Crypto World

RIVER coin price bounces back 27%: analysts fear it could be a dead bounce

- RIVER coin price has surged 27% on bridge launch and new exchange listing.

- The cryptocurrency’s volume has spiked 126%, confirming strong buyer interest.

- Key support lies at $15.40, and a break below risks causing a $14.09 pullback.

RIVER coin has surged 27.4% in the past 24 hours, reaching an intraday high of $17.94.

The sudden spike comes after a period of relative stagnation, sharply outperforming a broader flat crypto market.

Traders are cautiously optimistic, but some analysts warn this could be a short-lived recovery.

The catalysts behind the rally

The primary driver of the rally was the launch of RIVER’s official cross-chain bridge.

This bridge allows seamless asset transfers between Ethereum, Base, and BNB Chain.

By enabling smoother liquidity flows, it addresses a core challenge faced by many DeFi projects.

At the same time, RIVER went live on LBank, a major centralised exchange, sparking fresh market activity.

$RIVER spot trading is live on @LBank_Exchange pic.twitter.com/U7HCPJR2dG

— River (@RiverdotInc) February 9, 2026

The exchange listing was accompanied by a $50,000 trading competition, which boosted short-term trading volume.

Combined, these events enhanced the token’s utility and made it easier for investors to access RIVER.

Volume data confirms the strength of the move, with a 126% surge in 24-hour trading volume to $83 million.

This shows that the rally was driven by genuine buying interest rather than thin order books.

The token also benefited from positive sentiment in the broader DeFi sector, which continues to attract investor attention.

RIVER coin price outlook

Analysts are watching key price levels closely to gauge the sustainability of the bounce.

If RIVER can hold above $15.40, it could attempt to reach a near-term target of $20.65.

This would represent a continuation of the current bullish momentum and strengthen confidence in the token’s recovery.

However, a break below $14.09 could signal that the rally has lost steam.

In that case, the coin may experience a pullback toward $12.50, testing lower support levels.

Traders are advised to monitor volume and bridge adoption as indicators of whether the move has lasting strength.

The rally also coincides with broader infrastructure upgrades, which could attract long-term users.

The cross-chain bridge is designed to simplify liquidity access and reduce fragmentation across networks.

Sustained adoption of this feature will be critical for supporting higher prices in the coming months.

Despite these positive factors, some analysts caution that the rebound could be a “dead mouse bounce.”

They argue that while short-term catalysts are present, the coin is still trading far below its all-time high of $87.73 that it hit at the beginning of the year 2026.

Price action remains fragile, and a failure to maintain support levels could result in another rapid decline.

Investors are therefore advised to weigh the recent gains against the risk of a correction.

The combination of technical indicators, exchange activity, and sector momentum will likely determine the next phase.

For now, the market is watching closely to see whether RIVER can convert its recent spike into a sustainable uptrend.

Crypto World

HBAR $5 Million Short Positions Are At Risk: Here’s How

Hedera has remained under pressure after a sustained decline kept HBAR trapped within a month-long downtrend. Price has struggled to attract meaningful demand, leaving recovery attempts muted.

A breakout from this structure requires stronger investor support, which remains limited for now. This lack of conviction is giving derivatives traders time to position cautiously.

HBAR Traders Are Under Threat

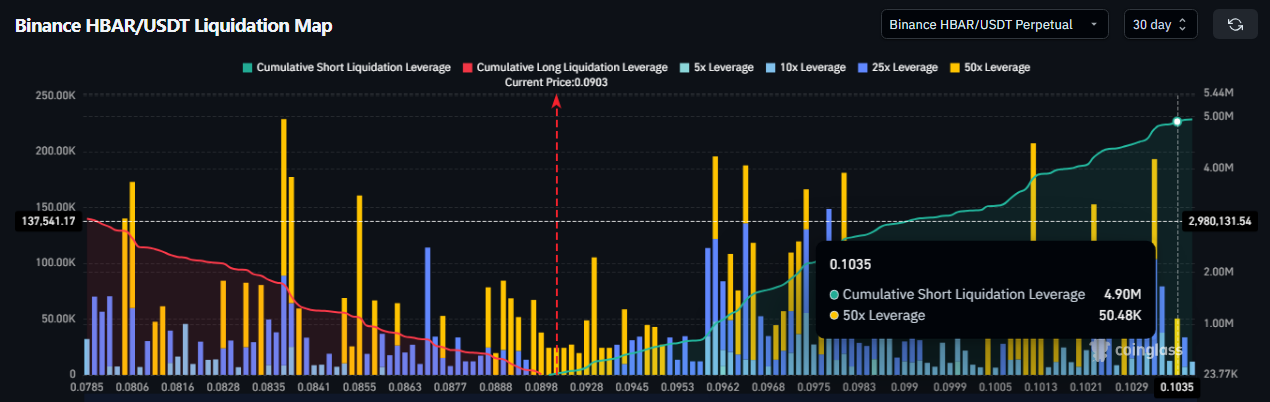

Futures positioning shows a clear bearish skew. The liquidation map indicates that short contracts carry greater exposure than longs across key price levels. This imbalance reflects traders’ expectations that HBAR may continue to face downside pressure before any durable recovery takes shape.

Sponsored

Sponsored

However, this setup creates a potential squeeze scenario. If HBAR escapes its downtrend and rallies toward the $0.1035 resistance, nearly $5 million in short positions could face liquidation. Such an event would force bearish traders to cover, potentially injecting sudden buying pressure and shifting short-term sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain momentum signals offer a mixed picture. The Chaikin Money Flow formed a bullish divergence against the price’s lower lows earlier this week. While price continued falling, CMF trended higher, suggesting selling pressure was easing rather than intensifying.

Despite this divergence, confirmation remains absent. CMF has yet to cross above the zero line, which would signal inflows dominating outflows. Capital continues leaving HBAR, albeit at a slower pace. Until this shift completes, the bullish signal remains tentative rather than decisive.

HBAR Price May Not See a Bounce Back Just Yet

HBAR is trading near $0.0903 at the time of writing. Price action at this level has not inspired confidence among investors. Weak participation continues to limit capital inflows, reinforcing bearish conviction among futures traders who see little reason to unwind positions prematurely.

The near-term outlook hinges on whether HBAR can break its downtrend. Continued consolidation above the $0.0901 support would reduce immediate downside risk. If inflows begin improving alongside price stability, HBAR could advance toward the $0.1030 resistance. Reaching this level would place short positions under pressure and potentially trigger liquidations.

Downside risk remains prominent if conditions deteriorate. A breakdown below the $0.0901 support would expose HBAR to further losses. Under that scenario, price could slide toward $0.0830. Continued weakness could extend declines to $0.0751, fully invalidating the bullish thesis and confirming continuation of the broader downtrend.

Crypto World

Why ZKP is the Best Crypto to Buy with 9,000% Potential, While Bitcoin Cash Price Stalls & Hyperliquid Price Dips

Global stock markets are tumbling, sparking massive sell-offs that have frozen the digital asset space near $2 trillion. As a result, older tokens are stalling; the Bitcoin Cash price is stuck below $850, while the Hyperliquid price has dropped 10% from its peak. This loss of steam brings up a vital point: does keeping sluggish assets with capped growth still justify your financial risk?

Searching for rapid gains, specialists now name ZKP crypto as the premier choice. Unlike dormant leaders, this Layer 1 presale employs a supply-squeeze mechanism that has already fueled a 2,100% climb since stage 1. Since the current $0.00012 cost is built to increase, experts forecast a massive 9,000% jump by Stage 17.

This proven growth path offers an uneven risk-reward ratio similar to early Ethereum profits. By providing planned growth rather than erratic swings, ZKP beats the rivals as the best crypto to buy for huge returns.

ZKP Crypto: A High-Speed Wealth Catalyst

ZKP crypto is moving fast through a high-demand presale as a private Layer 1 network. Unlike hype-based ideas, this chain debuts with $100 million in functional tech, establishing an instant lead. Therefore, this technical maturity turns the presale into a vital buying phase, putting early backers far ahead of the general public.

Because old markets are crowded and sluggish, they fail to produce high returns for newcomers. In contrast, ZKP provides a high-energy setting built for rapid growth, prompting top wealth experts to call it the best crypto to buy for bold expansion.

The system ignores fickle trends, using a firm auction model to drive value up through software. With the entry price at $0.00012, logic shows this rate is fleeting. As buying interest hits falling supply, the token’s worth must climb sharply.

Proof is clear; the shift from stage 1 to stage 2 sparked a documented 2,100% rally. Using these facts, estimates suggest a giant 9,000% gain by Stage 17, creating a scenario where a $100 buy could mimic early Ethereum wins.

In the end, this proven rarity makes the profit potential certain. Because the protocol mandates a shrinking supply, analysts agree that ZKP is the best crypto to buy to build lasting wealth.

Hyperliquid (HYPE) Price: Big Tech Joins the Chaos

Hyperliquid is growing its reach quickly, recently linking with Ripple Prime to offer over 300 corporate users direct market entry. This major win arrived with the “Outcomes” debut via the HIP-4 patch, a new tool adding safe betting markets to the hub. Thus, these moves sparked a big climb earlier this week, sending the Hyperliquid price toward $38 as it nearly beat Cardano in market rank.

Yet, the market is now bracing for a massive upcoming token release. Because roughly $287 million in coins will unlock on February 6, sellers have cashed out, causing a quick 10% dip. This “supply glut” has pushed the Hyperliquid price down to the $32 zone, leaving traders to see if new big-money backing can absorb the upcoming selling wave.

Successes & Obstacles for the Bitcoin Cash Price

Growth plans are picking up as the St. Kitts leaders debut a tax-free crypto hub for shops, boosting the chain’s daily use. At the same time, coders shared the final plans for the “Dragonfly” patch arriving in May 2026, which aims to make CashTokens much faster for DeFi. Still, despite these solid tech wins, market interest is low, leaving the Bitcoin Cash price fighting to cross the vital $850 wall.

The drive faces a sharp hurdle from big-money and tech pressures. Records show that fund inflows have stalled for two weeks as major wealth shifts elsewhere. Additionally, mid-tier miners are selling bags to pay for higher power costs, creating steady sell-side heat. Consequently, these trends have trapped the Bitcoin Cash price in a flat range between $815 and $842, showing a 1.5% dip as traders wait for a real spark.

The Bottom Line

The crypto world shows a split in momentum. The Bitcoin Cash price stays still despite tech updates, while the Hyperliquid price fights selling heat from new unlocks. Therefore, these crowded tokens lack the sharp growth needed for fast wallet building.

On the other hand, pros view the ZKP crypto presale as the smart move. Unlike coins moved by mood, ZKP uses a fixed math system. Experts stress that the $0.00012 buy-in is set to jump 9,000% by Stage 17, a claim backed by the proven 2,100% hike seen since stage 1.

Ultimately, this planned rise provides a rare win for small buyers. Because the system forces price growth, researchers confirm ZKP is the best crypto to buy for capturing huge market wins.

Explore ZKP:

Website: https://zkp.com/

Buy: buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Ethereum Classic (ETC) price struggles near $8 amid broader crypto weakness

- Ethereum Classic price hovered around 8.30 as Ethereum held the $2,000 level.

- The ETC coin has dropped more than 12% in the past week and could extend the decline.

- Analysts say Bitcoin remains bearish, and this could impact ETC price movement.

Ethereum Classic (ETC) traded in the red in early afternoon hours during the US session on Tuesday, February 10, 2026, down nearly 3% as top coins continued to struggle with bearish pressure.

With the price of Ethereum delicately poised near $2,000 and Bitcoin dropping to lows of $68,000, analysts at CryptoQuant say downside momentum could intensify.

Ethereum Classic, a proof-of-work cryptocurrency created after an Ethereum hardfork, changed hands around $8.30.

The technical picture suggests it could mirror potential broader market losses and touch new multi-year lows.

Ethereum Classic price today

The broad sell-off that hit altcoins on February 5, 2026, pushed Ethereum Classic down sharply to around $7.40.

Panic selling, driven by investors seeking to lock in profits amid heavy liquidations, deepened losses.

Many buyers who entered near the July 2025 highs of about $25 saw their positions turn into unrealised losses, most of which remain underwater at current levels.

Sentiment showed tentative improvement on February 10, when ETC climbed to intraday highs of $8.69.

The move was supported by a 5% rise in daily trading volume to around $64 million, pointing to the possibility of a short-term shift in momentum.

The rebound came as Ethereum posted modest declines but continued to hold above the $2,000 level on increasing volume.

CryptoQuant analysts on bear market

Analysts at CryptoQuant say the bear market is likely in its early stages and fresh losses for BTC and alts are possible.

According to an on-chain analyst at the firm, Bitcoin currently suffers from a lack of new capital injection, and that strengthens the prevailing bear conditions.

“New investor inflows have flipped negative. The sell-off is not being absorbed by fresh capital. In bull markets, drawdowns attract accelerating capital. In early bear markets, weakness triggers withdrawal,” the platform shared on X.

If downside pressure for Bitcoin cascades further into altcoins, ETH may retest recent lows below $1,800. ETC likewise could drop below the key support zone, with a sharper downturn.

ETC price forecast

Bulls need to defend the $8 level or engineer a quick rebound from support if selling pressure intensifies again, a move that could help limit further downside.

If this scenario unfolds, Ethereum Classic may begin to signal a potential trend reversal.

On the daily chart, the relative strength index has stabilised in oversold territory, pointing to the possibility of an upward shift in momentum.

Analysts note that signs of seller exhaustion and the emergence of a bullish divergence could increase the likelihood of a stronger recovery move.

The Moving Average Convergence Divergence (MACD) indicator is pointing to a potential bullish crossover, while improving on-chain accumulation metrics have added to tentative optimism.

However, the near-term technical outlook remains mixed and continues to lean toward downside risks, given persistent weakness across the broader market.

As noted by CryptoQuant, this pressure has remained in place as Bitcoin trades below $70,000 and Ethereum faces resistance near $2,000.

Against this backdrop, Ethereum Classic’s price action around the $8 level, closely linked to movements in ETH, is likely to determine its next major move.

On the downside, analysts point to primary support near $6.33 as a key level to watch.

Crypto World

Bitcoin Holds Near $69,000 as Near-Term Backdrop ‘Remains Fragile’

Most large-cap crypto assets are flat or slightly down today, while ETF flows turned positive.

Crypto markets slumped slightly on Tuesday morning, Feb. 10, with prices stabilizing among large-caps but conviction still thin as total market capitalization sank 2% to $2.43 trillion.

Bitcoin (BTC) is trading near $69,300 at press time, down about 1% over the past 24 hours, with weekly losses at 9%.

Ethereum (ETH) is holding out just above $2,000, slipping 3.3% on the day and down about 10% on the week. Price action across other large-cap altcoins were mixed, with most flat or slightly down today. Hyperliquid’s HYPE saw the biggest losses among the top-20 assets, down 7% on the day and over 15% on the week.

Groundwork for Stronger Returns

On-chain analytics firm Keyrock said in an update on Monday, Feb. 9, that investors remain cautious, with a liquidity-driven risk reset still underway and little sign the market is nearing a sustained recovery.

As speculative liquidity continues to retreat, crypto prices have become more sensitive to shifts in macro conditions and spot demand. And even though Bitcoin has stabilized above recent lows, the analysts say the broader backdrop remains fragile.

“While the near-term backdrop remains fragile, periods marked by pessimism, compressed liquidity, and elevated volatility have historically laid the groundwork for stronger long-term returns once expectations reset and macro clarity improves,” the Keyrock analysts said.

James Harris, chief executive of European crypto firm Tesseract Group, told The Defiant in commentary that macro conditions “are mixed but leaning supportive,” noting that the dollar has weakened over the past year and “rate markets are pricing cuts for later in 2026, though near term policy uncertainty remains.”

As for the on-chain perspective, Harris said exchange outflows and accumulation by larger holders “support the idea of inventory moving from weak hands to stronger hands.”

According to the Crypto Fear & Greed Index, investor sentiment still remains in the “extreme fear” zone, despite flatter markets.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Aster (ASTER) outperformed the broader market, jumping nearly 8%, while Quant (QNT) and MemeCore (M) rose about 5% and 3%, respectively.

On the downside, decentralized perpetual futures exchange MYX Finance (MYX) was today’s biggest loser, down 4.5%, followed by centralized exchange tokens KuCoin (KCS) and Bitget (BGB), also down about 4%.

As for liquidations, CoinGlass data shows that roughly $260 million in positions were liquidated over the past 24 hours. Bitcoin accounted for about $95.5 million in liquidations, followed by Ethereum at roughly $82.7 million.

ETFs and Macro Conditions

On Monday, Feb. 9, spot Bitcoin ETFs recorded $145 million in net inflows, lifting cumulative inflows to $54.83 billion, according to SoSoValue data. Total value traded reached $4.48 billion, with total net assets at $90.05 billion.

Spot Ethereum ETFs flows were also in the green with $57 million in net inflows yesterday, pushing cumulative inflows to $11.87 billion, despite recent price weakness.

In macro markets, fresh U.S. data reinforced concerns about slowing consumer momentum.

Retail sales were flat in December, missing expectations for a 0.4% increase, according to Commerce Department data published today. Annual retail sales growth slowed to 2.4%, down from 3.3% in November.

