Crypto World

Why the $60K-$62K Zone Is Make or Break

Bitcoin has entered a highly sensitive phase after an aggressive downside continuation. The recent sell-off has pushed it into a historically reactive demand region of $60K, while broader risk sentiment remains fragile. The market is approaching a juncture where technical structure, higher-timeframe demand, and on-chain liquidity dynamics converge, making the coming sessions critical for short- to mid-term direction.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin remains structurally bearish, as the price has been printing major lower highs and has reached the channel’s lower boundary. The recent sell-off also resulted in a clear breach of the prior major daily low around $75K, confirming a breakdown in market structure and triggering forced liquidation flows.

However, once the asset reached the $60K–$62K demand zone, selling pressure decelerated sharply. This area has historically acted as a high-interest accumulation region, and the latest reaction reinforces its relevance. Since tapping this zone, Bitcoin has managed to recover toward the $69K–$70K region, but the rebound has lacked momentum and follow-through.

The daily chart now reflects balance rather than trend. Sellers are no longer pressing prices lower aggressively, yet buyers are also unable to reclaim the former support at $75K–$77K, which has now transitioned into a clear supply zone. As long as Bitcoin remains capped below that area, the broader daily bias stays cautious, with consolidation favored over continuation.

BTC/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, it is evident that the price has rebounded from the $60K threshold, and is now oscillating around $69K–$70K. The character of price action has shifted from impulsive candles to overlapping ranges, signaling exhaustion on the sell side.

The channel’s mid trendline is considered the main supply range near the $73K area, while the internal resistance around the $70K consistently rejects upside attempts. On the downside, demand remains clearly defined between $60K and $62K, where buyers previously stepped in with conviction.

This creates a compressed environment where Bitcoin is effectively boxed between a rising demand floor and a descending resistance ceiling. Until price either loses the $60K–$62K support or reclaims $75K with strength, the most probable outcome remains range-bound price action rather than a directional move.

Sentiment Analysis

Bitcoin has now reached the realized price of the 18-month to 2-year holder cohort, placing this group in a breakeven state. This level, located around the $60K range, is particularly important because it often acts as a behavioral inflection point, where holders are more likely to either defend their cost basis or exit positions if confidence weakens.

From an on-chain perspective, this realized price currently functions as a key support zone. If buying pressure absorbs supply at this level, the market is likely to stabilize and transition into a consolidation phase. However, failure to hold this area could trigger additional sell pressure as this cohort moves into a loss.

On the upside, the realized price of the 12-month to 18-month cohort around $85K-$90K now represents a clear resistance, as these holders are underwater and may sell into any relief rally. Overall, Bitcoin is trading at a critical equilibrium zone where consolidation is favored unless a decisive break occurs in either direction.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Why is Hybrid tokenization model gaining traction in 2026?

Tokenization has rapidly evolved from a niche blockchain experiment into a strategic enabler for enterprises seeking greater liquidity, operational efficiency, and transparency across asset classes. However, as enterprises move beyond proof-of-concept initiatives, it has become increasingly clear that early, fully on-chain tokenization models are not designed to meet real-world enterprise requirements.

Enterprises operate within complex ecosystems defined by regulatory oversight, data privacy mandates, legacy infrastructure, and multi-jurisdictional compliance obligations. While public blockchain networks offer decentralization and transparency, they often lack the governance controls enterprises require. Conversely, fully private systems limit interoperability and long-term scalability.

This gap is being decisively filled by hybrid tokenization, a pragmatic and future-ready framework that blends blockchain innovation with enterprise-grade control. Hybrid models are emerging as the preferred foundation for enterprise asset tokenization, enabling organizations to unlock tokenized value without compromising compliance, privacy, or operational stability.

What Is Enterprise Asset Tokenization and Why Are Enterprises Re-Evaluating Tokenization Models in 2026?

Enterprise asset tokenization is the practice of using tokens built on blockchain technology to digitally represent ownership, rights and economic value of an enterprise’s asset[s] while embedding the governance, compliance, and operational controls that large organizations require.

Assets that can be tokenized include but are not limited to financial securities; portfolios of real estate; interests in private equity; commodities; infrastructure-related assets; intellectual property; and instruments for sharing revenue.

Numerous large structural shifts are influencing how organizations view and approach the tokenization of their assets:

- The regulatory landscape has matured. As such, regulators are now requiring that asset tokenization projects be auditable and provide investor protection through jurisdictional enforcement rather than being experimental efforts.

- Institutional participation has increased in the tokenization of assets. Institutional investors are establishing higher standards for how organizations should protect the confidentiality of their data, accurately report their results and mitigate risk.

- There has been an expansion of operational scale; enterprises have progressed from conducting small pilots of tokenizing their assets to developing and implementing broad-based strategies for tokenizing multiple types of assets in multiple markets.

- Enterprises can no longer avoid integrating their legacy systems and other operational platforms into their tokenization platforms. Tokenizing assets and developing tokenized asset-based products will require seamless integration between the tokenization platform and legacy ERP systems, the provider of custodial services, banks, and systems for complying with regulations.

These developments are causing organizations to rethink their evaluation of enterprise tokenization models by prioritizing those models that align with how they operate on a day-to-day basis rather than those that require organizations to alter their methods of operation.

Evaluate whether Hybrid Tokenization fits your Enterprise Roadmap

What Is a Hybrid Tokenization Model?

A hybrid tokenization model is an architectural approach that strategically distributes tokenization functions across blockchain networks and off-chain enterprise systems. Instead of forcing all processes onto a decentralized ledger, hybrid models apply blockchain selectively—where it delivers the greatest value—while retaining centralized control where required.

The following three components are integral to the hybrid tokenization architectural:

- A blockchain layer for token issuance, ownership tracking, and transaction immutability

- An off-chain enterprise layer for compliance, identity management, legal documentation, and sensitive data

- Middleware that synchronizes on-chain events with off-chain business logic and enterprise workflows

The Hybrid Tokenization Models provide a method for Enterprises to maximize the use of Blockchain technology while minimizing their exposure to regulatory and operational risks.

How Hybrid Tokenization Architecture Combines On-Chain and Off-Chain Tokenization

The success of tokenization of hybrid assets is dependent upon how well the on-chain and off-chain tokenization functions are coordinated. Each layer has been specifically designed to carry out the operations that will work most effectively in that environment.

1. On-chain Tokenization Layer

The on-chain tokenization layer has responsibility for activities that can be carried out in a decentralized, immutable, and automated manner:

- Issuing Tokens and Managing Their Life Cycle

Tokens will be generated on chain as a method of providing a cryptographic proof of ownership of the asset they represent. When life cycle events occur (minting, burning, freezing, or unlocking tokens), they are executed in an open and transparent manner to ensure that the integrity of the asset is maintained.

- Records of Transfer of Ownership

All transfers of the token from one holder to another will be recorded on the blockchain, resulting in an unalterable record of who owns an asset. The result is a reliable record for enterprises, investors & regulators to rely upon to establish provenance of the asset and validate any corresponding transactions.

Smart contracts provide an automated means of enforcing all contractual obligations (e.g., transfer restrictions, vesting schedules, dividend distributions, redemption of asset rights). As a result of using smart contract execution, manual interventions can be reduced, reducing the likelihood of operational errors. All contractual obligations will be consistently enforced.

Auditability in real time is possible due to the recordkeeping of the blockchain. Regulators and internal compliance departments can verify the validity of transactions with no reliance on reconciled reports, thereby creating far greater trust and transparency with all parties involved.

2. Off-chain enterprise layer

The off-chain layer provides functionality that requires privacy, flexibility, and regulatory discretion.

- KYC/AML Verification & Investor Accreditation

Identity verification in different jurisdictions has different processes and is continuously changing. By managing these workflows off-chain, businesses can quickly adapt their compliance logic to accommodate changing regulations and apply eligibility checks before participating on-chain.

- Legal Agreements & Contractual Governance

Ownership of assets is determined by legal documentation (prospectuses, shareholder agreements, and regulatory filings). Off-chain storage of these documents provides the ability to keep them updated and still be cryptographically linked to the on-chain token.

- Asset Valuation, Reporting, and Metadata Management

Many types of assets will need to be valued periodically, sometimes using third-party data feeds or human intervention. An off-chain system can facilitate accurate financial reporting and mitigate the risk of unnecessary oracle dependency.

- Integration to Enterprise Systems

Hybrid architectures facilitate the integration of ERP systems, accounting packages, custodial services and banking infrastructure. This enables tokenization to build on existing operations and not disrupt them.

Tokenization Models Comparison: Public, Private, and Hybrid Enterprise Tokenization Models

A comprehensive tokenization models comparison highlights why hybrid approaches are increasingly favored by enterprises.

Public tokenization models

Public models operate entirely on open blockchains, offering transparency and composability. However, they present challenges such as:

- Exposure of sensitive transaction data

- Limited jurisdictional enforcement capabilities

- Unpredictable transaction costs and network congestion

- Governance dependency on public network consensus

While suitable for open ecosystems, public-only models struggle to meet enterprise governance and compliance standards.

Private tokenization models

Private models emphasize control and confidentiality but introduce other limitations:

- Restricted interoperability and liquidity

- Heavy reliance on centralized administrators

- Limited external auditability

- Reduced long-term flexibility

These constraints can hinder scalability and investor confidence.

Hybrid enterprise tokenization models

Hybrid models combine the strengths of both approaches:

- Selective transparency with controlled access

- Built-in compliance and governance mechanisms

- Scalable participation across markets and asset classes

- Future adaptability to regulatory and technological change

For enterprises pursuing long-term digital asset strategies, hybrid models offer the most resilient foundation.

Why Hybrid Tokenization Will Define Enterprise Asset Strategies

As enterprises consider tokenization as long-term infrastructure, decision-makers are increasingly prioritizing frameworks that align with governance, compliance, and scalability. In this shift, the hybrid tokenization model is emerging as the most practical and future-ready choice for enterprise asset tokenization.

Key factors contributing to the adoption of hybrid tokenization by enterprises:

- Hybrid tokenization architecture balances decentralization with enterprise governance

Unlike fully public systems, hybrid tokenization architecture allows enterprises to use blockchain for immutable ownership and auditability while retaining off-chain control over compliance, identity, and legal enforcement—an essential requirement for regulated enterprise environments.

- Supports regulatory-ready enterprise tokenization models

Enterprise tokenization models will enable the enterprise to manage compliance regulations, jurisdictional limitations, and reporting procedures off-chain, therefore enabling the enterprise to update its compliance regulations more easily and with fewer disruptions than if using a fully decentralized architecture.

- Optimized use of on-chain and off-chain tokenization layers

A hybrid implementation allows an enterprise to maximize the benefits of implementing on-chain and off-chain tokenization while providing transparency, as appropriate, and confidentiality as needed on its blockchain infrastructure.

- Delivers superior results in tokenization models comparison

In any realistic tokenization models comparison, hybrid tokenization approaches often surpass completely public and completely private tokenization approaches by delivering selective transparency, controlled access, and long-term scalability—critical factors in determining whether enterprises will adopt tokenized assets.

- Enables scalable hybrid asset tokenization across multiple asset classes

With hybrid asset tokenization, enterprises can tokenize a variety of assets (e.g., securities, funds, real estate, RWAs) over a single shared blockchain layer while applying customized off-chain governance, valuation, and compliance workflows for each asset type.

- Reduces cost volatility and operational risk at scale

Enterprises using fully public or private on-chain systems experience significant volatility in fees due to fluctuating network congestion and stable fees. In contrast, hybrid tokenization models move the majority of high-volume and compliance-centric processes off-chain and deliver a more predictable level of performance and cost savings as a result of this approach.

- Strengthens institutional trust and accelerates market participation

Institutional investors require a high level of trust based upon the governance and enforceability of how assets are tokenized. Hybrid frameworks provide on-chain transparency coupled with off-chain legal and compliance controls to create a more credible and investable enterprise asset tokenization.

- Best implemented with an experienced asset tokenization development company

In order to implement hybrid tokenization solutions, it is important to partner with an experienced asset tokenization development company with expertise in blockchain, compliance, and enterprise integration so that the architecture supports legislative and operational realities.

Explore Enterprise-Ready Hybrid Tokenization

A Strategic Enterprise Outlook

With more organizations starting to implement their tokenization initiatives instead of merely experimenting with these new technologies as they come to market, hybrid tokenization models are clearly proving to be one of the leading approaches for enterprise asset tokenization due to their ability to combine on-chain and off-chain tokenization in a manner that ensures transparency, governance, and flexibility to operate in various asset classes and jurisdictions.

Of all the various tokenization models being evaluated today, hybrid tokenization models stand out because they achieve a proper balance between innovation and control; thus, providing enterprises with the means to execute their long-term tokenization strategy through 2026.

Organizations cannot achieve hybrid tokenization at scale without deep technical and regulatory knowledge. As an established and reliable asset tokenization development company, Antier is able to assist these enterprises by not only providing the asset tokenization development services and expertise needed to design and deploy compliant hybrid tokenization architectures but also by providing the blockchain, Web3, and enterprise integration capabilities necessary to create tokenization platforms that will meet future regulatory requirements in an efficient and secure manner.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

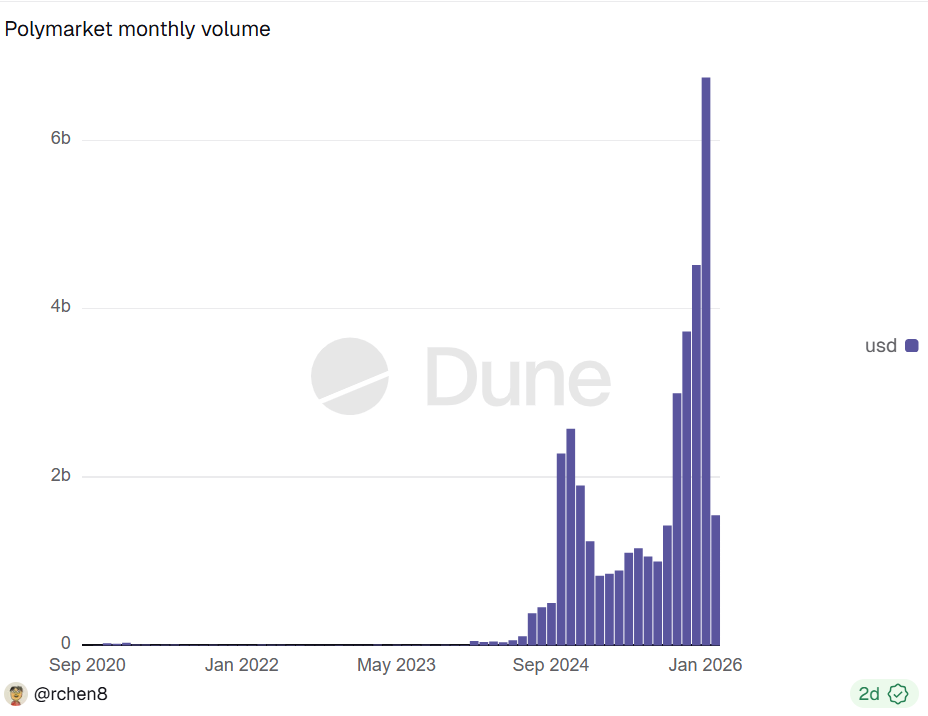

Jump Trading, a Chicago-based quantitative trading company, is reportedly set to acquire minority stakes in prediction market platforms Polymarket and Kalshi, underscoring growing institutional interest in the rapidly expanding sector.

The equity stakes would be obtained in exchange for providing trading liquidity on both platforms, Bloomberg reported Monday, citing people familiar with the discussions.

While the report did not disclose specific ownership percentages, Bloomberg said Jump’s stake in Polymarket would scale based on the liquidity the company ultimately provides.

Founded more than two decades ago, Jump Trading has long been a major player in proprietary financial trading and has expanded aggressively into digital assets. It has been active as both a market maker and venture investor in crypto, backing blockchain infrastructure projects and exchanges through its affiliated investment arms.

Polymarket and Kalshi are the two largest prediction market platforms, each commanding multibillion-dollar valuations following recent funding rounds.

As previously reported by Cointelegraph, Polymarket raised $2 billion from NYSE parent Intercontinental Exchange, valuing the company at $9 billion. In early December, Kalshi secured $1 billion in funding at an $11 billion valuation.

While both platforms allow users to trade on the outcomes of real-world events, they operate under different models. Polymarket is a decentralized platform built on the Polygon blockchain that enables onchain settlement of prediction contracts, whereas Kalshi operates as a centralized, federally regulated exchange in the United States.

Related: Trump Jr. joins Polymarket board as prediction market eyes US comeback

Prediction markets gain traction, but still face regulatory hurdles

Prediction markets gained mainstream attention after Polymarket’s event contracts accurately forecast the outcome of the 2024 US presidential election, highlighting the sector’s potential as a real-time information and risk-pricing tool. Industry analysts now estimate that prediction markets may generate trillions of dollars in annual trading volume by the end of the decade.

Eilers & Krejcik Gaming, a research and consulting company specializing in the global gambling and gaming industry, has identified sports-related contracts as a major driver of that growth. Speaking to CNBC in December, Eilers & Krejcik partner emeritus Chris Grove said sports betting could account for nearly half of the sector’s projected expansion.

Despite the growth potential, Grove cautioned that legal and regulatory challenges could slow adoption.

Kalshi, which operates as a federally regulated prediction market, has received approval from the US Commodity Futures Trading Commission to run as a Designated Contract Market. However, the platform is facing pushback at the state level. Regulators in Nevada, Maryland, New Jersey and Ohio have challenged Kalshi’s offerings, triggering ongoing litigation and cease-and-desist actions.

Related: Polymarket wins regulatory approval to operate US trading platform

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Ripple said on Monday it has expanded its institutional custody platform through new integrations with Securosys and Figment.

The company said it is adding hardware security modules to enable banks and custodians to deploy custody services and offer staking without necessarily operating their own validator or key-management infrastructure.

Building on Ripple’s recent acquisition of Palisade and the integration of Chainalysis compliance tools, the custody upgrades allow regulated institutions to manage cryptographic keys using on-premises or cloud-based HSMs and to offer staking on networks such as Ethereum (ETH) and Solana (SOL), with compliance checks embedded directly into transaction workflows.

Ripple said the integrations are intended to reduce deployment complexity and support faster rollout of custody services for institutional clients. Ripple has been pushing further into institutional infrastructure activity as it expands beyond payments with custody, treasury and post-trade services for regulated companies.

Ripple is a US-based blockchain infrastructure company that provides payment and custody technology to financial institutions and is the issuer of the XRP (XRP) token and the dollar-pegged stablecoin RLUSD, which it launched in December 2024.

The update comes weeks after the company launched a corporate treasury platform that integrates traditional cash management systems with digital asset infrastructure.

Related: Institutional staking and yield products gain traction

Institutional staking and yield products gain traction

Institutional interest in staking has grown as proof-of-stake networks mature and regulatory expectations continue to evolve.

In October, Figment expanded its integration with Coinbase, enabling Coinbase Custody and Prime clients to stake additional proof-of-stake (POS) assets beyond Ether. The update gave institutional customers access to staking on networks including Solana (SOL), Sui (SUI), Aptos (APT) and Avalanche (AVAX) through Figment’s infrastructure.

In November, Anchorage Digital added staking support for the Hyperliquid ecosystem, enabling HYPE (HYPE) staking alongside its existing custody services. The bank said the offering would be available through Anchorage Digital Bank, its Singapore entity, and its self-custody wallet Porto, with validator operations supported by Figment.

While staking enables institutions to earn rewards on proof-of-stake networks, parallel efforts have also emerged to generate yield from Bitcoin, which does not support staking.

Earlier this month, Fireblocks said it will integrate Stacks, enabling institutional clients to access Bitcoin-based lending and yield products. The integration uses Stacks’ roughly five-second block times while settling transactions to the Bitcoin ledger for finality, addressing latency constraints that have limited institutional use of BTC-based decentralized finance.

Magazine: A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Chainlink co-founder Sergey Nazarov argues the recent crypto market downturn is unlike any previous bear market — there have been no major FTX-style collapses, and tokenized real-world asset (RWA) growth remains substantial.

Market cycles are normal, “but what is important is what those cycles reveal about how far the industry has progressed,” said Nazarov on X on Tuesday.

Crypto market capitalization has fallen 44% from its October all-time high of $4.4 trillion, with almost $2 trillion exiting the space in just four months.

Nazarov, however, did not appear concerned, highlighting two primary factors that separate this current bear market from previous ones.

Unlike previous cycles, such as the FTX and crypto-lending failures in 2022, there haven’t been major institutional collapses during this drawdown, indicating the industry can now handle volatility more reliably, he said.

“There have been no large risk management failures leading to large institutional failures or widespread systemic risks.”

RWA growth will drive institutions and infrastructure

Secondly, RWA tokenization and on-chain perpetual contracts for traditional commodities continue accelerating regardless of crypto prices, proving this innovation has standalone value beyond speculation.

Tokenized RWA onchain value has increased 300% over the past 12 months, according to RWA.xyz.

This signals that having real-world assets on-chain “is not tightly coupled to cryptocurrency prices but provides its own unique value that can grow irrespective of market pricing of Bitcoin or other crypto assets,” he said.

The surge hasn’t been reflected in the price of Chainlink (LINK), however, with the blockchain oracle and RWA-centric asset tanking 67% since its October peak and down 83% since its 2021 all-time high, trading at a bear-market low below $9 at the time of writing.

Related: Crypto VC Funding Doubled in 2025 as RWA Tokenization Took the Lead

Nazarov also sees other converging trends reshaping the future of crypto.

On-chain perps and tokenization offer unique value, such as 24/7 markets, on-chain collateral, and real-time data, which is growing steadily. Institutional adoption will be driven by this fundamental utility, and infrastructure demand will surge as complex RWAs require more sophisticated on-chain systems, the Chainlink co-founder said.

“If these trends continue, I believe what I have been saying for years will happen; on-chain RWAs will surpass cryptocurrency in the total value in our industry, and what our industry is about will fundamentally change.”

Not all bear markets are equal

Bernstein analyst Gautam Chhugani echoed the sentiment in a note on Monday, writing that we are experiencing “the weakest Bitcoin bear case in its history.”

“The current Bitcoin price action is a mere crisis of confidence. Nothing broke, no skeletons will show up,” analysts led by Chhugani said.

Jeff Mei, chief operating officer at the BTSE exchange, told Cointelegraph that this sell-off is different “in that it was caused largely by non-crypto catalysts.”

Those include fears that a faltering AI tech boom could cause stocks to crash, “compounded by the appointment of Kevin Warsh to Fed chair, who many believe will reduce liquidity in the financial system,” he said.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Bitcoin, Ethereum News & Crypto Price Indexes

Chainlink (CRYPTO: LINK) co-founder Sergey Nazarov argues that the current crypto downturn is not a replay of previous bear markets. Speaking on X on Tuesday, Nazarov noted that there have been no FTX-style collapses this time and pointed to a persistent wave of tokenized real-world assets that continues to grow despite price declines. Crypto market capitalization has fallen about 44% from its October all-time high of $4.4 trillion, with roughly $2 trillion leaving the space in just four months. He frames the cycle as a test of the industry’s progress: cycles reveal how far the ecosystem has advanced, and this downturn is exposing both resilience and a real-world asset narrative that could outlast speculative pricing.

Key takeaways

- The downturn lacks a single systemic event comparable to FTX-era collapses, suggesting improved risk management across institutions.

- Tokenized real-world assets (RWAs) are expanding on-chain, signaling a use case beyond mere price speculation.

- On-chain perpetuals and asset tokenization offer 24/7 markets, on-chain collateral, and real-time data that could drive institutional adoption.

- Chainlink’s credibility as a backbone for on-chain RWAs remains intact even as the broader market experiences weakness.

- Analysts and industry observers see a bifurcation between crypto prices and the growth trajectory of on-chain RWAs, potentially reshaping the industry’s value proposition.

Tickers mentioned: $BTC, $ETH, $LINK

Sentiment: Neutral

Price impact: Negative. A broad sell-off and outflows have pressured prices and market capitalization, even as on-chain RWA activity trends higher.

Market context: The current cycle unfolds amid a shifting risk environment, macro uncertainty, and ongoing debates about liquidity and regulation that influence both crypto assets and tokenized RWAs.

Why it matters

The argument that the bear market is not a monolithic crash but a spectrum of dynamics matters because it reframes what investors should watch. Nazarov emphasizes that the absence of large, systemic failures this cycle points to improved risk controls and more mature market infrastructure. In practical terms, this could translate into steadier liquidity provision, fewer cascading liquidations, and greater confidence in deploying capital through on-chain channels rather than off-ramp exits.

Central to this narrative is the acceleration of RWA tokenization. According to RWA.xyz, tokenized RWAs on-chain have surged by about 300% over the past 12 months, underscoring a use case that can prosper irrespective of crypto price cycles. The implication is clear: real-world assets—ranging from securitized notes to commodity-linked contracts—are becoming meaningful, on-chain stores of value and collateral concepts, not merely speculative bets. This trend could feed into broader institutional demand, as on-chain mechanisms offer transparency, auditability, and cross-border settlement capabilities that traditional markets take days or weeks to deliver.

Yet the market’s performance remains tethered to macro and sector-specific catalysts. LINK, the token associated with pricing data and oracle services, has faced sustained weakness, trading in bear-market territory after peaking earlier in the cycle. The dynamic illustrates a decoupling: while RWAs push forward in practical utility, the crypto market, including major assets like Bitcoin and Ethereum, can diverge for periods where macro sentiment dominates. In this context, on-chain RWAs could gradually displace some narrative weight away from pure price action toward real-world utility and risk-adjusted capital formation.

Institutional involvement is widely anticipated to hinge on the utility of these on-chain structures. Nazarov argues that the combination of perpetual markets, tokenized assets, and robust on-chain collateral is creating a more resilient foundation for institutions to experiment with crypto-enabled finance. The broader ecosystem benefits from infrastructure upgrades that enable risk management, settlement, and governance in a transparent, programmable environment. The takeaway is not that crypto prices must explode to prove value, but that the underlying systems—the oracles, the data streams, and the contractual primitives—are becoming indispensable to professional finance.

As markets digest these developments, some observers emphasize that the current sell-off is driven by factors outside the crypto sector. Analysts have framed the move as a wider market concern about AI equities, liquidity expectations under a potentially tighter policy regime, and shifts in liquidity leadership. While these external pressures complicate the price narrative, the on-chain RWA ecosystem appears to be advancing on its own trajectory, aligned with broader fintech adoption and cross-chain interoperability goals.

“If these trends continue, I believe what I have been saying for years will happen; on-chain RWAs will surpass cryptocurrency in the total value in our industry, and what our industry is about will fundamentally change.”

Not all bear markets are equal

Industry observers have framed this downturn as potentially less damaging to the core ecosystem than prior cycles. Bernstein analyst Gautam Chhugani described the Bitcoin bear case as historically weak, suggesting that the price action reflects a crisis of confidence rather than a structural breakdown. “The current Bitcoin price action is a mere crisis of confidence. Nothing broke, no skeletons will show up,” the note said. The takeaway is that the macro environment, not just isolated crypto incidents, is weighing on sentiment.

Other voices emphasize a more nuanced picture. For instance, market participants note that macro catalysts—ranging from interest-rate expectations to tech-sector dynamics—have a disproportionate influence on crypto pricing versus on-chain activity. The sell-off has been described as being driven more by non-crypto catalysts than by internal systemic failures within the crypto space, a distinction that could support a faster reacceleration should risk appetite improve and liquidity return.

Market context

Against the backdrop of a 44% drawdown in crypto market cap from the October peak and substantial outflows, the story of RWAs on-chain remains a central pillar of longer-term value propositions in crypto. The dynamic underscores a broader trend toward tokenization and on-chain finance as mainstream infrastructure projects mature. If on-chain RWAs continue to gain traction, the sector could reorient investor attention toward scalable, real-world use cases, rather than relying solely on volatility-driven appetite for purely digital assets.

Why it matters

For builders, the message is clear: investing in robust on-chain infrastructure for RWAs—oracle reliability, settlement speed, and secure collateral mechanisms—could yield enduring demand. For investors, RWAs offer a potential hedge against crypto-price cycles by anchoring value in tangible, off-chain assets. For the market, the continued growth of RWAs may redefine what constitutes “crypto value,” expanding the spectrum of investable instruments and potentially attracting traditional finance players to participate in a more regulated, verifiable on-chain ecosystem.

What to watch next

- Updates from RWA.xyz on on-chain RWAs growth metrics and new asset classes tokenized on-chain.

- Institutional pilots adopting on-chain perpetuals and RWA-backed collateral frameworks.

- Regulatory developments affecting tokenized real-world assets and oracle data provisioning.

- Cross-chain integrations that improve liquidity, settling quickly, and governance for RWAs.

Sources & verification

- Sergey Nazarov’s X post discussing bear-market dynamics and RWAs growth.

- RWA.xyz data showing on-chain RWA value growth (about 300% YoY).

- LINK price/index coverage referenced in market commentary.

- Bernstein note on Bitcoin bear-case context.

- Wemade KRW stablecoin alliance with Chainlink coverage.

RWA momentum and a reshaping crypto market

Chainlink’s foundational role in powering on-chain RWAs remains a consistent thread as the sector charts its next phase. The on-chain RWA narrative is supported by observable growth metrics and a steady flow of products that enable real-world assets to exist, trade, and collateralize on-chain. While price action can swing with global liquidity and risk sentiment, the underlying technology stack—secure oracles, robust data feeds, and programmable contracts—continues to attract the interest of developers, institutions, and asset issuers alike. The broader question is whether on-chain RWAs will eventually carry a larger share of industry value than speculative crypto assets, a shift Nazarov has been vocal about predicting for years.

https://platform.twitter.com/widgets.js

Crypto World

Hyperliquid beats Coinbase in 2025 notional trading volume

Hyperliquid, a decentralized perpetual futures exchange, has quietly overtaken Coinbase in total notional trading volume, marking a major shift in how crypto traders are choosing to trade.

Summary

- Hyperliquid recorded about $2.6T in notional trading volume in 2025.

- Coinbase posted roughly $1.4T over the same period.

- The gap reflects rising demand for on-chain derivatives platforms.

According to data shared on Feb. 10 by on-chain analytics platform Artemis, Hyperliquid processed about $2.6 trillion in notional trading volume in 2025. Coinbase, one of the world’s largest centralized exchanges, recorded around $1.4 trillion over the same period.

Despite Hyperliquid (HYPE) launching only a few years ago and running entirely on-chain, the numbers show that it handled almost twice Coinbase’s trading volume. The milestone has drawn attention across the crypto industry, especially as decentralized platforms continue to challenge traditional exchanges.

How hyperliquid built its lead

Hyperliquid primarily focuses on trading perpetual futures and derivatives on its proprietary Layer 1 blockchain. Active traders seeking quick execution, cheap fees, and direct access to on-chain liquidity have been drawn to it thanks to its focused approach.

The platform grew quickly throughout 2025. Daily trading occasionally increased to close to $30 billion, while monthly volumes frequently reached hundreds of billions of dollars. The total value locked increased toward $6 billion, while open interest peaked at about $16 billion.

User growth also accelerated. The platform’s active user base grew from about 300,000 to more than 1.4 million in a year, driven largely by word-of-mouth and product performance rather than heavy marketing.

Fees collected on Hyperliquid are partly used for HYPE token buybacks and burns. This model has helped support long-term interest in the ecosystem. As of early 2026, HYPE is up roughly 31.7% on the year and continues to draw increasing attention from traders.

Coinbase operates very differently. Its higher fees, stricter compliance requirements, and fully centralized model for spot and derivatives trading still make it a key entry point for retail users. However, professional traders are increasingly turning their focus toward alternatives that offer more flexibility and lower costs.

Coinbase stock is down about 27.0% so far this year, showing how much pressure traditional crypto companies are under in the current market slowdown.

What this shift means for crypto trading

The growing gap between Hyperliquid and Coinbase reflects a change in how users trade. On-chain platforms offer speed and transparency without requiring users to hand over custody, and more traders are getting comfortable using them.

With Hyperliquid, derivatives traders do not need to trust a central operator with their funds. Smart contracts are used to manage risk, and trades settle on-chain. Users who have been wary of exchanges in the past will find this appealing.

At the same time, Hyperliquid has placed a strong emphasis on user experience. Its user interface is similar to that of large centralized platforms, which makes it easier for new users to get started. Its growth has largely been attributed to this combination of usability and decentralization.

Momentum has also been boosted by recent developments. The platform is being used to test new products such as outcome-based contracts and limited-risk options. Notable industry figures, like Arthur Hayes, who recently increased the size of his own HYPE holdings, have also taken notice of it.

But there are still issues. Competition in decentralized derivatives is increasing, and regulators are paying more attention to on-chain trading activity. Aster and Lighter, two rivals, are also expanding their product lines.

Crypto World

ZachXBT Flags Phantom Chat Risk as 3.5 WBTC Is Stolen

TLDR:

- New Phantom Chat feature expands wallet social tools while unresolved address poisoning risks remain active.

- ZachXBT linked a recent 3.5 WBTC loss to spam transactions that copied trusted wallet address patterns.

- Address poisoning exploits wallet history displays and can mislead users during routine transfers.

- Social wallet features may increase exposure to scams if interface protections remain unchanged.

Phantom has announced plans to launch a new social feature called Phantom Chat in 2026. The update aims to transform the Solana wallet into a messaging and discussion hub.

Soon after the reveal, security concerns surfaced about unresolved wallet vulnerabilities. The warnings focus on address poisoning and the risk of user fund losses.

Phantom Chat feature raises address poisoning concerns

Wu Blockchain reported that Phantom unveiled Phantom Chat as part of its long-term product roadmap.

The wallet compared its vision to Telegram groups and X communities for crypto discussions. Mockup images showed emoji-based group chats designed for real-time interaction.

Phantom already introduced live chat features through its prediction markets integration with Kalshi in December 2025. The new roadmap suggests a broader move toward social tools inside the wallet. The platform currently serves more than 15 million users across its ecosystem.

On-chain investigator ZachXBT responded to the announcement, warning about unresolved address-poisoning risks. He stated that Phantom still does not filter spam transactions from user histories. This allows look-alike addresses to appear among legitimate transaction records.

According to ZachXBT, one user lost 3.5 WBTC last week after copying the wrong address from recent activity.

He traced the theft to a transaction created through spam records that mimicked the first characters of a trusted wallet address. He shared the wallet and transaction hashes publicly to document the incident.

Security risks emerge as Phantom expands wallet social tools

Address poisoning occurs when attackers send small transactions from deceptive addresses. These addresses resemble legitimate ones and appear in wallet histories. Users who copy them may unknowingly send funds to attackers.

ZachXBT argued that adding social features without fixing this issue could widen the attack surface.

He warned that chat-based activity could increase exposure to malicious links and fake addresses. His comments focused on user interface design rather than blockchain flaws.

Phantom’s announcement attracted heavy engagement from memecoin promoters and trading communities. Replies included promotional messages tied to new tokens and groups. This activity highlighted the potential for spam to blend with legitimate discussions.

Wu Blockchain noted that Phantom Chat positions the wallet as a crypto super app combining trading, social interaction, and market sentiment. The move follows a broader trend of wallets adding communication tools.

Security researchers have stressed that transaction filtering and address verification remain essential for user protection.

Crypto World

Ripple Expands Institutional Stack: Will XRP Price React?

Ripple has announced two new partnerships with Figment and Securosys to expand the capabilities of Ripple Custody, its institutional digital asset custody solution.

It is evident that Ripple is currently in an infrastructure arms race to perfect its payment, custody, and staking services for institutions. However, real-world adoption and price have yet to show signs of a breakthrough.

Sponsored

Sponsored

Ripple Expands Custody Offering With Figment and Securosys Partnerships

Ripple said the partnerships are designed to simplify procurement and support faster deployment of custody services for regulated institutions. The move comes shortly after Ripple expanded its custody stack through the acquisition of Palisade and the integration of Chainalysis’s compliance tools.

As part of the partnership with Figment, Ripple will introduce staking functionality. This will allow institutional clients to offer staking services without operating their own validator infrastructure.

The integration is aimed at banks, custodians, and regulated entities seeking exposure to Proof-of-Stake networks while maintaining institutional security and governance standards.

Through Figment’s infrastructure, Ripple Custody clients will be able to support staking on major networks such as Ethereum (ETH) and Solana (SOL).

“By combining Ripple’s enterprise‑grade custody technology with Figment’s secure, non‑custodial staking platform, we’re giving regulated institutions a way to offer staking rewards to their customers on several blockchain networks,” Ben Spiegelman, VP – Head of Partnerships & Corporate Development at Figment, stated.

Separately, Ripple has partnered with Securosys to strengthen the security layer of Ripple Custody. The collaboration adds support for CyberVault HSM and CloudHSM. This gives institutions the option to deploy HSM-based custody either on premises or in the cloud.

According to Ripple, the Securosys integration is designed to address long-standing challenges around HSM adoption. This includes cost, complexity, and slow procurement processes.

Sponsored

Sponsored

Ripple also noted that the addition of Securosys expands the range of supported HSM providers on its custody platform. This provides greater flexibility for institutions operating across multiple regulatory environments.

“By integrating our CyberVault HSM with Ripple Custody, institutions gain an out-of-the-box, enterprise-grade solution that can be deployed quickly, without added complexity, while retaining full control over their cryptographic keys,” Robert Rogenmoser, CEO of Securosys, remarked.

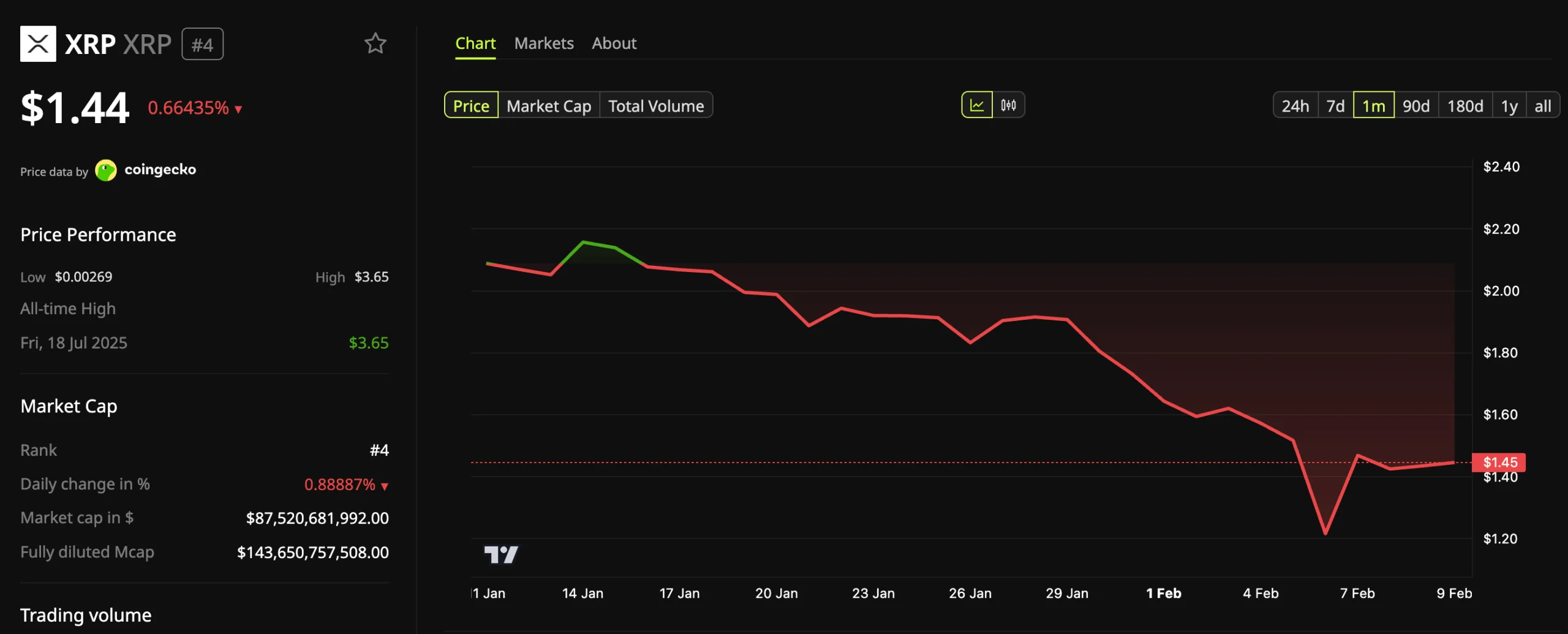

Institutional Focus Fails to Lift XRP as On-Chain Activity Cools

As Ripple continues to strengthen its institutional infrastructure, on-chain metrics from the XRP Ledger indicate that adoption remains moderate. According to data from DeFiLlama, XRPL’s total value locked declined from around $80 million in early January to approximately $49.6 million at press time, reflecting softer DeFi activity on the network.

Stablecoin data points to a similarly gradual pace. Based on DeFiLlama figures, the total stablecoin market capitalization on XRPL stands at roughly $415.85 million, suggesting steady but limited growth.

That said, much of Ripple’s institutional strategy is centered on custody, settlement, and permissioned financial use cases, which may not always be reflected in traditional DeFi metrics such as TVL.

Notably, so far, the expansion of institutional use cases has had a limited impact on XRP’s market performance.

The asset is down nearly 32% over the past month, broadly tracking the wider market downturn. At the time of writing, XRP was trading at $1.44, down 0.66% over the past day.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

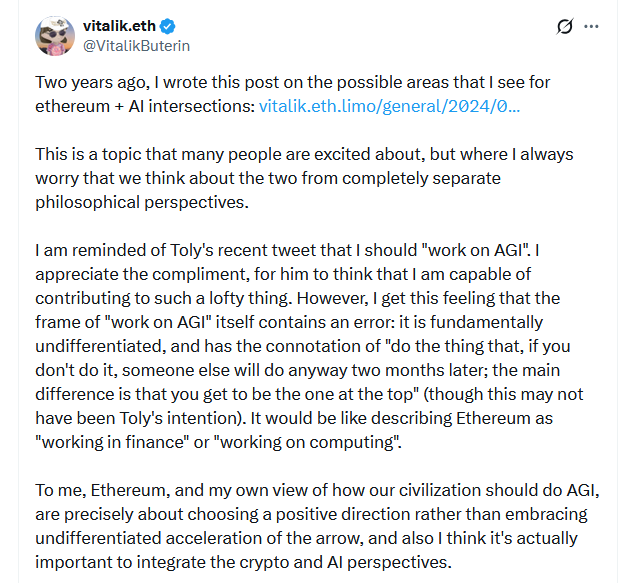

Ethereum co-founder Vitalik Buterin’s latest vision for Ethereum’s intersection with artificial intelligence sees the two working together to improve markets, financial safety and human agency.

In an X post on Monday, Buterin said his broader vision for the future of artificial intelligence (AI) sees humans being empowered by AI, rather than replaced, though he said the shorter term involves much more “ordinary” ideas.

Buterin pointed to four key areas where Ethereum and AI could intersect in the near future: enabling trustless and/or private interactions with AI, Ethereum becoming an economic layer for AI-to-AI interactions, using AI to fulfill the “mountain man” ideal by verifying everything onchain and improving market and governance efficiency.

Buterin argued that new tooling and integrations are required for AI use to be truly private, without leaking data or revealing personal identities.

Private data leaks by large language models (LLMs) have become an increasing area of concern since the rise of AI chatbots. Cointelegraph Magazine highlighted in an article last month that while ChatGPT can give you legal advice, your chat logs can be used against you in court.

He pointed to the need for tooling to support the use of LLMs locally on personal devices, utilizing zero-knowledge proofs to make API calls anonymously and improving cryptographic tech to verify work from AI, among other things.

Buterin also envisions AI becoming a user’s middleman to the blockchain, suggesting that AI agents could verify and audit every transaction, interact with decentralized apps and suggest transactions to users.

AI verification could be a major boon for crypto and other sectors, with increasingly sophisticated scammers on the rise. Address poisoning scams, just one attack vector, have seen a major uptick since December.

“Basically, take the vision that cypherpunk radicals have always dreamed of (don’t trust; verify everything), that has been nonviable in reality because humans are never actually going to verify all the code ourselves. Now, we can finally make that vision happen, with LLMs doing the hard part,” he said.

Adding to that, Buterin sees AI bots being able to “interact economically” to handle all onchain activity for users and make crypto much more accessible.

He said bots could be deployed to hire each other, handle API calls and make security deposits.

“Economies not for the sake of economies, but to enable more decentralized authority,” he said.

Related: Bitcoin miner Cango sells $305M BTC to cut leverage and fund AI pivot

Finally, Buterin thinks AI can enhance onchain governance and markets if LLMs are used to overcome the limits of human attention and decision-making capacity.

He said that while things like prediction markets and decentralized governance are “all beautiful in theory,” they are ultimately hampered by “limits to human attention and decision-making power.”

“LLMs remove that limitation, and massively scale human judgement. Hence, we can revisit all of those ideas,” he said.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

The Ethereum Foundation is sponsoring crypto security nonprofit Security Alliance (SEAL) to “track and neutralize” crypto drainers and other social engineering attackers targeting Ethereum users.

SEAL said on Monday that it launched the “Trillion Dollar Security” initiative with EF to support these efforts after reaching out to EF late last year about funding security engineers to more closely track drainer development and protect against wide-scale attacks.

The EF is now sponsoring a security engineer whose “sole mission” is to work with SEAL’s intelligence team to combat drainers targeting Ethereum users, said SEAL.

SEAL’s broader mission is to protect crypto market participants by providing collaborative tools for threat intelligence sharing and incident response while providing legal protection for its white-hat hackers.

“The Security Alliance has done important work to combat attacks and the ecosystem has benefited tremendously,” The Ethereum Foundation posted to X in response to SEAL’s announcement.

Phishing scammers and drainers often create fake websites or fraudulent emails that impersonate legitimate crypto protocols, tricking users into approving seemingly harmless wallet transactions that can result in the loss of funds.

Their tactics have become increasingly sophisticated over the years, prompting the need for improved detection and prevention mechanisms.

Crypto intelligence platform ScamSniffer estimates that these scammers have stolen nearly $1 billion in crypto over the years. However, efforts from SEAL and other crypto sleuths helped bring that tally down to $84 million in 2025, an all-time low.

Ethereum security dashboard launched to track progress

SEAL and the EF created a Trillion Dollar Security dashboard to track Ethereum’s security across six dimensions: user experience, smart contracts, infrastructure and cloud, consensus protocol, monitoring and incident response, social layer and governance.

Related: Crypto PACs secure massive war chests ahead of US midterms

Each dimension includes eight to 29 risk controls being closely monitored, along with identified “priority work” that must be addressed.

SEAL open to working with other crypto ecosystems

SEAL said the partnership with the EF is the first of many planned initiatives with other forward-thinking ecosystems, welcoming other crypto ecosystems to reach out:

“If your foundation or crypto ecosystem is interested in similar sponsorship opportunities, we’re happy to discuss how this model protects users at scale,” SEAL said.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat10 hours ago

NewsBeat10 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat21 hours ago

NewsBeat21 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports9 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report