Crypto World

Bitcoin’s Latest Drop May Be Proof the 4-Year Cycle Still Holds

Bitcoin’s (BTC) latest price correction is reinforcing, rather than undermining, the long-standing 4-year halving cycle that has historically shaped the asset’s market behavior, according to a new report from Kaiko Research.

The debate carries significant implications for traders and investors navigating Bitcoin’s volatility in early 2026.

Sponsored

Sponsored

Bitcoin Is Following Its 4-Year Cycle Amid Sharp Correction

Bitcoin fell from its cycle peak near $126,000 to the $60,000–$70,000 range in early February. This marked a drawdown of roughly 52%.

While the move rattled market sentiment, Kaiko argues the decline is fully consistent with previous post-halving bear markets and does not signal a structural break from historical patterns.

“Bitcoin’s decline from $126,000 to $60,000 confirms rather than contradicts the four-year halving cycle, which has consistently delivered 50-80% drawdowns following cycle peaks,” Kaiko’s data debrief read.

The report notes that the 2024 halving took place in April. Bitcoin topped out roughly 12–18 months later, aligning closely with prior cycles. In past instances, such peaks have typically been followed by extended bear markets lasting around a year before the next accumulation phase begins.

Kaiko says the current price action suggests Bitcoin has transitioned out of the euphoric post-halving phase and into that expected corrective period.

It is worth noting that many experts have previously challenged Bitcoin’s 4-year cycle. They argue that it no longer holds in today’s market. In October, Arthur Hayes said the 4-year Bitcoin cycle was over. He pointed instead to global liquidity as the dominant driver of price movements.

Sponsored

Sponsored

Others have argued that Bitcoin now follows a 5-year cycle rather than a 4-year one. They cite the growing influence of global liquidity conditions, institutional participation, and broader macroeconomic policy shifts.

Kaiko acknowledged that structural changes, including spot Bitcoin exchange-traded fund (ETF) adoption, greater regulatory clarity, and a more mature DeFi ecosystem, have distinguished 2024-2025 from previous cycles. Nonetheless, it said these developments have not prevented the expected post-peak retracement.

Instead, they have changed how volatility manifests. Spot Bitcoin ETFs recorded more than $2.1 billion in outflows during the recent sell-off.

This amplified downside pressure and demonstrated that institutional access increases liquidity in both directions, not just on the way up. According to Kaiko,

“While DeFi infrastructure has shown relative resilience compared to 2022, TVL declines and slowing staking flows indicate no sector is immune to bear market dynamics. Regulatory clarity has proven insufficient to decouple crypto from broader macro risk factors, with Fed uncertainty and risk-asset weakness dominating market direction.”

Kaiko also raised the key question now dominating market discussions: where is the bottom? The report explained that Bitcoin’s intraday rebound from $60,000 to $70,000 suggests initial support may be forming.

However, historical precedent shows that bear markets typically take six to 12 months and involve multiple failed rallies before a sustainable bottom is established.

Kaiko noted that stablecoin dominance stands at 10.3%, while funding rates have fallen close to zero and futures open interest has dropped by about 55%, signaling significant deleveraging across the market. Still, the firm cautioned that it remains unclear whether current conditions represent early, mid, or late-stage capitulation.

“The four-year cycle framework predicts we should be at the 30% mark. Bitcoin is doing exactly what it has done in every previous cycle, but it seems many market participants convinced themselves this time would be different,” Kaiko wrote.

As February 2026 progresses, market participants must weigh both sides of this argument. Bitcoin’s next moves will reveal whether history continues to repeat or a new market regime is taking shape.

Crypto World

Bitcoin Price Shows Bottom Signal Not Seen Since 2022

Bitcoin has attempted to recover in recent sessions, but upward momentum has stalled as the market waits for a clearer direction. Price remains range-bound after a sharp correction, frustrating short-term traders.

Despite this pause, historical indicators suggest a bottom may be forming. Past cycles show similar conditions often precede renewed recovery phases.

Sponsored

Sponsored

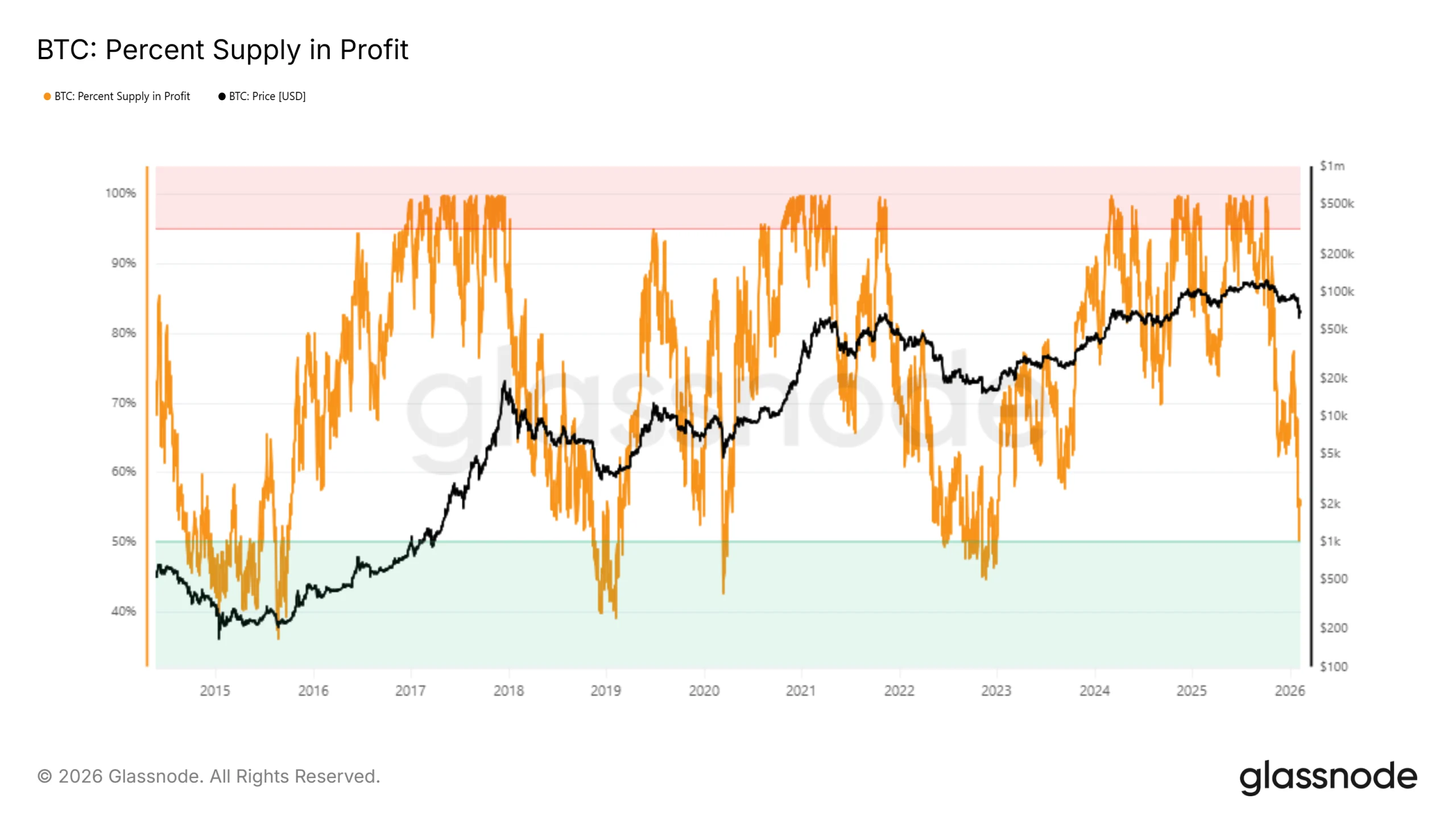

Bitcoin Profitable Supply Hits 2022 Level

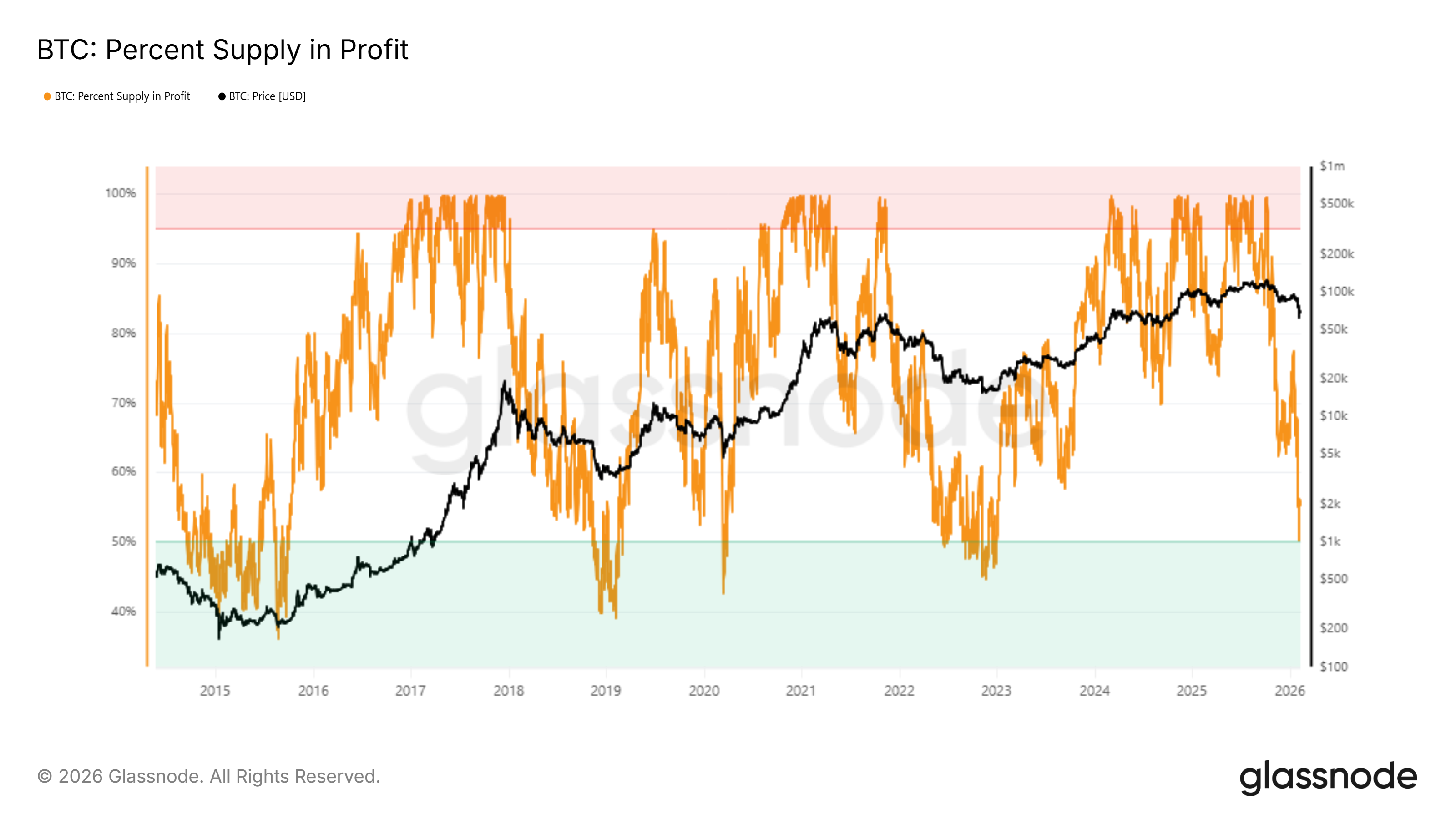

Bitcoin’s recent decline triggered a signal last seen during the 2022 bear market. The percentage of supply in profit fell to around 50%, meaning half of all circulating BTC is now underwater. This threshold has historically coincided with market bottoms rather than prolonged sell-offs.

When profitable supply compresses to these levels, selling incentives weaken. Holders become less willing to realize losses, reducing sell-side pressure. In previous cycles, this dynamic encouraged investors to hold through volatility, allowing the price to stabilize before recovery resumed.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Lower prices also attract fresh capital. Value-oriented buyers tend to enter when downside risk appears limited relative to upside potential. This influx of new demand has historically helped revive Bitcoin recoveries once profitable supply falls to or below the 50% mark.

Why Is Bitcoin Likely To Bounce Back?

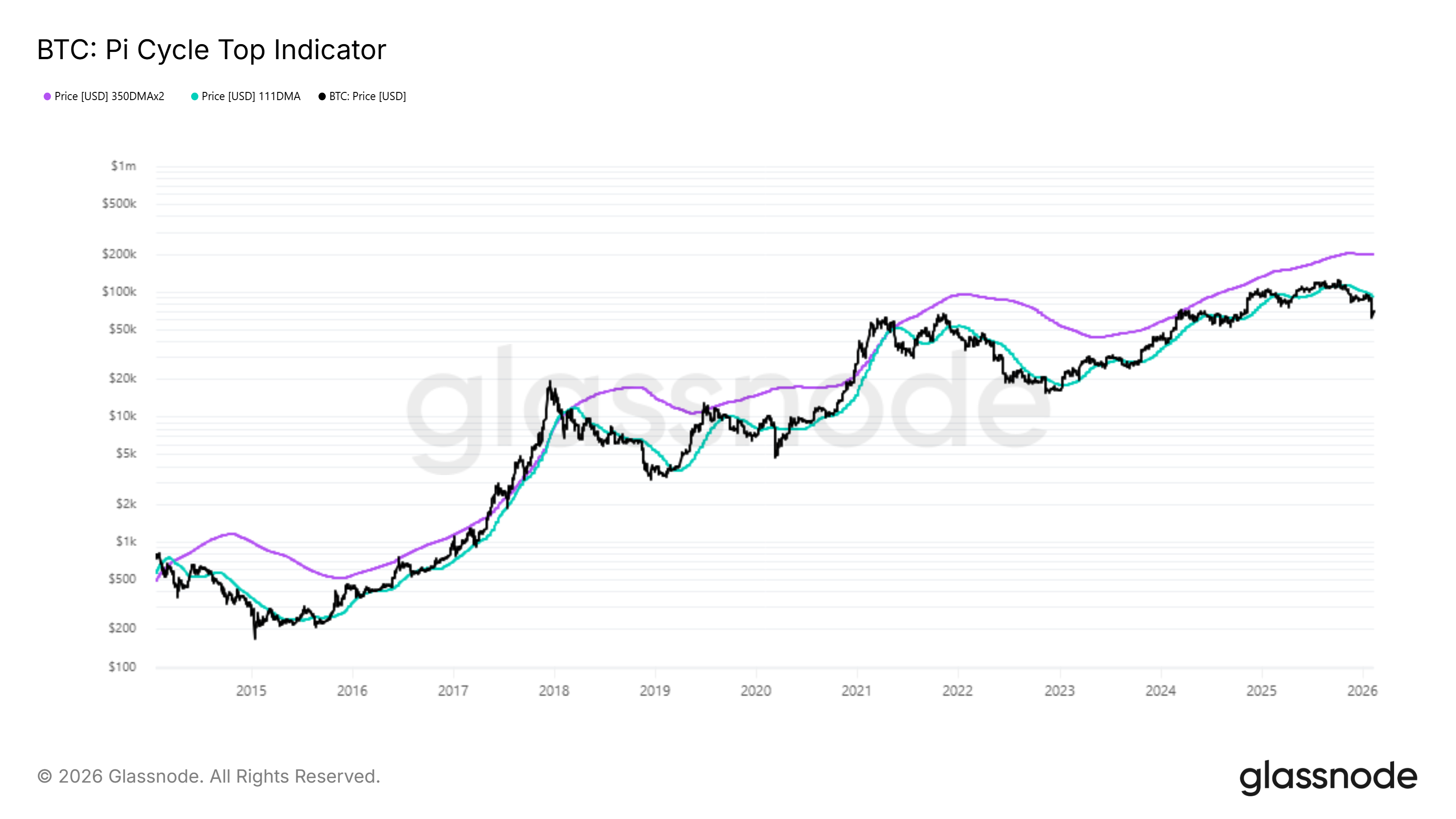

Macro indicators reinforce the bottoming narrative. The Pi Cycle Top Indicator, which compares the 111-day moving average to a doubled 350-day moving average, remains far from signaling BTC overheating. This indicator historically flags major tops when the shorter average crosses the higher threshold.

Sponsored

Sponsored

Currently, the opposite setup is unfolding. The shorter moving average is diverging below the longer one, signaling cooling conditions rather than excess speculation. In past cycles, such divergence often preceded sustained rebounds as Bitcoin reset from overheated levels.

This cycle differs from prior ones. Since March 2023, Bitcoin has maintained a macro uptrend without excessive overheating. Gradual price appreciation limited speculative excess, making this the first clear bottom signal in nearly three years rather than a sharp capitulation-driven low.

BTC Price Levels To Watch

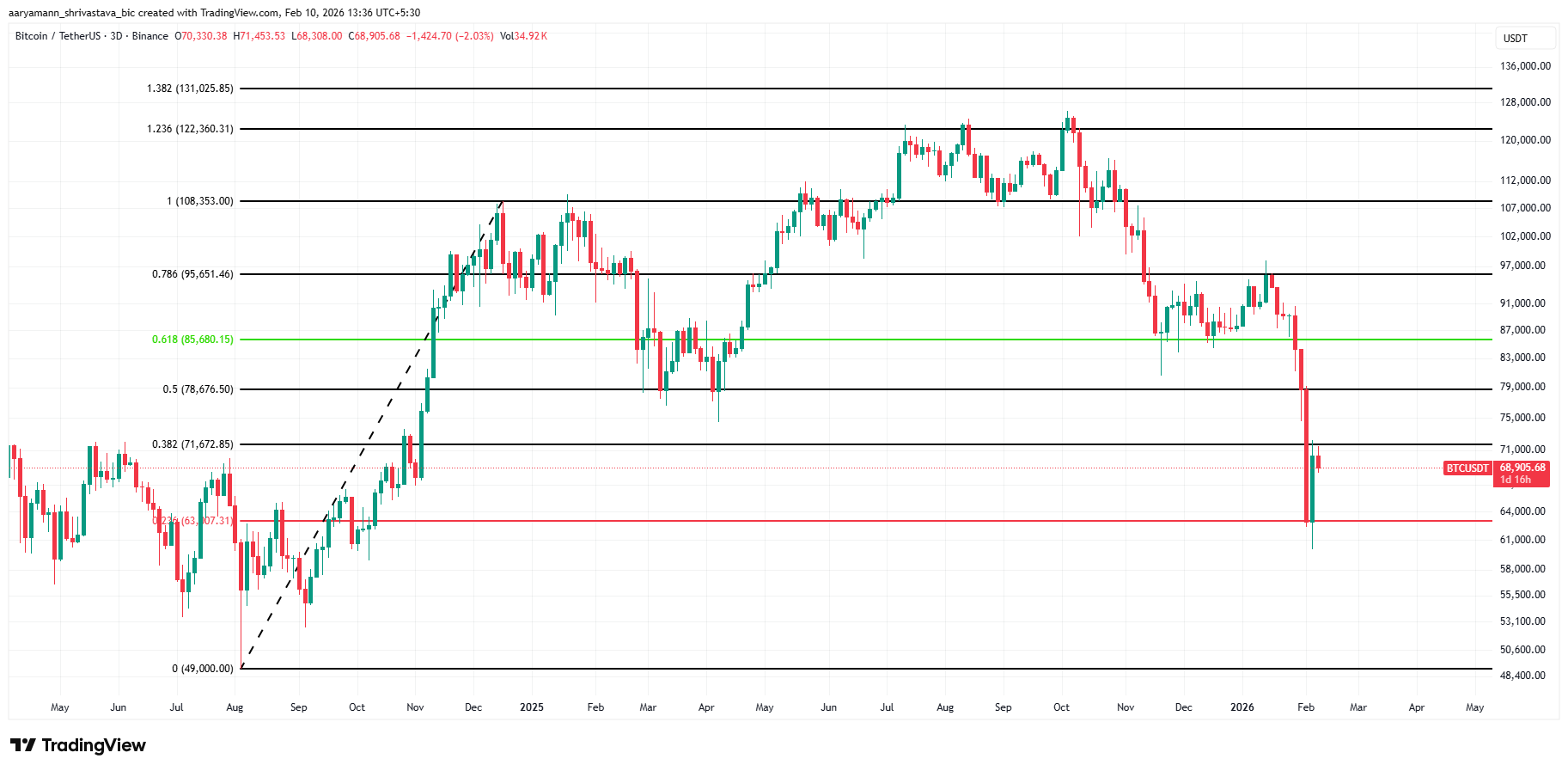

In the short term, Bitcoin is holding above the 23.6% Fibonacci retracement near $63,007. At the time of writing, BTC trades around $68,905, maintaining support despite repeated tests. However, price remains capped below the $71,672 resistance, limiting immediate upside.

If on-chain signals continue holding and inflows strengthen, Bitcoin could break above $71,672. Such a move would open the path toward $78,676. Stronger confirmation of recovery would come only if BTC reclaims $85,680 as a sustained support level.

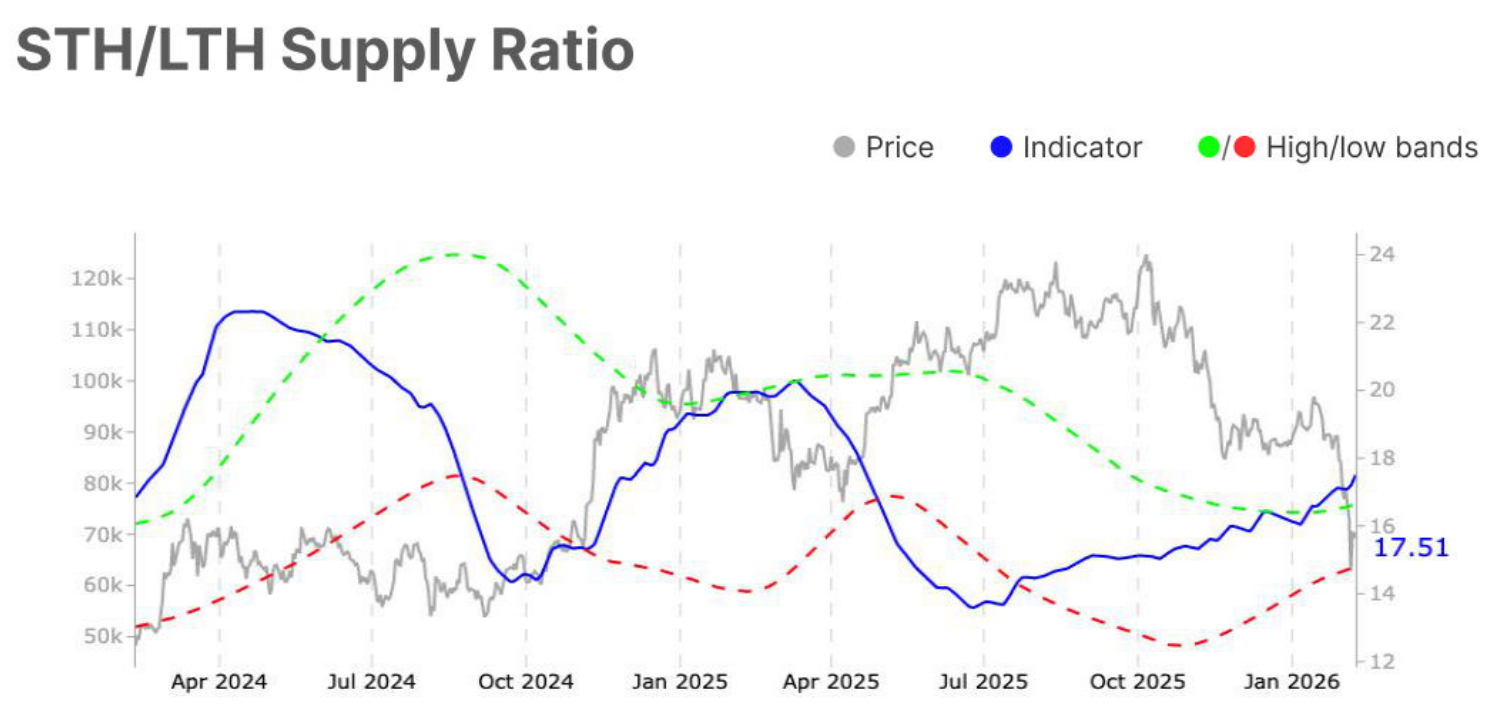

Risks remain on the downside due to the shifting market structure. The short-term holder to long-term holder supply ratio has moved above its upper band. This reflects growing short-term participation, often linked to higher volatility.

This would hurt Bitcoin’s price chances of crossing the $71,672 barrier, continuing its consolidation. Even if BTC does push past said resistance, the selling will pull it back down towards $63,000, invalidating the bullish thesis.

Crypto World

Nvidia (NVDA) Shares Rise Towards a Key Resistance Level

As the Nvidia (NVDA) share chart shows, during yesterday’s trading session the price advanced towards a key resistance area around $192.50, where notable peaks were formed in December 2025 and January 2026. The move was supported by several factors that boosted optimism:

→ Comments from company management. Nvidia CEO Jensen Huang stated that rising spending on AI is justified and reflects a long-term growth phase for the industry.

→ Goldman Sachs analyst Jim Schneider expects Nvidia’s fourth-quarter revenue to exceed forecasts and surpass $67 billion, and also anticipates strong sales and profit figures in the first quarter of the 2026 financial year.

Technical Analysis of the Nvidia (NVDA) Chart

On the morning of 4 February, when analysing NVDA price movements, we:

→ updated the long-term ascending channel, which remains intact;

→ noted the proximity of its lower boundary, which had acted as a key support level for many months;

→ suggested that NVDA’s price could stabilise in the lower quarter of the channel.

Since then:

→ between 4 and 6 February, the price moved sideways near the lower boundary of the channel, reflecting a balance between supply and demand;

→ following a false break below the December low, the share price staged a sharp rebound, signalling the dominance of buying pressure.

It is reasonable to assume that:

→ the initiative is currently on the side of the bulls, who appear determined to resume the long-term upward trend;

→ if another attempt is made to break through the aforementioned resistance level, it is likely to succeed, opening the way for NVDA shares to move towards the psychological $200 mark.

The realisation of this scenario could be supported by positive sentiment ahead of Nvidia’s earnings release on 25 February and the GTC 2025 conference in mid-March, when new product announcements may be made.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Fugitive Daren Li sentenced to 20 years in the U.S. for $73M international crypto scam

A federal judge in California sentenced in absentia a dual national of China and St. Kitts and Nevis to 20 years in prison for his role in a $73 million international crypto scam.

Daren Li, who is a fugitive after removing an ankle electronic monitoring device in December, was also handed three years of supervised release for his role in an international cryptocurrency investment conspiracy carried out from scam centers in Cambodia, according to a court statement on Monday.

Cambodia has become a hub for “pig butchering” crypto scams, generating over $30 million daily via forced labor compounds, according to a TRM Labs report. A separate TRM report revealed how over $96 billion in crypto has flowed to Cambodia-linked companies since 2021, used heavily for money laundering and fraud.

“As part of an international cryptocurrency investment scam, Daren Li and his co-conspirators laundered over $73 million dollars stolen from American victims,” Assistant Attorney General A. Tysen Duva of the Justice Department’s Criminal Division said in the statement.

Duva said the court’s criminal division is working with global law enforcement officials to find, detain and return Li to the U.S. to serve his entire sentence.

Li pleaded guilty on Nov. 12, 2024, in the Central District of California to conspiring with others to launder funds obtained from victims through crypto scams and related fraud. As part of his plea agreement, Li said he and his cronies would contact victims directly through unsolicited social-media interactions, telephone calls and messages and online dating services. Their tactics entailed gaining victims’ trust by establishing professional or romantic relationships with them, then luring them into using spoof platforms to appear to invest in crypto.

In other instances, the group posed as tech-support staff and induced victims to send funds via wire transfer or cryptocurrency trading platforms to purportedly remediate a non-existent virus or other false computer-related problem.

Social engineering scams, such as fake investment offers and impersonation tactics, were the leading threat to crypto users, accounting for losses in the billions of dollars and representing nearly 41% of all crypto security incidents in 2025.

Crypto World

5 Buy-the-Dip Signals Crypto Traders Are Watching Right Now

The crypto market capitalization has fallen more than 20% year-to-date. In February, investors are divided over whether prices are approaching a local bottom or whether the broader bear market still has room to run.

Amid persistent volatility and growing uncertainty, a key question remains: when is the right time to buy the dip? Analytics platform Santiment has outlined 5 signals to help traders.

Sponsored

Sponsored

Are Traders Missing Buy Signals During Market Fear? Santiment Shares 5 Signals

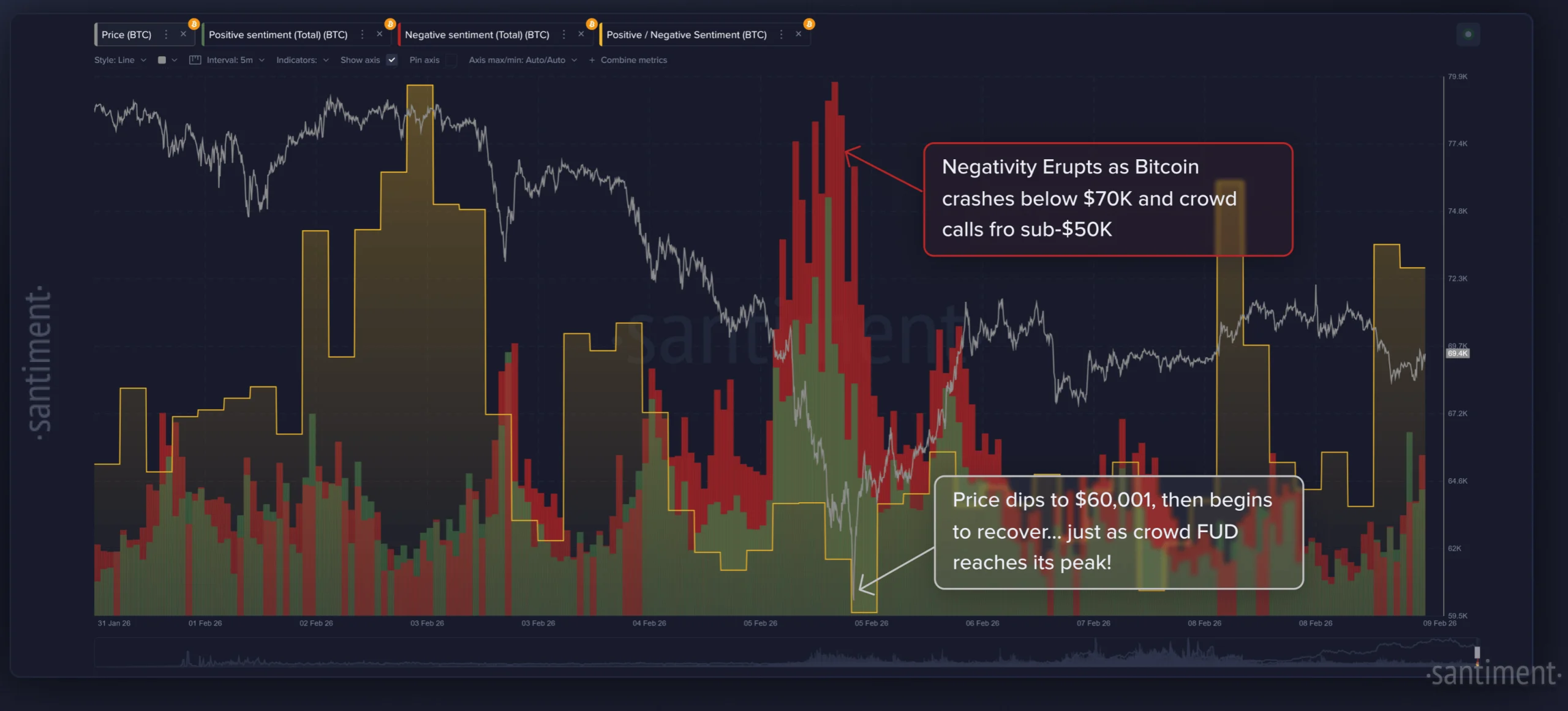

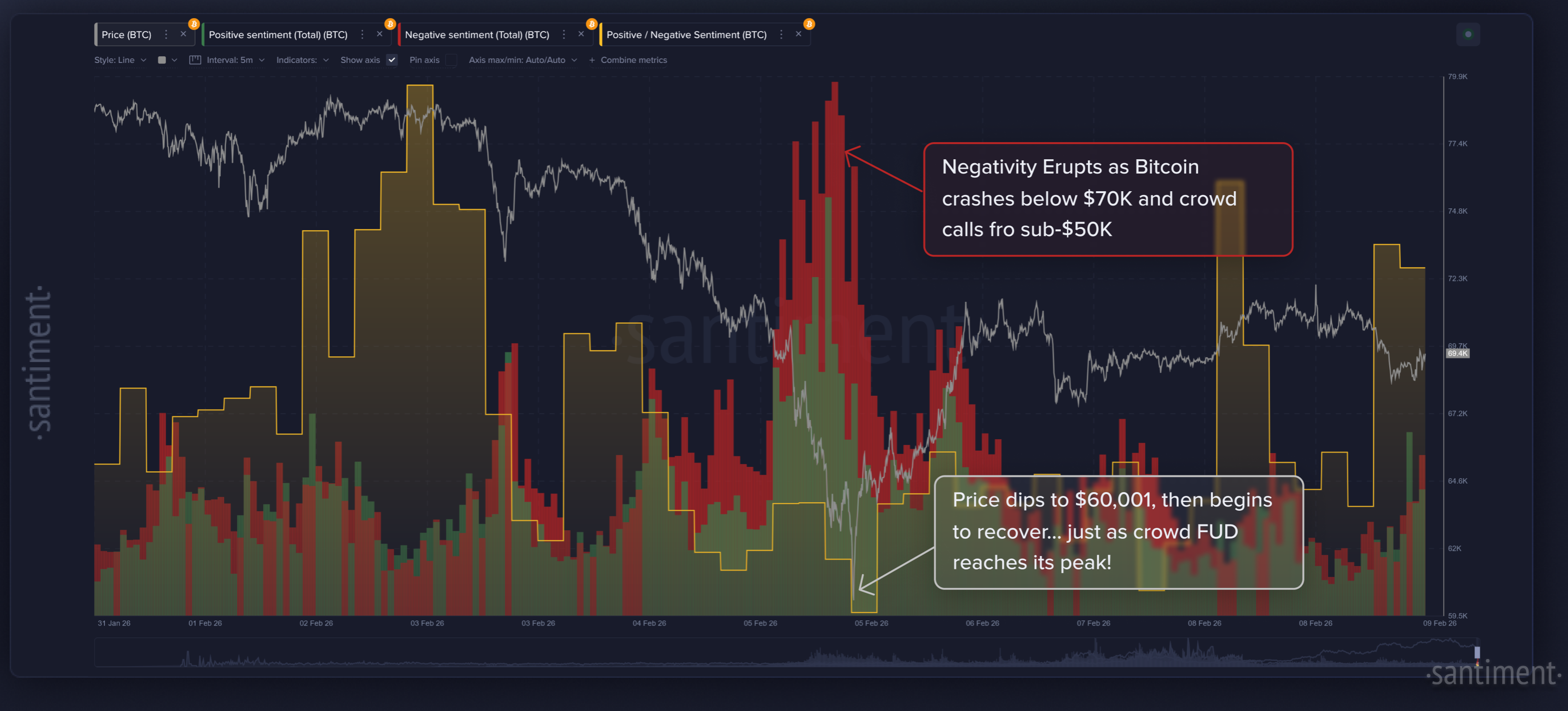

According to Santiment, the first indicator comes from extreme negative social sentiment. By measuring the balance of pessimistic and optimistic language tied directly to specific assets, traders can better filter out noise and identify moments when fear dominates discourse.

Sharp spikes in fear, uncertainty, and doubt (FUD) and pessimistic commentary across social media in past instances have been followed by market rebounds.

“Bottoming out at $60,001 back on Thursday, cryptocurrency’s top market cap asset rebounded a staggering +19% in just under 24 hours following the FUD,” the post read. “When negativity gets high, it’s usually because prices are getting low in a hurry. And once you see the predictions of doom for cryptocurrency, it’s generally the best time to officially buy the dip.”

Another signal comes from tracking mentions of phrases such as “buy”, “buying”, or “bought” in association with the word “dip.” While these mentions increase during sell-offs, Santiment cautions that this metric alone is unreliable. This is because markets can rebound before retail traders fully capitulate.

A more telling sign, according to the platform, is the shift in language from “dip” to more extreme terms like “crash.” When catastrophic language begins to dominate discussions, it suggests fear-driven capitulation.

Santiment also highlighted the value of monitoring trending bearish keywords. This includes “selling,” “down,” or narratives suggesting assets are “going to $0,” which often emerge when retail confidence breaks.

Sponsored

Sponsored

The final signal comes from on-chain data, specifically the 30-day Market Value to Realized Value (MVRV) ratio. This metric measures whether recently active wallets are, on average, in profit or at a loss.

When MVRV enters the “strongly undervalued” zone, it indicates that the most recent buyers are underwater. This condition could precede market rebounds.

“As the ‘zone’ graphics indicate, you typically want to avoid being heavily invested in an asset when it is above the ‘Strongly Overvalued Zone.’ But on the flip side, there is great upside to buying while it is below the “Strongly Undervalued Zone.” Santiment added.

The analysis stressed that defining what constitutes a “dip” largely depends on market context and the timeframe a trader is operating on. A short-term move of around 1.7% may present an opportunity for hourly swing traders.

Nonetheless, the platform noted that most market participants tend to react on a weekly basis. This better reflects the realistic trading bandwidth of the average trader.

Rather than relying on intuition or “anecdotal things,” the firm argues that objective data offers clearer insight into when fear-driven sell-offs may be nearing exhaustion.

It is worth noting that buying decisions ultimately depend on individual investor preferences and time horizons. While Santiment’s signals can help identify periods of heightened fear and potential opportunity, they do not guarantee that a market rebound will follow.

At present, many analysts suggest that the broader bear market may still have room to run. This means that prices could remain under pressure for longer.

As a result, decisions to buy or hold should be guided by each investor’s risk tolerance, strategy, and opportunity cost considerations.

Crypto World

How to Predict An October 10-Style Bitcoin Crash Early

Billion-dollar liquidation events are no longer rare in crypto markets. While these crashes often appear suddenly, on-chain data, leverage positioning, and technical signals usually reveal stress long before forced selling begins. This article examines whether reconstructing major historical events can help anticipate liquidation cascades.

Keep reading on for early signals and how to read them together. Throughout this piece, we analyze two major events: October 2025 (long liquidation cascade) and April 2025 (short squeeze), and trace the signals that appeared before both. The focus remains primarily on Bitcoin-specific metrics, as it still accounts for nearly 60% (59.21% at press time) of total market dominance.

October 10, 2025 — The Largest Long Liquidation Cascade Came With Signs

On October 10, 2025, more than $19 billion in leveraged positions were taken out, making it the largest liquidation event in crypto history. Although US–China tariff headlines are often cited as the trigger, market data show that structural weakness was around for weeks. The majority of these liquidations were long-biased, almost $17 billion.

Price Extension and Leverage Expansion (Sep 27 → Oct 5)

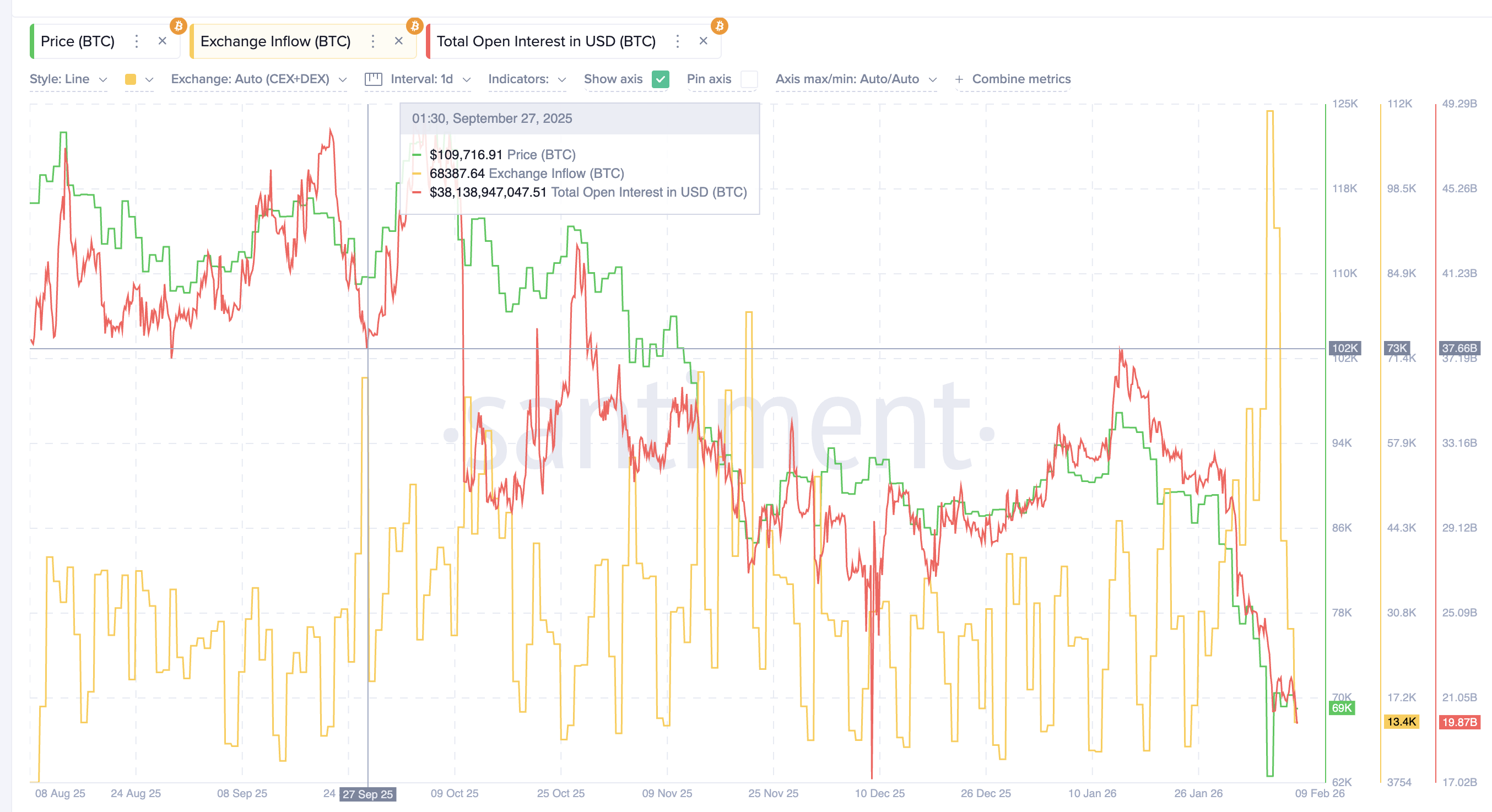

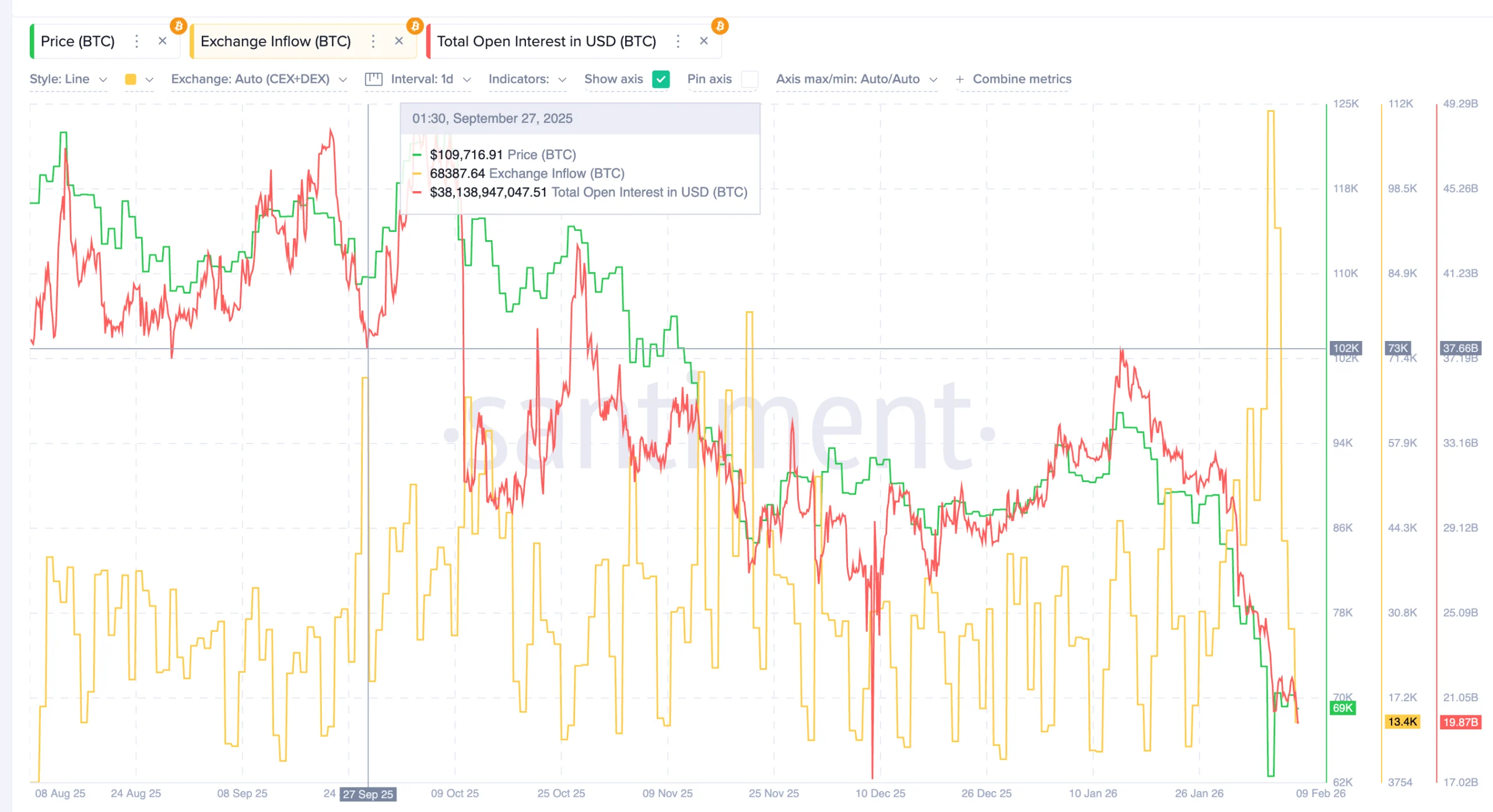

Between September 27 and October 5, Bitcoin rallied from around $109,000 to above $122,000, eventually testing the $126,000 area. This rapid move strengthened bullish sentiment and encouraged aggressive long positioning.

During the same period, open interest rose from roughly $38 billion to more than $47 billion. Leverage was expanding fast, indicating growing dependence on derivatives.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Gracy Chen, the CEO of Bitget, said modern market structure makes leverage far more synchronized than in earlier cycles.

Sponsored

Sponsored

“Positions are built and unwound faster, across more venues… leverage behaves more synchronously… When stress hits, the unwind is sharper, more correlated, and less forgiving,” she added.

At the same time, exchange inflows fell from around 68,000 BTC to near 26,000 BTC. Holders were not selling into strength. Instead, supply stayed off exchanges while leveraged exposure increased.

This combination reflected a late-stage rally structure.

At this stage of the cycle, rising leverage or open interest, for that matter, not only increases trader risk. It also raises balance-sheet and liquidity pressure on exchanges, which must ensure they can process liquidations, withdrawals, and margin calls smoothly during sudden volatility.

When asked how platforms prepare for such periods, Chen, said risk management starts long before volatility erupts:

“Holding a strong BTC reserve is a risk management decision before it’s a market view… prioritize balance-sheet resilience… avoid being forced into reactive moves when volatility spikes…,” she said

Profit-Taking Beneath the Surface (Late Sep → Early Oct)

On-chain profit data showed that distribution had already begun.

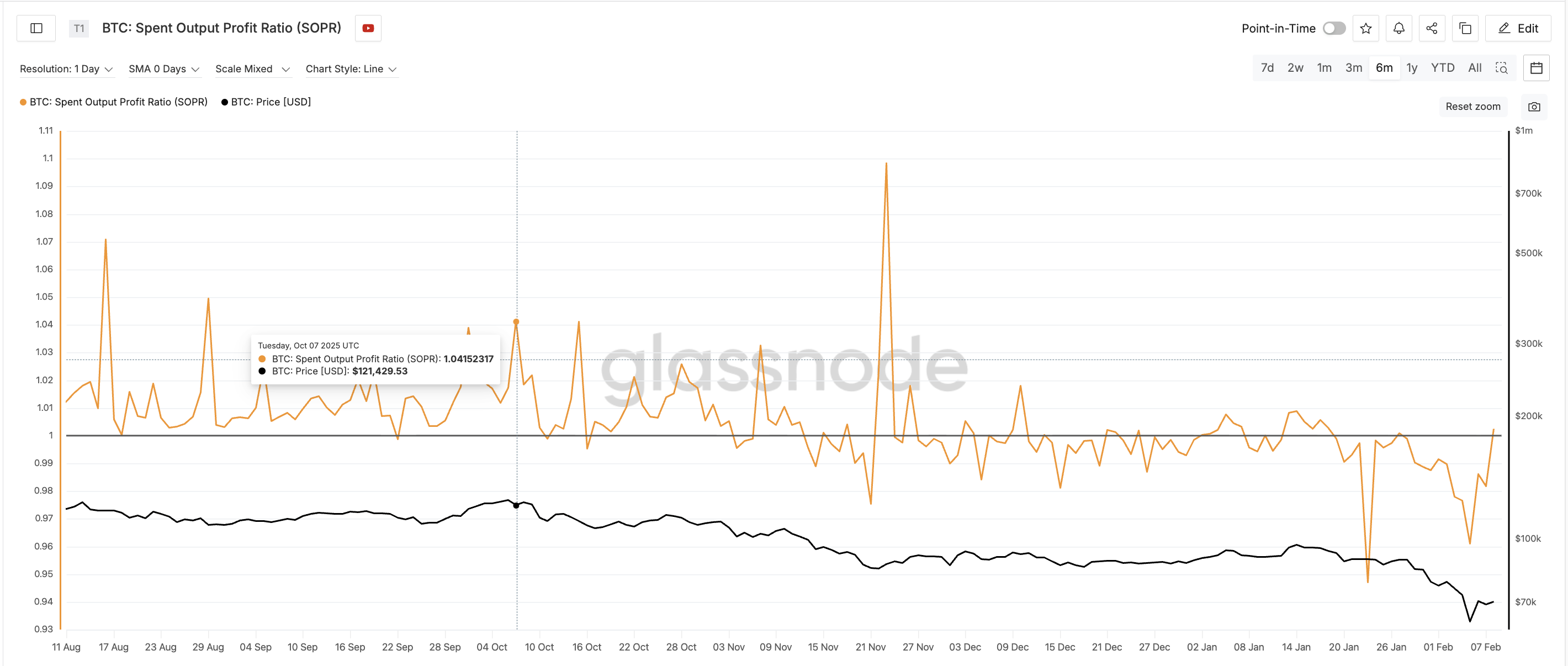

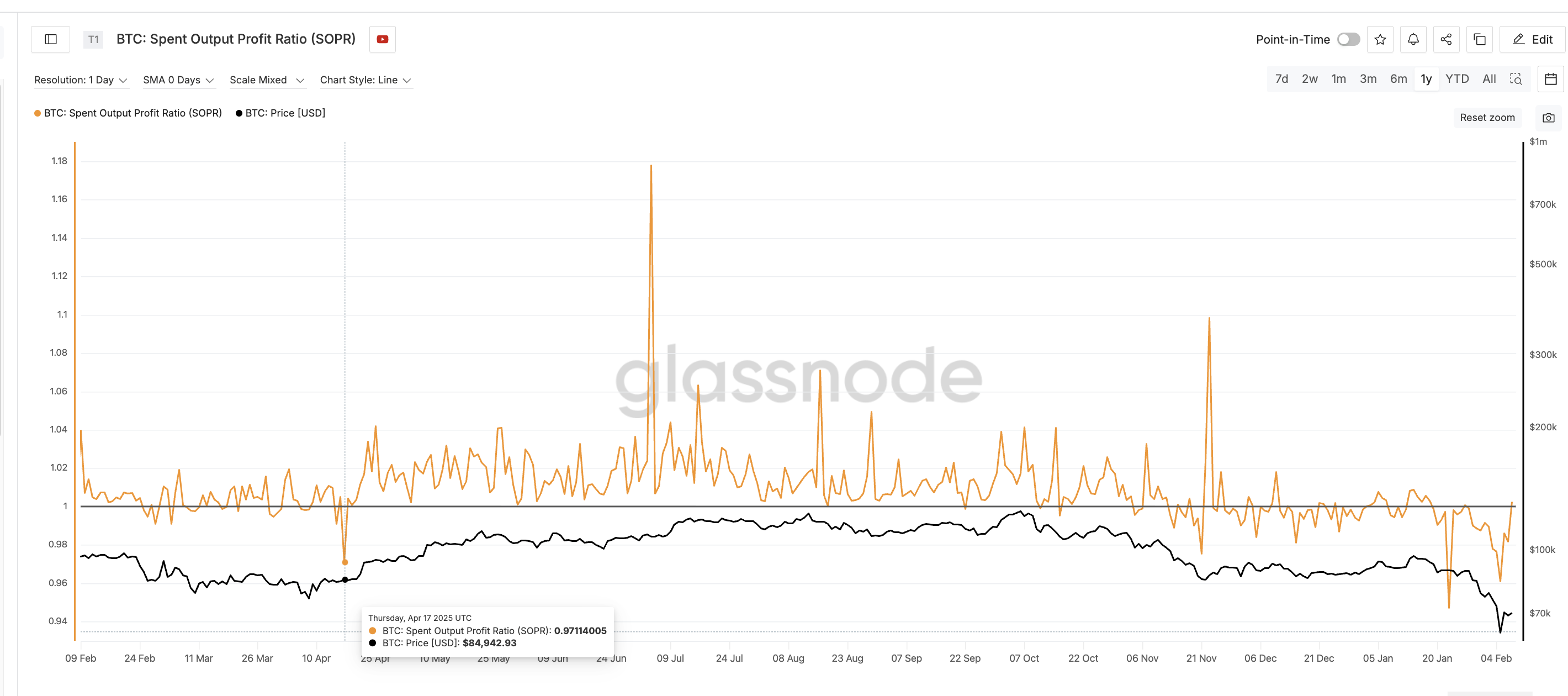

From late September into early October, Spent Output Profit Ratio (SOPR), which tracks whether coins are sold at profit or loss, went up from around 1.00 to roughly 1.04, with repeated spikes. This indicated that more coins were being sold at a profit.

Importantly, this happened while exchange inflows remained low. Early buyers (possibly already exchange-held supply) were quietly locking in gains without triggering visible selling pressure. And BTC was already at an all-time high during that time.

This pattern suggests a gradual transfer from early participants to late entrants, often seen near local tops.

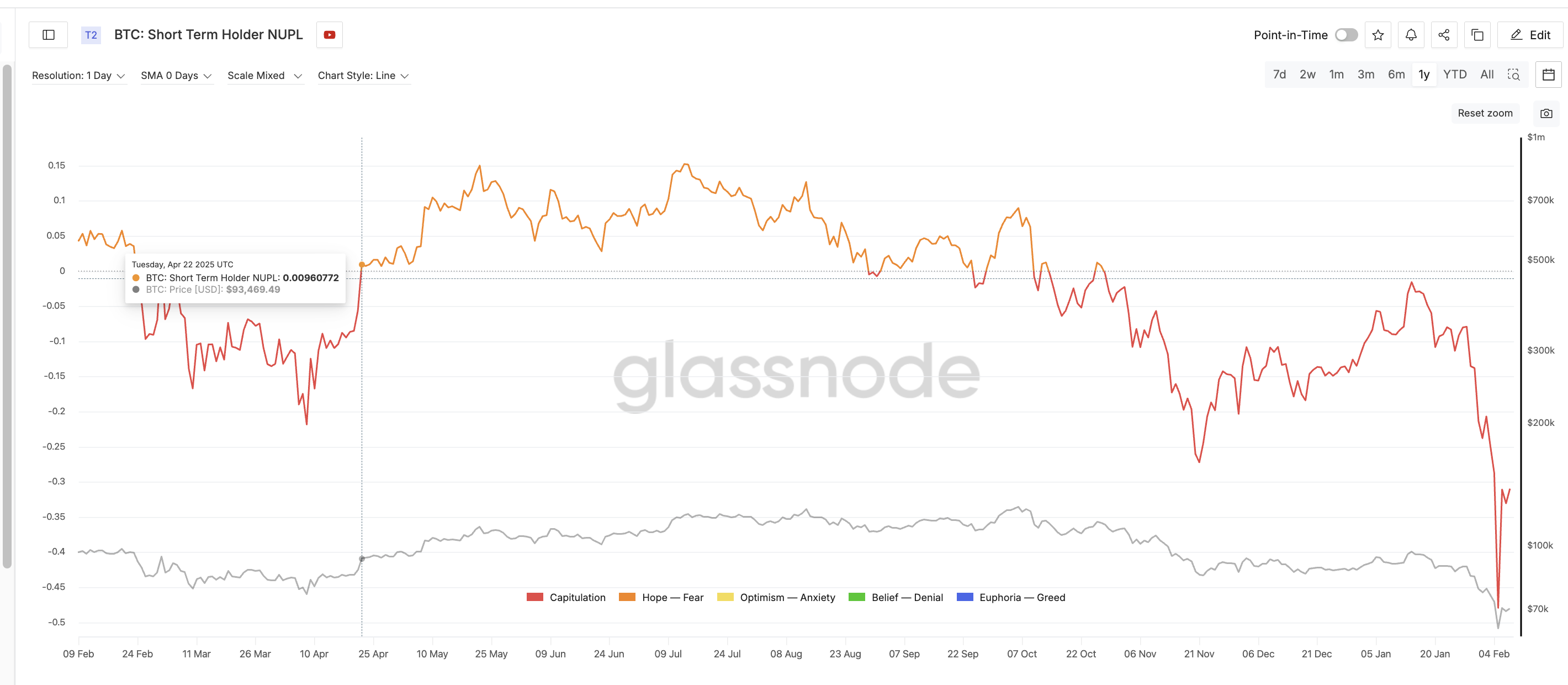

Short-Term Holders Flip From Capitulation to Optimism (September 27 → Oct 6)

Short-term holder NUPL (Net Unrealized Profit/Loss), measuring paper profits or losses. provided one of the clearest warning signals. On September 27, STH-NUPL stood near -0.17, reflecting recent capitulation. By October 6, it had surged to around +0.09.

In less than ten days, recent buyers moved from heavy losses to clear profits.

Such rapid transitions are dangerous. After emerging from losses, traders often become highly sensitive to pullbacks and eager to protect small gains, increasing the risk of sudden selling.

As sentiment improved, leverage continued rising. Open interest reached one of its highest levels on record while SOPR and NUPL began rolling over. BTC exchange inflows remained subdued, keeping risk concentrated in derivatives markets.

Instead of reducing exposure, traders increased it. This imbalance made the market structurally weak.

Momentum Weakens Ahead of the Breakdown (July → October)

Technical momentum had been deteriorating for months. From mid-July to early October, Bitcoin formed a clear bearish RSI divergence. Price made higher highs, while the Relative Strength Index, a momentum indicator, made lower highs.

This signaled weakening demand beneath the surface. By early October, the rally was increasingly sustained by leverage rather than organic buying, and the momentum indicator proved it.

Defense Phase and Structural Breakdown (Oct 6 → Oct 9)

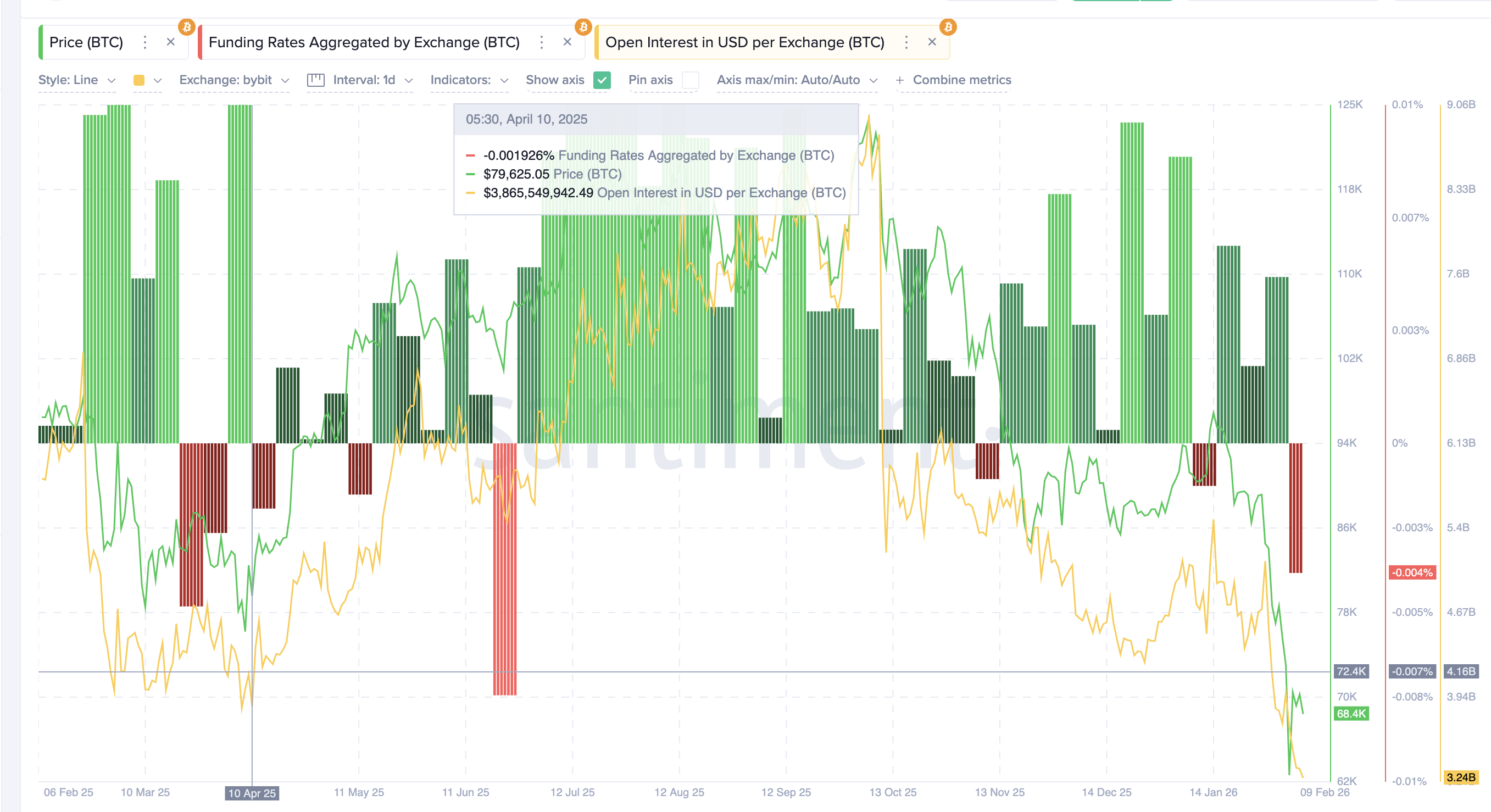

After October 6, price momentum faded, and support levels were tested. Despite this, open interest remained elevated, and funding rates, which reflect the cost of holding future positions, stayed positive. Traders were defending positions rather than exiting, possibly by adding margin.

Sponsored

Sponsored

Chen also mentioned that attempts to defend positions often amplify systemic risks:

“When positions approach liquidation, traders often add margin… Individually, that can make sense. Systemically, it increases fragility… Once those levels fail, the unwind is no longer gradual — it becomes a cascade,” she highlighted as the root cause for massive cascades.

More margin eventually led to a deeper crash.

October 10 — Trigger and Cascade

When tariff-related headlines emerged on October 10, the weak structure collapsed.

Price broke lower, leveraged positions moved into loss, and margin calls accelerated. Open interest fell sharply, and exchange inflows surged.

Forced short selling created a feedback loop, producing the largest liquidation cascade in crypto history.

Stephan Lutz, CEO of BitMEX, said liquidation cycles tend to appear repeatedly during periods of excessive risk-taking, in an exclusive quote to BeInCrypto:

“Normally, liquidations always come with cycles amid greedy times… they are good for market health…,” he mentioned.

Chen cautioned that liquidation data should not be mistaken for the root cause of crashes.

“Liquidations are… an accelerant, not the ignition… They tell you where risk was mispriced… how thin liquidity really was underneath, she said.”

Could This Long Liquidation Cascade Have Been Anticipated?

By early October, several long squeeze warning signs were already visible:

- Rapid price extension from late September

- Open interest near record levels

- Rising SOPR, indicating profit-taking

- STH-NUPL flipping positive in days

- Low exchange inflows concentrate risk in derivatives

- Long-term RSI divergence

Individually, these signals were not decisive. Together, they showed a market that was overleveraged, emotionally unstable, and structurally weak.

Lutz added that recent cascades have also exposed weaknesses in risk management.

“This cycle’s criticism isn’t much on leverage itself, but risk management and the lack of rigorous approach…”

The October 2025 collapse followed a clear sequence:

Sponsored

Sponsored

Price extension → Open interest expansion → Rising SOPR (selective profit-taking) → Rapid NUPL recovery (short-term optimism) → Long-term RSI divergence (weakening momentum) → Leverage defense through margin → External catalyst → Liquidation cascade

April 23, 2025 — How a Major Short Liquidation Cascade Came With Hints

On April 23, 2025, Bitcoin surged sharply, triggering more than $600 million in short liquidations in a single session. While the rally appeared sudden, on-chain and derivatives data show that a fragile market structure had been forming for weeks after the early-April sell-off.

Early Technical Reversal Without Confirmation (Late Feb → Early April)

Between late February and early April, Bitcoin continued making lower lows. However, on the 12-hour chart, the Relative Strength Index (RSI), a momentum indicator, formed a bullish divergence, with higher lows even as the price declined. This signaled that selling pressure was weakening.

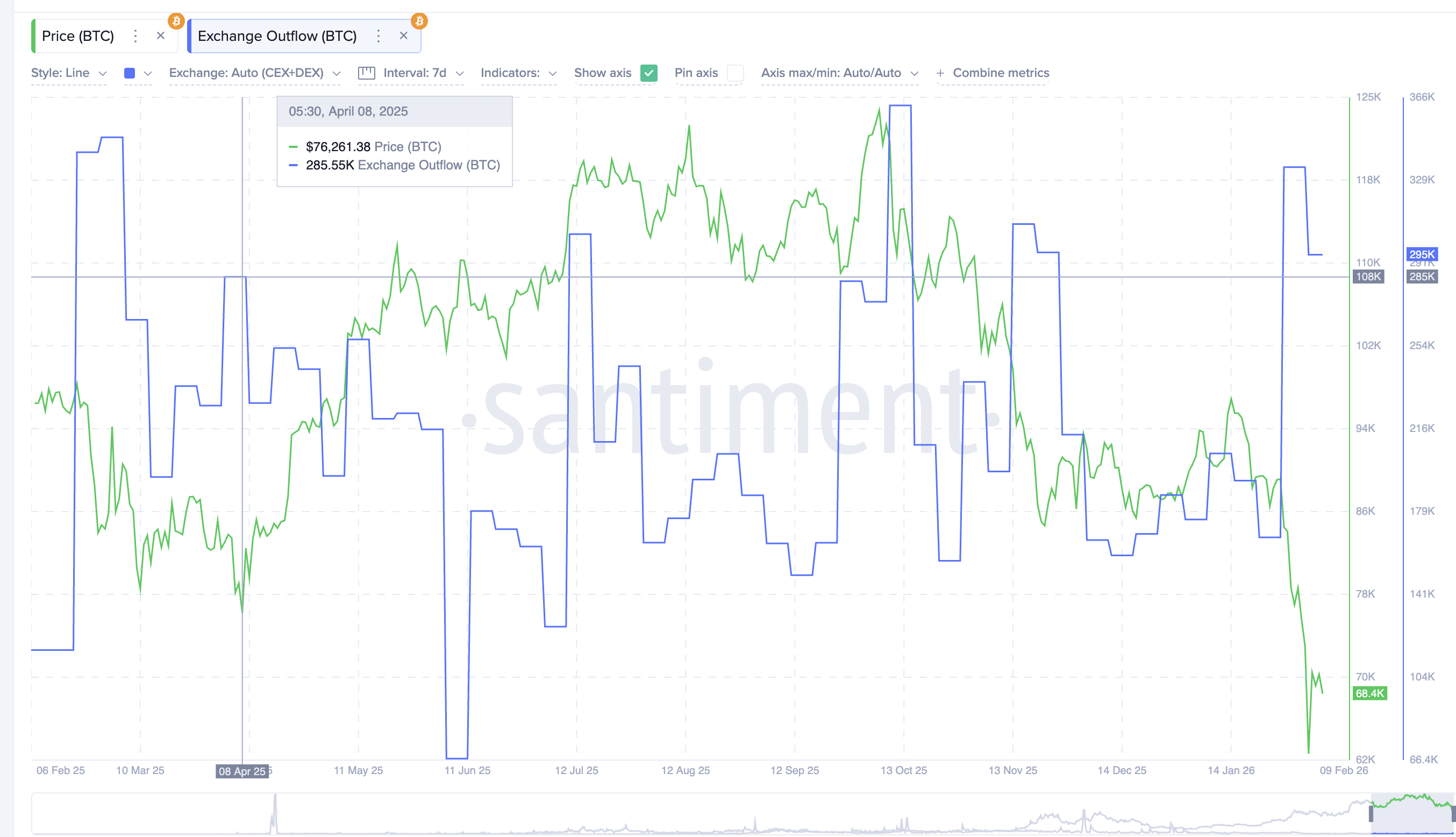

Despite this, exchange outflows, which measure coins leaving exchanges for storage, continued falling. Outflows dropped from around 348,000 BTC in early March to near 285,000 BTC by April 8.

This showed that dip buyers were hesitant and that accumulation remained limited. The technical reversal was largely ignored.

Bearish Positioning After the April 8 Low (Early → Mid April)

On April 8, Bitcoin formed a local bottom near $76,000. Instead of reducing risk, traders increased bearish exposure. Funding rates turned negative, indicating a strong short bias. At the same time, open interest, the total value of outstanding derivatives contracts, rose toward $4.16 billion (Bybit alone).

This showed that new leverage was being built primarily on the short side. Most traders expected the bounce to fail and prices to move lower.

Exchange outflows continued declining toward 227,000 BTC by mid-April, confirming that spot accumulation remained weak. Both retail and institutional participants stayed bearish.

Selling Exhaustion on Chain (April 8 → April 17)

On-chain data showed that selling pressure was fading.

The Spent Output Profit Ratio (SOPR) was near or below 1 and failed to sustain profit/loss spikes. This indicated that loss-driven selling was slowing, even when buying was not picking pace. That’s a classic bottom sign.

Short-term holder Net Unrealized Profit/Loss (STH-NUPL), which measures whether recent buyers are in profit or loss, remained in negative territory. It stayed in the capitulation zone with only shallow rebounds, reflecting low confidence and limited optimism.

Sponsored

Sponsored

Together, these signals showed exhaustion rather than renewed demand.

Compression and Structural Imbalance (Mid April)

By mid-April, Bitcoin entered a narrow trading range. Volatility declined, while open interest remained elevated and funding stayed mostly negative. Shorts were crowded, yet prices failed to break lower and began stabilizing instead.

With selling pressure fading (SOPR stabilizing) but no meaningful spot accumulation emerging (weak outflows), the market became increasingly dependent on derivatives positioning. Buyers remained hesitant, while bearish leverage continued rising against weakening downside momentum. This imbalance made the market structurally unstable.

April 23 — Trigger and Short Squeeze

By April 22–23, STH-NUPL moved back toward positive territory (shown earlier), showing that recent buyers had returned to small profits. Some holders were now able to sell into strength, while many traders still treated the rebound as temporary and added short exposure.

Notably, a similar NUPL rebound had appeared before the October 2025 long flush. The difference was context. In October, short-term holders turning profitable encouraged more long positioning as traders expected further upside. In April, the same return to small profits encouraged more short positioning, as traders in a corrective market viewed the rebound as temporary and bet on another decline.

This combination tightened liquidity and increased bearish positioning. When prices pushed higher, stop losses were triggered, short covering accelerated, and open interest dropped sharply. Forced buying created a feedback loop, and a positive tariff-related tweet helped, producing one of the largest short liquidation events of 2025.

Could This Short Squeeze Have Been Anticipated?

By mid-April, several warning signs were visible:

- Bullish RSI divergence from late February

- Persistently negative funding rates

- Rising open interest after the April low

- Weak exchange outflows and limited accumulation

- SOPR stabilizing near 1

- STH-NUPL stuck in capitulation

Individually, these signals appeared inconclusive. Together, they showed a market where shorts were crowded, selling was exhausted, and downside momentum was fading.

The April 2025 squeeze followed a clear sequence:

Momentum divergence → disbelief → short buildup → selling exhaustion (SOPR exhaustion) → price compression → positioning imbalance → short liquidation cascade.

Reflecting on repeated liquidation cycles, Chen said trader behavior remains remarkably consistent.

“Periods of low volatility trigger overconfidence… Liquidity is mistaken for stability… Volatility resets expectations… Each cycle clears excess leverage,” she added.

What These Case Studies Reveal About Future Liquidation Cascade Risk

The October 2025 and April 2025 events show that measurable changes in leverage and on-chain behavior led to the large liquidation cascades. Importantly, these cascades do not occur only at major market tops or bottoms. They form whenever leverage becomes concentrated and spot participation weakens, including during relief rallies and corrective bounces.

In both cases, these signals emerged 7–20 days before liquidation peaks.

In October 2025, Bitcoin rose from about $109,000 to $126,000 in nine days while open interest expanded from roughly $38 billion to over $47 billion. Exchange inflows fell below 30,000 BTC, SOPR rose above 1.04, and short-term holder NUPL moved from -0.17 to positive within ten days. This reflected rapid leverage growth and rising optimism near a local peak.

In April 2025, Bitcoin bottomed near $76,000 while funding stayed negative and open interest rebuilt toward $4.16 billion. Exchange outflows declined from around 348,000 BTC to near 227,000 BTC. SOPR remained near 1, and STH-NUPL stayed negative until just before the squeeze, showing selling exhaustion alongside growing short exposure.

Despite different market phases, both cascades shared three features. First, open interest increased while spot flows weakened. Second, funding remained strongly one-sided for several days. Third, short-term holder NUPL shifted rapidly shortly before forced liquidations. And finally, if a reversal or a bounce setup surfaces on the technical chart, the liquidation cascade tracking becomes clearer.

These patterns also appear during mid-trend pullbacks and relief rallies. When leverage expands faster than spot conviction and emotional positioning becomes one-sided, liquidation risk rises regardless of price direction. Tracking open interest, funding, exchange flows, SOPR, and NUPL together provides a consistent framework for identifying these vulnerable zones in real time.

Crypto World

Ethereum’s Big ZK Reveal Tomorrow: What to Expect

Tomorrow, February 11, 2026, the first L1-zkEVM workshop will give a first look at a new system that could make block validation faster, cheaper, and more accessible for everyone.

Instead of re-executing every transaction in a block, Ethereum may soon rely on zero-knowledge (ZK) proofs, enabling validators to verify correctness through cryptographic proofs.

Sponsored

Sponsored

Why Ethereum’s Shift to ZK Proofs Could Redefine Block Validation

Ethereum Foundation researcher Ladislaus.eth called it “arguably one of the more consequential” upgrades in the network’s history.

The change is part of the L1-zkEVM 2026 roadmap and focuses on the EIP-8025 (Optional Execution Proofs) feature. This allows certain validators, called zkAttesters, to confirm blocks using cryptographic proofs instead of checking every transaction themselves.

The shift is optional, meaning no one is forced to upgrade, and all existing nodes continue to work as they do today. However, for those who adopt it, the benefits may be significant.

“The first L1-zkEVM breakout call is scheduled for February 11, 2026, 15:00 UTC,” wrote Ladislaus.eth.

Today, validating a block requires re-executing every transaction, which takes more time and resources as the network grows.

ZK proofs enable zkAttesters to verify a block almost instantly without storing the entire blockchain.

This is not just about speed. By lowering the hardware, storage, and bandwidth requirements, Ethereum becomes far more accessible.

Sponsored

Sponsored

Solo stakers and home validators can participate fully using regular consumer hardware. This keeps the network decentralized and true to the “don’t trust, verify” philosophy.

Higher gas limits and faster execution can also be achieved without pushing smaller participants out of the system.

EIP-8025 emphasizes flexibility and security. Proofs from multiple clients are shared across the network, and validators accept a block once enough independent proofs have been verified (currently proposed to be three out of five).

This approach preserves diversity among client software while keeping the network safe, inclusive, and resistant to centralization.

Sponsored

Sponsored

Institutional Momentum and Tomorrow’s Workshop Signal a New Era for Ethereum Validation

The timing could not be more relevant. Ethereum’s institutional adoption is surging in 2026, with Fidelity Digital Assets, Morgan Stanley, Grayscale, BlackRock, and Standard Chartered actively building or investing in the network.

“2026 is off to a fast start on Ethereum…One month in. Should be a fun year,” remarked David Walsh, head of enterprise at the Ethereum Foundation.

Tokenized assets, stablecoins, and staking products continue to expand, while projects like the Glamsterdam hard fork (featuring enshrined proposer-builder separation, ePBS) support the practical implementation of ZK proof generation on L1.

L1-zkEVM development also benefits Layer 2 rollups and zkVM vendors such as ZisK, openVM, and RISC Zero, who are already proving Ethereum blocks today. Standardizing the execution witness and ZK VM APIs creates shared infrastructure, enabling both L1 validators and L2 protocols to leverage the same proofs.

The February 11 workshop will cover six core sub-themes:

Sponsored

Sponsored

- Execution witness and guest program standardization

- zkVM-guest API standardization

- Consensus layer integration

- Prover infrastructure

- Benchmarking, and

- Formal verification for security.

It marks the official kickoff of Ethereum’s 2026 roadmap to make block validation optional, proof-driven, and far more efficient.

If adoption grows, EIP-8025 could make full-verifying nodes viable on laptops again and scale Ethereum’s base layer without sacrificing decentralization or security.

For validators, developers, and users alike, this may be the moment Ethereum’s block validation truly enters a new era.

Tomorrow’s L1-zkEVM workshop promises a first glimpse at what could become Ethereum’s most transformative architectural leap since The Merge.

Crypto World

Pi Network (PI) Price Predictions for This Week

A closer look at where the Pi Network price might be headed in the next few days as the broader market continues to chop.

PI had no relief since early January. How low will the price go?

PI Network (PI) Price Predictions: Analysis

Key support levels: $0.13

Key resistance levels: $0.15

PI Downtrend Continues

Since the price began to decline in early January, PI has not experienced a relief rally. This selloff has been extremely aggressive and continues at the time of this post. With buyers absent, the search for a bottom continues. The current support is at 13 cents and the resistance is at 15 cents.

Selling Exploded

Since mid-January, selling pressure has increased sharply, which could indicate that some whales are exiting in a rush. This process appears to be ongoing, and until the sell volume drops, PI is unlikely to see a bounce.

Daily RSI Remains Oversold

Since January 20th, the daily RSI has been in the oversold region below 30. More concerning is that it has stayed in that zone since. This signals an extreme sell pressure that did not allow any recovery for the price. Expect lower lows as long as this persists.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Is Cardano in Trouble? Why Whales Are Abandoning Binance

ADA’s drop in open interest looks similar to Solana’s past pattern, where a fragmented market often comes before weaker altcoin momentum.

Cardano has experienced a sharp decline of over 10% over the past week. It started near $0.30, but heavy selling pushed it to $0.23, forming a consolidation to $0.26. Amidst strong bearish pressure, new data suggest that major traders have exited their ADA positions.

Alphractal founder Joao Wedson, for one, said that Cardano’s derivatives market is going through a major shift that could affect its price momentum.

Cardano Follows Solana’s Path

Open interest in ADA has declined sharply from $1.6 billion to $334 million, as major players have aggressively closed their positions. However, Wedson explained that the more important change lies in how OI is distributed across exchanges. In 2023, Binance controlled over 80% of ADA’s open interest, while 17 other exchanges combined held less than 20%.

By 2026, that balance has dramatically changed as Binance now holds only 22%, and Gate.io has emerged as the new leader with 31% of the market. Wedson observed that this change is significant because a similar pattern played out with Solana.

During SOL’s rally from $20 to $200 in 2023-2024, Binance’s dominance in open interest increased, thereby supporting price appreciation.

Later, as Binance’s share declined, Solana’s momentum weakened. The same trend appears to be unfolding with Cardano, and with open interest now fragmented, the altcoin’s upside potential may be limited as the overall crypto market remains fragile.

“Binance tends to be the exchange that fuels strong altcoin rallies, but only when leverage is concentrated and competition is limited.”

Long-Term Trend Remains Intact

Despite the short-term market uncertainty gripping the ADA market, pseudonymous analyst, ‘Crypto Patel,’ believes that the overall long-term structure stays bullish as long as the price does not fall below $0.13 on a weekly close.

You may also like:

On the upside, he says ADA needs to reclaim $0.44 to confirm a new uptrend. If that happens, the crypto asset could enter a new bull cycle, and long-term targets range from $1.20 to as high as over $10, similar to past cycles.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin-gold ratio flashes historic warning as altcoins sink to record lows

Gold at $5k exposes how brutally altcoins have lagged, even as gold-backed RWA tokens like PAXG and XAUT surge in adoption and on-chain trading.

Summary

- Analyst flags weekly RSI near 25 for altcoins versus gold, matching or exceeding COVID-crash style stress.

- Gold-backed RWA tokens PAXG and XAUT track spot near $5k yet remain a tiny slice of global bullion despite accelerating inflows.

- Tokenized gold and silver markets expand with volatile derivatives flow as investors hunt on-chain exposure to hard assets.

Michaël van de Poppe fires a warning flare. “The current valuation of #Altcoins against Gold is the lowest it has ever been… The RSI has turned to 25 on the weekly timeframe. This has never happened,” he writes, adding that the only prior analogue was “the COVID crash (a Black Swan).” With spot gold grinding around $5,000 per ounce, that ratio now acts as a brutal scoreboard of how far non‑major crypto has lagged the metal.

Real‑world‑asset tokens backed by gold sit at the center of this stress test. PAX Gold (PAXG), which represents title to allocated London Good Delivery bars, trades near $5,035.43, down 0.09% over the last 24 hours, with a $425.2M daily volume and a $4,985.75–$5,088.73 intraday range.

Leading the way are Ondo (ONDO), up about 0.3% over the last 24 hours, PAX Gold (PAXG), higher by roughly 0.6% on the day, Maker (MKR), gaining around 2–3% in 24 hours, and Chainlink (LINK), trading fractionally lower on the day, which analysts say may be bucking the broader crypto bear trend.

Tether Gold (XAUT) changes hands around $5,013.23, essentially flat on the day, after a 7.4% gain over the last week and an 11.41% rise over the past month. Both instruments track bullion tightly, but remain small compared with the broader crypto complex, underscoring how little capital has actually migrated into tokenized metals despite gold’s parabolic move. Live market stats for PAXG and XAUT are available on their respective crypto.news price pages:

The RWA Sector by the Numbers

Zooming out, the RWA sector is growing, but unevenly. CoinMetrics and Tokeny data put tokenized commodities—dominated by gold‑backed tokens like PAXG and XAUT—in roughly the $0.8–$1B range as of the latest comprehensive report, a rounding error next to spot gold’s multi‑trillion‑dollar market.

More recent industry analysis highlights a sharp acceleration: tokenized gold and silver market value has pushed to new highs into 2026 as regulatory clarity improves and large institutions experiment with on‑chain funds and vault‑linked products. Yet derivatives flow shows how violently this niche still trades; one recent week saw RWA perpetuals volume spike above $15.5B as gold futures dropped over 10% and silver nearly 28%, forcing liquidations across levered positions.

Altcoins vs Gold: Structural Cheapness, Not Just Panic

That backdrop explains why van de Poppe’s chart looks so extreme. Altcoins—especially sub‑top‑100 RWA plays—have been doubly hit: first by structural dilution (new token issuance, unlocks) and second by liquidity tightening that rewards “sleep‑at‑night” gold over speculative tails. As one responder put it, “altcoins hitting historic lows versus gold screams opportunity if you can stomach volatility… rsi at 25 on weekly shows extreme oversold conditions, rarely this extreme.” Whether that becomes the “ultimate arbitrage” for believers in the long‑term blockchain thesis, or just another value trap, will depend on the next macro liquidity flip—not on narratives alone.

Crypto World

Dollar Stays Weak on Worries Over Foreign Selling of U.S. Assets

The dollar was recovering only marginally after reaching a one-and-a-half-week low overnight on concerns about foreigners selling U.S. assets.

These concerns were triggered by a Bloomberg report that said Chinese regulators advised financial institutions to reduce their exposure to U.S. Treasury holdings.

Elsewhere, Federal Reserve governor Stephen Miran played down the dollar’s recent weakness. He said the dollar would need to register a steeper fall than it already has for it to affect inflation.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat15 hours ago

NewsBeat15 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports14 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World3 hours ago

Crypto World3 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 hours ago

Crypto World3 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout