Manchester United squandered a one-goal lead and are now winless in two games at home

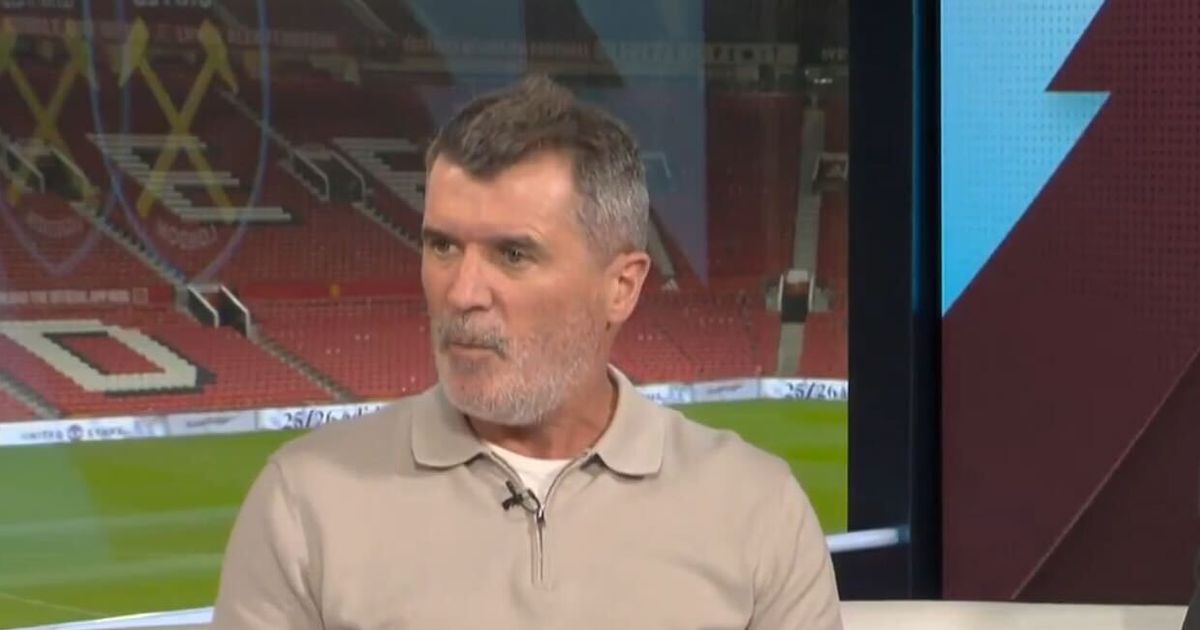

Roy Keane has accused Manchester United of being “frightened” to see games out. The former United captain slammed Ruben Amorim’s side after they failed to maintain the lead at home to West Ham United.

The 1-1 draw with the Hammers meant that they missed another opportunity to close the gap on the Champions League places and move up to fifth in the Premier League. Diogo Dalot handed United the lead after 58 minutes but seven minutes from time, Soungoutou Magassa levelled proceedings.

United have failed to win at Old Trafford in their last two, losing out to Everton last Monday. The defeat to the Toffees heaped misery on the Portuguese tactician after they failed to take advantage of Idrissa Gueye’s first-half red card.

READ MORE: Ruben Amorim explains controversial Manchester United subs vs West Ham after defensive criticismREAD MORE: Man United handed instant new Bryan Mbeumo penalty verdict vs West Ham

But Keane took aim at the mentality of the United team as he highlighted the frustration following the point.

“After getting the goal you’re thinking United…’now go on’. They’re playing a team in the bottom three they’re probably lacking confidence,” he said.

“You get a goal in front and United, they just take their foot off the gas. They made some substitutions, their subs are going off…everyone at Old Trafford now gets a standing ovation.

“It’s all a bit silly. You’re 1-0 up…United now last two home games, one goal. You’re just putting yourself under pressure.

“Every time I watch this United team, they just leave you disappointed. They weren’t clinical and nasty enough to get the job done.

“United again, people are scratching their heads. One minute, you’re giving United credit and if they win they go fifth.

“There will be a lot of frustration at Old Trafford tonight. I think the standard of United’s play in the last three or four games has been desperate, really really poor.

“Almost frightened to get the job done, frightened to go up to fifth. My goodness, we are talking about fifth here by the way, not top of the league. Same old problems.”

United move above rivals Liverpool in the table, to eighth, as they sit four points off Chelsea, who currently occupy the final Champions League place.

Amorim’s side travel to rock-bottom Wolves on Monday looking to kickstart momentum before the hectic festive period kicks in when they face Bournemouth, Aston Villa, Newcastle before hosting the reverse fixture against Rob Edwards’ side in 12 days.

From a defensive standpoint, Magassa’s leveller compounded a disappointing run of games without keeping a clean sheet.

The Frenchman’s 83rd-minute effort meant that United have not kept a clean sheet in seven, their last coming in the 2-0 win over Sunderland on October 4.