Crypto World

Crypto Token Development & ICO Software Development Guide

If you are reading this, you are not looking to launch “just another token.” You are building a serious digital asset venture with real fundraising goals and long-term ambition. This guide was written for founders who want clarity before committing capital, time, and reputation. It breaks down how crypto token development should be approached when the end goal is investor trust, regulatory alignment, and sustainable fundraising. By following this roadmap, you learn how to:

- Design a crypto business model that investors can evaluate and trust

- Build a secure, scalable token infrastructure that passes audits and due diligence

- Prepare your project for regulatory and institutional review

- Structure an ICO that attracts quality investors instead of short-term speculators

- Deploy professional fundraising platforms that reduce operational risk

- Manage capital responsibly and protect long-term value after fundraising

More importantly, this guide shows you how to think like your future investors. You now understand what decision-makers look for before backing a project, how risks are evaluated, and why execution quality determines fundraising outcomes. Instead of guessing, experimenting, or relying on hype, you have a structured framework to move from idea to investable venture with confidence. If your goal is serious capital, long-term credibility, and scalable growth, this is the foundation you build on.

Understanding the Foundation of Token-Based Business Models

Before writing code, founders must define how their project creates real value. A fundable crypto business model answers five critical questions:

- What problem does the token solve?

- Who are the primary users?

- How does the ecosystem generate revenue?

- Why will users hold or use the token?

- How does demand scale over time?

Professional token development begins with aligning token utility to business outcomes. Tokens should support governance, access, rewards, or infrastructure, rather than exist only for speculation. Investors prioritize projects where token economics reflect long-term platform growth. Without a strong business model, even technically sound projects struggle to raise capital. Weak fundamentals often lead to low investor confidence and poor long-term adoption.

At this stage, founders should also analyze competitors, market size, and regulatory exposure. A well-defined economic foundation increases investor confidence and reduces the need for future pivots. Many teams also rely on structured Token Development Services to validate their models and ensure that business strategy, technology, and compliance remain aligned from the start.

Check If Your Project Is Investor-Ready

Planning Your Cryptocurrency Before Writing Code

Once the business model is clear, development begins. Building a reliable token requires structured technical planning and disciplined execution. This is where professional token development services play a critical role in translating strategy into a secure, scalable infrastructure that supports long-term growth.

At this stage, founders must focus on building systems that are not only functional but also resilient under real-world usage and investor scrutiny. Key development components include:

1. Token Architecture

- Supply structure

- Issuance model

- Burn or inflation controls

- Governance logic

- Reserve management

A well-designed token architecture ensures that supply dynamics remain predictable and transparent. It also prevents excessive dilution and protects early investors.

2. Smart Contracts

- Modular design

- Upgrade mechanisms

- Emergency controls

- Treasury management

- Access permissions

Smart contracts form the operational backbone of your cryptocurrency. They must be written with security, flexibility, and compliance in mind. Poorly written contracts often become long-term liabilities.

3. Infrastructure

- Testnet deployment

- Integration pipelines

- Gas optimization

- Performance testing

- Monitoring systems

Robust infrastructure allows teams to identify weaknesses early and resolve them before public deployment. Testing environments are essential for validating transaction logic and platform stability. High-quality crypto token development ensures that contracts are audit-ready, scalable, and aligned with regulatory standards. It also improves interoperability with exchanges, wallets, and third-party platforms.

Security must be embedded from day one. Weak contracts expose projects to exploits, legal risk, and reputational damage, often ending fundraising efforts before they begin. This is why many serious founders partner with an experienced token development company that follows industry-standard security practices and formal audit processes. Strong technical foundations signal professionalism, reduce operational risk, and significantly improve investor confidence.

How Can You Prepare Your Cryptocurrency for Legal and Investor Approval?

After technical development, the next challenge is building legal credibility and investor trust through strong compliance systems and transparent operations. Before raising funds, projects must demonstrate full regulatory and operational readiness, including:

- Jurisdiction analysis and token classification reviews to ensure alignment with local securities and digital asset regulations.

- KYC and AML system integration to verify investor identity and prevent regulatory violations.

- Data protection and privacy compliance frameworks to safeguard user and investor information.

- Formal governance documentation defining decision-making authority and operational accountability.

Partnering with a reputable crypto token development company helps founders design compliant infrastructures that meet regulatory and institutional expectations. Investor approval depends on transparent documentation and verifiable disclosures, including:

- Legal opinions and independent audit reports to validate technical and regulatory integrity.

- Detailed whitepapers and risk disclosures outlining project structure, limitations, and obligations.

- Clearly defined treasury management policies to ensure responsible allocation and reporting of funds.

- Ongoing compliance monitoring to adapt to evolving regulatory requirements.

- Projects that delay legal preparation risk exchange listing delays, frozen assets, and enforcement actions.

In today’s market, regulatory readiness is a core fundraising requirement and a foundation of long-term investor confidence. The more regulatory frameworks your crypto complies with, the broader your global fundraising and growth opportunities become.

How Do You Structure and Launch a Successful ICO Token Sale?

Once your cryptocurrency is secure and compliant, the focus shifts from development to structured fundraising execution.

1. Fundraising Readiness

Professional ICO token development ensures that your token sale is transparent, scalable, and legally aligned with investor and exchange expectations.

2. Sale Phases

A successful ICO follows clearly defined fundraising stages to manage valuation and participation:

- Private rounds for early strategic investors

- Strategic rounds for institutional partners

- Public sales for community participation

3. Allocation Design

Balanced token allocation protects long-term value and investor confidence:

- Team vesting schedules to prevent early sell-offs

- Investor lockup periods to stabilize liquidity

- Ecosystem reserves to support sustainable growth

Plan Your ICO with Fundraising Experts

4. Pricing Strategy

Well-structured pricing models reflect market demand and project maturity:

- Fixed pricing for predictable valuation

- Dynamic valuation based on participation levels

- Demand-based tiers to incentivize early contributors

5. Investor Protection

Strong protection mechanisms reinforce trust and operational integrity:

- Refund logic to safeguard participant funds

- Oversubscription controls to manage excess demand.

- Allocation audits to ensure fair distribution

6. Execution Reliability

An experienced ICO token development company ensures that fundraising systems perform reliably under high transaction volumes and peak market activity. When these elements work together, token sales run smoothly, investor confidence remains strong, and projects build lasting credibility with exchanges and institutional partners.

What Platforms and Tools Are Best for Running a Secure ICO?

Modern ICOs require enterprise-grade technology that can handle high transaction volumes, strict compliance requirements, and real-time investor interactions. A professional ICO software development partner provides the infrastructure needed to manage fundraising securely, transparently, and at scale. It ensures that every transaction, allocation, and report remains accurate throughout the fundraising lifecycle.

At this stage, founders must prioritize system reliability, data security, and regulatory compatibility to avoid operational disruptions during live token sales. Core platform components include:

1. Investor Dashboard

- Wallet connectivity

- Contribution tracking

- Vesting overview

- Claim management

- Transaction history

The investor dashboard serves as the primary interface between participants and the fundraising platform. A clean, intuitive design improves trust and reduces support overhead.

2. Admin Console

- Sale configuration

- Compliance controls

- Allocation management

- Reporting systems

- Access permissions

The administrative console allows founders to manage fundraising operations efficiently while maintaining transparency and auditability.

3. Payment Layer

- Multi-chain support

- Stable coin acceptance

- Automated reconciliation

- Fiat gateway integration

- Liquidity routing

A robust payment layer ensures smooth capital inflows across multiple networks and currencies. It also simplifies financial reporting and treasury management. To accelerate deployment, many founders adopt white label ICO development solutions. These pre-tested frameworks reduce time-to-market while maintaining strong security standards and operational reliability.

When combined with tailored white label development, teams can customize branding, workflows, analytics, and third-party integrations without rebuilding core systems from scratch. The right platform improves investor experience, strengthens compliance posture, and significantly reduces operational risk during high-pressure fundraising campaigns.

How Do You Manage, Scale, and Protect Value After an ICO?

After an ICO, founders must shift immediately from fundraising mode to institutional-grade execution. This means implementing strict treasury governance, milestone-based capital deployment, and board-level financial oversight. Many teams continue working with their Token development company to maintain system security, upgrade infrastructure, and ensure long-term technical stability. Funds should be allocated against product development, compliance expansion, and market penetration objectives, with clear accountability at every stage. Regular investor briefings, third-party audits, and transparent performance reporting are essential to sustaining credibility with strategic backers and exchanges.

Scaling successfully requires more than feature releases. Leadership teams must focus on building defensible market positions through enterprise partnerships, regulatory alignment, and ecosystem integration. At the same time, liquidity management, risk controls, and community governance structures must be strengthened to protect long-term token value. Projects that maintain close coordination with experienced development and compliance partners are better positioned to adapt to market shifts and regulatory changes. Teams that treat post-ICO operations as a regulated financial enterprise, rather than a startup experiment, are the ones that attract institutional capital and achieve durable growth.

Plan Your ICO with Fundraising Experts

Conclusion: Build First, Raise Second, Scale Third

Great ideas alone do not raise capital. Execution does. Successful founders build secure products, follow regulatory frameworks, and launch fundraising campaigns with precision. This is where Antier becomes your competitive advantage. As a full-cycle token development company, Antier helps founders design strong token ecosystems, deploy compliant ICO platforms, and prepare projects for serious investor scrutiny. Every solution is built for scalability, transparency, and long-term value creation. With Antier, you move faster without sacrificing credibility. If you are preparing for fundraising in the next 1 to 2 months, now is the time to partner strategically.

Get your token and ICO strategy reviewed by Antier’s experts. Position your project for confident investor participation.

Frequently Asked Questions

01. What is the purpose of this guide for founders in the crypto space?

This guide aims to provide clarity and a structured roadmap for founders looking to build a serious digital asset venture, helping them design a viable business model, prepare for regulatory review, and attract quality investors.

02. What are the five critical questions a fundable crypto business model should answer?

A fundable crypto business model should address what problem the token solves, who the primary users are, how the ecosystem generates revenue, why users will hold or use the token, and how demand will scale over time.

03. Why is it important for tokens to have utility beyond speculation?

Tokens should support governance, access, rewards, or infrastructure to align with long-term platform growth, as investors prioritize projects with strong token economics, which enhances investor confidence and adoption.

Crypto World

Compliance-First Prediction Markets for White-Label Neo Banks

Prediction markets moved from niche experimentation to institutional-grade financial infrastructure in a very short time. For serious investors, the question is no longer whether they are interesting, but how they can be built, governed, and monetized inside regulated financial rails. The acceleration we saw in 2025 proved two things:

1. The market can scale to multi-billion dollar notional flows while attracting retail and institutional liquidity.

2. The ecosystem matured technically, with interoperable oracles, hybrid settlement rails, and audited market logic that reduces systemic counterparty risk.

For an investor evaluating white-label neo-banking platforms, embedding a prediction-market module is not a gimmick. It is a strategic lever that can unlock new fee streams, create stickier customer lifecycles, and produce market signals that feed risk systems and trading desks. Let us scroll through the blog to uncover the architecture, the regulatory contours, the commercial levers, and how an end-to-end partner can deliver enterprise production.

Are Prediction Markets Really Winning in 2026 & Beyond?

“In 2025 alone, global prediction market trading volumes hit $44 billion across major platforms, while economics-focused contracts grew roughly 905% YoY to about $112 million in volume.”

By the end of 2025, prediction markets had reached a scale that turned heads across capital markets. Aggregate platform volumes for the year were reported in the high tens of billions of dollars, and specialized economic contract categories posted triple- and quadruple-digit growth rates. demonstrating real demand for event-based hedging and information products.

The competitive landscape now features two complementary rails. Regulated derivatives exchanges provide a compliant on-ramp for retail and institutional brokerage integration. On-chain platforms provide composability, programmable settlement, and tokenized liquidity. Both rails are attracting strategic partnerships and buy-side interest, which drives network effects and market depth. At the same time, regulators are moving from avoidance to active rulemaking and engagement, which reduces legal tail risk for properly structured products.

This is a clear implication for all the serious and visionary investors interested in launching their own crypto-friendly banking solutions. Prediction markets are no longer experimental curiosities. They are a fast-growing market infrastructure with real revenue potential and predictable paths to regulatory clarity. The winners will be platforms that combine robust legal frameworks, audited market logic, institutional liquidity, and seamless integration into existing financial products.

Who Should Build a Crypto Neo Banking Platform With a Prediction Market In It?

Not every financial platform needs prediction markets, but for some, the opportunity is too strategic to ignore. Platforms aiming to move beyond conventional digital banking and introduce high-engagement, event-driven financial products are already exploring this direction. Enterprises evaluating white label crypto neo bank development are particularly well-positioned, as the infrastructure foundation is already in place, allowing them to experiment, launch, and scale advanced market features far more efficiently.

| Investor Type | Why should they build? | Expected benefits |

|---|---|---|

| Institutional asset managers and hedge funds | Access alternative data signals and hedging instruments | Real-time macro signals, bespoke hedging, new alpha sources |

| Challenger neo-banks and fintechs | Differentiate the product suite and boost retention | Higher DAU, cross-sell of savings and credit, premium subscriptions |

| Traditional retail brokers and wealth platforms | Provide event hedging products to clients | New fee lines, increased platform trading volume, client stickiness |

| Payment platforms and digital wallets | Embed engagement and micro-bets tied to promotions | Improved LTV, conversion from marketing, monetized data streams |

| Sportsbooks and media companies | Expand event offerings and monetize audience engagement | White-label markets, sponsored liquidity pools, integrable odds feeds |

| Venture funds and platform investors | Strategic asset with platform-level defensibility | Tokenomics-enabled governance, network effects, data monetization |

| Banks exploring innovation | Pilot regulated event contracts as a low-risk product | Controlled rollouts, offline audit trails, compliance-first revenue |

Each ICP will value different delivery attributes. Institutional buyers prioritize auditability, custody, and settlement certainty. Consumer platforms prioritize UX, onboarding friction and fraud protection. A good integration plan into a customized BaaS platform maps these priorities to architecture, compliance, and go-to-market.

Benefits of Integrating Prediction Markets Into Existing BaaS Solutions?

- New diversified revenue: trading fees, market creation fees, subscription products, and data licensing.

- Improved user engagement: gamified markets increase DAU, cross-sell rates, and deposit retention.

- Alternative hedging instruments: event-based positions for macro and idiosyncratic risk management.

- Premium product differentiation: unique features for high-value clients and institutional desks.

- Proprietary data assets: structured event outcomes become monetizable signals for research and asset management.

- Elastic scaling of product offerings: markets can be white-labeled for partners and sponsors.

- Regulatory arbitrage mitigation: hybrid designs enable compliant offerings that would otherwise be restricted to on-chain-only models.

- Operational synergy: integrates with existing KYC, custody, and customer support infrastructure to keep the marginal cost of new products low.

Essential Components of NeoBank App Platform Development with Prediction-Market

- Market engine: deterministic, auditable smart contracts or exchange matching logic with replayable trade history.

- Oracle fabric: redundant oracle sets with economic incentives, cryptographic proofs and dispute resolution.

- Liquidity stack: AMM templates, maker incentives, and external market maker APIs for deep order books.

- Settlement rail: choice of on-chain (USDC / stablecoin), off-chain clearing, or hybrid settlement to meet FX, custody, and reconciliation needs.

- Custody & KYC integration: segregated hot and cold custody, administrator keys, and seamless KYC/AML flows tied into the bank rails.

- Governance and dispute layer: tokenized or multisig dispute escalation, transparent resolution windows, and legal arbitration interfaces.

- Risk controls: real-time exposure limits, automated position throttles, and scenario stress testing.

- Front-end and trading UX: low latency order entry, tick-level market depth, market creation UI, and clear risk disclosures.

- Audit and verification: formal verification of contracts, third-party security audits, and reproducible testnets.

- Data and analytics: streaming market telemetry, user cohort metrics, pricing oracles, and API endpoints for downstream quant and trading desks.

These components should be architected as modular services, allowing regulated institutions to activate or restrict specific functionalities in alignment with their compliance frameworks. Delivering such a system with precision typically requires collaboration with a seasoned and certified crypto banking development company that brings extensive domain experience, a multidisciplinary engineering team, and in-house legal expertise to navigate regulatory and licensing complexities. In addition, the partner you engage should possess strong API integration capabilities and established working relationships with reputable third-party infrastructure providers, ensuring seamless interoperability and dependable operational continuity.

Evaluate Your Platform Architecture With Our Experts

How Does Antier Help Build Enterprise-Grade Prediction Market Integrated White-Label Neo Bank Apps?

Antier delivers a full A-to-Z white label neo bank app solution built for institutional buyers. The following is a pragmatic flow that maps to investor expectations and operational controls.

1. Discovery and requirements engineering

- Regulatory scoping for jurisdictions of operation.

- Product definition with investor KPIs such as take rates, expected volumes and settlement currencies.

- Risk appetite and allowed event categories.

2. Architecture and design

- Define settlement topology: L1, L2 or hybrid.

- Design oracle strategy: primary and fallback feeds, economic incentives and slashing rules.

- Select a liquidity approach: built-in AMM, partner market makers, and provisioned maker funds.

3. Smart contract and exchange development

- Build auditable market logic, a matching engine, or AMM contracts.

- Code formal verification where required.

- Implement staking, fee routing, and governance modules.

4. Compliance, legal, and controls

- Integrate KYC/AML providers and transaction monitoring.

- Draft product legal wrappers, customer terms and disclosure templates.

- Engage counsel for derivatives and gambling law as applicable.

5. Security and audit

- Comprehensive security audits from multiple independent firms.

- Penetration testing, bug bounty setup, and continuous monitoring.

- Operational runbooks and incident response plans.

6. Custody and settlement integration

- Integrate institutional custody providers for fiat and crypto.

- Implement ledger reconciliation, proofs of reserves, and audit trails.

7. UX, SDKs and APIs

- White-label web and mobile front ends designed for low-friction onboarding.

- Provide SDKs for market creation, order execution, data streams and settlement APIs.

8. Pilot and liquidity seeding

- Execute controlled pilots with predefined resolution windows.

- Provide initial liquidity incentives and market maker agreements.

9. Ops, reporting and monetization

- Build compliance reporting pipelines, audit logs, and tax reporting.

- Implement fee routing, subscription management and data productization.

10. Post-launch governance and scaling

- Ongoing legal support for emerging rules.

- Scalable infra upgrades for peak market days and institutional integrations like broker partners.

Being the leading blockchain and AI development company, Antier’s delivery emphasizes the separation of concerns. The bank retains control over custody and regulatory reporting. Antier provides the market logic, oracles, integration and production runbooks so that a neo-bank can operate prediction markets with institutional safeguards.

How Prediction Markets Create a Competitive Advantage for White-Label Neo Banking Platforms?

Prediction markets act as a true differentiation layer for white-label neo banks when they move the platform from a set of commoditized utilities into an interactive financial ecosystem. Rather than another feature checkbox, a well-designed prediction module changes how users interact with money, risk, and information inside the app. For investors, this matters because differentiation must translate into measurable business outcomes: higher retention, new revenue line,s and proprietary assets that are hard to copy.

How does it work in practice?

a) New financial primitives inside the product stack. Markets let customers take positions, hedge exposures or acquire probabilistic insights directly from the bank’s interface. These are not marketing gimmicks. They are real instruments that increase transaction frequency and stickiness.

b) quidity footprints and behavioral cohort patterns. Over time, those signals become a defensible data moat that can be monetized through research products, premium analytics,s or B2B feeds.

c) Network effects and liquidity defensibility. Active markets attract makers and takers. As liquidity deepens, spreads tighten, and user experience improves. This creates a virtuous cycle that raises the barrier to entry for competitors.

d) Faster monetization with modular integration. White-label neo bank solutions already have custody, KYC, and payment rails. Adding a prediction layer is largely incremental engineering that yields multiple monetization levers: fees, market creation commissions, and subscription analytics.

Investor-focused metrics to watch

- Incremental daily active users attributable to markets

- Fee per active market and margin after liquidity incentives

- Data revenue per month from market analytics and API clients

- Churn delta for users who participate in markets versus control group

Takeaway

For investors, prediction markets are not simply product innovation. When implemented with institutional rigor, they create measurable differentiation, recurring revenue, and a proprietary data asset that collectively strengthen the platform’s defensibility and valuation.

How Much Does a Prediction Market in White-Label BaaS Platforms Cost?

Cost is driven by architecture, jurisdiction, and desired speed to market. White label neo banking platform development with prediction market cost drivers includes legal and compliance, security audits, Oracle integration, liquidity seeding, smart contract engineering, and UI/UX. Choosing a true hybrid settlement model increases integration complexity and therefore cost but often lowers long-term operational risk and regulatory friction. From a strategic perspective, investors should focus less on headline integration cost and more on unit economics. That means modeling fee capture per market, expected liquidity depth, projected churn reduction, and data product revenue. Practical tactics to control spending include phased delivery, reusing audited open standards for AMMs and oracles, and using partner liquidity before committing proprietary capital.

Join Hands With Antier’s Accredited Fintech & Crypto Experts!

For institutional investors evaluating white-label neo-bank opportunities, prediction markets are a force multiplier. They provide distinct monetization avenues, generate proprietary data, and offer new hedging instruments. The market has matured to an inflection point where volumes and institutional participation justify production deployments, but regulatory work remains an essential part of the build plan.

Get in touch with Antier to launch your white label banking solution in just a few weeks and under professional guidance. Our approach combines deep technical engineering, formal verification, institutional custody integration, and specialist regulatory support so the client can scale markets responsibly. We help clients define the product, build robust market logic, integrate custody and compliance, seed liquidity, and operate at enterprise SLAs. If you are an investor or platform executive, integrating prediction markets is a strategic decision. With the right partner and a defensible compliance posture, it becomes a predictable, accretive growth engine.

Frequently Asked Questions

01. What are prediction markets and why are they gaining traction in 2026?

Prediction markets are platforms that allow users to bet on the outcomes of future events. They are gaining traction due to significant growth in trading volumes, reaching $44 billion in 2025, and the maturation of the ecosystem, which now features regulated exchanges and on-chain platforms that enhance liquidity and reduce risks.

02. How can embedding a prediction-market module benefit neo-banking platforms?

Embedding a prediction-market module in neo-banking platforms can unlock new fee streams, enhance customer engagement, and provide valuable market signals that inform risk management and trading strategies.

03. What regulatory changes are impacting prediction markets?

Regulators are shifting from avoidance to active engagement, which is leading to clearer rulemaking and reducing legal risks for properly structured prediction market products, thereby fostering a more stable environment for investment.

Crypto World

Jump Trading to take small stakes in prediction markets Polymarket, Kalshi: Bloomberg

Jump Trading plans to take a small stake in each of the prediction-market platforms Kalshi and Polymarket, Bloomberg reported on Monday, citing people with knowledge of the matter.

The trading powerhouse, which has a significant focus on cryptocurrency, will gain the stakes in exchange for providing liquidity on the two platforms.

Jump is set to take a fixed amount of equity in Kalshi, while its stake in Polymarket will grow over time depending on the trading capacity that the firm provides to the platform’s U.S. operation.

Kalshi and Polymarket are the two most prominent prediction-market platforms, having both acquired multibillion dollar valuations. They rely on market makers like Jump to put up the money to take the other side of customers’ trades. Market makers then profit from the difference in price movements.

Jump expanded into prediction-market trading in recent months, recruiting 20 staffers in recent months for that business, according to Bloomberg.

The firms did not immediately respond to CoinDesk’s request for further comment.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

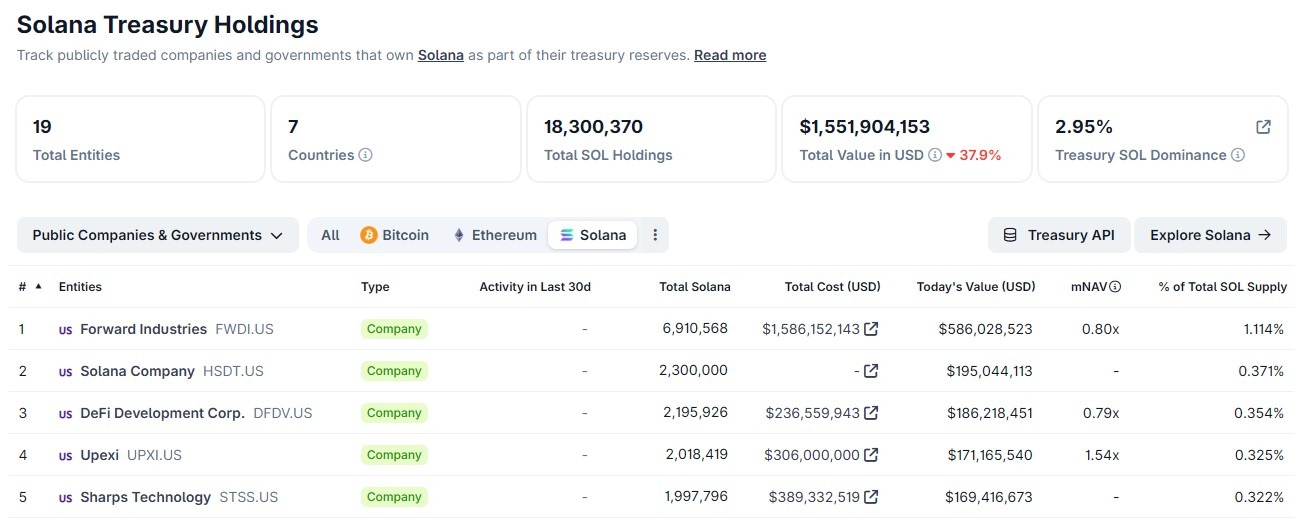

Publicly listed companies that hold Solana as a treasury asset are sitting on more than $1.5 billion in unrealized losses, based on disclosed acquisition costs and current market prices tracked by CoinGecko.

The losses are concentrated among a small group of United States-listed companies that collectively control over 12 million Solana (SOL) tokens, about 2% of the total supply. While losses remain unrealized, equity markets have already repriced the companies, with most trading well below the market value of their tokens.

CoinGecko data shows that Forward Industries, Sharps Technology, DeFi Development Corp and Upexi account for over $1.4 billion in disclosed unrealized losses. The total is likely understated, as Solana Company has not fully disclosed its acquisition costs.

The figures highlight a growing gap between paper losses and liquidity pressure. While none of the companies have been forced to sell their SOL, compressed net asset value (mNAV) multiples and falling share prices have constrained their ability to raise fresh capital.

Accumulation stalls across Solana treasuries

Transaction data compiled by CoinGecko shows that the bulk of SOL accumulation occurred between July and October 2025, when several companies made large, concentrated purchases.

Since then, none of the top five Solana treasury companies have disclosed meaningful new buys, and no onchain sales have been recorded.

Forward Industries, the largest holder, accumulated over 6.9 million SOL at an average cost of about $230. With SOL trading around $84, Forward has unrealized losses of over $1 billion.

Sharps Technology made a single $389 million purchase near the market peak. The company’s SOL is now worth about $169 million, down over 56% from its acquisition cost.

DeFi Development Corp followed a more gradual accumulation strategy and reports smaller losses, but its shares still trade below the value of its SOL holdings.

Solana Company, which built a 2.3 million SOL position over several tranches of purchases, has also paused accumulation since October, according to CoinGecko’s transaction history.

Related: Kyle Samani leaves Multicoin in ‘bittersweet moment’ to explore new tech

Equity markets signal a treasury winter

Equity price data from Google Finance shows that the top five Solana treasury companies have suffered sharp drawdowns in the last six months, significantly underperforming SOL itself.

Forward Industries, DeFi Development Corp, Sharps Technology and Solana Company stock prices are down between 59% and 73% in the six-month charts.

CoinGecko data shows that Upexi has $130 million in unrealized losses on its SOL holdings. However, its shares have fallen more sharply than its peers.

Upexi shares are down more than 80% over the past six months, according to Google Finance. Like other Solana treasury firms, Upexi has paused new accumulation since September.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

ASTER jumps 9% above $0.60 as traders eye breakout toward $1 target

- Aster traded to highs of $0.65 amid a 9% uptick in 24 hours.

- The bounce from lows of $0.43 on February 5, 2026, could extend amid a retest of key levels.

- Risks of a downturn remain as Bitcoin and Ethereum struggle.

ASTER is among the top-gaining altcoins on the day, as its price surges by nearly 9% to extend its upside movement above $0.60.

The token, native to the innovative decentralized exchange platform Aster, is showing this renewed strength amid broader market weakness.

On Tuesday, as Bitcoin and Ethereum held around $68,000 and $2,000, respectively, Aster jumped to intraday highs of $0.65.

A potential upside continuation as traders target more gains is shaping up, although overall sentiment means that profit-taking might still be a factor.

Aster price posts 9% bounce

The crypto market has significantly flipped bearish since the downturn that smashed bulls’ optimistic outlook on October 10, 2025.

In the latest extension of that negative sway, Aster’s price fell to lows of $0.43, with losses mirroring the sharp sell-off to $60k for BTC and $1,740 for ETH.

However, just as BTC bounced to $70k, the altcoin regained some upside momentum and surged to $0.60.

Bulls have held above this level in the past two days, having tested $0.65 on three occasions in the time frame.

ASTER recorded nearly 9% in 24-hour gains, cutting losses over the past week and now trades in the green over this period.

While the bounce aligns with a slight shift in broader sentiment, the dip in trading volume means buyers have not stepped in forcefully.

If the platform’s recent launch of 0% maker fees across all markets draws significant liquidity and user interest, bulls could seize control.

ASTER price forecast

On the one side, a potential pump to $1.30 looms, and on the other, a failure to solidify gains could spell danger.

For bulls, the daily chart reveals a falling wedge breakout, a bullish pattern signaling potential reversal as price compresses and escapes upward resistance.

Key oscillators also remain neutral but lean toward buy signals.

The daily RSI hovers around 53 and is upsloping. However, it is well off overbought conditions.

Meanwhile, the Commodity Channel Index and Average Directional Index both show neutral readings, while the MACD hints at a buy move as the histogram ticks positive with expanding bias.

This setup positions ASTER for a possible short-term pump, with primary supply zones at $0.80 and $0.95.

Breaking to $1 will bring the $1.22 to $1.30 range into view as the next target, which is the top of the projected wedge pattern from November 2025.

With risks of a pullback in play, key levels to watch include $0.54 and $0.46.

Crypto World

Cathie Wood’s ARK Buys $9.67M in Roblox Stock, Dumps PagerDuty

TLDR

- ARK Invest purchased 145,603 Roblox shares worth $9.67 million across three ETFs on February 9, 2026.

- The buy followed Roblox’s strong fourth-quarter results and improved bookings forecast from the gaming company.

- ARK continued selling PagerDuty stock, offloading $1.18 million worth of shares in its fifth consecutive day of reductions.

- The firm added healthcare positions in Recursion Pharmaceuticals and TharImmune while trimming digital ad stocks.

- Total sales included Pinterest and The Trade Desk as ARK shifts focus toward gaming and AI-driven healthcare.

Cathie Wood’s ARK Invest executed major portfolio moves on February 9, 2026. The firm bought 145,603 shares of Roblox worth $9.67 million across three exchange-traded funds.

ARK Innovation ETF, ARK Next Generation Internet ETF, and ARK Fintech Innovation ETF all participated in the purchase. The transaction represents one of ARK’s largest single-stock buys in recent trading sessions.

The Roblox purchase came days after the company released fourth-quarter earnings. The gaming platform posted results that exceeded Wall Street expectations. Management also issued positive guidance for upcoming bookings.

Several analysts have raised their price targets on Roblox stock. They point to increased engagement from users and higher spending patterns. Older demographics are spending more on the platform, which analysts view positively.

Healthcare and AI Investments Grow

ARK expanded its healthcare portfolio with two purchases on February 9. The firm bought 156,272 shares of Recursion Pharmaceuticals for $622,000. The biotech company uses artificial intelligence for drug discovery.

ARK also acquired 54,600 shares of TharImmune valued at $226,000. Both purchases align with Wood’s strategy of backing companies using technology to develop new medicines.

Additional buys included 2,114 shares of Kodiak AI worth $19,343. ARK added 444 shares of Tempus AI for $24,380. The firm also purchased 57,164 shares of Bullish totaling $1.57 million.

ARK Reduces Software and Ad Tech Exposure

ARK sold 147,125 shares of PagerDuty for approximately $1.18 million. The sale marks the fifth straight trading day ARK has reduced this position. Shares were sold through ARK Innovation ETF and ARK Next Generation Internet ETF.

The repeated selling indicates declining conviction in PagerDuty stock. The company provides incident management software for IT departments. ARK has now trimmed its stake substantially over the past week.

Pinterest was another stock ARK reduced. The firm sold 46,800 shares worth roughly $917,000. ARK also cut its Trade Desk position by 24,157 shares for about $653,000.

Both Pinterest and The Trade Desk generate revenue from digital advertising. The sales suggest ARK is moving capital away from ad-dependent business models. The firm appears to be favoring gaming and healthcare technology instead.

ARK sold 497 shares of Qualcomm for $68,257. This represents a minor position adjustment in the semiconductor sector.

Total sales on February 9 reached approximately $2.82 million. Combined with purchases of roughly $12.15 million, ARK increased its net equity exposure. The buying pattern shows Wood is deploying more capital into preferred holdings.

The portfolio changes reflect ARK’s focus on companies with strong growth potential. Roblox leads the buys while PagerDuty continues facing selling pressure. Healthcare and AI stocks received additional investment as digital advertising names were reduced.

Crypto World

Harvard endowment tilts harder into Bitcoin ETFs than Google stock

Harvard’s endowment has quietly made Bitcoin ETFs a top public holding, surpassing Google and joining other elite universities in rotating long‑term capital into digital assets.

Summary

- Filings show Harvard built and then tripled its BlackRock iShares Bitcoin Trust stake, lifting IBIT above Alphabet and other big‑tech names in its public portfolio.

- Brown, Emory, and other U.S. universities have also disclosed multi‑million‑dollar Bitcoin ETF and trust positions, signaling a broader endowment shift into crypto.

- The rotation comes as Bitcoin trades near $68,400, with Ethereum and Solana also rallying while digital assets again track global risk appetite.

Harvard University’s endowment is now leaning harder into Bitcoin (BTC) than into Silicon Valley’s most iconic search giant—and markets are taking note

Harvard’s Quiet Portfolio Pivot

“FUN FACT: Harvard University holds more in Bitcoin ETFs than it holds shares in Google,” Bitcoin Magazine posted on X on February 10, distilling a shift years in the making.

Regulatory filings show Harvard built a roughly $116.7 million position in BlackRock’s iShares Bitcoin Trust in 2025, lifting its Bitcoin exposure above stakes in Alphabet and other big‑tech mainstays.

Subsequent disclosures indicate Harvard increased that wager, with some estimates putting its Bitcoin ETF holdings in the hundreds of millions and ranking the position among its single largest listed assets.

Commentary from the digital‑asset industry has been blunt. “Most people think Bitcoin is the gamble, but Harvard’s math clearly suggests that not owning enough of it is the bigger risk to their long‑term portfolio,” wrote SIG Labs.

Another bitcoiner framed it more simply: “Bitcoin is moving from theory to balance sheets.”

Endowments Move Into Crypto

Harvard is not alone. Brown and Emory universities have both disclosed sizable Bitcoin ETF and trust positions, running into the tens of millions of dollars in IBIT and Grayscale’s Bitcoin Mini Trust. One crypto media noted that “several prominent U.S. university endowments have disclosed investments in cryptocurrency – including Emory, Brown, and Dartmouth Universities.”

Bitcoin, Google, and Macro Risk

Harvard’s rotation comes as digital assets again trade as a pure expression of global risk appetite. Bitcoin (BTC) is hovering around $68,400, with intraday swings pulling it below $70,000 twice in the past 24 hours as traders digest a near‑50% drawdown from its 2025 peak near $126,000.

Ethereum (ETH) changes hands near $4,760, up roughly 2.5% over the last day, while Solana (SOL) trades close to $208 after a gain of just over 5%, on volumes above $12 billion.

“This is Harvard flipping tech for BTC ETFs,” one trader wrote, calling it “wild” and a sign that “institutional adoption is officially peaking right now.”

If that proves true, Bitcoin beating Google inside the world’s richest university endowment may be remembered as more than just a memeable “fun fact.”

Crypto World

MrBeast Acquires Step Banking App After $200M BitMine Investment

TLDR

- YouTuber MrBeast’s company Beast Industries purchased Step, a banking app with 7 million teen and young adult users

- Deal follows $200 million investment from Ethereum treasury firm BitMine Immersion Technologies in January 2025

- Step provides FDIC-insured banking through Evolve Bank & Trust with features for credit building and money management

- MrBeast filed trademark for “MrBeast Financial” in October 2024 mentioning cryptocurrency exchange services

- Acquisition price not disclosed; Step previously raised $500 million from celebrity investors including Steph Curry

Jimmy Donaldson, known online as MrBeast, is expanding his business empire into financial services. His company Beast Industries completed an acquisition of Step, a mobile banking platform targeting teenagers and young adults.

Donaldson shared the news Monday on social media. He told his audience the purchase aims to give young people financial education he lacked growing up. “Nobody taught me about investing, building credit, or managing money when I was growing up,” the YouTuber explained.

Beast Industries did not reveal how much it paid for Step. The company declined to comment on financial terms of the transaction.

Step currently serves between 6.5 and 7 million users. The app launched in 2018 to help Gen Z manage finances, build credit scores, and access banking tools.

Banking Features and FDIC Insurance

Step partners with Evolve Bank & Trust to offer Federal Deposit Insurance Corporation-insured accounts. Users receive a Step Visa Card and can open accounts for spending, saving, and investing.

The platform charges no monthly fees. Step’s founders CJ MacDonald and Alexey Kalinichenko designed the app to improve financial literacy among younger users.

Beast Industries CEO Jeff Housenbold said the acquisition allows the company to provide practical financial solutions. He stated financial health is fundamental to overall wellbeing.

$200 Million Crypto Investment Preceded Deal

BitMine Immersion Technologies invested $200 million in Beast Industries during January 2025. The firm holds the largest corporate position in Ethereum cryptocurrency.

BitMine chair Tom Lee called the investment a long-term bet on the creator economy. He praised MrBeast’s reach among Gen Z, Gen Alpha, and Millennial demographics.

The investment came after Beast Industries filed a trademark application for “MrBeast Financial” in October 2024. That filing referenced cryptocurrency exchange services, payment processing, and decentralized exchanges.

Whether the trademark connects to the Step acquisition remains unknown. Beast Industries has not confirmed plans to add cryptocurrency features to Step’s platform.

Step’s Investor Base and Growth

Step raised roughly $500 million from various investors since launching. Celebrity backers include NBA player Steph Curry, singers Justin Timberlake and Charli D’Amelio, and actor Will Smith.

Payment processor Stripe invested in Step alongside venture firms Coatue, Collaborative Fund, Crosslink Capital, and General Catalyst. The company scaled its user base to 7 million over eight years.

MrBeast runs the largest YouTube channel globally with 466 million subscribers. His channels generate about 5 billion monthly views.

Beast Industries operates multiple businesses beyond YouTube. These include Feastables snack brand, Beast Philanthropy nonprofit, and Beast Games reality show on Amazon Prime Video.

Housenbold said Step’s technology platform and fintech team complement Beast Industries’ digital audience. The acquisition brings Step’s entire operation under the Beast Industries umbrella.

Crypto World

Memecoins lead crypto market gains as prices of major tokens BTC, ETH languish: Crypto Markets Today

Bitcoin is struggling to regain a foothold above $70,000 as altcoins outperform.

The largest cryptocurrency is little changed over 24 hours, while the broader CoinDesk 20 (CD20) index rose 0.40% even as ether declined. Memecoins are leading gains, with the CoinDesk Memecoin Index (CDMEME) adding 1.5% as PIPPIN climbed 46%.

Tokens linked to artificial intelligence (AI) also fared well. , co-founded by OpenAI CEO Sam Altman, rose more than 3% in the past day, while Virtuals’ VIRTUAL token rose 2.4%. That’s as the “agentic AI,” where AI tools now also execute tasks, narrative grows.

Still, the crypto Fear and Greed Index still points to “extreme fear” in the market after last week’s selloff.

Meanwhile, traditional markets steadied, buoyed in part by Prime Minister Sanae Takaichi’s landslide election victory in Japan. While Japanese bond yields rose after the result, they have since fallen near to pre-election levels. That reduces the risk of trillions of dollars invested overseas moving back to Japan in search of higher yields.

Derivatives Positioning

- Bearish momentum in BTC futures is intensifying as open interest (OI) continues its descent to $15.9 bo;;opm, signaling a deep and prolonged deleveraging phase.

- This shift is most evident in funding rates on Binance (-7%) and Bybit (-8%), which have collapsed into aggressive negative territory. That’s a sign short sellers are paying a heavy premium to maintain their dominance. With the three-month basis stagnant at 3%, institutional appetite remains sidelined.

- The BTC options market is showing a cooling of extreme defensive sentiment. The one-week 25-delta skew is at 16%, while call dominance has rebounded to 56%, indicating a shift toward bottom-fishing.

- The implied volatility (IV) term structure is transitioning from extreme backwardation toward a hybrid position that suggests that while near-term protection remains pricey, long-term volatility expectations are stabilizing.

- Coinglass data shows $290 million in 24-hour liquidations, with a 53-47 split between longs and shorts. BTC ($114 million), ETH ($89 million) and others ($16 million) were the leaders in terms of notional liquidations. Binance’s liquidation heatmap indicates $68,160 as a core liquidation level to monitor, in case of a price drop.

Token Talk

- Merkle Trade, the largest perpetual futures decentralized exchange on the Aptos blockchain, is in the throes of shutting down. The exchange disabled new trading positions on Friday and will forcibly close all open positions today.

- Merkle’s native token, MKL, has added 9% in the past 24 hours. It remains redeemable without withdrawal fees, with a final staking rewards payout scheduled for Feb. 12. The token has lost 77% in the past 12 months.

- The move comes less than two years after Merkle raised $2.1 million in a seed round backed by Aptos Labs, Hashed and Arrington Capital.

- Despite processing $30 billion in trading volume since its 2023 debut, the team gave no clear reason for the closure in a post on X last week, noting only that the decision followed “careful consideration.”

Crypto World

Hyperscale Data doubles down on Bitcoin as treasury hits 589 BTC

Hyperscale Data lifts its Bitcoin treasury to 589 BTC and targets $100m, using a strict dollar‑cost‑averaging plan as crypto remains a macro risk barometer.

Summary

- Hyperscale Data now holds 589.4502 BTC worth about $41.4m, aiming to scale its Bitcoin balance‑sheet position to $100m over time.

- The firm deploys at least 5% of allocated cash weekly into BTC via a disciplined dollar‑cost‑averaging strategy run through Sentinum and Ault Capital Group.

- Bitcoin, Ethereum, and Solana prices underscore the risk‑asset backdrop as external analyses flag elevated BTC volatility and deep drawdowns from 2025 highs.

Hyperscale Data tightens its grip on Bitcoin as treasury tops 589 BTC, sharpening a balance‑sheet bet on digital assets at a time when crypto remains the market’s rawest barometer of risk appetite.

Treasury milestone and $100m target

Hyperscale Data, Inc. said in a press release published today its Bitcoin treasury reached 589.4502 BTC as of February 8, 2026, with an implied value of roughly $41.4m at a closing Bitcoin price of $70,264. The company reiterated that its goal is to accumulate $100m worth of Bitcoin on its balance sheet over time.

Executive chairman Milton “Todd” Ault III framed the move as deliberate and incremental, stressing discipline over bravado. “We continue to demonstrate our dedication to our dollar‑cost average strategy,” he said, arguing that this approach “has allowed us to continually lower our average cost per Bitcoin and further strengthen the balance sheet and long‑term future of the Company.”

How Hyperscale is accumulating BTC

Through its subsidiaries Sentinum, Inc. and Ault Capital Group, Inc. (ACG), Hyperscale now holds 589.4502 BTC, with Sentinum controlling about 548.5903 BTC and ACG approximately 40.8994 BTC. Sentinum’s stack includes 108.3562 BTC mined in‑house and 440.2341 BTC bought in the open market, while ACG added 8.9000 BTC during the week ended February 8.

The firm plans to “fully deploy the cash allocated to its digital asset treasury (‘DAT’) strategy into Bitcoin purchases over time,” typically targeting at least 5% of allocated cash each week via daily buys, though actual deployment will flex with “market conditions and strategic considerations.” Management told investors to judge accumulation using multi‑week averages, consistent with first‑principles DCA practice common among institutional allocators.

Macro backdrop: crypto as risk gauge

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $69,095, with a recent 24‑hour range between roughly $69,319 and $70,123 and turnover anchored in deep, multi‑billion‑dollar spot and derivatives flows. Ethereum (ETH) changes hands near $2,060, down just over 2% on the session, after trading between about $2,000 and $2,150 over the last day. Solana (SOL) trades close to $83.9, slipping around 0.4% in the past 24 hours as volumes consolidate after a sharp multi‑week advance.

For readers tracking the broader context of Bitcoin’s pullback and volatility, recent analyses from outlets such as Phemex on BTC’s drawdown from its October 2025 highs, Journal du Coin’s coverage of the latest 50% correction, and XTB’s breakdown of the latest slide toward the high‑$60,000 region provide additional color on the forces shaping Hyperscale’s high‑conviction treasury strategy.

Crypto World

USD/JPY Drops by More Than 1% At the Start of the Week

As the USD/JPY chart shows, the pair has been exhibiting bearish momentum since the beginning of the week. This move has been driven by a combination of factors:

→ Yen strength on political news. Prime Minister Sanae Takaichi secured a decisive victory in Sunday’s snap election (8 February), winning a parliamentary majority. Although Takaichi has pledged large-scale fiscal stimulus of around ¥21 trillion, the prospect of increased money printing has not weakened the currency, as the market may (a) welcome political stability and (b) believe that the Bank of Japan will be forced to respond to inflation by raising interest rates.

→ US dollar weakness ahead of economic data releases. This reflects market sentiment ahead of labour market data due on Wednesday and the CPI report scheduled for Friday. In addition, the dollar’s status has come under pressure after Chinese regulators reportedly recommended limiting investments in US Treasuries.

On 26 January, when analysing fluctuations in the dollar–yen exchange rate, we:

→ noted that the long-term ascending channel had been broken near the 157.700 level;

→ constructed a parallel channel below and suggested that, following the sharp drop in USD/JPY (triggered by the possibility of coordinated currency intervention by the Bank of Japan and the Federal Reserve), a rebound could occur.

Indeed, since then (as indicated by the arrow):

→ on 28 January, the market formed a low slightly below the lower boundary of the parallel channel;

→ the pair subsequently rebounded towards the 157.700 level.

Technical Analysis of the USD/JPY Chart

The bearish tone of the current week allows us to highlight the following:

→ local support levels of the parallel channel (shown by thick blue lines) have been broken, and bulls may now have to rely on its lower boundary;

→ lower highs A–B–D have formed on the USD/JPY chart, with a bearish trend line drawn through them.

In this context, it is reasonable to assume that:

→ the sharp B→C impulse has disrupted the market’s multi-month bullish structure;

→ the C→D recovery (towards the 78.6% Fibonacci level) was an interim move within a broader bearish reversal.

The ability of the red A–B–D trend line to remain relevant over time would further support this hypothesis.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat16 hours ago

NewsBeat16 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports15 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 hours ago

Crypto World5 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World5 hours ago

Crypto World5 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout