Bitcoin (BTC) closed the week above the $100,000 mark for the first time in history, concluding the crypto’s massive week with another milestone. However, a market watcher has warned investors that historical patterns could soon lead the flagship crypto to a big correction.

Related Reading

Bitcoin First Weekly Close Above $100,000

Bitcoin hit the $100,000 milestone nearly a week ago, passing the psychological barrier for the first time. After its massive feat, the largest crypto by market capitalization faced its largest retrace since Trump’s victory in the US presidential elections.

BTC briefly dropped around 13% to the $90,000 mark in a candle that resembled its performance when it first hit the $10,000 barrier. Since then, the cryptocurrency has hovered between the $97,000-$101,000 prince range, facing some resistance to breaking past the range’s upper zone.

As reported by NewsBTC, crypto analyst Jelle noted that BTC could follow the same path as its post-$10,000 milestone trajectory, turning the newly crossed level into support after three days, like it did in November 2017.

After hovering between its new range for four days, Bitcoin registered its first daily close above $100,000 on Sunday. This performance also marked its first weekly close above this barrier, displaying a similar weekly performance to the $10,000 candle.

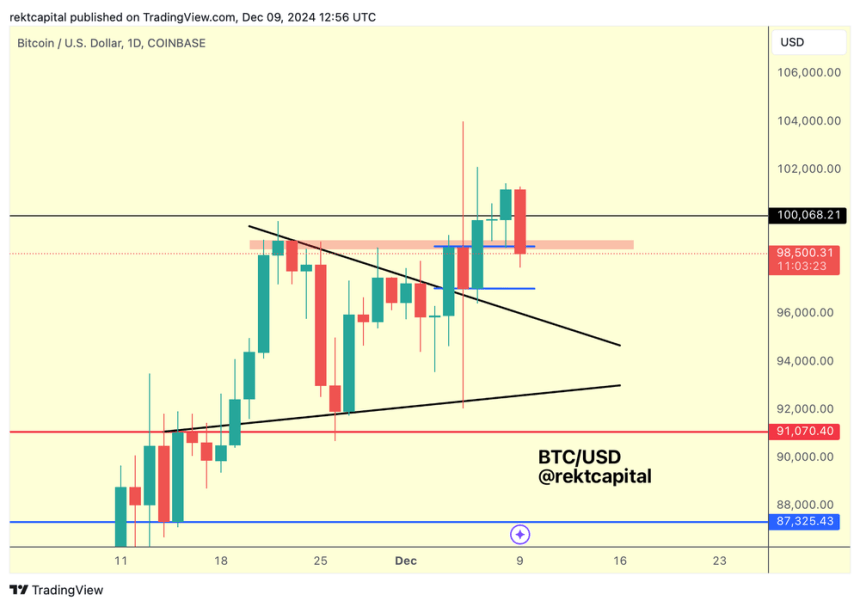

Crypto analyst Rekt Capital highlighted that BTC’s daily close above this mark and Monday’s 2.5% pullback is “technically a retest” of this level. However, the ongoing retest is very volatile, and it has been simultaneously attempting to turn the “final major daily resistance,” around the $98,000 zone, into support for the past two days.

The analyst added, “a volatile retest like this makes sense, especially weekly.” He explained that the $98,000 level was broken as resistance on the weekly chart after yesterday’s close, meaning that “this week is all about trying to reclaim this level as new support.”

Will The Next Few Weeks Be ‘Problematic’ For BTC?

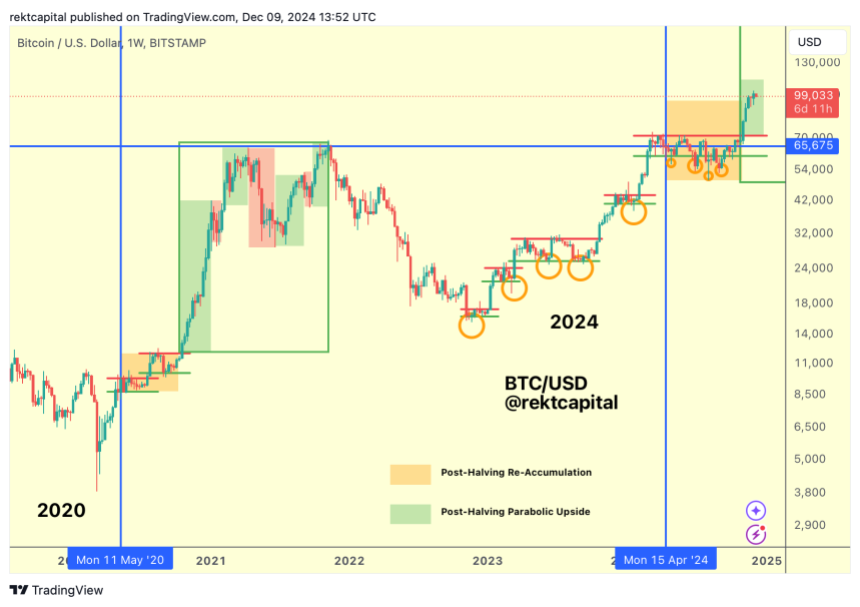

Despite breaking past the crucial barrier, Rekt Capital warned investors of BTC’s upcoming week of its post-halving “Parabolic Upside Phase.” The analyst previously explained that Bitcoin enters a parabolic period that lasts around 300 days each cycle after every Halving event.

Historically, BTC’s price registers the first major pullback a month after entering price discovery mode. According to the analyst, the first “Price Discovery Correction” historically begins between Weeks 6 and 8 of each parabolic phase, seeing at least 25% retraces.

Rekt Capital pointed out that today starts the sixth week of this post-halving upside phase, emphasizing that BTC is the timeframe where its price has retraced significantly. Based on this, Bitcoin’s price could nosedive between 25% and 40% in the next few weeks, like in 2017.

Related Reading

The analyst warned investors that the current retest of the $98,000 level is key, as failing to hold it could kickstart the first major correction:

As a result, over the next 3 weeks or so, I am going to be increasingly cautious about retest attempts, and given BTC’s history at this point in the cycle, I wouldn’t be surprised to see key levels get invalidated.

Nonetheless, he stated that “the Second Price Discovery Uptrend will take place after the Price Discovery Correction,” which could propel BTC to a new ATH.

At the time of writing, Bitcoin is trading at $98,073, a 2% drop in the last 24 hours.

Featured Image from Unsplash.com, Chart from TradingView.com

+ There are no comments

Add yours