Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

The Israeli Crypto Blockchain & Web 3.0 Companies Forum last week launched a lobbying effort to push regulatory reforms that research from KPMG says may add 120 billion shekels ($38.36 billion) to the country’s economy by 2035 and create 70,000 new jobs.

At a Feb. 3 event in Tel Aviv, Forum leader Nir Hirshman-Rub said there is broad public support for legislation that would relax rules on stablecoins and tokenization, along with simplifying tax compliance requirements.

In the wake of the US-brokered ceasefire of the Gaza war, 2026 is seen as a “defining year” for the local digital assets industry, Hirshman-Rub said.

“The Israeli public is already there and the politicians need to act,” Hirshman-Rub told Cointelegraph on the sidelines of the Tel Aviv event. “More than 25% of the public already has had crypto dealings in the last five years and more than 20% currently hold digital assets,” he said, citing the KPMG research.

Steady growth as digital asset landscape evolves

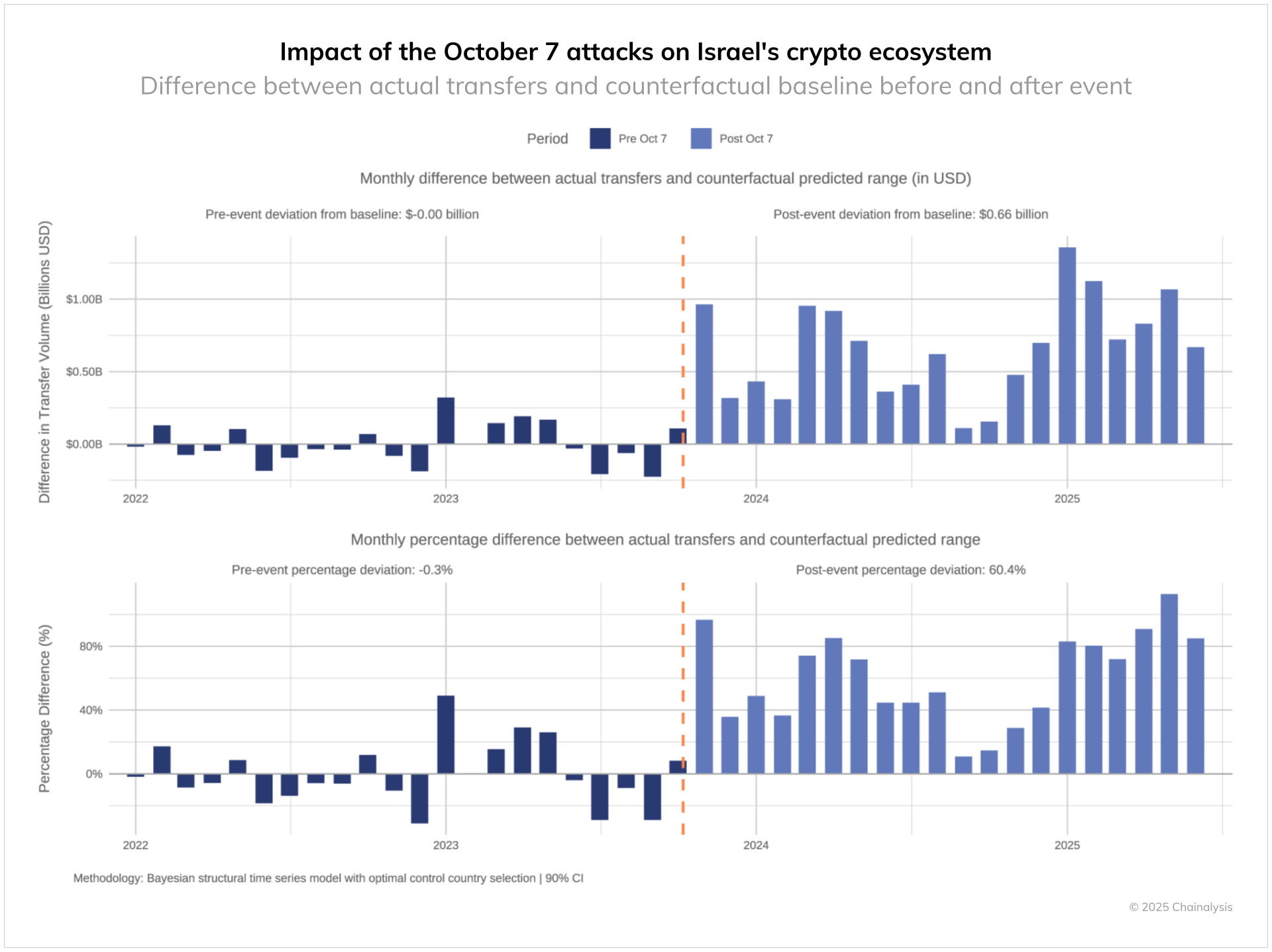

An October Chainalysis report showed that the G-20 country’s crypto economy has showed steady growth, with inflows topping $713 billion last year. Those levels reflect a sharp increase in crypto volumes in the aftermath of the October 2023 Hamas attacks, which were sustained by strong retail activity, the report said.

Israeli companies, such as Fireblocks and Starkware, have established leadership positions in the global digital assets landscape and are among the Forum’s sponsors. According to NGO Startup Nation Central, more than 160 locally founded companies have attracted more than 5% of the $30 billion invested worldwide in the sector, employing more than 2,500, primarily in the greater Tel Aviv area.

“The problem is that once a company here disclosed that it deals with digital assets, Israeli banks refuse to serve the company or require the company’s attorneys to make an impossible declaration that funds originating in a digital asset will not be deposited in an Israeli bank account,” said Hirshman-Rub. “It may not be outright refusal, but simply dragging their feet, adding demands in a never-ending due diligence process.”

Related: EU tokenization companies push for DLT pilot changes amid US momentum

Among other barriers that the group seeks to reform is an income tax ordinance that penalizes token distribution to employees as stock options. While traditional stock options provided to employees are taxed at a 25% rate, tokenized options will pay a 50% rate for similar value.

A national strategy

In July, the country’s National Crypto Strategy Committee presented an interim report to the Israeli Knesset for parliamentary review. The committee outlined a strategic framework underpinned by five pillars, including establishing a unified regulator, creating token issuance rules, and banking integration.

In August, the Israel Tax Authority published a new Voluntary Disclosure Procedure that would offer taxpayers a path to disclose previously unreported income and assets, including digital assets, and obtain immunity from criminal proceedings. It was the agency’s third attempt to implement a disclosure regime.

However, last month, the agency said taxpayer participation has so far fallen short of expectations, but committed to seeing the initiative through to the end of August 2026.

“The Israeli banking system is not willing to accept cryptocurrency, and it is also very difficult to bring in funds as a result of selling cryptocurrency,” Tax Authority director Shay Aharonovich said, according to local media reports. “There is no doubt that this also affects the willingness to make voluntary disclosure, because in the end people do not just want to pay the tax, but to use the money.”

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Vitalik Buterin Unveils Four-Pillar Framework for Ethereum AI Integration

TLDR:

- Buterin proposes local LLM tooling and zero-knowledge payments to enable private AI interactions on-chain.

- Ethereum could serve as economic infrastructure for autonomous AI agents to coordinate and transact.

- AI models can revitalize prediction markets and quadratic voting by overcoming human attention limits.

- The framework enables cypherpunk vision where local AI verifies transactions without third-party trust.

Ethereum co-founder Vitalik Buterin has presented an updated perspective on integrating blockchain technology with artificial intelligence. The framework moves beyond abstract concepts toward practical implementations in the near term. Buterin’s approach centers on preserving human freedom while building decentralized systems that leverage AI capabilities. His vision encompasses four distinct areas where Ethereum can facilitate meaningful AI interactions without compromising security or privacy.

Privacy-Focused Infrastructure for AI Interactions

Buterin criticizes undifferentiated approaches to AI development, comparing vague directives to “work on AGI” with describing Ethereum as “working in finance” or “working on computing.” He argues such framing lacks the specificity needed for meaningful progress. Instead, his framework emphasizes choosing positive directions rather than embracing acceleration without purpose. The technical vision prioritizes human empowerment and avoiding scenarios where humans lose agency.

The proposal includes developing local large language model tooling that allows users to maintain control over their data. Zero-knowledge payment systems for API calls would prevent identity linking across different transactions. This approach addresses growing concerns about data privacy in AI applications. Additionally, ongoing cryptographic research aims to enhance AI privacy protections.

Client-side verification methods such as cryptographic proofs and trusted execution environment attestations form another component. These mechanisms mirror previous work on Ethereum privacy improvements but apply specifically to LLM interactions. The goal is creating infrastructure comparable to existing non-LLM compute privacy solutions. Buterin referenced his earlier work on Ethereum privacy roadmaps from 2024.

That foundation now extends to protecting AI-related computational processes. The technical approach maintains consistency with established blockchain privacy principles while adapting to AI-specific requirements. This continuity ensures compatibility with existing Ethereum infrastructure. The emphasis on local processing and cryptographic verification reflects broader cypherpunk values.

Economic Coordination and Enhanced Governance Systems

Ethereum can function as an economic layer facilitating AI-to-AI interactions, according to Buterin’s framework. This includes API payments, autonomous agents hiring other agents, and security deposit mechanisms. The economic infrastructure enables decentralized AI architectures rather than centralized organizational control. Smart contracts could eventually handle complex dispute resolution between AI entities.

The proposal mentions ERC-8004 and AI reputation systems as potential standards. These tools would create accountability frameworks for autonomous agents operating on-chain. Economic coordination becomes essential for scaling decentralized authority across AI systems. Without such mechanisms, AI collaboration would remain confined within single organizations.

Buterin’s vision includes revitalizing market and governance concepts previously limited by human constraints. Prediction markets, quadratic voting, combinatorial auctions, and decentralized governance structures gain new viability. Large language models can overcome the attention and decision-making bottlenecks that hampered these systems. AI assistance effectively scales human judgment across complex coordination problems.

The framework also addresses what Buterin describes as the cypherpunk “mountain man” vision of “don’t trust; verify everything.” Local AI models could propose and verify blockchain transactions without third-party interfaces. Smart contract auditing and formal verification interpretation become accessible through AI assistance. This enables the verify-everything approach that was previously impractical for individual users.

Crypto World

Vitalik Buterin Slams ‘Fake’ DeFi, Backs ETH-Based Algo Stablecoins

Buterin criticized modern DeFi as centralized in disguise, arguing USDC yield farming misses core principles.

Ethereum co-founder Vitalik Buterin has questioned the legitimacy of popular USDC yield strategies, arguing they don’t follow the principles of true decentralized finance (DeFi).

His critique was in response to crypto analyst C-node, who said that most modern DeFi focuses on speculative gains instead of building genuinely decentralized infrastructure.

Critique of Modern DeFi

C-node challenged the crypto industry on social media, saying there is little reason to use DeFi unless users hold long cryptocurrency positions and need financial services while keeping self-custody.

Buterin supported this perspective, arguing that depositing stablecoins such as USDC into lending protocols like Aave does not count as true DeFi. He dismissed such strategies, stating, “inb4 ‘muh USDC yield,’ that’s not DeFi.”

In his view, the underlying asset remains controlled by Circle, meaning the arrangement is fundamentally centralized even if the protocol itself is decentralized.

The Ethereum developer suggested two frameworks for evaluating what should qualify as real DeFi. The first, which he described as the “easy mode,” centers on ETH-backed algorithmic stablecoins. In this model, users can shift counterparty risk to market makers through collateralized debt positions (CDPs), where assets are locked to mint stablecoins.

He explained that even if 99% of the liquidity is backed by CDP holders who hold negative algorithmic dollars while holding positive ones elsewhere, the ability to offload counterparty risk to a market maker remains an important feature.

You may also like:

The second, or “hard mode,” framework allows for real-world asset (RWA) backing, but only under strict conditions. Buterin said an algorithmic stablecoin backed by RWAs could still qualify as DeFi if it is sufficiently overcollateralized and diversified to survive the failure of any single backing asset.

Under this structure, the overcollateralization ratio must be more than the maximum share of any individual asset, ensuring the system remains solvent even if one part collapses. This means that it would act as a buffer that distributes risk instead of concentrating it within centralized entities.

“I feel like that sort of thing is what we should be aiming more towards,” Buterin said, adding that the long-term goal should be moving away from the dollar as the unit of account toward a more diversified index.

Crypto Community Response

The remarks were widely supported within the X crypto community, with one user calling it a “great take” and noting that ETH-backed algorithmic stablecoins offer real risk reduction, while RWA diversification spreads it instead of eliminating it. Another commented that “True DeFi needs real risk innovation, not just USDC parking.”

However, there were also some concerns. For instance, X user Kyle DH pointed out that algorithmic stablecoins have not updated their designs to address known issues, which makes them similar to money market funds that have the same “breaking the buck” risks seen before with TerraUSD and LUNA. They added that RWA backing requires careful diversification, warning that highly correlated assets or black swan events could still cause a stablecoin to fail.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Hyperliquid Is Challenging Crypto Exchange Hierarchy

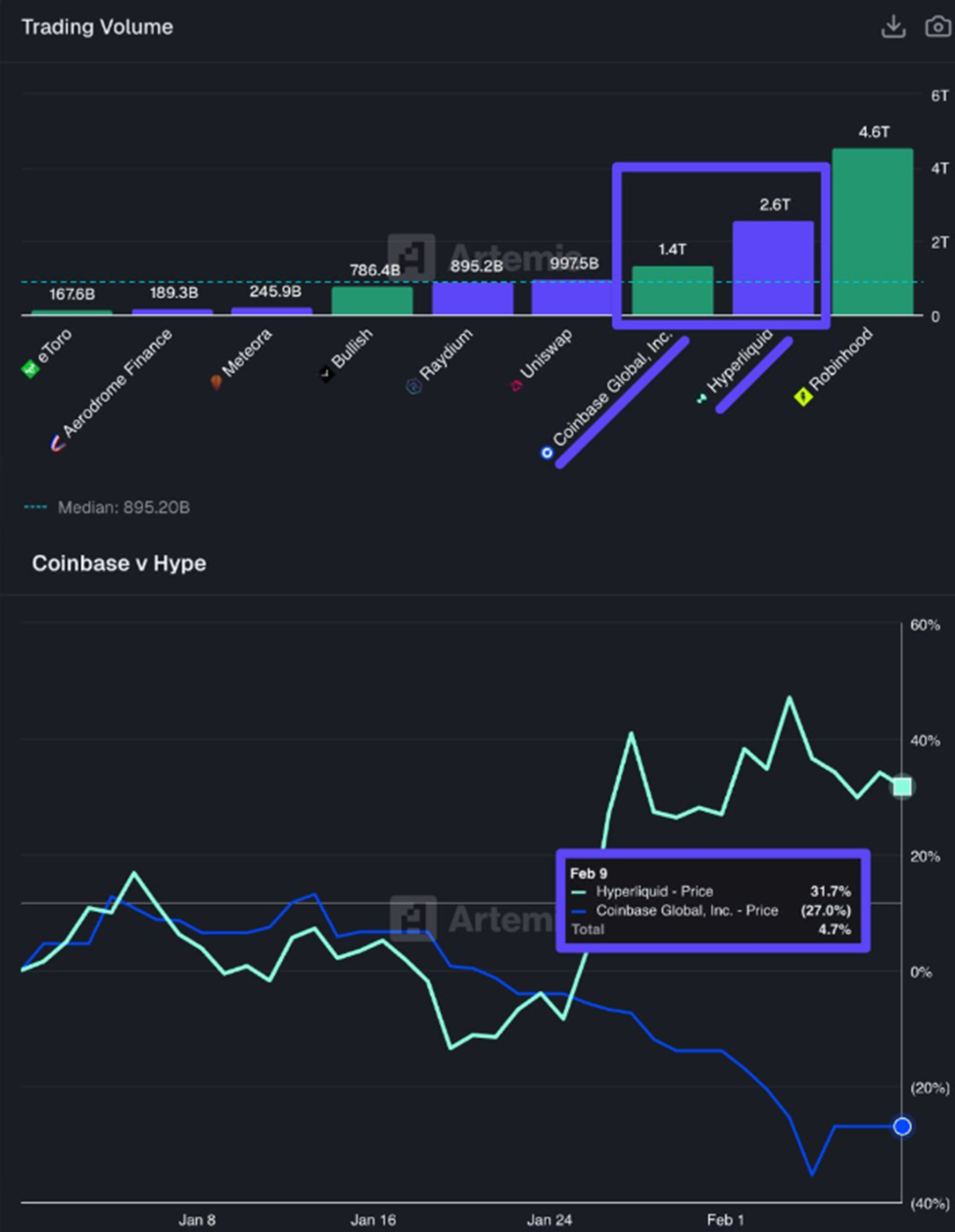

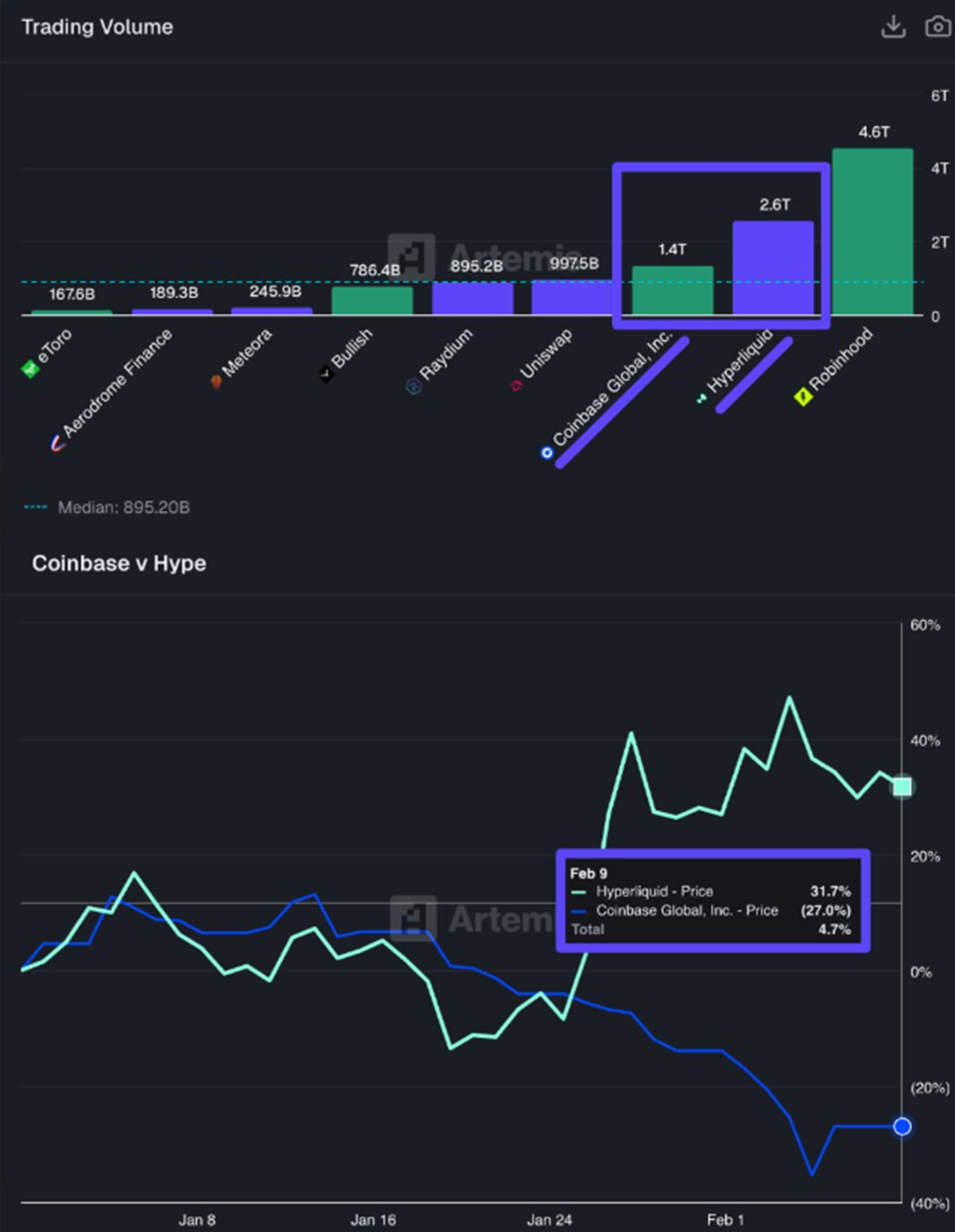

New data from Artemis shows that Hyperliquid, an on-chain derivatives platform, has overtaken Coinbase in notional trading volume. Notably, Coinbase is revered as the largest US-based exchange by trading volume.

Hyperliquid’s ascent is forcing the crypto industry to reassess long-held assumptions about where serious trading activity takes place.

Hyperliquid Surpasses Coinbase in Trading Volume

According to Artemis, Hyperliquid recorded roughly $2.6 trillion in notional trading volume, compared with $1.4 trillion for Coinbase, meaning nearly double the activity.

Sponsored

Sponsored

The figures mark one of the clearest signals yet that high-performance on-chain platforms are capturing a growing share of global derivatives flows.

This milestone fuels debate over whether decentralized trading venues are beginning to rival centralized exchanges in scale and influence.

“Hyperliquid is quietly outgrowing Coinbase. Trading Volume (Notional): Coinbase: $1.4T Hyperliquid: $2.6T That’s nearly 2x Coinbase’s volume… from an on-chain exchange. And the market is noticing,” Artemis stated.

The gap is not limited to trading volumes. Year-to-date performance data shows a striking divergence between the two companies.

Hyperliquid is up 31.7%, while Coinbase is down 27.0%, creating a 58.7% performance gap in just a matter of weeks.

For analysts, this divergence reflects deeper structural shifts rather than short-term volatility. Anthony, a data analyst at Artemis, emphasized that underlying metrics are increasingly driving market sentiment.

The comment highlights a growing belief among market observers that liquidity, execution quality, and user activity are beginning to shape valuations and investor narratives. This is as opposed to brand recognition alone.

Sponsored

Sponsored

One question raised by the data is why Binance, the world’s largest crypto derivatives exchange, was not included in the comparison.

The reason lies in what the figures are measuring and the narrative surrounding them. The Artemis analysis focused on Hyperliquid overtaking Coinbase, a major centralized exchange whose business is heavily weighted toward spot trading and regulated markets.

The milestone, therefore, highlights a shift in market structure rather than a direct challenge to the largest derivatives venue.

Binance remains the dominant player in perpetual futures trading by a wide margin. Coingecko data shows the exchange processing over $53 billion in daily derivatives volume. This exceeds Hyperliquid’s $6.4 billion.

Hyperliquid’s Surge Sparks a New Fight Over Who Controls Crypto Trading

The data has sparked strong reactions across the crypto community, highlighting long-standing tensions between centralized and decentralized trading models.

Sponsored

Sponsored

To some, Hyperliquid’s rise is a validation of on-chain markets, while others used the moment to criticize centralized exchanges.

Such criticism reflects a broader sentiment among some traders who argue that transparent, on-chain systems reduce counterparty risk and improve market fairness.

However, defenders of centralized exchanges note that they still dominate in fiat on-ramps, regulatory integration, and retail accessibility.

Perhaps the most significant implication of Hyperliquid’s growth is how it is changing the competitive sector. Rather than being compared primarily with other perpetual DEXs, the platform is increasingly being measured against major centralized derivatives venues.

Hyperliquid Hub, a community account tracking the ecosystem, argued that the platform has already pulled ahead of most decentralized rivals.

“Hyperliquid is now absolutely dominating the on-chain derivatives sector. At this point, people are only comparing Hyperliquid with major centralized exchanges like Binance, OKX, and Bybit. Other perp DEXs have already been left far behind by Hyperliquid in terms of technology, liquidity depth, and overall performance,” they wrote.

Sponsored

Sponsored

If this perception continues to gain traction, it could mark a turning point in how traders evaluate execution venues. It is less about whether they are centralized or decentralized and more about liquidity, speed, and reliability.

While the Coinbase exchange remains one of the largest and most regulated crypto platforms globally, Hyperliquid’s momentum highlights how quickly market structure can shift in the digital asset space.

Still, challenges exist, after Coinglass data showed major gaps between volume, open interest, and liquidations across perp DEXs.

As BeInCrypto reported, there remains disagreement about the lack of standards for defining “real” activity in decentralized derivatives markets.

Additionally, industry executives like Kyle Samani also bear reservations about the integrity of Hyperliquid, saying the DEX is in most respects, everything wrong with crypto.

Crypto World

Analysts Warn of Extended Downturn as Bitcoin Struggles at $68K

Crypto market analysts have become increasingly bearish, with technical signals favoring further downside before any meaningful recovery.

More and more peak bear market signals are flashing up on the Bitcoin charts, leading analysts to believe that the pain is not over yet, but we may be nearing the bottom.

Bitcoin has now closed for a third week below the 100-week moving average and has been under this long-term trendline for 13 days, observed Coin Bureau CEO Nic Puckrin on Monday.

Historically, BTC has remained below this for an average of 267 days, with the shortest period at 34 days during the Covid flash crash in March 2020, he added, before predicting it could stay below this for longer.

“Therefore, historically, we are more likely to remain below for a longer period of time. A quick bounce back is still possible, but the longer we remain below, the less likely.”

Further Losses Make Accumulation Opportunities

Meanwhile, MN Fund founder Michaël van de Poppe said the “holder’s supply in profit/loss is rising,” which means more people aren’t profiting from Bitcoin, and the loss is growing significantly.

“This is something we’ve only been seeing during peak bear markets in 2015, 2018, and 2022,” he said, before adding that it should provide accumulation opportunities.

CryptoQuant founder Ki Young Ju was also bearish, stating, “Bitcoin is not pumpable right now.”

Selling pressure is too heavy for any multiplier effect, he said before adding that digital asset treasuries “won’t work until it becomes pumpable again.”

You may also like:

Bitcoin is not pumpable right now.

In 2024, $10B in cash could create $26B in BTC book value. In 2025, $308B flowed in, yet the market cap fell $98B. Selling pressure is too heavy for any multiplier effect.

MSTR and DATs won’t work until it becomes pumpable again. pic.twitter.com/T8NZHio4H9

— Ki Young Ju (@ki_young_ju) February 9, 2026

Glasnode reported on Monday that the unrealized market loss of $70,000 is approximately 16% of the market cap.

“Current market pain echoes a similar structure seen in early May 2022.”

“Bitcoin volume is telling,” observed analyst ‘Sykodelic’. “On the nuke to $60k we hit the fourth largest volume period since the 2022 bottom,” he said.

However, the analyst also said that each period since then that has recorded volume to this degree “has marked a key pivot in price direction,” questioning whether $60,000 was the bottom.

Bitcoin Loses $70K Level Again

The bearish sentiment is for good reason. Bitcoin fell below $70,000 twice on Monday and traded around $69,000 on Tuesday morning in Asia.

The asset has been consolidating around this level since recovering from its crash to $60,000 on Friday. It remains down 44% from its peak and is in bear-market territory, with the path of least resistance downward.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP Price Analysis Reveals Why the 30% Bounce Failed

The XRP price rebounded more than 30% after bouncing from its early February low near $1.12. The move revived hopes of a recovery and briefly pushed the token toward the $1.50 zone. On the surface, the rally looked constructive. Momentum indicators improved. A breakout pattern began to form. Traders started discussing a possible trend reversal.

But blockchain data tells a different story. Instead of showing strong accumulation, on-chain metrics suggest that many holders used the rebound to exit losing positions. Selling at a loss remains dominant. Several groups are still reducing exposure. This raises a key question: was the bounce genuine demand, or simply exit liquidity for trapped sellers?

Technical Setup Shows Bounce Potential, But It Needs Confirmation

On the 12-hour chart, XRP is trading inside a falling wedge pattern, with a 56% breakout potential above the upper trendline.

Sponsored

Sponsored

For this pattern to activate, XRP needs to first reclaim its short-term moving average, the 20-period exponential moving average (EMA), which gives more weight to recent prices. This level acts as dynamic resistance in downtrends. In early January, a clean break above this EMA triggered a rally of nearly 30%.

Momentum is also showing early improvement.

Between January 31 and February 9, XRP printed a lower low in price. At the same time, the Relative Strength Index (RSI), a momentum indicator that measures buying and selling pressure, formed a higher low. This bullish divergence suggests that sellers are losing strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On its own, this setup points to a possible bounce.

But technical patterns only work when holders are willing to stay invested. To understand whether this bounce has real support, we need to look at how investors are behaving on-chain.

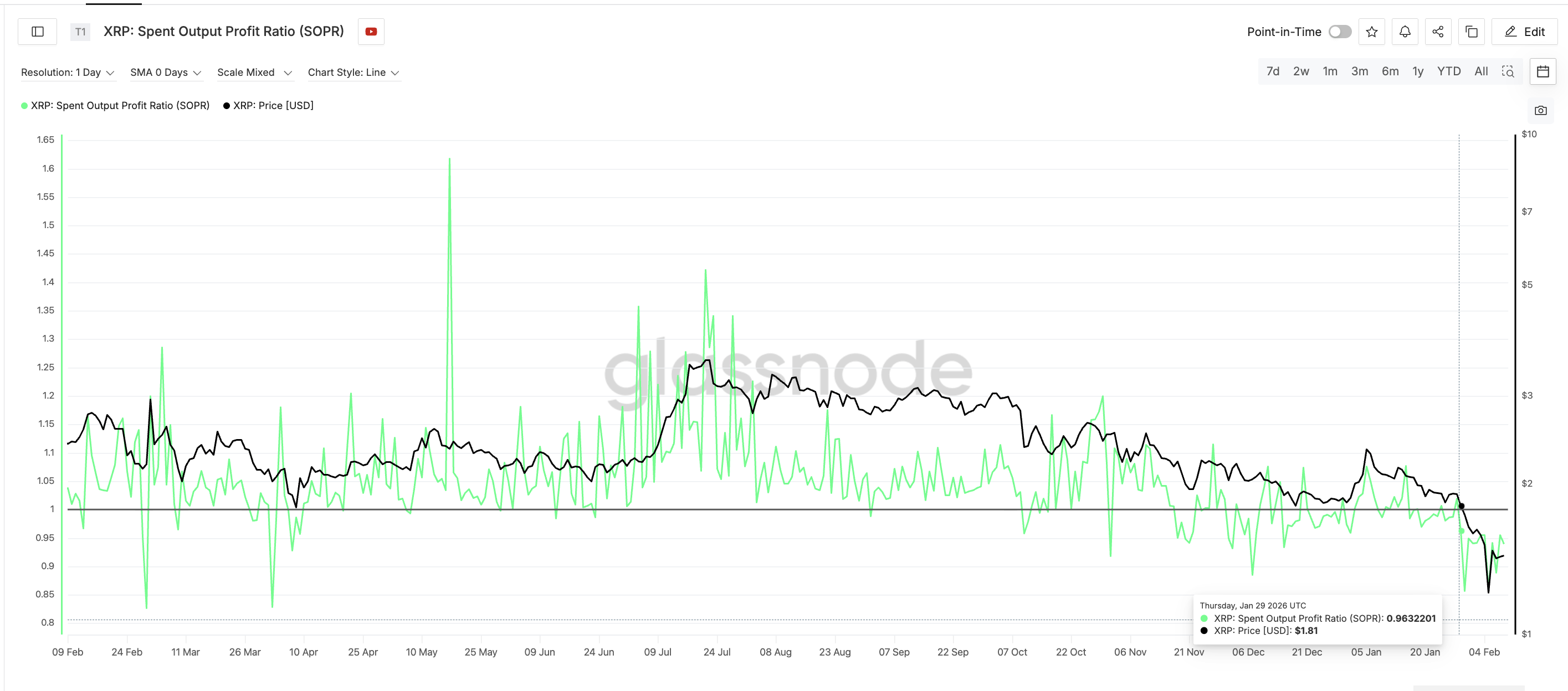

SOPR Shows Holders Are Still Selling at Losses Despite the Bounce

One of the clearest warning signals comes from the Spent Output Profit Ratio, or SOPR. SOPR measures whether coins being moved on-chain are sold in profit or at a loss. When it stays above 1, it shows profit-taking. When it remains below 1, it shows loss-selling.

Since late January, XRP’s SOPR has remained below 1 for more than ten consecutive days.

Sponsored

Sponsored

This is unusual. After a 30%+ rebound, short-term traders are normally sitting in profit. That usually pushes SOPR higher. But in XRP’s case, profitability never returned. Loss selling continued even as the price recovered. This means many holders are still exiting underwater positions.

In simple terms, the market is not seeing confident profit-taking. It is seeing stress-driven exits. To understand who is responsible, we need to look at holder cohorts.

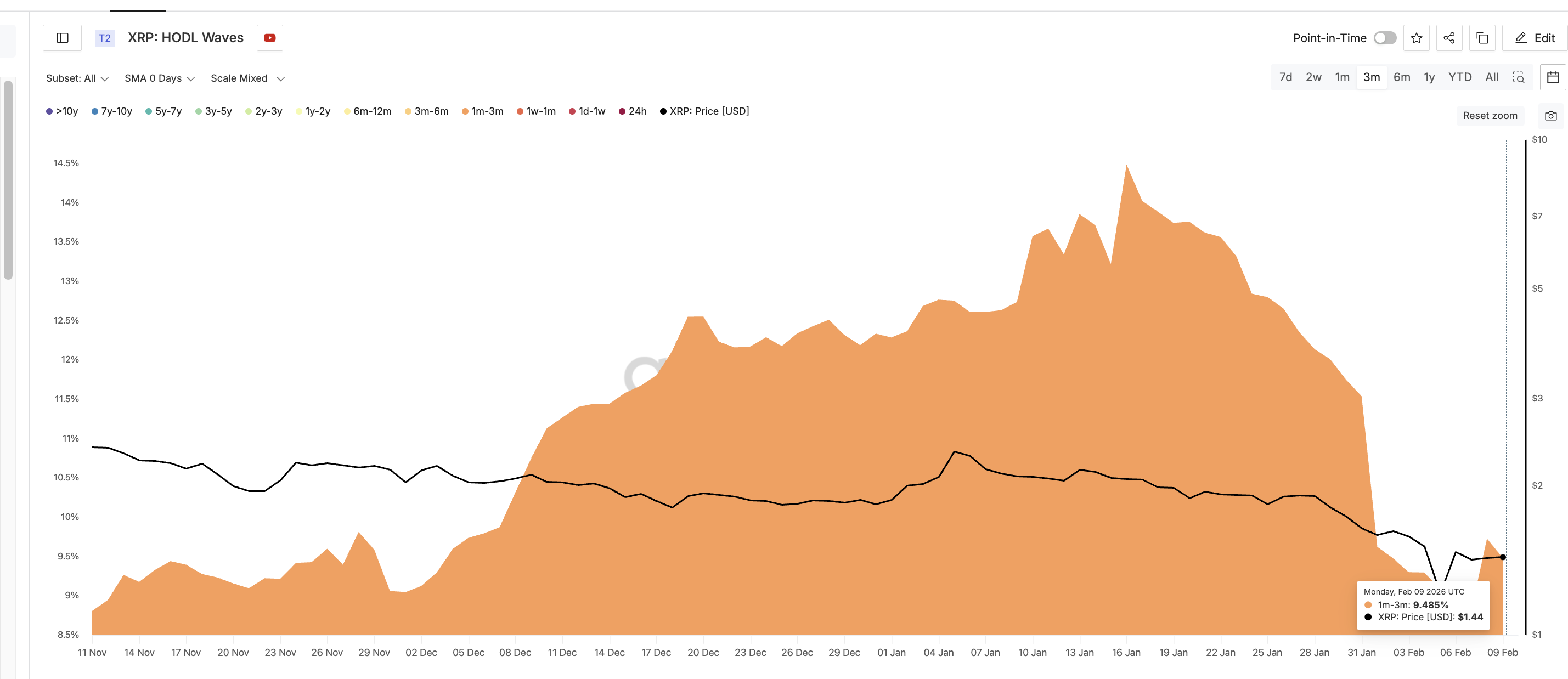

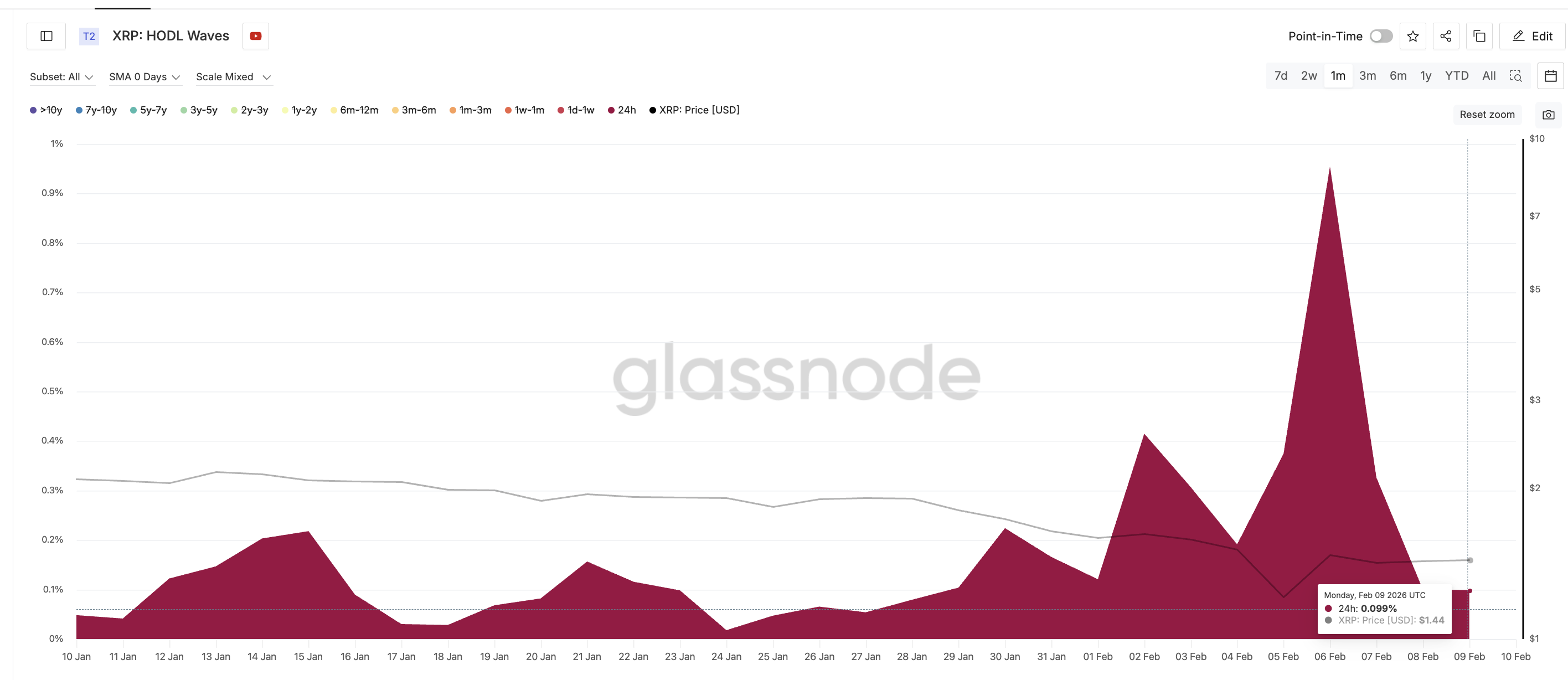

Holder Data Confirms the XRP Bounce Is Being Used to Exit, Not Accumulate

HODL Waves group XRP wallets based on how long they have held their coins. This helps identify which investor groups are buying or selling.

The most striking shift appeared in the 24-hour holder cohort.

On February 6, this group controlled about 1% of XRP’s circulating supply. Within days, that share collapsed to roughly 0.09%. That represents a decline of more than 90%.

Sponsored

Sponsored

These were highly reactive traders who entered during volatility and rushed to exit during the rebound.

Selling was not limited to this group.

The 1-month to 3-month cohort, which accumulated heavily in January when XRP traded near $2.07, has also been reducing exposure. Their share of supply fell from around 14.48% in mid-January to about 9.48% recently. That is a decline of roughly 35%.

These holders remain underwater. Instead of waiting for a full recovery, they are using rallies to minimize losses. Together, these two cohorts explain why SOPR has remained depressed for a long time now.

Short-term traders are exiting failed trades. Medium-term holders are cutting losing positions.

This behavior is typical of distribution phases, not early bull markets. And it directly impacts price structure.

Sponsored

Sponsored

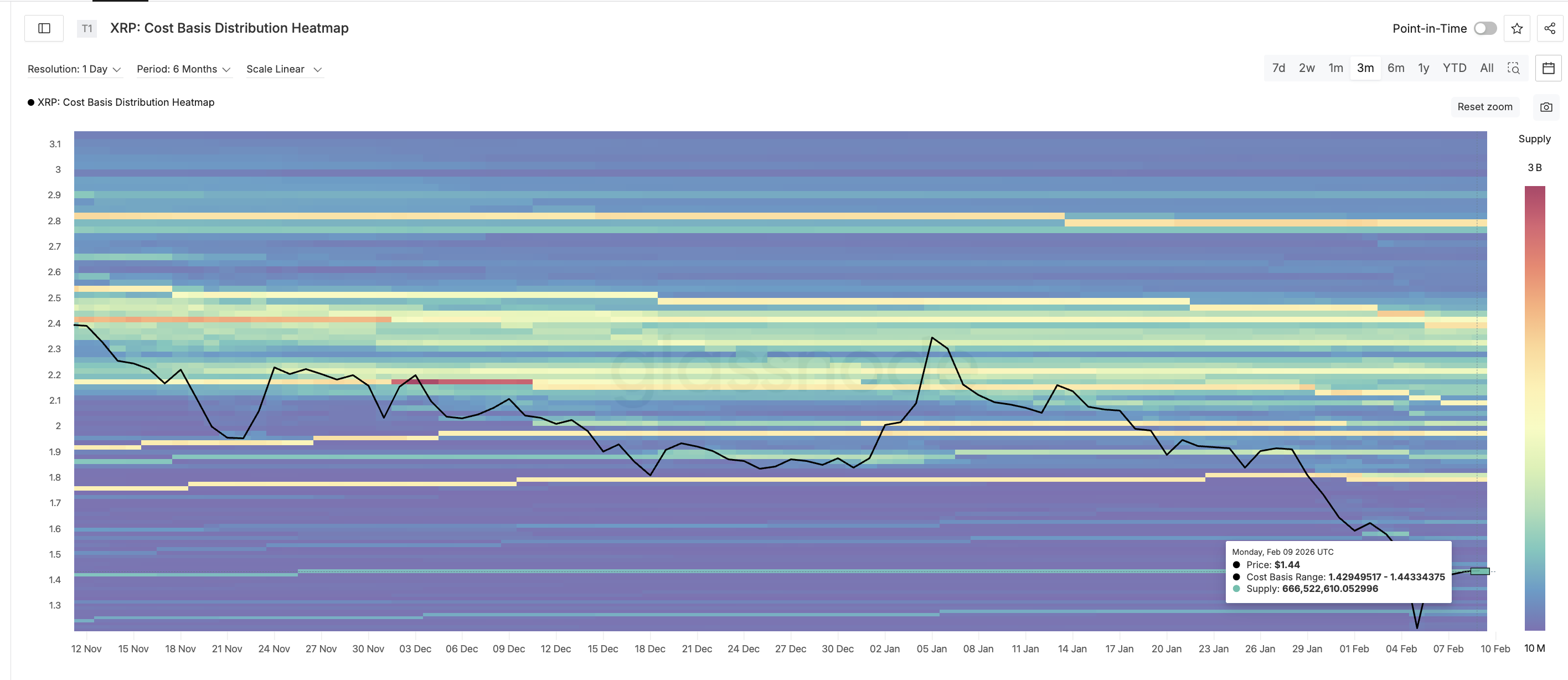

Cost Basis Data Shows Why $1.44–$1.54 Is a Wall for the XRP Price

Cost basis heat maps show where large groups of investors bought their coins. These zones often become resistance when the price returns to them.

For XRP, the strongest near-term cluster sits between $1.42 and $1.44. More than 660 million XRP were accumulated in this range. This creates a powerful sell zone.

When the price approaches this area, many holders reach break-even. After weeks of losses, they chose to exit.

Above this cluster lies the $1.54 level, which aligns with EMA resistance. Together, these zones form a barrier that XRP has repeatedly failed to clear. Each time the XRP price rallies into this region, selling intensifies. This is consistent with the distribution seen in SOPR and HODL Waves.

If XRP fails again near $1.44, downside risk increases. A rejection could send the price back toward $1.23 and possibly $1.12, the recent low. That would represent a decline of more than 20% from current levels.

Only a sustained break above $1.54, supported by improving profitability and reduced selling, would change this XRP price structure.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

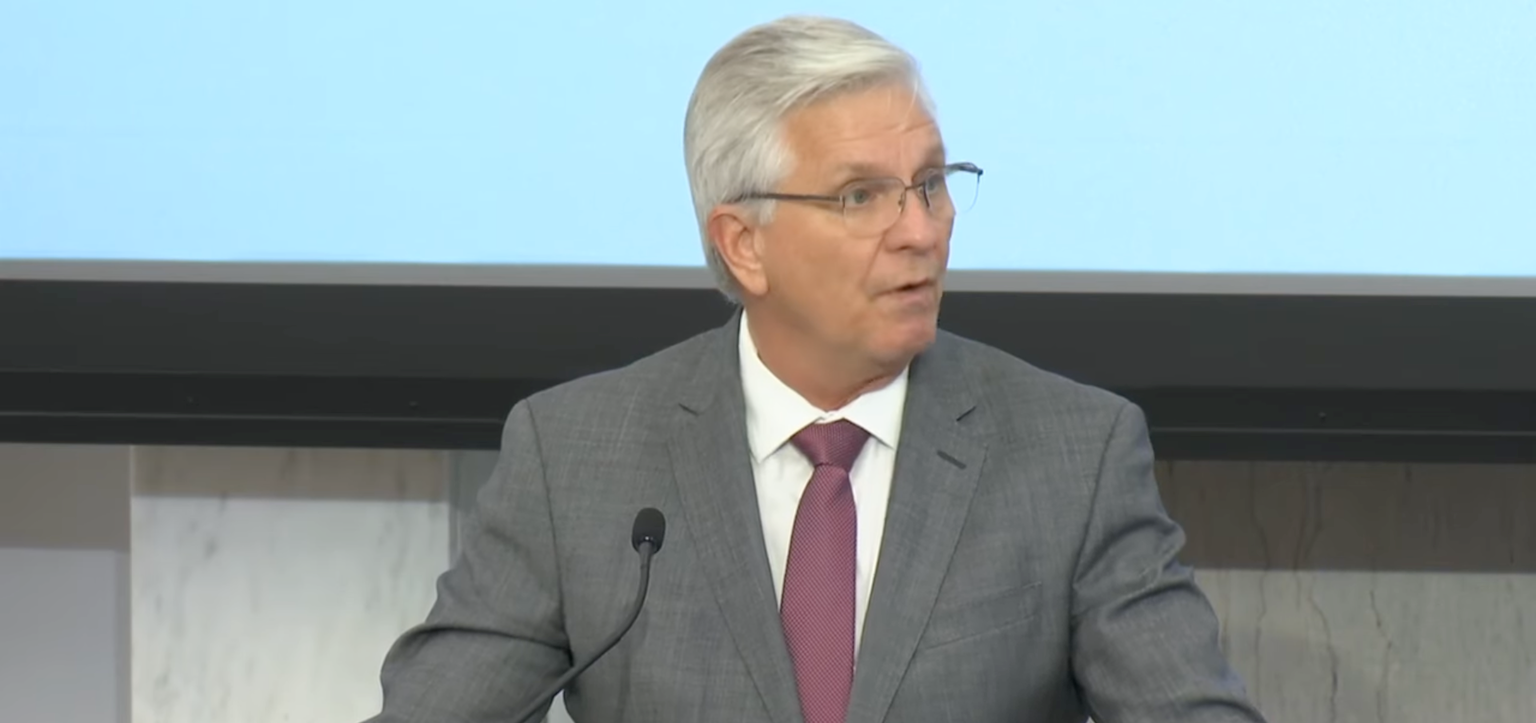

Federal Reserve Governor Chris Waller says the crypto hype that came with US President Donald Trump’s election victory has begun to wane as the market has become more entangled with traditional finance.

“I think some of the euphoria that came into the crypto world with the current administration, some of that’s kind of fading,” Waller said at a conference on Monday.

“A lot of it has been brought into the mainstream finance,” Waller said. “Then, you know, things have to happen there, so I think there was a lot of sell-off just because firms that got into it from mainstream finance had to adjust their risk positions.”

More traditional finance players have started to increase their exposure to crypto under the Trump administration, which has helped to elevate the market, but Waller argued that Congress’ failure to quickly pass the crypto market structure bill had also “put people off” as it leaves much uncertainty about how the products are regulated.

He also brushed off the recent market drop as “part of the game” with crypto. “You get in, you make some money, you might lose some money — that’s the nature of the beast.”

“Look, prices go up, prices go down — it’s just the nature of the business,” Waller said. “If you don’t like it, don’t get in it, that’s my advice to everybody.”

Bitcoin (BTC) has fallen 45% from its peak of $125,000 in October and is currently trading around $69,500 after a brief crash to under $60,000 on Friday.

Fed “skinny master accounts” to come this year: Waller

Waller said that the Fed would roll out its proposed “payment accounts” this year, which aims to give fintech and crypto firms limited access to the central banking system.

The Fed fielded feedback on the accounts, dubbed “skinny master accounts,” up until Friday, with crypto companies backing the plan while banking associations urged caution over the proposal.

Related: Bessent suggests Warsh nomination hearings alongside Powell probe

“We got a ton of stuff, and we’ll have to kind of work through that,” Waller said. “If we can get that done reasonably well, I’d like to try to have this done by the end of the year, if possible.”

The Fed’s proposal would see payment accounts given fewer privileges compared to master accounts commonly owned by major banks, such as removing the ability to earn interest and imposing balance limits.

Waller has previously said that payment accounts would “support innovation while keeping the payments system safe” and are necessary due to “rapid developments” in payments technology.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Vitalik Buterin’s Vision for Privacy, Economic Layer, and Governance

TLDR

- Vitalik Buterin proposes Ethereum as a key tool for privacy-preserving AI interactions and trust-minimized AI systems.

- He advocates for local AI models and cryptographic tools to protect users’ identities in AI interactions.

- Ethereum can serve as an economic layer for AI-to-AI interactions, supporting decentralized coordination and an AI reputation mechanism.

- Buterin envisions AI scaling human judgment to improve prediction markets and decentralized governance.

- Ethereum’s involvement in AI could decentralize power and shift control from corporations to more distributed systems.

Vitalik Buterin, the co-founder of Ethereum, shared his updated vision on the intersection of Ethereum and Artificial Intelligence (AI). In his statement, Buterin emphasized avoiding “accelerationist AGI” and instead focusing on human empowerment, privacy, and safety. He proposed that Ethereum could play a key role in building trust-minimized tools for secure AI interactions and integrating these technologies with crypto.

Building Privacy-Preserving AI Tools

Buterin advocates for the development of tools that prioritize privacy and trust in AI systems. He highlighted the importance of creating local AI models (LLMs) that allow users to interact without revealing their identities.

“ZK-payment for API calls” was also mentioned as a way to prevent linking users’ identities during transactions with remote models. Moreover, Buterin stressed the significance of cryptographic advancements that could improve AI privacy.

These technologies could include client-side verification of cryptographic proofs and trusted execution environments (TEEs). By implementing these tools, Ethereum could help ensure the safe interaction between AI systems and their users.

Ethereum as an Economic Layer for AI Interactions

Buterin envisions Ethereum becoming the backbone for economic transactions in AI ecosystems. He sees Ethereum facilitating AI-to-AI interactions, such as bots hiring bots and securing deposits for AI services.

By incorporating mechanisms like ERC-8004 for AI reputation, Ethereum can support decentralized coordination between AI systems. This setup would reduce the dependency on centralized organizations controlling AI models.

Ethereum could allow these systems to function economically, empowering more decentralized architectures. By doing so, Ethereum would help shift the power dynamic in AI from large corporations to a more distributed and transparent framework.

Decentralizing Governance and Expanding Human Judgment

In his vision, Buterin believes that AI could help overcome the limits of human decision-making. He emphasized how large language models (LLMs) can scale human judgment, making prediction markets and decentralized governance more efficient.

LLMs could help in areas like quadratic voting, combinatorial auctions, and universal barter economies. Buterin’s focus is on using AI to create better markets and governance structures that were previously limited by human attention.

With AI support, these systems could function more effectively, enabling more accurate decision-making at scale. Ethereum’s role in facilitating these interactions would strengthen the foundation of decentralized cooperation and improve future defense mechanisms.

Crypto World

Crypto exchange Backpack nears unicorn status as CEO lays out token strategy

Backpack Exchange, the crypto trading platform founded by former FTX and Alameda leaders, is reportedly in talks to raise around $50 million in new financing at a pre-money valuation above $1 billion.

Summary

- Backpack Exchange is reportedly in discussions to raise around $50 million at a valuation exceeding $1 billion, potentially elevating it to unicorn status.

- CEO Armani Ferrante outlined a tokenomics structure aimed at preventing early insider sell-offs and aligning incentives with long-term product growth.

- The company has also revealed plans for a 1 billion token supply, with 25% allocated at the token generation event, including community rewards.

If completed, the round would cement Backpack’s position in the crypto sector and potentially elevate it into unicorn status, a milestone for a firm still emerging from the post-FTX landscape.

The discussions come amid increased investor interest in fintech and crypto startups, and Backpack could parlay the fresh capital into expanding its exchange, wallet, and regulatory footprint globally.

The $50 million figure is a baseline, and reports suggest the eventual round size could grow larger.

Backpack CEO outlines tokenomics strategy

Meanwhile, Backpack CEO Armani Ferrante took to X to flesh out the company’s tokenomics framework ahead of a future token generation event.

Ferrante emphasized that the structure is designed to prevent early insiders from “dumping” tokens on retail investors, with no founders, executives, or venture backers receiving unlockable tokens until the product reaches significant traction, a concept he described as product “escape velocity.”

He also highlighted Backpack’s long-term goal of eventually going public in the U.S., signaling ambition beyond private fundraising and into regulated capital markets.

According to Ferrante, aligning token incentives with users, not short-term speculation, lays a foundation for sustainable growth and broader global adoption.

In a related post on the official Backpack account, the team confirmed elements of its upcoming token issuance plans. This includes a 1 billion token supply at launch and the allocation of 25 % of tokens at the Token Generation Event (TGE), with a portion earmarked for active community participants and points holders.

Crypto World

Bitmine ETH holdings hit 4.3M as firm buys $83M Ethereum in a day

Bitmine Immersion Technologies has pushed its Ethereum treasury to new highs, with total ETH holdings now standing at 4.326 million tokens, as the firm continued aggressive accumulation despite ongoing volatility in the crypto market.

Summary

- Bitmine Immersion Technologies’ Ethereum holdings have reached 4.326 million ETH, representing about 3.6% of ETH’s circulating supply.

- On-chain data shows the firm bought 40,000 ETH worth roughly $83.4 million in a single day, including a $42.3 million purchase from BitGo.

- Nearly 2.9 million ETH are staked, underscoring Bitmine’s long-term strategy despite ongoing market volatility.

The Tom Lee–chaired company disclosed in a recent press release that its Ethereum stash now represents around 3.6% of ETH’s total circulating supply, cementing Bitmine’s position as the largest known corporate holder of the asset.

Combined with Bitcoin and cash reserves, Bitmine’s total crypto and cash holdings are valued at approximately $10 billion.

Fresh $83M ETH buy signals continued accumulation

On-chain data flagged by Lookonchain shows that Bitmine added significantly to its position on Monday.

According to the analytics account, the firm purchased 20,000 ETH worth about $42.3 million from BitGo, following an earlier buy of the same size.

“Bitmine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals. In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance,” said Tom Lee, Executive Chairman of Bitmine.

Staking strategy anchors long-term bet on Ethereum

Bitmine said nearly 2.9 million ETH of its total holdings are currently staked, generating yield through its expanding Ethereum infrastructure operations. The company added that its ETH-focused strategy is aimed at long-term value creation rather than short-term price movements.

Chairman Tom Lee described recent price weakness as an opportunity, citing Ethereum’s history of sharp recoveries following deep drawdowns and pointing to staking yields as an additional source of return.

Ethereum has struggled to regain upside momentum amid broader risk-off sentiment across crypto markets. Still, Bitmine’s continued buying underscores growing interest among institutional players in Ethereum as a treasury asset, even as near-term price action remains uncertain.

Crypto World

Why is Hybrid tokenization model gaining traction in 2026?

Tokenization has rapidly evolved from a niche blockchain experiment into a strategic enabler for enterprises seeking greater liquidity, operational efficiency, and transparency across asset classes. However, as enterprises move beyond proof-of-concept initiatives, it has become increasingly clear that early, fully on-chain tokenization models are not designed to meet real-world enterprise requirements.

Enterprises operate within complex ecosystems defined by regulatory oversight, data privacy mandates, legacy infrastructure, and multi-jurisdictional compliance obligations. While public blockchain networks offer decentralization and transparency, they often lack the governance controls enterprises require. Conversely, fully private systems limit interoperability and long-term scalability.

This gap is being decisively filled by hybrid tokenization, a pragmatic and future-ready framework that blends blockchain innovation with enterprise-grade control. Hybrid models are emerging as the preferred foundation for enterprise asset tokenization, enabling organizations to unlock tokenized value without compromising compliance, privacy, or operational stability.

What Is Enterprise Asset Tokenization and Why Are Enterprises Re-Evaluating Tokenization Models in 2026?

Enterprise asset tokenization is the practice of using tokens built on blockchain technology to digitally represent ownership, rights and economic value of an enterprise’s asset[s] while embedding the governance, compliance, and operational controls that large organizations require.

Assets that can be tokenized include but are not limited to financial securities; portfolios of real estate; interests in private equity; commodities; infrastructure-related assets; intellectual property; and instruments for sharing revenue.

Numerous large structural shifts are influencing how organizations view and approach the tokenization of their assets:

- The regulatory landscape has matured. As such, regulators are now requiring that asset tokenization projects be auditable and provide investor protection through jurisdictional enforcement rather than being experimental efforts.

- Institutional participation has increased in the tokenization of assets. Institutional investors are establishing higher standards for how organizations should protect the confidentiality of their data, accurately report their results and mitigate risk.

- There has been an expansion of operational scale; enterprises have progressed from conducting small pilots of tokenizing their assets to developing and implementing broad-based strategies for tokenizing multiple types of assets in multiple markets.

- Enterprises can no longer avoid integrating their legacy systems and other operational platforms into their tokenization platforms. Tokenizing assets and developing tokenized asset-based products will require seamless integration between the tokenization platform and legacy ERP systems, the provider of custodial services, banks, and systems for complying with regulations.

These developments are causing organizations to rethink their evaluation of enterprise tokenization models by prioritizing those models that align with how they operate on a day-to-day basis rather than those that require organizations to alter their methods of operation.

Evaluate whether Hybrid Tokenization fits your Enterprise Roadmap

What Is a Hybrid Tokenization Model?

A hybrid tokenization model is an architectural approach that strategically distributes tokenization functions across blockchain networks and off-chain enterprise systems. Instead of forcing all processes onto a decentralized ledger, hybrid models apply blockchain selectively—where it delivers the greatest value—while retaining centralized control where required.

The following three components are integral to the hybrid tokenization architectural:

- A blockchain layer for token issuance, ownership tracking, and transaction immutability

- An off-chain enterprise layer for compliance, identity management, legal documentation, and sensitive data

- Middleware that synchronizes on-chain events with off-chain business logic and enterprise workflows

The Hybrid Tokenization Models provide a method for Enterprises to maximize the use of Blockchain technology while minimizing their exposure to regulatory and operational risks.

How Hybrid Tokenization Architecture Combines On-Chain and Off-Chain Tokenization

The success of tokenization of hybrid assets is dependent upon how well the on-chain and off-chain tokenization functions are coordinated. Each layer has been specifically designed to carry out the operations that will work most effectively in that environment.

1. On-chain Tokenization Layer

The on-chain tokenization layer has responsibility for activities that can be carried out in a decentralized, immutable, and automated manner:

- Issuing Tokens and Managing Their Life Cycle

Tokens will be generated on chain as a method of providing a cryptographic proof of ownership of the asset they represent. When life cycle events occur (minting, burning, freezing, or unlocking tokens), they are executed in an open and transparent manner to ensure that the integrity of the asset is maintained.

- Records of Transfer of Ownership

All transfers of the token from one holder to another will be recorded on the blockchain, resulting in an unalterable record of who owns an asset. The result is a reliable record for enterprises, investors & regulators to rely upon to establish provenance of the asset and validate any corresponding transactions.

Smart contracts provide an automated means of enforcing all contractual obligations (e.g., transfer restrictions, vesting schedules, dividend distributions, redemption of asset rights). As a result of using smart contract execution, manual interventions can be reduced, reducing the likelihood of operational errors. All contractual obligations will be consistently enforced.

Auditability in real time is possible due to the recordkeeping of the blockchain. Regulators and internal compliance departments can verify the validity of transactions with no reliance on reconciled reports, thereby creating far greater trust and transparency with all parties involved.

2. Off-chain enterprise layer

The off-chain layer provides functionality that requires privacy, flexibility, and regulatory discretion.

- KYC/AML Verification & Investor Accreditation

Identity verification in different jurisdictions has different processes and is continuously changing. By managing these workflows off-chain, businesses can quickly adapt their compliance logic to accommodate changing regulations and apply eligibility checks before participating on-chain.

- Legal Agreements & Contractual Governance

Ownership of assets is determined by legal documentation (prospectuses, shareholder agreements, and regulatory filings). Off-chain storage of these documents provides the ability to keep them updated and still be cryptographically linked to the on-chain token.

- Asset Valuation, Reporting, and Metadata Management

Many types of assets will need to be valued periodically, sometimes using third-party data feeds or human intervention. An off-chain system can facilitate accurate financial reporting and mitigate the risk of unnecessary oracle dependency.

- Integration to Enterprise Systems

Hybrid architectures facilitate the integration of ERP systems, accounting packages, custodial services and banking infrastructure. This enables tokenization to build on existing operations and not disrupt them.

Tokenization Models Comparison: Public, Private, and Hybrid Enterprise Tokenization Models

A comprehensive tokenization models comparison highlights why hybrid approaches are increasingly favored by enterprises.

Public tokenization models

Public models operate entirely on open blockchains, offering transparency and composability. However, they present challenges such as:

- Exposure of sensitive transaction data

- Limited jurisdictional enforcement capabilities

- Unpredictable transaction costs and network congestion

- Governance dependency on public network consensus

While suitable for open ecosystems, public-only models struggle to meet enterprise governance and compliance standards.

Private tokenization models

Private models emphasize control and confidentiality but introduce other limitations:

- Restricted interoperability and liquidity

- Heavy reliance on centralized administrators

- Limited external auditability

- Reduced long-term flexibility

These constraints can hinder scalability and investor confidence.

Hybrid enterprise tokenization models

Hybrid models combine the strengths of both approaches:

- Selective transparency with controlled access

- Built-in compliance and governance mechanisms

- Scalable participation across markets and asset classes

- Future adaptability to regulatory and technological change

For enterprises pursuing long-term digital asset strategies, hybrid models offer the most resilient foundation.

Why Hybrid Tokenization Will Define Enterprise Asset Strategies

As enterprises consider tokenization as long-term infrastructure, decision-makers are increasingly prioritizing frameworks that align with governance, compliance, and scalability. In this shift, the hybrid tokenization model is emerging as the most practical and future-ready choice for enterprise asset tokenization.

Key factors contributing to the adoption of hybrid tokenization by enterprises:

- Hybrid tokenization architecture balances decentralization with enterprise governance

Unlike fully public systems, hybrid tokenization architecture allows enterprises to use blockchain for immutable ownership and auditability while retaining off-chain control over compliance, identity, and legal enforcement—an essential requirement for regulated enterprise environments.

- Supports regulatory-ready enterprise tokenization models

Enterprise tokenization models will enable the enterprise to manage compliance regulations, jurisdictional limitations, and reporting procedures off-chain, therefore enabling the enterprise to update its compliance regulations more easily and with fewer disruptions than if using a fully decentralized architecture.

- Optimized use of on-chain and off-chain tokenization layers

A hybrid implementation allows an enterprise to maximize the benefits of implementing on-chain and off-chain tokenization while providing transparency, as appropriate, and confidentiality as needed on its blockchain infrastructure.

- Delivers superior results in tokenization models comparison

In any realistic tokenization models comparison, hybrid tokenization approaches often surpass completely public and completely private tokenization approaches by delivering selective transparency, controlled access, and long-term scalability—critical factors in determining whether enterprises will adopt tokenized assets.

- Enables scalable hybrid asset tokenization across multiple asset classes

With hybrid asset tokenization, enterprises can tokenize a variety of assets (e.g., securities, funds, real estate, RWAs) over a single shared blockchain layer while applying customized off-chain governance, valuation, and compliance workflows for each asset type.

- Reduces cost volatility and operational risk at scale

Enterprises using fully public or private on-chain systems experience significant volatility in fees due to fluctuating network congestion and stable fees. In contrast, hybrid tokenization models move the majority of high-volume and compliance-centric processes off-chain and deliver a more predictable level of performance and cost savings as a result of this approach.

- Strengthens institutional trust and accelerates market participation

Institutional investors require a high level of trust based upon the governance and enforceability of how assets are tokenized. Hybrid frameworks provide on-chain transparency coupled with off-chain legal and compliance controls to create a more credible and investable enterprise asset tokenization.

- Best implemented with an experienced asset tokenization development company

In order to implement hybrid tokenization solutions, it is important to partner with an experienced asset tokenization development company with expertise in blockchain, compliance, and enterprise integration so that the architecture supports legislative and operational realities.

Explore Enterprise-Ready Hybrid Tokenization

A Strategic Enterprise Outlook

With more organizations starting to implement their tokenization initiatives instead of merely experimenting with these new technologies as they come to market, hybrid tokenization models are clearly proving to be one of the leading approaches for enterprise asset tokenization due to their ability to combine on-chain and off-chain tokenization in a manner that ensures transparency, governance, and flexibility to operate in various asset classes and jurisdictions.

Of all the various tokenization models being evaluated today, hybrid tokenization models stand out because they achieve a proper balance between innovation and control; thus, providing enterprises with the means to execute their long-term tokenization strategy through 2026.

Organizations cannot achieve hybrid tokenization at scale without deep technical and regulatory knowledge. As an established and reliable asset tokenization development company, Antier is able to assist these enterprises by not only providing the asset tokenization development services and expertise needed to design and deploy compliant hybrid tokenization architectures but also by providing the blockchain, Web3, and enterprise integration capabilities necessary to create tokenization platforms that will meet future regulatory requirements in an efficient and secure manner.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat11 hours ago

NewsBeat11 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat22 hours ago

NewsBeat22 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports10 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report