Crypto World

Is Cardano in Trouble? Why Whales Are Abandoning Binance

ADA’s drop in open interest looks similar to Solana’s past pattern, where a fragmented market often comes before weaker altcoin momentum.

Cardano has experienced a sharp decline of over 10% over the past week. It started near $0.30, but heavy selling pushed it to $0.23, forming a consolidation to $0.26. Amidst strong bearish pressure, new data suggest that major traders have exited their ADA positions.

Alphractal founder Joao Wedson, for one, said that Cardano’s derivatives market is going through a major shift that could affect its price momentum.

Cardano Follows Solana’s Path

Open interest in ADA has declined sharply from $1.6 billion to $334 million, as major players have aggressively closed their positions. However, Wedson explained that the more important change lies in how OI is distributed across exchanges. In 2023, Binance controlled over 80% of ADA’s open interest, while 17 other exchanges combined held less than 20%.

By 2026, that balance has dramatically changed as Binance now holds only 22%, and Gate.io has emerged as the new leader with 31% of the market. Wedson observed that this change is significant because a similar pattern played out with Solana.

During SOL’s rally from $20 to $200 in 2023-2024, Binance’s dominance in open interest increased, thereby supporting price appreciation.

Later, as Binance’s share declined, Solana’s momentum weakened. The same trend appears to be unfolding with Cardano, and with open interest now fragmented, the altcoin’s upside potential may be limited as the overall crypto market remains fragile.

“Binance tends to be the exchange that fuels strong altcoin rallies, but only when leverage is concentrated and competition is limited.”

Long-Term Trend Remains Intact

Despite the short-term market uncertainty gripping the ADA market, pseudonymous analyst, ‘Crypto Patel,’ believes that the overall long-term structure stays bullish as long as the price does not fall below $0.13 on a weekly close.

You may also like:

On the upside, he says ADA needs to reclaim $0.44 to confirm a new uptrend. If that happens, the crypto asset could enter a new bull cycle, and long-term targets range from $1.20 to as high as over $10, similar to past cycles.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

US Court Sentences Fugitive in Major $73 Million Crypto Scam

A US federal court has sentenced a fugitive to the maximum statutory prison term for his role in a $73 million crypto fraud operation that targeted victims through fake investment platforms and online deception.

This case illustrates the growing risk of transnational crypto fraud. Scams like these have prompted US authorities to intensify investigations and enforcement targeting international money-laundering operations.

Sponsored

Sponsored

The Anatomy of a $73 Million Crypto Scam Operation

According to the Department of Justice, Daren Li, a dual national of China and St. Kitts and Nevis, played a key role in an international cryptocurrency investment scam. It operated out of scam centers in Cambodia.

The operation relied on social engineering, fake trading platforms, and money laundering networks to steal funds from victims in the US. Prosecutors said unindicted members of the conspiracy contacted victims through unsolicited social media messages, phone calls, and online dating services.

After building trust through professional or romantic relationships, often using end-to-end encrypted messaging apps, the scammers directed victims to spoofed websites designed to resemble legitimate cryptocurrency trading platforms.

“While technology has made it possible for people to quickly communicate with others who live oceans away, it also has made it easier for criminals to prey on innocent victims,” First Assistant US Attorney Bill Essayli for the Central District of California stated.

In other variations of the scheme, scammers told victims that they were representatives of customer support or tech service companies. They then pressured victims into sending funds via wire transfers or cryptocurrency platforms to resolve fake computer issues or non-existent security threats.

Sponsored

Sponsored

From Arrest to Escape: The Fugitive’s Flight

Li was arrested in April 2024 at Hartsfield-Jackson Atlanta International Airport. He pleaded guilty on November 12, 2024, to conspiring to launder proceeds from cryptocurrency scams and related fraud.

As part of his plea agreement, he admitted that at least $73.6 million in victim funds was deposited into bank accounts controlled by him and his co-conspirators. Of that total, at least $59.8 million flowed through US shell companies used to launder the proceeds.

Li also revealed that he directed others to open US bank accounts for shell companies, monitored international and domestic wire transfers, and oversaw the conversion of stolen funds into cryptocurrency to obscure their origin and ownership.

Prosecutors said Li is the first defendant in the case to be sentenced at that level of involvement. Eight co-conspirators have already pleaded guilty.

However, before sentencing, Li fled. Prosecutors said he cut off his electronic ankle monitoring device in December 2025 and absconded. He remains a fugitive.

Despite his disappearance, the court proceeded with sentencing. On February 9, 2026, a federal judge sentenced Li to the statutory maximum of 20 years in prison. This would be followed by three years of supervised release.

“The Criminal Division will work with our law enforcement partners around the world to ensure that Li is returned to the United States to serve his full sentence,” said Assistant Attorney General A. Tysen Duva of the Justice Department’s Criminal Division.

The sentencing marks the latest move in a broader Justice Department crackdown on global scam centers and crypto-related fraud. Last month, BeInCrypto reported that a US court sentenced a Chinese national to nearly 4 years in prison. The court also ordered him to pay more than $26 million in restitution for his involvement in a $36.9 million crypto scam.

Crypto World

Kyndryl (KD) Stock Plummets 53% After Delayed Filing and CFO Departure

TLDR

- Kyndryl (KD) stock tanked 53% to $11.05 after company delayed filing quarterly report over internal control problems

- Material weaknesses in financial reporting controls identified across fiscal 2025 and first half of fiscal 2026

- CFO David Wyshner and Global Controller Vineet Khurana departed, both replaced with interim executives

- Company reduced fiscal 2026 revenue forecast to -2% to -3% year-over-year on constant currency basis

- Shares touched 52-week low of $10.82, extending 12-month decline to 46% before Monday’s crash

Kyndryl stock suffered a devastating blow Monday, plunging 53% to $11.05. The IT services company delivered a trifecta of bad news that sent investors running for the exits.

The company announced it would delay filing its December quarter report. Internal control weaknesses over financial reporting forced the postponement.

These aren’t isolated problems. The material weaknesses stretch back through all of fiscal year 2025 and the first two quarters of fiscal 2026.

Kyndryl tried to calm nerves by saying financial statements won’t be affected. The company claims balance sheets, income statements, and cash flows remain accurate.

Wall Street wasn’t buying it.

Financial Leadership Vanishes Overnight

CFO David Wyshner walked out the door effective immediately. His sudden exit raised questions about what’s really happening behind the scenes.

Harsh Chugh took over as interim CFO. He currently serves as global head for corporate development and administration. Previous experience as Chief Operating Officer helps, but investors want permanent leadership.

Global Controller Vineet Khurana also left his position. That’s two top finance executives gone in one announcement.

Bhavna Doegar stepped up as interim corporate controller. She previously held the senior vice president of Finance and Strategy role.

When pressed about whether these exits connected to the accounting problems, Kyndryl refused to comment. The company’s silence only fueled more speculation.

Revenue Outlook Takes Major Hit

Kyndryl released third quarter earnings alongside brutal revised guidance. Fiscal 2026 revenue now expected to fall 2% to 3% on a constant currency basis.

Extended sales cycles drove the downgrade. Deals are taking longer to close across the business.

Kyndryl Consult, one of the company’s fastest-growing segments, saw particularly stretched deal timelines. Legacy IBM contracts from before the spinoff continue creating headwinds.

Oppenheimer analyst Ian Zaffino responded swiftly. He downgraded Kyndryl from Outperform to Perform and removed his price target completely.

The downgrade cited the shift in business dynamics and increased uncertainty from the CFO departure. Extended sales cycles in key growth areas added to concerns.

Shares hit a 52-week low of $10.82 during Monday’s rout. The stock had already fallen 46% over the previous 12 months.

Trading metrics show a P/E ratio of 13.91 and beta of 1.93, reflecting high volatility. Gross margins of 21.4% lag industry peers.

The company now faces extended uncertainty while working through accounting issues and filling two critical finance positions with permanent hires.

Crypto World

Nvidia (NVDA) Stock Jumps 5% on Big Tech Capital Spending Bonanza

TLDR

- Nvidia stock climbed 2.5% Monday following a 7.9% Friday rally driven by tech company AI spending plans

- Tech giants expected to spend over $650 billion on capital expenditure in 2026, heavily focused on AI infrastructure

- Analysts predict OpenAI’s $100 billion fundraising will benefit Nvidia, AMD, and Broadcom

- Stock still faces headwinds from tech rotation, custom chip competition, and memory cost increases

- February 25 earnings report expected to show 71% EPS growth and 67% revenue increase year-over-year

Nvidia shares rose 2.5% Monday, closing at $190.04. The gain extended a strong 7.9% rally from Friday that snapped a five-day decline.

The catalyst? Massive capital spending announcements from tech giants. Google parent Alphabet and Amazon led the charge with hefty infrastructure budgets.

Big U.S. tech companies are now projected to exceed $650 billion in capital expenditure for 2026. Most of that money will flow toward AI infrastructure buildout.

Capital Spending Wave Benefits Chip Makers

William Blair analyst Sebastien Naji sees Nvidia as a prime beneficiary. “The massive step-up in capex now expected in 2026 is likely to greatly benefit merchant accelerator providers like Nvidia,” he wrote.

Despite the recent gains, Nvidia shares remain barely positive for 2026. The stock has battled multiple headwinds in recent weeks.

Investor rotation away from technology stocks has pressured shares. Questions about OpenAI’s spending sustainability have also created uncertainty.

The rise of custom AI chips threatens Nvidia’s market dominance. Rising memory component costs add another layer of concern for investors.

OpenAI Fundraising Could Shift Sentiment

D.A. Davidson analysts believe OpenAI’s planned fundraising could reverse some bearish sentiment. The ChatGPT developer aims to raise up to $100 billion.

“We expect that as investors go back to seeing OpenAI as a winner, the public companies in its orbit could re-rate considerably,” analyst Gil Luria wrote. “Most importantly that should drive outperformance in Nvidia.”

The optimism extends beyond Nvidia. Advanced Micro Devices gained 2.0% Monday while Broadcom added 2.3%.

Both companies have supply deals with OpenAI. The entire AI chip sector appears to be catching a bid from the fundraising news.

Earnings Report Approaches

Nvidia reports quarterly results on February 25. Wall Street expects earnings per share of $1.52, representing 70.79% growth from last year’s comparable quarter.

Revenue projections sit at $65.56 billion. That would mark a 66.68% increase year-over-year.

Full-year estimates call for $4.66 in earnings per share on $212.62 billion in revenue. Those numbers represent growth of 55.85% and 62.93% respectively.

The stock trades at a forward P/E ratio of 25.33. That’s below the semiconductor industry average of 26.96.

Nvidia’s PEG ratio stands at 0.55, well under the industry average of 2. The company currently holds a Zacks Rank of #2, indicating a Buy rating.

The semiconductor sector ranks in the top 39% of all industries based on Zacks Industry Rank methodology.

Crypto World

Bitcoin Everlight App Now Offering 21% APY Rewards

In early 2026, Ethereum staking continues to expand despite the sustained turbulence in prices across the broader cryptocurrency market. Participation in protocol staking remains high even as the returns compress. This reinforces Ethereum’s role as one of the core infrastructure assets while also highlighting the tradeoffs faced by long-term operators.

Within this environment, some technically experienced participants are exploring whether their knowledge can be applied to systems in which compensation is generated in Bitcoin and linked to execution-layer activity rather than token inflation.

Ethereum Staking Is Crowded, Yield Is Compressing

More than 36.9 million ETH is currently being locked on the Beacon Chain, which is around 30% of the total circulating supply. Validator participation remains high even in the face of severe price volatility. This signals long-term commitment to protocol participation.

However, that participation has come at the cost of lower returns. The Composite Ethereum Staking Rate now sits near 3.11%. Solo validators using MEV-boost strategies can still achieve higher effective rewards, averaging up to 5.69%, while operators without MEV optimization typically earn closer to 4%. The net returns for retail participants are lower once you subtract the platform fees, with Coinbase offering between 2.32% and 2.46% APY, Kraken up to 2.96%–2.98% APR, and liquid staking via stETH hovering near 3.4%.

Institutional scale has become a defining advantage in this environment. Large holders such as Bitmine Immersion Technologies, which controls over 4.3 million ETH with roughly 2.9 million staked, are able to sustain meaningful revenue despite compressed yields. At the same time, continued validator queue growth and minimal exits reinforce that while commitment remains strong, reward dilution is tightening margins for smaller and less efficient operators.

How Everlight Operates Alongside Bitcoin

Bitcoin Everlight operates as a Bitcoin-adjacent execution network designed to extend transaction handling without altering Bitcoin’s base protocol, consensus rules, or monetary policy. Bitcoin remains the authoritative settlement layer, preserving its role as the source of finality and security, while Everlight is positioned strictly at the execution layer.

Within this structure, Everlight focuses on transaction coordination tasks that Bitcoin itself is not optimized for, including routing efficiency, availability management, and rapid confirmation. Transactions are processed through a distributed set of Everlight nodes that coordinate execution activity independently of Bitcoin’s block production, allowing confirmations to occur in seconds rather than minutes.

To maintain alignment with Bitcoin’s security model, Everlight supports optional anchoring mechanisms that periodically record execution data back to the Bitcoin blockchain. This approach links high-frequency execution activity to Bitcoin’s settlement finality without modifying Bitcoin itself, allowing each layer to operate within its intended design constraints.

Converting Execution Experience Into Bitcoin Rewards

Everlight participation centers on operating execution-layer nodes that manage transaction throughput and network availability. These nodes do not validate Bitcoin blocks and do not function as Bitcoin full nodes. Their performance is continuously evaluated based on responsiveness, routing efficiency, and reliability.

Node operators commit BTCL to participate and receive Bitcoin generated from real network usage. BTC distribution scales with transaction handling volume, availability scoring, performance efficiency, and operational class across multiple node tiers. Higher tiers assume greater routing responsibility and receive proportionally larger shares of Bitcoin distributions.

Participation carries no mandatory lock period. Bitcoin accrues only while a node remains active and meets performance thresholds. Nodes that fall below required standards are deprioritized until metrics recover. Under current network parameters, estimated annualized Bitcoin rewards reach up to 21%, reflecting aggregate transaction demand and operator contribution rather than fixed emissions.

Mobile App Simplifies Control for Node Operators

The Everlight mobile app is available to node operators and provides direct visibility into participation. Operators can monitor node status, uptime consistency, routing activity, and Bitcoin earned from network usage directly from a smartphone.

Live metrics are paired with smart alerts notifying operators of uptime disruptions, performance changes, and BTC distribution events. This app-based interface reduces operational overhead while keeping execution control with the operator.

Independent technical analysis examining Everlight’s execution model and node mechanics has been published by Crypto League.

Third-Party Security Reviews Support Credibility

Bitcoin Everlight has completed independent third-party security assessments focused on smart contract logic, execution-layer behavior, and deployment risk. The SpyWolf and SolidProof audits examine transaction handling, permission structures, and edge-case failure scenarios under realistic operating conditions.

Operational accountability is reinforced through independent team identity verification conducted via SpyWolf and Vital Block, confirming the individuals responsible for development and ongoing network operations.

Token Supply and Presale Parameters

Bitcoin Everlight operates with a fixed total supply of 21,000,000,000 BTCL. Allocation is defined as 45% public presale, 20% node rewards and network incentives, 15% liquidity provisioning, 10% team allocation under vesting, and 10% reserved for ecosystem development and treasury use.

The presale follows a 20-stage structure. Phase 3 is currently active, with BTCL priced at $0.0012. Presale allocations unlock 20% at token generation, with the remaining 80% distributed linearly over six to nine months. Team allocations follow a 12-month cliff with 24 months of vesting thereafter. BTCL utility is limited to transaction routing fees, node participation thresholds, performance incentives, and anchoring operations.

Learn More About BTCL:

Website: https://bitcoineverlight.com/

Security: https://bitcoineverlight.com/security

How to Secure: https://bitcoineverlight.com/articles/how-to-buy-bitcoin-everlight-btcl

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and to do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ripple expands RLUSD stablecoin use in UAE via Zand Bank

Ripple has expanded the reach of its RLUSD stablecoin in the Middle East through a new strategic partnership with UAE-based digital bank Zand, a move that could have longer-term implications for the XRP ecosystem.

Summary

- Ripple has expanded the reach of its RLUSD stablecoin in the Middle East through a strategic partnership with UAE-based digital bank Zand, targeting regulated on-chain finance use cases.

- The collaboration will deploy Zand’s AED-backed stablecoin (AEDZ) alongside RLUSD to support blockchain-based payments, settlement, liquidity management, and tokenization.

- While the deal focuses on stablecoins, Ripple’s growing institutional footprint is viewed as a supportive backdrop for XRP, which was trading at $1.41, up 1.3% over the past 24 hours.

Ripple and Zand target on-chain finance in the UAE

Under the partnership, Zand and Ripple will collaborate to advance the digital economy by deploying solutions powered by Zand’s AED-backed stablecoin (AEDZ) and Ripple’s U.S. dollar stablecoin (RLUSD).

The initiative aims to support the migration of traditional financial services on-chain using stablecoins, blockchain infrastructure, and tokenization.

Zand said the partnership represents a “significant step forward” in expanding real-world use cases for digital assets, particularly as regulated financial institutions explore blockchain-based settlement, payments, and liquidity management.

By combining AEDZ and RLUSD, the two firms are positioning themselves to facilitate multi-currency on-chain transactions in a regulated environment.

XRP price amid Ripple’s expansion

While the announcement centers on stablecoins rather than XRP directly, Ripple’s expanding institutional footprint is often viewed as a supportive backdrop for XRP’s long-term utility narrative.

XRP has historically traded as a proxy for sentiment around Ripple’s business momentum, particularly in regions where RippleNet adoption is growing. The Ripple token (XRP) was exchanging hands at $1.41 at press time, up 1.3% in the last 24 hours.

In the near term, XRP price action remains driven by broader crypto market conditions and risk appetite. However, continued progress in stablecoin adoption and enterprise partnerships could reinforce investor confidence in Ripple’s ecosystem over time.

As Ripple deepens its presence in the UAE through Zand, the move highlights how stablecoins, not just volatile cryptocurrencies, are becoming a core pillar of blockchain adoption in regulated financial markets.

Crypto World

Compliance-First Prediction Markets for White-Label Neo Banks

Prediction markets moved from niche experimentation to institutional-grade financial infrastructure in a very short time. For serious investors, the question is no longer whether they are interesting, but how they can be built, governed, and monetized inside regulated financial rails. The acceleration we saw in 2025 proved two things:

1. The market can scale to multi-billion dollar notional flows while attracting retail and institutional liquidity.

2. The ecosystem matured technically, with interoperable oracles, hybrid settlement rails, and audited market logic that reduces systemic counterparty risk.

For an investor evaluating white-label neo-banking platforms, embedding a prediction-market module is not a gimmick. It is a strategic lever that can unlock new fee streams, create stickier customer lifecycles, and produce market signals that feed risk systems and trading desks. Let us scroll through the blog to uncover the architecture, the regulatory contours, the commercial levers, and how an end-to-end partner can deliver enterprise production.

Are Prediction Markets Really Winning in 2026 & Beyond?

“In 2025 alone, global prediction market trading volumes hit $44 billion across major platforms, while economics-focused contracts grew roughly 905% YoY to about $112 million in volume.”

By the end of 2025, prediction markets had reached a scale that turned heads across capital markets. Aggregate platform volumes for the year were reported in the high tens of billions of dollars, and specialized economic contract categories posted triple- and quadruple-digit growth rates. demonstrating real demand for event-based hedging and information products.

The competitive landscape now features two complementary rails. Regulated derivatives exchanges provide a compliant on-ramp for retail and institutional brokerage integration. On-chain platforms provide composability, programmable settlement, and tokenized liquidity. Both rails are attracting strategic partnerships and buy-side interest, which drives network effects and market depth. At the same time, regulators are moving from avoidance to active rulemaking and engagement, which reduces legal tail risk for properly structured products.

This is a clear implication for all the serious and visionary investors interested in launching their own crypto-friendly banking solutions. Prediction markets are no longer experimental curiosities. They are a fast-growing market infrastructure with real revenue potential and predictable paths to regulatory clarity. The winners will be platforms that combine robust legal frameworks, audited market logic, institutional liquidity, and seamless integration into existing financial products.

Who Should Build a Crypto Neo Banking Platform With a Prediction Market In It?

Not every financial platform needs prediction markets, but for some, the opportunity is too strategic to ignore. Platforms aiming to move beyond conventional digital banking and introduce high-engagement, event-driven financial products are already exploring this direction. Enterprises evaluating white label crypto neo bank development are particularly well-positioned, as the infrastructure foundation is already in place, allowing them to experiment, launch, and scale advanced market features far more efficiently.

| Investor Type | Why should they build? | Expected benefits |

|---|---|---|

| Institutional asset managers and hedge funds | Access alternative data signals and hedging instruments | Real-time macro signals, bespoke hedging, new alpha sources |

| Challenger neo-banks and fintechs | Differentiate the product suite and boost retention | Higher DAU, cross-sell of savings and credit, premium subscriptions |

| Traditional retail brokers and wealth platforms | Provide event hedging products to clients | New fee lines, increased platform trading volume, client stickiness |

| Payment platforms and digital wallets | Embed engagement and micro-bets tied to promotions | Improved LTV, conversion from marketing, monetized data streams |

| Sportsbooks and media companies | Expand event offerings and monetize audience engagement | White-label markets, sponsored liquidity pools, integrable odds feeds |

| Venture funds and platform investors | Strategic asset with platform-level defensibility | Tokenomics-enabled governance, network effects, data monetization |

| Banks exploring innovation | Pilot regulated event contracts as a low-risk product | Controlled rollouts, offline audit trails, compliance-first revenue |

Each ICP will value different delivery attributes. Institutional buyers prioritize auditability, custody, and settlement certainty. Consumer platforms prioritize UX, onboarding friction and fraud protection. A good integration plan into a customized BaaS platform maps these priorities to architecture, compliance, and go-to-market.

Benefits of Integrating Prediction Markets Into Existing BaaS Solutions?

- New diversified revenue: trading fees, market creation fees, subscription products, and data licensing.

- Improved user engagement: gamified markets increase DAU, cross-sell rates, and deposit retention.

- Alternative hedging instruments: event-based positions for macro and idiosyncratic risk management.

- Premium product differentiation: unique features for high-value clients and institutional desks.

- Proprietary data assets: structured event outcomes become monetizable signals for research and asset management.

- Elastic scaling of product offerings: markets can be white-labeled for partners and sponsors.

- Regulatory arbitrage mitigation: hybrid designs enable compliant offerings that would otherwise be restricted to on-chain-only models.

- Operational synergy: integrates with existing KYC, custody, and customer support infrastructure to keep the marginal cost of new products low.

Essential Components of NeoBank App Platform Development with Prediction-Market

- Market engine: deterministic, auditable smart contracts or exchange matching logic with replayable trade history.

- Oracle fabric: redundant oracle sets with economic incentives, cryptographic proofs and dispute resolution.

- Liquidity stack: AMM templates, maker incentives, and external market maker APIs for deep order books.

- Settlement rail: choice of on-chain (USDC / stablecoin), off-chain clearing, or hybrid settlement to meet FX, custody, and reconciliation needs.

- Custody & KYC integration: segregated hot and cold custody, administrator keys, and seamless KYC/AML flows tied into the bank rails.

- Governance and dispute layer: tokenized or multisig dispute escalation, transparent resolution windows, and legal arbitration interfaces.

- Risk controls: real-time exposure limits, automated position throttles, and scenario stress testing.

- Front-end and trading UX: low latency order entry, tick-level market depth, market creation UI, and clear risk disclosures.

- Audit and verification: formal verification of contracts, third-party security audits, and reproducible testnets.

- Data and analytics: streaming market telemetry, user cohort metrics, pricing oracles, and API endpoints for downstream quant and trading desks.

These components should be architected as modular services, allowing regulated institutions to activate or restrict specific functionalities in alignment with their compliance frameworks. Delivering such a system with precision typically requires collaboration with a seasoned and certified crypto banking development company that brings extensive domain experience, a multidisciplinary engineering team, and in-house legal expertise to navigate regulatory and licensing complexities. In addition, the partner you engage should possess strong API integration capabilities and established working relationships with reputable third-party infrastructure providers, ensuring seamless interoperability and dependable operational continuity.

Evaluate Your Platform Architecture With Our Experts

How Does Antier Help Build Enterprise-Grade Prediction Market Integrated White-Label Neo Bank Apps?

Antier delivers a full A-to-Z white label neo bank app solution built for institutional buyers. The following is a pragmatic flow that maps to investor expectations and operational controls.

1. Discovery and requirements engineering

- Regulatory scoping for jurisdictions of operation.

- Product definition with investor KPIs such as take rates, expected volumes and settlement currencies.

- Risk appetite and allowed event categories.

2. Architecture and design

- Define settlement topology: L1, L2 or hybrid.

- Design oracle strategy: primary and fallback feeds, economic incentives and slashing rules.

- Select a liquidity approach: built-in AMM, partner market makers, and provisioned maker funds.

3. Smart contract and exchange development

- Build auditable market logic, a matching engine, or AMM contracts.

- Code formal verification where required.

- Implement staking, fee routing, and governance modules.

4. Compliance, legal, and controls

- Integrate KYC/AML providers and transaction monitoring.

- Draft product legal wrappers, customer terms and disclosure templates.

- Engage counsel for derivatives and gambling law as applicable.

5. Security and audit

- Comprehensive security audits from multiple independent firms.

- Penetration testing, bug bounty setup, and continuous monitoring.

- Operational runbooks and incident response plans.

6. Custody and settlement integration

- Integrate institutional custody providers for fiat and crypto.

- Implement ledger reconciliation, proofs of reserves, and audit trails.

7. UX, SDKs and APIs

- White-label web and mobile front ends designed for low-friction onboarding.

- Provide SDKs for market creation, order execution, data streams and settlement APIs.

8. Pilot and liquidity seeding

- Execute controlled pilots with predefined resolution windows.

- Provide initial liquidity incentives and market maker agreements.

9. Ops, reporting and monetization

- Build compliance reporting pipelines, audit logs, and tax reporting.

- Implement fee routing, subscription management and data productization.

10. Post-launch governance and scaling

- Ongoing legal support for emerging rules.

- Scalable infra upgrades for peak market days and institutional integrations like broker partners.

Being the leading blockchain and AI development company, Antier’s delivery emphasizes the separation of concerns. The bank retains control over custody and regulatory reporting. Antier provides the market logic, oracles, integration and production runbooks so that a neo-bank can operate prediction markets with institutional safeguards.

How Prediction Markets Create a Competitive Advantage for White-Label Neo Banking Platforms?

Prediction markets act as a true differentiation layer for white-label neo banks when they move the platform from a set of commoditized utilities into an interactive financial ecosystem. Rather than another feature checkbox, a well-designed prediction module changes how users interact with money, risk, and information inside the app. For investors, this matters because differentiation must translate into measurable business outcomes: higher retention, new revenue line,s and proprietary assets that are hard to copy.

How does it work in practice?

a) New financial primitives inside the product stack. Markets let customers take positions, hedge exposures or acquire probabilistic insights directly from the bank’s interface. These are not marketing gimmicks. They are real instruments that increase transaction frequency and stickiness.

b) quidity footprints and behavioral cohort patterns. Over time, those signals become a defensible data moat that can be monetized through research products, premium analytics,s or B2B feeds.

c) Network effects and liquidity defensibility. Active markets attract makers and takers. As liquidity deepens, spreads tighten, and user experience improves. This creates a virtuous cycle that raises the barrier to entry for competitors.

d) Faster monetization with modular integration. White-label neo bank solutions already have custody, KYC, and payment rails. Adding a prediction layer is largely incremental engineering that yields multiple monetization levers: fees, market creation commissions, and subscription analytics.

Investor-focused metrics to watch

- Incremental daily active users attributable to markets

- Fee per active market and margin after liquidity incentives

- Data revenue per month from market analytics and API clients

- Churn delta for users who participate in markets versus control group

Takeaway

For investors, prediction markets are not simply product innovation. When implemented with institutional rigor, they create measurable differentiation, recurring revenue, and a proprietary data asset that collectively strengthen the platform’s defensibility and valuation.

How Much Does a Prediction Market in White-Label BaaS Platforms Cost?

Cost is driven by architecture, jurisdiction, and desired speed to market. White label neo banking platform development with prediction market cost drivers includes legal and compliance, security audits, Oracle integration, liquidity seeding, smart contract engineering, and UI/UX. Choosing a true hybrid settlement model increases integration complexity and therefore cost but often lowers long-term operational risk and regulatory friction. From a strategic perspective, investors should focus less on headline integration cost and more on unit economics. That means modeling fee capture per market, expected liquidity depth, projected churn reduction, and data product revenue. Practical tactics to control spending include phased delivery, reusing audited open standards for AMMs and oracles, and using partner liquidity before committing proprietary capital.

Join Hands With Antier’s Accredited Fintech & Crypto Experts!

For institutional investors evaluating white-label neo-bank opportunities, prediction markets are a force multiplier. They provide distinct monetization avenues, generate proprietary data, and offer new hedging instruments. The market has matured to an inflection point where volumes and institutional participation justify production deployments, but regulatory work remains an essential part of the build plan.

Get in touch with Antier to launch your white label banking solution in just a few weeks and under professional guidance. Our approach combines deep technical engineering, formal verification, institutional custody integration, and specialist regulatory support so the client can scale markets responsibly. We help clients define the product, build robust market logic, integrate custody and compliance, seed liquidity, and operate at enterprise SLAs. If you are an investor or platform executive, integrating prediction markets is a strategic decision. With the right partner and a defensible compliance posture, it becomes a predictable, accretive growth engine.

Frequently Asked Questions

01. What are prediction markets and why are they gaining traction in 2026?

Prediction markets are platforms that allow users to bet on the outcomes of future events. They are gaining traction due to significant growth in trading volumes, reaching $44 billion in 2025, and the maturation of the ecosystem, which now features regulated exchanges and on-chain platforms that enhance liquidity and reduce risks.

02. How can embedding a prediction-market module benefit neo-banking platforms?

Embedding a prediction-market module in neo-banking platforms can unlock new fee streams, enhance customer engagement, and provide valuable market signals that inform risk management and trading strategies.

03. What regulatory changes are impacting prediction markets?

Regulators are shifting from avoidance to active engagement, which is leading to clearer rulemaking and reducing legal risks for properly structured prediction market products, thereby fostering a more stable environment for investment.

Crypto World

Jump Trading to take small stakes in prediction markets Polymarket, Kalshi: Bloomberg

Jump Trading plans to take a small stake in each of the prediction-market platforms Kalshi and Polymarket, Bloomberg reported on Monday, citing people with knowledge of the matter.

The trading powerhouse, which has a significant focus on cryptocurrency, will gain the stakes in exchange for providing liquidity on the two platforms.

Jump is set to take a fixed amount of equity in Kalshi, while its stake in Polymarket will grow over time depending on the trading capacity that the firm provides to the platform’s U.S. operation.

Kalshi and Polymarket are the two most prominent prediction-market platforms, having both acquired multibillion dollar valuations. They rely on market makers like Jump to put up the money to take the other side of customers’ trades. Market makers then profit from the difference in price movements.

Jump expanded into prediction-market trading in recent months, recruiting 20 staffers in recent months for that business, according to Bloomberg.

The firms did not immediately respond to CoinDesk’s request for further comment.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

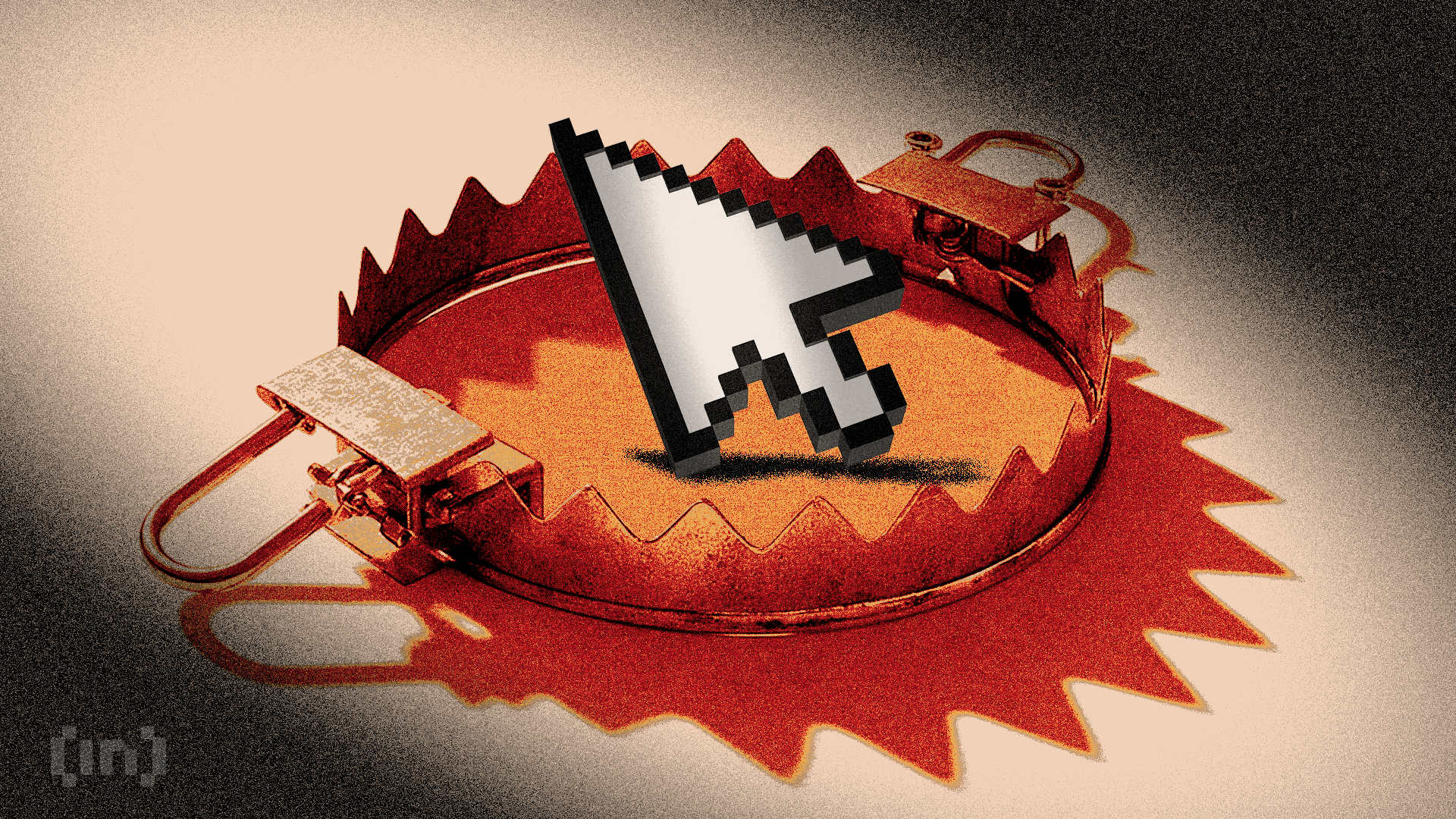

Publicly listed companies that hold Solana as a treasury asset are sitting on more than $1.5 billion in unrealized losses, based on disclosed acquisition costs and current market prices tracked by CoinGecko.

The losses are concentrated among a small group of United States-listed companies that collectively control over 12 million Solana (SOL) tokens, about 2% of the total supply. While losses remain unrealized, equity markets have already repriced the companies, with most trading well below the market value of their tokens.

CoinGecko data shows that Forward Industries, Sharps Technology, DeFi Development Corp and Upexi account for over $1.4 billion in disclosed unrealized losses. The total is likely understated, as Solana Company has not fully disclosed its acquisition costs.

The figures highlight a growing gap between paper losses and liquidity pressure. While none of the companies have been forced to sell their SOL, compressed net asset value (mNAV) multiples and falling share prices have constrained their ability to raise fresh capital.

Accumulation stalls across Solana treasuries

Transaction data compiled by CoinGecko shows that the bulk of SOL accumulation occurred between July and October 2025, when several companies made large, concentrated purchases.

Since then, none of the top five Solana treasury companies have disclosed meaningful new buys, and no onchain sales have been recorded.

Forward Industries, the largest holder, accumulated over 6.9 million SOL at an average cost of about $230. With SOL trading around $84, Forward has unrealized losses of over $1 billion.

Sharps Technology made a single $389 million purchase near the market peak. The company’s SOL is now worth about $169 million, down over 56% from its acquisition cost.

DeFi Development Corp followed a more gradual accumulation strategy and reports smaller losses, but its shares still trade below the value of its SOL holdings.

Solana Company, which built a 2.3 million SOL position over several tranches of purchases, has also paused accumulation since October, according to CoinGecko’s transaction history.

Related: Kyle Samani leaves Multicoin in ‘bittersweet moment’ to explore new tech

Equity markets signal a treasury winter

Equity price data from Google Finance shows that the top five Solana treasury companies have suffered sharp drawdowns in the last six months, significantly underperforming SOL itself.

Forward Industries, DeFi Development Corp, Sharps Technology and Solana Company stock prices are down between 59% and 73% in the six-month charts.

CoinGecko data shows that Upexi has $130 million in unrealized losses on its SOL holdings. However, its shares have fallen more sharply than its peers.

Upexi shares are down more than 80% over the past six months, according to Google Finance. Like other Solana treasury firms, Upexi has paused new accumulation since September.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

ASTER jumps 9% above $0.60 as traders eye breakout toward $1 target

- Aster traded to highs of $0.65 amid a 9% uptick in 24 hours.

- The bounce from lows of $0.43 on February 5, 2026, could extend amid a retest of key levels.

- Risks of a downturn remain as Bitcoin and Ethereum struggle.

ASTER is among the top-gaining altcoins on the day, as its price surges by nearly 9% to extend its upside movement above $0.60.

The token, native to the innovative decentralized exchange platform Aster, is showing this renewed strength amid broader market weakness.

On Tuesday, as Bitcoin and Ethereum held around $68,000 and $2,000, respectively, Aster jumped to intraday highs of $0.65.

A potential upside continuation as traders target more gains is shaping up, although overall sentiment means that profit-taking might still be a factor.

Aster price posts 9% bounce

The crypto market has significantly flipped bearish since the downturn that smashed bulls’ optimistic outlook on October 10, 2025.

In the latest extension of that negative sway, Aster’s price fell to lows of $0.43, with losses mirroring the sharp sell-off to $60k for BTC and $1,740 for ETH.

However, just as BTC bounced to $70k, the altcoin regained some upside momentum and surged to $0.60.

Bulls have held above this level in the past two days, having tested $0.65 on three occasions in the time frame.

ASTER recorded nearly 9% in 24-hour gains, cutting losses over the past week and now trades in the green over this period.

While the bounce aligns with a slight shift in broader sentiment, the dip in trading volume means buyers have not stepped in forcefully.

If the platform’s recent launch of 0% maker fees across all markets draws significant liquidity and user interest, bulls could seize control.

ASTER price forecast

On the one side, a potential pump to $1.30 looms, and on the other, a failure to solidify gains could spell danger.

For bulls, the daily chart reveals a falling wedge breakout, a bullish pattern signaling potential reversal as price compresses and escapes upward resistance.

Key oscillators also remain neutral but lean toward buy signals.

The daily RSI hovers around 53 and is upsloping. However, it is well off overbought conditions.

Meanwhile, the Commodity Channel Index and Average Directional Index both show neutral readings, while the MACD hints at a buy move as the histogram ticks positive with expanding bias.

This setup positions ASTER for a possible short-term pump, with primary supply zones at $0.80 and $0.95.

Breaking to $1 will bring the $1.22 to $1.30 range into view as the next target, which is the top of the projected wedge pattern from November 2025.

With risks of a pullback in play, key levels to watch include $0.54 and $0.46.

Crypto World

Cathie Wood’s ARK Buys $9.67M in Roblox Stock, Dumps PagerDuty

TLDR

- ARK Invest purchased 145,603 Roblox shares worth $9.67 million across three ETFs on February 9, 2026.

- The buy followed Roblox’s strong fourth-quarter results and improved bookings forecast from the gaming company.

- ARK continued selling PagerDuty stock, offloading $1.18 million worth of shares in its fifth consecutive day of reductions.

- The firm added healthcare positions in Recursion Pharmaceuticals and TharImmune while trimming digital ad stocks.

- Total sales included Pinterest and The Trade Desk as ARK shifts focus toward gaming and AI-driven healthcare.

Cathie Wood’s ARK Invest executed major portfolio moves on February 9, 2026. The firm bought 145,603 shares of Roblox worth $9.67 million across three exchange-traded funds.

ARK Innovation ETF, ARK Next Generation Internet ETF, and ARK Fintech Innovation ETF all participated in the purchase. The transaction represents one of ARK’s largest single-stock buys in recent trading sessions.

The Roblox purchase came days after the company released fourth-quarter earnings. The gaming platform posted results that exceeded Wall Street expectations. Management also issued positive guidance for upcoming bookings.

Several analysts have raised their price targets on Roblox stock. They point to increased engagement from users and higher spending patterns. Older demographics are spending more on the platform, which analysts view positively.

Healthcare and AI Investments Grow

ARK expanded its healthcare portfolio with two purchases on February 9. The firm bought 156,272 shares of Recursion Pharmaceuticals for $622,000. The biotech company uses artificial intelligence for drug discovery.

ARK also acquired 54,600 shares of TharImmune valued at $226,000. Both purchases align with Wood’s strategy of backing companies using technology to develop new medicines.

Additional buys included 2,114 shares of Kodiak AI worth $19,343. ARK added 444 shares of Tempus AI for $24,380. The firm also purchased 57,164 shares of Bullish totaling $1.57 million.

ARK Reduces Software and Ad Tech Exposure

ARK sold 147,125 shares of PagerDuty for approximately $1.18 million. The sale marks the fifth straight trading day ARK has reduced this position. Shares were sold through ARK Innovation ETF and ARK Next Generation Internet ETF.

The repeated selling indicates declining conviction in PagerDuty stock. The company provides incident management software for IT departments. ARK has now trimmed its stake substantially over the past week.

Pinterest was another stock ARK reduced. The firm sold 46,800 shares worth roughly $917,000. ARK also cut its Trade Desk position by 24,157 shares for about $653,000.

Both Pinterest and The Trade Desk generate revenue from digital advertising. The sales suggest ARK is moving capital away from ad-dependent business models. The firm appears to be favoring gaming and healthcare technology instead.

ARK sold 497 shares of Qualcomm for $68,257. This represents a minor position adjustment in the semiconductor sector.

Total sales on February 9 reached approximately $2.82 million. Combined with purchases of roughly $12.15 million, ARK increased its net equity exposure. The buying pattern shows Wood is deploying more capital into preferred holdings.

The portfolio changes reflect ARK’s focus on companies with strong growth potential. Roblox leads the buys while PagerDuty continues facing selling pressure. Healthcare and AI stocks received additional investment as digital advertising names were reduced.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat17 hours ago

NewsBeat17 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World5 hours ago

Crypto World5 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Sports16 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World5 hours ago

Crypto World5 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout