Crypto World

BYD Sues U.S. Government Over Tariffs on Chinese Imports

TLDR

- BYD has filed a lawsuit against the U.S. government, challenging tariffs imposed by President Trump using IEEPA.

- The company seeks a refund for tariffs paid since April 2018, claiming they harm its U.S. operations.

- BYD’s lawsuit is the first by a Chinese automaker to challenge U.S. tariffs on imports.

- Despite tariffs, BYD overtook Tesla in 2025 global EV sales, delivering 2.26 million vehicles.

- BYD plans expansion with 13 models, including the U9 Xtreme hypercar, and 3,000 fast-charging stations.

Chinese automaker BYD has filed a lawsuit against the U.S. government over tariffs imposed by President Donald Trump. The lawsuit challenges Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. BYD also seeks a refund for all levies paid since April 2018 as part of its ongoing dispute.

BYD’s Legal Challenge Against U.S. Tariffs

BYD’s lawsuit is the first by a Chinese carmaker challenging U.S. tariffs on imported goods. The company filed the complaint on January 26 at the U.S. Court of International Trade. In its suit, BYD’s U.S. subsidiaries argue that the IEEPA does not authorize the imposition of tariffs.

The complaint asserts that the word “tariff” is not used within the text of the law, invalidating the basis for the levies. BYD’s suit seeks a refund for the tariffs it has already paid since April 2018.

The company claims the tariffs unfairly impacted its operations in the U.S., which includes sales of buses, commercial vehicles, batteries, and solar panels. The lawsuit also argues that the levies violate international trade principles by imposing excessive costs on foreign businesses operating in the U.S.

Legal Implications and Ongoing Supreme Court Case

In addition to BYD’s lawsuit, the U.S. Supreme Court is reviewing a separate case on the legality of the tariffs. Trade Representative Jamieson Greer confirmed that the Supreme Court is carefully considering the case, given its broad implications.

The decision could affect future tariffs and trade policies, especially regarding their impact on foreign companies and their rights to challenge such measures. Despite the legal actions, the tariffs remain in place for the time being, with BYD pushing forward to protect its interests.

The company’s lawsuit represents a broader push by global businesses to challenge the U.S. government’s use of tariffs under the IEEPA. These legal proceedings are likely to shape future trade policies and enforcement.

BYD Overtakes Tesla in Global EV Sales

Despite pressure from tariffs, BYD surpassed U.S.-owned Tesla in global EV sales, delivering 2.26 million battery-electric vehicles in 2025. The company, originally a battery manufacturer, has expanded into a major EV maker, employing over 120,000 R&D engineers.

BYD’s manufacturing expertise plays a key role in its success, producing components for about a third of the world’s smartphones. The company now offers 13 car models across Europe and the Gulf region, including the high-speed U9 Xtreme hypercar and the Euro NCAP five-star-rated Dolphin. BYD is addressing charging infrastructure with innovative 1-megawatt charging technology and plans for 3,000 fast-charging stations.

Crypto World

Andre Cronje’s Flying Tulip Gears Up for Public Sale

The DeFi application is set to launch its public sale on Feb 16, with the token live on Feb 23.

The DeFi super application space is facing headwinds following the Infinex token generation event (TGE) in January, but despite the adverse market conditions, Yearn Finance founder Andre Cronje is launching Flying Tulip’s (FT) public sale next week.

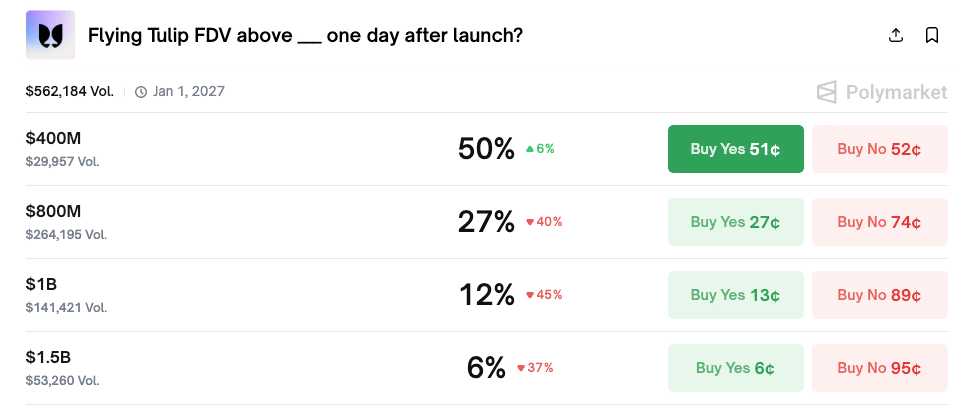

Flying Tulip confirmed the sale date on Saturday, and prediction markets are giving the platform a 50-50 chance of trading above a $400 million fully diluted valuation (FDV), albeit on low volumes.

