Crypto World

BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week

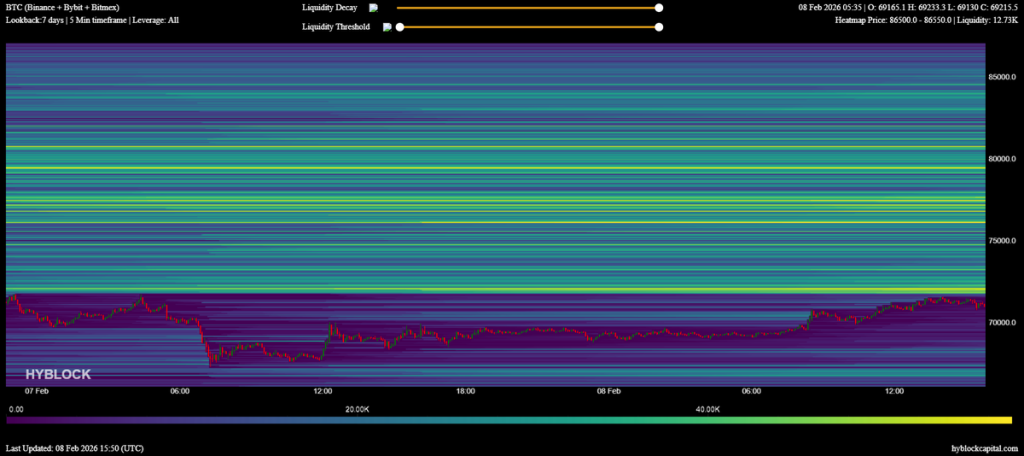

Bitcoin traders are glued to one price right now: $50,000.

After a brutal dip that saw prices flash below $60,000 for a hot minute, everyone’s wondering if we’ve finally hit rock bottom.

Yes, Bitcoin price bounced back above $70,000 temporarily, but here’s the thing, nobody’s really convinced this is “the bottom” just yet.

Key Takeaways

- Analysts warn the recent bounce to $71,000 may be a “bull trap” designed to liquidate shorts before a retest of $50,000 support.

- JPMorgan data indicates Bitcoin has traded below the estimated miner production cost of $87,000, a historical signal for capitulation.

- Technical patterns highlight critical support at $67,350, with a breakdown potentially opening the door to the $43,000 region.

Weekly Close Shows Fragility Despite $70K Rebound

Bitcoin found its way back to $71,000 as the week kicked off. However, most find this rally looking sketchy.

Sure, we saw a 7% bounce from last week’s $60,000 bloodbath, but there’s basically no volatility around the weekly close. And when things look too calm after a crash, traders get suspicious.

Trader CrypNuevo said on X: this whole move up looks like a calculated play to hunt down short positions stacked between $72,000 and $77,000.

If this “recovery” turns out to be fake, bears have one target in their crosshairs: $50,000.

Miner Costs and Stablecoin Flows Signal Caution

Here’s a number that should make you nervous: $67,000. That’s what it costs miners to produce one Bitcoin.

BTC might be trading below that soon. Historically, the miner production cost acts like a safety net, prices usually don’t stay below it for long.

if this continues, miners start going broke. And when miners capitulate? They dump their Bitcoin to stay alive, which creates even more sell pressure. It’s a vicious cycle.

While the fundamentals look grim, there’s a massive pile of cash sitting on the sidelines. Stablecoin inflows just doubled to $98 billion.

They’re ready to buy… they’re just waiting for the right moment.

Next Steps: Bitcoin Price Technical Levels to Watch

Traders are staring down at an interesting moment as inflation data drops this week. Right now, all eyes are on $67,350, that’s the support level holding this whole thing together.

If Bitcoin breaks below that? We’re looking at bearish flag patterns that could drag prices down to $50,000. Yeah, a potential 30%+ dive.

There’s a bullish scenario too. The magic number is $74,434. If BTC can reclaim and hold above that level, it kills the bearish setup and potentially opens the door back to $80,000.

The post BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week appeared first on Cryptonews.

