Video

Money vs Power | Rich vs Poor Mindset | Bitter Truths About Wealth | Financial Education Telugu

📅 For Appointments with Srinivas Chikati

📱 Mutual Funds, Health Insurance, Term Insurance & Other Products

📲 WhatsApp: 94918 58145 💬

📝 Forms

👉 మ్యూచువల్ ఫండ్ల కోసం ఈ ఫారమ్ నింపండి: https://forms.gle/SHRkHiMnhXYV3pYV8

👉 ఇన్సూరెన్స్ కోసం ఈ ఫారమ్ నింపండి: https://forms.gle/WHWBy2ggaPbfmjqz8

📖 Buy ‘Money Vitamin’: https://amzn.openinapp.co/dbweu

📸 Follow on Instagram : https://www.instagram.com/teluguassets

—

👉 డబ్బు – చేదు నిజాలు Playlist :

—

Money is not just paper – it is a powerful force that controls our decisions, relationships, confidence and even the respect we get in society. From birth to death, most people keep running behind money… but still feel poor, lonely and insecure.

This video is Part 4 of the “Money – Bitter Truths” series. In this episode, we go deep into the hidden side of money – how it exposes your character, how it gives you power, how passive income can save your life, and how 10 years of patience can make you truly rich.

In this video you will learn:

Why money is not a gift from God, but a test of how you use it

How the same money made people like Azim Premji and Ratan Tata legends… and pushed Vijay Mallya, Nirav Modi, Mehul Choksi into scams

Money vs Power – why your decisions, respect and freedom depend on your bank balance

The real meaning of: “Don’t stay in bed unless you can make money in bed” – introduction to passive income

Why depending only on a job salary is risky, and why you need 2–3 income streams

The importance of character over cash – what Steve Jobs, Kiran Mazumdar Shaw and Radhakishan Damani teach us about failure

“If you really know something, you should be able to earn from it” – learn → solve problems → earn money

Why the world only respects one colour – green (money), not caste, religion or background

The 10-Year Magic: how small SIPs, compounding and patience turn normal people into millionaires

If you are serious about wealth creation, financial freedom and long-term security, watch this video till the end. These are not motivational quotes – these are bitter truths that every middle-class family must understand.

💬 Need help with financial planning, mutual funds, term insurance or health insurance?

WhatsApp our team on the number given in the video description below. Please contact us only if you are serious about planning your wealth, not just for selfies or casual talk. Your time and money are valuable – use them wisely.

👍 If you want more such honest and practical money content,

Like this video (target: 5,000+ likes 🚀)

Comment your favourite money lesson from this video

Share it with friends and family

Subscribe to the channel and turn on 🔔 ALL notifications

Money itself will not make you rich.

How you treat money will decide whether you remain poor or become truly wealthy.

—

money bitter truths, Money vs Power, Rich vs Poor Mindset, Rich Mindset, Poor Mindset, Bitter Truths About Wealth, Financial Education Telugu, real wealth mindset, passive income ideas, financial freedom, money and power, rich vs poor mindset, character and money, multiple income streams, long term investing, sip investment explained, compounding magic, learn and earn, practical finance tips, middle class money problems, money and respect, how to build wealth, green color of money, failure and success stories, financial education for beginners, wealth creation journey

—

#money #financialfreedom #passiveincome #richmindset #moneytruths #personalfinance

#wealthcreation #moneymindset #compoundinterest #multipleincomestreams

#longterminvesting #middleclasslife #learnandearn #characterbuilding #financialeducation

source

Video

Why Did Bitcoin Crash, and When Will Crypto Recover?

Bitcoin tumbled below $61,000, as the unwinding of leveraged bets and broader market turbulence deepened a selloff that has wiped out all of the gains since President Donald Trump’s election set off a speculative rush into cryptocurrencies.

The token sank as much as 4.8% to $60,033 in early Asia trade Friday, extending a sharp selloff to plunge to its lowest since October 2024. The rout has erased half of Bitcoin’s value since it reached a record four months ago and has spread to other tokens, related ETFs and companies like Strategy Inc. that hold vast sums of coins.

#bitcoin #crypto #trump

———-

Like this video? Subscribe https://www.youtube.com/@Bloomberg-News

Bloomberg News is the first word in business news. Visit bloomberg.com for the latest on global business, markets and more.

Get unlimited access to Bloomberg.com for $1.99/month for the first 3 months: https://www.bloomberg.com/subscriptions?in_source=YoutubeOriginals

Bloomberg on YouTube:

https://www.youtube.com/@business

https://www.youtube.com/@markets

https://www.youtube.com/@BloombergTechnology

https://www.youtube.com/@BloombergPodcasts

Connect with us on social:

https://www.instagram.com/bloombergbusiness

https://www.linkedin.com/company/bloomberg-news

@bloombergbusiness

https://www.facebook.com/bloombergbusiness

source

Video

SteveWillDoIt Is Running Out of Money

SteveWillDoIt explains what’s really going on.

#stevewilldolt #shorts

source

Video

XRP HBAR UNBELIEVABLE NEWS!!! WE’VE WON!!!!!!!!!!!!!!!!

🔥Thanks for supporting the channel. Like, share, and comment if this helped clarify what’s really happening.

💳 Uphold – Trade, Spend & Earn XRP Rewards

➖ U.S. Debit Card: https://uphold.sjv.io/559kj9

➖ Uphold Website: https://uphold.sjv.io/dOmGMq

🔸4% on elite card / 2% on virtual card🔸

🛡️Hardware Wallets I Use for XRP

D’CENT Biometric Wallets

– Single Device – 18% Discount ($159 → $129)

Biometric Wallet – Affiliates

– Two-Pack – 31% Discount ($318 → $219)

Biometric Wallet 2X Package – Affiliates

Ledger – Official Store

https://www.ledger.com/crypto-sensei

🔗Contact & Collaborations

– Business: cryptosensei@cryptonairz.com

– Collabs: BD Manager – @Jaalyn_T (Telegram)

– Collab Form: https://forms.gle/E6fskio5BBvd4zVn9

– Social Links: https://linktr.ee/Crypt0Sensei

(YouTube partnerships & brand deals only – no agencies)

📰FREE XRP Newsletter: https://joincryptonairz.com/Newsletter

❗Full Legal & Regulatory Disclaimer

https://docs.google.com/document/d/1T_wTsSkXDZqdgKDUOKfIEKF-a7ur2kX8gw-e3aAq_Q4/edit?usp=sharing

source

Video

Strategi 1% rule: Kenapa simpan RM50 lebih baik dari berangan RM10k [Kewangan]

![Strategi 1% rule: Kenapa simpan RM50 lebih baik dari berangan RM10k [Kewangan]](https://wordupnews.com/wp-content/uploads/2026/02/1770720522_maxresdefault.jpg)

“Tahun depan aku nak simpan RM10k!” Tapi baru bulan Mac, planner dah berhabuk, duit simpanan pula dah jadi tiket flight atau sport rim baru. Bunyi macam familiar?

Masalahnya bukan azam tu tak logik, tapi korang yang tak ada sistem. Korang terlalu bergantung pada ‘semangat’ atau ‘willpower’ yang sebenarnya macam bateri telefon – pagi penuh, petang dah kong

Dalam episod ni, kita akan bedah kenapa azam korang selalu gagal setiap tahun dan kenapa korang patut berhenti fokus pada ‘Garis Penamat’ dan mula fokus pada ‘Sistem’

*Website*

🌐 Web ➜ https://financialfaiz.com

*Podcast player*

🍎 Apple ➜ https://financialfaiz.com/apple

🥑 Spotify ➜ https://financialfaiz.com/spotify

*Social media*

🐼 Tiktok ➜ https://financialfaiz.com/tiktok

🍇 Instagram ➜ https://financialfaiz.com/instagram

*Online hannels*

🧊 Telegram ➜ https://financialfaiz.com/telegram

💬 Whatsapp ➜ https://financialfaiz.com/whatsapp

Penafian: Segala kandungan yang dikongsi adalah untuk tujuan maklumat sahaja dan tidak boleh dianggap sebagai nasihat kewangan. Sebarang keputusan pelaburan adalah tanggungjawab anda sendiri dan perlu dibuat berdasarkan situasi kewangan peribadi anda. Saya tidak bertanggungjawab atas sebarang kesilapan, peninggalan atau akibat daripada penggunaan kandungan ini, termasuk komen atau tindakan pihak ketiga di platform ini. Segala pandangan yang dikemukakan adalah pandangan peribadi saya semata-mata.

00:00 Intro

01:41 Goal Fatigue

03:00 Kekurangan Willpower

04:05 Change your system

05:16 Atomic Habits

06:18 Focus on the identity

07:44 Conclusion

09:07 Penutup

#financialfaiz #newyear #azamtahunbaru #kewangan

Kenapa azam tahun baru selalu gagal?

source

Video

Why bitcoin is lingering around $70,000

CNBC’s MacKenzie Sigalos reports on trends in bitcoin.

source

Video

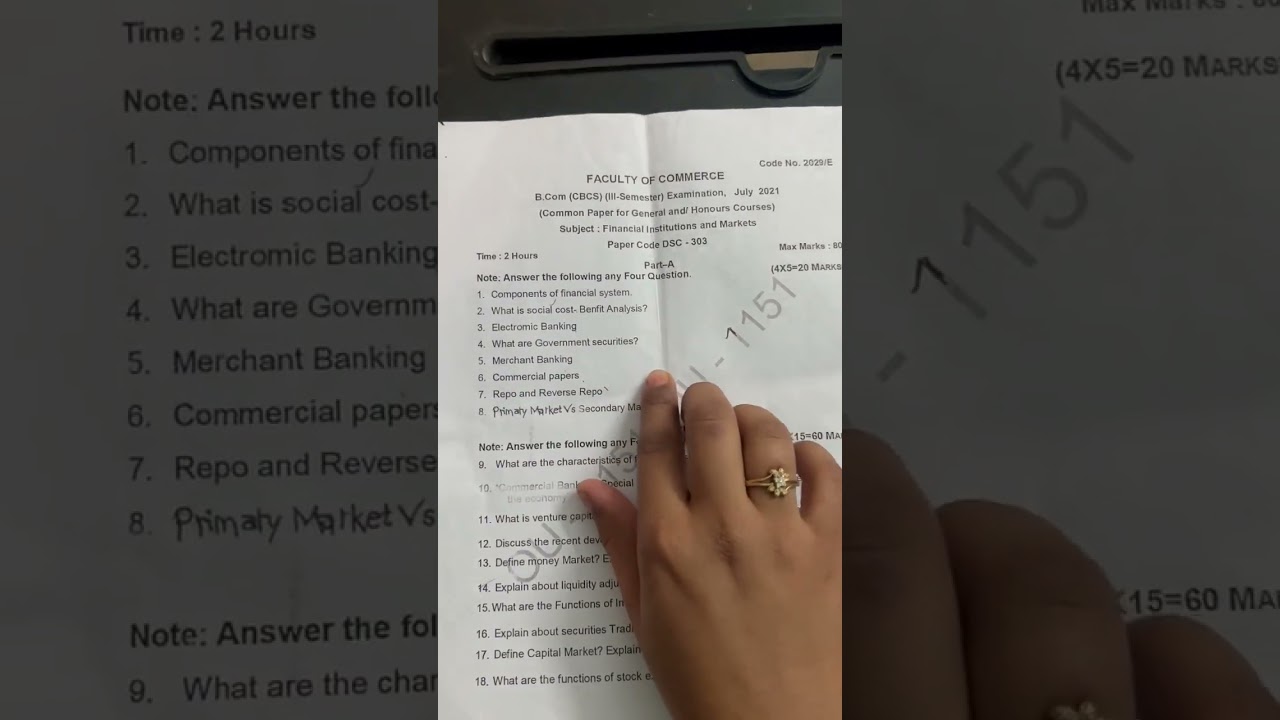

Degree 2nd year Bcom 3rd sem question paper financial institutional and markets #osmaniauniversity

Video

Donald Trump Is About To Crash Bitcoin Again | Mark Yusko’s 2026 Predictions

Mark Yusko Crypto Prediction’s 2026

Follow: https://x.com/MarkYusko

LIMITED TIME:

✅ Bitunix (no kyc, $10k bonus): https://www.bitunix.com/register?vipCode=AltcoinDaily

🟡 50% deposit bonus on first $100 (sign up on WEEX): https://www.weex.com/events/welcome-event?vipCode=oz5p&qrType=activity

🎁 Altcoin Daily Merch:

https://m046hz-bk.myshopify.com

🔵 Buy, Sell, & Trade Crypto on Coinbase:

https://advanced.coinbase.com/join/U5FN8P5

👉🔒 Get Ledger Wallet: Best Way to Keep your Crypto Safe!

https://www.ledger.com/?r=29fd4d75e9bc

🔴 Altcoin Daily in Spanish: https://www.youtube.com/@AltcoinDailyenEspanol

Follow Altcoin Daily on X: https://x.com/AltcoinDaily

Follow Altcoin Daily on Instagram: https://www.instagram.com/thealtcoindaily/

Video by Austin:

Follow Austin on Instagram: https://www.instagram.com/theaustinarnold/

Follow Austin on X: https://twitter.com/AustinArnol

TimeStamps:

00:00 Intro

01:20 What’s Next For Markets?

04:12 What Sectors Will Perform The BEST This Year?

19:50 Bitcoin Crash Not Over

32:32 How Low Will Bitcoin Go?

37:18 Tom Lee and Raoul Pal Are Wrong?

49:23 Bitcoin Price Prediction By 2029

52:42 Bitcoin or Ethereum?

58:40 How to Retire on Cryptocurrency by 2030 or Sooner (members)

***********************************************************************

#Bitcoin #Cryptocurrency #News #Ethereum #Invest #Metaverse #Crypto #Cardano #Binance #Chainlink #Polygon #Altcoin #Altcoins #DeFi #CNBC #Solana

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST ENTERTAINMENT! USE ALTCOIN DAILY AS A STARTING OFF POINT!

Bitunix, WEEX, CoinW, Binance are exchange partners for the channel.

*The channel is not responsible for the performance of sponsors and affiliates.

Disclosures of Material holdings:

Most of my crypto portfolio is Bitcoin, then Ethereum, but I hold many cryptocurrencies, possibly ones discussed in this video.

Material holdings over $5000 (in no particular order): BTC, ETH, SOL, MINA, DOT, SUPER, XCAD, LINK, INJ, BICO, METIS, SIS, BNB, PMX, LMWR, WMTx, HEART, TET, PAID, BORG, COTI, ADA, ONDO, ESE, ZKL, SUPRA, CELL, CTA, COOKIE, RSC, ATH, TAO.

Altcoin Daily is an ambassador for XBorg, Supra, WMTx.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

bitcoin, cryptocurrency, crypto, altcoins, altcoin daily, blockchain, best investment, top altcoins, altcoin, ethereum, best altcoin buys, bitcoin crash, xrp, cardano, 2026, ripple, buy bitcoin, buy ethereum, bitcoin prediction, cnbc crypto, bitcoin crash, cnbc, crypto news, crypto crash, crypto expert, best crypto, crypto today, bitcoin price, bitcoin crash, bitcoin ta, crypto buy now, crypto expert, bloomberg crypto, ethereum news, trading crypto, clarity act, mark yusko, cointelegraph, crypto prediction, trump crypto, crash

source

Video

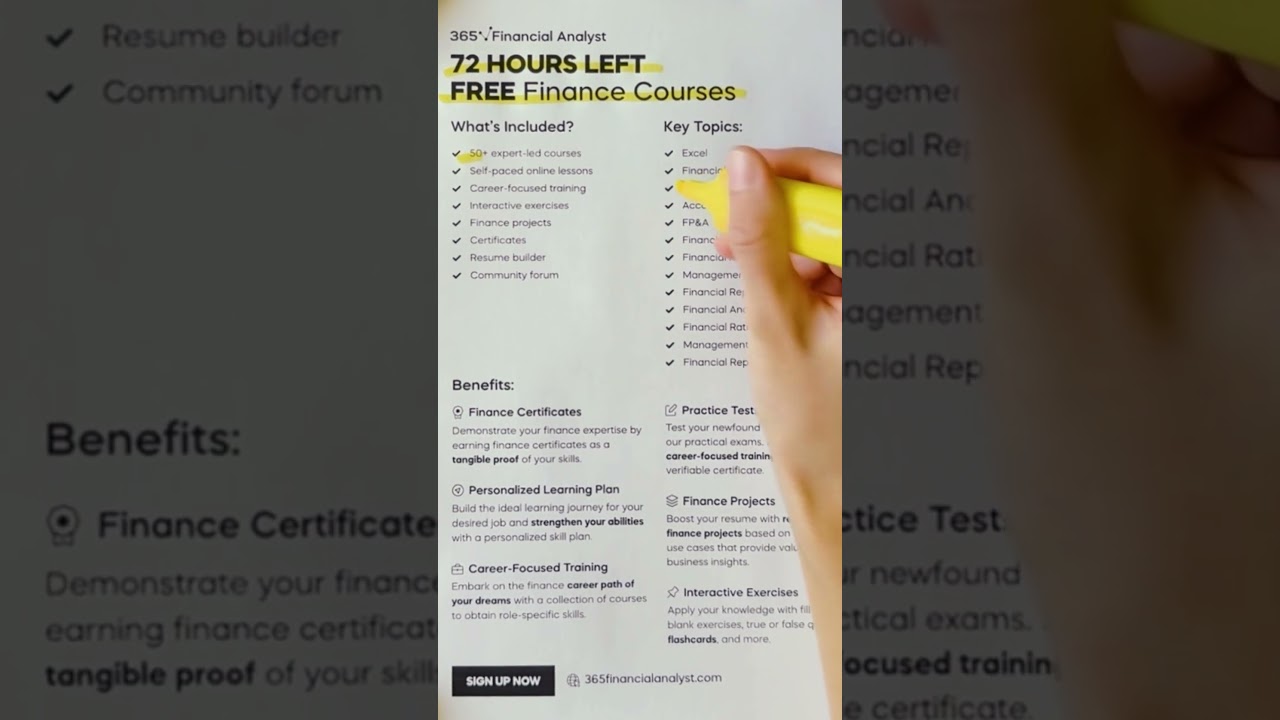

FREE Finance Courses (72H Left)

🚨𝐋𝐞𝐬𝐬 𝐭𝐡𝐚𝐧 𝟕𝟐 𝐡𝐨𝐮𝐫𝐬 𝐥𝐞𝐟𝐭 𝐭𝐨 𝐥𝐞𝐚𝐫𝐧 𝐟𝐢𝐧𝐚𝐧𝐜𝐞 𝐟𝐨𝐫 𝐅𝐑𝐄𝐄! Access ALL our finance courses and get certified at no cost.

Sign up before the clock runs out➡️ https://bit.ly/3SPJ29y

*𝘕𝘰 𝘤𝘢𝘳𝘥 𝘳𝘦𝘲𝘶𝘪𝘳𝘦𝘥

🆓 What’s FREE? Everything.

• 50+ expert-led finance courses

• Verifiable certificates

• Real-world projects

• Career-focused curriculums

• Mock tests & interactive exercises

• Study materials & community forum

• Resume builder

Topics covered include:

• Accounting, Excel (beginner to advanced)

• FP&A, Financial Analysis, Investment Banking

• Corporate Finance, Portfolio Management

• Financial Modeling, Derivatives, Equity Valuation

• And much more!

🗓️Hurry! 𝐓𝐡𝐢𝐬 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 𝐞𝐧𝐝𝐬 𝐢𝐧 𝐥𝐞𝐬𝐬 𝐭𝐡𝐚𝐧 𝟕𝟐 𝐡𝐨𝐮𝐫𝐬. Don’t wait—start learning and get certified today!

.

.

.

#365financialanalyst #careerinfinance #careerpath #finance #financialplanningandanalysis #learnfinance #cfaexam #cpa #frm #cfp #learn365 #acca #accounting #ai #financeterms #financelearningchallenge #learn365

source

Video

Macroeconomics | Money | Class 12 | chapter 5 | One Shot

Macroeconomics | Money | Class 12 | chapter 5 | One Shot

source

Video

How To Achieve Total Financial Peace in 30 Days

Feeling mo ba parang palaging kulang ang kita mo? Nahihirapan ka bang mag-ipon o mag-invest nang tama? At ang financial future mo, parang wala sa kontrol mo?

Ang stress na dulot ng pera ay hindi lang tungkol sa present mo—apektado nito ang iyong pamilya, mga plano, at pati na rin ang mental health mo. Pero paano kung may paraan para baguhin ang lahat ng ito sa loob ng 30 araw?

Sa video na ito, alamin kung paano mo maaabot ang TOTAL FINANCIAL PEACE gamit ang tamang kaalaman at diskarte. 💡 Madagdagan ang kita. Mag-ipon ng wais. Mag-invest nang matalino. At higit sa lahat, kontrolin ang kinabukasan mo!

👉 WATCH NOW at simulan ang pagbuo ng mas maliwanag na financial future!

Don’t forget to like, share, and subscribe para mas marami pang tips on paano yumaman nang may tamang mindset at action! 💰

👉 WATCH PART 2 here: https://youtu.be/Rp2bsPE_uMI

#FinancialFreedom #BudgetingTips #InvestmentGuideJoin

Join this channel to get access to perks:

https://www.youtube.com/channel/UCAgpONKAH237nr3IF_rWVlA/join

Watch our playlist!

EARN: https://youtube.com/playlist?list=PLMjKNhiK3DLAWKg4O94CECbagGfEYkXEF

GROW: https://youtube.com/playlist?list=PLMjKNhiK3DLAl1JkW6nlCadvhY-6RwoJC

MANAGE: https://youtube.com/playlist?list=PLMjKNhiK3DLB4P6QgjboDwMuiSCjYQ_MN

PROTECT: https://youtube.com/playlist?list=PLMjKNhiK3DLBQjFRmnrwTJaTh4d1t65a5

Lockdown Series: https://youtube.com/playlist?list=PLMjKNhiK3DLCFuBj0iEKPXNbYYIz7TaNH

Yamant Tips: https://youtube.com/playlist?list=PLMjKNhiK3DLCD20QOvhu9Rj72IbYJ4jy4

Latest Upload: https://youtube.com/playlist?list=PLMjKNhiK3DLA9oTakQlhhmARLwQMnTp0d

#PambansangWealthCoachngPilipinas #Helpingtobecomedebtfree #wealthy #BawatPilipinoayIponaryo #Iponaryo #ChinkPositive #ChinkeeTan

———————————————————————

Follow Chinkee Tan Everywhere to become wealthy and debt-free

TYL Exclusive Community: https://tylph.com?utm_source=youtube

———————————————————————

Get updated daily! Subscribe to Chinkee Tan’s Youtube: https://www.youtube.com/user/visionchinkee

For marriage and relationships, subscribe to my 2nd YT Channel HAPPY SPOUSE HAPPY HOUSE: https://www.youtube.com/@hshhofficial

Check out Chinkee Tan’s shop: https://chinkshop.com/

Enroll in Chinkee Tan’s online courses: https://chinktv.com/

———————————————————————

Chinkee Tan on Social Media

———————————————————————

Facebook page: https://www.facebook.com/chinkeetan/

Instagram: https://www.instagram.com/chinkeetan/

Twitter: https://twitter.com/chinkeetan

Tiktok: @chinkeetan

***For bookings and collaborations, visit our website: chinkeetan.com

or email me at invite@chinkeetan.com

source

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat15 hours ago

NewsBeat15 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports14 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 hours ago

Crypto World4 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 hours ago

Crypto World3 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout