Crypto World

UAE Enters Blockchain Execution Phase with Institutional Infrastructure

Editor’s note: The Blockchain Center Abu Dhabi has released a new flagship report examining how the UAE has moved beyond pilot projects to large-scale, regulated blockchain deployment across finance, payments, public services, and market infrastructure. Co-authored with Binance, the research outlines how regulatory clarity, institutional participation, and sovereign capital have enabled blockchain to operate as core economic infrastructure rather than a speculative technology. The report details live use cases already in production, from digital identity and stablecoins to tokenization and central bank initiatives, positioning the UAE as a reference point for compliant, institutional-grade blockchain adoption.

Key points

- The report documents the UAE’s shift from blockchain experimentation to supervised, national-scale deployment.

- Live use cases include digital identity for 11 million users, regulated stablecoins, CBDC pilots, and real-world asset tokenization.

- Payments and remittances are a major driver, with over AED 20 trillion processed domestically in 2025 to date.

- The ecosystem has evolved toward institutional players, including regulated exchanges, custodians, banks, and infrastructure providers.

- Binance is positioned within the UAE’s regulated framework as an institutional infrastructure participant.

Why this matters

The report provides a concrete snapshot of how blockchain is being embedded into real economic systems under regulatory oversight. For builders, financial institutions, and policymakers, it shows what production-grade deployment looks like when regulation, capital, and technology move in alignment. For the broader market, the UAE’s model highlights how blockchain can support payments, tokenization, and public services at scale, offering a practical reference for jurisdictions seeking to move from pilots to durable infrastructure.

What to watch next

- Further expansion of regulated tokenization projects across real estate and other asset classes.

- Progress of central bank digital currency pilots and additional live transactions.

- New institutional partnerships operating under DFSA and FSRA oversight.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, UAE [9 February 2026]— The Blockchain Center Abu Dhabi has released today a flagship report highlighting the UAE’s transition from blockchain experimentation to regulated, large-scale deployment across finance, governance, and public-sector efficiency. The report credits the UAE’s layered regulatory framework for enabling institutional adoption in payments, tokenization, custody, and market infrastructure, embedding blockchain as foundational economic infrastructure. As part of this initiative, The Blockchain Center Abu Dhabi has collaborated with Binance as a co-author, recognizing Binance’s evolution from a global crypto exchange to a core provider of institutional-grade digital asset infrastructure globally and within the UAE’s regulatory environment.

From experimentation to execution at national scale: The report highlights that the UAE has moved into an execution phase defined by scale, regulatory clarity, and institutional deployment. Evidence of blockchain adoption appears in live, regulated use cases, including a national digital identity infrastructure serving 11 million users, multiple DFSA- and FSRA-approved stablecoins already live, a central bank digital currency in pilot with first transactions executed, and real-world asset tokenization initiatives intending to tokenize $4 billion across real estate alone.

These deployments are emerging within a payments and remittance environment of significant scale: domestic payment systems processed over AED 20 trillion in transfers in the first ten months of 2025, and the UAE ranks among the world’s largest sources of outbound remittances. The research also notes that 95% of UAE residents send international remittances at least once per year, more than 71% of UAE e-commerce payments are completed using cards or mobile wallets, and cross-border flows supported by the UAE economy exceed USD 40 billion annually.

From startup ecosystem to institutional market structure: The research documents a structural shift in the UAE’s blockchain ecosystem, from early-stage startups to a dense, institutional landscape now spanning regulated exchanges and custodians, payment providers, tokenization platforms, infrastructure vendors, enterprise solution providers, banks, and multinational technology firms. Commenting on the findings, Abdulla Al Dhaheri, CEO of The Blockchain Center Abu Dhabi, said: “The UAE has created an environment where regulators, financial institutions, and technology providers can work together to deploy blockchain in a controlled and meaningful way. The result is an ecosystem focused on real use cases, regulatory clarity, and long-term financial infrastructure. This report captures that transition from experimentation to supervised deployment, and shows how global platforms such as Binance are increasingly participating within locally regulated market structures rather than operating on the periphery.”

Blockchain positioned as national economic infrastructure: The report positions blockchain as critical national economic infrastructure, likening it to transformative technologies like telecommunications and railways. Key live, regulated deployments include real-world asset tokenization, stablecoins and AED-backed tokenized deposits, payments and wholesale settlement platforms, and blockchain-powered trade, logistics, and government services. Digital identity infrastructure through UAE Pass serves 11 million users with over 2.5 billion authentications. The research also underscores the impact of sovereign and quasi-sovereign capital, managing over USD 2.5 trillion in assets, which can support and scale compliant blockchain initiatives.

Binance within the UAE’s institutional blockchain framework: Binance’s integration within the UAE’s institutional landscape as an ADGM FSRA-regulated entity, reflecting the country’s emphasis on compliant, large-scale digital asset and blockchain infrastructure. In 2025, MGX’s USD 2 billion investment into Binance, executed using regulated stablecoin infrastructure, demonstrated the UAE’s commitment to digital financial infrastructure and reinforced the jurisdiction’s credibility as a hub for globally scaled, institutional-grade platforms.

Tarik Erk, Regional Head for MENAT and Senior Executive Officer, Abu Dhabi at Binance, said: “What distinguishes the UAE is not just innovation, but execution within a regulated, institutional-grade framework. This research reflects how blockchain is now being deployed across payments, tokenization, custody, and market infrastructure as part of the country’s core economic systems. Binance’s participation in this initiative reflects our long-term commitment to operating within these structures and supporting the UAE’s vision for secure, scalable, and compliant blockchain infrastructure that serves real economic use cases.”

The Blockchain Center Abu Dhabi and Binance research positions the UAE as a global benchmark for institutional blockchain infrastructure, highlighting how deliberate regulatory design and ecosystem coordination have enabled and are further enabling blockchain to be deployed as production-grade infrastructure rather than speculative technology.

Crypto World

Alphabet highlights new AI-related risks in tapping debt market

Google CEO Sundar Pichai gestures to the crowd during Google’s annual I/O developers conference in Mountain View, California, on May 20, 2025.

David Paul Morris | Bloomberg | Getty Images

As Alphabet returns to the debt market to fund its artificial intelligence buildout, the company is acknowledging new risks tied to the rise of AI and its hefty investments in infrastructure.

In its annual financial report late last week, the Google parent highlighted the potential impact of AI on the company’s core advertising business and the possibility of ending up with “excess capacity” from its costly commitments.

“To meet the compute capacity demands of AI training and inference, as well as traditional cloud computing services, we are entering into significant leasing arrangements with third party operators, which may increase costs and operational complexity,” the company stated in the filing with the SEC. Large commercial agreements could also increase “liabilities and obligations in the event of nonperformance by us, our counterparties, or vendors,” Alphabet said.

One of the headline numbers in Alphabet’s earnings report was $185 billion, representing the high end of what the company says it may shell out in capital expenditures this year, more than double its 2025 capex.

To help finance its AI ambitions, Alphabet is planning to raise $20 billion from a U.S. dollar bond sale, according people familiar with the matter who asked not to be named because the details are confidential. The planned sale would take place over four tranches, including a 100-year bond deal in sterling, the people said, with one adding that the deal is five times oversubscribed.

Bloomberg first reported on the planned debt funding, which was originally expected to reach $15 billion.

Alphabet held a $25 billion bond sale in November. Its long-term debt quadrupled in 2025 to $46.5 billion. CFO Anat Ashkenazi said on last week’s earnings call that as the company considers its total investment, “we want to make sure we do it in a fiscally responsible way, and that we invest appropriately, but we do it in a way that maintains a very healthy financial position for the organization.”

When asked on the call what keeps executives up at night, CEO Sundar Pichai responded “compute capacity,” adding, “power, land, supply chain constraints, how do you ramp up to meet this extraordinary demand for this moment?”

In total, Alphabet, Microsoft, Meta and Amazon are now projected to increase capex this year by more than 60% from the historic levels reached in 2025, as they load up on high-priced chips, build new facilities and buy the networking technology to connect it all.

At the center of Google’s AI strategy is Gemini, its large language model and AI assistant that’s going head-to-head with OpenAI’s offerings and Anthropic’s Claude.

Pichai said on the earnings call that the Gemini AI app now has more than 750 million monthly active users, up from 650 million monthly active users last quarter.

With more consumers adopting generative AI, Google has to face the potential of people decreasing their use of internet search, which means possible changes in the company’s dominant ad business. It’s another thing that Google included in the risk sections of its financial filing for the first time.

“We and our competitors are constantly adjusting to meet this shift and provide new and evolving advertising formats,” the filing says. “There is no assurance that we will adapt effectively and competitively to meet this shift, and that such advertising formats, strategies, and offerings will be successful.”

Thus far, Google has been able to fend off concerns that AI will cannibalize its search and ads business. Ad revenue in the fourth quarter increased 13.5% from a year earlier to $82.28 billion.

— CNBC’s Seema Mody contributed to this report.

Crypto World

World Liberty crypto deals net Trump, Witkoff tons of cash

World Liberty Financial (WLFI) has generated at least $1.4 billion for the Trump and Witkoff families since November 2024, far surpassing the cash generated by Donald Trump’s real estate empire over an eight-year period.

Summary

- World Liberty Financial has generated at least $1.4 billion for the Trump and Witkoff families since late 2024.

- Most WLFI token proceeds flow to Trump-controlled entities.

- Related crypto ventures, including American Bitcoin, experienced dramatic post-listing declines

According to the Wall Street Journal, the Trump family received at least $1.2 billion in cash within roughly 16 months, along with an additional $2.25 billion in unrealized crypto gains. The Witkoff family earned at least $200 million over the same period.

WLFI disclosures show that 75% of WLFI token sales flow to a Trump-controlled entity, with 12.5% each allocated to the Witkoffs and co-founders Zak Folkman and Chase Herro. President Trump owns 70% of the Trump entity, with the remainder held by family members.

A major catalyst was a January 2025 deal in which Abu Dhabi-backed investors acquired 49% of World Liberty for $500 million, delivering $187 million upfront to Trump entities and $31 million to the Witkoffs.

Eric Trump finalized the deal just before the 2025 inauguration, according to the New York Times. It coincided with UAE efforts to secure U.S. artificial intelligence (AI) chips.

The firm also generated liquidity through a controversial mechanism involving Alt5 Sigma, a Nasdaq-listed company in which World Liberty acquired a controlling stake. Alt5 raised $750 million from investors and used most of the proceeds to purchase WLFI tokens directly from World Liberty at a premium price. More than $500 million flowed to Trump entities and $90 million to Witkoffs through this structure. Following the transaction, Alt5 shares fell sharply and WLFI tokens declined.

Separately, Eric Trump holds a significant stake in American Bitcoin, another crypto venture that saw its valuation surge and then collapse post-listing. The White House has denied conflicts of interest, stating the companies operate independently.

Crypto World

Is the Ethereum rebound over? ETH price slips towards $2k after hitting $2,136

- Ethereum (ETH) drops toward $2,000 amid continued market volatility and selling pressure.

- Whale moves, ETF activity, and Bitcoin weakness fuel the recent decline.

- MVRV suggests ETH may be near a historical bottom, signalling potential rebound.

Ethereum’s recent rebound appears to be losing steam after the cryptocurrency reached a high of $2,136.

The coin is now quickly slipping towards the $2,000 mark, marking a continuation of a downtrend that has persisted over the past month.

Ethereum (ETH) is currently trading around $2,015, representing a 34.9% decline over the last month.

The sharp monthly decline is part of a broader pattern of volatility in the crypto market this year.

Trading volumes, however, remain elevated, with over $21.5 billion worth of tokens exchanged in the last 24 hours.

Market factors driving the ETH price decline

Several factors are contributing to Ethereum’s recent weakness.

One of the main drivers is elevated volatility in the derivatives and ETF markets.

Recent activity in Ethereum ETFs and Bitcoin-linked derivatives has amplified price swings.

Whale movements have also added pressure.

Large holders transferring ETH to exchanges can trigger panic selling, and reports indicate this has happened in recent weeks.

Bitcoin’s recent weakness has further weighed on Ethereum, given the strong correlation between the two cryptocurrencies.

Analysts also point to the breakdown of key support levels near $3,000 as a signal of continued downside risk.

Ethereum’s 7-day range of $1,824 to $2,369 highlights just how volatile the market has been.

But despite the downward pressure, Ethereum’s network activity remains robust.

Daily transactions and active addresses have not declined, signalling that usage of the blockchain remains strong.

This suggests that fundamentals may still support the network even if prices are under pressure.

Could a market bottom be near?

On-chain analysis offers a possible silver lining for Ethereum investors.

The Market Value to Realised Value (MVRV) metric on Santiment indicates that ETH has approached historically significant levels.

The coin recently traded below the 0.80 MVRV pricing band, a zone that historically corresponds with market bottoms.

This level often signals that many investors are at a loss, creating conditions for accumulation.

Previous dips below this band have been followed by sustained price recoveries over weeks and months.

Current readings suggest Ethereum is undervalued relative to recent history, though the deepest bottom has not yet been confirmed.

If ETH continues to hold near $2,000 and rebounds, it could mark the start of a longer-term recovery phase.

Traders and long-term holders will be watching closely for confirmation of support around this level.

Ultimately, the short-term trend is bearish, but on-chain indicators suggest that Ethereum’s decline may be nearing a turning point.

The coming days will be critical in determining whether ETH stabilises or continues its descent toward lower support levels.

Crypto World

3 Altcoins to Watch In The Second Week Of February 2026

Altcoin momentum is picking up as renewed buying pressure returns to select high-beta tokens. After a period of consolidation and volatility, several charts are now flashing continuation signals and reversal signals.

BeInCrypto has analyzed three such altcoins that the investors should watch in the second week of February.

Sponsored

Sponsored

Axie Infinity (AXS)

AXS emerged as the best-performing altcoin today, surging 18% over the past 24 hours. The rally helped preserve the broader uptrend that began at the start of the year. Renewed buying interest suggests traders are regaining confidence after recent volatility weighed on momentum.

A recent pullback delayed a potential Golden Cross that AXS was approaching in early February. If bullish momentum resumes from current levels, the setup could re-emerge. Such a reversal may push AXS above $1.65, opening the path toward the $1.92 resistance zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk remains if bullish momentum fails to hold. A breakdown below $1.32 would signal a loss of uptrend support. Under that scenario, AXS could slide toward the $1.05 support, invalidating the bullish thesis and shifting sentiment back toward caution.

Sponsored

Sponsored

Kite (KITE)

KITE is among the strongest-performing altcoins in the market, continuing to post fresh all-time highs since February began. The altcoin set a new ATH at $0.1719 today, extending its momentum-led rally. Persistent buying interest highlights strong demand as traders favor high-momentum assets during the current market phase.

KITE recently bounced from the $0.1506 support, reinforcing bullish structure. The Parabolic SAR remains positioned below the price, signaling an active uptrend. This technical setup supports further upside and suggests the ATH rally may continue as long as buyers defend key support levels.

Profit-taking risk remains elevated after repeated ATHs. Additionally, a decisive drop below the $0.150 support would weaken the bullish structure. Under that scenario, KITE could retreat toward $0.127, invalidating the bullish thesis and signaling a deeper corrective phase.

BankrCoin (BANKR)

BankrCoin is showing strong bullish momentum after a sharp impulsive breakout from the $0.0007020 resistance, which has now flipped into support. Price accelerated toward the $0.00099 all-time high, followed by a tight consolidation near $0.00087. The structure suggests healthy continuation rather than distribution, positioning it as an altcoin to watch.

If buyers defend $0.00087, the price is likely to retest the $0.00099 all-time high. Furthermore, a clean breakout above $0.00099 would open price discovery toward $0.00110 next. Strong bullish candles, rising volume, and shallow pullbacks support continuation, indicating momentum remains firmly in favor of bulls.

Bullish invalidation occurs on an 8-hour close below $0.0007020, which would signal a failed breakout and shift momentum neutral. As a result, a deeper breakdown below $0.0005404 would fully invalidate the bullish structure.

Crypto World

Cango Offloads 4,451 BTC for $305M to Repay Loan and Fund AI

TLDR

- Cango sold 4,451 BTC, reducing Bitcoin reserves by 60% to repay a Bitcoin-collateralized loan.

- The company raised $305M, improving its financial leverage and balance sheet.

- Cango aims to pivot towards AI compute infrastructure, targeting small and medium enterprises.

- Jack Jin, former Zoom Communications leader, appointed CTO of Cango’s AI business line.

- Bitcoin’s price dropped 1.06%, while Cango saw a 3.26% after-hours rebound to $0.9500.

Cango, a Bitcoin mining company, has sold 4,451 BTC for approximately $305 million, reducing its Bitcoin reserves by 60%. The sale aims to repay a Bitcoin-collateralized loan amid recent market volatility.

Bitcoin Sale Reduces Cango’s Reserves and Strengthens Balance Sheet

The sale of 4,451 BTC represents a substantial reduction in Cango’s digital asset holdings. This move is part of a broader strategy to strengthen the company’s balance sheet and reduce financial leverage.

The $305 million raised from the sale was directly applied to partially repay a Bitcoin-backed loan, improving Cango’s financial position. The divestment comes at a time when Bitcoin prices have rebounded from a recent low.

By selling a portion of its reserves, Cango aims to maintain flexibility while funding strategic growth initiatives, including expansion into AI compute infrastructure.

Cango Shifts Focus to AI Compute Infrastructure

In addition to the sale, Cango is pivoting toward AI computing by leveraging its existing infrastructure. The company plans to offer distributed compute capacity for the AI industry, targeting small and medium-sized enterprises.

Cango’s modular approach promises faster deployment timelines compared to traditional data center models. Cango also appointed Jack Jin as CTO of its AI business line.

Jin, a former leader at Zoom Communications, brings expertise in AI/ML infrastructure and large-scale GPU systems. His experience aligns with Cango’s strategy to develop a global distributed inference platform using modular, containerized GPU compute nodes.

Bitcoin Dips 1.06% While Cango Inc. Sees After-Hours Rebound

At the time of press, CoinMarketCap data indicates that Bitcoin’s price is currently $69,983.52, down 1.06% in the last 24 hours. The price fluctuated between $69,730 and $71,000 during the day.

On the other side, Cango Inc. (CANG) closed at $0.9200, down 5.52% on the day. The stock fluctuated between $0.8840 and $0.9887. After hours, the price rose by 3.26%, reaching $0.9500.

The stock had a previous close of $0.9738. Trading volume reached 1,229,780 shares, with an average volume of 985,054. The 52-week range for Cango is between $0.8840 and $2.8750, with a market cap of $318.642 million.

Crypto World

3 Altcoins Facing Liquidation Risks in the 2nd Week of February

After three consecutive weeks of sharp declines, buying pressure has returned to the market. However, it remains insufficient to dispel investor skepticism fully. Several altcoins now show unique catalysts that could drive outsized recoveries this week, increasing liquidation risks.

Ethereum (ETH), Dogecoin (DOGE), and Zcash (ZEC) could collectively trigger more than $3.1 billion in liquidations if traders fail to assess the following risks properly.

1. Ethereum (ETH)

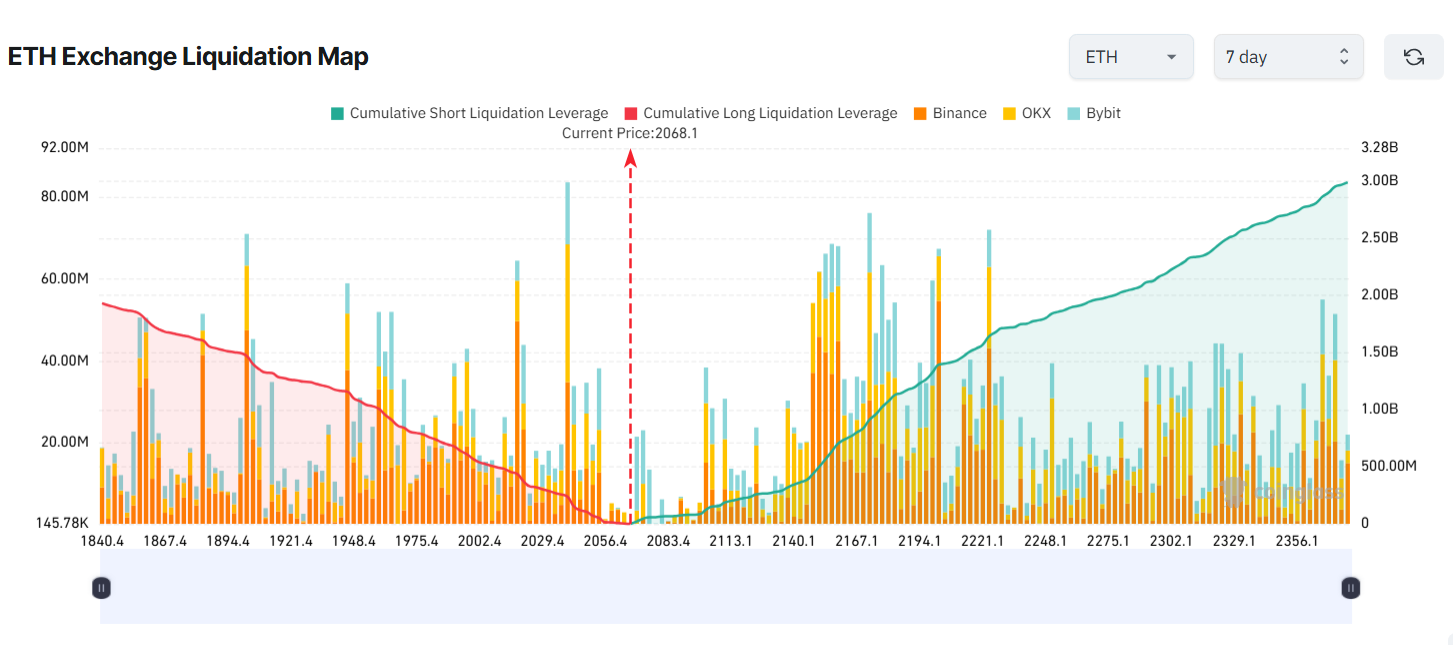

ETH’s 7-day liquidation map shows that potential liquidations from short positions outweigh those from long positions.

Sponsored

Sponsored

Many traders appear to expect further downside. ETH has already fallen about 40% since mid-January.

This bearish expectation faces growing risk. On-chain data shows that only around 16 million ETH remain on exchanges. This level marks the lowest since 2024.

Recent sell-offs have accelerated outflows from exchanges. Lower exchange balances reduce available supply. This dynamic can amplify price recoveries through supply–demand imbalances.

Additionally, more than 4 million ETH also sit in the staking queue. This further constrains the market’s liquid supply.

If ETH’s recovery strengthens due to these factors, short sellers could face significant risk. If ETH rises to $2,370 this week, potential liquidations from short positions could reach $3 billion.

Sponsored

Sponsored

2. Dogecoin (DOGE)

Dogecoin (DOGE) has fallen below $0.10. This level matches its 2024 price low. The 7-day liquidation map shows potential short liquidations of up to $98 million if DOGE rebounds to $0.109 this week.

Analysts argue that such a scenario remains plausible given both short- and long-term structures.

In the short term, trader Trader Tardigrade points to a Bull Flag pattern. This setup suggests DOGE could move toward $0.12 this week.

From a longer-term perspective, analyst Javon Marks highlights the formation of Higher Lows (HL) following Higher Highs (HH). This structure signals strength.

Sponsored

Sponsored

“As Higher Lows hold, we could see Dogecoin climb over 640% to and above the current ATH levels at ~$0.73905,” Javon Marks projected.

Discussion around Dogecoin may also regain momentum. In early February, billionaire Elon Musk responded to a question from the Tesla Owners Silicon Valley account regarding Dogecoin.

3. Zcash (ZEC)

Zcash (ZEC) has dropped about 50% since January 8. The decline followed the announcement that the entire Electric Coin Company (ECC) team, the core developer behind Zcash, would depart. Broader negative market sentiment has further prolonged the downturn.

ZEC’s liquidation map shows that potential liquidations from short positions dominate. This indicates that many traders still expect the downtrend to continue.

Sponsored

Sponsored

Several positive signals have emerged recently. Vitalik Buterin, the founder of Ethereum, publicly donated to Shielded Labs, a development group working on Zcash.

Buterin emphasized that privacy is not optional. He described it as core blockchain infrastructure. This action could help revive positive sentiment toward ZEC.

Data from zkp.baby shows that more than 5 million ZEC remain locked in the Shielded pool, despite the sharp price decline. Negative news and broader selling pressure appear not to have undermined investor confidence in Zcash’s technology.

Overall, the altcoin market has begun to rebound after a period of panic selling. Recent analyses suggest total market capitalization could recover above $2.8 trillion.

This broader recovery, combined with asset-specific catalysts, could push prices well beyond short sellers’ expectations, increasing the likelihood of liquidations.

Crypto World

WLFI price outlook as bulls target key resistance at $0.14

- World Liberty Financial’s price traded to highs of $0.1145 in the early hours on Monday.

- The WLFI token could break to $0.14 or higher if bulls hold.

- Broader market conditions may derail the momentum.

WLFI, the native token of the World Liberty Financial project, posted double-digit gains early on Monday, rebounding from losses that saw prices slide to lows near $0.09 on Friday.

Data from CoinMarketCap showed WLFI climbing more than 12% to intraday highs of $0.1145, placing it among the day’s top performers alongside Axie Infinity.

The rally was supported by a sharp rise in trading activity, with 24-hour volume surging 98% to more than $228 million.

The move also coincided with Bitcoin and Ethereum hovering near $70,000 and $2,000, respectively.

The rebound suggests the token is attempting to recover quickly from the lows recorded during last week’s broader market sell-off.

WLFI price jumps to near $0.12

WLFI’s upward momentum propelled the token close to $0.12, with likely bullish drivers being a confluence of whale accumulation and an upcoming high-profile event.

Blockchain analytics firm Lookonchain reported that a new wallet had deployed $10 million in USDC to acquire 47.6 million WLFI tokens.

The large purchase was at an average price of $0.109, and data showed the whale still held more than $4.8 million of dry powder ready for fresh buying.

Adding to the bullish sentiment is the anticipation surrounding the World Liberty Forum.

The event is slated for February 18 at Mar-a-Lago, and could feature investment heavyweights from Goldman Sachs, Franklin Templeton, and FIFA.

These developments come despite the latest spotlight on World Liberty Financial from Democrats, largely around the $500 million investment into the project by the UAE.

Investors defying the negative sentiment from this development look to have added to the buying pressure that pushed WLFI toward the $0.12 supply wall.

World Liberty Financial price prediction

Technical indicators on WLFI’s four-hour chart point to a strengthening near-term outlook, with prices trading above the midline of a descending channel.

Further upside could see the token test the upper boundary of the channel.

From a technical perspective, this setup suggests the potential for a breakout, with a key supply zone located around $0.14.

Momentum indicators are also supportive. The Moving Average Convergence Divergence (MACD) has registered a bullish crossover, while the Relative Strength Index (RSI) is hovering near 47, indicating neutral-to-bullish conditions as the market recovers from earlier overbought levels.

Traders are now focused on $0.14 as the main resistance level.

A sustained move above this zone could open the way toward $0.16, where the upper Bollinger Band and previous support levels converge.

On the downside, a failure to hold support near $0.13 could trigger a pullback toward the lower end of the channel, around $0.10, underscoring the importance of strong volume confirmation for any further upside move.

Crypto World

Will Bitcoin Pump or Crash From $70K? 3 Charts Can Answer

Bitcoin is holding firm around the $70,000 level after one of its sharpest sell-offs this cycle, leaving investors split on what comes next.

On-chain data, ETF flows, and market structure signals now point in two opposing directions, raising a key question: is Bitcoin preparing for another leg up, or setting up for renewed downside?

Sponsored

Sponsored

Selling Pressure Remains Elevated

One of the clearest warning signals comes from Bitcoin’s growth rate difference between market cap and realized cap. The indicator remains in negative territory, historically associated with heavier selling pressure.

When realized cap grows faster than market cap, it suggests coins are being redistributed at lower prices rather than pushed higher by fresh demand.

In past cycles, this environment made sustained price “pumps” difficult, as rallies were often met with distribution rather than follow-through.

Overall, current conditions suggest a structural selling pressure overwhelming demand.

Whales are Buying Bitcoin Aggressively

At the same time, on-chain accumulation data tells a very different story. Inflows to long-term accumulation addresses surged sharply during the recent dip, marking the largest single-day inflow of this cycle.

Sponsored

Sponsored

Historically, such spikes tend to appear near local bottoms rather than tops.

While accumulation does not guarantee an immediate rally, it signals that large holders are absorbing supply instead of distributing it.

This creates a floor effect, limiting downside even when broader sentiment remains fragile.

Sponsored

Sponsored

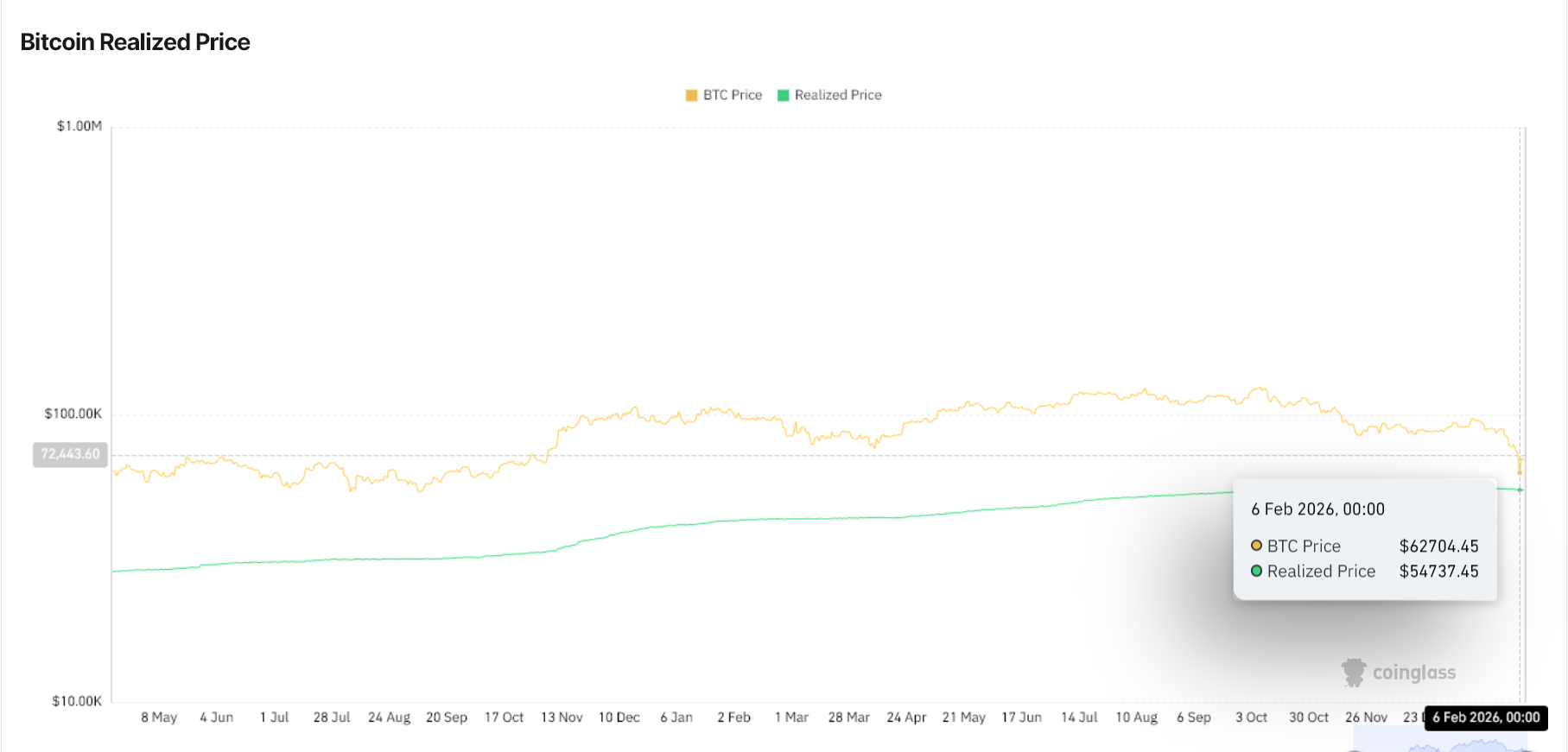

Price Holds Above Realized Value

Bitcoin is also trading well above its realized price, which currently sits near the mid-$50,000 range. That keeps the broader network in profit and reduces the risk of widespread capitulation.

Previous cycles show that deep, sustained bear markets typically occur only when price falls below realized levels for extended periods.

For now, Bitcoin remains in a neutral-to-positive regime.

Sponsored

Sponsored

ETF Flows Stabilize After Shock Outflows

US spot Bitcoin ETFs recorded heavy outflows during the crash, validating Arthur Hayes’ view that institutional hedging and dealer mechanics amplified the move. However, flows flipped back to strong inflows once prices stabilized near $60,000–$65,000.

That reversal suggests the worst forced selling has passed, though ETF demand has not yet returned to levels that would drive a breakout.

Range-Bound, Not Explosive

Taken together, the data points to a market caught between accumulation and distribution. Whale buying and ETF stabilization support the downside, while persistent sell pressure limits upside momentum.

In the near term, Bitcoin is more likely to remain range-bound around $70,000 than enter a decisive pump or dump.

Crypto World

HTX Launches USDe Minting and Redemption Service

TLDR

- HTX launches USDe minting and redemption service, offering an efficient platform for global users with enhanced features.

- The new minting and redemption service eliminates the need for OTC liquidity, simplifying the process for users.

- HTX introduces a daily rewards program for USDe holders, paid weekly, increasing capital efficiency and incentivizing participation.

- Users can now access USDe with unlimited minting and redemption capabilities and uniform transaction costs.

- HTX’s new campaigns, including APY boosts and trading competitions, encourage increased engagement with the USDe ecosystem.

HTX has launched its new USDe minting and redemption service, enhancing its platform with a daily rewards program for USDe holders. This service follows the recent listing of USDe and promises to provide a more efficient experience for HTX’s global user base.

USDe Minting and Redemption Now Available on HTX

According to the press release, the HTX minting and redemption process for USDe utilizes Ethena Labs’ smart contracts. The service eliminates the need for spot order books or OTC liquidity, simplifying the minting and redemption process.

This new feature provides benefits, including unlimited scale for minting and redemption and uniform transaction costs. With this integration, HTX users can smoothly enter or exit USDe positions, avoiding liquidity issues often seen in secondary markets.

The addition of USDe to HTX’s platform strengthens its position in both the DeFi and CeFi ecosystems. As HTX strives for innovation, these features enable users to manage their exposure to USDe with improved efficiency and transparency.

Daily Rewards and Additional Campaigns for USDe Holders

Alongside minting and redemption, HTX introduces a daily rewards program for users holding USDe in their spot accounts. Rewards will be paid weekly, allowing users to earn passive returns while maintaining dollar-denominated exposure.

The initiative enhances capital efficiency, offering an attractive incentive to hold USDe on the platform. HTX users can also participate in several campaigns, such as the upcoming APY boost for USDe in HTX Earn. This will provide subscribers with an annual percentage yield of up to 15%.

In addition, users can compete in a trading competition to share a 10,000 USDe prize pool. These initiatives aim to increase engagement with the USDe ecosystem and incentivize users to participate in HTX’s offerings.

Crypto World

Binance critics revive trading allegations against CZ after ETH whipsaw

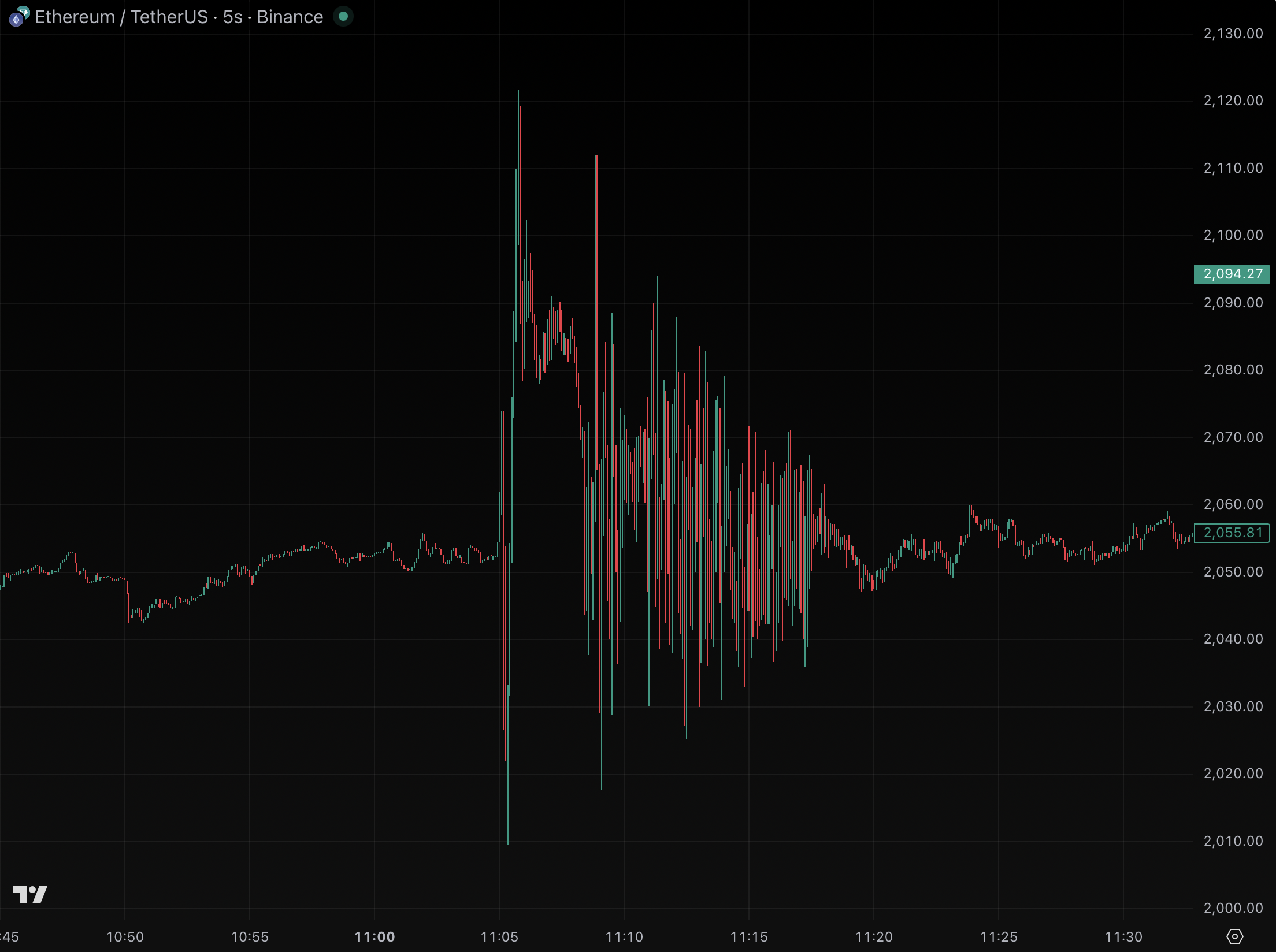

Amid ongoing backlash over its role in October 10’s liquidations and a bizarre chart of transactions from Saturday, critics of Binance are questioning founder Changpeng Zhao (CZ) over his repeated claims that he’s not an active crypto trader.

Sharing reminders about CZ’s ownership of market-makers Merit Peak Limited and Sigma Chain (which have both traded on Binance) critics decried a tether (USDT)-denominated ether (ETH) chart from Binance’s exchange on Saturday, alleging that CZ somehow was involved.

However, one of the most repeated assurances from CZ is that he is not an active crypto trader.

Indeed, in countless interviews, he tells a story of his brief attempt at active trading about a decade ago, concluding that he was entirely unskilled at that endeavor.

’I don’t trade at all’

For years, CZ has claimed, he’s not been an active crypto trader. Although he makes infrequent, long-term purchases, he reiterates that he’s “not a trader. I buy and hold.”

CZ worked at Bloomberg and built high-frequency trading platforms for stockbrokers, so he had plenty of experience with active traders before his career at crypto businesses Blockchain.info, OKCoin, and Binance.

According to CZ’s version of his biography, he wanted to become a trader during the early years of his crypto career, didn’t succeed, and instead decided to focus on building Binance.

Rather than trade along the way, he’s focused on long-term investments: bitcoin (BTC), the Binance Coin (BNB) he founded, and most of all, equity in Binance itself.

“I don’t trade at all, I just hold bitcoins,” CZ said in a representative interview. “I hold BNB, and I don’t do daytrading.”

Read more: Lawsuits are piling up against Binance over Oct. 10

CZ doesn’t need to trade to make billions from Binance

Bloomberg analysts agree that CZ’s long-held equity in Binance, for what it’s worth, accounts for the vast majority of his estimated $50 billion net worth.

Even without any digital asset holdings, CZ could easily be worth tens of billions of dollars simply as the founding shareholder of his profitable company.

However, critics on social media have recently become skeptical of CZ, alleging or insinuating that he’s concerned with manipulating Binance trading pairs.

A highly suspicious whipsaw in ETH renewed their anger.

Just because trades occur on Binance, however, doesn’t mean that CZ or Binance are participating in those markets beyond its customary commissions for matching third-party orders.

Wintermute CEO Evgeny Gaevoy called Saturday’s trading action “a market-maker bot blowing up to the tune of tens of millions,” defending his own market-making company from an accusation about scamming on Binance, for example.

For his part, CZ barely acknowledged the social media controversy. He summarized it as another example of FUD and posted recaps of his snowboarding trip, instead.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 hours ago

NewsBeat2 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat23 hours ago

NewsBeat23 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports18 hours ago

Sports18 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat13 hours ago

NewsBeat13 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout