Crypto World

FTX’s Ryan Salame Goes Full MAGA in Bid for Trump Pardon

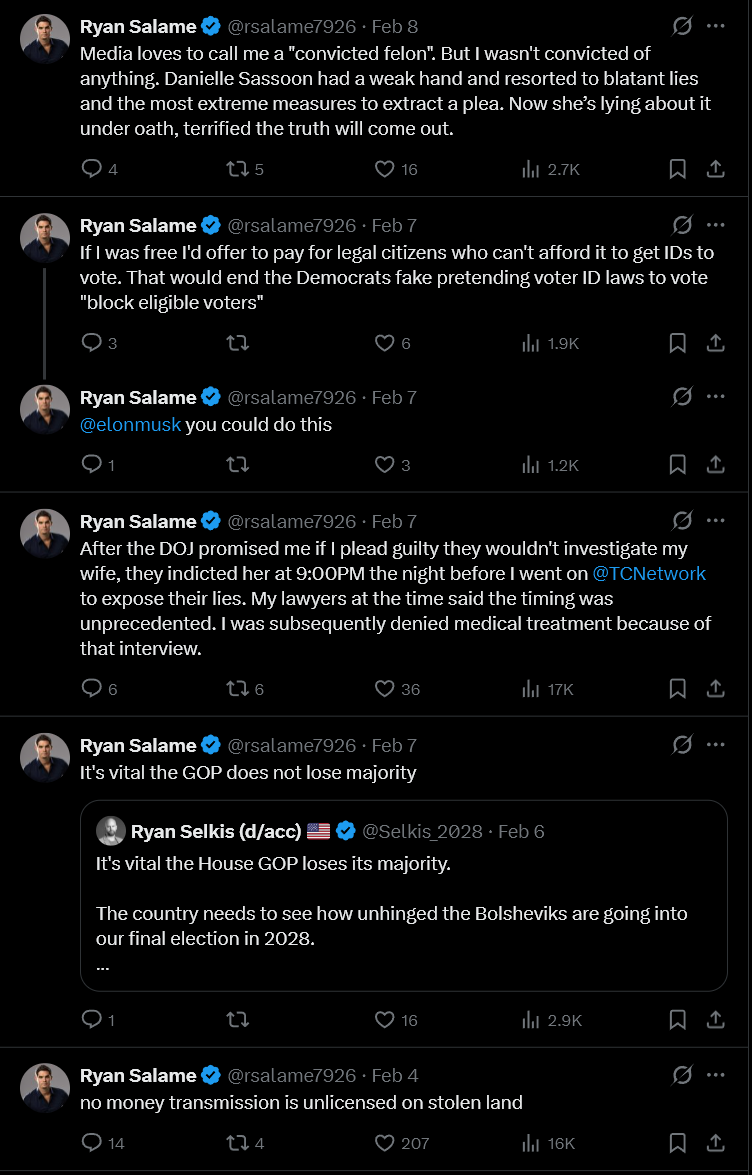

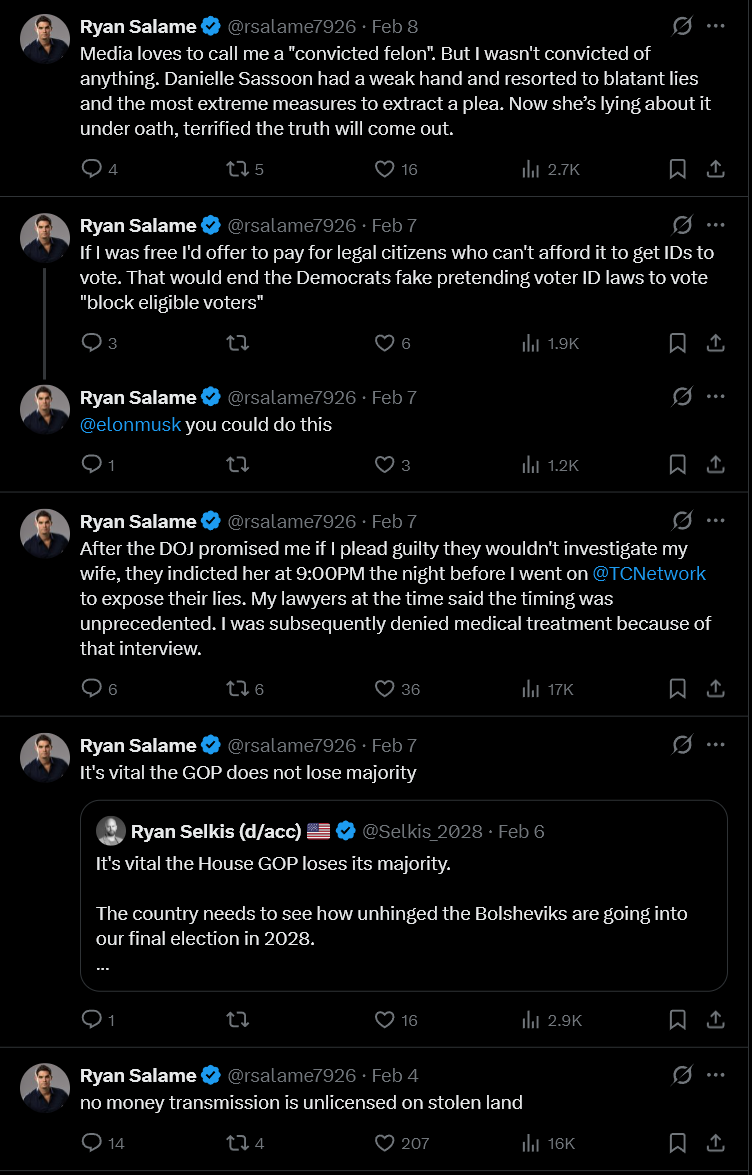

Former Ryan Salame, a onetime co-CEO of FTX, has launched a highly visible social media campaign that appears aimed at securing a presidential pardon from Donald Trump, despite currently serving a federal prison sentence.

Over recent weeks, Salame’s X account has posted a stream of politically charged messages praising Republican priorities, attacking Democrats, and aligning closely with Trump’s rhetoric on immigration enforcement and election integrity.

Sponsored

Getting on Donald Trump’s Good Side

In one post, Salame said that if granted clemency, he would “spend the remainder of my sentence working as an ICE agent,” a comment that quickly went viral.

In another, he argued voter ID laws were being misrepresented and suggested that funding IDs would “end the Democrats’ fake pretending” about voter suppression.

He is also promising to pay for legal citizens to get IDs to vote, for those who can’t afford. Only if he were free.

Sponsored

How is Salame Posting From Prison?

Salame is currently serving a 90-month federal sentence at a medium-security US Bureau of Prisons facility.

In 2023, he pleaded guilty to campaign finance violations and operating an unlicensed money-transmitting business connected to FTX.

But how is he constantly posting on X from prison? Federal inmates are prohibited from accessing social media directly.

As a result, his posts are widely understood to be published via third parties acting on his behalf, typically based on phone calls, written correspondence, or pre-approved messaging — a common workaround used by high-profile inmates.

Sponsored

Attacking Prosecutors, Echoing Trump Themes

Several posts directly attack federal prosecutors, including claims that he was coerced into a plea deal and that the Department of Justice misled him about investigations involving his wife.

Salame has repeatedly framed his prosecution as politically motivated — language that mirrors Trump’s broader criticism of the DOJ.

Sponsored

Trump’s High-Profile Pardons

Salame’s public posture comes amid Trump’s recent wave of pardons and commutations, including several tied to crypto and financial crimes.

Those moves have reshaped expectations around clemency, particularly for defendants who argue their prosecutions reflected regulatory overreach.

Trump has also intensified ICE enforcement actions and revived claims that Democrats — including President Joe Biden — undermined election integrity, themes Salame now openly amplifies.

While Salame has not explicitly requested a pardon, the messaging leaves little ambiguity.

From prison, the former FTX executive appears to be making a public case for inclusion on Trump’s clemency list. He is aligning himself with the president’s political agenda as aggressively as possible, one post at a time.

Crypto World

Polymarket sues Massachusetts over prediction market rules

Polymarket has taken legal action against Massachusetts officials, seeking to block the state from restricting its prediction markets.

Summary

- Polymarket sued Massachusetts officials after a court ruling against rival Kalshi.

- The platform says federal CFTC rules override state gambling laws.

- The case could shape how prediction markets operate across the U.S.

The move comes as U.S. regulators and courts step up scrutiny of platforms that allow users to trade on real-world events, especially in sports.

On Feb. 10, Polymarket filed a lawsuit in federal court against Massachusetts Attorney General Andrea Campbell and state gaming regulators. The company said the threat of enforcement is “immediate and concrete,” following a recent ruling against rival platform Kalshi.

According to Polymarket, state intervention would disrupt its national operations, fragment its user base, and force it to choose between federal compliance and state restrictions. The company argues that its markets fall under federal oversight and should not be treated as local gambling products.

Federal authority vs. state gambling laws

At the center of the case is a dispute over who has the right to regulate prediction markets.

Polymarket says its event contracts are governed by the Commodity Futures Trading Commission. Under federal law, the CFTC oversees derivatives and futures markets, including certain types of prediction products. The company claims this authority overrides state-level gambling rules.

In its complaint, Polymarket pointed to comments made on Jan. 29 by CFTC Chairman Michael Selig, who said the agency would re-assess how it handles cases testing its jurisdiction. Shortly after, the CFTC filed an amicus brief in a related lawsuit involving Crypto.com.

Massachusetts courts have taken a different view. Last week, a state judge refused to pause a ban on Kalshi’s sports contracts, ruling that the platform must follow state gaming laws. The judge said Congress did not intend federal regulation to replace traditional state powers over gambling.

Kalshi has appealed the decision but was denied a stay. The ruling requires the company to block Massachusetts users from sports markets within 30 days.A federal judge in Nevada also recently denied Coinbase’s request for protection from a similar enforcement action, adding to the legal pressure on prediction platforms.

Robinhood, which partners with Kalshi, is now seeking its own injunction in Massachusetts to avoid state licensing requirements.

Growing pressure on prediction platforms

Polymarket’s lawsuit reflects wider tensions between fast-growing prediction markets and state regulators.

In a statement posted on social media, Polymarket chief legal officer Neal Kumar said the company is fighting “for the users.” He argued that state officials are racing to shut down innovation and ignoring federal law.

He added that Massachusetts and Nevada risk missing an opportunity to support new market models that blend finance, data, and public forecasting. State officials have so far declined to comment on the lawsuit.

The case arrives as prediction markets gain mainstream attention. Jump Trading recently made investments in Polymarket and Kalshi, two platforms that have garnered institutional support. According to recent funding rounds, Polymarket is valued at approximately $9 billion.

Supporters claim that by enabling users to trade on economic, sports, and election data, these markets enhance price discovery and public insight. Many contracts, according to critics, resemble unlicensed gambling and may put users at risk.

If Polymarket succeeds, it could limit the ability of states to regulate prediction markets and strengthen the CFTC’s role nationwide. A loss, however, may encourage more states to impose licensing rules or bans.

Crypto World

Chainlink CEO Says On-Chain RWAs Are Reshaping Crypto Market Structure

TLDR:

- On-chain RWAs continue expanding despite crypto price swings, showing independence from speculative market cycles.

- Institutional data providers now supply pricing and reserve data to support tokenized asset markets.

- Blockchain connectivity systems are becoming essential for linking financial infrastructure with on-chain trading.

- Orchestration tools now manage cross-chain workflows, data feeds, and privacy for complex RWA applications.

The current crypto market cycle is revealing signs of structural change rather than financial stress. Industry data shows fewer systemic failures compared with previous downturns.

At the same time, real-world assets are steadily moving onto blockchains. These developments suggest a shift in how value forms across digital markets.

On-chain RWAs reshape crypto market structure

Recent commentary from Chainlink co-founder Sergey Nazarov highlighted the absence of major institutional collapses during recent price drawdowns. He contrasted this with past cycles that saw large failures among centralized lenders and exchanges.

According to Nazarov, the industry now shows stronger risk controls and infrastructure resilience.

He also pointed to continued growth in on-chain RWAs despite volatile crypto prices. Tokenized commodities and financial instruments have expanded across decentralized platforms. This trend indicates that RWA adoption operates independently from short-term crypto market movements.

Data feeds and proof mechanisms now support on-chain trading for assets such as silver and tokenized funds.

Nazarov noted that on-chain perpetual markets for traditional commodities rival activity seen in permissioned financial venues. These markets rely on transparent pricing and continuous settlement.

The shift has attracted attention from established data providers.

Chainlink confirmed integrations with institutions, including S&P and ICE, to support pricing and reserve verification for RWAs. These integrations aim to standardize how off-chain financial data enters blockchain systems.

Infrastructure demand grows with institutional adoption of on-chain RWAs

Nazarov identified connectivity as a central requirement for scaling RWA markets.

Blockchain networks must link with accounting systems, payment rails, and risk management platforms. Chainlink’s interoperability tools have been selected by several Web3 security teams due to their operational track record.

He also emphasized orchestration as a technical layer coordinating multiple systems in one transaction flow. This includes cross-chain operations, off-chain data feeds, and automated settlement processes.

Chainlink’s Runtime Environment currently supports these workflows for enterprise applications.

Privacy features are also becoming critical for advanced RWA use cases. Nazarov stated that new orchestration tools aim to combine data transparency with confidential execution. These features target institutions that require regulatory compliance and internal controls.

According to Nazarov’s assessment, on-chain RWAs may eventually exceed cryptocurrencies in total on-chain value.

He described this shift as a transition from speculative markets to functional financial infrastructure. The growth of tokenized assets would still support crypto liquidity by bringing more capital onto blockchains.

Crypto World

XRP ETFs See $6.31 Million in Daily Inflows as XRPC, GXRP, and XRPZ Excel

TLDR

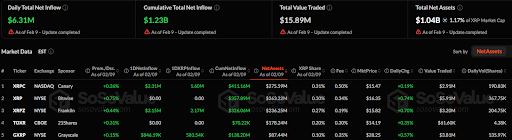

- XRP ETFs total daily net inflows of $6.31M with a cumulative net inflow of $1.23B as of February 9.

- The XRPC ETF on NASDAQ reports a $2.31M daily inflow, holding net assets of $275.59M.

- GXRP ETF on NYSE has daily inflows of $846.19K, with net assets of $87.44M.

- The Franklin XRPZ ETF sees a daily inflow of $3.15M and holds $236.25M in assets.

- TOXR and Bitwise XRP ETFs report no daily inflows or outflows, maintaining minimal changes.

According to a recent SoSoValue update as of February 9, the total daily net inflow for XRP ETFs stands at $6.31 million, with a cumulative net inflow of $1.23 billion. The total value traded on this day is recorded at $15.89 million.

XRP ETFs See Inflows Across XRPC, GXRP, and XRPZ

The XRP ETF products on various exchanges have reported varying levels of performance. A deep dive on the individual ETFs reveals that the XRPC ETF on NASDAQ, managed by Canary, shows a premium of +0.26%. The daily net inflow for this ETF amounts to $2.31 million, with a cumulative inflow of $411.16 million. It holds net assets of $275.59 million, equating to a 0.31% share of the total XRP market cap.

The GXRP ETF, also on the NYSE and managed by Grayscale, reports a daily inflow of $846.19K. GXRP holds the lowest net assets at $87.44 million, which represents 0.10% of XRP’s total market cap. The market price of this ETF is $28.25, with a daily change of +0.57%.

The Franklin XRPZ ETF, listed on the NYSE, has a daily inflow of $3.15 million. It currently holds $236.25 million in net assets, representing a 0.27% XRP share. Its market price stands at $15.82, with a daily increase of +0.70%.

TOXR and XRP ETFs Record No Inflow or Outflow

The TOXR ETF, trading on CBOE under the 21Shares sponsor, reports no change in daily flow with a cumulative net inflow of $70.22K. With net assets of $178.24 million, it has a minimal XRP share of 0.20%. The ETF shows a market price of $14.19, with a daily change of +0.35%.

On the NYSE, the Bitwise XRP ETF has gained a premium of +0.75%, with no changes in daily inflow and a cumulative net inflow of $357.89 million. This XRP ETF holds net assets of $263.22 million and a 0.30% XRP share. Its market price is $16.35, with a daily change of +0.74%.

Crypto World

Digital Assets & TradFi Convergence

From 2023 to 2026, from Hong Kong to a global stage, institutions from around the world convened once again. As the next decade of digital assets unfolds, LTP looks ahead alongside the industry.

What does it feel like to observe—at close range—the front-line pulse of digital assets and traditional finance (TradFi) amid market volatility?

On Feb. 9, 2026, Liquidity 2026, the annual flagship institutional digital asset summit hosted by LTP Hong Kong, concluded successfully in Hong Kong. Now in its fourth consecutive year, the event once again brought together senior representatives from hedge funds, market makers, high-frequency trading firms, family offices, asset managers, exchanges, custodians, banks, and technology service providers, marking another milestone in the accelerating convergence of digital assets and traditional financial markets.

Throughout the full-day agenda, the summit featured keynote addresses, fireside chats, and in-depth roundtable discussions. Speakers and participants engaged in rigorous exchanges around the evolution of the global financial system, the rise of tokenization, and the rapid integration of multi-asset ecosystems—exploring what new opportunities and new paradigms may emerge as institutional adoption deepens.

As the summit drew to a close, a clear consensus emerged across diverse perspectives: at a turning point in the reshaping of the global financial landscape, infrastructure development, regulatory dialogue, and cross-institutional collaboration will be the critical variables shaping the industry’s sustainable growth.This was not merely a forum for ideas, but a defining step in the digital asset industry’s progression toward standardization, institutionalization, and mainstream relevance.

Full Agenda Highlights and Key Takeaways

At Liquidity 2026, LTP convened global experts to examine the future of institutional digital asset markets through multiple lenses—including core infrastructure, liquidity connectivity, tokenization, and emerging market paradigms.

Multi-Asset Trading and Market Convergence: Compatibility and Resilience

Participants broadly agreed that crypto assets are increasingly being redefined as a core asset class that must be integrated into institutional portfolio management frameworks, rather than treated as a standalone alternative market. Stephan Lutz, CEO of BitMEX, noted that CIOs can no longer afford to ignore this asset class. As institutions formally incorporate digital assets into allocation frameworks, the design logic of trading systems is shifting—from pursuing peak performance to enabling seamless integration within existing governance structures, API architectures, and risk controls.

System resilience was repeatedly emphasized. Tom Higgins, Founder and CEO of Gold-i, remarked during a roundtable that system design must assume failure as inevitable, with redundancy and survivability achieved through multi-venue aggregation. At a macro level, regulatory fragmentation remains a key obstacle to global market interoperability; without cross-jurisdictional alignment, genuine multi-asset convergence will remain constrained.

The New Settlement Layer: Clearing, Custody, and Interoperability

Discussions around settlement and custody pointed to a clear direction: custodians are evolving from passive asset safekeeping toward becoming a core infrastructure layer supporting clearing, settlement, and risk management. As institutional participation grows, custody is no longer viewed solely as a compliance requirement, but as a critical nexus connecting regulatory certainty with operational scalability.

The definition of trust is also evolving. Ian Loh, CEO of Ceffu, emphasized that trust must be embedded in executable on-chain mechanisms, with assets generating tangible yield through collaboration between custodians and prime brokers. The importance of mature third-party technology has become increasingly evident. Amy Zhang, Head of APAC at Fireblocks, highlighted the industry’s growing reliance on established infrastructure providers, noting that Europe is emerging as a strategic hub for institutional digital assets due to its regulatory clarity and infrastructure maturity.

Technological redundancy was widely seen as essential to mitigating systemic disruptions. As Darren Jordan, Chief Commercial Officer at Komainu, observed, the future of custody lies in asset usability—shifting the core question from whether assets are safely stored to whether they can be securely and reliably mobilized.

Rebuilding Infrastructure and the Price of Data

Johann Kerbrat, SVP and GM of Robinhood Crypto, shared how Robinhood is evolving from a crypto trading platform into a general-purpose financial infrastructure provider, leveraging blockchain to re-architect payments, settlement, and traditional asset trading—while abstracting complexity away from the end user.

In his view, TradFi’s core bottleneck remains settlement efficiency, often operating at T+1 or longer, whereas crypto-native systems offer 24/7 availability, near-instant transfers, and composability that materially reduce capital costs and counterparty risk. Within regulatory frameworks, Robinhood is advancing equity tokenization on a fully collateralized, 1:1 basis, anticipating that tokenization will expand beyond stablecoins into equities, ETFs, and private markets. The central challenge, he argued, lies not in technology, but in regulatory implementation and collective adoption.

Cory Loo, Head of APAC at Pyth Network, described market data as a structurally underappreciated industry—generating over $50 billion in annual revenue, with data costs rising more than 15-fold over the past 25 years. The true cost, he noted, stems not from information asymmetry, but from data quality, which ultimately determines whether traders achieve best execution.

Pyth Network aims to reconstruct traditional data pipelines by bringing price inputs directly from trading firms and exchanges into a shared price layer, which is then redistributed to institutions at higher quality and lower cost with millisecond-level multi-asset updates. Loo disclosed that Pyth Pro attracted over 80 subscribers within two months of launch, achieving more than $1 million in ARR in its first month. The project also plans to implement a value-capture mechanism whereby subscription revenue flows into a DAO, which repurchases tokens and builds long-term reserves.

Institutional Capital Allocation: From Speculation to Systematic Exposure

A notable shift in capital allocation is underway. Institutional capital is rotating away from narrative-driven assets toward instruments with clear demand drivers and regulatory visibility. Fabian Dori, CIO of Sygnum, observed that as metaverse narratives faded, institutions have refocused on leveraging smart contracts for value-chain integration and process automation. Risk management has increasingly displaced return speculation as the primary screening criterion.

Tokenization is widely expected to drive structural, rather than incremental, change—but scale will depend on demonstrable client demand rather than technological capability alone. Interest in index-based and structured products is rising, and Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group, noted that the future market landscape will likely be defined by the coexistence of multiple technologies and market structures.

Trading Convergence: Bridging Liquidity, Pricing, and Risk

In discussions on liquidity and risk management, participants focused on system stability during extreme market conditions. Jeremi Long, CIO of Ludisia, highlighted how infrastructure upgrades have materially improved execution quality, while emphasizing that risk management must be designed for worst-case scenarios.

Improving cross-venue capital efficiency was identified as a key solution to fragmented capital deployment. Collaborative models between exchanges and custodians—enabling shared capital pools—are increasingly being explored. In this context, transparency has become paramount. Giuseppe Giuliani, Vice President of Kraken’s Institutional team, stressed that liquidity depends on risks being clearly priced, and that exchange transparency and operational stability directly influence market-maker participation.

Building Institutional Rails for the Digital Asset Economy

At the institutional and infrastructure level, multiple case studies suggest a shift from proof-of-concept to real-world deployment. Stablecoin pilots in insurance and payments demonstrate the tangible efficiency gains of on-chain settlement. Some institutions are now exploring migrating flagship products directly on-chain to access broader global liquidity.

System stability is increasingly viewed as a form of revenue protection. Zeng Xin, Senior Web3 Solutions Architect at AWS, noted that stability functions as “income insurance,” with cloud infrastructure providing the resilience and elasticity required for digital markets. Meanwhile, traditional regulatory frameworks continue to impose structural constraints on capital allocation.

Sherry Zhu, Global Head of Digital Assets at Futu Holdings Limited for Futu Group, emphasized that trust and convenience represent core opportunities for brokerage platforms, while acknowledging the capital constraints imposed by frameworks such as Basel. Balancing compliance, privacy, and custody remains a critical threshold for institutional participation in DeFi.

Everything as Collateral: RWA, Stablecoins, and Tokenized Credit

Debates around whether tokenized assets can serve as core collateral are moving from theory to practice. Compared with traditional structures, on-chain collateral—enabled by 24/7 settlement—is better suited to meet sudden margin requirements in derivatives markets. However, legal clarity remains the determining factor.

Chetan Karkhanis, SVP at Franklin Templeton, emphasized the importance of choosing natively on-chain asset structures rather than digital replicas, ensuring a single source of legal truth. Regulatory classification and its impact on capital requirements are equally critical. Institutions evaluating tokenized collateral tend to focus on four dimensions: legal ownership, operational risk, custody arrangements, and liquidity depth.

Beyond the Hype: Where the Industry Goes Next

As the summit concluded, participants converged on a shared view: tokenization alone does not constitute a competitive advantage. The true differentiator lies in whether it delivers measurable improvements across reserves, trading, or settlement.

Erkan Kaya, CEO of ABEX, suggested that tokenization has the potential to fully absorb traditional finance into crypto-native systems, with a tipping point likely to emerge over the next decade. As regulatory credentials, system stability, and user experience become decisive factors, the evolution of financial infrastructure appears irreversible. Digital assets are no longer a peripheral complement to TradFi, but a force increasingly capable of reshaping its operating logic and power structures.Moses Lee, Head of APAC at Anchorage Digital, summarized the sentiment succinctly: tokenization does not equal success—its value depends on delivering clear functional advantages in reserves, trading, or settlement.

Closing Thoughts

For LTP, the industry’s transition into a more mature phase—marked by the fading of hype—also represents the optimal moment for infrastructure, compliance, and sustainable innovation to take root. We remain firmly convinced that lasting value creation resides in the foundational systems that quietly support market operations.

From 2023 to 2026, from regional markets to a global perspective, LTP has remained committed to observing, documenting, and actively participating in the structural, institutional, and regulatory evolution of the digital asset industry. The successful conclusion of Liquidity 2026 marks another meaningful milestone in our long-term effort to advance the integration of digital assets and TradFi.

Looking ahead, LTP will continue to invest heavily in ecosystem development—championing more resilient infrastructure and more open collaboration—to help shape the next decade of digital assets.

With infrastructure build-out, regulatory engagement, and cross-institutional collaboration converging, a healthier, more professional, and increasingly mainstream digital asset era is taking shape.

While Liquidity 2026 has just concluded, the marathon toward deep digital asset–TradFi integration is only entering its second half. As a long-term participant and observer, LTP will continue to dedicate resources to ecosystem building and industry dialogue, helping to usher in the next decade of digital assets.

A full post-event report, including detailed roundtable highlights and key speaker insights, will be released shortly. Stay tuned.

About LTP

LTP is a global institutional prime broker, purpose-built to meet the evolving needs of digital asset market participants. By applying traditional financial standards to blockchain innovation, LTP provides end-to-end prime services spanning trade execution, clearing, settlement, custody, and financing. Its offerings further extend to institutional asset management, regulated OTC block trading, and compliant on/off-ramp solutions — delivering a secure and scalable foundation for institutions across the digital asset ecosystem.

LiquidityTech Limited is HK SFC licensed for Type 1, 2, 4, 5, and 9 regulated activities.

Liquidity Technology Limited is BVI FSC licensed to act as a Virtual Asset Service Provider and licensed under SIBA for Dealing in Investments activities.

Liquidity Technology S.L. is registered with Bank of Spain as a Virtual Asset Service Provider.

Liquidity Fintech Pty Ltd AUSTRAC registered for digital currency exchange, remittance, and foreign exchange service provider activities.

Liquidity Fintech Investment Limited is BVI FSC licensed to provide investment management services.

Neutrium Trust Limited is registered as a Trust Company under the Trustee Ordinance and licensed as a Trust or Company Service Provider under AMLO.

Liquidity Fintech FZE, granted In-Principle Approval (IPA) by the Dubai VARA for a VASP licence (note: IPA does not permit regulated activities).

Disclaimer: All regulated activities are performed exclusively by the relevant entities that are duly licensed or registered, and strictly within the boundaries of their respective regulatory approvals and jurisdictions.

More details: https://www.liquiditytech.com

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

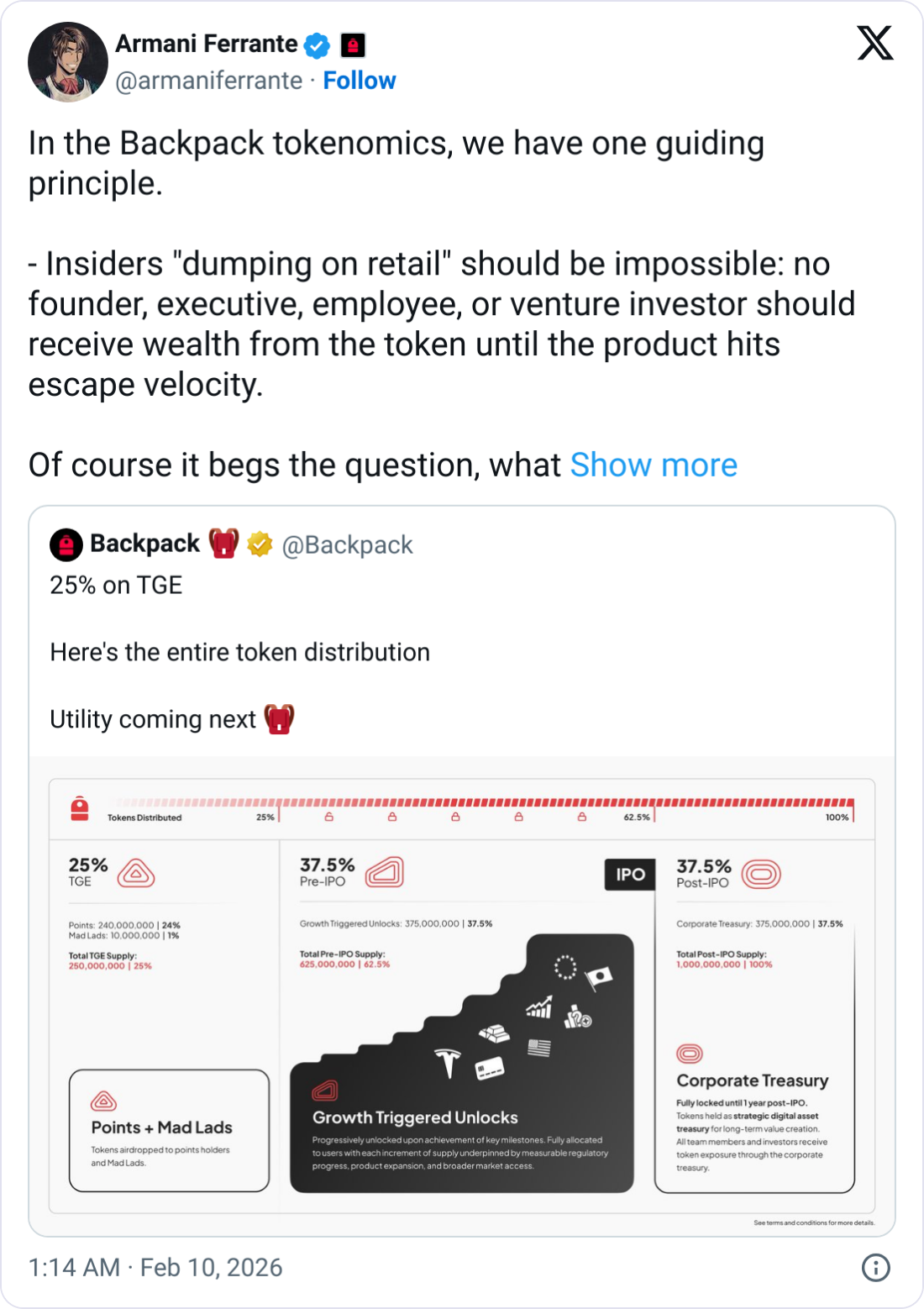

Backpack, a crypto exchange founded by former employees of FTX, says it will launch a 1-billion-supply token in the future, with its distribution schedule tied to its goal of going public in the US.

Backpack posted to X on Monday that its token launch will begin with 25% of the intended supply, or 250 million tokens, to become available on a yet-to-be-disclosed launch date.

Another 37.5% of the total supply, or 375 million pre-IPO tokens, will be made available “upon achievement of key milestones,” which Ferrante said would include opening in a new region or launching a new product.

The remaining 375 million post-IPO tokens would be locked until a year after the company goes public, with the tokens held strategically in a corporate treasury.

The IPO push comes as Axios reported on Monday that Backpack is in discussions to raise $50 million at a $1 billion pre-money valuation, potentially making it the crypto industry’s latest unicorn.

In a separate post, Backpack co-founder and CEO Armani Ferrante wrote on X on Monday that the “guiding principle” for its token unlocks was that “insiders ‘dumping on retail’ should be impossible.”

Ferrante, an early employee at the FTX-linked Alameda Research, added that none of the Backpack team or investors should gain wealth from the token “until the product hits escape velocity,” which he said would happen when the company launches an initial public offering.

“Going public might happen quickly, it might happen not so quickly, and in fact, it might not happen at all,” Ferrante said. “In any case, we’re going for it.”

Related: Backpack Exchange launches beta testing of prediction market platform

Ferrante said that “not a single founder, executive, team member, or venture investor has been given a direct token allocation,” and that the team instead owns equity in the company.

“It’s not until the company goes public (or has some other type of equity exit event), that the team can earn any wealth from the project,” he added.

“It’s not until the company has done all the hard work to earn access to those markets that the team can reap the rewards of the value created by the Backpack community from now until then.”

Backpack launched in 2022 and Ferrante co-founded the exchange alongside former FTX.US strategy lead Tristan Yver and former FTX general counsel Can Sun.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

YouTube star MrBeast buys youth-focused financial services app Step

Creator, Entrepreneur and Philanthropist Jimmy Donaldson, also known as MrBeast, speaks onstage during the 2025 New York Times Dealbook Summit at Jazz at Lincoln Center on December 03, 2025 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

The world’s largest YouTuber by subscriber count, Jimmy Donaldson, better known as MrBeast, has acquired the financial services app Step, marking his company’s entry into fintech with a focus on serving younger users.

Step is advertised as an all-in-one money app for teens and young adults to manage money, build credit and access financial tools. The app will operate under the umbrella of Donalson’s company, Beast Industries.

“Nobody taught me about investing, building credit, or managing money when I was growing up. That’s exactly why we’re joining forces with Step,” MrBeast told his millions of fans on Monday. “I want to give millions of young people the financial foundation I never had. Lots to share soon.”

Beast Industries did not disclose how much it paid for Step. CNBC contacted the company for comment but did not receive a response by publication.

Beast Industries has been fundraising over the past year, including a recent $200 million investment from Bitmine Immersion Technologies, the largest corporate holder of the cryptocurrency Ether and chaired by Fundstrat’s Tom Lee.

Step is backed by fintech giant Stripe, as well as venture capital firms such as Coatue, Collaborative Fund, Crosslink Capital and General Catalyst.

The newly acquired Step was founded in 2018 by fintech veterans CJ MacDonald and Alexey Kalinichenko, with a mission of providing the next generation with tools for financial literacy.

While it is not a bank, Step partnered with Evolve Bank & Trust, a consumer banking company, for banking services in 2022. The platform also includes a Step Visa Card, an account for saving, spending, sending money and investing, with no monthly fees.

Beast Industries said in a press release Step’s over 7 million users, technology platform and in-house fintech team would complement its large digital audience and philanthropic initiatives.

“This acquisition positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better,” Jeff Housenbold, CEO of Beast Industries, said in a statement.

Beast Industries’ other ventures include Feastables, a snack brand, Beast Philanthropy, its non-profit arm, and Beast Games, its reality competition series on Amazon Prime Video.

Those ventures leverage Donaldson’s YouTube brand, which had over 450 million subscribers and 5 billion monthly views across channels as of early 2026.

Crypto World

Bitcoin’s U.S. demand signal flickers back after crash

Bitcoin’s sharp rebound from last week’s plunge toward $60,000 has been accompanied by a subtle but important shift in one closely watched indicator of U.S. demand.

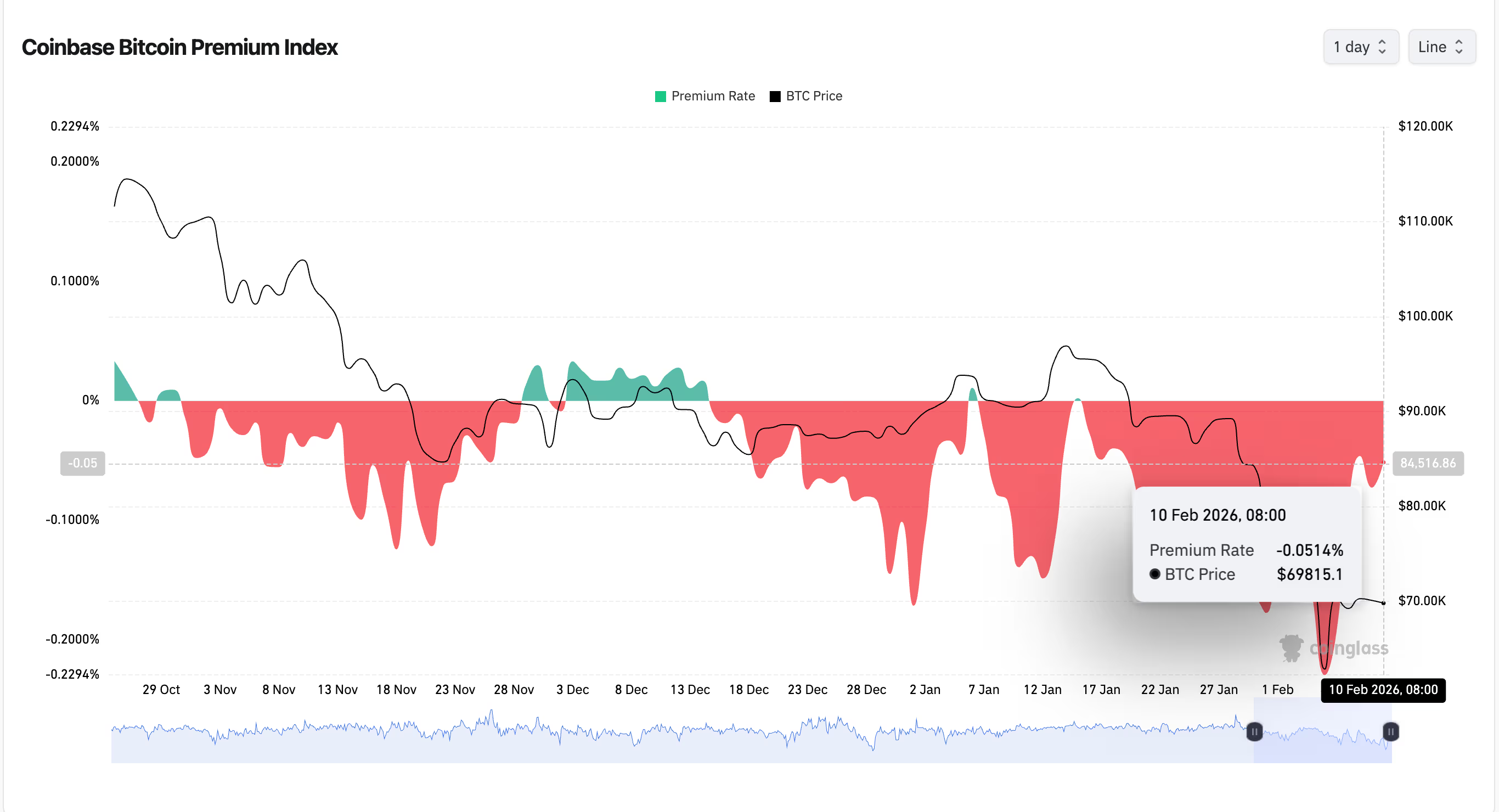

The Coinbase Bitcoin Premium Index — which tracks the price gap between bitcoin traded on Coinbase and the global market average — has climbed sharply from deeply negative territory, moving from around -0.22% at the height of the selloff to roughly -0.05% by Tuesday.

While the index remains below zero, the rebound suggests U.S.-based investors stepped in to buy the dip as forced selling pressure eased.

Coinbase is widely viewed as a proxy for institutional and dollar-based flows. A deeply negative premium typically signals U.S. investors are either selling aggressively or staying on the sidelines altogether. The move back toward neutral indicates that some buyers found value at lower levels, particularly as bitcoin stabilized after its fastest drawdown since the FTX collapse in 2022.

Still, the premium has not turned positive, a threshold that historically coincides with sustained accumulation and renewed risk appetite among U.S. funds. Instead, the current move points to selective buying rather than broader conviction.

Market structure data supports that cautious interpretation. Aggregate trading volumes across major exchanges remain well below late-2025 highs, according to Kaiko, with spot activity showing signs of gradual attrition rather than a decisive surge in demand.

Thin liquidity means prices can bounce sharply once selling exhausts itself, but also leaves the market vulnerable to renewed downside if buyers fail to follow through.

Bitcoin is currently trading just under $70,000 after recovering more than 15% from its intraday low, though it remains down over 10% on the week.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

The Israeli Crypto Blockchain & Web 3.0 Companies Forum last week launched a lobbying effort to push regulatory reforms that research from KPMG says may add 120 billion shekels ($38.36 billion) to the country’s economy by 2035 and create 70,000 new jobs.

At a Feb. 3 event in Tel Aviv, Forum leader Nir Hirshman-Rub said there is broad public support for legislation that would relax rules on stablecoins and tokenization, along with simplifying tax compliance requirements.

In the wake of the US-brokered ceasefire of the Gaza war, 2026 is seen as a “defining year” for the local digital assets industry, Hirshman-Rub said.

“The Israeli public is already there and the politicians need to act,” Hirshman-Rub told Cointelegraph on the sidelines of the Tel Aviv event. “More than 25% of the public already has had crypto dealings in the last five years and more than 20% currently hold digital assets,” he said, citing the KPMG research.

Steady growth as digital asset landscape evolves

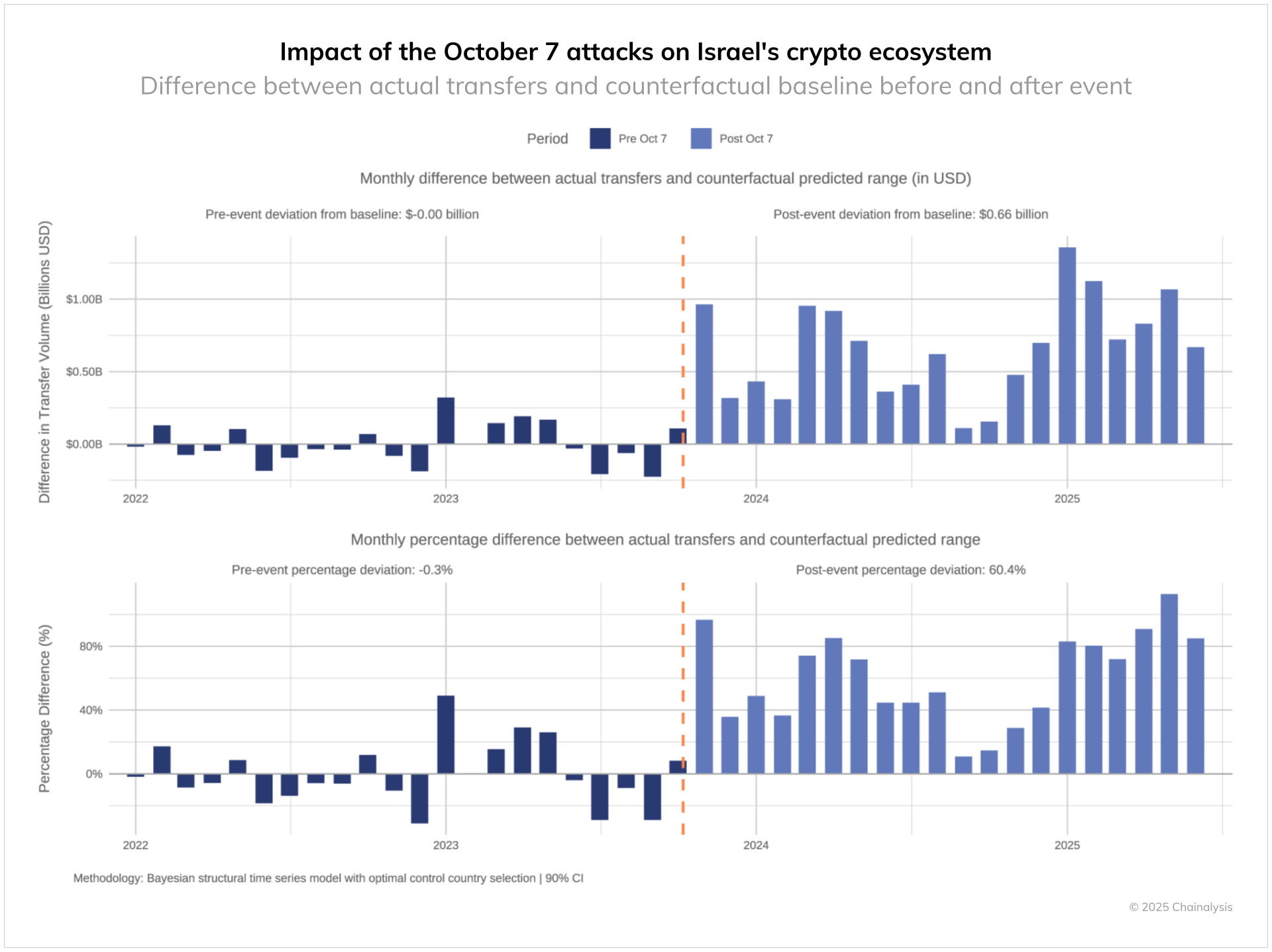

An October Chainalysis report showed that the G-20 country’s crypto economy has showed steady growth, with inflows topping $713 billion last year. Those levels reflect a sharp increase in crypto volumes in the aftermath of the October 2023 Hamas attacks, which were sustained by strong retail activity, the report said.

Israeli companies, such as Fireblocks and Starkware, have established leadership positions in the global digital assets landscape and are among the Forum’s sponsors. According to NGO Startup Nation Central, more than 160 locally founded companies have attracted more than 5% of the $30 billion invested worldwide in the sector, employing more than 2,500, primarily in the greater Tel Aviv area.

“The problem is that once a company here disclosed that it deals with digital assets, Israeli banks refuse to serve the company or require the company’s attorneys to make an impossible declaration that funds originating in a digital asset will not be deposited in an Israeli bank account,” said Hirshman-Rub. “It may not be outright refusal, but simply dragging their feet, adding demands in a never-ending due diligence process.”

Related: EU tokenization companies push for DLT pilot changes amid US momentum

Among other barriers that the group seeks to reform is an income tax ordinance that penalizes token distribution to employees as stock options. While traditional stock options provided to employees are taxed at a 25% rate, tokenized options will pay a 50% rate for similar value.

A national strategy

In July, the country’s National Crypto Strategy Committee presented an interim report to the Israeli Knesset for parliamentary review. The committee outlined a strategic framework underpinned by five pillars, including establishing a unified regulator, creating token issuance rules, and banking integration.

In August, the Israel Tax Authority published a new Voluntary Disclosure Procedure that would offer taxpayers a path to disclose previously unreported income and assets, including digital assets, and obtain immunity from criminal proceedings. It was the agency’s third attempt to implement a disclosure regime.

However, last month, the agency said taxpayer participation has so far fallen short of expectations, but committed to seeing the initiative through to the end of August 2026.

“The Israeli banking system is not willing to accept cryptocurrency, and it is also very difficult to bring in funds as a result of selling cryptocurrency,” Tax Authority director Shay Aharonovich said, according to local media reports. “There is no doubt that this also affects the willingness to make voluntary disclosure, because in the end people do not just want to pay the tax, but to use the money.”

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

American billionaire and hedge fund manager Ray Dalio has warned that central bank digital currencies (CBDCs) are coming, which will offer benefits but also potentially allow governments to exert more control over people’s finances.

“I think it will be done,” said Dalio on CBDCs in a wide-ranging interview on the Tucker Carlson Show on Monday, which also included topics on the US debt crisis, gold prices, and even a potential civil war.

Raymond Dalio is a billionaire hedge fund manager who has been co-chief investment officer of Bridgewater Associates since 1985, after founding the firm in 1975.

During the interview, Dalio said CBDCs could be appealing due to the ease of transactions, comparing them to money market funds in functionality, but he also cautioned about their downsides.

He said there will be a debate, but CBDCs “probably won’t” offer interest, so they will not be “an effective vehicle to hold because you’ll have the depreciation [of the dollar].”

Dalio also cautioned that all CBDC transactions will be known to the government, which is good for controlling illegal activity, but also provides a great deal of control in other areas.

“There will be no privacy, and it’s a very effective controlling mechanism by the government.”

Taxation, forex controls and political debanking

A programmable digital currency will enable the government to tax directly, “they can take your money,” and establish foreign exchange controls, he said.

That will be an “increasing issue,” particularly for international holders of that currency, as the government can seize funds from nationals of sanctioned countries.

Dalio also said that you could be “shut off” from a CBDC if you were “politically disfavored.”

Related: China-led CBDC project mBridge tops $55B in cross-border payments

An American CBDC is not likely to be deployed in the near future, however, as US President Donald Trump has been vocally opposed to them.

Soon after taking office in January 2025, Trump signed an executive order prohibiting “the establishment, issuance, circulation, and use” of a US CBDC.

Only three countries have launched a CBDC

According to the Atlantic Council’s CBDC tracker, only three countries have officially launched one: Nigeria, Jamaica, and The Bahamas.

49 countries are in the pilot testing phase, including China, Russia, India, and Brazil. 20 nations have a CBDC in development, and 36 are still researching central bank digital currencies.

India’s central bank reportedly proposed an initiative in January linking BRICS CBDCs to facilitate cross-border trade and tourism payments.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Bitcoin & Ethereum News, Crypto Prices & Indexes

Coinbase’s Base App, pitched as a central piece of Coinbase’s “Everything App” strategy, is winding down its Creator Rewards program and its Farcaster-powered social feed. The move signals a shift away from social incentives toward a trading-first experience that prioritizes tradable assets. The Creator Rewards program, launched in July to foster a more social Base ecosystem, distributed roughly $450,000 to about 17,000 creators over seven months, according to an official Base App X update. That translates to an average payout of around $26 per creator. As the project evolves, the team underlined that the app’s core mission is changing, with trading taking center stage.

Base App’s creator-focused initiative will culminate with final payouts on February 18, and the program will wrap on the preceding Sunday. The decision comes alongside a broader reorientation of Base App’s social features. Founder Jesse Pollak framed the pivot by stressing simplicity and focus: “As we’ve rolled the app out, we’ve realized we need to do less, better. And by focusing on tradable assets, that’s exactly what we can do.” He added, “The app needs to have one primary focus, and that thing is trading.” The message reflects Coinbase’s intent to consolidate Base App as the trading hub for a suite of crypto primitives rather than a multi-faceted social platform.

With the Creator Rewards sunset, Base App’s social feed powered by Farcaster is unlikely to remain a central pillar of the user experience. Pollak acknowledged the talk feed’s misalignment with Base App’s core capabilities and said the team plans to continue supporting the decentralized social network and its developer ecosystem, even as the product emphasis shifts. “…candidly, I think the truth is that the base app was always an imperfect farcaster client,” he noted. “With this change, I expect those users to flow back to the farcaster app (myself included) and inject more energy into the economy there, with a best in class interface.”

Base App is at the center of Coinbase’s future

The refocus aligns with Coinbase’s broader ambition to become an Everything App spanning spot trading, derivatives, stablecoins, tokenization of real-world assets, prediction markets, and more. The company has signaled ongoing exploration of Base’s tokenization potential, though public commentary from CEO Brian Armstrong and Pollak on a Base token has been relatively quiet in recent months. The move also preserves Base App’s Creator Coins program, which enables users to mint ERC-20 tokens linked to their Base profile and the Zora ecosystem, even as the social feed portion is deprioritized. The platform’s December launch, following a longer beta period, established Base App as a self-custody wallet and all-in-one trading companion for a growing trading experience.

The broader strategy, including a renewed emphasis on tradable assets, occurs in a context where retail liquidity and investor appetite for accessible tokenized products remain central to crypto markets. The enterprise behind Base App continues to weave its product narrative around asset ownership, on-chain tokenization, and user-controlled liquidity, rather than social hooks alone. The project’s trajectory has also intersected with conversations about a Base token, a notion that has drawn attention even as the leadership has offered few recent public updates. Meanwhile, Base App’s Creator Coins program remains active, offering a way for users to deploy ERC-20 tokens tied to their Base activity and to participate in broader ecosystems such as Zora.

Beyond its internal pivots, the initiative sits within a wider industry discourse about how social tooling, creator monetization, and trading workflows intersect on-chain. In related coverage, the industry has noted the growing interest in open, interoperable tools for prediction markets and open-source data feeds, underscoring a trend toward more modular, developer-friendly ecosystems.

Base App’s evolution also points to a continued emphasis on practical utility for users who want to manage custody, trading, and tokenization in a single interface. The product’s December launch, together with the sunset of Creator Rewards, reflects a clear prioritization of liquidity and tradable assets over experimental social features, even as the company remains committed to supporting its broader developer network and ecosystem partners.

Related discussions around Base and its ecosystem continue to surface in strategy discussions about decentralized social networks, on-chain governance, and the role of creator-driven tokens in digital economies. The product’s remaining integration points, including its links to broader Coinbase services, will likely shape how users navigate the interface as it moves deeper into the trading-centric phase of its development.

Why it matters

The decision to sunset Creator Rewards and narrow the Base App’s focus to tradable assets marks a significant strategic refinement for Coinbase’s technology roadmap. By concentrating on a trading-first experience, Base App aims to streamline user flows, reduce feature complexity, and enhance liquidity within its ecosystem. The change also signals how Coinbase views social features as a potential risk to a clean, asset-centered user journey, especially in an environment where on-chain trading and asset tokenization are increasingly central to platform differentiation.

For developers and creators, the move redraws incentives. While Creator Rewards offered a tangible earnings stream, the shift reallocates attention and resources toward building robust trading experiences, improved interfaces, and more reliable asset integrations. The ongoing support for Farcaster suggests a recognition that decentralized social ecosystems remain valuable to certain user segments, even if they no longer sit at the core of Base App’s product strategy. In practice, users who valued social signals and creator-driven tokens may migrate toward stand-alone social clients or alternative on-chain ecosystems, while trading-centric features gain momentum on Base App.

From a market perspective, the development underscores how major crypto players balance social experimentation with the economics of liquidity and tradable assets. It also reinforces Coinbase’s narrative around the Everything App, positioning Base App as a strategic hub for on-chain activity, rather than a standalone social portal. The outcome will hinge on how effectively Base App can scale its trading features, attract liquidity, and maintain a coherent user experience as more functions are integrated into the ecosystem. In short, the Pivot foregrounds trading utility as the backbone of a user-centric on-chain toolset, while social experiments take a back seat until or unless they prove to materially enhance liquidity and engagement.

What to watch next

- Final Creator Rewards payouts on February 18 — confirm user receipts and overall distribution metrics.

- Any updates regarding Base Token discussions and public messaging from Coinbase/Base leadership.

- Progress on Farcaster integration strategy and how users engage with decentralized social features outside Base App.

- Updates to the Creator Coins program and its interaction with Zora and other on-chain ecosystems.

- Shifts in Base App’s feature set and new liquidity- or asset-focused updates as part of the Everything App roadmap.

Sources & verification

- Base App X post detailing roughly $450,000 distributed to about 17,000 creators over seven months.

- Announcement that Creator Rewards will end with final payouts on February 18.

- Jesse Pollak’s comments on focusing on trading and the imperfect fit of Farcaster for Base App.

- Base App’s December launch and its role as a self-custody wallet within the trading experience.

- Creator Coins program page and its ERC-20 token mechanics tied to Base App profiles and Zora.

Base App pivots toward trading-first design

Coinbase’s Base App is pruning its social-oriented features to emphasize tradable assets, a move underscored by public remarks from Base’s leadership and corroborated by the platform’s payout data. By winding down the Creator Rewards program and tightening feature focus, Base App aims to deliver a cleaner, more efficient trading experience that aligns with the broader mission of Coinbase’s Everything App. The decision to sunset social incentives comes alongside ongoing conversations about Base’s strategic direction and the potential paths for tokenization and open-access financial tooling within the Coinbase ecosystem.

Ethereum (CRYPTO: ETH) remains a reference point in these discussions, as Base App seeks to harness its layer-2 capabilities and on-chain liquidity to support a more robust trading flow. The emphasis on tradable assets is intended to create a more compelling value proposition for users who want direct asset ownership, faster settlement, and accessible DeFi-native workflows within a single interface. As Base App navigates these changes, observers will be watching not only for concrete product updates but also for how the ecosystem adapts to maintain creator engagement and developer participation without relying primarily on social reward mechanics.

In the evolving crypto landscape, open-source tooling, tokenized assets, and streamlined custody play increasingly central roles. The Base App pivot illustrates how major platforms are recalibrating to align product-market fit with liquidity pressures and regulatory expectations, while still preserving avenues for creator-led innovation through tokens and decentralized ecosystems. The ongoing dialogue around Base’s roadmap, tokenization ambitions, and the role of social features will shape how users engage with Coinbase’s broader platform — and how new entrants attempt to replicate or improve upon this integrated, trading-focused approach.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat8 hours ago

NewsBeat8 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat19 hours ago

NewsBeat19 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports7 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report