Crypto World

XRP Leads Altcoin Inflows While Bitcoin Investment Products Struggle

XRP leads year-to-date inflows with $109M, while Chainlink and Litecoin register modest gains.

Investors withdrew $187 million from digital asset products last week, but the pace of outflows has slowed significantly. Historically, these changes reveal crucial inflection points in investor sentiment.

CoinShares stated that the deceleration suggests that panic selling may be subsiding, which may imply that the market could be stabilizing and that a potential low point in crypto prices might be forming.

Altcoins Outshine Bitcoin

In its latest edition of Digital Asset Fund Flows Weekly Report, CoinShares revealed that the latest price correction pushed total assets under management (AuM) down to $129.8 billion, the lowest level since the announcement of US tariffs in March 2025, which also coincided with a local low in asset prices. Trading activity surged last week, which drove exchange-traded product (ETP) volumes to a record-breaking $63.1 billion.

This figure exceeded the previous peak of $56.4 billion recorded in October of the prior year. The strong activity indicates increased investor interest and momentum.

Investor sentiment was negative for Bitcoin, which experienced $264 million in outflows, alongside $11.6 million moving out of short positions. On the other hand, altcoins attracted fresh capital, as XRP led with $63.1 million, Solana $8.2 million, and Ethereum $5.3 million. XRP continues to dominate year-to-date inflows, recording $109 million. Chainlink and Litecoin saw more modest gains of $1.5 million and $1 million.

Additionally, multi-asset products raked in $9.3 million over the past week.

Outflows were concentrated in the US at $214 million, with Sweden at $135 million, and Australia at just $1.2 million. Despite this, other regions experienced meaningful inflows. For instance, Germany received $87.1 million, Switzerland $30.1 million, Canada $21.4 million, Brazil $16.7 million, and Hong Kong $6.8 million. The data highlights a mixed global picture.

You may also like:

Favorable ETFs and Macro Trends

Price weakness continues as Bitcoin slipped to $69,000 on Sunday and has hovered near that level into Monday. Despite this, Bitget CMO Ignacio Aguirre Franco said that the crypto asset has a path to the $150,000-$180,000 range this year if ETF flows stabilize and macro conditions improve. Ongoing Layer 2 development and growing DeFi activity strengthen Ethereum’s outlook, the exec said while predicting a potential target of $5,000-$6,000 with increased traditional finance participation. Franco added,

“Regulatory developments like the recent Clarity Bill and advancing market-structure legislation will also positively impact crypto markets by providing clearer compliance frameworks that reduce uncertainty and make these assets more attractive to institutions and traditional funds. As institutional capital finds easier entry points and global regulatory alignment improves, overall market stability and innovation are reinforced.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Hyperliquid beats Coinbase in 2025 notional trading volume

Hyperliquid, a decentralized perpetual futures exchange, has quietly overtaken Coinbase in total notional trading volume, marking a major shift in how crypto traders are choosing to trade.

Summary

- Hyperliquid recorded about $2.6T in notional trading volume in 2025.

- Coinbase posted roughly $1.4T over the same period.

- The gap reflects rising demand for on-chain derivatives platforms.

According to data shared on Feb. 10 by on-chain analytics platform Artemis, Hyperliquid processed about $2.6 trillion in notional trading volume in 2025. Coinbase, one of the world’s largest centralized exchanges, recorded around $1.4 trillion over the same period.

Despite Hyperliquid (HYPE) launching only a few years ago and running entirely on-chain, the numbers show that it handled almost twice Coinbase’s trading volume. The milestone has drawn attention across the crypto industry, especially as decentralized platforms continue to challenge traditional exchanges.

How hyperliquid built its lead

Hyperliquid primarily focuses on trading perpetual futures and derivatives on its proprietary Layer 1 blockchain. Active traders seeking quick execution, cheap fees, and direct access to on-chain liquidity have been drawn to it thanks to its focused approach.

The platform grew quickly throughout 2025. Daily trading occasionally increased to close to $30 billion, while monthly volumes frequently reached hundreds of billions of dollars. The total value locked increased toward $6 billion, while open interest peaked at about $16 billion.

User growth also accelerated. The platform’s active user base grew from about 300,000 to more than 1.4 million in a year, driven largely by word-of-mouth and product performance rather than heavy marketing.

Fees collected on Hyperliquid are partly used for HYPE token buybacks and burns. This model has helped support long-term interest in the ecosystem. As of early 2026, HYPE is up roughly 31.7% on the year and continues to draw increasing attention from traders.

Coinbase operates very differently. Its higher fees, stricter compliance requirements, and fully centralized model for spot and derivatives trading still make it a key entry point for retail users. However, professional traders are increasingly turning their focus toward alternatives that offer more flexibility and lower costs.

Coinbase stock is down about 27.0% so far this year, showing how much pressure traditional crypto companies are under in the current market slowdown.

What this shift means for crypto trading

The growing gap between Hyperliquid and Coinbase reflects a change in how users trade. On-chain platforms offer speed and transparency without requiring users to hand over custody, and more traders are getting comfortable using them.

With Hyperliquid, derivatives traders do not need to trust a central operator with their funds. Smart contracts are used to manage risk, and trades settle on-chain. Users who have been wary of exchanges in the past will find this appealing.

At the same time, Hyperliquid has placed a strong emphasis on user experience. Its user interface is similar to that of large centralized platforms, which makes it easier for new users to get started. Its growth has largely been attributed to this combination of usability and decentralization.

Momentum has also been boosted by recent developments. The platform is being used to test new products such as outcome-based contracts and limited-risk options. Notable industry figures, like Arthur Hayes, who recently increased the size of his own HYPE holdings, have also taken notice of it.

But there are still issues. Competition in decentralized derivatives is increasing, and regulators are paying more attention to on-chain trading activity. Aster and Lighter, two rivals, are also expanding their product lines.

Crypto World

ZachXBT Flags Phantom Chat Risk as 3.5 WBTC Is Stolen

TLDR:

- New Phantom Chat feature expands wallet social tools while unresolved address poisoning risks remain active.

- ZachXBT linked a recent 3.5 WBTC loss to spam transactions that copied trusted wallet address patterns.

- Address poisoning exploits wallet history displays and can mislead users during routine transfers.

- Social wallet features may increase exposure to scams if interface protections remain unchanged.

Phantom has announced plans to launch a new social feature called Phantom Chat in 2026. The update aims to transform the Solana wallet into a messaging and discussion hub.

Soon after the reveal, security concerns surfaced about unresolved wallet vulnerabilities. The warnings focus on address poisoning and the risk of user fund losses.

Phantom Chat feature raises address poisoning concerns

Wu Blockchain reported that Phantom unveiled Phantom Chat as part of its long-term product roadmap.

The wallet compared its vision to Telegram groups and X communities for crypto discussions. Mockup images showed emoji-based group chats designed for real-time interaction.

Phantom already introduced live chat features through its prediction markets integration with Kalshi in December 2025. The new roadmap suggests a broader move toward social tools inside the wallet. The platform currently serves more than 15 million users across its ecosystem.

On-chain investigator ZachXBT responded to the announcement, warning about unresolved address-poisoning risks. He stated that Phantom still does not filter spam transactions from user histories. This allows look-alike addresses to appear among legitimate transaction records.

According to ZachXBT, one user lost 3.5 WBTC last week after copying the wrong address from recent activity.

He traced the theft to a transaction created through spam records that mimicked the first characters of a trusted wallet address. He shared the wallet and transaction hashes publicly to document the incident.

Security risks emerge as Phantom expands wallet social tools

Address poisoning occurs when attackers send small transactions from deceptive addresses. These addresses resemble legitimate ones and appear in wallet histories. Users who copy them may unknowingly send funds to attackers.

ZachXBT argued that adding social features without fixing this issue could widen the attack surface.

He warned that chat-based activity could increase exposure to malicious links and fake addresses. His comments focused on user interface design rather than blockchain flaws.

Phantom’s announcement attracted heavy engagement from memecoin promoters and trading communities. Replies included promotional messages tied to new tokens and groups. This activity highlighted the potential for spam to blend with legitimate discussions.

Wu Blockchain noted that Phantom Chat positions the wallet as a crypto super app combining trading, social interaction, and market sentiment. The move follows a broader trend of wallets adding communication tools.

Security researchers have stressed that transaction filtering and address verification remain essential for user protection.

Crypto World

Ripple Expands Institutional Stack: Will XRP Price React?

Ripple has announced two new partnerships with Figment and Securosys to expand the capabilities of Ripple Custody, its institutional digital asset custody solution.

It is evident that Ripple is currently in an infrastructure arms race to perfect its payment, custody, and staking services for institutions. However, real-world adoption and price have yet to show signs of a breakthrough.

Sponsored

Sponsored

Ripple Expands Custody Offering With Figment and Securosys Partnerships

Ripple said the partnerships are designed to simplify procurement and support faster deployment of custody services for regulated institutions. The move comes shortly after Ripple expanded its custody stack through the acquisition of Palisade and the integration of Chainalysis’s compliance tools.

As part of the partnership with Figment, Ripple will introduce staking functionality. This will allow institutional clients to offer staking services without operating their own validator infrastructure.

The integration is aimed at banks, custodians, and regulated entities seeking exposure to Proof-of-Stake networks while maintaining institutional security and governance standards.

Through Figment’s infrastructure, Ripple Custody clients will be able to support staking on major networks such as Ethereum (ETH) and Solana (SOL).

“By combining Ripple’s enterprise‑grade custody technology with Figment’s secure, non‑custodial staking platform, we’re giving regulated institutions a way to offer staking rewards to their customers on several blockchain networks,” Ben Spiegelman, VP – Head of Partnerships & Corporate Development at Figment, stated.

Separately, Ripple has partnered with Securosys to strengthen the security layer of Ripple Custody. The collaboration adds support for CyberVault HSM and CloudHSM. This gives institutions the option to deploy HSM-based custody either on premises or in the cloud.

According to Ripple, the Securosys integration is designed to address long-standing challenges around HSM adoption. This includes cost, complexity, and slow procurement processes.

Sponsored

Sponsored

Ripple also noted that the addition of Securosys expands the range of supported HSM providers on its custody platform. This provides greater flexibility for institutions operating across multiple regulatory environments.

“By integrating our CyberVault HSM with Ripple Custody, institutions gain an out-of-the-box, enterprise-grade solution that can be deployed quickly, without added complexity, while retaining full control over their cryptographic keys,” Robert Rogenmoser, CEO of Securosys, remarked.

Institutional Focus Fails to Lift XRP as On-Chain Activity Cools

As Ripple continues to strengthen its institutional infrastructure, on-chain metrics from the XRP Ledger indicate that adoption remains moderate. According to data from DeFiLlama, XRPL’s total value locked declined from around $80 million in early January to approximately $49.6 million at press time, reflecting softer DeFi activity on the network.

Stablecoin data points to a similarly gradual pace. Based on DeFiLlama figures, the total stablecoin market capitalization on XRPL stands at roughly $415.85 million, suggesting steady but limited growth.

That said, much of Ripple’s institutional strategy is centered on custody, settlement, and permissioned financial use cases, which may not always be reflected in traditional DeFi metrics such as TVL.

Notably, so far, the expansion of institutional use cases has had a limited impact on XRP’s market performance.

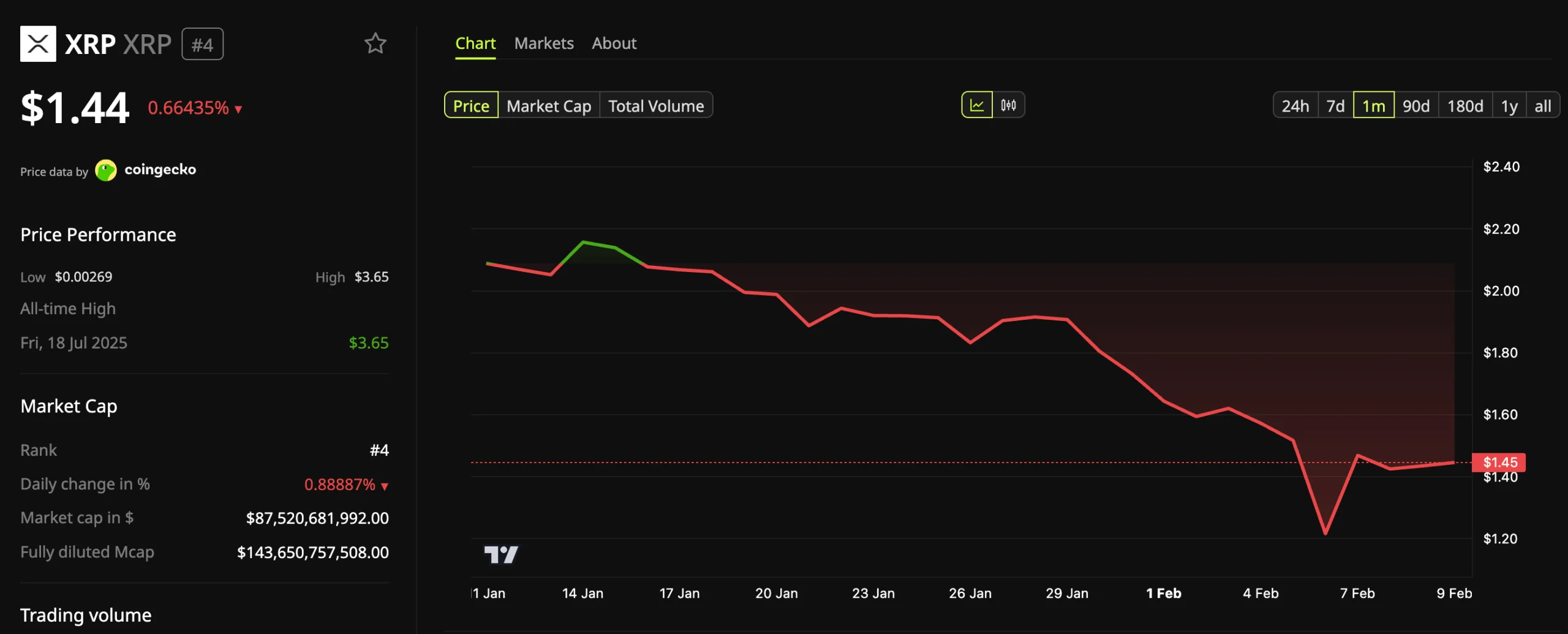

The asset is down nearly 32% over the past month, broadly tracking the wider market downturn. At the time of writing, XRP was trading at $1.44, down 0.66% over the past day.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

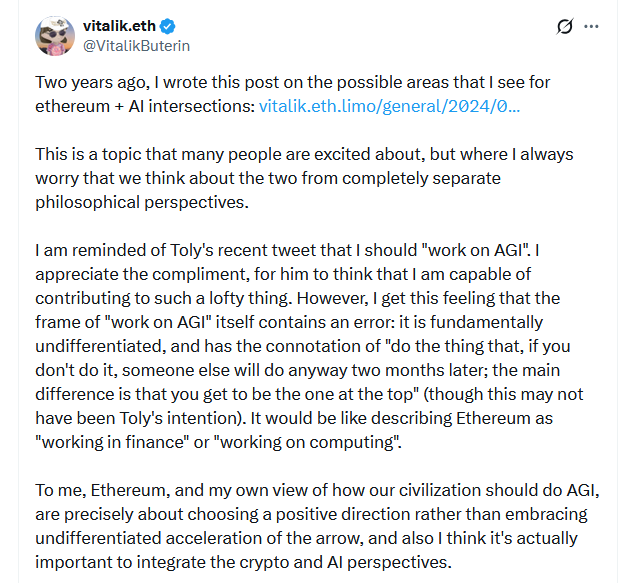

Ethereum co-founder Vitalik Buterin’s latest vision for Ethereum’s intersection with artificial intelligence sees the two working together to improve markets, financial safety and human agency.

In an X post on Monday, Buterin said his broader vision for the future of artificial intelligence (AI) sees humans being empowered by AI, rather than replaced, though he said the shorter term involves much more “ordinary” ideas.

Buterin pointed to four key areas where Ethereum and AI could intersect in the near future: enabling trustless and/or private interactions with AI, Ethereum becoming an economic layer for AI-to-AI interactions, using AI to fulfill the “mountain man” ideal by verifying everything onchain and improving market and governance efficiency.

Buterin argued that new tooling and integrations are required for AI use to be truly private, without leaking data or revealing personal identities.

Private data leaks by large language models (LLMs) have become an increasing area of concern since the rise of AI chatbots. Cointelegraph Magazine highlighted in an article last month that while ChatGPT can give you legal advice, your chat logs can be used against you in court.

He pointed to the need for tooling to support the use of LLMs locally on personal devices, utilizing zero-knowledge proofs to make API calls anonymously and improving cryptographic tech to verify work from AI, among other things.

Buterin also envisions AI becoming a user’s middleman to the blockchain, suggesting that AI agents could verify and audit every transaction, interact with decentralized apps and suggest transactions to users.

AI verification could be a major boon for crypto and other sectors, with increasingly sophisticated scammers on the rise. Address poisoning scams, just one attack vector, have seen a major uptick since December.

“Basically, take the vision that cypherpunk radicals have always dreamed of (don’t trust; verify everything), that has been nonviable in reality because humans are never actually going to verify all the code ourselves. Now, we can finally make that vision happen, with LLMs doing the hard part,” he said.

Adding to that, Buterin sees AI bots being able to “interact economically” to handle all onchain activity for users and make crypto much more accessible.

He said bots could be deployed to hire each other, handle API calls and make security deposits.

“Economies not for the sake of economies, but to enable more decentralized authority,” he said.

Related: Bitcoin miner Cango sells $305M BTC to cut leverage and fund AI pivot

Finally, Buterin thinks AI can enhance onchain governance and markets if LLMs are used to overcome the limits of human attention and decision-making capacity.

He said that while things like prediction markets and decentralized governance are “all beautiful in theory,” they are ultimately hampered by “limits to human attention and decision-making power.”

“LLMs remove that limitation, and massively scale human judgement. Hence, we can revisit all of those ideas,” he said.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

The Ethereum Foundation is sponsoring crypto security nonprofit Security Alliance (SEAL) to “track and neutralize” crypto drainers and other social engineering attackers targeting Ethereum users.

SEAL said on Monday that it launched the “Trillion Dollar Security” initiative with EF to support these efforts after reaching out to EF late last year about funding security engineers to more closely track drainer development and protect against wide-scale attacks.

The EF is now sponsoring a security engineer whose “sole mission” is to work with SEAL’s intelligence team to combat drainers targeting Ethereum users, said SEAL.

SEAL’s broader mission is to protect crypto market participants by providing collaborative tools for threat intelligence sharing and incident response while providing legal protection for its white-hat hackers.

“The Security Alliance has done important work to combat attacks and the ecosystem has benefited tremendously,” The Ethereum Foundation posted to X in response to SEAL’s announcement.

Phishing scammers and drainers often create fake websites or fraudulent emails that impersonate legitimate crypto protocols, tricking users into approving seemingly harmless wallet transactions that can result in the loss of funds.

Their tactics have become increasingly sophisticated over the years, prompting the need for improved detection and prevention mechanisms.

Crypto intelligence platform ScamSniffer estimates that these scammers have stolen nearly $1 billion in crypto over the years. However, efforts from SEAL and other crypto sleuths helped bring that tally down to $84 million in 2025, an all-time low.

Ethereum security dashboard launched to track progress

SEAL and the EF created a Trillion Dollar Security dashboard to track Ethereum’s security across six dimensions: user experience, smart contracts, infrastructure and cloud, consensus protocol, monitoring and incident response, social layer and governance.

Related: Crypto PACs secure massive war chests ahead of US midterms

Each dimension includes eight to 29 risk controls being closely monitored, along with identified “priority work” that must be addressed.

SEAL open to working with other crypto ecosystems

SEAL said the partnership with the EF is the first of many planned initiatives with other forward-thinking ecosystems, welcoming other crypto ecosystems to reach out:

“If your foundation or crypto ecosystem is interested in similar sponsorship opportunities, we’re happy to discuss how this model protects users at scale,” SEAL said.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Telegram Mini Apps Development on TON Network

Telegram is quietly transforming from a messaging app into a distribution platform for lightweight applications, games, and digital services. For enterprises watching user acquisition costs rise and app store competition intensify, Telegram mini apps represent a structural shift in how products reach audiences. The best part is that:

There are no installs

No app-store approvals

No onboarding friction

Therefore, users can conveniently access mini apps directly inside chats, often in one tap.

When combined with the TON blockchain, Telegram mini apps development can readily support payments, tokenized incentives, and ownership models, all inside a familiar interface. This is exactly the reason why these apps are no longer considered as experimental. They are becoming a serious growth channel.

To understand why, let’s examine some of the Telegram mini apps leading the TON ecosystem and what makes them successful from a business perspective.

Check Out TON Ecosystem’s Top 7 Telegram Mini Apps

1) Notcoin

Notcoin became one of the fastest-growing Telegram-native experiences by reducing gameplay to the simplest possible action that is just tapping. However, its success is not just about simplicity. Notcoin leveraged:

- Viral referral loops

- Social bragging rights

- Progress-based incentives

- Low cognitive load gameplay

It aligned perfectly with Telegram’s quick-interaction behavior. For businesses, the lesson is clear: Complex mechanics reduce adoption inside chat ecosystems.

2) Hamster Kombat

Hamster Kombat added humor, storytelling, and crypto rewards. It built a narrative-driven engagement model instead of just pure mechanics. It demonstrates that:

- Branding matters even in mini apps

- Identity-driven communities retain better

- Humor and culture drive sharing

For enterprises, this is a very clear indication that Telegram mini apps development can build brand affinity, not just usage. In this regard, if enterprises have a stricter time frame, they can launch a Hamster Combat clone script in just 7 days with the help of experts.

3) Catizen

Catizen combines community engagement with recurring reward cycles. It readily encourages habitual interaction. It proves that retention comes from:

- Community alignment

- Predictable reward schedules

- Social belonging

Hence, it is clear that Telegram mini apps can act as social ecosystems, not just tools. However, it is also possible to build a game like Catizen from scratch in 15 days when you seek the help of professional Telegram game developers.

4) Yescoin

Yescoin uses swipe-based interactions that feel natural in messaging contexts. Designing for Telegram means:

- One-handed interactions

- Short session times

- Instant feedback loops

This is worth noting here that it is UX strategy and not just design.

5) TapSwap

TapSwap introduced gamified token accumulation tied to user activity. Players respond strongly to visible progress and accumulation psychology. However, sustainability requires careful tokenomics, which happens to be a key lesson for enterprises planning to explore the field.

6) Tonkeeper Mini App Integrations

Wallet integrations like Tonkeeper show mini apps can deliver real financial utility. Utility apps build long-term value because they solve actual problems. It needs to be kept in mind that not every Telegram mini app needs to be a game. Financial tools and service apps are equally viable.

7) Fragment

Fragment enables buying and selling Telegram usernames and collectibles on TON. This shows Telegram mini apps can power real marketplaces with:

- Verified ownership

- Scarcity mechanics

- On-chain transactions

This is where mini apps cross into digital commerce infrastructure and opens up opportunities for businesses.

What Businesses Should Notice

The real takeaway for businesses is not the apps themselves. However, it is essential to note the patterns:

✔ Frictionless onboarding

✔ Native distribution

✔ Social virality

✔ Micro-session engagement

✔ Incentivized retention

✔ Integrated payments

Telegram mini apps succeed because they align with user behavior, not because they are Web3.

Want to Build Telegram Mini Apps in the TON Ecosystem?

Telegram Mini Apps & TON Ecosystem — By the Numbers

900M+ Monthly Active Users on Telegram

Telegram’s massive global user base gives mini-apps instant distribution without app-store dependency.

30%+ of Mobile Engagement Happens in Messaging Apps

Messaging platforms are now primary digital environments, making in-chat apps highly discoverable and frequently used.

120%+ Year-Over-Year Growth in TON Transactions

TON’s transaction growth reflects rising adoption and real economic activity across mini-apps and wallets.

Why TON Makes Telegram Mini Apps Viable

TON is not just a blockchain attached to Telegram; it is a purpose-built infrastructure designed to support high-frequency, low-friction digital interactions at scale.

For enterprises evaluating Telegram mini apps as business channels, the viability of the underlying blockchain is critical. Slow, expensive, or congested networks kill user experience quickly.

However, TON addresses this in several ways:

1. High Throughput for Micro-Transactions

Telegram mini apps often rely on small, frequent user actions, like reward claims, token distributions, in-app purchases, and micro-payments. TON’s architecture supports high transaction volumes with minimal latency, making it practical for real-time mini app interactions. For businesses, this ensures smoother user journeys and fewer drop-offs due to delays.

2. Low Transaction Costs

User-facing apps cannot survive on high gas fees. TON’s low-cost transaction model enables sustainable reward systems and micro-economies.

This is especially important for:

- Tap-to-earn models

- Reward distribution

- In-app asset transfers

- Marketplace transactions

Low fees allow businesses to experiment without burning capital on infrastructure costs.

3. Native Telegram Integration

TON is tightly aligned with Telegram’s ecosystem. Wallets, usernames, and mini app interactions can be linked seamlessly. This, in turn, reduces onboarding friction, which happens to be one of the biggest barriers in Web3 adoption. Here users do not feel like they are “entering crypto.” They simply feel like they are using a feature. For enterprises, this means faster adoption and lower user education costs.

4. Scalable Architecture

TON’s sharding design enables horizontal scalability. As user demand grows, the network can handle more load without congestion spikes. This matters because Telegram mini apps can scale rapidly overnight. A viral app can jump from thousands to millions of users quickly. Infrastructure that cannot scale becomes a liability.

5. Built-In Asset Logic

TON supports token creation, NFTs, and digital asset management natively. This allows businesses to design reward systems and ownership layers without building custom infrastructure from scratch. This shortens Telegram mini app development timelines and reduces technical risk.

Business Benefits for Early Movers

Timing plays a major role in emerging ecosystems. Telegram mini apps are still in a growth phase, which creates strategic advantages for early entrants.

1. Lower Competition for Attention

As the ecosystem matures, user attention becomes expensive. Early movers benefit from less crowded discovery environments and higher visibility.

This translates to:

- Faster user acquisition

- Lower marketing spend

- Higher organic reach

2. First Access to Community Loyalty

Users who adopt early platforms often develop stronger loyalty. They associate their early experiences with the brand or ecosystem that introduced them.

For businesses, this creates:

- Long-term retention

- Stronger community identity

- Higher lifetime value per user

3. Data & Learning Advantage

Early projects gain valuable behavioral data, such as what works, what retains users, what monetizes. Late entrants must rely on assumptions. Early movers rely on insights. This data advantage compounds over time.

4. Partnership & Ecosystem Opportunities

Early builders often secure stronger partnerships within the ecosystem, like wallets, marketplaces, other mini apps, and cross-promotions. Once the space matures, these partnerships become harder to secure.

5. Category Leadership Positioning

Brands that enter early often become synonymous with the category itself. This positioning is hard to replicate later. Being “one of the first” often leads to being “one of the biggest.”

Wish to Explore the Benefits of Launching Telegram Mini Apps in the TON Ecosystem?

The Hidden Complexity

From the outside, Telegram mini apps appear lightweight. However, building scalable, secure, and sustainable mini apps requires serious engineering. This is where a number of projects tend to fail.

1. Backend Infrastructure

Mini apps still require reliable servers, databases, and APIs. Handling spikes in user activity requires cloud architecture that can auto-scale. Without this, apps crash during viral growth.

2. TON Smart Contract Design

Smart contracts must be secure and efficient. Poorly designed contracts can lead to exploits, fund loss, or frozen assets. Auditing and optimization are critical.

3. Tokenomics & Reward Logic

Designing reward systems that retain users without inflating value is complex. Many mini apps fail because their token economies collapse. Economic modeling is not optional, it’s foundational.

4. Anti-Bot & Anti-Exploit Systems

Tap-to-earn and reward-based systems attract bots. Without anti-abuse mechanisms, economies break quickly. Enterprises must invest in fraud detection and behavioral monitoring.

5. UX Simplicity with Technical Depth

Mini apps must feel simple while hiding complex infrastructure. Balancing UX and blockchain logic during Telegram mini apps development is a design challenge. Users expect instant responses and zero friction.

6. Security & Compliance

Handling wallets and digital assets introduces security responsibilities. Enterprises must consider:

- Smart contract audits

- Secure wallet flows

- Regulatory awareness

Security lapses destroy trust very quickly.

Strategic Takeaway

Telegram mini apps might look easy to build. However, they are not easy to scale or sustain. The difference between a viral hit and a short-lived experiment often lies in architecture, economy design, and security readiness. This is exactly the reason why experienced Telegram mini app developers matter.

Why the Right Development Partner Matters

Successful Telegram mini apps blend:

- UX design

- Game psychology

- Blockchain logic

- Infrastructure scalability

- Economic modeling

This is multidisciplinary and a capable Telegram game development company rightly understands how these layers interact.

Antier works with startups and enterprises to build Telegram mini apps and TON-powered games that are designed for real adoption. This includes:

- Mini game design

- TON smart contract development

- Token and reward systems

- Scalable architecture

- Security-first development

It is to be kept in mind that in Telegram ecosystems, scale can happen overnight and only well-architected systems survive rapid growth.

Final Thoughts

Telegram mini apps are evolving into a major distribution channel where gaming, finance, and community intersect. They reduce friction, shorten adoption cycles, and enable creative monetization. The opportunity is real. However, success depends on execution. Businesses entering the field now are not chasing trends. Their focus is on positioning themselves in a new app ecosystem forming inside Telegram. Antier, with its sheer level of expertise as a Telegram game development company, helps businesses build scalable mini apps that not only sustain but also deliver the intended results.

Frequently Asked Questions

01. What are Telegram mini apps and how do they differ from traditional apps?

Telegram mini apps are lightweight applications that can be accessed directly within chats without the need for installations, app-store approvals, or onboarding friction, making them more convenient for users.

02. How do Telegram mini apps leverage the TON blockchain?

Telegram mini apps can utilize the TON blockchain to support payments, tokenized incentives, and ownership models, all within the familiar Telegram interface, enhancing user engagement and monetization.

03. What are some key factors that contribute to the success of Telegram mini apps?

Successful Telegram mini apps often incorporate elements like simplicity in gameplay, community engagement, branding, humor, and predictable reward systems, which align with user behavior and enhance retention.

Crypto World

The Role of AI Chatbots in Modern HR Process Automation

Human Resources has evolved from an administrative function into a strategic driver of organizational performance. Yet, despite this shift, many HR teams remain burdened by manual processes, fragmented systems, and reactive workflows that do not scale with modern workforce demands. As organizations grow across geographies, compliance frameworks, and talent models, the complexity of HR operations increases exponentially. Traditional HR automation tools, built on rigid workflows and static portals, fail to deliver the responsiveness and intelligence required today.

This is where AI chatbots in HR are redefining how organizations automate, scale, and modernize HR operations. By partnering with an experienced AI Chatbot Development Company, enterprises can implement conversational interfaces powered by artificial intelligence to unlock a new era of HR process automation – one that is proactive, context-aware, and deeply integrated into core business systems.

The Limitations of Traditional HR Automation Systems

Before understanding the impact of AI chatbots, it is critical to examine why legacy HR automation approaches fall short.

Key Challenges in Traditional HR Operations

- HR systems operate in silos (HRMS, ATS, payroll, compliance tools)

- Employees struggle to navigate complex portals for simple queries

- Most HR workflows rely on email-based approvals

- Policy interpretation remains manual and inconsistent

- HR teams spend the majority of their time on repetitive support tasks

Despite digitization, HR remains process-heavy but intelligence-light. Automation exists, but decision-making and interpretation still require human intervention. This operational gap has created the need for HR automation using AI, where systems can understand, decide, and act without constant manual oversight.

How AI Chatbots Enable HR Workflow Automation at Enterprise Scale

Unlike traditional rule-based systems that rely on fixed keywords, modern AI chatbots are built to understand how employees naturally communicate. Powered by advanced language intelligence and enterprise integrations, they play an active role in automating HR operations rather than simply responding to queries.

Key Differentiators of AI Chatbots in HR

- Intent-based understanding, not keyword matching

AI chatbots use Natural Language Processing to accurately interpret employee intent even when questions are informal, incomplete, or phrased differently. - Context-aware conversations

By retaining conversation history and employee context such as role, location, and policy eligibility, chatbots deliver consistent and personalized responses without repetition. - Direct integration with HR systems

AI chatbots connect seamlessly with HRMS, payroll, ATS, and compliance platforms to retrieve real-time data and perform actions securely. - Built-in workflow execution

Beyond answering questions, chatbots can initiate and complete HR workflows, including leave applications, approvals, and record updates. - Active participation in HR operations

These capabilities allow AI chatbots to move beyond static FAQs and function as intelligent, action-driven components of end-to-end HR process automation.

Together, these capabilities form the intelligence layer that differentiates AI-powered HR solutions from traditional, rule-based HR software.

AI Chatbots for Employee Self-Service: Redefining HR Accessibility

One of the most impactful and widely adopted use cases of AI chatbots in HR is employee self-service automation. As organizations scale, HR teams are increasingly overwhelmed by repetitive, high-volume queries that do not require human intervention but still consume significant time and resources.

The Employee Experience Challenge

Employees regularly reach out to HR for routine requests such as:

- Leave balances and approval status

- HR policy explanations and clarifications

- Payroll and salary-related questions

- Benefits eligibility and coverage details

- Tax documents and compliance information

While these queries are essential, they are largely repetitive and manual, leading to slower response times, employee frustration, and reduced HR productivity.

How AI Chatbots Enable Self-Service at Scale

When integrated with core HRMS and payroll systems, AI chatbots for employee self-service can:

- Securely authenticate employees

- Retrieve real-time, role-specific HR data

- Interpret policies contextually based on eligibility

- Deliver instant, conversational responses

This approach significantly reduces dependency on HR support tickets while ensuring employees receive accurate, consistent, and timely information—anytime they need it.

HR Workflow Automation Using AI Chatbots

The true power of AI chatbots lies in their ability to execute HR workflows, not just provide information.

Examples of Automated HR Workflows

- Leave requests and approvals

- Attendance regularization

- Shift and roster management

- Policy acknowledgment tracking

- Employee exit and clearance processes

How Workflow Automation Works

Instead of navigating forms or sending emails, employees interact naturally:

Employee: “Apply for three days of leave starting Monday.”

AI Chatbot:

- Validates leave balance

- Checks policy rules

- Routes approval to the manager

- Updates HRMS automatically

This is HR workflow automation driven by conversation, fast, accurate, and scalable.

AI Chatbots for Recruitment: Automating Talent Acquisition at Scale

Recruitment is one of the most resource-intensive HR functions, making it an ideal candidate for automation.

AI Chatbots for Recruitment and Candidate Engagement

AI chatbots assist recruitment teams by:

- Engaging candidates 24/7

- Answering role-specific queries

- Screening candidates based on predefined criteria

- Scheduling interviews automatically

- Sending follow-ups and reminders

This improves both recruiter efficiency and candidate experience.

Intelligent Candidate Screening

Chatbots can evaluate:

- Skill relevance

- Experience thresholds

- Availability and location preferences

- Role alignment

By automating early-stage screening, recruiters focus on high-quality candidates instead of manual filtering.

AI Chatbots for Onboarding: Accelerating Time-to-Productivity

Once a candidate is hired, onboarding becomes the next critical HR challenge.

How AI Chatbots Improve Onboarding

AI chatbots guide new employees through:

- Document submission and verification

- Policy walkthroughs

- IT and access requests

- Training module assignments

- First-week task coordination

This structured, guided onboarding experience improves retention, engagement, and early productivity.

Payroll and HR Compliance Automation with AI Chatbots

Payroll and compliance processes involve high risk, strict regulations, and minimal tolerance for errors.

1. Payroll Automation Use Cases

AI chatbots can:

- Explain salary structures

- Break down tax deductions

- Track reimbursements

- Answer bonus and incentive queries

2. HR Compliance Automation

Chatbots assist with:

- Labor law interpretation

- Location-specific compliance rules

- Policy enforcement consistency

- Audit-ready interaction logs

This enables payroll and HR compliance automation with reduced manual dependency and lower risk exposure.

AI Chatbots for Internal HR Support and Knowledge Management

HR knowledge often exists in scattered formats, such as PDFs, intranets, shared drives, and emails.

Centralized HR Knowledge Access

AI chatbots for internal HR support act as a unified interface that:

- Retrieves policy documents instantly

- Interprets complex policy queries

- Escalates sensitive issues appropriately

- Provides role-specific guidance to managers and employees

This transforms HR from a reactive support function into a structured, intelligent service layer.

Enterprise Architecture for AI-Powered HR Solutions

Enterprise-grade HR chatbots require a robust technical foundation.

Key Components:

- Conversational AI and LLMs

- Secure HR data retrieval (RAG pipelines)

- HRMS, ATS, and payroll integrations

- Workflow orchestration engines

- Role-based access control (RBAC)

- Compliance logging and audit trails

Because of this complexity, most enterprises partner with an experienced AI Chatbot Development Company to design, build, and maintain these systems.

Data Privacy, Security, and Compliance Considerations

HR data includes sensitive personal and financial information. Any AI-driven HR system must prioritize security.

Best Practices

- End-to-end data encryption

- On-premises or private cloud deployment

- Zero data retention for AI models

- Access control by role and hierarchy

- Compliance with GDPR and regional labor laws

Without these safeguards, HR automation introduces operational risk.

The New Standard for HR Operations

As workforce structures grow more complex and distributed, organizations must move beyond basic digitization and embrace intelligent, AI-driven automation. AI chatbots are no longer optional add-ons; they are becoming the backbone of modern HR operations and a core component of enterprise HR workflow automation solutions. By enabling employee self-service, automating recruitment and onboarding, streamlining payroll and compliance, and strengthening internal HR support, AI chatbots deliver faster execution, consistent governance, and significantly improved employee experiences. The future of HR belongs to organizations that invest early in scalable, secure, and AI-powered HR solutions, setting new benchmarks for efficiency, agility, and workforce engagement.

Antier empowers enterprises to build next-gen AI-driven HR ecosystems as a trusted AI Chatbot Development Company, delivering secure, enterprise-grade chatbot solutions tailored for complex HR environments. With deep expertise in AI, automation, and system integration, Antier helps organizations transform HR into a strategic, future-ready function.

Frequently Asked Questions

01. How have HR operations evolved in recent years?

HR operations have shifted from being purely administrative to becoming a strategic driver of organizational performance, although many teams still face challenges with manual processes and fragmented systems.

02. What are the limitations of traditional HR automation systems?

Traditional HR automation systems often operate in silos, require manual intervention for decision-making, and rely on outdated workflows, making them less responsive to modern workforce demands.

03. How do AI chatbots improve HR workflow automation?

AI chatbots enhance HR workflow automation by using Natural Language Processing to understand employee intent, enabling proactive and context-aware interactions that streamline HR operations.

Crypto World

Polymarket sues Massachusetts over prediction market rules

Polymarket has taken legal action against Massachusetts officials, seeking to block the state from restricting its prediction markets.

Summary

- Polymarket sued Massachusetts officials after a court ruling against rival Kalshi.

- The platform says federal CFTC rules override state gambling laws.

- The case could shape how prediction markets operate across the U.S.

The move comes as U.S. regulators and courts step up scrutiny of platforms that allow users to trade on real-world events, especially in sports.

On Feb. 10, Polymarket filed a lawsuit in federal court against Massachusetts Attorney General Andrea Campbell and state gaming regulators. The company said the threat of enforcement is “immediate and concrete,” following a recent ruling against rival platform Kalshi.

According to Polymarket, state intervention would disrupt its national operations, fragment its user base, and force it to choose between federal compliance and state restrictions. The company argues that its markets fall under federal oversight and should not be treated as local gambling products.

Federal authority vs. state gambling laws

At the center of the case is a dispute over who has the right to regulate prediction markets.

Polymarket says its event contracts are governed by the Commodity Futures Trading Commission. Under federal law, the CFTC oversees derivatives and futures markets, including certain types of prediction products. The company claims this authority overrides state-level gambling rules.

In its complaint, Polymarket pointed to comments made on Jan. 29 by CFTC Chairman Michael Selig, who said the agency would re-assess how it handles cases testing its jurisdiction. Shortly after, the CFTC filed an amicus brief in a related lawsuit involving Crypto.com.

Massachusetts courts have taken a different view. Last week, a state judge refused to pause a ban on Kalshi’s sports contracts, ruling that the platform must follow state gaming laws. The judge said Congress did not intend federal regulation to replace traditional state powers over gambling.

Kalshi has appealed the decision but was denied a stay. The ruling requires the company to block Massachusetts users from sports markets within 30 days.A federal judge in Nevada also recently denied Coinbase’s request for protection from a similar enforcement action, adding to the legal pressure on prediction platforms.

Robinhood, which partners with Kalshi, is now seeking its own injunction in Massachusetts to avoid state licensing requirements.

Growing pressure on prediction platforms

Polymarket’s lawsuit reflects wider tensions between fast-growing prediction markets and state regulators.

In a statement posted on social media, Polymarket chief legal officer Neal Kumar said the company is fighting “for the users.” He argued that state officials are racing to shut down innovation and ignoring federal law.

He added that Massachusetts and Nevada risk missing an opportunity to support new market models that blend finance, data, and public forecasting. State officials have so far declined to comment on the lawsuit.

The case arrives as prediction markets gain mainstream attention. Jump Trading recently made investments in Polymarket and Kalshi, two platforms that have garnered institutional support. According to recent funding rounds, Polymarket is valued at approximately $9 billion.

Supporters claim that by enabling users to trade on economic, sports, and election data, these markets enhance price discovery and public insight. Many contracts, according to critics, resemble unlicensed gambling and may put users at risk.

If Polymarket succeeds, it could limit the ability of states to regulate prediction markets and strengthen the CFTC’s role nationwide. A loss, however, may encourage more states to impose licensing rules or bans.

Crypto World

Chainlink CEO Says On-Chain RWAs Are Reshaping Crypto Market Structure

TLDR:

- On-chain RWAs continue expanding despite crypto price swings, showing independence from speculative market cycles.

- Institutional data providers now supply pricing and reserve data to support tokenized asset markets.

- Blockchain connectivity systems are becoming essential for linking financial infrastructure with on-chain trading.

- Orchestration tools now manage cross-chain workflows, data feeds, and privacy for complex RWA applications.

The current crypto market cycle is revealing signs of structural change rather than financial stress. Industry data shows fewer systemic failures compared with previous downturns.

At the same time, real-world assets are steadily moving onto blockchains. These developments suggest a shift in how value forms across digital markets.

On-chain RWAs reshape crypto market structure

Recent commentary from Chainlink co-founder Sergey Nazarov highlighted the absence of major institutional collapses during recent price drawdowns. He contrasted this with past cycles that saw large failures among centralized lenders and exchanges.

According to Nazarov, the industry now shows stronger risk controls and infrastructure resilience.

He also pointed to continued growth in on-chain RWAs despite volatile crypto prices. Tokenized commodities and financial instruments have expanded across decentralized platforms. This trend indicates that RWA adoption operates independently from short-term crypto market movements.

Data feeds and proof mechanisms now support on-chain trading for assets such as silver and tokenized funds.

Nazarov noted that on-chain perpetual markets for traditional commodities rival activity seen in permissioned financial venues. These markets rely on transparent pricing and continuous settlement.

The shift has attracted attention from established data providers.

Chainlink confirmed integrations with institutions, including S&P and ICE, to support pricing and reserve verification for RWAs. These integrations aim to standardize how off-chain financial data enters blockchain systems.

Infrastructure demand grows with institutional adoption of on-chain RWAs

Nazarov identified connectivity as a central requirement for scaling RWA markets.

Blockchain networks must link with accounting systems, payment rails, and risk management platforms. Chainlink’s interoperability tools have been selected by several Web3 security teams due to their operational track record.

He also emphasized orchestration as a technical layer coordinating multiple systems in one transaction flow. This includes cross-chain operations, off-chain data feeds, and automated settlement processes.

Chainlink’s Runtime Environment currently supports these workflows for enterprise applications.

Privacy features are also becoming critical for advanced RWA use cases. Nazarov stated that new orchestration tools aim to combine data transparency with confidential execution. These features target institutions that require regulatory compliance and internal controls.

According to Nazarov’s assessment, on-chain RWAs may eventually exceed cryptocurrencies in total on-chain value.

He described this shift as a transition from speculative markets to functional financial infrastructure. The growth of tokenized assets would still support crypto liquidity by bringing more capital onto blockchains.

Crypto World

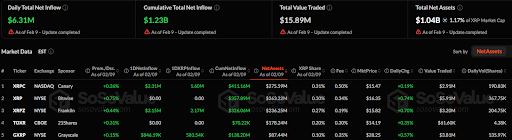

XRP ETFs See $6.31 Million in Daily Inflows as XRPC, GXRP, and XRPZ Excel

TLDR

- XRP ETFs total daily net inflows of $6.31M with a cumulative net inflow of $1.23B as of February 9.

- The XRPC ETF on NASDAQ reports a $2.31M daily inflow, holding net assets of $275.59M.

- GXRP ETF on NYSE has daily inflows of $846.19K, with net assets of $87.44M.

- The Franklin XRPZ ETF sees a daily inflow of $3.15M and holds $236.25M in assets.

- TOXR and Bitwise XRP ETFs report no daily inflows or outflows, maintaining minimal changes.

According to a recent SoSoValue update as of February 9, the total daily net inflow for XRP ETFs stands at $6.31 million, with a cumulative net inflow of $1.23 billion. The total value traded on this day is recorded at $15.89 million.

XRP ETFs See Inflows Across XRPC, GXRP, and XRPZ

The XRP ETF products on various exchanges have reported varying levels of performance. A deep dive on the individual ETFs reveals that the XRPC ETF on NASDAQ, managed by Canary, shows a premium of +0.26%. The daily net inflow for this ETF amounts to $2.31 million, with a cumulative inflow of $411.16 million. It holds net assets of $275.59 million, equating to a 0.31% share of the total XRP market cap.

The GXRP ETF, also on the NYSE and managed by Grayscale, reports a daily inflow of $846.19K. GXRP holds the lowest net assets at $87.44 million, which represents 0.10% of XRP’s total market cap. The market price of this ETF is $28.25, with a daily change of +0.57%.

The Franklin XRPZ ETF, listed on the NYSE, has a daily inflow of $3.15 million. It currently holds $236.25 million in net assets, representing a 0.27% XRP share. Its market price stands at $15.82, with a daily increase of +0.70%.

TOXR and XRP ETFs Record No Inflow or Outflow

The TOXR ETF, trading on CBOE under the 21Shares sponsor, reports no change in daily flow with a cumulative net inflow of $70.22K. With net assets of $178.24 million, it has a minimal XRP share of 0.20%. The ETF shows a market price of $14.19, with a daily change of +0.35%.

On the NYSE, the Bitwise XRP ETF has gained a premium of +0.75%, with no changes in daily inflow and a cumulative net inflow of $357.89 million. This XRP ETF holds net assets of $263.22 million and a 0.30% XRP share. Its market price is $16.35, with a daily change of +0.74%.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat9 hours ago

NewsBeat9 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat20 hours ago

NewsBeat20 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports8 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report