Business

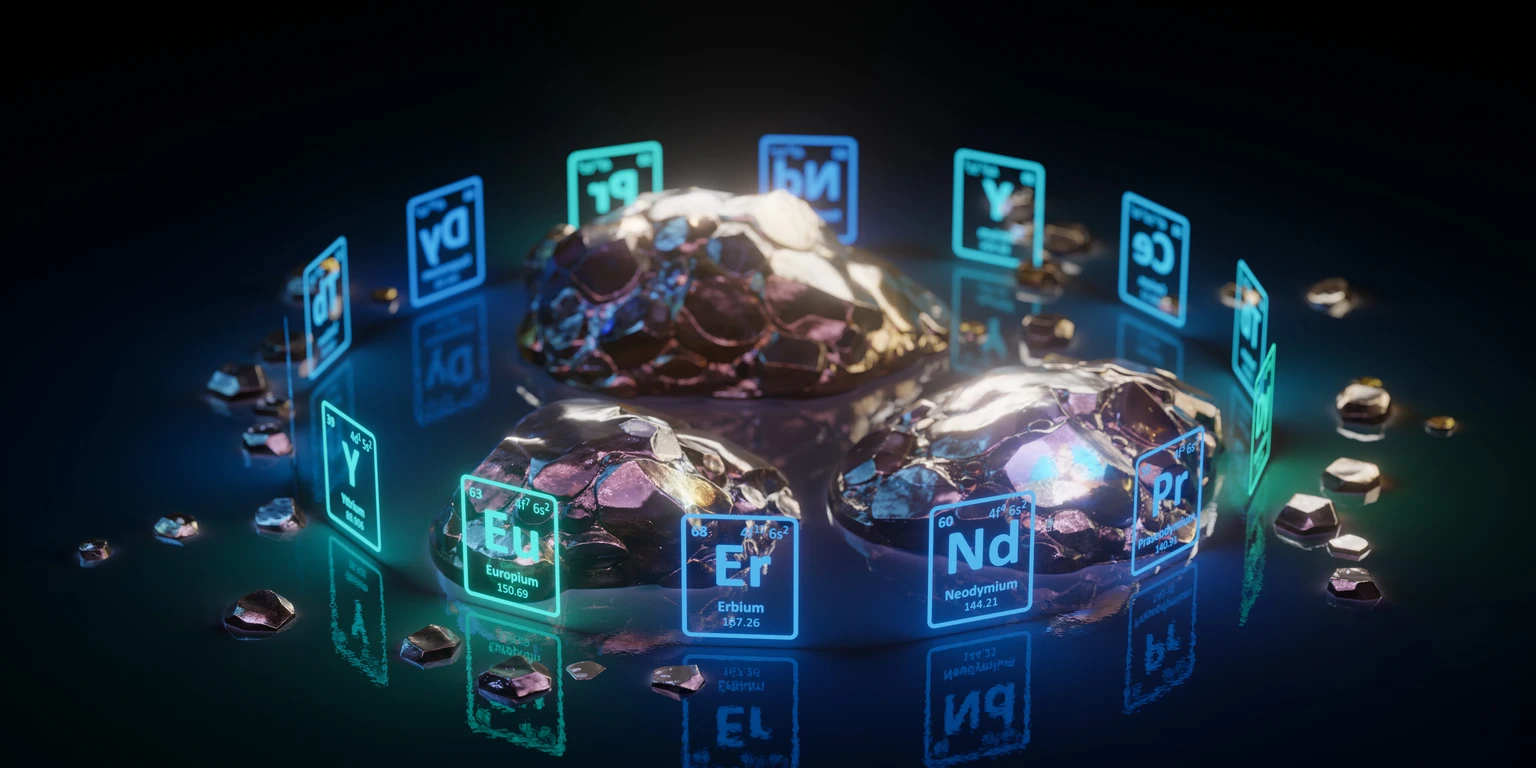

Rare Earth Element Prices Are Making New Highs

I graduated from the University of Western Australia in 1984 with a degree in electronic engineering and from 1984 until 1998 worked in the commercial construction industry as an engineer, a project manager and an operations manager.

I began investing in the stock market 2 months prior to the 1987 stock market crash and thus quickly learned about the downside potential of stocks. Only slightly daunted by the rather inauspicious timing of my entry into the world of financial market investments, my interest in the stock market grew steadily over the years.

In 1993, after studying the history of money, the nature of our present-day fiat monetary system and the role of banks in the creation of money, I developed an interest in gold. Another very important lesson soon followed: gold may be the ideal form of money for those who believe in free markets and a wonderful hedge against the inherent instability of the government-imposed paper currencies, but it is not always a good investment.

By mid-1998 the time and money involved in my financial market research/investments had grown to the point where I was forced to make a decision: scale back on my involvement in the financial world or give up my day job. The decision was actually quite an easy one to make and so, at the beginning of 1999, I began investing/trading on a full-time basis.

My major concern in deciding to pursue a career in which I devoted all of my time to my own investments was that I would miss the personal interaction that had been part and parcel of my business management career. The Speculative Investor (TSI) web site was launched in August of 1999 as a means for me to interact with the world by making my analysis/ideas available on the Internet and inviting feedback from others with similar interests.

During its first 14 months of operation the TSI web site was free of charge, but due to the site’s growing popularity I changed it to a subscription-based service in October of 2000. Its popularity continued to grow, although I remained — and remain to this day — a professional speculator who happens to write a newsletter as opposed to someone whose overriding focus is selling newsletter subscriptions.

My approach is ‘top down’; specifically, I first ascertain overall market trends and then use a combination of fundamental and technical analysis to find individual stocks that stand to benefit from these broad trends. This approach is based on my experience that it’s an order of magnitude easier to pick a winning stock from within a market or market sector that’s immersed in a long-term bullish trend than to do so against the backdrop of a bearish overall market trend. Fortunately, there’s always a bull market somewhere.

I’ve lived in Asia (Hong Kong, China and Malaysia) since 1995 and currently reside in Malaysian Borneo.

Business

Market Wrap: Sensex adds 208 points, Nifty extends gain for third session, reclaims 25,900; auto, metal stocks shine

The BSE Sensex rose 208 points to close the session at 84,274 or 0.25% higher, while the Nifty 50 gained 68 points or 0.26% points to end the day at 25,935.

On the 30–share Sensex, Eternal rose over 5% to end the session as the top gainer on the index. Tata Steel followed suit with a rise of 2.82%, while M&M and Tech Mahindra gained more than 1.5% each. HCL Tech, Bajaj Finance, Bharti Airtel, and Adani Ports fell up to 2% on Tuesday.

Expert views

Vinod Nair, Head of Research, Geojit Investments said today’s rise was supported by the US trade agreement and positive cues from key Asian markets. A strong resurgence in FII inflows, coupled with rupee appreciation, is further bolstering the investor sentiment, although intermittent profit-booking was visible across sectors. With tariff-related concerns largely easing, the near-term market trajectory will hinge on Q3 earnings, which have been mixed and below expectations so far. Investors are now focused on the combined impact of recent fiscal and monetary measures to revive earnings momentum in the coming quarters.”

Global Markets

Asian equities moved higher on Tuesday, with gains led by Tokyo markets extending their rally after Japanese Prime Minister Sanae Takaichi’s decisive election win over the weekend. MSCI’s broad Asia-Pacific index excluding Japan rose 0.6%, while the Nikkei 225 climbed 2.3% for a third straight session to a fresh high. The yen also strengthened for a second consecutive day.European markets opened on a mixed note as investors assessed a wave of corporate earnings announcements. The Stoxx index was largely flat with no clear trend across major markets and sectors, while Germany’s DAX advanced 0.4%.

U.S. stock futures traded slightly lower on Tuesday morning after the Dow Jones Industrial Average closed at a fresh record high. Dow futures declined by 25 points, or about 0.04%, while S&P 500 futures slipped 0.06% and Nasdaq 100 futures fell 0.2%.

Crude impact

Oil prices edged higher on Tuesday as traders assessed the risk of potential supply disruptions, with U.S. guidance for vessels passing through the Strait of Hormuz keeping geopolitical tensions between Washington and Tehran in focus.

Brent crude futures rose 29 cents, or 0.4%, to $69.33 per barrel by 0916 GMT, while U.S. West Texas Intermediate crude gained 22 cents, or 0.3%, to $64.58 per barrel. “The market is still focused on the tensions between Iran and the U.S.,” said Tamas Varga, oil analyst at brokerage PVM.

Rupee vs Dollar

The Indian rupee ended 0.2% higher at 90.5775 against the U.S. dollar, compared with its previous close of 90.7575.

(With inputs from agencies)

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Australian shares pare early gains for flat finish

The Australian share market has handed back some of its early gains but finished higher as sluggish banks and insurers weighed against upticks in miners, energy and IT stocks.

Business

Evaluation Of Preferred Stock Of Wells Fargo In Current Economic Environment (WFC.PR.L)

I am a chemical engineer with a MS in Food Technology and Economics, and a MENSA member. I am the author of the book “Investing in Stocks and Bonds: The Early Retirement Project” (2024):I am also the author of the book “Mental Math: How to perform math calculations in your mind”.I am also the author of 2 other mathematics books (“Arithmetic calculations without a calculator” and “Word Problems”) and perform almost all the calculations in my mind, without a calculator, making it easier to make immediate investing decisions among many alternatives. I invest applying fundamental and technical analysis and mainly use options as a tool for both investing and trading. I achieved my goal of financial independence at the age of 45. In my spare time, I follow Warren Buffett’s principle: “Some men read playboy. I read financial statements”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

At Close of Business podcast February 10 2026

Jayde Andrews and Ella Loneragan discuss Smith Sculptors and their works around the Perth CBD.

Business

stock picks: 2 top stock recommendations from Vinay Rajani

Speaking to ET Now, market expert Vinay Rajani from HDFC Securities highlighted the technical resilience of the Nifty, pointing to a strong recovery from recent lows. “So, nice recovery from the lower level. Nifty partially filled the gap which was formed on the 3rd February on the back of the US-India trade deal and that gap was partially filled and Nifty bounced back. So, a typical gap has acted as a support area and now Nifty has witnessed a 500 points recovery from that level,” he said.

Rajani added that the index remains structurally strong, supported by key technical indicators. “So, Nifty is looking very strong as it is still holding above 20, 50, 100, and 200 days’ moving average, so that way also it is very strong,” he noted.

He also pointed out that broader markets are beginning to participate more actively in the rally, aided by the nearing end of the earnings season. “Broader markets are gaining strength. We are at the fag end of the result season, getting over, so that is also a good sign for the broader markets because most of the negatives and positives have been discounted and now broader market can increase their participation in this rally,” Rajani said.

On the outlook for the benchmark index, Rajani maintained a bullish stance, citing strong support levels. “So, on the Nifty we are bullish. We feel that there is a strong support around 25,600 and with that stop loss one should continue to hold on to the long position and we are expecting Nifty to hit an all-time high above 26,373. So, overall, things are quite strong and broader markets have started participating. So, we are bullish on the market with a stop loss of 25,600,” he added.

Turning to sectoral and stock-specific opportunities, Rajani said metals remain a clear outperformer in the current market phase. “Yes, so metal is the space which is continuously outperforming. So, out of that segment steel stocks have started performing well and getting momentum on the charts,” he said.

He highlighted Steel Authority of India (SAIL) as a preferred trading pick. “So, Steel Authority of India, SAIL, is looking very strong to me. Around 160 one can take entry, for trading stop loss can be kept at 157, on the upside I am expecting a short-term target at 166,” Rajani said.In the PSU banking space, Rajani identified Bank of Maharashtra as another stock showing strength. “The second stock I would pick from the PSU banking space, that is Bank of Maharashtra, which is looking quite strong. So, after some small consolidation it is trying to resume its primary uptrend. So, around 66.80, 66.90 one can go long, I would suggest a stop loss at 65 for the trading, on the upside I am expecting an immediate target at 70,” he added.

With both frontline and broader indices showing sustained strength, market participants remain cautiously optimistic, watching key resistance levels while selectively focusing on outperforming sectors such as metals and PSU banks.

Business

Target slashes 500 jobs as retailer seeks to invest in its stores

Executives said the reductions were part of a restructuring meant to help fix stagnant sales.

Business

Telstra, Accenture Joint Venture Slashes 209 Jobs

The joint venture (JV) between Telstra and Accenture has axed 209 jobs due to the company’s rollout of its AI capabilities.

In addition, some jobs are confirmed to have been moved to India.

209 Jobs Slashed by Telstra, Accenture Joint Venture

According to a report by ABC News, a spokesperson confirmed the news by saying “we spoke with the Telstra Accenture Data & AI Joint Venture (JV) team today about proposed changes to its workforce, including reducing roles where work is no longer needed, and moving some work to the JV team in India.”

“These changes would see the JV use Accenture’s global capabilities, advanced AI expertise and specialist hub in India to deliver Telstra’s data and AI roadmap more quickly,” the spokesperson added.

As of press time, it has not been confirmed how many jobs will be moved to India.

Not the First Time Jobs Were Cut

According to The Guardian, the slashing of 209 jobs is not the first time that Telstra has cut jobs.

In 2024, the company announced that it would slash 2,800 jobs from its enterprise business. Telstra assured at that time that the job cuts would not affect its retail customers.

Telstra has not been shy either about its heavy AI adoption and how it would affect the company’s operations. As noted by The Guardian’s report, the company said last May that “AI efficiencies” will pave the way for more job cuts by 2030.

Business

ACCC flags 'problematic conduct' in NDIS sector

The consumer watchdog has raised serious concerns about misleading advertising, wrongful charges and scams within the NDIS sector.

Business

Bull Market For Silver And Associated Stocks Presents Opportunities Via Traded Options

Bob Kirtley has traded options and stocks since 1980. Bob Kirtley spent many years working on Oil projects including some in Alberta, such as the tar sands installations in Fort McMurray. He lived and worked in many different countries, as that is the nature of the construction business. Planning and cost control are key to a projects success and he tries to apply those disciplines on a daily basis when dealing with investments. His training in such areas as SWOT and Risk analysis can be applied from time to time. His qualifications include being chartered in the United Kingdom, which is similar to that of a Professional Engineer in Canada, along with a Masters Degree in Project Management from South Bank University, London, England. He has been working for a number of years on a full time basis representing a group of investors in England.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPM, SILJ, AG, PAAS, SVM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Software Sell-Off May Be Overdone Yet Exposes Deeper Concerns

Software Sell-Off May Be Overdone Yet Exposes Deeper Concerns

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat14 hours ago

NewsBeat14 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports14 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World3 hours ago

Crypto World3 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 hours ago

Crypto World3 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

![Strategi 1% rule: Kenapa simpan RM50 lebih baik dari berangan RM10k [Kewangan]](https://wordupnews.com/wp-content/uploads/2026/02/1770720522_maxresdefault-80x80.jpg)