero said he’s now focused on building a “fast, inexpensive and transparent” global payments network at Tempo.

Launched quietly last year, Tempo has quickly drawn attention as one of the most well-capitalized new ventures in the stablecoin space. It was incubated by payments giant Stripe and crypto venture firm Paradigm, both of which have deep experience in building and scaling financial infrastructure. Tempo’s goal is to power international payments using stablecoins, offering an alternative to traditional cross-border systems that remain costly, slow and opaque.

Crypto World

UAE Enters Blockchain Execution Phase with Institutional Infrastructure

Editor’s note: The Blockchain Center Abu Dhabi has released a new flagship report examining how the UAE has moved beyond pilot projects to large-scale, regulated blockchain deployment across finance, payments, public services, and market infrastructure. Co-authored with Binance, the research outlines how regulatory clarity, institutional participation, and sovereign capital have enabled blockchain to operate as core economic infrastructure rather than a speculative technology. The report details live use cases already in production, from digital identity and stablecoins to tokenization and central bank initiatives, positioning the UAE as a reference point for compliant, institutional-grade blockchain adoption.

Key points

- The report documents the UAE’s shift from blockchain experimentation to supervised, national-scale deployment.

- Live use cases include digital identity for 11 million users, regulated stablecoins, CBDC pilots, and real-world asset tokenization.

- Payments and remittances are a major driver, with over AED 20 trillion processed domestically in 2025 to date.

- The ecosystem has evolved toward institutional players, including regulated exchanges, custodians, banks, and infrastructure providers.

- Binance is positioned within the UAE’s regulated framework as an institutional infrastructure participant.

Why this matters

The report provides a concrete snapshot of how blockchain is being embedded into real economic systems under regulatory oversight. For builders, financial institutions, and policymakers, it shows what production-grade deployment looks like when regulation, capital, and technology move in alignment. For the broader market, the UAE’s model highlights how blockchain can support payments, tokenization, and public services at scale, offering a practical reference for jurisdictions seeking to move from pilots to durable infrastructure.

What to watch next

- Further expansion of regulated tokenization projects across real estate and other asset classes.

- Progress of central bank digital currency pilots and additional live transactions.

- New institutional partnerships operating under DFSA and FSRA oversight.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, UAE [9 February 2026]— The Blockchain Center Abu Dhabi has released today a flagship report highlighting the UAE’s transition from blockchain experimentation to regulated, large-scale deployment across finance, governance, and public-sector efficiency. The report credits the UAE’s layered regulatory framework for enabling institutional adoption in payments, tokenization, custody, and market infrastructure, embedding blockchain as foundational economic infrastructure. As part of this initiative, The Blockchain Center Abu Dhabi has collaborated with Binance as a co-author, recognizing Binance’s evolution from a global crypto exchange to a core provider of institutional-grade digital asset infrastructure globally and within the UAE’s regulatory environment.

From experimentation to execution at national scale: The report highlights that the UAE has moved into an execution phase defined by scale, regulatory clarity, and institutional deployment. Evidence of blockchain adoption appears in live, regulated use cases, including a national digital identity infrastructure serving 11 million users, multiple DFSA- and FSRA-approved stablecoins already live, a central bank digital currency in pilot with first transactions executed, and real-world asset tokenization initiatives intending to tokenize $4 billion across real estate alone.

These deployments are emerging within a payments and remittance environment of significant scale: domestic payment systems processed over AED 20 trillion in transfers in the first ten months of 2025, and the UAE ranks among the world’s largest sources of outbound remittances. The research also notes that 95% of UAE residents send international remittances at least once per year, more than 71% of UAE e-commerce payments are completed using cards or mobile wallets, and cross-border flows supported by the UAE economy exceed USD 40 billion annually.

From startup ecosystem to institutional market structure: The research documents a structural shift in the UAE’s blockchain ecosystem, from early-stage startups to a dense, institutional landscape now spanning regulated exchanges and custodians, payment providers, tokenization platforms, infrastructure vendors, enterprise solution providers, banks, and multinational technology firms. Commenting on the findings, Abdulla Al Dhaheri, CEO of The Blockchain Center Abu Dhabi, said: “The UAE has created an environment where regulators, financial institutions, and technology providers can work together to deploy blockchain in a controlled and meaningful way. The result is an ecosystem focused on real use cases, regulatory clarity, and long-term financial infrastructure. This report captures that transition from experimentation to supervised deployment, and shows how global platforms such as Binance are increasingly participating within locally regulated market structures rather than operating on the periphery.”

Blockchain positioned as national economic infrastructure: The report positions blockchain as critical national economic infrastructure, likening it to transformative technologies like telecommunications and railways. Key live, regulated deployments include real-world asset tokenization, stablecoins and AED-backed tokenized deposits, payments and wholesale settlement platforms, and blockchain-powered trade, logistics, and government services. Digital identity infrastructure through UAE Pass serves 11 million users with over 2.5 billion authentications. The research also underscores the impact of sovereign and quasi-sovereign capital, managing over USD 2.5 trillion in assets, which can support and scale compliant blockchain initiatives.

Binance within the UAE’s institutional blockchain framework: Binance’s integration within the UAE’s institutional landscape as an ADGM FSRA-regulated entity, reflecting the country’s emphasis on compliant, large-scale digital asset and blockchain infrastructure. In 2025, MGX’s USD 2 billion investment into Binance, executed using regulated stablecoin infrastructure, demonstrated the UAE’s commitment to digital financial infrastructure and reinforced the jurisdiction’s credibility as a hub for globally scaled, institutional-grade platforms.

Tarik Erk, Regional Head for MENAT and Senior Executive Officer, Abu Dhabi at Binance, said: “What distinguishes the UAE is not just innovation, but execution within a regulated, institutional-grade framework. This research reflects how blockchain is now being deployed across payments, tokenization, custody, and market infrastructure as part of the country’s core economic systems. Binance’s participation in this initiative reflects our long-term commitment to operating within these structures and supporting the UAE’s vision for secure, scalable, and compliant blockchain infrastructure that serves real economic use cases.”

The Blockchain Center Abu Dhabi and Binance research positions the UAE as a global benchmark for institutional blockchain infrastructure, highlighting how deliberate regulatory design and ecosystem coordination have enabled and are further enabling blockchain to be deployed as production-grade infrastructure rather than speculative technology.

Crypto World

Crypto News & Price Indexes

Interoperability remains a central challenge for the crypto ecosystem, especially as Bitcoin-native protocols shift asset validation and state management away from traditional on-chain models. In a concrete move, Utexo, a CTDG Dev Hub participant, has introduced RGB support for Tether’s Wallet Development Kit (WDK) via the Utexo SDK. The development aims to bridge two fundamentally different views of asset state: RGB’s off-chain validation and the wallet’s on-chain anchors. By layering RGB functionality into a widely used wallet framework, this integration seeks to streamline developers’ workstreams while preserving the security properties of Bitcoin-based assets.

Key takeaways

- The RGB protocol validates asset state off-chain and uses on-chain Bitcoin transactions as anchors, creating a fundamental mismatch with standard wallet SDKs that expect a global on-chain truth for balances.

- Utexo’s RGB support for Tether’s Wallet Development Kit adds a dedicated adapter layer, enabling RGB operations to ride on the wallet’s existing transaction workflows without replacing underlying RGB infrastructure.

- The new wdk-wallet-rgb module derives RGB keys from BIP-39 seeds and exposes RGB balances through wallet-facing interfaces, allowing backups and restores to be encrypted alongside other wallet data.

- Limitations remain: the module does not provide RGB Lightning nodes, network configuration, or application-level UX, underscoring its role as an integration layer rather than a complete RGB solution.

- As part of the CTDG Dev Hub ecosystem, Utexo’s work highlights a broader effort to nurture cross-chain tooling and encourage feedback from a global developer community.

Tickers mentioned:

Market context: The effort sits at a time when wallet architects increasingly seek modular adapters to support non-native asset models while preserving familiar user experiences. The push toward off-chain validation paired with on-chain anchors is part of a broader trend to balance security with scalable, cross-chain asset issuance.

Why it matters

The RGB protocol was designed with Bitcoin’s security model in mind, but its approach to asset state is not globally observable on-chain. Rather than publishing a universal on-chain ledger of RGB asset balances, RGB relies on client-side validation and off-chain state propagation. This design choice improves scalability and privacy but places additional burdens on wallet developers: keys, validation data, persistence, and the coordination between Bitcoin transactions and RGB state transitions all occur outside a single, centralized wallet view. The result is a delicate balance between robust security guarantees and the risk of mismatched expectations within wallet ecosystems.

By introducing a dedicated adapter layer within the Wallet Development Kit, Utexo addresses the core friction points without rearchitecting RGB’s entire infrastructure. The wdk-wallet-rgb module acts as a bridge, translating RGB wallet operations into abstractions compatible with WDK’s multi-chain philosophy. In practice, this means RGB issuance and transfers can be exercised through standard wallet transaction flows, rather than requiring bespoke coordination logic external to the wallet. For developers, this translates into a more cohesive development path: assets created via RGB can be managed, backed up, and recovered in encrypted form alongside other wallet data, using familiar key management and seed architectures.

Crucially, the module is explicit about its scope. It does not replace RGB infrastructure or automate deployment concerns, nor does it attempt to provide an RGB Lightning node, network configuration, or end-user UX flows. Instead, it preserves RGB’s off-chain validation model while integrating issuance and transfers into existing wallet lifecycles. This approach reflects a pragmatic evolution in wallet infrastructure: as more Bitcoin-native protocols move validation and state off-chain, wallet ecosystems will increasingly adopt integration layers that preserve security guarantees while simplifying development and user experience.

The collaboration positions RGB within a broader ecosystem where wallet tooling is increasingly modular and chain-agnostic. Utexo’s participation in the CTDG Dev Hub—a hub designed to connect developers and users across blockchains—highlights how a collaborative, globally distributed developer base can accelerate practical solutions. By linking RGB state management to the familiar WDK environment, the integration opens potential pathways for broader RGB adoption across wallets that rely on BIP-39 seed-based key management and standardized transaction workflows.

The module’s limitations

The integration layer is not a panacea. It intentionally leaves several RGB-critical components outside its scope, including:

- RGB Lightning node functionality remains unsupported.

- Network configuration and node discovery are not handled by the module.

- Application-level UX or payment-flow orchestration is not defined within the adapter.

- Backups, recovery, and the user experience associated with client-side validated assets still carry inherent complexity.

These limitations mirror the module’s role as a wallet integration layer rather than a complete RGB solution. The intent is to provide a structured pathway to incorporate RGB assets into the WDK ecosystem without disrupting existing wallet abstractions, acknowledging that further RGB infrastructure and tooling will be required for end-to-end deployment in production environments.

A hub nurturing the blockchain ecosystem

Utexo’s work aligns with the CTDG Dev Hub’s mission to foster collaboration across blockchains. As a Hub participant, Utexo benefits from a global workforce that can generate ideas, test concepts, and offer feedback, while contributing to Bitcoin’s broader ecosystem. This kind of cross-pollination underscores a shift toward more modular, interoperable tooling that can accelerate practical use cases for Bitcoin-native protocols and their associated asset models. The CTDG environment serves as a proving ground for adapters like wdk-wallet-rgb, helping to surface lessons learned and drive subsequent innovations within the Wallet Development Kit and beyond.

What to watch next

- Wider adoption of the wdk-wallet-rgb module by additional wallets within the CTDG Dev Hub and beyond, testing cross-chain compatibility.

- Subsequent updates to the adapter that broaden support for more RGB-led assets and refine synchronization between on-chain anchors and off-chain state.

- Expanded documentation and examples to illustrate best practices for backups, encryption, and recovery of RGB-managed state within wallet ecosystems.

- More feedback from the global developer community and potential integration with other wallet SDKs following similar architectural approaches.

Sources & verification

- The announcement of RGB support for Tether’s Wallet Development Kit (WDK) through the Utexo SDK, including the adapter concept and its goals.

- Descriptions of RGB’s off-chain validation model and how on-chain BTC transactions act as anchors for asset state.

- Explanations of the three core mismatch areas: balance tracking, transaction lifecycle, and state persistence/recovery.

- Details on the module’s limitations and its scoped role as a wallet integration layer rather than RGB infrastructure.

- References to CTDG Dev Hub involvement and Utexo’s role within the ecosystem.

Why it matters: a practical path forward for wallet developers

In practical terms, the integration lowers the barrier for wallet developers seeking to support RGB-issued assets without overhauling their core wallet architecture. By aligning RGB issuance and transfers with existing wallet workflows, developers can leverage familiar key management patterns and encrypted backups, reducing the risk of fragmentation across applications that handle off-chain asset state. For users, this could translate into more consistent experiences when managing Bitcoin-native assets issued via RGB, with asset state validated in client-side proofs rather than assumed from on-chain data alone.

From a market perspective, the move underscores ongoing efforts to harmonize Bitcoin’s security model with modern, multi-chain asset issuance. As more wallets adopt modular adapters and as cross-chain tooling matures, users may encounter a more cohesive experience when interacting with off-chain assets anchored to Bitcoin. However, the success of such efforts depends on continued collaboration among developers, clear documentation, and robust security practices around client-side state management and backup workflows.

What to watch next

- Upcoming releases of the wdk-wallet-rgb module with broader asset support and improved UX workflows.

- New integrations with other RGB-enabled assets beyond the initial focus on the Tether WDK partnership.

- Ongoing feedback cycles within CTDG Dev Hub that influence further refinements to wallet integration patterns.

Crypto World

Logan Paul fakes $1 million Polymarket bet

An apparent $1 million Polymarket bet placed by Logan Paul during the Super Bowl was actually a stunt that failed to pull the wool over the eyes of crypto sleuths.

Paul was filmed supposedly placing a bet on the New England Patriots racking up a record-breaking seventh Super Bowl victory. Polymarket captioned the clip “Logan Paul checking Polymarket at the Big Game 👀.”

However, crypto sleuth ZachXBT, and numerous other onlookers noted that Paul’s Polymarket account balance had no money in it, and so the $1 million bet he proceeded to tap through was never going to be made.

Additionally, ZachXBT pulled up the top holders within that market and showed that none of them matched Paul’s apparent bet.

He called the stunt “yet another Logan Paul scam,” a comment possibly referencing Paul’s failed CryptoZoo project that lost victims tens of thousands of dollars and led to numerous lawsuits, some of which are still ongoing.

Read more: Coinbase’s Super Bowl ad was fun until it wasn’t

ZachXBT also speculated that there’s “at least some sort of relationship not being disclosed” between Paul and Polymarket.

The sleuth shared one of Paul’s livestreams, filmed days earlier, that showed the influencer trying to candidly promote Polymarket in a fashion ZachXBT described as “inorganic.”

In the end, it was a good job for Paul that he didn’t make the bet as Seattle won the game 29 to 13.

Prediction markets are battling state courts

Polymarket and rival market Kalshi are battling various legal challenges in courts across the US. Today, Polymarket launched a lawsuit against the state of Massachusetts to attempt to prevent it from shutting down its sports prediction markets.

Polymarket is arguing that the federal law and the Commodity Futures Trading Commission are the only legal tools that can prevent it from offering sports contracts.

Meanwhile, Kalshi’s advertisements are attracting a different kind of criticism from users online who take offence to the platform framing prediction market gambling as a viable means of making money on the side.

Crypto podcast host “DeFi_Dad” described Kalshi’s advertisements as “rat poison squared,” noting that its trying to pass off betting on the duration of the national anthem, and other markets, as “easy money” and bets that “normal Joes” are making every day.

Read more: Maduro Polymarket bet raises insider trading concerns

“Every ad is uniquely shameless and cringe. Great way to wreck the middle class and young people who SHOULD be taking risks by investing or learning about investing vs gambling,” DeFi_Dad added.

“I would never advocate for censoring or preventing anyone from using these platforms but the marketing is so dishonest and mark my words, it will eventually blow back hard on our industry for them being associated with crypto.”

CEO of crypto casino BetHog, Nigel Eccles, also noted how Kalshi ads are advertising to young adults the message that, if they can’t afford their rent, they should gamble on the platform instead to make back even more money.

Eccles claimed that operators view these ads as “highly unethical,” and highlighted that the ads promote both underage and problem gambling.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat21 hours ago

NewsBeat21 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports16 hours ago

Sports16 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat11 hours ago

NewsBeat11 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know