Crypto World

Bitmine Ignores $7.8B Paper Losses, Buys $83M Worth of ETH as Market Dips

Tom Lee’s BitMine added 40,000 ETH during the dip, brushing off $7.8 billion losses as Ethereum trades near lows.

BitMine, the Ethereum-focused treasury firm chaired by Fundstrat’s Tom Lee, bought roughly $83 million worth of ETH on Monday, with its existing holdings sitting deep in the red.

The purchases came during another volatile session for Ethereum, with on-chain data showing heavy selling from other large holders and ETH trading near multi-month lows.

BitMine Adds to ETH Stash While Others Exit

Data from the analytics platform Lookonchain, posted on February 10 and 11, shows Bitmine executed two large purchases of 20,000 ETH each from institutional platforms BitGo and FalconX.

Last week, the firm bought 40,613 ETH, and the week prior, it added 41,788 tokens. It now holds approximately 4.32 million ETH, acquired at an average cost of $3,850 per coin. However, at current levels around $2,040, Lookonchain estimates BitMine’s average entry price leaves its position down more than $7.8 billion on paper.

Despite that, Lee has publicly dismissed the recent sell-off as disconnected from Ethereum’s on-chain activity. In comments reported earlier this month, he said BitMine viewed the pullback as attractive, given his view of strengthening Ethereum fundamentals, such as record-high daily transactions. He attributed the price weakness to factors like a rally in gold and a lack of leverage rather than problems with the Ethereum network itself.

Lee also stressed that Bitmine has no debt obligations that would force it to sell any of its ETH, a position that is in contrast to other large players like Trend Research, which, according to Lookonchain, has sold nearly all of its Ethereum since early February, locking in losses of about $747 million after depositing more than 650,000 ETH to Binance during the drop.

Ethereum Price Struggles Amid Heavy On-Chain Movement

Looking at the market, ETH is down about 1% over the past 24 hours, and nearly 13% in the last seven days. The world’s second-largest cryptocurrency by market cap has also lost more than 34% of its value over the past month, according to CoinGecko data.

You may also like:

It fell below $2,000 on February 5 for the first time in months, but despite the volatility and evident selling from some large holders, other data points to a potential reduction in available sell pressure. For example, analyst CoinNiel recently reported that exchange reserves for ETH have dropped to multi-year lows, suggesting longer-term holders are moving assets off trading platforms.

The market now presents a clear divide: one side is cutting losses after a severe downturn, while the other, led by firms like Bitmine, is doubling down on a long-term conviction play, betting that current prices do not reflect the network’s underlying utility.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dogecoin, Shiba Inu slide as meme coins break key support

Dogecoin fell 4% and Shiba Inu dropped 2% on Tuesday, with both meme coins accelerating lower after breaking key support levels.

Summary

- Dogecoin broke below the $0.10 level, confirming bearish momentum with resistance at $0.105–$0.12.

- Support sits at $0.08, potentially falling to $0.07 if downward pressure continues.

- Shiba Inu trades near $0.00000552 with extreme selling pressure, a bearish Supertrend at $0.00000753, and broken support zones; token burns offer partial support, but recovery requires reclaiming $0.00000700.

DOGE broke below the $0.10 psychological level, signaling a significant technical failure. The Supertrend at $0.11958 confirms bearish momentum, while the Parabolic SAR at $0.10544 acts as resistance.

Selling pressure intensified as DOGE moved toward the lower boundary of its channel. Horizontal support sits around $0.08, but the steep decline suggests strong downward momentum.

Open interest decreased 1.02% to $962.62 million, and options volume plunged 48.58%, reflecting reduced trading activity.

The Binance long/short ratio of 2.1756 indicates many traders positioned for a bounce are now underwater. Recovery requires DOGE to reclaim $0.10 and break above the Supertrend at $0.12; otherwise, support at $0.08 and potentially $0.07 remains key.

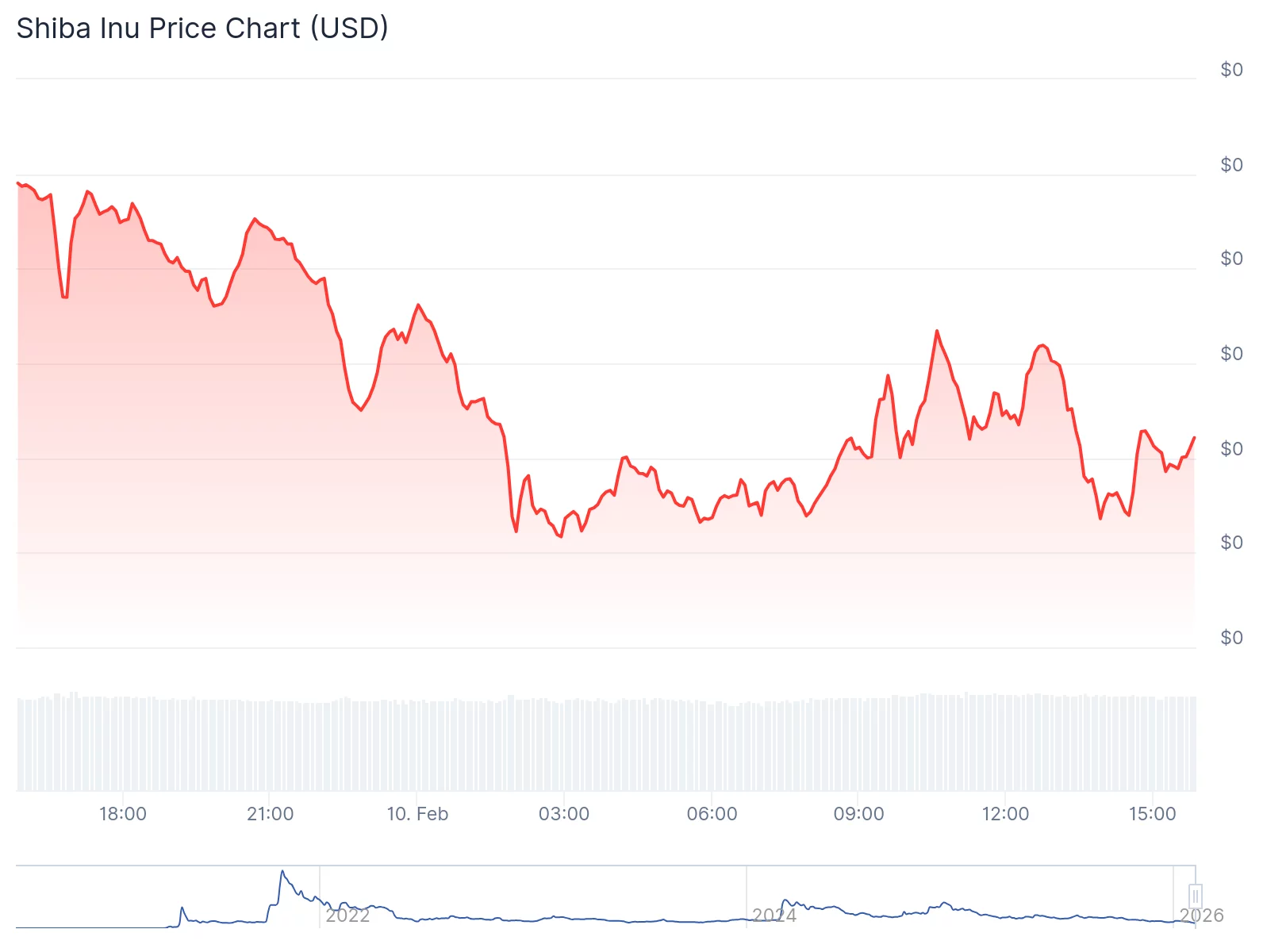

SHIB trades near the lower Bollinger Band at $0.00000552, showing extreme selling pressure. The Supertrend at $0.00000753 is bearish, and the upper Bollinger Band at $0.00000837 marks how far SHIB has fallen.

A descending trendline limits rallies, while previous support zones have been broken. Token burns rose 65.52% in 24 hours with 2.5 million SHIB removed, but 585.45 trillion remain in circulation, offering only partial long-term support.

Immediate support is $0.00000550-$0.00000600, with a potential drop to $0.00000500 if broken. Recovery needs SHIB to reclaim $0.00000700 and surpass the Supertrend.

Crypto World

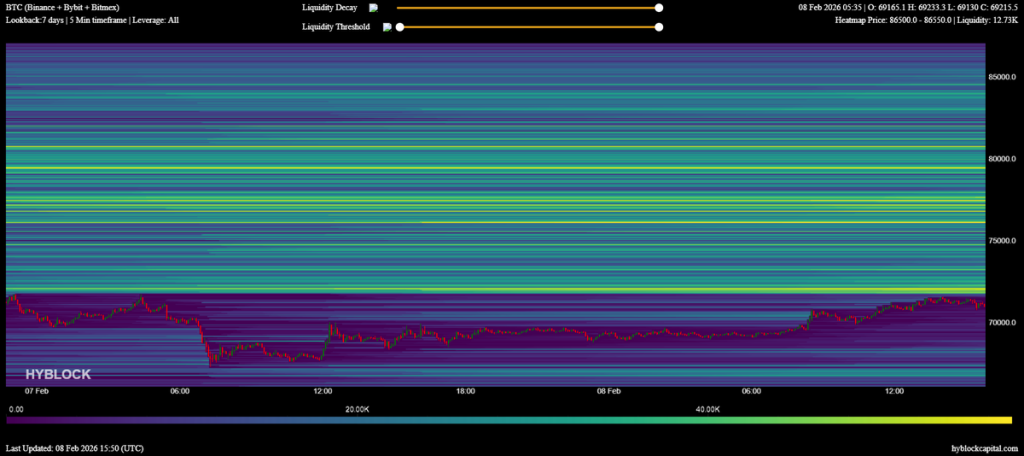

BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week

Bitcoin traders are glued to one price right now: $50,000.

After a brutal dip that saw prices flash below $60,000 for a hot minute, everyone’s wondering if we’ve finally hit rock bottom.

Yes, Bitcoin price bounced back above $70,000 temporarily, but here’s the thing, nobody’s really convinced this is “the bottom” just yet.

Key Takeaways

- Analysts warn the recent bounce to $71,000 may be a “bull trap” designed to liquidate shorts before a retest of $50,000 support.

- JPMorgan data indicates Bitcoin has traded below the estimated miner production cost of $87,000, a historical signal for capitulation.

- Technical patterns highlight critical support at $67,350, with a breakdown potentially opening the door to the $43,000 region.

Weekly Close Shows Fragility Despite $70K Rebound

Bitcoin found its way back to $71,000 as the week kicked off. However, most find this rally looking sketchy.

Sure, we saw a 7% bounce from last week’s $60,000 bloodbath, but there’s basically no volatility around the weekly close. And when things look too calm after a crash, traders get suspicious.

Trader CrypNuevo said on X: this whole move up looks like a calculated play to hunt down short positions stacked between $72,000 and $77,000.

If this “recovery” turns out to be fake, bears have one target in their crosshairs: $50,000.

Miner Costs and Stablecoin Flows Signal Caution

Here’s a number that should make you nervous: $67,000. That’s what it costs miners to produce one Bitcoin.

BTC might be trading below that soon. Historically, the miner production cost acts like a safety net, prices usually don’t stay below it for long.

if this continues, miners start going broke. And when miners capitulate? They dump their Bitcoin to stay alive, which creates even more sell pressure. It’s a vicious cycle.

While the fundamentals look grim, there’s a massive pile of cash sitting on the sidelines. Stablecoin inflows just doubled to $98 billion.

They’re ready to buy… they’re just waiting for the right moment.

Next Steps: Bitcoin Price Technical Levels to Watch

Traders are staring down at an interesting moment as inflation data drops this week. Right now, all eyes are on $67,350, that’s the support level holding this whole thing together.

If Bitcoin breaks below that? We’re looking at bearish flag patterns that could drag prices down to $50,000. Yeah, a potential 30%+ dive.

There’s a bullish scenario too. The magic number is $74,434. If BTC can reclaim and hold above that level, it kills the bearish setup and potentially opens the door back to $80,000.

The post BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week appeared first on Cryptonews.

Crypto World

Bitcoin in Focus as State Street Warns Dollar Could Fall 10% on Fed Cuts

Strategists at State Street, one of the world’s largest asset managers, say the US dollar’s worst run in nearly a decade could deepen if the Federal Reserve eases policy more aggressively than markets expect, which is a distinct possibility following a possible leadership change at the central bank.

Speaking at a conference in Miami, State Street strategist Lee Ferridge said the dollar could decline by as much as 10% this year if financial conditions loosen further. While he described two rate cuts as a “reasonable base case,” he warned that the risks are skewed toward more reductions. “Three is possible,” Ferridge said.

Lower US interest rates tend to reduce the appeal of dollar-denominated assets, especially for foreign investors. As rate differentials narrow, overseas investors are more likely to increase currency hedging, which involves selling dollars to protect returns. That added hedging demand can amplify downward pressure on the currency.

Dollar weakness could also be tied to Kevin Warsh, US President Donald Trump’s pick to succeed Jerome Powell as Fed chair. If confirmed, Warsh is widely expected to favor a more aggressive pace of rate cuts.

With the central bank’s current target rate range of 3.50%-3.75%, markets are currently aligned with the more cautious scenario. According to CME Group’s FedWatch Tool, investors are pricing in two rate cuts this year, with the first likely coming in June. Two policy meetings are scheduled before then.

Related: Bitcoin is trading like a growth asset, not digital gold: Grayscale

Weak dollar seen as catalyst for Bitcoin

A weaker US dollar has often coincided with stronger demand for risk assets, including Bitcoin (BTC) and other digital assets. Analysts frequently point to an inverse relationship between the US Dollar Index and Bitcoin, where periods of dollar softness tend to create a more favorable backdrop for crypto prices.

A falling dollar can ease financial conditions, boost global liquidity and push investors toward assets seen as alternatives to fiat currencies. That dynamic has helped support Bitcoin during several past dollar downturns.

Still, the relationship is far from automatic. Recent analysis suggests Bitcoin’s short-term performance has not consistently tracked dollar weakness, and in some periods, prices have even fallen alongside declines in the greenback.

Profit-taking, investor positioning, broader risk sentiment and uncertainty around monetary policy can all dampen the impact of currency moves.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Crypto World

Solana price eyes $57 fibonacci extension, bullish volume fades

Solana price remains under corrective pressure as fading bullish volume and unresolved liquidity below price open the door for a move toward the $57 Fibonacci extension.

Summary

- $170 support flipped to resistance, confirming bearish market structure

- Low-volume bounces signal weak demand, increasing downside risk

- $57 Fibonacci extension is critical, acting as a potential capitulation and reversal zone

Solana (SOL) price action continues to trade within a broader corrective phase after losing key structural support earlier in the cycle. While short-term bounces have emerged, the lack of strong bullish participation suggests these moves may be temporary rather than trend-defining.

As Solana struggles to reclaim former support that has now become resistance, technical conditions are aligning for a deeper downside move before any meaningful reversal can occur.

With volume declining and liquidity building below current price levels, attention is now shifting toward a key high-timeframe Fibonacci extension zone near $57, a level that may act as a pivotal inflection point for Solana’s next major move.

Solana price key technical points

- Former support at $170 has flipped into resistance, confirming bearish structure

- Bullish bounces are occurring on low volume, signaling weak demand

- $57 Fibonacci extension stands out as a macro reversal zone, with strong confluence

The current corrective move accelerated after Solana decisively broke below the $170 level, which had previously acted as a major area of support. Once this level was lost, price quickly transitioned into resistance, reinforcing the bearish shift in market structure. Multiple attempts to reclaim this zone have failed, confirming that sellers remain in control.

Following the breakdown, Solana experienced a sharp downside expansion into the high-timeframe support region near $157. This move reflected capitulation-style selling, though price has so far failed to officially retest the exact support level, instead printing a higher low just above it. While this may appear constructive at first glance, the broader context suggests unfinished business remains below the current price.

Low-volume bounce raises downside risk

One of the most notable aspects of Solana’s recent price behavior is the lack of bullish volume accompanying the bounce from the $157 region. In healthy reversals, price rebounds are typically supported by expanding volume, signaling strong buyer conviction. In this case, however, volume has remained subdued, indicating that the bounce may be driven more by short covering than genuine accumulation.

This type of low-volume recovery often leaves price vulnerable to further downside, particularly when liquidity remains concentrated below recent lows. As a result, the probability increases that Solana may revisit the lower support zone to fully clear remaining sell-side liquidity.

$57 fibonacci extension comes into focus

From a Fibonacci and market structure perspective, the 0.618 extension near $57 represents a critical macro level. This zone aligns with multiple technical factors, including historical demand areas and structural liquidity pockets, making it a high-probability target if the current corrective phase continues.

Such extension levels often act as magnets for price during strong corrective moves, particularly when broader sentiment remains cautious and volume fails to confirm reversals. A move toward $57 would likely coincide with heightened volatility and emotional selling, conditions that frequently precede meaningful market bottoms.

Importantly, a test of this level would not necessarily signal further breakdown. Instead, it may represent the final leg of the corrective structure, setting the stage for a potential macro reversal if buyers step in decisively.

Conditions for a bullish reversal

If Solana does trade into the $57 Fibonacci extension zone, the quality of the reaction will be crucial. A strong defense of the high timeframe support, combined with expanding volume and clear bullish rejection signals, would increase the probability of a sustainable reversal.

Should such a reversal occur, Solana could begin a rotational move back toward higher resistance levels, with the $170 region once again coming into focus. This would effectively keep the broader trading range intact, transforming the recent decline into a completed corrective cycle rather than the start of a prolonged downtrend.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana remains vulnerable to further downside as long as bullish volume continues to fade. The $57 Fibonacci extension is the most important downside target and potential reversal zone.

Until that area is tested or convincingly invalidated, traders should remain cautious of short-term rallies. Volatility is likely to remain elevated, with price action driven by liquidity dynamics rather than sustained trend shifts. How Solana reacts near $57 may ultimately determine whether the market is preparing for a deeper correction or laying the groundwork for its next major bullish phase.

Crypto World

Ripple Expands Digital Asset Custody with Key Partnerships and Innovations

Ripple, a leader in the digital asset space, has unveiled a series of strategic partnerships that are set to expand its custody offerings for institutional clients. This new development highlights Ripple’s focus on simplifying digital asset custody services for banks and financial institutions. The company has secured collaborations with Securosys and Figment, with the potential to revolutionize the digital asset landscape, particularly for institutional staking and security.

Ripple’s new partnerships with Securosys and Figment represent significant steps toward enhancing its custody services. The collaboration with Figment will enable banks and custodians to offer staking capabilities for leading proof-of-stake networks, including Ethereum and Solana. This integration allows institutions to provide staking rewards to clients while maintaining full control over the custody process.

The addition of Securosys brings a new level of security to Ripple Custody. By integrating Securosys’ CyberVault HSM and CloudHSM, Ripple can provide its clients with top-tier key management services. These high-security solutions eliminate the usual procurement delays and complexities, streamlining digital asset custody for financial institutions.

Ripple’s CEO, Reece Merrick, emphasized the vast potential of these partnerships. According to Merrick, the addition of staking services with Figment and enhanced security measures with Securosys will redefine the digital asset custody landscape for banks. He believes this will allow institutions to expand their offerings while adhering to the highest security and compliance standards.

Chainalysis Integration for Enhanced Compliance

Ripple has also integrated Chainalysis, a leading blockchain analysis platform, into its custody services. This collaboration ensures real-time transaction screening and policy enforcement for institutions using Ripple Custody. Chainalysis’s technology will allow Ripple Custody clients to monitor all transactions before assets leave their vaults.

This addition is vital in ensuring regulatory compliance for institutions dealing with digital assets. Ripple has embedded Chainalysis into its services to help prevent illicit activities such as money laundering and fraud. The integration aligns with Ripple’s mission to create a secure, compliant, and scalable platform for institutional digital asset management.

The integration of Chainalysis strengthens Ripple Custody’s position as a trustworthy and secure platform for institutional clients. Financial institutions will now have access to advanced tools for monitoring digital asset transactions, further reinforcing Ripple’s commitment to providing secure and compliant solutions.

Palisade Acquisition Adds Wallet-as-a-Service Capability

In addition to the partnerships with Securosys and Figment, Ripple has also acquired Palisade, a company specializing in wallet-as-a-service solutions. This acquisition introduces scalable wallet services with Multi-Party Computation (MPC) and multi-chain support. These capabilities are crucial for managing digital asset treasury functions, payments, and fintech integrations.

The addition of Palisade’s technology to Ripple Custody strengthens its multi-chain support, allowing institutions to manage assets across different blockchains. The wallet-as-a-service model enables financial institutions to securely manage digital assets without the need to develop their own infrastructure. This solution is ideal for organizations looking to streamline their digital asset operations.

Ripple’s acquisition of Palisade complements its broader strategy of enhancing the capabilities of its custody platform. The integration of wallet-as-a-service further positions Ripple as a leading provider of secure and scalable digital asset management solutions for institutions.

Ripple Partners with Zand to Strengthen Digital Asset Ecosystem

In a separate move, Ripple has partnered with Zand to advance the digital asset ecosystem. This collaboration aims to combine Ripple’s USD (RLUSD) stablecoin with Zand’s AED (AEDZ) stablecoin. The goal is to unlock new use cases for digital assets as traditional finance moves on-chain.

The partnership between Ripple and Zand represents a step forward in bridging the gap between traditional finance and the blockchain ecosystem. The integration of both stablecoins will provide businesses and financial institutions with more flexible solutions for cross-border payments and digital asset transfers. Ripple’s collaboration with Zand highlights its commitment to pushing the boundaries of digital finance.

This partnership comes at a time when the demand for digital asset solutions is growing. Ripple’s ability to innovate and build strategic partnerships enables it to stay ahead in the rapidly evolving blockchain space.

Ripple’s Vision for the Future of Custody and Compliance

Ripple’s advancements in custody and compliance are laying the foundation for the next wave of institutional digital asset adoption. By partnering with Securosys, Figment, and other strategic players, Ripple is positioning itself as a leader in the digital asset custody space. These collaborations pave the way for banks, custodians, and regulated enterprises to securely manage digital assets while complying with industry standards.

As Ripple continues to expand its partnerships and offerings, it is clear that the company’s vision for the future of digital asset custody is one of innovation, security, and compliance. Ripple’s ability to integrate cutting-edge technology with real-time transaction monitoring and multi-chain support will help redefine the digital asset landscape for institutions.

The future of Ripple Custody looks bright, with a strategic focus on simplifying the digital asset management process for financial institutions worldwide. Through its partnerships and acquisitions, Ripple is not only enhancing its services but also shaping the future of digital finance.

Crypto World

Sam Bankman-Fried files for new trial over FTX fraud charges

Sam Bankman-Fried, the former CEO of collapsed crypto exchange FTX, is seeking a new trial, according to a request filed in a New York federal court by his mother.

Since being convicted and imprisoned on a 25-year sentence, SBF has been continually challenging his situation in court. The latest motion for a new trial, first reported on Tuesday by Inner City Press, was filed by his mother, Barbara Fried, claiming new evidence in the case would justify a reset. The filing noted the initial absence of testimony from figures, including FTX’s Ryan Salame, who fought his own, separate legal battle.

The former FTX executive, Salame, was also convicted on federal charges but had claimed he made an arrangement to cooperate with prosecutors that should have protected his wife, Michelle Bond, from legal pursuit. She was later charged with allegedly taking illegal campaign contributions in her congressional bid.

SBF’s 35-page document arrived at the court as a pro se request, meaning the defendant is representing himself.

Earlier efforts by SBF to argue he didn’t get a fair initial trial — which came to a head in November — were met with some skepticism by appellate judges. SBF’s defense in seeking a retrial through appeal focused attention on the later solvency of FTX, and his account on the social media site X continues to make the argument that the company wasn’t bankrupt when it collapsed. However, judges contended in November that solvency didn’t seem to be the primary issue.

“Part of the government’s theory of the case is that the defendant misrepresented to investors that their money was safe, was not being used in the way that it was the government claims and the jury convicted it was, in fact, used,” said Circuit Judge Maria Araújo Kahn, referring to the misappropriation of customer money at the heart of his conviction.

Shutting down another potential path to freedom, President Donald Trump recently said he wouldn’t consider clemency for SBF. However, the former FTX CEO is still campaigning for himself via his account on X, arguing he’s a victim of former President Joe Biden’s “lawfare machine.”

Crypto World

Bitwise CIO cites ‘the four-year cycle’ for losses

A multibillion-dollar crypto asset manager cites several reasons for the bitcoin plunge, but he’s listing “the four-year cycle” as the No. 1 downward catalyst.

According to Matt Hougan, chief investment officer at Bitwise Asset Management, it’s a phenomenon that’s happened three other times in the crypto market.

“People are looking for one thing to blame for the current retracement in bitcoin. But there is not any one thing to blame,” he told “ETF Edge” on Monday.

Hougan contends investors have been favoring other hot investments including gold and artificial intelligence stocks over cryptocurrencies, too.

“There is some quantum risk. There is fear of [Fed nominee] Kevin Warsh,” he said. “In bear markets, all these things are amplified.”

When he was on “ETF Edge” last November, bitcoin had fallen below the $90,000 mark for the first time since April. Its record high of $126,279 was hit in October.

Crypto ETF disruption?

But bitcoin weakness shouldn’t ultimately disrupt the rise of exchange-traded funds specializing in crypto, according to Hougan — who thinks a “self-fulfilling prophecy” is dominating the crypto market right now.

“There is good news underneath the surface. It’s just slow to materialize. So, I don’t think this sort of financialization of bitcoin fundamentally changes the scarcity argument,” Hougan said. “It may change some intraday movements or short-term trading dynamics, but it doesn’t change the sort of fundamental fact there are only 21 million bitcoin. All that derivative demand has to pass through eventually to the spot market.”

His firm, which has more than $15 billion in assets under management, is heavily involved in crypto ETFs.

It launched the Bitwise Solana Staking ETF, which tracks the price of cryptocurrency solana, on Oct. 28. The fund is down about 57% since the launch. So far this year, the cryptocurrency is off more than 30%.

Meanwhile, bitcoin tumbled below $61,000 last Thursday — its lowest level in roughly 16 months.

Crypto World

Ethereum Floods Out of Exchanges in Biggest Withdrawal Wave Since October

Over 220,000 ETH have exited exchanges in the strongest withdrawal wave seen since last October.

Ethereum appears to be struggling to hold on to $2,000 following the market-wide pullback. Over the past week, the leading altcoin has shed almost 14%.

However, it just recorded its largest exchange outflows since October as traders move assets out to accumulate.

ETH Withdrawals Accelerate

ETH withdrawals from trading platforms have risen sharply. Data compiled by CryptoQuant revealed that the figure has reached its highest level since October. Recent Ethereum exchange netflow data shows a clear acceleration in outflows, which is indicative of a shift in investor behavior toward reducing the amount of ETH held on such venues.

Across all exchanges, net Ethereum outflows have surpassed 220,000 ETH over the past few days. This marks the largest wave of withdrawals since last October. Such an increase reflects a significant volume of ETH being moved from exchanges to private wallets or long-term storage protocols.

CryptoQuant stated that such movements are commonly associated with accumulation phases or with investors seeking to reduce risk by holding assets off exchanges. Binance accounted for a large share of this activity, as daily net outflows reached around 158,000 ETH on February 5.

This was the highest level of Ethereum withdrawals from Binance since last August, which implied that much of the recent exchange outflow was concentrated on the platform with the deepest liquidity.

From a price perspective, these strong outflows occurred while the crypto asset was trading in the $1,800 to $2,000 range. This means that some investors were repositioning or holding ETH at these price levels following the recent market pullback.

You may also like:

CryptoQuant further added that steady Ethereum outflows of this magnitude reduce the amount of supply readily available for selling. As a result, this trend is viewed as structurally supportive for price in the near term, particularly if market momentum stabilizes or improves.

$2,000 Level Now Under Heavy Watch

All eyes are on the $2,000 level after ETH faced rejection near higher resistance, according to market experts. Ted Pillows, for one, said ETH was rejected from the $2,100 resistance zone and identified $2,000 as the key level to hold. He warned that losing it could lead to a sweep of last week’s low. Analyst Ali Martinez also echoed the focus on this level.

Additionally, MN Capital founder Michaël van de Poppe shed light on the gap between network activity and price performance. He said that in the early stages of growth, price action often lags behind fundamentals, similar to Ethereum’s 2019 cycle, when market growth was initially limited.

Van de Poppe also explained that the asset’s price began to rise only after stablecoin transactions on the network reached their peak and observed that stablecoin transaction volumes on Ethereum are up 200% over the past 18 months, while ETH is down around 30%, which presents an opportunity for buyers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ledger Wallet Adds OKX DEX for On-Device DeFi Swaps

Ledger, the French digital asset security company known for its hardware wallets, has integrated OKX DEX into its Wallet app, enabling users to execute multichain token swaps directly from a self-custodial environment.

According to the company, the integration provides access to OKX DEX’s liquidity aggregation from within the Ledger Wallet app, allowing users to swap tokens with the need to interact with external decentralized exchange interfaces.

Ledger said trades are routed using OKX DEX’s proprietary X-Routing technology, which aggregates liquidity across hundreds of decentralized exchanges to identify efficient execution paths. Transactions remain signed on the user’s Ledger device, with private keys never leaving the hardware wallet.

A spokesperson for Ledger told Cointelegraph that access to the OKX DEX integration is rolling out gradually, starting with availability for about 20% of Ledger Wallet users beginning today, with no device firmware or app update required.

At launch, swaps are supported on Ethereum (ETH), Arbitrum (ARB), Optimism (OP), Base (BASE), Polygon (POL) and BNB Chain (BNB), with no cross-chain or cross-seed swaps enabled.

OKX DEX is a decentralized exchange aggregator within the OKX ecosystem that routes trades across multiple onchain liquidity venues, separate from the company’s centralized exchange.

Related: Uniswap lands on OKX’s X Layer as exchange deepens DeFi strategy

Crypto IPOs expected in 2026

The integration follows reports in January that Ledger is exploring a US initial public offering that could value the company at more than $4 billion, with Goldman Sachs, Jefferies and Barclays involved in early discussions.

While Ledger would not confirm the reports, if true, it would join a growing list of crypto companies with their eyes set on public listings this year.

In January, tokenization platform Securitize advanced plans to go public through a merger with a Cantor Fitzgerald–backed blank-check company, disclosing in related filings that its revenue grew more than 840% through September 2025.

That same month, digital asset custodian Copper was reported to be exploring public listing options, though the company said it is not currently planning an IPO.

US-based crypto exchange Kraken is also expected to go public sometime in 2026. In November, Kraken said it had confidentially filed a draft registration statement with the US Securities and Exchange Commission, taking a formal step toward a potential initial public offering of its common stock.

However, on Tuesday, multiple media outlets reported that the company’s CFO, Stephanie Lemmerman, had been ousted. Her name does not appear on Kraken-parent Payward leadership page, which now lists Robert Moore, formerly VP of business expansion, as deputy CFO.

Inquiries on the change to Payward and Kraken by CoinTelegraph were not immediately replied.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

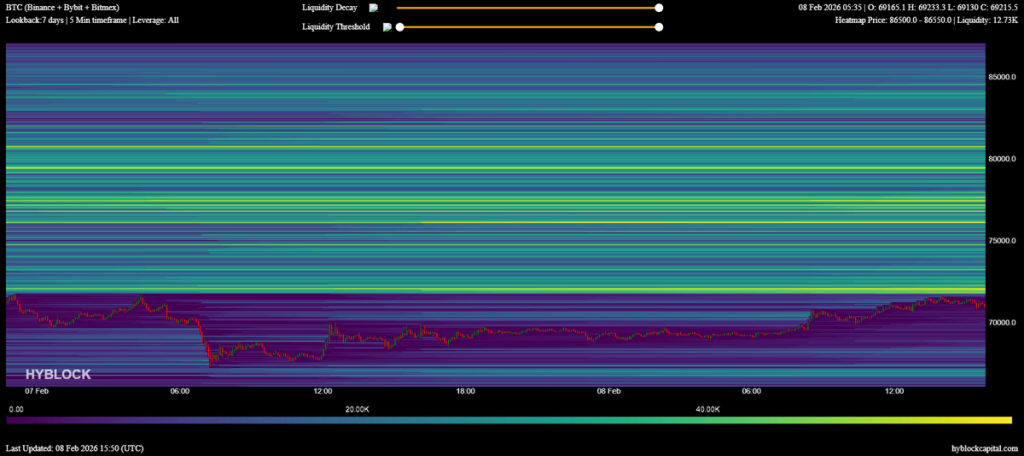

Could a 220% BTC Rally Follow?

Bitcoin has paused near recent highs, trading south of $69,000 as markets digest a period of consolidation after a volatile move that saw a dip to $60,000 followed by a rally to $72,000. Analysts note that price indicators have shifted into what some describe as a deep-value zone, prompting renewed debate about whether buyers will step in at these levels. Behind the scenes, researchers rely on two long-running metrics—realized price bands and a power-law quantile framework—that together frame the asset’s potential next leg. Taken together, these measures point to a broad, data-driven picture of accumulation forming at multiple support bands.

Key takeaways

- Bitcoin’s realized price bands align with a long-term accumulation zone that has preceded major price advances in prior cycles.

- The shifted realized price sits near $42,000 while the current realized price hovers around $55,000, signaling a structural support window roughly between $40,000 and $55,000 with potential upside if the pattern repeats.

- The power-law quantile model places BTC near the 14th percentile of its long-term log–log price corridor, suggesting a period of relative undervaluation after a cycle peak that could reach toward $210,000 in 2025 per the model.

- History shows rallies often follow a re-test of these bands, implying meaningful upside potential—roughly 170%–220%—in the next bullish phase and targets above $150,000.

- Consolidation after testing these zones has typically stretched six to eight months before the market resumes its upward trajectory toward new highs.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The current price dynamics unfold within a broader crypto environment where on-chain signals and valuation models increasingly inform timing. As liquidity ebbs and flows, accumulation zones identified by realized price bands and corroborated by long-term percentile analyses offer a framework for understanding potential inflection points, even as near-term moves remain uncertain.

Why it matters

For long-term holders and traders alike, the convergence of realized price bands with a low percentile reading from the power-law framework adds nuance to market timing. The near-term picture depicts a tug-of-war between downside risk—as implied by lower-bound scenarios in the $40k–$50k range—and the prospect of a broader upcycle should accumulation hold and demand re-emerge. This dynamic matters because it shapes risk budgeting and entry points during periods of sector-wide caution.

Beyond price, the implications ripple through market infrastructure and product design. If these bands function as gravity wells, participants in mining, staking, and decentralized finance may recalibrate risk models and deployment schedules in anticipation of a sustained rebound. The research also underscores the value of on-chain metrics that anchor sentiment, especially when macro conditions remain uncertain and with the possibility of regime shifts in liquidity and risk appetite.

Analysts emphasize that the synthesis of historical patterns with current readings still requires prudence. While the path to new highs has historically followed a phase of accumulation, each cycle contains unique catalysts and macro-tempo changes that can alter outcomes. The narrative around realized price bands and percentile positioning should therefore be viewed as one tool among many in assessing future trajectories, rather than as a guaranteed roadmap.

What to watch next

- Watch for Bitcoin price testing and holding the $55,000 area as a critical inflection point over the next several weeks.

- Monitor how often the price re-tests the realized price bands; a sustained move above the mid-$50ks would bolster the case for continued accumulation.

- Pay attention to the alignment with the power-law percentile, particularly if readings settle within the $50,000–$62,000 corridor, described as a long-term support floor in prior cycles.

- Observe any shifts in the BTC/Gold ratio or related macro indicators that could signal a risk-off or risk-on tilt, which would influence the timing of any durable bottom and subsequent rally.

Sources & verification

- On-chain realized price and shifted realized price concepts used to identify long-term accumulation zones and their historical relevance.

- The visual mapping of monthly price zones based on realized price bands, with sources cited to TradingView.

- The power-law quantile model’s positioning of BTC around the 14th percentile and its implied target near $210,000 in 2025, as discussed by the model’s proponents.

- Related discussion referencing large BTC holders and macro conditions as part of the broader context of market bottoms and pullbacks.

Market reaction and key details

Bitcoin (CRYPTO: BTC) has cooled after a volatile stretch, trading just below the $69,000 mark as market participants digest the move from a dip to $60,000 and a subsequent push back toward the $70,000 level. The retreat comes as analysts revisit two on-chain gauges that have historically framed long-run value zones. Realized price, which tracks the average cost basis of BTC the last time it moved on-chain, and its shifted counterpart, which smooths this signal forward in time, are currently signaling a broad accumulation range. In practical terms, this means that the market is tracking a price floor around the mid-$40,000s to mid-$50,000s, with the potential for outsized upside if history repeats itself and buyers re-enter the market en masse.

The current readings place realized price near $55,000 and the shifted realized price around $42,000, reinforcing the idea that a robust support base is forming amid a broader pattern of value-driven accumulation. A chart illustrating these zones, which connects monthly price action to realized-price bands, is available via the linked visualization (Cointelegraph/TradingView) and provides a historical lens on how retests of these bands have historically preceded meaningful rallies. For readers curious about the visual, the chart references BTCUSDT on TradingView.

Beyond the realized-price framework, another analytic approach gaining attention is a power-law quantile model popularized by BTC researcher Giovanni Santostasi. The latest update places BTC near the 14th percentile of a long-term log–log price corridor, suggesting a phase of relative undervaluation after a cycle peak that the model projected could reach as high as $210,000 in 2025. This confluence—price trading near realized bands and a low percentile reading on the long-term corridor—has historically coincided with recoveries, even as the structure permits the possibility of further drawdowns in the near term. The model’s $210,000 target underscores the scale of potential upside that such a framework envisions, even as the timing remains uncertain.

The discourse is not without caution. Observers such as Jelle (CryptoJelleNL) have pointed to periods where the BTC price has fallen around 31% from a prior RSI-based breakout, warning that a retracement toward the $52,000s could occur before a durable bottom takes hold. Another analyst, Sherlock, has flagged a breakdown in the BTC/Gold ratio below recent support, a condition that has previously coincided with transitions into bearish phases. In light of these signals, some analysts argue that a deeper retest—potentially into the $38,000–$40,000 region—remains plausible if historical patterns repeat. Still, the broader narrative remains that a test of the realized bands could, if met with a sustained bid, propel BTC into the next leg of its cycle.

As markets weigh these views, traders will be watching for alignment between on-chain signals and price action. The convergence of the realized-price framework with percentile positioning offers a structured lens through which to assess risk and potential catalysts, even as external factors continue to influence risk sentiment across the crypto space. The discussion around Bitcoin’s long-term value, and how that value translates into price, remains highly dependent on a delicate balance of on-chain activity, macro conditions, and investor appetite for risk.

Related: Bitcoin holders sell 245K BTC in tight macro conditions: Did the market bottom?

https://platform.twitter.com/widgets.js

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World13 hours ago

Crypto World13 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World4 hours ago

Crypto World4 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports24 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World13 hours ago

Crypto World13 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition