Crypto World

What It Actually Takes to Prove Someone Is Satoshi Nakamoto

Verifying Satoshi Nakamoto: A matter of math, not media

From time to time, individuals claim to be Satoshi Nakamoto, Bitcoin’s pseudonymous creator. Such announcements generate headlines, spark heated debates and trigger instant skepticism. Yet after years of assertions, lawsuits, leaked files and media interviews, no claim has been backed by definitive proof.

The reason is simple. Proving someone is Satoshi is not a matter of storytelling, credentials or courtroom victories. It is a cryptographic problem governed by unforgiving rules.

Nakamoto built Bitcoin (BTC) to function as a peer-to-peer (P2P) cryptocurrency without requiring trust in people. It is widely assumed that Satoshi Nakamoto is an adopted name rather than a real one. As a result, anyone who claims to be Satoshi, or is presented as such, must prove that identity. That proof would likely involve identity documents, historical communication records and, most critically, control of a private key associated with one of Bitcoin’s earliest addresses.

Over the years, several individuals have been speculated to be Satoshi Nakamoto, but only a few have publicly claimed to be the creator of Bitcoin.

The most prominent claimant is Craig Steven Wright, who repeatedly asserted that he was Satoshi. That claim collapsed after a UK High Court ruling explicitly determined he was not Satoshi Nakamoto and sharply criticized the credibility of his evidence.

Dorian S. Nakamoto was identified by Newsweek in 2014 as Satoshi Nakamoto, but he immediately denied any connection to Bitcoin’s creator. Early Bitcoin pioneer Hal Finney also rejected speculation that he was Satoshi Nakamoto before his passing. Nick Szabo has likewise been speculated to be Satoshi over the years and has consistently denied the claim.

What constitutes genuine proof of ownership in Bitcoin

In cryptographic systems like Bitcoin, identity is bound to private key ownership. Demonstrating control requires signing a message with that key, a process that anyone can verify publicly.

This distinction is clear:

-

Evidence can be debated, interpreted or challenged.

-

Cryptographic verification is binary; it either checks out or it does not.

Bitcoin’s verification model does not rely on authority, credentials or expert consensus. It depends on mathematics, not people, institutions or opinion.

Did you know? Early Bitcoin forum posts and the white paper used British spellings like “colour” and “favour.” This sparked theories about Satoshi’s geographic background, though linguists caution that spelling alone can be easily imitated or deliberately altered.

The gold standard: Signing with early keys

The most conclusive proof of being Satoshi would be a public message signed using a private key from one of Bitcoin’s earliest blocks, particularly those associated with Satoshi’s known mining activity in 2009.

Such a signature would be:

-

Verifiable by anyone using standard tools

-

Impossible to forge without the actual private key

-

Free from dependence on courts, media or trusted third parties.

The tools required for such proof are simple, accessible and decisive, yet no one has ever provided it.

Did you know? Satoshi gradually stepped away from public communication in 2010, just as Bitcoin started attracting developers and media attention. Their final known message suggested they had “moved on to other things,” fueling speculation about motive and timing.

Moving early coins: Even more powerful, but improbable

An even stronger demonstration would be transferring Bitcoin from an untouched Satoshi-era wallet. That single onchain action would dispel nearly all doubt.

Yet it carries massive downsides:

-

Instant worldwide scrutiny

-

Severe personal security threats

-

Potential tax, legal and regulatory fallout

-

Market disruption from anticipated dumps.

The most ironclad proof is also the most disruptive. It makes inaction a rational choice, even for the true creator.

Did you know? Blockchain researchers estimate that early mining patterns linked to Satoshi may represent roughly 1 million BTC, making those dormant wallets some of the most closely watched in crypto history.

Why documents, emails and code don’t settle the ownership

While emails, draft papers, forum posts and code contributions can support a claim, they do not constitute definitive evidence. Such materials can be forged, edited, selectively leaked or misinterpreted.

Code authorship does not prove key control. In Bitcoin, keys define identity, and everything else is secondary. Analysis of emails, draft papers and forum posts may offer intriguing correlations between an individual and Bitcoin, but it lacks certainty. The samples are limited, and styles can overlap or be mimicked.

In social settings or conventional legal disputes, identity can be supported by personal testimony or documentation. However, such evidence is irrelevant within Bitcoin’s decentralized model.

Human memory is fallible, and incentives can be misaligned. Bitcoin was designed specifically to avoid reliance on such factors. Cryptographic proof removes any human role from the verification process.

Why partial proof is not proof

Some claimants offer evidence behind closed doors. However, material shown only to select individuals, or signatures produced using later Bitcoin keys, does not meet the required standard.

To convince the world, proof must be:

-

Public: Visible to anyone

-

Reproducible: Independently verifiable

-

Direct: Tied to Satoshi-era keys.

Anything less leaves room for doubt, which is unacceptable to the Bitcoin community.

For Bitcoin to function, its creator does not need to be known or visible. On the contrary, its decentralization narrative is strengthened by the creator’s absence. There is no founder to defer to, no authority to appeal to and no identity to attack or defend.

While most organizations or projects rely on founders or management teams, Bitcoin functions precisely because identity is irrelevant.

Crypto World

What to expect at CoinDesk’s Consensus Hong Kong 2026

CoinDesk’s Consensus Hong Kong 2026 is here. Over the next two days, more than 10,000 attendees will hear from over 350 speakers across five stages as they discuss tokenization, stablecoins, AI and more.

The conference comes just after crypto markets hit a period of intense volatility. Bitcoin crashed from over $95,000 to near $60,000 before rebounding to $70,000 within a few short weeks, swings that are familiar to longtime industry participants but jarring nonetheless.

Against this backdrop, we’ll hear from Hong Kong policymakers, including Chief Executive John KC Lee, legislator Johnny Ng and Securities and Futures Commission CEO Julia Leung about their work drafting crypto-focused policies for the special administrative region.

Industry leaders like Animoca’s Yat Siu, Solana Foundation’s Lily Liu and BitMine’s Tom Lee will present the crypto world’s current status and lay out the trends they expect to see in the coming months.

It may be that the crypto industry is now melding more with traditional finance, leaving some of its more esoteric products by the wayside. Consensus speaker Armani Ferrante told CoinDesk last month that blockchains are looking more like financial infrastructure than support tools for non-fungible tokens (NFTs) or other projects.

Even so, the markets still need to mature to truly support institutional demand, Auros’ Jason Atkins told CoinDesk last month.

The institutions themselves — for example, Robinhood — are also looking more deeply into blockchain as a tool that can support financialization for institutional clients, the company’s head of crypto, Johan Kerbrat, said last month.

Crypto World

South Korea Expands Crypto Market Probes After $44B Bithumb Bitcoin Error

This $44 billion Bithumb “Oops” just changed everything for crypto in South Korea.

On Monday, regulators confirmed a major crackdown after the Bithumb exchange accidentally sent 620,000 Bitcoin, roughly $44 billion, in a single transaction.

That chaos exposed how fast whales move when platforms break. Now the Financial Supervisory Service is pushing its 2026 plan, with a sharp focus on hunting big players who exploit exchange failures.

Regulators Target ‘Gating’ and Infrastructure Failures

Bithumb API promo glitch sent 620,000 BTC to 249 users. Recovery started as soon as possible, but the mess exposed real cracks in South Korea crypto infrastructure.

Local reports say the Financial Supervisory Service is now probing gating, when exchanges halt deposits or withdrawals to trap supply and distort prices.

FSS governor Lee Chang-jin said the agency will aggressively target schemes exploiting these breakdowns, including fishbowl tactics that manipulate prices inside frozen exchanges.

AI Surveillance and New Trading Restrictions

The Financial Supervisory Service says it is rolling out automated systems to track weird price moves down to the millisecond.

As of February 2, it expanded AI powered surveillance to cut manual monitoring and move faster. These tools are built to flag racehorse trading, where traders pile in fast to spark price spikes, plus coordinated moves fueled by social media misinformation.

Under the upcoming Digital Asset Basic Act, the FSS plans to hit IT failures hard, with heavy fines and direct accountability for CEOs and CISOs.

On top of that, the Fair Trade Commission already raided Bithumb’s Seoul office over misleading liquidity ads, signaling a full multi agency crackdown on an exchange that handles 28% of the country trading volume.

Global Availability Amid IPO Ambitions

The timing of these probes complicates Bithumb’s strategic goals, specifically its target for a New York Stock Exchange IPO within the year. The investigations arrive as broader Asian markets tighten controls, evident as China bans unapproved Yuan-pegged stablecoins to protect currency stability.

South Korea’s strict enforcement could force exchanges to overhaul their API offerings and internal controls to remain compliant.

With Upbit dominating 68% of the local market, Bithumb’s regulatory hurdles may widened the gap between the two rivals.

The FSS is expected to activate the financial sector’s integrated monitoring system (FIRST) later this month to further standardize cyber threat sharing and compliance reporting.

The post South Korea Expands Crypto Market Probes After $44B Bithumb Bitcoin Error appeared first on Cryptonews.

Crypto World

Zero Maker Fees on Stock & Metal Perpetuals for E-Season

Bitget, the world’s largest Universal Exchange (UEX), announced the launch of zero maker fees and ultra-low taker fees for its stock perpetuals and precious metal perpetuals, effective from February 10 through April 30, 2026. The move positions Bitget as the lowest-cost venue in the market while offering one of the broadest selections of stock and metal perps.

The fee adjustment comes as global markets enter earnings season, a period marked by heightened volatility and frequent position adjustments. In such environments, trading costs and asset availability play a decisive role in execution efficiency.

Under the new pricing structure, maker fees for stock perpetuals have been reduced from 0.02% to zero, while taker fees have been lowered from 0.06% to as low as 0.0065%. For precious metal perpetuals, including gold-linked contracts, maker fees have also been set to zero, with taker fees discounted by up to 70%, subject to a minimum of 0.0065%.

“Earnings season is when trading costs and access really start to matter. Traders need the flexibility to move quickly without worrying about fees eating into every decision,” said Gracy Chen, CEO of Bitget. “Our job is to remove friction and give people the tools they need to trade stocks and metals anywhere from the world 24/7.”

Bitget currently offers 33 stock perpetual trading pairs, spanning micro-caps to mega-cap equities, including major global technology stocks, alongside four precious metal perpetuals. The platform also supports one of the highest offerings of up to 100x on selected stock perpetuals, including pairs such as NVDAUSDT, TSLAUSDT, and GOOGLUSDT, offering one of the highest leverage ceilings available in the market.

Beyond cost efficiency, stock perpetuals lower the barrier to participation by allowing traders to gain exposure without purchasing full shares. This structure enables more flexible position sizing and capital allocation, particularly for users navigating short-term earnings or macro-driven price movements.

The update reinforces Bitget’s Universal Exchange model, which brings crypto, stocks and traditional market exposure together under a unified interface. By combining low fees, broad asset coverage, and capital-efficient structures, Bitget continues to position itself as the trading venue for traders moving across asset classes and market cycles.

To find out more, please visit here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

US Banking Giant Goldman Sachs Invests Millions in XRP

Goldman Sachs disclosed significant crypto exposure in its Q4 2025 13F filing, revealing more than $2.36 billion in digital asset holdings.

The filing shows $1.1 billion in Bitcoin, $1.0 billion in Ethereum, $153 million in XRP, and $108 million in Solana, representing a 0.33% allocation of its reported investment portfolio.

Sponsored

Sponsored

Banking Giant Embraces XRP Exposure

The disclosure places Goldman among the most exposed major US banks to crypto-linked assets, albeit still at a small percentage of total holdings.

A closer look at the filing shows Goldman’s XRP exposure comes specifically through XRP exchange-traded funds, with holdings valued at approximately $152 million.

US Spot XRP ETFs currently hold over $1.04 billion in total net assets. XRP ETFs have been trading for 56 days now, and they have only recorded 4 days of outflow.

Goldman Sachs is one of the world’s most influential investment banks, advising governments and corporations on mergers, capital markets, and restructuring.

Sponsored

Sponsored

As of early 2026, the investment bank oversees roughly $3.6 trillion in assets under supervision for institutional and private clients. It also operates large trading, asset management, and wealth management businesses.

As a market bellwether, its portfolio disclosures often signal broader institutional sentiment.

Goldman Sachs Historical Bitcoin Stance

Historically, Goldman’s public stance on Bitcoin was skeptical.

Before 2020, executives and research teams described Bitcoin as a speculative asset with limited use as money and no intrinsic cash flows.

The firm consistently framed crypto as unsuitable for conservative portfolios and emphasized volatility and regulatory risk.

That position began to soften after 2020 as institutional demand increased. Goldman restarted its crypto trading desk, expanded derivatives access, and produced research acknowledging Bitcoin’s role as a potential inflation hedge, while still stopping short of endorsing it as a core asset class.

Following the crypto winter in 2022, the firm again stressed infrastructure and counterparty risks.

More recently, Goldman has shifted toward cautious participation. It has engaged through ETFs, structured products, and tokenization initiatives, while maintaining that crypto remains speculative.

Crypto World

SafeMoon CEO Gets 8 Years, Victims Tell Heartbreaking Stories

A US federal judge sentenced Braden John Karony, the former CEO of SafeMoon, to 100 months in prison, following his conviction for fraud tied to the collapse of the once-hyped Solana token.

US District Judge Eric Komitee delivered the sentence after hearing emotional victim testimony and forceful arguments from prosecutors, who accused Karony of exploiting investor trust while secretly diverting funds.

Sponsored

Sponsored

The court also scheduled a separate hearing on restitution and financial penalties for April 23.

“This Was a Massive Fraud”: Judge Rejects Defense Pleas

During sentencing, Judge Komitee dismissed defense arguments that Karony’s age and background should mitigate his punishment.

“This was a massive fraud,” the judge said, adding that Karony and his co-conspirators “went to great pains to earn the trust” of investors by repeatedly assuring them that a rug pull was impossible.

Victims described losing life savings, selling personal assets, and delaying home ownership and education plans.

Several said they invested because Karony made himself highly visible and trustworthy, contrasting him with Bitcoin’s anonymous creator.

Sponsored

Sponsored

Prosecutors sought a 12-year sentence, arguing Karony showed no remorse and understood the consequences of lying to investors.

The judge ultimately imposed a shorter but still substantial sentence of 8 years and 4 months.

How SafeMoon Collapsed

SafeMoon launched in 2021 with promises of long-term rewards and a “locked” liquidity pool that executives claimed could not be accessed.

Federal prosecutors later alleged that those claims were false.

According to the case, insiders retained control over the liquidity and misappropriated millions of dollars, while publicly assuring investors their funds were safe.

Authorities said Karony personally benefited from diverted assets while continuing to promote the token and deny any risk of a rug pull.

The prosecution framed the scheme as deliberate deception, not mismanagement or market failure. A jury agreed, convicting Karony on fraud-related counts earlier this year.

With today’s sentence, the SafeMoon case joins a growing list of crypto prosecutions where courts have treated broken trust and liquidity abuse as criminal theft, not innovation gone wrong.

Crypto World

SBF Seeks New FTX Fraud Trial After Fresh Witness Testimony

Former FTX chief executive Sam Bankman-Fried has asked a federal court for a new trial, arguing that testimony from witnesses not available at the original 2023 trial could undermine the government’s portrayal of FTX’s finances before its collapse. The Feb. 5 filing, submitted to the Manhattan federal court by Bankman-Fried’s mother, Barbara Fried, a retired Stanford law professor, is being reviewed separately from the formal appeal process. Legal observers described the move as a long shot, noting that motions for a new trial face steep legal hurdles. The filing keeps the case active as the crypto industry continues to reckon with the fallout from FTX’s collapse. Bankman-Fried was convicted on seven counts tied to the misuse of customer funds at FTX and Alameda Research and was subsequently sentenced to 25 years in prison.

Key takeaways

- Bankman-Fried filed for a new-trial request in Manhattan federal court on February 5, arguing that testimony from witnesses not previously available could alter the government’s narrative about FTX’s financial condition before November 2022.

- The filing is distinct from his ongoing appeal and is considered a high-risk, rarely-granted remedy, according to coverage of the development.

- The witnesses cited include former FTX executives Daniel Chapsky and Ryan Salame; Salame has already pleaded guilty to related charges and is serving a seven-and-a-half-year sentence.

- Bankman-Fried is asking for a different judge to review the motion, contending that the trial judge, Lewis Kaplan, showed “manifest prejudice” during the proceedings.

- Separately, the FTX bankruptcy estate continues to unwind assets and make payments to creditors, with billions disbursed in 2025 and further payouts anticipated as asset recoveries and claims reviews proceed.

Sentiment: Neutral

Market context: The case sits at the intersection of a reopened legal battle over crypto exchange governance and the ongoing process of asset recovery in the FTX bankruptcy, a backdrop shaping investor sentiment in the broader crypto ecosystem as markets adjust to renewed regulatory scrutiny and liquidity considerations.

Why it matters

The motion filed by Bankman-Fried signals an enduring strategy to contest every possible avenue of review, even after a high-profile conviction that has already reverberated through the industry. By arguing that testimony from former executives who did not appear at trial could alter the narrative surrounding FTX’s finances, the defense aims to inject fresh context into a case that has already established a precedent for the treatment of customer funds and corporate governance within crypto-linked entities. While the odds of a successful new trial remain remote, the procedural maneuver underscores how defendants in landmark crypto cases may pursue multiple tracks to challenge outcomes, particularly when complex financial arrangements are involved.

The allegations hinge on questions about how FTX and Alameda Research presented their financial position in the crucial period leading up to the collapse in November 2022. The defense contends that additional perspective from former executives could complicate the government’s portrayal of solvency and liquidity, potentially altering jurors’ understanding of the company’s underlying finances. The decision to seek a different judge for review adds another layer to the strategy, suggesting the defense believes the presiding judge’s conduct during trial could have influenced the jury’s interpretation. This line of argument echoes earlier appeals discussions that suggested the defense perceived improper constraints on explaining investor fund availability during the proceedings.

On the other side, prosecutors and the bankruptcy team remain focused on recovering value for creditors through a phased payout schedule. The FTX estate’s process has already distributed billions of dollars to creditors in 2025, and officials indicate that additional disbursements will follow as asset recoveries continue and claims are reviewed. The contrast between ongoing asset recovery efforts and a post-conviction legal bid highlights how the FTX saga continues to unfold across multiple fronts—criminal accountability, civil actions, and creditor recovery—well after the initial collapse and sentencing.

What to watch next

- Whether the court will accept the new-trial motion for review, and if so, whether the request is reassigned to a different judge for consideration.

- Any formal responses from prosecutors and the defense, including potential replies outlining why the witnesses’ testimony could be deemed significant or inconsequential to the verdict.

- Timing and scope of further rulings in the criminal case, including any procedural milestones tied to the appellate process or ancillary motions.

- Progress of the FTX bankruptcy estate’s payout plan, including any announced disbursements or adjustments to the repayment calendar as asset recoveries evolve.

Sources & verification

- Motion filed on February 5 in Manhattan federal court by Sam Bankman-Fried’s team, with commentary noting its position as a long-shot challenge.

- Bloomberg’s coverage of the new-trial bid and related scheduling considerations.

- Details of Bankman-Fried’s seven-count conviction tied to the alleged misuse of customer funds at FTX and Alameda Research.

- Salame’s guilty plea and seven-and-a-half-year prison sentence as a related development in the case.

- FTX bankruptcy estate updates describing the phased payout approach and cumulative distributions to creditors in 2025, along with ongoing reviews of remaining claims.

New-trial bid keeps FTX fallout in play as prosecutors press ahead

The central argument in Bankman-Fried’s latest filing rests on the potential impact of testimony from witnesses who were not called at trial, specifically former FTX executives Daniel Chapsky and Ryan Salame. By positing that such testimony could challenge the government’s narrative about FTX’s financial health before the collapse, the defense is attempting to reopen questions about solvency and liquidity that were central to the jury’s assessment in 2023. While the court process for a new trial remains arduous, the submission indicates that the defense believes new material could alter the perception of the company’s finances, a linchpin of the government’s case against Bankman-Fried on seven criminal counts tied to customer funds misuse.

The move to seek a different judge to review the motion adds a procedural layer to the strategy. Bankman-Fried’s team argues that Judge Lewis Kaplan’s conduct during the trial may have introduced what the defense characterizes as “manifest prejudice.” This argument mirrors prior appellate contentions that Kaplan did not allow certain defenses relating to the availability of funds to repay investors to be presented to jurors. The defense’s aim appears to be twofold: to introduce new witnesses who could reframe the financial narrative and to secure an impartial reassessment of the trial dynamics, should the court grant a fresh review.

At the same time, the broader legal and regulatory environment surrounding FTX remains unsettled. The bankruptcy estate’s ongoing efforts to return capital to creditors underscore the complexity of unwinding a multibillion-dollar platform that collapsed under rapid liquidity strains and stakeholder risk. In 2025, the estate distributed billions and indicated that further disbursements would follow as asset recoveries progress and claims are thoroughly reviewed. This ongoing process continues to shape the broader market’s expectations for recovery timelines and the level of restitution investors and customers might eventually receive.

Observers emphasize that even if the new-trial bid does not succeed, it keeps the legal narrative alive, ensuring continued scrutiny of evidence and procedures that could influence future crypto-related prosecutions and settlements. The case thus remains a focal point for discussions about governance, financial disclosures, and customer protections within the crypto space, reinforcing the idea that accountability mechanisms beyond initial verdicts may play a meaningful role in shaping industry standards and investor confidence.

Crypto World

Sam Bankman-Fried Makes False Claims in Bid for Trump’s Favor

FTX founder Sam Bankman-Fried has launched a fresh public campaign on X that appears aimed at reinforcing his request for a new trial. However, several of the claims he is using to argue his innocence conflict with court records and established facts.

The posts, published days after filings seeking a retrial, frame Bankman-Fried as a victim of politically motivated “lawfare,” alleging misconduct by prosecutors, judicial bias, and retaliation against former FTX executives.

Yet, a review of the claims shows repeated factual errors and logical gaps.

Sponsored

Sponsored

Claims of Gag Orders and Judicial Bias

Bankman-Fried claims both he and Donald Trump were “gagged” by Judge Lewis Kaplan.

Court records show this comparison is inaccurate. Kaplan presided over Trump’s civil defamation case and imposed courtroom conduct limits, not a formal public gag order.

In reality, Trump’s criminal gag orders were issued by other judges in unrelated cases.

In contrast, Bankman-Fried was subject to a criminal gag order after repeated violations of pretrial release conditions — a standard judicial response.

Sponsored

Sponsored

Repeating Solvency Arguments Rejected at Trial

Bankman-Fried again asserts that FTX “was always solvent” and that prosecutors falsely claimed customer funds were stolen.

That argument was central to his defense at trial and was rejected by a jury, which found that customer assets were misused and misrepresented.

Also, federal courts have consistently ruled that post-collapse asset recoveries do not retroactively establish solvency at the time of misuse.

Sponsored

Mischaracterizing Prosecutorial Actions

Bankman-Fried also claims Trump “fired” one of his prosecutors, former SDNY official Danielle Sassoon.

Public records show Sassoon resigned after refusing a DOJ directive in an unrelated corruption case. She was not dismissed, and her departure had no direct connection to the FTX prosecution.

Linking DOJ Actions to Politics and Crypto Regulation

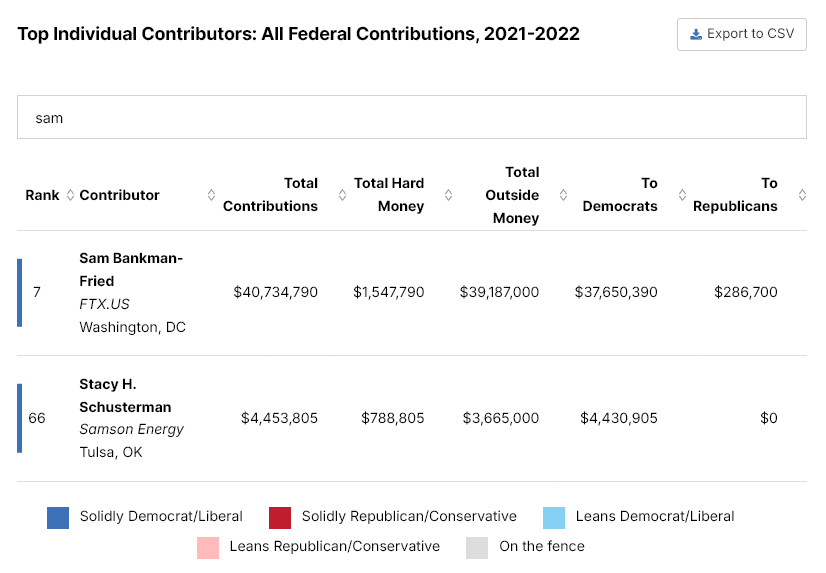

Several posts allege the Biden administration targeted him because he opposed Gary Gensler, donated to Republicans, and represented crypto interests.

Sponsored

Sponsored

While Bankman-Fried was active in Washington, no court filings or rulings have supported claims that political donations or regulatory lobbying drove the prosecution.

Judges ruled the case on documentary evidence, internal messages, and witness testimony.

In fact, the FTX founder himself directly donated to Joe Biden’s campaign.

Bankman-Fried also defends former FTX co-CEO Ryan Salame, claiming he was coerced into pleading guilty and barred from presenting exculpatory evidence.

Salame pleaded guilty to campaign finance and money-transmission violations and has acknowledged those pleas in court. His sentencing record shows no judicial finding that evidence was unlawfully suppressed.

Crypto World

Ex-SafeMoon CEO gets 8-year prison sentence for defrauding investors

Former SafeMoon CEO Braden John Karony will face an 8-year prison sentence after being convicted last year on a string of federal charges tied to defrauding investors in his digital assets operation.

The 100-month sentence was handed down Tuesday in U.S. District Court for the Eastern District of New York, and Karony must also forfeit $7.5 million and two residences in the case.

“Karony lied to investors from all walks of life — including military veterans and hard-working Americans — and defrauded thousands of victims in order to buy mansions, sports cars, and custom trucks,” stated United States Attorney Nocella, in a statement. “Our office will continue to vigorously prosecute economic crimes that harm investors and weaken societal trust in the stability and security of digital asset markets.”

Karony was said to have participated in manipulating the price of the SafeMoon token and illicitly controlling liquidity pools in the failed Utah-based company to drain millions of dollars, according to the Department of Justice. After a three-week trial, he was convicted of conspiracy to commit securities fraud, wire fraud, and money laundering.

One co-conspirator, Thomas Smith, also pleaded guilty in February 2025 to conspiracy to commit securities fraud and wire fraud, though he hasn’t yet been sentenced. Another alleged SafeMoon conspirator, Kyle Nagy, is still wanted by authorities.

Read More: SafeMoon Execs Arrested by DOJ in Fraud Investigation, Charged by SEC

Crypto World

Tom Lee-Backed Bitmine Controls 3.6% of Ethereum Supply After Price Crash

In a risky but potentially rewarding play, Ethereum treasury company Bitmine Immersion Technologies (BMNR) has become the largest corporate holder of ETH, now controlling 3.6% of the total supply after aggressively buying the dip.

The firm, backed by Fundstrat’s Tom Lee, purchased an additional 40,613 Ether last week as prices collapsed toward $1,700, bringing Bitmine’s total treasury to over 4.3 million tokens despite sitting on massive unrealized losses from its ETH portfolio, which holds 4.3 million tokens at an average price of $3,826.

- Bitmine added 40,613 ETH during the crash, bringing total holdings to 4.3 million tokens.

- The firm now controls roughly 3.6% of the total circulating Ethereum supply.

- Unrealized losses exceed $7.8 billion with an average entry price of $3,826.

Bitmine Ethereum Accumulation Strategy Explained

Led by Chairman Tom Lee, Bitmine pivoted from mining for Bitcoin to an Ethereum-exclusive treasury strategy in mid-2025 with a goal to eventually acquire 5% of the total ETH supply.

The company sees temporary market downturns as acquisition opportunities rather than setbacks, mirroring high-conviction plays seen in broader crypto selloff contexts.

“Bitmine has been steadily buying Ethereum… given the strengthening fundamentals,” Lee stated in a press release, countering concerns about the firm’s $7.8 billion paper loss.

Lee argues that current prices do not reflect Ethereum’s utility as the “future of finance,” positioning the firm for long-term dominance despite the immediate pain on its balance sheet.

What 3.6% Supply Control Means for Ethereum Markets

Bitmine’s total stack now sits at approximately $8.7 billion based on current prices hovering just above $2,000.

On-chain data indicates the firm bought the latest tranche of 40,613 tokens as ETH plunged from $2,300 to lows of $1,700.

Unlike purely speculative holders, Bitmine leverages its position for yield; nearly 2.9 million of its tokens are currently staked, generating an estimated $202 million in annualized rewards at current prices.

While investors continue pouring capital into the sector despite the wipeout, Bitmine’s sheer scale allows it to absorb significant liquidity during panic events.

The company plans to launch MAVAN, a proprietary U.S.-based validator network, to potentially stake its entire holding and maximize yield generation.

How Bitcoin’s Concentration of Ethereum Could Affect ETH Price

The concentration of such a vast amount of Ether in a single corporate entity raises questions about market influence and liquidation risks.

While Lee predicts a V-shaped recovery, the firm remains deeply underwater with an average purchase price of $3,826. This resilience stands in stark contrast to other institutional players; for instance, Trend Research slashed Ether holdings to cover loans during the same market crash.

If Bitmine sustains its position without forced selling, it removes substantial supply from the market, potentially accelerating price appreciation if demand returns.

The post Tom Lee-Backed Bitmine Controls 3.6% of Ethereum Supply After Price Crash appeared first on Cryptonews.

Crypto World

Cardano price gets oversold, crashes to key suppport level

The Cardano price continued its strong downward trend, reaching its lowest level since October 2023, making it one of the crypto industry’s top laggards.

Summary

- Cardano price dropped to a crucial support level this week.

- The developers are working on Pentad, which aims to grow the ecosystem.

- The coin has become highly oversold, with the RSI moving to 28.

Cardano (ADA), a top layer-1 network, slipped to $0.2640, down over 80% from its December 2024 peak and 91% below its all-time high of $3 in 2021.

ADA extended its sharp decline despite several major catalysts, including this week’s CME futures launch and the upcoming Midnight mainnet debut. The futuress product made it available to American retail and institutional investors.

Midnight, its upcoming zero-knowledge sidechain, is expected to launch either later this month or in March. Data shows that its testnet continues to perform well, having handled over 185,000 blocks and 295 million slots. NIGHT, its native token, has achieved a market capitalization of over $800 million.

Cardano’s developers are working to fix the network and attract more creators. They are working on the Leios upgrade, which will make it a faster network than many popular chains.

At the same time, they are implementing the Pentad program, which aims to attract more oracle network, tier-1 stablecoins like USDT and USDC, and analytics tools. It has already attracted Pyth Network, a top oracle network, and Dune, a popular analytics tool.

Therefore, Cardano price is falling because of the ongoing crypto market crash, which has affected Bitcoin and most altcoins.

Cardano price prediction: technical analysis

The weekly timeframe chart shows that ADA token has continued falling in the past few months. It has slumped from a high of $1.3230 in December 2024 to the current $0.2638.

The coin has dropped below the 50-week Exponential Moving Average, a sign that bears remain in control. Also, Cardano token has settled at the key support at $0.2212, the neckline of the head-and-shoulders pattern.

ADA has become oversold, with the Relative Strength Index at 28, the oversold level. The Stochastic Oscillator has also moved below the oversold line.

Therefore, the coin may rebound in the coming days, potentially to the psychological level of $0.50. However, a drop below the current support level at $0.2212 will confirm more downside, potentially to $0.15.

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World6 hours ago

Crypto World6 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World14 hours ago

Crypto World14 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World14 hours ago

Crypto World14 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

(@gothburz)

(@gothburz)  BITHUMB ERROR SPARKS KOREA'S CRACKDOWN ON CRYPTO

BITHUMB ERROR SPARKS KOREA'S CRACKDOWN ON CRYPTO