Crypto World

24/7 Futures Trading for Modern Markets

Markets have modernized in almost every way—except one. Trading infrastructure has gone digital, execution is instantaneous, and information moves globally in real time. Yet most traditional markets still shut down on nights, weekends, and holidays.

This is where TradFi intersects with crypto-native infrastructure. Platforms like Phemex are narrowing that gap by listing TradFi futures—price-tracking contracts tied to assets such as gold and silver—on infrastructure built for continuous markets.

Spot trading vs futures contracts

Spot and futures markets work differently, and that difference explains why TradFi futures matter. Put simply, spot trading means you buy the asset itself at the current price, whereas a futures contract tracks price under contract terms rather than giving direct ownership.

In traditional spot trading, buying a share or commodity involves a complex chain of custody, legal ownership transfer, and T+2 settlement cycles. This infrastructure requires banks and clearinghouses to be open, which is why trading halts on weekends and holidays.

A futures contract is a derivative, an agreement based on the price of an asset, not the exchange of the asset itself. Because of this, there is no physical action or need for a transfer in the event of a closed exchange market.

When the market closes, only the conventional infrastructure ceases to function; assets retain their worth. Phemex fills this gap by delivering a marketplace where price discovery and risk management continue uninterrupted.

Macro News Don’t Wait for Monday

Traditional finance (TradFi) and cryptocurrency markets are increasingly moving in the same direction. As crypto trading has matured, digital asset prices have become more closely linked to macroeconomic indicators that have long driven equities and commodities.

Interest rate decisions by the U.S. Federal Reserve, inflation data, labor market reports, and geopolitical developments now influence both stock indices and major cryptocurrencies. This growing correlation has reshaped how traders think about risk, timing, and market access across asset classes.

The introduction of TradFi futures on crypto-native trading platforms allows traders to respond to macroeconomic developments in real time. Instead of waiting for traditional market hours, traders can hedge positions or manage volatility as events unfold—an approach that is increasingly central to modern risk management.

Whether it is hedging a position or capitalizing on volatility, the ability to execute trades based on real-time macro news is no longer a luxury,; it is a necessity for modern risk management.

Why TradFi Futures Matter for 24/7 Market Access

The 24/7 openness of markets, remaining functional even during holidays and non-working days, is not merely a new generation innovation; it represents the natural evolutionary progression of trading. In the traditional financial world, when the market is closed, uncertainty and suspense tend to take hold.

If a major event occurs over the weekend, traditional investors face significant gap risk, where the price jumps or drops substantially between Friday’s close and Monday’s open.

Through TradFi futures trading found on Phemex, traders can manage their positions at any time, day or night. This eliminates the waiting game that often leaves investors vulnerable to global news cycles that do not stop for bank holidays.

Unified Trading Across Crypto and TradFi Futures on a Single Platform

Phemex focuses on reducing the liquidity and access friction typical of traditional markets.

The platform offers USDT-settled derivatives linked to traditional assets such as gold, silver, and selected stocks, alongside crypto derivatives. This structure allows traders to access multiple asset classes from a single account, without opening separate brokerage relationships or navigating lengthy funding and settlement processes.

(USDT-settled derivatives mean that profits and losses are settled in USDT rather than through delivery of the underlying asset.)

Phemex operates a unified margin system, enabling the same USDT balance to be used across gold, silver, and crypto futures. Because these contracts track price rather than involve physical settlement, custody and operational complexity are reduced.

As with cryptocurrency perpetual contracts, TradFi futures can be traded with leverage, allowing traders to increase exposure and improve capital efficiency without committing the full notional amount typically required by traditional brokers. Historically, access to equities or commodities—whether via direct ownership, ETFs, or futures—often required substantial upfront capital and fragmented infrastructure.

As demand grows for continuous market access and more flexible risk management, crypto-native platforms are increasingly addressing these structural limitations. Phemex positions itself within this shift by offering infrastructure designed for continuous, multi-asset trading.

The Modern Market Is Open 24/7

Market evolution is no longer a question of if, but how. As crypto and traditional assets increasingly respond to the same macro forces, their separation at the infrastructure level has started to break down.

The objective isn’t to replicate stock exchanges on crypto platforms. It’s to build faster, more flexible systems that allow traders to access traditional asset exposure with the efficiency they expect from modern markets.

Phemex is approaching this by replacing ownership friction with futures-based access. By using price-tracking contracts rather than physical settlement, traditional assets can be traded alongside crypto within a unified, USDT-settled environment.

Moving into the second quarter of 2026, trading across asset classes from a single margin currency is no longer a differentiator; it’s becoming the baseline for how modern markets operate.

As part of the launch of its TradFi futures offering, Phemex has introduced a limited-time campaign aimed at familiarizing traders with the new product. The campaign includes a temporary zero-fee trading period, loss-protection incentives for first trades, trading leaderboards, and task-based rewards. The initiative is designed to support early adoption and allow traders to explore TradFi futures within a controlled, risk-aware framework.

Crypto World

Jump Trading to take small stakes in prediction markets Polymarket, Kalshi: Bloomberg

Jump Trading plans to take a small stake in each of the prediction-market platforms Kalshi and Polymarket, Bloomberg reported on Monday, citing people with knowledge of the matter.

The trading powerhouse, which has a significant focus on cryptocurrency, will gain the stakes in exchange for providing liquidity on the two platforms.

Jump is set to take a fixed amount of equity in Kalshi, while its stake in Polymarket will grow over time depending on the trading capacity that the firm provides to the platform’s U.S. operation.

Kalshi and Polymarket are the two most prominent prediction-market platforms, having both acquired multibillion dollar valuations. They rely on market makers like Jump to put up the money to take the other side of customers’ trades. Market makers then profit from the difference in price movements.

Jump expanded into prediction-market trading in recent months, recruiting 20 staffers in recent months for that business, according to Bloomberg.

The firms did not immediately respond to CoinDesk’s request for further comment.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

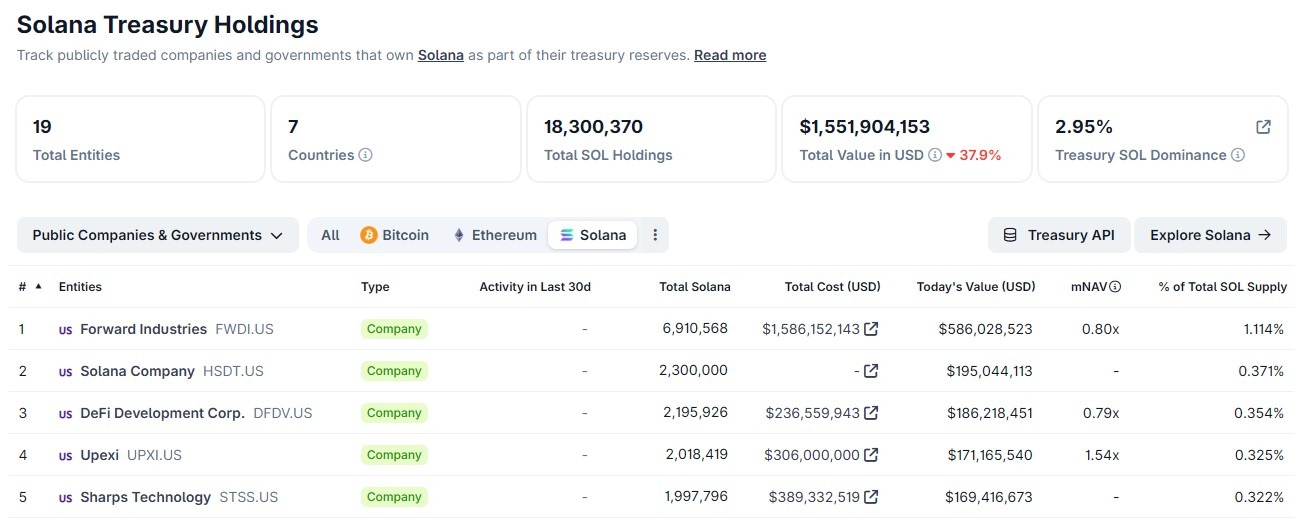

Publicly listed companies that hold Solana as a treasury asset are sitting on more than $1.5 billion in unrealized losses, based on disclosed acquisition costs and current market prices tracked by CoinGecko.

The losses are concentrated among a small group of United States-listed companies that collectively control over 12 million Solana (SOL) tokens, about 2% of the total supply. While losses remain unrealized, equity markets have already repriced the companies, with most trading well below the market value of their tokens.

CoinGecko data shows that Forward Industries, Sharps Technology, DeFi Development Corp and Upexi account for over $1.4 billion in disclosed unrealized losses. The total is likely understated, as Solana Company has not fully disclosed its acquisition costs.

The figures highlight a growing gap between paper losses and liquidity pressure. While none of the companies have been forced to sell their SOL, compressed net asset value (mNAV) multiples and falling share prices have constrained their ability to raise fresh capital.

Accumulation stalls across Solana treasuries

Transaction data compiled by CoinGecko shows that the bulk of SOL accumulation occurred between July and October 2025, when several companies made large, concentrated purchases.

Since then, none of the top five Solana treasury companies have disclosed meaningful new buys, and no onchain sales have been recorded.

Forward Industries, the largest holder, accumulated over 6.9 million SOL at an average cost of about $230. With SOL trading around $84, Forward has unrealized losses of over $1 billion.

Sharps Technology made a single $389 million purchase near the market peak. The company’s SOL is now worth about $169 million, down over 56% from its acquisition cost.

DeFi Development Corp followed a more gradual accumulation strategy and reports smaller losses, but its shares still trade below the value of its SOL holdings.

Solana Company, which built a 2.3 million SOL position over several tranches of purchases, has also paused accumulation since October, according to CoinGecko’s transaction history.

Related: Kyle Samani leaves Multicoin in ‘bittersweet moment’ to explore new tech

Equity markets signal a treasury winter

Equity price data from Google Finance shows that the top five Solana treasury companies have suffered sharp drawdowns in the last six months, significantly underperforming SOL itself.

Forward Industries, DeFi Development Corp, Sharps Technology and Solana Company stock prices are down between 59% and 73% in the six-month charts.

CoinGecko data shows that Upexi has $130 million in unrealized losses on its SOL holdings. However, its shares have fallen more sharply than its peers.

Upexi shares are down more than 80% over the past six months, according to Google Finance. Like other Solana treasury firms, Upexi has paused new accumulation since September.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

ASTER jumps 9% above $0.60 as traders eye breakout toward $1 target

- Aster traded to highs of $0.65 amid a 9% uptick in 24 hours.

- The bounce from lows of $0.43 on February 5, 2026, could extend amid a retest of key levels.

- Risks of a downturn remain as Bitcoin and Ethereum struggle.

ASTER is among the top-gaining altcoins on the day, as its price surges by nearly 9% to extend its upside movement above $0.60.

The token, native to the innovative decentralized exchange platform Aster, is showing this renewed strength amid broader market weakness.

On Tuesday, as Bitcoin and Ethereum held around $68,000 and $2,000, respectively, Aster jumped to intraday highs of $0.65.

A potential upside continuation as traders target more gains is shaping up, although overall sentiment means that profit-taking might still be a factor.

Aster price posts 9% bounce

The crypto market has significantly flipped bearish since the downturn that smashed bulls’ optimistic outlook on October 10, 2025.

In the latest extension of that negative sway, Aster’s price fell to lows of $0.43, with losses mirroring the sharp sell-off to $60k for BTC and $1,740 for ETH.

However, just as BTC bounced to $70k, the altcoin regained some upside momentum and surged to $0.60.

Bulls have held above this level in the past two days, having tested $0.65 on three occasions in the time frame.

ASTER recorded nearly 9% in 24-hour gains, cutting losses over the past week and now trades in the green over this period.

While the bounce aligns with a slight shift in broader sentiment, the dip in trading volume means buyers have not stepped in forcefully.

If the platform’s recent launch of 0% maker fees across all markets draws significant liquidity and user interest, bulls could seize control.

ASTER price forecast

On the one side, a potential pump to $1.30 looms, and on the other, a failure to solidify gains could spell danger.

For bulls, the daily chart reveals a falling wedge breakout, a bullish pattern signaling potential reversal as price compresses and escapes upward resistance.

Key oscillators also remain neutral but lean toward buy signals.

The daily RSI hovers around 53 and is upsloping. However, it is well off overbought conditions.

Meanwhile, the Commodity Channel Index and Average Directional Index both show neutral readings, while the MACD hints at a buy move as the histogram ticks positive with expanding bias.

This setup positions ASTER for a possible short-term pump, with primary supply zones at $0.80 and $0.95.

Breaking to $1 will bring the $1.22 to $1.30 range into view as the next target, which is the top of the projected wedge pattern from November 2025.

With risks of a pullback in play, key levels to watch include $0.54 and $0.46.

Crypto World

Cathie Wood’s ARK Buys $9.67M in Roblox Stock, Dumps PagerDuty

TLDR

- ARK Invest purchased 145,603 Roblox shares worth $9.67 million across three ETFs on February 9, 2026.

- The buy followed Roblox’s strong fourth-quarter results and improved bookings forecast from the gaming company.

- ARK continued selling PagerDuty stock, offloading $1.18 million worth of shares in its fifth consecutive day of reductions.

- The firm added healthcare positions in Recursion Pharmaceuticals and TharImmune while trimming digital ad stocks.

- Total sales included Pinterest and The Trade Desk as ARK shifts focus toward gaming and AI-driven healthcare.

Cathie Wood’s ARK Invest executed major portfolio moves on February 9, 2026. The firm bought 145,603 shares of Roblox worth $9.67 million across three exchange-traded funds.

ARK Innovation ETF, ARK Next Generation Internet ETF, and ARK Fintech Innovation ETF all participated in the purchase. The transaction represents one of ARK’s largest single-stock buys in recent trading sessions.

The Roblox purchase came days after the company released fourth-quarter earnings. The gaming platform posted results that exceeded Wall Street expectations. Management also issued positive guidance for upcoming bookings.

Several analysts have raised their price targets on Roblox stock. They point to increased engagement from users and higher spending patterns. Older demographics are spending more on the platform, which analysts view positively.

Healthcare and AI Investments Grow

ARK expanded its healthcare portfolio with two purchases on February 9. The firm bought 156,272 shares of Recursion Pharmaceuticals for $622,000. The biotech company uses artificial intelligence for drug discovery.

ARK also acquired 54,600 shares of TharImmune valued at $226,000. Both purchases align with Wood’s strategy of backing companies using technology to develop new medicines.

Additional buys included 2,114 shares of Kodiak AI worth $19,343. ARK added 444 shares of Tempus AI for $24,380. The firm also purchased 57,164 shares of Bullish totaling $1.57 million.

ARK Reduces Software and Ad Tech Exposure

ARK sold 147,125 shares of PagerDuty for approximately $1.18 million. The sale marks the fifth straight trading day ARK has reduced this position. Shares were sold through ARK Innovation ETF and ARK Next Generation Internet ETF.

The repeated selling indicates declining conviction in PagerDuty stock. The company provides incident management software for IT departments. ARK has now trimmed its stake substantially over the past week.

Pinterest was another stock ARK reduced. The firm sold 46,800 shares worth roughly $917,000. ARK also cut its Trade Desk position by 24,157 shares for about $653,000.

Both Pinterest and The Trade Desk generate revenue from digital advertising. The sales suggest ARK is moving capital away from ad-dependent business models. The firm appears to be favoring gaming and healthcare technology instead.

ARK sold 497 shares of Qualcomm for $68,257. This represents a minor position adjustment in the semiconductor sector.

Total sales on February 9 reached approximately $2.82 million. Combined with purchases of roughly $12.15 million, ARK increased its net equity exposure. The buying pattern shows Wood is deploying more capital into preferred holdings.

The portfolio changes reflect ARK’s focus on companies with strong growth potential. Roblox leads the buys while PagerDuty continues facing selling pressure. Healthcare and AI stocks received additional investment as digital advertising names were reduced.

Crypto World

Harvard endowment tilts harder into Bitcoin ETFs than Google stock

Harvard’s endowment has quietly made Bitcoin ETFs a top public holding, surpassing Google and joining other elite universities in rotating long‑term capital into digital assets.

Summary

- Filings show Harvard built and then tripled its BlackRock iShares Bitcoin Trust stake, lifting IBIT above Alphabet and other big‑tech names in its public portfolio.

- Brown, Emory, and other U.S. universities have also disclosed multi‑million‑dollar Bitcoin ETF and trust positions, signaling a broader endowment shift into crypto.

- The rotation comes as Bitcoin trades near $68,400, with Ethereum and Solana also rallying while digital assets again track global risk appetite.

Harvard University’s endowment is now leaning harder into Bitcoin (BTC) than into Silicon Valley’s most iconic search giant—and markets are taking note

Harvard’s Quiet Portfolio Pivot

“FUN FACT: Harvard University holds more in Bitcoin ETFs than it holds shares in Google,” Bitcoin Magazine posted on X on February 10, distilling a shift years in the making.

Regulatory filings show Harvard built a roughly $116.7 million position in BlackRock’s iShares Bitcoin Trust in 2025, lifting its Bitcoin exposure above stakes in Alphabet and other big‑tech mainstays.

Subsequent disclosures indicate Harvard increased that wager, with some estimates putting its Bitcoin ETF holdings in the hundreds of millions and ranking the position among its single largest listed assets.

Commentary from the digital‑asset industry has been blunt. “Most people think Bitcoin is the gamble, but Harvard’s math clearly suggests that not owning enough of it is the bigger risk to their long‑term portfolio,” wrote SIG Labs.

Another bitcoiner framed it more simply: “Bitcoin is moving from theory to balance sheets.”

Endowments Move Into Crypto

Harvard is not alone. Brown and Emory universities have both disclosed sizable Bitcoin ETF and trust positions, running into the tens of millions of dollars in IBIT and Grayscale’s Bitcoin Mini Trust. One crypto media noted that “several prominent U.S. university endowments have disclosed investments in cryptocurrency – including Emory, Brown, and Dartmouth Universities.”

Bitcoin, Google, and Macro Risk

Harvard’s rotation comes as digital assets again trade as a pure expression of global risk appetite. Bitcoin (BTC) is hovering around $68,400, with intraday swings pulling it below $70,000 twice in the past 24 hours as traders digest a near‑50% drawdown from its 2025 peak near $126,000.

Ethereum (ETH) changes hands near $4,760, up roughly 2.5% over the last day, while Solana (SOL) trades close to $208 after a gain of just over 5%, on volumes above $12 billion.

“This is Harvard flipping tech for BTC ETFs,” one trader wrote, calling it “wild” and a sign that “institutional adoption is officially peaking right now.”

If that proves true, Bitcoin beating Google inside the world’s richest university endowment may be remembered as more than just a memeable “fun fact.”

Crypto World

MrBeast Acquires Step Banking App After $200M BitMine Investment

TLDR

- YouTuber MrBeast’s company Beast Industries purchased Step, a banking app with 7 million teen and young adult users

- Deal follows $200 million investment from Ethereum treasury firm BitMine Immersion Technologies in January 2025

- Step provides FDIC-insured banking through Evolve Bank & Trust with features for credit building and money management

- MrBeast filed trademark for “MrBeast Financial” in October 2024 mentioning cryptocurrency exchange services

- Acquisition price not disclosed; Step previously raised $500 million from celebrity investors including Steph Curry

Jimmy Donaldson, known online as MrBeast, is expanding his business empire into financial services. His company Beast Industries completed an acquisition of Step, a mobile banking platform targeting teenagers and young adults.

Donaldson shared the news Monday on social media. He told his audience the purchase aims to give young people financial education he lacked growing up. “Nobody taught me about investing, building credit, or managing money when I was growing up,” the YouTuber explained.

Beast Industries did not reveal how much it paid for Step. The company declined to comment on financial terms of the transaction.

Step currently serves between 6.5 and 7 million users. The app launched in 2018 to help Gen Z manage finances, build credit scores, and access banking tools.

Banking Features and FDIC Insurance

Step partners with Evolve Bank & Trust to offer Federal Deposit Insurance Corporation-insured accounts. Users receive a Step Visa Card and can open accounts for spending, saving, and investing.

The platform charges no monthly fees. Step’s founders CJ MacDonald and Alexey Kalinichenko designed the app to improve financial literacy among younger users.

Beast Industries CEO Jeff Housenbold said the acquisition allows the company to provide practical financial solutions. He stated financial health is fundamental to overall wellbeing.

$200 Million Crypto Investment Preceded Deal

BitMine Immersion Technologies invested $200 million in Beast Industries during January 2025. The firm holds the largest corporate position in Ethereum cryptocurrency.

BitMine chair Tom Lee called the investment a long-term bet on the creator economy. He praised MrBeast’s reach among Gen Z, Gen Alpha, and Millennial demographics.

The investment came after Beast Industries filed a trademark application for “MrBeast Financial” in October 2024. That filing referenced cryptocurrency exchange services, payment processing, and decentralized exchanges.

Whether the trademark connects to the Step acquisition remains unknown. Beast Industries has not confirmed plans to add cryptocurrency features to Step’s platform.

Step’s Investor Base and Growth

Step raised roughly $500 million from various investors since launching. Celebrity backers include NBA player Steph Curry, singers Justin Timberlake and Charli D’Amelio, and actor Will Smith.

Payment processor Stripe invested in Step alongside venture firms Coatue, Collaborative Fund, Crosslink Capital, and General Catalyst. The company scaled its user base to 7 million over eight years.

MrBeast runs the largest YouTube channel globally with 466 million subscribers. His channels generate about 5 billion monthly views.

Beast Industries operates multiple businesses beyond YouTube. These include Feastables snack brand, Beast Philanthropy nonprofit, and Beast Games reality show on Amazon Prime Video.

Housenbold said Step’s technology platform and fintech team complement Beast Industries’ digital audience. The acquisition brings Step’s entire operation under the Beast Industries umbrella.

Crypto World

Memecoins lead crypto market gains as prices of major tokens BTC, ETH languish: Crypto Markets Today

Bitcoin is struggling to regain a foothold above $70,000 as altcoins outperform.

The largest cryptocurrency is little changed over 24 hours, while the broader CoinDesk 20 (CD20) index rose 0.40% even as ether declined. Memecoins are leading gains, with the CoinDesk Memecoin Index (CDMEME) adding 1.5% as PIPPIN climbed 46%.

Tokens linked to artificial intelligence (AI) also fared well. , co-founded by OpenAI CEO Sam Altman, rose more than 3% in the past day, while Virtuals’ VIRTUAL token rose 2.4%. That’s as the “agentic AI,” where AI tools now also execute tasks, narrative grows.

Still, the crypto Fear and Greed Index still points to “extreme fear” in the market after last week’s selloff.

Meanwhile, traditional markets steadied, buoyed in part by Prime Minister Sanae Takaichi’s landslide election victory in Japan. While Japanese bond yields rose after the result, they have since fallen near to pre-election levels. That reduces the risk of trillions of dollars invested overseas moving back to Japan in search of higher yields.

Derivatives Positioning

- Bearish momentum in BTC futures is intensifying as open interest (OI) continues its descent to $15.9 bo;;opm, signaling a deep and prolonged deleveraging phase.

- This shift is most evident in funding rates on Binance (-7%) and Bybit (-8%), which have collapsed into aggressive negative territory. That’s a sign short sellers are paying a heavy premium to maintain their dominance. With the three-month basis stagnant at 3%, institutional appetite remains sidelined.

- The BTC options market is showing a cooling of extreme defensive sentiment. The one-week 25-delta skew is at 16%, while call dominance has rebounded to 56%, indicating a shift toward bottom-fishing.

- The implied volatility (IV) term structure is transitioning from extreme backwardation toward a hybrid position that suggests that while near-term protection remains pricey, long-term volatility expectations are stabilizing.

- Coinglass data shows $290 million in 24-hour liquidations, with a 53-47 split between longs and shorts. BTC ($114 million), ETH ($89 million) and others ($16 million) were the leaders in terms of notional liquidations. Binance’s liquidation heatmap indicates $68,160 as a core liquidation level to monitor, in case of a price drop.

Token Talk

- Merkle Trade, the largest perpetual futures decentralized exchange on the Aptos blockchain, is in the throes of shutting down. The exchange disabled new trading positions on Friday and will forcibly close all open positions today.

- Merkle’s native token, MKL, has added 9% in the past 24 hours. It remains redeemable without withdrawal fees, with a final staking rewards payout scheduled for Feb. 12. The token has lost 77% in the past 12 months.

- The move comes less than two years after Merkle raised $2.1 million in a seed round backed by Aptos Labs, Hashed and Arrington Capital.

- Despite processing $30 billion in trading volume since its 2023 debut, the team gave no clear reason for the closure in a post on X last week, noting only that the decision followed “careful consideration.”

Crypto World

Hyperscale Data doubles down on Bitcoin as treasury hits 589 BTC

Hyperscale Data lifts its Bitcoin treasury to 589 BTC and targets $100m, using a strict dollar‑cost‑averaging plan as crypto remains a macro risk barometer.

Summary

- Hyperscale Data now holds 589.4502 BTC worth about $41.4m, aiming to scale its Bitcoin balance‑sheet position to $100m over time.

- The firm deploys at least 5% of allocated cash weekly into BTC via a disciplined dollar‑cost‑averaging strategy run through Sentinum and Ault Capital Group.

- Bitcoin, Ethereum, and Solana prices underscore the risk‑asset backdrop as external analyses flag elevated BTC volatility and deep drawdowns from 2025 highs.

Hyperscale Data tightens its grip on Bitcoin as treasury tops 589 BTC, sharpening a balance‑sheet bet on digital assets at a time when crypto remains the market’s rawest barometer of risk appetite.

Treasury milestone and $100m target

Hyperscale Data, Inc. said in a press release published today its Bitcoin treasury reached 589.4502 BTC as of February 8, 2026, with an implied value of roughly $41.4m at a closing Bitcoin price of $70,264. The company reiterated that its goal is to accumulate $100m worth of Bitcoin on its balance sheet over time.

Executive chairman Milton “Todd” Ault III framed the move as deliberate and incremental, stressing discipline over bravado. “We continue to demonstrate our dedication to our dollar‑cost average strategy,” he said, arguing that this approach “has allowed us to continually lower our average cost per Bitcoin and further strengthen the balance sheet and long‑term future of the Company.”

How Hyperscale is accumulating BTC

Through its subsidiaries Sentinum, Inc. and Ault Capital Group, Inc. (ACG), Hyperscale now holds 589.4502 BTC, with Sentinum controlling about 548.5903 BTC and ACG approximately 40.8994 BTC. Sentinum’s stack includes 108.3562 BTC mined in‑house and 440.2341 BTC bought in the open market, while ACG added 8.9000 BTC during the week ended February 8.

The firm plans to “fully deploy the cash allocated to its digital asset treasury (‘DAT’) strategy into Bitcoin purchases over time,” typically targeting at least 5% of allocated cash each week via daily buys, though actual deployment will flex with “market conditions and strategic considerations.” Management told investors to judge accumulation using multi‑week averages, consistent with first‑principles DCA practice common among institutional allocators.

Macro backdrop: crypto as risk gauge

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $69,095, with a recent 24‑hour range between roughly $69,319 and $70,123 and turnover anchored in deep, multi‑billion‑dollar spot and derivatives flows. Ethereum (ETH) changes hands near $2,060, down just over 2% on the session, after trading between about $2,000 and $2,150 over the last day. Solana (SOL) trades close to $83.9, slipping around 0.4% in the past 24 hours as volumes consolidate after a sharp multi‑week advance.

For readers tracking the broader context of Bitcoin’s pullback and volatility, recent analyses from outlets such as Phemex on BTC’s drawdown from its October 2025 highs, Journal du Coin’s coverage of the latest 50% correction, and XTB’s breakdown of the latest slide toward the high‑$60,000 region provide additional color on the forces shaping Hyperscale’s high‑conviction treasury strategy.

Crypto World

USD/JPY Drops by More Than 1% At the Start of the Week

As the USD/JPY chart shows, the pair has been exhibiting bearish momentum since the beginning of the week. This move has been driven by a combination of factors:

→ Yen strength on political news. Prime Minister Sanae Takaichi secured a decisive victory in Sunday’s snap election (8 February), winning a parliamentary majority. Although Takaichi has pledged large-scale fiscal stimulus of around ¥21 trillion, the prospect of increased money printing has not weakened the currency, as the market may (a) welcome political stability and (b) believe that the Bank of Japan will be forced to respond to inflation by raising interest rates.

→ US dollar weakness ahead of economic data releases. This reflects market sentiment ahead of labour market data due on Wednesday and the CPI report scheduled for Friday. In addition, the dollar’s status has come under pressure after Chinese regulators reportedly recommended limiting investments in US Treasuries.

On 26 January, when analysing fluctuations in the dollar–yen exchange rate, we:

→ noted that the long-term ascending channel had been broken near the 157.700 level;

→ constructed a parallel channel below and suggested that, following the sharp drop in USD/JPY (triggered by the possibility of coordinated currency intervention by the Bank of Japan and the Federal Reserve), a rebound could occur.

Indeed, since then (as indicated by the arrow):

→ on 28 January, the market formed a low slightly below the lower boundary of the parallel channel;

→ the pair subsequently rebounded towards the 157.700 level.

Technical Analysis of the USD/JPY Chart

The bearish tone of the current week allows us to highlight the following:

→ local support levels of the parallel channel (shown by thick blue lines) have been broken, and bulls may now have to rely on its lower boundary;

→ lower highs A–B–D have formed on the USD/JPY chart, with a bearish trend line drawn through them.

In this context, it is reasonable to assume that:

→ the sharp B→C impulse has disrupted the market’s multi-month bullish structure;

→ the C→D recovery (towards the 78.6% Fibonacci level) was an interim move within a broader bearish reversal.

The ability of the red A–B–D trend line to remain relevant over time would further support this hypothesis.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Chainlink founder says these 3 trends will define crypto’s next era

Chainlink co-founder Sergey Nazarov says the current market cycle is offering a clearer view of where crypto is headed next – not through price action, but through structural changes taking place beneath the surface.

Summary

- Chainlink founder Sergey Nazarov says fewer institutional blowups signal a more resilient crypto market.

- Real-world asset adoption is accelerating regardless of price cycles.

- Infrastructure demand could push RWAs to surpass crypto-native assets over time.

In a post on X, Nazarov argued that the most important signals this cycle are emerging from infrastructure resilience and real-world adoption rather than speculation.

This suggests the industry is entering a more durable phase.

1. Crypto is surviving volatility with fewer systemic failures

Nazarov’s first signal of progress is the absence of large, cascading institutional collapses during recent market drawdowns. He noted that despite sharp volatility, the industry has avoided the kind of failures that defined the previous cycle.

“This cycle so far has not had the same types of cascading institutional blowups,” Nazarov wrote, pointing to improved risk management and capital discipline across crypto firms.

According to Nazarov, this resilience is a critical prerequisite for long-term institutional participation and signals a maturing market structure.

2. Real-world assets are moving on-chain regardless of prices

The second trend shaping crypto’s next era is the steady migration of real-world assets (RWAs) onto blockchains. Nazarov emphasized that tokenization activity is continuing even as broader crypto markets fluctuate.

“The adoption of RWAs is continuing independent of crypto market cycles,” he said, highlighting on-chain issuance and the growth of perpetual markets tied to traditional assets such as commodities.

He added that features like 24/7 trading, transparent collateral, and global access are driving demand beyond speculative use cases.

3. Infrastructure is becoming the core value proposition

Nazarov’s final trend centers on infrastructure. As RWAs scale, he said the need for reliable data, interoperability, and secure coordination between on-chain and off-chain systems is increasing rapidly.

“In the long run, RWAs can become larger than crypto-native assets,” Nazarov wrote, suggesting blockchains are evolving into foundational financial infrastructure rather than niche markets.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat16 hours ago

NewsBeat16 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports15 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 hours ago

Crypto World5 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World4 hours ago

Crypto World4 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout