Crypto World

Strategy hasn’t sold any STRC shares despite advertising on X

Strategy (formerly MicroStrategy) has been using its X marketing budget to advertise STRC, its quasi-pegged, 11.25% dividend-yielding preferred share. Unfortunately, that expensive, direct response ad campaign didn’t yield any results for shareholders last week.

For the week of February 2-8, Strategy didn’t sell any new shares of STRC nor any other preferred shares. It only succeeded in taking out the bid on its common stock, MSTR, to raise capital from its so-called at-the-market (ATM) shareholder dilution program.

Worse, its ad campaign didn’t yield any results in the prior week. From January 26 to February 1, the company failed to sell any preferred shares.

BTC yield growth slows despite STRC ads

Ultimately, what matters to shareholders of Michael Saylor’s bitcoin (BTC) acquisition entity is whether or not its management can sustainably increase BTC per share over time on a dilution-adjusted basis.

Although Strategy succeeded at generating BTC yield in prior years, its recent progress has slowed to a crawl.

After an impressive 7.3% in 2023, 74.3% in 2024, and 22.8% in 2025, the company was only able to accrete 0.3% BTC per share of MSTR in January 2026.

Unfortunately, its last two weeks of pure dilution of MSTR at a basic multiple-to-Net Asset Value (mNAV) below 1x, with no success at selling non-dilutive preferred shares over the past two weeks, will not improve that BTC yield number.

Worse, its average purchase price last week of $76,056 per BTC — and an even worse $87,974 the prior week — is continuing to lose money for the company based on the current market price for BTC closer to $70,000.

Read more: 100% of Strategy’s convertible debt is now out-of-the-money

Indeed, its entire investment return on its $54 billion investment is decidedly negative.

The company paid an average of more than $76,000 apiece for its BTC — more than 8% higher than BTC’s current value.

Strategy pays for the X Premium Business Full Access tier, currently priced at $10,000 per year, to secure its gold checkmark and affiliate employees under a clickable Strategy logo.

Because this package includes a credit for X ad spend, it’s unknown how much new money Strategy outlayed, if any, to pay for its disappointing STRC ad campaign.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Axie Infinity price jumps 15% after bounce, dead cat bounce risk remains

- AXS jumps over 15% after bouncing off $1.20 support amid rising trading activity.

- bAXS rollout and higher volume fuel rally, but broader market sentiment stays weak.

- Failure above $1.60 may signal a dead cat bounce, with downside risk toward $0.80.

Gaming token Axie Infinity is up by more than 15% in the past 24 hours as bulls show a notable bounce off the $1.20 support level.

The AXS price ticked up amid heightened trader activity, with the intraday surge pushing the cryptocurrency towards the top 100 by market capitalization.

However, with sentiment across the market still fragile, the big question is whether the upward move signals renewed bullish momentum or merely a fleeting “dead cat bounce”.

Why is Axie Infinity price up today?

AXS is among the top altcoin gainers with double-digit advances on February 9, 2026, posting gains that outpace all top 10 coins by market cap.

This outperformance coincides with Bitcoin’s steady hold above $70,000, bolstered by fresh institutional buying such as Binance’s acquisition of 4,225 BTC as it looks to convert its $1 billion SAFU Fund into BTC.

While the buying, much like Strategy’s (formerly known as MicoStrategy) BTC purchase over the past weeks, has not triggered bulls, stability has benefited small altcoins.

Notably, trader interest in AXS has also spiked following recent announcements from Sky Mavis, the developer behind Axie Infinity, regarding the rollout of bAXS.

The token offers in-ecosystem utility as well as staking and gameplay rewards, and bulls have shown excitement since the news.

What is bAXS and what can you do with it?

bAXS will do the same things as AXS: Use it to ascend, evolve, and breed axies.

Spend it in-game, forge new items on App.axie, and more.

Over time, we’ll also distribute most rewards in bAXS.

The difference between both tokens is… pic.twitter.com/X8kcpNTlGf

— Axie Infinity (@AxieInfinity) February 5, 2026

Axie Infinity price outlook: Momentum or dead cat bounce?

AXS recently surged to highs near $3 earlier in the year, before plummeting sharply amid last week’s market bloodbath.

The intraday gains of over 15% has therefore emboldened bulls, who targeted strength above $1.50.

Accompanied by a 250% spike in trading volume, AXS rose to above $1.56 as of writing.

The 4-hour chart shows a potential falling wedge breakout, with the RSI and MACD signaling room for more gains.

However, the broader crypto market remains mired in bearish sentiment.

Weakness, despite the impending bAXS airdrop, also saw bears retest the downtrend line from above $4.54.

Losses may mean fleeting gains or what analysts call a “dead cat bounce” scenario.

The outlook of the RSI on the 4-hour chart suggests fresh selling may strengthen this prospect.

In this case, a breakdown below the pivotal $1.20 support could accelerate downside momentum, potentially driving AXS toward lows of $0.80.

Prior accumulation zones sit here and might offer relief.

On the downside, a decisive close above $1.60 could invalidate the short-term bearish setup and allow buyers to test horizontal resistance near $3.00.

Crypto World

How 2 Wallet Errors and Phishing Attacks Cost Crypto Users $62M

Two crypto users lost $12.25 million and $50 million after copying incorrect wallet addresses.

In January, a crypto user lost $12.25 million by copying the wrong wallet address. In December as well, another one ended up losing $50 million in a similar way.

Together, the two incidents cost $62 million, according to the popular Web3 security solution, Scam Sniffer.

Crypto Blunders

Signature phishing attacks also surged in January. In fact, Scam Sniffer found that $6.27 million was stolen from 4,741 victims, which is a 207% increase from December. The largest cases involved $3.02 million from SLVon and XAUt via permit/increaseAllowance, and $1.08 million from aEthLBTC via permit.

Two wallets alone accounted for 65% of all phishing losses.

Address poisoning is a scam where attackers send small transactions from wallet addresses that closely resemble real ones, hoping users copy the wrong address from their transaction history. This can lead to funds being sent directly to scammers by mistake. Signature phishing further increases the risk by tricking users into signing malicious approvals that give attackers permission to move funds later. As such, these tactics rely on social engineering and human error, and may make even experienced users vulnerable.

In November last year, a crypto holder lost over $3 million worth of PYTH tokens after mistakenly sending funds to a scammer’s wallet. The error occurred when the victim copied a fake deposit address from their transaction history.

Blockchain analysts at Lookonchain said the attacker created a lookalike address matching the first four characters of the real wallet and sent a tiny SOL transaction to appear legitimate. The victim later transferred 7 million PYTH tokens without fully verifying the address and fell victim to an address poisoning attack. The transferred stash was worth about $3.08 million at that time.

You may also like:

Coordinated Multisig Scam Attempt

Amidst the growing frequency of such attacks, the non-custodial wallet, Safe, formerly known as Gnosis Safe, also issued a warning for its users about a large-scale address poisoning and social engineering campaign targeting multisig wallets. According to the platform, attackers created thousands of lookalike Safe addresses to trick users into sending funds to the wrong destination. It disclosed that the incident was not a protocol exploit, infrastructure breach, or smart contract vulnerability.

Safe identified around 5,000 malicious addresses, which have now been flagged and removed from the Safe Wallet interface to reduce the risk of accidental fund transfers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

McHenry predicts fast crypto deal as Witt brokers talks

Speaking on CoinDesk Live at the Ondo Summit in New York City, former House Financial Services Chair Patrick McHenry and White House advisor Patrick Witt said a sweeping crypto market structure bill could pass within months.

Latest developments: Optimism is rising across Washington and industry.

- McHenry and Witt discussed the growing momentum for landmark crypto legislation, even as debates intensify over yield, DeFi, and ethics.

- McHenry predicted a finalized market structure bill could reach the president’s desk by Memorial Day.

- Witt said President Trump has personally prioritized the legislation following passage of the Genius Act.

Inside the White House push: Negotiations are narrowing.

- Witt said a recent White House–brokered meeting on stablecoin yield surfaced “new areas of agreement” while clearly defining remaining red lines.

- He said the administration’s goal is to move from high-level principles to drafting actual legislative language.

- Witt emphasized his role is to broker a deal that can survive both Senate and House scrutiny.

The sticking point: Stablecoin yield is the biggest unresolved issue.

- Witt said there is broad agreement on banning deceptive practices, including marketing stablecoins as FDIC-insured deposits.

- The dispute centers on whether centralized exchanges should be allowed to pay passive yield on idle stablecoin balances.

- Banks, especially community lenders, see yield as a threat to deposit funding, while crypto firms argue yield drives platform engagement.

Why DeFi matters: McHenry says it’s foundational.

- McHenry said market structure legislation “doesn’t work without DeFi.”

- He argued decentralization is the source of crypto’s efficiency, transparency and lower costs compared with traditional finance.

- McHenry said tokenized lending products are already cheaper than traditional securities lending, signaling strong market demand.

The politics: Ethics concerns loom but may not block passage.

- McHenry said ethics rules should apply permanently to all officials, not target any single administration or family.

- Witt said some Democratic proposals would have imposed sweeping restrictions on officials’ spouses and were “grossly over-scoped.”

- Both said a narrower ethics compromise could still unlock bipartisan support, though Republicans could move the bill forward on partisan votes if needed.

What comes next: A compressed legislative timeline.

- Witt said drafting teams are now “trading paper” and working through specific statutory language.

- He said the White House is pushing banks and crypto firms to negotiate in good faith.

- McHenry said Senate action could come before Easter, setting up a rapid sprint toward final passage.

Watch CoinDesk Live from Ondo Summit here.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Bitcoin (BTC) is trading above $70,000 as traders attempt to stabilize price action following the sharp sell-off last Friday, which briefly pushed BTC below $60,000 and erased nearly $10,000 in a single session.

Onchain data shows long-term holders (LTHs) reduced exposure at the fastest pace since December 2024, but the total supply held by long-term investors continued to rise in 2026, a divergence that may indicate traders repositioning and what may prove to be discounted Bitcoin.

Key takeaways:

-

Bitcoin long-term holders recorded a –245,000 BTC net position change last week, the largest daily outflow since December 2024.

-

Despite selling, LTH supply rose to 13.81 million from 13.63 million BTC in 2026, showing investors believe the sell-off generated discounted buying opportunities.

Bitcoin distribution rises, but supply continues to age

Glassnode data shows that the BTC LTH net-position change over 30 days reduced exposure by 245,000 BTC last Thursday, marking a cycle-relative extreme in daily distribution. Similar spikes in LTH net position change appeared during the corrective phases in 2019 and mid-2021, when prices consolidated rather than transitioning into downtrends.

Meanwhile, CryptoQuant data shows total LTH supply increased to 13.81 million from 13.63 million BTC in 2026, despite the ongoing distribution. This divergence reflects the time-based nature of LTH classification.

As the short-term holders reduce trading activity during periods of uncertainty, supply continues to age into long-term status. As a result, the LTH supply can rise even while older cohorts sell.

The long-term holder spent-output profit ratio (SOPR) regained a position above 1 on Monday, signaling recovery after a period of realized losses. With Bitcoin above the overall realized price of $55,000, this condition may be aligned with a base or bottom building phase.

Related: Bitcoin whales took advantage of $60K price dip, scooping up 40K BTC

Macro conditions continue to dominate near-term risk

Macroeconomic factors may remain the main driver of near-term volatility, with January U.S. Consumer Price Index (CPI) data due Wednesday amid elevated policy uncertainty.

Markets currently assign 82.2% odds of no rate cut at the March Federal Open Market Committee (FOMC) meeting, according to CME FedWatch, reflecting persistent inflation pressure and a restrictive policy outlook.

Uncertainty around Kevin Warsh’s anticipated appointment as the US Federal Reserve chair has added pressure to risk assets. Elevated treasury yields and tight financial conditions continue to pressure risk assets, with the US 10-year yield holding near multi-month highs of 4.22% and credit spreads remaining compressed. Periods of high real yields have coincided with lower crypto liquidity and muted BTC spot demand.

Meanwhile, the US dollar index (DXY) has dropped below 97 on Monday, after rebounding from January lows, remaining a key source of volatility for Bitcoin.

Related: BTC traders wait for $50K bottom: Five things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

ETH price moved above $2,150 as Bitcoin and US stock markets rallied, but does data show whether derivatives traders have turned bullish yet?

Key takeaways:

-

Ethereum maintains dominance in its total value locked metric, yet faces scrutiny over layer-2 scaling.

-

ETH inflation rose to 0.8% as onchain activity slowed, while US macroeconomic fears kept the derivatives markets in bearish territory.

Ether (ETH) price managed to reclaim the $2,100 level following a 43% crash over nine days that culminated in the altcoin making a $1,750 low on Friday. Despite a 22% relief bounce after hitting its lowest price since April 2025, ETH derivatives markets continue to reflect investors’ fear of further downside. Regardless of whether the macroeconomic environment is driving investor concerns, the odds of sustainable bullish momentum for ETH in the short term remain dim.

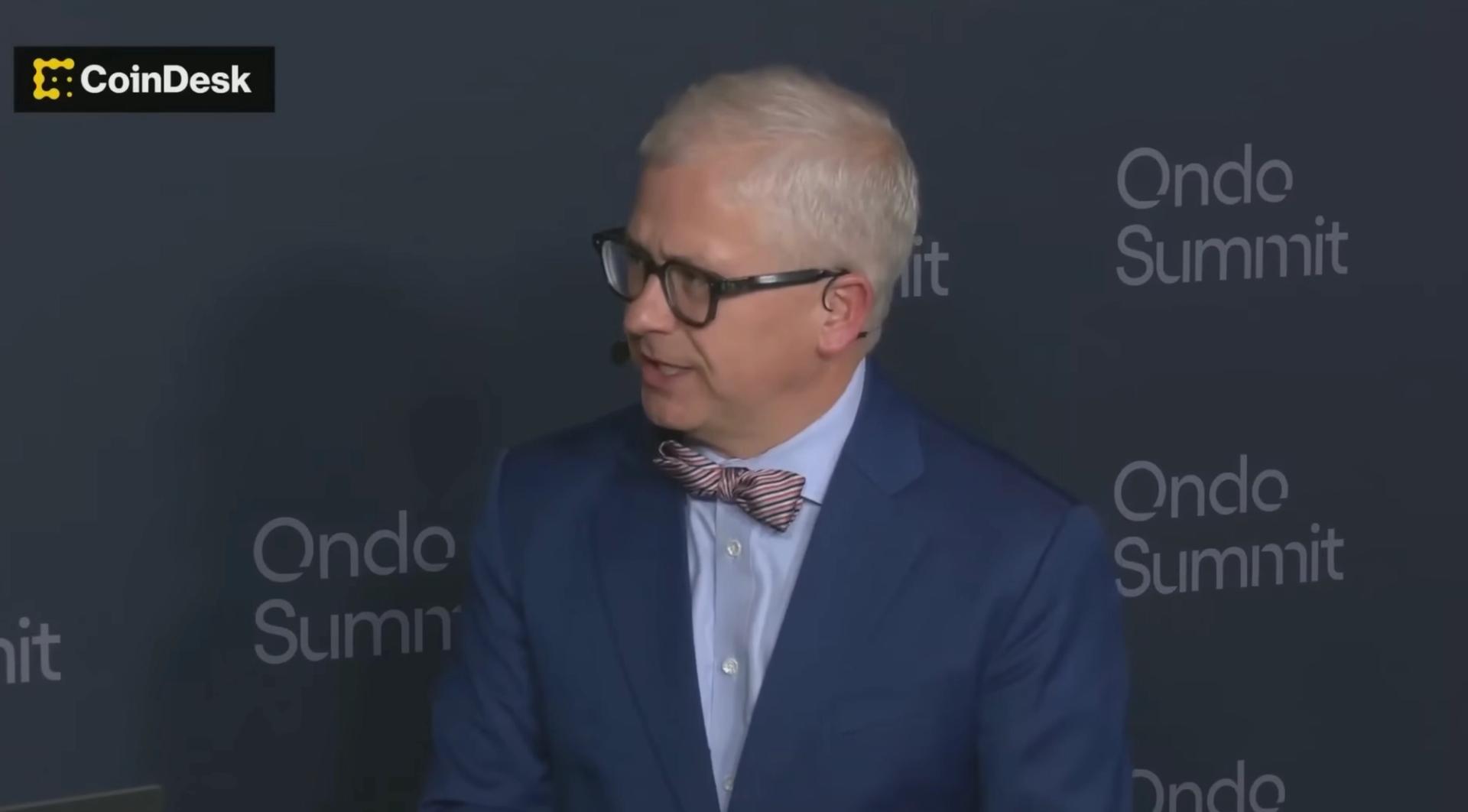

ETH monthly futures traded at a 3% premium relative to regular spot markets on Monday, which is below the 5% neutral threshold. This lack of optimism among Ether traders has been constant over the past month, showing no signs of improvement even as the price dropped toward $1,800. Unless bulls step in to demonstrate a strong appetite for risk at these levels, bears will likely remain in control.

ETH has underperformed the broader cryptocurrency market capitalization by 9% in 2026, leading investors to question what is driving capital away. From a broader perspective, the declining interest in decentralized applications (DApps) is not exclusive to Ethereum. The network remains the dominant leader in Total Value Locked (TVL) and fee generation when aggregating its layer-2 solutions.

Deposits on the Ethereum base layer account for 58% of the entire blockchain industry; that figure surpasses 65% when including Base, Arbitrum, and Optimism. For instance, the largest application on Solana hardly exceeds $2 billion in deposits. By comparison, the largest DApp on the Ethereum base layer holds over $23 billion in TVL. Solana’s Jupiter would not even crack the top 14 on Ethereum.

ETH supply growth and layer-2 subsidies remain problematic

The Ethereum base layer ranked third in network fees, generating $19 million over 30 days, while the layer-2 ecosystem contributed another $14.6 million. Ethereum has faced criticism for heavily subsidizing scalability via optimistic rollups—a strategy Vitalik Buterin himself admitted needs adjustment. The Ethereum co-founder argued on Tuesday that the network should prioritize base layer scalability.

According to Buterin, the layer-2 path to decentralization turned out more difficult than anticipated. The present solutions reportedly rely on multisig-controlled bridges, which does not meet security standards required by Ethereum’s original vision. Buterin notes that this is not the end game for layer-2 as demand for networks offering privacy features and application-specific design will continue to exist, especially for non-financial use cases.

Related: Vitalik draws line between ‘real DeFi’ and centralized yield stablecoins

Part of investor disappointment can be explained by the failure of Ether’s strategy to become deflationary, which is a secondary effect of reduced Ethereum network activity. The built-in burn mechanism depends on demand for base layer data processing; without it, there is a net increase in the ETH supply. The annualized growth of the total ETH issued reached 0.8% over the last 30 days, a significant jump from one year prior when equivalent inflation was near 0%.

Ether traders remain skeptical that a sustainable rally can occur in the near term due to increased uncertainty in the US job market and the long-term sustainability of investments in artificial intelligence infrastructure. Consequently, the weak ETH derivatives markets are a reflection of generalized risk aversion and a slowdown in onchain activity—factors that will likely take more time to stabilize.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

AI Deepfake Videos of Binance’s CZ and Yi He Flood Crypto Twitter

AI-generated deepfake videos portraying former Binance CEO Changpeng Zhao and Yi He have flooded Crypto Twitter. This has sparked debate over how far artificial intelligence has advanced in replicating real crypto figures.

The short videos, styled as dramatic “internal affairs” mini-series, use highly realistic AI avatars modeled on Zhao and Yi He, complete with lifelike voices, facial expressions, and emotional delivery.

Sponsored

Sponsored

While many users have clearly labeled the videos as AI-generated satire, the quality of the videos has shocked parts of the crypto community. Several clips circulated widely across X throughout the day, with users noting that the visuals and dialogue now rival professional studio productions.

Deepfakes and Crypto’s Growing Problem

Zhao and Yi He, who co-founded Binance in 2017, have long been known to share both a close professional partnership and a personal relationship.

The videos lightly reference that dynamic but focus primarily on imagined corporate tensions rather than real-world events.

Neither Zhao nor Yi He has publicly commented on the videos.

Sponsored

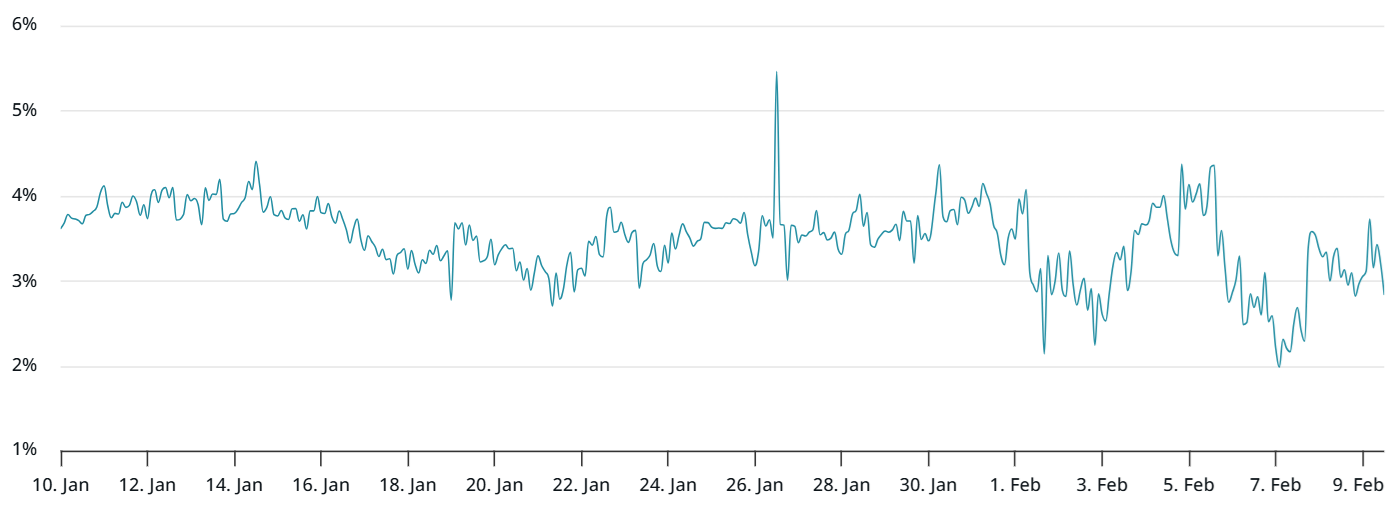

The viral clips arrive amid a broader surge in AI-driven deepfake content across the crypto sector.

In recent months, researchers have warned that crypto remains the most targeted industry for deepfake impersonation.

AI-generated videos, voice cloning, and synthetic avatars are increasingly used in scams impersonating founders, executives, and influencers.

According to Chainalysis, AI-generated impersonation scams surged by more than 1,400% in 2025. Law enforcement agencies have also warned that the line between satire, misinformation, and outright fraud is becoming harder to detect as generative AI improves.

A New Cultural Flashpoint

In this case, the Binance videos appear designed for entertainment rather than deception. However, their realism underscores how easily similar tools could be weaponized for market manipulation or investment fraud.

As deepfake technology becomes cheaper and more accessible, the crypto industry faces growing pressure to educate users on verification and digital literacy.

Crypto World

CME Group to Launch Futures for Cardano, Chainlink, and Stellar

CME Group is set to expand its cryptocurrency derivatives lineup with new futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar Lumens (XLM), pending regulatory approval.

CME Group, the world’s largest derivatives marketplace, has announced plans to introduce regulated futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar Lumens (XLM) on February 9, pending regulatory review. This move marks a significant expansion of CME’s cryptocurrency offerings, which already include Bitcoin and Ether futures.

The new contracts will be available in both standard and micro sizes. ADA futures will be offered in 100,000 ADA contracts and Micro ADA in 10,000 ADA contracts. Similarly, LINK futures will be available in 5,000 LINK contracts, with Micro LINK at 250 LINK. Stellar futures will see contracts of 250,000 Lumens, along with Micro Lumens at 12,500 Lumens.

“Given crypto’s record growth over the last year, clients are looking for trusted, regulated products to manage price risk as well as additional tools to gain exposure to this dynamic market,” said Giovanni Vicioso, CME Group’s Global Head of Cryptocurrency Products. He emphasized the greater choice and enhanced flexibility these new products provide to both retail and institutional clients.

The development is part of CME Group’s broader strategy to augment its crypto derivatives suite.

This article was generated with the assistance of AI workflows.

Crypto World

Alphabet highlights new AI-related risks in tapping debt market

Google CEO Sundar Pichai gestures to the crowd during Google’s annual I/O developers conference in Mountain View, California, on May 20, 2025.

David Paul Morris | Bloomberg | Getty Images

As Alphabet returns to the debt market to fund its artificial intelligence buildout, the company is acknowledging new risks tied to the rise of AI and its hefty investments in infrastructure.

In its annual financial report late last week, the Google parent highlighted the potential impact of AI on the company’s core advertising business and the possibility of ending up with “excess capacity” from its costly commitments.

“To meet the compute capacity demands of AI training and inference, as well as traditional cloud computing services, we are entering into significant leasing arrangements with third party operators, which may increase costs and operational complexity,” the company stated in the filing with the SEC. Large commercial agreements could also increase “liabilities and obligations in the event of nonperformance by us, our counterparties, or vendors,” Alphabet said.

One of the headline numbers in Alphabet’s earnings report was $185 billion, representing the high end of what the company says it may shell out in capital expenditures this year, more than double its 2025 capex.

To help finance its AI ambitions, Alphabet is planning to raise $20 billion from a U.S. dollar bond sale, according people familiar with the matter who asked not to be named because the details are confidential. The planned sale would take place over four tranches, including a 100-year bond deal in sterling, the people said, with one adding that the deal is five times oversubscribed.

Bloomberg first reported on the planned debt funding, which was originally expected to reach $15 billion.

Alphabet held a $25 billion bond sale in November. Its long-term debt quadrupled in 2025 to $46.5 billion. CFO Anat Ashkenazi said on last week’s earnings call that as the company considers its total investment, “we want to make sure we do it in a fiscally responsible way, and that we invest appropriately, but we do it in a way that maintains a very healthy financial position for the organization.”

When asked on the call what keeps executives up at night, CEO Sundar Pichai responded “compute capacity,” adding, “power, land, supply chain constraints, how do you ramp up to meet this extraordinary demand for this moment?”

In total, Alphabet, Microsoft, Meta and Amazon are now projected to increase capex this year by more than 60% from the historic levels reached in 2025, as they load up on high-priced chips, build new facilities and buy the networking technology to connect it all.

At the center of Google’s AI strategy is Gemini, its large language model and AI assistant that’s going head-to-head with OpenAI’s offerings and Anthropic’s Claude.

Pichai said on the earnings call that the Gemini AI app now has more than 750 million monthly active users, up from 650 million monthly active users last quarter.

With more consumers adopting generative AI, Google has to face the potential of people decreasing their use of internet search, which means possible changes in the company’s dominant ad business. It’s another thing that Google included in the risk sections of its financial filing for the first time.

“We and our competitors are constantly adjusting to meet this shift and provide new and evolving advertising formats,” the filing says. “There is no assurance that we will adapt effectively and competitively to meet this shift, and that such advertising formats, strategies, and offerings will be successful.”

Thus far, Google has been able to fend off concerns that AI will cannibalize its search and ads business. Ad revenue in the fourth quarter increased 13.5% from a year earlier to $82.28 billion.

— CNBC’s Seema Mody contributed to this report.

Crypto World

World Liberty crypto deals net Trump, Witkoff tons of cash

World Liberty Financial (WLFI) has generated at least $1.4 billion for the Trump and Witkoff families since November 2024, far surpassing the cash generated by Donald Trump’s real estate empire over an eight-year period.

Summary

- World Liberty Financial has generated at least $1.4 billion for the Trump and Witkoff families since late 2024.

- Most WLFI token proceeds flow to Trump-controlled entities.

- Related crypto ventures, including American Bitcoin, experienced dramatic post-listing declines

According to the Wall Street Journal, the Trump family received at least $1.2 billion in cash within roughly 16 months, along with an additional $2.25 billion in unrealized crypto gains. The Witkoff family earned at least $200 million over the same period.

WLFI disclosures show that 75% of WLFI token sales flow to a Trump-controlled entity, with 12.5% each allocated to the Witkoffs and co-founders Zak Folkman and Chase Herro. President Trump owns 70% of the Trump entity, with the remainder held by family members.

A major catalyst was a January 2025 deal in which Abu Dhabi-backed investors acquired 49% of World Liberty for $500 million, delivering $187 million upfront to Trump entities and $31 million to the Witkoffs.

Eric Trump finalized the deal just before the 2025 inauguration, according to the New York Times. It coincided with UAE efforts to secure U.S. artificial intelligence (AI) chips.

The firm also generated liquidity through a controversial mechanism involving Alt5 Sigma, a Nasdaq-listed company in which World Liberty acquired a controlling stake. Alt5 raised $750 million from investors and used most of the proceeds to purchase WLFI tokens directly from World Liberty at a premium price. More than $500 million flowed to Trump entities and $90 million to Witkoffs through this structure. Following the transaction, Alt5 shares fell sharply and WLFI tokens declined.

Separately, Eric Trump holds a significant stake in American Bitcoin, another crypto venture that saw its valuation surge and then collapse post-listing. The White House has denied conflicts of interest, stating the companies operate independently.

Crypto World

Is the Ethereum rebound over? ETH price slips towards $2k after hitting $2,136

- Ethereum (ETH) drops toward $2,000 amid continued market volatility and selling pressure.

- Whale moves, ETF activity, and Bitcoin weakness fuel the recent decline.

- MVRV suggests ETH may be near a historical bottom, signalling potential rebound.

Ethereum’s recent rebound appears to be losing steam after the cryptocurrency reached a high of $2,136.

The coin is now quickly slipping towards the $2,000 mark, marking a continuation of a downtrend that has persisted over the past month.

Ethereum (ETH) is currently trading around $2,015, representing a 34.9% decline over the last month.

The sharp monthly decline is part of a broader pattern of volatility in the crypto market this year.

Trading volumes, however, remain elevated, with over $21.5 billion worth of tokens exchanged in the last 24 hours.

Market factors driving the ETH price decline

Several factors are contributing to Ethereum’s recent weakness.

One of the main drivers is elevated volatility in the derivatives and ETF markets.

Recent activity in Ethereum ETFs and Bitcoin-linked derivatives has amplified price swings.

Whale movements have also added pressure.

Large holders transferring ETH to exchanges can trigger panic selling, and reports indicate this has happened in recent weeks.

Bitcoin’s recent weakness has further weighed on Ethereum, given the strong correlation between the two cryptocurrencies.

Analysts also point to the breakdown of key support levels near $3,000 as a signal of continued downside risk.

Ethereum’s 7-day range of $1,824 to $2,369 highlights just how volatile the market has been.

But despite the downward pressure, Ethereum’s network activity remains robust.

Daily transactions and active addresses have not declined, signalling that usage of the blockchain remains strong.

This suggests that fundamentals may still support the network even if prices are under pressure.

Could a market bottom be near?

On-chain analysis offers a possible silver lining for Ethereum investors.

The Market Value to Realised Value (MVRV) metric on Santiment indicates that ETH has approached historically significant levels.

The coin recently traded below the 0.80 MVRV pricing band, a zone that historically corresponds with market bottoms.

This level often signals that many investors are at a loss, creating conditions for accumulation.

Previous dips below this band have been followed by sustained price recoveries over weeks and months.

Current readings suggest Ethereum is undervalued relative to recent history, though the deepest bottom has not yet been confirmed.

If ETH continues to hold near $2,000 and rebounds, it could mark the start of a longer-term recovery phase.

Traders and long-term holders will be watching closely for confirmation of support around this level.

Ultimately, the short-term trend is bearish, but on-chain indicators suggest that Ethereum’s decline may be nearing a turning point.

The coming days will be critical in determining whether ETH stabilises or continues its descent toward lower support levels.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat3 hours ago

NewsBeat3 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports19 hours ago

Sports19 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat14 hours ago

NewsBeat14 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports3 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout