Entertainment

Ray J Calls Out Mario & Wale as 3rd Best Singer Behind Chris Brown & Usher

Ray J

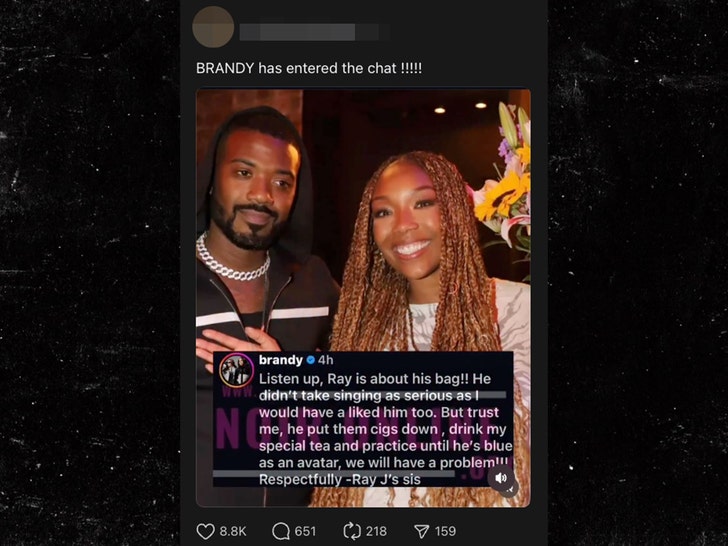

Brandy’s Gonna Be My Vocal Coach …

Mario & Wale Don’t Want These Problems!!!

Published

TMZ.com

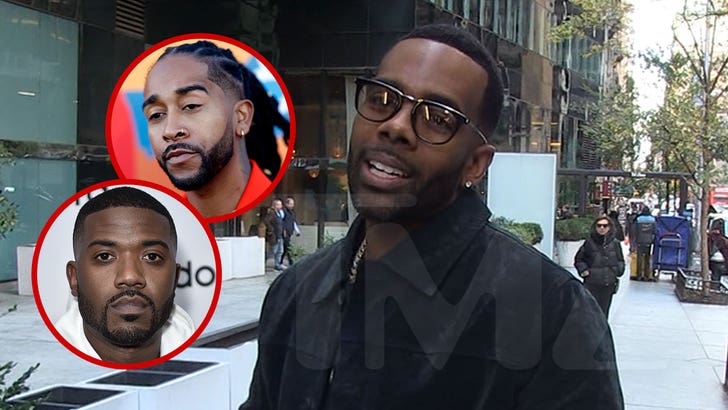

Ray J isn’t backing down from challenging Mario in a singing battle … despite his opp not taking the competition too seriously.

We caught up with Ray in NYC mid-morning Tuesday, where he was advocating for a TMZ After Dark and Brunch Tours in the Big Apple — a move which definitely has a nice ring to it.

TMZ.com

After all, Ray has become quite the Hollywood draw with our bus patrons, so an expansion may be on the horizon!!!

TMZ.com

Back to the matter at hand … Mario and Ray are currently in a volley of words about singing superiority, and Ray demands some respect be put on his name.

Waiting for your permission to load the Instagram Media.

Ray recently attempted to crash Wale‘s homecoming stage in Baltimore alongside Mario, only to be stiffed … so now he has smoke with the “Lotus Flower Bomb” rapper as well!

Like Mario, Ray’s also seen Brandy’s comments about him not taking his craft seriously, but tells us he’s turning over a new leaf — by getting her to retrain his vocal chords.

TMZ.com

Brandy’s currently on tour with Monica — and already has to approval of Mario, so Ray has to lock in or get passed by.

Ray J signs off swearing that the all-time male singer list goes Chris Brown, Usher, and then HIM … the HELL with Mt. Rushmore!!!