Crypto World

Crypto Miner Canaan Shares Sink 7% Despite Strong Q4

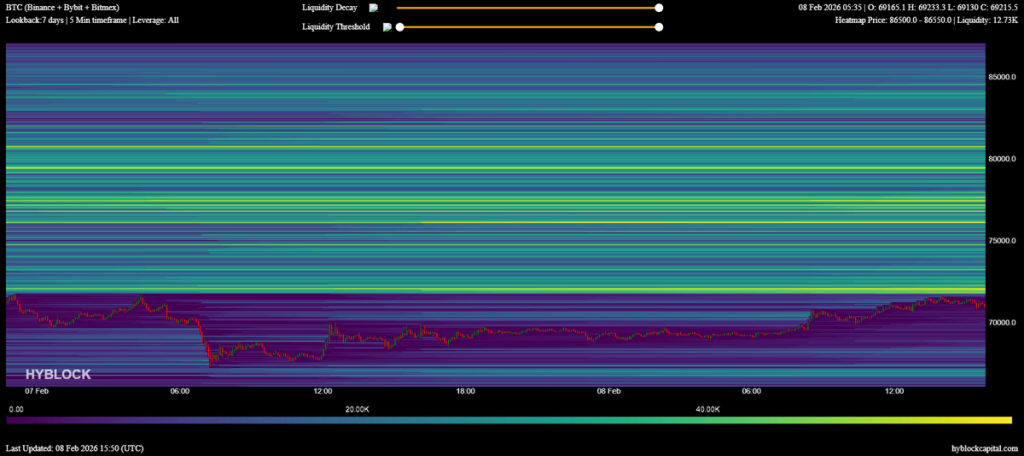

Crypto miner and manufacturer Canaan fell 6.9% on the Nasdaq on Tuesday despite reporting a 121.1% year-on-year increase in revenue to $196.3 million in the fourth quarter, driven by an increase in hardware sales and stronger mining performance.

Canaan reported that its Bitcoin (BTC) mining revenue rose 98.5% year-on-year to $30.4 million, helping boost its Bitcoin treasury to a record 1,750 BTC, valued at nearly $120 million, while the company also increased its Ether (ETH) holdings to 3,950 ETH, worth $7.9 million.

The revenue figure is Canaan’s highest quarterly posting in three years, and was also driven by Bitcoin mining machine sales, with the company shipping a record 14.6 exahashes per second (EH/s) of computing power during the quarter.

Canaan said computing power sales were supported by a “milestone order” from a US-based institutional miner, helping it set a new quarterly record for computing power sales and achieve a 60% year-on-year increase.

On the mining front, the Singapore-based company said it expanded its installed hashrate to 9.91 EH/s, with 7.65 EH/s operational during the quarter.

Bitcoin network hashrate has fallen from a record 1,150 EH/s in mid-October to 980 EH/s as miners continue to unplug unprofitable machines and pivot to AI and high-performance computing.

Despite the strong Q4 performance, Canaan (CAN) shares tanked another 6.87% to $0.56, Google Finance data shows, making it one of the lowest performers among the 15 largest Bitcoin miners by market cap.

Canaan’s risk of Nasdaq delisting worsens

At its current price of $0.56, the company is now down 18.1% year-to-date and 70.2% over the last 12 months.

On Jan. 16, Canaan said it received a letter from the Nasdaq warning that it must increase its share price to above $1 to meet the stock exchange’s minimum bid rule or risk being delisted.

Related: Bitcoin ETFs extend rebound as $145M in fresh inflows hit market

The Nasdaq gave the Singapore company 180 days, until July 13, to regain compliance with the rule, which requires its closing bid price to hit at least $1 for a minimum of 10 consecutive trading days. Canaan last closed above $1 on Nov. 28, 2025.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Descending Channel Dominates as ETH Tests Demand Zone

Ethereum remains in a cyclical downswing after the recent capitulation leg that drove the price from the mid-$2,000s into the $1,800 demand region. The structure across higher timeframes is still dominated by a well-defined descending channel, with lower highs since late 2025 and momentum readings in oversold territory now attempting to stabilize.

Current conditions, therefore, reflect a market in the process of digesting a sharp repricing, where the next impulse will likely be defined by how the price reacts to the nearest resistance band around $2,700 and the reclaimed support zone near $1,800–$2,000.

Ethereum Price Analysis: The Daily Chart

The daily chart shows Ethereum trending within a broad downward channel, with the latest sell-off driving the asset into the lower boundary and the horizontal demand region between roughly $1,800 and $1,700. This zone has produced an initial reaction, but the sequence of lower highs and lower lows remains intact, and the bearish fair value gap around $2,300–$2,400 now acts as the first short-term resistance cluster.

Daily RSI has also bounced from deeply oversold readings but still resides in a bearish regime, indicating that any recovery for now is best classified as a corrective rebound within a dominant downtrend. Yet, a sustained move back above $2,400–$2,500 and the channel midline would be required to argue for a more durable trend change.

ETH/USDT 4-Hour Chart

On the 4-hour timeframe, the market displays a short-term basing attempt after the steep decline. The price carved out a descending leg that terminated near the $1,800 demand zone while the 4-hour RSI formed a clear bullish divergence, signalling seller exhaustion and prompting the current consolidation above the support zone at $1,800 and below the resistance level at $2,100.

This range now defines the tactical battlefield: holding above $1,800 would keep the developing recovery structure valid and open the door for a retest of the $2,200 short-term resistance level, whereas a decisive breakdown below $1,800 would indicate that the relief phase has failed and expose the lower daily supports closer to $1,600.

On-Chain Analysis

The Exchange Supply Ratio for Ethereum has continued to trend lower and currently sits near the lowest levels of the displayed series, around 0.135, implying that an increasingly smaller fraction of the total ETH supply is held on centralized exchanges. This persistent decline, even as prices have sold off toward the $2,000 area, suggests that a significant portion of the supply has migrated to self-custody or staking and is less immediately available for sale, reducing structural spot sell-side liquidity.

In the short term, this configuration can amplify volatility, with sharp downtrends driven by derivatives and forced selling facing relatively thin spot order books. But from a medium-term perspective, a depressed exchange supply ratio combined with already realized downside often characterizes late-stage phases of a corrective cycle, where additional marginal supply becomes progressively harder to source if demand begins to recover.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Crypto’s ‘age of speculation’ is over, says Galaxy CEO Mike Novogratz

Justin Tallis | Afp | Getty Images

Throughout its history, bitcoin and other cryptocurrencies have been subject to significant price fluctuations, whether that’s due to larger macro factors impacting all asset classes or during “crypto winters” tied to industry concerns.

But with a crypto-friendly Trump administration and expectations for passage of a cryptocurrency market structure bill, many onlookers expected another bull run in digital assets to start 2026. However, it’s been the exact opposite. Bitcoin is down more than 21% so far this year, and it fell to $60,062.00 last week — its lowest level in roughly 16 months. That marked a drop of nearly 50% from its record back in October 2025.

What is driving this latest decline? Rather than a single event, Galaxy founder and CEO Mike Novogratz said at the CNBC Digital Finance Forum on Tuesday in New York City that it’s a reflection of a larger industry shift. When bitcoin fell 22% in less than a day back in November 2022 following the collapse of FTX, there was a “breakdown in trust,” Novogratz told CNBC’s MacKenzie Sigalos at the event. “This time, there’s no smoking gun,” he said. “You look around like, what happened?”

Bitcoin price since the start of 2026

Novogratz did note the wipeout that occurred in October 2025 as a significant event, when more than 1.6 million traders suffered a combined $19.37 billion erasure of leveraged positions over a 24-hour period, a situation that he said, “wiped out a lot of retail and market makers” and put plenty of pressure on prices.

“Crypto is all about narratives, it’s about stories,” he said. “Those stories take a while to build and you’re pulling people in … so when you wipe out a lot of those people, Humpty Dumpty doesn’t get put back together right away,” he said.

But Novogratz also sees something more lasting he expects to come out of the current downturn, saying the recent era of crypto investing, “the age of speculation,” will be phased out going forward as the crypto industry has brought in “institutions where people have a different risk tolerance.”

“Retail people don’t get into crypto because they want to make 11% annualized,” he said. “They get in because they want to make 30 to one, eight to one, 10 to one.”

Some traders will always speculate, Novogratz says, but overall, “it’s going to be transposed or replaced by us using these same rails, these crypto rails, to bring banking [and] financial services to the whole world. And so, it’s going to be real world assets with much lower returns.”

He also pointed to tokenized stocks as assets that will have “a different return profile.”

Sigalos asked Novogratz if the eventual passage of the CLARITY Act could be a catalyst for the industry, with the stall in the crypto market structure bill’s momentum on Capitol Hill at least a short-term headwind. He is confident a crypto market structure bill will eventually become law.

“I talked to [Senate Minority Leader] Chuck Schumer two nights ago and he said ‘We’re going to pass the goddamn CLARITY Act,’” Novogratz said. “The Democrats want to pass the act, and the Republicans want to.”

Novogratz said the crypto industry needs the bill for “a lot of reasons,” but notably, “We need it for spirit back in the crypto market.”

Crypto World

Davos WEF 2026: Crypto Enters Its Execution Phase

At the World Economic Forum 2026 in Davos, crypto was no longer framed as a parallel financial system. Instead, it appeared as emerging institutional infrastructure—regulated, operational, and increasingly shaped by legislation, market structure, and real deployment timelines.

Across CNBC House and Bloomberg House, the conversation shifted decisively away from hype. The focus was execution: what can realistically ship in 2026, under which rules, and with what return on capital.

Sponsored

Why Davos Matters for Crypto in 2026

Davos is less about announcements and more about institutional alignment. This year’s theme, “A Spirit of Dialogue,” reflected crypto’s transition from ideology to negotiation—between regulators, market operators, and incumbents.

Crypto repeatedly surfaced in discussions around financial infrastructure modernization, settlement efficiency, tokenization of regulated assets, and market resilience. The signal was clear: crypto is now being judged on compliance, governance, and measurable outcomes, not narratives.

CNBC House: Stablecoins and Tokenization, Narrowed

CNBC House debuted in 2026 as a curated venue for C-suite and policy-level discussions. Its tone was pragmatic. Conversations with Binance Co-CEO Richard Teng and Ripple CEO Brad Garlinghouse positioned 2026 as an execution year, not a speculative cycle.

Sponsored

Stablecoins emerged as the most deployable use case—where institutional demand, technical readiness, and regulatory attention already overlap. Tokenization, meanwhile, was framed less as a sweeping transformation and more as a targeted efficiency upgrade: faster settlement, improved collateral mobility, lower operational risk, and better auditability.

Crypto’s challenge at Davos was attention. It now competes directly with AI, cybersecurity, and operational resilience for executive capital. The bar in 2026 is ROI.

Sponsored

Bloomberg House: Legislation as the Bottleneck

If CNBC House captured intent, Bloomberg House captured constraints.

Coinbase CEO Brian Armstrong focused on US legislation, particularly the stalled Clarity Act. In early 2026, Coinbase withdrew support for the Senate market structure bill, arguing its latest draft could restrict tokenized equities, DeFi, and stablecoin rewards—putting crypto firms at a disadvantage to banks.

His opposition delayed the bill’s markup and highlighted a key reality: policy details, not technology, are pacing adoption. Stablecoins sit at the center of that debate, with yield, consumer protection, and financial stability now active fault lines.

Sponsored

Tokenization at Bloomberg House was framed as market structure competition. Moves toward 24/7 trading and blockchain-based rails suggest the battle is no longer about feasibility, but about who controls standards, fees, and distribution.

What Davos Made Clear

Crypto’s next phase is defined by integration, not disruption. Stablecoins are the leading institutional wedge. US legislation sets the tempo. Tokenization is becoming incremental, regulated, and competitive.

Davos sent a clear message: crypto’s future will be decided less by narratives—and more by who can deliver institution-grade infrastructure under real-world rules.

This article was contributed by Ionut Gaucan, an independent industry expert reporting from Davos. The views expressed are the author’s own and do not necessarily reflect those of BeInCrypto.

Crypto World

Hyperliquid Records $2.6T Volume, Leaving Coinbase Behind: Artemis

Coinbase is being quietly eclipsed by Hyperliquid, whose trading volume is nearly double that of Coinbase.

The prominent decentralized perpetual futures exchange, Hyperliquid, has surpassed Coinbase in terms of trading volume, according to Artemis. The data revealed that Hyperliquid recorded $2.6 trillion in trading volume, compared with Coinbase’s $1.4 trillion within the same timeframe.

This represents nearly double the notional volume of Coinbase.

Hyperliquid vs. Coinbase

Findings shared by Artemis also disclosed that the year-to-date price performance highlights a stark contrast between the two platforms. Hyperliquid has gained 31.7% so far in 2026, while Coinbase has declined by 27.0%. This resulted in a divergence of 58.7% over just a few weeks.

Coinbase is one of the most established centralized exchanges in the world, while Hyperliquid is still an emerging decentralized player in the space. Following the significant gap in both trading activity and asset performance, Artemis described it as a sign that the market is paying attention to the decentralized perpetuals exchange’s rapid growth.

Throughout 2025, the platform generated $822 million in revenues. So far this year alone, it recorded $79.1 million in revenues.

Meanwhile, open interest on Hyperliquid, over the past 24 hours, stood at $4.1 million.

Amid rapid growth, Ripple announced that its Ripple Prime brokerage platform will now support Hyperliquid. This would allow institutional clients to access Hyperliquid’s on-chain derivatives while cross-margining exposure across other assets, including cleared derivatives, OTC swaps, fixed income, forex, and digital assets, under a single counterparty.

You may also like:

Michael Higgins, international CEO of Ripple Prime, said the integration merges decentralized finance with traditional prime brokerage, improving liquidity access and trading efficiency. The move comes as Hyperliquid continues to see billions in daily volumes, as the platform sees growing influence in the decentralized perpetual futures market.

HYPE Shorting Controversy

Hyperliquid’s popularity has not been without controversy. In December, the exchange confirmed that a former employee, dismissed in early 2024 for insider trading, was behind large short positions in its native HYPE token. On-chain analysis verified that the wallet responsible executed leveraged shorts totaling over $223,000, including $180,000 in HYPE at 10x leverage.

The platform reiterated its zero-tolerance policy for insider trading and said employees and contractors are prohibited from trading HYPE derivatives.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BlackRock Bitcoin ETF Options Surge, Overtake Gold in Market Volume

BlackRock’s Bitcoin ETF (IBIT) options have surged to new heights, surpassing gold ETFs in both open interest and trading volume. As of February 10, IBIT options reached a total of 7.33 million active contracts, positioning it as the ninth-largest options market in the U.S. This marks a significant shift, as Bitcoin gains momentum over traditional assets like gold.

The surge in IBIT options highlights a growing interest in cryptocurrency. This uptick has coincided with Bitcoin’s strong performance, outpacing gold in recent trading sessions. As Bitcoin continues to rise, the surge in IBIT options reflects broader market trends, with investors responding to changing global risk sentiment.

BlackRock Bitcoin ETF’s Growing Dominance in the Options Market

The rise of IBIT options points to a shifting preference towards Bitcoin-based assets. With 7.33 million IBIT contracts now open, Bitcoin has solidified its position in the options market, surpassing even gold ETFs like SPDR Gold Shares (GLD). By contrast, GLD options currently sit at 6.44 million, showing a distinct advantage for Bitcoin in this space.

IBIT options have recorded impressive trading volumes, with over 284 million shares traded, resulting in more than $10 billion in notional value. This represents a notable increase from the previous record set in November. The growing volume and interest reflect a clear trend of Bitcoin gaining ground in the financial market.

The put/call ratio for IBIT options is currently 0.64, indicating a more balanced market outlook compared to gold’s ratio of 0.50. As Bitcoin continues to rise, its options market is becoming increasingly influential, while interest in gold begins to wane. This shift signals a broader change in market sentiment, with Bitcoin gaining prominence over gold.

Bitcoin Options Outpace Gold Amid Global Market Shifts

Bitcoin options have experienced significant growth, while the price of gold has weakened. A resurgence in global risk appetite has caused gold prices to ease, as equity indices show positive performance. This shift in sentiment has been attributed to anticipation surrounding upcoming U.S. economic data, including jobs reports and CPI inflation figures.

Despite expectations that gold could hit new highs in the coming years, Bitcoin continues to outperform it in terms of market sentiment. BNP Paribas has projected that gold could reach $6,000 by 2026, but Bitcoin has maintained a stronger position in the current market. This shift in favor of Bitcoin reflects a reassessment of traditional safe-haven assets.

As market conditions change, the growing focus on Bitcoin-based assets like IBIT may continue to challenge traditional investments such as gold. With Bitcoin rising in prominence, it could represent an increasing share of investor portfolios, reshaping the landscape for safe-haven investments.

Bitcoin’s Performance in the Face of Increased Volatility

Despite a 30% crash in the market recently, Bitcoin has shown remarkable resilience. This volatility has sparked ongoing debates regarding Bitcoin’s future, especially in comparison to gold. However, some analysts believe that Bitcoin’s volatility could attract more investors if market conditions continue to favor riskier assets.

JPMorgan’s Nikolaos Panigirtzoglou noted that Bitcoin’s volatility relative to gold has decreased to a record low of 1.5. This reduced volatility ratio makes Bitcoin more attractive to investors looking for higher returns. As Bitcoin’s volatility continues to drop, it may attract a new wave of interest from risk-seeking investors.

With this shift in market dynamics, Bitcoin’s recognition as a significant asset is growing. Many experts suggest that Bitcoin’s price may rally toward $266,000 once the current negative sentiment dissipates. This potential for growth signals that Bitcoin could become even more appealing to investors in the near future.

Spot Bitcoin ETF Sees Record Inflows Despite BlackRock ETF Redemptions

BlackRock’s Bitcoin ETF (IBIT) has seen a surge in options activity, but its overall performance has been mixed. On February 6, spot Bitcoin ETFs recorded $144.9 million in net inflows, signaling renewed interest in cryptocurrency. This marks a positive reversal after a period of outflows, demonstrating a shift in sentiment towards Bitcoin.

However, BlackRock’s Bitcoin ETF faced redemptions of $20.9 million, signaling a less favorable outlook for the ETF itself. Despite this, the IBIT ETF remains an influential player in the market. The growing activity in Bitcoin options, along with fluctuating ETF inflows and outflows, suggests that Bitcoin’s role in traditional financial markets is evolving.

This discrepancy between inflows and redemptions highlights the complexity of investor behavior in the cryptocurrency space. While Bitcoin options gain in popularity, the ETF market remains volatile. Nonetheless, the rise in Bitcoin options is a strong signal that Bitcoin is establishing itself as a dominant asset in global financial markets.

Crypto World

Interop Protocol LayerZero Unveils L1 Blockchain Zero

Alongside its permissionless blockchain, the firm also revealed investments from Citadel Securities and ARK Invest.

LayerZero, a cross-chain interoperability protocol, has announced the launch of a new Layer 1 blockchain, dubbed Zero, that aims to address “long-standing scalability challenges” in blockchain, according to a press release shared with The Defiant.

The new blockchain — backed by heavyweight collaborators including Citadel Securities, The Depository Trust & Clearing Corporation (DTCC), Intercontinental Exchange (ICE), and Google Cloud — is positioned as core infrastructure for financial markets, rather than just another platform for crypto apps, the developers said.

Alongside the launch, LayerZero said Citadel Securities, a multi-billion-dollar market maker, is making a strategic investment in the network’s ZRO token. ARK Invest is also coming on board as a holder of LayerZero equity, as well as its native token.

The Defiant reached out to LayerZero to clarify the funding terms, but didn’t receive a response by press time.

Citadel Securities is exploring how Zero could be used across trading, clearing, and settlement workflows, per the announcement. Meanwhile, DTCC said it’s looking into using the new network for tokenized securities and large-scale collateral management.

ICE, which owns the New York Stock Exchange, said it’s also evaluating using Zero as it adapts its infrastructure for 24/7 tokenized markets. Meanwhile, Google Cloud will be joining as a partner “to explore how to enable AI agents to make micropayments,” per the press release.

LayerZero said it has also formed an advisory board that includes ARK Invest founder and CEO Cathie Wood, alongside current and former executives from ICE and BNY Mellon.

Earlier today, stablecoin giant Tether also announced a strategic investment in LayerZero, though the funding size wasn’t disclosed.

How Zero Works

At the technical level, the team behind Zero says the network employs a different approach from many blockchains, especially around consensus. Rather than requiring “every node to replicate the same work,” by validating transactions and updating the blockchain ledger, Zero uses zero-knowledge proofs to separate transaction execution from verification.

That design, combined with what the team describes as advances in compute, storage, and networking, allows Zero to potentially reach as many as 2 million transactions per second (TPS) across multiple “zones,” which the team describes as permissionless environments owned and governed by the network itself.

For context, Ethereum currently operates at around 20-30 TPS, while Solana boasts over 3,000 TPS.

According to the press release, Zero will be launched with three initial zones, including a general-purpose Ethereum Virtual Machine (EVM) environment, a privacy-focused payments setup, and a trading-oriented zone covering multiple asset classes. The network will be permissionless, with LayerZero’s native token used for governance.

ZRO is currently trading around $1.80, flat today but up about 21% in the past 30 days.

Crypto World

XRP Price Prediction: Could XRP Really Flip Bitcoin and Ethereum? One Analyst Says the Battle Has Already Begun

XRP price has dropped 12% in the last 7 days has held $1.40 this week and hasn’t let go of that level.

A well-known crypto analyst called CryptoInsightUK pointed out that XRP is showing strength relative to Bitcoin and ETH, which fuels a bullish XRP price prediction amid weak sentiment.

The analyst highlighted large liquidity clusters above XRP price around ~$2.29, ~$3.60, and ~$4.20, $4.40, which he believes could fuel strong upside if price begins to move up.

What is interesting is that metrics like XRP “dominance” have bounced off support and are showing bullish patterns, which the analyst interprets as a sign of strengthening market posture.

He also mentions that it is possible for XRP to flip Ethereum, as it would only need a 189% move from here. He called it possible, but a very hard task.

With all that said, traders might be asking one question: is it time for XRP price to overtake ETH?

XRP Price Prediction: Is XRP Preparing For a 189% Rally?

XRP Price has been grinding lower inside a well-defined descending channel.

Now it’s pressing into a key demand zone around $1.30–$1.50, an area where it bounced many times before.

The Selling pressure has noticeably slowed here.

If XRP can reclaim $1.50, it opens the door to a move toward $2.50, where a major liquidity pocket sits, followed by $3.50–$3.60, a level that lines up with both past resistance and the liquidity clusters highlighted by analysts.

As long as $1 holds, this looks less like a breakdown and more like price preparing up before its next move.

This downtrend has pushed a lot of smart whales to look for something shinier and more interesting.

Here is why many of them are starting to buy Maxi Doge.

That is The Gap Maxi Doge ($MAXI) Is Built For.

Maxi Doge is not trying to out-tech anyone. It is leaning into what actually moves markets. Momentum, memes, and conviction. The same forces that turned Dogecoin from a joke into a cycle-defining asset.

Maxi Doge does not fight narratives. It weaponizes them. Clear branding, aggressive positioning, and a community-first approach designed to thrive when sentiment flips fast and liquidity chases hype, not whitepapers.

And the numbers are already backing it up. The $MAXI presale has raised nearly $4.6 million so far, with early buyers earning up to 68% APY through staking rewards.

If this cycle is about attention over perfection, Maxi Doge is playing the game exactly as the market wants.

Visit the Official Maxi Doge Website Here

The post XRP Price Prediction: Could XRP Really Flip Bitcoin and Ethereum? One Analyst Says the Battle Has Already Begun appeared first on Cryptonews.

Crypto World

Citadel Securities backs LayerZero as it unveils ‘Zero’ blockchain for global markets

LayerZero Labs on Tuesday unveiled Zero, a new blockchain aimed at powering institutional-grade financial markets, alongside a strategic investment from Citadel Securities into ZRO, the network’s native token and governance asset.

ARK Invest is also investing in LayerZero’s equity and ZRO token, with CEO Cathie Wood joining a newly formed advisory board alongside ICE executive Michael Blaugrund and former BNY Mellon digital assets head Caroline Butler, the company said in a press release. The size of the investments were not disclosed.

The announcement signals a deeper push by traditional market infrastructure players into blockchain-based trading, clearing and settlement, as scalability and performance constraints have long limited real-world adoption.

Tether Investments, the investment arm of the leading stablecoin issuer, has also made a strategic investment in LayerZero Labs, it said earlier on Tuesday.

Citadel Securities said it is working with LayerZero to evaluate how Zero’s architecture could support high-throughput workflows across trading and post-trade processes. The firm’s investment in ZRO adds to growing institutional interest in LayerZero, which is best known for operating one of crypto’s largest interoperability networks.

After years of pilot projects and cautious experimentation, large financial institutions are moving more decisively into crypto as infrastructure improves and regulatory clarity advances. Asset managers, exchanges and clearing houses are increasingly viewing blockchains not as speculative rails but as potential upgrades to legacy systems, particularly for trading, settlement and collateral management. The shift reflects a growing belief that crypto-native technology is maturing enough to support real-world financial markets at scale.

Zero is designed around LayerZero’s first-of-its-kind heterogeneous architecture, which uses zero-knowledge proofs (ZKPs) to separate transaction execution from verification. The company claims the design can scale to roughly 2 million transactions per second across multiple zones, with transaction costs approaching a millionth of a dollar and effectively unlimited blockspace.

Zero-knowledge proofs let blockchains verify that a statement is true without revealing the underlying data, preserving privacy while ensuring validity.

LayerZero said the system delivers step-change improvements across compute, storage, networking and cryptography, allowing different zones to be optimized for specific use cases rather than forcing all nodes to perform identical work.

The project is launching in collaboration with several major institutions. The Depository Trust & Clearing Corporation (DTCC) said it will explore using Zero to enhance the scalability of its tokenization and collateral initiatives, while Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, is examining applications tied to 24/7 trading and tokenized collateral. Google Cloud is partnering with LayerZero to explore blockchain-based micropayments and resource trading for AI agents, reflecting growing interest in programmable money for machine-driven economies.

“Zero’s architecture moves the industry’s roadmap forward by at least a decade,” said Bryan Pellegrino, CEO of LayerZero Labs, in the release. “We believe we can actually bring the entire global economy onchain with this technology.

The blockchain is set to debut with three initial zones: a general-purpose Ethereum Virtual Machine (EVM) environment, a privacy-focused payments system, and a purpose-built trading venue. ZRO will anchor network governance and security, while LayerZero’s interoperability stack links Zero to more than 165 blockchains.

Read more: Robinhood is investing in crypto trading platform Talos at $1.5 billion valuation

Crypto World

HOOD falls another 7% on Q4 revenue miss

Robinhood (HOOD) said revenue from crypto-related transactions fell 38% year over year in the fourth quarter, highlighting how lower digital asset prices continue to curb trading activity even as platforms push deeper into the sector.

The trading app reported $221 million in revenue from crypto trades, down from $358 million a year earlier, according to its latest earnings report. The decline came despite Robinhood’s efforts to make crypto a bigger part of its business.

Over the past year, the company has rolled out new crypto features and expanded its offerings. Robinhood launched crypto transfers across more regions, allowing users to move assets on and off the platform. It also added a large slate of new trading tokens, expanding beyond the small set of major coins it once limited customers to. The company has pitched these moves as steps toward becoming a broader gateway into digital assets rather than a simple trading app.

That strategy has yet to shield crypto revenue from market swings. Lower prices tend to dampen trading, especially among retail investors who drive much of Robinhood’s volume.

The crypto slowdown stood in contrast to Robinhood’s broader business. Overall transaction-based revenue reached $776 million, a 15% increase from the year prior. Gains in equity and options trading helped offset the drop in crypto, pointing to a more balanced revenue mix than in past cycles.

The company reported EPS of $0.66 in the fourth quarter, topping Wall Street estimates for $0.63, but revenue of $1.28 billion fell short of forecasts for $1.33 billion.

Shares are lower by 7.7% in after-hours trading, continuing a plunge that began around the time crypto topped in early October 2025. Trading at $79, the stock’s now down nearly 50% from that record high.

Competitor Coinbase (COIN) is set to report earnings on Thursday. Analysts expect it to post lower trading volume and weaker revenue, reflecting the same market conditions that hit Robinhood’s crypto business. COIN is lower by 1.6% after hours on the HOOD results.

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World7 hours ago

Crypto World7 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World16 hours ago

Crypto World16 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World16 hours ago

Crypto World16 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition