Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

ETH price moved above $2,150 as Bitcoin and US stock markets rallied, but does data show whether derivatives traders have turned bullish yet?

Key takeaways:

-

Ethereum maintains dominance in its total value locked metric, yet faces scrutiny over layer-2 scaling.

-

ETH inflation rose to 0.8% as onchain activity slowed, while US macroeconomic fears kept the derivatives markets in bearish territory.

Ether (ETH) price managed to reclaim the $2,100 level following a 43% crash over nine days that culminated in the altcoin making a $1,750 low on Friday. Despite a 22% relief bounce after hitting its lowest price since April 2025, ETH derivatives markets continue to reflect investors’ fear of further downside. Regardless of whether the macroeconomic environment is driving investor concerns, the odds of sustainable bullish momentum for ETH in the short term remain dim.

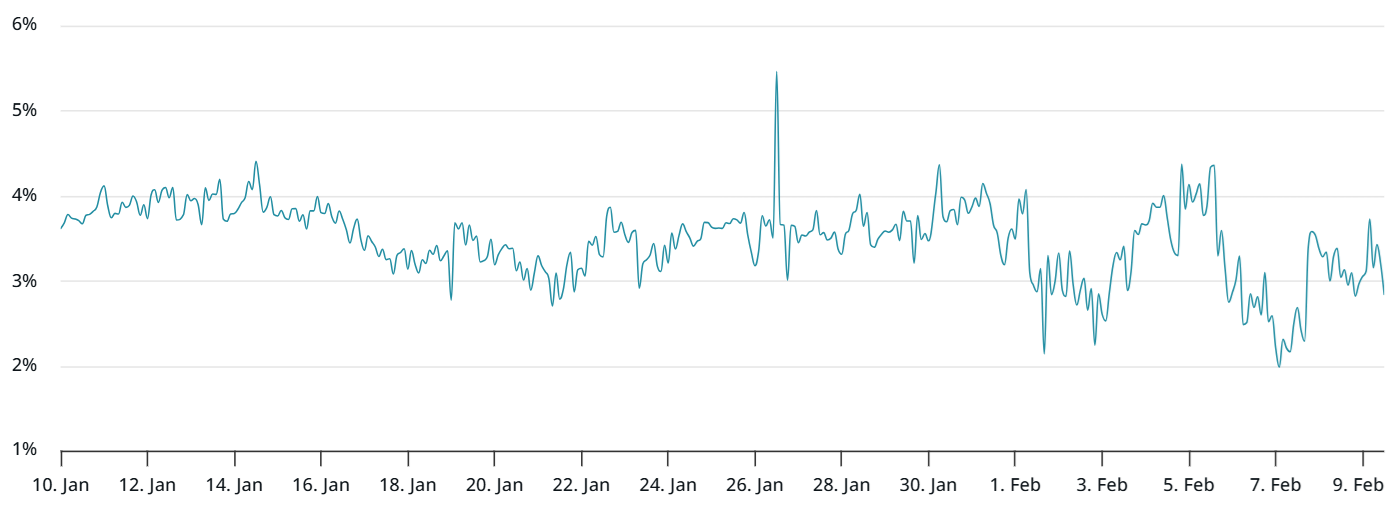

ETH monthly futures traded at a 3% premium relative to regular spot markets on Monday, which is below the 5% neutral threshold. This lack of optimism among Ether traders has been constant over the past month, showing no signs of improvement even as the price dropped toward $1,800. Unless bulls step in to demonstrate a strong appetite for risk at these levels, bears will likely remain in control.

ETH has underperformed the broader cryptocurrency market capitalization by 9% in 2026, leading investors to question what is driving capital away. From a broader perspective, the declining interest in decentralized applications (DApps) is not exclusive to Ethereum. The network remains the dominant leader in Total Value Locked (TVL) and fee generation when aggregating its layer-2 solutions.

Deposits on the Ethereum base layer account for 58% of the entire blockchain industry; that figure surpasses 65% when including Base, Arbitrum, and Optimism. For instance, the largest application on Solana hardly exceeds $2 billion in deposits. By comparison, the largest DApp on the Ethereum base layer holds over $23 billion in TVL. Solana’s Jupiter would not even crack the top 14 on Ethereum.

ETH supply growth and layer-2 subsidies remain problematic

The Ethereum base layer ranked third in network fees, generating $19 million over 30 days, while the layer-2 ecosystem contributed another $14.6 million. Ethereum has faced criticism for heavily subsidizing scalability via optimistic rollups—a strategy Vitalik Buterin himself admitted needs adjustment. The Ethereum co-founder argued on Tuesday that the network should prioritize base layer scalability.

According to Buterin, the layer-2 path to decentralization turned out more difficult than anticipated. The present solutions reportedly rely on multisig-controlled bridges, which does not meet security standards required by Ethereum’s original vision. Buterin notes that this is not the end game for layer-2 as demand for networks offering privacy features and application-specific design will continue to exist, especially for non-financial use cases.

Related: Vitalik draws line between ‘real DeFi’ and centralized yield stablecoins

Part of investor disappointment can be explained by the failure of Ether’s strategy to become deflationary, which is a secondary effect of reduced Ethereum network activity. The built-in burn mechanism depends on demand for base layer data processing; without it, there is a net increase in the ETH supply. The annualized growth of the total ETH issued reached 0.8% over the last 30 days, a significant jump from one year prior when equivalent inflation was near 0%.

Ether traders remain skeptical that a sustainable rally can occur in the near term due to increased uncertainty in the US job market and the long-term sustainability of investments in artificial intelligence infrastructure. Consequently, the weak ETH derivatives markets are a reflection of generalized risk aversion and a slowdown in onchain activity—factors that will likely take more time to stabilize.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

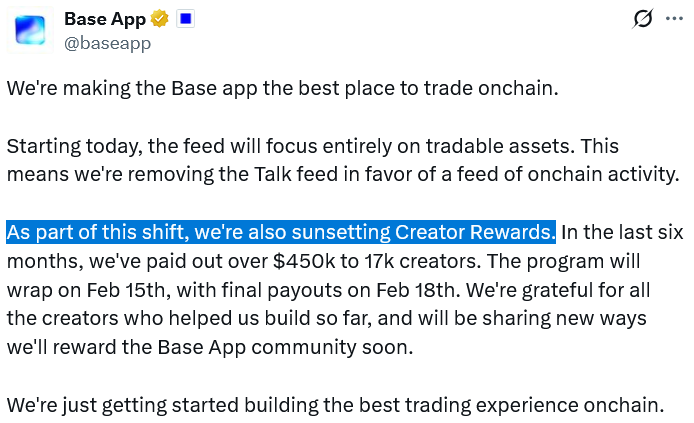

Coinbase’s “Everything App,” Base App, is sunsetting its Creator Rewards program and Farcaster-powered social feed as part of a strategic shift to focus entirely on tradable assets.

The Creator Rewards program was launched in July and was intended to make Ethereum layer 2 Base a more social ecosystem, where activity and engagement translated into earnings.

The Base App X account said on Monday that it handed out around $450,000 to 17,000 creators over seven months, with the data suggesting that creators earned an average of $26.

“As we’ve rolled the app out, we’ve realized we need to do less, better. And by focusing on tradable assets, that’s exactly what we can do,” Base creator Jesse Pollak said, adding:

“The app needs to have one primary focus, and that thing is trading.”

The Base App’s Creator Rewards program will wrap on Sunday, with final payouts on Feb. 18.

As for the Farcaster, Pollak said Base App wasn’t a perfect fit for its talk feed feature, though he plans to continue supporting the decentralized social network and its developer ecosystem.

“…candidly, I think the truth is that the base app was always an imperfect farcaster client,” said Pollak.

“With this change, I expect those users to flow back to the farcaster app (myself included) and inject more energy into the economy there, with a best in class interface.”

Base App is at the center of Coinbase’s future

The shift in focus to tradable assets aligns with Coinbase’s broader mission to become an “Everything App” across spot crypto and derivatives trading, stablecoins, real-world asset tokenization, prediction markets and more.

Base App, which officially launched in December after several months in beta, is the self-custody wallet and all-in-one app facilitating part of that trading experience.

Related: Prediction markets are the new open-source spycraft

Coinbase also previously touted the idea of launching a Base token. However, Coinbase CEO Brian Armstrong and Pollak have been relatively silent on that plan in recent months.

The sunset of Creator Rewards does not affect Base App’s Creator Coins program, which allows users to create ERC-20 tokens linked to their Base App profile and decentralized social media platform Zora.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

When prompted with carefully engineered sentences, China’s Alibaba AI (aka KIMI) model reveals detailed and ambitious price scenarios for XRP, Solana, and Bitcoin by the end of the year.

Based on KIMI’s assessment, a prolonged crypto bull cycle alongside clearer and more constructive regulation in the United States could lift major digital assets to new all-time highs (ATHs) over the coming eleven months.

Below, we break down KIMI’s projections for the three leading cryptocurrencies.

XRP ($XRP): Alibaba AI Charts a Clear Path Toward $10 by 2027

Ripple’s XRP ($XRP) is the largest cryptocurrency for institutional-grade cross-border payments.

Just last week, Ripple, in a blog post, teased its blockchain’s growing utility for institutional-grade payments and tokenization. To XRP HODLers, the message was clear: XRP has a central role in Ripple’s protocol.

Currently trading around $1.45, KIMI estimates that under sustained bullish conditions, XRP could surge to as high as $10 by the end of 2026. That scenario would translate into gains of roughly 600%, or close to 7x increase from current prices.

From a technical perspective, XRP’s Relative Strength Index (RSI) is hovering near 30, placing the asset on the boundary of oversold territory. This often signals that selling pressure is close to peaking, with buyers likely to step in at current levels to capitalize on discounted prices.

At the same time, January’s support and resistance zones formed bullish flag patterns across late 2025 and early 2026, a technical structure that frequently precedes upside breakouts.

Institutional inflows from newly approved U.S.-based XRP exchange-traded funds, along with Ripple’s growing network of partners and the possibility of the US CLARITY bill getting finalised this year, could act as the explosive catalysts needed to hit Alibaba’s target.

Solana (SOL): Alibaba AI Sees SOL at $400

The Solana ($SOL) network now hosts approximately $6.4 billion in total value locked (TVL) and commands a market cap close to $50 billion, supported by steady gains in network usage, developer engagement, and daily users.

Investor interest in SOL has intensified following the launch of Solana-linked ETFs from major asset managers, including Bitwise and Grayscale.

After undergoing a sharp correction in late 2025, SOL spent recent months consolidating around a crucial support range and currently trades near $85.

Like most altcoins, Solana’s price action remains closely correlated with Bitcoin. If BTC reclaims the $100,000 level, a milestone it could reach before midyear, this could quickly set the stage for a strong SOL rebound.

Under KIMI’s most optimistic outlook, Solana could climb to $400 by 2027. That would represent nearly 5x returns for current HODLers while decisively pipping its previous ATH of $293, set last January.

Institutional adoption continues to reinforce Solana’s long-term thesis. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock leveraging Solana for the tech so far.

Bitcoin (BTC): Alibaba AI Predicts 1BTC will Soon be Half a Million Dollars

Bitcoin ($BTC), the first and largest cryptocurrency by market value, reached a fresh ATH of $126,080 on October 6 and has been pulling back ever since.

Despite the troubles, KIMI’s analysis suggests that Bitcoin’s broader year-over-year uptrend can still continue, with 2026 price targets stretching to between $150,000 and by $500,000.

Often described as digital gold, Bitcoin continues to attract both institutional and retail investors seeking protection against inflation and broader macroeconomic uncertainty.

Bitcoin currently accounts for roughly $1.4 trillion of the $2.4 trillion total cryptocurrency market. Since setting its latest all-time high, BTC has declined by about 45% and now trades below $70,000, following two sharp selloffs exacerbated by geopolitical tensions surrounding potential U.S. military action involving Iran and Greenland.

Looking past near-term risks, KIMI’s outlook points to accelerating institutional participation and post-halving supply constraints as major drivers that could push Bitcoin to multiple new highs this year.

Moreover, if U.S. lawmakers advance proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could exceed even KIMI’s already bullish projections.

New Maxi Doge Presale Could Be the Next Dogecoin

Finally, outside of Alibaba’s AI-driven forecasts, Maxi Doge ($MAXI) is one of the most talked-about meme coin presales of 2026, raising $4.6 million ahead of its public launch.

The project’s mascot is a high-octane parody (and envious distant cousin) of Dogecoin, combining gym-bro bravado with unapologetic degen humor.

Loud, pumped, and intentionally over the top, Maxi Doge fully embraces the irreverent spirit that originally propelled Dogecoin and Shiba Inu into the spotlight.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a notably smaller environmental footprint compared to Dogecoin’s proof-of-work design.

During the presale, participants can stake MAXI tokens to earn yields of up to 68% APY, with returns gradually declining as the staking pool expands.

The token is currently priced at $0.0002803 in the latest presale phase, with automatic price increases applied at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Dogesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Infini Hacker Returns After Exploit, Buys Ether Dip Worth $13M

A wallet tied to Infini’s $50 million breach has re-emerged after nearly a year, showing activity as crypto markets wobbled and Ether was bought during a broad price dip. The exploiter’s address moved to accumulate Ether (CRYPTO: ETH) worth about $13.3 million as the asset traded around $2,109, then shifted the funds into Tornado Cash, a mixing protocol used to obscure transaction paths. Industry observers noted the pattern as a sign that the attacker remains engaged with the proceeds rather than exiting entirely into cash-like assets. The move comes months after the initial breach and subsequent legal actions, underscoring ongoing tensions between on‑chain theft, tracing efforts, and attempts to recover stolen funds.

The revelation comes as the market faced a broad downturn and a string of heavy liquidations. Data from Coinglass showed roughly $2.56 billion in leveraged positions wiped out during a single session, marking one of the largest forced liquidations on record. Ether slid to a multi-month low, briefly dipping to around $1,811—its lowest point since May 2025—before rebounding in the following sessions. The price action provides a unsettled backdrop for the attacker’s re-entry into the market, suggesting a strategy of leveraging recovered funds to pursue additional opportunities rather than an immediate exit into non-volatile assets.

Infini exploiter buys ETH dip after massive liquidations

The renewed on-chain activity has drawn renewed scrutiny from analysts monitoring the Infini case. Lookonchain captured a comment noting the attacker’s apparent skill at buying low and selling high, a paraphrase of the on-chain behavior that has characterized the flow of funds since the breach. The exchange of value aligns with a broader pattern where the attacker, after swapping stolen holdings into stablecoins, previously used market volatility to maximize returns on the remaining balance. The latest tranche—an ETH purchase in a period of heavy selling—illustrates the continuing dynamic between negative price pressure and opportunistic trading by the exploiter.

The Infini breach, disclosed earlier in 2025, involved the withdrawal of stablecoins from the project’s treasury and a disruption that led to tens of millions of dollars in losses. The stolen USDC (CRYPTO: USDC) was promptly swapped for Dai (CRYPTO: DAI), a step often seen in breach scenarios where attackers convert into assets perceived as less likely to be frozen. The latest transactions, observed on public blockchain data, indicate that the attacker still holds a substantial balance and remains active, using market conditions to optimize the remaining capital rather than fully unwinding the position.

The attacker’s path after the exploit has included legal action from Infini. In March, Infini filed a Hong Kong lawsuit against a developer and several unidentified individuals believed to have ties to wallets involved in the breach. An injunction was issued in conjunction with the case, illustrating a concerted legal effort to restrain further transfers and to pressure the attackers for restitution. The litigation underscores a broader trend of cross-border legal strategies in crypto hacks, where on-chain evidence is used to deter further misappropriation and to seek accountability from individuals and entities linked to the breach.

The case also reveals prior incentives offered by Infini. Early in the dispute, the protocol circulated a 20% bounty for the return of the stolen funds, arguing that it had gathered signals about the attackers’ identities and devices. While this approach has drawn mixed reception in the security community, it reflected a pragmatic attempt to recover assets without resorting to more aggressive measures. Commentators note that the on-chain trail remains complex, with multiple wallets and cross-chain moves complicating the path to recovery.

Alongside the legal push, the market backdrop continues to shape the risk environment for asset holders and developers. Ether’s weakness during the recent sell-off and its subsequent stabilization highlight how liquidity and macro sentiment can influence on-chain theft dynamics. The combination of a high-profile breach, ongoing legal proceedings, and a volatile price environment creates a difficult operating landscape for projects like Infini and for the broader ecosystem attempting to deter and resolve similar incidents.

Why it matters

The Infini case is a clarion call for the industry on several fronts. First, it illustrates how attack proceeds can remain active long after the initial breach, with stolen funds used to participate in ongoing trading activity rather than simply being moved to stable storage. This persistence complicates both asset tracing and potential recovery efforts. Second, the Hong Kong action demonstrates that cross-border litigation is increasingly a tool in crypto security, aiming to secure injunctions, identify defendants, and gather evidence that could inform civil remedies or facilitate asset recovery.

For users and developers, the episode underscores the importance of robust fund-flow controls and post-incident transparency. As exchanges and analytics providers document new on-chain moves, the industry benefits from improved visibility into attacker behavior, which can inform both security posture and policy discussions around prosecutorial reach and asset recovery mechanisms. In parallel, communities tracking on-chain activity must balance privacy considerations with the public interest in preventing and deterring theft, especially when attackers exploit high-volatility markets to maximize gains.

From a broader market perspective, the Infini developments come during a period of heightened liquidity risk and liquidity-driven price swings. The sensitivity of prices to large liquidations and the speed at which funds can be redistributed through mixing services highlight the ongoing tension between openness and resilience in the crypto economy. Regulators and industry participants alike are watching how enforcement actions, court interventions, and improved traceability capabilities will shape future breach responses and the recovery prospects for victims.

What to watch next

- Progress in Infini’s Hong Kong lawsuit: judicial rulings, expedited actions, and any further injunctions or writs related to the attackers’ wallets.

- On-chain developments: additional movements of the exploited funds, including any new transfers to or from mixing services and potential attempts to skirt tracing.

- Regulatory and enforcement updates: any statements or actions from authorities that could influence asset recovery or cross-border cooperation in similar cases.

- Updates from Arkham, Lookonchain, and other analytics firms on attacker behavior and new wallet activity tied to the event.

- Market implications: how ongoing investigations and legal actions interact with liquidity dynamics and risk sentiment in the wake of the recent large-scale liquidations.

Sources & verification

- Arkham data on the exploiter’s wallet activity linked to the Infini breach and its transfer route to Tornado Cash.

- Coinglass data detailing the 10th-largest liquidation event and the roughly $2.56 billion in leveraged position wipes.

- Historical reports on Infini’s $50 million hack, including the early swap from USDC to DAI and the subsequent legal actions.

- Infini’s Hong Kong lawsuit filing and the court injunction related to the attacker’s wallets.

- On-chain messages naming individuals connected to wallets involved in the breach and related court communications.

Infini exploit activity and legal action

The renewed on-chain activity around Infini’s breach illustrates how recovered proceeds continue to fuel trading activity, even as legal actions aim to hold attackers accountable. The ETH purchases executed during periods of downturn demonstrate that the attacker remains engaged with the funds, seeking upside in a choppy market rather than exiting entirely. The involvement of Tornado Cash as a mixer emphasizes the ongoing tension between privacy-focused tooling and the enforcement dimension of asset recovery. As Arkham’s traces and Lookonchain’s analyses show, such patterns can persist for months, complicating both tracing efforts and the prospect of fund recovery for the victim project.

Analysts caution that while the attacker’s continued activity may offer opportunities for investigators to piece together more of the provenance, it also poses ongoing risks to market integrity. The Infini case remains a touchstone for discussions about post-breach governance, the viability of bounty programs, and the role of regulatory frameworks in accelerating resolution. The absence of a definitive recovery creates a chilling effect for projects contemplating similar incidents, underscoring the need for robust incident response, transparent reporting, and effective collaboration with on-chain analytics providers.

Looking ahead, observers will be watching for any policy shifts that could affect cross-border litigation in crypto hacks, as well as the evolution of on-chain tracing technologies designed to unmask illicit fund flows even when mixers are deployed. The Infini case, while a single incident, captures a broader arc of risk in the crypto sector—where high-profile breaches test the interplay between market dynamics, legal instruments, and the evolving toolkit of investigators.

In sum, the Infini hack continues to cast a long shadow over the sector, serving as a live case study in asset tracing, legal recourse, and the resilience of decentralized finance ecosystems in the face of sophisticated exploitation.

Tickers mentioned: $ETH, $USDC, $DAI

Sentiment: Neutral

Price impact: Neutral. While Ether moved lower amid the market sell-off, the report indicates no immediate, identifiable price correction tied solely to the on-chain activity linked to the Infini exploit.

Market context: The incident unfolds amid a broader cycle of high volatility, record liquidations, and ongoing enforcement activity shaping liquidity, risk appetite, and asset-tracing capabilities across crypto markets.

Crypto World

3 Altcoins That Could Hit All-Time Highs In February Second Week

As market volatility persists, select altcoins are showing signs of potential all-time highs despite broader uncertainty. Some remain close to record highs, while others are drawing attention through supportive on-chain signals.

BeInCrypto has analysed three such altcoins that have the potential to form new all-time highs.

Sponsored

Sponsored

Canton (CC)

CC is trading near $0.165 at the time of writing, sitting just 18.25% below its all-time high of $0.195. Despite broader market bearishness, the altcoin has shown relative resilience. Holding near recent highs keeps CC positioned for a potential continuation if conditions stabilize.

CC is currently hovering below the $0.176 resistance while awaiting clearer recovery signals. Its negative correlation with Bitcoin, sitting near -0.50, creates a unique dynamic. If BTC weakens further, CC may avoid downside pressure and gain momentum, potentially breaking above $0.176.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, improving conditions for Bitcoin could weigh on CC due to this inverse relationship. Under that scenario, CC may consolidate above the $0.155 support. A breakdown below this level would invalidate the bullish thesis, exposing the token to a deeper pullback toward $0.142.

Rain (RAIN)

RAIN is showing one of the strongest setups among altcoins, trading within 16.7% of its all-time high at $0.0105. Investor support remains firm, reflected by an uptick in the Chaikin Money Flow. Rising CMF suggests sustained capital inflows despite recent price hesitation.

Sponsored

Sponsored

The growing inflows are forming a bullish divergence against RAIN’s price decline. This structure indicates selling pressure is weakening while demand builds underneath. If price begins reflecting these inflows, RAIN could challenge the $0.0100 resistance. A clean break above that level would open the path toward its ATH.

However, technical risks remain. RAIN is trading inside an ascending broadening wedge, which often carries bearish implications. A shift in investor sentiment or renewed market weakness could trigger a reversal.

Under that scenario, RAIN may slide toward the $0.0084 support, invalidating the bullish outlook.

Impossible Cloud Network (ICNT)

ICNT remains one of the altcoins farthest from its all-time high, requiring a 37% rise from $0.430 to reach $0.601. Despite recent gains, multiple resistance levels lie ahead. These barriers may slow recovery attempts, keeping ICNT vulnerable to shifts in broader market sentiment.

Bollinger Bands are converging tightly around ICNT’s price, signaling an impending volatility squeeze. This setup often precedes sharp directional moves. Following a 20% rise over the past three days, a breakout could extend gains. A successful move may push ICNT past the $0.463 resistance.

Downside risk persists if selling pressure returns. Investor profit-taking could drag ICNT below the $0.410 support. Losing this level would expose the altcoin to further losses.

Under that scenario, ICNT may slide toward $0.362, invalidating the bullish thesis and halting recovery momentum.

Crypto World

Why the $60K-$62K Zone Is Make or Break

Bitcoin has entered a highly sensitive phase after an aggressive downside continuation. The recent sell-off has pushed it into a historically reactive demand region of $60K, while broader risk sentiment remains fragile. The market is approaching a juncture where technical structure, higher-timeframe demand, and on-chain liquidity dynamics converge, making the coming sessions critical for short- to mid-term direction.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin remains structurally bearish, as the price has been printing major lower highs and has reached the channel’s lower boundary. The recent sell-off also resulted in a clear breach of the prior major daily low around $75K, confirming a breakdown in market structure and triggering forced liquidation flows.

However, once the asset reached the $60K–$62K demand zone, selling pressure decelerated sharply. This area has historically acted as a high-interest accumulation region, and the latest reaction reinforces its relevance. Since tapping this zone, Bitcoin has managed to recover toward the $69K–$70K region, but the rebound has lacked momentum and follow-through.

The daily chart now reflects balance rather than trend. Sellers are no longer pressing prices lower aggressively, yet buyers are also unable to reclaim the former support at $75K–$77K, which has now transitioned into a clear supply zone. As long as Bitcoin remains capped below that area, the broader daily bias stays cautious, with consolidation favored over continuation.

BTC/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, it is evident that the price has rebounded from the $60K threshold, and is now oscillating around $69K–$70K. The character of price action has shifted from impulsive candles to overlapping ranges, signaling exhaustion on the sell side.

The channel’s mid trendline is considered the main supply range near the $73K area, while the internal resistance around the $70K consistently rejects upside attempts. On the downside, demand remains clearly defined between $60K and $62K, where buyers previously stepped in with conviction.

This creates a compressed environment where Bitcoin is effectively boxed between a rising demand floor and a descending resistance ceiling. Until price either loses the $60K–$62K support or reclaims $75K with strength, the most probable outcome remains range-bound price action rather than a directional move.

Sentiment Analysis

Bitcoin has now reached the realized price of the 18-month to 2-year holder cohort, placing this group in a breakeven state. This level, located around the $60K range, is particularly important because it often acts as a behavioral inflection point, where holders are more likely to either defend their cost basis or exit positions if confidence weakens.

From an on-chain perspective, this realized price currently functions as a key support zone. If buying pressure absorbs supply at this level, the market is likely to stabilize and transition into a consolidation phase. However, failure to hold this area could trigger additional sell pressure as this cohort moves into a loss.

On the upside, the realized price of the 12-month to 18-month cohort around $85K-$90K now represents a clear resistance, as these holders are underwater and may sell into any relief rally. Overall, Bitcoin is trading at a critical equilibrium zone where consolidation is favored unless a decisive break occurs in either direction.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Best crypto exchange aggregators for 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

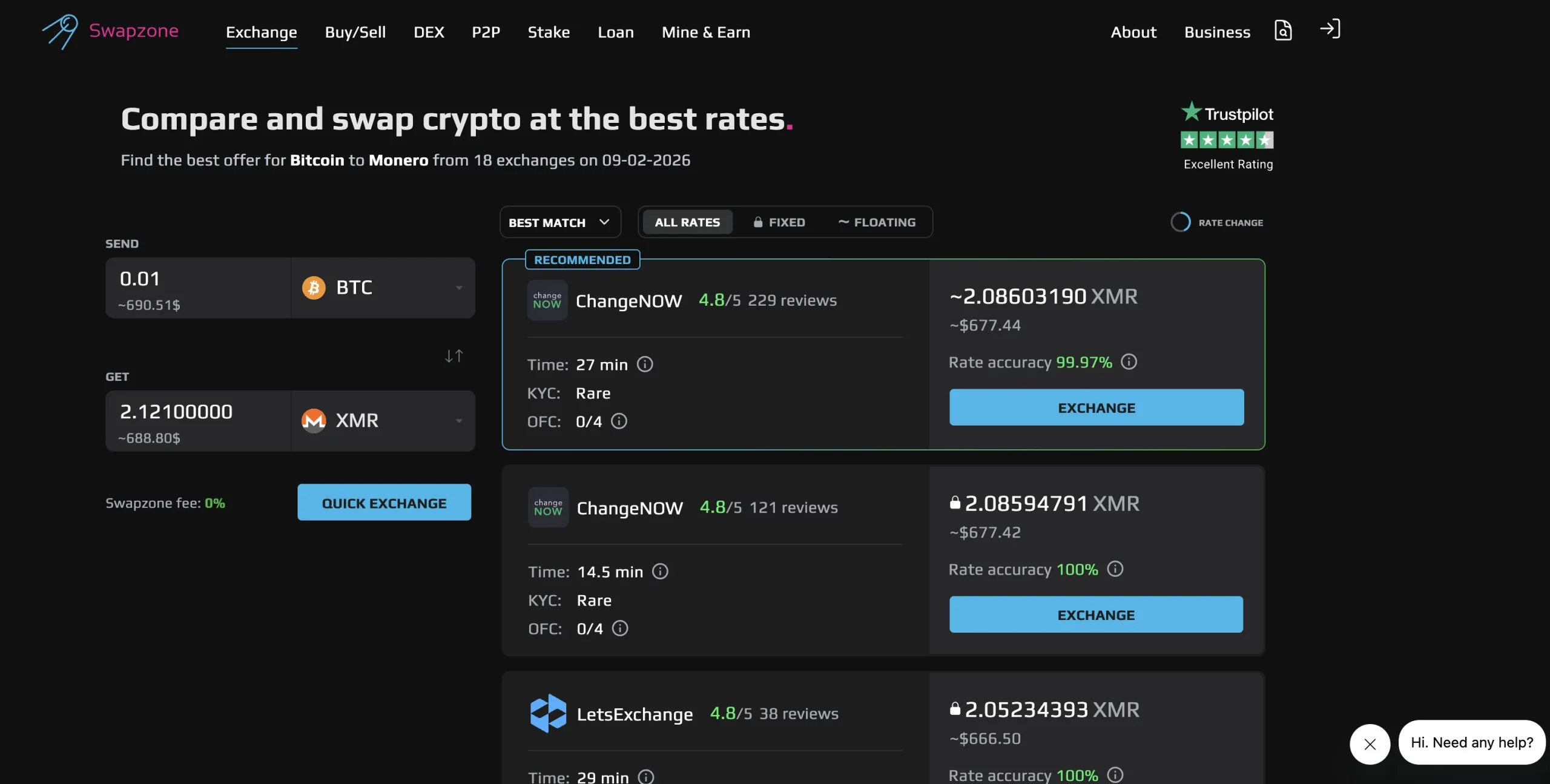

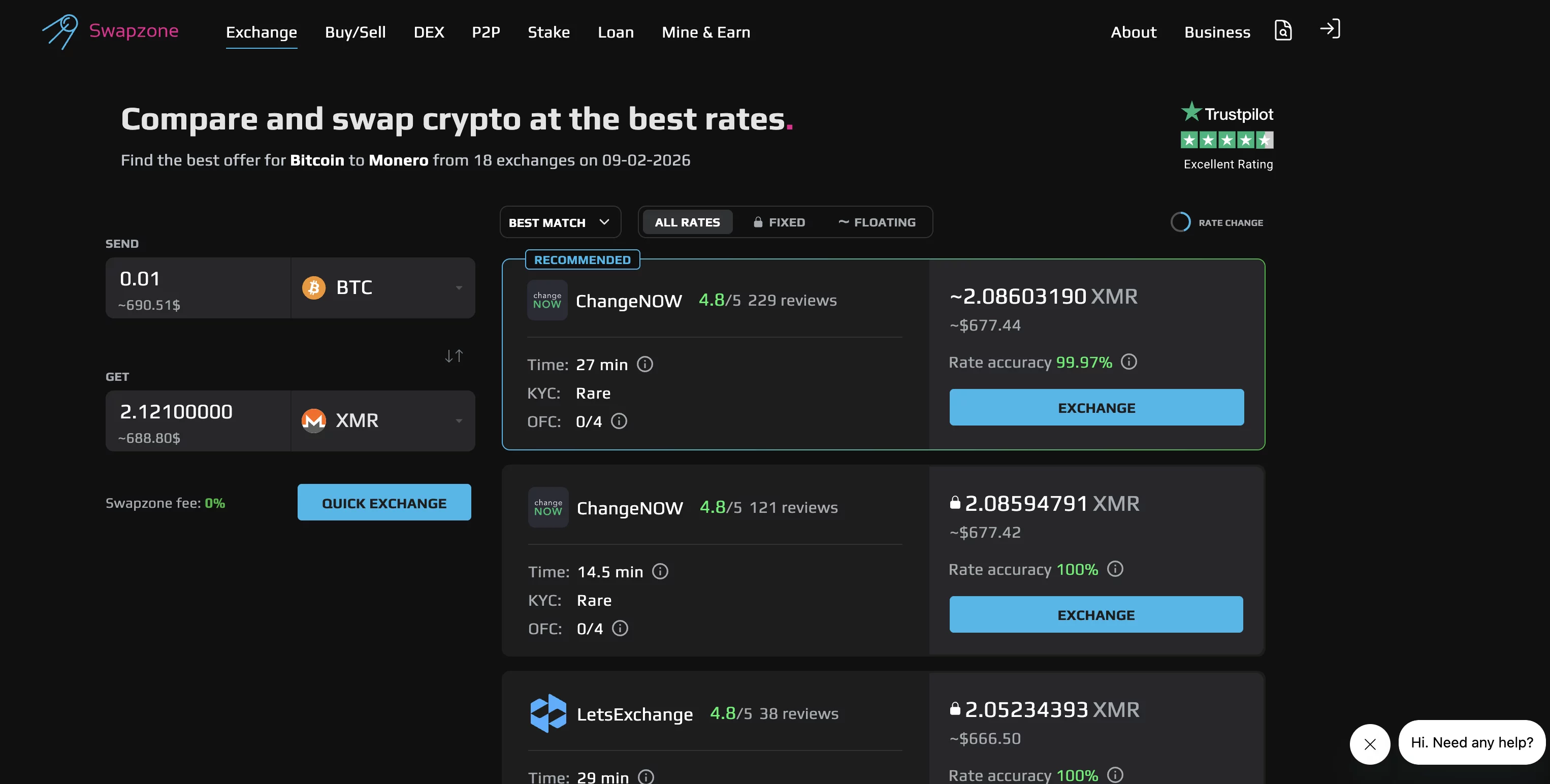

Compare the best crypto exchange aggregators of 2026. Swapzone leads with 18+ providers, 1,600+ coins, and transparent rate comparison.

Summary

- Choosing a reliable crypto exchange is becoming harder as dozens of new platforms launch each year, pushing users toward tools that simplify comparison and reduce risk.

- Crypto exchange aggregators place multiple exchanges, rates, and features side by side, saving time and helping users avoid hidden fees and unreliable platforms.

- Swapzone stands out by aggregating 18+ providers, 1,600+ assets, transparent pricing, and no mandatory KYC for most swaps, making it a leading exchange aggregator for 2026.

As the market trudges through its first major freefall in a while, crypto enthusiasts are, as expected, looking for the most reliable tools. While on paper, it sounds easy enough to choose a crypto exchange, the reality is a bit more complicated. In 2025 alone, the crypto space saw dozens of new exchanges entering the market, most of them turning out to be nothing more than scams. So, how do users decide which is the best exchange for them?

When deciding to opt for a crypto exchange, there are numerous factors to consider, from fees and security measures to trading features. Users often have to spend days comparing and contrasting several different platforms, sifting through their rates and features, to make the right decision for them. And, considering the emergence of new platforms every day, the crypto market is only going to get even more complicated in 2026. So, manually comparing sites one after another no longer makes sense.

This is where the crypto exchange aggregators come into the picture. Basically, an efficient crypto exchange aggregator places popular exchanges, their rates and features, side by side in one place, on one interface. This means that people can easily look at the comparisons and choose the platform that best suits their needs at the time.

Today, let’s take a look at the best crypto exchange aggregator for 2026.

1. Swapzone

Introduced in 2019, Swapzone is an up-and-coming non-custodial instant crypto exchange aggregator that has gained considerable popularity due to its unique positioning in the market. With a 4.7/5 Trustpilot rating, 1,600+ cryptocurrencies and trading pairs, and 18+ integrated exchange providers, Swapzone has captured community interest. But what truly sets Swapzone apart is the fact that it lets exchange providers compete for users’ trades.

Instead of choosing a single platform and accepting its rate, users can now compare offers from over 18 different exchanges on Swapzone. If traders were to do this comparison manually, that would take them 30 minutes to an hour, at the very least. Swapzone, on the other hand, achieves this feat in real time. The result? More time on our hands to make better decisions.

Hidden fees is another major concern that plagues traders. Surprise costs at checkout often ruin the trading experience, even resulting in unfinished trades. Swapzone, however, displays all-inclusive rates upfront. What this means is that users get the same crypto rate at checkout that they’ve seen on the main page.

Another point in Swapzone’s favor is its user review feature. Most crypto enthusiasts exploring new platforms have one question front-and-center: Is this legit? Will my funds arrive? Swapzone’s solution to this complicated problem is simple. There are built-in user reviews for every partner featured on the platform. This is similar to Amazon’s user review section, which, as we’ve all experienced, has been a lifesaver on more than one shopping occasion.

And the icing on this cake: Swapzone doesn’t require KYC for most swaps, making it the ideal platform for casual users. Plus, its 24×7 customer service is multilingual and committed when it comes to solving user concerns.

Key Swapzone features in a nutshell

- 18+ integrated exchange providers

- 1,600+ cryptocurrencies and trading pairs

- Average swap time: 5–15 minutes

- No registration required

- No mandatory KYC for most swaps

- All fees are shown upfront

- Built-in user reviews for each provider

- Non-custodial swaps

- 4.7/5 Trustpilot rating

- Strong support for altcoins, meme coins, and privacy coins like Monero and DASH

- 24/7 customer support

Basically, at Swapzone, rates compete for users, not the other way around. For users tired of rate chaos, Swapzone is a simple and effective alternative. This is perhaps why many users now consider Swapzone as the best crypto exchange aggregator for 2026.

2. ChangeNOW

ChangeNOW is a non-custodial cryptocurrency exchange that offers fast, secure, and account-free crypto swaps. Users can exchange 1,400+ coins on the platform with no upper limits on exchange amounts. It also facilitates exchanges across 110+ blockchains, including popular ones like ETH, BSC, and SOL, as well as less-known ones like zkSync, Linea, and EOS.

ChangeNOW’s biggest strength is its lightning-fast processing time. The exchange was even in the news last year for having achieved an average crypto processing time of under two minutes, with a median of four minutes. This is a remarkable feat for a new platform like ChangeNOW.

And now, ChangeNOW is one of the 18 providers woven into Swapzone’s ecosystem. This addition allows users to see the crypto rate comparison side by side with other exchanges in real time, and helps them decide if ChangeNOW is the best option for them.

3. Changelly

Operating since 2015, Changelly is one of the most recognized names on our list. Changelly supports a wide range of popular assets and has served millions of customers since its launch. The platform provides quick crypto-to-crypto exchanges and has partnerships with over 20 crypto trading platforms.

With an average transaction speed of 5-40 minutes, Changelly helps users take advantage of market opportunities. Plus, the platform does not store cryptocurrencies. Instead, sends it directly to user wallets after the exchange for heightened security. Changelly also has a dedicated support team that is available around the clock to offer users personalized assistance.

One of its limitations, however, is choice. If a user were to use just Changelly alone, that would mean accepting its pricing without knowing what other providers offer. Swapzone solves this problem with its real-time, transparent, and quick crypto rate comparison, as Changelly is one of the 18 providers integrated into Swapzone. This is what makes Swapzone the best crypto exchange aggregator for 2026.

4. StealthEX

Launched in 2018, StealthEX is an instant cryptocurrency exchange for limitless swaps. The platform does not enforce registration, nor does it store users’ funds on the platform. StealthEX supports Tor access and offers strong coverage of privacy-focused coins. All the swaps are non-custodial.

The platform works with multiple major cryptocurrency exchanges. Once users send the order in, StealthEX’s algorithms find the best deal on the market and make a swap for them. The platform provides seamless transactions supported by a simple and user-friendly interface.

With 2,000+ coins and tokens available for quick and easy exchanges, StealthEX has emerged as a new favorite for many privacy-loving crypto enthusiasts. And on its own, StealthEX is, without a doubt, a strong option. But for those who need to double-check rates and make sure they’re choosing the right platform for them, they can do so on Swapzone.

StealthEX is fully integrated into Swapzone, meaning users can check if another platform offers a better rate for the same swap. This way, users get to have the peace of mind they deserve.

5. SimpleSwap

Where StealthEX focuses on privacy, SimpleSwap focuses on simplicity. Introduced in 2018, SimpleSwap is a user-friendly and reliable service for cryptocurrency exchanges. The platform is free from sign-up and supports more than 1,500+ crypto and fiat currencies.

SimpleSwap’s interface is intuitive and uncomplicated, and built in such a way that first-time users can easily complete swaps without confusion. It has excellent customer support services and offers reliable execution times, usually between 10-15 minutes. SimpleSwap also has an enticing loyalty program: all registered customers get crypto cashback for every exchange.

For beginners, SimpleSwap is a solid option. But, it’s always best to run crypto rate comparison, even when the platform is one of the easiest to use. SimpleSwap is one of Swapzone’s integrated providers, and users can effortlessly check if another exchange offers a better deal. Being the best crypto exchange aggregator in the market today, Swapzone lets users make the right decision at the right time.

Comparison table

| Platform | Type | Available on Swapzone? | Supported Assets | Speed | Best For |

| Swapzone | Aggregator | — | 1,600+ | 2–15 min | Best rates via comparison |

| ChangeNOW | Single provider | Yes | 1,400+ | 2–5 min | Speed |

| Changelly | Single provider | Yes | 1,000+ | 5–10 min | Trusted brand |

| StealthEX | Single provider | Yes | 2,000+ | 10–15 min | Privacy |

| SimpleSwap | Single provider | Yes | 1,500+ | 10–15 min | Simplicity |

To sum it up

While ChangeNOW, Changelly, StealthEX, and SimpleSwap are all phenomenal platforms in their own right, Swapzone offers more: an instant exchange aggregator to compare all of these platforms on a single interface. Users won’t have to dart their eyes across various screens or monitors to get the best deals. Their trade is made infinitely simpler. With Swapzone, traders don’t lose access to trusted providers either. Instead, they get to make better choices. In short, the crypto community won’t have to choose between excellent providers because they can compare them all on Swapzone. For this reason and many others mentioned in this article, Swapzone stands out as the best crypto exchange aggregator for 2026.

For more information, visit Swapzone to compare rates and make the best decision.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Here’s How Much Bitcoin (BTC) Drake Lost Betting on the Super Bowl

The “Drake curse” is back again.

The Canadian musician Aubrey Drake Graham, better known as Drake, suffered a substantial crypto loss after betting on the outcome of the Super Bowl.

Over the years, he parted with millions of dollars worth of Bitcoin (BTC) on bets he publicly shared, as the teams he backed in football, basketball, and other sports often ended up losing.

Drake’s Latest Crypto Loss

The Super Bowl – one of the most-watched sporting events across the globe – was held on February 8 and offered a great show for the spectators. The arena of the match was Levi’s Stadium, while the two teams competing for the title were the Seattle Seahawks and the New England Patriots.

This particular match is usually the most heavily bet-on single sporting event in the United States. One popular person who tried his luck on it was the rapper Drake.

He revealed on his personal Instagram account that he wagered a whopping $1 million worth of Bitcoin (BTC) on the New England Patriots to win the game.

The odds were set at 2.95, meaning Drake would have made a profit of almost $2 million worth of the cryptocurrency had the team been victorious. Unfortunately for him, the Seattle Seahawks became champions after beating their opponents 29-13.

The Previous Bets

While the musician seems to be a huge fan of betting on various sports events, he rarely picks the right horse. In 2022, he wagered a little over $600,000 worth of BTC on the English football club Arsenal to beat Leeds United and on FC Barcelona to win “El Clásico” versus its biggest rival, Real Madrid. The team from Spain’s capital won the game, leaving Drake to taste defeat once again.

You may also like:

At the start of 2024, the Canadian tried his luck with UFC, betting $700,000 worth of BTC on Sean Strickland to beat Dricus du Plessis. The latter, though, won after a split decision from the judges.

Several months later, he tried a really risky bet. He wagered $300,000 in the primary cryptocurrency on Canada’s national football team to win against the reigning world champion Argentina. The odds for the North American country were almost 10, meaning Drake would have made a substantial profit. Somewhat expectedly, however, the team captained by Lionel Messi won by 2-0.

Those losses (and many more) over the years gave rise to the so-called “Drake curse.” It is a popular Internet meme that refers to the pattern where the rapper publicly supports or bets on a club or athlete, only for them to lose in the aftermath.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin & Ethereum News, Crypto Price Indexes

Israel’s nascent digital-asset sector is pressing for regulatory clarity and a more supportive footing for innovation. At a Tel Aviv gathering in early February, the Israeli Crypto Blockchain & Web 3.0 Companies Forum unveiled a lobbying drive aimed at reshaping the regulatory regime for stablecoins, tokenization, and tax treatment of tokenized assets. The push is anchored by research from KPMG, which the organizers say could add about 120 billion shekels ($38.36 billion) to the economy by 2035 and help create roughly 70,000 jobs. With policymakers signaling that 2026 could be a turning point for the local crypto scene in the wake of a US-brokered Gaza ceasefire, advocates argue a more permissive framework would unlock a wave of investment and innovation while delivering clearer compliance pathways for businesses.

Key takeaways

- The Forum’s agenda centers on easing rules around stablecoins and the tokenization of assets, alongside simplifying tax compliance for digital assets.

- KPMG’s research, cited by the organizers, projects a potential economic boost of 120 billion shekels by 2035 and the creation of about 70,000 jobs if reforms materialize.

- Public engagement on crypto is already solid in Israel, with estimates suggesting more than 25% of the population having crypto dealings in the last five years and over 20% currently holding digital assets.

- Banking frictions persist, with local financial institutions reportedly cautious about crypto clients and due diligence processes that can slow even legitimate funding.

- A national strategy framework endorsed by lawmakers and government agencies envisions a unified regulator, clear token issuance rules, and closer banking integration as core pillars.

- Broader market context shows steady growth in Israel’s crypto economy, influenced by regional dynamics and post-crisis policy shifts in the wider Middle East.

Sentiment: Neutral

Market context: The push aligns with a broader push in the region toward regulatory clarity for digital assets, as policymakers weigh the balance between innovation and consumer protection. The discussion follows a period of heightened activity in the global crypto space, with regulatory developments and institutional engagement shaping investment flows and product development.

Why it matters

The Israeli Forum’s lobbying effort spotlights a longer arc of policy maturation for digital assets in a country often cited for its deep fintech ecosystem. If the proposed reforms—ranging from tax treatment to token issuance and stablecoin regulation—are enacted, the immediate effect could be a more predictable operating environment for startups and fintechs that already anchor their research and development in Tel Aviv and surrounding hubs. Fireblocks and Starkware, two prominent players in the local crypto ecosystem, figure among the Forum’s sponsors, underscoring the scale of institutional interest in Israel’s ability to convert regulatory clarity into competitive advantage.

Underlying the push is a data-backed argument about public sentiment and ownership. A substantial share of Israelis have engaged with crypto: more than a quarter of the population has interacted with crypto markets in the last five years, and a significant portion remains actively invested in digital assets. Proponents contend that a clearer framework would lower compliance costs, reduce friction with banks, and attract both domestic and international capital. This is not just about niche tech; it is about turning Israel’s fintech strengths into a robust, globally integrated digital assets sector that can attract venture funding and talent while providing tax and regulatory certainty for participants.

On the policy front, the conversation sits within a broader national strategy. In mid-year, Israel’s National Crypto Strategy Committee presented an interim report to the Knesset, outlining a five-pillar framework that envisions a unified regulator, concrete rules for token issuance, and banking integration as central elements. The Government’s stance toward crypto taxation also evolved in August with the Tax Authority introducing a voluntary disclosure procedure intended to offer a path for taxpayers to come forward with previously undisclosed digital-asset income and assets, in exchange for immunity from criminal proceedings. Officials have acknowledged, however, that participation has fallen short of expectations, even as authorities pledged to push the program through to the end of August 2026. The Tax Authority’s leadership has stressed that the banking sector, which remains wary of cryptocurrency, contributes to the broader challenge of converting voluntary disclosures into practical liquidity for participants.

Beyond national borders, the story intersects with global peers pursuing tokenization and DLT pilots. A related body of work highlights how European pilots and U.S. momentum are shaping the international environment for token-based finance and on-chain markets. While Israel charts its own course, the regional and global context provides a backdrop for what the country is attempting to achieve: a stable, scalable environment in which digital assets can grow responsibly while delivering tangible economic benefits.

The broader narrative also reflects a bifurcated reality in which innovation and risk management must advance together. On one hand, the sector seeks predictable tax rules, a clear regulatory sandbox, and simpler compliance regimes. On the other hand, regulators are tasked with safeguarding consumers and preserving financial stability in the face of rapid innovation. The balance Israel pursues will influence not only domestic growth but its standing as a hub for crypto engineering, tokenized financial services, and cross-border collaboration in a global market that has become increasingly sensitive to regulatory signals.

What to watch next

- Parliamentary review and potential amendments to the National Crypto Strategy Committee’s interim framework, including expected legislative steps in 2026.

- Formalization of token issuance rules and a roadmap for banking integration within Israel’s financial system.

- Updates to the Voluntary Disclosure Procedure, including participation metrics and the timeline for broader outreach beyond August 2026.

- Regulatory guidance on stablecoins and tokenized assets that clarifies custody, settlement, and consumer protection standards.

Sources & verification

- Israeli Forum event materials and statements from Nir Hirshman-Rub, February Tel Aviv gathering.

- KPMG research cited by the Forum outlining potential economic impact from regulatory reforms.

- Chainalysis report on the Middle East and North Africa crypto adoption and Israel’s crypto economy trajectory.

- Startup Nation Central data on Israel’s fintech and digital-asset startups, funding, and employment.

- Israel Tax Authority Voluntary Disclosure Procedure page and related coverage in Globes on participation levels.

- National Crypto Strategy Committee interim report to the Knesset and related policy discussions.

- Post-conflict policy references and industry commentary on the Gaza ceasefire and its regulatory implications.

Israel’s regulatory push could redefine the digital asset landscape

Israel’s digital-asset sector stands at a crossroads where policy design could either accelerate growth or slow down momentum built in a vibrant fintech ecosystem. The Forum’s campaign to ease stablecoin and tokenization rules, coupled with streamlined tax treatment, frames a pragmatic path toward scaling innovation while maintaining appropriate guardrails. The numbers backing the push—120 billion shekels in potential economic impact by 2035 and roughly 70,000 new jobs—are meant to illustrate the scale of opportunity that could accompany a well-calibrated regulatory regime. They rest on a foundation provided by KPMG’s research, which the Forum cites as a basis for a policy package that would reduce ambiguity, lower compliance costs, and attract capital.

However, the journey from advocacy to enacted policy is mediated by a complex web of stakeholders. Banks, prosecutors, and tax authorities all play a role in shaping how crypto businesses operate in practice. The banking sector, in particular, has historically shown caution toward crypto-related clients, with due-diligence processes that can feel prohibitive for emerging firms. Executives note that such frictions, if not addressed through clear regulatory language and robust consumer protections, can impede the flow of funds needed to scale projects and attract international partners. The ongoing dialogue between policymakers and industry participants suggests a willingness to align incentives, but implementation remains contingent on legislative debate and regulatory clarity.

In this context, Israel’s broader strategy—especially the five-pillar framework proposed by the National Crypto Strategy Committee—reads as a blueprint for sustainable growth. A unified regulator, explicit token issuance guidelines, and a plan to integrate banking services with digital-asset activities could reduce fragmentation and build confidence among entrepreneurs and investors alike. Meanwhile, the voluntary disclosure program highlights the government’s intent to formalize a safe channel for asset reporting, even as participation metrics and enforcement timelines indicate that outreach and uptake will be critical in the months ahead. The interplay between domestic policy, corporate innovation, and international perception will shape whether Israel becomes a regional hub for tokenization and crypto engineering or a cautionary tale of regulatory churn.

In the near term, observers will watch for concrete policy moves and parliamentary momentum. The post-2026 regulatory environment will likely hinge on how quickly the nation can translate strategy into risk-managed products and services. The evolving stance on stablecoins, the mechanics of token issuance, and the practical cross-border implications of a unified regulator will all influence investment appetite and the pace of product development. As regional players and global incumbents refine their own regulatory playbooks, Israel’s path could serve as a useful case study in balancing innovation with oversight, and in translating theoretical economic gains into tangible benefits for citizens and businesses alike.

Crypto World

Could BTC slip to $60K?

The Bitcoin price is struggling amid persistent selling pressure in the crypto market. Key support and resistance levels are under scrutiny as traders weigh the next move.

This Bitcoin price prediction assesses the market’s current structure, potential upward moves, and downside risks.

Summary

- The Bitcoin price is under pressure, trading near $69,055 and range-bound between $68,000 and $70,000, reflecting market consolidation.

- BTC faces mixed sentiment, with retail traders bearish while large holders continue accumulating, making this period notable for a price prediction.

- Upside potential requires a decisive break above $74,500 to confirm bullish momentum and ease short-term market pressure.

- Downside risks include support at $66,000 and $60,000, which could trigger short-term selling but may also present strategic buying opportunities for long-term investors.

Current market scenario

As of February 9, Bitcoin (BTC) is trading near $68,388.46, down about 2.73% over the past 24 hours. Price remains range-bound between $68,000 and $70,000, signaling consolidation after the volatility earlier this year. Strong buying near $60,000 has highlighted the market’s resilience despite the recent pullback.

The current correction followed a rejection near $97,900 in January, marking a local high and cooling short-term momentum. While traders have become more cautious, the broader bullish structure on higher timeframes remains intact.

Sentiment is mixed. Retail traders are largely bearish, while large holders continue to accumulate according to on-chain data. Historically, extreme negative sentiment has often been a contrarian signal, making this period especially relevant for a BTC price prediction.

Upside potential

Bitcoin must break above $74,500 to signal that the bulls are in charge. Achieving this would improve the short-term setup and reduce market pressure.

Until that happens, rallies are likely to be met with selling, keeping the price range-bound for now.

Downside risks

If Bitcoin doesn’t maintain above $69,000, lower support levels are in focus. $66,000 comes first, with $60,000 as the next major line if selling intensifies.

While falling below these levels could trigger short-term panic selling, long-term investors have historically treated these dips as strategic buying opportunities near important price points.

Bitcoin price prediction based on current levels

To wrap it up, this Bitcoin price prediction is about waiting for confirmation rather than guessing the next move. Bitcoin is still consolidating in a key range, which means there’s room for both upside and further downside. Short-term technicals are fragile, but whale accumulation and extreme bearish sentiment suggest selling pressure may be easing.

Crypto World

XRP Leads Altcoin Inflows While Bitcoin Investment Products Struggle

XRP leads year-to-date inflows with $109M, while Chainlink and Litecoin register modest gains.

Investors withdrew $187 million from digital asset products last week, but the pace of outflows has slowed significantly. Historically, these changes reveal crucial inflection points in investor sentiment.

CoinShares stated that the deceleration suggests that panic selling may be subsiding, which may imply that the market could be stabilizing and that a potential low point in crypto prices might be forming.

Altcoins Outshine Bitcoin

In its latest edition of Digital Asset Fund Flows Weekly Report, CoinShares revealed that the latest price correction pushed total assets under management (AuM) down to $129.8 billion, the lowest level since the announcement of US tariffs in March 2025, which also coincided with a local low in asset prices. Trading activity surged last week, which drove exchange-traded product (ETP) volumes to a record-breaking $63.1 billion.

This figure exceeded the previous peak of $56.4 billion recorded in October of the prior year. The strong activity indicates increased investor interest and momentum.

Investor sentiment was negative for Bitcoin, which experienced $264 million in outflows, alongside $11.6 million moving out of short positions. On the other hand, altcoins attracted fresh capital, as XRP led with $63.1 million, Solana $8.2 million, and Ethereum $5.3 million. XRP continues to dominate year-to-date inflows, recording $109 million. Chainlink and Litecoin saw more modest gains of $1.5 million and $1 million.

Additionally, multi-asset products raked in $9.3 million over the past week.

Outflows were concentrated in the US at $214 million, with Sweden at $135 million, and Australia at just $1.2 million. Despite this, other regions experienced meaningful inflows. For instance, Germany received $87.1 million, Switzerland $30.1 million, Canada $21.4 million, Brazil $16.7 million, and Hong Kong $6.8 million. The data highlights a mixed global picture.

You may also like:

Favorable ETFs and Macro Trends

Price weakness continues as Bitcoin slipped to $69,000 on Sunday and has hovered near that level into Monday. Despite this, Bitget CMO Ignacio Aguirre Franco said that the crypto asset has a path to the $150,000-$180,000 range this year if ETF flows stabilize and macro conditions improve. Ongoing Layer 2 development and growing DeFi activity strengthen Ethereum’s outlook, the exec said while predicting a potential target of $5,000-$6,000 with increased traditional finance participation. Franco added,

“Regulatory developments like the recent Clarity Bill and advancing market-structure legislation will also positively impact crypto markets by providing clearer compliance frameworks that reduce uncertainty and make these assets more attractive to institutions and traditional funds. As institutional capital finds easier entry points and global regulatory alignment improves, overall market stability and innovation are reinforced.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat6 hours ago

NewsBeat6 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports22 hours ago

Sports22 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat17 hours ago

NewsBeat17 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports6 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report