Crypto World

Bitmine Ignores $7.8B Paper Losses, Buys $83M Worth of ETH as Market Dips

Tom Lee’s BitMine added 40,000 ETH during the dip, brushing off $7.8 billion losses as Ethereum trades near lows.

BitMine, the Ethereum-focused treasury firm chaired by Fundstrat’s Tom Lee, bought roughly $83 million worth of ETH on Monday, with its existing holdings sitting deep in the red.

The purchases came during another volatile session for Ethereum, with on-chain data showing heavy selling from other large holders and ETH trading near multi-month lows.

BitMine Adds to ETH Stash While Others Exit

Data from the analytics platform Lookonchain, posted on February 10 and 11, shows Bitmine executed two large purchases of 20,000 ETH each from institutional platforms BitGo and FalconX.

Last week, the firm bought 40,613 ETH, and the week prior, it added 41,788 tokens. It now holds approximately 4.32 million ETH, acquired at an average cost of $3,850 per coin. However, at current levels around $2,040, Lookonchain estimates BitMine’s average entry price leaves its position down more than $7.8 billion on paper.

Despite that, Lee has publicly dismissed the recent sell-off as disconnected from Ethereum’s on-chain activity. In comments reported earlier this month, he said BitMine viewed the pullback as attractive, given his view of strengthening Ethereum fundamentals, such as record-high daily transactions. He attributed the price weakness to factors like a rally in gold and a lack of leverage rather than problems with the Ethereum network itself.

Lee also stressed that Bitmine has no debt obligations that would force it to sell any of its ETH, a position that is in contrast to other large players like Trend Research, which, according to Lookonchain, has sold nearly all of its Ethereum since early February, locking in losses of about $747 million after depositing more than 650,000 ETH to Binance during the drop.

Ethereum Price Struggles Amid Heavy On-Chain Movement

Looking at the market, ETH is down about 1% over the past 24 hours, and nearly 13% in the last seven days. The world’s second-largest cryptocurrency by market cap has also lost more than 34% of its value over the past month, according to CoinGecko data.

You may also like:

It fell below $2,000 on February 5 for the first time in months, but despite the volatility and evident selling from some large holders, other data points to a potential reduction in available sell pressure. For example, analyst CoinNiel recently reported that exchange reserves for ETH have dropped to multi-year lows, suggesting longer-term holders are moving assets off trading platforms.

The market now presents a clear divide: one side is cutting losses after a severe downturn, while the other, led by firms like Bitmine, is doubling down on a long-term conviction play, betting that current prices do not reflect the network’s underlying utility.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dow Jones Index gains steam ahead of key earnings, US inflation, and NFP data

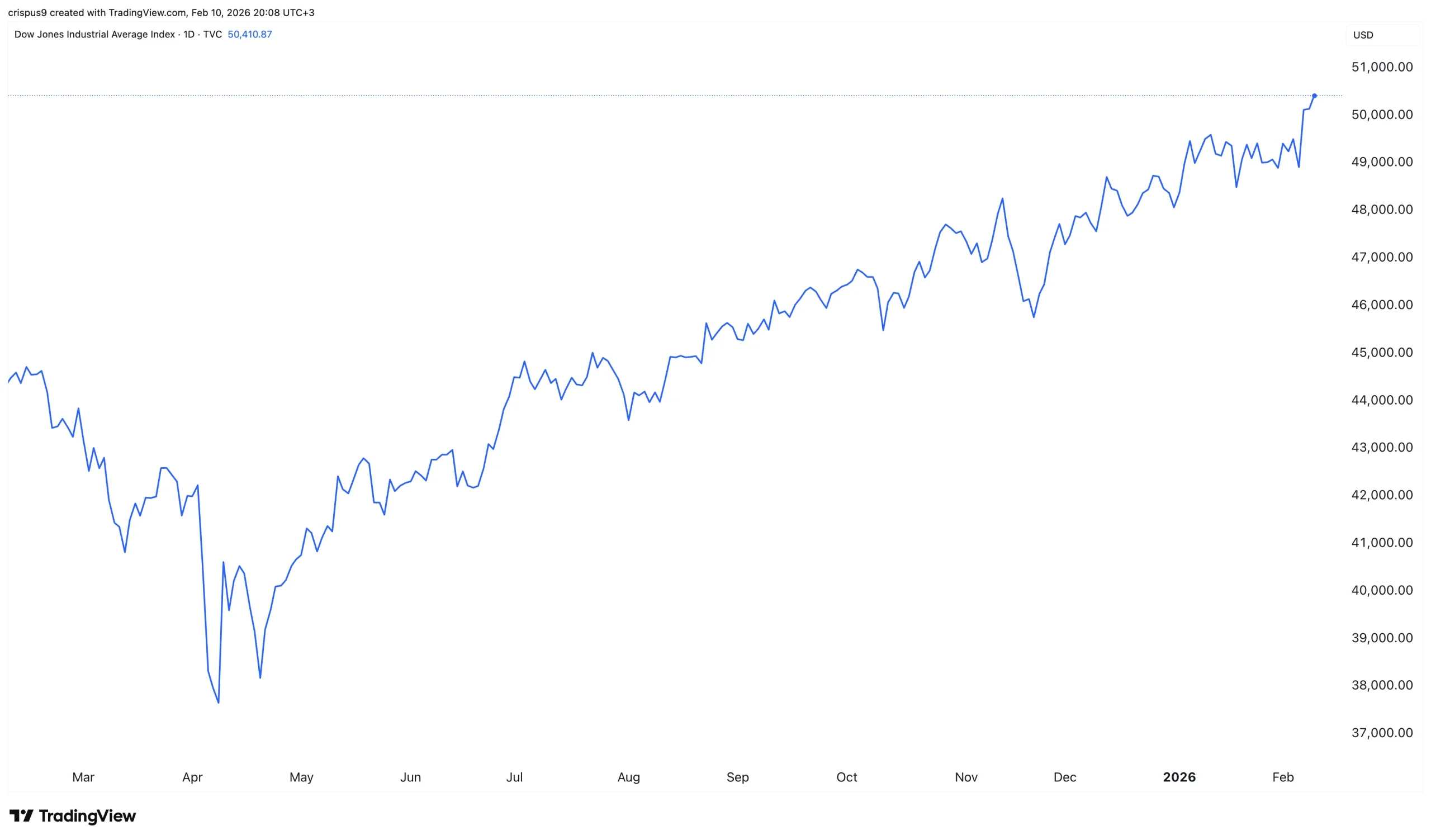

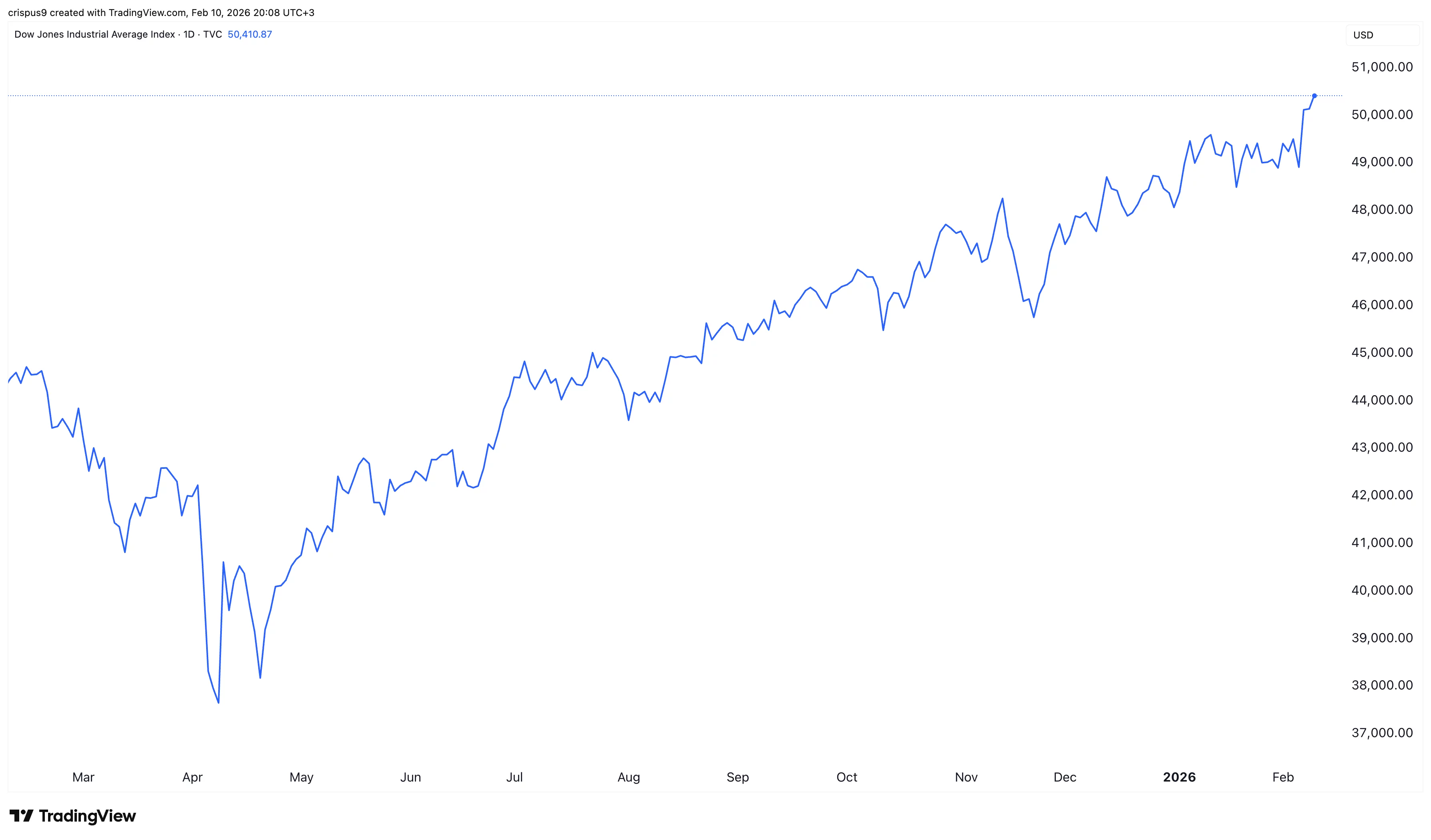

The Dow Jones Index continued its strong bull run, reaching a new all-time high on Tuesday, as investors waited for the upcoming corporate earnings and key macro data.

Summary

- The Dow Jones Index continued its strong bull run ahead of the upcoming earnings.

- It has jumped by 37% from its lowest level in April last year.

- The US will publish key macro data on Wednesday and Friday.

Dow Jones, which tracks 30 diverse companies, reached a record high of $50,520, three days after it crossed the important $50,000 milestone. Other blue-chip indices like the S&P 500 and the Nasdaq 100 continued their uptrend.

Dow Jones Index rallies

The Dow Jones has done well in the ongoing earnings season. Data compiled by FactSet show that most American companies have reported strong financial results, with 76% of S&P 500 companies reporting a positive surprise.

The blended earnings growth of all S&P 500 Index companies that have reported is 13%. If this is the final number, it will be the fifth consecutive quarter of double-digit growth.

Dom key companies in the Dow Jones will publish their numbers this week. The most notable ones will be Cisco and McDonald’s. Other notable companies to watch this week will be Applied Materials, Arista Networks, T-Mobile, Shopify, and Ford.

US stocks to react to key macro data

The Dow Jones Index will also react to upcoming U.S. macroeconomic data.

The first will be the delayed U.S. non-farm payrolls report, which comes out on Wednesday. Economists polled by Reuters expect the upcoming report to show that the economy created 70,000 jobs in January, higher than the 50k it created in December. The unemployment rate is expected to remain at 4.4%.

These numbers come as some major American companies have recently announced layoffs. Amazon is shedding over 16,000 layoffs on top of the 15,000 it announced last year.

Other top companies, including UPS, Dow Inc., Verizon, Citigroup, and Salesforce, have announced large layoffs. According to Challenger & Gray, companies announced over 108k layoffs.

The most important data will come out on Friday when the United States will publish the latest consumer inflation report. Economists expect the data to show that inflation softened a bit in January, with the headline CPI falling to 2.5%.

A lower inflation figure than expected will be highly bullish for the Dow Jones as it will lead to higher odds of Federal Reserve interest rate cuts this year.

Crypto World

No Systemic Failures, Rising On-Chain Assets

Chainlink’s Nazarov said real-world assets could surpass cryptocurrencies in total value.

Bitcoin and the rest of the cryptocurrencies can’t shake off the doldrums. Despite the ongoing weakness, this cycle has at least avoided major institutional failures that were seen in past bear markets.

And as investors weather the drawdowns, real-world assets (RWAs) are quietly expanding on-chain regardless of crypto prices.

RWAs Keep Moving On-Chain

In a recent post on X, Chainlink co-founder Sergey Nazarov highlighted that, unlike the previous cycle, which saw the collapse of FTX and multiple lenders during large price drops, this cycle has not produced large systemic risks. He said that crypto systems have managed price and liquidity drawdowns more effectively, thereby creating a more “reliable” environment for both retail and institutional capital.

Nazarov also said that the migration of real-world assets onto blockchains is accelerating independently of cryptocurrency prices. He pointed to ongoing RWA issuance and the growth of on-chain perpetual markets for traditional commodities such as silver, which are rivaling traditional markets, particularly during periods when permissioned trading becomes more restrictive or risky.

According to Nazarov, the growth of RWAs is driven by the value of 24/7/365 markets, on-chain collateral management, and access to reliable market data, rather than fluctuations in Bitcoin or other crypto assets.

He identified three trends expected to shape the next stage of crypto adoption. First, on-chain perpetual markets and tokenized real-world assets provide long-term, durable value. Second, institutional adoption is being driven by fundamental technological advantages, including permissionless, always-on DeFi markets. Third, infrastructure supporting RWAs is in increasing demand, as more complex assets require reliable systems for tokenization, data management, and market operation.

Nazarov added that if current trends continue, RWAs on-chain could surpass cryptocurrencies in total value, and potentially redefine the industry while continuing to support cryptocurrency growth by bringing more capital on-chain.

You may also like:

Developer Activity Across RWA Projects

Data shared by Santiment shows strong developer activity across RWA projects over the past 30 days. Hedera (HBAR) ranked first, followed by Chainlink (LINK) and Avalanche (AVAX). Stellar (XLM) and IOTA (IOTA) placed fourth and fifth. Chia Network (XCH), VeChain (VET), Lumerin (LMR), Creditcoin (CTC), and Injective (INJ) completed the top ten.

The rankings also revealed that RWA-focused blockchain projects continue to see steady development activity despite market turbulence.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why BlockDAG leads ahead of Bitcoin Cash, Hyperliquid, and Monero with 200x ROI potential

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Leading cryptos to buy now span BCH, XMR, HYPE, and BlockDAG as traders seek utility, growth potential, and strong momentum.

Summary

- Bitcoin Cash, Monero, and Hyperliquid show strong utility, but BlockDAG leads with speed, smart contracts, and early-sale upside.

- Fast payments, true privacy, and DeFi rewards highlight top contenders, yet BlockDAG’s tech and timing make it stand out today.

- As traders seek scalable, high-growth crypto, BlockDAG’s speed, smart features, and early access drive major attention.

The past year has shown that cryptocurrencies can be some of the most profitable assets in a portfolio, covering a wide range of niches, from payments and privacy to decentralized finance. But with thousands of tokens on the market, it can be overwhelming to figure out which ones are actually worth buying right now.

Traders are increasingly looking for projects that combine solid technology, growth potential, and strong market momentum. In this guide, we highlight some of the top candidates for the best crypto to buy today, including established coins like Bitcoin Cash (BCH) and Monero (XMR), the rising DeFi token Hyperliquid (HYPE), and the high-performance newcomer BlockDAG (BDAG).

Whether someone is a long-term investor or just starting out, understanding each project’s unique features can help them make smarter moves and seize opportunities before the wider market catches on.

1. BlockDAG: Final week to enter before exchange listings

BlockDAG isn’t just another crypto project; its network is powered by a unique DAG-based protocol capable of handling more than 10,000 transactions per second (TPS) at launch. Essentially, it combines speed and efficiency with smart contract functionality on a single platform. This means high-speed payments and automated contract operations can run side by side without slowing the network.

On top of its technical capabilities, BlockDAG is offering a final private sale before its February 16 exchange listings. Under this, tokens are priced at just $0.00025, with the entire purchase delivered to wallets on launch day, so there’s no vesting period to worry about.

Buyers can even start trading nine hours before public markets open, giving them a chance to position themselves before wider demand shapes the price. Plus, with the launch price set at $0.05, current buyers are looking at an instant 200× jump when the listings go live.

For anyone looking at both technology and timing, BlockDAG stands out. It’s quite rare for such a high-performance platform to allow traders to enter at a bargain this close to public trading. In short, it’s a mix of speed, smart tech, and a clear, last-chance entry that isn’t common in crypto launches, making BlockDAG the best crypto to buy today.

2. Bitcoin Cash: Fast, low-cost payments for everyone

Bitcoin Cash is a peer-to-peer digital currency designed for fast, low-cost transactions, making it a practical alternative to Bitcoin for everyday payments. Currently, BCH is facing resistance near $535, but if buyers push past this level, it could climb toward $562 and even $604, showing strong upside potential. The $497 level is a key support to watch, as holding above it signals that the market sentiment remains positive.

BCH’s advantage lies in its faster block times and lower fees, which are appealing for users tired of Bitcoin’s slower confirmations. With increasing merchant adoption and ongoing development upgrades, BCH could be an attractive option for investors looking for a crypto with real-world utility and solid growth prospects.

3. Hyperliquid: The high-risk, high-reward crypto

Hyperliquid is a relatively new and highly speculative token gaining attention for its strong community and innovative use cases in decentralized finance. It recently broke the $35.50 resistance, showing that buyers are interested in higher levels, but the market still faces selling pressure. If the price sustains above this level, it could surge toward $44, signaling a potential end to the corrective phase.

HYPE’s appeal lies in its fast-paced ecosystem and frequent opportunities for staking or liquidity provision, which can generate rewards for holders. For traders looking for a higher-risk, higher-reward asset, HYPE presents an exciting chance to enter before wider adoption. Watching the $28.79 support is crucial, as holding this floor could confirm bullish momentum.

4. Monero: Untraceable transactions, maximum security

Monero is a privacy-focused cryptocurrency that ensures transactions are completely untraceable, making it a favorite for users seeking financial confidentiality. Currently, XMR is finding support at $360, with potential resistance at $412 and $461.

If buyers can push above the 20-day EMA, Monero could rise toward $500, offering a strong upside opportunity. Its core value comes from advanced privacy features like ring signatures and stealth addresses, which make it unique among major cryptocurrencies.

Monero also benefits from growing interest in privacy coins amid increased regulation in mainstream finance. For investors seeking a coin with strong fundamentals and a clear niche in the market, XMR offers both technological innovation and the potential for significant gains.

Which is the best crypto to buy today?

All four projects highlighted here have unique strengths that make them worth considering. Bitcoin Cash stands out for fast, low-cost transactions and growing merchant adoption, while Monero offers unmatched privacy for those who value financial confidentiality. Hyperliquid is a speculative but exciting DeFi token, backed by a strong community and opportunities for staking rewards.

Yet among these options, BlockDAG clearly takes the lead as the best crypto to buy today. Its DAG-based protocol delivers blazing-fast transaction speeds and smart contract functionality on a single platform. Plus, with the ongoing private sale, buyers can secure early trading access and a potential 200× ROI!

For traders looking for a combination of cutting-edge technology, scalability, and perfect timing, BlockDAG offers a rare chance to get in early and capture massive gains. Savvy traders are already taking action, as the private sale wraps up in just seven days, which is when BDAG hits exchanges.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

JPMorgan cuts Coinbase (COIN) price target to $290 ahead of earnings

The crypto market downturn has been particularly hard on leading American exchange Coinbase (COIN), which has seen its stock plunge more than 50% since bitcoin’s early October record above $126,000, including a 27% decline in 2026 alone.

Attempting to catch up to that fast tumble, JPMorgan’s Ken Worthington slashed his price target on COIN to $290 from $399 ahead of the company’s fourth quarter earnings report coming after the close on Thursday.

Worthington remains a bull on the stock and his reduced target still suggests 75% upside from COIN’s current price of $1655.

Worthington projects adjusted EBITDA of $734 million, down from $801 million in the third quarter. That would mark a sharp drop from prior quarters, driven mainly by lower trading volumes, weaker crypto prices and slower growth in USDC stablecoin balances, he said.

Worthington estimates spot crypto trading volume of $263 billion for the quarter. He also pointed to lower USDC in circulation, modeling stablecoin-related revenue of $312 million. Those headwinds were partially offset by a full quarter of contributions from Deribit, the crypto derivatives exchange Coinbase acquired in August.

Including Deribit, JPMorgan models total transaction revenue of $1.06 billion, with Deribit contributing about $117 million on an estimated $586 billion in trading volume. In the previous quarter, the exchange reported $1 billion in transaction revenue.

On the subscription and services side, the bank expects revenue of $670 million, below Coinbase’s prior guidance range of $710 million to $790 million, reflecting softer crypto prices, lower staking yields and slower USDC growth. Worthington also expects operating expenses to come in below guidance as the company reins in costs.

Other sell-siders weigh in

Barclays analyst Benjamin Budish said his estimates sit roughly 10% below consensus on adjusted EBITDA, driven by weaker retail trading and blockchain rewards revenue. “We are notably lower on retail trading revenues, based on read-throughs from Robinhood, and blockchain rewards revenues,” Budish wrote, adding that consensus estimates may not yet fully reflect publicly available volume data.

Barclays estimates Coinbase exchange volume of about $261 billion in the quarter. He said Robinhood’s (HOOD) reported retail crypto volumes, which have historically tracked closely with Coinbase’s, fell about 15% quarter over quarter.

Compass Point struck a more bearish tone. Analyst Ed Engel said he is negative on the stock into earnings, expecting disappointment in the subscription and services segment. “While investors place a premium multiple on COIN’s S&S segment, we expect 4Q results to affirm overall revenue remains tied to overall crypto prices,” Engel wrote. He also expects January trading revenue to reflect what he described as Coinbase’s weakest retail engagement since the third quarter of 2024.

Beyond the headline numbers, investors are likely to focus on commentary on trading activity early in 2026, the sustainability of USDC-related income, and whether newer initiatives, such as Deribit and Coinbase’s futures business, can meaningfully offset swings in spot crypto markets.

Crypto World

What Are The Chances Of Ethereum Price Recovery To $2,500

Ethereum has shown early signs of recovery after a prolonged period of weakness that pushed prices sharply lower. ETH has attempted to stabilize near key support levels, but further upside depends on sustained backing from investors and broader market conditions.

At present, Ethereum appears to have at least one of these factors working in its favor, keeping recovery prospects alive.

Sponsored

Sponsored

Ethereum Investors Change Stance

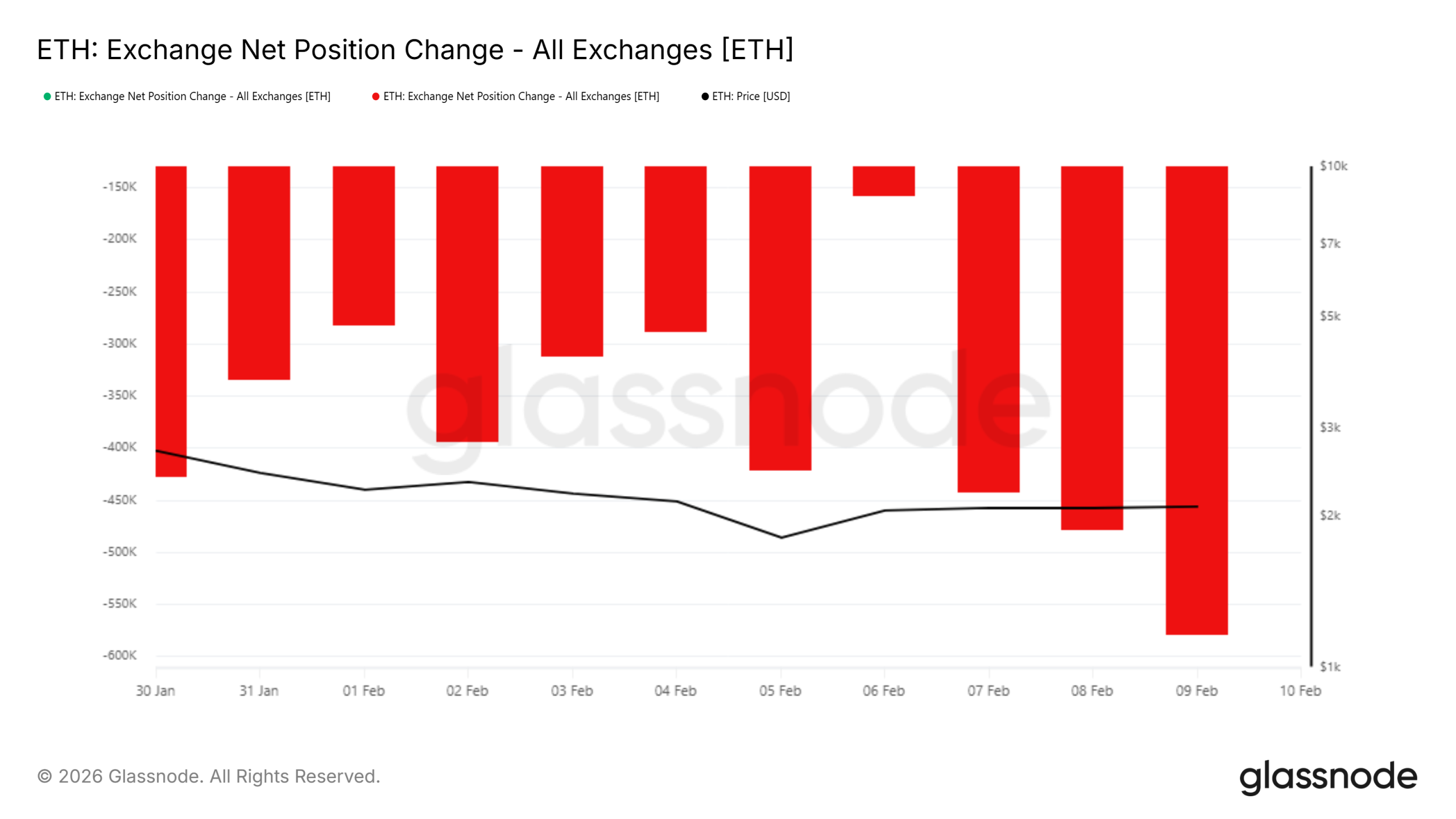

On-chain data suggests a notable shift in investor behavior. The exchange net position change indicator, which tracks capital flows into and out of exchanges, has turned negative for Ethereum. This signals that more ETH is leaving exchanges than entering them, a pattern typically associated with accumulation rather than distribution.

Such outflows suggest holders are choosing to buy and move ETH into private wallets instead of preparing to sell. Lower prices often encourage this behavior as investors position for potential rebounds. This shift in stance reflects improving confidence, even as the price has yet to fully reflect rising demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Broader momentum indicators support this narrative. The Chaikin Money Flow has shown a steady uptick over the past week, reinforcing the trend observed in exchange data. Rising CMF values indicate declining outflows and improving capital flow dynamics across Ethereum markets.

Sponsored

Sponsored

A move above the zero line would mark inflows overtaking outflows, a bullish development for ETH. At the same time, Ethereum has managed to hold above the 23.6% Fibonacci retracement near $2,054. Maintaining this level often acts as a trigger for renewed participation, encouraging investors to deploy capital as downside risk appears more contained.

What Is ETH Price’s Next Target?

Ethereum is trading near $2,018 at the time of writing, signaling that demand remains present beneath current prices. The challenge lies in translating that demand into sustained upward movement. A successful bounce from the $2,000 level could push ETH through $2,205, a key short-term resistance. Beyond that, the psychological target of $2,500 comes into focus.

Reaching $2,500 may not prove difficult from a structural standpoint. Cost basis distribution data shows relatively light accumulation around this zone, suggesting limited overhead supply. As a result, ETH could move through this range with less resistance once momentum builds. Stronger accumulation clusters appear closer to $2,800, which is likely to act as a more meaningful barrier.

Before that scenario plays out, Ethereum must clear intermediate hurdles. A decisive move above $2,344 would confirm recovery strength and validate the path toward $2,500 and potentially higher levels. Failure to sustain current support, however, would undermine the bullish setup. A loss of the $2,000 level would expose ETH to renewed downside risk, with $1,796 emerging as the next major support area.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat22 hours ago

NewsBeat22 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World10 hours ago

Crypto World10 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports21 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World10 hours ago

Crypto World10 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoDriving instructor urges all learners to do 1 check before entering roundabout