Business

Jewellery stocks rally on back of US-India trade deal

Kalyan Jewellers shot up 14.7%, leading the surge. Motisons Jewellers, Vaibhav Global, Goldiam International, Sky Gold and Diamonds, Thangamayil Jewellery and P N Gadgil Jewellers climbed 9-16%, while Titan Company gained 3%. The benchmark Nifty 50 rose 0.7%, and the Nifty Midcap 150 and Smallcap 250 indices advanced 1.6% and 2.6%, respectively.

“Monday’s run-up is largely a combination of strong results by Kalyan Jewellers and P N Gadgil, as well as tariff reduction on jewellery exports as part of the India-US bilateral trade deal,” said Gaurang Kakkad, head of research at Centrum Broking.

A joint statement issued on Friday said the US would cut tariffs on gems and diamonds exported from India, lowering them from 50% to 18%.

Harsh Thakkar, research analyst at Samco Securities, said investors expect the momentum seen in the October-December to continue into the fourth quarter, aided by wedding-season demand – a view echoed in the recent commentary from Kalyan Jewellers’ management.

Kalyan posted an 60% jump in consolidated net profit for the third quarter from July-September, while P N Gadgil posted a 115.5% rise in October– December profit. “We have seen strong thirdquarter numbers from Sky Gold and P N Gadgil, and we expect strong results from other key players such as Titan Company and Senco Gold. Investors may consider accumulating shares of leading companies in the segment on dips,” Thakkar said.

Agencies

AgenciesUS Trade Deal: Market expects Q3 momentum to continue with reduction in sector tariffs

Kakkad said the third quarter saw strong momentum across jewellery retailers, supported by gold price inflation and robust wedding-related buying. In the October- –December period, international gold prices rose nearly 12% as per data from investing- .com. So far in 2026, gold is up over 16% in a volatile trading period. Kakkad added that the structural story remains intact, with organised jewellers benefiting from market-share gains from the unorganised sector, continued store additions and entry into newer categories, including lab-grown diamonds and lightweight jewellery. His top pick in the sector is Titan.

“Despite gold price volatility, January has remained healthy in terms of KPIs (Key Performance Indicators) like walk-ins, footfalls and consumer traction,” said Kakkad. “We expect that some correction in gold prices will provide an opportunity to consumers who were on the fence, and therefore demand momentum should remain strong in the fourth quarter as well.”

Business

India’s Lupin settles US patent dispute with Astellas Pharma for $90 million

India’s Lupin settles US patent dispute with Astellas Pharma for $90 million

Business

CrowdStrike After The Correction: Same Story, Far Cheaper

CrowdStrike After The Correction: Same Story, Far Cheaper

Business

Thai Baht Strengthens Following Bhumjaithai Party’s Election Victory

The Thai baht rose 1.3% to 31.2 per dollar, boosted by the Bhumjaithai Party’s election victory, securing 191 seats and enhancing market confidence and policy continuity in Thailand.

Key Points

- The Thai baht increased by 1.3% to 31.2 per dollar on Monday, recovering from previous losses and reaching a one-week high due to improved market sentiment following the Bhumjaithai Party’s election win.

- The ruling Bhumjaithai Party secured 191 out of 500 seats in the House of Representatives, nearly tripling its 2023 count, enhancing market confidence and reducing risks of political instability.

- This election outcome suggests policy continuity regarding social handouts and budget approvals, while the pro-democracy People’s Party, which led in pre-election surveys, is projected to win 115 seats.

Market Sentiment Improvement

The Thai baht rose by 1.3% to 31.2 per dollar on Monday, recovering from previous losses and reaching a high not seen in over a week. This rebound can be largely attributed to enhanced market sentiment following the substantial election success of the Bhumjaithai Party. As Thailand’s ruling conservative party, the Bhumjaithai Party has made a significant impact by winning 191 of the 500 seats in the House of Representatives, a notable increase nearly triple that of their 2023 performance. This solid victory has instilled confidence among investors, signaling a more stable political environment.

Implications for Political Stability

With a solid electoral win, the Bhumjaithai Party is predicted to reduce the risks associated with political deadlock or instability. A robust showing by Prime Minister Anutin Charnvirakul and his anticipated coalition partners suggests a more cohesive governing body and the potential for policy continuity. This outcome is not just about immediate political dynamics; it enables the continuation of the party’s social handouts and lays the groundwork for the approval of a new budget. As the electorate embraces this new direction, hopes for progress in governance and economic policy remain optimistic.

Opposition Landscape Overview

On the other hand, the pro-democracy People’s Party, which had been a front-runner in pre-election polls, is expected to secure 115 seats. Despite the party’s inability to match the Bhumjaithai Party’s success, their presence will likely contribute to a more diverse political discourse in Thailand. The results highlight a shifting electoral landscape where traditional party dominance faces challenges from emerging political entities. In summary, the elections have not only altered the composition of Thailand’s legislature but also the broader implications for future governance and public policy.

Other People are Reading

Business

RLF Agtech appoints Upton as CEO

RLF AgTech has appointed Stuart Upton as its chief executive, effective immediately.

Business

Standard Chartered names Peter Burrill as interim CFO

Standard Chartered names Peter Burrill as interim CFO

Business

Navin Fluorine shares up 3% as Q3 net profit soars 122% to Rs 185 crore

Revenue from operations increased 47.2% YoY to Rs 892.3 crore compared with Rs 606.2 crore a year earlier.

Operating performance improved significantly during the quarter. EBITDA climbed to Rs 307.4 crore from Rs 147.3 crore in the year-ago period, while the EBITDA margin expanded to 34.4% from 24.3%, reflecting stronger operating leverage and a favourable business mix.

As for the revenue split, HPP (high-performance products), which includes refrigerants and inorganic fluorides, reported a 35% increase in revenue at Rs 412 crore in Q3FY26. The specialty chemicals business recorded a 60% increase to Rs 354 crore, while the CDMO business rose 61% in revenue terms to Rs 127 crore, the company’s regulatory filing showed.

Also Read | Quant MF cuts gold, silver exposure near peak levels in multi-asset fund

The HPP segment reported revenue growth during the period, supported by higher realisations along with increased volumes. The AHF capex was commissioned in Q4FY26 and dispatches have already commenced. It also noted that the pricing environment for HFC continues to remain constructive.

The specialty chemicals business continues to maintain a strong product pipeline, with scale-up underway in existing molecules and new molecule launches planned. De-bottlenecking of the MPP capacity at the Dahej facility is progressing as scheduled and is expected to be commissioned in Q3FY27. The segment delivered its highest-ever quarterly performance and the outlook remains positive, backed by strong order visibility for Q4 and beyond.The CDMO business maintained its momentum with robust order visibility. The company highlighted progress in its strategy, focusing on a balanced portfolio with a mix of early-stage and late or commercial-stage molecules. Supplies for a material order to one EU major have been completed and discussions for future supplies are ongoing, while another EU major has placed a scale-up order scheduled for Q4 supplies.

Navin Fluorine is a specialty fluorochemicals manufacturer serving global customers across pharmaceuticals, agrochemicals, specialty chemicals and high-performance materials.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

The Chinese ‘Auntie’ Investors Behind the Gold and Silver Frenzy

Rose Tian is worried about the economy and global instability. So she does what millions of people in China do: buys gold.

This past week, the 43-year-old high-school teacher visited one of Beijing’s biggest jewelry markets to browse gold bracelets, necklaces and rings ahead of the Lunar New Year. She has purchased thousands of dollars’ worth of gold for herself and relatives over the years.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

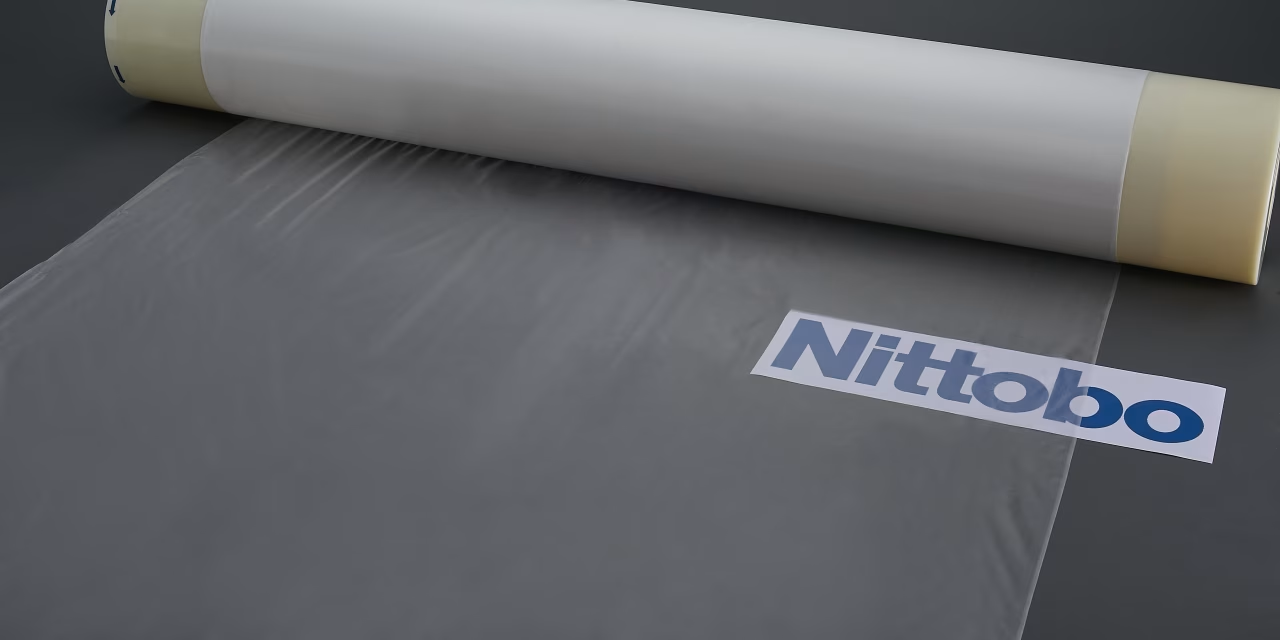

A Critical AI Niche Is Dominated by One Little-Known Japanese Company

TOKYO—Imagine a sheet made of microscopic glass fibers, woven by a former silk maker and thinner than a human hair. A shortage of this material—essential in artificial-intelligence chips—is looming over companies including Apple and Nvidia.

The cloth-like material known as T-glass comes almost entirely from a single century-old Japanese textile company called Nittobo that doesn’t expect to bring significant new capacity online until late this year.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

AFMC ETF: Mid-Cap Multifactor ETF Worth Shortlisting (NYSEARCA:AFMC)

Vasily Zyryanov is an individual investor and writer.He uses various techniques to find both relatively underpriced equities with strong upside potential and relatively overappreciated companies that have inflated valuation for a reason.In his research, he pays much attention to the energy sector (oil & gas supermajors, mid-cap, and small-cap exploration & production companies, the oilfield services firms), while he also covers a plethora of other industries from mining and chemicals to luxury bellwethers.He firmly believes that apart from simple profit and sales analysis, a meticulous investor must assess Free Cash Flow and Return on Capital to gain deeper insights and avoid sophomoric conclusions.While he favors underappreciated and misunderstood equities, he also acknowledges that some growth stocks do deserve their premium valuation, and its an investor’s primary goal to delve deeper and uncover if the market’s current opinion is correct or not.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

NDIS director charged after alleged transferring funds to gambling accounts

Byson James Kete Turner has been charged after allegedly transferring nearly $860,000 from an NDIS firm he directed to his online gambling accounts, including Sportsbet and TABTouch.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat9 hours ago

NewsBeat9 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat20 hours ago

NewsBeat20 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports8 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report