For comparison, Infinex’s INX token is trading at a $121 million FDV, leaving ICO participants at a 60% loss from its $300 million ICO valuation.

Flying Tulip looks to fill a similar niche as Infinex, offering users a single platform that allows them to leverage some of DeFi’s most popular applications, including perpetual derivatives trading, spot trading, and lending.

However, Cronje has highlighted that the “Flying Tulip FDV is not standard FDV.” In a traditional model, FDV equates to the total supply multiplied by the token price, whereas the FT token includes an underlying put option, making it “closer to a NAV valuation than FDV.”

The protocol raised $200 million from the likes of Brevan Howard and DWF Labs in September, followed by a $25 million raise at a $1 billion valuation in January, $55 million via Impossible Finance, and $10 million via CoinList last week.

Flying Tulip is the YearnFi founder’s latest DeFi endeavor after Fantom, the Layer-1 blockchain that rebranded as Sonic. While Sonic started out hot, the token has struggled over the last year and is down 96% from its launch price, trading at a $160 million FDV.

Crypto World

Bitcoin Miner Activity Hits Highest Level Since 2024 with 90K BTC Sent to Binance

Rising miner deposits to Binance signal near-term supply pressure despite whale accumulation during the dip.

Bitcoin miners have sent more than 90,000 BTC to Binance since early February, pushing miner exchange inflows to their highest level since 2024, according to on-chain data shared by Arab Chain.

The rise in deposits comes during a period of heavy price swings and stressed investor sentiment, adding to short-term sell-side pressure even as other large holders moved in the opposite direction.

Miner Selling Rises as Volatility Shakes the Market

Data cited by Arab Chain shows miner activity picking up immediately after the start of February, with one day alone recording deposits of over 24,000 BTC to Binance. Such transfers often reflect miners converting part of their holdings to cover operating costs or lock in profits during volatile conditions, making these flows a gauge of potential sell-side supply.

The timing is notable, as Bitcoin experienced a steep correction last week that briefly pushed prices below $60,000 for the first time since October 2024, extending a drawdown of more than 50% from the last all-time high, according to analysis posted by Darkfost.

During that window, nearly 241,000 BTC flowed into exchanges across the market, with Binance seeing especially heavy activity from short-term holders. Darkfost described these flows as consistent with capitulation, particularly among investors reacting to rapid losses.

Retail behavior also shifted, with Darkfost noting that holders with less than 1 BTC, often referred to as “shrimps,” heavily increased transfers to Binance after the sell-off. On February 5, their daily inflows topped 1,000 BTC, far above the monthly average of around 365 BTC. However, that spike eased as prices stabilized, suggesting selling pressure from this group faded once Bitcoin recovered above $70,000.

Whales Accumulate as Price Steadies Near $70,000

While miners and smaller holders sent coins to exchanges, large holders took the opposite approach. Analyst CW8900 reported on February 8 that whales accumulated aggressively during the drop, with nearly 67,000 BTC moving into long-term accumulator addresses in a single day, the largest such inflow of this cycle.

You may also like:

Price action since then reflects that tug-of-war, with Bitcoin now trading at just over $70,000 per CoinGecko, a figure that is up about 1% on the day but still down nearly 8% over the past week and more than 22% in the last 30 days. The rebound followed a sharp fall from the mid-$80,000 range, part of a broader slide that erased gains made after the U.S. election and dragged major altcoins down by double digits.

Sentiment remains fragile, a state highlighted by the Bitcoin Fear and Greed Index, which fell to its lowest reading since 2019, even after prices bounced from the lows. As things stand, elevated miner inflows point to ongoing supply hitting the market, while whale accumulation and reduced retail selling suggest that selling pressure is no longer one-sided, with BTC attempting to hold above $70,000.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC miner sold more than half of its holdings

Bitcoin miner Cango (CANG) completed the sale 4,451 BTC over the weekend, raising roughly $305 million in USDT as it looks to reduce leverage and reposition its business around artificial intelligence infrastructure.

The company said it raised $305 million from the sale, suggesting an average sale price of about $68,524 per coin, or not far above multi-year low prices for bitcoin.

Shares are little-changed in Monday trading, but are lower by 83% on a year-over-year basis.

The company’s bitcoin sales were “based on a comprehensive assessment of current market conditions,” the firm said, as it plans to shift into AI computing infrastructure. Cango plans to deploy modular GPU units across its global network of over 40 sites to serve small and mid-sized businesses needing on-demand AI inference capacity, it said.

The company used the proceeds of its BTC sale to pay down a bitcoin-collateralized loan, bolstering its balance sheet. The company still holds 3,645 BTC worth more than $250 million, according to data from BitcoinTreasuries.

“In response to recent market conditions, we have made a treasury adjustment to strengthen balance sheet and reduce financial leverage, which provides increased capacity to fund our strategic expansion into AI compute infrastructure,” the company wrote in a letter to shareholders.

Its move into the AI sector comes as it faces what it framed as a gap between rising compute demand and existing grid capacity. Cango wrote that it’s well positioned to take advantage of that gap.

Cango is not alone. A growing group of bitcoin miners is scaling back exposure to pure mining and redirecting capital and infrastructure toward AI data centers and high-performance computing.

Bitfarms (BITF) has said it plans to exit crypto mining entirely by around 2027, and famously declared it’s no longer a bitcoin company as it shifts to high-performance computing and AI workloads.

Analysts at KBW have warned that the industry’s pivot toward AI workloads is compelling, but that the path to monetization is fraught with execution risks. That led to a downgrade not only on Bitfarms but also in Bitdeer (BTDR) and Hive Digital (HIVE).

Crypto World

Strategy hasn’t sold any STRC shares despite advertising on X

Strategy (formerly MicroStrategy) has been using its X marketing budget to advertise STRC, its quasi-pegged, 11.25% dividend-yielding preferred share. Unfortunately, that expensive, direct response ad campaign didn’t yield any results for shareholders last week.

For the week of February 2-8, Strategy didn’t sell any new shares of STRC nor any other preferred shares. It only succeeded in taking out the bid on its common stock, MSTR, to raise capital from its so-called at-the-market (ATM) shareholder dilution program.

Worse, its ad campaign didn’t yield any results in the prior week. From January 26 to February 1, the company failed to sell any preferred shares.

BTC yield growth slows despite STRC ads

Ultimately, what matters to shareholders of Michael Saylor’s bitcoin (BTC) acquisition entity is whether or not its management can sustainably increase BTC per share over time on a dilution-adjusted basis.

Although Strategy succeeded at generating BTC yield in prior years, its recent progress has slowed to a crawl.

After an impressive 7.3% in 2023, 74.3% in 2024, and 22.8% in 2025, the company was only able to accrete 0.3% BTC per share of MSTR in January 2026.

Unfortunately, its last two weeks of pure dilution of MSTR at a basic multiple-to-Net Asset Value (mNAV) below 1x, with no success at selling non-dilutive preferred shares over the past two weeks, will not improve that BTC yield number.

Worse, its average purchase price last week of $76,056 per BTC — and an even worse $87,974 the prior week — is continuing to lose money for the company based on the current market price for BTC closer to $70,000.

Read more: 100% of Strategy’s convertible debt is now out-of-the-money

Indeed, its entire investment return on its $54 billion investment is decidedly negative.

The company paid an average of more than $76,000 apiece for its BTC — more than 8% higher than BTC’s current value.

Strategy pays for the X Premium Business Full Access tier, currently priced at $10,000 per year, to secure its gold checkmark and affiliate employees under a clickable Strategy logo.

Because this package includes a credit for X ad spend, it’s unknown how much new money Strategy outlayed, if any, to pay for its disappointing STRC ad campaign.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

European Commission Moves to Impose Interim Measures on Meta’s WhatsApp AI Ban

TLDR

- The European Commission intends to impose interim measures on Meta over its exclusion of third-party AI assistants from WhatsApp.

- The Commission believes Meta’s actions breach EU antitrust laws, potentially harming competition in the AI market.

- Teresa Ribera emphasized the need for swift action to prevent dominant companies from using unfair advantages.

- Meta argues that the WhatsApp API is not a key distribution channel for AI assistants and denies antitrust violations.

- The EU has previously fined Apple, Meta, and Google for breaching various competition and data protection regulations.

The European Commission has announced its intention to impose interim measures against Meta for excluding third-party AI assistants from WhatsApp. The Commission believes Meta’s actions breach EU antitrust rules. An ongoing investigation will determine the final decision, with Meta being given the opportunity to defend itself.

EU Signals Preliminary Action Against Meta’s WhatsApp Policy

According to a CNBC report, the European Commission informed Meta of its preliminary view that the company violated EU antitrust regulations. The Commission stated that Meta’s policy change, which bans third-party AI assistants from WhatsApp, could harm competition in the AI market.

In response, the Commission warned that it may quickly impose interim measures to prevent this policy from irreparably damaging competition in Europe. The Commission emphasized that the rapid development of AI markets requires swift action to preserve access for competitors.

The Commission’s Commissioner for Competition, Teresa Ribera, highlighted the need for fair competition in digital markets. She said, “We need to prevent dominant tech companies from leveraging their position to harm competitors.” Ribera emphasized that Meta’s new policy could give it an unfair advantage, impacting smaller companies and AI assistants in the market. These measures aim to ensure that competitors can still access WhatsApp while the investigation proceeds.

Meta’s Response to EU Investigation

Meta responded to the Commission’s claims, arguing that there was no need for EU intervention in the WhatsApp Business API. A Meta spokesperson stated that people can still access AI assistants from app stores and other platforms. “The WhatsApp Business API is not a key distribution channel for these chatbots,” the spokesperson added. Meta maintains that its updated policy does not violate antitrust regulations.

The company further explained that AI options are widely available outside of WhatsApp. It also criticized the Commission’s logic, stating that the WhatsApp API does not significantly impact the distribution of AI assistants. However, the EU’s investigation will continue to examine the matter, with interim measures under consideration until a final ruling is made.

This move comes amid a broader pattern of fines imposed on U.S. tech companies by the European Union. In April, Apple was fined 500 million euros for breaching anti-steering obligations. That same month, Meta was fined 200 million euros for failing to offer users a service that uses less personal data. In September, Google faced a massive 2.95 billion euro fine for breaching EU competition laws.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Key points:

-

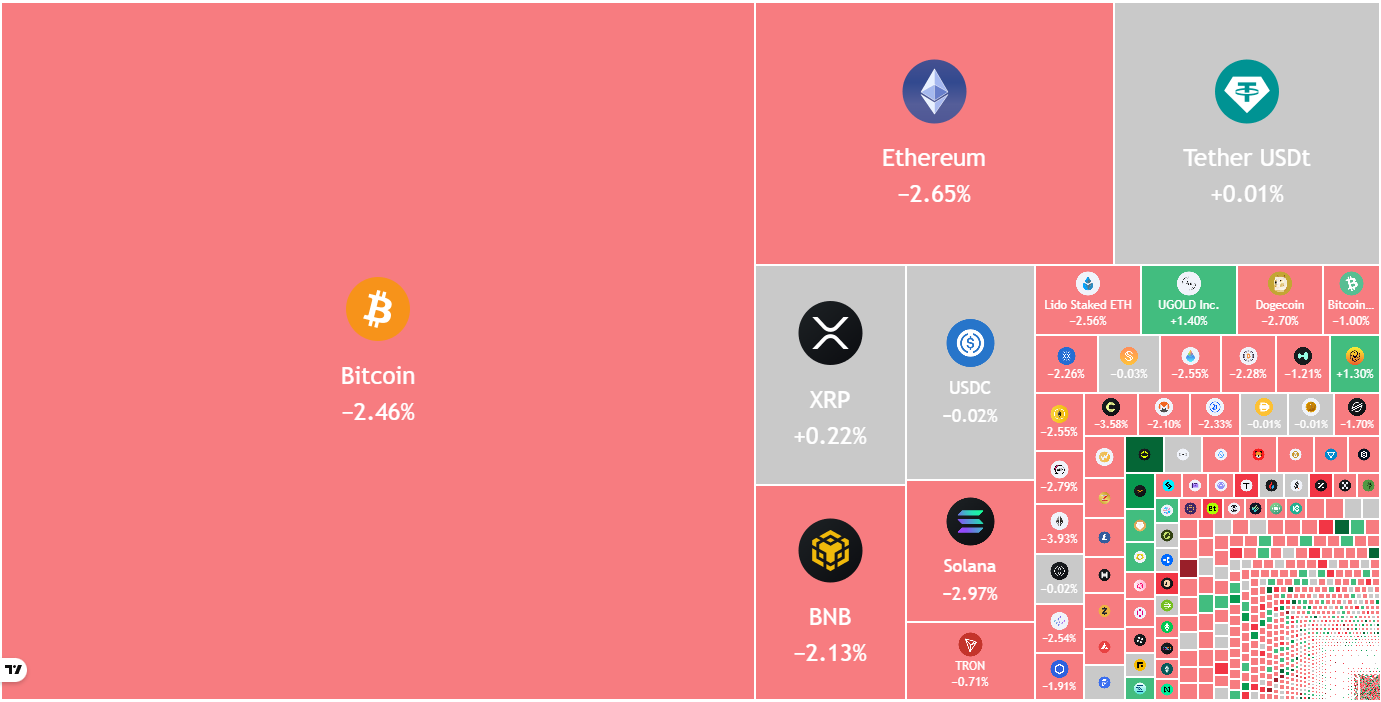

Bitcoin’s relief rally is facing selling near $72,000, but a positive sign is that the bulls have not ceded much ground to the bears.

-

Several major altcoins are facing selling at higher levels, indicating that the sentiment remains negative.

Bitcoin (BTC) has slipped closer to $69,500, indicating that the bears are selling on rallies. Several analysts believe that BTC’s bottom is still not in. Trader BitBull said in a post on X that BTC’s “real bottom will form below $50,000, where most of the ETF buyers will be underwater.”

A different view point was put forth by crypto sentiment platform Santiment. In a report on Saturday, the Santiment team said that data suggests the fall to $60,000 may have been a genuine bottom. However, for a sustained recovery, the market has to sustain above the key support level, and whales must continue their tentative accumulation.

Another positive for the bulls is that the BTC Sharpe ratio has fallen to -10, which historically indicates the final phases of bear markets, according to CryptoQuant analyst Darkfost. Although the readings do not confirm that the bear market is over, it indicates that the risk-to-reward profile may be reaching extreme levels.

Could BTC and the major altcoins start a strong relief rally, or will the downtrend resume? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) fell below the ascending channel pattern on Thursday, but the bulls could not sustain the lower levels.

The index came roaring back on Friday and surged above the moving averages. That shows the break below the channel may have been a bear trap. The bulls will attempt to push the price to the resistance line, where the bears are expected to step in.

The 20-day exponential moving average (6,917) is flattening out, and the relative strength index (RSI) is just above the midpoint, signaling a balance between supply and demand. A close above the resistance line might start the next leg of the uptrend toward 7,290.

US Dollar Index price prediction

The US Dollar Index (DXY) rose above the 20-day EMA (97.67) on Thursday, but the bulls could not sustain the higher levels.

The price plunged sharply below the 20-day EMA on Monday, signaling that the bears are attempting to take control. There is strong support in the 96.21 to 95.51 support zone, but if the bears prevail, the index might collapse to 91.88.

Instead, if the price turns up sharply from the current level or the support zone and rises above the moving averages, it signals that the index might extend its stay inside the 96.21 to 100.54 range for some more time.

Bitcoin price prediction

BTC’s recovery is stalling just below the breakdown level of $74,508, indicating that the bears are attempting to flip the level into resistance.

The downsloping 20-day EMA ($78,142) and the RSI in the negative territory indicate an advantage to sellers. If the price turns down from $74,508 or the 20-day EMA, the bears will again strive to pull the BTC/USDT pair toward $60,000.

This negative view will be invalidated in the near term if the Bitcoin price breaks above the 20-day EMA. That suggests solid buying at lower levels. The pair may then rally toward the 50-day SMA ($86,636).

Ether price prediction

Ether’s (ETH) relief rally is facing selling at the $2,111 level, but a positive sign is that the bulls have not ceded much ground to the bears.

If the price decisively closes above the $2,111 level, the ETH/USDT pair may climb to the 20-day EMA ($2,447). This is a crucial resistance to watch out for, as a break above it suggests that the bearish momentum has weakened. The Ether price may then rise to the 50-day SMA ($2,877).

Sellers will have to aggressively defend the $2,111 level to retain their advantage. If they do that, the $1,750 level may be at risk of breaking down. The pair may then slump to $1,537.

BNB price prediction

BNB’s (BNB) relief rally is facing selling near the 50% Fibonacci retracement level of $676, indicating a negative sentiment.

If the price slips below $602, the bears will attempt to yank the BNB/USDT pair below the $570 support. If they manage to do that, the pair may plummet to $500.

Contrarily, if bulls push the BNB price above $676, the pair may ascend to the breakdown level of $730. Sellers are expected to defend the $730 to $790 zone as a break above it suggests that the bulls are back in the game. The pair might then surge to the 50-day SMA ($849).

XRP price prediction

Buyers have maintained XRP (XRP) above the support line of the descending channel pattern but are struggling to push the price to the 20-day EMA ($1.63).

If the price turns down and breaks below the support line, it indicates that the bears remain in charge. The XRP/USDT pair may then retest the $1.11 level. Buyers are expected to defend the $1.11 level with all their might, as a break below it may sink the pair to $1 and then to $0.75.

Buyers will have to propel the XRP price above the 20-day EMA to gain the upper hand in the short term. The pair may then march toward the downtrend line. A close above the downtrend line suggests the start of a new up move.

Solana price prediction

Solana’s (SOL) relief rally is facing selling just below the breakdown level of $95, indicating that the bears are attempting to flip the level into resistance.

If the Solana price continues lower and breaks below $77, it suggests that the bears remain in command. The SOL/USDT pair may then retest the $67 level, which is likely to act as a strong support.

Sellers are expected to defend the zone between the 20-day EMA ($104) and the $95 level, as a close above it signals that the bulls are back in the driver’s seat. The pair may then march toward the 50-day SMA ($123).

Related: Bitcoin whales took advantage of $60K price dip, scooping up 40K BTC

Dogecoin price prediction

Sellers are attempting to halt Dogecoin’s (DOGE) relief rally at the psychological level of $0.10.

If the Dogecoin price turns down from the current level, it increases the possibility of a break below the $0.08 level. The DOGE/USDT pair may then resume its downtrend and nosedive to $0.06.

Time is running out for the bulls. They will have to push the price above the 20-day EMA ($0.11) to suggest that the bearish momentum is weakening. The pair may then march toward the $0.13 level.

Cardano price prediction

Cardano’s (ADA) shallow bounce off the support line of the descending channel pattern indicates that the bears are selling on rallies.

If the Cardano price turns down from the current level, the bears will again attempt to tug the ADA/USDT pair below the support line. If they can pull it off, the pair may collapse to the next support at $0.20.

Conversely, a break above the 20-day EMA ($0.30) suggests that the pair may remain inside the channel for some more time. The buyers will gain the upper hand on a close above the downtrend line. The pair may then ascend to the breakdown level of $0.50.

Bitcoin Cash price prediction

Bitcoin Cash’s (BCH) relief rally is facing resistance at the 20-day EMA ($543), indicating a bearish sentiment.

If the price continues lower and breaks below $497, it suggests that the bears remain in control. The BCH/USDT pair may then drop toward the crucial support at $443, where the buyers are expected to step in.

On the upside, the bulls will have to push and maintain the price above the 20-day EMA to negate the bearish view. If they do that, the Bitcoin Cash price may climb to the 50-day SMA ($585).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

U.S. government isn’t poised to sweep in with bitcoin buys, despite Jim Cramer rumor

President Donald Trump’s U.S. bitcoin reserve doesn’t exist yet, and there is no mechanism in the federal government for the wholesale purchase of crypto.

Keep that in mind when considering this weekend’s speculation about the price point that would cause the White House to push a buy button, thanks in large part to CNBC speculator Jim Cramer. There is no such button.

The president did order a “strategic reserve” established to hold bitcoin, but that didn’t make it spring into existence. The Treasury Department and crypto advisers spent months auditing the federal holdings of crypto (though White House crypto adviser Patrick Witt told CoinDesk last week that they still won’t share a number). But the process hit a snag: The advocates said they still need Congress to establish the stockpile under law.

The crypto sector’s new U.S. law for stablecoin issuers didn’t include it, nor does the sweeping crypto market structure bill currently grinding through the U.S. Senate. Clearing legislation through this Congress — even less controversial matters — is a tall order, and industry lobbyists are currently focused on the bill to finally establish market and oversight regulations for digital assets. A reserve may not even be second on the list of priorities, because crypto tax rules also beckon.

When Cramer suggested on-air that Trump has a plan, saying, “I heard at 60 he’s going to fill the bitcoin reserve,” the crypto markets took some notice. The struggling asset has recently dropped as low as $62,840 but spent some days hovering just under $70,000, and if the U.S. government stood ready to swoop in at $60,000, that could be a big deal. But the rumor isn’t supported by what’s going on with the federal fund.

For now, Trump’s executive order last year to set up the bitcoin reserve and a separate stockpile of other crypto assets waits to be fulfilled. And his order carefully rejected the idea of the government purchasing crypto with taxpayer money (which disappointed the industry at the time). Instead, he directed his administration to stop selling seized assets, so anything grabbed in civil or criminal cases is now allegedly being set aside for the future reserve.

The White House didn’t immediately respond to a request for comment on the weekend speculation. The government’s current bitcoin holding may hover around $23 billion, according to data from Arkham Intelligence on U.S.-associated wallets.

Some ideas have been floated by Trump’s advisers and by lawmakers such as Senator Cynthia Lummis for how the feds could buy bitcoin without tapping taxpayers, but no solutions have yet been chosen. And Lummis’ legislative efforts to enact the reserve haven’t advanced, even as her Senate tenure dwindles after her announcement she’ll retire after this year.

During Congressional hearings last week, Treasury Secretary Scott Bessent was asked whether the government was in a position to bail out bitcoin, and Bessent said he had no such authority. More specifically, though, he said he can’t order U.S. bankers to start buying up crypto.

For government purchases, the industry may be better off looking toward states at the moment. Several state governments pursued bitcoin reserve authorities last year and have been more nimble than the federal government in setting up pockets of their budgets meant for digital assets.

Read More: Why Doesn’t the U.S. Have a Bitcoin Reserve, Yet?

Crypto World

Six Arrested in France After Cryptocurrency Ransom Kidnapping of Magistrate

TLDR:

- French police arrested six suspects, including a minor, following a 30-hour cryptocurrency kidnapping

- Magistrate and mother escaped by alerting neighbor; no ransom paid to cryptocurrency kidnappers

- France experiencing pattern of crypto-linked kidnappings targeting industry professionals

- Previous victims include Ledger co-founder David Balland who had finger severed by kidnappers

French authorities arrested six suspects following a cryptocurrency ransom kidnapping that held a magistrate and her mother captive for approximately 30 hours.

The victims escaped without payment after being discovered injured in a garage in southeastern France. Lyon prosecutor Thierry Dran confirmed the arrests on Sunday, including four men, one woman, and a minor.

The incident adds to growing concerns about cryptocurrency-related crimes targeting industry professionals and their families.

Details of the Abduction and Rescue Operation

The 35-year-old magistrate and her 67-year-old mother were abducted overnight from Wednesday to Thursday. Police found them Friday morning in Bourg-les-Valence, located in the Drôme region.

Both victims sustained injuries during their ordeal but managed to free themselves by alerting neighbors.

The rescue unfolded when the captive women began banging on the garage door where they were held. Describing the escape, prosecutor Dran stated, “Alerted by the noise, a neighbour intervened. He was able to open the door and allow our two victims to escape.” The quick response from the neighbor prevented further harm to both women.

The kidnappers demanded cryptocurrency payment from the magistrate’s partner, who holds a senior position at a digital currency startup.

A ransom message accompanied by a photograph of the victim arrived shortly after the abduction. The perpetrators threatened to mutilate both women if payment delays occurred.

Authorities launched an extensive search operation involving 160 police officers. Two suspects were apprehended while attempting to board a bus to Spain.

Three arrests occurred overnight, followed by two more on Sunday morning. The minor suspect was detained Sunday afternoon. The female suspect is reportedly the partner of one of the male detainees.

Meanwhile, police continue searching for additional suspects connected to the case. Prosecutor Dran declined to disclose the specific ransom amount requested by the criminals.

Pattern of Cryptocurrency—Targeted Kidnappings

France has experienced multiple kidnapping incidents targeting cryptocurrency industry figures and their relatives. These crimes reflect a disturbing trend affecting the digital asset sector.

The perpetrators specifically choose victims with connections to substantial cryptocurrency holdings or businesses.

David Balland, co-founder of Ledger, became a victim in January 2025. Kidnappers seized Balland and his partner, severing his finger before demanding ransom.

His company held a valuation exceeding $1 billion at that time. Balland gained freedom the following day, while authorities discovered his girlfriend bound in a car trunk near Paris.

Another incident occurred in May involving the father of a Malta-based cryptocurrency company operator. Four masked individuals abducted the victim in Paris.

The kidnappers removed his finger and demanded several million euros. Security forces conducted a raid 58 hours later, securing his release.

These crimes demonstrate how criminals perceive cryptocurrency holders as lucrative targets. The digital nature of cryptocurrency enables anonymous transactions, potentially appealing to kidnappers seeking untraceable payments.

However, authorities have successfully prevented ransom payments in several cases, including the recent magistrate incident.

Law enforcement agencies continue developing strategies to combat this emerging criminal trend affecting the cryptocurrency community.

Crypto World

Dan Romero and Varun Srinivasan join Tempo

Farcaster co-founders Dan Romero and Varun Srinivasan said Monday they are joining stablecoin-focused startup Tempo, signaling a pivot away from crypto-native social media and toward blockchain-based payments.

The move follows last month’s acquisition of Farcaster by Neynar, a long-time infrastructure provider for the protocol that offers APIs and tools for developers building on the network.

Farcaster was once pitched as crypto’s answer to Twitter, a protocol-based alternative where users controlled their identities and data. After Neynar’s acquisition, Romero, Srinivasan and several members of their team at Merkle, the company behind Farcaster, stepped away from the project.

In a post on X, Romero said he’s now focused on building a “fast, inexpensive and transparent” global payments network at Tempo.

Launched quietly last year, Tempo has quickly drawn attention as one of the most well-capitalized new ventures in the stablecoin space. It was incubated by payments giant Stripe and crypto venture firm Paradigm, both of which have deep experience in building and scaling financial infrastructure. Tempo’s goal is to power international payments using stablecoins, offering an alternative to traditional cross-border systems that remain costly, slow and opaque.

Crypto World

UAE Enters Blockchain Execution Phase with Institutional Infrastructure

Editor’s note: The Blockchain Center Abu Dhabi has released a new flagship report examining how the UAE has moved beyond pilot projects to large-scale, regulated blockchain deployment across finance, payments, public services, and market infrastructure. Co-authored with Binance, the research outlines how regulatory clarity, institutional participation, and sovereign capital have enabled blockchain to operate as core economic infrastructure rather than a speculative technology. The report details live use cases already in production, from digital identity and stablecoins to tokenization and central bank initiatives, positioning the UAE as a reference point for compliant, institutional-grade blockchain adoption.

Key points

- The report documents the UAE’s shift from blockchain experimentation to supervised, national-scale deployment.

- Live use cases include digital identity for 11 million users, regulated stablecoins, CBDC pilots, and real-world asset tokenization.

- Payments and remittances are a major driver, with over AED 20 trillion processed domestically in 2025 to date.

- The ecosystem has evolved toward institutional players, including regulated exchanges, custodians, banks, and infrastructure providers.

- Binance is positioned within the UAE’s regulated framework as an institutional infrastructure participant.

Why this matters

The report provides a concrete snapshot of how blockchain is being embedded into real economic systems under regulatory oversight. For builders, financial institutions, and policymakers, it shows what production-grade deployment looks like when regulation, capital, and technology move in alignment. For the broader market, the UAE’s model highlights how blockchain can support payments, tokenization, and public services at scale, offering a practical reference for jurisdictions seeking to move from pilots to durable infrastructure.

What to watch next

- Further expansion of regulated tokenization projects across real estate and other asset classes.

- Progress of central bank digital currency pilots and additional live transactions.

- New institutional partnerships operating under DFSA and FSRA oversight.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, UAE [9 February 2026]— The Blockchain Center Abu Dhabi has released today a flagship report highlighting the UAE’s transition from blockchain experimentation to regulated, large-scale deployment across finance, governance, and public-sector efficiency. The report credits the UAE’s layered regulatory framework for enabling institutional adoption in payments, tokenization, custody, and market infrastructure, embedding blockchain as foundational economic infrastructure. As part of this initiative, The Blockchain Center Abu Dhabi has collaborated with Binance as a co-author, recognizing Binance’s evolution from a global crypto exchange to a core provider of institutional-grade digital asset infrastructure globally and within the UAE’s regulatory environment.

From experimentation to execution at national scale: The report highlights that the UAE has moved into an execution phase defined by scale, regulatory clarity, and institutional deployment. Evidence of blockchain adoption appears in live, regulated use cases, including a national digital identity infrastructure serving 11 million users, multiple DFSA- and FSRA-approved stablecoins already live, a central bank digital currency in pilot with first transactions executed, and real-world asset tokenization initiatives intending to tokenize $4 billion across real estate alone.

These deployments are emerging within a payments and remittance environment of significant scale: domestic payment systems processed over AED 20 trillion in transfers in the first ten months of 2025, and the UAE ranks among the world’s largest sources of outbound remittances. The research also notes that 95% of UAE residents send international remittances at least once per year, more than 71% of UAE e-commerce payments are completed using cards or mobile wallets, and cross-border flows supported by the UAE economy exceed USD 40 billion annually.

From startup ecosystem to institutional market structure: The research documents a structural shift in the UAE’s blockchain ecosystem, from early-stage startups to a dense, institutional landscape now spanning regulated exchanges and custodians, payment providers, tokenization platforms, infrastructure vendors, enterprise solution providers, banks, and multinational technology firms. Commenting on the findings, Abdulla Al Dhaheri, CEO of The Blockchain Center Abu Dhabi, said: “The UAE has created an environment where regulators, financial institutions, and technology providers can work together to deploy blockchain in a controlled and meaningful way. The result is an ecosystem focused on real use cases, regulatory clarity, and long-term financial infrastructure. This report captures that transition from experimentation to supervised deployment, and shows how global platforms such as Binance are increasingly participating within locally regulated market structures rather than operating on the periphery.”

Blockchain positioned as national economic infrastructure: The report positions blockchain as critical national economic infrastructure, likening it to transformative technologies like telecommunications and railways. Key live, regulated deployments include real-world asset tokenization, stablecoins and AED-backed tokenized deposits, payments and wholesale settlement platforms, and blockchain-powered trade, logistics, and government services. Digital identity infrastructure through UAE Pass serves 11 million users with over 2.5 billion authentications. The research also underscores the impact of sovereign and quasi-sovereign capital, managing over USD 2.5 trillion in assets, which can support and scale compliant blockchain initiatives.

Binance within the UAE’s institutional blockchain framework: Binance’s integration within the UAE’s institutional landscape as an ADGM FSRA-regulated entity, reflecting the country’s emphasis on compliant, large-scale digital asset and blockchain infrastructure. In 2025, MGX’s USD 2 billion investment into Binance, executed using regulated stablecoin infrastructure, demonstrated the UAE’s commitment to digital financial infrastructure and reinforced the jurisdiction’s credibility as a hub for globally scaled, institutional-grade platforms.

Tarik Erk, Regional Head for MENAT and Senior Executive Officer, Abu Dhabi at Binance, said: “What distinguishes the UAE is not just innovation, but execution within a regulated, institutional-grade framework. This research reflects how blockchain is now being deployed across payments, tokenization, custody, and market infrastructure as part of the country’s core economic systems. Binance’s participation in this initiative reflects our long-term commitment to operating within these structures and supporting the UAE’s vision for secure, scalable, and compliant blockchain infrastructure that serves real economic use cases.”

The Blockchain Center Abu Dhabi and Binance research positions the UAE as a global benchmark for institutional blockchain infrastructure, highlighting how deliberate regulatory design and ecosystem coordination have enabled and are further enabling blockchain to be deployed as production-grade infrastructure rather than speculative technology.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat21 hours ago

NewsBeat21 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports16 hours ago

Sports16 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat11 hours ago

NewsBeat11 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know