Crypto World

Bitcoin price low-volume bounce raises bull trap concerns

Bitcoin’s price has bounced from key support near $60,000, but declining volume and rising overhead resistance are raising concerns that the move may be a bull trap rather than a sustainable recovery.

Summary

- $60,000 support sparked the bounce, but demand remains weak

- Low volume and VWAP/Fibonacci rejection, signal fragile upside

- Acceptance below the point of control, favors rotation back toward support

Bitcoin (BTC) price action has staged a short-term rebound after successfully retesting a major high-timeframe support level near $60,000. While the bounce initially appeared constructive, deeper analysis reveals that the move higher has lacked strong participation.

Declining volume during the rally suggests that bullish momentum remains fragile, increasing the probability that the recent upside is corrective rather than trend-defining.

Bitcoin price key technical points

- $60,000 support has held, triggering a short-term bounce

- Rising price on declining volume, signaling weak bullish conviction

- Rejection at VWAP and 0.618 Fibonacci, reinforcing local resistance

From a volume profile perspective, Bitcoin’s recent advance has occurred on noticeably declining volume. In healthy bullish reversals, price expansion is typically accompanied by increasing participation, reflecting strong demand and conviction from buyers. In contrast, the current rally lacks this confirmation, suggesting the move may be driven by short-covering or opportunistic buying rather than sustained accumulation.

This type of low-volume bounce often appears during corrective phases within broader bearish or range-bound environments. Without renewed volume expansion, the probability of follow-through remains limited, leaving price vulnerable to renewed selling pressure.

Rejection from key resistance levels

Technically, Bitcoin is now facing a strong confluence of resistance. The current rejection is occurring near the 0.618 Fibonacci retracement of the recent decline, an area that often acts as a decision point in corrective rallies. This level is reinforced by VWAP resistance, drawn from the recent swing high prior to the series of sharp sell-offs.

The combination of Fibonacci resistance and VWAP creates a high-probability supply zone. Price rejection from this area, particularly on weak volume, strengthens the case that sellers remain active and willing to defend higher levels.

Acceptance below the point of control

Another important development is Bitcoin’s inability to hold above the local point of control (POC). The POC represents the price level at which the highest trading volume has occurred and often serves as a market balance point.

Finding acceptance below this level suggests that sellers are regaining control and that the market is transitioning back into imbalance. Historically, acceptance below the POC following a low-volume rally increases the likelihood of a rotational move lower, especially when broader structure remains bearish or neutral.

Range rotation likely to continue

From a market structure perspective, Bitcoin appears to be trading within a developing high-timeframe range. The lower boundary of this range is defined by the $60,000 support, while the upper boundary sits near $76,200. Until price can break above resistance with strong volume confirmation, rotations within this range remain the higher-probability outcome.

Given the current rejection and lack of bullish participation, the probability favors a move back toward the lower end of the range. A rotation toward $60,000 would be consistent with range behavior and would test whether buyers can continue to defend this critical support.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin’s recent bounce shows signs of weakness. The combination of declining volume, rejection from key resistance, and acceptance below the point of control raises the risk that the move higher is a bull trap.

If selling pressure increases, Bitcoin is likely to rotate back toward the $60,000 region to retest high-timeframe support. A strong reaction from this level would keep the broader range intact, while failure to hold could expose deeper downside risk.

Crypto World

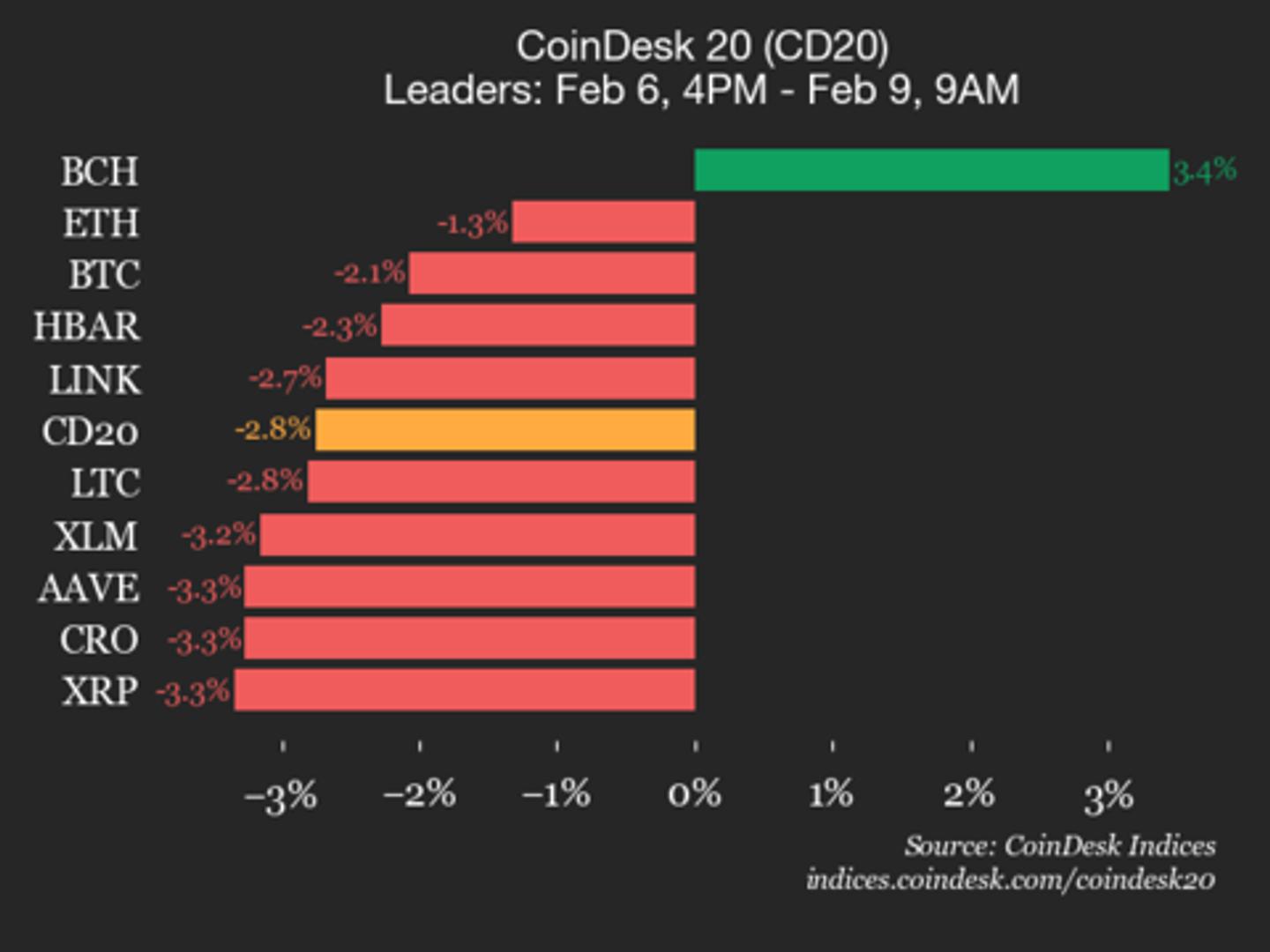

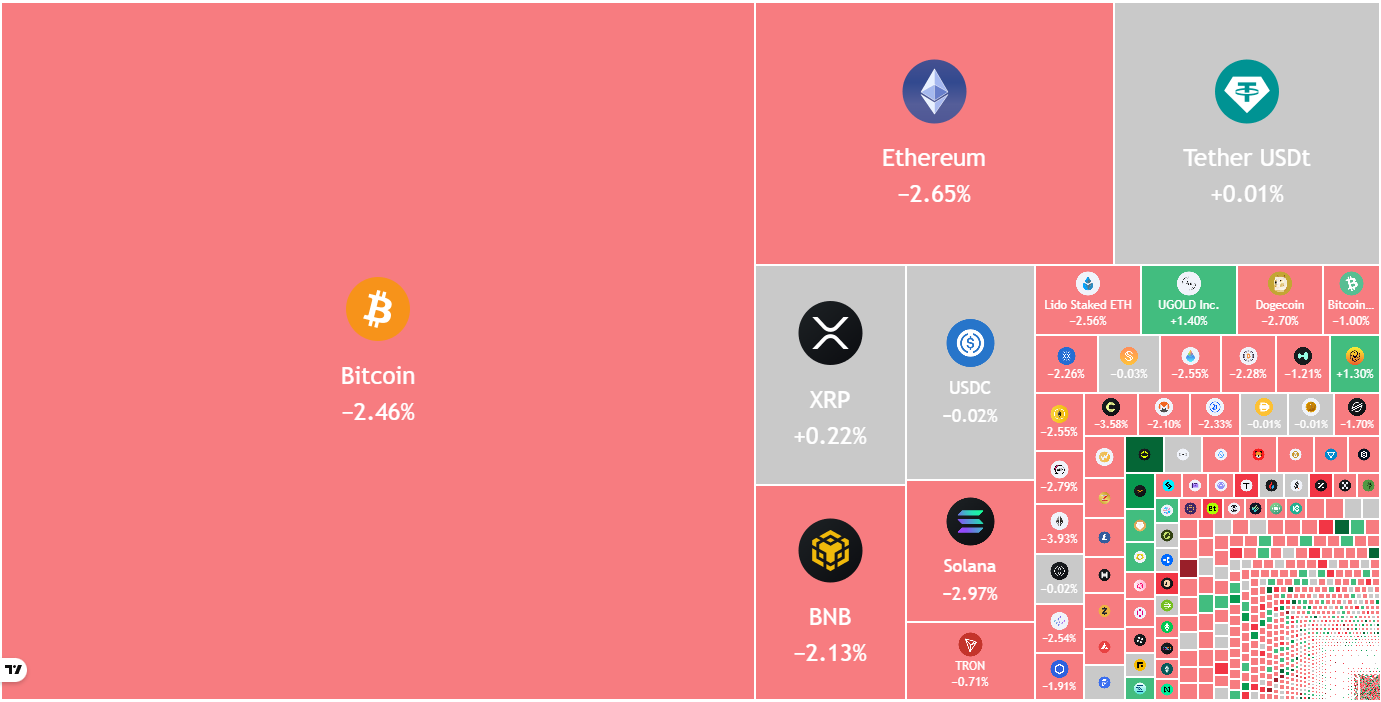

CoinDesk 20 performance update: Bitcoin Cash (BCH) is only gainer, up 3.4%

Aptos (APT) declined 9.4% and NEAR Protocol (NEAR) fell 8%, leading index lower.

Crypto World

Solana price near key $75 support as RSI oversold signals potential bounce

- Solana (SOL) currently trades near $83 after a nearly 39% monthly drop.

- Weekly and daily RSI signal the token is oversold, hinting at a possible short bounce.

- The key support around $75 is critical to prevent further decline.

Solana (SOL) has been under intense pressure in recent weeks.

The altcoin currently trades around $83, down nearly 39% over the past month.

This decline comes amid broader weakness in the crypto market and low retail engagement.

Technical analysis shows that SOL’s weekly Relative Strength Index (RSI) is deeply oversold.

Some are suggesting that the token may have reached a “final dip,” referencing a long-term structural support around the $75 level, and eyes are now on whether this support can hold.

Solana price technical analysis

From a technical standpoint, Solana’s trading volume remains high, with over $3.9 billion exchanging in the past 24 hours.

But despite this high activity, the token is trading well below key moving averages.

The 50-day and 200-day averages now act as the immediate resistance levels and remain out of reach for now.

Short-term momentum indicators, including the MACD histogram, have flattened, reflecting waning bearish momentum.

In addition, on the daily and weekly charts, RSI remains near historic lows, indicating extreme oversold conditions.

This combination suggests potential for a short-term relief bounce, though trend reversal is not guaranteed.

Market sentiment shows a muted retail engagement

Retail interest in Solana remains muted, with recent reports showing low futures open interest, signalling that traders are reducing exposure.

Derivatives funding rates are also negative, suggesting bias toward short positions.

Solana ETFs have also recorded outflows, reinforcing weak institutional participation.

Analysts note that these factors add to the bearish pressure on the token.

Still, technical indicators hint at a potential stabilisation near critical support zones, with the $75 level having been repeatedly cited as key support in recent forecasts.

Breaking below this threshold could open the door to further downside, possibly toward $67 or even $51 in extreme scenarios.

On the upside, recovery faces resistance around $111 and $138, which would need to be breached to shift the market sentiment positively.

Long-term Solana market analysis

Long-term forecasts for Solana remain mixed.

Some analysts foresee recovery toward the mid-$100s if support holds and broader market conditions improve.

Bullish projections even extend toward $250, though these are contingent on sustained buying pressure and macro-level stability.

For now, the focus remains on short-term price stability.

Investors and traders should keep a close eye on the $75 support, viewing it as a potential floor for consolidation.

SOL’s trajectory will likely depend on a combination of market sentiment, institutional flows, and technical momentum.

As it stands, Solana is navigating a critical juncture where its next move could define the tone for the coming months.

Crypto World

Phemex introduces 24/7 TradFi futures trading with 0-Fee Carnival, creating an all-in-one trading hub

- Phemex, a user-first crypto exchange, announced the launch of Phemex TradFi, a new futures trading offering.

- Futures linked to commodities, foreign exchange, and global indices will be introduced in subsequent phases.

- Phemex TradFi is designed for traders seeking simplicity and continuity across markets.

Apia, Samoa, February 9, 2025 — Phemex, a user-first crypto exchange, announced the launch of Phemex TradFi, a new futures trading offering that allows users to access traditional financial assets, including stocks and precious metals, on a 24/7 basis.

Futures linked to commodities, foreign exchange, and global indices will be introduced in subsequent phases.

The launch marks Phemex’s entry into multi-market derivatives, enabling traders to manage exposure to both crypto and traditional assets within a single, USDT-settled futures framework.

To support early adoption, Phemex is introducing a 0-Fee TradFi Futures Carnival, offering three months of zero trading fees, starting from February 6, on stock futures alongside a $100,000 incentive pool aimed at structured and risk-aware participation, and a first-trade protection mechanism that reimburses eligible users with trading bonus if their initial TradFi futures trade results in a loss.

Unlike spot markets that are constrained by exchange hours, TradFi futures continue price discovery outside standard trading sessions.

By bringing this derivative structure into a crypto-native environment, Phemex allows users to respond to global macro events as they unfold, whether during nights, weekends, or market closures—without switching platforms or settlement systems.

Phemex TradFi is designed for traders seeking simplicity and continuity across markets.

Users can trade crypto and traditional futures side by side, benefit from transparent maker-taker pricing rather than spread-based execution, and apply strategy-driven tools to manage risk more systematically.

Copy trading support for TradFi futures is also planned, extending Phemex’s strategy trading ecosystem into traditional markets.

“As markets become more connected and operate beyond fixed sessions, platforms need to evolve with them” commented Federico Variola, CEO of Phemex.

“Our goal with Phemex TradFi is not to replicate traditional markets, but to rethink how they are accessed — bringing continuous availability, unified settlement, and risk-aware tools into a single trading environment that reflects how traders actually operate today.”

The introduction of TradFi futures signals Phemex’s evolution from a crypto-native exchange into a broader derivatives platform built for always-on global markets.

As additional asset classes roll out, Phemex aims to offer traders a more integrated, resilient, and forward-looking way to navigate both digital and traditional finance.

About Phemex

Founded in 2019, Phemex is a user-first crypto exchange trusted by over 10 million traders worldwide. The platform offers spot and derivatives trading, copy trading, and wealth management products designed to prioritize user experience, transparency, and innovation.

With a forward-thinking approach and a commitment to user empowerment, Phemex delivers reliable tools, inclusive access, and evolving opportunities for traders at every level to grow and succeed.

For media inquiries, please contact: [email protected]

For more information, please visit: https://phemex.com/

Media contact Oyku Yavuz PR Lead [email protected]

This article is authored by a third party, and CoinJournal does not endorse or take responsibility for its content, accuracy, quality, advertisements, products, or materials. Readers should independently research and exercise due diligence before making decisions related to the mentioned company.

Crypto World

Mother of Olympics TV host kidnapped for bitcoin ransom

Nancy Guthrie, the 84 year-old mother of Today host Savannah Guthrie, was kidnapped from her rural Tuscon, Arizona home on February 1. While law enforcement has refused to confirm or deny whether two ransom notes sent to TMZ, KOLD, and KGUN were real, the media is operating under the assumption that they are.

The notes included two deadlines — one that passed without any updates and another that TMZ states has “an element of ‘or else’” — and demanded $6 million worth of bitcoin (BTC).

Media outlets haven’t clarified if the abductors are demanding a specific amount of BTC or a specific amount valued in dollars. If they’re demanding a specific number of BTC, the recent fall in the price could actually suggest that more than $6 million worth of the cryptocurrency was originally demanded.

As of today, $6 million would equate to roughly 85 BTC, on February 1, it would be 75-76 BTC.

Savannah Guthrie has hosted NBC’s coverage of three recent Olympic games, however, she’s understandably unable to host this year.

During the opening ceremony, three hosts acknowledged her difficult situation and wished her well.

A hoax and a second note

In a confusing set of circumstances, a man from California sent the Guthries a fake ransom demand shortly before the likely real kidnappers, who had originally stated they wouldn’t contact any media or the family in the first note, sent a second ransom note.

A local reporter at KOLD spoke to CNN and stated that the note was shorter than the first and seemed to be an attempt to provide some sort of proof they still had Guthrie in their possession.

Reporters have suggested that the emailed ransom demands are extremely secure and unlikely to be traced.

Read more: Crypto execs hiring private security after high-profile kidnappings, report

Sloppy or brilliant?

It is difficult to establish whether the Guthrie abductors are brilliant, investigators have been sloppy, or some combination of the two.

Surprises have included that there has reportedly been no footage obtained of either the perpetrators or the vehicle(s) in which they escaped, no suggestion that a so-called “proof-of-life” has been shared with the family, and that the abductors used BTC instead of a coin that is easier to shield, such as Monero or Zcash.

It’s unknown if the kidnappers have demanded the BTC be sent to a single wallet address or want it broken up, or if they believe they know an exchange or mixer that would reliably accept the BTC and not be easily traced.

Damning for law enforcement is the fact that they have combed through the crime scene in Tuscon at least three times and have yet to come up with any leads or new information to share with the public.

A deadline and an introduction

It’s still unclear which timezone the 5:00pm deadline refers to or what threat is being levelled. The Guthries have sent out a distressing, public video in which they speak directly to the kidnappers.

“We received your message and we understand. We beg you now to return our mother to us so that we can celebrate with her. This is the only way that we will have peace. This is very valuable to us and we will pay.”

While there’s little doubt that this horrifying crime has had a profound effect on the Guthrie family, Savannah Guthrie’s co-workers at Today, and others close to her, it’s also becoming more clear that entirely new demographics of the US population are about to be introduced to one of the absolute darkest sides to crypto.

The Today show averages almost 3 million viewers a day, with those who regularly tune in skewing older.

This means that an ongoing and growing global problem — that crypto is enabling kidnappers and extortionists to set up scam call centers or abduct the mother of a wealthy celebrity — will begin to finally worry older Americans.

Perhaps a new issue for the “Crypto President.”

Not surprising, but shocking

Anyone who’s been following crypto for the past several years has heard about pig butchering.

The scam works by luring victims, usually from developing nations like China and Thailand, to vast scam call center campuses almost always located in Cambodia, Laos, or Myanmar.

Once the victim arrives, they’re imprisoned in apartment blocks and offices where they’re forced to cold text and call Westerners and romance them in a long con to get crypto.

Read more: Bitcoin torture suspects granted bail in Manhattan court

An underreported, but important, element of the pig butchering scam is that victims are often able to contact family members to demand a ransom for their eventual release.

While an outsized ransom, such as the $6 million in BTC being demanded by the Nancy Guthrie kidnappers, is never asked for, the numbers are still high enough as to be out of reach for an average Chinese or Thai family.

This leads to victims languishing in the compounds for months or years at a time, but also leads pig butcherers to a secondary, less profitable source of income: kidnapping.

In this sense, perhaps the Guthrie kidnapping, while equal parts disturbing, terrible, and disheartening, is an important spotlight on what is now becoming a problem for everyone: cryptocurrency providing kidnappers a new, innovative way to actually get away with it.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

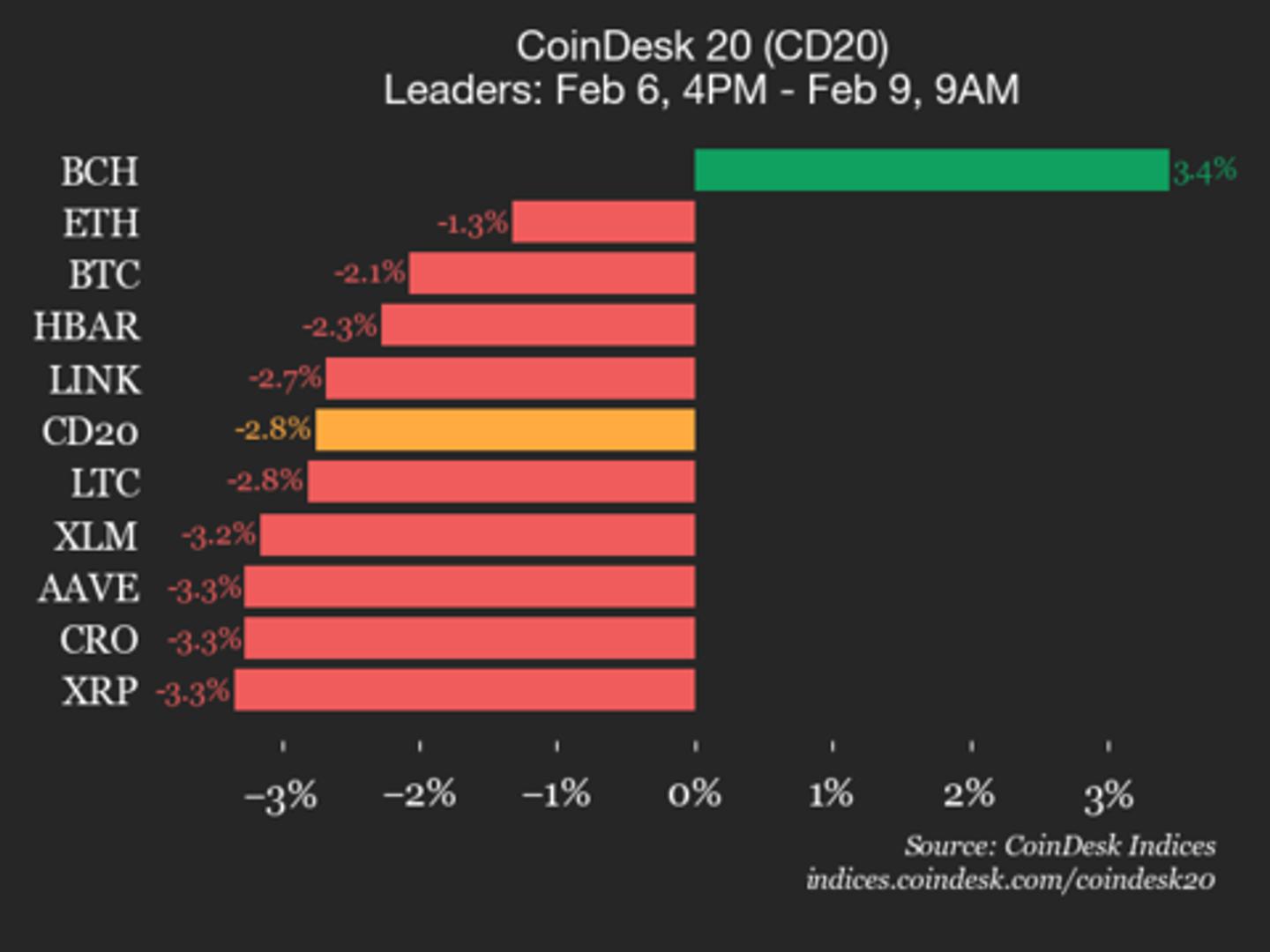

Andre Cronje’s Flying Tulip Gears Up for Public Sale

The DeFi application is set to launch its public sale on Feb 16, with the token live on Feb 23.

The DeFi super application space is facing headwinds following the Infinex token generation event (TGE) in January, but despite the adverse market conditions, Yearn Finance founder Andre Cronje is launching Flying Tulip’s (FT) public sale next week.

Flying Tulip confirmed the sale date on Saturday, and prediction markets are giving the platform a 50-50 chance of trading above a $400 million fully diluted valuation (FDV), albeit on low volumes.

For comparison, Infinex’s INX token is trading at a $121 million FDV, leaving ICO participants at a 60% loss from its $300 million ICO valuation.

Flying Tulip looks to fill a similar niche as Infinex, offering users a single platform that allows them to leverage some of DeFi’s most popular applications, including perpetual derivatives trading, spot trading, and lending.

However, Cronje has highlighted that the “Flying Tulip FDV is not standard FDV.” In a traditional model, FDV equates to the total supply multiplied by the token price, whereas the FT token includes an underlying put option, making it “closer to a NAV valuation than FDV.”

The protocol raised $200 million from the likes of Brevan Howard and DWF Labs in September, followed by a $25 million raise at a $1 billion valuation in January, $55 million via Impossible Finance, and $10 million via CoinList last week.

Flying Tulip is the YearnFi founder’s latest DeFi endeavor after Fantom, the Layer-1 blockchain that rebranded as Sonic. While Sonic started out hot, the token has struggled over the last year and is down 96% from its launch price, trading at a $160 million FDV.

Crypto World

Bitcoin Miner Activity Hits Highest Level Since 2024 with 90K BTC Sent to Binance

Rising miner deposits to Binance signal near-term supply pressure despite whale accumulation during the dip.

Bitcoin miners have sent more than 90,000 BTC to Binance since early February, pushing miner exchange inflows to their highest level since 2024, according to on-chain data shared by Arab Chain.

The rise in deposits comes during a period of heavy price swings and stressed investor sentiment, adding to short-term sell-side pressure even as other large holders moved in the opposite direction.

Miner Selling Rises as Volatility Shakes the Market

Data cited by Arab Chain shows miner activity picking up immediately after the start of February, with one day alone recording deposits of over 24,000 BTC to Binance. Such transfers often reflect miners converting part of their holdings to cover operating costs or lock in profits during volatile conditions, making these flows a gauge of potential sell-side supply.

The timing is notable, as Bitcoin experienced a steep correction last week that briefly pushed prices below $60,000 for the first time since October 2024, extending a drawdown of more than 50% from the last all-time high, according to analysis posted by Darkfost.

During that window, nearly 241,000 BTC flowed into exchanges across the market, with Binance seeing especially heavy activity from short-term holders. Darkfost described these flows as consistent with capitulation, particularly among investors reacting to rapid losses.

Retail behavior also shifted, with Darkfost noting that holders with less than 1 BTC, often referred to as “shrimps,” heavily increased transfers to Binance after the sell-off. On February 5, their daily inflows topped 1,000 BTC, far above the monthly average of around 365 BTC. However, that spike eased as prices stabilized, suggesting selling pressure from this group faded once Bitcoin recovered above $70,000.

Whales Accumulate as Price Steadies Near $70,000

While miners and smaller holders sent coins to exchanges, large holders took the opposite approach. Analyst CW8900 reported on February 8 that whales accumulated aggressively during the drop, with nearly 67,000 BTC moving into long-term accumulator addresses in a single day, the largest such inflow of this cycle.

You may also like:

Price action since then reflects that tug-of-war, with Bitcoin now trading at just over $70,000 per CoinGecko, a figure that is up about 1% on the day but still down nearly 8% over the past week and more than 22% in the last 30 days. The rebound followed a sharp fall from the mid-$80,000 range, part of a broader slide that erased gains made after the U.S. election and dragged major altcoins down by double digits.

Sentiment remains fragile, a state highlighted by the Bitcoin Fear and Greed Index, which fell to its lowest reading since 2019, even after prices bounced from the lows. As things stand, elevated miner inflows point to ongoing supply hitting the market, while whale accumulation and reduced retail selling suggest that selling pressure is no longer one-sided, with BTC attempting to hold above $70,000.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC miner sold more than half of its holdings

Bitcoin miner Cango (CANG) completed the sale 4,451 BTC over the weekend, raising roughly $305 million in USDT as it looks to reduce leverage and reposition its business around artificial intelligence infrastructure.

The company said it raised $305 million from the sale, suggesting an average sale price of about $68,524 per coin, or not far above multi-year low prices for bitcoin.

Shares are little-changed in Monday trading, but are lower by 83% on a year-over-year basis.

The company’s bitcoin sales were “based on a comprehensive assessment of current market conditions,” the firm said, as it plans to shift into AI computing infrastructure. Cango plans to deploy modular GPU units across its global network of over 40 sites to serve small and mid-sized businesses needing on-demand AI inference capacity, it said.

The company used the proceeds of its BTC sale to pay down a bitcoin-collateralized loan, bolstering its balance sheet. The company still holds 3,645 BTC worth more than $250 million, according to data from BitcoinTreasuries.

“In response to recent market conditions, we have made a treasury adjustment to strengthen balance sheet and reduce financial leverage, which provides increased capacity to fund our strategic expansion into AI compute infrastructure,” the company wrote in a letter to shareholders.

Its move into the AI sector comes as it faces what it framed as a gap between rising compute demand and existing grid capacity. Cango wrote that it’s well positioned to take advantage of that gap.

Cango is not alone. A growing group of bitcoin miners is scaling back exposure to pure mining and redirecting capital and infrastructure toward AI data centers and high-performance computing.

Bitfarms (BITF) has said it plans to exit crypto mining entirely by around 2027, and famously declared it’s no longer a bitcoin company as it shifts to high-performance computing and AI workloads.

Analysts at KBW have warned that the industry’s pivot toward AI workloads is compelling, but that the path to monetization is fraught with execution risks. That led to a downgrade not only on Bitfarms but also in Bitdeer (BTDR) and Hive Digital (HIVE).

Crypto World

Strategy hasn’t sold any STRC shares despite advertising on X

Strategy (formerly MicroStrategy) has been using its X marketing budget to advertise STRC, its quasi-pegged, 11.25% dividend-yielding preferred share. Unfortunately, that expensive, direct response ad campaign didn’t yield any results for shareholders last week.

For the week of February 2-8, Strategy didn’t sell any new shares of STRC nor any other preferred shares. It only succeeded in taking out the bid on its common stock, MSTR, to raise capital from its so-called at-the-market (ATM) shareholder dilution program.

Worse, its ad campaign didn’t yield any results in the prior week. From January 26 to February 1, the company failed to sell any preferred shares.

BTC yield growth slows despite STRC ads

Ultimately, what matters to shareholders of Michael Saylor’s bitcoin (BTC) acquisition entity is whether or not its management can sustainably increase BTC per share over time on a dilution-adjusted basis.

Although Strategy succeeded at generating BTC yield in prior years, its recent progress has slowed to a crawl.

After an impressive 7.3% in 2023, 74.3% in 2024, and 22.8% in 2025, the company was only able to accrete 0.3% BTC per share of MSTR in January 2026.

Unfortunately, its last two weeks of pure dilution of MSTR at a basic multiple-to-Net Asset Value (mNAV) below 1x, with no success at selling non-dilutive preferred shares over the past two weeks, will not improve that BTC yield number.

Worse, its average purchase price last week of $76,056 per BTC — and an even worse $87,974 the prior week — is continuing to lose money for the company based on the current market price for BTC closer to $70,000.

Read more: 100% of Strategy’s convertible debt is now out-of-the-money

Indeed, its entire investment return on its $54 billion investment is decidedly negative.

The company paid an average of more than $76,000 apiece for its BTC — more than 8% higher than BTC’s current value.

Strategy pays for the X Premium Business Full Access tier, currently priced at $10,000 per year, to secure its gold checkmark and affiliate employees under a clickable Strategy logo.

Because this package includes a credit for X ad spend, it’s unknown how much new money Strategy outlayed, if any, to pay for its disappointing STRC ad campaign.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

European Commission Moves to Impose Interim Measures on Meta’s WhatsApp AI Ban

TLDR

- The European Commission intends to impose interim measures on Meta over its exclusion of third-party AI assistants from WhatsApp.

- The Commission believes Meta’s actions breach EU antitrust laws, potentially harming competition in the AI market.

- Teresa Ribera emphasized the need for swift action to prevent dominant companies from using unfair advantages.

- Meta argues that the WhatsApp API is not a key distribution channel for AI assistants and denies antitrust violations.

- The EU has previously fined Apple, Meta, and Google for breaching various competition and data protection regulations.

The European Commission has announced its intention to impose interim measures against Meta for excluding third-party AI assistants from WhatsApp. The Commission believes Meta’s actions breach EU antitrust rules. An ongoing investigation will determine the final decision, with Meta being given the opportunity to defend itself.

EU Signals Preliminary Action Against Meta’s WhatsApp Policy

According to a CNBC report, the European Commission informed Meta of its preliminary view that the company violated EU antitrust regulations. The Commission stated that Meta’s policy change, which bans third-party AI assistants from WhatsApp, could harm competition in the AI market.

In response, the Commission warned that it may quickly impose interim measures to prevent this policy from irreparably damaging competition in Europe. The Commission emphasized that the rapid development of AI markets requires swift action to preserve access for competitors.

The Commission’s Commissioner for Competition, Teresa Ribera, highlighted the need for fair competition in digital markets. She said, “We need to prevent dominant tech companies from leveraging their position to harm competitors.” Ribera emphasized that Meta’s new policy could give it an unfair advantage, impacting smaller companies and AI assistants in the market. These measures aim to ensure that competitors can still access WhatsApp while the investigation proceeds.

Meta’s Response to EU Investigation

Meta responded to the Commission’s claims, arguing that there was no need for EU intervention in the WhatsApp Business API. A Meta spokesperson stated that people can still access AI assistants from app stores and other platforms. “The WhatsApp Business API is not a key distribution channel for these chatbots,” the spokesperson added. Meta maintains that its updated policy does not violate antitrust regulations.

The company further explained that AI options are widely available outside of WhatsApp. It also criticized the Commission’s logic, stating that the WhatsApp API does not significantly impact the distribution of AI assistants. However, the EU’s investigation will continue to examine the matter, with interim measures under consideration until a final ruling is made.

This move comes amid a broader pattern of fines imposed on U.S. tech companies by the European Union. In April, Apple was fined 500 million euros for breaching anti-steering obligations. That same month, Meta was fined 200 million euros for failing to offer users a service that uses less personal data. In September, Google faced a massive 2.95 billion euro fine for breaching EU competition laws.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Key points:

-

Bitcoin’s relief rally is facing selling near $72,000, but a positive sign is that the bulls have not ceded much ground to the bears.

-

Several major altcoins are facing selling at higher levels, indicating that the sentiment remains negative.

Bitcoin (BTC) has slipped closer to $69,500, indicating that the bears are selling on rallies. Several analysts believe that BTC’s bottom is still not in. Trader BitBull said in a post on X that BTC’s “real bottom will form below $50,000, where most of the ETF buyers will be underwater.”

A different view point was put forth by crypto sentiment platform Santiment. In a report on Saturday, the Santiment team said that data suggests the fall to $60,000 may have been a genuine bottom. However, for a sustained recovery, the market has to sustain above the key support level, and whales must continue their tentative accumulation.

Another positive for the bulls is that the BTC Sharpe ratio has fallen to -10, which historically indicates the final phases of bear markets, according to CryptoQuant analyst Darkfost. Although the readings do not confirm that the bear market is over, it indicates that the risk-to-reward profile may be reaching extreme levels.

Could BTC and the major altcoins start a strong relief rally, or will the downtrend resume? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) fell below the ascending channel pattern on Thursday, but the bulls could not sustain the lower levels.

The index came roaring back on Friday and surged above the moving averages. That shows the break below the channel may have been a bear trap. The bulls will attempt to push the price to the resistance line, where the bears are expected to step in.

The 20-day exponential moving average (6,917) is flattening out, and the relative strength index (RSI) is just above the midpoint, signaling a balance between supply and demand. A close above the resistance line might start the next leg of the uptrend toward 7,290.

US Dollar Index price prediction

The US Dollar Index (DXY) rose above the 20-day EMA (97.67) on Thursday, but the bulls could not sustain the higher levels.

The price plunged sharply below the 20-day EMA on Monday, signaling that the bears are attempting to take control. There is strong support in the 96.21 to 95.51 support zone, but if the bears prevail, the index might collapse to 91.88.

Instead, if the price turns up sharply from the current level or the support zone and rises above the moving averages, it signals that the index might extend its stay inside the 96.21 to 100.54 range for some more time.

Bitcoin price prediction

BTC’s recovery is stalling just below the breakdown level of $74,508, indicating that the bears are attempting to flip the level into resistance.

The downsloping 20-day EMA ($78,142) and the RSI in the negative territory indicate an advantage to sellers. If the price turns down from $74,508 or the 20-day EMA, the bears will again strive to pull the BTC/USDT pair toward $60,000.

This negative view will be invalidated in the near term if the Bitcoin price breaks above the 20-day EMA. That suggests solid buying at lower levels. The pair may then rally toward the 50-day SMA ($86,636).

Ether price prediction

Ether’s (ETH) relief rally is facing selling at the $2,111 level, but a positive sign is that the bulls have not ceded much ground to the bears.

If the price decisively closes above the $2,111 level, the ETH/USDT pair may climb to the 20-day EMA ($2,447). This is a crucial resistance to watch out for, as a break above it suggests that the bearish momentum has weakened. The Ether price may then rise to the 50-day SMA ($2,877).

Sellers will have to aggressively defend the $2,111 level to retain their advantage. If they do that, the $1,750 level may be at risk of breaking down. The pair may then slump to $1,537.

BNB price prediction

BNB’s (BNB) relief rally is facing selling near the 50% Fibonacci retracement level of $676, indicating a negative sentiment.

If the price slips below $602, the bears will attempt to yank the BNB/USDT pair below the $570 support. If they manage to do that, the pair may plummet to $500.

Contrarily, if bulls push the BNB price above $676, the pair may ascend to the breakdown level of $730. Sellers are expected to defend the $730 to $790 zone as a break above it suggests that the bulls are back in the game. The pair might then surge to the 50-day SMA ($849).

XRP price prediction

Buyers have maintained XRP (XRP) above the support line of the descending channel pattern but are struggling to push the price to the 20-day EMA ($1.63).

If the price turns down and breaks below the support line, it indicates that the bears remain in charge. The XRP/USDT pair may then retest the $1.11 level. Buyers are expected to defend the $1.11 level with all their might, as a break below it may sink the pair to $1 and then to $0.75.

Buyers will have to propel the XRP price above the 20-day EMA to gain the upper hand in the short term. The pair may then march toward the downtrend line. A close above the downtrend line suggests the start of a new up move.

Solana price prediction

Solana’s (SOL) relief rally is facing selling just below the breakdown level of $95, indicating that the bears are attempting to flip the level into resistance.

If the Solana price continues lower and breaks below $77, it suggests that the bears remain in command. The SOL/USDT pair may then retest the $67 level, which is likely to act as a strong support.

Sellers are expected to defend the zone between the 20-day EMA ($104) and the $95 level, as a close above it signals that the bulls are back in the driver’s seat. The pair may then march toward the 50-day SMA ($123).

Related: Bitcoin whales took advantage of $60K price dip, scooping up 40K BTC

Dogecoin price prediction

Sellers are attempting to halt Dogecoin’s (DOGE) relief rally at the psychological level of $0.10.

If the Dogecoin price turns down from the current level, it increases the possibility of a break below the $0.08 level. The DOGE/USDT pair may then resume its downtrend and nosedive to $0.06.

Time is running out for the bulls. They will have to push the price above the 20-day EMA ($0.11) to suggest that the bearish momentum is weakening. The pair may then march toward the $0.13 level.

Cardano price prediction

Cardano’s (ADA) shallow bounce off the support line of the descending channel pattern indicates that the bears are selling on rallies.

If the Cardano price turns down from the current level, the bears will again attempt to tug the ADA/USDT pair below the support line. If they can pull it off, the pair may collapse to the next support at $0.20.

Conversely, a break above the 20-day EMA ($0.30) suggests that the pair may remain inside the channel for some more time. The buyers will gain the upper hand on a close above the downtrend line. The pair may then ascend to the breakdown level of $0.50.

Bitcoin Cash price prediction

Bitcoin Cash’s (BCH) relief rally is facing resistance at the 20-day EMA ($543), indicating a bearish sentiment.

If the price continues lower and breaks below $497, it suggests that the bears remain in control. The BCH/USDT pair may then drop toward the crucial support at $443, where the buyers are expected to step in.

On the upside, the bulls will have to push and maintain the price above the 20-day EMA to negate the bearish view. If they do that, the Bitcoin Cash price may climb to the 50-day SMA ($585).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat22 hours ago

NewsBeat22 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports17 hours ago

Sports17 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat12 hours ago

NewsBeat12 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know