Crypto World

Harvard endowment tilts harder into Bitcoin ETFs than Google stock

Harvard’s endowment has quietly made Bitcoin ETFs a top public holding, surpassing Google and joining other elite universities in rotating long‑term capital into digital assets.

Summary

- Filings show Harvard built and then tripled its BlackRock iShares Bitcoin Trust stake, lifting IBIT above Alphabet and other big‑tech names in its public portfolio.

- Brown, Emory, and other U.S. universities have also disclosed multi‑million‑dollar Bitcoin ETF and trust positions, signaling a broader endowment shift into crypto.

- The rotation comes as Bitcoin trades near $68,400, with Ethereum and Solana also rallying while digital assets again track global risk appetite.

Harvard University’s endowment is now leaning harder into Bitcoin (BTC) than into Silicon Valley’s most iconic search giant—and markets are taking note

Harvard’s Quiet Portfolio Pivot

“FUN FACT: Harvard University holds more in Bitcoin ETFs than it holds shares in Google,” Bitcoin Magazine posted on X on February 10, distilling a shift years in the making.

Regulatory filings show Harvard built a roughly $116.7 million position in BlackRock’s iShares Bitcoin Trust in 2025, lifting its Bitcoin exposure above stakes in Alphabet and other big‑tech mainstays.

Subsequent disclosures indicate Harvard increased that wager, with some estimates putting its Bitcoin ETF holdings in the hundreds of millions and ranking the position among its single largest listed assets.

Commentary from the digital‑asset industry has been blunt. “Most people think Bitcoin is the gamble, but Harvard’s math clearly suggests that not owning enough of it is the bigger risk to their long‑term portfolio,” wrote SIG Labs.

Another bitcoiner framed it more simply: “Bitcoin is moving from theory to balance sheets.”

Endowments Move Into Crypto

Harvard is not alone. Brown and Emory universities have both disclosed sizable Bitcoin ETF and trust positions, running into the tens of millions of dollars in IBIT and Grayscale’s Bitcoin Mini Trust. One crypto media noted that “several prominent U.S. university endowments have disclosed investments in cryptocurrency – including Emory, Brown, and Dartmouth Universities.”

Bitcoin, Google, and Macro Risk

Harvard’s rotation comes as digital assets again trade as a pure expression of global risk appetite. Bitcoin (BTC) is hovering around $68,400, with intraday swings pulling it below $70,000 twice in the past 24 hours as traders digest a near‑50% drawdown from its 2025 peak near $126,000.

Ethereum (ETH) changes hands near $4,760, up roughly 2.5% over the last day, while Solana (SOL) trades close to $208 after a gain of just over 5%, on volumes above $12 billion.

“This is Harvard flipping tech for BTC ETFs,” one trader wrote, calling it “wild” and a sign that “institutional adoption is officially peaking right now.”

If that proves true, Bitcoin beating Google inside the world’s richest university endowment may be remembered as more than just a memeable “fun fact.”

Crypto World

RIVER coin price bounces back 27%: analysts fear it could be a dead bounce

- RIVER coin price has surged 27% on bridge launch and new exchange listing.

- The cryptocurrency’s volume has spiked 126%, confirming strong buyer interest.

- Key support lies at $15.40, and a break below risks causing a $14.09 pullback.

RIVER coin has surged 27.4% in the past 24 hours, reaching an intraday high of $17.94.

The sudden spike comes after a period of relative stagnation, sharply outperforming a broader flat crypto market.

Traders are cautiously optimistic, but some analysts warn this could be a short-lived recovery.

The catalysts behind the rally

The primary driver of the rally was the launch of RIVER’s official cross-chain bridge.

This bridge allows seamless asset transfers between Ethereum, Base, and BNB Chain.

By enabling smoother liquidity flows, it addresses a core challenge faced by many DeFi projects.

At the same time, RIVER went live on LBank, a major centralised exchange, sparking fresh market activity.

$RIVER spot trading is live on @LBank_Exchange pic.twitter.com/U7HCPJR2dG

— River (@RiverdotInc) February 9, 2026

The exchange listing was accompanied by a $50,000 trading competition, which boosted short-term trading volume.

Combined, these events enhanced the token’s utility and made it easier for investors to access RIVER.

Volume data confirms the strength of the move, with a 126% surge in 24-hour trading volume to $83 million.

This shows that the rally was driven by genuine buying interest rather than thin order books.

The token also benefited from positive sentiment in the broader DeFi sector, which continues to attract investor attention.

RIVER coin price outlook

Analysts are watching key price levels closely to gauge the sustainability of the bounce.

If RIVER can hold above $15.40, it could attempt to reach a near-term target of $20.65.

This would represent a continuation of the current bullish momentum and strengthen confidence in the token’s recovery.

However, a break below $14.09 could signal that the rally has lost steam.

In that case, the coin may experience a pullback toward $12.50, testing lower support levels.

Traders are advised to monitor volume and bridge adoption as indicators of whether the move has lasting strength.

The rally also coincides with broader infrastructure upgrades, which could attract long-term users.

The cross-chain bridge is designed to simplify liquidity access and reduce fragmentation across networks.

Sustained adoption of this feature will be critical for supporting higher prices in the coming months.

Despite these positive factors, some analysts caution that the rebound could be a “dead mouse bounce.”

They argue that while short-term catalysts are present, the coin is still trading far below its all-time high of $87.73 that it hit at the beginning of the year 2026.

Price action remains fragile, and a failure to maintain support levels could result in another rapid decline.

Investors are therefore advised to weigh the recent gains against the risk of a correction.

The combination of technical indicators, exchange activity, and sector momentum will likely determine the next phase.

For now, the market is watching closely to see whether RIVER can convert its recent spike into a sustainable uptrend.

Crypto World

Stellar (XLM) outlook: recovery signals emerge amid long-term growth prospects

- Stellar (XLM) shows short-term recovery potential around $0.15–$0.23.

- Oversold indicators suggest a possible upward correction soon.

- Long-term adoption could drive significant value growth.

Stellar has recently shown signs of stabilising after a bearish period followed by consolidation.

The current XLM price hovers around $0.156, reflecting modest upward movement in the past 24 hours.

In addition, the token’s trading volumes remain healthy at nearly $97 million over the last day, signalling that market participants are actively engaging with the token.

Despite the ongoing volatility, the cryptocurrency is demonstrating key technical behaviours that hint at a potential recovery in the short term.

Short-term XLM recovery signals emerge

After a 31% decline in a month, the immediate support zone around $0.15 has been critical in preventing a further downside for Stellar Lumen’s XLM token.

Price action indicates that XLM is testing a make-or-break region, where sellers have been active but not dominant.

Exchange inflows data suggest that some investors are moving coins onto trading platforms, which could temporarily increase selling pressure.

However, technical indicators like the Relative Strength Index (RSI) suggest that the coin is near oversold conditions, often a precursor to upward correction.

If the upward recovery happens, the immediate short-term recovery targets range from $0.18 to $0.23 if the support holds and momentum shifts favourably.

While the XLM price is currently trading below key moving averages, reflecting a cautious outlook, the convergence of indicators points toward a possible stabilisation.

Breaking above $0.18 would signal a strengthening trend and could pave the way for a test of the $0.23 level in the coming weeks.

But until these levels are convincingly breached, bearish pressure remains a concern.

Long-term Stellar growth prospects

Beyond short-term fluctuations, Stellar’s long-term outlook remains compelling.

XLM has historically been tied to cross-border payments and financial infrastructure, which gives it real-world utility beyond speculative trading.

Analysts forecast that as adoption grows, XLM could see substantial appreciation over the next few months, with potential price levels ranging significantly higher than today.

Even modest increases in network activity, stablecoin usage, and partnerships with financial institutions could drive long-term value.

The coin’s past all-time high near $0.88 demonstrates its capacity for growth, despite the current market price being a fraction of that peak.

Stellar’s network fundamentals, combined with increasing adoption of blockchain-based payment solutions, create a foundation for sustained growth.

Investors looking at a long-term horizon may view the current price as an entry point ahead of broader adoption and utility expansion.

While short-term volatility will likely persist, the convergence of recovery signals and long-term adoption prospects creates a favourable risk-reward scenario.

Crypto World

Coca-Cola (KO) Stock Falls 4% on Weak Q4 Revenue and Sluggish 2026 Outlook

TLDR

- Coca-Cola stock fell nearly 4% in premarket trading after missing Q4 revenue expectations and issuing weak 2026 guidance

- Q4 revenue came in at $11.82 billion versus analyst estimates of $12.03 billion as soda demand weakened in North America and Asia

- Company forecasts 2026 organic revenue growth of 4-5%, below analyst expectations of 5.3% and slower than 2025’s 5% growth

- Price increases of 4% for full year 2025 helped offset higher input costs but pressured inflation-hit consumers seeking cheaper options

- Volume growth remained flat in Asia-Pacific as consumers increasingly shift to regional brands over global names

Coca-Cola shares dropped nearly 4% in premarket trading Tuesday after the beverage giant missed fourth-quarter revenue expectations and forecast slower-than-expected growth for 2026.

The Atlanta-based company reported Q4 revenue of $11.82 billion, falling short of the $12.03 billion analysts had projected. The miss came as demand for sodas weakened across key markets in North America and Asia.

The company’s 2026 organic revenue growth forecast of 4-5% came in below Wall Street’s 5.3% expectation. This also represents a deceleration from the 5% growth Coca-Cola posted in 2025.

“The forecast reads conservative, but is appropriate for the start of the year,” Jefferies analyst Kaumil Gajrawala wrote in a note. “Street likely wanted more.”

Price Hikes Pressure Consumer Demand

Coca-Cola has been raising beverage prices throughout the past year to offset higher input costs. Prices rose 4% for full-year 2025, helping to drive overall performance.

But these price increases have weighed on inflation-hit U.S. consumers who are increasingly seeking cheaper pantry options. Unit case volumes rose just 1% in the fourth quarter, matching the growth rate from the previous three months.

For the full year, volumes were flat. The company relied entirely on pricing power to drive results.

Rival PepsiCo announced last week it would cut prices on key snacks like Lay’s and Doritos. The move came after consumers pushed back on several rounds of price hikes over recent years.

The timing creates pressure on Coca-Cola as it navigates a CEO transition. Veteran executive Henrique Braun is set to take over as chief executive on March 31.

Shifting Consumer Preferences Challenge Growth

Coca-Cola adjusted earnings came in at 58 cents per share, beating analyst estimates of 56 cents. But the revenue miss highlighted ongoing challenges in key markets.

Volume growth was flat in the Asia-Pacific region during the quarter. The company faces increasing competition from regional brands in the world’s most populous continent.

Coca-Cola has been trying to adapt to changing consumer preferences. The company is leaning on zero-sugar sodas, sports drinks, and bottled teas as U.S. consumers shift to low-sugar options.

The rise of appetite-suppressing weight-loss drugs has accelerated demand for healthier beverage choices. Coca-Cola has invested in products like protein-infused Fairlife milk to capture health-conscious consumers.

The company forecast annual adjusted profit per share growth of 7-8% for 2026. This came in slightly below analyst expectations of 7.9% growth.

Despite Tuesday’s premarket decline, Coca-Cola shares have risen about 12% in 2025. The stock has outperformed PepsiCo over the past few years.

Crypto World

Enterprise dApp Development Cost Guide

Enterprises considering dApp development are not looking for hype. They are looking for clear answers. They want to know whether a decentralized platform can integrate with existing systems, meet security and compliance standards, and scale without constant redesign. They want to understand what drives cost, where projects usually fail, and how risks can be controlled before development begins.

Most decision-makers are trying to avoid three things: unpredictable budgets, delayed launches, and dependency on external vendors. They want a delivery model that supports internal governance, protects data, and remains manageable after deployment. They are also looking for practical guidance on architecture, audits, integrations, and operational ownership. Not generic estimates, but structured frameworks that explain how technical choices affect stability, timelines, and resource planning. This guide addresses those concerns directly. It explains how enterprise dApp development projects are planned, executed, and maintained, and how disciplined teams achieve predictable outcomes without compromising security or control.

Why Enterprise dApp Development Costs Are Often Misjudged

Most enterprises approach dApp initiatives using traditional software assumptions. That is where the disconnect begins, especially when organizations rely on generic services without fully accounting for the structural differences between decentralized and centralized systems. dApp introduces new cost variables that do not exist in Web2 environments:

- Smart contract immutability

- External security audits

- Blockchain infrastructure dependencies

- Regulatory exposure

- Governance and upgrade mechanisms

When these factors are underestimated or addressed too late, costs rise sharply, not because vendors are inefficient, but because the system was never designed for enterprise scale and accountability. As projects progress, gaps in planning, security alignment, and integration strategy begin to affect execution quality. These challenges become more visible during advanced dApp development phases, where architectural limitations and compliance constraints restrict flexibility.

The true cost of enterprise dApp development is not a single figure. It is the cumulative outcome of architectural discipline, risk management practices, and operational maturity, reinforced through professional development services that emphasize transparency and sustainability.

Request a Custom Enterprise DApp Budget Analysis

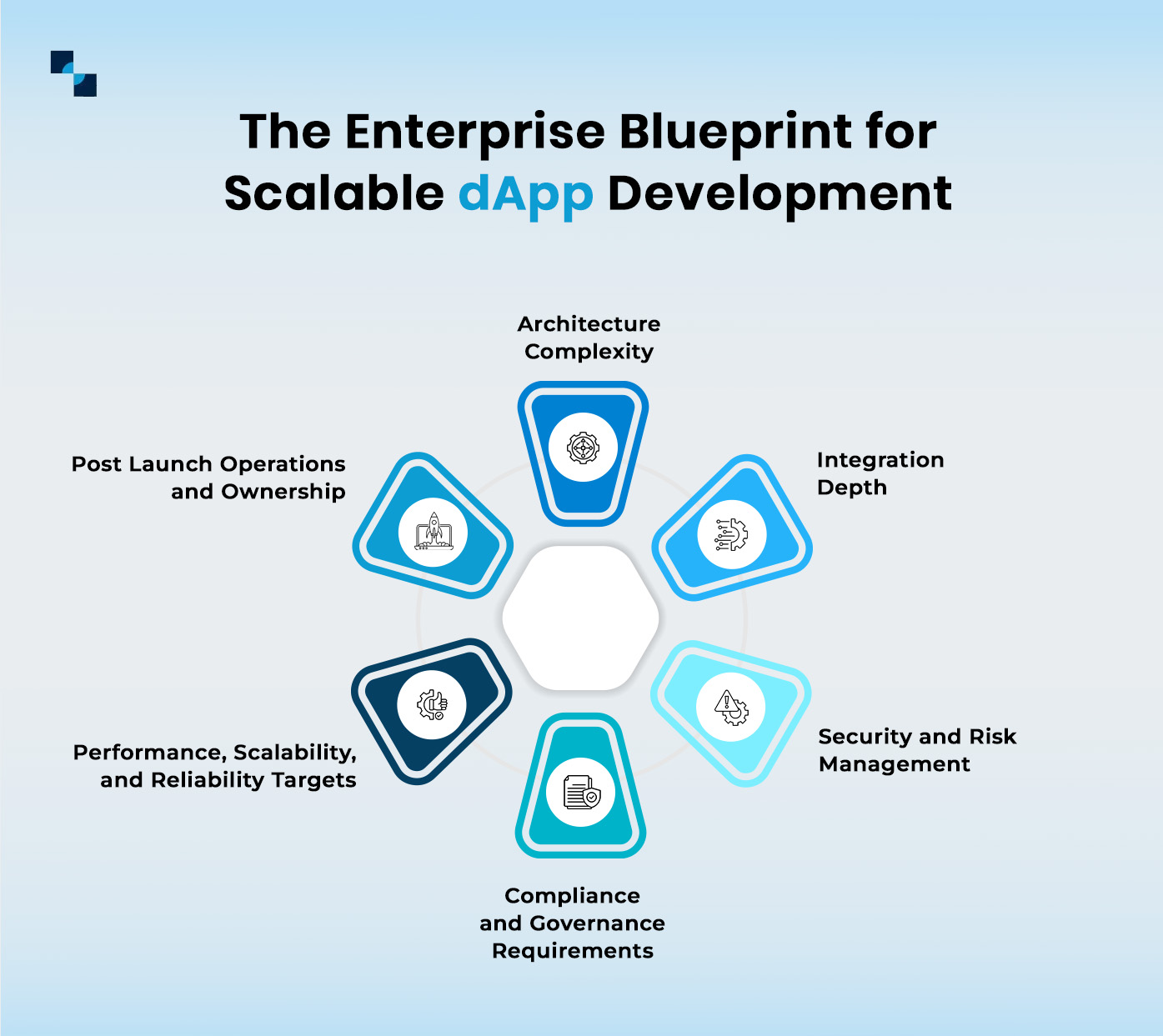

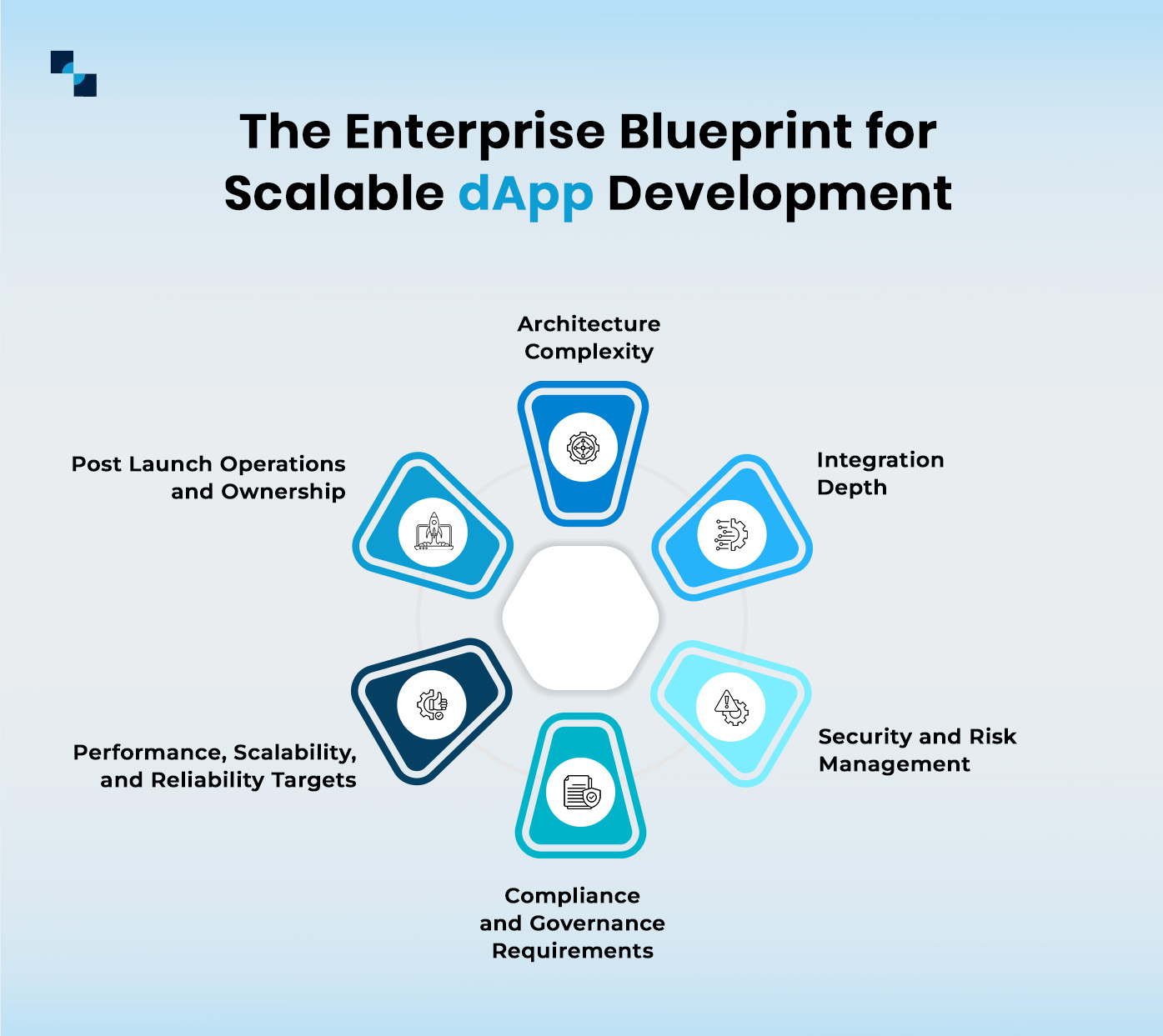

The Six Core Factors That Determine Enterprise dApp Cost

Instead of asking for price quotes, enterprise leaders should evaluate the structural and operational cost drivers that shape every decentralized application initiative.

- Architecture Complexity

Architecture is the single largest determinant of cost predictability in enterprise blockchain initiatives. Key contributors include:

- Number of smart contracts

- Upgradeability requirements

- On-chain and off-chain logic distribution

- Cross-chain or multi-network support

Poor architectural decisions often lead to expensive rewrites, repeated audit failures, and performance bottlenecks. In contrast, well-designed systems built through structured dApp development practices reduce long-term cost by minimizing rework, simplifying governance, and enabling controlled scalability.

- Integration Depth

Enterprise dApps rarely operate in isolation within modern digital ecosystems. They must integrate with:

- Identity and access management systems

- Payment rails

- ERP, CRM, or legacy databases

- Compliance and reporting tools

Each integration layer increases testing requirements, security validation, and operational oversight. Organizations that fail to evaluate integration complexity during early planning stages often experience budget overruns during production rollout, especially when enterprise-grade dApp development services are not aligned with existing infrastructure.

- Security and Risk Management

Security is not an optional line item in enterprise dApp initiatives. It is foundational to long-term viability. Enterprise dApp security includes:

- Secure contract design

- Internal code reviews

- External audits

- Ongoing monitoring

- Incident response planning

The cost impact rarely comes from audits themselves. It comes from the rework required when vulnerabilities are discovered late. Mature teams embed security into their development lifecycle from day one, which significantly reduces financial exposure and reputational risk.

- Compliance and Governance Requirements

Regulatory expectations vary by geography and industry, but enterprises must account for:

- Data privacy considerations

- Transaction traceability

- Governance controls

- Upgrade and kill switch mechanisms

Compliance work does not simply add effort. It shapes system design and operational workflows. When governance frameworks are ignored early, enterprises are forced into costly architectural changes later, which remains one of the most common causes of project escalation.

- Performance, Scalability, and Reliability Targets

Enterprise dApps are expected to meet production-grade performance standards from the outset. These include:

- High availability

- Predictable latency

- Fault tolerance

- Disaster recovery capabilities

These requirements directly influence infrastructure design, node management strategies, and monitoring systems. Teams that postpone scalability planning often face rising operational costs and service disruptions once adoption increases.

- Post-Launch Operations and Ownership

Many enterprises allocate budgets for development but underestimate the financial impact of sustained ownership. Ongoing cost drivers include:

- Monitoring and analytics

- Upgrades and governance changes

- Support SLAs

- Security patching

Without a structured post-launch strategy, operational expenses gradually increase over time. Enterprises that fail to plan for maintenance and lifecycle management experience cost creep long after initial deployment, which undermines projected ROI.

Understand Your Enterprise DApp Investment Before Making Final Decisions

The Hidden Cost Traps Enterprises Fall Into

Across enterprise blockchain initiatives, the same financial and operational mistakes appear repeatedly, especially when organizations choose a dApp development company based only on speed or pricing rather than architectural and governance maturity.

Trap 1: Skipping Structured Discovery

Rushing into development without proper discovery creates unclear scope and unrealistic expectations.

Trap 2: Treating MVPs Like Prototypes

Enterprise MVPs must follow production standards. Disposable MVPs increase technical debt and force costly rebuilds.

Trap 3: Delaying Security Decisions

Late audits expose design flaws that require major rework. Early security planning within professional dApp development services helps control risk and budget.

Trap 4: Vendor Lock In

Poor documentation and limited knowledge transfer create dependency, increasing operational cost and reducing flexibility.

How Leading Enterprises Reduce dApp Development Cost

Enterprises that control costs do not rely on shortcuts. They apply repeatable operating principles and work with a capable dApp development company that aligns technology decisions with business accountability.

| Strategic Focus Area | What Leading Enterprises Do | Why It Reduces Cost |

|---|---|---|

| Architecture Planning | Define system boundaries, modular contracts, and upgrade paths before development begins | Prevents redesign cycles and architectural rework |

| Execution Model | Break initiatives into gated phases with clear validation points | Limit overinvestment before assumptions are proven |

| Security Strategy | Integrate reviews and testing during design and early builds | Reduces late-stage remediation and audit friction |

| Engineering Efficiency | Use proven frameworks, middleware, and standardized integrations | Lowers the custom development effort during dApp development |

| Ownership Readiness | Maintain documentation, access controls, and governance workflows | Reduces dependency and support overhead through professional dApp development services |

Why does this approach work?

This model shifts cost control upstream. Instead of reacting to overruns, enterprises design predictability into execution. Each decision reduces uncertainty, improves accountability, and supports stable delivery as systems move toward production.

Final Thoughts: Cost Control Is a Leadership Decision

For enterprises, dApp development is a strategic infrastructure decision, not an experiment. Success depends on architectural clarity, disciplined execution, and experienced guidance. Organizations that partner with a trusted dApp development company avoid uncertainty by focusing on governance, security, and operational readiness across the development lifecycle. This approach delivers predictability and confidence as systems move into production.

Antier brings proven expertise in building secure, scalable decentralized platforms for enterprise use cases. Our dApp development services are designed to help organizations reduce risk, maintain control, and move forward with clarity. Book an Enterprise dApp Assessment!

Frequently Asked Questions

01. What are the main concerns enterprises have when considering dApp development?

Enterprises are primarily concerned about integration with existing systems, meeting security and compliance standards, managing costs, avoiding project delays, and minimizing dependency on external vendors.

02. Why are costs often misjudged in enterprise dApp development?

Costs are often misjudged because enterprises apply traditional software assumptions to dApp initiatives, overlooking unique factors like smart contract immutability, external security audits, and blockchain infrastructure dependencies.

03. What factors contribute to the true cost of enterprise dApp development?

The true cost is influenced by architectural discipline, risk management practices, operational maturity, and the need for professional development services that ensure transparency and sustainability throughout the project.

Crypto World

3 Top Cryptos to Hold for the Coming Market Rebound

The crypto market seeks sturdy projects for its next upswing. Shiba Inu (SHIB) and Solana (SOL) show recent strain but modest potential, but a new decentralized finance contender, Mutuum Finance (MUTM), presents a grounded alternative. With its ongoing presale already raising $20,400,000 and attracting 18,980 holders, MUTM offers tangible utility and a structured growth path. For instance, a $250 commitment at the current Phase 7 price of $0.04 could grow 25x within weeks based on its launch and post-listing trajectory, framing it as a calculated entry for the anticipated rebound.

Shiba Inu’s Uphill Struggle

Shiba Inu (SHIB) currently trades around $0.000006, reflecting a steep 60% decline from its 2021 peak. The token faces significant resistance levels, with analysts warning of a potential further 20% drop if key support fails. Its primary driver remains community sentiment and meme culture, lacking the foundational utility and revenue models that define sustainable DeFi projects. This reliance on hype over substantive mechanics makes it a speculative and riskier hold compared to protocols with clear economic functions.

Solana’s Technical Pressure

Solana (SOL) is experiencing pronounced bearish pressure, having broken below crucial support at $100 and $95. Recent data shows notable ETF outflows and large-scale sell-offs by major holders, contributing to a weak technical structure.

While its ecosystem possesses long-term innovation potential, the current convergence of leveraged shorting and whale distribution creates significant near-term headwinds. Investors seeking stability during a rebound may find its present volatility unappealing compared to projects in earlier, more predictable growth phases. Thus Solana is not a leader in the top cryptos to hold.

Mutuum Finance’s Structured Ascent

Mutuum Finance distinguishes itself with a real application as a live lending protocol on testnet. Its presale is a core feature, demonstrating impressive momentum. The project is currently in Phase 7, offering tokens at $0.04—a 300% increase from Phase 1. This phase is selling out rapidly, after which Phase 8 will begin at $0.045.

Buying now provides immediate gains after the planned $0.06 launch price. Furthermore, analysts project prices could reach $1 following exchange listings. This 25x forecast is supported by an in-demand presale, a live successful testnet launch showcasing how the protocol works. These aspects make MUTM a prime candidate for the next crypto to explode.

Dual-Model Lending for Real Yield

The protocol’s operational engine is its dual lending system, generating actual yield. The Peer-to-Contract (P2C) model lets users earn passive income by depositing assets like ETH into shared pools. For example, supplying 2 ETH could yield up to 10% APY annually, creating profit without selling the original asset.

Simultaneously, the Peer-to-Peer (P2P) market facilitates direct loans for niche tokens. Lenders and borrowers agree on loan terms without third-party involvement, which could mean an even higher yield, e.g. 15% APY on an asset. This dual approach ensures the platform serves a wide range of assets and risk appetites, creating multiple demand streams for the MUTM token within its economy.

Revenue Sharing and Incentive Alignment

Another of MUTM’s key pillars is the buy-and-redistribute mechanism, which directly ties user profit to protocol success. A portion of all platform fees automatically purchases MUTM from the open market, distributing these tokens to users who stake their mtTokens in the protocol’s safety module.

This creates a powerful feedback loop: as platform usage grows, fee revenue increases, leading to larger MUTM buybacks and greater rewards for stakers. It transforms every participant into a long-term stakeholder, with the potential for regular dividend-like rewards alongside asset appreciation making MUTM likely the next crypto to explode.

A Foundation for Sustained Growth

Mutuum Finance is built for longevity. Its code has been audited by Halborn Security, a critical step that mitigates risk and builds trust, and a stark contrast to projects launched without such scrutiny. The fixed total supply of 4 billion tokens, with 45% allocated to the presale, means no future inflation will dilute holder value.

Combined with active community initiatives like the $100,000 giveaway and a daily $500 MUTM leaderboard bonus, the project fosters both security and vibrant participation. For investors, this combination of defensive traits and aggressive growth incentives makes MUTM a standout candidate for capitalizing on the next market cycle.

Mutuum Finance merges an immediate presale opportunity with long-term protocol economics. While other assets grapple with volatility and speculative pressure, MUTM offers a clear path grounded in utility and shared success. Investors positioning for the rebound will find its blend of early access, yield generation, and structured tokenomics compelling.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Wintermute warns AI-fueled liquidity drain is suffocating Bitcoin

Wintermute says AI stocks are siphoning liquidity from crypto, leaving Bitcoin stuck in high‑volatility, low‑spot demand price discovery as U.S. selling and ETF outflows bite.

Summary

- Wintermute flags a rotation into AI assets, with U.S. counterparties and ETF redemptions driving persistent structural Bitcoin selling.

- Thin spot volumes and elevated leverage leave BTC in “surrender‑style” swings, with $60,000 acting as key downside liquidity in recent price action.

- A real recovery needs spot demand, a positive Coinbase premium, and stabilizing ETF flows as BTC trades near $68,700 and AI‑linked tokens show mixed momentum.

Bitcoin’s latest lurch lower is no mystery: liquidity is bleeding into the AI trade, and the crypto market is being left to dance on thinning ice.

Macro rotation and Wintermute’s warning

Market maker Wintermute notes that Bitcoin “briefly fell to $60,000 last Monday, erasing all gains since Trump’s election,” as spot flows reveal “significant structural pressure.” The firm highlights that the “Coinbase premium has consistently been in a discount state… since last December, indicating ongoing selling pressure from the U.S.,” while internal OTC data shows “U.S. counterparties were the main sellers throughout the week,” a trend “amplified by continuous ETF fund redemptions.”

Wintermute argues that “over the past few months, AI‑related assets have been continuously absorbing available market funds, crowding out the allocation space for other asset classes,” with crypto underperformance largely explained by “the rotation of funds towards the AI sector.”

High‑volatility price discovery

Last week’s action resembled a “surrender‑style clearing, with volatility soaring and buying support emerging at $60,000,” Wintermute observes, adding that “in an environment where spot trading remains relatively low, leverage has become the dominant factor in price fluctuations.” Without a rebound in open interest, “it will be difficult for the market to form sustained follow‑through on either the long or short side.”

A “true structural recovery” now hinges on “a return of spot demand,” a positive Coinbase premium, reversing ETF flows, and stabilizing basis, the firm says. Until then, Bitcoin is “entering a phase of high volatility and choppy price discovery,” with direction “increasingly dominated by institutional fund flows from ETFs and derivatives channels” as retail attention drifts elsewhere.

Related coverage on structural selling and ETF flows can be found via ChainCatcher’s analysis of Bitcoin slipping below key moving averages, BlackRock’s renewed transfers to Coinbase Prime, and Hyperscale Data’s growing BTC treasury holdings.

Spot benchmarks and AI‑crypto pulse

At the time of writing, Bitcoin trades near $68,700, down less than 1% over 24 hours, on roughly $46B in volume, while total market value hovers around $1.37T. Ethereum’s market cap stands near $242B, with about $28.6B changing hands in the last day.

Within AI‑linked crypto, the Artificial Superintelligence Alliance’s FET token changes hands around $0.16, on roughly $39M in 24‑hour volume. Render (RENDER) trades close to $1.31, with about $35.8M in daily turnover. Akash Network (AKT) is near $0.32, with a market cap just under $92M and 24‑hour volume around $2.8M. SingularityNET (AGIX) sits near $0.07, on modest volume of around $41K.

Wintermute’s bottom line is blunt: “For crypto assets to outperform again, AI trading needs to cool down first.” Until that rotation snaps back, Bitcoin’s next act will be written in volatility, not in trend.

Crypto World

Bybit becomes the title partner of Stockholm Open

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bybit EU has secured a three-year title partnership with the Stockholm Open, renaming the tournament the Bybit Stockholm Open from 2026 to 2028.

Bybit EU, the European arm of Bybit and a MiCAR-licensed crypto-asset service provider, is entering a three-year title partnership with the Stockholm Open that will see the tournament compete under the name Bybit Stockholm Open from 2026 through 2028.

The partnership marks a long-term commitment from Bybit EU and provides the historic tennis tournament with a stable partner to support its continued development for players and spectators. As part of the agreement, the tournament will reclaim its classic name, reinforcing its identity and long-standing ties to Stockholm and Swedish tennis.

Bybit views the Nordic region as a strategically important market and considers the Stockholm Open a strong platform for building a lasting presence. Gustav Buder, Regional Partner Nordics at Bybit EU, said the tournament’s strong history, high credibility, and audience that values quality and long-term commitment made it a natural fit. He noted that the partnership represents an important step in establishing trust and a durable presence in the Nordic market.

Since its start the Stockholm Open has served as a meeting point for sport, business, and the public, with a long tradition of collaboration with partners from the financial sector. The tournament attracts an audience with a strong interest in finance and business, aligning closely with Bybit EU’s profile.

The partnership will enable Bybit to engage its premium client base through the Bybit VIP program, offering select clients curated access to the tournament and bespoke experiences that bridge finance, sport, and long-term value creation.

Rasmus Hult, CEO of Bybit Stockholm Open, said the tournament has extensive experience working with financial partners and views Bybit as a strong, long-term partner that shares its ambition to continue developing the event. He added that jointly reclaiming the tournament’s classic name clearly reflects its home and heritage.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Will ETH & SOL bounce back?

Crypto markets are definitely under pressure. The year got off to a shaky start, and weakness has continued as traders remain cautious in a low-liquidity, macro-uncertain environment. That’s left Ethereum and Solana stuck in corrective moves for now.

Let’s take a closer look at ETH and SOL, analyzing recent price moves and network fundamentals to gauge their near-term price predictions.

Summary

- Crypto markets remain volatile and risk-off as of February 10, 2026, with large-cap coins like Ethereum and Solana trading below last year’s highs.

- ETH is around $2,016, showing short-term bearish momentum, with key support at $1,760 and resistance near $2,150–$2,500.

- SOL trades near $84 in a clear downtrend, with short-term support at $80–$90, major downside at $70–$65, and resistance at $100, keeping the SOL outlook cautious.

Current market scenario

As of February 10, crypto markets remain unsettled. Volatility is elevated, sentiment is fragile, and rallies are quickly met with selling pressure. Many large-cap coins are still trading below last year’s highs, highlighting a risk-off environment.

Altcoins have borne the brunt of selling, with investors either rotating into cash or waiting for confirmation of trends. Ethereum and Solana remain technically bearish for now, although network activity continues in the background.

Ethereum price prediction

Ethereum (ETH) is currently trading around $2,016, having failed to hold above the key $2,100 resistance zone. Year-over-year, ETH is down roughly 20–25%, showing the ongoing pressure on large-cap altcoins. Short-term momentum hasn’t helped either, with the ETH price falling 0.9% in the last 24 hours and 11.6% over the past week.

Technically, the short-term trend is still bearish. On Sunday, a bearish pin bar showed up just under $2,100, meaning sellers are in control there. If price can’t get past this level, the next downside target is around $1,760, which acted as support the last time price dipped this low.

From a fundamentals perspective, things are still solid for Ethereum. Developers are busy, users are active, and Layer-2 adoption keeps expanding. These network improvements ease congestion and boost throughput, even if the ETH price doesn’t show it yet. They remain a key part of the longer-term ETH forecast.

If buyers step in and push Ethereum over $2,150 for a daily close, the bearish trend would start to fade. After that, a move toward $2,500 looks more likely.

Solana price prediction

Solana (SOL) is currently trading near $84. While the SOL price is up 0.5% on the day, the bigger picture remains ugly, with the token down nearly 18.4% over the past week.

From a technical standpoint, Solana is still in a clear downtrend. Price recently dropped below a descending channel and is now holding in the $80–$90 zone as short-term support. Trend-wise, nothing much has changed— lower highs and lower lows remain dominant.

If this support breaks, the next downside area to watch is $70–$65, which marks the last strong demand zone before liquidity dries up. On the flip side, $100 is the key resistance bulls need to reclaim to shift sentiment.

For now, the SOL outlook remains cautious, at least until we see buyers show real strength.

Final thoughts

Right now, Ethereum and Solana aren’t having an easy time. Bears are in control in the short term, but Ethereum’s bigger picture is still intact. Until the price can get back above key resistance levels, rallies are likely to be shaky. Patience and waiting for confirmation will be important for anyone following ETH or SOL.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Bitcoin’s sharp correction at the start of the month may represent a critical “halfway point” in the current bear market, according to Kaiko Research.

Bitcoin (BTC) fell to $59,930 on Friday, marking its lowest level since October 2024, before the re-election of US President Donald Trump, according to TradingView data.

The decline suggests the market has moved out of the euphoric post-halving phase and into what Kaiko described as a historically typical bear market period that lasts about 12 months before a new accumulation phase begins.

In a research note shared with Cointelegraph on Monday, Kaiko said Bitcoin’s 32% crash was the most significant correction since the 2024 Bitcoin halving and may mark the “halfway point” of the current bear market.

“Analysis of on-chain metrics and comparative performance across tokens reveals a market approaching critical technical support levels that will determine whether the four-year cycle framework remains intact,” Kaiko said.

Related: Trend Research cuts ETH exposure by over 400K as liquidation risk rises

Kaiko’s report highlighted several emerging onchain bear market signals, including a 30% drop in aggregate spot crypto trading volume across the 10 leading centralized exchanges, from around $1 trillion in October 2025 down to $700 billion in November.

At the same time, combined Bitcoin and Ether (ETH) futures open interest declined from $29 billion to $25 billion over the past week, a 14% reduction that Kaiko said reflects ongoing deleveraging.

While Bitcoin has realigned with the historical four-year halving cycle since the beginning of the year, determining the depth of the current bear market is complex, as “many catalysts that fueled BTC’s rally to $126,000 are still in effect,” said Shawn Young, chief analyst, MEXC Research.

“With oversold indicators emerging on multiple timeframes, the rebound conversation around BTC is more a question of when, not if,” Young said, adding that Bitcoin may be entering a new cycle that will only become clear over the next year.

Related: Binance adds $300M in Bitcoin to SAFU reserve during market dip

Is $60,000 the bear market bottom?

The key question for investors is whether the dip to $60,000 represents the low of the current bear market. The level roughly aligns with Bitcoin’s 200-week moving average, which has historically acted as long-term support.

Still, more market volatility is expected in the absence of crypto-specific market catalysts, Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph, adding:

“With that said, it is still very hard to say if it means we are going back to the conventional 4-year cycle. I have seen many prominent figures in the space air the idea, but equally many who do not think so.”

However, Kaiko pointed to a 52% retracement from Bitcoin’s previous all-time high being “unusually shallow” compared to previous bear market cycles.

A 60% to 68% retracement would “align more closely” with historical drawdowns, which implies a Bitcoin cycle bottom around $40,000 to $50,000, Kaiko said.

Still, some market participants argue that $60,000 already marked a local bottom. Analyst and MN Capital founder Michaël van de Poppe called the crash to $60,000 the local market bottom for Bitcoin’s price, citing a record low in investor sentiment and a critical low in the relative strength index, which sank to values last seen in 2018 and 2020.

Crypto World

Ripple (XRP) News Today: February 10th

Here’s everything most interesting related to Ripple and its ecosystem.

Ripple remains among the most discussed topics in the crypto space due to constant news and developments across its ecosystem.

Meanwhile, the company’s cross-border token partially recovered from the February 6th crash, which sent shockwaves through the broader crypto market.

Partnerships and More

Due to regulatory uncertainty in its home country, primarily driven by the already resolved legal case between Ripple and the SEC, the company was mainly focused on global expansion over the past few years. The United Arab Emirates (UAE) has been a key area, and in 2025, the firm teamed up with the local bank Zand.

Just hours ago, Reece Merrick (Managing Director, Middle East and Africa at Ripple) revealed that the partnership has been extended “to explore a range of initiatives.” Some of the goals include supporting Ripple’s RLUSD stablecoin within Zand’s regulated digital asset custody.

The firm has also expanded its footprint in other Middle Eastern markets in recent months, with notable progress in Bahrain and Saudi Arabia.

Besides its advancement in the region, Ripple made headlines for another reason. Some members of the XRP Army disclosed that the entity has entered the prestigious list of the top 10 most valuable private companies across the world. Data shows that it has a valuation of $40 billion and ranks in the 10th spot. Some of those ahead include Revolut, xAI, SpaceX, and OpenAI.

The Big Event

Ripple’s XRP Community Day (a global event dedicated to the entire ecosystem and its community of investors, backers, and developers) will kick off on February 11. There will be many sessions, and participants include high-ranking individuals from Bitwise, Grayscale, Gemini, and more.

You may also like:

The first “fireside chat” will feature Ripple’s CEO, Brad Garlinghouse, and the crypto podcaster Tony Edward. They are expected to delve into topics such as XRP’s growing usage, the macro shift in institutional adoption and acceptance of crypto, and other subjects.

The ETFs

2025 has been a milestone year for Ripple for many reasons. One of the key achievements is the launch of the first spot XRP ETF, which has 100% exposure to the asset.

Canary Capital was the pioneer in that field, introducing its product, XRPC, in mid-November. Shortly after, Bitwise, Franklin Templeton, 21Shares, and Grayscale followed suit.

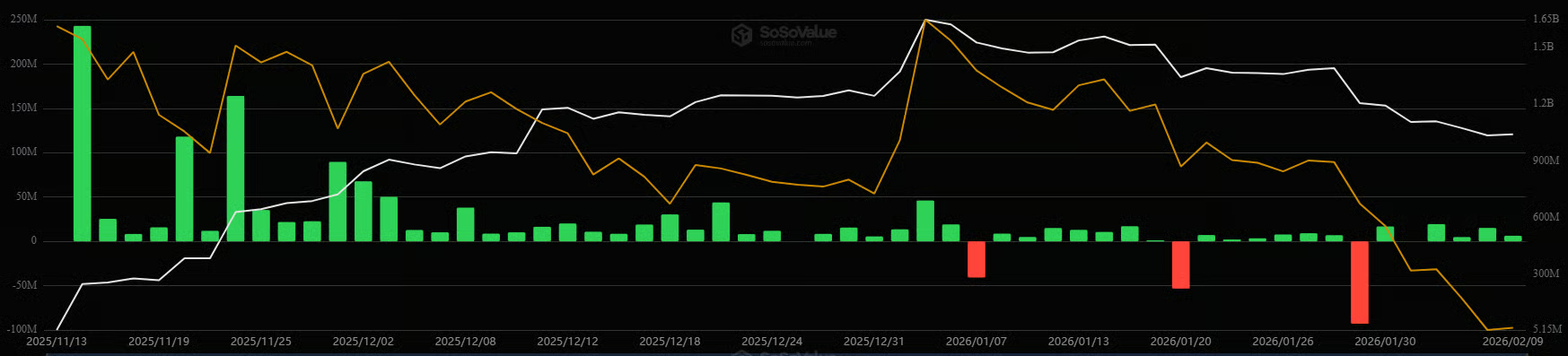

The investment vehicles have attracted significant interest, and cumulative net inflows have surpassed $1.23 billion. In the past several days (despite the market’s turbulence), the netflows remained positive. In fact, the last day with a red candle was January 29.

XRP Price Outlook

Ripple’s native cryptocurrency nosedived to as low as $1.11 last week amid heavy bleeding across the entire market. Over the following days, the bulls reclaimed some lost ground, and XRP currently trades at around $1.42, representing a 3% weekly gain.

Some analysts believe there might be a new correction in the near future. X user Robert Mercer envisioned a plunge to $1.10 “very soon,” whereas Crypto Seth claimed that losing the area at around $1.41 could result in a drop to $1.

Of course, optimists are not completely absent. X user EGRAG CRYPTO noted that a few years ago, XRP was worth only $0.30, and in 2025, it surged above $3. Based on that, they believe the price could skyrocket to $30 in the future.

Such a rally would require XPR’s market capitalization to explode above $1.8 trillion, which seems quite unrealistic (at least as of now).

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat19 hours ago

NewsBeat19 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World7 hours ago

Crypto World7 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Sports18 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World7 hours ago

Crypto World7 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout