Business

Your Essential Guide to Group Coach Travel

As the UK’s second-largest city, Birmingham presents both tremendous opportunities and unique challenges for group travel.

From the bustling Bull Ring shopping centre and the historic Jewellery Quarter to world-class venues like the NEC and Symphony Hall, Birmingham attracts millions of visitors annually for business, leisure, and cultural events. Yet navigating this sprawling metropolis with a large group requires careful planning and the right transportation solution.

Whether you’re coordinating a corporate conference at the ICC, organising a school trip to Cadbury World, planning wedding guest transport, or arranging a sporting event visit to Villa Park or St Andrew’s, the logistics of moving groups through Birmingham’s busy streets can quickly become overwhelming. The solution lies in selecting professional coach services that understand the city’s geography, traffic patterns, and venue requirements.

Why Birmingham Groups Choose Coach Services

Conquering Urban Complexity

Birmingham’s one-way systems, pedestrianised zones, and congestion hotspots present significant challenges for those unfamiliar with the city. Professional drivers navigate these complexities daily, knowing the optimal routes to major venues, alternative options during peak traffic periods, and the most efficient approaches to hotels and attractions. This expertise proves invaluable when schedules are tight and punctuality matters.

Centralised Convenience

Coordinating multiple vehicles through Birmingham’s busy streets creates unnecessary complications. A single coach keeps your entire group together, eliminates the risk of anyone getting lost in unfamiliar surroundings, and ensures simultaneous arrival at your destination—particularly crucial for time-sensitive events like theatre performances at the Alexandra or Hippodrome.

Parking Solutions

Birmingham’s parking challenges are legendary, with limited spaces at premium prices and strict enforcement in most areas. Coach drop-offs at major venues eliminate these concerns entirely, with designated zones at most significant locations. Your group disembarks steps from your destination whilst the coach manages parking logistics separately.

Cost-Effective Group Transport

When travelling to Birmingham from elsewhere or moving around the city, splitting coach hire costs amongst your group often proves more economical than individual train tickets, multiple taxis, or parking fees for numerous cars. The savings become particularly apparent for larger groups of 30 or more passengers.

Common Applications for Birmingham Coach Hire

Exhibition and Conference Transport

The NEC hosts hundreds of events annually, from industry exhibitions to consumer shows, whilst the ICC and other venues attract countless conferences. Coach Hire Birmingham services provide seamless transport between hotels and venues, allowing delegates to network during travel and arrive professionally without the stress of navigating unfamiliar routes or searching for parking.

Educational Visits

Birmingham’s rich industrial heritage and cultural attractions make it a popular educational destination. From the Birmingham Museum and Art Gallery to Thinktank science museum and the Black Country Living Museum, schools benefit from reliable transport that allows teachers to focus on supervision and learning objectives rather than driving and directions.

Shopping and Leisure Trips

The Bull Ring, Grand Central, and Mailbox attract shopping groups from across the region. Coach services drop groups in the city centre, arrange collection times, and eliminate concerns about shopping bags, parking, or coordinating return journeys after a long day browsing.

Corporate Events and Team Building

Birmingham businesses regularly organise team-building activities, client entertainment, and corporate hospitality events. Professional transport ensures staff arrive together and on time, whilst journey time can be utilised for briefings, networking, or simply allowing teams to unwind before important events.

Sporting Fixtures

Aston Villa, Birmingham City, Warwickshire County Cricket Club, and major events at venues like Arena Birmingham all attract passionate supporters. Coach travel maintains team spirit throughout the journey whilst avoiding the notorious parking difficulties and traffic congestion around major stadiums on match days.

Airport Transfers

Birmingham Airport serves millions of passengers annually, with groups requiring transport for holidays, business trips, and international visits. Door-to-door coach services eliminate the complexity of coordinating multiple taxis or managing luggage on public transport connections.

Essential Booking Considerations

Timeline Planning: Birmingham hosts major events year-round, from the Frankfurt Christmas Market to summer festivals and countless NEC exhibitions. These peak periods create high demand for coach services, making advance booking essential. Aim for 6-8 weeks ahead for standard journeys, extending to 2-3 months for major event periods or school holidays.

Route Specifics: Birmingham’s geography affects journey planning significantly. Provide detailed information about pick-up and drop-off locations, including specific venue entrances where relevant. Many Birmingham venues have designated coach areas, and your provider needs this information for accurate planning.

Traffic Considerations: Birmingham experiences significant rush-hour congestion, particularly on key routes like the Aston Expressway and around Spaghetti Junction. Discuss timing with your provider to avoid predictable delays, or build appropriate buffers into time-sensitive schedules.

Group Size Accuracy: Vehicles range from 16-seat minibuses to 70+ passenger coaches. Accurate numbers ensure appropriate allocation, particularly important in Birmingham where venue access may restrict vehicle sizes in certain areas.

Frequently Asked Questions

How does Birmingham traffic affect journey planning?

Birmingham experiences peak congestion during typical rush hours (7:30-9:30am and 4:30-6:30pm weekdays), with additional pressures around major events. Professional providers factor these patterns into journey planning, suggesting optimal departure times or alternative routes to ensure punctual arrival.

Can coaches access Birmingham city centre venues?

Most major Birmingham venues provide coach drop-off and collection facilities, though locations vary. Venues like Symphony Hall, the Hippodrome, and major hotels have designated coach areas. Some city centre locations may require drop-offs at nearby points rather than directly outside, particularly in pedestrianised zones.

What’s included in typical Birmingham coach hire costs?

Standard packages generally include the vehicle, experienced driver, fuel, and comprehensive insurance. Additional charges may apply for Birmingham’s Clean Air Zone (CAZ) if applicable, parking fees at certain venues, and extended waiting times. Always request detailed quotations that clearly itemise all costs.

How far in advance should I book for NEC events?

Major NEC exhibitions attract thousands of visitors, creating exceptional demand for accommodation and transport. For significant events, booking 2-3 months ahead is advisable. Last-minute bookings during major shows often face limited availability and premium pricing.

Can routes include multiple Birmingham locations?

Absolutely. Providers can accommodate itineraries including multiple venues, hotels, or attractions. However, Birmingham’s traffic patterns mean journey times between locations can vary significantly depending on routes and timing, so discuss your requirements thoroughly when planning to ensure realistic scheduling.

Maximising Your Birmingham Coach Experience

Successful Birmingham group travel depends on clear communication and realistic planning. Designate a coordinator to liaise with your coach provider and communicate with passengers. Provide comprehensive briefings about meeting points—Birmingham landmarks like New Street Station or specific hotel entrances make excellent reference points for those unfamiliar with the city.

Build modest time buffers into your schedule, particularly when travelling during peak periods or around major events. Birmingham’s unpredictability means a 15-minute contingency can prevent minor delays from becoming significant problems.

Maintain communication with your driver throughout the day, particularly if plans change. Their Birmingham knowledge often provides valuable alternatives if traffic issues arise or timings need adjustment.

Conclusion

Birmingham’s status as a major UK city brings tremendous opportunities for business, education, leisure, and cultural experiences, but successfully navigating the city with groups requires professional transport solutions. Quality coach services transform potentially stressful logistics into seamless journeys, allowing your group to focus on the purpose of your visit rather than the mechanics of getting there. By selecting experienced providers who understand Birmingham’s unique characteristics, booking with adequate notice, and communicating your requirements clearly, you ensure every group journey begins and ends successfully. The investment in professional transport pays dividends in punctuality, passenger comfort, and overall satisfaction, making it an essential component of any successful Birmingham group visit.

Business

Investors back MyCredit’s technology-led approach to digital lending expansion

Investors have committed new capital to fintech company MyCredit, backing its strategy of scaling technology-driven credit platforms rather than a conventional lending operation.

The investment reflects a broader shift in fintech funding toward platforms where software, data infrastructure and AI form the primary drivers of innovation, growth, enabling companies to expand across markets without proportional increases in staffing or operational complexity.

MyCredit’s platform is designed to automate and innovate large parts of the credit lifecycle — from application assessment to risk scoring — using real-time data processing and machine-learning-based models. Industry analysts note that this architecture is particularly suited to expansion in regulated and emerging markets, where speed, transparency and consistency are critical.

Rather than allocating capital toward rapid loan book expansion, the investment was driven by MyCredit’s long-term platform strategy, market participants say. Investors were attracted by the company’s ability to embed risk management, regulatory logic and automation directly into its technology stack, allowing the business to scale without increasing operational complexity.

In contrast to many consumer lenders that rely on manual processes and market-specific workflows, MyCredit’s architecture is designed to be adapted across jurisdictions with minimal structural changes, a factor that has become increasingly important as fintech companies face tighter regulatory scrutiny.

People familiar with the investment say this approach resonated particularly with backers seeking repeatable, technology-led growth models rather than short-term financial returns tied to a single market.

Aleksandr Katsuba, co-founder of MyCredit, has played a central role in shaping MyCreditinnovation and product strategy. According to sources close to the process, he led engagement with investors and framed the company’s value around its proprietary technology stack, positioning MyCredit as a fintech platform with long-term scalability rather than a market-specific lender.

“Technology allows fintech businesses to grow sustainably,” Katsuba said. “By investing in automation, data systems and controlled decisioning, the platform can expand without increasing risk exposure.”

Industry observers note that this truly aligns with current investor preferences, particularly as fintech markets mature and regulatory scrutiny increases. Platforms that embed compliance and risk management directly into their technology are increasingly seen as better positioned for cross-border growth.

Business

Fifth Third Bancorp (FITB) Presents at Bank of America Financial Services Conference 2026 Transcript

Ebrahim Poonawala

BofA Securities, Research Division

Next up with us, we have Fifth Third Bancorp. From Fifth Third, we have Jamie Leonard, Chief Operating Officer. And joining Jamie, we have Brennen Willingham who is the Treasurer of Fifth Third. So thank you, both of you for joining us.

James Leonard

Executive VP & COO

Thank you.

Ebrahim Poonawala

BofA Securities, Research Division

And I believe, Jamie has some prepared remarks for us. So I hand it over to Jamie, first.

James Leonard

Executive VP & COO

Thank you, Ebrahim. And good afternoon. Thanks for joining us today. It is a pleasure to be out of the Cincinnati snow to discuss in Florida, why the Comerica acquisition represents such an important milestone for Fifth Third. How we are executing on the integration. And why we believe this transaction positions us for stronger, more resilient performance in the years ahead.

When we evaluated this transaction, we focused on one question. Will this combination create a meaningfully better bank? The answer is unequivocally yes, strategically, financially and operationally. This acquisition strengthens our competitive position, expands our capabilities and support superior long-term returns. It creates a more durable, more efficient and better growth-oriented franchise, not just a larger one. The financial logic is also compelling. There’s no tangible book dilution at close, with expected tangible book value per share accretion each quarter this year, achievable cost synergies and a long runway for sustainable growth.

This is a disciplined acquisition, aligned with our long-standing commitment to through-the-cycle value creation. As you know, while it’s important that the

Business

How to Manage Rapid International Growth in a Regulated Market

Expanding a business globally used to feel like a slow, decade-long slog. Today, digital platforms let us flip a switch and reach customers in Sydney or Stockholm overnight.

But here is the catch: if you are operating in a regulated space—think fintech, healthcare, or gaming—that “switch” is attached to a mountain of legal paperwork and local hurdles. You simply can’t move fast and break things when the things you might break are national laws.

The Agility Paradox in Tight Markets

Scaling across borders is a massive feat, but if you’re playing in a heavily regulated field, you need a strange mix of speed and an almost total obsession with the rules. Lottoland has shown that the trick to growing fast without getting shut down lies in a “decentralized yet unified” approach—adapting the core product to meet local licensing requirements and cultural nuances without breaking the underlying tech. By investing in a modular tech stack that can quickly integrate regional payment gateways and regulatory reporting tools, they manage to move faster than traditional competitors. For UK entrepreneurs looking to export their services, the Lottoland model proves that entering a regulated market isn’t just about following rules; it’s about building a system where compliance is the engine itself, not a weight holding you back.

It sounds counterintuitive, doesn’t it? Usually, we think of “compliance” as the department that says “no” to every cool new idea. But when your tech is built to be modular, compliance becomes a plug-and-play feature. If a country changes its data privacy laws, you don’t need to rewrite your whole codebase; you just swap out a module.

Local Friction is a Reality

Let’s be honest: no two regulators think alike. You might have a green light in London, but find yourself stuck in a yellow-light purgatory in Berlin or Rome. This is where the human element of scaling comes in. You need local boots on the ground who actually understand the “vibe” of the local regulator. Are they sticklers for specific documentation? Do they prefer a certain reporting cadence?

The ground moves fast. For instance, consider how different regions handle consumer protection. Take the issue of gambling on credit; the Swedish government is currently closing all remaining loopholes to address consumer debt, effectively tightening the screws on how operators function. If your system isn’t flexible enough to pivot for a specific Swedish rule in a matter of weeks, your expansion is going to hit a wall. This kind of sudden legislative shift is becoming the norm, not the exception, across Europe and beyond.

Infrastructure as a Safety Net

Ultimately, the winners in this decade aren’t the ones with the loudest marketing, but the ones with the most resilient “plumbing.” This means moving away from monolithic systems toward microservices. It means hiring compliance officers who actually enjoy the puzzle of international law. It’s tough, and honestly, it’s often quite expensive at the start. But the alternative? A single fine that wipes out your year’s profits.

How is your business handling the balance between speed and safety? Do you think the UK is doing enough to help small firms navigate these international rules? Drop a comment below and share your experience.

Business

Commodity costs continue to challenge The Hershey Co.

Company focused on R&D and product innovation in 2026.

Business

Housing market cools as US home prices grow 0.9% annually

‘The Big Money Show’ discusses why millions of American homeowners are not selling.

The housing market has cooled off this winter with the annual pace of home price growth easing to levels unseen since the nation was recovering from the Great Recession. And while some areas continue to see strong price growth, others have seen notable declines.

New data from Cotality, a data analytics and tech company in the real estate, mortgage and insurance industries, showed that annual housing price growth slowed to just 0.9% in December, which was one of the softest rates since the post-Great Recession recovery.

“We are seeing a significant departure from the rapid surges of recent years; while the upward pressure on prices remains, the momentum has moderated enough to suggest that the market is finally becoming more navigable for prospective buyers,” said Cotality Chief Economist Selma Hepp.

HOMEBUYERS GAIN UPPER HAND IN 3 MAJOR CITIES AS INVENTORIES GROW

Home prices have declined in several key areas across the South and West, particularly in areas that had previously seen rapid expansion as in-migration trends moderate and inventory levels increase.

Workers build homes in the Bridgeland master-planned community in Cypress, Texas, Nov. 10, 2025. (Brett Coomer/Houston Chronicle via Getty Images)

Cotality’s report found that the local housing market with the steepest declines was Kahului-Wailuku, Hawaii, with prices down 8% in December on a year-over-year basis.

The Lone Star State had a pair of localities in the top 10, with Victoria, Texas, down 7.4% and Wichita Falls, Texas, down 7.2%.

Napa, California, had the steepest decline among West Coast localities, with prices falling 7.1%.

THE ‘POISON PILL’ AND DIGITAL SECRETS FLIPPING THE SUNSHINE STATE’S CONDO POWER DYNAMIC

Florida had five communities represented in the top 10 localities with the steepest price declines, led by Naples (-6.8%), Punta Gorda and Cape Coral (-6.2% each), North Port (-5.9%) and Sebastian (-5.2%).

Rome, Georgia, rounded out the top 10 with a 5.2% year-over-year price decline.

The hottest housing market identified in Cotality’s report was Youngstown, Ohio, which saw prices surge 15.9% over the last year.

THESE STATES ARE CONSIDERING ELIMINATING PROPERTY TAXES FOR HOMEOWNERS

Four of the hottest markets were in the state of Indiana, led by national runner-up Terre Haute’s gain of 11.4%. Other Hoosier State metros with notable price rises were Columbus and Muncie, with 10.2% gains each, and Kokomo’s 8.8% increase.

Illinois was home to a pair of housing markets with strong price growth, as prices in Decatur rose 10.5% and Peoria 8.9%.

Naples, Fla., was one of the 10 communities with the steepest home price declines. (Lisette Morales McCabe/Bloomberg via Getty Images)

Two other markets in the Midwest and Plains were in the 10 hottest markets, with prices up 8.7% in Manhattan, Kansas, and 8.5% in Traverse City, Michigan.

The hottest housing market in the South was in Hattiesburg, Mississippi, which saw prices rise 8.4% over the last year.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“As we move through 2026, the market’s trajectory will depend heavily on wage growth and how soon buyers regain the purchasing power needed to meet sellers’ pricing thresholds. For now, Cotality data shows a housing landscape is still finding its footing, but it is ultimately stabilizing after an extended period of imbalance,” Hepp said.

Fox News Digital’s Amanda Macias contributed to this report.

Business

OMV Aktiengesellschaft 2025 Q4 – Results – Earnings Call Presentation (OTCMKTS:OMVKY) 2026-02-10

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Arbor Investments buys Furlani Foods

Acquisition adds to baking portfolio holdings.

Business

Eight Saks Fifth Avenue stores, one Nieman Marcus location closing

FOX Business’ Lauren Simonetti joins ‘Mornings with Maria’ to report on how artificial intelligence is transforming the retail shopping experience.

Saks Global Enterprises said Tuesday it will close nine stores as it shifts its focus to more profitable locations.

The company said eight Saks Fifth Avenue locations and one Neiman Marcus store will close.

“By optimizing our operational footprint, we will be better positioned to deliver exceptional products, elevated experiences and highly personalized service across all channels, while simultaneously positioning our company to make investments that enable long-term growth and value creation,” Saks Global Enterprises CEO Geoffroy van Raemdonck said in a statement.

Shoppers leave a Saks Fifth Avenue store Dec. 30, 2025, in Chicago. (Scott Olson/Getty Images)

SAKS GLOBAL FILES FOR BANKRUPTCY AFTER $2.7 BILLION NEIMAN MARCUS ACQUISITION DEAL

Saks Global Enterprises filed for Chapter 11 bankruptcy protection in mid-January in the U.S. Bankruptcy Court for the Southern District of Texas after missing a $100 million interest payment in December, adding to mounting debt obligations.

Saks will ask a U.S. bankruptcy judge to approve the nine store closings at a court hearing Friday, the company said in a court document filed Tuesday.

After the filing, Saks Global announced it secured a financing commitment of approximately $1.75 billion backed by senior secured bondholders and asset-based lenders to support operations during the restructuring.

Holiday shoppers walk outside the Saks Fifth Avenue flagship store in Manhattan in New York City Dec. 5, 2023. (Reuters/Mike Segar/File Photo / Reuters Photos)

CONSUMER CONFIDENCE PLUNGES TO LOWEST LEVEL IN MORE THAN A DECADE

Saks Global announced last month that most Saks Off 5th locations across the U.S. would close, just weeks after its bankruptcy filing.

The luxury retailer closed 23 of its Saks Off 5th stores Feb. 2, while another 34 held closing sales starting at the end of January. Only 12 locations in New York, Florida, New Jersey, Georgia, California and Texas will remain open.

MOST SAKS OFF 5TH LOCATIONS NATIONWIDE TO CLOSE AMID BANKRUPTCY PROCEEDINGS

Shoppers enter the Saks Fifth Avenue store on Fifth Avenue in New York Nov. 27, 2020. (Gabriela Bhaskar/Bloomberg via Getty Images / Getty Images)

Here’s which Saks Fifth Avenue stores are closing:

The Summit – Birmingham, Alabama

Polaris Fashion Place – Columbus, Ohio

American Dream – East Rutherford, New Jersey

Shops at Canal Place – New Orleans, Louisiana

Bala Plaza – Philadelphia, Pennsylvania

Biltmore Fashion Park – Phoenix, Arizona

Stony Point Fashion Park – Richmond, Virginia

Utica Square – Tulsa, Oklahoma

Here’s the Neiman Marcus store that’s closing:

Copley Place – Boston, Massachusetts

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business’ Greg Norman and Reuters contributed to this report.

Business

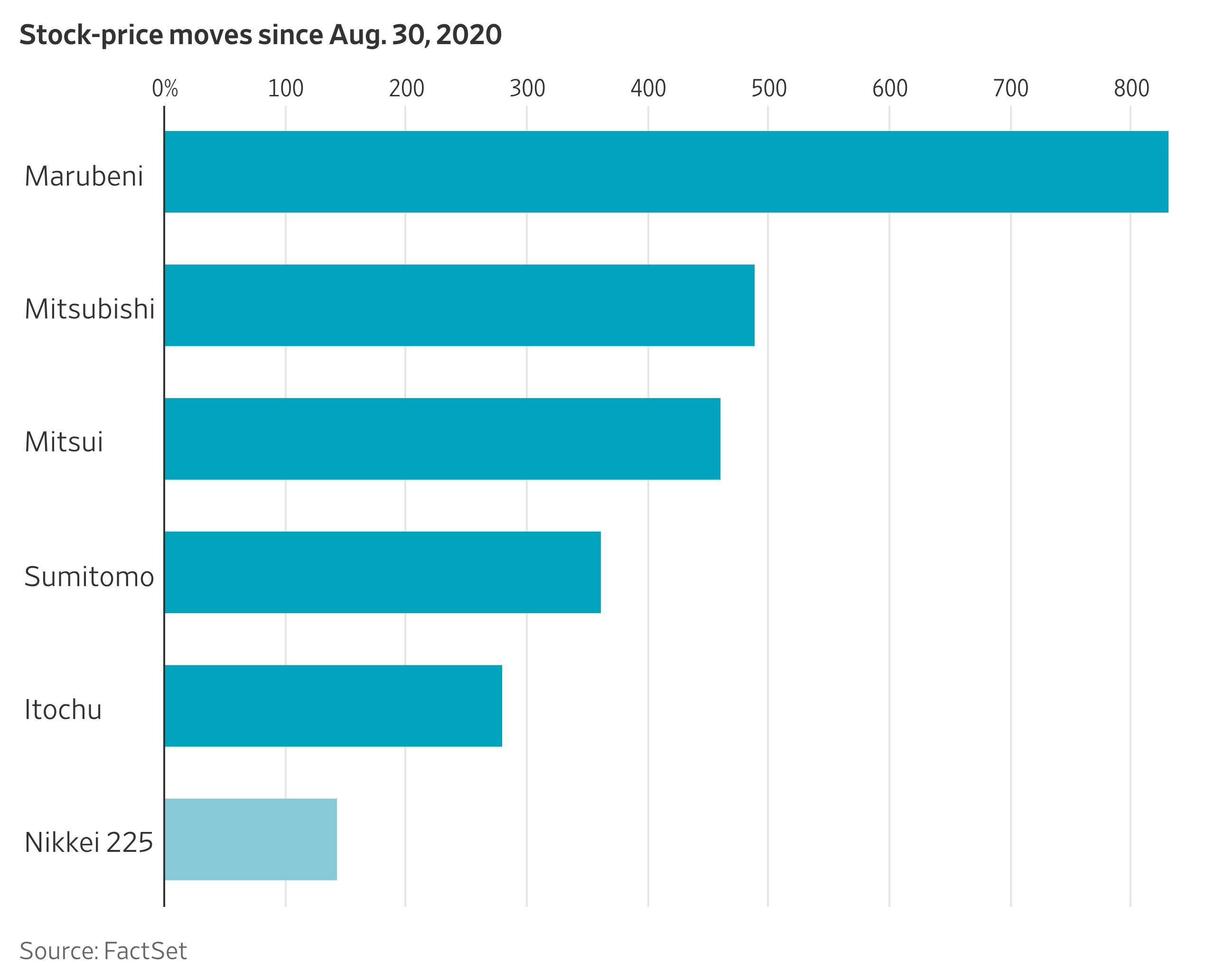

Warren Buffett’s Japanese Bets Keep Paying Off

Berkshire holds stakes in Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.

The firms operate in a wide range of businesses, in areas such as chemicals, agricultural commodities, mining and consumer products.

Itochu stock was roughly flat Monday, but the others added between 3% and 5.3%—with each of the four notching new record closing highs, according to Dow Jones Market Data.

Berkshire first revealed it had taken positions in the quintet in August 2020, though stake building started about a year earlier. It has subsequently increased those holdings.

Since Berkshire first disclosed that it was investing in the trading firms, their shares have gained between 280% and 832%.

Business

Gilead Sciences, Inc. 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:GILD) 2026-02-10

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World7 hours ago

Crypto World7 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World16 hours ago

Crypto World16 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World16 hours ago

Crypto World16 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition