Business

Walmart boosts pay potential, elevates 3,000 pharmacy roles

Walmart CEO Doug McMillan joins ‘Mornings with Maria’ to discuss his retirement, inflation pressures, tariffs, AI-driven growth and the future of America’s largest retailer.

Walmart is expanding higher-paying pharmacy leadership roles and boosting earning potential for thousands of workers, opening new career paths that do not require a college degree.

The retail giant said it will elevate about 3,000 positions to pharmacy operations team lead roles, with average pay around $28 an hour and the potential to earn up to $42 an hour plus bonuses, depending on location.

The move is part of Walmart’s effort to strengthen staffing inside its pharmacies while creating clearer advancement opportunities for technicians already working in stores.

People wait at a pharmacy in a Walmart store that is offering COVID-19 vaccines during the pandemic. (Creative Touch Imaging Ltd./NurPhoto via Getty Images)

“Pharmacy technicians are a critical part of the healthcare journey, supporting patients, coordinating care and helping keep pharmacies running smoothly,” the company said. “The new operations team lead role creates opportunities for technicians to step into leadership, build new skills and take on greater responsibility while continuing to serve their communities.”

COSTCO DROPS FRESH LINEUP OF VALENTINE’S TREATS AND SAVORY BITES FOR SHOPPERS: REPORT

Unlike many healthcare roles, Walmart said these positions – including pharmacy sales associate, pharmacy technician and operations team lead – are open to workers without a college degree. Instead, employees advance through training and certification earned on the job.

Walmart said the changes are aimed at improving patient care while also addressing workforce shortages. (Luke Sharrett/Bloomberg via Getty Images)

Since 2016, more than 22,000 Walmart associates have completed pharmacy certification programs, allowing them to move into leadership roles and higher-paying positions within the company.

Since 2016, more than 22,000 Walmart associates have completed pharmacy certification programs, according to the retailer. (George Frey/Bloomberg via Getty Images)

Walmart said the changes are aimed at improving patient care while also addressing workforce shortages in healthcare by lowering barriers to entry and advancement.

CLICK HERE TO GET FOX BUSINESS ON THE GO

“By increasing pay, elevating thousands of leadership roles and removing barriers to advancement, we are strengthening pharmacy teams while helping associates build meaningful careers and support healthier communities every day,” the company said.

Business

Marketing Isn’t Broken – The Brand Beneath It Is

Luxury brands rarely suffer from a lack of marketing activity.

Campaigns are running. Content is being produced. Agencies are in place. Budgets are approved. On paper, everything looks correct.

And yet, momentum does not build. Each initiative feels isolated. Messaging shifts more often than it should. Growth happens, but it does not compound. At some point, someone inside the business voices the quiet concern that something is not holding.

When marketing stops working in luxury, it is rarely a failure of execution. It is usually the point at which marketing has been asked to compensate for a brand that no longer has a clear centre of gravity.

When marketing is forced to carry the brand

Marketing is an amplifier. It performs best when it has something stable to express.

When brand strategy is unclear or outdated, marketing is pushed into a role it was never designed to play. It is expected to create coherence where none exists. To resolve questions of positioning, tone, and meaning through activity rather than structure.

The result is not a lack of visibility, but a surplus of noise. Campaigns may perform individually, but they do not accumulate. Each new push feels like a reset rather than a continuation. The brand becomes increasingly busy, but no more confident.

This is not a question of effort or talent. It is a structural limitation.

Why luxury exposes the problem earlier

Luxury brands encounter this ceiling sooner than most.

Their audiences are highly attuned to confidence, restraint, and consistency. They notice when a brand over-communicates. Tactical messaging reads as uncertainty. Excessive activity signals restlessness rather than ambition.

In this context, marketing does not simply underperform. It becomes visibly ineffective. The brand starts to feel reactive, even when the output is polished.

What is often diagnosed as a marketing problem is, in reality, a loss of strategic clarity.

The familiar pattern behind ineffective marketing

Across luxury sectors, the pattern repeats.

A brand grows organically at first. Over time, complexity increases. New audiences, products, or markets are introduced. Different parts of the business evolve at different speeds.

What was once intuitive becomes fragmented.

Marketing is then asked to reconnect the dots. To sharpen positioning. To smooth inconsistencies. To restore confidence through output.

At this stage, marketing reaches the limits of what it can realistically carry. Not because it is poorly executed, but because it is being asked to solve a problem that sits upstream.

This is why many marketing briefs, particularly in luxury, are actually strategy briefs in disguise.

Why marketing enquiries often reveal deeper issues

Many luxury brands seek marketing support not because they believe in marketing as a solution, but because they sense that something is no longer aligned.

The brand feels diluted. Visual and verbal language no longer travels cleanly. Growth is happening, but without a clear sense of direction.

Marketing becomes the language used to describe that discomfort.

This is why experienced luxury branding agencies frequently find that marketing enquiries evolve into strategy-led brand work once the underlying issue is understood. Marketing was not the wrong instinct. It was simply the wrong starting point.

When marketing starts working again

When brand strategy is clarified, marketing changes almost immediately.

Messaging sharpens. Visual systems regain discipline. Campaigns begin to feel cumulative rather than episodic. Less needs explaining. Fewer messages are required.

Marketing becomes quieter, not louder. More effective, not more visible.

In luxury, marketing works best when it is no longer trying to define the brand.

It is simply expressing it.

Business

Netflix exec calls DOJ probe into $82.7B Warner Bros deal ‘totally ordinary’

Netflix chief global affairs officer Clete Willems discusses the company’s planned acquisition of Warner Bros. Discovery and the Department of Justice’s antitrust probe into the deal on ‘The Claman Countdown.’

Netflix chief global affairs officer Clete Willems addressed a newly launched federal probe into the company’s proposed acquisition of Warner Bros. Discovery Monday on “The Claman Countdown.”

“This is just ordinary course of business stuff,” Willems said. “Of course, the Department of Justice is going to investigate this transaction and make sure that it’s good for our economy and good for consumers.”

The Justice Department has opened an investigation into whether Netflix used anti-competitive strategies in its $82.7 billion acquisition of Warner Bros and HBO Max, The Wall Street Journal reported Friday.

In his first public comments on the Warner Bros merger, Willems insisted that the DOJ probe poses no concern for the streaming giant and said the company is actively working with the DOJ.

Netflix announced a partnership with global beer producer Ab InBev on Monday. (Mario Tama/Getty Images / Getty Images)

“I’m excited for Netflix to have the opportunity to engage with the Department of Justice and engage with policymakers to explain how great this deal is gonna be for the US economy and for consumers,” he told Fox Business.

Netflix announced its proposed acquisition of Warner Bros in December. Days later, Paramount Skydance submitted a counter-all-cash offer.

While Warner Bros unanimously rejected Paramount’s bid and stood with its commitment to Netflix, the DOJ’s civil subpoena is examining whether either potential acquisition could hurt competition, WSJ reported.

TRUMP SAYS ‘ANY DEAL’ TO BUY WARNER BROS SHOULD INCLUDE CNN

Willems criticized Netflix’s rival bidder, noting that Paramount failed to appear for a Senate hearing, while Netflix participated.

“Netflix has been very open and transparent about this deal and all of its implications, and Paramount, as you know, didn’t show for the hearing. So I think there’s a clear difference,” he said.

Netflix agreed last year to acquire Warner Bros. Discovery’s film and television studios and streaming platform, HBO Max, in a cash-and-stock deal valued at $27.75 per Warner Bros. Discovery share. (Anna Barclay/Getty Images / Getty Images)

The Netflix executive also highlighted Paramount’s recent business challenges, arguing Netflix is better positioned to acquire a major studio like Warner Bros.

DARRELL ISSA OBJECTS TO POTENTIAL NETFLIX-WARNER BROS DISCOVERY DEAL, CITING ANTITRUST CONCERNS

“We’re tripling jobs, while Paramount has cut 3,500 jobs in recent years,” he claimed. “Paramount have identified $6 billion in synergies in the offer that they made, which is code for $6 billion in job cuts.”

Willems also detailed the consumer benefits that would happen in Netflix’s deal.

Warner Bros. Discovery announced on Wednesday that its board unanimously rejected Paramount’s tender offer. (Mario Tama/Getty Images / Getty Images)

“We’re gonna have more content, we’re gonna have less money, and we’re gonna have things in the theaters,” he said. “We’re gonna keep Warner Brothers shows in the theater. So there’s gonna be lots of great consumer benefits here that I think people can be excited about.”

Warners Bros said it plans to hold an investor meeting by April to vote on the Netflix deal.

An antitrust representative at the DOJ did not immediately respond to FOX Business’ request for comment.

Business

DFJ: Japanese Dividend Stocks Remain Attractive As Political Uncertainty Fades

I ventured into investing in high school in 2011, mainly in REITs, preferred stocks, and high-yield bonds, starting a fascination with markets and the economy that has not faded despite the years. More recently I have been combining long stock positions with covered calls and cash secured puts. I approach investing purely from a fundamental long-term point of view. On Seeking Alpha I mostly cover REITs and financials, with occasional articles on ETFs and other stocks driven by a macro trade idea.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

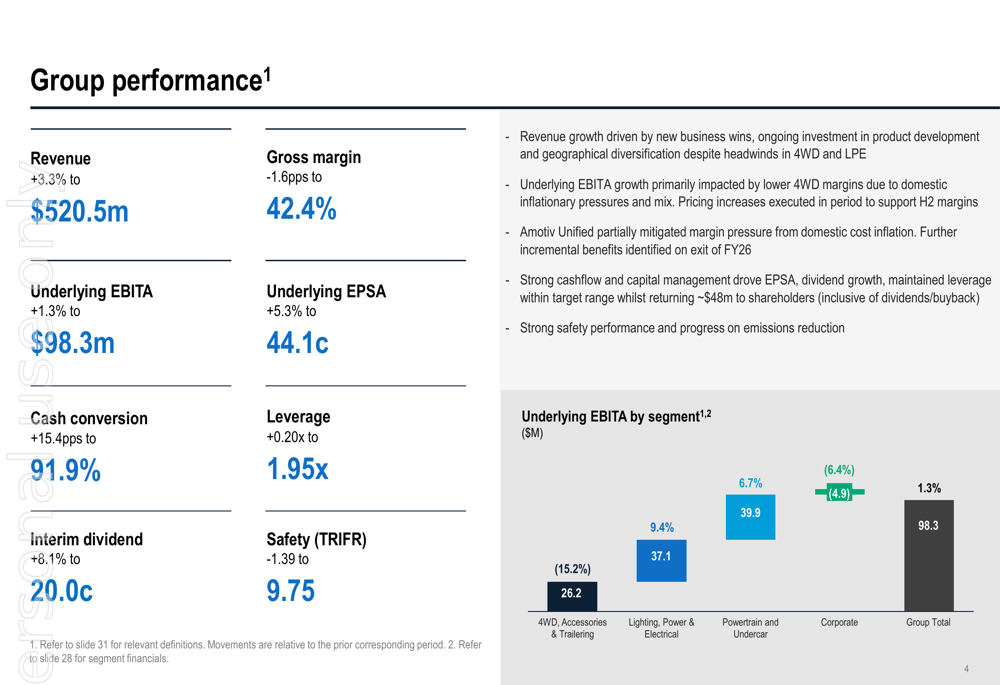

Amotiv H1 FY26 presentation slides: Revenue grows 3.3% amid strategic transformation

Amotiv H1 FY26 presentation slides: Revenue grows 3.3% amid strategic transformation

Business

A Business Case for Accelerating Digital Streaming Momentum

People now prefer to listen to music through online platforms because these services enable them to access music more quickly and track their listening activities.

Successful market expansion requires companies to maintain regular product launches because customers need to trust their brand, and marketing strategies must maintain their business reputation.

Sustained chart success depends on strategic promotion, creative consistency, and thoughtful audience engagement. Many creators investigate ethical methods of promotion, while some creators use services such as buy spotify plays to gain visibility and develop real fanbases.

Audience Engagement Factors

Strong listener connection supports lasting growth and sustained chart performance. Clear communication and creative presentation strengthen audience loyalty over time.

- Consistent release schedules help listeners stay interested and maintain steady platform interaction

• Visual storytelling increases recognition and builds memorable identity among varied listener groups

• Interactive fan communication channels encourage loyalty and a deeper emotional connection with content

• Analytics-guided adjustments improve targeting accuracy and support continuous listener satisfaction

Revenue Expansion Opportunities

The platform generates new revenue streams through ongoing user interaction, which benefits both its streaming service and advertising partnerships and creator partnerships.Monetization increases when user engagement stays constant and users share content with others. Businesses achieve financial stability through multiple income sources which also allow them to fund their upcoming innovative endeavors.

Platform Optimization Priorities

Careful optimization enhances discoverability and strengthens performance across listening platforms. Focused improvements ensure consistent audience reach and sustainable growth patterns.

- Profile optimization improves search visibility and strengthens professional presentation for emerging creators

• Playlist placement strategies increase exposure and support steady audience discovery across platforms

• Consistent artwork themes build brand recall and encourage repeated listener interaction naturally

• Timely response to listener feedback strengthens trust and improves long-term audience retention

Brand Visibility Impact

Well-planned promotion contributes to strong recognition. Broad audiences might be attracted to the music either by the colors of music or simply because of their frustration. Clear branding, engaging visuals, and regular interaction all support stronger recall, enabling sustained chart performance and wider reach.

Data Insight Benefits

Careful data review helps guide strategic decisions and optimize future releases. Insights improve planning accuracy and audience targeting efficiency.

- Listener behavior analysis reveals content preferences and supports smarter creative planning decisions

• Performance metrics highlight successful releases and indicate areas needing improvement quickly

• Demographic trends guide communication tone and enhance targeted promotional campaign effectiveness

• Engagement patterns reveal optimal release timing and improve audience responsiveness over time

Competitive Positioning Advantages

Organizations focusing on online audience expansion gain stronger recognition and sustained listener loyalty. The content distribution system needs improvement because it currently lacks effective methods to reach a wider audience while achieving better ranking results. The combination of creativity, analytics, and consistent branding enables creators to gain a competitive edge because they meet listener needs.

Strategic Outlook

The potential for growth stays strong when companies develop new products that match customer needs and use honest marketing methods. The three factors of consistency and creativity together with audience understanding create the central elements that drive organizations toward success.

| Focus Area | Business Value | Productivity Impact |

| Audience Analytics | Improves targeting precision and engagement stability | Higher Conversion Rates: By identifying exactly who listens and when, you stop wasting ad spend on low-interest segments. |

| Promotion Planning | Enhances visibility and supports consistent listener growth | Revenue Scalability: Strategic boosts (like buying plays to trigger the “Discover Weekly” algorithm) become predictable instead of random. |

| Content Consistency | Strengthens trust and encourages repeat listening behavior | Fan Retention: Regularly scheduled releases (the “Every 6-8 Weeks” rule) create a mental habit for your audience, reducing churn. |

FAQs

How can creators maintain steady streaming growth?

Regular releases, audience communication, and data-based promotion help maintain stable performance.

Does branding influence chart performance?

Yes, strong identity improves recall, builds loyalty, and supports broader audience reach.

Momentum Ahead

Balanced approaches that respect authenticity while exploring ethical growth tools according to their options to buy spotify plays will enable artists to increase their visibility when they establish real listener connections and maintain consistent brand identity.

Business

Philip Morris Is Doing Everything Right, Except Being Cheap Enough (NYSE:PM)

Equity Research Analyst with a broad career in the financial market, covered both Brazilian and global stocks. As a value investor, my analysis is primarily fundamental, focusing on identifying undervalued stocks with growth potential. Feel free to reach out for collaborations or to connect!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

How North York Sleep & Diagnostic Centre Built a Community-First Clinic

North York Sleep & Diagnostic Centre is a physician-led healthcare organisation based in Toronto, Ontario. Founded in 2008 by two local physicians, the Centre was established to meet a growing need for accessible, high-quality sleep diagnostic services in the community.

From the beginning, the focus was clear. Provide professional sleep disorder testing and treatment. Do it with clinical rigour. And keep patient care at the centre of every decision. What started as a local diagnostic clinic gradually expanded to include clinical research trials.

“We were focused on doing the work properly from day one,” the leadership explains. “That meant licensed physicians, trained technologists, and clear standards.”

Today, the Centre is recognised for its depth of expertise in sleep medicine. All patients are assessed by ABSM licensed sleep physicians. Sleep studies are conducted by Registered Polysomnographic Technologists. This structure reflects a leadership philosophy built on credentials, accountability, and trust.

Growth has been steady but disciplined. Expansion is regulated by the licensing of Integrated Community Health Services Centres, which limits the number of beds. Rather than chasing scale, the Centre prioritises quality and patient outcomes.

“We operate at full capacity,” the team notes. “So our focus stays on excellence, not volume.”

During COVID, the Centre continued to operate under strict standards, ensuring continuity of care for patients who relied on its services.

After treating tens of thousands of patients, North York Sleep & Diagnostic Centre remains guided by professionalism, patient feedback, and a long-term commitment to community healthcare leadership.

Take us back to the beginning. How did North York Sleep & Diagnostic Centre start?

The Centre was founded in 2008 by two local physicians in Toronto. At the time, access to proper sleep diagnostics was limited for many patients. We saw a clear gap in community care. The original goal was straightforward. Provide professional diagnostic and therapeutic services for sleep disorders, led by licensed physicians, and make them accessible to the community.

What were the early years like as a new clinic?

The early years were very hands-on. We focused on building strong clinical processes and on earning the trust of referring physicians and patients. Initially, the work focused on sleep studies and treatment for conditions such as insomnia, snoring, and daytime fatigue. Over time, as our experience grew, we expanded into clinical research trials while keeping patient care as the foundation.

How did your scope of work evolve over time?

It evolved naturally. We started with diagnostics and therapeutic studies. As we treated more patients, we gained deeper insight into long-term sleep disorders. That experience allowed us to contribute to clinical research.

The Centre places strong emphasis on credentials. Why is that important in your field?

Sleep medicine is highly specialised and regulated. All our physicians are licensed in Sleep Medicine and Respirology. Our sleep studies are conducted by Registered Polysomnographic Technologists. That structure is essential. Patients deserve to know they are being assessed and treated by fully qualified professionals. There is no room for shortcuts in this industry.

How do regulations shape how you operate and grow?

Regulation plays a major role. The number of beds is licensed by the Integrated Community Health Services Centres. We operate at full capacity, but growth is limited by those licences. That reality forces discipline. Instead of focusing on expansion, we focus on efficiency, quality of care, and adherence to professional standards.

What defines leadership in sleep medicine from your perspective?

Leadership is consistency. It is maintaining standards year after year, even when conditions are challenging. It is staying compliant with licensing requirements and continually engaging with best practices. Leadership is also listening. Patient feedback informs how we improve our services and processes.

COVID was a major test for healthcare providers. How did it affect your Centre?

COVID was challenging on every level. Protocols changed frequently, staffing pressures increased, and safety requirements were strict. Despite that, we continued to provide services throughout the pandemic. Patients still needed answers about their sleep health. Our focus remained on providing excellent medical care despite those barriers.

How do you maintain quality while operating at full capacity?

Systems matter. Clear clinical workflows, proper staffing, and strong communication are key. Because we are constrained by the number of licensed beds, we must operate efficiently without compromising care. That means constant process review and close collaboration among physicians and technologists.

You have treated tens of thousands of patients over the years. What keeps the team motivated?

Impact. Sleep disorders affect every part of a person’s life. When patients improve, it is tangible. The team takes pride in knowing that providing excellent healthcare also contributes positively to our own well-being. That shared purpose keeps people engaged and committed.

Looking back, what has remained constant since 2008?

The mission. We were founded to provide sleep and diagnostic services to the community, and that remains our goal. We believe these services should be accessible to all patients. Professionalism, quality care, and adherence to standards have guided us from the beginning and continue to shape how we operate today.

How would you describe the Centre’s role in the industry today?

We see ourselves as a steady, trusted provider. Not driven by rapid growth, but by responsibility. Our name reflects where we are and who we serve. That local focus, combined with clinical rigour, defines our role in sleep medicine.

Business

Hims & Hers Health: Don’t Fall For The Hysteria (NYSE:HIMS)

Stone Fox Capital is an RIA from Oklahoma. Mark Holder is a CPA with degrees in Accounting and Finance. He is also Series 65 licensed and has 30 years of investing experience, including 15 years as a portfolio manager. Mark leads the investing group Out Fox The Street where he shares stock picks and deep research to help readers uncover potential multibaggers while managing portfolio risk via diversification. Features include various model portfolios, stock picks with identifiable catalysts, daily updates, real-time alerts, and access to community chat and direct chat with Mark for questions. Learn more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HIMS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

BIV: Intermediate Fixed Income Diversified Across Treasuries And Corporates (BIV)

Monte Independent Investment Research: Michael Del Monte is a buy-side equity analyst with expertise in the technology, energy, industrials, and materials sectors. Prior to working in the investment management industry, Michael spent over a decade in professional services working across industries that include O&G, OFS, Midstream, Industrials, Information Technology, EPC Services, and consumer discretionary.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

KeyCorp (KEY) Presents at UBS Financial Services Conference 2026 Transcript

L. Erika Penala

UBS Investment Bank, Research Division

All right. Good afternoon, everybody. So rounding off the corporate presentation today, we have KeyCorp. And we had Ken Gavrity. He is the Head of the Commercial Bank. And before he sits down with me for a fireside chat, he wanted to share a few slides. Ken, thank you for coming.

Ken Gavrity

Head of Commercial Banking

Perfect. Well, thanks for having me, Erika, pleased to be here, of course. So as Erika said, I lead Key’s Commercial Banking business, which includes our Middle Market business segment as well as our Commercial Payments platform, and as a reminder, we define the middle market segment as companies with annual revenue size from $10 million in revenue, up to as high as $1 billion in revenue. And our commercial payments organization serves a broader range of customers that goes all the way down from small business through middle market, up to our corporate and institutional clients as well.

So before I jump into the slides, I’ve been asked to read the following in the back of today’s presentation, which you can find in the Investor Relations section of key.com website. You’ll find our statements on forward-looking disclosures. These statements cover our presentation and related comments as well as the question-and-answer segment of today’s webcast.

Forward-looking statements speak only as of today, February 9, 2026. So with that, okay, I’m going to start on Slide 2, overview of the Commercial Bank. So from a size and scale perspective, you can see on the right-hand side of the page, it’s a significant portion of Key’s overall revenue and core

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat3 hours ago

NewsBeat3 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports19 hours ago

Sports19 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat14 hours ago

NewsBeat14 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports3 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout