Crypto World

WLFI price outlook as bulls target key resistance at $0.14

- World Liberty Financial’s price traded to highs of $0.1145 in the early hours on Monday.

- The WLFI token could break to $0.14 or higher if bulls hold.

- Broader market conditions may derail the momentum.

WLFI, the native token of the World Liberty Financial project, posted double-digit gains early on Monday, rebounding from losses that saw prices slide to lows near $0.09 on Friday.

Data from CoinMarketCap showed WLFI climbing more than 12% to intraday highs of $0.1145, placing it among the day’s top performers alongside Axie Infinity.

The rally was supported by a sharp rise in trading activity, with 24-hour volume surging 98% to more than $228 million.

The move also coincided with Bitcoin and Ethereum hovering near $70,000 and $2,000, respectively.

The rebound suggests the token is attempting to recover quickly from the lows recorded during last week’s broader market sell-off.

WLFI price jumps to near $0.12

WLFI’s upward momentum propelled the token close to $0.12, with likely bullish drivers being a confluence of whale accumulation and an upcoming high-profile event.

Blockchain analytics firm Lookonchain reported that a new wallet had deployed $10 million in USDC to acquire 47.6 million WLFI tokens.

The large purchase was at an average price of $0.109, and data showed the whale still held more than $4.8 million of dry powder ready for fresh buying.

Adding to the bullish sentiment is the anticipation surrounding the World Liberty Forum.

The event is slated for February 18 at Mar-a-Lago, and could feature investment heavyweights from Goldman Sachs, Franklin Templeton, and FIFA.

These developments come despite the latest spotlight on World Liberty Financial from Democrats, largely around the $500 million investment into the project by the UAE.

Investors defying the negative sentiment from this development look to have added to the buying pressure that pushed WLFI toward the $0.12 supply wall.

World Liberty Financial price prediction

Technical indicators on WLFI’s four-hour chart point to a strengthening near-term outlook, with prices trading above the midline of a descending channel.

Further upside could see the token test the upper boundary of the channel.

From a technical perspective, this setup suggests the potential for a breakout, with a key supply zone located around $0.14.

Momentum indicators are also supportive. The Moving Average Convergence Divergence (MACD) has registered a bullish crossover, while the Relative Strength Index (RSI) is hovering near 47, indicating neutral-to-bullish conditions as the market recovers from earlier overbought levels.

Traders are now focused on $0.14 as the main resistance level.

A sustained move above this zone could open the way toward $0.16, where the upper Bollinger Band and previous support levels converge.

On the downside, a failure to hold support near $0.13 could trigger a pullback toward the lower end of the channel, around $0.10, underscoring the importance of strong volume confirmation for any further upside move.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Bitcoin (BTC) pushed back above $71,000 on Monday, after market sentiment indicators across the crypto market dropped to new lows.

Some analysts believed that “extreme fear” and upside liquidity may help Bitcoin hold above its yearly-low at $60,000, but others warned that weak market conditions and bearish futures volume may push prices even lower.

Key takeaways:

-

The Crypto Fear & Greed Index dropped to a record low of 7, showing extreme fear in the market.

-

More than $5.5 billion in short liquidations above current prices may fuel a rebound.

-

Weak price trends and rising derivatives selling may still drag Bitcoin below $60,000.

Sentiment and liquidation suggeset $60,000 remains support

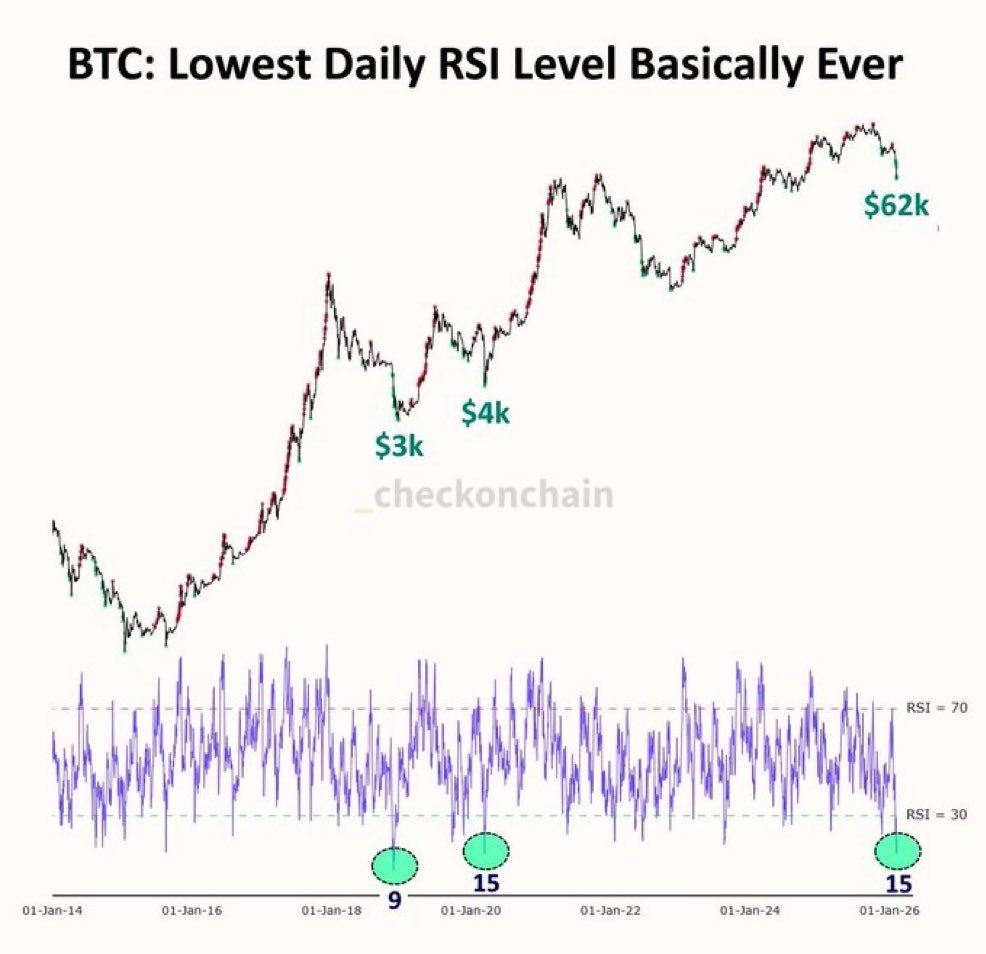

MN Capital founder Michaël van de Poppe said Bitcoin is flashing sentiment readings that have previously marked market bottoms. According to Van De Poppe, the Crypto Fear & Greed Index had dropped to 5 over the weekend (final recorded reading is 7), its lowest reading in history, while the daily relative strength index (RSI) for BTC has fallen to 15, signaling deeply oversold conditions.

These levels were last seen during the 2018 bear market and the March 2020 COVID-19 crash. Van de Poppe said such conditions may allow BTC to exhibit recovery and avoid an immediate retest of the $60,000 level.

CoinGlass data adds to the bullish case. Bitcoin’s liquidation heatmap shows over $5.45 billion in cumulative short liquidations positioned if the price moves roughly $10,000 higher, compared with $2.4 billion in liquidations on a retest of $60,000.

This imbalance suggests that an upward move may trigger forced shorts covering, leading to a BTC rally.

Related: Bitcoin circles $70K as Coinbase Premium sees first green spike in a month

BTC structural weakness keeps downside risks in focus

Data from CryptoQuant shows Bitcoin trading below its 50-day moving average near $87,000, while further below the 200-day moving average around $102,000. This wide gap reflects a corrective or “repricing” phase following the prior rally.

CryptoQuant’s Price Z-Score is also negative at -1.6, indicating BTC is trading below its statistical mean, a sign of selling pressure and trend exhaustion. Such conditions have preceded extended base-building rather than immediate rebounds.

Crypto analyst Darkfost highlighted a growing selling dominance in the derivatives markets. Monthly net taker volume has turned sharply negative at -$272 million on Sunday, while Binance’s taker buy-sell ratio has slipped below 1, signaling a strong selling pressure.

With futures volumes outweighing spot flows at the moment, stronger spot demand is needed to trigger a bullish reaction from BTC.

Adding a longer-term caution, Bitcoin investor Jelle noted that past Bitcoin bear market bottoms formed below the 0.618 Fibonacci retracement. For the current cycle, that level sits near $57,000, with deeper downside scenarios extending toward $42,000 if history repeats.

Related: Saylor’s Strategy buys $90M in Bitcoin as price trades below cost basis

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

FTX’s Ryan Salame Goes Full MAGA in Bid for Trump Pardon

Former Ryan Salame, a onetime co-CEO of FTX, has launched a highly visible social media campaign that appears aimed at securing a presidential pardon from Donald Trump, despite currently serving a federal prison sentence.

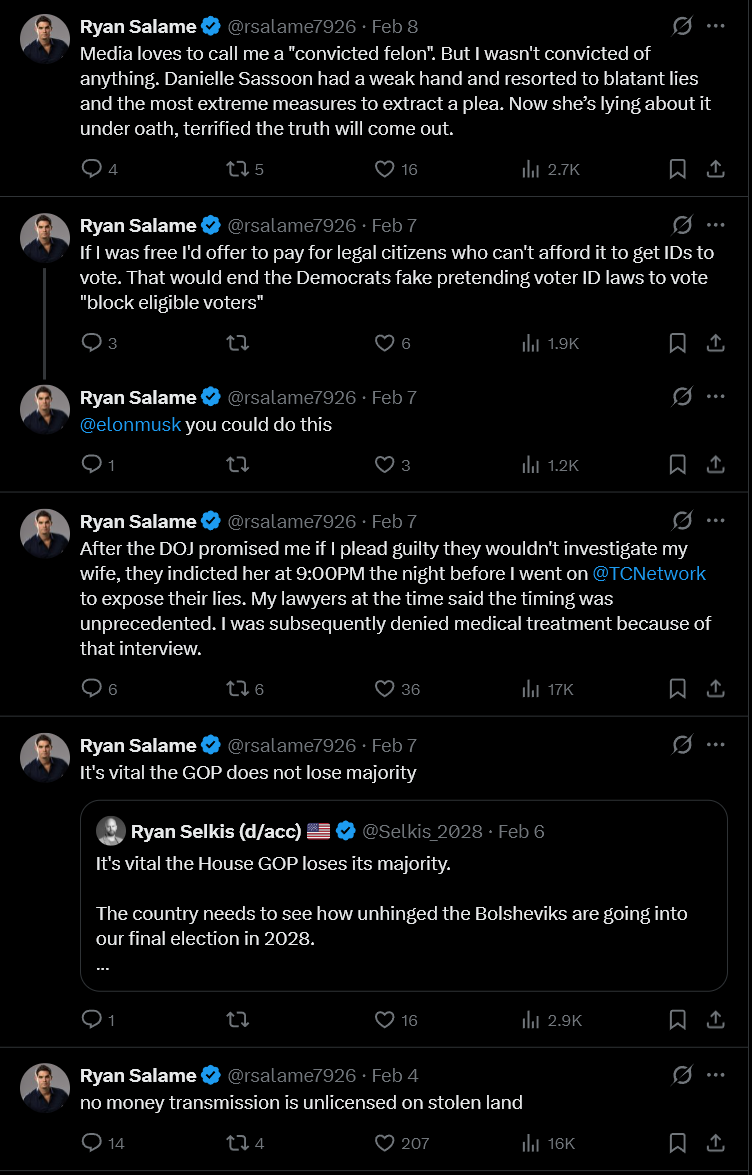

Over recent weeks, Salame’s X account has posted a stream of politically charged messages praising Republican priorities, attacking Democrats, and aligning closely with Trump’s rhetoric on immigration enforcement and election integrity.

Sponsored

Getting on Donald Trump’s Good Side

In one post, Salame said that if granted clemency, he would “spend the remainder of my sentence working as an ICE agent,” a comment that quickly went viral.

In another, he argued voter ID laws were being misrepresented and suggested that funding IDs would “end the Democrats’ fake pretending” about voter suppression.

He is also promising to pay for legal citizens to get IDs to vote, for those who can’t afford. Only if he were free.

Sponsored

How is Salame Posting From Prison?

Salame is currently serving a 90-month federal sentence at a medium-security US Bureau of Prisons facility.

In 2023, he pleaded guilty to campaign finance violations and operating an unlicensed money-transmitting business connected to FTX.

But how is he constantly posting on X from prison? Federal inmates are prohibited from accessing social media directly.

As a result, his posts are widely understood to be published via third parties acting on his behalf, typically based on phone calls, written correspondence, or pre-approved messaging — a common workaround used by high-profile inmates.

Sponsored

Attacking Prosecutors, Echoing Trump Themes

Several posts directly attack federal prosecutors, including claims that he was coerced into a plea deal and that the Department of Justice misled him about investigations involving his wife.

Salame has repeatedly framed his prosecution as politically motivated — language that mirrors Trump’s broader criticism of the DOJ.

Sponsored

Trump’s High-Profile Pardons

Salame’s public posture comes amid Trump’s recent wave of pardons and commutations, including several tied to crypto and financial crimes.

Those moves have reshaped expectations around clemency, particularly for defendants who argue their prosecutions reflected regulatory overreach.

Trump has also intensified ICE enforcement actions and revived claims that Democrats — including President Joe Biden — undermined election integrity, themes Salame now openly amplifies.

While Salame has not explicitly requested a pardon, the messaging leaves little ambiguity.

From prison, the former FTX executive appears to be making a public case for inclusion on Trump’s clemency list. He is aligning himself with the president’s political agenda as aggressively as possible, one post at a time.

Crypto World

Dogecoin jumps as $20m whale transfer hits Robinhood

A large Dogecoin transfer to Robinhood has drawn attention amid a volatile crypto market. On Saturday, 203.6 million DOGE—worth roughly $20.1 million—was moved from an unknown wallet to the trading platform, coinciding with a 6% rebound in Dogecoin’s price.

Summary

- A large Dogecoin “whale” transfer to Robinhood—203.6 million DOGE worth about $20.1 million—coincided with a 6% price rebound.

- Nearly 278 million DOGE moved to Robinhood on February 4, signaling heightened activity by large holders during unstable market conditions.

- Whale Alert data shows this was the second major transfer in days.

The move followed several days of declines and marked a short-term reversal from a broader downward trend.

According to Whale Alert, this was not an isolated event.

Just days earlier, on February 4, nearly 278 million DOGE valued at about $29.5 million was also transferred to Robinhood. These repeated large movements suggest heightened activity by major holders during a period of market instability.

The broader cryptocurrency market has struggled since a sharp sell-off in October that eroded investor confidence. More recently, prices have been pressured by the unwinding of leveraged positions and increased volatility. Dogecoin fell for three consecutive sessions, hitting a low of $0.0799 on February 6 before rebounding to around $0.10, with losses attributed to risk-off sentiment and heavy derivatives trading.

Liquidity conditions have also weakened. Dogecoin’s market depth declined from roughly $12 million at the start of January 2026 to about $10 million in early February, a drop that can amplify price swings during turbulent periods.

Traders are closely watching key technical levels. A break below $0.07 could open the door to further downside toward $0.05, while a sustained move above the $0.106–$0.110 range may be needed to confirm a recovery. Overall, Dogecoin’s recent price action and whale activity point to ongoing uncertainty, with volatility likely to persist in the near term.

Crypto World

Trump’s Bitcoin bet? Cramer hints at $60k strategic reserve

Market commentator Jim Cramer claimed on CNBC that the Trump administration plans to purchase Bitcoin for a proposed U.S. Strategic Reserve amid ongoing market volatility.

Summary

- Cramer claimed the Trump administration may buy Bitcoin for a proposed U.S. Strategic Reserve, reportedly targeting a $60,000 entry price amid recent market volatility.

- The U.S. government currently holds 328,372 BTC (over $23 billion), with executive orders specifying that reserves come from asset forfeitures and cannot be sold; Treasury officials say public funds cannot be used to buy crypto.

- Interest in a Strategic Bitcoin Reserve is rising, with Polymarket placing the probability of establishment before 2027 at 31%, while BTC trades around $71,133, up 3% over the past 24 hours.

“I heard at $60,000 the President is gonna fill the Bitcoin Reserve,” Cramer said on Friday’s Squawk on the Street segment.

The remark coincided with a sharp Bitcoin sell-off earlier in the week, which saw BTC briefly approach $60,000 before rebounding above $70,000. If the purchase occurs at the cited price, Bitcoin would need to decline more than 15% for the administration to execute it.

What the data shows

According to Arkham data, the U.S. government currently holds 328,372 BTC, valued at over $23 billion, with no recent changes in holdings. An executive order from March 2025 specifies that BTC for the reserve would come from criminal and civil asset forfeitures, and deposits cannot be sold.

Treasury Secretary Scott Bessent has stressed that the federal government has no legal authority to bail out Bitcoin or compel banks to purchase it, reinforcing that public funds cannot be used to acquire cryptocurrency assets.

Despite these legal constraints, interest in a Strategic Bitcoin Reserve appears to be growing. Polymarket data shows the probability of such a reserve being officially established before 2027 has risen to 31%, up from 23% in early January.

At the time of reporting, Bitcoin was trading at $71,133.74, up roughly 3% over 24 hours, reflecting ongoing market volatility and investor attention on potential government involvement.

Crypto World

Pi Network (PI) Faces ‘Pyramid Scheme’ Accusations as Analyst Issues Crucial Warning

“RIP to the bags still being held. Touch some grass, seriously,” the analyst said.

Pi Network’s PI has been on a massive price decline over the past several months, causing many community members to lose patience and call the project a scam.

Meanwhile, the bearish conditions of the broader crypto market and some other important factors signal that the asset could experience a further downfall in the near future.

‘Not a Healthy Correction’

It seems rather absurd that PI was trading at around $3 nearly a year ago, given its current valuation. Last week, the token slipped to a new all-time low of approximately $0.13, and as of press time, it is worth roughly $0.14, representing a staggering 95% collapse from the historical peak.

According to X user pinetworkmembers, the decline is not “a healthy correction,” but a market pricing of the biggest issues of the controversial project behind the cryptocurrency:

“That’s not a healthy correction, that’s the market finally pricing in the obvious: no functioning mainnet after years of promises, no real-world utility beyond ‘keep the app open’, and a whole lot of mobile mining theater.”

They claimed that at first PI was sold as “revolutionary,” but eventually ended up appearing like “the longest-running pyramid scheme dressed up as Web3 empowerment for hopeful retirees and late-night scrollers.”

They opined that Pi Network users (known as Pioneers) should admit that the experiment failed and redirect their energy toward something more productive that can actually bring them profit.

“RIP to the bags still being held. Touch some grass, seriously,” the X user concluded.

This isn’t the first time the project has become the subject of criticism. Earlier this month, Pi Network’s Core Team celebrated the so-called “Moderator Appreciation Day.” The event aimed to acknowledge moderators and praise their role in building and supporting the community.

You may also like:

The statement, however, triggered significant backlash, as many members argued that the project should focus on more pressing issues, such as expediting the verification process and related tasks.

What Lies Ahead?

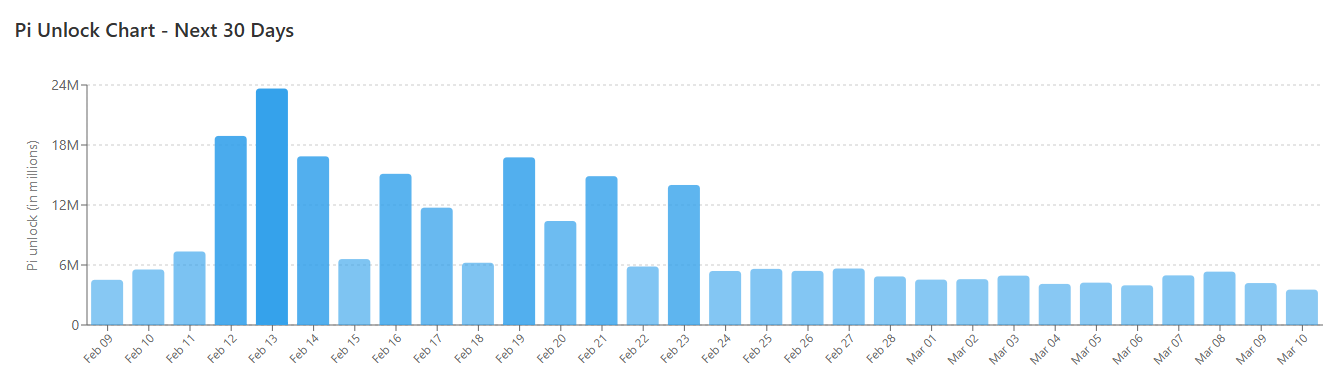

Several concerning factors, including the upcoming token unlocks, suggest PI’s price could fall further in the short term. Data shows that nearly 250 million coins will be released over the next 30 days, resulting in an average daily unlock of more than 8.3 million.

February 13 is expected to be the record day, when 23.6 million PI will be freed up. While the development doesn’t guarantee an additional price collapse, it can be considered bearish because it increases the selling pressure.

On the other hand, PI’s Relative Strength Index (RSI) signals that a rebound could also be on the horizon. The technical analysis tool measures the speed and magnitude of recent price changes and helps traders identify potential reversal points. It varies from 0 to 100, and ratios below 30 indicate that PI has entered oversold territory and may be due for a resurgence. According to RSI Hunter, the RSI currently stands at around 35.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Crypto News, Prices & Indexes

Bitcoin and Ethereum led a broad rally in risk assets as traders priced in cooling inflation and firmer macro signals, but the rebound for Ether came with a caveat: derivatives markets remained largely cautious. The on-chain picture shows a liquidity landscape that is still hunting for clear catalysts, even as Ether clears key price resistances. In short, a positive price move does not yet translate into a confident shift in momentum, with traders continuing to weigh the risk of another leg lower as macro headlines evolve.

Key takeaways

- Ethereum maintains dominance in total value locked (TVL), but scrutiny of layer-2 scaling and its subsidy model persists as investors assess long-term efficiency.

- Ether’s inflation metric rose to ~0.8% over the last 30 days as on-chain activity cooled, while macro concerns kept derivatives in a cautious, risk-off stance.

- ETH 2‑month futures traded at roughly a 3% premium to spot, below the 5% neutral threshold, signaling tepid optimism from Ether traders despite the rally.

- Year-to-date, Ether has underperformed the broader crypto market by about 9%, raising questions about where capital is flowing and how much is staying tethered to Ethereum’s core ecosystem.

- Deposits on the Ethereum base layer account for roughly 58% of the entire blockchain industry; including Base, Arbitrum, and Optimism, that figure rises to about 65%. The largest DApp on the Ethereum base layer holds more than $23 billion in TVL, underscoring Ethereum’s ongoing scale advantage over competitors like Solana, where the top DApp’s TVL remains far smaller.

Sentiment: Bearish

Price impact: Positive. Ether reclaimed the $2,100 level as the broader market rose, but the bounce remains tentative amid persistent risk-off signals in the derivatives space.

Trading idea (Not Financial Advice): Hold. The current price recovery lacks clear, durable conviction from buyers, and any sustained advance will depend on a shift in risk appetite and improved on-chain activity.

Market context: The price move comes within a broader environment of liquidity fluctuations and macro uncertainty, where flows into crypto often track traditional risk indicators and regulatory chatter as much as technical levels.

Why it matters

The Ethereum ecosystem remains the cornerstone of DeFi and NFT activity, with the base layer continuing to attract the majority of on-chain value. Even as the chain holds a commanding TVL lead, the narrative around layer-2 solutions—how they decentralize, secure, and scale applications—has grown more nuanced. Ethereum’s current stance reflects a tension between the heavy usage that has historically fueled its dynamics and the structural questions about how best to sustain growth without compromising security or centralizing risk through bridges or trusted constructs.

Data from ultrasound.money shows Ether’s supply growth accelerating to about 0.8% on an annualized basis over the last month, a sign that the burn dynamics intended to counter inflation are not as punitive as hoped when network demand softens. The built-in burn mechanism relies on base-layer data processing activity; when that activity wanes, the net effect can be a modest supply expansion, tempering the deflationary narrative some bulls have pushed. This dynamic aligns with the observed softness in on-chain activity and the tepid appetite in the derivatives market, where a 3% premium for 2‑month Ether futures sits below the 5% neutral threshold—an indication that traders are not aggressively pricing in rapid upside (Laevitas data: laevitas.ch).

On the fundamental side, the ladder of TVL metrics continues to illustrate Ethereum’s centrality. The Ethereum base layer alone accounts for the majority of blockchain deposits, while including the leading layer-2 ecosystems—Base, Arbitrum, and Optimism—pushes the share to well above two-thirds of industry activity. In contrast, Solana’s leading DApp sits far behind, a reminder that capital has not yet pursued a broad shift away from Ethereum despite competition. This shape of the market matters for developers evaluating where to build and for investors weighing the durability of Ethereum’s moat in a multi-chain era.

The pace of adoption in layer-2 networks is another focal point. Vitalik Buterin has argued that the L2 path to decentralization has proven more challenging than originally envisioned, given reliance on multisig-controlled bridges and security trade-offs. In interviews and analyses, he has signaled a pivot toward base-layer scalability while acknowledging that privacy-focused features and application-specific designs on L2s will continue to influence capital allocation patterns. The inherent tension between scalability and security is central to investors’ risk calculus as they parse long-term returns from layer-1 vs. layer-2 deployments. For context, related discussions emphasize the difference between “real DeFi” and centralized yield constructs, underscoring how policy choices and technology design shape the sustainable value proposition of Ethereum’s ecosystem (Vitalik Buterin commentary: Ethereum scaling pivot).

Another facet of the narrative is the relationship between price performance and liquidity provision. Ether’s price recovery has not yet translated into a broad-based rally in the derivatives market, where risk-off sentiment remains visible in pricing and open interest. While the disappearance of a rapid down-leg is a relief for holders, the absence of robust upside pressure suggests traders remain cautious, watching macro data and regulatory signals for any signs that capital will pivot back toward higher-yield opportunities. In this context, the chart of Ether against the overall crypto capitalization illustrates a persistent lag, with Ether’s performance this year lagging the broader market by roughly 9% as capital rotates among competing use cases and networks (TradingView: ETH/USD vs. total crypto capitalization).

Finally, the market’s attention remains split between long-term fundamental deployments and near-term price movements. The burn mechanism’s trajectory depends on on-chain activity, while the composition of TVL—especially the share captured by L2s—will influence how investors perceive Ethereum’s ability to sustain network effects. The ongoing debate about L2 security, decentralization, and throughput feeds into price dynamics and shapes the risk-reward calculus for traders and developers alike. As developers experiment with privacy-focused features and bespoke, application-specific layer designs, Ethereum’s scale narrative remains central to the crypto economy’s evolution, even as other chains strive to carve out niche advantages.

What to watch next

- Monitor Ether’s price action around the $2,200 area and whether buying pressure gains enough momentum to sustain a breakout.

- Track Vitalik Buterin’s public comments and any policy shifts from major layer-2 projects regarding decentralization and security architecture.

- Observe on-chain activity metrics and the burn rate versus supply growth using ultrasound.money data to gauge deflationary pressure.

- Watch DefiLlama for TVL movements between the Ethereum base layer and its Layer-2 ecosystem to assess flow shifts across the ecosystem.

- Keep an eye on macro indicators and central bank signals that influence liquidity and risk sentiment, as these ultimately drive derivative pricing and capital allocation.

Sources & verification

- ETH price levels and movement relative to the $2,150 threshold and recovery to $2,100+ zones.

- 2-month Ether futures annualized premium data from Laevitas as a gauge of derivatives sentiment.

- ETH supply growth metrics (0.8% annualized over the last 30 days) from ultrasound.money.

- TVL breakdowns and main chain vs. Layer-2 deposits from DefiLlama data.

- Official commentary by Vitalik Buterin on Layer-2 decentralization and the burn mechanism, including linked analyses.

What the numbers say about the market today

Market breadth has improved modestly as Ether reclaims price levels, yet the path to a sustainable rally remains uncertain. The interplay between layer-2 subsidies, base-layer scalability, and on-chain activity will continue to shape price dynamics and capital flows. Investors are watching for signals that derivatives markets finally align with price action, suggesting a broader willingness to take on risk. Until then, Ether’s leadership in TVL and ongoing L2 development will be essential barometers for the health and direction of the crypto ecosystem.

Crypto World

Bitcoin at Critical $69K-$72K Support: Death Cross Signals Deeper Correction Risk

TLDR:

- Bitcoin death cross forms on daily charts with moving averages positioned far above current price

- Weekly close below $69K-$72K support could trigger next leg down into deeper correction territory

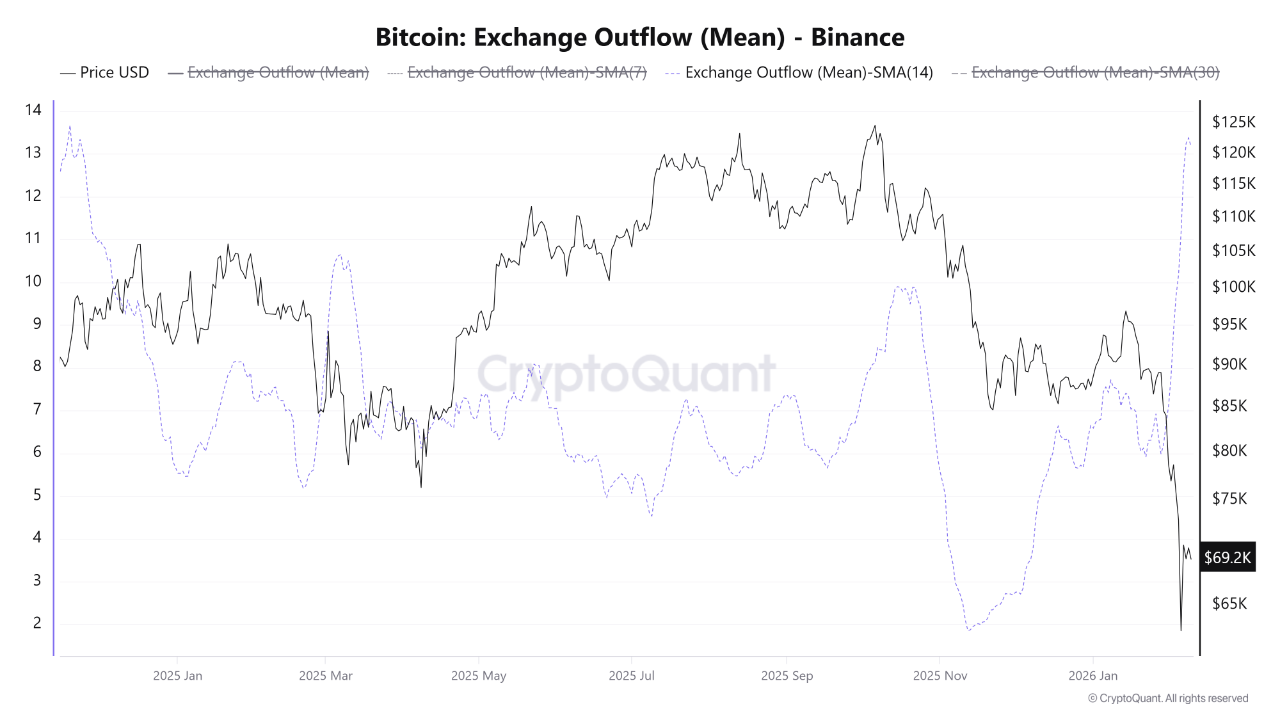

- Binance withdrawal data shows whale accumulation doubled to 13.3 BTC average since late January

- Price must reclaim $82K then mid-$90Ks to establish bottoming pattern and reverse bearish trend

Bitcoin faces a critical test as price slides into the $69,000 to $72,000 support zone amid mounting bearish technical signals.

A death cross has formed on daily charts while weekly moving averages remain far overhead. Traders warn that a clean weekly close below this range could trigger a deeper correction phase.

The current price action shows weak bounce attempts with consistent rejections at key resistance levels.

Death Cross Formation Signals Bearish Trend Structure

The technical setup has deteriorated significantly as BTC continues its descent from higher levels. Daily charts now display an active death cross with the 50-day and 200-day moving averages positioned miles above current price. This configuration represents a classic bearish trend structure where rallies meet aggressive selling pressure.

Weekly timeframes confirm the concerning technical picture. Price remains trapped below the exponential moving average ribbon with repeated rejection attempts at that level.

Any upward moves are functioning as retests rather than genuine reversals. Trader @DamiDefi emphasized that pumps are getting sold while supports face continuous stress tests.

The $69,000 to $72,000 band now represents the final line of defense. This zone determines whether the market experiences a temporary shakeout or enters a prolonged correction phase. Price behavior at this level will dictate the trajectory for coming weeks and potentially months.

A breakdown below $69,000 on a weekly closing basis would open the next leg down. The accumulation phase would become considerably more painful before any bullish momentum could rebuild.

Historical patterns suggest that losing major support zones often leads to cascading liquidations and accelerated downside movement.

Support Test Occurs Despite Whale Buying Activity

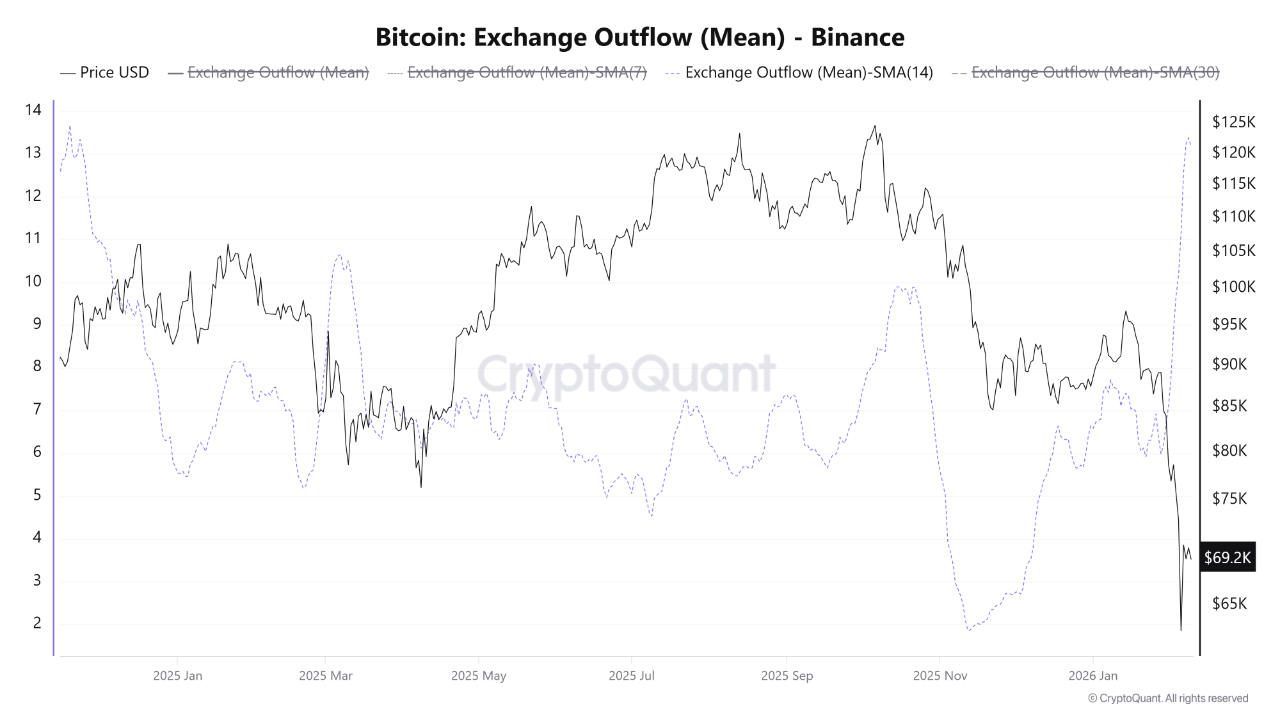

The bearish price action persists even as on-chain data reveals unusual buying patterns. Binance exchange metrics show a significant increase in average withdrawal sizes during the decline.

The 14-day simple moving average of mean outflows has doubled from approximately 6 BTC on January 28 to 13.3 BTC by February 8.

This withdrawal pattern indicates whale and institutional activity at current price levels. Large entities appear to be accumulating Bitcoin around $69,000 despite the technical deterioration.

The average outflow size represents the highest level recorded since November 2024, according to CryptoOnchain data.

However, this accumulation has not yet translated into price stability or reversal. The gap between falling prices and rising withdrawal sizes creates a divergence worth monitoring. Smart money appears to be positioning for longer-term gains while accepting near-term downside risk.

Moving coins off exchanges to cold storage traditionally reduces immediate selling pressure. Yet the current market structure suggests this effect remains insufficient to halt the decline.

Bulls need price to reclaim $82,000 first, then push back into the low-to-mid $90,000s to establish a credible bottoming range. Without holding the $69,000 to $72,000 support zone, those recovery targets become increasingly distant possibilities.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

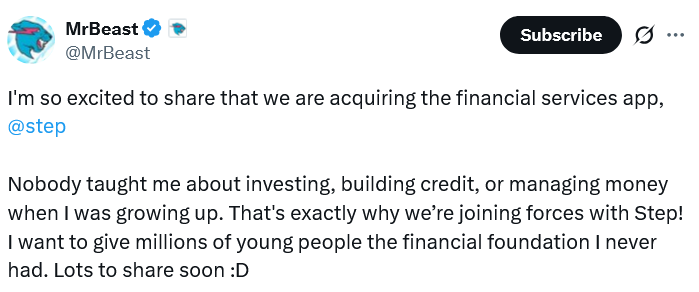

Beast Industries, the entertainment company founded by YouTuber Jimmy “MrBeast” Donaldson, is acquiring Step, a mobile banking app focused on teenagers and young adults, marking its most significant push into finance to date.

In a post to X on Monday, Donaldson said the motivation behind the acquisition was to equip young people with the tools and guidance needed to navigate personal finance from an early age.

Beast Industries CEO Jeff Housenbold said, “Financial health is fundamental to overall wellbeing, yet too many people lack access to the tools and knowledge they need to build financial security.”

The acquisition cost was not disclosed.

The YouTube channel’s expansion into finance comes after it received a $200 million investment from Ethereum treasury firm BitMine Immersion Technologies in January and a separate trademark filing for “MrBeast Financial” in October.

That trademark filing mentioned “cryptocurrency exchange services,” “cryptocurrency payment processing,” and “cryptocurrency via decentralized exchanges.”

However, it isn’t clear whether that trademark filing is related to the Step acquisition.

Cointelegraph reached out to Beast Industries for comment, but didn’t receive an immediate response.

Step scales to 6.5 million users in 8 years

The Step app aims to help Gen Z users manage money, build credit, earn rewards, and deepen their financial literacy. Spending accounts are Federal Deposit Insurance Corporation-insured through Evolve Bank & Trust.

The banking app has scaled to 6.5 million users since launching in 2018, having raised around $500 million from the likes of Steph Curry, Justin Timberlake, Will Smith, and Charli D’Amelio.

Related: Crypto PACs secure massive war chests ahead of US midterms

The MrBeast YouTube channel has 466 million subscribers, the largest channel on the video-streaming platform.

Housenbold said the Step acquisition “positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better.”

At the time of the strategic $200 million BitMine investment, its chair, Tom Lee, said the company viewed the deal as a long-term bet on the creator economy, stating:

“MrBeast and Beast Industries, in our view, is the leading content creator of our generation, with a reach and engagement unmatched with GenZ, GenAlpha and Millennials.”

Lee said that BitMine’s corporate values were “strongly aligned” with Beast Industries, but didn’t mention anything about integrating crypto at the time.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

CryptoGames Advances Transparency and Mathematical Fairness in iGaming

[PRESS RELEASE – Willemstad, Curaçao, February 9th, 2026]

CryptoGames announced that players on its platform have placed over 9.5 billion Dice bets, marking a notable usage milestone and reflecting consistent engagement with its provably fair gaming system. The volume of verified wagers underscores the platform’s ongoing focus on transparency, statistical fairness, and game integrity.

Founded in 2020, CryptoGames was built around a clear guiding principle: to offer a gambling environment where fairness can be independently verified, odds are fully understood, and competition takes place on equal terms. Rather than relying on large libraries of third-party games with opaque mechanics, CryptoGames delivers a focused portfolio of internally developed titles, each engineered with some of the lowest house edges available online.

House Edge as a Foundation of Long-Term Value

In gambling mathematics, house edge defines the casino’s statistical advantage over time. While short-term outcomes can vary, long-term results are shaped almost entirely by this single metric. Even small differences in house edge can have a measurable impact when applied across a high volume of bets.

CryptoGames emphasizes transparency in house edge as a core aspect of its platform design. The platform offers low-margin games, which may result in higher value retention for players over extended periods of play, compared to traditional online casinos where house edges typically range from 4% to 10%.

In-House Development Enables Competitive Margins

All games on CryptoGames are developed internally. This approach removes the need for third-party licensing fees and external profit margins, allowing the platform to operate efficiently while offering leaner house edges.

Standard House Edge Across Games

CryptoGames maintains consistent and competitive margins across its game selection:

- Dice – 1.0%

- DiceV2 – 1.0%

- Keno – 1.0%

- Minesweeper – 1.0%

- Blackjack – 1.25%

- Roulette – 2.7%

- Plinko – 1.72%

- Slot – 1.97%

The Lottery game stands out with a 0.0% house edge, an uncommon structure that reinforces CryptoGames’ commitment to fairness and transparency.

By comparison, these margins offer players a measurable advantage over conventional casino offerings over time.

Provably Fair Technology Built Into Every Bet

Transparency is reinforced through full implementation of provably fair gaming across the CryptoGames platform.

Before each wager, the server seed is hashed and presented to the player. Once the bet concludes, the original seed is revealed, allowing independent verification of the outcome using the published algorithm.

By design, this eliminates one of the most common trust concerns in online gambling.

Broad Cryptocurrency Support and Flexible Access

CryptoGames supports betting with 14 cryptocurrencies, accommodating a wide range of blockchain users.

Through ChangeNow integration, users can also deposit more than 50 additional altcoins, which are automatically converted into supported assets. For those new to crypto, CryptoGames integrates the Swapped fiat-to-crypto gateway, enabling purchases via credit cards, Apple Pay, and Google Pay.

Ongoing Rewards Designed for Consistent Engagement

CryptoGames emphasizes long-term engagement through recurring rewards rather than one-time promotional offers.

Monthly Wagering Contest With Major Prize Pools

The platform hosts a monthly wagering contest offering rewards of up to $500,000 USD, depending on market conditions.

Leaderboards are separated by cryptocurrency, ensuring fair competition among players using the same assets. Participants also receive lottery tickets throughout the month, adding additional reward opportunities tied to consistent participation.

VIP Program Focused on Statistical Advantage

CryptoGames’ VIP program is tailored for high-volume and competitive players.

VIP Benefits

- Reduced dice house edge of 0.8%

- Removal of server-side betting delays

- Increased daily exchange limits up to 1 BTC

- Access to a private VIP chat room

- VIP chat identification

- $100 Bitcoin birthday bonus (Tier 3 KYC required)

- Additional faucet level

- Monthly voucher distributions

Players who maintain VIP status for three consecutive months retain most benefits even if they do not immediately requalify, reinforcing long-term loyalty.

Optimized User Experience and Community Engagement

CryptoGames delivers a clean, high-performance interface designed for speed and efficiency. Betting remains smooth even at high volumes. An active chatbox, blog, and forum further support transparency and community interaction.

A Platform Built for Fairness, Strategy, and Confidence

With more than 9.5 billion Dice bets placed, CryptoGames continues to demonstrate the scalability and reliability of its provably fair systems. Through in-house development, transparent odds, extensive crypto support, and competitive reward structures, CryptoGames sets a disciplined standard in the crypto gambling space.

For users focused on long-term value, verifiable fairness, and confident decision-making, CryptoGames represents a clear and data-driven approach to crypto gaming.

About CryptoGames

CryptoGames is a cryptocurrency-focused iGaming platform founded in 2020, built around the principles of transparency, mathematical fairness, and player-verifiable outcomes. The platform offers a curated selection of internally developed games with consistently low house edges, supported by provably fair technology that allows every wager to be independently verified. By combining in-house development, broad cryptocurrency support, and data-driven game design, CryptoGames provides a gambling environment designed for informed decision-making and long-term value.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Cardano Price Near Breakout as Selling Hits 6-Month Low

The Cardano price is down nearly 4% over the past 24 hours and remains about 33% lower over the past month. Despite this weakness, several technical and on-chain signals suggest that selling pressure is fading.

The share of ADA supply in profit has dropped by roughly 75% since January, sharply reducing profit-taking incentives. At the same time, a potential reversal pattern is forming on lower time frames. Together, these signals raise a key question: is this Charles Hoskinson-led token preparing for a rebound toward $0.34, or is this just another failed recovery attempt?

Sponsored

Sponsored

Inverse Pattern And Divergence Hint At Buyers Regaining Control

On the 4-hour chart, Cardano is forming an inverse head-and-shoulders pattern. This structure often appears near local bottoms and signals that sellers may be losing control. It consists of a left shoulder, a deeper central low, and a higher right shoulder.

In this case, the neckline is sloping downward. A downward-sloping neckline makes breakouts harder because buyers must push through falling resistance. For this pattern to activate, ADA needs a clear four-hour close above the $0.275–$0.280 zone.

A momentum indicator, the Relative Strength Index (RSI), also supports this early recovery attempt. Between January 31 and February 9, Cardano seems to be printing lower lows on price, while the Relative Strength Index or RSI is printing higher lows. This developing bullish divergence shows that selling pressure is weakening even as price tests new short-term lows.

The divergence signal would confirm if the next ADA price candle forms above $0.259.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, sellers are becoming less aggressive. Buyers are slowly stepping in. But this setup only works if demand continues to build. Without follow-through, these patterns usually fail. That brings attention to whether sellers still have strong reasons to exit.

Sponsored

Sponsored

Profit-Taking and Coin Activity Have Collapsed, Reducing Sell Pressure

On-chain data shows that selling incentives have dropped sharply over the past month.

The percentage of total ADA supply in profit has fallen from above 33% in mid-January to about 8% in early February. That represents a decline of roughly 75%. It places profitable supply close to its lowest level in six months.

When so few holders are in profit, fewer investors are motivated to sell into small rallies. Most are either at break-even or sitting on losses. This reduces natural selling pressure.

Another supportive signal comes from spent coins age data, which tracks how many coins, across old and young cohorts, are being moved. During the February 6 sell-off, coin activity surged to around 168 million ADA. Since then, it has dropped to roughly 92 million. That is a decline of about 45%.

Sponsored

Sponsored

This shows that long-term holders are no longer rushing to move or sell their coins. Panic-driven exits have slowed. Many investors are choosing to wait. When falling profit supply aligns with declining coin movement, it usually means distribution is easing. This does not guarantee a rally, but it creates space for one to develop.

With fewer motivated sellers, the next move depends mainly on buyer strength.

Volume and Cardano Price Levels Will Decide If $0.34 Comes Into Play

Despite improving structure and weaker selling pressure, buying strength remains limited.

On-Balance Volume, which tracks whether volume supports rising or falling prices, is still trending lower. It remains below a descending trendline. This shows that recent rebounds have not been supported by sustained demand.

Sponsored

Sponsored

The last major surge in buying happened on February 6, when ADA rallied from near $0.220 to around $0.285 in one day, almost 30%. Volume expanded sharply during that move. Since then, participation has cooled.

For a true breakout to develop, volume must expand again and push OBV above its downtrend. Without that, rallies are likely to fade. Key ADA price levels reflect this balance.

The first major resistance sits near $0.275. A confirmed break above this zone would validate the inverse pattern. Above that, $0.285 becomes the next hurdle. Clearing both would open the path toward $0.346, almost 30% from the pattern’s neckline.

On the downside, $0.259 is critical support. A break below this level would weaken the right shoulder and damage the bullish setup. Full invalidation occurs below $0.220, which would place the price back under the pattern’s base.

In simple terms, Cardano is approaching a decision point. Selling incentives have dropped about 75%. Coin activity has cooled. Momentum is improving. But volume has not yet confirmed buyer control.

If strong participation returns and $0.275 breaks, a move toward $0.34 ($0.346 to be exact) becomes realistic. If not, the ADA price risks drifting lower again.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 hours ago

NewsBeat5 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports21 hours ago

Sports21 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat16 hours ago

NewsBeat16 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know